1. Introduction

Cash flow is paramount to the growth and sustainability of a business. Though impressive revenues give the appearance of financial health, they can be misleading. A company may well go out of business despite reporting positive revenues, because cash is usually needed in order to buy materials or pay operating expenses such as lease and labor. Even if a business earns a profit, it may be unable to grow without cash. If a company is unable to replenish inventory, it will not be able to generate new sales. This, in addition to an inability to afford operating expenses, would likely repel potential investors and limit financing. Without cash, a business cannot survive.

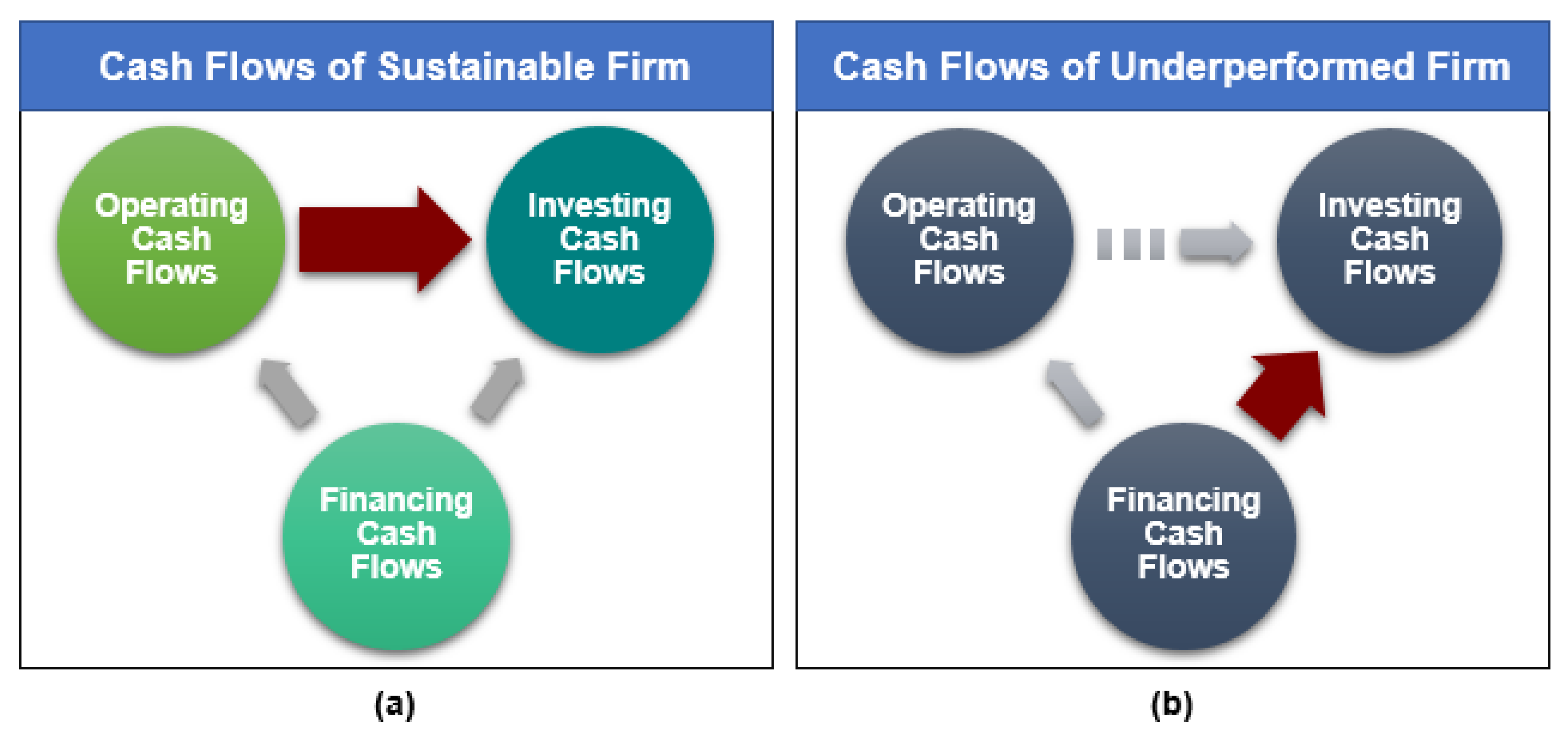

The sustainability of a company is often determined by its ability to generate a positive long-term cash flow, with inflows exceeding outflows in the long term. By delaying payment of debts or judiciously allocating resources, companies can survive for a short length of time despite making a loss but in the long term, companies must earn enough cash to meet its needs. Therefore, cash flow management is vital to sustaining a healthy business. The most common cause of bankruptcy is a failure to repay debts. The prospect of insolvency should encourage caution regarding a company’s management of cash, as effective cash flow management not only helps to prevent bankruptcy but also enhances the financial outlook and sustainability of a business [

1].

By analyzing financial reporting of Korean-listed companies, this paper reexamines the ability of earnings and operating cash flows to accurately predict future cash flows. Furthermore, this study examines external monitoring by foreign investors and analyzes the potentially mitigating effect those investors have on the agency problem regarding the corporate forecasting of future cash flow. One of the most fundamental functions of financial reporting is to forecast the timing, size and volatility of future cash flows. Financial statements are generally considered to be the most important source of future cash flow predictions. There has been a great deal of literature written on the effectiveness of earnings as a measure of company performance but when it comes to predicting future cash flow, current cash flow is an equally important measure. Cash flow statements show the amount of money that goes into and comes out of a company over a specific period of time and they are prepared using cash-based accounting rather than the accrual-based accounting used to prepare the income statements that show earnings. Investors examining a company may prefer to analyze current cash flow over earnings, because earnings, which are more prone to manipulation, do not always accurately represent a firm’s condition, as demonstrated by firms such as Enron and WorldCom. Cash flow statements, on the other hand, show the amount of actual cash a company has generated as well as its capability to meet its liabilities, which makes them crucially important to investors and debt holders.

Prior research shows that cash flow is more predictive of future cash flow than earnings [

2,

3] and Sloan [

4] supports this idea by finding that cash flow is more persistent and therefore more predictive, than accruals. However, other studies find that accrual accounting alleviates some fluctuations in cash flow, which can be useful when evaluating a company [

3,

5,

6]. This claim is backed up by Dechow [

5] and Dechow et al. [

6], who find that accrual accounting can enhance the accuracy of the valuation of a company by reconciling some matching and timing issues related to cash flow. The conceptual foundation of the Financial Accounting Standards Board (FASB) also assumes the primacy of accrual-based accounting (FASB, 1978).

The FASB has suggested that financial reporting can be helpful in predicting future cash flow (FASB, 1978). According to the FASB, the main purpose of financial statements is to provide investors, creditors and anyone otherwise interested in the financial health of a particular company with information with which they can assess the amount and timing of future cash flow, which is most accurately predicted by earnings (FASB, 1978). The basis of this claim may lie in the theory that accrual-based accounting of earnings mitigates matching and timing issues inherent in cash-based accounting [

7]. Though a number of past studies have been conducted on the relative effectiveness of current cash flow versus current earnings in predicting future cash flow, those studies have mainly examined data from companies based in the United States. Later, Garrod and Hadi [

8] and Al-Attar and Hussain [

9] conducted similar studies using data from companies based in the United Kingdom. More recently, studies have been conducted using data from a number of other countries, such as Australia [

10], Tunisia [

11], Spain [

12], India [

13] and Nigeria [

14]. Still, in regard to the effectiveness with which various aspects of financial reporting can be used to predict future cash flow, there has been little research done using data from companies based in emerging markets such as South Korea.

South Korea is an emerging market that, as of 2017, boasts the 12th-highest GDP in the world despite recently weathering two significant outflows of foreign capital—the 1997 Asian crisis and the 2008 global financial crisis [

15]. The Korean stock market began liberalization in early 1992. The Korean economy was restructured following the 1997 Asian crisis and the ensuing International Monetary Fund bailout in May of 1998, which lifted most restrictions on foreign ownership. As other emerging markets started to open to foreign investors over the past two decades, the behavior of those investors has been studied from many angles. Recent studies have found that, in developing countries, stock market liberalization can improve investment and economic growth [

16,

17], pacify the volatility of stock returns, boost prices of information-efficient stocks [

18,

19] and promote transparent and well-run companies [

20,

21]. With this in mind, the Korean market serves as a good case study in the effects foreign investors have in emerging markets.

This paper compares two bases of future operating cash flow prediction—accrual-based earnings and operating cash flow. More precisely, this study investigates the differences in predictive abilities of earnings versus operating cash flow in regard to future cash flow as well as the investment patterns of foreign investors. The main finding of this study is that current earnings and cash flow information enhance the predictability of future cash flow. However, the presence of foreign investors noticeably enhances the predictability of future cash flow by emphasizing the analysis of operating cash flow rather than earnings when making investment decisions. The results of clustering analyses are consistent with the main results suggesting that the relationship between current operating cash flow, current earnings and future operating cash flow was still significant after controlling for the robustness. Furthermore, this study finds that the effect of foreign investors’ preference for operating cash flow to the prediction of future cash flow is more significant in chaebol governance mechanism and it is more pronounced in environments where monitoring is unobstructed by information asymmetry.

This study contributes to the literature by providing noteworthy implications. First, this study proves that it may be hasty generalization to consider accounting earnings as the solely critical factor for investment decision-making of market participants as suggested in prior studies. It is essential to bring in a fresh perspective through on this phenomenon through future cash flow predictability. As professional investors, foreign investors utilize current operating cash flow as the key investment decision-making factor when considering future cash-flow predictability. Another significant finding was that foreign investors preferred operating cash flow than accounting earnings of financial statements when making decisions on investment. This indicates the importance of exploring the tendency and investing behaviors of foreign investors in view of future cash flow when conducting research connected with foreign investors.

Second, this study adds to the preexisting literature by connecting the monitoring and investing techniques of foreign investors to the quality and utility of financial reporting. Other studies have found positive effects of foreign investors, including the reduced cost of capital [

22], the promotion of investment in research and development [

23], the positive spillover effect [

24,

25] and the instigation of changes in the corporate governance of domestic firms [

26,

27] but by testing only the relationship between variables connected to foreign investors and various other variables, these studies only provide superficial findings. However, this paper attempts to more substantially determine the role foreign investors play in recognizing the managerial agency problem, thereby making future operating cash flow more predictable.

Finally, this study enhances understanding of the quality investing and effects of monitoring by foreign investors have on earnings management. The findings of this study suggest that the effect foreign monitoring has on the predictability of future cash flow is negatively correlated with information asymmetry and is more pronounced in chaebol governance systems. Further, the differences in various effects are determined by the examination of cross-sectional variations in the relationship between foreign ownership and cash flow predictability. The monitoring environment is also considered during the analysis, which allows for the identification of influences on those cross-sectional variations and ultimately suggests that the effectiveness of foreign investing is determined by the degree of transparency of the environment in which the foreign investor is operating.

This paper is organized in five sections—

Section 2 explains the theoretical basis of the study and proposes the hypotheses,

Section 3 describes the design of the research and the sample selection process,

Section 4 presents the empirical results and

Section 5 offers the conclusions.

5. Conclusions

The inflow of foreign investors into the domestic market from 1992 has been gradually increasing until today and they are regarded as having their positions as professional investors. Moreover, with the introduction of the fourth industrial revolution, open innovation becomes the core corporate strategy that firms implement to combine in-house research and development, expertise and capabilities with external knowledge on product and technology development. More companies are shifting their innovation strategy towards ‘open innovation model’ in South Korea regardless of the sector and industry. For example, ‘Deloitte’s 2017 Global Health Sciences Outlook Report’ documented that the probability of success in developing new drugs through the open innovation model is three times higher than that of conventional closed models. Meanwhile, many researchers have long considered foreign direct investment an important channel for the transfer of technology to emerging markets, since the recent inflow of foreign investors contains knowledge about new technologies and materials, production methods or organizational management skills. In this regard, although the research on foreign investors, who are perceived as crucial market participants to trigger open innovation in the South Korean market, have been constantly conducted through various measurements and research methods from early 1990s to the present, the fact that no research exists regarding the foreign investors and the future operating cash flow predictability can greatly contribute to the revitalization of research in this field.

Thus, this study examines whether the future operating cash flow predictability of current operating cash flow and current earnings vary with the foreign investors’ ownership of a company. Since corporate value can be measured with the current valuation on future cash flow, considering the predictability of future operating cash flow can be said to have a significant meaning for the entire market participants including foreign investors when making decisions on investment. Prior studies report that the future operating cash flow predictability of accounting earnings is much higher than the future operating cash flow predictability though operating cash flow [

7]. In fact, predictability retains utility as information reflecting corporate intrinsic values in capital market. Nevertheless, unlike the investment decision-making factor of regular investors who are solely fixed to earnings of the financial statement, in case of foreign investors retaining superior information power in the capital market, they might have more interest in operating cash flow from which the investment profits come. Thus, this study will first observe which factor between the operating cash flow and accounting earnings predicts the future cash flow predictability better in the domestic capital market of Korea. Afterwards, it will analyze whether operating cash flow and earnings for future cash flow predictability rise as the foreign ownership increases. This is to clarify which factor in the financial statement between cash flow and accounting earnings the foreign investors consider more when predicting future cash flow for decision-making on investment.

As a result, the future operating cash flow predictability in the Korean capital market was found to be the same as the existing prior studies which have sample periods before this study and the predictability of accounting earnings appeared relatively higher than the predictability of operating cash flow. Moreover, in case of foreign investors who are the main interesting variable of this study, they appeared to make decisions on investment considering more of operating cash flow than accounting earnings when predicting future cash flow. Such a tendency can seemingly be the result caused by the fact that foreign investors, who are regarded as prudent investors, relatively have more interest on operating cash flows over earnings that are likely to be distorted by managerial earnings management. However, in situations where foreign investors are not able to distinguish accruals from the accounting earnings or where they receive low profit, they would follow the second best plan of making decisions on investment regarding definite operating cash flow even though information value may be relatively lacking. Moreover, since foreign investors have the ability to analyze distinguishing the accounting earnings, the reliability towards accounting earnings can be decreased [

54]. These results appeared robust to several alternative specifications of our models, a series of additional analyses, including fixed effects and cluster analyses [

59], firm size [

60], consideration of information asymmetry [

64], the chaebol governance [

65,

66], the industry-level competition as an external governance mechanism [

68] and the grants of stock option as an internal governance mechanism [

73].

This paper contributes to the growing body of literature in several ways. First, to our knowledge, there is little literature that assess the effect of foreign monitoring on predictability of future operating cash flows in South Korea. With the financial liberalization of emerging market, foreign investors’ trading behaviors have attracted much attention from academic and regulatory bodies. Also attracting foreign investment is vitally crucial in global capital markets in order to improve the liquidity of Korean firms and the overall capital market. The prior studies report that foreign investors occupy a superior position in collecting, processing and trading on private information [

40]. The empirical finding that foreign investors are likely to make decisions on investment considering more of operating cash flows rather than accounting earnings indicates that current earnings are not sustainable measure to predict future cash flows. This is because the accrual component of earnings can be manipulated through discretionary accruals that reverse in subsequent periods and deteriorate earnings sustainability. Therefore, the results of this study can warn the naïve investors that temporarily overvalue the earnings sustainability of issuing firms and consequently, are disappointed by the decrease in earnings due to the earnings management. Second, the empirical findings of this paper should be of interest to sophisticated investors, especially foreign investors evaluating South Korean firms. For instance, professional investors outside South Korea may use current cash flows of firms in South Korea more efficiently, as current cash flows allow little room for earnings management compared to current earnings. Future study can construct on these outcomes by concentrating on other proxies of monitoring and by investigating data from other emerging markets where sophisticated investors such as foreign investors and financial analysts are concerned for investments. Finally, although some prior studies examine the relation between current operating cash flows, current earnings and future operating cash flows by centering on the developed nations such as European Union and United States, there is scarce research documenting from emerging market such as South Korea because of the discrepancies in the level of openness in the foreign currency market. This study can complement prior studies that attempt to link predictability of future cash flows to sophisticated monitoring mechanism.

This paper is subject to limitations. For example, nevertheless the fact that focuses on the foreign investors can provide a powerful setting to examine the research topics on financial liberalization of emerging market, it can be hard to generalize the empirical results to other countries with different capital environments. Furthermore, although this study incorporates the various robust tests, there can exist the possibility of omitted variable problems. This is because we are not able to precisely measure the foreign monitoring due to the difficulty that there are many firm fundamentals that can determine foreign ownership and cash flows simultaneously. Still, this paper contributes to the prior studies through a presentation of how monitoring effect of foreign investors impacts the association between current cash flows, current earnings and future operating future cash flows by comparing the degree of foreign investors’ investing preference.