Is There a Kuznets Curve Effect for China’s Land-Driven Development Mode?

Abstract

1. Introduction

2. Literature Review on the Land-Driven Development Mode

2.1. Reasons Why Land Resources Can Become Important for Local Governments

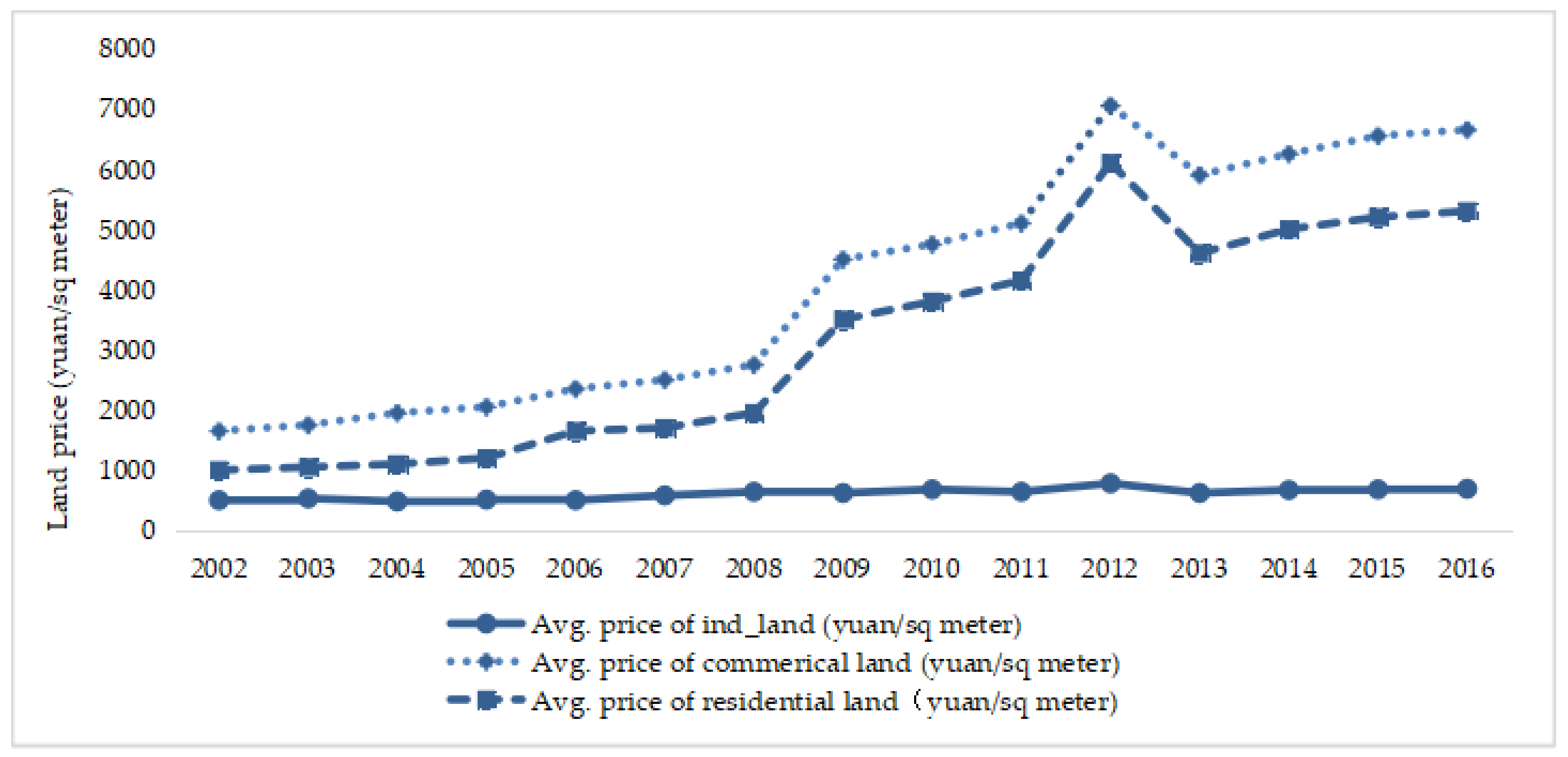

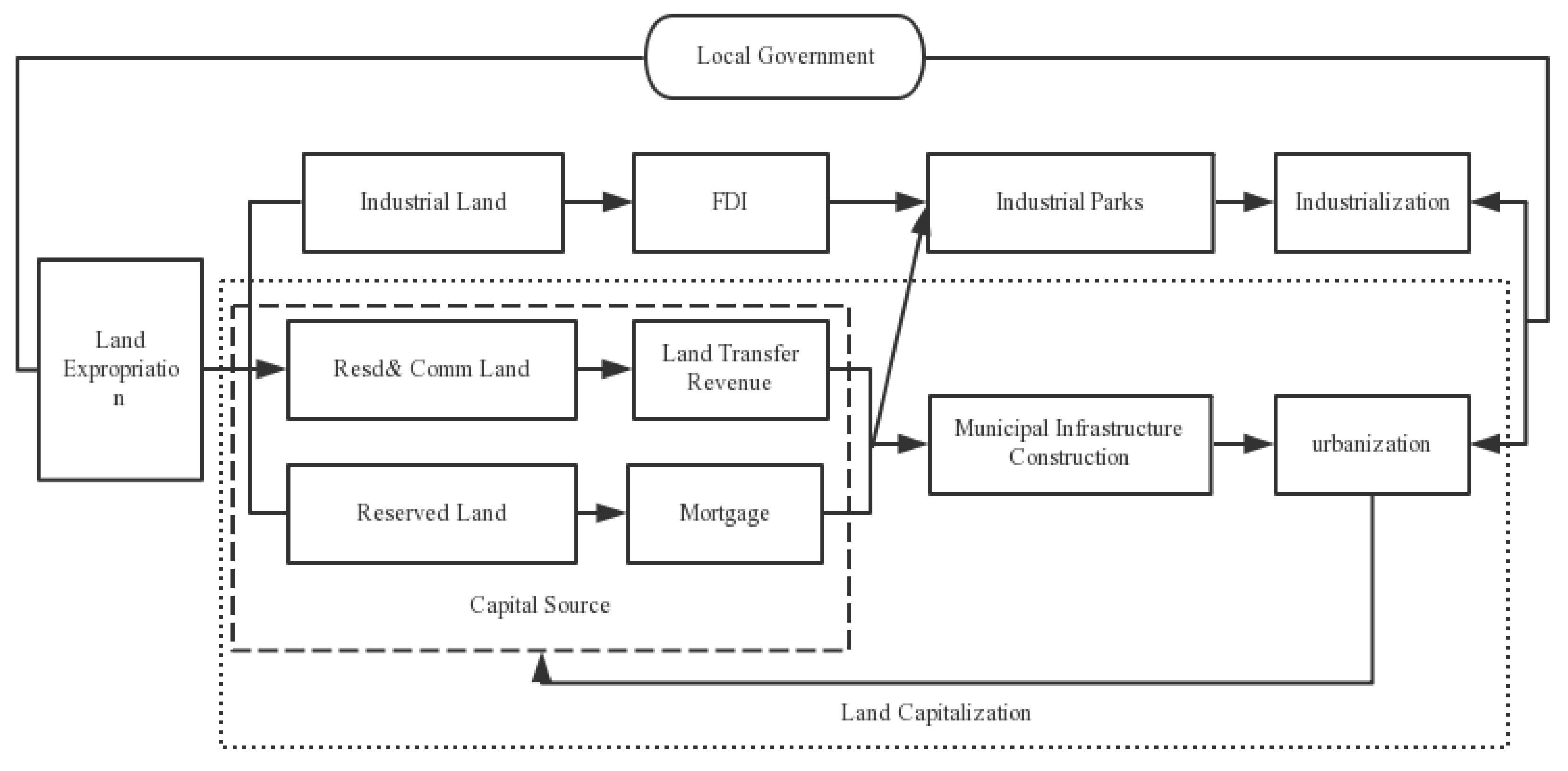

2.2. Main Features of Land-Driven Development Mode

2.3. Sustainability of Land-Driven Development Mode

- At the national level, does the impact of the land-driven development on economic growth have the Kuznets effect? Since the impact of local government on the economy through land supply is mainly seen in urbanization and industrialization, has the impact of land supply on urbanization and industrialization passed the turning point and gone from positive to negative? Is this mechanism still sustainable?

- Do local governments have an oversupply of land at present?

- At the regional level, the local governments in the mid-western region adopt the same development mode as the eastern region; however, there is a big economic gap between the eastern region and the mid-western region. Has the mid-western region achieved the same results as the eastern region? Are there significant regional differences, and what are the underlying mechanisms?

3. Theoretical Analysis of the Problems and Decline of Land-Driven Development Mode

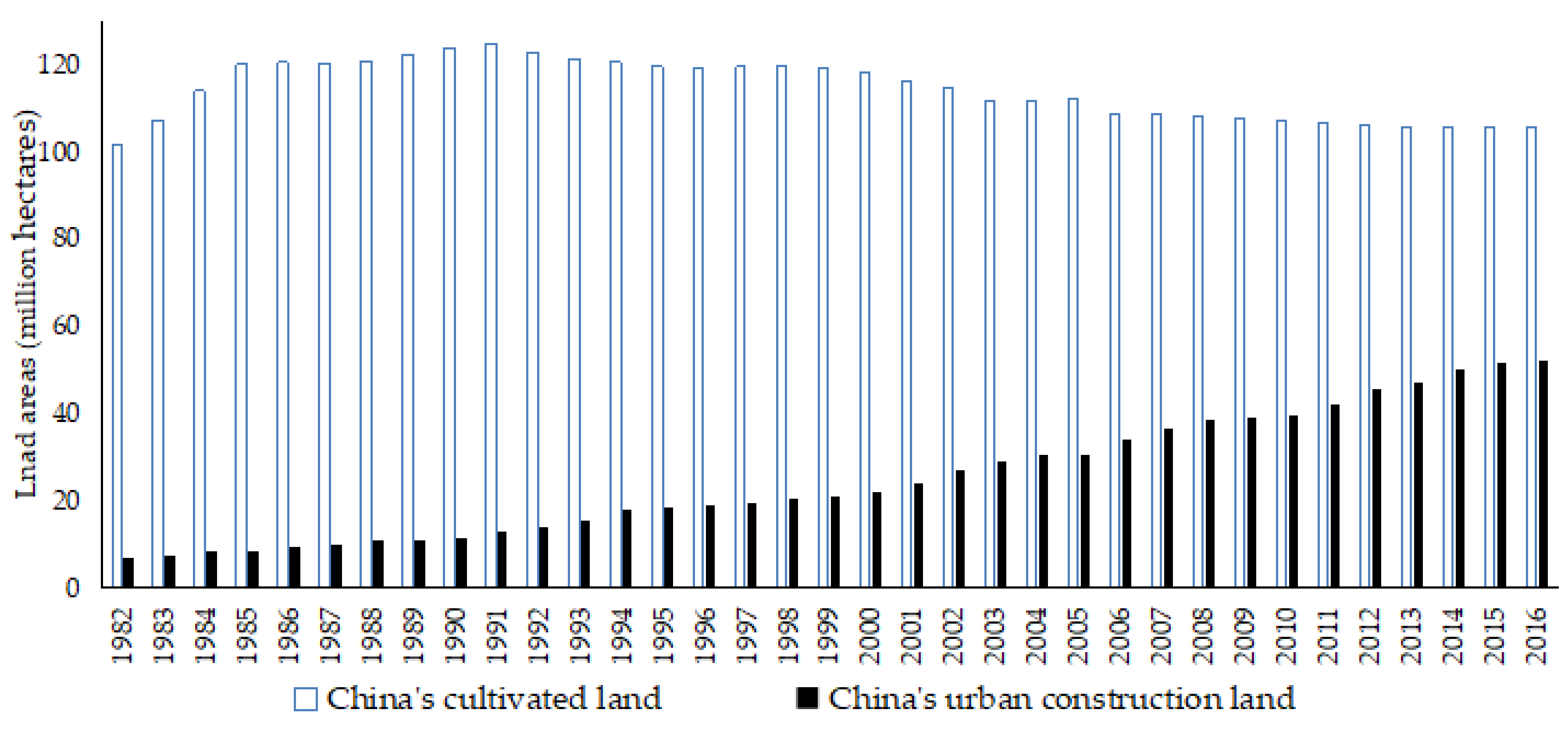

3.1. Land Expropriation Is Unsustainable

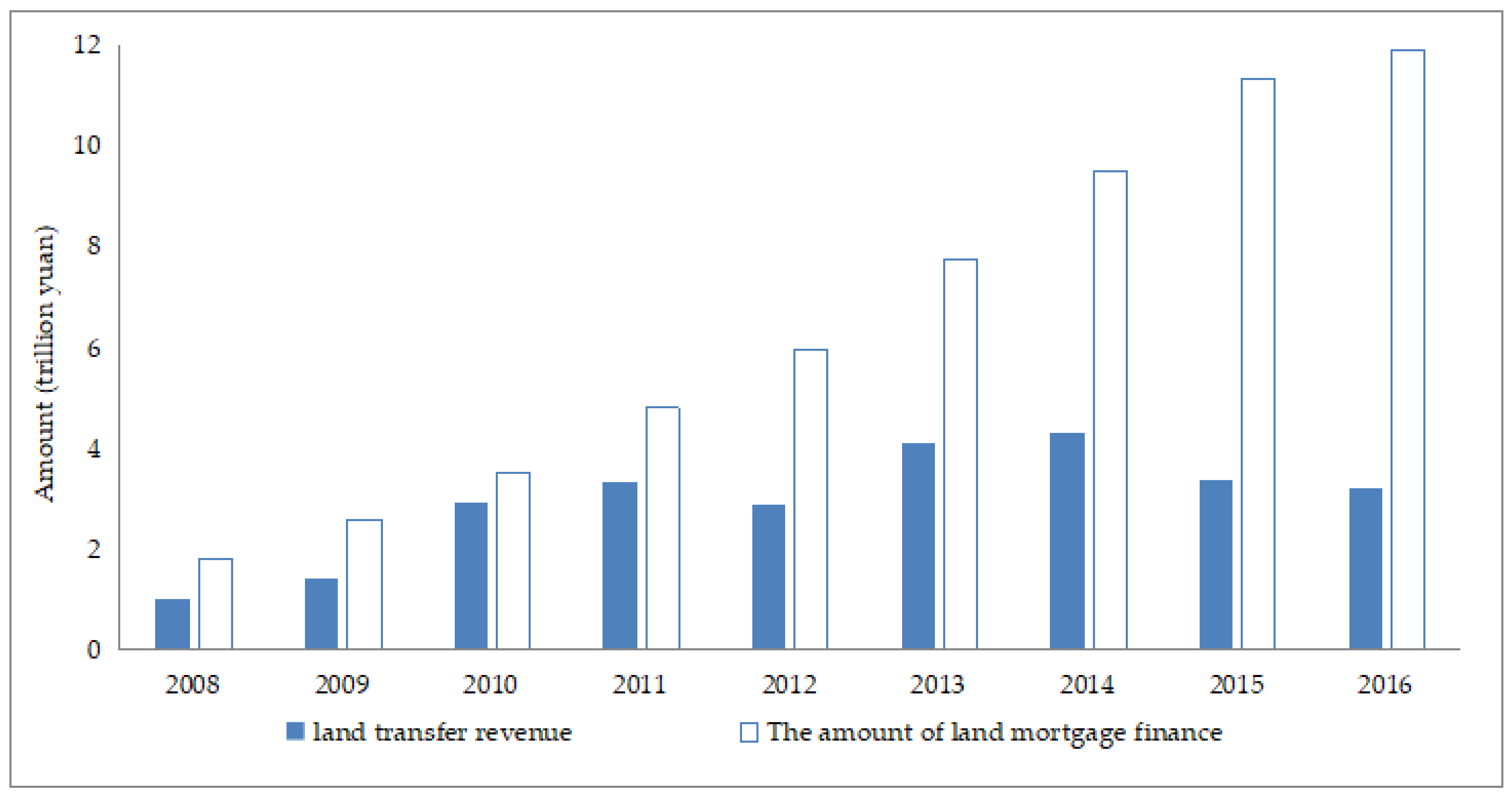

3.2. Serious Debt and Financial Risk Result from Land-Driven Urbanization

3.3. Industrial Upgrading is Inhibited Caused by Low-Price Land-Driven Industrialization

4. Model Specifications and Variables, Materials, and Methods

4.1. Database and Descriptive Statistics

4.2. Methods

5. Empirical Results

5.1. The Kuznets Curve Effect for Urbanization

5.2. The Kuznets Curve Effect for Industrialization

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Zheng, S.Q.; Sun, W.Z.; Wu, J.; Yun, W. Infrastructure investment, land leasing and real estate price: A unique financing and investment channel for urban development in Chinese cities. Econ. Res. J. 2014, 8, 75–81. [Google Scholar]

- Zhang, X.; Zhang, A.L.; Deng, C. Study on land resources distorted allocation and economic efficiency loss. China Popul. Resour. Environ. 2017, 3, 170–176. [Google Scholar]

- Jin, W.F.; Zhou, C.S.; Luo, L.J. Impact of Land Input on Economic Growth at Different Stages of Development in Chinese Cities and Regions. Sustainability 2018, 10, 2847. [Google Scholar] [CrossRef]

- Liu, S.Y. Land institutional reform and structural transformation in china: An economic interpretation for China’s 40 years development experience. China Land Sci. 2018, 1, 1–10. [Google Scholar]

- Liu, T.; Cao, G.; Yan, Y.; Wang, R.Y. Urban land marketization in China: Central policy, local initiative, and market mechanism. Land Use Policy 2016, 57, 265–276. [Google Scholar] [CrossRef]

- Wang, X.B.; Zhang, L.; Xu, X.X. local government land lease, infrastructure investment and local economic growth. China Ind. Econ. 2014, 7, 31–43. [Google Scholar]

- Peng, L.; Thibodeau, T.G. Government interference and the efficiency of the land market in China. J. Real Estate Financ. Econ. 2012, 45, 919–938. [Google Scholar] [CrossRef]

- Ge, Y.; Cen, S.T. Land contributions to the supernormal development of infrastructure in China. Econ. Res. J. 2017, 2, 35–51. [Google Scholar]

- Buxton, M.; Taylor, E. Urban land supply, governance and the pricing of land. Urban Policy Res. 2011, 29, 5–22. [Google Scholar] [CrossRef]

- Rong, Z. Tudi Tiaokong Zhong de Zhongyang Yu Difang Boyi: Zhengce Bianqian de Zhengzhi Jingjixue Fenxi [Central Local Gaming in the Regulation and Control of Land: A Political Economic Analysis of Policy Change]; Zhongguo shehui kexue chubanshe: Beijing, China, 2010. [Google Scholar]

- Broitman, D.; Koomen, E. Residential density change: Densification and urban expansion. Comput. Environ. Urban Syst. 2015, 54, 32–46. [Google Scholar] [CrossRef]

- Ministry of Finance of the People’s Republic of China. Available online: http://www.mof.gov.cn/was5/web/czb/wassearch.jsp (accessed on 31 October 2018).

- Ye, L.; Wu, A.M. Urbanization, Land Development, and Land Financing: Evidence from Chinese Cities. J. Urban Aff. 2014, 36, 354–368. [Google Scholar] [CrossRef]

- He, C.; Zhou, Y.; Huang, Z. Fiscal decentralization, political centralization, and land urbanization in China. Urban Geogr. 2016, 37, 436–457. [Google Scholar] [CrossRef]

- Zhang, L.; Nian, Y.W.; Liu, J.J. Land market fluctuations and local government debts: Evidence from the municipal investment bonds in China. China Econ. Q. 2018, 3, 1103–1126. [Google Scholar]

- Lichtenberg, E.; Ding, C.R. Land and urban economic growth in China. J. Reg. Sci. 2011, 51, 299–317. [Google Scholar]

- Huang, Z.; Du, X. Strategic interaction in local governments’ industrial land supply: Evidence from China. Urban Stud. 2017, 54, 1328–1346. [Google Scholar] [CrossRef]

- Report on Foreign Investment in China (2018). Available online: http://images.mofcom.gov.cn/wzs/201810/20181009090547996.pdf (accessed on 12 January 2019).

- Barro, R.J. Government spending in a simple model of endogenous growth. J. Political Econ. 1990, 98, S103–S125. [Google Scholar] [CrossRef]

- Demetriades, P.O.; Mamuneas, T.P.; Mamuneas, T. Intertemporal Output and Employment Effects of Public Infrastructure Capital: Evidence from 12 OECD Economies. Econ. J. 2000, 110, 687–712. [Google Scholar] [CrossRef]

- Tao, R.; Yuan, F.; Cao, G.Z. Regional competition, land transfer and local finance effect. J. World Econ. 2007, 10, 15–27. [Google Scholar]

- Li, Y.G.; Luo, H.Y. Does land resource misallocation hinder the upgrading of industrial structure? Empirical evidence from Chinese 35 large and medium-sized cities. J. Financ. Econ. 2017, 9, 110–121. [Google Scholar]

- Égert, B.; Koźluk, T.; Sutherland, D. Infrastructure and Growth: Empirical Evidence. CESIFO 2009. [Google Scholar]

- Bougheas, S.; Demetriades, P.O.; Mamuneas, T.P. Infrastructure, specialization, and economic growth. Can. J. Econ./Rev. Can. D’économique 2000, 33, 506–522. [Google Scholar] [CrossRef]

- Seto, K.C.; Fragkias, M.; Güneralp, B.; Reilly, M.K. A Meta-Analysis of Global Urban Land Expansion. PLoS ONE 2011, 6, e23777. [Google Scholar] [CrossRef] [PubMed]

- Huang, Z.J.; He, C.F.; Zhu, S.J. Do China’s economic development zones improve land use efficiency? The effects of selection, factor accumulation and agglomeration. Landsc. Urban Plan. 2017, 162, 145–156. [Google Scholar] [CrossRef]

- Lin, L.; Ye, Z.; Gan, M.; Shahtahmassebi, A.R.; Weston, M.; Deng, J.; Lu, S.; Wang, K. Quality Perspective on the Dynamic Balance of Cultivated Land in Wenzhou, China. Sustainability 2017, 9, 95. [Google Scholar] [CrossRef]

- Liu, L.; Xu, X.; Chen, X. Assessing the impact of urban expansion on potential crop yield in China during 1990–2010. Food Secur. 2014, 7, 33–43. [Google Scholar] [CrossRef]

- Tan, R.; Qu, F.; Heerink, N.; Mettepenningen, E. Rural to urban land conversion in China—How large is the over-conversion and what are its welfare implications? China Econ. Rev. 2011, 22, 474–484. [Google Scholar] [CrossRef]

- Feng, X. Local Government Debt and Municipal Bonds in China: Problems and a Framework of Rules. Cph. J. Asian Stud. 2014, 31, 23. [Google Scholar] [CrossRef]

- Du, J.; Peiser, R.B. Land supply, pricing and local governments’ land hoarding in China. Reg. Sci. Urban Econ. 2014, 48, 180–189. [Google Scholar] [CrossRef]

- He, C.F.; Huang, Z.J.; Wang, R. Land use change and economic growth in urban China: A structural equation analysis. Urban Stud. 2014, 51, 2880–2898. [Google Scholar] [CrossRef]

- Liu, S.Y. Risks and reform of land-based development model. Int. Econ. Rev. 2012, 2, 92–109. [Google Scholar]

- Yan, J.H. Land mortgage, bank loans and financial risks: Theoretical, empirical and policy analysis. China Land Sci. 2007, 1, 17–23. [Google Scholar]

- Woo, W.T. The Necessary Demand-Side Supplement to China’s Supply-Side Structural Reform: Termination of the Soft Budget Constraint. SSRN Electron. J. 2016, 1, 139. [Google Scholar] [CrossRef]

- Wang, Y.L.; Zou, X.Q. Land transfer in China: To obtain land revenue or attract business and investment? Econ. Rev. 2016, 5, 68–82. [Google Scholar]

- Yang, Q.J.; Zhuo, P.; Yang, J.D. Industrial land supply and FDI quality bottom line competition. Manag. World 2014, 11, 24–34. [Google Scholar]

- Zhang, S.H.; Yu, Y.Z. Land lease, resource misallocation and total factor productivity. J. Financ. Econ. 2019, 2, 73–85. [Google Scholar]

- Deng, X.; Huang, J.; Rozelle, S.; Uchida, E. Growth, population and industrialization, and urban land expansion of China. J. Urban Econ. 2008, 63, 96–115. [Google Scholar] [CrossRef]

- World Bank. China Data. Available online: https://data.worldbank.org/indicator/AG.LND.AGRI.K2?locations=CN (accessed on 17 December 2018).

- China Land and Resources Statistical Yearbook. Available online: http://tongji.cnki.net/kns55/Navi/HomePage.aspx?id=N2015050178&name=YGTTJ&floor=1 (accessed on 3 February 2019). (In Chinese).

- China City Statistical Yearbook. Available online: http://tongji.cnki.net/kns55/Navi/HomePage.aspx?id=N2010042092&name=YZGCA&floor=1 (accessed on 3 February 2019). (In Chinese).

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econ. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, X.B.; Xu, X.X. Fiscal incentive, political incentive and local officials’ land supply. China Ind. Econ. 2011, 4, 35–43. [Google Scholar]

- Liu, S.Y. China’s Two-Stage Land Reform. Int. Econ. Rev. 2017, 5, 29–56. [Google Scholar]

| Variables | Variable Description | Unit | Mean | SD |

|---|---|---|---|---|

| Dependent variables | Completed investment in fixed assets (completed_inv) | Billion yuan | 48.70 | 112.4 |

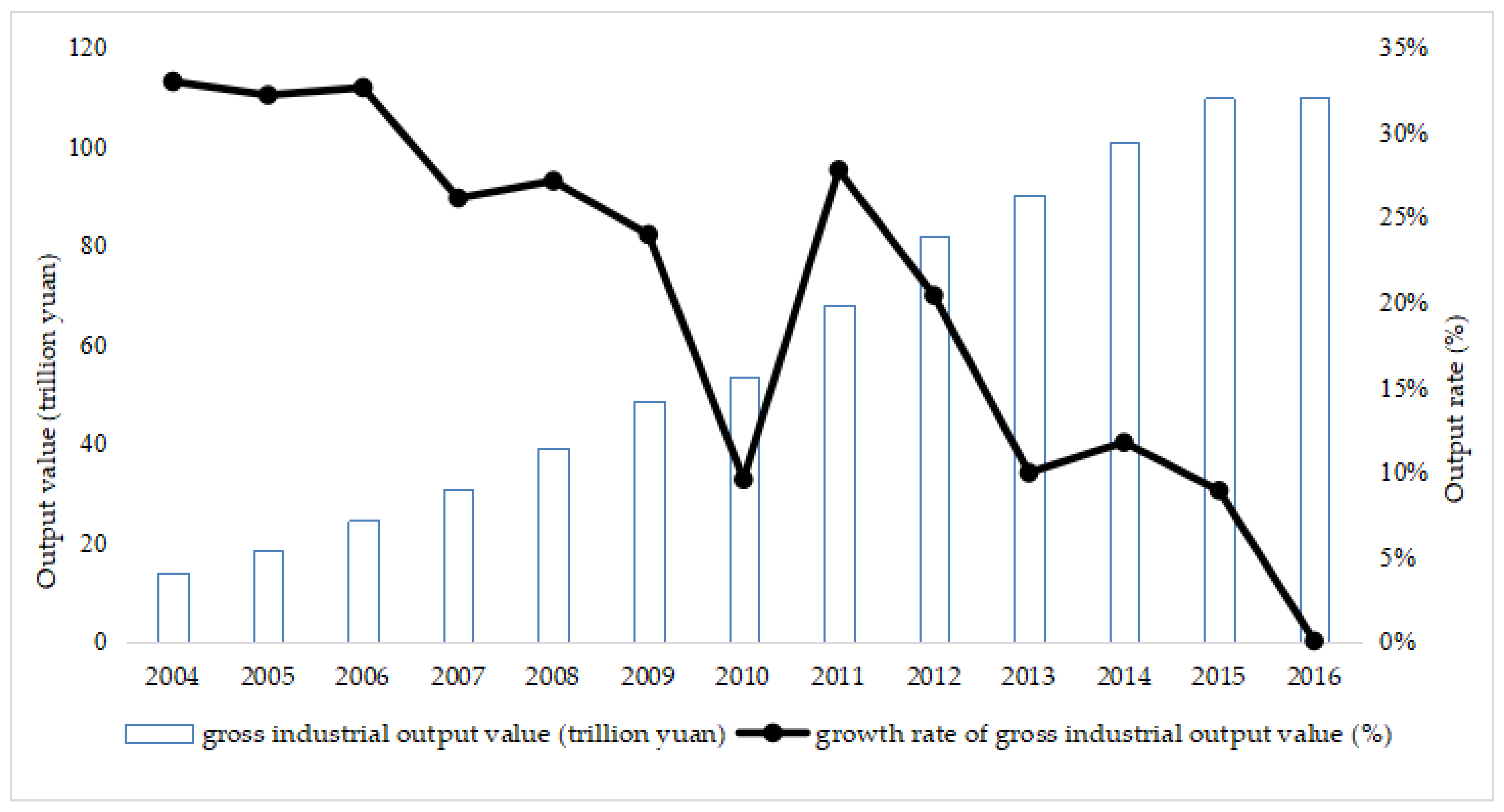

| Gross industrial output value (gross_ind) | Billion yuan | 316.25 | 426.26 | |

| Core independent variables | Urbanized land (urb_land) | Hectare/year | 406.74 | 604.66 |

| Industrial land (ind_land) | Hectare/year | 281.184 | 511.83 | |

| Control variables | Trade dependence (TD) | 0.207 | 0.339 | |

| Foreign direct investment (FDI) | Billion yuan | 5.61 | 12.38 | |

| Urban population density (UPD) | Population/hectare | 458.58 | 330.49 | |

| Financial interrelations ratio (FIR) | 2.01 | 1.01 | ||

| Industrial structure (IS) | % | 36.67 | 8.79 |

| Variables | Complete_inv (Urbanization) | ||

|---|---|---|---|

| FE | DIF-GMM | SYS-GMM | |

| (1) | (2) | (3) | |

| L.complete_inv | 0.376 ** (2.28) | 0.890 *** (19.09) | |

| urb_land | 0.567 * (1.84) | 0.176 ** (2.35) | 0.184 *** (2.71) |

| urb_land2 | −0.001 *** (−2.87) | −0.00027 ** (1.99) | −0.0003 ** (−2.46) |

| TD | −28.54 * (−1.69) | −2.856 ** (−2.01) | −7.56 ** (−2.23) |

| FDI | 2.88 *** (3.92) | 0.641 ** (2.31) | 0.524 ** (2.47) |

| UPD | 0.012 ** (2.46) | 0.0101 * (1.71) | 0.0086 * (1.88) |

| FIR | 10.23 * (1.85) | 1.636 (1.52) | 1.794 (1.58) |

| IS | 0.35 (0.443) | 0.053 (0.91) | 0.103 (0.81) |

| Constant | 6.79 ** (2.00) | 7.38 ** (2.57) | |

| Overall R2 | 0.54 | ||

| AR(2) test | 0.958 | 0.896 | |

| Hansen test | 0.207 | 0.266 | |

| Sample size | 2040 | 2040 | 2040 |

| Variables | Complete_inv (Urbanization) | |

|---|---|---|

| East | Mid-West | |

| (1) | (2) | |

| L.complete_inv | 0.886 *** (20.02) | 0.875 *** (6.71) |

| urb_land | 0.164 *** (3.35) | 0.222 *** (2.89) |

| urb_land2 | 0.00024 *** (4.10) | 0.00027 (0.08) |

| TD | −10.55 ** (−2.50) | −3.828 ** (−2.65) |

| FDI | 0.720 ** (2.06) | 0.353 *** (3.20) |

| UPD | 0.0651 * (1.77) | 0.026 ** (2.29) |

| FIR | 4.04 (1.40) | 1.77 (1.11) |

| IS | 0.15 (1.20) | 0.14 (1.41) |

| Constant | 12.33 ** (2.61) | 9.652 *** (3.23) |

| AR(2) test | 0.972 | 0.900 |

| Hansen test | 0.530 | 0.421 |

| Sample size | 656 | 1384 |

| Variables | Gross_ind (Industrialization) | ||

|---|---|---|---|

| FE | DIF-GMM | SYS-GMM | |

| (1) | (2) | (3) | |

| L.gross_ind | 0.804 *** (12.47) | 0.914 *** (24.25) | |

| Ind_land−2 | 0.903 ** (2.13) | 0.349 (1.10) | 0.385 ** (2.19) |

| Ind_land−22 | −0.0018 *** (−2.99) | −0.00069 *** (−3.01) | −0.0009 *** (−3.41) |

| TD | −15.87 ** (−2.35) | 10.044 ** (1.99) | 10.367 ** (2.12) |

| FDI | 10.36 *** (5.26) | 2.62 ** (2.30) | 2.04 * (1.83) |

| UPD | 0.0739 *** (3.04) | 0.0442 * 1.73) | 0.021 * (1.89) |

| FIR | −10.36 (−1.00) | −1.974 (−0.71) | −0.95 (−0.67) |

| IS | 10.28 *** (5.78) | −2.83 *** (−4.75) | −2.03 *** (−3.21) |

| Constant | 39.270 *** (3.28) | 39.86 *** (3.49) | |

| Overall R2 | 0.52 | ||

| AR(2) test | 0.414 | 0.439 | |

| Hansen test | 0.545 | 0.605 | |

| Sample size | 1530 | 1530 | 1530 |

| Variables | Gross_ind (Industrialization) | |

|---|---|---|

| East | Mid-west | |

| (1) | (2) | |

| L.gross_ind | 0.931 *** (42.22) | 0.793 *** (7.15) |

| Ind_land−2 | 0.554 ** (2.19) | 0.651 ** (2.15) |

| Ind_land−22 | −0.0011 *** (−3.44) | 0.0017 (0.01) |

| TD | 10.191 *** (3.56) | 12.241 ** (2.19) |

| FDI | 1.49 ** (2.23) | 5.065 ** (2.35) |

| UPD | 0.0142 ** (1.97) | 0.029 * (1.81) |

| FIR | −0.558 (−1.08) | −1.198 (−0.96) |

| IS | −2.356 ** (−2.30) | −1.357 *** (−3.96) |

| Constant | 109.43 *** (3.25) | 65.883*** (4.02) |

| AR(2) test | 0.426 | 0.315 |

| Hansen test | 0.604 | 0.403 |

| Sample size | 492 | 1038 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, W.; Song, Y. Is There a Kuznets Curve Effect for China’s Land-Driven Development Mode? Sustainability 2019, 11, 4446. https://doi.org/10.3390/su11164446

Zhang W, Song Y. Is There a Kuznets Curve Effect for China’s Land-Driven Development Mode? Sustainability. 2019; 11(16):4446. https://doi.org/10.3390/su11164446

Chicago/Turabian StyleZhang, Weifan, and Yan Song. 2019. "Is There a Kuznets Curve Effect for China’s Land-Driven Development Mode?" Sustainability 11, no. 16: 4446. https://doi.org/10.3390/su11164446

APA StyleZhang, W., & Song, Y. (2019). Is There a Kuznets Curve Effect for China’s Land-Driven Development Mode? Sustainability, 11(16), 4446. https://doi.org/10.3390/su11164446