Does Fiscal Policy Promote Third-Party Environmental Pollution Control in China? An Evolutionary Game Theoretical Approach

Abstract

1. Introduction

- (1)

- Could the implementation of fiscal policies promote third-party environmental pollution control? How do the actions of the government, the polluting enterprise and the third-party enterprise interact?

- (2)

- What other important factors influence the behavior of the government, the polluting enterprise and the third-party enterprise? How do these factors promote third-party environmental pollution control?

- (3)

- What fiscal policies and suggestions could be proposed to promote third-party environmental pollution control in China?

2. Theory and Methodology

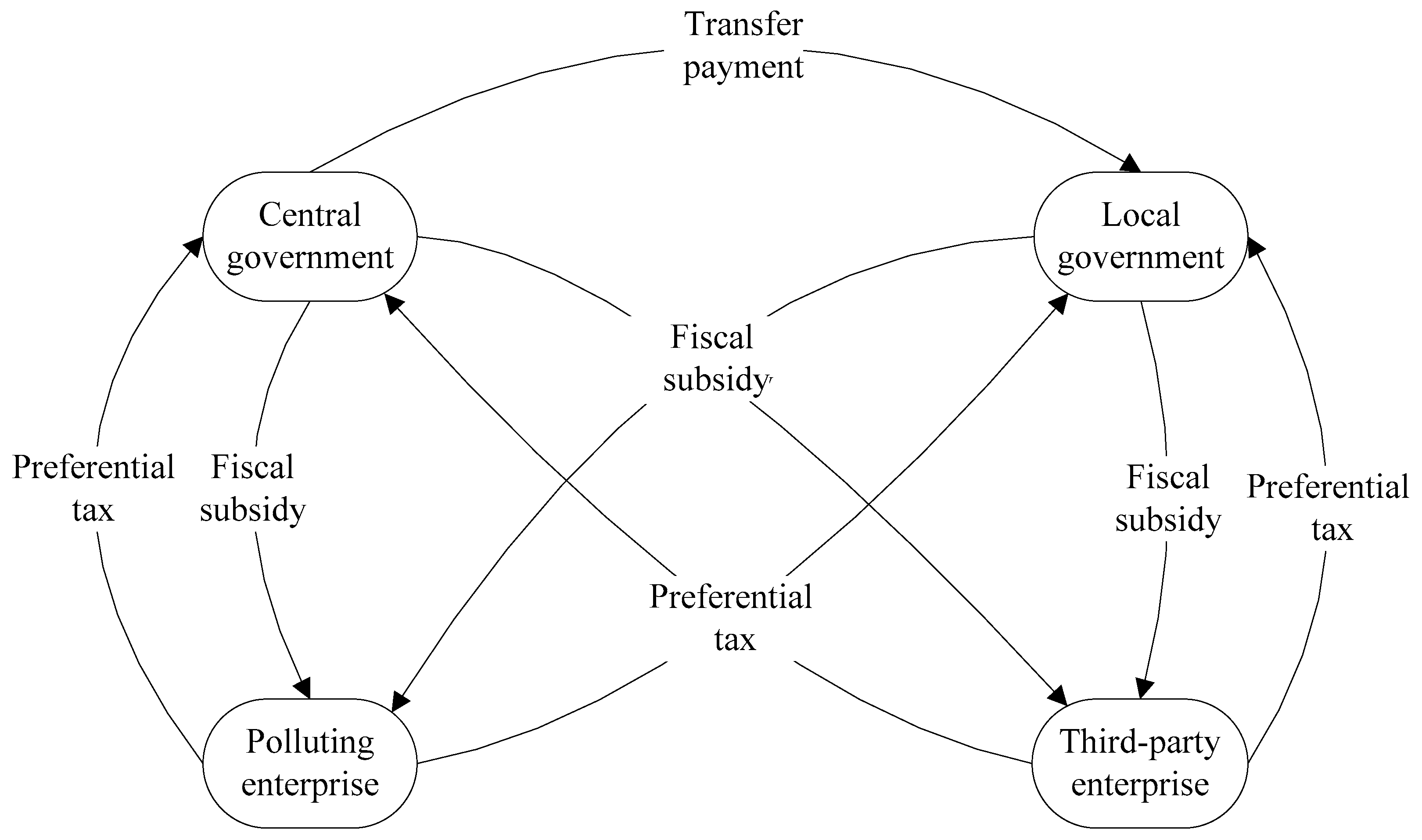

2.1. Acting Paths of Fiscal Policies on Third-Party Environmental Pollution Control

2.2. Research Methodology

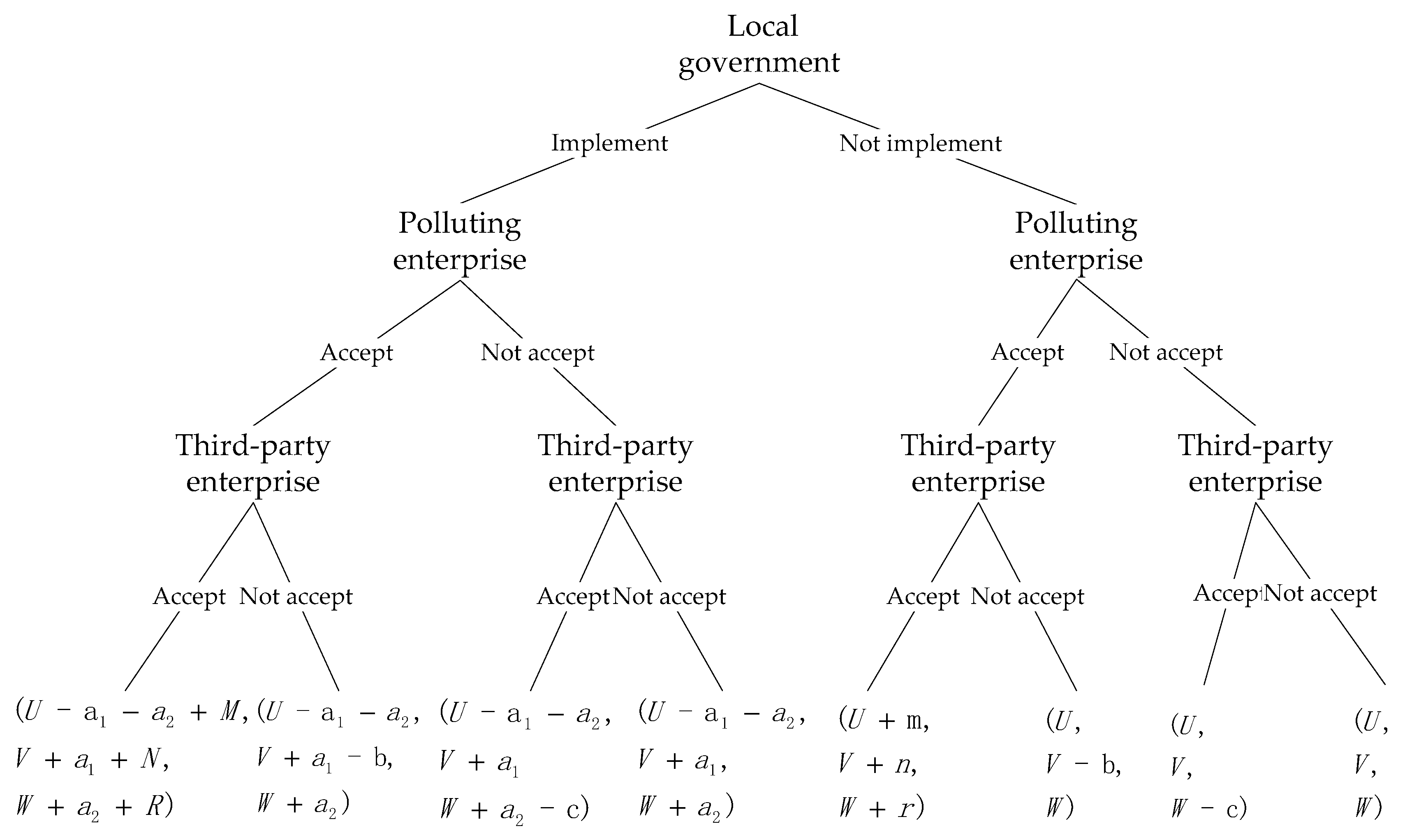

3. Basic Assumptions and Modeling

- (1)

- When the local government does not implement a fiscal expenditure policy and neither the polluting enterprise nor the third-party enterprise accepts the policy, the three subjects gain , respectively.

- (2)

- When the local government implements a fiscal expenditure policy for the polluting enterprise and the third-party enterprise with the intensity of and , respectively, and the polluting enterprise and the third-party enterprise accept the fiscal policy and improve the demand and supply for third-party control, the three parties will gain , , and , respectively. represent the benefits that the local government, the polluting enterprise and the third-party enterprise obtained from the third-party control. For example, represents a higher tax revenue, reduced regulatory costs and improved social welfare; represents a reduction in the pollution control cost and improvement in enterprise competitiveness; and represents a higher economic benefit or technological progress.

- (3)

- When the local government implements a fiscal expenditure policy, the polluting enterprise accepts the fiscal policy and improves the demand for third-party control, and the third-party enterprise accepts the fiscal subsidy without improving the supply for third-party control, the benefit to the local government is , the benefit to the polluting enterprise is under the assumption that the search risk of the polluting enterprise increasing the demand for third-party control is , and the benefit to the third-party enterprise increases to .

- (4)

- When the local government implements a fiscal expenditure policy for third-party environmental pollution control, the third-party enterprise accepts the fiscal policy and improves the supply for third-party control, and the polluting enterprise accepts the fiscal subsidy without improving the demand for third-party control, the benefit to the local government is , the benefit to the polluting enterprise increases to , and the benefit to the third-party enterprise is under the assumption that the risk the third-party enterprise incurs when increasing the supply of third-party control is c.

- (5)

- When the local government implements a fiscal expenditure policy and neither the polluting enterprise nor the third-party enterprise accepts the policy, the three parties will gain , respectively.

- (6)

- When the local government does not implement a fiscal expenditure policy but the polluting enterprise and third-party enterprise believe that the government will implement the fiscal policy and accordingly improve the demand and supply for third-party control, the three parties will gain , , and , respectively. Simultaneously, the trading volume of the third-party control market is lower than that of the fiscal policy implementation. The revenue increment of the three parties should be lower than the benefit when the fiscal policy is implemented, i.e., .

- (7)

- When the local government does not implement a fiscal expenditure policy and only the polluting enterprise believes that the government will implement a fiscal policy and chooses third-party control, the benefit to the local government is , the benefit to the polluting enterprise is , and the benefit to the third-party enterprise is .

- (8)

- When the local government does not implement a fiscal expenditure policy and only the third-party enterprise believes that the government will implement a fiscal policy and accordingly improves the supply for third-party control, the benefit to the local government is , the benefit to the polluting enterprise is , and the benefit to the third-party enterprise is .

- (9)

- Suppose that . Since fiscal expenditure plays an expansionary role in the GDP, increasing the fiscal expenditure can expand the aggregate demand with a multiplier greater than 1. In the long-term, third-party environmental pollution control will yield increasing taxes, reduce the regulatory costs and increase social welfare for the local government, i.e., .

4. Evolutionary Path and Simulation Analysis

4.1. Replicator Dynamics Analysis

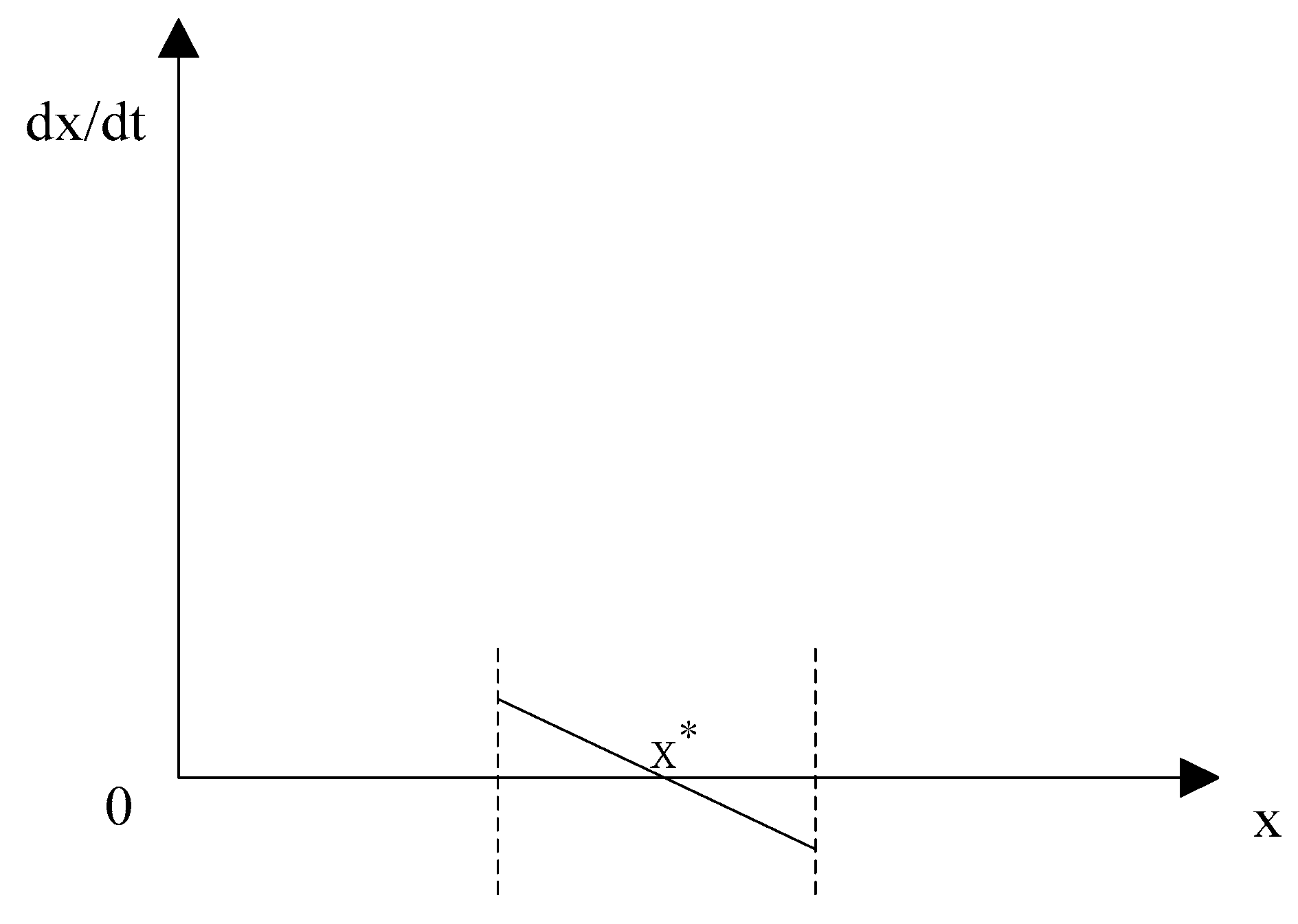

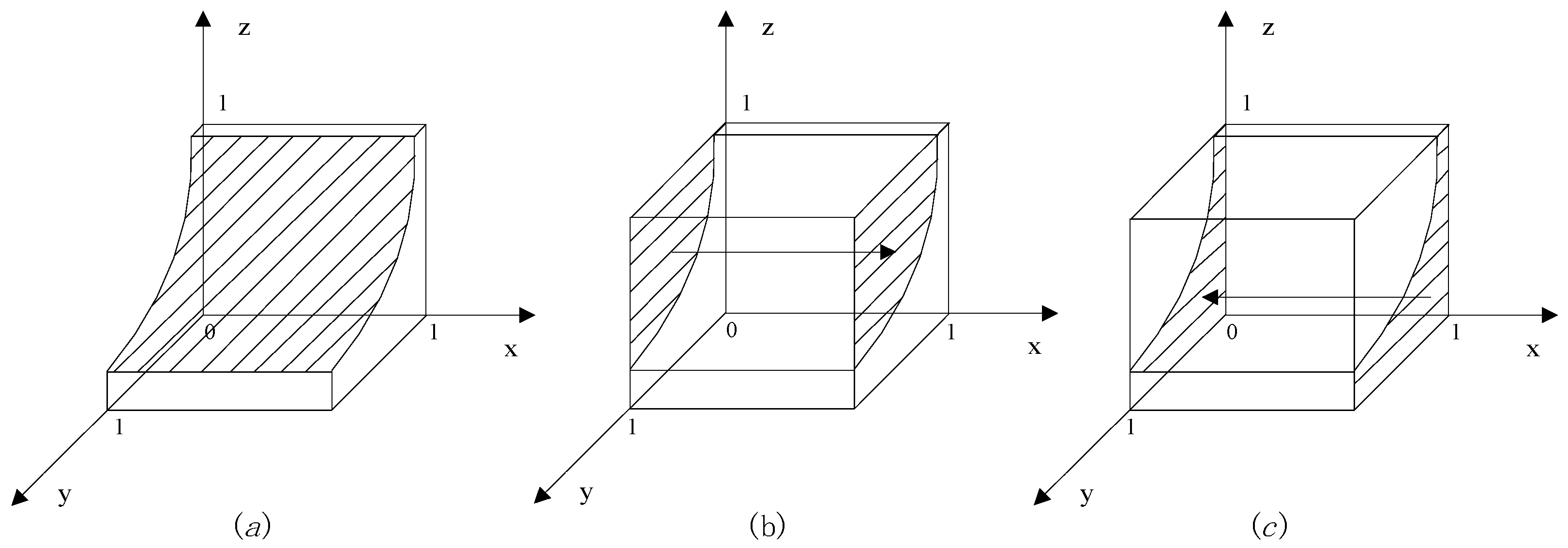

- When , , suggesting that regardless of the proportion of the local government implementing the fiscal policy, the strategy will not change over time as shown in Figure 5a.

- When , let ; and are the two stability points of the local government.

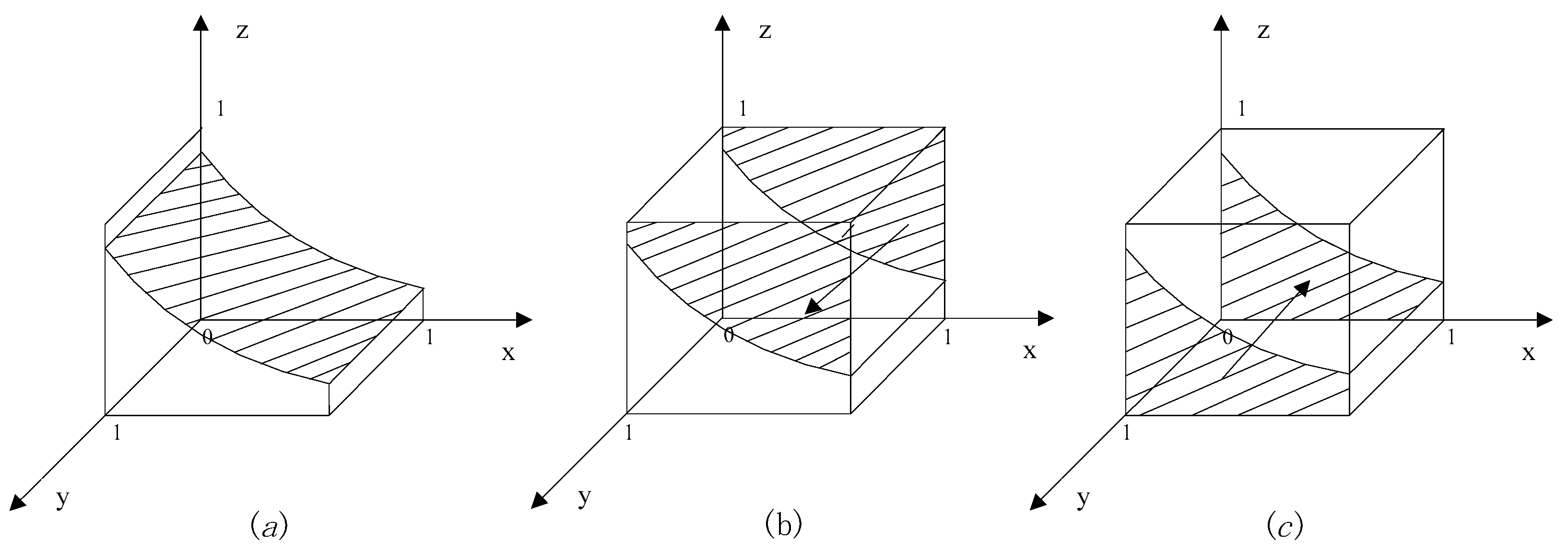

- When , , suggesting that regardless of the proportion of the polluting enterprise choosing to accept the fiscal policy, the strategy will not change over time as shown in Figure 6a.

- When , let ; are the two stability points of the polluting enterprise.

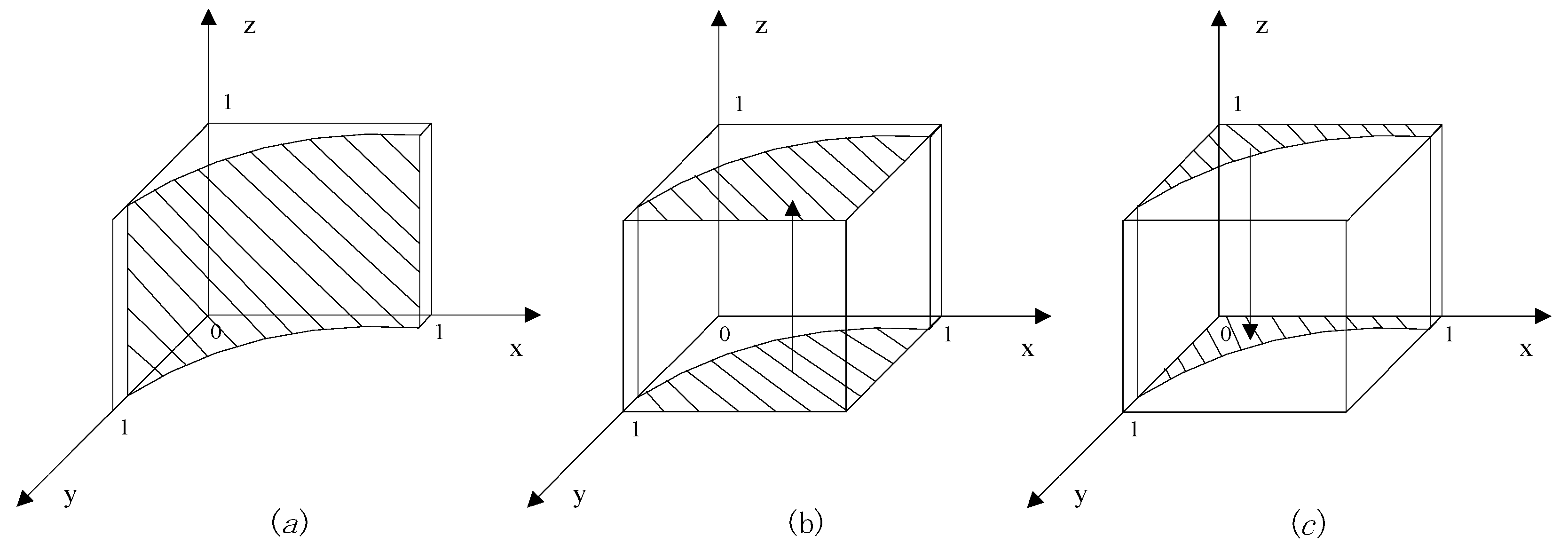

- When , , suggesting that regardless of the proportion of the third-party enterprise choosing to accept the fiscal policy, the strategy will not change over time as shown in Figure 7a.

- When , let are the two stability points of the third-party enterprise.

4.2. Stability of the Evolutionary Strategies Analysis

4.3. Numerical Simulation

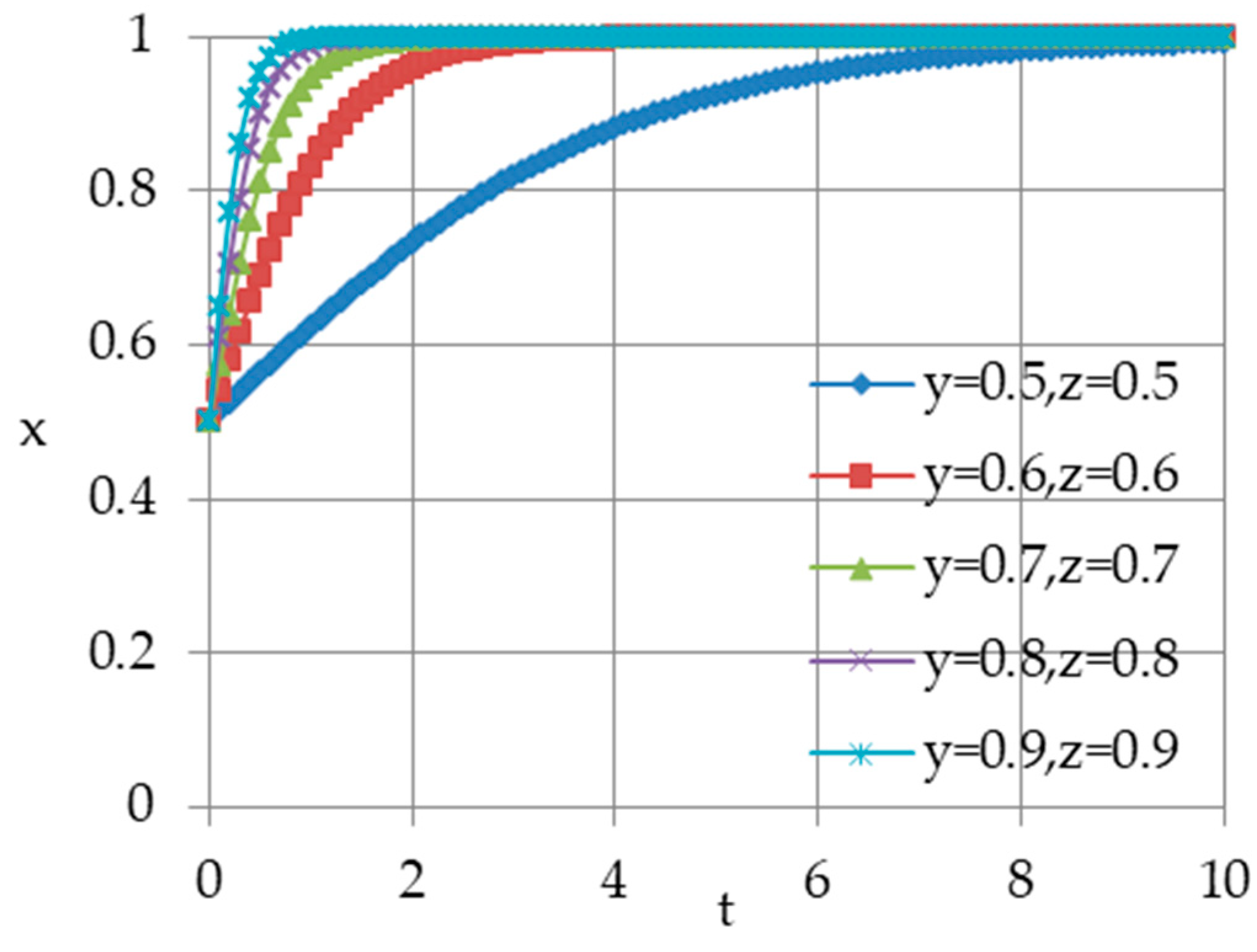

- (1)

- For the fixed x initial value (e.g., x = 0.5) to achieve the ideal state of equilibrium, it needs to satisfy . From the random initial value of y and z, the evolution curve of x () is shown in Figure 8. As shown, the different initial values of y and z have an impact on the convergence rate of x, but x still monotonically increases and converges to 1, indicating that the proportion of the local governments choosing the “implementation” strategy continues to increase over time until all local governments eventually choose “implementation”.

- (2)

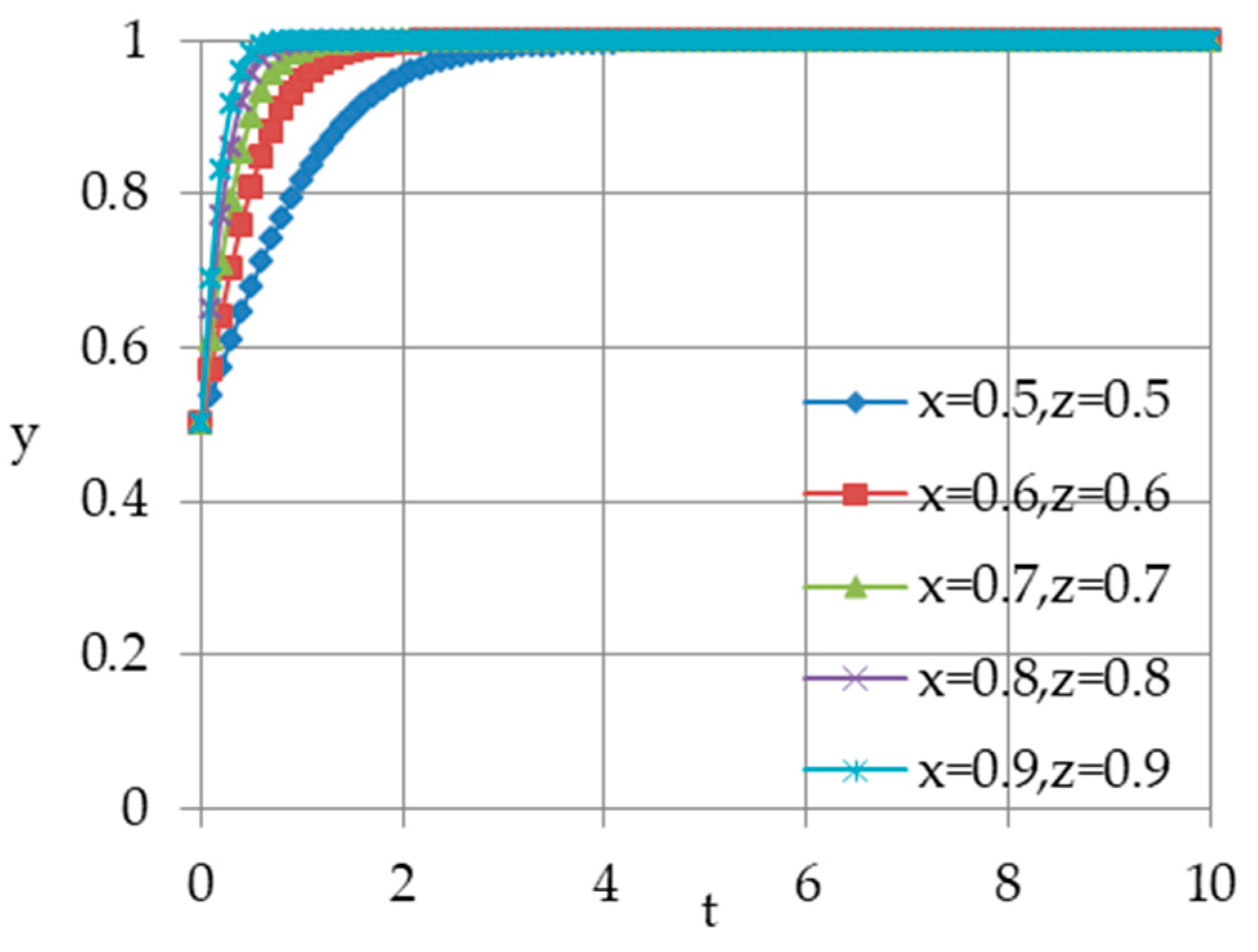

- For the fixed y initial value (e.g., y = 0.5) to achieve the ideal state of equilibrium, it needs to satisfy . From a random initial value of x and z, the evolution curve of y () is shown in Figure 9. As shown, the different initial values of x and z have an impact on the convergence rate of y, but y still monotonically increases and converges to 1, indicating that the proportion of the polluting enterprises choosing the “acceptance” strategy continues to increase over time until all polluting enterprises eventually choose “acceptance”.

- (3)

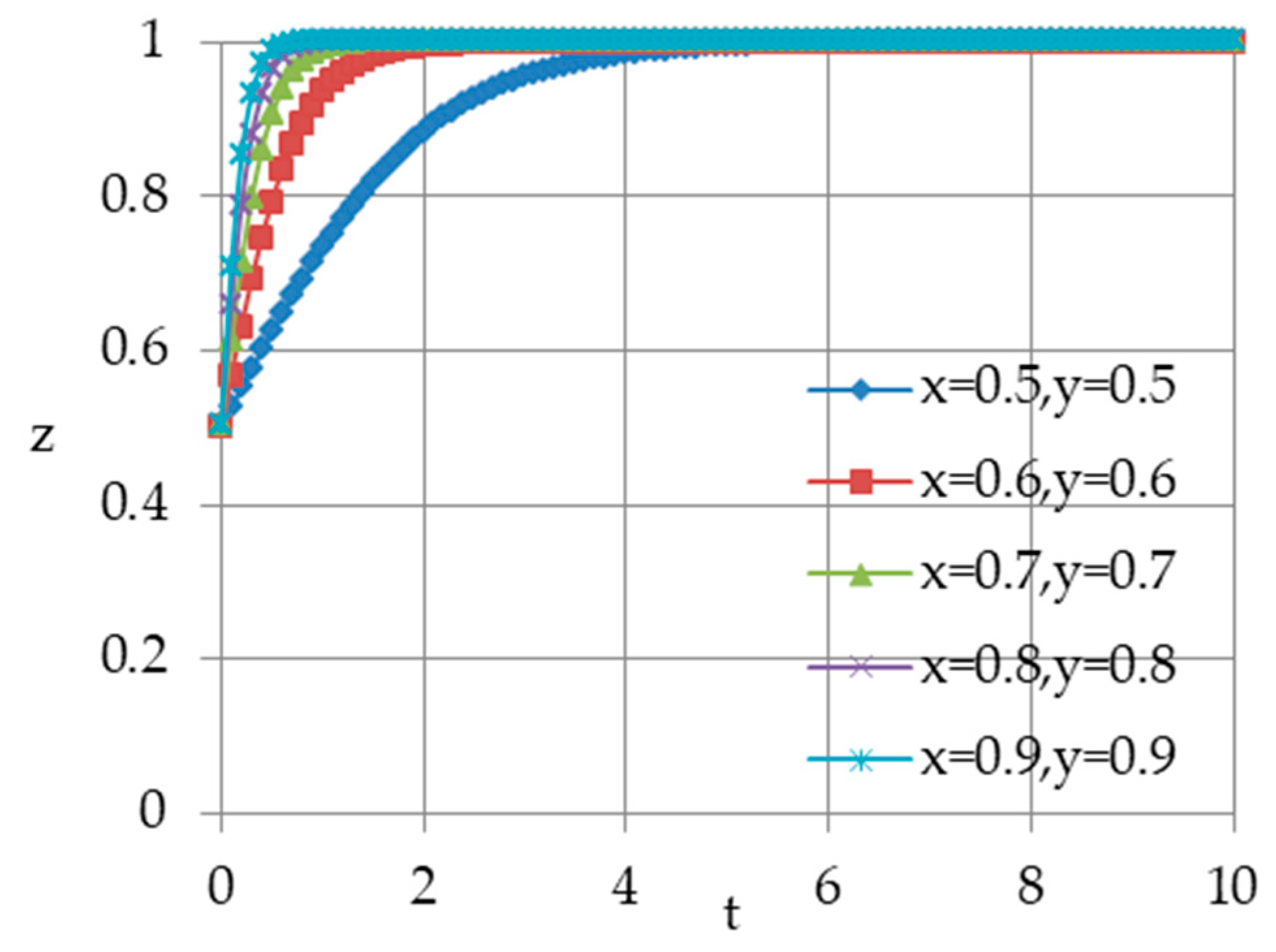

- For the fixed z initial value (e.g., z = 0.5) to achieve the ideal state of equilibrium, it needs to satisfy . From a random initial value of x and y, the evolution curve of z () is shown in Figure 10. As shown, the different initial values of x and y have an impact on the convergence rate of z, but y still monotonically increases and converges to 1, indicating that the proportion of the third-party enterprises choosing the “acceptance” strategy continues to increase over time until all third-party enterprises eventually choose “acceptance”.

5. Parameter Analysis

- (1)

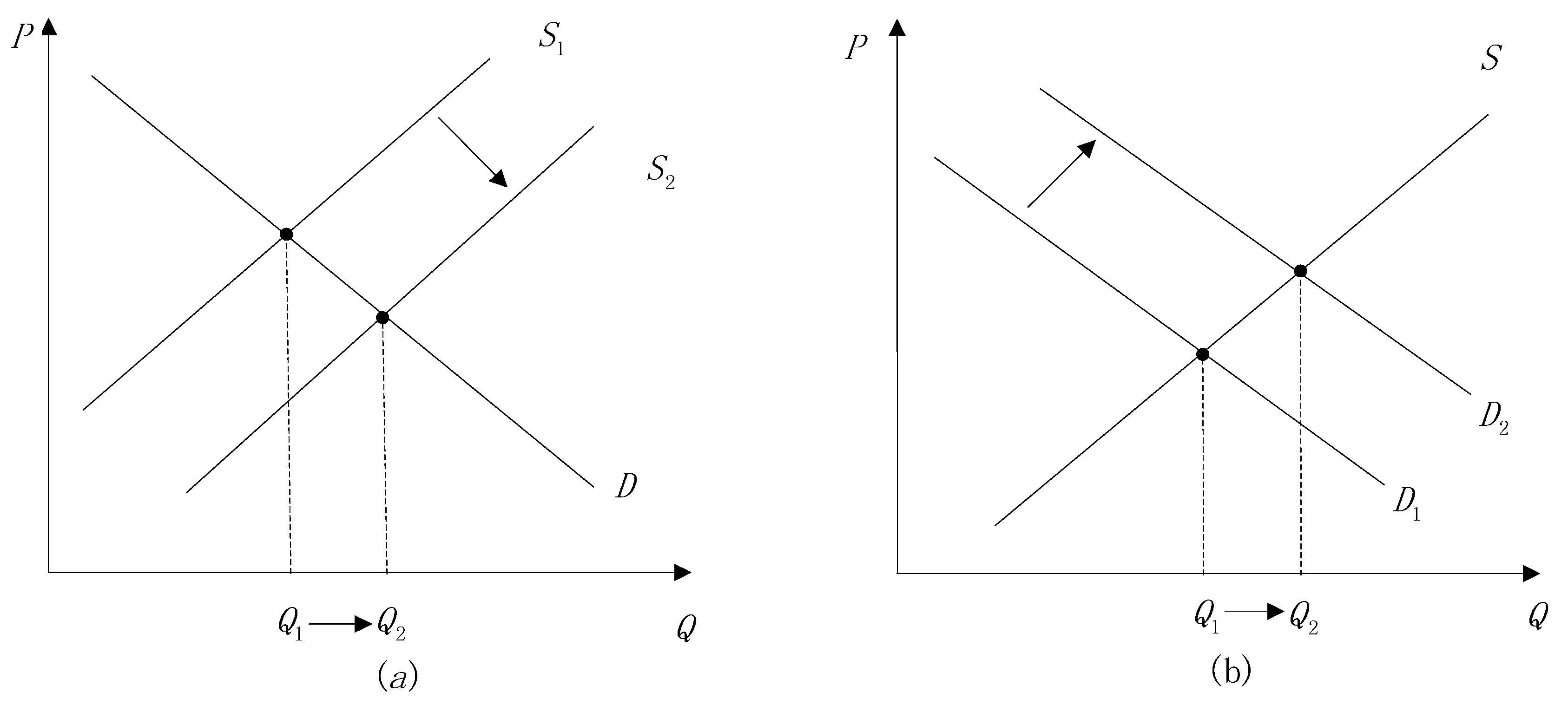

- Parameter represents the fiscal expenditure policy formulated by the local government to encourage the polluting enterprise and third-party enterprise to choose third-party control. Solving a partial derivative of with respect to parameter yields . Therefore, the change in parameter will affect the decision-making behaviors of the three parties under the premise that the other parameters remain unchanged.

- When , the local government will choose to implement the fiscal policy. Increasing leads to decreasing and . Thus, moves inward, leading the probability of to increase. Therefore, the possibility of the local government choosing to implement fiscal policy will increase.

- When , the polluting enterprise will accept the fiscal policy and choose third-party control. Increasing leads to an increase in and a decrease in . However, the proportion of the increase in and decrease in determines the immobility of . Therefore, the possibility of the polluting enterprise choosing to accept the fiscal policy will be unchanged.

- When , the third-party enterprise will accept the fiscal policy and increase the supply for third-party control. Increasing leads to an increase in and a decrease in . However, the proportion of the increase in and decrease in determines the immobility of . Therefore, the possibility that the third-party enterprise chooses to accept the fiscal policy will be unchanged.

- (2)

- Parameter represents the risk faced by the polluting enterprise when choosing third-party control without expanding the supply of third-party enterprises. Solving a partial derivative of with respect to parameter yields . Therefore, the change in parameter will affect the decision-making behaviors of the three parties under the premise that the other parameters remain unchanged.

- When , the local government will choose to implement the fiscal policy. Increasing leads to a decrease in and an increase in . However, the proportion of the decrease in and increase in determines the immobility of . Therefore, the possibility of the local government choosing to implement the fiscal policy will increase.

- When , the polluting enterprise will accept the fiscal policy and choose third-party control. Increasing leads to increases in and . Thus moves outward, leading to the probability that will decrease. Therefore, the possibility of the polluting enterprise choosing to accept the fiscal policy will decrease.

- When , the third-party enterprise will accept the fiscal policy and increase the supply for third-party control. Increasing leads to an increase in and a decrease in . However, the proportion of the increase in and decrease in determines the immobility of . Therefore, the possibility that the third-party enterprise chooses to accept the fiscal policy will be unchanged.

- (3)

- Parameter represents the risk faced by the third-party enterprise when expanding the supply of third-party control without expanding the demand. Solving a partial derivative of with respect to parameter yields . Therefore, the change in parameter will affect the decision-making behaviors of the three parties under the premise that the other parameters remain unchanged.

- When , the local government will choose to implement the fiscal policy. The change in does not affect the position of . Therefore, the possibility that the local government chooses to implement the fiscal policy will be unchanged.

- When , the polluting enterprise will accept the fiscal policy and choose third-party control. The change in does not affect the position of . Therefore, the possibility of the polluting enterprise choosing to accept the fiscal policy will be unchanged.

- When , the third-party enterprise will accept the fiscal policy and increase the supply for third-party control. Increasing leads to increases in and . Thus, moves outward, leading the probability of to decrease. Therefore, the possibility of the third-party enterprise choosing to accept the fiscal policy will decrease.

- (4)

- Parameter represents the local government’s benefits when implementing the fiscal policy and when the polluting enterprise and the third-party enterprise expand the demand and supply of third-party control. Solving a partial derivative of with respect to parameter yields . Therefore, the change in parameter will affect the decision-making behaviors of the three parties under the premise that the other parameters remain unchanged.

- When , the local government will choose to implement the fiscal policy. Increasing leads to a decrease in and . Thus, moves inward, leading the probability o to increase. Therefore, the possibility that the local government chooses to implement the fiscal policy will increase.

- When , the polluting enterprise will accept the fiscal policy and choose third-party control. Increasing leads to an increase in and a decrease in . The change in does not affect the position of . Therefore, the possibility of the polluting enterprise choosing to accept the fiscal policy will be unchanged.

- When , the third-party enterprise will accept the fiscal policy and increase the supply for third-party control. Increasing leads to an increase in and a decrease in . The change in does not affect the position of . Therefore, the possibility of the third-party enterprise choosing to accept the fiscal policy will decrease.

6. Conclusions and Policy Implications

6.1. Conclusions

- (1)

- When the local government implements a fiscal policy for third-party environmental pollution control, the decisions of the local government, the polluting enterprise and the third-party enterprise influence each other. The choices of third-party governance made by the polluting enterprise and the third-party enterprise are affected by the fiscal policy.

- (2)

- The strength of the fiscal policy, the risks to the polluting enterprise and the third-party enterprise, and the benefit to the local government from third-party control affect the speed of the convergence of the local government, the polluting enterprise and the third-party enterprise towards the ideal ESS (implementation, acceptance, acceptance). Improving the strength of the fiscal policy, reducing the risks to the polluting enterprise and third-party enterprise, and improving the benefit to the local government are conducive for promoting third-party environmental pollution control.

6.2. Policy Implications

6.3. Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Wang, F.; Wang, K. Assessing the Effect of Eco-City Practices on Urban Sustainability Using an Extended Ecological Footprint Model: A Case Study in Xi’ an, China. Sustainability 2017, 9, 1591. [Google Scholar] [CrossRef]

- Li, L.; Yang, W. Total Factor Efficiency Study on China’s Industrial Coal Input and Wastewater Control with Dual Target Variables. Sustainability 2018, 10, 2121. [Google Scholar] [CrossRef]

- Xie, H.; Chen, Q.; Lu, F.; Wang, W.; Yao, G.; Yu, J. Spatial-temporal disparities and influencing factors of total-factor green use efficiency of industrial land in China. J. Clean. Prod. 2019, 207, 1047–1058. [Google Scholar] [CrossRef]

- Yang, W.; Li, L. Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China. Sustainability 2017, 9, 912. [Google Scholar] [CrossRef]

- Liu, K.; Lin, B. Research on influencing factors of environmental pollution in China: A spatial econometric analysis. J. Clean. Prod. 2019, 206, 356–364. [Google Scholar] [CrossRef]

- Long, X.; Ji, X. Economic Growth Quality, Environmental Sustainability, and Social Welfare in China – Provincial Assessment Based on Genuine Progress Indicator (GPI). Ecol. Econ. 2019, 159, 157–176. [Google Scholar] [CrossRef]

- Hardin, G. The Tragedy of the Common. Science 1968, 162, 1243–1248. [Google Scholar] [PubMed]

- Tiebout, C.M. A Pure Theory of Local Expenditures. J. Polit. Econ. 1956, 64, 416–424. [Google Scholar] [CrossRef]

- Glazer, A. Local regulation may be excessively stringent. Reg. Sci. Urban Econ. 1999, 29, 553–558. [Google Scholar] [CrossRef]

- Sigman, H. Letting states do the dirty work: State responsibility for federal environmental regulation. Natl. Tax J. 2003, 56, 107–122. [Google Scholar] [CrossRef]

- Liu, Q. Fiscal Decentralization, Governmental Incentives and Environmental Pollution Abatement. Econ. Survey 2013, 1, 127–132. (In Chinese) [Google Scholar]

- Li, H.; Zhou, L. Political Turnover and Economic Performance: The Incentive Role of Personnel Control in China. J. Public Econ. 2005, 89, 1743–1762. [Google Scholar] [CrossRef]

- Costanza, R.; Cumberland, J.H.; Daly, H. An Introduction to Ecological Economics, 2nd ed.; The Chemical Rubber Company Press: Boca Raton, FA, USA, 2014. [Google Scholar]

- Zhou, L. A study on promotion modes of local officials in China. Econ. Res. 2007, 7, 36–50. (In Chinese) [Google Scholar]

- Liu, Y.; Martinez-Vazquez, J. Public Input Competition under Stackelberg Equilibrium: A Note. J. Public Econ. Theory 2015, 17, 1022–1037. [Google Scholar] [CrossRef][Green Version]

- Rauscher, M. Economic Growth and Tax-competition Leviathans. Int. Tax Public Finan. 2005, 12, 457–474. [Google Scholar] [CrossRef]

- Abdessalam, A.H.; Kamwa, E. Tax Competition and Determination of the Quality of Public Goods. Econo. Open-Access 2014, 8, 1–20. [Google Scholar] [CrossRef]

- Xu, X.; Li, H.; Wang, M. Regional integration, economic growth and political promotion. Economics (Quarterly) 2007, 4, 1075–1096. (In Chinese) [Google Scholar]

- Oates, W.E.; Schwab, R.M. The Window Tax: A Case Study in Excess Burden. J. Econ. Perspect. 2015, 29, 163–180. [Google Scholar] [CrossRef]

- Xu, S.; Lu, Y.; Chen, P.; Gao, J. Research on the current situation and development trend of financial expenditure for environmental protection. Ecological Economy 2018, 34, 71–76. (In Chinese) [Google Scholar]

- Cui, Y.; Liu, X. Game analysis of environmental pollution control strategies between local governments in China based on the perspective of government social welfare goals. Theory Reform 2009, 6, 62–65. (In Chinese) [Google Scholar]

- Zhang, Z.; Zhao, W. Research on Financial Pressure, Poverty Governance, and Environmental Pollution in China. Sustainability 2018, 10, 1834. [Google Scholar] [CrossRef]

- Lenka, S.; Tatiana, K.; Jiřina, J. Bridging theories on environmental governance: Insights from free-market approaches and institutional ecological economics perspectives. Ecol. Econ. 2010, 69, 1368–1372. [Google Scholar]

- Vatn, A. Environmental Governance–From Public to Private? Ecol. Econ. 2018, 148, 170–177. [Google Scholar] [CrossRef]

- The Third Plenary Session of the 18th Central Committee of the People’s Republic of China. Decision of the CPC Central Committee on Several Major Issues Concerning Comprehensively Deepening Reform. Available online: http://www.gov.cn/jrzg/2013-11/15/content_2528179.htm (accessed on 12 November 2013).

- General Office of the State Council of China. Opinions on Implementing Third-Party Environmental Pollution Control. Available online: http://www.gov.cn/xinwen/2015-01/14/content_2804015.htm (accessed on 14 January 2015).

- Cao, L. Market players, performance distribution and third-party treatment of environmental pollution. Reform 2017, 10, 95–104. (In Chinese) [Google Scholar]

- Li, C.; Mao, S. The structural obstacles to the third-party treatment of environmental pollution in China. Environmental Protection 2018, 46, 46–50. (In Chinese) [Google Scholar]

- Ge, C.; Cheng, C.; Dong, Z. Problems and development ideas of third-party environmental pollution control. Environ. Prot. 2014, 20, 28–30. (In Chinese) [Google Scholar]

- Marshall, A. The Principles of Economics; Macmillan: London, UK, 1890. [Google Scholar]

- Pigou. The Economics of Welfare; Macmillan Co: London, UK, 1920. [Google Scholar]

- Paul, S.A. The Pure Theory of Public Expenditure. Rev. Econ. Stat. 1954, 36, 387–389. [Google Scholar]

- Nash, R. Wilderness and the American Mind; Yale University Press: New Haven, CO, USA, 2001. [Google Scholar]

- Cioc, M. The Rhine: An Eco-Biography, 1815–2000; University of Washington Press: Washington, WA, USA, 2002. [Google Scholar]

- Lee, S.Y. Drivers for the participation of small and medium-sized suppliers in green supply chain initiatives. Supply Chain Manag. 2008, 13, 185–198. [Google Scholar] [CrossRef]

- Alm, J.; Banzhaf, H.S. Designing economic instruments for the environment in a decentralized fiscal system. J. Econ. Surv. 2012, 26, 177–202. [Google Scholar] [CrossRef]

- Vatn, A. Markets in environmental governance–From theory to practice. Ecol. Econ. 2015, 117, 225–233. [Google Scholar] [CrossRef]

- Ministry of Finance, Administration of Taxation, Development and Reform Commission, Ministry of Ecology and Environment of the People’s Republic of China No. 60 Notice in 2019. Available online: http://szs.mof.gov.cn/zhengwuxinxi/zhengcefabu/201904/t20190425_3234504.html (accessed on 13 April 2019).

- Zhao, Y.; Lu, Y.; Xin, L. Practice and prospect of financial fund policy for promoting the development of environmental protection industry. China Popul. Res. Environ. 2012, S1, 20–23. (In Chinese) [Google Scholar]

- Liu, W. Discussion on the construction path of third-party environmental pollution control industry investment fund in China. Environ. Prot. 2014, 42, 23–27. (In Chinese) [Google Scholar]

- Luo, J. Suggestions on the development and improvement of third-party environmental pollution control. Environ. Prot. 2014, 20, 16–19. (In Chinese) [Google Scholar]

- Liu, C. Regulation, interaction and third-party control of environmental pollution. China Population Res. Environ. 2015, 25, 96–104. (In Chinese) [Google Scholar]

- Friedman, D. Evolutionary Games in Economics. Econometrica 1991, 59, 637. [Google Scholar] [CrossRef]

- Friedman, D. On economic application of evolutionary game theory. J. Evol. Econ. 1998, 8, 15–43. [Google Scholar] [CrossRef]

- Zhang, M.; Li, H. New evolutionary game model of the regional governance of haze pollution in China. Appl. Math. Model. 2018, 63, 577–590. [Google Scholar] [CrossRef]

- Jiang, K.; You, D.; Merrill, R.; Li, Z. Implementation of a multi-agent environmental regulation strategy under Chinese fiscal decentralization: An evolutionary game theoretical approach. J. Clean. Prod. 2019, 214, 902–915. [Google Scholar] [CrossRef]

- Du, J.; Zhao, L.; Chen, L. Study on the Evolution Game between the Governments and the Third Party Pollution Treatment companies. Sci. Technol. Manage. Res. 2015, 35, 214–218. (In Chinese) [Google Scholar]

- Xu, R.; Wang, Y.; Wang, W. Evolutionary game analysis for third-party governance of environmental pollution. J. Amb. Intel. Hum. Comp. 2018, 5, 1–12. [Google Scholar] [CrossRef]

- Duan, W.; Li, C.; Zhang, P. Game modeling and policy research on the system dynamics-based tripartite evolution for government environmental regulation. Cluster Comput. 2016, 19, 2061–2074. [Google Scholar] [CrossRef]

- Xie, H.; Wang, W.; Zhang, X. Evolutionary Game and Simulation of Management Strategies of Fallow Cultivated land: A Case Study in Hunan Province, China. Land Use Policy 2018, 71, 86–97. [Google Scholar] [CrossRef]

- Long, R.; Yang, J.; Chen, H. Co-evolutionary simulation study of multiple stakeholders in the take-out waste recycling industry chain. J. Environ. Manage. 2019, 231, 701–713. [Google Scholar] [CrossRef] [PubMed]

- Liu, C.; Huang, W.; Yang, C. The evolutionary dynamics of China’s electric vehicle industry Taxes vs. subsidies. Comput. Ind. Eng. 2017, 113, 103–122. [Google Scholar] [CrossRef]

- Chen, W.; Hu, Z. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Smith, J.M. The theory of games and the evolution of animal conflicts. J. Theor. Biol. 1974, 47, 209–221. [Google Scholar] [CrossRef]

- Ritzberger, K.; Weibull, J.W. Evolutionary Selection in Normal Form Games. Econometrica 1995, 63, 1371–1399. [Google Scholar] [CrossRef]

- Lyapunov, A.M. The general problems of stability of motions. Moscow Fizmatgiz 1950, 55, 531–534. (In Russian) [Google Scholar]

| Equilibrium | Characteristic Roots and Symbols | Local Stability |

|---|---|---|

| , , | ESS | |

| , , | Unstable | |

| , , | Unstable | |

| , , | Unstable | |

| , , | Unstable | |

| , , | Unstable | |

| , , | Unstable | |

| , , | ESS |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, C.; Xie, H.; Zhang, X. Does Fiscal Policy Promote Third-Party Environmental Pollution Control in China? An Evolutionary Game Theoretical Approach. Sustainability 2019, 11, 4434. https://doi.org/10.3390/su11164434

Zhou C, Xie H, Zhang X. Does Fiscal Policy Promote Third-Party Environmental Pollution Control in China? An Evolutionary Game Theoretical Approach. Sustainability. 2019; 11(16):4434. https://doi.org/10.3390/su11164434

Chicago/Turabian StyleZhou, Caihua, Hualin Xie, and Xinmin Zhang. 2019. "Does Fiscal Policy Promote Third-Party Environmental Pollution Control in China? An Evolutionary Game Theoretical Approach" Sustainability 11, no. 16: 4434. https://doi.org/10.3390/su11164434

APA StyleZhou, C., Xie, H., & Zhang, X. (2019). Does Fiscal Policy Promote Third-Party Environmental Pollution Control in China? An Evolutionary Game Theoretical Approach. Sustainability, 11(16), 4434. https://doi.org/10.3390/su11164434