5.1. Two-Stage DEA Calculation Result Analysis

In this paper, MaxDEA 8 Ultra software was used to calculate the technical efficiency of the sample companies.

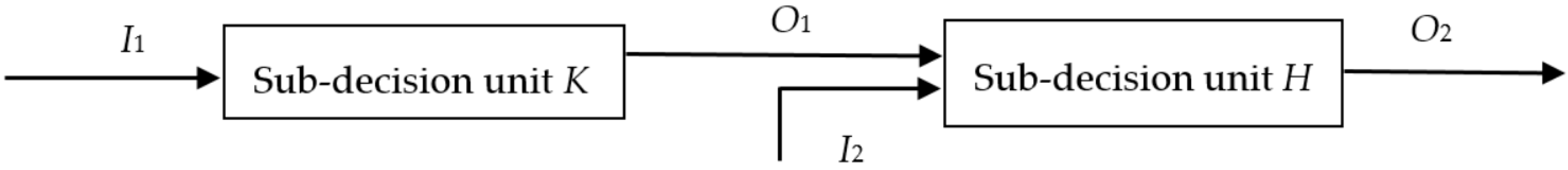

Table 4 and

Table 5 report the technical efficiency scores of 34 rural revitalization companies. Companies with a score of 1 were efficient, while companies with a score of less than 1 were inefficient. In the 1st stage, the funds raising efficiency score (

θ1) was between 0.247 and 1.000, with an average of 0.710. Only ten companies were efficient in funds raising, accounting for 29.41% of the total, and nine out of the remaining 24 inefficient companies had efficiency scores below 0.500. In the 2nd stage, the funds using efficiency score (

θ2) was between 0.216 and 1.000, and the average was 0.739. Among these companies, 17 companies were efficient in funds using, accounting for 50% of the total. Ten of the remaining 17 inefficient companies had efficiency scores below 0.500.

From

Table 5 we could also see that the overall financing efficiency score of rural revitalization listed companies was between 0.395 and 1.000, with an average of 0.724. Only eight companies have an overall financing efficiency of 1, which is technically efficient, accounting for 23.53% of the total. The remaining 26 companies could not be efficient in two stages at the same time, financing was not efficient, accounting for 76.47% of the total, and 19 companies had an efficiency score lower than the average of 0.724, accounting for 55.88% of the total.

Table 6 statistics on the efficiency according to the types of the sample companies. From the perspective of the property rights of the sample companies. The state-owned holding companies’ overall financing efficiency (0.708) and funds using efficiency (0.703) were lower than those of private companies. However, the efficiency of funds raising of state-owned holding companies (0.714) was higher than that of private companies (0.704), which is consistent with the current situation that private companies pay more attention to efficiency and more policies support to state-owned companies and easier access to financing.

From the perspective of the industry, the average efficiency value of different industries was similar. The efficiency score of funds using in the manufacturing industry (0.720) was the lowest, while the efficiency scores of funds raising in agriculture and other industries were lower. From the perspective of the listed plate, the average efficiency score of the main board listed companies (0.760) was significantly higher than that of the SMEs and GEM companies, which was more likely to be related to the easier access to equity financing in Chinese main board market. The average efficiency score of funds using of GEM companies was much higher than that of companies in the other two plates, while the SMEs had low-efficiency scores because SMEs were faced with some problems, such as difficulties in financing, high financing costs, and poor profitability.

In general, the financing efficiency of rural revitalization companies was low. Companies that performed well during the funds raising stage did not necessarily perform well on funds using, and vice versa. These companies could improve overall financing efficiency by improving the efficiency of funds raising or the efficiency of funds using, or both. We also note that the average efficiency scores of funds raising in the 1st stage were lower than those of funds using in the 2nd stage. Therefore, to improve the overall financing efficiency more effectively, the companies should focus on improving the efficiencies of funds raising that is reducing the financing costs.

5.2. Grey Relational Analysis of Factors Affecting Financing Efficiency

Financing efficiency is affected by many factors of the internal and external environment. It is difficult to control the influence of external factors and measure it. Therefore, this paper only analyzed internal influencing factors. Combined with the characteristics that listed companies of rural revitalization in China were mainly the agricultural and manufacturing industries, the study was conducted from the perspective of company size, company age, governance structure, capital structure, debt-paying ability, development ability, operation ability, and profitability.

(1) Company size, company age, and governance structure. In general, the greater the size of a company’s assets are, or the stronger its development ability and growth potential are, the lower the financing interest rate can be obtained in the bond market. According to the life cycle theory, at different stages of enterprise growth, with the constraints of information constraints, enterprise size, and capital requirements, the financing structure of the enterprise also changes, the ability to obtain external financing and the cost is also different. In this paper, the governance structure was represented by the first largest equity concentration. The equity concentration refers to the concentration of equity expressed by all shareholders due to the difference in shareholding ratio or the quantitative indicator of the dispersion of equity. The equity concentration is the main indicator to measure the company’s equity distribution, and it is also an important indicator to measure the company’s stability.

(2) Capital structure and debt-paying ability. The capital structure refers to the proportional relationship between the owner’s equity and the creditor’s rights, which is the result of the fundraising portfolio of the enterprise for a certain period. It determines the debt repayment and refinancing ability of the enterprise to a large extent, and determines the future profitability of the enterprise. It is also an important indicator of a company’s financial situation. A reasonable financing structure can reduce the financing cost and play the role of financial leverage. The debt paying ability is an important indicator of the company’s financial status and operational capabilities. Whether the company can pay cash and pay debts is the key to its survival and healthy development of the company. The capital structure and debt-paying ability of this paper were expressed by the asset-liability ratio indicator and the quick ratio, respectively.

(3) Development capacity and operational capacity. Development capacity is the potential ability of enterprises to expand their scale and improve their strength. In this paper, development capacity was expressed by the revenue growth rate indicator. The higher the value of the indicator, the faster the growth of the company’s operating income, the better and stronger the market prospects of the company. The operation ability reflects the company’s business strategy ability, decision-making ability, and management ability. The strength of the operation ability indicates the degree of utilization of the company assets and the efficiency of use. The continuous improvement of operation capability is the basis of company survival. This paper uses the total asset turnover rate to reflect the company’s operating capacity.

(4) Company value and profitability. The company value is the present value of the company’s expected free cash flow discounted by its weighted average cost of capital as a discount rate. It is closely related to the company’s financial decisions, reflecting the time value of the company’s funds, risk, and sustainable development. Profitability is the ability of a company to make a profit. The profitability will directly affect the interests of investors and creditors and have an impact on the refinancing of the company.

The indicators are shown in

Table 7, and the descriptive statistics of grey relational analysis indicators are indicated, as in

Table 8.

For gray relational analysis, reference series must be determined first. This paper used the overall financing efficiency

reference series: A′

0 = (a′

0(1),

′

0(2),…, a′

0(34)), each factor indicator A

j was used as a comparison series: A′

j = (a′

j(1), a′

j(2),…, a′

j(34)), (j = 1,2,…,9). To eliminate the influence of the dimension, the paper used the mean method to normalize the original data. The standardized data is shown in

Table 9. The companies’ ages were calculated, and the data of other indicators were derived from the CSMAR database.

When calculating the grey relational degree,

was taken as 0.5. The results of the GRA are shown in

Table 10.

The ranking of relational degrees shows that: R4 > R5 > R3 > R2 > R7 > R1 > R8 > R9 > R6.

The relational degrees of the asset-liability ratio, quick ratio, first largest equity concentration, company age, and total assets turnover rate were all over 0.900. These show that capital structure, debt-paying ability, governance structure, company age, and operation ability were the five most important factors affecting the financing efficiency of rural revitalization listed companies. The asset-liability ratio had the highest relational degree, 0.940. The asset-liability ratio not only reflects the capital structure of the company but also reflects the repayment ability of the company’s long-term liabilities. The excessive asset-liability ratio will affect debt financing, and on the contrary, it will affect equity financing, which is the key factor affecting the financing efficiency. The relational degree of the quick ratio was 0.938. The higher the quick ratio, the stronger the short-term repayment ability of the company, the easier it is to obtain external short-term loans. However, the high quick ratio easily leads to the inefficiency of the funds using. The impact on the first largest equity concentration (0.933) on financing efficiency was second only to the quick ratio, which is an important indicator for measuring the company’s structure. Demsetz and Lehn (1985) argued that when the shareholding ratio of large shareholders was high enough, it would have an “encroachment effect” on minority shareholders, thus reducing company performance [

45]. The relational degree of the company age was also as high as 0.916, which indicates that the financing costs and capital allocation efficiency of listed companies in different stages of development were quite different. In general, for companies with a high total assets turnover rate (0.908), their funds using efficiencies were also high, which could improve the financing efficiency of companies.

The relational degrees of company size, company value, and profitability were 0.894, 0.836, and 0.819, respectively, which have significant impacts on the financing efficiency of the rural revitalization listed companies. The listed companies with high total assets (0.894) had abundant resources and strong financial resources, which could disperse certain operational risks. The total assets indicator is an essential factor for creditors and investors to consider. Free cash flow (0.836) is the cash that the company holds to return to shareholders actually. The higher the free cash flow, the easier it is for the company to obtain equity, and the higher the financing efficiency. Earnings per share (EPS; 0.819) was one of the most important financial indicators for investors and other information users to evaluate the companies’ profitability, predict the company’s growth potential, and then make relevant economic decisions.

The development capability had little impact on the financing efficiency of rural revitalization listed companies. The relational degree of the revenue growth rate was only 0.704. In theory, the stronger the company’s development capabilities, the higher the company’s value, and the easier it is to raise funds. However, we found that 11 of the 34 listed companies had negative operating profit, while only five companies had negative total profits. Five of the remaining 23 companies had operating profits of less than 80 percent of the total profit. This shows that many rural revitalization companies had invested more in non-main business, and the qualities of operating profit were not high, which had no important impact on the company’s financing efficiency.