Relationship between Sustainable Disclosure and Performance—An Extension of Ullmann’s Model

Abstract

1. Introduction

2. A Review of Ullmann’s Model

3. Theoretical Framework

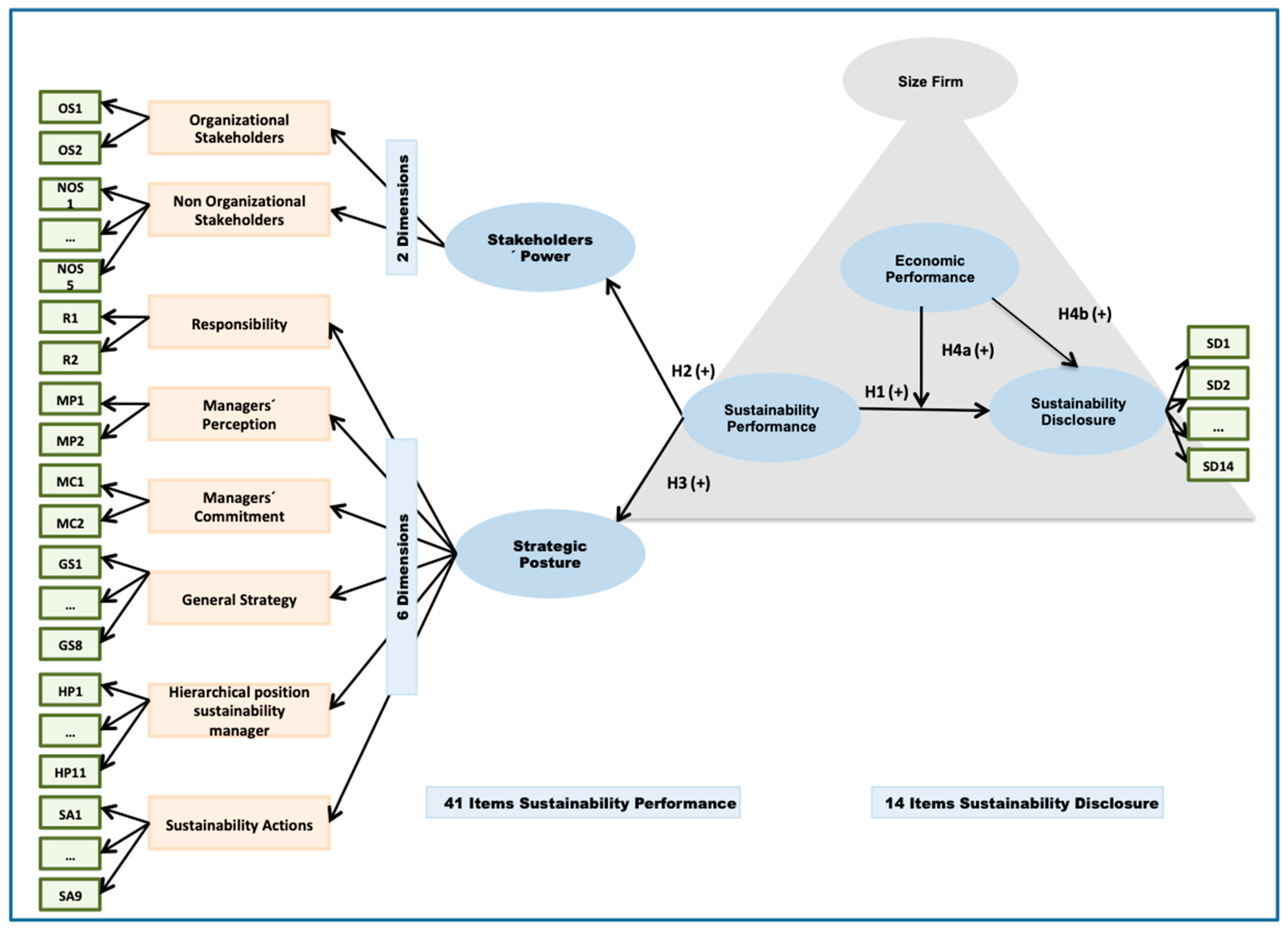

3.1. Theoretical Model

3.1.1. Sustainability Disclosure

3.1.2. Sustainability Performance

3.2. Hypothesis

3.2.1. Sustainability Disclosure–Sustainability Performance Relationship (H1)

3.2.2. Stakeholders’ Power (H2)

3.2.3. Strategic Posture (H3)

3.2.4. Economic Performance (H3)

3.2.5. Company’s Size (H5)

4. Methodology

4.1. Structural Equation Modelling

4.2. Sample Selection

4.3. Measurement Instrument and Data Extraction Method

5. Results

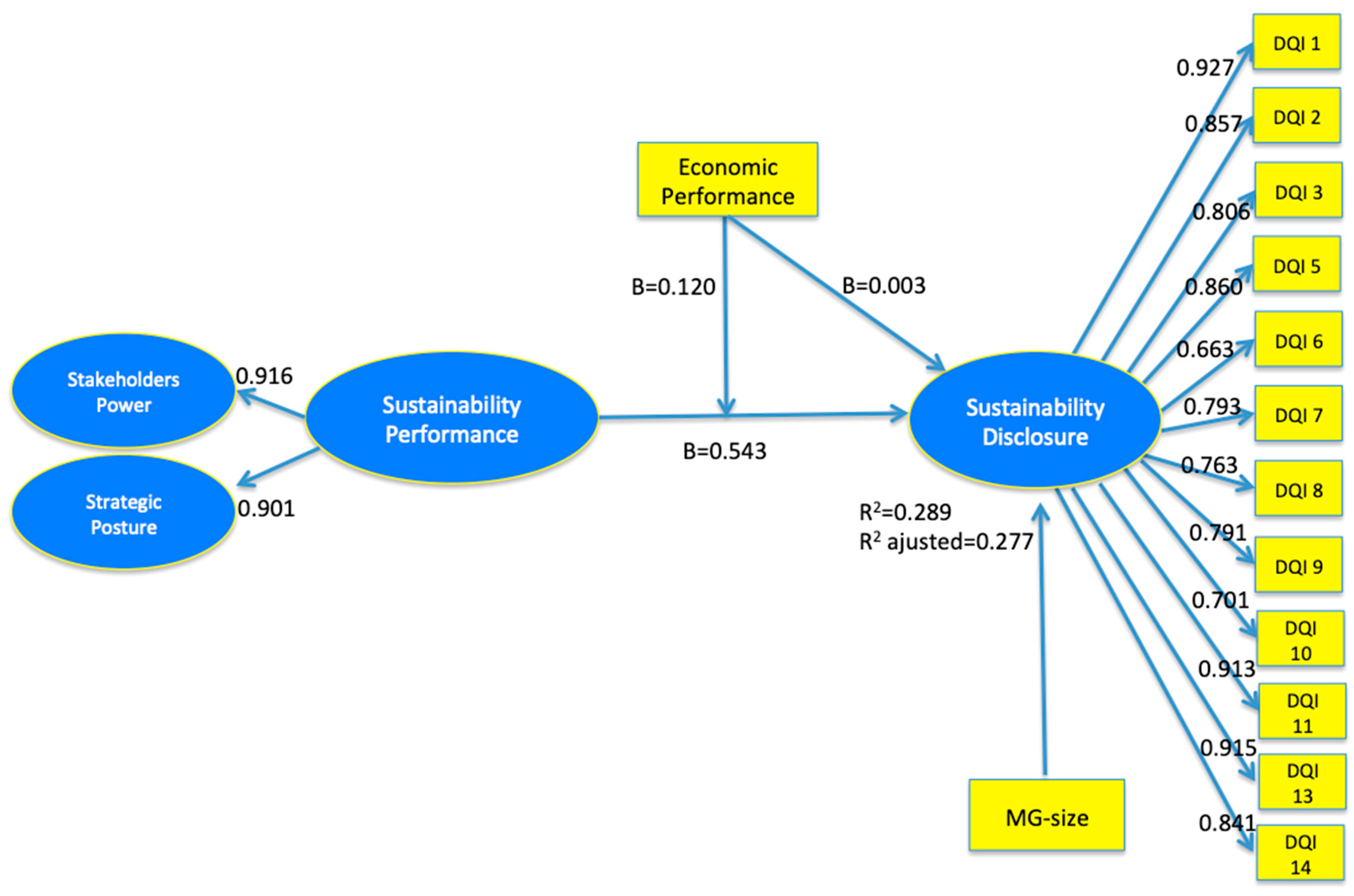

5.1. Inner Model Evaluation

5.2. Outer Model Evaluation

5.3. Moderating Effects

6. Discussion

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Dresner, S. The Principles of Sustainability; Routledge: Abington, UK, 2012. [Google Scholar]

- Aras, G.; Crowther, D. Corporate sustainability reporting: A study in disingenuity? J. Bus. Ethics 2009, 87, 279. [Google Scholar] [CrossRef]

- Herremans, I.M.; Nazari, J.A.; Mahmoudian, F. Stakeholder relationships, engagement, and sustainability reporting. J. Bus. Ethics 2016, 138, 417–435. [Google Scholar] [CrossRef]

- Aras, G.; Tezcan, N.; Furtuna, O.K. Multidimensional comprehensive corporate sustainability performance evaluation model: Evidence from an emerging market banking sector. J. Clean. Prod. 2018, 185, 600–609. [Google Scholar] [CrossRef]

- Boud, D.; Soler, R. Sustainable assessment revisited. Assess. Eval. High Educ. 2016, 41, 400–413. [Google Scholar] [CrossRef]

- Goyal, P.; Rahman, Z.; Kazmi, A.A. Corporate sustainability performance and firm performance research: Literature review and future research agenda. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Jiang, Q.; Liu, Z.; Liu, W.; Li, T.; Cong, W.; Zhang, H.; Shi, J. A principal component analysis based three-dimensional sustainability assessment model to evaluate corporate sustainable performance. J. Clean. Prod. 2018, 187, 625–637. [Google Scholar] [CrossRef]

- Singh, R.K.; Murty, H.R.; Gupta, S.K.; Dikshit, A.K. An overview of sustainability assessment methodologies. Ecol. Indic. 2012, 15, 281–299. [Google Scholar] [CrossRef]

- Waas, T.; Hugé, J.; Block, T.; Wright, T.; Benitez-Capistros, F.; Verbruggen, A. Sustainability assessment and indicators: Tools in a decision-making strategy for sustainable development. Sustainability 2014, 6, 5512–5534. [Google Scholar] [CrossRef]

- Schaltegger, S.; Lüdeke-Freund, F.; Hansen, E.G. Business cases for sustainability: The role of business model innovation for corporate sustainability. Int. J. Innov. Sustain. Dev. 2012, 6, 95–119. [Google Scholar] [CrossRef]

- Kolstad, I. Why firms should not always maximize profits. J. Bus. Ethics 2007, 76, 137–145. [Google Scholar] [CrossRef]

- Schaltegger, S.; Wagner, M. Managing the Business Case for Sustainability: The Integration of Social, Environmental and Economic Performance; Routledge: Abington, UK, 2017. [Google Scholar]

- Baumgartner, R.J.; Ebner, D. Corporate sustainability strategies: Sustainability profiles and maturity levels. Sustain. Dev. 2010, 18, 76–89. [Google Scholar] [CrossRef]

- Lu, Y.; Abeysekera, I. Stakeholders’ power, corporate characteristics, and social and environmental disclosure: Evidence from China. J. Clean. Prod. 2014, 64, 426–436. [Google Scholar] [CrossRef]

- Abu Bakar, A.S.; Ameer, R. Readability of corporate social responsibility communication in Malaysia. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 50–60. [Google Scholar] [CrossRef]

- Ali, W.; Faisal Alsayegh, M.; Ahmad, Z.; Mahmood, Z.; Iqbal, J. The relationship between social visibility and CSR disclosure. Sustainability 2018, 10, 866. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. Organized hypocrisy, organizational façades, and sustainability reporting. Account. Organ. Soc. 2015, 40, 78–94. [Google Scholar] [CrossRef]

- Ballou, B.; Heitger, D.; Landes, C. The rise of corporate sustainability reporting: A rapidly growing assurance opportunity. J. Account. 2006, 202, 65–74. [Google Scholar]

- Coupland, C. Corporate social responsibility as argument on the web. J. Bus. Ethics 2005, 62, 355–366. [Google Scholar] [CrossRef]

- Higgins, C.; Coffey, B. Improving how sustainability reports drive change: A critical discourse analysis. J. Clean. Prod. 2016, 136, 18–29. [Google Scholar] [CrossRef]

- Chu, C.I.; Chatterjee, B.; Brown, A. The current status of greenhouse gas reporting by Chinese companies: A test of legitimacy theory. Manag. Audit. J. 2012, 28, 114–139. [Google Scholar]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Org. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Banerjee, S.B. Corporate social responsibility: The good, the bad and the ugly. Crit. Sociol. 2008, 34, 51–79. [Google Scholar] [CrossRef]

- Boiral, O. Sustainability reports as simulacra? A counter-account of A and A+ GRI reports. Account. Audit. Account. J. 2013, 26, 1036–1071. [Google Scholar] [CrossRef]

- Moneva, J.M.; Archel, P.; Correa, C. GRI and the camouflaging of corporate unsustainability. Account. Forum. 2006, 30, 121–137. [Google Scholar] [CrossRef]

- Hahn, R.; Lülfs, R. Legitimizing negative aspects in GRI-oriented sustainability reporting: A qualitative analysis of corporate disclosure strategies. J. Bus. Ethics 2014, 123, 401–420. [Google Scholar] [CrossRef]

- Deegan, C.; Rankin, M.; Tobin, J. An examination of the corporate social and environmental disclosures of BHP from 1983–1997: A test of legitimacy theory. Account. Audit. Account. J. 2002, 15, 312–343. [Google Scholar] [CrossRef]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes, K.E., II. The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Account. Org. Soc. 2004, 29, 447–471. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Overell, M.B.; Chapple, L. Environmental reporting and its relation to corporate environmental performance. Abacus 2011, 47, 27–60. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Fang, X.; Li, Y.; Richardson, G. The relevance of environmental disclosures: Are such disclosures incrementally informative? J. Account. Public Pol. 2013, 32, 410–431. [Google Scholar] [CrossRef]

- Buhr, N. Histories of and rationales for sustainability reporting. Sustain. Account. Account. 2007, 57, 59–62. [Google Scholar]

- Haniffa, R.M.; Cooke, T.E. The impact of culture and governance on corporate social reporting. J. Account. Public Pol. 2005, 24, 391–430. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Org. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Cho, C.H.; Guidry, R.P.; Hageman, A.M.; Patten, D.M. Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Account. Org. Soc. 2012, 37, 14–25. [Google Scholar] [CrossRef]

- Brine, M.; Brown, R.; Hackett, G. Corporate social responsibility and financial performance in the Australian context. Econ. Round Up 2007, 2, 47–58. [Google Scholar]

- Gallardo-Vázquez, D.; Barroso-Méndez, M.J.; Pajuelo-Moreno, M.L.; Sánchez-Meca, J. Corporate Social Responsibility Disclosure and Performance: A Meta-Analytic Approach. Sustainability 2019, 11, 1115. [Google Scholar] [CrossRef]

- Hooghiemstra, R. Corporate communication and impression management—New perspectives why companies engage in corporate social reporting. J. Bus. Ethics 2000, 27, 55–68. [Google Scholar] [CrossRef]

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Factors influencing social responsibility disclosure by Portuguese companies. J. Bus. Ethics 2008, 83, 685–701. [Google Scholar] [CrossRef]

- Mahadeo, J.D.; Oogarah-Hanuman, V.; Soobaroyen, T. A longitudinal study of corporate social disclosures in a developing economy. J. Bus. Ethics 2011, 104, 545–558. [Google Scholar] [CrossRef]

- Reverte, C. Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. J. Bus. Ethics 2009, 88, 351–366. [Google Scholar] [CrossRef]

- Williams, S.M. Voluntary environmental and social accounting disclosure practices in the Asia-Pacific region: An international empirical test of political economy theory. Int. J. Account. 1999, 34, 209–238. [Google Scholar] [CrossRef]

- Li, F.; Li, T.; Minor, D. CEO power, corporate social responsibility, and firm value: A test of agency theory. Int. J. Manag. Financ. 2016, 12, 611–628. [Google Scholar] [CrossRef]

- Amran, A.B.; Devi, S.S. Corporate social reporting in Malaysia: An institutional perspective. World Rev. Entrepr. Manag. Sustain. Dev. 2007, 3, 20–36. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Chen, S.; Bouvain, P. Is corporate responsibility converging? A comparison of corporate responsibility reporting in the USA, UK, Australia, and Germany. J. Bus. Ethics 2009, 87, 299–317. [Google Scholar] [CrossRef]

- Fortanier, F.; Kolk, A.; Pinkse, J. Harmonization in CSR reporting. Manag. Intern. Rev. 2011, 51, 665. [Google Scholar] [CrossRef]

- Jensen, J.C.; Berg, N. Determinants of traditional sustainability reporting versus integrated reporting. An institution a list approach. Bus. Strateg. Environ. 2012, 21, 299–316. [Google Scholar] [CrossRef]

- Rahaman, A.S.; Lawrence, S.; Roper, J. Social and environmental reporting at the VRA: Institutionalised legitimacy or legitimation crisis? Crit. Perspect. Account. 2004, 15, 35–56. [Google Scholar] [CrossRef]

- Adams, C.A.; Hill, W.Y.; Roberts, C.B. Corporate social reporting practices in Western Europe: Legitimating corporate behaviour? Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Criado-Jiménez, I.; Fernández-Chulián, M.; Larrinaga-González, C.; Husillos-Carqués, F.J. Compliance with mandatory environmental reporting in financial statements: The case of Spain (2001–2003). J. Bus. Ethics 2008, 79, 245–262. [Google Scholar] [CrossRef]

- De Villiers, C.; Van Staden, C.J. Can less environmental disclosure have a legitimising effect? Evidence from Africa. Account. Org. Soc. 2006, 31, 763–781. [Google Scholar] [CrossRef]

- Deegan, C. Introduction: The legitimising effect of social and environmental disclosures–a theoretical foundation. Account. Audit. Account. J. 2002, 15, 282–311. [Google Scholar] [CrossRef]

- Guthrie, J.; Parker, L.D. Corporate social reporting: A rebuttal of legitimacy theory. Account. Bus. Res. 1989, 19, 343–352. [Google Scholar] [CrossRef]

- Patten, D.M. Exposure, legitimacy, and social disclosure. J. Account. Public Policy 1991, 10, 297–308. [Google Scholar] [CrossRef]

- Patten, D.M. Intra-industry environmental disclosures in response to the Alaskan oil spill: A note on legitimacy theory. Account. Org. Soc. 1992, 17, 471–475. [Google Scholar] [CrossRef]

- Amran, A.; Haniffa, R. Evidence in development of sustainability reporting: A case of a developing country. Bus. Strateg. Environ. 2011, 20, 141–156. [Google Scholar] [CrossRef]

- Belal, A.R.; Roberts, R.W. Stakeholders’ perceptions of corporate social reporting in Bangladesh. J. Bus. Ethics 2010, 97, 311–324. [Google Scholar] [CrossRef]

- Chiu, T.K.; Wang, Y.H. Determinants of social disclosure quality in Taiwan: An application of stakeholder theory. J. Bus. Ethics 2015, 129, 379–398. [Google Scholar] [CrossRef]

- Habisch, A.; Patelli, L.; Pedrini, M.; Schwartz, C. Different talks with different folks: A comparative survey of stakeholder dialog in Germany, Italy, and the US. J. Bus. Ethics 2011, 100, 381–404. [Google Scholar] [CrossRef]

- Huang, C.L.; Kung, F.H. Drivers of environmental disclosure and stakeholder expectation: Evidence from Taiwan. J. Bus. Ethics 2010, 96, 435–451. [Google Scholar] [CrossRef]

- Van Der Laan Smith, J.; Adhikari, A.; Tondkar, R.H. Exploring differences in social disclosures internationally: A stakeholder perspective. J. Account. Public Policy 2005, 24, 123–151. [Google Scholar] [CrossRef]

- Manetti, G. The quality of stakeholder engagement in sustainability reporting: Empirical evidence and critical points. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 110–122. [Google Scholar] [CrossRef]

- Parsa, S.; Kouhy, R. Social reporting by companies listed on the alternative investment market. J. Bus. Ethics 2008, 79, 345–360. [Google Scholar] [CrossRef]

- Perrini, F. SMEs and CSR theory: Evidence and implications from an Italian perspective. J. Bus. Ethics 2006, 67, 305–316. [Google Scholar] [CrossRef]

- Reynolds, M.; Yuthas, K. Moral discourse and corporate social responsibility reporting. J. Bus. Ethics 2008, 78, 47–64. [Google Scholar] [CrossRef]

- Thomson, I.; Bebbington, J. Social and environmental reporting in the UK: A pedagogic evaluation. Crit. Perspect. Account. 2005, 16, 507–533. [Google Scholar] [CrossRef]

- Thijssens, T.; Bollen, L.; Hassink, H. Secondary stakeholder influence on CSR disclosure: An application of stakeholder salience theory. J. Bus. Ethics 2015, 132, 873–891. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- O’Dwyer, B. Managerial perceptions of corporate social disclosure: An Irish story. Account. Audit. Account. J. 2002, 15, 406–436. [Google Scholar] [CrossRef]

- Husillos, J.; Álvarez-Gil, M.J. A Stakeholder-Theory Approach to Environmental disclosures by Small and Medium Enterprises (SMEs). Account. Rev. 2008, 11, 125–156. [Google Scholar]

- Peloza, J.; Papania, L. The missing link between corporate social responsibility and financial performance: Stakeholder salience and identification. Corp. Rep. Rev. 2008, 11, 169–181. [Google Scholar] [CrossRef]

- Spence, C.; Husillos, J.; Correa-Ruiz, C. Cargo cult science and the death of politics: A critical review of social and environmental accounting research. Crit. Perspect. Account. 2010, 21, 76–89. [Google Scholar] [CrossRef]

- Islam, M.A.; Deegan, C. Motivations for an organisation within a developing country to report social responsibility information: Evidence from Bangladesh. Account. Audit. Account. J. 2008, 21, 850–874. [Google Scholar] [CrossRef]

- Gray, R.; Kouhy, R.; Lavers, S. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Account. Audit. Account. J. 1995, 8, 47–77. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Jennifer, H.L.C.; Taylor, M.E. An empirical analysis of triple bottom-line reporting and its determinants: Evidence from the United States and Japan. J. Intern. Fin. Manag. Account. 2007, 18, 123–150. [Google Scholar] [CrossRef]

- Fifka, M.S. Corporate responsibility reporting and its determinants in comparative perspective–a review of the empirical literature and a meta-analysis. Bus. Strateg. Environ. 2013, 22, 1–35. [Google Scholar] [CrossRef]

- Ullmann, A.A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of US firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- Freeman, R.E. Strategic management: A stakeholder approach. Adv. Strateg. Manag. 1983, 1, 31–60. [Google Scholar]

- Roberts, R.W. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Account. Org. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef]

- Brammer, S.; Pavelin, S. Voluntary environmental disclosures by large UK companies. J. Bus. Fin. Account. 2006, 33, 1168–1188. [Google Scholar] [CrossRef]

- Elijido-Ten, E. Applying stakeholder theory to analyze corporate environmental performance: Evidence from Australian listed companies. Asian Rev. Account. 2007, 15, 164–184. [Google Scholar] [CrossRef]

- Herbohn, K.; Walker, J.; Loo, H.Y.M. Corporate social responsibility: The link between sustainability disclosure and sustainability performance. Abacus 2014, 50, 422–459. [Google Scholar] [CrossRef]

- Kent, P.; Chan, C. Application of stakeholder theory to corporate environmental disclosures. Corp. Owners. Control. 2009, 7, 394–410. [Google Scholar] [CrossRef]

- Kent, P.; Zunker, T. A stakeholder analysis of employee disclosures in annual reports. Account. Fin. 2017, 57, 533–563. [Google Scholar] [CrossRef]

- Magness, V. Strategic posture, financial performance and environmental disclosure: An empirical test of legitimacy theory. Account. Audit. Account. J. 2006, 19, 540–563. [Google Scholar] [CrossRef]

- Michelon, G. Sustainability disclosure and reputation: A comparative study. Corp. Rep. Rev. 2011, 14, 79–96. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.M.; Gallego-Alvarez, I.; Garcia-Sanchez, I.M. Stakeholder engagement and corporate social responsibility reporting: The ownership structure effect. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 94–107. [Google Scholar] [CrossRef]

- Sun, N.; Salama, A.; Hussainey, K.; Habbash, M. Corporate environmental disclosure, corporate governance and earnings management. Manag. Audit. J. 2010, 25, 679–700. [Google Scholar] [CrossRef]

- Aras, G.; Crowther, D. What level of trust is needed for sustainability? Soc. Responsib. J. 2007, 3, 60–68. [Google Scholar] [CrossRef]

- Aras, G.; Crowther, D. The Durable Corporation: Strategies for Sustainable Development; Routledge: Abington, UK, 2016. [Google Scholar]

- Lozano, R.; Huisingh, D. Inter-linking issues and dimensions in sustainability reporting. J. Clean. Prod. 2011, 19, 99–107. [Google Scholar] [CrossRef]

- Schaltegger, S.; Bennett, M.; Burritt, R.L. Sustainability accounting and reporting: Development, linkages and reflection. An introduction. In Sustainability Accounting and Reporting; Schaltegger, S., Bennett, M., Burritt, R.L., Eds.; Springer: Dordrecht, The Netherlands, 2006; pp. 1–33. [Google Scholar]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strateg. Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Schaltegger, S.; Burritt, R. Corporate Sustainability; Doctoral Dissertation; Edward Elgar: Northampton, MA, USA, 2005. [Google Scholar]

- Martinez, E.O.; Crowther, D. Corporate social responsibility creates an environment for business success. Represent. Soc. Responsib. 2005, 1, 125–140. [Google Scholar]

- Van Marrewijk, M. Concepts and definitions of CSR and corporate sustainability: Between agency and communion. J. Bus. Ethics 2003, 44, 95–105. [Google Scholar] [CrossRef]

- Schaltegger, S.; Wagner, M. Integrative management of sustainability performance, measurement and reporting. Intern. J. Account. Audit. Perform. Eval. 2006, 3, 1–19. [Google Scholar] [CrossRef]

- Milne, M.J.; Tregidga, H.; Walton, S. Words not actions! The ideological role of sustainable development reporting. Account. Audit. Account. J. 2009, 22, 1211–1257. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. Corporate environmental disclosure strategies: Determinants, costs and benefits. J. Account. Audit. Fin. 1999, 14, 429–451. [Google Scholar] [CrossRef]

- Freedman, M.; Jaggi, B. An analysis of the association between pollution disclosure and economic performance. Account. Audit. Account. J. 1988, 1, 43–58. [Google Scholar] [CrossRef]

- Weber, O. Environmental, social and governance reporting in China. Bus. Strateg. Environ. 2014, 23, 303–317. [Google Scholar] [CrossRef]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Fin. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Li, Y.; Richardson, G.D.; Thornton, D.B. Corporate disclosure of environmental liability information: Theory and evidence. Contemp. Account. Res. 1997, 14, 435–474. [Google Scholar] [CrossRef]

- Patten, D.M. The relation between environmental performance and environmental disclosure: A research note. Account. Org. Soc. 2002, 27, 763–773. [Google Scholar] [CrossRef]

- Freedman, M.; Wasley, C. The association between environmental performance and environmental disclosure in annual reports and 10Ks. Adv. Public Interest Account. 1990, 3, 183–193. [Google Scholar]

- Ingram, R.W.; Frazier, K.B. Environmental performance and corporate disclosure. J. Account. Res. 1980, 614–622. [Google Scholar] [CrossRef]

- Purushothaman, M.A.Y.A.; Tower, G.; Hancock, P.; Taplin, R. Determinants of corporate social reporting practices of listed Singapore companies. Pac. Account. Rev. 2000, 12, 101. [Google Scholar]

- Luque-Vílchez, M.; Mesa-Pérez, E.; Husillos, J.; Larrinaga, C. The influence of pro-environmental managers’ personal values on environmental disclosure: The mediating role of the environmental organizational structure. Sustain. Account. Manag. Pol. J. 2019, 10, 41–61. [Google Scholar] [CrossRef]

- Chapple, W.; Moon, J. Corporate social responsibility (CSR) in Asia: A seven-country study of CSR web site reporting. Bus. Soc. 2005, 44, 415–441. [Google Scholar] [CrossRef]

- Brammer, S.; Pavelin, S. Factors influencing the quality of corporate environmental disclosure. Bus. Strat. Environ. 2008, 17, 120–136. [Google Scholar] [CrossRef]

- Castilla-Polo, F.; Gallardo-Vázquez, D.; Sánchez-Hernández, M.I.; Ruiz-Rodríguez, M.C. An empirical approach to analyse the reputation-performance linkage in agrifood cooperatives. J. Clean. Prod. 2018, 195, 163–175. [Google Scholar] [CrossRef]

- Freeman, R. Strategic Management: A Stakeholder’s Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strat. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Wang, H.; Qian, C. Corporate philanthropy and corporate financial performance: The roles of stakeholder response and political access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Burritt, R.L.; Schaltegger, S. Sustainability accounting and reporting: Fad or trend? Account. Audit. Account. J. 2010, 23, 829–846. [Google Scholar] [CrossRef]

- Schaltegger, S. Sustainability as a driver for corporate economic success: Consequences for the development of sustainability management control. Soc. Econ. 2011, 33, 15–28. [Google Scholar] [CrossRef]

- Hasseldine, J.; Salama, A.I.; Toms, J.S. Quantity versus quality: The impact of environmental disclosures on the reputations of UK Plcs. Br. Account. Rev. 2005, 37, 231–248. [Google Scholar] [CrossRef]

- Perrini, F.; Russo, A.; Tencati, A. CSR strategies of SMEs and large firms. Evidence from Italy. J. Bus. Ethics 2007, 74, 285–300. [Google Scholar] [CrossRef]

- Epstein, M.J. Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental and Economic Impacts; Routledge: Abington, UK, 2018. [Google Scholar]

- Álvarez-Gil, M.J.; Berrone, P.; Husillos, F.J.; Lado, N. Reverse logistics, stakeholders’ influence, organizational slack, and managers’ posture. J. Bus. Res. 2007, 60, 463–473. [Google Scholar] [CrossRef]

- Schaltegger, S.; Wagner, M. Sustainable entrepreneurship and sustainability innovation: Categories and interactions. Bus. Strat. Environ. 2011, 20, 222–237. [Google Scholar] [CrossRef]

- Székely, F.; Knirsch, M. Responsible leadership and corporate social responsibility: Metrics for sustainable performance. Eur. Manag. J. 2005, 23, 628–647. [Google Scholar] [CrossRef]

- Fassin, Y.; Van Rossem, A. Corporate governance in the debate on CSR and ethics: Sensemaking of social issues in management by authorities and CEOs. Corp. Gov. Int. Rev. 2009, 17, 573–593. [Google Scholar] [CrossRef]

- Angus-Leppan, T.; Metcalf, L.; Benn, S. Leadership styles and CSR practice: An examination of sensemaking, institutional drivers and CSR leadership. J. Bus. Ethics 2010, 93, 189–213. [Google Scholar] [CrossRef]

- Lozano, R. A holistic perspective on corporate sustainability drivers. Corp. Soc. Resp. Environ. Manag. 2015, 22, 32–44. [Google Scholar] [CrossRef]

- Fraj-Andrés, E.; Martinez-Salinas, E.; Matute-Vallejo, J. A multidimensional approach to the influence of environmental marketing and orientation on the firm’s organizational performance. J. Bus. Ethics 2009, 88, 263. [Google Scholar] [CrossRef]

- Banerjee, S.B. Managerial perceptions of corporate environmentalism: Interpretations from industry and strategic implications for organizations. J. Manag. Stud. 2001, 38, 489–513. [Google Scholar] [CrossRef]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate environmentalism: Antecedents and influence of industry type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Schendel, D.; Hofer, C.W. (Eds.) Strategic Management: A New View of Business Policy and Planning; Little Brown: Boston, MA, USA, 1979. [Google Scholar]

- De Villiers, C.J. Why do South African companies not report more environmental information when managers are so positive about this kind of reporting? Meditari Account. Res. 2003, 11, 11–23. [Google Scholar] [CrossRef]

- Kuasirikun, N. Attitudes to the development and implementation of social and environmental accounting in Thailand. Crit. Perspect. Account. 2005, 16, 1035–1057. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Murillo, D.; Lozano, J.M. SMEs and CSR: An approach to CSR in their own words. J. Bus. Ethics 2006, 67, 227–240. [Google Scholar] [CrossRef]

- Mitchell, C.G.; Hill, T. Corporate social and environmental reporting and the impact of internal environmental policy in South Africa. Corp. Soc. Resp. Environ. Manag. 2009, 16, 48–60. [Google Scholar] [CrossRef]

- Likierman, A.; Creasey, P. Objectives and entitlements to rights in government financial information. Fin. Account. Manag. 1985, 1, 33–50. [Google Scholar] [CrossRef]

- Milne, M.J.; Gray, R. W(h)ither ecology? The triple bottom line, the global reporting initiative, and corporate sustainability reporting. J. Bus. Ethics 2013, 118, 13–29. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar]

- Benn, S.; Edwards, M.; Williams, T. Organizational Change for Corporate Sustainability; Routledge: Abington, UK, 2014. [Google Scholar]

- Lo, S.F.; Sheu, H.J. Is corporate sustainability a value-increasing strategy for business? Corp. Gov. Int. Rev. 2007, 15, 345–358. [Google Scholar] [CrossRef]

- Tregidga, H.; Milne, M.J. From sustainable management to sustainable development: A longitudinal analysis of a leading New Zealand environmental reporter. Bus. Strat. Environ. 2006, 15, 219–241. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Pol. 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Orlitzky, M.; Siegel, D.S.; Waldman, D.A. Strategic corporate social responsibility and environmental sustainability. Bus. Soc. 2011, 50, 6–27. [Google Scholar] [CrossRef]

- Klewitz, J.; Hansen, E.G. Sustainability-oriented innovation of SMEs: A systematic review. J. Clean. Prod. 2014, 65, 57–75. [Google Scholar] [CrossRef]

- Alt, E.; Díez-de-Castro, E.P.; Lloréns-Montes, F.J. Linking employee stakeholders to environmental performance: The role of proactive environmental strategies and shared vision. J. Bus. Ethics 2015, 128, 167–181. [Google Scholar] [CrossRef]

- Broman, G.I.; Robèrt, K.H. A framework for strategic sustainable development. J. Clean. Prod. 2017, 140, 17–31. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate governance and sustainability performance: Analysis of triple bottom line performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar] [CrossRef]

- Moroncini, A. Stratégie Environnementale des Entreprises: Contexte, Typologie et Mise en Oeuvre; PPUR Presses Polytechniques: Lausanne, Switzerland, 1998; Volume 16. [Google Scholar]

- Coles, J.L.; Daniel, N.D.; Naveen, L. Managerial incentives and risk-taking. J. Fin. Econ. 2006, 79, 431–468. [Google Scholar] [CrossRef]

- Griffin, J.J.; Mahon, J.F. The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research. Bus. Soc. 1997, 36, 5–31. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Engert, S.; Rauter, R.; Baumgartner, R.J. Exploring the integration of corporate sustainability into strategic management: A literature review. J. Clean. Prod. 2016, 112, 2833–2850. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance–financial performance link. Strat. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strat. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Miras-Rodríguez, M.D.M.; Carrasco-Gallego, A.; Escobar-Pérez, B. Responsabilidad social corporativa y rendimiento financiero: Un Meta-análisis. Span. J. Fin. Account. 2014, 43, 193–215. [Google Scholar] [CrossRef]

- Lu, W.; Taylor, M.E. Which factors moderate the relationship between sustainability performance and financial performance? A meta-analysis study. J. Int. Account. Res. 2015, 15, 1–15. [Google Scholar] [CrossRef]

- Grewatsch, S.; Kleindienst, I. When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: A critical review. J. Bus. Ethics 2017, 145, 383–416. [Google Scholar] [CrossRef]

- Aras, G.; Aybars, A.; Kutlu, O. Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets. Intern. J. Product. Perform. Manag. 2010, 59, 229–254. [Google Scholar] [CrossRef]

- Hackston, D.; Milne, M.J. Some determinants of social and environmental disclosures in New Zealand companies. Account. Audit. Account. J. 1996, 9, 77–108. [Google Scholar] [CrossRef]

- Dienes, D.; Sassen, R.; Fischer, J. What are the drivers of sustainability reporting? A systematic review. Sustain. Account. Manag. Pol. J. 2016, 7, 154–189. [Google Scholar] [CrossRef]

- Pajuelo, M.L. Assessment of the impact of business activity in sustainability terms. Empirical confirmation of its determination in Spanish companies. Sustainability 2013, 5, 2389–2420. [Google Scholar] [CrossRef]

- Schreck, P.; Raithel, S. Corporate social performance, firm size, and organizational visibility: Distinct and joint effects on voluntary sustainability reporting. Bus. Soc. 2018, 57, 742–778. [Google Scholar] [CrossRef]

- Lowry, P.B.; Gaskin, J. Partial Least Squares (PLS) Structural Equation Modeling (SEM) for Building and Testing Behavioral Causal Theory: When to Choose and How to Use It. IEEE Trans. Prof. Commun. 2014, 57, 123–146. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, M.D.; Sánchez-Hernández, I. Measuring Corporate Social Responsibility for competitive success at a regional level, J. Clean. Prod. 2014, 72, 14–22. [Google Scholar] [CrossRef]

- Chin, W. Issues and opinion on structural equation modeling. MIS Quarterly. 1998, 22, 1. [Google Scholar]

- Henseler, J. Partial least squares path modeling: Quo vadis? Qual. Quan. 2018, 52, 1–8. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Chin, W.W.; Newsted, P.R. Structural equation modeling analysis with small samples using partial least squares. Stat. Strat. Small Sample Res. 1999, 1, 307–341. [Google Scholar]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; Mora, M., Gelman, O., Steenkamp, A., Raisinghani, M., Eds.; IGI Global: Hershey, PA, USA, 2012; pp. 193–221. [Google Scholar]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS. Smart PLS GmbH; Boenningstedt: Schleswig, Germany, 2015. [Google Scholar]

- Henseler, J.; Ringle, C.; Sinkovics, R. The use of partial least squares path modeling in international marketing. In New Challenges to International Marketing (Advances in International Marketing); Rudolf, R., Sinkovics, P., Ghauri, N., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2009; pp. 277–319. [Google Scholar]

- Nunnally, J.C.; Bernstein, I.H. McGraw-Hill series in psychology. In Psychometric Theory; McGraw-Hill: New York, NY, USA, 1967. [Google Scholar]

- Gorsuch, R. Factor Analysis, 2nd ed.; Lawrence Erlbaum Associates: Hillsdale, NJ, USA, 1983. [Google Scholar]

- Anderson, J.C.; Gerbing, D.W. The effect of sampling error on convergence, improper solutions, and goodness-of-fit indices for maximum likelihood confirmatory factor analysis. Psychometrika 1984, 49, 155–173. [Google Scholar] [CrossRef]

- Marsh, H.W.; Craven, R.; Debus, R. Structure, stability, and development of young children’s self-concepts: A multicohort–multioccasion study. Child Dev. 1998, 69, 1030–1053. [Google Scholar] [CrossRef]

- Bentler, P.M. EQS 6 Structural Equations Modeling Program Manual; Multivariate Software: Encino, CA, USA, 2006. [Google Scholar]

- Chulián, M.F.; González, C.L. Percepciones sobre contabilidad de costes ecológicos completos: Análisis empírico en el sector energético español. Span. J. Fin. Account. 2006, 35, 225–254. [Google Scholar] [CrossRef]

- Carmines, E.G.; Zeller, R.A. Reliability and Validity Assessment; Sage Publications: Thousand Oaks, CA, USA, 1979; Volume 17. [Google Scholar]

- Chin, W.W.; Dibbern, J. An introduction to a permutation based procedure for multi-group PLS analysis: Results of tests of differences on simulated data and a cross cultural analysis of the sourcing of information system services between Germany and the USA. In Handbook of Partial Least Squares; Vinzi, V.E., Chin, W., Henseler, J., Wang, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 171–193. [Google Scholar]

- Roberts, P.; Priest, H.; Traynor, M. Reliability and validity in research. Nurs. Stand. 2006, 20, 41–45. [Google Scholar] [CrossRef]

- Nunnally, J. Psychometric Methods, 2nd ed.; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Vandenberg, R.J.; Lance, C.E. A review and synthesis of the measurement invariance literature: Suggestions, practices, and recommendations for organizational research. Org. Res. Methods 2000, 3, 4–70. [Google Scholar] [CrossRef]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- Hair, J.; Black, W.; Babin, B.; Anderson, R.; Tatham, R. Multivariate Data Analysis, 6th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Dijkstra, T.K.; Henseler, J. Consistent partial least squares path modeling. MIS Q. 2015, 39, 297–316. [Google Scholar] [CrossRef]

- Werts, C.E.; Linn, R.L.; Jöreskog, K.G. Intraclass reliability estimates: Testing structural assumptions. Educ. Psychol. Meas. 1974, 34, 25–33. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM) An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Henseler, J. Bridging design and behavioral research with variance-based structural equation modeling. J. Advert. 2017, 46, 178–192. [Google Scholar] [CrossRef]

- Dijkstra, T.K.; Henseler, J. Consistent and asymptotically normal PLS estimators for linear structural equations. Comput. Stat. Data An. 2015, 81, 10–23. [Google Scholar] [CrossRef]

- Henseler, J. Partial least squares path modeling. In Advanced Methods for Modeling Markets; Springer: Berlin/Heidelberg, Germany, 2017; pp. 361–381. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychol. Methods 1998, 3, 424. [Google Scholar] [CrossRef]

- Hu, L.T.; Bentler, P.M. Cut off criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Bentler, P.M.; Bonett, D.G. Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 1980, 88, 588. [Google Scholar] [CrossRef]

- Byrne, B. Testing for multigroup equivalence of a measuringins-trument: A walk through the process. Psicothema 2008, 20, 872–882. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Chin, W.W.; Marcolin, B.L.; Newsted, P.R. A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Inform. Syst. Res. 2003, 14, 189–217. [Google Scholar] [CrossRef]

- Henseler, J.; Chin, W.W. A comparison of approaches for the analysis of interaction effects between latent variables using partial least squares path modeling. Struct. Equ. Model. 2010, 17, 82–109. [Google Scholar] [CrossRef]

- Henseler, J.; Fassott, G. Testing moderating effects in PLS path models: An illustration of available procedures. In Handbook of Partial Least Squares; Springer: Berlin, Heidelberg, 2010; pp. 713–735. [Google Scholar]

- Fassott, G.; Henseler, J.; Coelho, P.S. Testing moderating effects in PLS path models with composite variables. Ind. Manag. Data Syst. 2016, 116, 1887–1900. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behaviors Science, 2nd ed.; Laurence Erlbaum Associates: New Jersey, NJ, USA, 1988. [Google Scholar]

- Pettigrew, A.M.; Woodman, R.W.; Cameron, K.S. Studying organizational change and development: Challenges for future research. Acad. Manag. J. 2001, 44, 697–713. [Google Scholar]

- Volberda, H.W.; Elfring, T. (Eds.) Rethinking Strategy; Sage: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Whittington, R. What is Strategy and does It Matter? Cengage Learning EMEA: London, UK, 2001; ISBN 9781861523778. [Google Scholar]

- Hansen, E.G.; Schaltegger, S. The sustainability balanced scorecard: A systematic review of architectures. J. Bus. Ethics 2016, 133, 193–221. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. Environmental reporting management: A continental European perspective. J. Account. Public Pol. 2003, 22, 43–62. [Google Scholar] [CrossRef]

- Odriozola, M.D.; Baraibar-Diez, E. Is corporate reputation associated with quality of CSR reporting? Evidence from Spain. Corp. Soc. Resp. Environ. Manag. 2017, 24, 121–132. [Google Scholar] [CrossRef]

- Lozano, R.; Nummert, B.; Ceulemans, K. Elucidating the relationship between sustainability reporting and organisational change management for sustainability. J. Clean. Prod. 2016, 125, 168–188. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Matuszak, Ł.; Różańska, E. CSR disclosure in Polish-listed companies in the light of directive 2014/95/EU requirements: Empirical evidence. Sustainability 2017, 9, 2304. [Google Scholar] [CrossRef]

- Fijałkowska, J.; Zyznarska-Dworczak, B.; Garsztka, P. Corporate social-environmental performance versus financial performance of banks in Central and Eastern European countries. Sustainability 2018, 10, 772. [Google Scholar] [CrossRef]

| Authors | Sample | Country | Period | Methodology | Disclosure | Hypothesis | Findings |

|---|---|---|---|---|---|---|---|

| Al-Tuwaijri et al. [28] | 198 U.S. “Standard & Poor’s 500” firms | US | 1994 | Simultaneous equations models | Environmental | H1: ECP—Good ENVP (N) | + |

| H2: ENVD—Good ENVP (N) | + | ||||||

| H3: Good ENVP—ENVD (N) | + | ||||||

| Brammer and Pavelin [83] | 447 large UK firms in the FTSE All-Share Index (from a diverse range of industrial sectors) | UK | 1998–2000 | Regression Model | Environmental | H1: Quantity (H1a)/Quality ENVD (H1B)—Visible Environmental Issues (+) | +/+ |

| H2: Quantity (H2a)/Quality ENVD (H2B)—ENVP (+) | N/+ | ||||||

| H3: Quantity (H3a)/Quality ENVD (H3B)—Size (+) | +/+ | ||||||

| H4: Quantity (H4a)/Quality ENVD (H4B)—Media Exposure (+) | N/N | ||||||

| H5: Quantity (H5a)/Quality ENVD (H5B)—Dispersion of share ownership (+) | −/− | ||||||

| H6: Quantity (H6a)/Quality ENVD (H6B)—Profitability (+) | N/N | ||||||

| H7: Quantity (H7a)/Quality ENVD (H7B)—Leverage (+) | −/− | ||||||

| H8: Quantity (H8a) and Quality ENVD (H8B)—Non-executive directors (+) | N/N | ||||||

| Chiu and Wang [60] | 246 firms listed on the Taiwan Stock Exchange (from a diverse range of industrial sectors) | Taiwan | 2010–2011 | Regression Model | CSR | H1: Quality CSRD—RP supply chain (+) | + |

| H2: Quality CSRD—RP International Capital Market (+) | + | ||||||

| H3: Quality CSRD—Dispersal of share ownership (+) | N | ||||||

| H4: Quality CSRD—Positive Strategic posture towards CSRD (+) | + | ||||||

| H5: Quality CSRD—Profitability (+) | N | ||||||

| H6: Quality CSRD—Leverage (−) | N | ||||||

| H7: Quality CSRD—Size (+) | + | ||||||

| H8: Quality CSRD—Media Exposure (+) | + | ||||||

| Elijido-Ten [84] | Stock Exchange and Australia’s top 100 companies ranking in Australian Conservation Foundation’s (2002) (ACF’s) | Australia | 2002 | Regression Model | Environmental | H1a: Shareholder concentration—ENVP (−) | − |

| H1b: Financial leverage (debt/equity ratio)—ENVP (+) | N | ||||||

| H1c: Environment sensitive industries—ENVP (−) | − | ||||||

| H2: ENVD and Commitment and/or environmental concern—ENVP (+) | + | ||||||

| H3: EP (ROA)—ENVP (+) | N | ||||||

| Herbohn et al. [85] | 339 mining and energy firms listed on the Australian Securities Exchange | Australia | 2006 | Regression Model | Sustainability | H1: SD—SP (+) | + |

| Herremans et al. [3] | 11 oil and gas companies | Canada | − | Qualitative Methods. Multiple-case | Sustainability | − | − |

| Husillos and Álvarez-Gil [72] | 135 SMEs (auxiliary automobile industry) | Spain | Structural Equation Modeling | Environmental | H1: Non-organizational Stakeholders—ENVP (+) | + | |

| H2: Organizational Stakeholders—ENVP (+) | + | ||||||

| H3: Pro-active posture manager—ENVP (+) | + | ||||||

| H4: Organizational lack—ENVP (+) | + | ||||||

| H4: ENVP—ENVD (+) | + | ||||||

| Kent and Chan [86] | 102 of the largest companies listed on the Australian Stock Exchange | Australia | 1995 | Regression Model | Environmental | H1: Quantity and Quality ENVD—Stakeholders’ Power (+) | + |

| H2: Quantity and Quality ENVD—Active posture toward environmental issues (+) | + | ||||||

| H3: Quantity and Quality ENVD—ECP (+) | N | ||||||

| Kent and Zunker [87] | 970 listed companies on the Australian Securities Exchange Limited | Australia | 2004 | Regression Model | Social (employee) | H1: Voluntary Employee Disclosure—Employee Power (+) | + |

| H2: Voluntary Employee Disclosure—Strategic posture of employees (+) | + | ||||||

| H3: Voluntary Employee Disclosure—ECP (+) | + | ||||||

| Magness [88] | 41 gold mining companies | Canada | 1995 | Regression Model | Environmental | H1: ENVD—Number of press releases (prior year) (+) | + |

| H2: ENVD—Size (+) | + | ||||||

| H3: ENVD—Debt or equity (+) | + | ||||||

| H4: ENVD—Profitability (ROA) (+) | +/− | ||||||

| Michelon [89] | 57 DJSI companies and 57 DJGI companies | EU, UK and USA | 2003 | Regression model | Sustainability | H1: SD—Commitment with stakeholders (+) | + |

| H2: SD—ECP (+) | N | ||||||

| H3: SD—Media Exposure (+) | + | ||||||

| Prado-Lorenzo et al. [90] | 99 nonfinancial firms quoted on the Spanish continuous…market | Spain | − | Regression model | CSR | H1: CSRD—Financial Institutions in ownership (+) | N |

| H2: CSRD—Person in ownership who exercises control over firm (−/+) | + | ||||||

| H3: CSRD—Independent directors in ownership (+) | N | ||||||

| Roberts [82] | 130 major corporations (CEP) (Fortune 500) (from a diverse range of industrial sectors) | US | 1984–1986 | Regression Model | CSR | H1: CSRD—Dispersal of share ownership (−) | − |

| H2: CSRD—Corporate political action (+) | + | ||||||

| H3: CSRD—Debt to equity (+) | + | ||||||

| H4: CSRD—Corporate public affairs staff members employed (+) | + | ||||||

| H5: CSRD—Sponsorship of philanthropy (+) | + | ||||||

| H6: CSRD—Profitability (+) | + | ||||||

| H7: CSRD—Market (−) | − | ||||||

| H8: CSRD—Age (+) | + | ||||||

| H9: CSRD—Industry sensitive (+) | + | ||||||

| H10: CSRD—Size (+/−) | − | ||||||

| Sun et al. [91] | 245 non-financial companies | UK | 2006–2007 | Regression Model (OLS) | CSR | H1: EM—CSR/CSRD (+) | N |

| H2: Board size—CSR/CSRD (+) | N | ||||||

| H3: Greater board size—Lesser CSR/CSRD (−) | N | ||||||

| H4: Num. audit committee meetings—CSR/CSRD (+) | + | ||||||

| H5: Greater Num. audit committee meetings—Lesser CSR/CSRD (−) | + |

| Lack and Problem | How We Mean to Improve It | |

|---|---|---|

| Theoretical Model | Lack of theory: How SD is used to engage stakeholders is understudied, there does not exist a robust theoretical model which explains the motivation for SD | Specifying the theoretical model more completely, elaborating a holistic model which jointly relates SD, SP and Stakeholders’ power, introducing firm size and the type of activity carried out as moderators of EP |

| There are few works which relate SD and SP, as they are centered mainly on the EP and especially on the ENVD | Focus on SD–SP link | |

| No introduction of innovative ideas | Introducing new ideas and approaches, such as legal and moral responsibility | |

| Inappropriate definition of key terms that are vaguely delimited | Providing an appropriate definition of all theoretical terms which make up the model for it to be replicated | |

| Homogeneity of strategic postures in the samples | Analyzing the role of the firm’s strategic posture in general (setting out from different corporate postures) and of the managers in particular (with surveys to determine their positions) | |

| New ideas and approaches among social performance measures | Introducing different accounting and management tools and measures to evaluate and assess the performance, such as Full Cost Accounting, Life Cycle Analysis, Balanced Scorecard, among others | |

| Lack of focus of theorization of different relationships: No consideration of the interactive impact of profit and the strategic posture | Moderation imposed by the characteristics of firms, such as size, sector and profitability (variables moderating and not explanatory as in previous models) | |

| Lack of methodology. There does not exist a robust methodology which completely explains SD | PLS, introducing variables which moderate the relation: size, sector, profitability (because companies currently have assumed social, environmental and ethical responsibility, as part of their business strategy, regardless of whether their size or profitability is greater or lesser, and irrespective of the sector of activity to which they belong) | |

| Empirical Data | Samples with similar strategic postures | Including samples with different strategic postures |

| Similar samples | Segmenting the sample according to the size of the companies to test if the greater the company the greater the disclosure regardless of its profitability | |

| No examination of the nature of disclosure: Voluntary versus mandatory | Separation between mandated and voluntary disclosure |

| Constructs | Definition | Relation | Hypothesis | Expected Sign | |||

|---|---|---|---|---|---|---|---|

| Sustainability Disclosure (SD) | Economic, social, ethics and environmental information | SD—SP | H1 | + | |||

| Sustainability Performance (SP) | Overall | SP is a composite of stakeholders’ power and strategic posture | SP—SD | ||||

| Stakeholders’ Power | Organizational Stakeholders | Prioritization that managers grant to the interests of some stakeholders over those of others | Stakeholders’ Power—SP | H2 | + | ||

| Non-organizational Stakeholders | |||||||

| Strategic Posture | Personal characteristics of the decision makers | Managers’ Perception | Managers’ opinions on CSR, sustainability, ethics and pro-environment are the most important internal drivers toward sustainability from a holistic perspective | Managers’ Perception—SP | H3 | + | |

| Managers’ Commitment | Personal characteristics of the decision makers to pursue sustainability and satisfy the needs of the different stakeholder | Managers’ Commitment—SP | |||||

| Integration sustainability | Company’s responsibility regarding sustainability | Legal and moral corporate responsibility about economic, ethical, social and environmental development | Corporate Sustainability Responsibility—SP | ||||

| General strategy of the firm | Strategic proactivity vs. Strategic passivity | General Strategy—SP | |||||

| Hierarchical position of the sustainability manager | Existence and hierarchical position responsible for sustainability | Position Sustainability Manager—SP | |||||

| Actions to achieve the SP and SD of a firm’s activities and satisfy stakeholders’ needs | Sustainability strategy is reflected in the different actions carried out for the integration of sustainability in the core business, strategy, performance and purpose of the company (Internal (administrative, management and evaluation) and external (diagnosis, evaluation and certification) actions) | Sustainability Actions—SP | |||||

| Economic Performance | ROA | Moderating effects on SD–SP link | H4 | + | |||

| Size | Large companies | H4a | + | ||||

| Small companies | H4b | + | |||||

| Performance | Disclosure | ||||

|---|---|---|---|---|---|

| Environmental | Social | CSR | Sustainable | ||

| Economic | (+) Al-Tuwaijri et al. [28] (+) Husillos and Álvarez-Gil [72] (+) Cormier and Magnan [102] (N) Freedman and Jaggi [103] (N) Brammer and Pavelin [83] (N) Magness [88] (N) Elijido-Ten [84] (N) Sun et al. [91] | (+) Kent and Zunker [87] (+) Chiu and Wang [60] (−) Cho et al. [35] | (+) Roberts [82] (+) Haniffa and Cooke [33] (+) Orlitzky et al. [34] (+) Lu and Abeysekera [14] (N) Brine et al. [36] (N) Chiu and Wang [60] | (+) Buhr [32] (+) Weber [104] (+) Artiach et al. [105] (−) Moneva et al. [25] | |

| Environmental | Good | (+) Al-Tuwaijri et al. [28] (+) Li et al. [106] | |||

| Bad | (+) Li et al. [106] (+) Cho et al. [35] (+) Patten [107] | ||||

| Higher Impact | (+) Brammer and Pavelin [83] | ||||

| Overall | (+) Clarkson et al. [29,30] (+) Clarkson et al. [31] (–) Cho and Patten [22] (–) De Villiers and van Staden [53] (N) Husillos and Álvarez-Gil [72] (N) Elijido-Ten [84] (N) Sun et al. [91] (N) Freedman and Wasley [108] | (N) Ingram and Frazier [109] | (+) Weber [104] | ||

| Sustainability | (N) Gallardo-Vázquez et al. [37] | (+) Herbohn et al. [85] | |||

| Type of Disclosure | |||||||

|---|---|---|---|---|---|---|---|

| Social | Environmental | CSR | Sustainability | ||||

| + | N | + | – | N | + | + | |

| Stakeholder Power | Chiu and Wang [60] 1 Kent and Zunker [87] | Brammer and Pavelin [83] | Husillos and Álvarez-Gil [72] Kent and Chan [86] 1 | Prado-Lorenzo et al. [90] Roberts [82] Lu and Abeysekera [14] Chiu and Wang [60] Purushothaman et al. [110] Branco and Rodrigues [40] Reverte [42] | Michelon [89] | ||

| Strategic Posture/Managers’ Concern and Commitment | Chiu and Wang [60] 1 | Elijido-Ten [84] Kent and Chan [86] 1 Sun et al. [91] Luque-Vílchez et al. [111] | Roberts [82] Chapple and Moon [112] | Herbohn et al. [85] | |||

| Size | Chiu and Wang [60] 1 | Brammer and Pavelin [83,113] 1,2,3 | Elijido-Ten [84] | Lu and Abeysekera [14] Chiu and Wang [60] Purushothaman et al. [110] Branco and Rodrigues [40] Reverte [42] Artiach et al. [105] | Herbohn et al. [85] | ||

| Media Visibility/Press | Chiu and Wang [60] 1 | Magness [88] | Brammer and Pavelin [83,113] 1,2,3 | Herbohn et al. [85] Michelon [89] | |||

| Leverage | Brammer and Pavelin [83,113] 1,2,3 | Artiach et al. [105] | |||||

| Dispersed Ownership | Brammer and Pavelin [83,113] 1,2,3 Elijido-Ten [84] | Prado-Lorenzo et al. [90] | |||||

| Business activity | Brammer and Pavelin [83,113] 1,2,3 Elijido-Ten [84] | Lu and Abeysekera [14] | |||||

| Assets age | Elijido-Ten [84] | Herbohn et al. [85] | |||||

| Environmental Performance | Brammer and Pavelin [83,113] 1,2,3 Al-Tuwaiji et al. [14] 1 | Weber [104] | |||||

| Sustainable Performance | Herbohn et al. [85] | ||||||

| Technical Data Sheet | |

|---|---|

| Universe | Electrical energy, petroleum refining, coking, metallurgy, cement, glass, ceramic products, and paper and cardboard |

| Geographical area | Spain |

| Population | 440 Spanish companies affected by the Kyoto Protocol |

| Period | October 2010–March 2011 |

| Method of gathering information | Electronic questionnaire reinforced by previous phone calls and e-mails |

| Sampling unit | Managers in charge of social, environmental and sustainability management |

| Final sample | 195 |

| Participation rate | 44.32% |

| Maximum error sample | 0% (no error sample) |

| Confidence Level | 95% |

| Source: Own elaboration. | |

| Variable | Category | Frequency | Percentage (%) | Cumulative Percentage (%) |

|---|---|---|---|---|

| Kind of company | Electrical energy | 104 | 53.33 | 53.33 |

| Petroleum refining | 5 | 2.56 | 55.90 | |

| Metallurgy | 33 | 16.92 | 72.82 | |

| Cement | 8 | 4.10 | 76.92 | |

| Glass | 12 | 6.15 | 83.08 | |

| Ceramic products | 15 | 7.69 | 90.77 | |

| Chemical products | 4 | 2.05 | 92.82 | |

| Paper and cardboard | 14 | 7.18 | 100.00 | |

| Operating Income | 0–10 Mill. € | 42 | 21.54 | 21.54 |

| 11–50 Mill. € | 49 | 25.13 | 46.67 | |

| 51–100 Mill. € | 30 | 15.38 | 62.05 | |

| 101–150 Mill. € | 12 | 6.15 | 68.21 | |

| 151–200 Mill. € | 8 | 4.10 | 72.31 | |

| 201–500 Mill. € | 20 | 10.26 | 82.56 | |

| 501–1000 Mill. € | 14 | 7.18 | 89.74 | |

| 1001–2000 Mill. € | 8 | 4.10 | 93.85 | |

| 2001–5000 Mill. € | 5 | 2.56 | 96.41 | |

| More than 5000 Mill. € | 7 | 3.59 | 100.00 | |

| Source: Own elaboration. | ||||

| Variable | Category | Frequency | Percentage (%) | Cumulative Percentage (%) |

|---|---|---|---|---|

| Chairpersonship | 2 | 1 | 1 | |

| Higher level manager (Sustainability/Environment) | 60 | 30.8 | 31.8 | |

| Intermediate level manager (Sustainability/Environment) | 38 | 19.5 | 51.3 | |

| Lower level manager (Sustainability/Environment) | 8 | 4.1 | 55.4 | |

| Associate to managers (Sustainability/Environment) | 25 | 12.8 | 68.2 | |

| Environmental Department Director | 51 | 26.3 | 94.5 | |

| Quality Department Director | 1 | 0.5 | 95 | |

| Productive Process Director | 1 | 0.5 | 95.5 | |

| Marketing Director | 3 | 1.5 | 97 | |

| Externally Subcontracted Service | 3 | 1.5 | 98.5 | |

| Other | 3 | 1.5 | 100 | |

| Source: Own elaboration. | ||||

| Variable | Name | In This Company Greater Importance is Given to... |

|---|---|---|

| Organizational Stakeholders | OS1 | Customers |

| OS2 | Shareholders | |

| Non-Organizational Stakeholders | NO1 | Trade Unions |

| NO2 | Employers’ Associations | |

| NO3 | Ecological Associations | |

| NO4 | Financial Entities | |

| NO5 | Investment Funds | |

| Responsibility | R1 | Legal Responsibility (legislation) |

| R2 | Moral Responsibility (commitment greater than what is legal) | |

| Managers’ Perception | MP1 | The activity of the company affects the environment and society |

| MP2 | The activity of the company has a greater effect than other sectors | |

| Managers’ Commitment | MC1 | Manager’s Proactivity (Responsibility) |

| MC2 | Adverse attitude toward the search for Sustainable Development | |

| General Strategy | GS1 | Products Leadership |

| GS2 | Cost Leadership | |

| GS3 | Differentiation and competitive advantage | |

| GS4 | Excellence of the productive process | |

| GS5 | Proximity to clients | |

| GS6 | Segmentation or market approach | |

| GS7 | Sustainability | |

| GS8 | Other | |

| Hierarchical Position Sustainability Manager | HP1 | Chairpersonship |

| HP2 | Higher level manager (Sustainability/Environment) | |

| HP3 | Intermediate level manager (Sustainability/Environment) | |

| HP4 | Lower level manager (Sustainability/Environment) | |

| HP5 | Associate to managers (Sustainability/Environment) | |

| HP6 | Environmental Department Director | |

| HP7 | Quality Department Director | |

| HP8 | Production Process Director | |

| HP9 | Marketing Director | |

| HP10 | Externally Subcontracted Service | |

| HP11 | Other | |

| Sustainability Actions (Administrative, Diagnostic and Certification) | SA1 | Environmental Policy |

| SA2 | Environmental/CSR/Sustainability Manager | |

| SA3 | Protection Manual | |

| SA4 | Social and Environmental Disclosure | |

| SA5 | Staff Training | |

| SA6 | Diagnostic Analysis: Social and Environmental Impacts | |

| SA7 | Analysis of the Cycle Life | |

| SA8 | ISO 14001 | |

| SA9 | EMAS | |

| Sustainability Disclosure | SD1 | Social and Environmental Provisions |

| SD2 | Social and Environmental Contingencies | |

| SD3 | Financial Estimates of Social and Environmental Cost Not Internalized | |

| SD4 | Social and Environmental Investments | |

| SD5 | Estimation of social and environmental costs | |

| SD6 | Waste Management | |

| SD7 | Energy Saving | |

| SD8 | Recycling | |

| SD9 | Compliance with legislations | |

| SD10 | Sanctions | |

| SD11 | Litigations | |

| SD12 | Social and environmental audit and management systems | |

| SD13 | Estimation of social and environmental income | |

| SD14 | Assurance of Social and Environmental Responsibilities | |

| Source: Own elaboration. | ||

| Items | All | ||

|---|---|---|---|

| SP | AVE | 0.826 | |

| Composite Reliability | 0.904 | ||

| Cronbach’s Alpha | 0.789 | ||

| Stakeholders’ Powers | 0.901 | ||

| Strategic Position | 0.916 | ||

| SD | AVE | 0.677 | |

| Composite Reliability | 0.961 | ||

| Cronbach’s Alpha | 0.956 | ||

| Accountability on environmental provisions | 0.927 | ||

| Accountability on environmental contingencies | 0.857 | ||

| Accountability on non-internalized environmental costs estimates | 0.806 | ||

| Accountability on internalized environmental costs estimates | 0.860 | ||

| Accountability on resource management | 0.663 | ||

| Accountability on energy savings | 0.793 | ||

| Recycling | 0.763 | ||

| Compliance with legislations | 0.791 | ||

| Accountability on sanctions | 0.701 | ||

| Accountability on litigations | 0.913 | ||

| Accountability on estimation of environmental income | 0.915 | ||

| Accountability on the assurance of environmental responsibilities | 0.841 | ||

| EP | |||

| Economic Performance | N.A. | N.A. | |

| Items | All | Large | Small | ||

|---|---|---|---|---|---|

| SP | AVE | 0.826 | 0.804 | 0.800 | |

| Composite Reliability | 0.904 | 0.891 | 0.930 | ||

| Cronbach’s Alpha | 0.789 | 0.757 | 0.850 | ||

| Stakeholders’ Powers | 0.901 | 0.910 | 0.922 | ||

| Strategic Position | 0.916 | 0.883 | 0.942 | ||

| SD | |||||

| SD | N.A. | N.A. | |||

| EP | |||||

| EP | N.A. | N.A. |

| Moderating Effect EP | EP | SD | SP | |

|---|---|---|---|---|

| Moderating Effect EP | 1.00 | |||

| EP | −0.11 | 1.00 | ||

| SD | 0.04 | 0.07 | 0.82 | |

| SP | −0.16 | 0.15 | 0.52 | 0.90 |

| Moderating Effect EP | EP | SD | SP | |

|---|---|---|---|---|

| Moderating Effect EP | ||||

| EP | 0.11 | |||

| SD | 0.04 | 0.07 | ||

| SP | 0.18 | 0.17 | 0.57 |

| Moderating Effects | EP | SD | SP | |

|---|---|---|---|---|

| Moderating Effects | 1.035 | |||

| EP | 1.031 | |||

| SD | ||||

| SP | 1.041 |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | t Statistics (|O/STDEV|) | p Values | |

|---|---|---|---|---|---|

| Moderating Effect ≥ SD | 0.120 ** | 0.123 | 0.047 | 2.586 | 0.010 |

| EP ≥ SD | 0.003 (n.s.) | 0.005 | 0.066 | 0.048 | 0.962 |

| SP ≥ SD | 0.543 *** | 0.548 | 0.048 | 11.380 | 0.000 |

| Large | Small | Large–Small | Henseler’s p Value (sig) | |

|---|---|---|---|---|

| Moderating Effects ≥ SD | 0.38 *** | 0.05 (n.s.) | 0.33 | 0.33 (n.s.) |

| EP ≥ SD | 0.08 (n.s.) | −0.14 (n.s.) | 0.22 | 0.22 (s.) |

| SP ≥ SD | 0.44 *** | 0.48 *** | 0.04 | 0.04 (n.s.) |

| SRMR | (O) | 2.5% | 97.5% |

| Saturated model | 0.086 | 0.032 | 0.046 |

| Estimated model | 0.086 | 0.032 | 0.046 |

| d_ULS | (O) | 2.5% | 97.5% |

| Saturated model | 0.880 | 0.119 | 0.255 |

| Estimated model | 0.880 | 0.120 | 0.258 |

| d_G | (O) | 2.5% | 97.5% |

| Saturated model | 1.099 | 0.167 | 0.439 |

| Estimated model | 1.099 | 0.170 | 0.442 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pajuelo Moreno, M.L.; Duarte-Atoche, T. Relationship between Sustainable Disclosure and Performance—An Extension of Ullmann’s Model. Sustainability 2019, 11, 4411. https://doi.org/10.3390/su11164411

Pajuelo Moreno ML, Duarte-Atoche T. Relationship between Sustainable Disclosure and Performance—An Extension of Ullmann’s Model. Sustainability. 2019; 11(16):4411. https://doi.org/10.3390/su11164411

Chicago/Turabian StylePajuelo Moreno, María Luisa, and Teresa Duarte-Atoche. 2019. "Relationship between Sustainable Disclosure and Performance—An Extension of Ullmann’s Model" Sustainability 11, no. 16: 4411. https://doi.org/10.3390/su11164411

APA StylePajuelo Moreno, M. L., & Duarte-Atoche, T. (2019). Relationship between Sustainable Disclosure and Performance—An Extension of Ullmann’s Model. Sustainability, 11(16), 4411. https://doi.org/10.3390/su11164411