Effects of Sustainability and Technology Orientations on Firm Growth: Evidence from Chinese Manufacturing

Abstract

Our mission is to be the leading global innovator, developer and provider of cleaning, sanitation and maintenance products, systems, and services. As a team, we will achieve aggressive growth and fair return for our shareholders. We will accomplish this by exceeding the expectations of our customers while conserving resources and preserving the quality of the environment.—Mission statement of Ecolab INC

1. Introduction

2. Theoretical Background and Hypotheses

2.1. What is Strategic Orientation?

2.2. Strategic Orientations and Firm Growth

2.2.1. Technology Orientation and Firm Growth

2.2.2. Sustainability Orientation and Firm Growth

2.3. The Contextual Mechanism on Strategic Orientations

3. Methodology

3.1. Empirical Setting

3.2. Data

3.3. Measures

3.3.1. Dependent Variable

3.3.2. Independent Variables

3.3.3. Moderator Variables

3.3.4. Control Variables

4. Results

4.1. Descriptive Statistics

4.2. Results on Strategic Orientations and Firm Growth

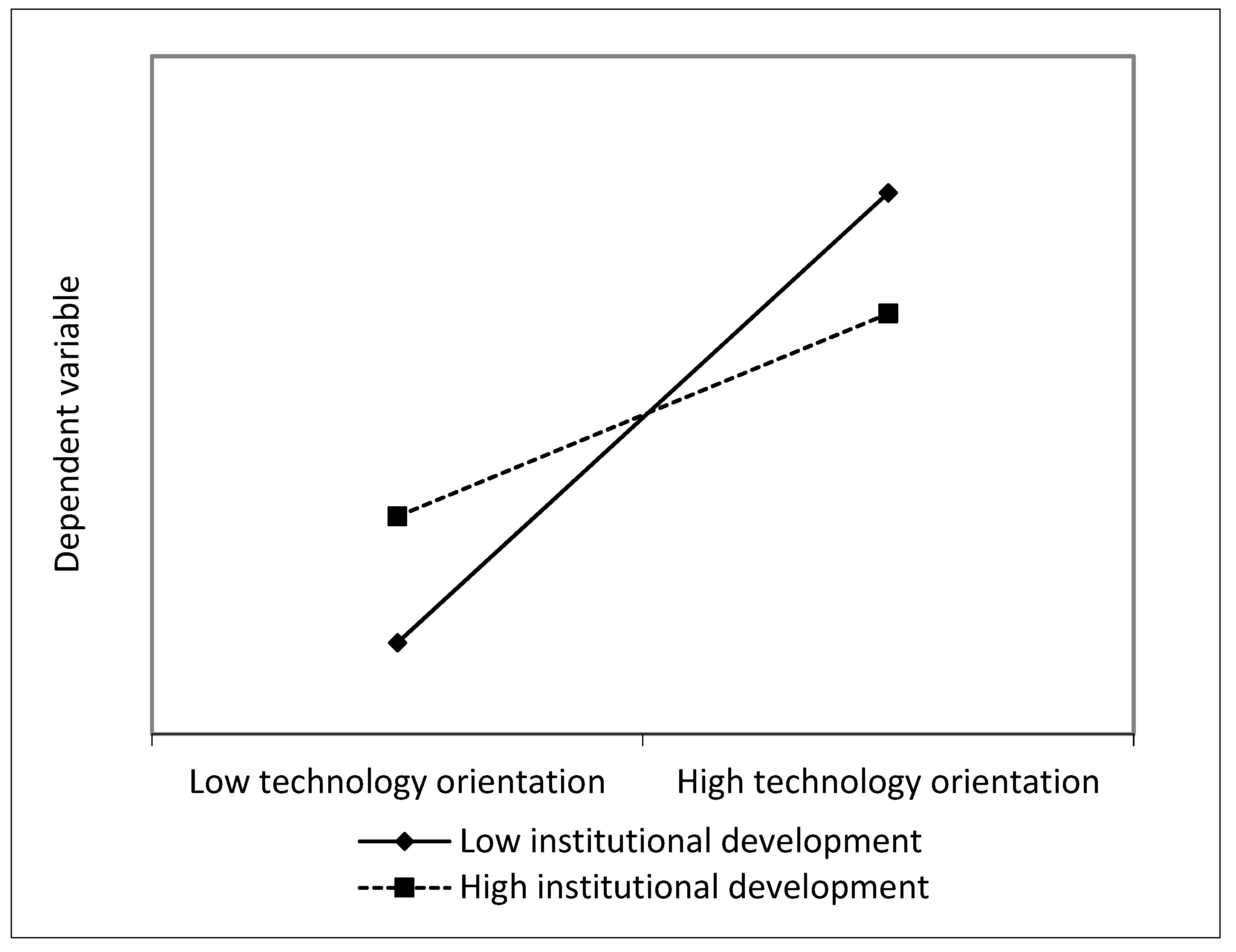

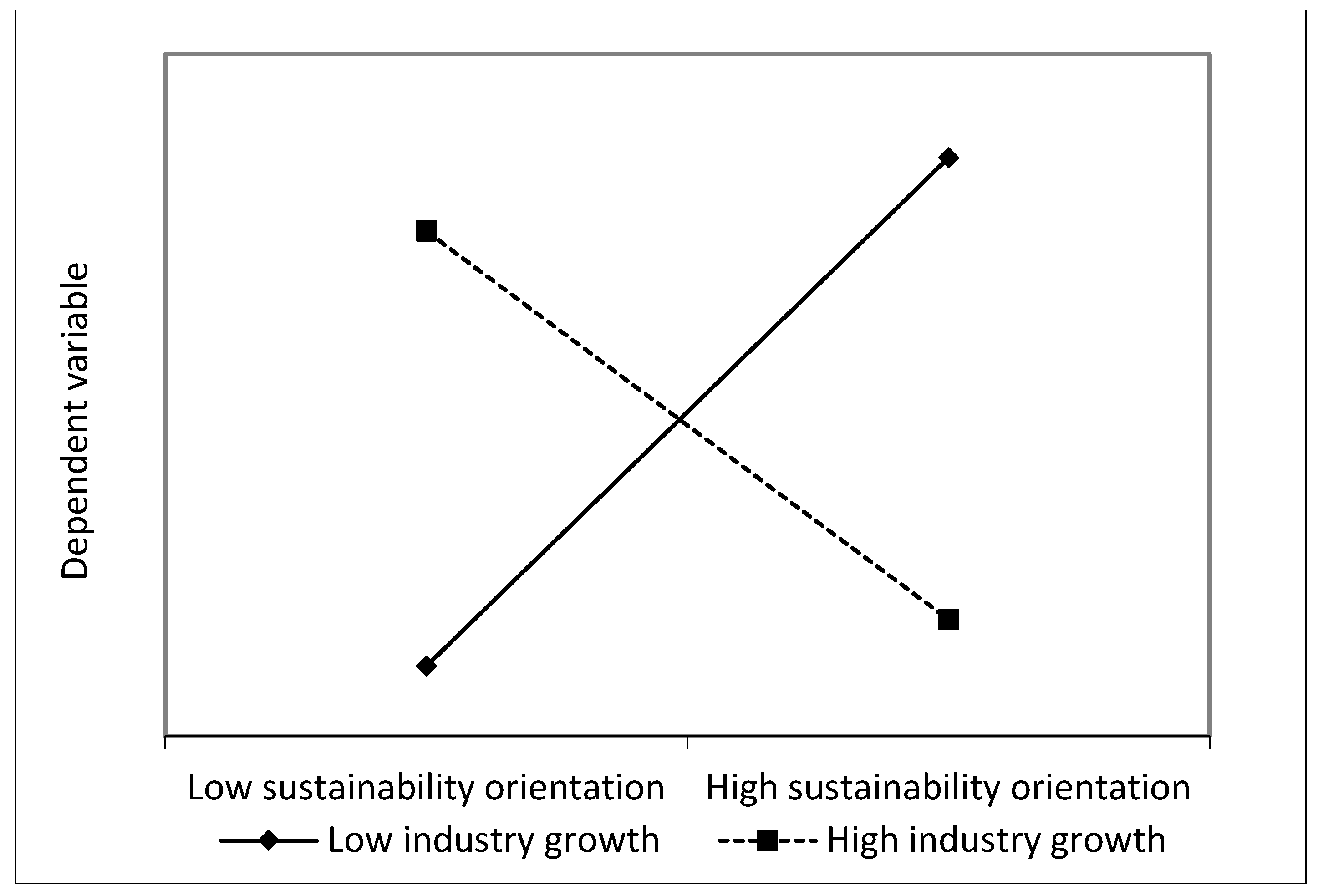

4.3. Results on the Moderation of External Environment

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Leng, Z.; Liu, Z.; Tan, M.; Pang, J. Speed leaders and quality champions. Manag. Decis. 2015, 53, 1247–1267. [Google Scholar] [CrossRef]

- Ameer, R.; Othman, R. Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations. J. Bus. Ethics 2012, 108, 61–79. [Google Scholar] [CrossRef]

- Grewatsch, S.; Kleindienst, I. When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: A critical review. J. Bus. Ethics 2017, 145, 383–416. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strat. Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An Empirical Examination of the Relationship between Corporate Social Responsibility and Profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar]

- Barnett, M.L.; Salomon, R.M. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strat. Manag. J. 2012, 33, 1304–1320. [Google Scholar] [CrossRef]

- Lankoski, L. Corporate responsibility activities and economic performance: A theory of why and how they are connected. Bus. Strat. Environ. 2008, 17, 536–547. [Google Scholar] [CrossRef]

- Surroca, J.; TribÓ, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strategic Manage. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Zahra, S.A.; Bogner, W.C. Technology strategy and software new ventures’ performance: Exploring the moderating effect of the competitive environment. J. Bus. Ventur. 2000, 15, 135–173. [Google Scholar] [CrossRef]

- Barr, P.S.; Stimpert, J.L.; Huff, A.S. Cognitive change, strategic action, and organizational renewal. Strat. Manag. J. 1992, 13, 15–36. [Google Scholar] [CrossRef]

- Nadkarni, S.; Barr, P.S. Environmental context, managerial cognition, and strategic action: An integrated view. Strat. Manag. J. 2008, 29, 1395–1427. [Google Scholar] [CrossRef]

- Hahn, T.; Preuss, L.; Pinkse, J.; Figge, F. Cognitive Frames in Corporate Sustainability: Managerial Sensemaking with Paradoxical and Business Case Frames. Acad. Manag. Rev. 2014, 39, 463–487. [Google Scholar] [CrossRef]

- Adams, P.; Freitas, I.M.B.; Fontana, R. Strategic orientation, innovation performance and the moderating influence of marketing management. J. Bus. Res. 2019, 97, 129–140. [Google Scholar] [CrossRef]

- Hakala, H. Strategic orientations in management literature: Three approaches to understanding the interaction between market, technology, entrepreneurial and learning orientations. Int. J. Manag. Rev. 2011, 13, 199–217. [Google Scholar] [CrossRef]

- Kreitler, S.; Kreitler, H.; Zigler, E. Cognitive orientation and curiosity. Br. J. Psychol. 1974, 65, 43–52. [Google Scholar] [CrossRef]

- Voss, G.B.; Voss, Z.G. Strategic Orientation and Firm Performance in an Artistic Environment. J. Mark. 2000, 64, 67–83. [Google Scholar] [CrossRef]

- Neill, S.; Rose, G.M. The effect of strategic complexity on marketing strategy and organizational performance. J. Bus. Res. 2006, 59, 1–10. [Google Scholar] [CrossRef][Green Version]

- Hakala, H. Entrepreneurial and learning orientation: Effects on growth and profitability in the software sector. Balt. J. Manag. 2013, 8, 102–118. [Google Scholar] [CrossRef]

- Gatignon, H.; Xuereb, J.M. Strategic Orientation of the Firm and New Product Performance. J. Mark. Res. 1997, 34, 77. [Google Scholar] [CrossRef]

- Scott-Kennel, J.; Giroud, A. MNEs and FSAs: Network knowledge, strategic orientation and performance. J. World Bus. 2015, 50, 94–107. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Hurley, R.F.; Knight, G.A. Innovativeness: Its antecedents and impact on business performance. Ind. Mark. Manag. 2004, 33, 429–438. [Google Scholar] [CrossRef]

- Roxas, B.; Coetzer, A. Institutional Environment, Managerial Attitudes and Environmental Sustainability Orientation of Small Firms. J. Bus. Ethic 2012, 111, 461–476. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper Echelons: The Organization as a Reflection of Its Top Managers. Acad. Manag. Rev. 1984, 9, 193. [Google Scholar] [CrossRef]

- Kiesler, S.; Sproull, L. Managerial Response to Changing Environments: Perspectives on Problem Sensing from Social Cognition. Adm. Sci. Q. 1982, 27, 548. [Google Scholar] [CrossRef]

- Daft, R.L.; Weick, K.E. Toward a Model of Organizations as Interpretation Systems. Acad. Manag. Rev. 1984, 9, 284. [Google Scholar] [CrossRef]

- Frambach, R.T.; Fiss, P.C.; Ingenbleek, P.T. How important is customer orientation for firm performance? A fuzzy set analysis of orientations, strategies, and environments. J. Bus. Res. 2016, 69, 1428–1436. [Google Scholar] [CrossRef]

- Laukkanen, T.; Nagy, G.; Hirvonen, S.; Reijonen, H.; Pasanen, M. The effect of strategic orientations on business performance in SMEs: A multigroup analysis comparing Hungary and Finland. Int. Mark. Rev. 2013, 30, 510–535. [Google Scholar] [CrossRef]

- Al-Ansaari, Y.; Bederr, H.; Chen, C. Strategic orientation and business performance. Manag. Decis. 2015, 53, 2287–2302. [Google Scholar] [CrossRef]

- Hortinha, P.; Lages, C.; Lages, L.F. The Trade-off between Customer and Technology Orientations: Impact on Innovation Capabilities and Export Performance. J. Int. Mark. 2011, 19, 36–58. [Google Scholar] [CrossRef]

- Grewal, R.; Tansuhaj, P. Building Organizational Capabilities for Managing Economic Crisis: The Role of Market Orientation and Strategic Flexibility. J. Mark. 2001, 65, 67–80. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. A Conceptual Model of Entrepreneurship as Firm Behavior. Entrep. Theory Pr. 1991, 16, 7–26. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Schepers, J.; Voordeckers, W.; Steijvers, T.; Laveren, E. The entrepreneurial orientation-performance relationship in private family firms: The moderating role of socioemotional wealth. Small Bus. Econ. 2014, 43, 39–55. [Google Scholar] [CrossRef]

- Lee, D.H.; Dedahanov, A.T.; Rhee, J. Moderating role of external networks and mediating effect of innovation performance on the relationship between technology orientation and firm performance. Asian J. Technol. Innov. 2015, 23, 321–334. [Google Scholar] [CrossRef]

- Kocak, A.; Carsrud, A.; Oflazoglu, S. Market, entrepreneurial, and technology orientations: Impact on innovation and firm performance. Manag. Decis. 2017, 55, 248–270. [Google Scholar] [CrossRef]

- Chen, Y.; Tang, G.; Jin, J.; Xie, Q.; Li, J. CEOs’ Transformational Leadership and Product Innovation Performance: The Roles of Corporate Entrepreneurship and Technology Orientation. J. Prod. Innov. Manag. 2014, 31, 2–17. [Google Scholar] [CrossRef]

- Hong, P.; Jagani, S.; Kim, J.; Youn, S.H. Managing sustainability orientation: An empirical investigation of manufacturing firms. Int. J. Prod. Econ. 2019, 211, 71–81. [Google Scholar] [CrossRef]

- Bansal, P. The corporate challenges of sustainable development. Acad. Manag. Perspect. 2002, 16, 122–131. [Google Scholar] [CrossRef]

- Hart, S.L. A Natural-Resource-Based View of the Firm. Acad. Manag. Rev. 1995, 20, 986. [Google Scholar] [CrossRef]

- Cheng, C.J. Sustainability Orientation, Green Supplier Involvement, and Green Innovation Performance: Evidence from Diversifying Green Entrants. J. Bus. Ethics 2018, 1–22. [Google Scholar] [CrossRef]

- Danso, A.; Adomako, S.; Lartey, T.; Amankwah-Amoah, J.; Owusu-Yirenkyi, D. Stakeholder integration, environmental sustainability orientation and financial performance. J. Bus. Res. 2019. [Google Scholar] [CrossRef]

- Bansal, P.; Clelland, I. Talking trash: legitimacy, impression management, and unsystematic risk in the context of the natural environment. Acad. Manag. J. 2004, 47, 93–103. [Google Scholar]

- De Mol, E.; Khapova, S.N.; Elfring, T. Entrepreneurial Team Cognition: A Review. Int. J. Manag. Rev. 2015, 17, 232–255. [Google Scholar] [CrossRef]

- Adams, R.; Jeanrenaud, S.; Bessant, J.; Denyer, D.; Overy, P. Sustainability-oriented Innovation: A Systematic Review. Int. J. Manag. Rev. 2016, 18, 180–205. [Google Scholar] [CrossRef]

- Escribá-Esteve, A.; Sánchez-Peinado, L.; Sánchez-Peinado, E. Moderating Influences on the Firm’s Strategic Orientation-Performance Relationship. Int. Small Bus. J. Res. Entrep. 2008, 26, 463–489. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Yang, Z.; Zhou, N. Developing strategic orientation in China: Antecedents and consequences of market and innovation orientations. J. Bus. Res. 2005, 58, 1049–1058. [Google Scholar] [CrossRef]

- Meyer, K.E.; Estrin, S.; Bhaumik, S.K.; Peng, M.W. Institutions, resources, and entry strategies in emerging economies. Strat. Manag. J. 2009, 30, 61–80. [Google Scholar] [CrossRef]

- Hao, R.; Wei, Z. Fundamental causes of inland–coastal income inequality in post-reform China. Ann. Regional Sci. 2010, 45, 181–206. [Google Scholar] [CrossRef]

- Liu, X.; Lu, J.; Chizema, A. Top executive compensation, regional institutions and Chinese OFDI. J. World Bus. 2014, 49, 143–155. [Google Scholar] [CrossRef]

- North, D. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Wang, C.; Yi, J.; Kafouros, M.; Yan, Y. Under what institutional conditions do business groups enhance innovation performance? J. Bus. Res. 2015, 68, 694–702. [Google Scholar] [CrossRef]

- Roxas, B.; Ashill, N.; Chadee, D. Effects of entrepreneurial and environmental sustainability orientations on firm performance: A study of small businesses in the Philippines. J. Small Bus. Manag. 2017, 55, 163–178. [Google Scholar] [CrossRef]

- Hajer, M. Policy without polity? Policy analysis and the institutional void. Policy Sci. 2003, 36, 175–195. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate Social Responsibility Reporting in China: Symbol or Substance? Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef]

- Abernathy, W.J.; Utterback, J.M. Patterns of industrial innovation. Technol. Rev. 1978, 80, 40–47. [Google Scholar]

- Pagell, M.; Claudy, M.C.; Peterson, M. The Roles of Sustainability Orientation and Market Knowledge Competence in New Product Development Success. J. Prod. Innov. Manag. 2016, 33, 72–85. [Google Scholar]

- Elzen, M.D.; Fekete, H.; Höhne, N.; Admiraal, A.; Forsell, N.; Hof, A.F.; Olivier, J.G.; Roelfsema, M.; Van Soest, H. Greenhouse gas emissions from current and enhanced policies of China until 2030: Can emissions peak before 2030? Energy Policy 2016, 89, 224–236. [Google Scholar] [CrossRef]

- Townshend, T.; Fankhauser, S.; Matthews, A.; Feger, C.; Liu, J.; Narciso, T.; Fankhauser, S. Legislating Climate Change on a National Level. Environ. Sci. Policy Sustain. Dev. 2011, 53, 5–17. [Google Scholar] [CrossRef]

- China’s National People’s Congress. The Twelfth Five-Year Plan for National Economic and Social Development. 2011–2015. Available online: http://ghs.ndrc.gov.cn/ghwb/gjwngh/201109/P020110919590835399263.pdf (accessed on 19 September 2011).

- Surroca, J.; Prior, D.; Tribó Giné, J.A. Using panel data DEA to measure CEOs’ focus of attention: An application to the study of cognitive group membership and performance: Using Panel Data DEA to Measure CEOs’ Focus of Attention. Strategic Manage. J. 2016, 37, 370–388. [Google Scholar] [CrossRef]

- Eberhart, R.N.; Eesley, C.E.; Eisenhardt, K.M. Failure Is an Option: Institutional Change, Entrepreneurial Risk, and New Firm Growth. Organ. Sci. 2017, 28, 93–112. [Google Scholar] [CrossRef]

- Nadkarni, S.; Narayanan, V.K. Strategic schemas, strategic flexibility, and firm performance: The moderating role of industry clockspeed. Strat. Manag. J. 2007, 28, 243–270. [Google Scholar] [CrossRef]

- Kim, J.; Lee, C.Y.; Cho, Y. Technological diversification, core-technology competence, and firm growth. Res. Policy 2016, 45, 113–124. [Google Scholar] [CrossRef]

- Wang, X.; Fan, G.; Yu, J. Marketization Index of China’s Provinces: NERI Report 2016; Social Science Academic Press: Beijing, China, 2017; pp. 1–6. [Google Scholar]

- Xie, Q. Firm age, marketization, and entry mode choices of emerging economy firms: Evidence from listed firms in China. J. World Bus. 2017, 52, 372–385. [Google Scholar] [CrossRef]

- Chen, D.N.; Liang, T.P. Knowledge diversity and firm performance: An ecological view. J. Knowl. Manag. 2016, 20, 671–686. [Google Scholar] [CrossRef]

- Davidsson, P. Small Firm Growth. Found. Trends® Entrep. 2010, 6, 69–166. [Google Scholar] [CrossRef]

- Plambeck, N.; Weber, K. CEO Ambivalence and Responses to Strategic Issues. Organ. Sci. 2009, 20, 993–1010. [Google Scholar] [CrossRef]

- De Ruyter, K.; de Jong, A.; Wetzels, M. Antecedents and consequences of environmental stewardship in boundary-spanning B2B teams. J. Acad. Mark. Sci. 2009, 37, 470–487. [Google Scholar] [CrossRef]

| Author | Year | Journal | Key Findings |

|---|---|---|---|

| Prior Studies Investigating Parallel Direct Influences of Strategic Orientations on Firm Performance | |||

| Al-Ansaari, Bederr, & Chen | 2015 | MD | MO has a positive influence on firm performance compared to TO and AO. |

| Frambach, Fiss, & Ingenbleek | 2016 | JBR | MO has a positive effect on superior performance. |

| Grewal & Tansuhaj | 2001 | JOM | MO has an adverse effect on firm performance after a crisis. The main effect is moderated by demand and technological uncertainty, and could be enhanced by competitive intensity. |

| Hortinha, Lages, & Lages | 2011 | JIM | Exporters with poor past performance may achieve higher export performance when they have a high MO compared to a high TO. |

| Laukkanen et al., | 2013 | IMR | For SMEs in both Hungary and Finland, EO and MO have positive effects on business growth. |

| Schepers et al., | 2014 | SBE | EO has a positive effect on firm performance for family business. |

| Prior Studies Investigating Influences of SO on Firm Performance | |||

| Cheng | 2018 | JBE | With a high SO, firms are more likely to have better green innovation performance. |

| Danso et al., | 2019 | JBR | The relation between stakeholder integration and firm’s financial performance is mediated by SO. |

| Roxas, Ashill, & Chadee | 2017 | JSBM | SO positively associates with the performance of small businesses under a developing country context, and it mediates the effects of EO on the performance. |

| Prior Studies Investigating Parallel Direct Influences of PO/TO on Firm Performance | |||

| Lau | 2011 | JBR | Strategic orientations on product innovation are positively related to higher firm performance. |

| Lee, Dedahanov, & Rhee | 2015 | AJTI | Innovation performance mediates the relationship between TO and firms’ financial performance. |

| Kocak Carsrud, & Oflazoglu | 2017 | MD | TO had a negative effect on firm performance in the sample of SME firms. |

| Voss & Voss | 2000 | JoM | The results offered little support for the positive relationship between PO and firm performance |

| Selection Standards | |

|---|---|

| Market position | Operating in industries with 4-digit SCI code; |

| Leadership | No.1 in China or Top 3 in the world market; |

| Sales | Less than 10 billion RMB in 2016; |

| Industry | Manufacturing in SCI code (C13–C43); |

| Listed company | IPO before 2010; |

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Firm Growth | 19.113 | 1.244 | 1 | ||||||||

| 2. Size | 7.570 | 0.802 | 0.417 *** | 1 | |||||||

| 3. Age | 9.636 | 4.084 | 0.019 | 0.166 * | 1 | ||||||

| 4. Institution | 7.502 | 3.860 | 0.066 | −0.116 | −0.013 | 1 | |||||

| 5. Industry Growth | 0.113 | 0.197 | 0.058 | 0.182 ** | 0.093 | −0.066 | 1 | ||||

| 6. Comprehensiveness | 0.822 | 0.099 | −0.174 * | −0.01 | −0.037 | 0.047 | −0.229 *** | 1 | |||

| 7. Connectedness | 0.427 | 0.160 | −0.037 | −0.178 ** | −0.036 | 0.026 | −0.234 *** | 0.461 *** | 1 | ||

| 8. Sustainability Orientation | 0.089 | 0.106 | 0.170 * | 0.128 | 0.192 ** | 0.190 ** | −0.01 | 0.119 | −0.029 | 1 | |

| 9. Technology Orientation | 0.302 | 0.127 | −0.038 | −0.183 ** | −0.129 | −0.094 | −0.107 | 0.177 ** | 0.190 ** | −0.308 *** | 1 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Size | 0.723 *** | 0.738 *** | 0.742 *** | 0.712 *** |

| (0.146) | (0.147) | (0.145) | (0.148) | |

| Age | −0.00919 | −0.0144 | −0.0145 | −0.00776 |

| (0.0311) | (0.0315) | (0.0311) | (0.0318) | |

| Institution | 0.0276 | 0.0227 | 0.0145 | 0.0189 |

| (0.0304) | (0.0301) | (0.0300) | (0.0299) | |

| Industry Growth (IG) | −0.308 | −0.199 | −0.251 | −0.650 |

| (0.634) | (0.624) | (0.613) | (0.661) | |

| Comprehensiveness | −3.218 ** | −4.143 *** | −3.822 *** | −4.003 *** |

| (1.252) | (1.285) | (1.278) | (1.276) | |

| Connectedness | 1.351 * | 1.490 * | 1.440 * | 1.479 * |

| (0.780) | (0.771) | (0.757) | (0.772) | |

| Technology Orientation (TO) | 1.670 * | 1.685 * | 1.695 * | |

| (0.983) | (0.982) | (0.974) | ||

| Sustainability Orientation (SO) | 2.452 ** | 2.723 ** | 2.860 ** | |

| (1.142) | (1.133) | (1.155) | ||

| Institution × SO | −0.113 | |||

| (0.271) | ||||

| Institution × TO | −0.638 ** | |||

| (0.268) | ||||

| IG × SO | −21.37 * | |||

| (11.64) | ||||

| IG × TO | −7.048 | |||

| (5.812) | ||||

| Constant | 15.60 *** | 16.24 *** | 16.03 *** | 16.33 *** |

| (1.427) | (1.458) | (1.432) | (1.449) | |

| N | 103 | 103 | 103 | 103 |

| R ^ 2 | 0.2341 | 0.2796 | 0.3228 | 0.3079 |

| ΔR ^ 2 | / | 0.0455 | 0.0432 | 0.0283 |

| F-Value | 4.89 *** | 4.56 *** | 4.38 *** | 4.09 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lei, L.; Wu, X.; Fu, Y. Effects of Sustainability and Technology Orientations on Firm Growth: Evidence from Chinese Manufacturing. Sustainability 2019, 11, 4406. https://doi.org/10.3390/su11164406

Lei L, Wu X, Fu Y. Effects of Sustainability and Technology Orientations on Firm Growth: Evidence from Chinese Manufacturing. Sustainability. 2019; 11(16):4406. https://doi.org/10.3390/su11164406

Chicago/Turabian StyleLei, Linan, Xiaobo Wu, and Yanan Fu. 2019. "Effects of Sustainability and Technology Orientations on Firm Growth: Evidence from Chinese Manufacturing" Sustainability 11, no. 16: 4406. https://doi.org/10.3390/su11164406

APA StyleLei, L., Wu, X., & Fu, Y. (2019). Effects of Sustainability and Technology Orientations on Firm Growth: Evidence from Chinese Manufacturing. Sustainability, 11(16), 4406. https://doi.org/10.3390/su11164406