Livelihood and Environmental Impacts of Payments for Forest Environmental Services: A Case Study in Vietnam

Abstract

1. Introduction

- •

- The first layout of the framework shows the related activities of FESs such as demand–supply transactions embedded in payments for using power and water from hydropower companies. This layout also indicates the enabling conditions such as regulations, capacity building, governing, monitoring, and evaluation, following Decree 99/2010/ND-CP on PFES policy implementation. These activities are being conducted by different FES stakeholders (indirect FES users) as inputs (layout 2) for water supply and hydropower, and by tourism companies (direct FES users) to operate their businesses.

- •

- Based on the enabling conditions, including contract arrangements, these direct FES users collect FES payments and transfer 100% of those payments to the central and/or provincial Forest Protection and Development Funds (FPDFs) under Ministry of Agriculture and Rural Development (MARD) or Department of Agriculture and Rural Development (DARD). The collected FES payments, as intermediate outputs (layout 3), are managed by government trust fund managers. These managers are entitled to reserve up to 15% of the total payment (10% for administrative costs and 5% for forest protection in the case of natural disaster or drought).

- •

- Through subcontracting arrangements with FES providers, trust fund managers (from central and provincial FPDFs) transfer the remaining 85% of the collected FES payment to FES providers who are individual household (HH) forest owners, organization forest owners (e.g., commune people’s committees, companies, forest management units, youth unions, etc.), and/or village, community, or household group forest owners. FES providers receive these FES payments, one of the short-term livelihood outcomes of the PFES policy (layout 4), to better manage, protect, and develop their respective forest areas, and to contribute to building financial capital for their families, enhancing natural capital and strengthening social capital.

- •

- Consequently, it is expected that with FES payments, HH income (financial capital) of FES providers will be increased and forest environmental services (natural capital) will be enhanced. This is the expected medium-term outcome of the PFES policy (layout 5). As a result, the PFES policy would contribute to improved well-being, poverty reduction, social development, and a healthy environment as long-term outcomes (layout 6). Eventually, the healthier environment/nature will provide better ecosystem services for humans (including indirect and direct FES users from levels 1 to 6 of Figure 1) and other organisms.

2. Livelihood and Environmental Impacts of PES

2.1. PES Schemes Have a Positive Impact on Financial Outcomes at the Household Level

2.2. Natural Capital Impacts of PES

3. Materials and Methods

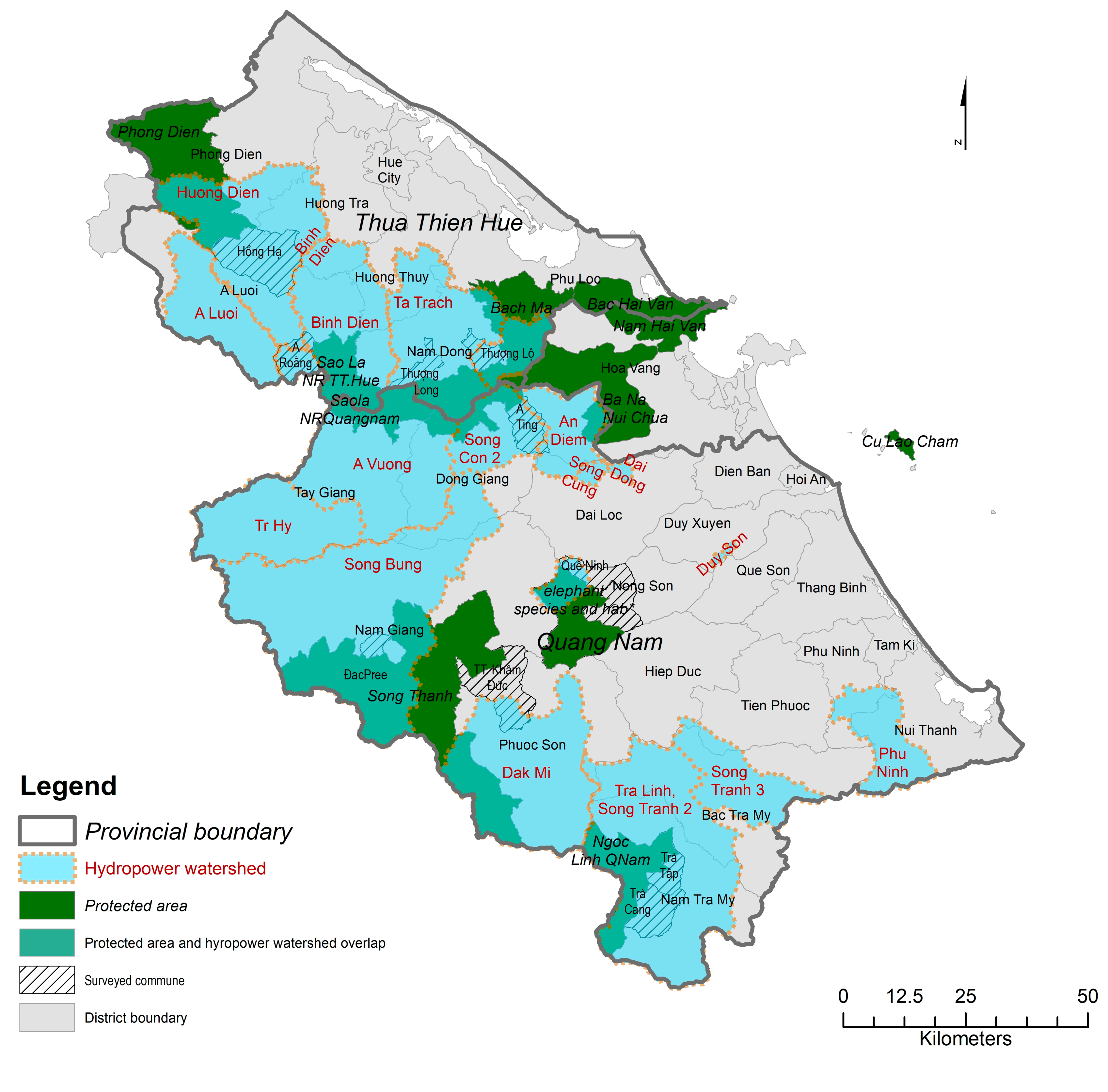

3.1. Study Area

3.2. Data Collection and Analysis

3.2.1. Sampling and Sample Size

3.2.2. Data Quality Assurance

3.2.3. Outlier Checking

3.2.4. Data Analysis

4. Results

4.1. Characteristics of Sampled Households

4.2. PFES and Financial Capital

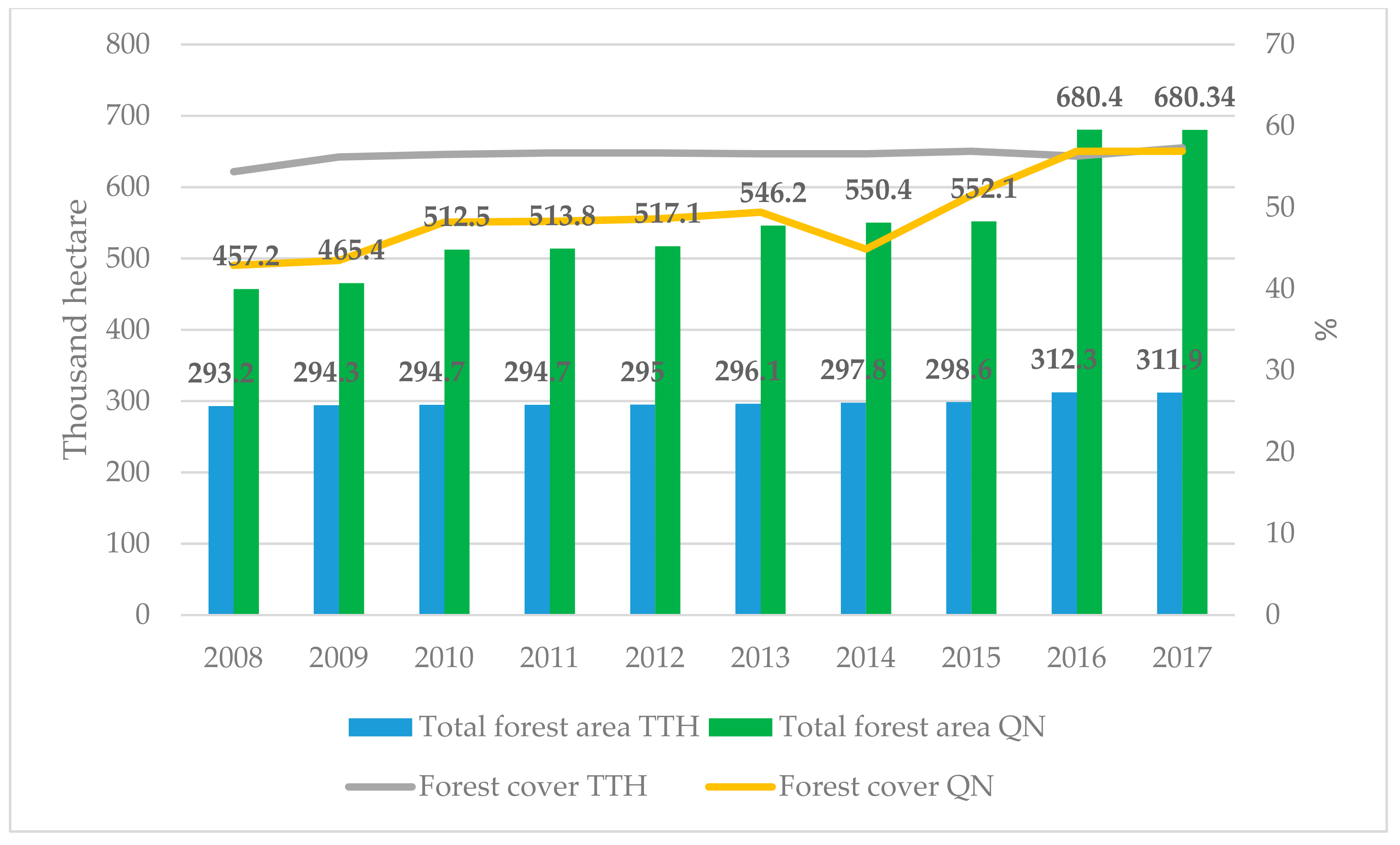

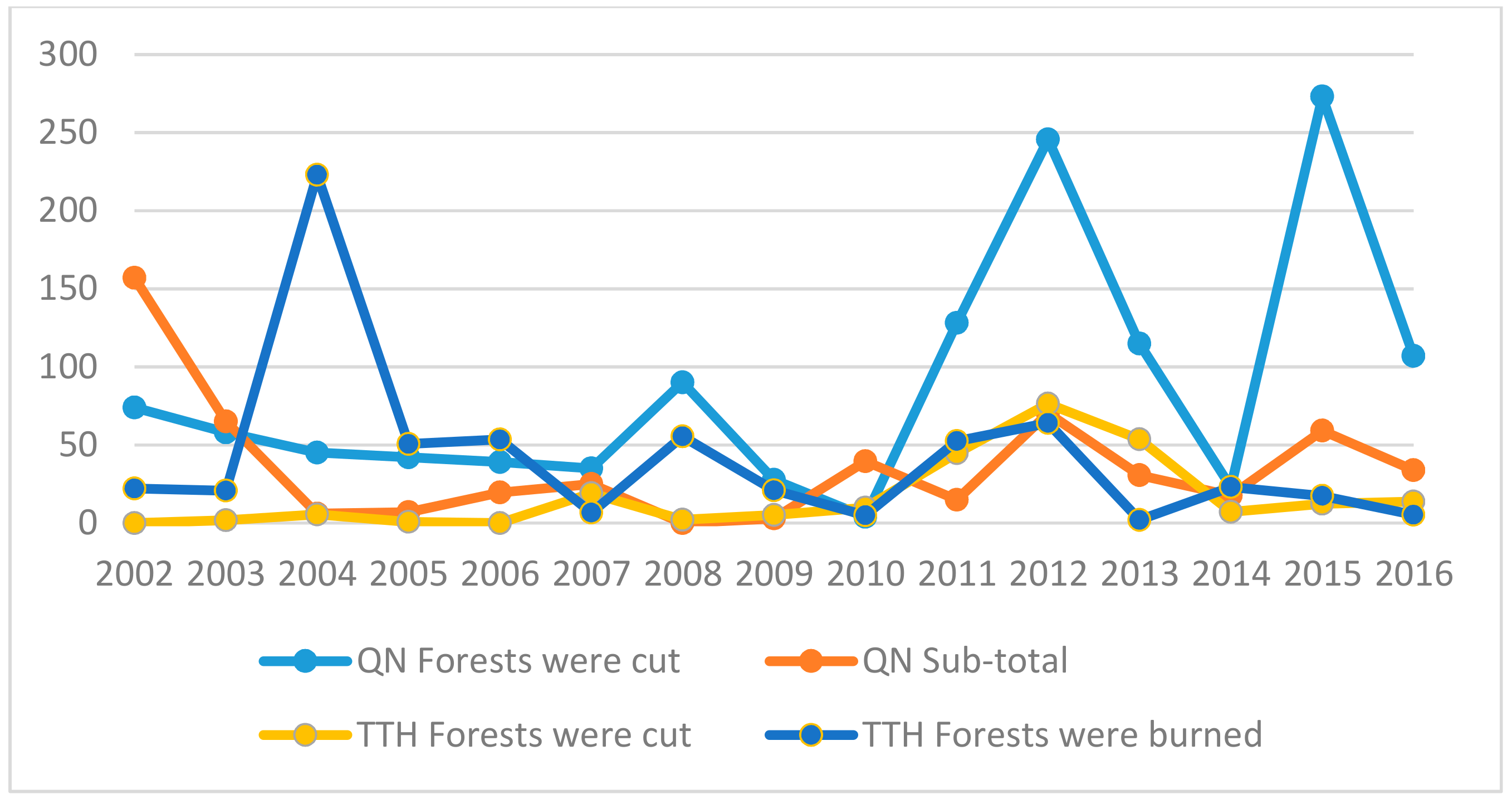

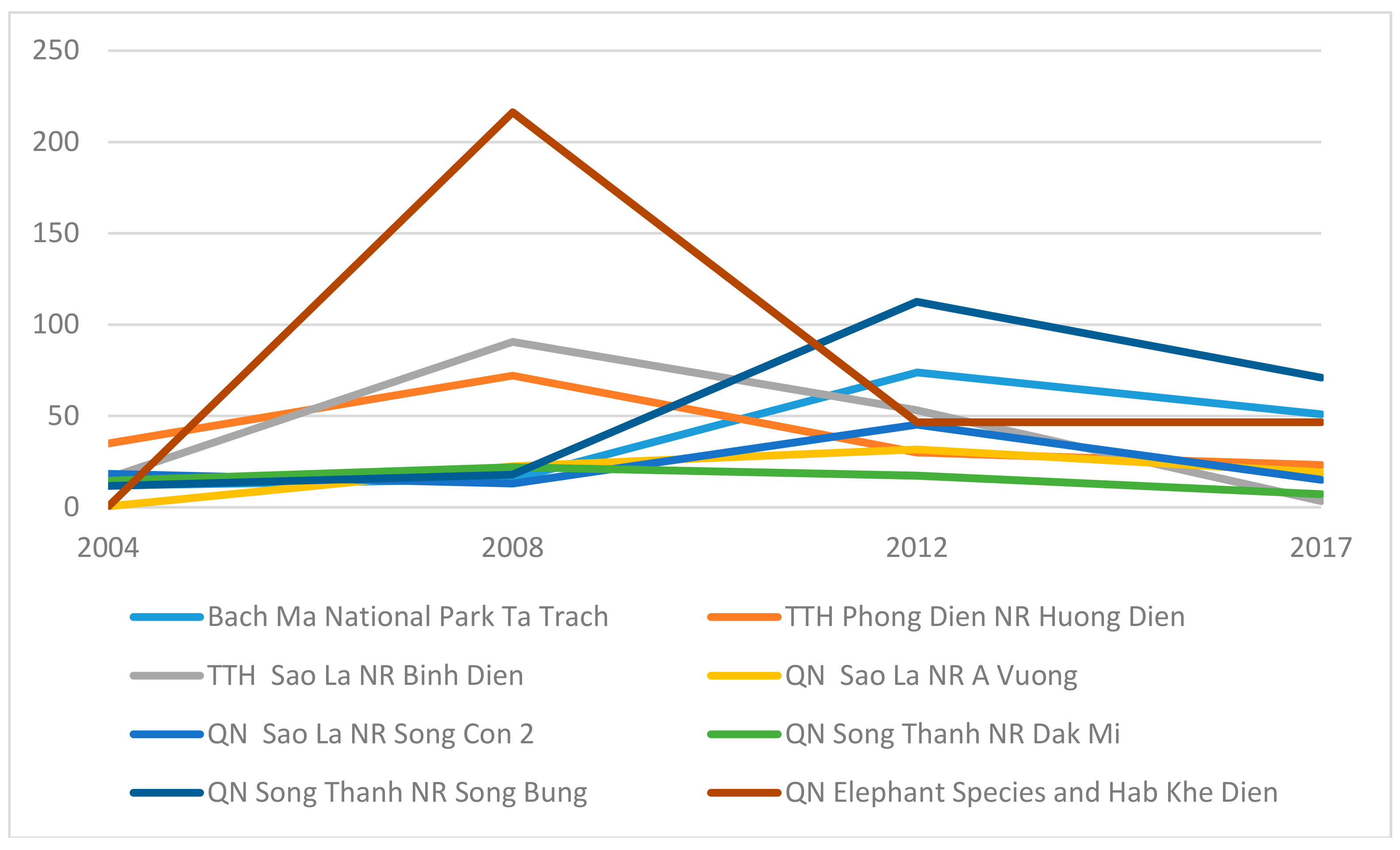

4.3. PFES and Natural Capital

5. Discussion, Implications, and Limitations

5.1. Financial Capital Impacts of PFES

5.2. Natural Capital Impacts of PFES

5.3. Implications

5.4. Limitations of the Study

6. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Cortés-Arriagada, D.; Villegas-Escobar, N.; Ortega, D.E. Fe-doped graphene nanosheet as an adsorption platform of harmful gas molecules (CO, CO2, SO2 and H2S), and the co-adsorption in O2 environments. Appl. Surf. Sci. 2018, 427, 227–236. [Google Scholar] [CrossRef]

- Norgaard, R.B. Ecosystem services: From eye-opening metaphor to complexity blinder. Ecol. Econ. 2010, 69, 1219–1227. [Google Scholar] [CrossRef]

- Grieg-Gran, M.; Porras, I.; Wunder, S. How can market mechanisms for forest environmental services help the poor? Preliminary lessons from Latin America. World Dev. 2005, 33, 1511–1527. [Google Scholar] [CrossRef]

- Pagiola, S.; Arcenas, A.; Platais, G. Can payments for environmental services help reduce poverty? An exploration of the issues and the evidence to date from Latin America. World Dev. 2005, 33, 237–253. [Google Scholar] [CrossRef]

- Porras, I.T.; Grieg-Gran, M.; Neves, N. All that Glitters: A Review of Payments for Watershed Services in Developing Countries; IIED: London, UK, 2008. [Google Scholar]

- Wunder, S.; Engel, S.; Pagiola, S. Taking stock: A comparative analysis of payments for environmental services programs in developed and developing countries. Ecol. Econ. 2008, 65, 834–852. [Google Scholar] [CrossRef]

- Muradian, R.; Arsel, M.; Pellegrini, L.; Adaman, F.; Aguilar, B.; Agarwal, B.; Corbera, E.; Ezzine de Blas, D.; Farley, J.; Froger, G. Payments for ecosystem services and the fatal attraction of win-win solutions. Conserv. Lett. 2013, 6, 274–279. [Google Scholar] [CrossRef]

- Wunder, S. When payments for environmental services will work for conservation. Conserv. Lett. 2013, 6, 230–237. [Google Scholar] [CrossRef]

- Tallis, H.; Kareiva, P.; Marvier, M.; Chang, A. An ecosystem services framework to support both practical conservation and economic development. Proc. Natl. Acad. Sci. USA 2008, 105, 9457–9464. [Google Scholar] [CrossRef]

- Landell-Mills, N.; Porras, I.T. Silver Bullet or Fools’ Gold? A Global Review of Markets for Forest Environmental Services and Their Impact on the Poor; IIED: London, UK, 2002. [Google Scholar]

- Wunder, S. Payments for environmental services and the poor: Concepts and preliminary evidence. Environ. Dev. Econ. 2008, 13, 279–297. [Google Scholar] [CrossRef]

- Li, F.; Wenhua, L.; Lin, Z.; Heqing, H.; Yunjie, W.; Naomi, I. Estimating eco-compensation requirements for forest ecosystem conservation: A case study in Hainan province, southern China. Outlook Agric. 2011, 40, 51–57. [Google Scholar]

- Chen, X.; Lupi, F.; An, L.; Sheely, R.; Viña, A.; Liu, J. Agent-based modeling of the effects of social norms on enrollment in payments for ecosystem services. Ecol. Model. 2012, 229, 16–24. [Google Scholar] [CrossRef] [PubMed]

- Yin, R.; Liu, C.; Zhao, M.; Yao, S.; Liu, H. The implementation and impacts of China’s largest payment for ecosystem services program as revealed by longitudinal household data. Land Policy 2014, 40, 45–55. [Google Scholar] [CrossRef]

- McAfee, K.; Shapiro, E.N. Payments for ecosystem services in Mexico: Nature, neoliberalism, social movements, and the state. Ann. Am. Assoc. Geogr. 2010, 100, 579–599. [Google Scholar] [CrossRef]

- Hegde, R.; Bull, G.Q. Performance of an agro-forestry based Payments-for-Environmental-Services project in Mozambique: A household level analysis. Ecol. Econ. 2011, 71, 122–130. [Google Scholar] [CrossRef]

- Alix-Garcia, J.M.; Shapiro, E.N.; Sims, K.R. Forest conservation and slippage: Evidence from Mexico’s national payments for ecosystem services program. Land Econ. 2012, 88, 613–638. [Google Scholar] [CrossRef]

- Dempsey, J.; Robertson, M.M. Ecosystem services: Tensions, impurities, and points of engagement within neoliberalism. Prog. Hum. Geogr. 2012, 36, 758–779. [Google Scholar] [CrossRef]

- Wunder, S. Revisiting the concept of payments for environmental services. Ecol. Econ. 2015, 117, 234–243. [Google Scholar] [CrossRef]

- Engel, S.; Pagiola, S.; Wunder, S. Designing payments for environmental services in theory and practice: An overview of the issues. Ecol. Econ. 2008, 65, 663–674. [Google Scholar] [CrossRef]

- Muradian, R.; Corbera, E.; Pascual, U.; Kosoy, N.; May, P.H. Reconciling theory and practice: An alternative conceptual framework for understanding payments for environmental services. Ecol. Econ. 2010, 69, 1202–1208. [Google Scholar] [CrossRef]

- Corbera, E.; Soberanis, C.G.; Brown, K. Institutional dimensions of Payments for Ecosystem Services: An analysis of Mexico’s carbon forestry programme. Ecol. Econ. 2009, 68, 743–761. [Google Scholar] [CrossRef]

- Kosoy, N.; Martinez-Tuna, M.; Muradian, R.; Martinez-Alier, J. Payments for environmental services in watersheds: Insights from a comparative study of three cases in Central America. Ecol. Econ. 2007, 61, 446–455. [Google Scholar] [CrossRef]

- Kronenberg, J.; Hubacek, K. Could Payments for Ecosystem Services Create an Ecosystem Service Curse? Ecol. Soc. 2013, 18. [Google Scholar] [CrossRef]

- Ezzine-de-Blas, D.; Wunder, S.; Ruiz-Pérez, M.; del Pilar Moreno-Sanchez, R. Global patterns in the implementation of payments for environmental services. PLoS ONE 2016, 11, e0149847. [Google Scholar] [CrossRef] [PubMed]

- Schomers, S.; Matzdorf, B. Payments for ecosystem services: A review and comparison of developing and industrialized countries. Ecosyst. Serv. 2013, 6, 16–30. [Google Scholar] [CrossRef]

- VNFF. 10-Year PFES Policy Review Report; Vietnam Forest Protection and Development Fund: Hanoi, Vietnam, 2018. [Google Scholar]

- Mousquès, C.; George, A.; Sengsoulichanh, P.; Latchachack, K.; Sengtaheuanghoung, O.; Ribolzi, O.; Pierret, A. Relevance of payments for environmental services (PES) for watershed management in northern Lao PDR. Lao J. Agric. For. 2008, 17, 129–148. [Google Scholar]

- Kerr, J.; Lapinski, M.; Liu, R.; Zhao, J. Long-term effects of payments for environmental services: Combining insights from Communication and Economics. Sustainability 2017, 9, 1627. [Google Scholar] [CrossRef]

- Li, P.; Chen, M.-H.; Zou, Y.; Beattie, M.; He, L. Factors Affecting Inn Operators’ Willingness to Pay Resource Protection Fees: A Case of Erhai Lake in China. Sustainability 2018, 10, 4049. [Google Scholar] [CrossRef]

- Lawlor, K.; Madeira, E.; Blockhus, J.; Ganz, D. Community Participation and Benefits in REDD+: A Review of Initial Outcomes and Lessons. Forests 2013, 4, 296–318. [Google Scholar] [CrossRef]

- Wunder, S. Are direct payments for environmental services spelling doom for sustainable forest management in the tropics? Ecol. Soc. 2006, 11, 23. [Google Scholar] [CrossRef]

- Liang, J.; Zhong, M.; Zeng, G.; Chen, G.; Hua, S.; Li, X.; Yuan, Y.; Wu, H.; Gao, X. Risk management for optimal land use planning integrating ecosystem services values: A case study in Changsha, Middle China. Sci. Total Environ. 2017, 579, 1675–1682. [Google Scholar] [CrossRef]

- Narloch, U.L.F.; Pascual, U.; Drucker, A.G. Cost-effectiveness targeting under multiple conservation goals and equity considerations in the Andes. Environ. Conserv. 2011, 38, 417–425. [Google Scholar] [CrossRef][Green Version]

- Pascual, U.; Muradian, R.; Rodríguez, L.C.; Duraiappah, A. Exploring the links between equity and efficiency in payments for environmental services: A conceptual approach. Ecol. Econ. 2010, 69, 1237–1244. [Google Scholar] [CrossRef]

- Miranda, M.; Porras, I.T.; Moreno, M.L. The Social Impacts of Payments for Environmental Services in Costa Rica: A Quantitative Field Survey and Analysis of the Virilla Watershed; IIED: London, UK, 2003. [Google Scholar]

- Locatelli, B.; Rojas, V.; Salinas, Z. Impacts of payments for environmental services on local development in northern Costa Rica: A fuzzy multi-criteria analysis. For. Policy Econ. 2008, 10, 275–285. [Google Scholar] [CrossRef]

- Tacconi, L. Redefining payments for environmental services. Ecol. Econ. 2012, 73, 29–36. [Google Scholar] [CrossRef]

- Molnar, J.L.; Gamboa, R.L.; Revenga, C.; Spalding, M.D. Assessing the global threat of invasive species to marine biodiversity. Front. Ecol. Environ. 2008, 6, 485–492. [Google Scholar] [CrossRef]

- Tacconi, L.; Mahanty, S.; Suich, H. Assessing the Livelihood Impacts of Payments for Environmental Services: Implications for Avoided Deforestation; Research Summary; Crawford School of Economics and Government: Canberra, Australia, 2009. [Google Scholar]

- Ingram, J.C.; Wilkie, D.; Clements, T.; McNab, R.B.; Nelson, F.; Baur, E.H.; Sachedina, H.T.; Peterson, D.D.; Foley, C.A.H. Evidence of Payments for Ecosystem Services as a mechanism for supporting biodiversity conservation and rural livelihoods. Ecosyst. Serv. 2014, 7, 10–21. [Google Scholar] [CrossRef]

- Blundo-Canto, G.; Bax, V.; Quintero, M.; Cruz-Garcia, G.S.; Groeneveld, R.A.; Perez-Marulanda, L. The different dimensions of livelihood impacts of Payments for Environmental Services (PES) schemes: A systematic review. Ecol. Econ. 2018, 149, 160–183. [Google Scholar] [CrossRef]

- Tacconi, L.; Mahanty, S.; Suich, H. Forest, payments for environmental services and livelihoods. In Payments for Environmental Services, Forest Conservation and Climate Change livelihood in REED+; Tacconi, L., Mahanty, S., Suich, H., Eds.; Edward Elgar: Northampton, MA, USA, 2010. [Google Scholar]

- Ma, S.; Swinton, S.M.; Lupi, F.; Jolejole-Foreman, C. Farmers’ willingness to participate in Payment-for-Environmental-Services programmes. J. Agric. Econ. 2012, 63, 604–626. [Google Scholar] [CrossRef]

- Tacconi, L.; Mahanty, S.; Suich, H. The livelihood impacts of payments for environmental services and implications for REDD+. Soc. Nat. Resour. 2013, 26, 733–744. [Google Scholar] [CrossRef]

- Clements, T.; Milner-Gulland, E. Impact of payments for environmental services and protected areas on local livelihoods and forest conservation in northern Cambodia. Conserv. Biol. 2015, 29, 78–87. [Google Scholar] [CrossRef]

- Zheng, H.; Robinson, B.E.; Liang, Y.-C.; Polasky, S.; Ma, D.-C.; Wang, F.-C.; Ruckelshaus, M.; Ouyang, Z.-Y.; Daily, G.C. Benefits, costs, and livelihood implications of a regional payment for ecosystem service program. Proc. Natl. Acad. Sci. 2013, 110, 16681–16686. [Google Scholar] [CrossRef]

- Bremer, L.L.; Farley, K.A.; Lopez-Carr, D. What factors influence participation in payment for ecosystem services programs? An evaluation of Ecuador’s SocioPáramo program. Land Use Policy 2014, 36, 122–133. [Google Scholar] [CrossRef]

- USAID Green Annamites. Thua Thien Hue Portal. Available online: https://thuathienhue.gov.vn/en-us/Investor/Investor-detail/tid/Truong-Son-Xanh-Green-Annamites-project-launched/newsid/4559E212-9B7F-43B7-B18C-A8C100EE401E/cid/A188E73D-A1A6-4843-A990-C4E40BC3B182 (accessed on 18 December 2018).

- Babbie, E. The Practice of Social Research; Wadsworth: Belmont, CA, USA, 2010; p. 625. [Google Scholar]

- USAID Green Annamites Project. Livelihood Needs Assessment in Quang Nam and Thua Thien Hue Province; CRD funded by USAID: Washington, DC, USA, 2017; p. 191.

- Dana Tomlin, C. Geographic Information Systems and Cartographic Modeling; Englewoods Cliffs, Prentice-Hall: Upper Saddle River, NJ, USA, 1990; p. 249. [Google Scholar]

- Campbell, J.B. Introduction to Remote Sensing; The Guilford Press: New York, NY, USA, 1987. [Google Scholar]

- General Statistics Office of Vietnam. Available online: https://www.gso.gov.vn/Default_en.aspx?tabid=491 (accessed on 15 December 2018).

- USAID Green Annamites Project. Final Report of Baseline Assessments for Low Emission Land Use Planning and to Support. Development of REDD+; CRD funded by USAID: Washington, DC, USA, 2018; p. 101.

- Ezzine-de-Blas, D.; Corbera, E.; Lapeyre, R. Payments for environmental services and motivation crowding: Towards a conceptual framework. Ecol. Econ. 2019, 156, 434–443. [Google Scholar] [CrossRef]

- Bremer, L.L.; Farley, K.A.; Lopez-Carr, D.; Romero, J. Conservation and livelihood outcomes of payment for ecosystem services in the Ecuadorian Andes: What is the potential for ‘win–win’? Ecosyst. Serv. 2014, 8, 148–165. [Google Scholar] [CrossRef]

- Pham, T.V. Lessons and Experiences from Implementation of PFES in Vietnam. Presented at the ASFN Workshop Inle Lake, Shan State, Myanmar, 1–3 June 2015. [Google Scholar]

- Alston, L.J.; Andersson, K.; Smith, S.M. Payment for Environmental Services: Hypotheses and Evidence. Annu. Rev. Resour. Econ. 2013, 5, 139–159. [Google Scholar] [CrossRef]

- Wunder, S.; Albán, M. Decentralized payments for environmental services: The cases of Pimampiro and PROFAFOR in Ecuador. Ecol. Econ. 2008, 65, 685–698. [Google Scholar] [CrossRef]

- De Man, M. Local Impacts and Effectiveness of Payments for Environmental Services in Costa Rica: The Case of Payments for Forest Hydrological Services in Costa Rica’s Aranjuez Watershed; Utretch University: Utrecht, The Netherlands, 2004. [Google Scholar]

- Calvet-Mir, L.; Corbera, E.; Martin, A.; Fisher, J.; Gross-Camp, N. Payments for ecosystem services in the tropics: A closer look at effectiveness and equity. Curr. Opin. Environ. Sustain. 2015, 14, 150–162. [Google Scholar] [CrossRef]

- Kwayu, E.J.; Paavola, J.; Sallu, S.M. The livelihood impacts of the Equitable Payments for Watershed Services (EPWS) Program in Morogoro, Tanzania. Environ. Dev. Econ. 2017, 22, 328–349. [Google Scholar] [CrossRef]

- Trac, C.J.; Schmidt, A.H.; Harrell, S.; Hinckley, T.M. Environmental reviews and case studies: Is the returning farmland to forest program a success? Three case studies from Sichuan. Environ. Pract. 2013, 15, 350–366. [Google Scholar] [CrossRef]

- Hansen, M.C.; Potapov, P.V.; Moore, R.; Hancher, M.; Turubanova, S.; Tyukavina, A.; Thau, D.; Stehman, S.; Goetz, S.; Loveland, T.R. High-resolution global maps of 21st-century forest cover change. Science 2013, 342, 850–853. [Google Scholar] [CrossRef]

- Samii, C.; Lisiecki, M.; Kulkarni, P.; Paler, L.; Chavis, L. Effects of payment for environmental services (PES) on deforestation and poverty in low and middle income countries: A systematic review. Campbell Syst. Rev. 2014, 10, 1–95. [Google Scholar] [CrossRef]

| Authors | Case Studies | Financial Capital | Natural Capital |

|---|---|---|---|

| Hegde and Bull [16] | PES project in Mozambique |

|

|

| Pagiola, Arcenas, and Platais [4] | Latin America |

|

|

| Clements and Milner-Gulland [46] | PES and forest conservation in northern Cambodia |

|

|

| Zheng et al. [47] | Paddy Land-to-Dry Land program in Beijing, China |

|

|

| Bremer, Farley, and Lopez-Carr [48] | Payments for ecosystem services in the Ecuadorean Andes |

|

|

| Nature Reserve/National Park | Date Established | Total Areas (Core and Buffer Zones) of PA (ha) | Areas Covered by PFES (ha) | No. of Communes in Buffer zones | Total HHs/Surveyed HHs | % Poor | % Ethnic | % Forest Cover | Surveyed Communes | Number of HHs | Surveyed Villages | Sample Size |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bach Ma National Park (NP) | A Ting | 654 | Cho Nech | 32 | ||||||||

| 37,487 | 13,812 | 15 | 15,350/105 | 21.27 | 43.54 | 70.20 | Pa Zih | 23 | ||||

| July 1991 | 58,676 | Thuong Lo | 318 | Cha Mang | 15 | |||||||

| Doi | 35 | |||||||||||

| Phong Dien Nature Reserve (NR) | Hong Ha | 424 | Pa Hy | 37 | ||||||||

| November 2002 | 41,508 | 14,000 | 9 | 8794/150 | 30.56 | 64.79 | 65.99 | Pa Ring | 30 | |||

| 43,600 | Hong Kim | 526 | Dut 1 | 43 | ||||||||

| A Tia 2 | 40 | |||||||||||

| Thua Thien Hue (TTH) Sao La Nature Reserve (SLNR) | A Roang | Ka Lo | 26 | |||||||||

| 627 | Karon Aho | 35 | ||||||||||

| October 2013 | 15,520 | 6889 | 4 | 2096/ | 30 | 87.13 | 82 | Amin C9 | 38 | |||

| 16,554 | 172 | Thuong Long | 629 | Village 3 | 31 | |||||||

| Village 4 | 35 | |||||||||||

| Village 8 | 33 | |||||||||||

| Song Thanh National Reserve | October 2000 | 54,897 | 46,213 | 14 | 7781/54 | 55.79 | 88.15 | 73.185 | Dac Pre | 341 | Village 58 | 29 |

| 22,067 | Phuoc Xuan | 293 | Lao Du | 16 | ||||||||

| Nuoc Lang | 9 | |||||||||||

| Elephant National Reserve | Phuoc Ninh | 826 | Binh Yen | 47 | ||||||||

| September 2017 | 18,977 35,135 | 5130 | 6 | 5736/163 | 43.5 | 48.78 | 76.78 | Dui Chieng 2 | 23 | |||

| Que Lam | 1097 | Cam La | 38 | |||||||||

| Phuoc Hoi | 55 | |||||||||||

| Ngoc Linh National Reserve | Tra Cang | 869 | Village 3 | 37 | ||||||||

| November 2016 | 54,010 | 39,992 | 6 | 4379/125 | 63.5 | 91.97 | 60.83 | Village 4 | 36 | |||

| 2718 | Tra Tap | 617 | Village 1 | 25 | ||||||||

| Village 2 | 27 | |||||||||||

| Total | 238,399 | 134,913 | 58 | 46,214/795 | 43.44 | 73.94 | 73.03 | 12 | 7,220 | 25 | 795 |

| Wealth Ranking | PFES/Without PFES | Number of Data Values | Q1 | Q2 | IQR | Lower Bound | Upper Bound | Number of Outliers |

|---|---|---|---|---|---|---|---|---|

| Poor | PFES | 80 | 10,540,000 | 32,075,000 | 21,535,000 | –21,762,500 | 64,377,500 | 3 |

| Without PFES | 255 | 8,206,500 | 31,950,000 | 23,743,500 | –27,408,750 | 67,565,250 | 13 | |

| Near poor | PFES | 37 | 15,900,000 | 60,400,000 | 44,500,000 | –50,850,000 | 127,150,000 | 1 |

| Without PFES | 118 | 14,000,025 | 43,260,000 | 29,259,976 | –29,889,939 | 87,149,963 | 6 | |

| Non-poor | PFES | 81 | 26,200,000 | 84,200,000 | 58,000,000 | –60,800,000 | 171,200,000 | 5 |

| Without PFES | 223 | 17,150,000 | 74,050,049 | 56,900,049 | –68,200,074 | 159,400,123 | 8 |

| Wealth Ranking | PFES/Without PFES | Number of Data Values | Min | Max | Mean | Standard Deviation |

|---|---|---|---|---|---|---|

| Poor | PFES | 77 | 2,470,098 | 59,280,000 | 20,943,477 | 14,030,345 |

| Without PFES | 242 | 500,000 | 62,552,000 | 19,842,702 | 14,861,901 | |

| Near poor | PFES | 36 | 3,500,000 | 97,720,000 | 38,272,083 | 28,255,531 |

| Without PFES | 112 | 1,600,000 | 86,700,000 | 28,276,119 | 19,999,208 | |

| Non-poor | PFES | 76 | 2,650,000 | 164,200,000 | 54,526,212 | 39,263,325 |

| Without PFES | 215 | 400,000 | 144,500,000 | 45,988,760 | 35,858,670 |

| PFES | Non-Poor Households (N = 279) | Poor Households (N = 446) | ||

|---|---|---|---|---|

| Coef. | P > |z| | Coef. | P > |z| | |

| Age | 0.007185 | 0.000 | –0.0066152 | 0.002 |

| Ethnicity | 0.0095029 | 0.003 | –0.366203 | 0.037 |

| Education | 0.1179336 | 0.001 | 0.1379293 | 0.000 |

| Forest area | 0.0000110 | 0.005 | 0.0021009 | 0.003 |

| Gender | 0.0247456 | 0.000 | 0.0000111 | 0.000 |

| Rice consumption | 0.0020609 | 0.010 | –.00013708 | 0.005 |

| Water consumption | –.0035307 | 0.048 | –.00097307 | 0.013 |

| Area of living | 0.0000562 | 0.014 | 0.0000906 | 0.004 |

| _cons | –1.382108 | 0.013 | –0.3291032 | 0.016 |

| LR chi2(8) Prob > chi2 Log likelihood Pseudo R2 | 15.69 0.0000 –160.23398 0.0467 | 31.42 0.0000 –240.95549 0.0612 | ||

| Variable | Non-Poor (N = 279) | Poor (N = 446) | ||

|---|---|---|---|---|

| Without PFES | PFES | Without PFES | PFES | |

| Sample size | 198 | 81 | 329 | 117 |

| Age | 39.04 | 40.47 | 39.83 | 38.37 |

| Education | 4.37 | 5.33 | 3.50 | 4.28 |

| Family size | 4.57 | 4.22 | 4.44 | 4.21 |

| Total income (million VND/year) | 72.8 | 62.9 | 26.8 | 26.7 |

| Total expenses (million VND/year) | 40.3 | 45.0 | 26.1 | 29.6 |

| Asset value (million VND/year) | 166.6 | 153.2 | 64.1 | 72.4 |

| Land for housing (m2) | 565.61 | 642.51 | 418.12 | 615.21 |

| Forest income (million VND/year) | 6.0 | 8.5 | 2.9 | 2.9 |

| Agri-income (million VND/year) | 10.9 | 9.5 | 4.4 | 7.2 |

| Bias-Adjusted ATT | Nearest Neighbor | Radius Cal | Kernel | |||

|---|---|---|---|---|---|---|

| Difference | T-Stat | Difference | T-Stat | Difference | T-Stat | |

| Non-poor | ||||||

| Total income (million VND) | 1.90 | 1.80 | –10.30 | –0.83 | –11.10 | –1.19 |

| Income sources | 2.00 | 9.21 | 2.10 | 12.88 | 2.20 | 13.81 |

| Total expenditure (million VND) | 0.90 | 0.23 | –0.50 | –0.10 | 2.70 | 0.57 |

| Consumable items (million VND) | 0.90 | 0.23 | 1.10 | 0.38 | 2.90 | 1.03 |

| Days of food shortage (days) | 1.80 | 0.24 | 5.40 | 0.70 | 3.00 | 0.46 |

| Loan access (million VND) | –4.90 | -0.51 | –0.40 | –0.07 | 0.96 | 0.16 |

| Poor | ||||||

| Total income (million VND) | 1.00 | 0.29 | 0.90 | 0.31 | 0.40 | 0.14 |

| Income sources | 1.60 | 9.91 | 1.70 | 13.85 | 1.60 | 14.17 |

| Total expenditure (million VND) | 2.30 | 0.50 | 4.60 | 1.10 | 3.90 | 0.96 |

| Consumable items (million VND) | 0.90 | 0.45 | 0.30 | 0.17 | –0.20 | –0.13 |

| Days of food shortage (days) | 0.90 | 0.12 | –5.90 | –1.13 | –0.40 | –0.06 |

| Loan access (million VND) | 3.50 | 2.02 | 2.80 | 0.92 | 1.70 | 0.58 |

| Protected Area | Hydropower Watershed | Annual Forest Cover Loss (ha/Year) | Total Forest Cover Loss (ha) | Annual Forest Cover Loss (ha/Year) | Total Forest Cover Loss (ha) |

|---|---|---|---|---|---|

| 2004–2012 | 2004–2012 | 2013–2017 | 2013–2017 | ||

| Bach Ma NP | Ta Trach | 8.4 | 101.1 | 10.2 | 50.9 |

| TTH Phong Dien NR | Huong Dien | 11.4 | 137.1 | 4.6 | 23.1 |

| TTH Sao La NR | Binh Dien | 13.3 | 159.8 | 0.7 | 3.4 |

| QN Sao La NR | A Vuong | 4.5 | 54.6 | 3.8 | 19.2 |

| QN Sao La NR | Song Con 2 | 6.4 | 76.7 | 3.0 | 15.0 |

| QN Song Thanh NR | Dak Mi | 4.5 | 53.8 | 1.4 | 7.2 |

| QN Song Thanh NR | Song Bung | 11.8 | 142.1 | 14.2 | 71.0 |

| QN Elephant Species | Khe Dien | 21.9 | 263.3 | 9.3 | 46.6 |

| Bias-Adjusted ATT | Nearest Neighbor | Radius | Kernel | |||

|---|---|---|---|---|---|---|

| Difference | T-Stat | Difference | T-Stat | Difference | T-Stat | |

| Households with PFES collecting NTFPs | –0.139175258 | –1.74 | –0.152409548 | –2.22 | –0.135613943 | –1.74 |

| Poor households with PFES collecting NTFPs | –0.25862069 | –2.44 | –0.254821238 | –3.01 | –0.16975548 | –1.92 |

| Non-poor households collecting NTFPs | 0.112903226 | 0.73 | .043587033 | 0.37 | .132384251 | 1.12 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dang Do, T.; NaRanong, A. Livelihood and Environmental Impacts of Payments for Forest Environmental Services: A Case Study in Vietnam. Sustainability 2019, 11, 4165. https://doi.org/10.3390/su11154165

Dang Do T, NaRanong A. Livelihood and Environmental Impacts of Payments for Forest Environmental Services: A Case Study in Vietnam. Sustainability. 2019; 11(15):4165. https://doi.org/10.3390/su11154165

Chicago/Turabian StyleDang Do, Teo, and Anchana NaRanong. 2019. "Livelihood and Environmental Impacts of Payments for Forest Environmental Services: A Case Study in Vietnam" Sustainability 11, no. 15: 4165. https://doi.org/10.3390/su11154165

APA StyleDang Do, T., & NaRanong, A. (2019). Livelihood and Environmental Impacts of Payments for Forest Environmental Services: A Case Study in Vietnam. Sustainability, 11(15), 4165. https://doi.org/10.3390/su11154165