Thinking Outside the Box: Deepening Private Sector Investments in Fiji’s Nationally Determined Contributions through Scenario Analysis

Abstract

1. Introduction

2. Country Overview

2.1. Fiji’s Energy Sector

2.2. Financing Fiji’s NDC: The Road to 2030

3. Method

3.1. Applying the Method

3.1.1. Step 1: Identifying the Barriers to RE Investment

3.1.2. Step 2: Ranking Barriers by Significance and Uncertainty

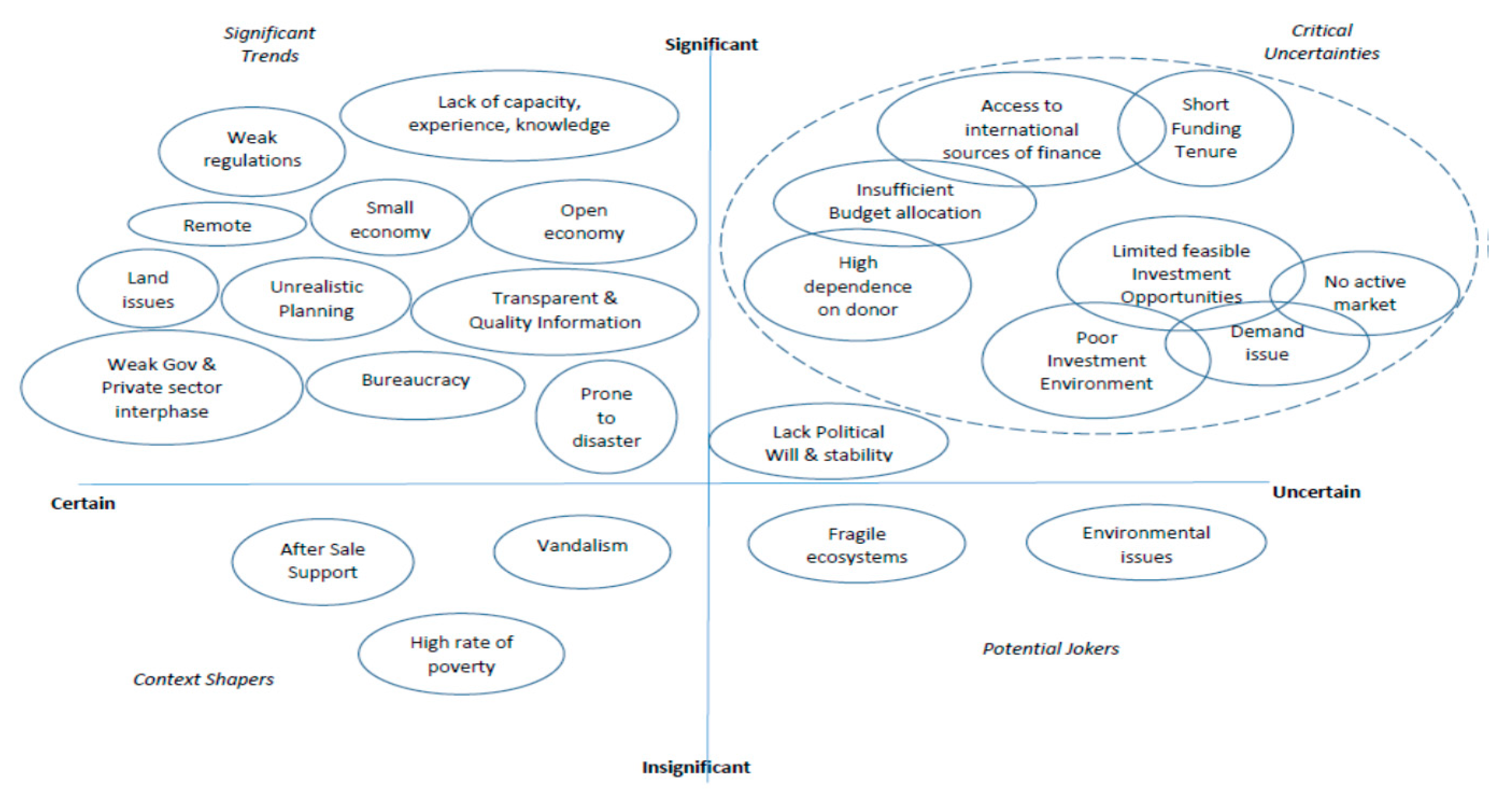

3.1.3. Step 3: Plotting the Barriers by Significance and Uncertainty

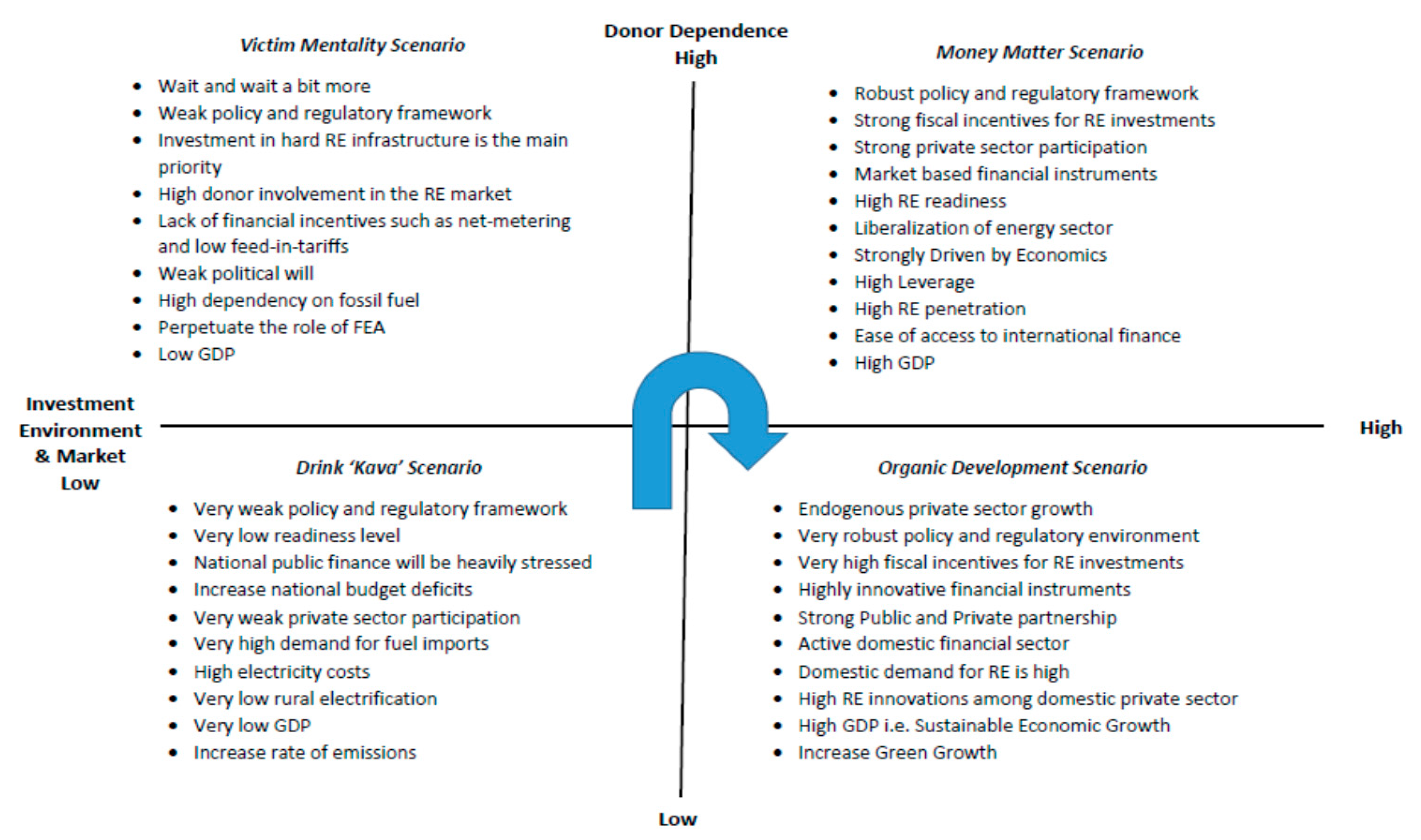

3.1.4. Step 4: Creating New Emerging Axes

3.1.5. Step 5: Developing the Scenarios

3.2. Scenario Validation

4. Results

4.1. Step by Step Outcomes of the Five-Step Approach

4.1.1. Plotting the Barriers by Significance and Uncertainty

4.1.2. New Emerging Axes

4.1.3. Developing the Scenarios

4.2. Narrative of the Future Investment Scenarios

5. Discussion

5.1. Current Approach towards Private Sector Investment in Fiji’s Energy Sector

5.2. The Resource Mobilization Framework—A Proposition from the Scenario Analysis

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- United Nations Framework Convention on Climate Change (UNFCCC). The Paris Agreement; FCCC/CP/2015/L.9/Rev.1; UNFCCC: Paris, France, 2015; pp. 1–32. [Google Scholar]

- United Nations Environment Programme (UNEP). The Emission Gap Report 2016; A UNEP Synthesis Report; UNEP: Nairobi, Kenya, 2016; pp. 1–86. [Google Scholar]

- International Renewable Energy Agency (IRENA). Untapped Potential for Climate Action Renewable Energy in Nationally Determined Contributions; IRENA: Abu Dhabi, UAE, 2017; pp. 1–36. [Google Scholar]

- International Energy Agency (IEA). World Energy Outlook 2015; IEA: Paris, France, 2015; Available online: https://webstore.iea.org/world-energy-outlook-2015 (accessed on 31 May 2019).

- Bointner, R.; Pezzutto, S.; Grilli, G.; Sparber, W. Financing Innovations for the Renewable Energy Transition in Europe. Energies 2016, 9, 990. [Google Scholar] [CrossRef]

- Cooke, K.; Gogoi, E.; Petrarulo, L. Overcoming the NDC Implementation Gap: Lessons from Experience; Oxford Policy Management: Oxford, UK, 2017; pp. 1–16. [Google Scholar]

- UNFCCC. Bridging Climate Ambition and Finance Gaps; UNFCCC: Bonn, Germany, 2019; Available online: https://unfccc.int/news/bridging-climate-ambition-and-finance-gaps (accessed on 27 June 2019).

- Selin, H. Climate Finance and Developing Countries: The Need for Regime Development; GEGI Working Pap No 009; Boston University, Global Economic Governance Initiative: Boston, MA, USA, 2016; pp. 1–14. [Google Scholar]

- Betzold, C. Aid and Adaptation to Climate Change in Pacific Island Countries; Development Policy Center Discussion Pap. No. 46; The Australian National University: Canberra, Australia, 2016; pp. 1–26. [Google Scholar]

- Atteridge, A.; Canales, N. Climate Finance in the Pacific: An Overview of Flows to the Region’s Small Island Developing States; Working Pap. No. 2017-04; Stockholm Environment Institute: Stockholm, Sweden, 2017; pp. 1–74. [Google Scholar]

- World Economic Forum. Green Investment; World Economic Forum: Geneva, Switzerland, 2016; Available online: http://reports.weforum.org/green-investing-2013/introduction/ (accessed on 20 March 2018).

- Buchner, B.; Oliver, P.; Wang, X.; Carswell, C.; Meattle, C.; Mazza, F. Global Landscape of Climate Finance 2017; CPI: San Francisco, CA, USA, 2017; pp. 1–20. [Google Scholar]

- UNEP. Financial Institutions Taking Action on Climate Change: A Report on How Climate Leadership Is Emerging in the Finance Sector—And on How Public and Private Actors Need to Work Together to Grow Leadership into a New Normal; UNEP: Nairobi, Kenya, 2014; pp. 1–36. [Google Scholar]

- Maclean, J.; Tan, J.; Tirpak, D.; Sonntag-O’Brien, V.; Usher, E. Public Finance Mechanisms to Mobilize Investment in Climate Change Mitigation: An Overview of Mechanisms Being Used Today to Help Scale up the Climate Mitigation Markets, with a Particular Focus on Clean Energy Sector; UNEP: Nairobi, Kenya, 2008; pp. 1–40. [Google Scholar]

- Goundar, A.; Newell, A.; Nuttall, P.; Rojon, I.; Samuwai, J. King Canute muses in the South Seas: Why aren’t Pacific Islands transitioning to low carbon sea transport futures? Mar. Policy 2017, 81, 80–90. [Google Scholar] [CrossRef]

- Fiji Electricity Authority (FEA). Annual Report. Fiji; FEA: Suva, Fiji, 2016; pp. 1–35. Available online: http://www.fea.com.fj/about-us/company-information/company-reports/ (accessed on 5 January 2018).

- IRENA. Fiji Renewables Readiness Assessment; IRENA: Abu Dhabi, UAE, 2015; pp. 1–60. [Google Scholar]

- Dornan, M. Renewable Energy Development in Small Island Developing States of the Pacific. Resources 2015, 4, 490–506. [Google Scholar] [CrossRef]

- Dornan, M.; Jotzo, F. Renewable technologies and risk mitigation in small island developing states: Fiji’s electricity sector. Renew. Sustain. Energy Rev. 2015, 48, 35–48. [Google Scholar] [CrossRef]

- Juswanto, W.; Ali, Z. Renewable Energy and Sustainable Development in Pacific Island Countries; Asian Development Bank Institute: Tokyo, Japan, 2016; pp. 1–6. [Google Scholar]

- Michalena, E.; Kouloumpis, V.; Hills, J.M. Challenges for Pacific Small Island Developing States in achieving their Nationally Determined Contributions (NDC). Energy Policy 2018, 114, 508–518. [Google Scholar] [CrossRef]

- Ministry of Economy (MOE). Fiji NDC Implementation Roadmap 2017–2030 Setting a Pathway for Emissions Reduction Target. Under the Paris Agreement; Ministry of Economy: Suva, Fiji, 2017; pp. 1–62. [Google Scholar]

- Prasad, R.D.; Bansal, R.C.; Raturi, A. A review of Fiji’s energy situation: Challenges and strategies as a small island developing state. Renew. Sustain. Energy Rev. 2017, 75, 278–292. [Google Scholar] [CrossRef]

- Blyth, M. Learning from the Future Through Scenario Planning. 2005. Available online: https://www.researchgate.net/profile/Michael_Blyth2/publication/267386135_Learning_from_the_future_through_scenario_planning/links/5865c0d408ae8fce490c2960.pdf (accessed on 10 October 2017).

- Börjeson, L.; Höjer, M.; Dreborg, K.H.; Ekvall, T.; Finnveden, G. Scenario types and techniques: Towards a user’s guide. Futures 2006, 38, 723–739. [Google Scholar] [CrossRef]

- Schwartz, P. The Art of the Long View: Planning for the Future in an Uncertain World; Currency: New York, NY, USA, 1996. [Google Scholar]

- Gray, S.; O’Mahony, C.; Hills, J.; O’Dwyer, B.; Devoy, R.J.; Gault, J. Strengthening coastal adaptation planning through scenario analysis: A beneficial but incomplete solution. Mar. Policy 2016. [Google Scholar] [CrossRef]

- Hall, T.H. Emotional Diplomacy: Official Emotion on the International Stage; Cornell University Press: Ithaca, NY, USA, 2015. [Google Scholar]

- Michalena, E.; Hills, J.M. Paths of renewable energy development in small island developing states of the South Pacific. Renew. Sustain. Energy Rev. 2018, 82, 343–352. [Google Scholar] [CrossRef]

- Investment Fiji. Fiji. 2017. Available online: http://www.investmentfiji.org.fj/pages.cfm/for-exporters/export-opportunities-in-fiji/fastest-growing-exports-1.html (accessed on 15 February 2018).

- Reserve Bank of Fiji (RBF). Reserve Bank Introduces Agriculture and Renewable Energy Loans Ratio; Press Release No. 06/2012; RBF: Suva, Fiji, 2012; pp. 1–2.

- Fiji Development Bank (FDB). Sustainable Energy Financing Facility; Fiji Development Bank: Suva, Fiji, 2017; Available online: http://www.fdb.com.fj/sustainable-energy-financing-facility/ (accessed on 5 January 2018).

- The World Bank. Fiji Issues First Developing Country Green Bond, Raising $50 Million for Climate Resilience. 2017. Available online: http://www.worldbank.org/en/news/press-release/2017/10/17/fiji-issues-first-developing-country-green-bond-raising-50-million-for-climate-resilience (accessed on 17 November 2017).

- Dornan, M.; Shah, K.U. Energy policy, aid, and the development of renewable energy resources in Small Island Developing States. Energy Policy 2016, 98, 759–767. [Google Scholar] [CrossRef]

- Betzold, C. Fuelling the Pacific: Aid for renewable energy across Pacific Island countries. Renew. Sustain. Energy Rev. 2016, 58, 311–318. [Google Scholar] [CrossRef]

- Anantharajah, K. Governing Climate Finance in Fiji: Barriers, Complexity & Interconnectedness. Sustainability 2019, 11, 3414. [Google Scholar] [CrossRef]

- Jafar, M. Renewable energy in the South Pacific—Options and constraints. Renew. Energy 2000, 19, 305–309. [Google Scholar] [CrossRef]

- The World Bank. Sustainable Energy Finance Project; The World Bank: Washington, DC, USA, 2017; Available online: http://projects.worldbank.org/P098423/sustainable-energy-finance-project?lang=en&tab=documents&subTab=projectDocuments (accessed on 7 March 2018).

- Gesellschaft für Internationale Zusammenarbeit (GIZ). Financing Green Growth: A Review of Green Financial Sector Policies in Emerging and Developing Countries; GIZ: Bonn, Germany, 2016; pp. 1–112. [Google Scholar]

- Asian Development Bank (ADB). Pacific Private Sector Development Initiative a Decade of Reform Annual Progress Report 2015–2016; Asian Development Bank: Manila, Philippines, 2017; Available online: https://www.adb.org/documents/psdi-progress-report-2015-2016 (accessed on 1 January 2018).

- Urmee, T.; Harries, D. The solar home PV program in Fiji—A successful RESCO approach? Renew. Energy 2012, 48, 499–506. [Google Scholar] [CrossRef]

- Chand, D. Promoting Sustainability of Renewable Energy Technologies and Renewable Energy Service Companies in the Fiji Islands. Energy Procedia 2013, 32, 55–63. [Google Scholar] [CrossRef][Green Version]

- European Bank for Reconstruction and Development (ERBD). Green Economy Transition Approach; EBRD: London, UK, 2015; Available online: http://www.ebrd.com/cs/Satellite?c=Content&cid=1395250237163&d=Mobile&pagename=EBRD%2FContent%2FContentLayout (accessed on 12 February 2018).

- Taibi, E.; Gualberti, G.; Bazilian, M.; Gielen, D. A framework for technology cooperation to accelerate the deployment of renewable energy in Pacific Island Countries. Energy Policy 2016, 98, 778–790. [Google Scholar] [CrossRef]

| Investment Opportunity | Incentives |

|---|---|

| 1. IPP Tariff Rate * * applies to all RE investments | • 33.08 cents VEP (VAT exclusive price) |

| 2. Bio-Fuel | • 10-year tax holiday for new activity but minimum level • Duty free importation of assets required to establish the factory • Duty free on chemicals for bio-fuel production * To qualify, investors total investment must be >1 million FJD and must employ >20 people |

| 3. Renewable Energy Production and Power Co-Generation | • Five years of tax holidays for new activity |

| 4. Energy Efficient Equipment | • Five years of tax incentives (only VAT paid) for imported equipment |

| 5. RE Equipment | • Five years of tax incentives (only VAT paid) for imported equipment |

| 6. Foreign Investment | • No minimum investment needed for investment in energy sector |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Samuwai, J.; Hills, J.M.; Michalena, E. Thinking Outside the Box: Deepening Private Sector Investments in Fiji’s Nationally Determined Contributions through Scenario Analysis. Sustainability 2019, 11, 4161. https://doi.org/10.3390/su11154161

Samuwai J, Hills JM, Michalena E. Thinking Outside the Box: Deepening Private Sector Investments in Fiji’s Nationally Determined Contributions through Scenario Analysis. Sustainability. 2019; 11(15):4161. https://doi.org/10.3390/su11154161

Chicago/Turabian StyleSamuwai, Jale, Jeremy Maxwell Hills, and Evanthie Michalena. 2019. "Thinking Outside the Box: Deepening Private Sector Investments in Fiji’s Nationally Determined Contributions through Scenario Analysis" Sustainability 11, no. 15: 4161. https://doi.org/10.3390/su11154161

APA StyleSamuwai, J., Hills, J. M., & Michalena, E. (2019). Thinking Outside the Box: Deepening Private Sector Investments in Fiji’s Nationally Determined Contributions through Scenario Analysis. Sustainability, 11(15), 4161. https://doi.org/10.3390/su11154161