The empirical study of this paper will include three parts: the construction of the FCI, the measurement of synergy, and the analysis of transmission pathways. The research methods to be adopted in each part are described as follows.

3.3.1. Construction Method of the FCI

The formulas for calculating the FCI used to measure the financial cycle are as follows:

where

represents the gap sequence of the country’s

ith financial index, with

being its corresponding weight.

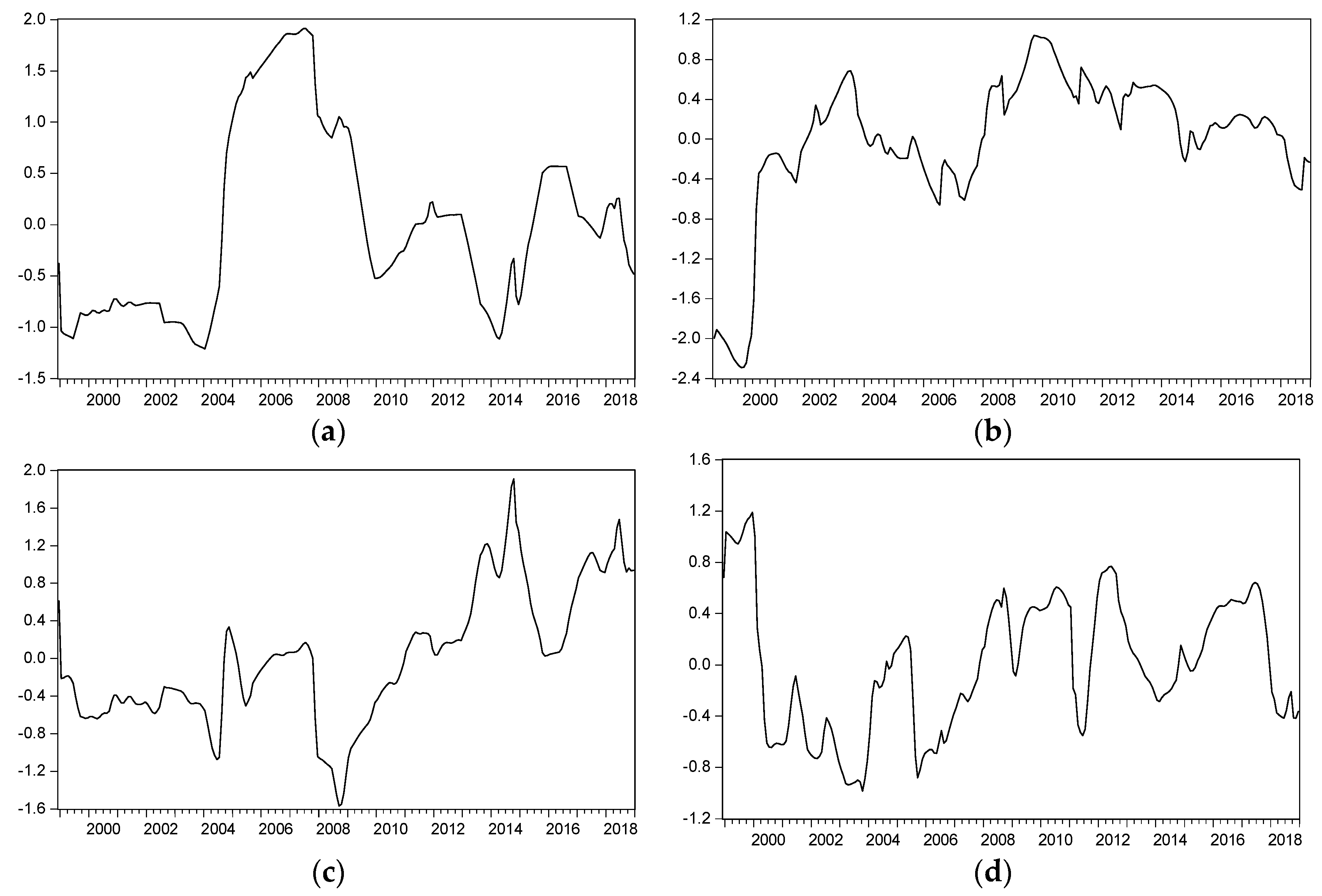

Because the financial indicators used in the calculation of the FCI are all processed by de-trend and standardization, the calculated FCI directly reflects the deviation of a country’s financial activities from the equilibrium state. Specifically, if the value of the FCI is close to zero, it means that the financial environment is in a moderate state; if the FCI is positive (negative), it means that the financial situation is prosperous (recession); if the FCI is rising (falling), it means that the financial situation is getting better (worse).

The key problem is how to determine the weight,

. A mature method is to use the impulse response function of the VAR model [

34]. The weights are determined by measuring the cumulative impact of financial variables on economic growth or inflation. By contrast, the SVAR model not only retains the hypothesis of endogenous variables, but also takes into account the current relationship between variables, so it is more reasonable to determine the weight of variables [

36,

37]. This paper chooses to use the inflation rate

to form a seven-element SVAR model with six financial variables. The reason for this is mainly based on the following two points: first, China’s GDP data, which characterizes economic growth, can only collect quarterly data, and all data in this paper are monthly data. Second, existing research [

35,

37] shows that the FCI is generally the leading indicator of economic growth and is more consistent with inflation.

Thus, the following

p-order SVAR model is firstly constructed:

where

;

,

, and

are structural coefficient matrices; and

is the orthonormal unobserved structural innovations with

. Since

A is generally invertible, the corresponding reduced-form VAR model can be obtained:

and the reduced form error structure is given by

In order to obtain the uniquely determined estimates of the corresponding structural parameters from the simplified parameter estimation, the problem of identification is often encountered [

45]. If the constraints are imposed on matrix

A and matrix

B, they are called

AB-model, and the constraints on matrix

S are called

S-model. The identifying restrictions embodied in the relations

and

are commonly referred to as short-run restrictions.

Constraints usually come from economic theory, while mature and easily deterministic theories are generally long run. Blanchard and Quah [

46] proposed an alternative identification method using restrictions on the long-run properties of the accumulated impulse responses. Based on the model (3), these long-run constraints can be expressed as follows:

where

is the long-run multiplier, which may be estimated using the reduced form VAR parameter estimate. It is also evident that

. The SVAR model that imposes constraints on matrix

F is called

F model. Note that knowledge of

and

is sufficient to compute

or

, but the converse is not true. The long-run identifying restrictions are specified in terms of the elements of this matrix

, typically in the form of zero restrictions. The restriction

means that the accumulated response of the

i-th variable to the

j-th structural shock is zero in the long run.

Considering the economic significance of constraints, this paper chose F model to estimate the weight of the FCI, i.e., long-run constraints are imposed on the SVAR model to satisfy the identifying conditions. According to the principle of SVAR modeling, if there are k variables, at least k(k − 1)/2 constraints must be applied to the matrix F to be identified. Here, we have seven variables, so 21 constraints are required. A common setting method is to set F to the lower triangular matrix. However, if the order of the variables is different, the economic meaning of the constraints will be different. Hence, the ordering of variables is important.

The standardized financial gap variables used in this paper are all converted using the consumer price index (CPI) and can be regarded as real variables. According to the principle of currency neutrality, inflation has no long-term impact on them. At the same time, the calculation of the FCI weight is due to the cumulative reaction of inflation to the impact of various financial variables, so it is assumed that each financial variable has a long-term impact on inflation. Thus, the inflation rate

is ranked as the seventh variable. In addition, it is generally believed that policy variables have long-term effects on other financial variables, while other financial variables do not easily affect policy variables in the long run. Therefore, this paper ranks the broad money supply gap variable and the real interest rate gap variable in the first and second positions. For other variables, the policy tendencies of the variables are ranked in descending order, followed by the social credit loan gap, exchange rate gap, stock price index gap, and house price gap. In fact, the order of the six financial variables is the same as the order shown in

Table 1. In the actual estimation, it will also be adjusted based on the estimation results of the

F matrix elements. If the element

fij is not significant, it is adjusted to zero and

fji set to non-zero. The final form of

F is set as follows:

The long-term constraints imposed by China and the United States are basically the same. The main difference is reflected in the long-term effects between the money supply and the exchange rate, i.e., the setting of and . The reason for this setting is that China’s is not significant and is significant, while the converse is true for the United States. Given the dominant position of the US dollar in the international money market, this result is reasonable.

Based on the estimation results of the above SVAR model, the impulse response function is used to further calculate the cumulative response of the inflation rate to the impact of each financial variable. Considering that the short economic cycle is generally 3–5 years [

16], this paper selects the cumulative generalized impulse response value of 60 months. Finally, the weight of the

i-th financial indicator in the FCI is calculated according to the following formula:

where

is the 60-stage cumulative generalized impulse response of inflation to the gap value of financial variable,

i. Thus, in conjunction with Equation (1), the calculation of the FCI can be completed.

3.3.2. Measurement Method of the Comovement

Before the analysis of the synergy between the financial cycles of China and the United States, it is necessary to first divide the fluctuations of the two financial cycles. In the study of the traditional economic cycle, a turning point method, such as the Bry–Boschan method [

47], is widely used to identify the peaks and troughs in the time series cycle. However, the turning point obtained by this method needs to satisfy certain rules. The durations of the cycle and its expansion and contraction phases must all exceed the minimum values set in advance. In order to avoid artificially set interference, this paper chose the Markov regime switching (MRS) model proposed by Hamilton [

48]—in which the turning point is endogenously determined—to identify the fluctuation characteristics of the financial cycle.

Suppose there are two possible states of boom and depression represented by the regime variable, where

.

means boom, and

means depression. In the MRS model, the probability that the

t-th period is in a certain regime

j depends on the state

i during the previous period. Although these probabilities can be set to be time-varying, Markov switching models are generally specified with constant probabilities [

49]. The transition probability

from regime

i in period

t − 1 to regime

j in period

t can be expressed as

where

,

or 2. We can list these probabilities in a transition matrix as follows:

It is easy to see that there should be

and

. Typically, we parameterize these probabilities in terms of a logit,

where

are parameters that determine the regime probabilities with the identifying normalizations

and

. Then, the following MRS model with mean values

varying with different regimes is constructed:

where

. The model (11) is estimated by using the switching regression algorithm in Eviews 10.0 software, and the filtered estimates of the regime probabilities

and

can also be calculated. Here,

is the information set in period,

t.

Next, the following indicators are defined for China and the United States, respectively:

Finally, referring to Harding and Pagan’s method [

50,

51], a synergy index (

SI) is constructed to examine the comovement between the financial cycles of the two countries. The difference is that this paper calculates the rolling form of the

T period, where the value of

T refers to the summation result of the average duration of each regime estimated by the MRS model, i.e., the average duration of the entire cycle. The specific calculation method of the consistency index is as follows:

It can be seen that the index calculates the proportion of time in which the financial cycles of the two countries are in the same stage (prosperous or depressed) in a complete cycle. Therefore, this paper uses SI to measure the synergy between the financial cycles of China and the United States. Obviously, SI is greater than 0 and less than 1. The closer SI is to 1, the stronger the synchronization of the two cycles.

3.3.3. Analytical Method of Transmission Paths

In theory, financial fundamentals, bilateral trade, and spillover effects of macroeconomic policies can all cause changes in a country’s financial cycle [

20,

24,

31,

37]. In order to identify the impact of these factors on the financial cycle synergy between China and the United States, we select and deal with the various influencing factors as follows.

The financial indicators used in the calculation of the FCI in China and the United States already cover the description of financial fundamentals and monetary policy. However, the factor of bank credit loan (CL) was not considered when analyzing risk transmission. First, this is the result of the variable selection based on empirical results when modeling. We did not remove it at the beginning, but its load in each factor is not large in the factor analysis, and its coefficient is also not significant in regression analysis with other factors. Second, we consider that the fluctuation of bank credit loan is an influencing factor of internal financial fluctuations, but it is not a channel for risk transmission between the two countries. For example, the US financial crisis may be related to its own credit expansion, which is one of the reasons for the fluctuation of the US financial market, but the transmission of US financial risks to other countries depends on other paths, such as trade, stock and other asset markets, exchange rates, etc. Considering the limited impact of the domestic credit loan scale on the international market, it should be excluded. Therefore, we calculate the fixed T-period rolling correlation coefficient between the remaining five financial indicators to measure the synergy between the real estate market, stock market, and foreign exchange market, as well as the coordination of monetary policy in the two countries. Noting that the variables for calculating the correlation coefficient need to satisfy the law of large numbers, the stability test will be first performed on each gap sequence in the empirical part. In addition, the T-period moving average growth rate of bilateral trade between China and the United States (expressed by TR) is selected as a proxy indicator for describing trade links. Correspondingly, in this part of the analysis, the dependent variable also selects the T-phase smooth correlation coefficient of the FCIs of the two countries.

Using

and

to represent the relevant sequences of China and the United States used in this paper, respectively, the calculation formula of the

T-phase rolling correlation coefficient

of both countries is as follows:

where

,

and

.

Considering the strong collinearity between independent variables

,

, this paper will extract several common factors with obvious economic significance based on factor analysis. Suppose there are

m common factors, denoted by

, then the factor model of a single variable can be expressed as

where

represents a special factor, which contains a random error, and is only related to the

i-th variable,

is called the load of the

i-th variable on the

j-th factor, and the matrix

L, which is composed of it, is called the factor load matrix. This can be expressed in matrix form as follows:

where

,

and

.

In order to make the practical meaning of the factor clearer, it is often necessary to orthogonally rotate the load matrix

L. Suppose there is an m-dimensional orthogonal matrix

H, so that

In this paper, the maximum variance rotation method is used to obtain

, and then the regression method is used to obtain the estimations of common factors.

where

is the sample correlation matrix.

At the same time, there may be differences in the financial risk transmission paths and transmission effects between China and the United States under different financial cycle synergy levels. Hence, a threshold regression model [

52] will be established to test and analyze the transmission paths of financial cooperation between China and the United States. Taking two thresholds as an example, the two thresholds are represented by

and

, and

. Then, the model can be constructed as follows

where

is an indicative function. When an event in parentheses occurs, its value is 1.