The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK

Abstract

1. Introduction

2. Background and Conceptualisation

2.1. Economic Resilience and Its Drivers

2.2. Embeddedness and Resilience

- -

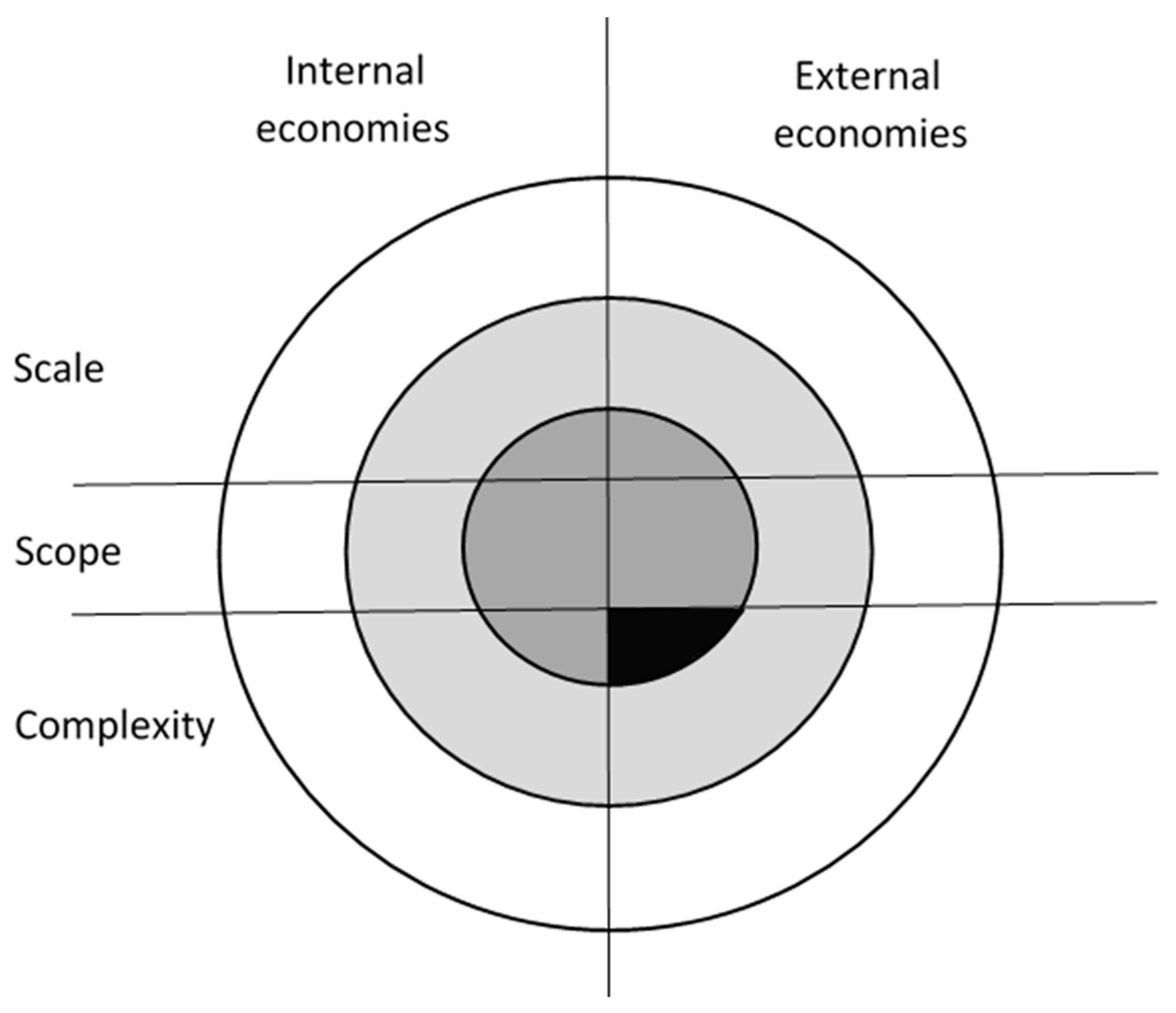

- Scale, scope, and complexity (vertical categories);

- -

- Whether it is internal or external to the firm (horizontal dichotomy);

- -

- Spatial constraint (darker shades more spatially constrained externalities).

3. Data and Operationalisation

4. Results

Industrial Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Goal nr. | Short description | Resilience as… |

|---|---|---|

| 1 | No Poverty | capacity to shield local populations from the effects of a crisis |

| 3 | Good Health and Well-being | ability to ensure health and well-being is not negatively affected by a shock |

| 4 | Quality Education | a direct outcome of quality education |

| 8 | Decent Work and Economic Growth | a catalyst for decent work and economic growth |

| 9 | Industry, Innovation, and Infrastructure | an enabler of continuous investment in innovation and infrastructure |

| 10 | Reduced Inequalities | a facilitator to reduce inequalities |

| 11 | Sustainable Cities and Communities | a contributor to sustainable cities and communities |

| 12 | Responsible Production and Consumption | a framework for responsible production and consumption |

| 17 | Partnership for Goals | an example of multi-stakeholder endeavour |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Emb_man | −0.0418 (0.0767) | 0.0920 (0.228) | 0.361 (0.277) | 0.279 (0.317) | 0.0360 (0.532) | −0.0285 (0.541) | −0.0285 (0.541) |

| Crisis | −0.0611 *** (0.0163) | −0.0848 *** (0.0196) | −0.0840 *** (0.0198) | −0.0837 *** (0.0202) | −0.0833 *** (0.0204) | −0.0827 *** (0.0207) | −0.0827 *** (0.0207) |

| Crisis#Emb_man | 0.295 * (0.153) | 1.037 ** (0.391) | 1.083 ** (0.391) | 1.095 ** (0.402) | 1.092 ** (0.406) | 1.063 ** (0.415) | 1.064 ** (0.415) |

| Emb_man_sqr | −0.108 (1.017) | −0.741 (1.058) | −0.451 (1.191) | 0.242 (1.834) | 0.368 (1.858) | 0.368 (1.861) | |

| Crisis#Emb_man_sqr | −4.537 ** (1.848) | −4.800 ** (1.864) | −4.899 ** (1.922) | −4.916 ** (1.955) | −4.747 ** (2.002) | −4.747 ** (1.999) | |

| FB_Pop | 0.00565 ** (0.00194) | 0.00541 ** (0.00206) | 0.00593 ** (0.00188) | 0.00583 *** (0.00177) | 0.00583 *** (0.00174) | ||

| Growth | 0.0321 (0.0240) | 0.0199 (0.0261) | 0.0180 (0.0260) | 0.0179 (0.0248) | |||

| NVQ4+ | −0.000921 (0.00103) | 0.00000042 (0.00125) | 0.00000194 (0.00138) | ||||

| NO_NVQ | 0.00177 ** (0.000744) | 0.00176 ** (0.000722) | |||||

| Pop_den | −0.000345 (0.0564) | ||||||

| Constant | 0.0225 ** (0.00764) | 0.0115 (0.0114) | −0.0278 (0.0220) | −0.0237 (0.0241) | 0.0137 (0.0585) | −0.0301 (0.0663) | −0.0282 (0.312) |

| Observations | 396 | 396 | 396 | 396 | 396 | 396 | 396 |

| N_g | 36 | 36 | 36 | 36 | 36 | 36 | 36 |

| sigma_e | 0.0234 | 0.0232 | 0.0229 | 0.0229 | 0.0229 | 0.0229 | 0.0229 |

| sigma_u | 0.00620 | 0.00977 | 0.0168 | 0.0155 | 0.0121 | 0.0107 | 0.0104 |

| rho | 0.0656 | 0.151 | 0.349 | 0.313 | 0.218 | 0.179 | 0.171 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Emb_ser | −0.0545 (0.0399) | 0.197 (0.164) | 0.100 (0.212) | 0.0864 (0.213) | 0.160 (0.238) | 0.270 (0.226) | 0.271 (0.229) |

| Crisis | −0.0706 *** (0.0148) | −0.0938 *** (0.0119) | −0.0935 *** (0.0130) | −0.0927 *** (0.0141) | −0.0919 *** (0.0134) | −0.0914 *** (0.0129) | −0.0914 *** (0.0129) |

| Crisis#Emb_ser | 0.110 ** (0.0389) | 0.294 *** (0.0568) | 0.301 *** (0.0628) | 0.304 *** (0.0695) | 0.302 *** (0.0661) | 0.295 *** (0.0652) | 0.295 *** (0.0657) |

| Emb_ser_sqr | −0.352 (0.217) | −0.362 (0.226) | −0.317 (0.223) | −0.296 (0.249) | −0.391 (0.232) | −0.398 (0.241) | |

| Crisis#Emb_ser_sqr | −0.312 *** (0.0737) | −0.325 *** (0.0839) | −0.325 *** (0.0931) | −0.323 *** (0.0885) | −0.313 *** (0.0882) | −0.314 *** (0.0906) | |

| FB_Pop | 0.00415 ** (0.00185) | 0.00411 * (0.00185) | 0.00557 ** (0.00180) | 0.00547 *** (0.00165) | 0.00540 *** (0.00168) | ||

| Growth | 0.0738 *** (0.0218) | 0.0352 (0.0269) | 0.0291 (0.0293) | 0.0315 (0.0255) | |||

| NVQ4+ | −0.00120 ** (0.000462) | 0.0000242 (0.000810) | −0.000109 (0.00114) | ||||

| NO_NVQ | 0.00218 ** (0.000964) | 0.00221 ** (0.000914) | |||||

| Pop_den | 0.0263 (0.0755) | ||||||

| Constant | 0.0366 ** (0.0132) | −0.00202 (0.0287) | 0.0152 (0.0377) | 0.0110 (0.0380) | 0.0116 (0.0399) | −0.0747 (0.0622) | −0.224 (0.427) |

| Observations | 396 | 396 | 396 | 396 | 396 | 396 | 396 |

| N_g | 36 | 36 | 36 | 36 | 36 | 36 | 36 |

| sigma_e | 0.0233 | 0.0232 | 0.0230 | 0.0230 | 0.0229 | 0.0228 | 0.0228 |

| sigma_u | 0.00713 | 0.0163 | 0.0205 | 0.0179 | 0.0158 | 0.0175 | 0.0438 |

| rho | 0.0856 | 0.331 | 0.442 | 0.379 | 0.324 | 0.370 | 0.787 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Emb_agr | 0.721 (0.943) | 3.480 (1.949) | 4.687 ** (1.886) | 4.668 ** (1.829) | 3.902 * (1.997) | 3.912 * (1.973) | 3.837 * (2.008) |

| Crisis | −0.0362 *** (0.00761) | −0.0367 *** (0.00594) | −0.0366 *** (0.00599) | −0.0347 *** (0.00702) | −0.0343 *** (0.00692) | −0.0347 *** (0.00657) | −0.0346 *** (0.00645) |

| Crisis#Emb_agr | 0.0299 (0.398) | 0.129 (0.776) | 0.266 (0.759) | 0.201 (0.667) | 0.237 (0.770) | 0.349 (0.802) | 0.307 (0.830) |

| Emb_agr_sqr | −130.6 (115.1) | −136.9 (114.4) | −125.3 (115.3) | −96.83 (114.9) | −116.2 (121.6) | −107.2 (120.7) | |

| Crisis#Emb_agr_sqr | −2.517 (52.18) | −8.897 (52.31) | −6.435 (45.28) | −3.031 (49.52) | −12.13 (53.23) | −10.56 (55.44) | |

| FB_Pop | 0.00375 ** (0.00133) | 0.00394 ** (0.00137) | 0.00613 *** (0.00157) | 0.00599 *** (0.00143) | 0.00587 *** (0.00150) | ||

| Growth | 0.0720 * (0.0347) | 0.0279 (0.0434) | 0.0232 (0.0440) | 0.0278 (0.0368) | |||

| NVQ4+ | −0.00125 *** (0.000347) | −0.0000216 (0.000710) | −0.000290 (0.00118) | ||||

| NO_NVQ | 0.00201 ** (0.000719) | 0.00205 ** (0.000653) | |||||

| Pop_den | 0.0468 (0.0984) | ||||||

| Constant | 0.0142 ** (0.00569) | 0.00517 (0.00482) | −0.0162 * (0.00878) | −0.0208 * (0.0106) | 0.00806 (0.0173) | −0.0502 (0.0318) | −0.315 (0.533) |

| Observations | 396 | 396 | 396 | 396 | 396 | 396 | 396 |

| N_g | 36 | 36 | 36 | 36 | 36 | 36 | 36 |

| sigma_e | 0.0240 | 0.0240 | 0.0239 | 0.0239 | 0.0237 | 0.0237 | 0.0237 |

| sigma_u | 0.00708 | 0.0102 | 0.0154 | 0.0161 | 0.0161 | 0.0122 | 0.0618 |

| rho | 0.0801 | 0.152 | 0.292 | 0.312 | 0.315 | 0.210 | 0.872 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Emb_con | 0.440 (0.324) | 1.370 (0.971) | 1.086 (0.828) | 0.806 (0.951) | 0.900 (1.138) | 0.773 (1.035) | 0.755 (1.029) |

| Crisis | −0.0730 *** (0.0202) | −0.101 *** (0.0202) | −0.101 *** (0.0208) | −0.101 *** (0.0220) | −0.0994 *** (0.0220) | −0.0992 *** (0.0216) | −0.0994 *** (0.0218) |

| Crisis#Emb_con | 0.863 * (0.394) | 2.695 *** (0.702) | 2.708 *** (0.717) | 2.803 *** (0.767) | 2.749 *** (0.758) | 2.747 *** (0.742) | 2.761 *** (0.758) |

| Emb_con_sqr | −7.774 (10.55) | −6.244 (9.495) | −4.600 (10.26) | −5.262 (11.73) | −4.094 (10.87) | −3.717 (10.97) | |

| Crisis#Emb_con_sqr | −25.14 *** (6.947) | −25.37 *** (6.874) | −26.67 *** (7.407) | −25.87 *** (7.157) | −26.06 *** (7.032) | −26.31 *** (7.298) | |

| FB_Pop | 0.00255 * (0.00134) | 0.00276 * (0.00131) | 0.00507 ** (0.00171) | 0.00513 *** (0.00152) | 0.00498 *** (0.00155) | ||

| Growth | 0.0700 *** (0.0213) | 0.0227 (0.0237) | 0.0198 (0.0260) | 0.0236 (0.0228) | |||

| NVQ4+ | −0.00131 *** (0.000301) | −0.000175 (0.000718) | −0.000412 (0.00111) | ||||

| NO_NVQ | 0.00188 ** (0.000790) | 0.00194 ** (0.000695) | |||||

| Pop_den | 0.0443 (0.0906) | ||||||

| Constant | −0.000410 (0.0145) | −0.0249 (0.0229) | −0.0252 (0.0209) | −0.0203 (0.0243) | 0.00402 (0.0309) | −0.0489 (0.0459) | −0.300 (0.484) |

| Observations | 396 | 396 | 396 | 396 | 396 | 396 | 396 |

| N_g | 36 | 36 | 36 | 36 | 36 | 36 | 36 |

| sigma_e | 0.0234 | 0.0233 | 0.0233 | 0.0232 | 0.0231 | 0.0230 | 0.0231 |

| sigma_u | 0.0113 | 0.0163 | 0.0148 | 0.0131 | 0.0156 | 0.0142 | 0.0671 |

| rho | 0.189 | 0.327 | 0.288 | 0.240 | 0.312 | 0.276 | 0.894 |

| Region Number | Code | Region Name |

|---|---|---|

| R220 | UKC1 | Tees Valley and Durham |

| R221 | UKC2 | Northumberland Tyne and Wear |

| R222 | UKD1 | Cumbria |

| R223 | UKD2 | Cheshire |

| R224 | UKD3 | Greater Manchester |

| R225 | UKD4 | Lancashire |

| R226 | UKD5 | Merseyside |

| R227 | UKE1 | East Riding and North Lincolnshire |

| R228 | UKE2 | North Yorkshire |

| R229 | UKE3 | South Yorkshire |

| R230 | UKE4 | West Yorkshire |

| R231 | UKF1 | Derbyshire and Nottinghamshire |

| R232 | UKF2 | Leicestershire Rutland and Northants |

| R233 | UKF3 | Lincolnshire |

| R234 | UKG1 | Herefordshire Worcestershire and Warks |

| R235 | UKG2 | Shropshire and Staffordshire |

| R236 | UKG3 | West Midlands |

| R237 | UKH1 | East Anglia |

| R238 | UKH2 | Bedfordshire Hertfordshire |

| R239 | UKH3 | Essex |

| R240 | UKI1 | Inner London |

| R241 | UKI2 | Outer London |

| R242 | UKJ1 | Berkshire Bucks and Oxfordshire |

| R243 | UKJ2 | Surrey East and West Sussex |

| R244 | UKJ3 | Hampshireand Isle of Wight |

| R245 | UKJ4 | Kent |

| R246 | UKK1 | Gloucestershire Wiltshire and North Somerset |

| R247 | UKK2 | Dorset and Somerset |

| R248 | UKK3 | Cornwall and Isles of Scilly |

| R249 | UKK4 | Devon |

| R250 | UKL1 | West Wales and The Valleys |

| R251 | UKL2 | East Wales |

| R252 | UKM2 | North Eastern Scotland |

| R253 | UKM3 | Eastern Scotland |

| R254 | UKM5 | South Western Scotland |

| R255 | UKM6 | Highlands and Islands |

| R256 | UKN0 | Northern Ireland |

| Code | Sector Name |

|---|---|

| ss1 | Agriculture |

| ss2 | Mining quarrying and energy supply |

| ss3 | Food beverages and tobacco |

| ss4 | Textiles and leather, etc. |

| ss5 | Coke, refined petroleum, nuclear fuel, and chemicals, etc. |

| ss6 | Electrical and optical equipment and Transport equipment |

| ss8 | Other manufacturing |

| ss9 | Construction |

| ss10 | Distribution |

| ss11 | Hotels and restaurant |

| ss12 | Transport storage and communication |

| ss13 | Financial intermediation |

| ss14 | Real estate, renting and business activities |

| ss15 | Non-Market services |

| Emb | Emb_sqr | Emb_man | Emb_man_sqr | Emb_agr | Emb_agr_sqr | Emb_con | Emb_con_sqr | Emb_ser | Emb_ser_sqr | Crisis | FB_Pop | Growth | NVQ4+ | NO_NVQ | Pop_den | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Emb | 1 | |||||||||||||||

| Emb_sqr | 0.96 | 1 | ||||||||||||||

| Emb_man | 0.43 | 0.26 | 1 | |||||||||||||

| Emb_man_sqr | 0.3 | 0.16 | 0.96 | 1 | ||||||||||||

| Emb_agr | 0.09 | −0.04 | 0.54 | 0.5 | 1 | |||||||||||

| Emb_agr_sqr | 0.06 | −0.04 | 0.41 | 0.38 | 0.95 | 1 | ||||||||||

| Emb_con | 0.72 | 0.58 | 0.51 | 0.33 | 0.28 | 0.18 | 1 | |||||||||

| Emb_con_sqr | 0.66 | 0.57 | 0.39 | 0.22 | 0.2 | 0.12 | 0.97 | 1 | ||||||||

| Emb_ser | 0.94 | 0.97 | 0.13 | 0.01 | −0.13 | −0.12 | 0.56 | 0.54 | 1 | |||||||

| Emb_ser_sqr | 0.82 | 0.93 | −0.08 | −0.15 | −0.25 | −0.2 | 0.33 | 0.35 | 0.95 | 1 | ||||||

| Crisis | −0.04 | −0.07 | −0.02 | −0.04 | 0.06 | 0.04 | 0.03 | 0.02 | −0.05 | −0.08 | 1 | |||||

| FB_Pop | 0.49 | 0.58 | −0.11 | −0.13 | −0.04 | −0.04 | 0.09 | 0.1 | 0.59 | 0.67 | −0.15 | 1 | ||||

| Growth | 0.03 | 0.05 | 0.09 | 0.12 | −0.01 | −0.02 | −0.02 | −0.01 | 0.01 | 0.03 | −0.36 | 0.07 | 1 | |||

| NVQ4+ | 0.06 | 0.22 | −0.52 | −0.48 | −0.24 | −0.2 | −0.28 | −0.24 | 0.26 | 0.42 | 0.02 | 0.6 | −0.13 | 1 | ||

| NO_NVQ | −0.09 | −0.14 | 0.06 | 0.05 | −0.3 | −0.23 | −0.05 | −0.09 | −0.09 | −0.12 | −0.06 | −0.39 | 0.15 | −0.63 | 1 | |

| Pop_den | 0.72 | 0.73 | 0.06 | −0.04 | −0.43 | −0.37 | 0.41 | 0.39 | 0.8 | 0.76 | −0.05 | 0.37 | −0.02 | 0.06 | 0.3 | 1 |

References

- Kitsos, A.; Bishop, P. Economic resilience in Great Britain: The crisis impact and its determining factors for local authority districts. Ann. Reg. Sci. 2018, 60, 329–347. [Google Scholar] [CrossRef]

- Martin, R.; Gardiner, B. The resilience of cities to economic shocks: A tale of four recessions (and the challenge of Brexit). Pap. Reg. Sci. 2019, 1–32. [Google Scholar] [CrossRef]

- Modica, M.; Reggiani, A. Spatial Economic Resilience: Overview and Perspectives. Netw. Spat. Econ. 2014, 5, 211–233. [Google Scholar] [CrossRef]

- West Midlands Combined Authority. West Midlands Local Industrial Strategy; Strategy, Ministry of Housing, Communities & Local Government and Department for Business, Energy & Industrial Strategy: London, UK, 2019; p. 84. [Google Scholar]

- Fratesi, U.; Rodríguez-Pose, A. The crisis and regional employment in Europe: What role for sheltered economies? Camb. J. Reg. Econ. Soc. 2016, 9, 33–57. [Google Scholar] [CrossRef]

- Rocchetta, S.; Mina, A. Technological coherence and the adaptive resilience of regional economies. Reg. Stud. 2019, 1–14. [Google Scholar] [CrossRef]

- Parr, J.B.; Hewings, G.J.D.; Sohn, J.; Nazara, S. Agglomeration and Trade: Some Additional Perspectives. Reg. Stud. 2002, 36, 675–684. [Google Scholar] [CrossRef]

- Boschma, R.; Iammarino, S. Related Variety, Trade Linkages, and Regional Growth in Italy. Econ. Geogr. 2009, 85, 289–311. [Google Scholar] [CrossRef]

- Grabher, G. The Embedded Firm; Routledge: London, UK, 1993. [Google Scholar]

- Holling, C.S. Resilience and Stability of Ecological Systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Noy, I.; Yonson, R. Economic Vulnerability and Resilience to Natural Hazards: A Survey of Concepts and Measurements. Sustainability 2018, 10, 2850. [Google Scholar] [CrossRef]

- Evenhuis, E. New directions in researching regional economic resilience and adaptation. Geogr. Compass 2017, 11, e12333. [Google Scholar] [CrossRef]

- Faggian, A.; Gemmiti, R.; Jaquet, T.; Santini, I. Regional economic resilience: The experience of the Italian local labor systems. Ann. Reg. Sci. 2018, 60, 393–410. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2014, 15, 1–42. [Google Scholar] [CrossRef]

- Kitsos, A. Economic resilience in Great Britain: an examination of the determinants of the 2008 crisis impact on GB’s local authority districts. Ph.D. Thesis, University of Plymouth, Plymouth, UK, 2018. [Google Scholar]

- Hill, E.; Clair, T.; Wial, H.; Wolman, H.; Atkins, P.; Blumenthal, P.; Ficenec, S.; Fiedhoff, A. Economic shocks and regional economic resilience. In Urban and Regional Policy and Its Effects: Building Resilient Regions; Brookings Institution Press: Washington, DC, USA, 2012; pp. 20–21. [Google Scholar]

- Reggiani, A.; De Graaff, T.; Nijkamp, P. Resilience: An Evolutionary Approach to Spatial Economic Systems. Netw. Spat. Econ. 2002, 2, 211–229. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Cross, R.; Grinfeld, M.; Lamba, H. Hysteresis and economics. Control Syst. IEEE 2009, 29, 30–43. [Google Scholar] [CrossRef]

- Bristow, G.; Healy, A. Regional Resilience: An Agency Perspective. Reg. Stud. 2013, 48, 923–935. [Google Scholar] [CrossRef]

- Bristow, G.; Healy, A. Crisis response, choice and resilience: Insights from complexity thinking. Camb. J. Reg. Econ. Soc. 2015, 8, 241–256. [Google Scholar] [CrossRef]

- Sensier, M.; Bristow, G.; Healy, A. Measuring Regional Economic Resilience across Europe: Operationalizing a complex concept. Spat. Econ. Anal. 2016, 11, 128–151. [Google Scholar] [CrossRef]

- Psycharis, Y.; Kallioras, D.; Pantazis, P. Economic crisis and regional resilience: Detecting the ‘geographical footprint’ of economic crisis in Greece. Reg. Sci. Policy Pract. 2014, 6, 121–141. [Google Scholar] [CrossRef]

- Pontarollo, N.; Serpieri, C. A composite policy tool to measure territorial resilience capacity. Socio-Econ. Plan. Sci. 2018. [Google Scholar] [CrossRef]

- Yu, H.; Liu, Y.; Liu, C.; Fan, F. Spatiotemporal Variation and Inequality in China’s Economic Resilience across Cities and Urban Agglomerations. Sustainability 2018, 10, 4754. [Google Scholar] [CrossRef]

- Giovannini, E.; Nardo, M.; Saisana, M.; Saltelli, A.; Tarantola, A.; Hoffman, A. Handbook on Constructing Composite Indicators: Methodology and User Guide; OECD: Paris, France, 2008. [Google Scholar]

- Lee, N. Grim down South? The Determinants of Unemployment Increases in British Cities in the 2008–2009 Recession. Reg. Stud. 2014, 48, 1761–1778. [Google Scholar] [CrossRef]

- Clayton, N. The spatial impacts of the recession. In The Recession and beyond: Local and Regional Responses to the Downturn; Bailey, D., Chapain, C., Eds.; Routledge: New York, NY, USA, 2011; pp. 27–44. [Google Scholar]

- Brinkley, I.; Clayton, N.; Coats, D.; Hutton, W.; Overell, S. Hard Labour: Jobs, Unemployment and the Recession; Work Foundation: London, UK, 2008. [Google Scholar]

- Bell, D.N.F.; Blanchflower, D.G. UK Unemployment in the Great Recession. Natl. Inst. Econ. Rev. 2010, 214, R3–R25. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How Regions React to Recessions: Resilience and the Role of Economic Structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Fratesi, U.; Perucca, G. Territorial capital and the resilience of European regions. Ann. Reg. Sci. 2018, 60, 241–264. [Google Scholar] [CrossRef]

- Urso, G.; Modica, M.; Faggian, A. Resilience and Sectoral Composition Change of Italian Inner Areas in Response to the Great Recession. Sustainability 2019, 11, 2679. [Google Scholar] [CrossRef]

- Holtermann, L.; Hundt, C. Hierarchically Structured Determinants and Phaserelated Patterns of Economic Resilience: An Empirical Case Study for European Regions; Working Papers on Innovation and Space; EconStor: Kiel, Germany, 2018. [Google Scholar]

- Di Caro, P. Testing and explaining economic resilience with an application to Italian regions. Pap. Reg. Sci. 2017, 96, 93–113. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. Employment Resilience in Europe and the 2008 Economic Crisis: Insights from Micro-Level Data. Reg. Stud. 2016, 50, 644–656. [Google Scholar] [CrossRef]

- Acs, Z.; Armington, C. Employment Growth and Entrepreneurial Activity in Cities. Reg. Stud. 2004, 38, 911–927. [Google Scholar] [CrossRef]

- Doran, J.; McCarthy, N.; O’Connor, M. Entrepreneurship and employment growth across European regions. Reg. Stud. Reg. Sci. 2016, 3, 121–128. [Google Scholar] [CrossRef]

- Thompson, P.; Zang, W. The foreign business and domestic enterprise relationship: Its implications for local entrepreneurial resilience. Local Econ. 2018, 33, 10–39. [Google Scholar] [CrossRef]

- Bishop, P. Knowledge diversity and entrepreneurship following an economic crisis: An empirical study of regional resilience in Great Britain. Entrep. Reg. Dev. 2018, 31, 496–515. [Google Scholar] [CrossRef]

- Kacher, N.; Kitsos, A.; Petach, L.; Ortega-Argilés, R.; Weiler, S. Entrepreneurship and Resilience: Implications for Regional Development in the US and UK. In Proceedings of the North American Regional Science Association, 65th Annual Meeting, San Antonio, TX, USA, 7–10 November 2018. [Google Scholar]

- Klimek, P.; Poledna, S.; Thurner, S. Economic resilience from input-output susceptibility improves predictions of economic growth and recovery. arXiv 2019, arXiv:1903.03203. [Google Scholar] [CrossRef] [PubMed]

- ONS. The Impact of the Recession on the Labour Market; Office for National Statistics: Newport, UK, 2009. [Google Scholar]

- Bristow, G.I.; Healy, A.; Norris, L.; Wink, R.; Kafkalas, G.; Kakderi, C.; Espenberg, K.; Varblane, U.; Sepp, V.; Sagan, I.; et al. ECR2. In Economic Crisis: Regional Economic Resilience; ESPON: Brussels, Belgium, 2014; pp. 1–110. [Google Scholar]

- Bishop, P.; Gripaios, P. Spatial Externalities, Relatedness and Sector Employment Growth in Great Britain. Reg. Stud. 2010, 44, 443–454. [Google Scholar] [CrossRef]

- De Groot, H.L.; Poot, J.; Smit, M.J. Which Agglomeration Externalities Matter Most and Why? J. Econ. Surv. 2016, 30, 756–782. [Google Scholar] [CrossRef]

- Tan, J.; Lo, K.; Qiu, F.; Liu, W.; Li, J.; Zhang, P. Regional economic resilience: Resistance and recoverability of resource-based cities during economic crises in Northeast China. Sustainability 2017, 9, 2136. [Google Scholar] [CrossRef]

- Di Caro, P. Recessions, recoveries and regional resilience: Evidence on Italy. Camb. J. Reg. Econ. Soc. 2015, 8, 273–291. [Google Scholar] [CrossRef]

- Li, L.; Zhang, P.; Li, X. Regional Economic Resilience of the Old Industrial Bases in China—A Case Study of Liaoning Province. Sustainability 2019, 11, 723. [Google Scholar] [CrossRef]

- Parr, J.B. Agglomeration Economies: Ambiguities and Confusions. Environ. Plan. A Econ. Space 2002, 34, 717–731. [Google Scholar] [CrossRef]

- Ohlin, B. Interregional and International Trade; Harvard University Press: Cambridge, MA, USA, 1933. [Google Scholar]

- Isard, W. Location and Space-Economy; The Technology Press of Massachusetts Institute of Technology: Cambridge, MA, USA, 1956. [Google Scholar]

- Robinson, E. The Structure of Competitive Industry; Cambridge University Press: Cambridge, MA, USA, 1958. [Google Scholar]

- Parr, J.B. Missing Elements in the Analysis of Agglomeration Economies. Int. Reg. Sci. Rev. 2002, 25, 151–168. [Google Scholar] [CrossRef]

- McCann, P. Rethinking the Economics of Location and Agglomeration. Urban Stud. 1995, 32, 563–577. [Google Scholar] [CrossRef]

- Hess, M. ‘Spatial’ relationships? Towards a reconceptualization of embeddedness. Prog. Hum. Geogr. 2004, 28, 165–186. [Google Scholar] [CrossRef]

- Hess, M.; Coe, N.M. Making Connections: Global Production Networks, Standards, and Embeddedness in the Mobile-Telecommunications Industry. Environ. Plan. A Econ. Space 2006, 38, 1205–1227. [Google Scholar] [CrossRef]

- Amin, A.; Thrift, N. Neo-Marshallian nodes in global networks. Int. J. Urban Reg. Res. 1992, 16, 571–587. [Google Scholar] [CrossRef]

- Lagravinese, R. Economic crisis and rising gaps North–South: Evidence from the Italian regions. Camb. J. Reg. Econ. Soc. 2015, 8, 331–342. [Google Scholar] [CrossRef]

- Conroy, M.E. Regional Economic Diversification; Praeger: New York, NY, USA, 1975. [Google Scholar]

- Miller, R.E.; Blair, P.D. Input-output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Los, B.; Timmer, M.P.; de Vries, G.J. How Global are Global Value Chains? A New Approach to Measure International Fragmentation. J. Reg. Sci. 2015, 55, 66–92. [Google Scholar] [CrossRef]

- Chen, W.; Los, B.; McCann, P.; Ortega-Argilés, R.; Thissen, M.; van Oort, F. The continental divide? Economic exposure to Brexit in regions and countries on both sides of The Channel. Pap. Reg. Sci. 2018, 97, 25–54. [Google Scholar] [CrossRef]

- Thissen, M.; Lankhuizen, M.; van Oort, F.; Los, B.; Diodato, D. EUREGIO: The Construction of a Global IO Database with Regional Detail for Europe for 2000–2010; Tinbergen Institute Discussion Paper; No. TI 2018-084/VI; Tinbergen Institute: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Timmer, M.P.; Dietzenbacher, E.; Los, B.; Stehrer, R.; de Vries, G.J. An Illustrated User Guide to the World Input–Output Database: The Case of Global Automotive Production. Rev. Int. Econ. 2015, 23, 575–605. [Google Scholar] [CrossRef]

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

| Perspective | Meaning | Measurement |

|---|---|---|

| Resilience of ecosystems (Engineering resilience) | Movement back to equilibrium (Single equilibrium approach) | Speed or amount of force counterbalanced |

| Ecology (Ecological resilience) | Movement to new equilibrium point or stability domain (multiple equilibria with adaptation perspectives) | Amount of force sustained until change of structural characteristics |

| Resilience as a dynamic process | Adaptation to continuously changing environments | Capacity to adapt and create new development paths |

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Emb | 396 | 0.487 | 0.152 | 0.056 | 0.811 |

| Emb_sqr | 396 | 0.260 | 0.133 | 0.003 | 0.658 |

| Emb_man | 396 | 0.087 | 0.039 | 0.006 | 0.172 |

| Emb_man_sqr | 396 | 0.009 | 0.007 | 0.000 | 0.030 |

| Emb_agr | 396 | 0.007 | 0.005 | 0.000 | 0.023 |

| Emb_agr_sqr | 396 | 0.000 | 0.000 | 0.000 | 0.001 |

| Emb_con | 396 | 0.043 | 0.013 | 0.007 | 0.069 |

| Emb_con_sqr | 396 | 0.002 | 0.001 | 0.000 | 0.005 |

| Emb_ser | 396 | 0.328 | 0.129 | 0.031 | 0.751 |

| Emb_ser_sqr | 396 | 0.124 | 0.097 | 0.001 | 0.564 |

| Crisis | 396 | 0.328 | 0.470 | 0.000 | 1.000 |

| FB_Pop | 396 | 3.656 | 1.215 | 1.562 | 10.218 |

| Growth | 396 | 0.038 | 0.030 | −0.057 | 0.119 |

| NVQ4+ | 396 | 25.966 | 5.251 | 17.300 | 48.400 |

| NO_NVQ | 396 | 14.140 | 3.537 | 7.400 | 23.600 |

| Pop_den | 396 | 5.804 | 1.258 | 2.197 | 9.207 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Emb | 0.552 (0.602) | 0.575 ** (0.235) | 0.561 ** (0.218) | 0.539 ** (0.211) | 0.504 ** (0.218) | 0.464 * (0.224) | 0.455 ** (0.204) |

| Emb_sqr | −0.229 (0.563) | −0.491 * (0.253) | −0.437 (0.243) | −0.463 * (0.231) | −0.500 * (0.262) | −0.462 (0.276) | −0.445 * (0.242) |

| Crisis | −0.0355 *** (0.00527) | −0.0346 *** (0.00563) | −0.0335 *** (0.00589) | −0.0328 *** (0.00580) | −0.0331 *** (0.00579) | −0.0331 *** (0.00587) | |

| FB_pop | 0.00329 * (0.00150) | 0.00320 * (0.00151) | 0.00530 *** (0.00161) | 0.00535 *** (0.00143) | 0.00525 *** (0.00147) | ||

| Growth | 0.0587 ** (0.0238) | 0.0238 (0.0334) | 0.0203 (0.0344) | 0.0224 (0.0305) | |||

| NVQ4+ | −0.00131 ** (0.000477) | −0.000107 (0.000881) | −0.000264 (0.00122) | ||||

| NO_NVQ | 0.00200 ** (0.000734) | 0.00204 ** (0.000663) | |||||

| Pop_den | 0.0318 (0.0860) | ||||||

| Constant | −0.202 (0.148) | −0.133 ** (0.0521) | −0.153 *** (0.0460) | −0.138 ** (0.0449) | −0.0837 * (0.0396) | −0.134 ** (0.0506) | −0.314 (0.487) |

| Observations | 396 | 396 | 396 | 396 | 396 | 396 | 396 |

| N_g | 36 | 36 | 36 | 36 | 36 | 36 | 36 |

| sigma_e | 0.0292 | 0.0239 | 0.0238 | 0.0238 | 0.0237 | 0.0236 | 0.0237 |

| sigma_u | 0.0574 | 0.0331 | 0.0372 | 0.0317 | 0.0277 | 0.0245 | 0.0571 |

| Rho | 0.795 | 0.657 | 0.709 | 0.640 | 0.577 | 0.518 | 0.853 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Emb | 0.0919 (0.0587) | 0.424 *** (0.123) | 0.407 ** (0.135) | 0.384 ** (0.161) | 0.355 * (0.181) | 0.319 (0.195) | 0.317 (0.195) |

| Crisis | −0.0805 *** (0.0138) | −0.0938 *** (0.0121) | −0.0932 *** (0.0129) | −0.0929 *** (0.0139) | −0.0921 *** (0.0141) | −0.0916 *** (0.0141) | −0.0916 *** (0.0142) |

| Crisis#Emb | 0.0952 *** (0.0248) | 0.182 *** (0.0383) | 0.183 *** (0.0423) | 0.188 *** (0.0466) | 0.190 *** (0.0473) | 0.187 *** (0.0485) | 0.187 *** (0.0496) |

| Emb_sqr | −0.327 *** (0.100) | −0.266 ** (0.103) | −0.292 ** (0.121) | −0.327 ** (0.146) | −0.293 (0.162) | −0.290 * (0.155) | |

| Crisis#Emb_sqr | −0.115 ** (0.0370) | −0.113 ** (0.0424) | −0.120 ** (0.0468) | −0.126 ** (0.0478) | −0.122 ** (0.0502) | −0.122 ** (0.0523) | |

| FB_Pop | 0.00361 ** (0.00130) | 0.00352 ** (0.00132) | 0.00538 *** (0.00163) | 0.00544 *** (0.00148) | 0.00542 *** (0.00148) | ||

| Growth | 0.0607 ** (0.0206) | 0.0295 (0.0218) | 0.0262 (0.0228) | 0.0266 (0.0208) | |||

| NVQ4+ | −0.00117 ** (0.000499) | −0.0000524 (0.000993) | −0.0000818 (0.00126) | ||||

| NO_NVQ | 0.00186 * (0.000846) | 0.00187 ** (0.000797) | |||||

| Pop_den | 0.00593 (0.0787) | ||||||

| Constant | −0.0261 (0.0289) | −0.103 ** (0.0375) | −0.124 ** (0.0433) | −0.108 * (0.0510) | −0.0602 (0.0621) | −0.107 (0.0836) | −0.141 (0.428) |

| Observations | 396 | 396 | 396 | 396 | 396 | 396 | 396 |

| N_g | 36 | 36 | 36 | 36 | 36 | 36 | 36 |

| sigma_e | 0.0231 | 0.0231 | 0.0230 | 0.0229 | 0.0229 | 0.0228 | 0.0228 |

| sigma_u | 0.0201 | 0.0324 | 0.0378 | 0.0316 | 0.0265 | 0.0239 | 0.0292 |

| rho | 0.430 | 0.663 | 0.730 | 0.656 | 0.574 | 0.523 | 0.621 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kitsos, A.; Carrascal-Incera, A.; Ortega-Argilés, R. The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK. Sustainability 2019, 11, 3800. https://doi.org/10.3390/su11143800

Kitsos A, Carrascal-Incera A, Ortega-Argilés R. The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK. Sustainability. 2019; 11(14):3800. https://doi.org/10.3390/su11143800

Chicago/Turabian StyleKitsos, Anastasios, André Carrascal-Incera, and Raquel Ortega-Argilés. 2019. "The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK" Sustainability 11, no. 14: 3800. https://doi.org/10.3390/su11143800

APA StyleKitsos, A., Carrascal-Incera, A., & Ortega-Argilés, R. (2019). The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK. Sustainability, 11(14), 3800. https://doi.org/10.3390/su11143800