3.1. Conditional Forecasts Using Bayesian VAR

In this section, we investigate the potential changes in the proportion of vulnerable households following a shock in which the U.S. policy rate would change for upcoming years. This paper uses the effects on the domestic call rate instead of the bank household lending rate. This has two implications. First, it enables us to deal directly with the transmission channel between an exogenous U.S. policy rate and the domestic policy rate. Second, the call rate as the basis interest rate can have effects not only on bank lending rates, but also on nonbank financial sector lending rates. In addition, the limited availability for the interest rate data of the nonbank financial sector is another reason for focusing on the policy-related call rate. The changes in balance sheet of the U.S. Federal Reserve known as quantitative easing can affect global financial markets. Under zero interest rates, the changes in the federal funds rate are unlikely to reflect the financial situation, but since the normalization of the interest rate in December 2015, the U.S. policy rate reflects this.

For this analysis, we first construct a Bayesian VAR model incorporating the U.S. policy rate and domestic macro and financial variables. The reason for adopting the Bayesian VAR model comes from its well-known superior performance in forecasting. Second, we execute the forecasts for domestic variables including the call rate conditional on the U.S. policy rate’s path, which is exogenously imposed. Finally, we conduct projections for households that are vulnerable in their debt repayments, given various macroeconomic scenarios associated with the conditional forecasts for domestic interest rates.

The endogenous variables in our Bayesian VAR model are displayed in

Table 1. The most exogenous and shock-generating variable is the effective federal funds rate in the United States, denoted by

funds rate. The other endogenous variables are all domestic variables related to the Korean economy: Korean Won/US

$ foreign exchange rate, denoted by

fxr; the real gross domestic product (GDP) growth rate, denoted by

y; the rate of consumer price index (CPI) increase, that is, inflation, denoted by

p; and the call rate, a typical overnight interest rate in the interbank money market, denoted by

call rate.

The causal flow in the VAR model indicates that a shock from the federal funds rate can ultimately affect the call rate via transmission channels through factors in both the external and internal sectors such as the foreign exchange market and internal real economic conditions. The former includes the foreign exchange rate, and the latter includes GDP growth and inflation. The foreign exchange rate related to external shocks is assumed to have a greater degree of exogeneity than internal variables such as economic growth and inflation, as displayed in

Table 1. This causal flow represents that the central bank’s policy for the interest rate would be implemented after observing domestic economic activities indicated by GDP growth and inflation. In addition, the interest rate can affect domestic economic variables in advance. Whether the call rate would be in advance or follow in the VAR structure does not make any critical differences in forecasts of the call rate responding to projected path of the federal funds rate.

The data sample is from 2000 Q1 to 2017 Q4, thus excluding the periods of the 1997 Asian Crisis and the years of sharp rebound from the crisis through 1999. We use quarterly frequency basis data in this section, however, rather than monthly, on the grounds that quarterly frequency data can be more stable for drawing economic implications under the conditional forecasting setup using the Bayesian VAR model. The four lags of the endogenous variables are used in the VAR framework, which indicates that one year of lagged variables is allowed in the quarterly frequency data. The conventional Choleski decomposition is adopted for the VAR identification, where the ordering of the degrees of exogeneity from top to bottom is just the same as that displayed in

Table 1.

The typical Minnesota prior [

15] is adopted for the Bayesian VAR model. The use of Minnesota prior implies that the distributions for the dynamic coefficients are set so that the lower the effects of the lagged variables, the more the lags in the endogenous variables. More specifically, the distributions from which the dynamic coefficients are drawn are set to be more tightly condensed around zero as the lags grow. The Bayesian VAR model is estimated by Gibbs sampling, a numerical method in which a posterior density can be estimated from conditional posterior densities using zigzag random sampling across each conditional density. Finally, the VAR equation is written as shown in Equation (1).

where A is a constant vector, the Bs are dynamic coefficient matrices, and E is an error term vector. Y is the data matrix for endogenous variables reflecting the degree of exogeneity, such as

and B

0 is the lower triangular matrix for the Choleski decomposition. The conditional forecasts for the upcoming years are conducted using the method from the authors of [

16]. The conditional forecast can be described as similar to estimating the response functions of the endogenous variables of interest to continue impulses from an exogenously fixed path. In this paper, the variable of interest is the call rate, the base interest rate for all interest rates in Korea, and the exogenously fixed path is the trend of increase in the U.S. federal funds rate.

The previous literature exploring the mechanism of transmission from U.S. to Korean interest rates has focused heavily on term structure approaches [

1,

2]. Here, we are more interested in the historical responses of domestic macro variables such as the call rate to shocks from the U.S. policy rate. Korean monetary policy is likely to consider not only domestic growth and inflation, but also changes in external conditions including global interest rates and the foreign exchange market.

On the basis of the projection for the federal funds rate as of 19 June 2019 [

17], the latest updated projection as of today, a realistic scenario for the path of the effective federal funds rate from 2018 Q2 to 2020 Q4, can be set as follows:

Q2 2018: 1.70%

Q4 2018: 2.20%

Q4 2019: 2.40%

Q4 2020: 2.10%

Under this scenario, the policy rate would increase by approximately 2.40%p, in a gradual manner, over the four years from 2016 to 2019, and then the projected rate for 2020 was reversed to decline to 2.10% recently, reflecting the heightened uncertainty for the upcoming world economic situation. The magnitude of increment in the rate is slightly lower than that of the average among the three cases of tightening phases in the U.S. policy rate since 1990. During the periods, the rate had increased by 3.07%p on average within a year and a half. In contrast, the speed of the increase in the U.S. policy rate for the current tightening phase is definitely slower than that in the previous three cases, in that the U.S. policy rate would be increasing approximately 0.8%p on average for a year and a half from 2016 to 2019.

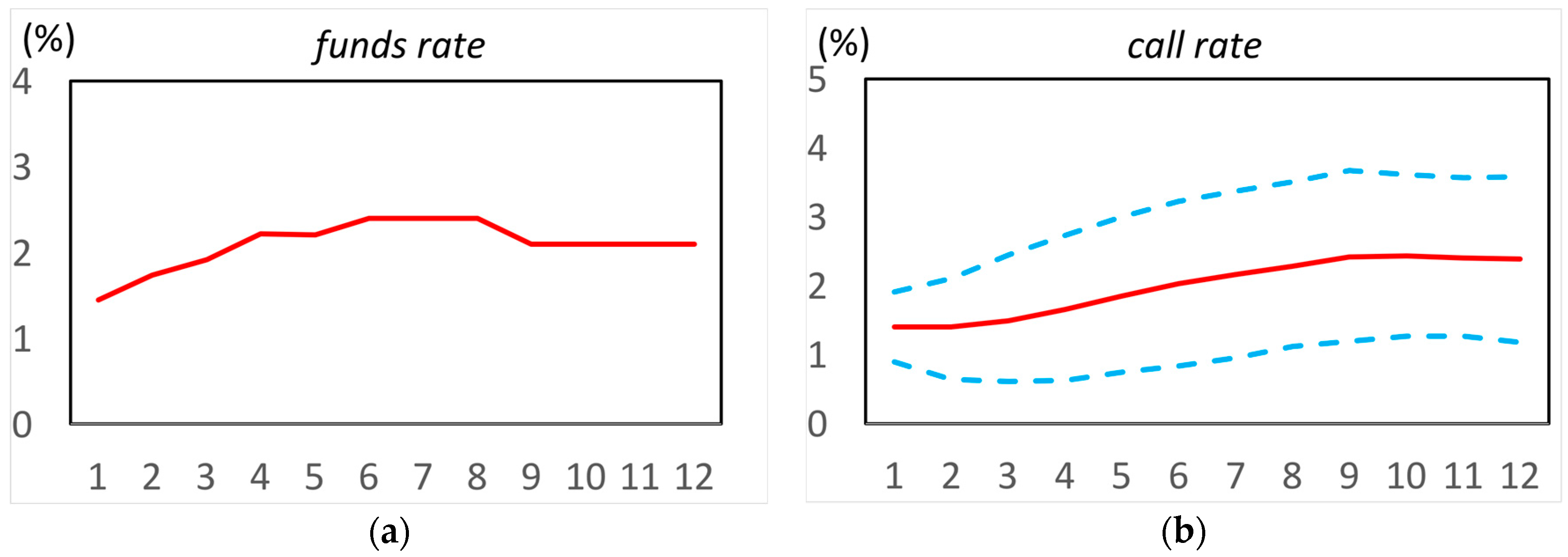

The forecasts for the domestic macro variables conditional on the three-year U.S. rate path are shown in

Figure 1. The red lines are the forecast means, and the dotted lines are the 68% boundaries of the respective forecast distributions. For the U.S. federal funds rate, only a single mean value exists, as its conditional path is exogenously imposed. Expectedly, the call rate, on which open market operations in Korea are conducted, is closely linked with the movements of the U.S. policy rate. The forecasts for the increase in the call rate following increases in the U.S. rates are as follows:

Q4 2018: 1.56 < 2.17 < 2.78

Q4 2019: 1.94 < 2.73 < 3.51

Q4 2020: 2.05 < 2.87 < 3.69

The lower values indicate the lower ends of the 68% distributions, and the upper values indicate the upper ends. The lower end of the forecasted call rate distribution would increase a little to approximately 2.05% in Q4 2020 from 1.94% in Q4 2019, given that the projection for U.S. interest rates would decrease in 2020. The upper end of the forecast distribution turns out above 3%, a scenario that seems less likely given the current sluggish economic conditions in Korea and the heightened sensitivity of economic participants who have become accustomed to a long period of low interest rates. The mean forecast is below 2% at the end of 2020, conditional upon the U.S. rate path. The approximately 1.6%p increment in domestic interest rates, from 1.25%, a historically low level, in Q1 2018 to 2.87% in Q4 2020 would amount to 77.1% of the total increment of 2.10%p in the U.S. federal funds rate, which has increased from the zero lower bound. An enhanced synchronization among international interest rates is also found in recent studies such as the works of [

18,

19].

3.2. Identifying Households with Debt Repayment Vulnerabilities

In this section, issues related to the identification of households that are vulnerable in their debt repayments are discussed, and we apply novel identification methodologies using household-level panel data. For this task, balanced household-level panel data are constructed using the Household Finance and Living Conditions Panels from 2012 to 2017. After some relevant treatment for missing subitems, the balanced panel data include annual amounts of 6151 households for the common panels and approximately 3100 households for the finance panels. The common panels originally had approximately 20,000 households annually, but have been cut by more than two-thirds because of natural attrition and missing variables in the process of balanced panel construction. In addition, the finance panels began with approximately 10,000 households, but have similarly been reduced to approximately one-third of that.

Following the work of [

20], a new debt service ratio (DSR) methodology is applied based upon gross income in place of disposable income, because disposable income has many weaknesses as an indicator including its less solid definition and numerous missing variables. There can be a sizable negative disposable income-based DSR thanks to a negative denominator, that is, a negative disposable income that can occur after subtracting social contributions, taxes, and principal plus interest repayments from gross income. Cases of negative disposable incomes can easily come to be deleted, which can consequently lead to a smaller estimate of vulnerable households than the true value. The concept of disposable income can also vary across countries. Nordic countries can, for example, have relatively smaller disposable incomes because of their large social contributions, which may, as a result, mean high DSRs in terms of disposable income that do not, however, necessarily indicate deteriorations in the debt repayment capacities of households. Therefore, here we attempt to investigate households that are vulnerable in their debt repayments using their DSRs based on gross income, as shown in Equation (2).

where D indicates total debt including financial debt and residential deposits; FA, financial assets; R, repayments for principal and interest; Y, gross income; and FI, financial income. Equation (2) implies that a household with a DSR of more than 30% could be excluded from the vulnerable households’ category if the household has sufficient financial assets to cancel out its current debt. Moreover, financial income should be deducted from the gross income because of the disposals of the financial assets. The cutoff rule of 30% is adopted following the work of [

20], which is quite reasonable in that the households having more than 30% of their gross income being used for principal or interest payments are likely to undergo decline in their debt sustainability.

Next, we can consider debt repayments through disposals of real assets as well as financial assets, as shown in Equation (3). Here, real assets excluding owners’ personal dwellings can be easily converted into liquid assets to repay debt.

where RA2 indicates real assets except the owner’s residential house and RAI is real asset income.

Finally, an indebted household can reduce its total volume of debt through the disposal even of its own dwelling, as specified in Equation (4). However, after disposals of their own dwellings, the households must pay rents throughout their lifetimes. They should only utilize their residual life estate values (f) after reserving future expected rental payments. Therefore, a certain percentage of the market value of a household’s own dwelling should be secured for its future payments of rent. We apply the reverse mortgage valuations of the Korea Housing Finance Corporation, which depend on the ages of the households’ heads such that the residual life estate value is 0.4 (or 40% of the housing price) if the age of household head is between 20 and 35 years, 0.5 if it is between 36 and 45 years, 0.6 if between 46 and 55 years, 0.7 if between 56 and 65 years, 0.8 if between 66 and 75 years, and 0.9 for a household head aged 76 years or above. As the age of the household head grows, the residual life estate value (f) increases.

where RA1 indicates the owner’s residential house, and f is the residential life estate value for debt repayments.

In addition, two indicators of the Bank of Korea—the traditionally used marginal households (Kim et al., 2014) and a newly introduced indicator of households at risk of default (BOK, 2015)—are also reviewed together. These indicators are defined in Equations (5) and (6).

where HRD is defined as (1 + (DSR − 40%)) × (1 + (liabilities/assets − 100) × 100).

The DSRs in the two indices defined in Equations (5) and (6) are based on disposable incomes including interest payments. The original definition of disposable income does not include interest payments, but a revised disposable income is needed for DSR calculation. Sometimes there can be confusion as to whether households are paying interest only or interest plus principal. This is another potential weakness of using a DSR based on disposable income.

Marginal households indicate that even households with a DSR of more than 40% are not included in the category if they have sufficient financial and real assets to settle their current debts. The concept of the HRD index is basically similar to the marginal households, but its coverage could expand as a result of the multiplication restriction between the DSR and the net asset condition instead of the additional restriction in the marginal households in Equation (5). We do not apply real asset valuations differentiated in accordance with the degrees of liquidity in our calculation of households at risk of default, owing to the absence of information on that.

The results of estimation to identify over-indebted households are displayed in

Table 2. Two more indicators,

Households under the poverty line and

Households borrowing from noninstitutional lenders, are also introduced. The former indicates households that have less than 60% of the median levels of equalized disposable incomes after their interest and principal repayments, where equalized disposable income is disposable income adjusted for the number of household members. The latter comprises households that are indebted to Daebu money lenders and credit-specialized financial companies, among others, which charge very high rates of interest in their household lending.

Table 2 indicates that the values of the three major indices—over-indebted households with A3 in Equation (4), marginal households, and households at risk of default—rose continuously from 2012 to 2017, from 1.9%p to more than 4.5%p. The strong policy encouragement of amortized mortgage lending since 2012 presumably also contributed to these trends, in part by reducing the share in total mortgage loans of those on which interest only is paid. In addition, the annual average increases in the three indicators ranged from 0.38%p to 0.92%p, very high speeds compared with those in other countries in Organization for Economic Cooperation and Development (OECD) whose household debts have been deleveraged or stagnated since the 2008 global financial crisis.

The share of total indebted households of households at risk of default in 2014 is 11.3%, slightly higher than the 10.3% value published by the Bank of Korea (2015). As discussed earlier, this difference can result from several sources—differences in treatment for missing items, whether balanced panels are used or not, and whether real asset valuation in terms of liquidity is applied or not. At any rate, the gap is relatively small, and the estimated indicators are good enough to be trusted in the identification of vulnerable households. Moreover, the corresponding value for over-indebted households with A3 is a mere 1.1% in Italy, discussed in the work of [

20], and the corresponding value for households under the poverty line in Italy is only 6.2%, indicating that the problem of households having debt repayment vulnerabilities could be more critical in Korea.