Development of an Innovative Land Valuation Model (iLVM) for Mass Appraisal Application in Sub-Urban Areas Using AHP: An Integration of Theoretical and Practical Approaches

Abstract

1. Introduction

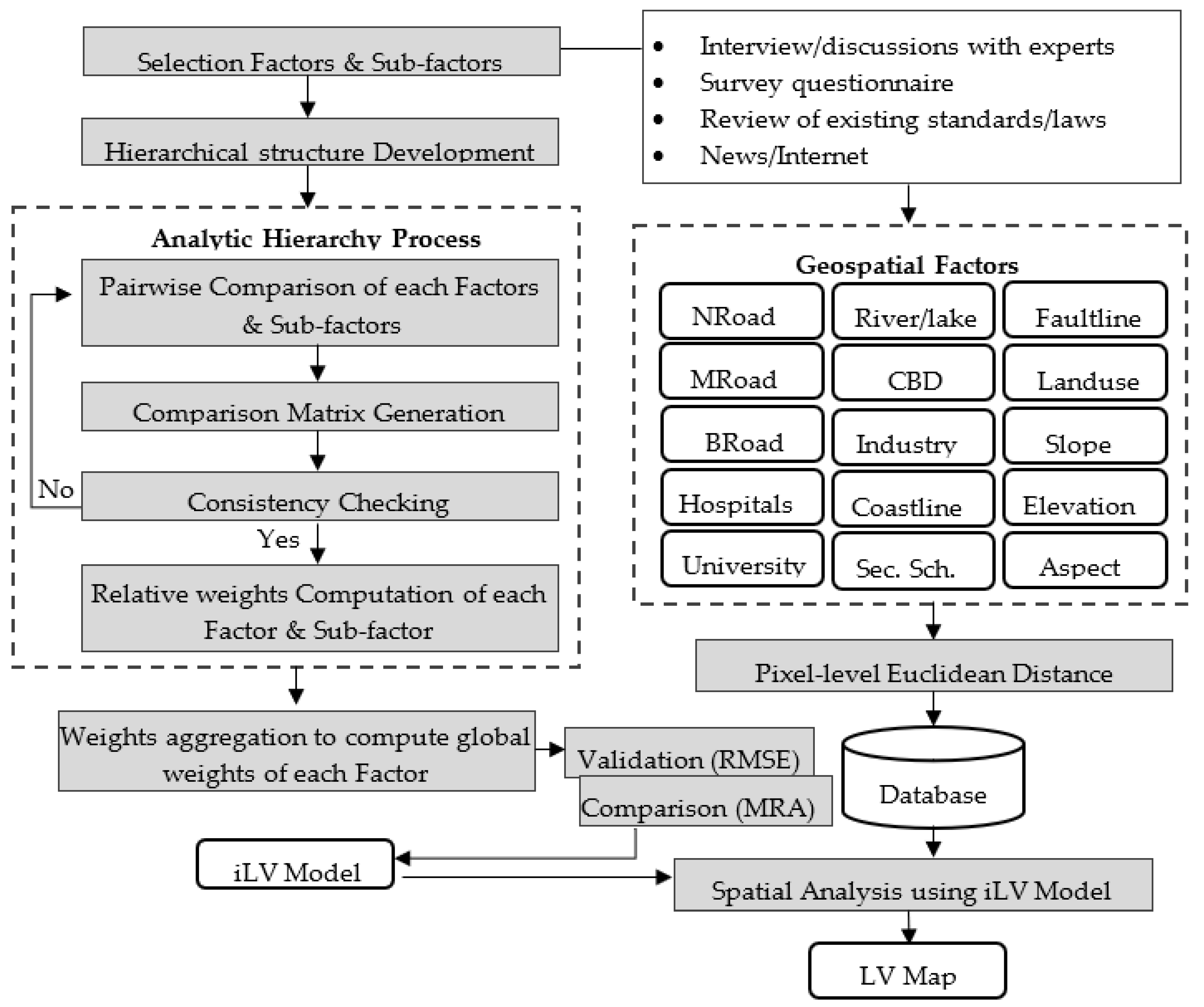

2. Methodology

2.1. Analytic Hierarchy Process

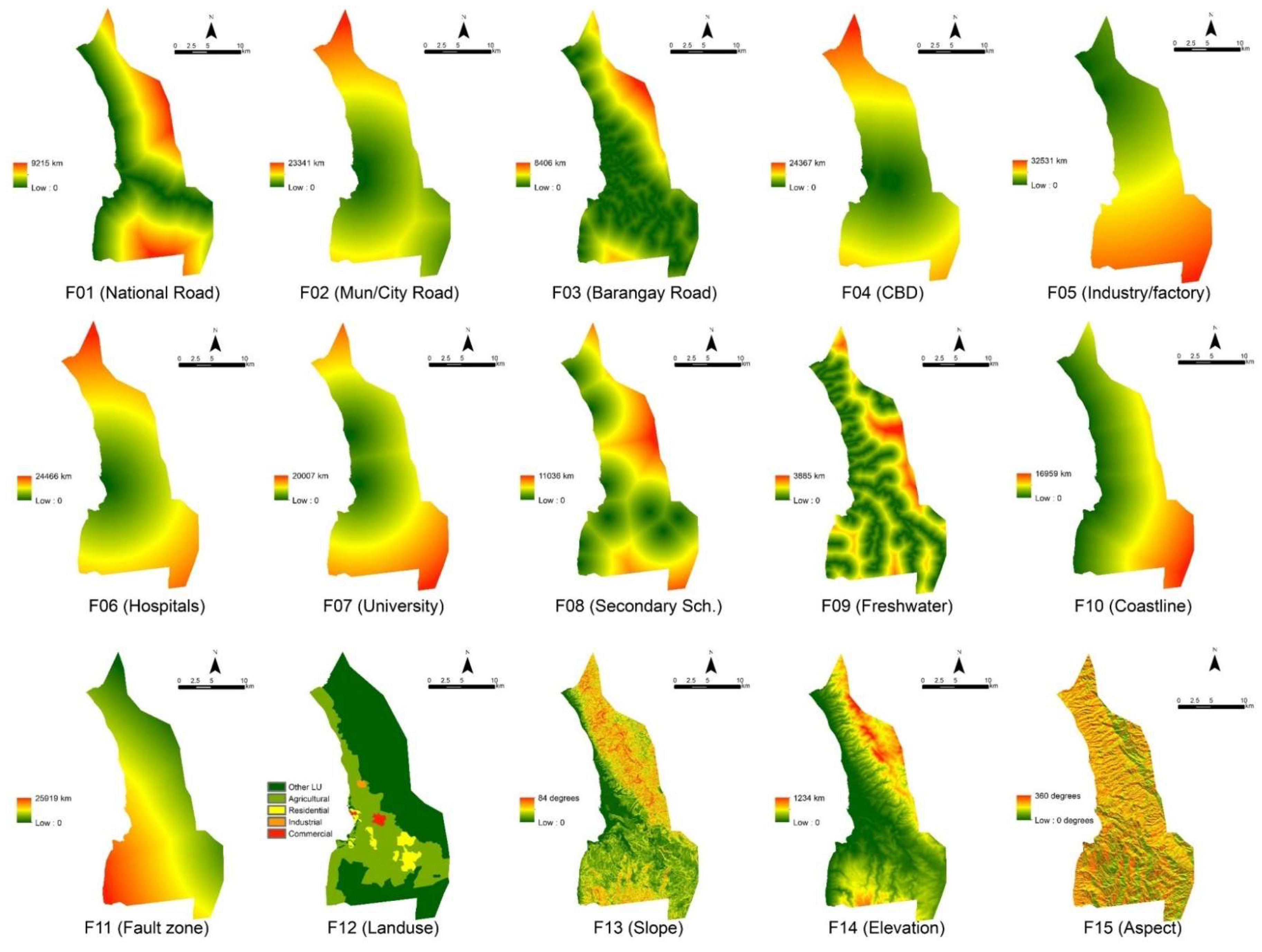

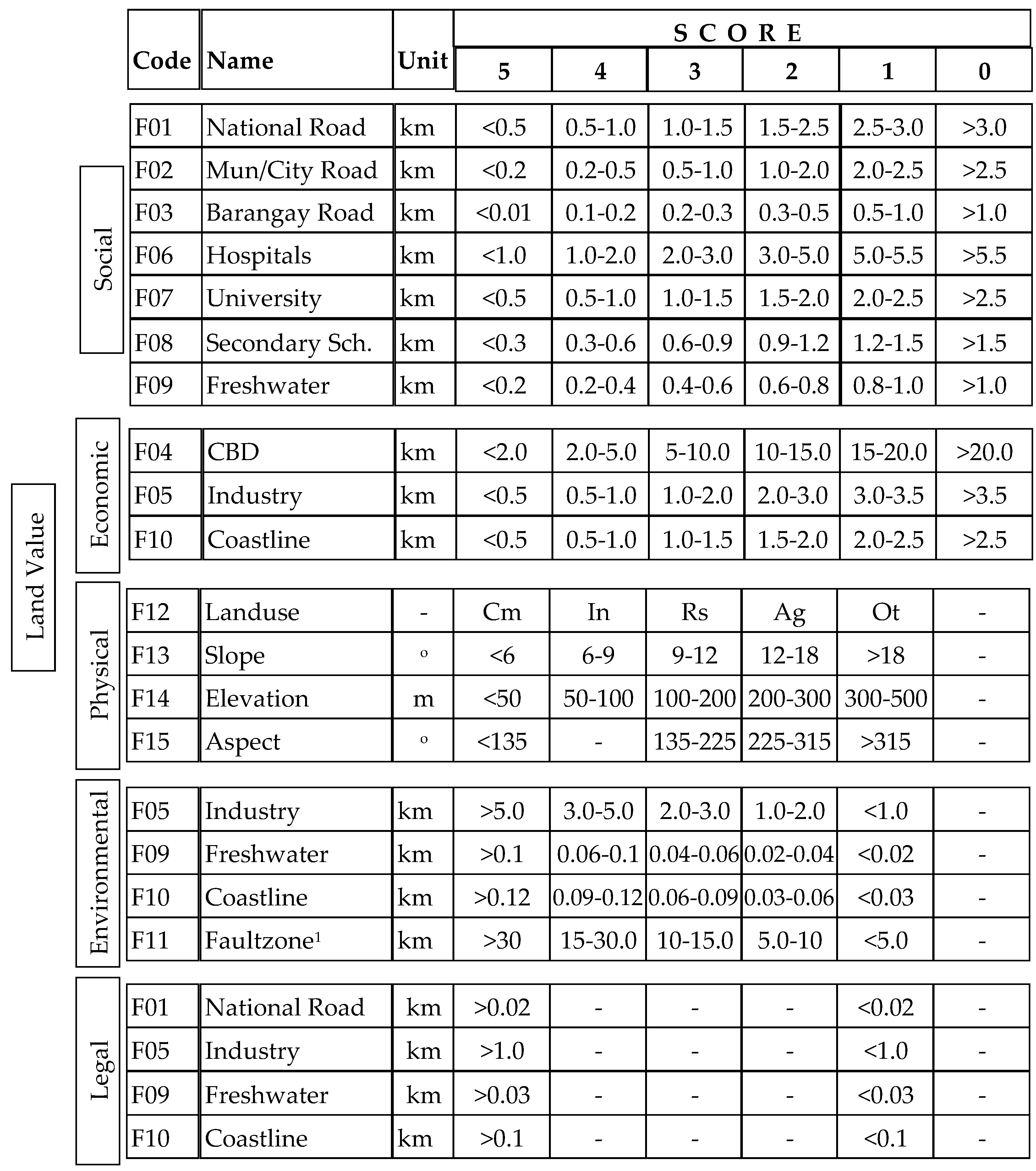

2.2. Geospatial Land Valuation Factors for iLVM Development

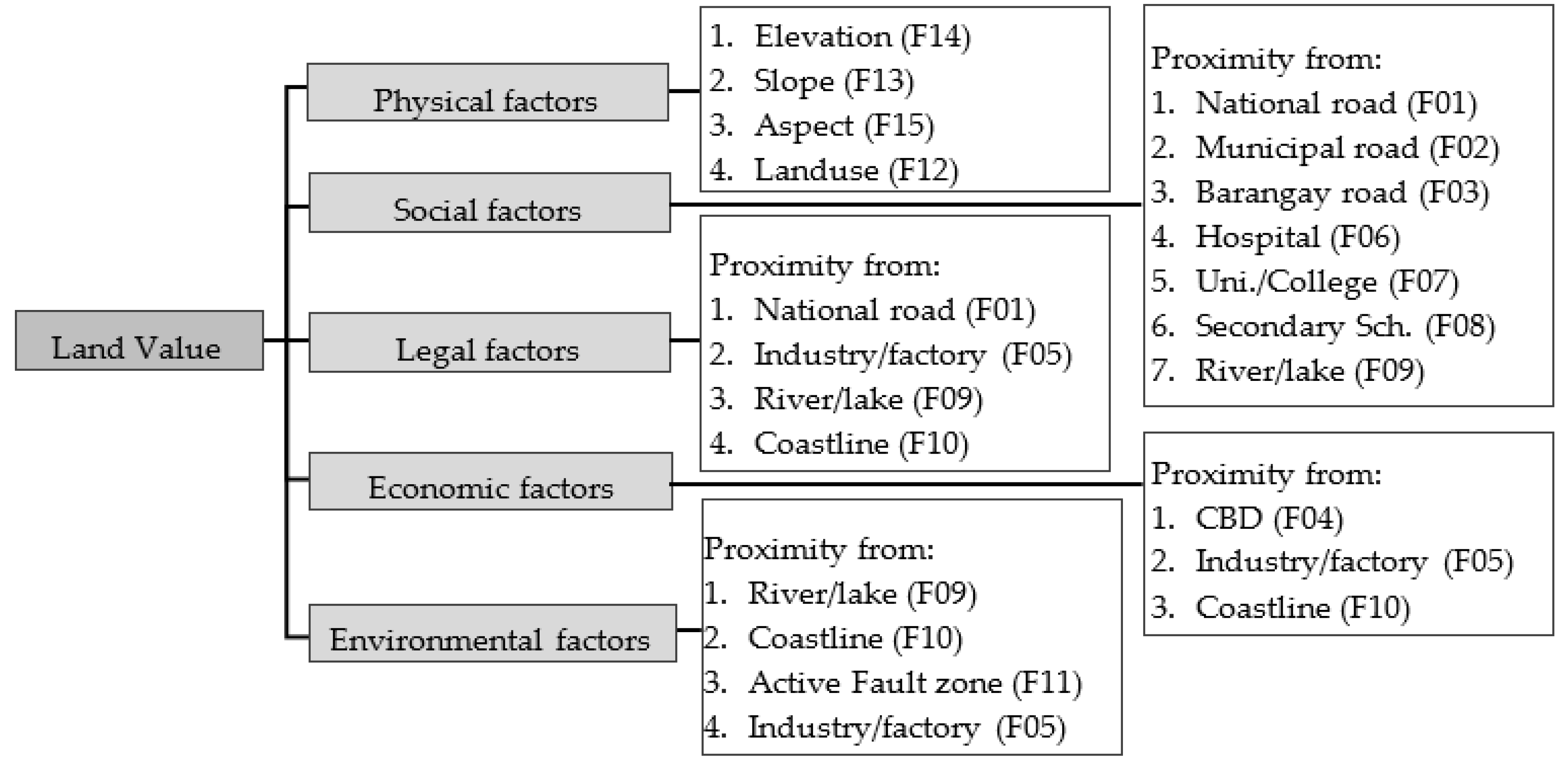

2.3. Hierarchical Modelling

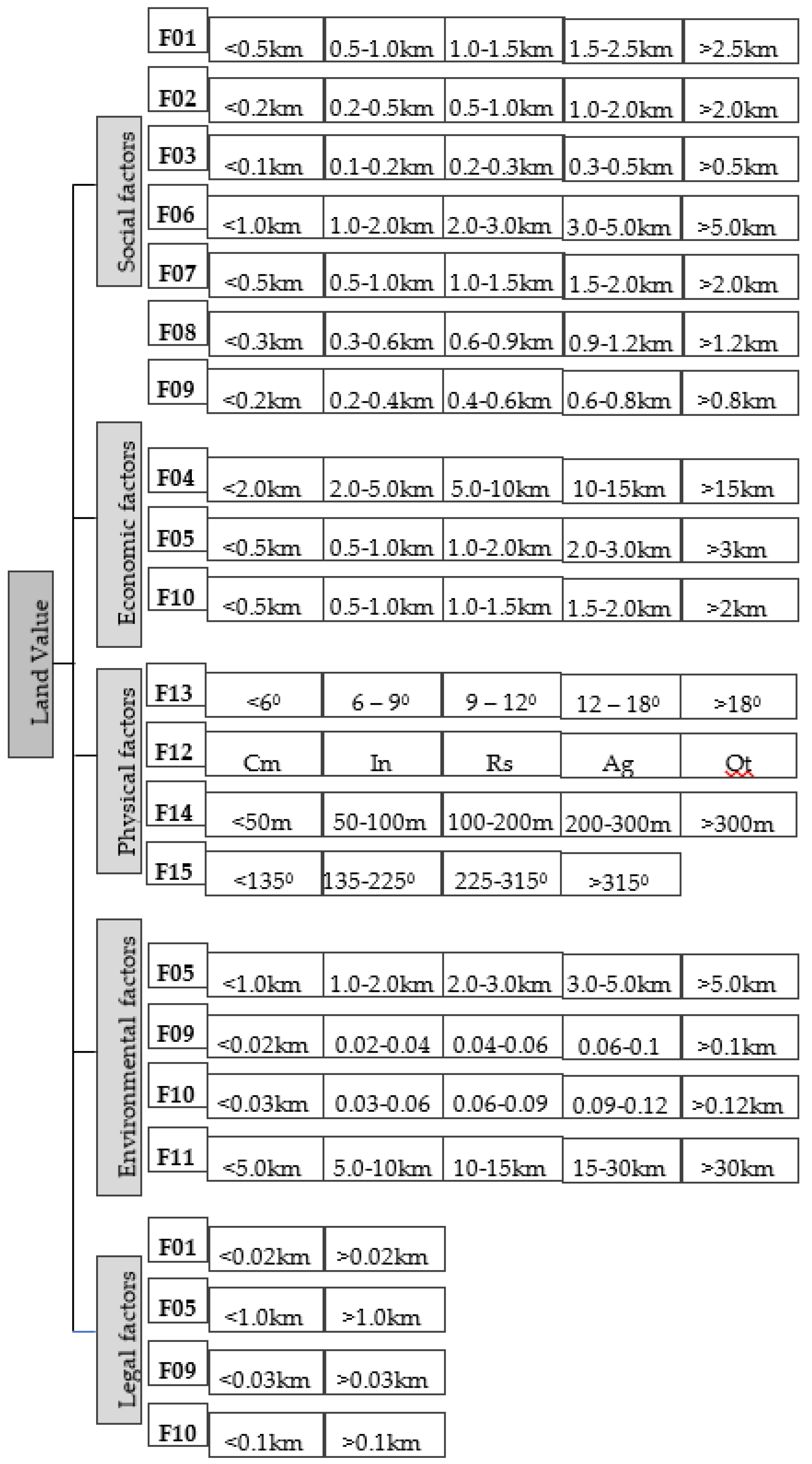

2.4. Scoring of Sub-Factors

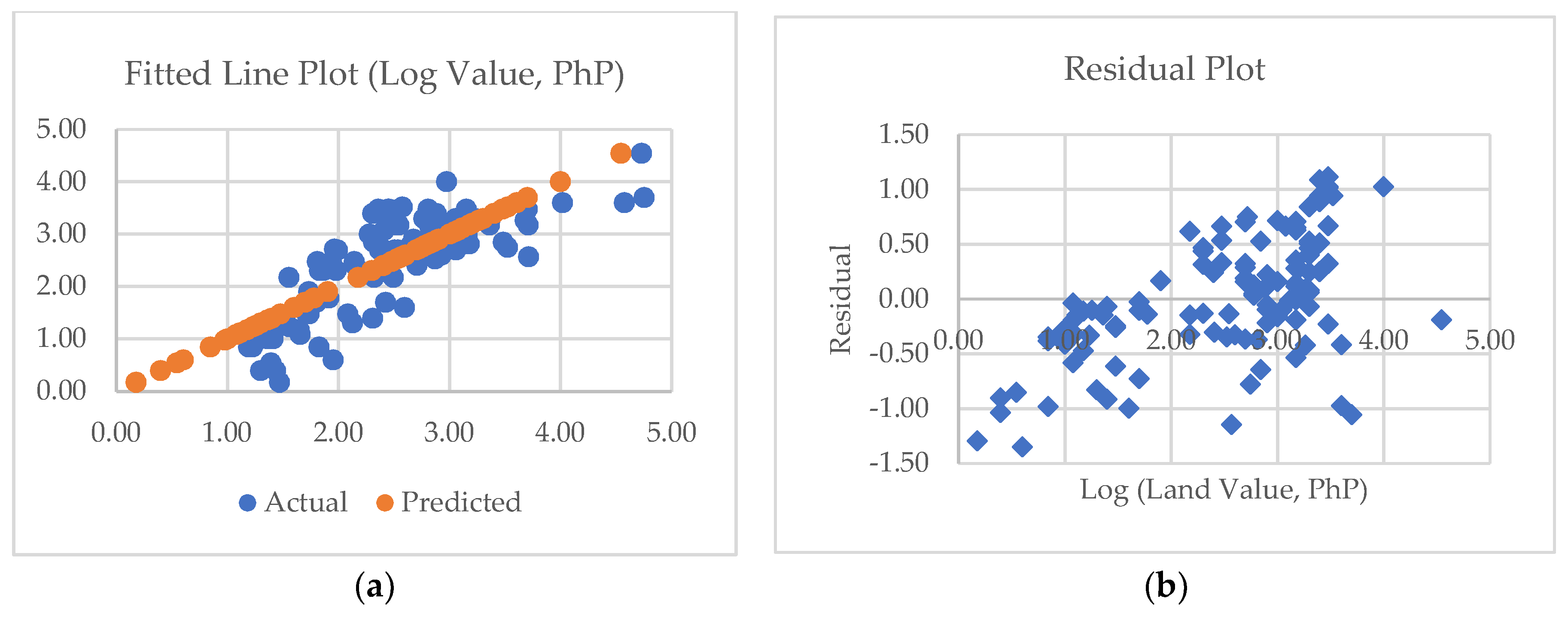

2.5. Evaluation of Judgement Consistency and Validation of iLVM Performance

3. Data and Case Study

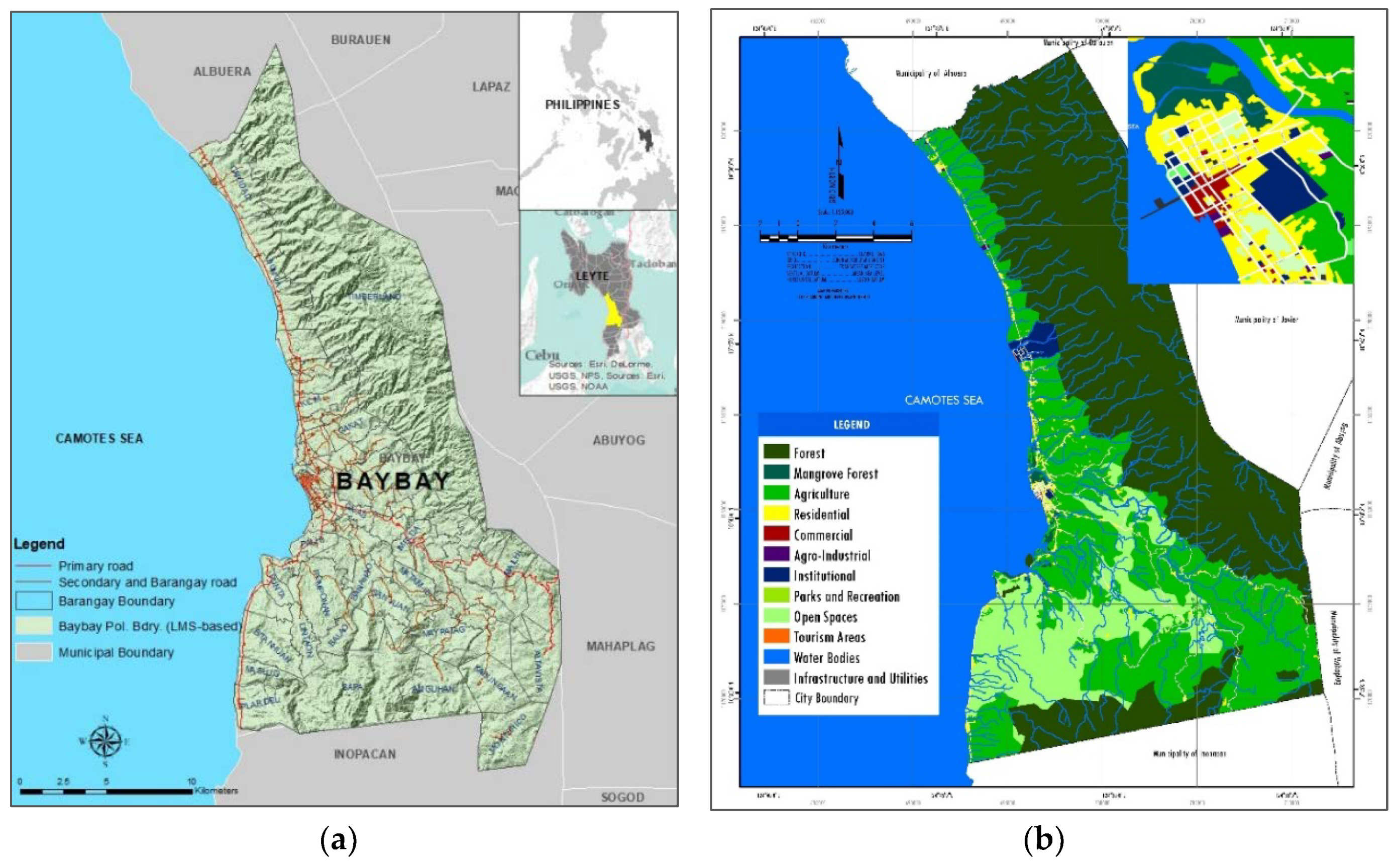

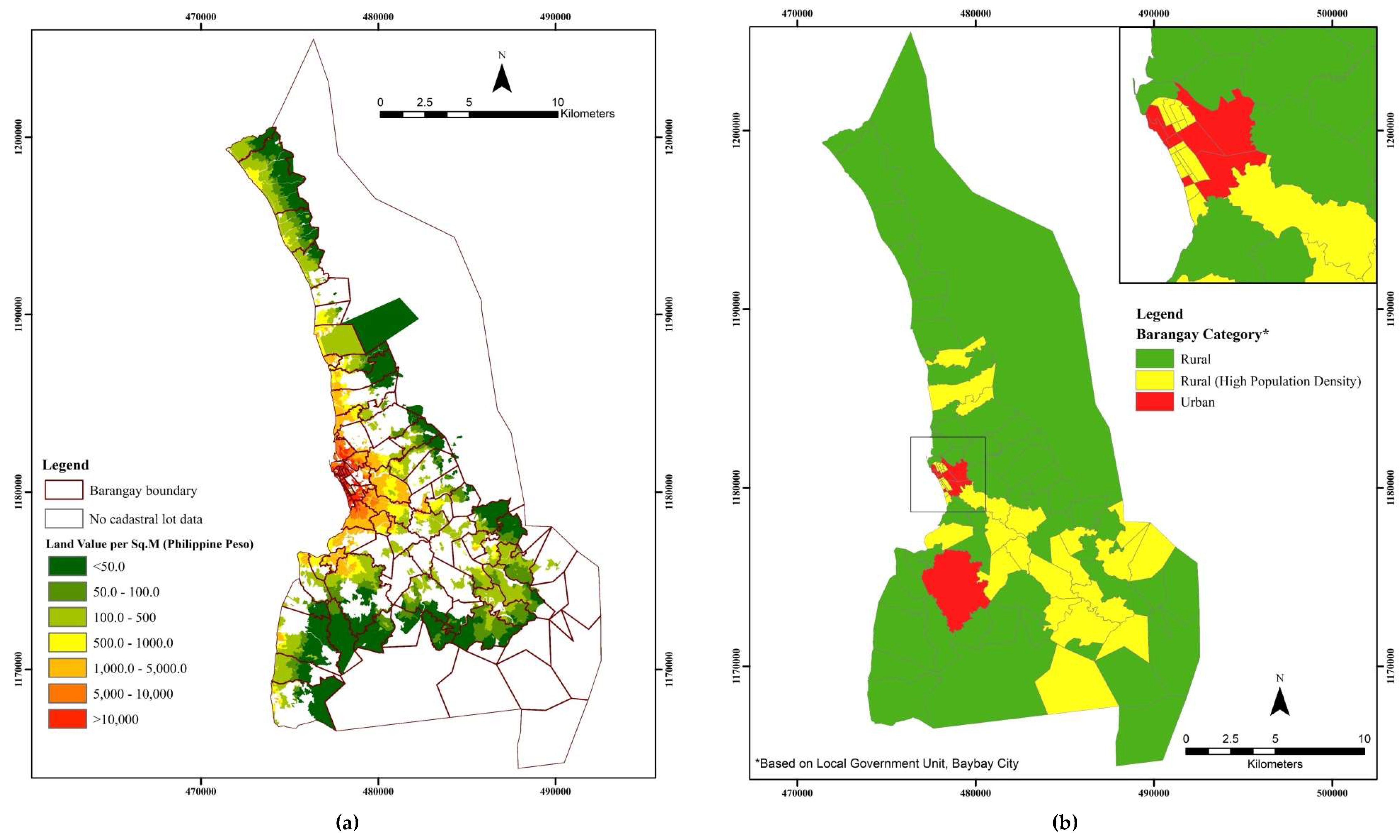

3.1. Study Area: Baybay City, Philippines

3.2. Data and Preprocessing

4. Results

4.1. Weights of Main Factors and Sub-factors

4.2. The Developed iLVM and Its Perfomance

4.3. LV Map of Baybay City, Leyte

5. Discussions

6. Summary and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- ELD Initiative. The Value of Land: Prosperous Lands and Positive Rewards through Sustainable Land Management. 2015. Available online: www.eld-initiative.org (accessed on 4 March 2018).

- Demetriou, D. The assessment of land valuation in land consolidation schemes: The need for a new land valuation framework. Land Use Policy 2016, 54, 487–498. [Google Scholar] [CrossRef]

- Omari, M.A. The Role of Reliable Land Valuation Systems in Land Management and Land Administration Systems efficiency. In FIG Working Week 14–19 June 2008: Integreting Generations; FIG (International Federation of Surveyors): Stockholm, Sweden, 2008. [Google Scholar]

- Tsoodle, L.J.; Featherstone, A.M.; Golden, B.B. Combining Hedonic and Negative Exponential Techniques to Estimate the Market Value of Land. Agric. Financ. Rev. 2007, 67, 225–239. [Google Scholar] [CrossRef]

- Dale, P.; McLaughlin, J. Land Administration; Oxford University Press, Inc.: New York, NY, USA, 2003. [Google Scholar]

- Lavee, D.; Baniad, G. Assessing the value of non-marketable land: The case of Israel. Land Use Policy 2013, 34, 276–281. [Google Scholar] [CrossRef]

- Sesli, F.A. Creating real estate maps by using GIS: A case study of Atakum-Samsun/Turkey. Acta Montan. Slovaca 2015, 20, 260–270. [Google Scholar]

- Bogataj, M.; Suban, D.T.; Drobne, S. Regression-fuzzy approach to land valuation. Cent. Eur. J. Oper. Res. 2011, 19, 253–265. [Google Scholar] [CrossRef]

- Herrerias, J.M.; Herrerias, R. Valuation method for land pricing based on two cumulative distribution functions. Span. J. Agric. Res. 2010, 8, 538–546. [Google Scholar] [CrossRef]

- Schulz, R.; Wersing, M.; Werwatz, A. Automated valuation modelling: A specification exercise. J. Prop. Res. 2014, 31, 131–153. [Google Scholar] [CrossRef]

- Yalpir, S. Enhancement of parcel valuation with adaptive artificial neural network modeling. J. Artif. Intell. Rev. 2016, 1–13. [Google Scholar] [CrossRef]

- Naudé, S.D.; Kleynhans, T.E.; van Niekerk, A.; Ellis, F.; Lambrechts, J.J.N. Application of spatial resource data to assist in farmland valuation. Land Use Policy 2012, 29, 614–628. [Google Scholar] [CrossRef]

- Garcia, C.; Garcia, J.; Lopez, M.M.; Salmeron, R. A generalized method for valuing agricultural farms under uncertainty. Land Use Policy 2017, 65, 121–127. [Google Scholar] [CrossRef]

- Cotteleer, G.; Stobbe, T.; van Kooten, C.G. A Spatial Bayesian Hedonic Pricing Model of Farmland Values. J. Agric. Econ. 2008, 1–8. [Google Scholar] [CrossRef]

- Manganelli, B.; Pontrandolfi, P.; Azzato, A.; Murgante, B. Using geographically weighted regression for housing market segmentation. Int. J. Bus. Intell. Data Min. 2014, 9, 161–177. [Google Scholar] [CrossRef]

- Hu, S.; Yang, S.; Li, W.; Zhang, C.; Xu, F. Spatially non-stationary relationships between urban residential land price and impact factors in Wuhan city, China. J. Appl. Geogr. 2016, 68, 48–56. [Google Scholar] [CrossRef]

- Ahn, J.J.; Byun, H.W.; Oh, K.J.; Kim, T.Y. Using ridge regression with genetic algorithm to enhance real estate appraisal forecasting. Expert Syst. Appl. 2012, 39, 8369–8379. [Google Scholar] [CrossRef]

- Kuburić, M.; Tomić, H.; Ivić, S.M. Use of Multicriteria Valuation of Spatial Units in a System of Mass Real Estate Valuation. Kartogr. Geoinf. 2012, 11, 58–74. [Google Scholar]

- Antipov, E.A.; Pokryshevskaya, E.B. Mass appraisal of residential apartments: An application of Random forest for valuation and a CART-based approach for model diagnostics. Expert Syst. Appl. 2012, 39, 1772–1778. [Google Scholar] [CrossRef]

- Aragonés-Beltrán, P.; Aznar, J.; Ferrís-Oñate, J.; García-Melón, M. Valuation of urban industrial land: An analytic network process approach. Eur. J. Oper. Res. 2008, 185, 322–339. [Google Scholar] [CrossRef]

- Aydinoglu, A.C.; Bovkir, R. An approach for calculating land valuation by using INSPIRE data models. Int. Arch. Photogramm. Remote Sens. Spat. Inf. Sci. 2017, 42, 19–21. [Google Scholar] [CrossRef]

- O’geen, A.T.; Southard, S.B.; Southard, R.J. Revised Storie Index for Use with Digital Soils Information. Agric. Nat. Resour. Publ. 2008. [Google Scholar] [CrossRef]

- Verheye, W.H. Use of land evaluation techniques to assess the market value of agricultural land. Agropedology 2000, 10, 88–100. [Google Scholar]

- Hu, S.; Cheng, Q.; Wang, L.; Xu, D. Modeling land price distribution using multifractal IDW interpolation and fractal filtering method. J. Landsc. Urban Plan. 2013, 110, 25–35. [Google Scholar] [CrossRef]

- Jahanshiri, E.; Buyong, T.; Shariff, A.R.M. A review of property mass valuation models. Pertanika J. Sci. Technol. 2011, 19, 23–30. [Google Scholar]

- Vaidya, O.S.; Kumar, S. Analytic hierarchy process: An overview of applications. Eur. J. Oper. Res. 2006, 169, 1–29. [Google Scholar] [CrossRef]

- Philippine Statistics Authority. Road Classification. 2017. Available online: https://psa.gov.ph/content/road-classification (accessed on 2 February 2019).

- Zyoud, S.; Fuchs-Hanusch, D. A bibliometric-based survey on AHP and TOPSIS techniques. Expert Syst. Appl. 2017, 78, 158–181. [Google Scholar] [CrossRef]

- Kocharyan, G.G.; Kishkina, S.B.; Ostapchuk, A.A. Seismogenic width of a fault zone. Dokl. Earth Sci. 2011, 437, 412–415. [Google Scholar] [CrossRef]

- Ilumin, R.C.; Oreta, A.W.C. A Post-Disaster Functional Asset Value Index for School Buildings. Procedia Eng. 2018, 212, 230–237. [Google Scholar] [CrossRef]

- Baybay City Local Goverment Unit. Comprehensive Landuse Plan 2009—2020 of Baybay City, Philippines; Baybay City Local Government: Leyte, Philippines, 2010.

- Bureau of Local Government Finance—Department of Finance Philippines. LGU Taxation and Revenue Practices; Bureau of Local Government Finance: Manila, Philippines, 2015.

- Ma, S.; Swinton, S.M. Valuation of ecosystem services from rural landscapes using agricultural land prices. Ecol. Econ. 2011, 70, 1649–1659. [Google Scholar] [CrossRef]

- Bunyan Unel, F.; Yalpir, S. Valuations of Building Plots Using the Ahp Method. Int. J. Strateg. Prop. Manag. 2019, 23, 197–212. [Google Scholar] [CrossRef]

- Nilsson, P.; Johansson, S. Location determinants of agricultural land prices. Rev. Reg. Res. 2013, 33, 1–21. [Google Scholar] [CrossRef][Green Version]

- Galeon, F.; Albano, M. The Effect of Proximity to Fault Line as a Land Value Determinant in Metro. In FIG Working Week 2016: Recovery from Disaster; FIG (International Federation of Surveyors): Christchurch, New Zealand, 2016. [Google Scholar]

- Wyatt, P.J.; Wyatt, P.J. The development of a GIS-based property information system for real estate valuation. Int. J. Geogr. Inf. Sci. 1997, 11, 435–450. [Google Scholar] [CrossRef]

- Malaitham, S.; Fukuda, A.; Vichiensan, V.; Wasuntarasook, V. Hedonic pricing model of assessed and market land values: A case study in Bangkok metropolitan area, Thailand. Case Stud. Transp. Policy 2018. [Google Scholar] [CrossRef]

- Kilpatrick, J. Expert systems and mass appraisal. J. Prop. Invest. Financ. 2011, 29, 529–550. [Google Scholar] [CrossRef]

| Data Description | Sources | Format |

|---|---|---|

| 1. Landuse based on the LU Plan | Local Government Unit, Baybay City | Map |

| 2. IfSAR DEM 1 | Dept. of Science and Technology, Philippines | Raster |

| 3. Hospital location | Dept. of Health, Philippines (www.doh.gov.ph) Google maps | Shp 2 |

| 4. Road network | Dept. of Public Works and Highways, Philippines Local Government Unit, Baybay City; Local Government Unit, Baybay City; Open Street Map; Google Satellite Image | Shp 2 |

| 5. Schools | Commission on Higher Education, Philippines (www.ched.gov.ph); www.gov.ph; Google maps | List/Shp |

| 6. Freshwater | PhilGIS (www.philgis.org) | Shp 2 |

| 7. Center Business Center | Local Government Unit, Baybay City | Map |

| 8. Industries | Local Government Unit, Baybay City; | Map |

| Open Street Map, Google Satellite Image | Shp 2 | |

| 9. Landsat OLI8, P113/R52-53 | https://earthexplorer.usgs.gov/ (for coastline) | Raster |

| 10. Active Fault Line | PHIVOLCS http://faultfinder.phivolcs.dost.gov.ph/ | Shp 2 |

| 11. Sales data (2013–2015) | Local Government Unit, Baybay City | List |

| 12. Cadastral Lot | DENR-Land Management Bureau, Philippines | CAD |

| Physical | Social | Economic | Environment | Legal | Weights | |

|---|---|---|---|---|---|---|

| Physical | 1 | 1/3 | 1/2 | 2 | 4 | 0.184 |

| Social | 3 | 1 | 3 | 3 | 5 | 0.432 |

| Economic | 2 | 1/3 | 1 | 2 | 2 | 0.201 |

| Environment | 1/2 | 1/3 | 1/2 | 1 | 1 | 0.101 |

| Legal | 1/4 | 1/5 | 1/2 | 1 | 1 | 0.082 |

| CR = 0.06 | ||||||

| a. Physical factors | b. Legal factors | ||||||||||||||||||||||

| F13 | F14 | F15 | F12 | Weights | F01 | F05 | F09 | F10 | Weights | ||||||||||||||

| F13 | 1 | 2 | 3 | 1/3 | 0.237 | F01 | 1 | 1 | 3 | 1/2 | 0.265 | ||||||||||||

| F14 | 1/2 | 1 | 2 | 1/3 | 0.151 | F05 | 1 | 1 | 2 | 1 | 0.275 | ||||||||||||

| F15 | 1/3 | 1/2 | 1 | 1/6 | 0.080 | F09 | 1/3 | 1/2 | 1 | 1/2 | 0.128 | ||||||||||||

| F12 | 3 | 3 | 6 | 1 | 0.532 | F10 | 2 | 1 | 2 | 1 | 0.332 | ||||||||||||

| CR = 0.02 | CR = 0.05 | ||||||||||||||||||||||

| c. Social factors | |||||||||||||||||||||||

| F01 | F02 | F03 | F06 | F07 | F08 | F09 | Weights | ||||||||||||||||

| F01 | 1 | 2 | 3 | 1 | 2 | 1 | 5 | 0.223 | |||||||||||||||

| F02 | 1/2 | 1 | 1 | 1/2 | 1/3 | 1 | 4 | 0.113 | |||||||||||||||

| F03 | 1/3 | 1 | 1 | 1 | 2 | 1 | 4 | 0.145 | |||||||||||||||

| F06 | 1 | 2 | 1 | 1 | 3 | 2 | 5 | 0.220 | |||||||||||||||

| F07 | 1/2 | 3 | 1/2 | 1/3 | 1 | 1/2 | 3 | 0.119 | |||||||||||||||

| F08 | 1 | 1 | 1 | 1/2 | 2 | 1 | 2 | 0.139 | |||||||||||||||

| F09 | 1/5 | 1/4 | 1/4 | 1/5 | 1/3 | 1/2 | 1 | 0.041 | |||||||||||||||

| CR = 0.07 | |||||||||||||||||||||||

| d. Economic factors | e. Environmental factors | ||||||||||||||||||||||

| F04 | F05 | F10 | Weights | F05 | F09 | F11 | F10 | Weights | |||||||||||||||

| F04 | 1 | 3 | 2 | 0.539 | F05 | 1 | 1 | 1/2 | 1 | 0.204 | |||||||||||||

| F05 | 1/3 | 1 | 1/2 | 0.164 | F09 | 1 | 1 | 1/2 | 1 | 0.204 | |||||||||||||

| F10 | 1/2 | 2 | 1 | 0.297 | F11 | 2 | 2 | 1 | 1 | 0.346 | |||||||||||||

| CR = 0.01 | F10 | 1 | 1 | 1 | 1 | 0.246 | |||||||||||||||||

| CR = 0.02 | |||||||||||||||||||||||

| Model | RMSE | Significant factors |

|---|---|---|

| iLVM | 0.526 | All considered |

| MRA | 1.953 | F11, F13, F14, F12 1 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bencure, J.C.; Tripathi, N.K.; Miyazaki, H.; Ninsawat, S.; Kim, S.M. Development of an Innovative Land Valuation Model (iLVM) for Mass Appraisal Application in Sub-Urban Areas Using AHP: An Integration of Theoretical and Practical Approaches. Sustainability 2019, 11, 3731. https://doi.org/10.3390/su11133731

Bencure JC, Tripathi NK, Miyazaki H, Ninsawat S, Kim SM. Development of an Innovative Land Valuation Model (iLVM) for Mass Appraisal Application in Sub-Urban Areas Using AHP: An Integration of Theoretical and Practical Approaches. Sustainability. 2019; 11(13):3731. https://doi.org/10.3390/su11133731

Chicago/Turabian StyleBencure, Jannet C., Nitin K. Tripathi, Hiroyuki Miyazaki, Sarawut Ninsawat, and Sohee Minsun Kim. 2019. "Development of an Innovative Land Valuation Model (iLVM) for Mass Appraisal Application in Sub-Urban Areas Using AHP: An Integration of Theoretical and Practical Approaches" Sustainability 11, no. 13: 3731. https://doi.org/10.3390/su11133731

APA StyleBencure, J. C., Tripathi, N. K., Miyazaki, H., Ninsawat, S., & Kim, S. M. (2019). Development of an Innovative Land Valuation Model (iLVM) for Mass Appraisal Application in Sub-Urban Areas Using AHP: An Integration of Theoretical and Practical Approaches. Sustainability, 11(13), 3731. https://doi.org/10.3390/su11133731