Abstract

While it is well-known knowledge management is crucial for an organization’s competitive advantage, relatively little research has explored the process whereby knowledge management affects firm performance in a collectivistic culture such as China. This study is to explore the mechanism through which knowledge management helps improve firm performance and then to examine the mediating role of decision quality in the Chinese context. Using a self-administered questionnaire to collect data from Chinese entrepreneurs and with structural equation modeling, this study shows that knowledge accumulation, internal sharing, and external knowledge sharing all have a positive impact on firm performance, and decision quality partially mediates the impact of knowledge management on firm performance. This study adds value to the knowledge management literature by introducing decision quality as a mediating variable to examine the impact of knowledge sharing on firm performance in China. The findings of this study can help enrich the literature on knowledge management and firm performance and highlight the important impact of decision quality on knowledge management and firm performance. Management practitioners can also benefit from the findings.

1. Introduction

With the fast development of the knowledge economy in the globalized world market, organizations are facing an increasingly complex business environment, and management practitioners have considered knowledge management as one of the most important factors for organizational success [1,2,3]. The ability to generate, transfer, and further share knowledge within an organization can greatly affect the organization’s long-term growth and strategic resource allocation [4]. It has been shown that organizational performance is directly associated with the knowledge possessed and created by organization members [4,5]. It is thus very important that entrepreneurs should accumulate sufficient relevant knowledge and then apply the knowledge to make appropriate decisions in order to cope with the ever-changing environment and achieve business success [6]. The current business environment is more dynamic and complex than it was in the past decade, and a firm’s strategic decision-making process has to take into consideration the uncertain, vague, and sometimes conflicting requirements from the market, a new challenge for all entrepreneurs [4,6,7]. Management practitioners have been searching for better approaches to improve firm performance [8,9], and many have considered knowledge as a valuable organizational resource to deal with these new challenges [10,11]. It is imperative that entrepreneurs gain a better understanding of knowledge and knowledge management as well as its complex mechanisms through which knowledge management helps improve firm performance.

Recent empirical studies have suggested that knowledge management is an important antecedent of firm performance and there exists a positive relationship between knowledge management and firm performance [4,6,12,13,14]. However, although an impressive array of research has showed that knowledge management is positively related to firm performance [2,15], relatively few have explored the impact of decision-making as an important variable on how knowledge management affects firm performance in a collectivistic context [4,6]. This study is to explore the process of knowledge management by integrating knowledge management, decision quality, and firm performance into an integrated framework. It is expected that effective knowledge management in organizations can improve entrepreneurs’ decision-making by helping gather and sort relevant information, providing superior knowledge-based decision-making support, and choosing the best alternative for an organization’s strategic direction, which then leads to the improvement of firm performance [16]. This study intends to examine the impact of knowledge accumulation, internal knowledge sharing, and external knowledge sharing as three key components of knowledge management on decision quality, and then on firm performance. The findings will not only help enrich the literature on knowledge management and strategy decision-making, but also provide valuable insights for entrepreneurs to enhance their decision-making quality through organizational learning and knowledge management in order to improve firm performance.

In addition, the increasingly globalized world economy has made it important to explore knowledge management and its impact on firm performance in a variety of cultural contexts [4,6,12,17]. However, there is a paucity in current literature of the impact of knowledge management practice in the international contexts [4,17] and it is less clear how people share their knowledge to improve decision-making in different cultural contexts [4,17]. This study will explore the relationship between knowledge management and decision-making in an international context, China, one of the most important emerging markets [4]. Within a collectivistic culture like China, group interests and collective good are more important than individual interests [18], quite different from individual-centered Western countries where personal interests are often more important. As a result, it is reasonable to expect that people in the collectivistic cultures are more willing to share their knowledge in order to increase firm performance [4]. At the same time, the collectivistic cultures also pose a challenge to the universality of knowledge sharing theories wherein many cultural barriers might exist which hinder effective knowledge management. This study will be able to help bridge the research gap by exploring the impact of knowledge management on firm performance, and then exploring the mediation effect of decision quality in China. The findings will help enrich our understanding of knowledge management in different international contexts and offer insightful suggestions to knowledge management practitioners and international entrepreneurs.

2. Conceptual Framework and Hypotheses

The new era of knowledge economy presents great challenges to entrepreneurs as decision makers, and knowledge has become an important resource to create and maintain competitive advantages [4,6,19]. Organizations must create a balanced intellectual capital portfolio and manage it efficiently in order to maintain their competitive edge [13,20]. Knowledge management can help entrepreneurs resolve problems and optimize the decision-making process [21]. Decision-making is an organization’s response to problems based on information and knowledge processing. It is also the process of applying shared knowledge to solve a problem as part of the dynamic process of knowledge creation [17,19]. To achieve better firm performance, entrepreneurs need to employ knowledge management to improve their decision-making quality [20,21]. Knowledge management is also dynamic and multidimensional, covering most aspects of firms’ knowledge activities, including knowledge creation, knowledge accumulation, and knowledge sharing [19]. It is expected that the emphasis on knowledge creation, accumulation, and sharing and their impact on decision quality and firm performance will continue to be the focus of future research on knowledge management and firm performance, even in the international context [4,22,23].

2.1. Knowledge Management and Firm Performance

Firm performance depends on a firm’s capabilities to process, implement, and innovate knowledge [1], and the relationship between knowledge management and firm performance is proved to be significant [24]. Research on knowledge management and firm performance in China focuses on searching for cultural barriers to knowledge sharing and further on how to remove cultural barriers within the organization to facilitate knowledge management activities [4], and only a few have examined the impact of knowledge management on firm performance. It is expected that excellent knowledge management capabilities enable a firm to stimulate knowledge creation, sharing, and application in order to achieve the continuity of organization life through organizational learning [25]. Knowledge sharing behaviors are promoted by organizational learning orientation, which will help the firm achieve sustainable development by improving knowledge management ability, allocating resources more efficiently, and meeting customer needs more rapidly [26]. At the same time, a firm’s strategic orientation, which is often the result of long-term decision-making processes, is another indispensable element to achieve successful implementation of knowledge management [23,27,28,29]. A firm’s strategic orientation affects knowledge management by forming knowledge hypotheses, regulating the relationship between personal knowledge and organization knowledge, building social interactions, and creating and applying new knowledge [30]. Firms with strong knowledge management capabilities often become more innovative and perform better [31,32], for which decision-making is the application of knowledge to determine the firm’s strategic direction. Often, entrepreneurs develop high-quality decisions to solve problems through collective knowledge management activities, a common phenomenon in collectivistic cultures like China [17]. High-quality decisions can bring better firm performance.

Knowledge management can also maintain and speed up firm growth through absorption, transformation, and application of knowledge in an organization [5]. Entrepreneurs can deliver knowledge to organization members at the right time, and organization members can achieve the best learning results only when they receive knowledge that is related to the knowledge they possess. This way, organization members can create and apply knowledge to enhance firm performance. To a certain extent, knowledge management itself is a firm’s strategic decision. In an uncertain environment, diversified knowledge backgrounds provide a favorable foundation for employees’ learning and opportunity perceiving, and knowledge management is one important approach to developing knowledge diversity in order to facilitate knowledge communication. At the same time, effective knowledge communication within the organization can promote the socialization of knowledge and further promote individual efficiency and team efficiency, which can enhance firm performance [33].

Knowledge management includes different processes: Knowledge creation, storage or indexing, transfer, and application [5,19]. It can be further divided into generating internal knowledge, obtaining external knowledge, storing knowledge in various formats, and updating and sharing internal and external knowledge [34]. In this study, the creation of internal knowledge, the acquisition of external knowledge, and the storage of knowledge are important components of knowledge management, and consequently knowledge management is divided into three key dimensions in this study: Knowledge accumulation, internal knowledge sharing, and external knowledge sharing.

As a key to organizational resources, knowledge is embedded in various firm practices and other organizational resources. A firm’s competitive advantage has to be developed through internal knowledge accumulation [35]. Knowledge accumulation derives from organization members who preserve and inherit knowledge and experiences related to a particular production, organization, and management practice. Knowledge accumulation can promote innovation activities and develop new products. When the organization has sufficient knowledge accumulation, it stimulates knowledge commercialization [36]. In other words, knowledge accumulation can serve as a foundation for knowledge utilization and help entrepreneurs identify and take advantage of potential opportunities to develop new products to satisfy market demands. Knowledge accumulation can also make subsequent knowledge accumulation more effective and thus becomes a necessary condition for a firm’s sustainable growth. Therefore, knowledge accumulation is considered an important step of knowledge management, which is conducive for organization members to obtain more information and resources for further knowledge creation, and thus helps promote firm performance [19].

Hypothesis 1a (H1a).

Knowledge accumulation has a positive impact on firm performance.

Internal knowledge sharing is a firm’s interactive activities that promote the absorption and application of knowledge, information, and experience within organizations, such as knowledge sharing and information exchange between departments and among organization members. Internal knowledge sharing is a key factor for organization members to learn more knowledge. Through internal knowledge sharing, individual knowledge and organizational knowledge are exchanged and developed incessantly. The cohesiveness within the firm and the ability of excavating potential resources can also be enhanced continuously through internal knowledge sharing. In the process of deep exchange and wide spreading of knowledge, tacit knowledge can become explicit, and then is applied to create value and improve firm performance. Internal knowledge sharing not only helps knowledge and information spread effectively, but also promotes mutual learning and cooperation among organization members. It plays a key role in high-level knowledge innovation and thus greatly promotes firm performance. Estrada, Faems, and Faria [37] have found that competitors can cooperate to improve product innovation performance, but only through internal knowledge sharing. Other studies also show that internal knowledge sharing has a positive impact on firm performance even in an international context like in China [38].

Hypothesis 1b (H1b).

Internal knowledge sharing has a positive impact on firm performance.

External knowledge sharing refers to a firm’s interactive activities including knowledge sharing and information exchange with other organizations. External knowledge sharing helps entrepreneurs and employees to acquire more knowledge or information, understand them more completely, and better identify strategic opportunities. Meanwhile, it also helps entrepreneurs broaden their scope of knowledge, understand strategic prospects, and promote their ability of knowledge management. The ability to absorb and utilize external knowledge is an important source of competitive advantage. The flow of knowledge inside and outside a firm can effectively stimulate knowledge sharing, optimize organizational knowledge structures, and provide an impetus to the improvement of firm performance. The acquisition of strategic information, the formation of a strategic framework, and the learning from external knowledge sharing can also help a firm attract more potential stakeholders such as new customers, suppliers, and strategic investors [39]. Therefore, external knowledge sharing is also an important element of knowledge management and is expected to exert a positive impact on firm performance [40]. Based on these discussions, it is thus hypothesized in this study that:

Hypothesis 1c (H1c).

External knowledge sharing has a positive impact on firm performance.

2.2. Knowledge Management and Decision Quality

Knowledge accumulation represents the quantity of knowledge stock and it is the basis for knowledge sharing and knowledge application in various organizational practices [41]. Knowledge accumulation is expected to play a critical role in problem solving and strategy selection. In the process of decision-making, accumulated knowledge can improve the quality of decision-making by enhancing entrepreneurs’ ability to identify new opportunities [42]. Entrepreneurs with rich knowledge accumulation are more sensitive in problem perceiving, more knowledgeable in situation assessment and opportunity identification, and more capable in developing viable solutions. It is well-known that strategic decision-making depends on a large collection of relevant information, and the quality of a firm’s strategic decision relies not only on knowledge and information flow within the organization, but also on entrepreneurs’ knowledge accumulation. When facing challenging situations, entrepreneurs can use the accumulated knowledge to search for problem-solving schemes and identify the most viable course of action for organizational success. In essence, decision-making and resource allocation for the chosen course of action are both knowledge-based utilizations [43]. Therefore, knowledge accumulation can help an organization to make high-quality decisions [41], and knowledge accumulation is expected to exert a positive impact on decision-making, thus:

Hypothesis 2a (H2a).

Knowledge accumulation has a positive impact on the quality of decision-making.

Knowledge sharing and intensive communication among organization members, or internal knowledge sharing, can promote the formation of an “interactive community” [5], facilitate the emergence of new knowledge in strategic decision-making, and stimulate new perspectives of information processing, a foundation for high-quality strategic decisions. Internal knowledge sharing facilitates internal communication among members, and it is beneficial for all members, including entrepreneurs, to exchange knowledge. Internal knowledge sharing can further foster organizational learning within the organization [44]. The more members communicate, the more smoothly and efficiently knowledge is shared among organization members. Internal knowledge sharing thus provides comprehensive and diversified information for strategic decision-making, which will help improve decision quality. Good communication will not only inspire entrepreneurs to participate more within group discussions, but also encourage them to share more knowledge and work more proactively with other members to optimize decision-making processes in response to the challenge caused by market uncertainty and technology development. On the contrary, lack of internal knowledge sharing will lead to misunderstanding and further reduced mutual enlightenment among organization members. This will reduce their information processing capabilities and ultimately lower the quality of decisions. Therefore, internal knowledge sharing also exerts a positive impact on decision quality.

Hypothesis 2b (H2b).

Internal knowledge sharing has a positive impact on the quality of decision-making.

Under an increasingly turbulent business environment, the quality of strategic decisions also depends on whether entrepreneurs can effectively match firms’ internal resources with the needs of the external environment. Entrepreneurs as the decision-makers are the connector between the firm and the external environment, and they often have extensive connections with the government, service agencies, customers, suppliers, and competitors. With good understanding of a firm’s internal resources and capabilities, entrepreneurs as decision makers can match internal resources and capabilities with the external environment more effectively through external knowledge and information sharing, which will help improve the quality of decision-making. External agencies such as finance, consulting, and research organizations can provide external knowledge, information, and support for strategic decision-making [45] and help firms to get up-to-date information about market development, which again helps improve the quality of decision-making. The acquisition of strategic information through external knowledge sharing increases the firm’s ability to make effective strategic decisions in an uncertain environment [46]. Based on these discussions, it is hypothesized in this study that:

Hypothesis 2c (H2c).

External knowledge sharing has a positive impact on the quality of decision-making.

2.3. Decision Quality and Firm Performance

High-quality decision-making is a firm’s source of competitive advantage [21,47,48], and it helps firms with continuous development and growth. Empirical studies have suggested that a senior manager’s failure in making fast and high-quality strategic decisions is the main factor that constrains the financial performance of any organization and the quality of decision-making plays an important role in improving firm performance [49]. Most organizational failure is caused by low quality decision-making, often the result of neglecting or misinterpreting key information or a lack of enough relevant knowledge [50]. While the outcomes of strategic decision-making are also affected by factors such as cognitive diversity, conflict, organizational resources, and trust [51], a wrong strategic decision, as a result of misunderstanding the significance of market events or a lack of sufficient knowledge in finding the most viable solution in the decision-making process, will lead the organization to disaster. A knowledge-based high-quality decision, on the contrary, can help the firm match the strategic decision with internal and external environments and catch the market opportunities to achieve sustainable growth, especially in a complex environment. Therefore, decision-making quality will directly affect firm performance [52]. It is thus hypothesized in this study that:

Hypothesis 3 (H3).

The quality of decision-making has a positive impact on firm performance.

2.4. The Mediating Effect of Decision Quality

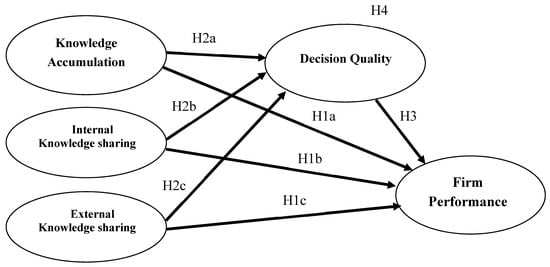

Decision-making is the application process of knowledge management in order to achieve high firm performance [47], and it is also one of the key steps of the dynamic knowledge creation process. Nonaka and colleagues [19] consider that choosing the right solution through decision-making is both the application of shared knowledge and the beginning of generating new knowledge through the action of problem solving [19]. Knowledge management helps entrepreneurs choose the best alternative to solve problems. Knowledge, including experiences and expertise, can help decision-makers better understand economic and managerial environments. In an unstructured world, the right decisions always come from accurate information and relevant practical knowledge. Knowledge management can enrich a firm’s knowledge stock and refine new ideas. Knowledge sharing is also a construction process by which learners actively link new information with previous experiences. The more knowledge is constructed, the higher the cognitive level of entrepreneurs will reach, and the more likely they will make high-quality decisions, which can then bring better performance. It is expected that effective knowledge management, including knowledge accumulation and internal and external knowledge sharing, helps improve decision quality, and further leads to high firm performance. In other words, high-quality decision-making mediates the relationship between knowledge management and firm performance in such a way that decision-making relays the positive impact of effective knowledge management through more viable courses of action determined by high-quality decision-making to improve firm performance. Please refer to Figure 1 for the overall research model.

Figure 1.

A research model of knowledge management, decision quality, and firm performance.

Hypothesis 4 (H4).

The quality of decision-making mediates the relationship between knowledge management and firm performance.

3. Methods

3.1. Sample and Procedures

The data used in this study were collected from the southern region of China, mainly the Jiangsu province and the surrounding economically well-developed areas where the knowledge economy has become increasingly important. Emails and phone calls were first used to contact potential respondents based on the information from the management training centers in Jiangnan University and other local training institutes. In order to reduce the common method variances, we collected the data from both the entrepreneurs/owners of the firms and their senior managers. We sent out a total of 600 questionnaires to all the entrepreneurs who agreed to participate, and after two rounds of follow-ups, 256 questionnaires were collected. We removed the incomplete data and the remaining 213 valid questionnaires were used for analysis in this study, a response rate of 35.5%.

All scales in this study were in Chinese Mandarin. The scales developed in previous studies were adapted and adopted in this study after they were translated into Chinese Mandarin using the translation and back-translation procedure, whereby they were first translated into Chinese from English and then back into English to ensure equivalency of meaning, following the commonly prescribed procedures [53]. All entrepreneurs answered the questions on a series of 5-point Likert-type scales, with 1 representing “completely disagree” and 5 representing “completely agree.” All these scales were first tested in a pilot study with a small sample of senior executives and then a group of researchers from the knowledge management field were invited to review the questionnaire. The final scales were then revised according to their feedback, and minor revision was also made to ensure the scales were consistent with the Chinese context.

3.2. Measures

Knowledge Management. Based on the research of Sáenz, Bontis, Rivera, and Aramburu [54,55] and Sáenz, Aramburu, and Rivera (2009), we designed the knowledge management scale to measure knowledge accumulation, internal knowledge sharing, and external knowledge sharing, with four items for each dimension. Sample items for these measures include “our organization is able to collect, analyze, and store knowledge and relevant information on products and services in our sector,” “we are willing to share knowledge and information with team members,” and “we are willing to collect relevant information and knowledge from professionals in various fields.” The Cronbach alphas are 0.83, 0.83, and 0.80, respectively, for these three scales.

Decision Quality. Based on the scale used in previous studies [51], we designed a decision quality scale that uses three items to measure the quality of entrepreneurs’ decision-making. Sample items include “our strategic decision is consistent with the company’s relevant decisions” and “our strategic decision fits in with our internal resources and capabilities,” with the Cronbach alpha at 0.80.

Firm Performance. The measurement of firm performance is based on the scale used by Lee [56] and Tan and Litsschert [57], with four items included to measure the firm’s profitability, sales growth, market share, and customer satisfaction. Sample items include “our profitability is higher than industry average” and “our sales growth is higher than industry average,” with the Cronbach alpha at 0.82.

4. Results

4.1. Reliability and Validity Test

In this study, we first calculated the Cronbach’s alpha coefficients using SPSS 20.0 to test the reliability of all the variables. Confirmatory factor analysis was also performed using AMOS 20.0, and the convergence validity was tested by calculating the AVE value of each variable (please see Table 1). Table 1 shows that the Cronbach’s alpha coefficients of knowledge accumulation, internal knowledge sharing, external knowledge sharing, decision quality, and firm performance are all greater than or equal to 0.80, indicating that the scales had good reliability. The AVE of each variable is greater than 0.5, showing that the convergent validity is good. Comparing the data in Table 1 and Table 2, the square root of the extracted mean square error of each variable is greater than the correlation coefficient between the variables, indicating a good discriminant validity of all variables studied in this study.

Table 1.

Variable reliability and validity test.

Table 2.

Descriptive statistics and correlation coefficients.

We used Structural Equation Modeling (SEM) in this study to test the developed hypotheses. Because the SEM method does not have a single indicator to test the model fit, we used several indexes to assess the goodness-of-fit of the model, including the Chi-square (χ2), the comparative fit index (CFI), the root mean-square error of approximation (RMSEA), the goodness-of-fit Index (GFI), the Akaike information criterion (AIC), and the Bentler–Bonett normed fit index (NFI). Among these indexes, it is expected that AIC should be as small as possible. The RMSEA should be 0.08 or below, and CFI, GFI, and NFI should be 0.90 or above to be acceptable.

The SEM approach includes two basic steps: The measurement model assessment and the structural model assessment. Scholars have argued that SEM analysis should first assess the full measurement model underlying the structural model, and if the fit of the measurement model is proven acceptable, then the second step of assessing the structural model should be calculated to obtain various indexes of the goodness-of-fit [58]. It would make no sense to assess the structural model before the measurement model is proved valid. Based on this recommendation, we conducted a two-step analysis to examine the relationship between knowledge management, decision-making quality, and firm performance.

4.2. Measurement Model

The assessment of the measurement model is essentially a confirmatory factor analysis (CFA) of all variables examined in this study. We present the descriptive statistics in Table 2, and the outcome of a robust maximum likelihood analysis on the full measurement model provides a set of model fit indexes and a robust chi-square statistic. The results clearly showed that a five-factor measurement model (knowledge accumulation, internal knowledge sharing, external knowledge sharing, decision quality, and firm performance) has a very good fit with the data (Please refer to Table 3), with χ2 = 126.69; GFI = 0.94; NFI = 0.92; CFI = 0.99; RMSEA = 0.028. Therefore, this five-factor model was used in the assessment of the structure model.

Table 3.

Assessment of the measurement model on knowledge sharing and firm performance.

4.3. Structural Model

Our hypotheses predicted that the quality of decision-make mediates the positive relationship between knowledge management and firm performance. Based on the measurement model constructed above, a structural model was built and then assessed. This structural model included all the paths as hypothesized in this study. In the test, we controlled for the impact of tenure, education, age, and gender because participants who have worked in a company for a longer time may be more likely to make appropriate decisions due to organizational learning and socialization. Similarly, the level of education of the participants also influences their own professional qualities, which may affect a firm’s business performance. In addition, age and gender also affect the quality of decision-making and further firm performance. Therefore, our analysis controlled for the impact of these control variables.

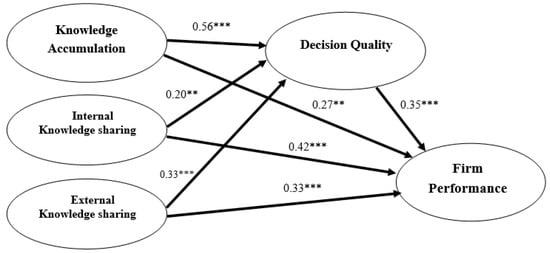

As shown in Table 4, in addition to the proposed model, we also tested eight different alternatives to examine every possible alternative path for the proposed model. The results showed that the Akaike Information Criterion (AIC) value of Model 2 was the smallest of all models. When the AIC value was used for comparing models from the same dataset, the model with a smaller AIC value was preferred. Among the models built in this study, Model 2 had the smallest AIC value, and the fit indexes of Model 2 were also the best (χ2 = 137.55; RMSEA = 0.033; AIC = 219.55; CFI = 0.98; GFI = 0.93; NFI = 0.92; TLI = 0.98). Model 2 was therefore selected as the final structure model to test all the hypotheses of this study. The results of Model 2 clearly indicate a partial mediation relationship among knowledge management, decision quality, and firm performance. The final structural model and the estimates of each parameter are reported in Figure 2. The numbers along the paths are the standardized coefficients for each path.

Table 4.

Alternative models on knowledge sharing and firm performance.

Figure 2.

A revised structural model on knowledge management, decision quality, and firm performance; * p < 0.05, ** p < 0.01, *** p < 0.001 (two-tailed).

The SEM analysis indicates that knowledge accumulation, internal knowledge sharing, and external knowledge sharing are all positively related to decision quality (β = 0.56, p < 0.001; β = 0.20, p < 0.01; β = 0.33, p < 0.001, respectively), which supports H2a–c, and decision quality further leads to high firm performance (β = 0.35, p < 0.001), which supports H3. Furthermore, knowledge accumulation, internal knowledge sharing, and external knowledge sharing are all positively associated with firm performance (β = 0.27 p < 0.01; β = 0.42, p < 0.001; β = 0.33, p < 0.001, respectively), in support of H1a–c. In addition, the final structure model also shows decision quality partially mediates the relationship between knowledge management (including knowledge accumulation and internal and external knowledge sharing) and firm performance, which supports H4. The overall results thus suggest another perspective to explore the mechanism on how knowledge management influences decision quality and furthers firm performance.

5. Discussion and Conclusions

Our study is intended to examine the impact of knowledge management on firm performance in China from a decision-making perspective. The study surveyed Chinese entrepreneurs in the southern part of China where the knowledge economy is becoming increasingly important in order to test the proposed mediating model on the relationship between knowledge management, decision quality, and firm performance [59]. The results demonstrated that knowledge management has a positive impact on firm performance, and the quality of decision-making plays a mediating role between knowledge management and firm performance. Specifically, knowledge accumulation and internal and external knowledge sharing all have a significant positive impact on firm performance, and the quality of decision-making partially mediates their impact on firm performance. The findings are consistent with previous research on knowledge management and firm performance [60,61], and our study provides a new and more nuanced explanation on the mechanism by which knowledge management affects firm performance.

5.1. Theoretical Contributions

This study explores the mechanism through which knowledge management affects firm performance. The findings of this study have several theoretical implications and can make important contributions to the research on knowledge management and firm performance. First, this study complements the existing literature on knowledge management and firm performance. While past studies have found a positive relationship between firm performance and knowledge management [60,61], few of them have considered knowledge management as a multi-component concept and further distinguished the impact of each component in examining the impact of knowledge management on firm performance. In this study, we systematically analyzed and developed hypotheses on the impact of each of the components of knowledge management, including knowledge accumulation, internal knowledge sharing, and external knowledge sharing, on firm performance, and the results support our hypotheses. The results of this study can help to better understand knowledge management and firm performance in a more nuanced way, which will have important practical implications for designing effective intervention programs.

Second, our study explores the mechanisms through which knowledge management affects firm performance. Past studies have shed light on the need to consider intervening conditions and possible processes affecting the relationship between knowledge management and firm performance and the mediating mechanism [4,11,20]. Since knowledge management is an interactive process, this study focuses on how the shared and enhanced knowledge as a result of such an interaction can help improve the quality of the decision-making process, through which knowledge management impacts firm performance. The empirical results support our proposed model. Therefore, this study is an important addition to the current literature on knowledge management, decision-making, and firm performance.

Finally, we tested this model in an international context—China, a highly collectivistic society [18] where knowledge sharing is consistent with the dominant values, i.e., sharing the knowledge for the collective good rather than keeping the knowledge to yourself for individual interests. This way we extend the existing model of knowledge management and firm performance to the international context, an important step towards developing a more robust global theory on knowledge management that can help resolve challenges in the increasingly globalized world market and a valuable addition to knowledge management theories [17]. This again will enrich the existing literature on the relationships between knowledge management and firm performance. While a large amount of research has been published on knowledge management, there is still relatively little literature on the theoretical connections among knowledge management, decision quality, and firm performance in the international context. This study moves forward the research on firm performance improvement through enhancing the impact of knowledge management on the quality of strategic decision-making.

5.2. Managerial Implications

The findings of this study also have important managerial implications, mainly on how entrepreneurs improve firm performance through high-quality decision-making processes. First, organizations need to establish a knowledge-based decision support system to improve entrepreneurs’ decision-making quality. This study shows that the quality of decision-making plays a mediating role between knowledge management and firm performance, and thus knowledge management can improve firm performance by improving the quality of decision-making. On the one hand, both knowledge accumulation and knowledge sharing can help entrepreneurs enhance their cognitive skills and decision-making abilities. When entrepreneurs’ knowledge stock is insufficient in facing complex environments, an effective knowledge-based decision support system can assist them in seeking and acquiring relevant resources to improve the quality of the decision-making process. On the other hand, it is recommended that firms build their own knowledge management system, which not only helps create and accumulate knowledge and information, but also helps create and manage knowledge assets within the organization. Nonaka and colleagues [19] adopt a dynamic view of knowledge creation and contend that applying the right solution through decision-making is both the application of shared knowledge and the beginning of generating new knowledge through the action of problem solving [19]. Therefore, in order to develop high-quality, strategic decisions consistent with internal and external environments for more competitive advantages, it is essential for entrepreneurs to create an effective knowledge-based decision support system, for which the findings of this study provide empirical support.

Second, the findings of this study suggest that it is critical for firms to carry out knowledge management activities in order to improve overall firm performance. The results show that both knowledge accumulation and knowledge sharing positively affect firm performance, so entrepreneurs ought to pay more attention to knowledge management activities and use them as a strategic weapon to improve overall performance. For example, entrepreneurs can motivate employees to obtain more information, acquire different experiences and cultivate and improve employees’ ability to quickly collect information, analyze data, and convert them into organizational knowledge for accumulation and sharing. Organizations should also establish an efficient knowledge sharing system to strengthen internal communication and information exchange in order to promote knowledge sharing among employees. Meanwhile, it would also be beneficial for all organization members to communicate with various external partners and identify and seize every business opportunity to improve firm performance through external knowledge sharing.

6. Limitations and Future Research

This study attempts to explore knowledge management and firm performance from a decision-making perspective, but caution must be used in applying the findings of this study. First, this study examined only one mediator—decision quality, and the effect of knowledge management is more than just through improving the quality of decision-making. This study does not consider other possible mediating or moderating factors such as trust, rewarding policy, and other situational variables. Future research should explore more factors to investigate their impact on the relationship between knowledge management and firm performance, and to improve the rigor of the knowledge management research by measuring and controlling for the effect of other relevant intervention mechanisms.

Second, our research is based on the individual-level data to explore the impact of knowledge management on firm performance. However, it is well known that many firms encourage employees to work as teams. Therefore, future research should explore how to stimulate team-level knowledge management, another important and valuable challenge for organizations. Finally, this study is a cross-sectional design, and conclusions about the causality in our model cannot be easily drawn. Future research should obtain data from experimental and longitudinal designs and from different sectors in order to better identify the underlying causal directions.

To conclude, knowledge management has become more important for a firm’s success along with the advent of the knowledge economy [23,62,63]. Since knowledge management plays an important role in improving firm performance, we develop an integrated model to explore the mechanism through which knowledge management affects firm performance and thus provides a new perspective to examine this relationship. In this model, we propose that the knowledge accumulation, internal knowledge sharing, and external knowledge sharing all have a unique influence on firm performance and we further identify and empirically test the important role of decision quality as a potential mediator for the relationships between knowledge management and firm performance. More research is called upon to validate the model proposed in this study and new findings will be able to provide more insights on the overall impact of knowledge management on firm performance.

Author Contributions

Conceptualization, Z.M. and H.Y.; methodology, H.Y. and Y.S.; software, Y.S.; validation, Y.S. and H.Y.; formal analysis, Y.S.; investigation, H.Y. and Y.S.; resources, N.W. and Z.M.; data curation, H.Y. and Y.S.; writing—original draft preparation, Y.S., Z.M. and N.W.; writing—review and editing, Z.M. and N.W.; visualization, N.W.; supervision, Z.M.; project administration, Z.M.; funding acquisition, H.Y., N.W., and Z.M.

Funding

This research was funded by a grant from the Fundamental Research Funds for Central Universities (Grant#:2017JDZD14), a grant from Beijing’s “High-grade, Precision and Advanced Discipline Construction Project (Municipal)—Business Administration” (Grant # 19005902053), and the grants from the National Natural Science Foundation of China (#71802098, #71602006, #71572027).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Al-Hakim, L.A.; Hassan, S. Core Requirements of Knowledge Management Implementation, Innovation and Organizational Performance. J. Bus. Econ. Manag. 2016, 17, 109–124. [Google Scholar] [CrossRef]

- Inkinen, H. Review of Empirical Research on Knowledge Management Practices and Firm Performance. J. Knowl. Manag. 2016, 20, 230–257. [Google Scholar] [CrossRef]

- Zack, M.; McKeen, J.; Singh, S. Knowledge Management and Organizational Performance: An Exploratory Analysis. J. Knowl. Manag. 2009, 13, 392–409. [Google Scholar] [CrossRef]

- Ma, Z.; Huang, Y.; Wu, J.; Dong, W.; Qi, L. What matters for knowledge sharing in collectivistic cultures? Empirical evidence from China. J. Knowl. Manag. 2014, 18, 1004–1019. [Google Scholar] [CrossRef]

- Nonaka, I. A Dynamic Theory of Organizational Knowledge Creation. Organ. Sci. 1994, 5, 3–42. [Google Scholar] [CrossRef]

- Migdadi, M.M.; Zaid, M.K.A.; Yousif, M.; Almestarihi, R.; Alhyari, K. An Empirical Examination of Knowledge Management Processes and Market Orientation, Innovation Capability, and Organizational Performance: Insights from Jordan. J. Inf. Knowl. Manag. 2017, 16, 1–32. [Google Scholar]

- Wong, W.P.; Wong, K.Y. Supply chain management, knowledge management capability, and their linkages towards firm performance. Bus. Process Manag. J. 2011, 17, 940–964. [Google Scholar] [CrossRef]

- Adrian, S. Leaders and their Teams: Learning to Improve Performance with Emotional Intelligence and Using Choice Theory. Int. J. Real. Ther. 2008, 27, 40–45. [Google Scholar]

- Yukl, G. How Leaders Influence Organizational Effectiveness. Leadersh. Q. 2008, 19, 708–722. [Google Scholar] [CrossRef]

- Ding, X.H.; Huang, R.H. Effects of Knowledge Spillover on Inter-organizational Resource Sharing Decision in Collaborative Knowledge Creation. Eur. J. Oper. Res. 2010, 201, 949–959. [Google Scholar] [CrossRef]

- Ma, Z.; Qi, L.; Wang, K. Knowledge Sharing in Chinese Construction Project Teams and its Affecting Factors: An Empirical Study. Chin. Manag. Stud. 2008, 2, 97–108. [Google Scholar] [CrossRef]

- Ibarra Cisneros, M.A.; Hernández-Perlines, F. Intellectual Capital and Organization Performance in the Manufacturing Sector of Mexico. Manag. Decis. 2018, 56, 1818–1834. [Google Scholar] [CrossRef]

- Kianto, A. The Influence of Knowledge Management on Continuous Innovation. Int. J. Technol. Manag. 2011, 55, 110–121. [Google Scholar] [CrossRef]

- Liao, Y.S. The Effect of Human Resource Management Control Systems on the Relationship between Knowledge Management Strategy and Firm Performance. Int. J. Manpow. 2011, 32, 494–511. [Google Scholar] [CrossRef]

- Holsapple, C.W.; Wu, J. An Elusive Antecedent of Superior Firm Performance: The Knowledge Management Factor. Decis. Support Syst. 2011, 52, 271–283. [Google Scholar] [CrossRef]

- Anantatmula, V.; Kanungo, S. Structuring the Underlying Relations among the Knowledge Management Outcomes. J. Knowl. Manag. 2006, 10, 25–42. [Google Scholar] [CrossRef]

- Kaya, T.; Erkut, B. Tacit knowledge capacity: A comparison of university lecturers in Germany and North Cyprus. Electron. J. Knowl. Manag. 2018, 16, 131–142. [Google Scholar]

- Hofstede, G. Culture’s Consequences: International Differences in Work-Related Values; Sage: Beverly Hills, CA, USA, 2001. [Google Scholar]

- Nonaka, I.; Toyama, R.; Konno, N. SECI, Ba and leadership: A unified model of dynamic knowledge creation. Long Rang Plan. 2000, 33, 5–34. [Google Scholar] [CrossRef]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Olaru, M.; Popescu, D. An exploratory study on knowledge management process barriers in the oil industry. Energies 2018, 11, 1977. [Google Scholar] [CrossRef]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Marin, I. Assessing role of strategic choice on organizational performance by Jacquemin- Berry entropy index. Entropy 2017, 19, 448. [Google Scholar] [CrossRef]

- Aboelmaged, M.G. Linking operations performance to knowledge management capability: The mediating role of innovation performance. Prod. Plan. Control Manag. Oper. 2014, 25, 44–58. [Google Scholar] [CrossRef]

- Ma, Z.; Yu, K. Research Paradigms of Contemporary Knowledge Management Studies: 1998–2007. J. Knowl. Manag. 2010, 14, 175–189. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Wastyn, A. Does Professional Knowledge Management Improve Innovation Performance at the Firm Level? Soc. Sci. Electron. Publ. 2009, 24, 1–33. [Google Scholar] [CrossRef][Green Version]

- Nevo, D.; Chan, Y.E. A Delphi Study of Knowledge Management Systems: Scope and Requirements. Inf. Manag. 2007, 44, 583–597. [Google Scholar] [CrossRef]

- Dröge, C.; Claycomb, C.; Germain, R. Does Knowledge Mediate the Effect of Context on Performance? Some Initial Evidence. Decis. Sci. 2003, 34, 541–568. [Google Scholar] [CrossRef]

- Fong, P.S.W.; Kwok, C.W.C. Organizational Culture and Knowledge Management Success at Project and Organizational Levels in Contracting Firms. J. Constr. Eng. Manag. 2009, 135, 1348–1356. [Google Scholar] [CrossRef][Green Version]

- Leidner, D.; Alavi, M.; Kayworth, T. The Role of Culture in Knowledge Management: A Case Study of Two Global Firms. Int. J. e-Collab. 2007, 2, 17–40. [Google Scholar]

- Nguyen, H.N.; Mohamed, S. Leadership Behaviors, Organizational Culture and Knowledge Management Practices. J. Manag. Dev. 2011, 30, 206–221. [Google Scholar] [CrossRef]

- Long, D.W.D.; Fahey, L. Diagnosing Cultural Barriers to Knowledge Management. Acad. Manag. Exec. 2000, 14, 113–127. [Google Scholar] [CrossRef]

- Darroch, J. Knowledge Management, Innovation and Firm Performance. J. Knowl. Manag. 2005, 9, 101–115. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Xu, W. Conditional Mediation of Absorptive Capacity and Environment in International Entrepreneurial Orientation of Family Businesses. Front. Psychol. 2018, 9, 102. [Google Scholar] [CrossRef] [PubMed]

- Scarbrough, H. Knowledge management, HRM and the Innovation Process. Int. J. Manpow. 2003, 24, 501–516. [Google Scholar] [CrossRef]

- Alavi, M. Knowledge Management and Knowledge Management Systems: Conceptual Foundations and Research Issues. MIS Q. 2001, 25, 107–136. [Google Scholar] [CrossRef]

- Palermo, V. Internal Knowledge Accumulation and the Acquisition of External Technology: Is There a Trade-off? Acad. Manag. Proc. 2014, 1, 16854. [Google Scholar] [CrossRef]

- Zahra, S.A.; Nielsen, A.P. Sources of Capabilities, Integration and Technology Commercialization. Strateg. Manag. J. 2002, 23, 377–398. [Google Scholar] [CrossRef]

- Estrada, I.; Faems, D.; Faria, P.D. Coopetition and Product Innovation Performance: The Role of Internal Knowledge Sharing Mechanisms and Formal Knowledge Protection Mechanisms. Ind. Mark. Manag. 2016, 53, 56–65. [Google Scholar] [CrossRef]

- Du, R.; Ai, S.; Ren, Y. Relationship between Knowledge Sharing and Performance: A Survey in Xi’an, China. Expert Syst. Appl. 2007, 32, 38–46. [Google Scholar] [CrossRef]

- Acquaah, M. Managerial social capital, strategic orientation, and organizational performance in an emerging economy. Strateg. Manag. J. 2007, 28, 1235–1255. [Google Scholar] [CrossRef]

- Ritala, P.; Olander, H.; Michailova, S.; Husted, K. Knowledge Sharing, Knowledge Leaking and Relative Innovation Performance: An Empirical Study. Technovation 2015, 35, 22–31. [Google Scholar] [CrossRef]

- Gray, P.H. A Problem-solving Perspective on Knowledge Management Practice. Decis. Support Syst. 2001, 31, 87–102. [Google Scholar] [CrossRef]

- Baron, R.A.; Ensley, M.D. Opportunity Recognition as the Detection of Meaningful Patterns: Evidence from Comparisons of Novice and Experienced Entrepreneurs. Manag. Sci. 2006, 52, 1331–1344. [Google Scholar] [CrossRef]

- Lam, A.; Lambermont-Ford, J.-P. Knowledge Sharing in Organizational Contexts: A Motivation-based Perspective. J. Knowl. Manag. 2010, 14, 51–66. [Google Scholar] [CrossRef]

- Lauring, J.; Selmer, J. Positive Dissimilarity Attitudes in Multicultural Organizations. Corp. Commun. Int. J. 2012, 17, 156–172. [Google Scholar] [CrossRef]

- Arendt, L.A.; Priem, R.L.; Ndofor, H.A. A CEO-adviser Model of Strategic Decision Making. J. Manag. 2005, 31, 680–699. [Google Scholar] [CrossRef]

- Sommer, S.C.; Loch, C.H.; Dong, J. Managing Complexity and Unforeseeable Uncertainty in Startup Companies: An Empirical Study. Organ. Sci. 2009, 20, 118–133. [Google Scholar] [CrossRef]

- Goll, I.; Johnson, N.B.; Rasheed, A.A. Knowledge Capability, Strategic Change, and Firm Performance. Manag. Decis. 2007, 45, 161–179. [Google Scholar] [CrossRef]

- Jones, R. Measuring the Benefits of Knowledge Management at the Financial Services Authority: A Case Study. J. Inf. Sci. 2003, 29, 475–487. [Google Scholar] [CrossRef]

- Mankins, M.C. Stop Wasting Valuable Time. Harv. Bus. Rev. 2004, 82, 58–60. [Google Scholar]

- Klein, G.; Wiggins, S.; Dominguez, C.O. Team Sense-making. Theor. Issues Ergon. Sci. 2010, 11, 304–320. [Google Scholar] [CrossRef]

- Olson, B.J.; Parayitam, S.; Bao, Y. Strategic decision making: The effects of cognitive diversity, conflict, and trust on decision outcomes. J. Manag. 2007, 33, 196–222. [Google Scholar] [CrossRef]

- Amason, A.C. Distinguishing the Effects of Functional and Dysfunctional Conflict on Strategic Decision Making: Resolving a Paradox for Top Management Teams. Acad. Manag. J. 1996, 39, 123–148. [Google Scholar]

- Brislin, R.W. Translation and content analysis of oral and written materials. In Handbook of Cross-Cultural Psychology: Methodology; Triandis, H.C., Berry, J.W., Eds.; Allyn and Bacon: Boston, MA, USA, 1980; pp. 389–444. [Google Scholar]

- Sáenz, J.; Bontis, N.; Rivera, O.; Aramburu, N. Knowledge Sharing and Innovation Performance. J. Inf. Knowl. Manag. 2008, 7, 187–195. [Google Scholar] [CrossRef]

- Sáenz, J.; Aramburu, N.; Rivera, O. Knowledge Sharing and Innovation Performance: A Comparison between High-tech and Low-tech Companies. J. Intellect. Cap. 2009, 10, 22–36. [Google Scholar] [CrossRef]

- Lee, R.P. Extending the environment-strategy-performance framework: The roles of multinational corporation network strength, market responsiveness, and product innovation. J. Int. Mark. 2010, 18, 58–73. [Google Scholar] [CrossRef]

- Tan, J.J.; Litsschert, R.J. Environment-strategy Relationship and its Performance Implications: An Empirical Study of the Chinese Electronics Industry. Strateg. Manag. J. 1994, 15, 1–20. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practices of Structural Equation Modeling, 2nd ed.; The Guilford Press: New York, NY, USA, 2005. [Google Scholar]

- Huang, Y.; Ma, Z.; Meng, Y. High performance work systems and employee engagement: Empirical evidence from China. Asia Pac. J. Hum. Resour. 2018, 56, 341–359. [Google Scholar] [CrossRef]

- Chuang, S.H. A resource-based perspective on knowledge management capability and competitive advantage: An empirical investigation. Expert Syst. Appl. 2004, 27, 459–465. [Google Scholar] [CrossRef]

- Salmador, M.P.; Bueno, E. Knowledge creation in strategy-making: Implications for theory and practice. Eur. J. Innov. Manag. 2007, 10, 367–390. [Google Scholar] [CrossRef]

- Liu, Y.W.; DeFrank, R.S. Self-interest and Knowledge-sharing Intentions: The Impacts of Transformational Leadership Climate and HR Practices. Int. J. Hum. Resour. Manag. 2013, 24, 1151–1164. [Google Scholar] [CrossRef]

- Yang, J. The knowledge Management Strategy and its Effect on Firm Performance: A Contingency Analysis. Int. J. Prod. Econ. 2010, 125, 215–223. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).