Coffee Output Reaction to Climate Change and Commodity Price Volatility: The Nigeria Experience

Abstract

:1. Introduction

2. Methodology

2.1. Study Area

2.2. Sources of Data

2.3. Method of Data Analysis

2.4. Volatility Test

- yt = measure of commodity price volatility at time t,

- α = mean,

- xt−1 = exogenous variables,

- εt = error term.

- δ = variance,

- xi = mean,

- = standard deviation.

- 2 = conditional variance,

- P = order of the GARCH,

- .= the GARCH term.

2.5. Baseline Model Specification

- Yt = Tree crop yield at time t;

- CM = Climate change at time t;

- CP = Commodity price change at time t;

- (CM × CP)t = interaction between CM and CP at time t; and

- µt = other unobserved variables.

2.6. The FM-OLS Regression Approach

- Yit = yield for crop i at time t (tons/hectare),

- CPit = Coffee commodity price at time t (U.S. $),

- T = mean annual temperature (°C),

- P = total annual rainfall (mm),

- IR = total annual Inflation rate (%),

- TO = Trade openness (%),

- ER = Exchange Rate (Naira),

- CM × CP = climate variables × coffee commodity price at time t (U.S. $),

- Σt = error term

- Pit = yield for the coffee crop at time t (tons/hectare),

- CPit = Coffee commodity price at time t (U.S. $),

- T = mean annual temperature (°C),

- P = total annual rainfall (mm),

- IR = total annual Inflation rate (%),

- TO = Trade openness (%),

- ER = Exchange Rate (Naira),

- CM × CP = climate variables × commodity price of the crop I at time t (U.S. $),

- Σt = error term.

2.7. The Granger Causality Test Model

- Wt = yield for each of coffee tree crop (tons/hectare),

- Zt = commodity price for coffee tree crop (U.S. $),

- t−1 = lag variables,

- α1 and β1 = parameters to be estimated,

- U1t and U2t = error terms.

2.8. Estimating Trade Openness

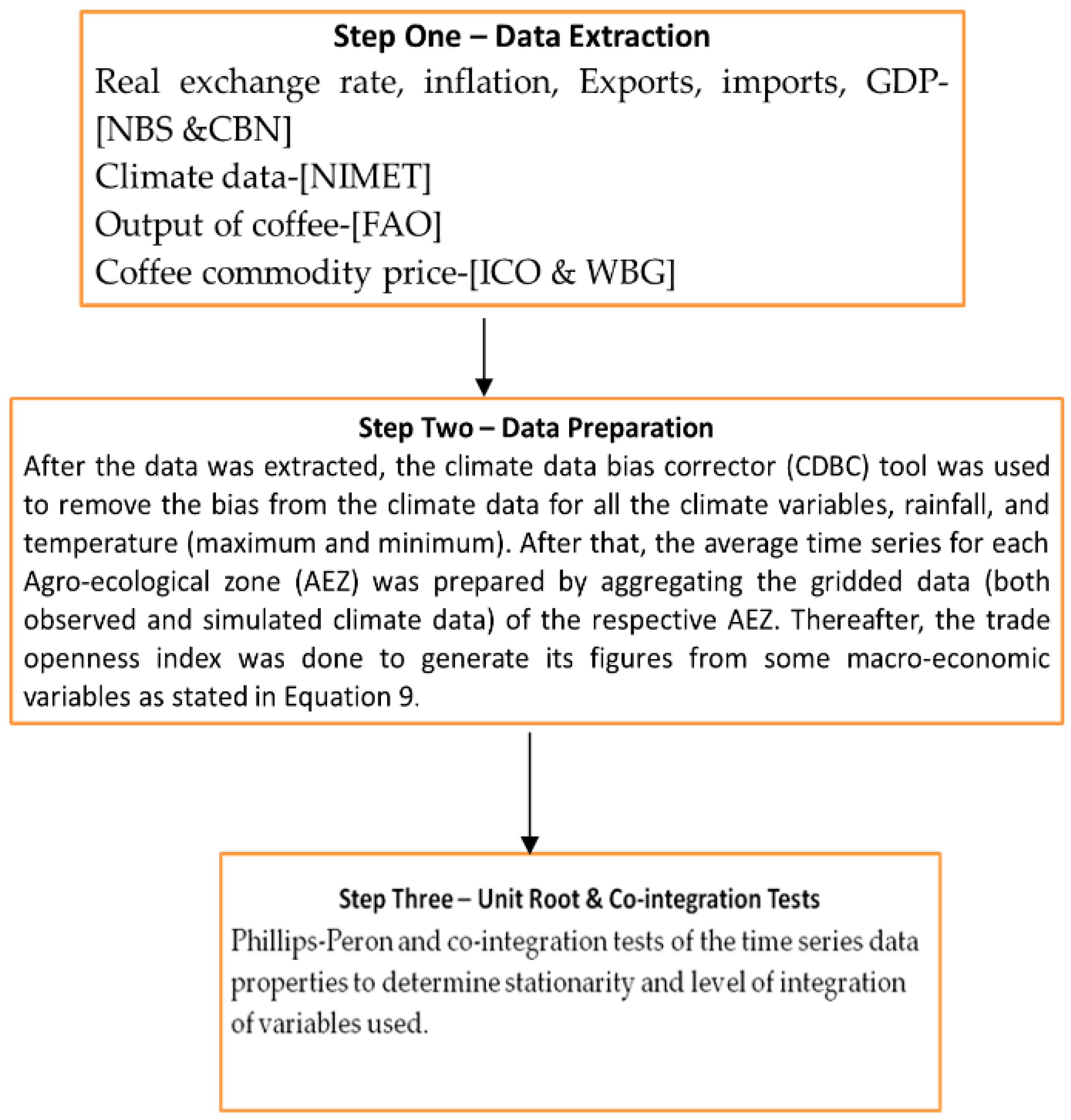

2.9. Pre-Data Processing Flow Chart

2.10. Similar Studies with Their Adopted Analytical Models

3. Results and Discussions

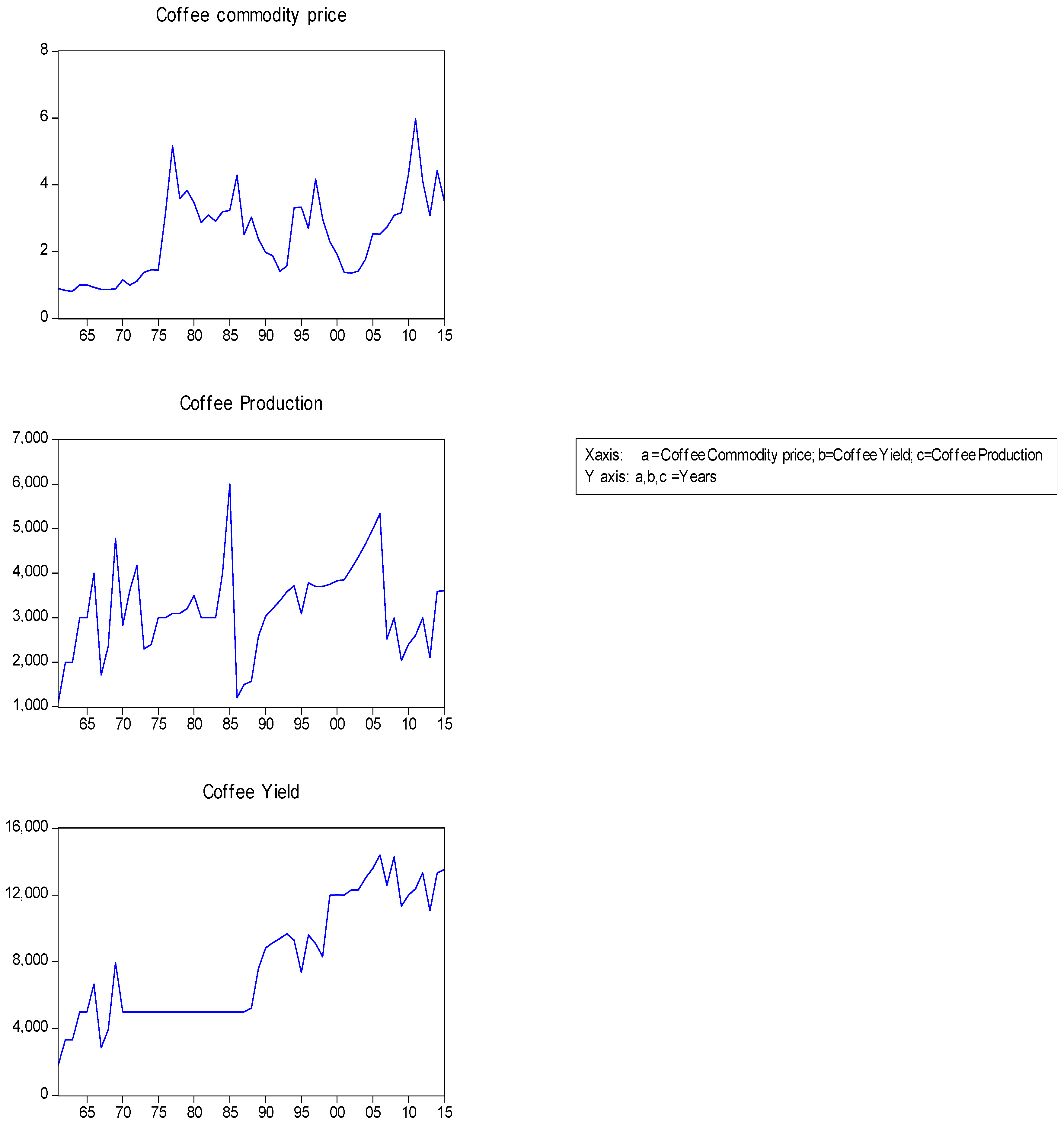

3.1. The Trend of Coffee Tree Crop Commodity Price, Production, and Yield 1961–2015

3.2. Determination of the Time Series Properties of Data Employed for Analysis

3.3. Volatility Test for Coffee Commodity Price

3.4. Effects of Climatic Variations and Commodity Price Volatility on the Yield and Output of the Coffee Output

3.5. Effects of Climatic Variations, Commodity Prices Volatility, and Joint Effects of Climatic Variations with Commodity Prices Volatility on Coffee Production

3.6. Test of Hypotheses

3.7. Summary of Findings

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- World Bank Group. Agribusiness and Value Chains. Understanding Poverty Report Updated. Available online: https://www.worldbank.org/en/topic/agribusiness (accessed on 24 September 2018).

- African Development Bank (AfDB). Level 1 Development in Africa. In Annual Development Effectiveness Review; AfDB: Abidjan, Côte d’Ivoire, 2015. [Google Scholar]

- World Bank Group. World Bank Report on the Potential of Agribusiness in Africa 2018. Available online: http://www.worldbank.org/en/news/feature/2013/03/04/africa-agribusiness-report (accessed on 15 March 2019).

- Akinbobola, T.O.; Adedokun, S.A.; Nwosa, P.I. The Impact of Climate Change on Composition of Agricultural Output in Nigeria. Am. J. Environ. Prot. 2015, 3, 44–47. Available online: http://pubs.sciepub.com/env/3/2/1/env-3-2-1.pdf (accessed on 7 September 2016). [CrossRef]

- International Coffee Organization (ICO). World Coffee Production Report. 2019. Available online: http://www.ico.org/prices/po-production.pdf (accessed on 15 March 2019).

- Petchers, S.; Harris, S. The roots of the coffee crisis. In Confronting the Coffee Crisis: Fair Trade Sustainable Livelihoods and Ecosystems in Mexico and Central America; Bacon, C.M., Méndez, V.E., Gliessman, S.R., Goodman, D., Fox, J.A., Eds.; MIT Press: Cambridge, MA, USA, 2008; pp. 43–66. [Google Scholar]

- International Coffee Organization (ICO). Volatility of Prices Paid to Coffee Growers in Selected Exporting Countries; ICO Document; ICC: London, UK, 2011; pp. 107–110. [Google Scholar]

- International Coffee Council (ICC). Impact of the Coffee Crisis on Poverty in Producing Countries; 89th Session; ICC: Cartagena, Colombia, 2003; pp. 89–95, Rev. 1. [Google Scholar]

- Ortiz-Miranda Dionisio, A.; Moragues-Faus, M. Governing Fair Trade Coffee Supply: Dynamics and Challenges in Small Farmers’ Organizations. Sustain. Dev. 2015, 23, 41–54. [Google Scholar] [CrossRef]

- Food and Agriculture Organization (FAO). The State of Food Insecurity in the World 2011, Policy Options to Address Price Volatility and High Prices. Available online: http://www.fao.org/docrep/014/i2330e/i2330e05.pdf (accessed on 7 September 2016).

- African Development Bank (AfDB). AfDB Gender Strategy (2014–2018); AfDB: Tunis, Tunisia, 2014. [Google Scholar]

- Ayodeji, A.; Ajibola, C.; Oladipo Akogun, E.; Owoniyi Adebayo, C.; Shaba, M.; Mercy, N.; Halimat, S.; Hamdalat Opeyemi, J. Gender Differentials among Subsistence Rice Farmers and Willingness to undertake Agribusiness in Africa: Evidence and Issues from Nigeria. Afr. Dev. Rev. 2017, 29, 198–212, No. S2. [Google Scholar]

- Federal Office of Statistics (FOS). Geography of Federal Republic of Nigeria; FOS: Malaysia, Vietnam, 1989. [Google Scholar]

- World Bank. Project Appraisal Document on a Proposed Credit for Transforming Irrigation Management in Nigeria Project; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Food and Agriculture Organization (FAO). How to Feed the World in 2050, High Level Expert Forum-Office of the Director, Agricultural Development Economics Division Economic and Social Development Department Viale delle Terme di Caracalla, 00153 Rome, Italy. 2009. Available online: http://www.fao.org/fileadmin/templates/wsfs/docs/Issues_papers/HLEF2050_Investment.pdf (accessed on 7 September 2016).

- National Bureau of Statistics (NBS). National Bureau of Statistics Report on Nigerian Population Estimate as at 2013. Available online: http://www.nigerianstat.gov.ng/pdfuploads/2014%20Statistical%20Report%20on%20Women%20and%20Men%20in%20Nigeria_.pdf (accessed on September 2016).

- Nigerian Meteorological Agency (NIMET). Nigerian Meteorol Agency Report; NIMET: Kaduna, Nigeria, 2008. [Google Scholar]

- Phillips, S.J.; Anderson, R.P.; Schapire, R.E. Maximum entropy modeling of species geographic distributions. Ecol. Model. 2006, 190, 231–259. [Google Scholar] [CrossRef] [Green Version]

- Schroth, G.; Laderach, P.; Dempewolf, J.; Philpott, S.M.; Haggar, J.P.; Eakin, H.; Castillejos, T.; Garcia-Moreno, J.; Soto-Pinto, L.; Hernandez, R.; et al. Towards a climate change adaptation strategy for coffee communities and ecosystems in the Sierra Madre de Chiapas, Mexico. Mitig. Adapt. Strateg. Glob. Chang. 2009, 14, 605–625. [Google Scholar] [CrossRef] [Green Version]

- Rahn, E.; Laderach, P.; Baca, M.; Cressy, C.; Schroth, G.; Malin, D.; van Rikxoort, H.; Shriver, J. Climate change adaptation and mitigation in coffee production: Where are the synergies? Mitig. Adapt. Strateg Glob. Chang. 2014. [Google Scholar] [CrossRef]

- Laderach, P.; van Asten, P. Coffee and climate change. Coffee suitability in East Africa. In Proceedings of the 9th African Fine Coffee Conference and Exhibition, Addis Ababa, Ethiopia, 16–18 February 2012. [Google Scholar]

- Laderach, P.; Martinez, A.; Schroth, G.; Castro, N. Predicting the future climatic suitability for cocoa farming of the world’s leading producer countries, Ghana and Côte d’Ivoire. Clim. Chang. 2013, 119, 841–854. [Google Scholar] [CrossRef]

- Guardian. Much ado about Nigeria’s Dwindling Coffee Cultivation Level. Guardian Newspapers. 2019. Features Report By Gbenga Akinfenwa on 06 January 2019. Available online: https://guardian.ng/features/agro-care/much-ado-about-nigerias-dwindling-coffee-cultivation-level/ (accessed on 15 March 2019).

- Hijmans, R.J.; Cameron, S.E.; Parra, J.L.; Jones, P.G.; Jarvis, A. Very high resolution interpolated climate surfaces for global land areas. Int. J. Climatol. 2005, 25, 1965–1978. [Google Scholar] [CrossRef]

- Lobo, J.M.; Tognelli, M.F. Exploring the effects of quantity and location of pseudo-absences and sampling biases on the performance of distribution models with limited point occurrence data. J. Nat. Conserv. 2011, 19, 1–7. [Google Scholar] [CrossRef]

- Barbet-Massin, M.; Jiguet, F.; Albert, C.H.; Thuiller, W. Selecting pseudo-absences for species distribution models: How, where and how many? Methods Ecol. Evol. 2012, 3, 327–338. [Google Scholar] [CrossRef]

- Schroth, G.; Läderach, P.; Blackburn, D.S.B.; Neilson, J.; Bunn, C. Winner or loser of climate change? A modeling study of current and future climatic suitability of Arabica coffee in Indonesia. Reg. Environ. Chang. 2015, 15, 1473–1482. [Google Scholar] [CrossRef]

- Liu, C.; White, M.; Newell, G. Selecting thresholds for the prediction of species occurrence with presence-only data. J. Biogeogr. 2013, 40, 778–789. [Google Scholar] [CrossRef]

- Kenen, P.B.; Rodrik, D. Measuring and Analysing the Effects of Short-term Volatility in Real Exchange Rate. Rev. Econ. Stat. 1986, 68, 311–315. [Google Scholar] [CrossRef]

- Bailey, M.; George, T.; Micheal, U. Exchange Rate Variability and Trade Performance: Evidence for the Big Seven Industrial Countries. Weltwirlschaftliches Archiv. 1986, 1, 467–477. [Google Scholar] [CrossRef]

- Peree, E.; Steineir, A. Exchange Rate Uncertainty and Foreign Trade. Eur. Econ. Rev. 1989, 33, 1241–1264. [Google Scholar] [CrossRef]

- Côté, A. Exchange Rate Volatility and Trade: A Survey. In Bank of Canada. Working Paper; Bank of Canada: Ottawa, ON, Canada, 1994; pp. 94–95. Available online: https://www.bankofcanada.ca/wp-content/uploads/2010/04/wp94-5.pdf (accessed on 15 March 2019).

- McKenzie, M.; Brooks, R.D. The impact of ERV on German-U.S Trade Flows. J. Int. Financ. Mark. Inst. Money 1997, 7, 73–87. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of UK Inflation. Econometrica 1982, 50, 987–1008. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized Autoregressive Conditional Heteroscedasticity. J. Econom. 1986, 6, 307–327. [Google Scholar] [CrossRef]

- Yinusa, D.O. Between dollarization and Exchange Rate Volatility: Nigeria’s Portfolio Diversification Option. J. Policy Model. 2008, 30, 811–826. [Google Scholar] [CrossRef]

- Akpokodje, G. Exchange rate volatility and External Trade: The Experience of Selected African Countries. In Applied Econometrics and Macroeconomic Modelling in Nigeria; Adeola, A., Dipo, B., Olofin, S., Eds.; Ibadan University Press: Ibadan, Nigerija, 2009; pp. 79–87. [Google Scholar]

- Olowe, R.A. Modelling Naira/Dollar Exchange Rate Volatility: Application of GARCH and Assymetric Models. Int. Rev. Bus. Res. Pap. 2009, 5, 377–398. [Google Scholar]

- Phillips, P.C.B.; Hansen, B.E. Statistical inference in instrumental variables regression with I (1) processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Philips, P.C.B.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 73, 335–346. [Google Scholar] [CrossRef]

- Abdul, Q.K.; Naima, S.; Syeda, T.F. Financial development, income inequality, and CO2 emissions in Asian countries using STIRPAT model. Environ. Sci. Pollut. Res. 2018, 25, 6308–6319. [Google Scholar] [CrossRef]

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- Ahmed, K.; Shahbaz, M.; Qasim, A.; Long, W. The linkages between deforestation, energy and growth for environmental degradation in Pakistan. Ecol. Indic. 2015, 49, 95–103. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I. The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 2015, 84, 382–389. [Google Scholar] [CrossRef]

- Bello, A.K.; Abimbola, O.M. Does the level of economic growth influence environmentalquality in Nigeria: A test of environmental Kuznets curve (EKC) hypothesis. Pak. J. Soc. Sci. 2010, 7, 325–329. [Google Scholar]

- Dogan, E.; Turkekul, B. CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 2016, 23, 1203–1213. [Google Scholar] [CrossRef]

- Fan, Y.; Liu, L.C.; Wu, G.; Wei, Y.M. Analyzing impact factors of CO2 emissions using STIRPAT model. Environ. Impact Assess. Rev. 2006, 26, 377–395. [Google Scholar] [CrossRef]

- Farhani, S.; Ozturk, I. Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ. Sci. Pollut. Res. 2015, 22, 15663–15676. [Google Scholar] [CrossRef] [PubMed]

- Islam, F.; Shahbaz, M.; Alam, M. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. In MPRA Paper 28403; University Library of Munich: Munch, Germany, 2011. [Google Scholar]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Azam, M.; Khan, A.Q.; Bakhtyar, B.; Emirullah, C. The causal relationship between energy consumption and economic growth in the ASEAN-5 countries. Renew. Sustain. Energy Rev. 2015, 47, 732–745. [Google Scholar] [CrossRef]

- Lau, L.S.; Choong, C.; Eng, Y.K. Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: Do foreign direct investment and trade matter? Energy Policy 2014, 68, 490–497. [Google Scholar] [CrossRef]

- Lin, S.; Zhao, D.; Marinova, D. Environmental impact of China: Analysis based on the STIRPAT model. In Proceedings of the Second International Association for Energy Economics (IAEE) Asian Conference, Perth, Australia, 5–7 November 2008; Cabalu, H., Marinova, D., Eds.; Curtin University of Technology: Perth, Australia, 2008; pp. 164–192. [Google Scholar]

- Ozturk, I.; Acaravci, A. The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 2013, 36, 262–267. [Google Scholar] [CrossRef]

- Acaravci, A.; Ozturk, I. On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 2010, 35, 5412–5420. [Google Scholar] [CrossRef]

- Saboori, B.; Soleymani, A. CO2 emissions, economic growth and energy consumption in Iran: A cointegration approach. Int. J. Environ. Sci. 2011, 2, 44–53. [Google Scholar]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mutascu, M.; Azim, P. Environmental Kuznets curve in Romania and the role of energy consumption. Renew. Sustain. Energy Rev. 2013, 18, 165–173. [Google Scholar] [CrossRef] [Green Version]

- Hahbazm, O.I.; Afza, T.; Ali, A. Revisiting the environmental Kuznets curve in a global economy. Renew. Sustain. Energy Rev. 2013, 25, 494–502. [Google Scholar] [Green Version]

- Shahbaz, M.; Hye, Q.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Ziaei, S.M. Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew. Sustain. Energy Rev. 2015, 42, 752–759. [Google Scholar] [CrossRef]

- Yusuf, S.A.; Yusuf, W.A. Determinants of selected agricultural export crops in Nigeria: An ECM approach. In Proceedings of the African Association of Agricultural Economists, Abuja Nigeria, 23–26 September 2007; pp. 469–472. [Google Scholar]

- Cashin, P.; Céspedes, L.; Sahay, R. Commodity Currencies and the Real Exchange Rate. J. Dev. Econ. 2004, 75, 239–268. [Google Scholar] [CrossRef]

- Musunuru, N. Testing the presence of calendar anomalies in agricultural commodity markets. Reg. Bus. Rev. 2013, 32, 32–47. [Google Scholar]

- Kalu, C. Impact of Climate Variability and Change on Supply of Grain in Nigeria from 1961–2012. Unpublished Ph.D. Dissertation, Department of Agribusiness and Management, Michael Okpara University of Agriculture, Umudike, Abia State, Nigeria, 2015; pp. 28–45. [Google Scholar]

- Lloyd, T.A.; McCorriston, S.; Morgan, C.W.; Zgovu, E. The Experience of Food Price Inflation across the EU. In TRANSFOP; Working Paper No.5, TRANSFOP Project, EU 7th Framework Programme, Grant Agreement No. KBBE-265601-4-TRANSFOP; 2014; Available online: http://www.transfop.eu/ (accessed on 7 September 2016).

- Ayinde, O.E.; Ojehomon, V.E.T.; Daramola, F.S.; Falaki, A.A. Evaluation of the effects of climate change on rice production in Niger State, Nigeria. Ethiop. J. Environ. Stud. Manag. 2013, 6, 763–773. [Google Scholar] [CrossRef]

| Authors | Region | Period | Methods |

|---|---|---|---|

| [41] | Asian Countries | 1980-2014 | FMOLS |

| [42] | Pakistan | 1988–2011 | VAR, ARDL, and VECM |

| [43] | Pakistan | 1980–2013 | ARDL and VECM |

| [44] | 14 MENA countries | 1996–2012 | FMOLS |

| [45] | Nigeria | 1980–2008 | ARDL and VECM |

| [46] | USA | 1960–2010 | VAR and ARDL |

| [47] | China | 1975–2000 | STIRPAT model |

| [48] | Tunisia | 1971–2012 | ARDL and ECM |

| [49] | Malaysia | VECM Model | |

| [50] | China | 1953–2006 | ARDL |

| [51] | South Asia | 1975–2011 | Co-integration test and Granger causality test |

| [52] | Malaysia | 1970–2008 | Bounds test and Granger causality |

| [53] | China | 1978–2006 | STIRPAT model + |

| [54] | Turkey | 1960–2007 | F test |

| [55] | Turkey | 1968–2005 | VAR |

| [56] | Iran | 1971–2007 | ARDL |

| [57] | 22 emerging countries | 1990–2006 | GMM |

| [58,59] | South Africa | 1965–2008 | ARDL |

| [60] | Indonesia | 1975Q1–2011Q4 | ARDL VECM IAA |

| [61] | 13 European and 12 East Asia and Oceania countries | 1989–2011 | PVAR |

| Phillips-Perron Test | |||

|---|---|---|---|

| Variable | Level | 1st Difference | Order of Integration |

| Climate change | |||

| Rainfall | −5.045133 (0.0001) | I(0) | |

| Temperature | −4.260020 (0.0013) | I(0) | |

| Commodity prices | |||

| Coffee | −2.565541 (0.1064) | −8.338275 (0.0000) | I(1) |

| Output (production) | |||

| Coffee | −5.406997 (0.0000) | I(0) | |

| Output (Yield) | |||

| Coffee | −2.724048 (0.0766) | I(0) | |

| Others | |||

| Real Exchange rate | 1.310611 (0.9984) | −6.287971 (0.0000) | I(1) |

| Trade openness | −3.007864 (0.1396) | −9.084742 (0.0000) | I(1) |

| Inflation rate | −3.243140 (0.0228) | I(0) |

| Heteroskedasticity Test: ARCH | |||

| F-statistic | 4262.971 | Prob. F(1,657) | 0.0000 |

| Obs*R-squared | 570.9989 | Prob. Chi-Square(1) | 0.0000 |

| GARCH = C(4) + C(5) × RESID(−1)2 | ||||

| Variable | Coefficient | Std. Error | z-Statistic | Prob. |

| Intercept | 2.420292 | 0.226604 | 10.68073 *** | 0.0000 |

| Rainfall | −0.000204 | 0.000196 | −1.041463 | 0.2977 |

| Temperature | 0.010139 | 0.008497 | 1.193291 | 0.2328 |

| Variance Equation | ||||

| C | 0.036791 | 0.006877 | 5.349758 *** | 0.0000 |

| RESID(−1)2 | 1.016783 | 0.120992 | 8.403714 *** | 0.0000 |

| R-squared | −0.025073 | Mean dependent var | 2.458062 | |

| Adjusted R-squared | −0.028193 | S.D. dependent var | 1.303766 | |

| S.E. of regression | 1.322017 | Akaike info criterion | 2.611361 | |

| Sum squared resid | 1148.258 | Schwarz criterion | 2.645394 | |

| Log-likelihood | −856.7493 | Hannan-Quinncriteria. | 2.624552 | |

| Durbin-Watson stat | 0.030283 | |||

| Dependent variable | Coffee Yield | |

|---|---|---|

| Independent variables | Coefficient | Standard Error |

| Intercept | −59,997.33 (−2.486005) | 24,134.030 |

| Trend | 129.0227 (5.134969) *** | 25.126 |

| Rainfall | −0.001484 (−0.617369) | 0.002 |

| Temperature | 204.0113 (2.638827) * | 77.311 |

| Commodity price | 28,474.40 (3.174368) *** | 8970.099 |

| Inflation | 0.757708 (0.079467) | 9.535 |

| Trade openness | 94.24276 (3.364582) *** | 28.011 |

| Real exchange rate | 11.32584 (2.095428) ** | 5.405 |

| Rainfall with commodity price | 0.002371 (3.003671) *** | 0.001 |

| Temperature with commodity price | −95.73729 (−3.297216) *** | 29.036 |

| R-squared | 0.94 | |

| Adjusted R-squared | 0.92 | |

| Jarque Bera Statistic | 0.100 | |

| Engle-Granger tau-statistic | −7.076 *** | |

| Long Run Variance | 698472.1 | |

| Remark on Correlogram of Residuals Squared | Not significant at 10% | |

| Mean dependent var | 8092.722 | |

| Dependent Variable | Coffee Production | |||

|---|---|---|---|---|

| Independent Variables | Coefficient | Standard Error | Coefficient | Standard Error |

| Intercept | −1,561,618 (−1.821641) * | 857,259.1 | −2905.669 (−2.419072) ** | 1201.150 |

| Trend | 274.5286 (0.341982) | 802.757 | 0.038157 (2.813904) *** | 0.014 |

| Rainfall | −0.077223 (−0.959398) | 0.081 | 6.27 × 10−6 (2.093096) ** | 3.00E-06 |

| Temperature | 5805.777 (2.128044) ** | 2728.222 | −1.919630 (−2.466962) ** | 0.778 |

| Commodity price | 905,802.5 (2.133219) ** | 424617.6 | −616.4039 (−2.446665) ** | 251.936 |

| Inflation | 434.9243 (1.320889) | 329.266 | 0.002577 (0.054020) | 0.048 |

| Trade openness | 2280.705 (2.349205) ** | 970.841 | 0.062987 (3.438604) *** | 0.018 |

| Real exchange rate | 567.4082 (2.767124) *** | 205.053 | −0.331229 (−3.195231) *** | 0.104 |

| Rainfall with commodity price | 0.175076 (4.080897) *** | 0.043 | −3.985003 (−1.589991) | 2.506 |

| Temperature with commodity price | −3328.699 (−2.426696) ** | 1371.7 | 620.0767 (2.456328) ** | 252.441 |

| R-squared | 0.36 | |||

| Adjusted R-squared | 0.21 | |||

| Jarque Bera Statistic | 6.014 | |||

| Engle-Granger tau-statistic | −6.575 ** | |||

| Long Run Variance | 0.041624 | |||

| Remark on Correlogram of Residuals Squared | Significant at 1% | |||

| Mean dependent var | 8.046639 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

|---|---|---|---|

| The coffee output does not Granger Cause Rainfall | 53 | 0.22433 | 0.7999 |

| Rainfall does not Granger Cause coffee output | 0.19904 | 0.8202 | |

| The coffee output does not Granger Cause Temperature | 53 | 3.05113 * | 0.0566 |

| Temperature does not Granger Cause coffee output | 1.06039 | 0.3543 | |

| Temperature does not Granger Cause D(coffee commodity price) | 52 | 0.04543 | 0.9556 |

| D(commodity price) does not Granger Cause Temperature | 0.38295 | 0.6840 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oko-Isu, A.; Chukwu, A.U.; Ofoegbu, G.N.; Igberi, C.O.; Ololo, K.O.; Agbanike, T.F.; Anochiwa, L.; Uwajumogu, N.; Enyoghasim, M.O.; Okoro, U.N.; et al. Coffee Output Reaction to Climate Change and Commodity Price Volatility: The Nigeria Experience. Sustainability 2019, 11, 3503. https://doi.org/10.3390/su11133503

Oko-Isu A, Chukwu AU, Ofoegbu GN, Igberi CO, Ololo KO, Agbanike TF, Anochiwa L, Uwajumogu N, Enyoghasim MO, Okoro UN, et al. Coffee Output Reaction to Climate Change and Commodity Price Volatility: The Nigeria Experience. Sustainability. 2019; 11(13):3503. https://doi.org/10.3390/su11133503

Chicago/Turabian StyleOko-Isu, Anthony, Agnes Ugboego Chukwu, Grace Nyereugwu Ofoegbu, Christiana Ogonna Igberi, Kennedy Okechukwu Ololo, Tobechi Faith Agbanike, Lasbrey Anochiwa, Nkechinyere Uwajumogu, Michael Oguwuike Enyoghasim, Uzoma Nnaji Okoro, and et al. 2019. "Coffee Output Reaction to Climate Change and Commodity Price Volatility: The Nigeria Experience" Sustainability 11, no. 13: 3503. https://doi.org/10.3390/su11133503

APA StyleOko-Isu, A., Chukwu, A. U., Ofoegbu, G. N., Igberi, C. O., Ololo, K. O., Agbanike, T. F., Anochiwa, L., Uwajumogu, N., Enyoghasim, M. O., Okoro, U. N., & Iyaniwura, A. A. (2019). Coffee Output Reaction to Climate Change and Commodity Price Volatility: The Nigeria Experience. Sustainability, 11(13), 3503. https://doi.org/10.3390/su11133503