Review of Empirical Studies on the Relationship between IPRs and Agricultural Innovations and Productivity

Plant breeders’ rights (PBRs) are a form of intellectual property rights (IPRs) that provide exclusive rights to the breeder so they can benefit from their innovations. This means the breeder has protection from unauthorized imitation of the protected variety for commercial purposes by competitors and farmers. Furthermore, investments in agricultural innovations such as varietal improvements are motivated by objectives of acquiring and growing market share by breeders [

12]. For example, the main factors that contribute to the growth in private agricultural R&D investments include increased demand for modern agricultural inputs driven by increased demand for food and fiber, incentives stimulated by policy reforms that deregulated agricultural input sectors and the strengthening of IPRs that help protect innovations from being imitated without permission [

13,

14,

15]. Overall, the strengthening of the IPRs for plant varieties is expected to provide incentives for breeding companies to invest more resources in plant breeding. The strengthening of IPRs for plants is expected to result in an increased release of improved crop varieties and technologies that positively contribute to enhancing agricultural productivity and economic growth [

5,

6].

Despite the incentives presented for promoting IPRs for plants, the development of new plant innovations requires access to existing genetic material. The restrictions on access to existing genetic material presented by IPRs in plant varieties may affect breeding programs, although there may be legislative exceptions that provide access to such material for R&D purposes [

5]. The protection from the IPRs can lead to high concentration and creation of monopolistic actors in seed input markets that adversely impact local innovations, market development and productivity [

8,

11]. On the contrary, Wright and Pardey [

16] argue that since the diffusion of IPRs across the world, developments in scientific innovations (rather than IPRs) have contributed to yield improvements.

The impact pathway of the effects of IPRs on productivity is indirectly observed and may be difficult to isolate. Most of the research on effects of IPRs focus on their impacts on agricultural innovations, and there is limited empirical evidence on the relationship between IPRs and productivity [

5]. This means research on the effects of IPRs on wheat productivity provides an important contribution to empirical knowledge in this field. Empirical research on the relationship between IPRs, varietal innovations, agricultural productivity, trade and economic growth have produced mixed results. Some of the empirical findings are briefly discussed below. Using a panel of countries and data from the years 1961 to 2011, Campi [

5] assessed the effects of strengthening intellectual property (IP) protection on agricultural productivity. The effect of strengthening IP rights (IPRs) on both wheat and maize was explored using an index of IP protection for plant varieties. Empirical results found that for middle-income countries such as South Africa, the relationship between stronger IPRs and cereal productivity (wheat and maize) was insignificant. This was contrary to the same relationship in high- and low-income countries. The implications for these results is that variety IP protection may not have positively impacted on commercial wheat productivity in South Africa.

Spielman and Ma [

17] applied an Arellano–Bond linear dynamic panel data estimation approach using a data set of six major crops to assess the effect of IPRs on yield growth through stimulating incentives for investments by the private sector in varietal improvements. The findings from the study showed that despite the effects being crop-specific, different forms of IPRs (biological and legal) contributed to the reduction of the gap in yields between developing and developed countries. In a separate study, Payumo et al. [

18] analyzed the effect of strengthening IPRs systems in Trade-Related Aspects of Intellectual Property Rights (TRIPS) member countries on agricultural gross domestic product (GDP) for the period of 1980–2005. The two variables were found to be positively related in both developed and developing countries.

Pray and Nagarajan [

19] found that in India, strengthened IPRs allowing innovators to patent their innovation positively impacted on private agricultural research. Flister and Galushko [

20] argue that introduction of the PVP Law in Brazil stimulated private investments in wheat R&D and the establishment of a strong private wheat breeding sector. These results indicate that strengthening IPRs systems would contribute to stimulating private sector investments in agricultural R&D.

Kolady and Lesser [

21] analyzed the impacts of the implementation of PVP to crop productivity in Washington State of the United States. The findings from this study showed that PVPs had a positive relationship with private investments in open pollinated crops (such as wheat). Additionally, implementation of PVPs resulted in an increased number of high yielding varieties of these crops that were released from both private and public breeding programs. The authors extended the implications from their analysis as important lessons for developing countries on how IPRs for plants and their Trade-Related Aspects of Intellectual Property Rights (TRIPS) commitments can affect both the release of high yielding varieties and private sector investments.

Naseem et al. [

7] examined the effects of PVP and cotton yields in the United States. The empirical findings found that PVP contributed to the development of more cotton varieties and had a positive impact on yields. The results contrasted the criticism that PVP was more than a marketing tool with insignificant impacts on agricultural productivity.

Knudson and Pray [

22] analyzed the impacts of the Plant Variety Protection Act of 1970 (PVPA) on public sector research priorities of five crops (corn, wheat, sorghum, cotton and soybeans) in the United States. The empirical regression results showed social benefits from public research investments were important in directing research priorities. Furthermore, the results showed some support that new income opportunities provided by the PVPA influenced the direction of public research. Similarly, for the current research, the expectation was that granting of PBRs and a stronger IPRs environment would stimulate further investments in wheat varietal improvements and the release of improved varieties that would contribute to improved productivity.

Tripp et al. [

6] examined the effects of PVP systems in five developing countries (China, Colombia, India, Kenya and Uganda). The findings from the study showed that PVP systems were inadequate for stimulating development of commercial seed development. The authors argued that to be effective, PVP systems should be framed within broader seed system development strategies. Léger [

23] investigated the role IPRs in the Mexican maize breeding industry. The empirical results indicated that IPRs had no role in the industry and did not stimulate innovation as expected. The author argued for revision of the IPRs theory to integrate country characteristics such as quality of the institutional environment and role of transaction all important for well-functioning IPR systems. Considering these factors is expected to result in IPRs systems contributing even a small role in developing countries.

Dosi et al. [

24] analyzed the relations between appropriability, opportunities and rates of innovation. The evidence from the study suggested that IPRs were not a very important mechanism for breeding firms to earn profits from their innovation. Based on the findings, the authors highlighted that, at best, IPRs have no impact, or could have negative impacts on rates of innovation. The authors argued that each technology paradigm was more important in determining technology- and industry-specific patterns of innovation.

Alston and Venner [

25] analyzed the effects of the PVP Act (PVPA) of 1970 in the United States on the wheat genetic improvement. The PVPA was expected to strengthen IP protection for plant breeders, stimulate investments in varietal R&D and improve varietal quality and enhance royalties. The empirical results found that the PVPA contributed to increased public investments (and not private sector investments) in wheat varietal improvement. The results on the impacts of the PVPA on experimental and commercial wheat yields was negative. The authors found that the PVPA did not have much impact on excludability in wheat varieties.

Campi and Duenas [

11] explored the effects of IPRs on agricultural trade for the period of 1995 to 2011 using an IPRs index for 60 countries since the signing of the TRIPS agreement. Various econometric methods were used on panel data of the 60 countries, comprising 28 developed countries and 32 developing countries. The results showed that strengthening IPRs does not have a clear cut relationship with an increase in trade volumes. The authors found a negative relationship between stronger IPRs and trade volumes for imports and exports of agricultural products. In addition, the estimated gravity model predicted negative effects of IP protection on total bilateral trade for both importers and exporters in developing countries. Strengthening IPRs systems in exporting countries had a negative effect on the probability of creating new trade partners in developing countries. On the other hand, strengthening IPRs protection in importing countries had a positive effect on the probability of finding new trade partners for the samples that included developing countries. Overall, the authors found that strengthening IPRs has a negative effect on agricultural trade since the signing of the TRIPS agreement, mainly in developing countries

Zhou and Sheldon [

26] analysed the relevance of trade of agricultural seeds and its sensitivity to the levels of intellectual property rights of a country. The authors further investigated the role of IPRs in terms of seed transfer through trade, asking the questions of whether IPRs promote access to seeds or not. The IPRs variables were included in the modified gravity model as trade distortions on seed trade between the U.S. and other countries. Specifically, relevant international agreements on IPRs (UPOV and World Trade Organisation (WTO)) were considered as membership dummies. The results showed that the U.S. WTO-TRIPS membership has a significant positive impact on seed exports, suggesting that seed trade is positively affected by implementation of the TRIPS agreement.

Sweet and Eterivic [

27] examined the effects of patent rights (intellectual property rights systems) on total factor productivity. The authors applied a dynamic panel regression for 70 countries for the period 1965 to 2009. The results showed that stronger patents rights were insignificant for agricultural productivity growth in developing and industrialized countries. Over the period of analysis, the results showed that growth in productivity cannot be attributed to patent rights. The authors argued that patent rights were not a good proxy for technological progress as they can only cover patentable innovation. The authors also found that patent rights were irrelevant to productivity. From this study, improving and upgrading productivity does not depend on the organization of private rights or the extension of their monopoly power.

Gold et al [

28]. examined the questionable issue on the positive impact of IPRs on economic growth in developed and developing countries. In the study, an index was used to assess the strength of IP protection in 124 countries for the period 1995 to 2011. They also examined the relationship between IP protection and GDP per capita in detail. The results show that the assumptions that higher levels of IP protection lead to increased economic growth is misleading and conflicting. Much of the problem arises from the way IP protection is measured through laws and formal IP, while not measuring the actual IP practiced in the countries. The authors found that increased levels of formal IP protections lead to economic growth in lower-middle-income countries through the encouragement of high levels of IP-rich imports and the boosting of domestic levels of innovative activities. For higher lower-middle-income countries, higher levels of IP protection encouraged IP-rich imports but not domestic innovation. Finally, on the relationship between IP protection and GDP per capita, political influence was found to be much stronger than economic influence.

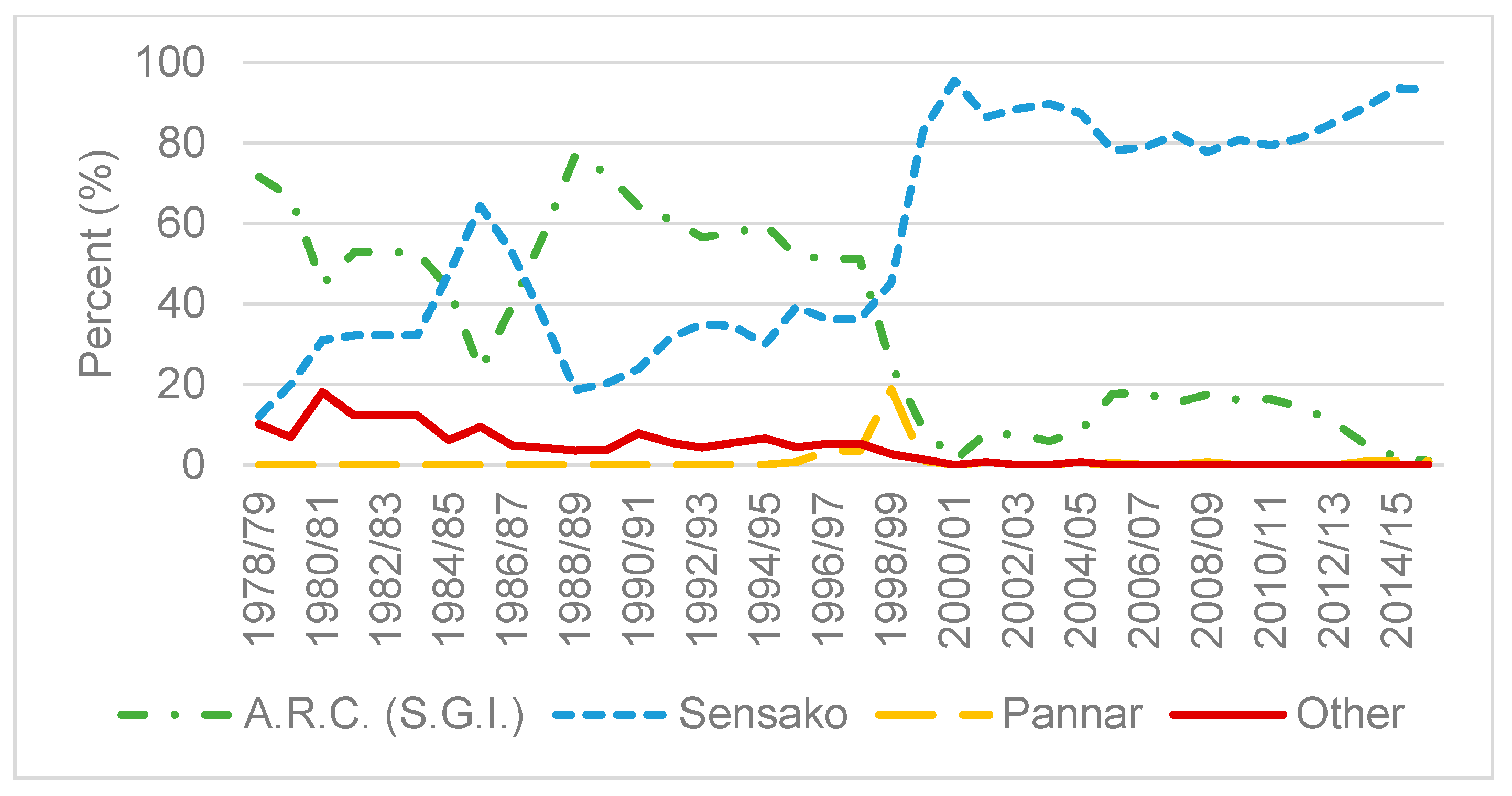

In line with all the literature highlighted above, all studies showed the different relationships of IPR systems on innovation, productivity and yields. Many authors found mixed results in these relationships. This study aims to show the relationship and status of intellectual property rights systems in South Africa. South Africa and Kenya are the only countries in Africa who are members of UPOV. South Africa has a well-established PBR system that has not been thoroughly analyzed. This study seeks to further analyze the relationship of IPRs systems on productivity and varietal release in South Africa, focusing on the wheat breeding program. This brings the African status of IPRs systems to the body of knowledge.

Based on this review of literature and findings presented above, we expect the strengthened PBRs and IPRs environment to have positive effects on varietal improvements and productivity in South Africa and proposed the following hypotheses:

Hypothesis 1 (H1). Strengthening plant breeders’ rights in South Africa increased investments and the release of improved wheat varieties.

Hypothesis 2 (H2). Strengthening plant breeders’ rights in South Africa positively and significantly impacted wheat productivity.

The discussion above indicates that the empirical research on the effects of IPRs for plants on varietal innovations and crop productivity are mixed. Some of the contributing factors to the mixed findings may include country specific characteristics (such as institutional environment), the technologies being considered and imperfect data. Campi [

5] argues that IPRs systems may be the result and not the cause of innovation and improvements in productivity. There is need for further empirical research to explore the relationship between IPRs systems in different country contexts and sectors. The current study contributes to the growing knowledge in the field of IPRs systems through analyzing the effects of plant breeders’ rights in the South African wheat sector on the release of new high yielding varieties and wheat productivity. The proposed hypotheses above are empirically tested below.