Public and Private Infrastructure Investment and Economic Growth in Pakistan: An Aggregate and Disaggregate Analysis †

Abstract

1. Introduction

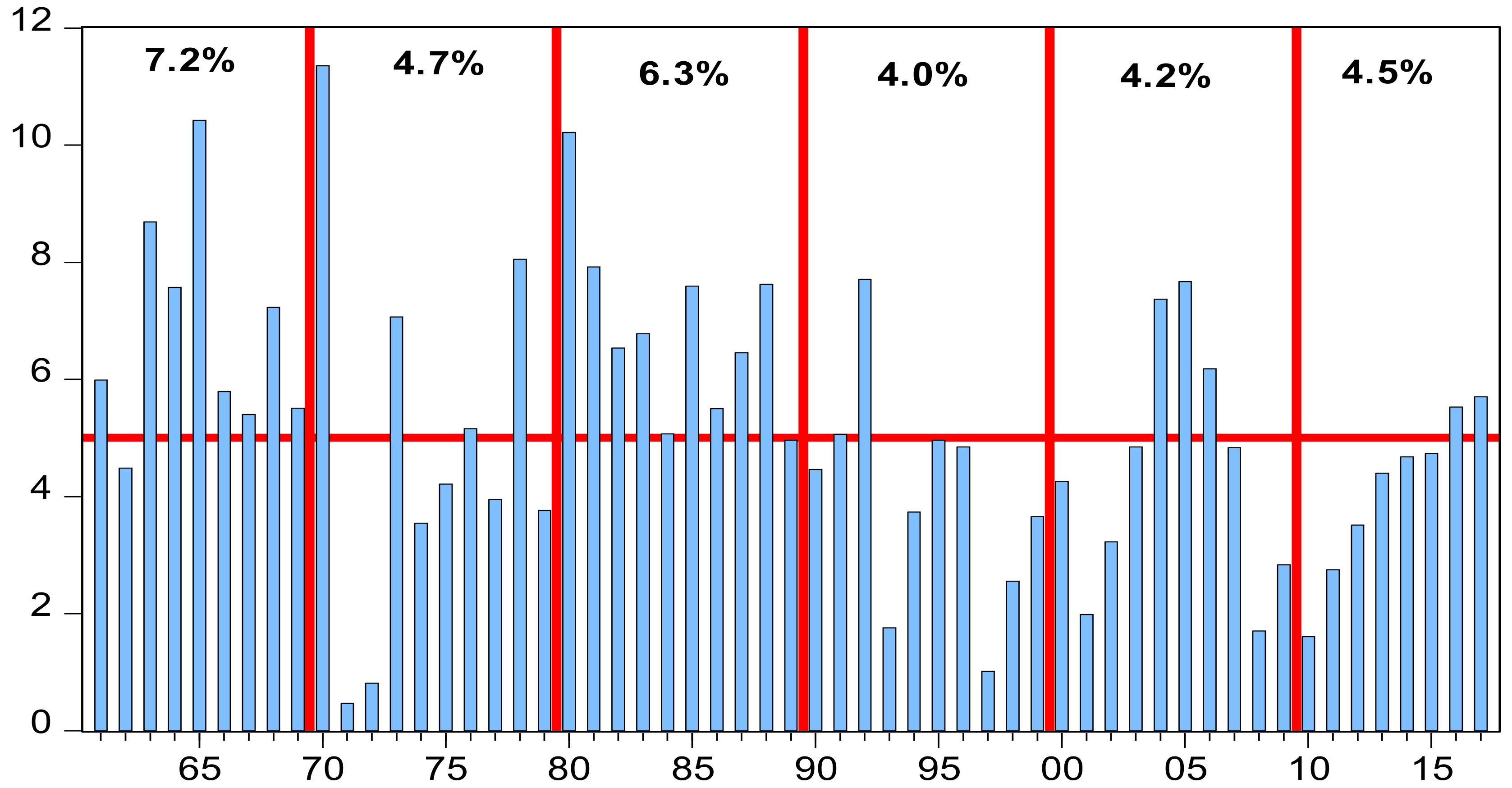

2. Overview of Economic Growth and Infrastructure in Pakistan

3. Infrastructure and Economic Growth

3.1. Direct Channel

3.2. Indirect Channels

3.2.1. Adjustment Cost

3.2.2. Labor Productivity

3.2.3. The Durability of Private Capital

3.2.4. Public versus Private Investment and Economic Growth

4. Model and Econometric Technique

Empirical Strategy

5. Results

5.1. Unit Root Test and Structural Breaks

5.2. Coinegration Test

5.3. Growth Impacts of Aggregate Infrastructure Investment

| Whole Economy | Industrial | Agricultural | Services | |||||

|---|---|---|---|---|---|---|---|---|

| Capital Stock | 0.03 (0.67) | 0.08 b (2.30) | −0.02 (−0.28) | −0.01 (−0.13) | −0.03 (−1.20) | −0.01 (−1.42) | 0.21 c (5.70) | 0.12 c (3.42) |

| Human Capital | 0.21 c (3.01) | 0.45 c (9.63) | 0.28 (2.47) b | 0.34 c (3.47) | 0.49 c (6.91) | 0.29 c (10.1) | 0.28 c (4.15) | 0.25 c (4.98) |

| Aggregate Infra | 0.19 c (6.97) | 0.32 c (4.83) | 0.11 c (2.96) | 0.06 b (2.58) | ||||

| Public | 0.08 c (9.87) | 0.17 c (5.06) | 0.07 c (10.8) | 0.06 c (5.0) | ||||

| Private | 0.003 (0.45) | 0.06 b (2.09) | 0.12 c (13.4) | −0.04 b (−2.84) | ||||

| Constar | 6.95 c (7.99) | 4.89 c (9.49) | 4.48 c (3.54) | 4.51 c (4.02) | 4.20 c (7.58) | 5.92 c (4.78) | 5.62 c (6.32) | 7.30 c (9.55) |

| Trend | −0.01 (−3.09) | 0.01 c (7.76) | 0.02 c (8.67) | 0.01 c (8.27) | 0.0c (10.1) | |||

| Structural Break | 0.05 c (3.02) | 0.09 c (6.53) | 0.07 b (2.29) | 0.07 b (2.48) | −0.11 c (−4.43) | −0.01 (−1.38) | 0.06 c (3.65) | 0.0a (1.88) |

| R2 | 0.97 | 0.96 | 0.97 | 0.97 | 0.89 | 0.96 | 0.96 | 0.97 |

| Adj R2 | 0.96 | 0.96 | 0.97 | 0.97 | 0.88 | 0.95 | 0.96 | 0.96 |

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variable Name | Definition |

|---|---|

| Gross Domestic Product (GDP) | Constant Price |

| Industrial GDP (Rs Million) | Constant Price |

| Agriculture GDP (Rs Million) | Constant Price |

| Services Sector GDP (Rs Million) | Constant Price |

| Capital Stock a (Rs Million) | Gross fixed capital formation (Constant Price) |

| Human Capital (in Million) | Total number of pupils enrolled at secondary level in public and private school |

| Labor Force (in Million) | |

| Aggregate infrastructure Investment (Rs Million) | Sum of gross fixed capital formation of public and private sector in electricity generation distribution, gas distribution, and transport and communication |

| Public Infrastructure Investment (Rs Million) | Sum of gross fixed capital formation of public sector in electricity generation distribution, gas distribution, and transport and communication |

| Private Infrastructure Investment (Rs Million) | Sum of gross fixed capital formation of private sector in electricity generation distribution, gas distribution, and transport and communication |

| Investment in Energy sector (Rs Million) | sum of public and private investment in electricity generation distribution, gas distribution |

| Investment in Transport and telecommunication (Rs Million) | Sum of public and private investment in and transport communication. |

References

- Agénor, P.R.; Moreno-Dodson, B. Public Infrastructure and Growth: New Channels and Policy Implications; The World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Sahoo, P.; Dash, R.K. Infrastructure development and economic growth in India. J. Asia Pac. Econ. 2009, 14, 351–365. [Google Scholar] [CrossRef]

- Aschauer, D.A. Does public capital crowd out private capital? J. Monet. Econ. 1989, 24, 171–188. [Google Scholar] [CrossRef]

- Holtz-Eakin, D.; Schwartz, A.E. Spatial productivity spillovers from public infrastructure: Evidence from state highways. Int. Tax Public Financ. 1995, 2, 459–468. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Pinnoi, N. Public capital stock and state productivity growth: Further evidence from an error components model. Empir. Econ. 1995, 20, 351–359. [Google Scholar] [CrossRef]

- Gupta, S.; Kangur, A.; Papageorgiou, C.; Wane, A. Efficiency-adjusted public capital and growth. World Dev. 2014, 57, 164–178. [Google Scholar] [CrossRef]

- Abiad, M.A.; Furceri, D.; Topalova, P. The Macroeconomic Effects of Public Investment: Evidence from Advanced Economies; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Magud, N.E.; Sosa, S. Investment in Emerging Markets We Are Not in Kansas Anymore... Or Are We? International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Ansar, A.; Flyvbjerg, B.; Budzier, A.; Lunn, D. Does infrastructure investment lead to economic growth or economic fragility? Evidence from China. Oxf. Rev. Econ. Policy 2016, 32, 360–390. [Google Scholar] [CrossRef]

- Banerjee, A.; Duflo, E.; Qian, N. On the Road: Access to Transportation Infrastructure and Economic Growth in China; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar]

- Demurger, S. Infrastructure development and economic growth: An explanation for regional disparities in China? J. Comp. Econ. 2001, 29, 95–117. [Google Scholar] [CrossRef]

- Straub, S. nfrastructure and Growth in Developing Countries: Recent Advances and Research Challenges; The World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Barro, R.J. Economic growth in a cross section of countries. Q. J. Econ. 1991, 106, 407–443. [Google Scholar] [CrossRef]

- Devarajan, S.; Swaroop, V.; Zou, H.F. The composition of public expenditure and economic growth. J. Monet. Econ. 1996, 37, 313–344. [Google Scholar] [CrossRef]

- Holtz-Eakin, D.; Schwartz, A.E. Infrastructure in a structural model of economic growth. Reg. Sci. Urban Econ. 1995, 25, 131–151. [Google Scholar] [CrossRef]

- Adam, C.S.; Bevan, D.L. Fiscal deficits and growth in developing countries. J. Public Econ. 2005, 89, 571–597. [Google Scholar] [CrossRef]

- Dessus, S.; Herrera, R. Public capital and growth revisited: A panel data assessment. Econ. Dev. Cult. Chang. 2000, 48, 407–418. [Google Scholar] [CrossRef]

- Gupta, S.; Clements, B.; Baldacci, E.; Mulas-Granados, C. Fiscal policy, expenditure composition, and growth in low-income countries. J. Int. Money Financ. 2005, 24, 441–463. [Google Scholar] [CrossRef]

- Gupta, M.S.; Simone, M.A.; Segura-Ubiergo, M.A. New Evidenceon Fiscal Adjustment and Growth in Transition Economies; International Monetary Fund: Washington, DC, USA, 2006. [Google Scholar]

- Straub, S. Infrastructure and development: A critical appraisal of the macro-level literature. J. Dev. Stud. 2011, 47, 683–708. [Google Scholar] [CrossRef]

- Fedderke, J.W.; Bogetic, Z. Infrastructure and growth in South Africa: Direct and indirect productivity impacts of 19 infrastructure measures. World Dev. 2009, 37, 1522–1539. [Google Scholar] [CrossRef]

- Calderón, C.; Servén, L. The Effects of Infrastructure Development on Growth and Income Distribution; World Bank: Washington, DC, USA, 2004. [Google Scholar]

- Akintoye, A.; Beck, M. Introduction: Perspectives on PPP Policy, Finance and Management, Policy, Finance and Management for Public–Private Partnerships; Blackwell Publishing Ltd: Hoboken, NJ, USA, 2009. [Google Scholar]

- Khmel, V.; Zhao, S. Arrangement of financing for highway infrastructure projects under the conditions of Public–Private Partnership. IATSS Res. 2016, 39, 138–145. [Google Scholar] [CrossRef]

- Roehrich, J.K.; Lewis, M.A.; George, G. Are public–private partnerships a healthy option? A systematic literature review. Soc. Sci. Med. 2014, 113, 110–119. [Google Scholar] [CrossRef]

- Kwak, Y.H.; Chih, Y.; Ibbs, C.W. Towards a comprehensive understanding of public private partnerships for infrastructure development. Calif. Manag. Rev. 2009, 51, 51–78. [Google Scholar] [CrossRef]

- Khan, M.S.; Reinhart, C.M. Private investment and economic growth in developing countries. World Dev. 1990, 18, 19–27. [Google Scholar] [CrossRef]

- Lanau, M.S. The Growth Return of Infrastructure in Latin America; International Monetary Fund: Washington, DC, USA, 2017. [Google Scholar]

- Cantos, P.; Gumbau-Albert, M.; Maudos, J. Transport infrastructures, spillover effects and regional growth: Evidence of the Spanish case. Transp. Rev. 2005, 25, 25–50. [Google Scholar] [CrossRef]

- Feltenstein, A.; Ha, J. The role of infrastructure in Mexican economic reform. World Bank Econ. Rev. 1995, 9, 287–304. [Google Scholar] [CrossRef]

- Morrison, C.J.; Schwartz, A.E. Public infrastructure, private input demand, and economic performance in New England manufacturing. J. Bus. Econ. Stat. 1996, 14, 91–101. [Google Scholar]

- Nadiri, M.I.; Mamuneas, T.P. Infrastructure and Public R&D Investments, and the Growth of Factor Productivity in US Manufacturing Industries; National Bureau of Economic Research: Cambridge, MA, USA, 1994. [Google Scholar]

- Rioja, F.K. Growth, welfare, and public infrastructure: A general equilibrium analysis of latin american economies. J. Econ. Dev. 2001, 26, 119–130. [Google Scholar]

- Sturm, J.-E. The Impact of Public Infrastructure Capital on the Private Sector of The Netherlands; Research Memorandum; CPB Netherlands Bureau for Economic Analysis: The Hague, The Netherlands, 1997. [Google Scholar]

- State Bank of Pakistan. The Pakistan Infrastructure Report State Bank of Pakistan Infrastructure Taskforce 2007. Available online: http://www.sbp.org.pk/departments/ihfd/InfrastructureTaskForceReport.pdf (accessed on 16 June 2019).

- Haque, N.; Pirzada, A.; Ahmed, V. Rethinking Connectivity as Interactivity: A Case Study of Pakistan 2011. Available online: https://mpra.ub.uni-muenchen.de/34049/1/MPRA_paper_34049.pdf (accessed on 16 June 2019).

- Biller, D.; Sanchez-Triana, E. Revitalizing Manufacturing: Pakistan Policy Note 5; World Bank: Washington, DC, USA, 2013. [Google Scholar]

- De Jong, J.; Ferdinandusse, M.; Funda, J.; Vetlov, I. The Effect of Public Investment in Europe: A Model-Based Assessment; ECB Working Paper; European Central Bank (ECB): Frankfurt, Germany, 2017. [Google Scholar]

- Pereira, A.M.; Andraz, J.M. On the economic effects of public infrastructure investment: A survey of the international evidence. J. Econ. Dev. 2013, 38, 1–37. [Google Scholar]

- Romp, W.; De Haan, J. Public capital and economic growth: A critical survey. Perspekt. Wirtsch. 2007, 8, 6–52. [Google Scholar] [CrossRef]

- Brons, M.; Kalantzis, F.; Maincent, E.; Arnoldus, P. Infrastructure in the EU: Developments and Impact on Growth; Occasional Papers 203; European Commission, Directorate-General for Economic and Financial Affairs: Brussels, Belgium, 2014; Available online: http://ec.europa.eu/economy_finance/publications/ (accessed on 16 June 2019). [CrossRef]

- Ghani, E.; Din, M.-U. The impact of public investment on economic growth in Pakistan. Pak. Dev. Rev. 2006, 45, 87–98. [Google Scholar] [CrossRef]

- Ahmed, V.; Abbas, A.; Ahmed, S. Public Infrastructure and Economic Growth in Pakistan: A Dynamic CGE-Microsimulation Analysis Infrastructure and Economic Growth in Asia; Springer: Berlin/Heidelberg, Germany, 2013; pp. 117–143. [Google Scholar]

- Ahmed, Q.M.; Ali, S.A. Public Investment Efficiency and Sectoral Economic Growth in Pakistan; International Food Policy Research Institute: Washington, DC, USA, 2014; Volume 22. [Google Scholar]

- Rehman, C.A.; Ilyas, M.; Alam, H.M.; Akram, M. The impact of infrastructure on foreign direct investment: The case of Pakistan. Int. J. Bus. Manag. 2011, 6, 268. [Google Scholar] [CrossRef]

- Faridi, M.Z.; Malik, M.S.; Bashir, F. Transportation, telecommunication and economic development in Pakistan. Interdiscip. J. Res. Bus. 2011, 1, 45–52. [Google Scholar]

- Hashim, S.; Munir, A.; Khan, A. Telecom Infrastructure and economic development of Pakistan: An empirical Analysis. Int. Res. J. Arts Humanities 2009, 37, 147–156. [Google Scholar]

- Looney, R.E. Infrastructure and private sector investment in Pakistan. J. Asian Econ. 1997, 8, 393–420. [Google Scholar] [CrossRef]

- Iqbal, J.; Nadeem, K. Exploring the causal relationship among social, real, monetary and infrastructure development in Pakistan. Pak. Econ. Soc. Rev. 2006, 44, 39–56. [Google Scholar]

- Haq, A.U. Impact of investment activities on economic growth of Pakistan. Bus. Manag. Rev. 2012, 2, 92–100. [Google Scholar]

- Weitzman, M.L. Soviet postwar economic growth and capital-labor substitution. Am. Econ. Rev. 1970, 60, 676–692. [Google Scholar]

- Arrow, K.J.; Kurz, M. Optimal growth with irreversible investment in a Ramsey model. Econom. J. Econom. Soc. 1970, 38, 331–344. [Google Scholar] [CrossRef]

- Duggal, V.G.; Saltzman, C.; Klein, L.R. Infrastructure and productivity: A nonlinear approach. J. Econ. 1999, 92, 47–74. [Google Scholar] [CrossRef]

- Sturm, J.-E.; Jacobs, J.; Groote, P. Output effects of infrastructure investment in the Netherlands, 1853–1913. J. Macroecon. 1999, 21, 355–380. [Google Scholar] [CrossRef]

- Sturm, J.E.; Kuper, G.H.; De Haan, J. Modelling government investment and economic growth on a macro level: A review. In Market Behaviour and Macroeconomic Modelling; Palgrave Macmillan: London, UK, 1998; pp. 359–406. [Google Scholar]

- World Bank. Annual Report; World Bank: Washington, DC, USA, 1994. [Google Scholar]

- Hulten, C.R.; Bennathan, E.; Srinivasan, S. Infrastructure, externalities, and economic development: A study of the Indian manufacturing industry. World Bank Econ. Rev. 2006, 20, 291–308. [Google Scholar] [CrossRef]

- Straub, S.; Vellutini, C.; Warlters, M. Infrastructure and Economic Growth in East Asia; The World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Shanks, S.; Barnes, P. Econometric Modelling of Infrastructure and Australia’s Productivity; Research Memorandum; Australia Productivity Commission: Melbourne, Australia, 2008. [Google Scholar]

- Aschauer, D.A. Is public expenditure productive? J. Monet. Econ. 1989, 23, 177–200. [Google Scholar] [CrossRef]

- Barro, R.J. Government spending in a simple model of endogeneous growth. J. Political Econ. 1990, 98 (5 Pt 2), S103–S125. [Google Scholar] [CrossRef]

- Albala-Bertrand, J.M.; Mamatzakis, E.C. The impact of public infrastructure on the productivity of the Chilean economy. Rev. Dev. Econ. 2004, 8, 266–278. [Google Scholar] [CrossRef]

- Agénor, P.-R.; Nabli, M.K.; Yousef, T.M. Public Infrastructure and Private Investment in the Middle East and North Africa; World Bank: Washington, DC, USA, 2005; Volume 3661. [Google Scholar]

- Nadiri, M.I.; Mamuneas, T.P. Contribution of Highway Capital to Industry and National Productivity Growth; Federal Highway Administration: Washington, DC, USA, 1996. [Google Scholar]

- Otto, G.; Voss, G.M. Public capital and private sector productivity. Econ. Rec. 1994, 70, 121–132. [Google Scholar] [CrossRef]

- Reinikka, R.; Svensson, J. Coping with poor public capital. J. Dev. Econ. 2002, 69, 51–69. [Google Scholar] [CrossRef]

- Alby, P.; Dethier, J.; Straub, S. Firms Operating under Infrastructure and Credit Constraints in Developing Countries; The Case of Power Generators; Policy Research Working Paper; World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Lee, K.S.; Anas, A.; Oh, G.-T. Costs of Infrastructure Deficiencies in Manufacturing in Indonesia, Nigeria, and Thailand; World Bank: Washington, DC, USA, 1996. [Google Scholar]

- Torvik, R. Natural resources, rent seeking and welfare. J. Dev. Econ. 2002, 67, 455–470. [Google Scholar] [CrossRef]

- Canning, D.; Bennathan, E. The Social Rate of Return on Infrastructure Investments; The World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Gyamfi, P.; Ruan, G. Road Maintenance by Contract: Dissemination of Good Practice in Latin America and the Caribbean Region. 1996. Available online: http://documents.worldbank.org/curated/pt/130191538244189821/Road-maintenance-by-contract-dissemination-of-good-practice-in-Latin-America-and-the-Caribbean-Region (accessed on 16 June 2019).

- Röller, L.-H.; Waverman, L. Telecommunications infrastructure and economic development: A simultaneous approach. Am. Econ. Rev. 2001, 91, 909–923. [Google Scholar] [CrossRef]

- Eberts, R.W.; Fogarty, M.S. Estimating the Relationship Between Local Public and Private Investment; Federal Reserve Bank of Cleveland: Cleveland, OH, USA, 1987; Volume 8703. [Google Scholar]

- Merriman, D. Public capital and regional output: Another look at some Japanese and American data. Reg. Sci. Urban Econ. 1991, 20, 437–458. [Google Scholar] [CrossRef]

- Wang, B. Effects of government expenditure on private investment: Canadian empirical evidence. Empir. Econ. 2005, 30, 493–504. [Google Scholar] [CrossRef]

- Khan, M.S.; Kumar, M.S. Public and private investment and the growth process in developing countries. Oxf. Bull. Econ. Stat. 1997, 59, 69–88. [Google Scholar] [CrossRef]

- Gramlich, E.M. Infrastructure investment: A review essay. J. Econ. Lit. 1994, 32, 1176–1196. [Google Scholar]

- Kumo, W.L. Infrastructure Investment and Economic Growth in South Africa: A Granger Causality Analysis; Working Paper Series (160); African Development Bank Group: Tunis, Tunisia, 2012. [Google Scholar]

- Canning, D.; Pedroni, P. Infrastructure and Long Run Economic Growth; Working Paper; Center for Analytical Economics, Cornell University: New York, NY, USA, 1999. [Google Scholar]

- Finn, M. GIs all government capital productive? Frb Richmond Econ. Q. 1993, 79, 53–80. [Google Scholar]

- Ai, C.; Cassou, S.P. A normative analysis of public capital. Appl. Econ. 1995, 27, 1201–1209. [Google Scholar] [CrossRef]

- Phillips, P.C.; Hansen, B.E. Statistical inference in instrumental variables regression with I (1) processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Phillips, P.C. Fully modified least squares and vector autoregression. Econom. J. Econom. Soc. 1995, 63, 1023–1078. [Google Scholar] [CrossRef]

- Christopoulos, D.K.; Tsionas, E.G. Financial development and economic growth: Evidence from panel unit root and cointegration tests. J. Dev. Econ. 2004, 73, 55–74. [Google Scholar] [CrossRef]

- Di Iorio, F.; Fachin, S. A note on the estimation of long-run relationships in panel equations with cross-section linkages. Econ. Discuss. Pap. 2012. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- DeJong, D.N.; Nankervis, J.C.; Savin, N.E.; Whiteman, C.H. The power problems of unit root test in time series with autoregressive errors. J. Econ. 1992, 53, 323–343. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J. Econ. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Ferreira, A.L.; León-Ledesma, M.A. Does the real interest parity hypothesis hold? Evidence for developed and emerging markets. J. Int. Money Financ. 2007, 26, 364–382. [Google Scholar] [CrossRef]

- Perron, P. The great crash, the oil price shock, and the unit root hypothesis. Econom. J. Econom. Soc. 1989, 57, 1361–1401. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econom. J. Econom. Soc. 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Zou, Y. Empirical studies on the relationship between public and private investment and GDP growth. Appl. Econ. 2006, 38, 1259–1270. [Google Scholar] [CrossRef]

- Fedderke, J.; Garlick, R. Infrastructure development and economic growth in South Africa: A review of the accumulated evidence. Policy Pap. 2008, 12, 1–28. [Google Scholar]

- Pereira, A.M. Is all public capital created equal? Rev. Econ. Stat. 2000, 82, 513–518. [Google Scholar] [CrossRef]

| Level | First Difference | |||||

|---|---|---|---|---|---|---|

| ADF | PP | KPSS | ADF | PP | KPSS | |

| Aggregate Economy | ||||||

| GDP | −1.64 | −1.48 | 0.19 a | −10.4 a | −9.61 a | 0.23 |

| Capital Stock | −1.99 | −1.99 | 0.39 a | −6.98 a | −6.97 a | 0.21 |

| Human Capital | −2.0 | −2.26 | 0.77 a | −6.6 a | −6.57 a | 0.06 |

| Aggregate Investment | −2.46 | −2.38 | 0.23 a | −7.03 a | −7.34 a | 0.12 |

| Public Investment | −2.4 | −4.15 a | 0.20 a | −6.67 a | −6.77 a | 0.05 |

| Private Investment | −2.58 | −2.59 | 0.11 a | −7.1 a | −7.09 a | 0.06 |

| Electricity | −2.41 | −2.3 | 0.19 a | −7.8 a | −7.82 a | 0.06 |

| Roads & Telecommunication | −2.31 | −2.42 | 0.12 a | −5.62a | −6.55 a | 0.22 |

| Industry | ||||||

| GDP | −1.43 | −1.45 | 0.19 a | −6.95 a | −6.95 a | 0.08 |

| Capital Stock | −151 | −1.47 | 0.38 a | −6.28 a | −6.29 a | 0.31 |

| Human Capital | −0.87 | −1.02 | 0.69 a | −5.27 a | −5.37 a | 0.08 |

| Aggregate Investment | −1.87 | −1.83 | 0.19 a | −6.36 a | −6.44 a | 0.30 |

| Public Investment | −2.11 | −2.03 | 0.21 a | −6.39 a | −6.44 a | 0.31 |

| Private Investment | −2.33 | −2.41 | 0.12 a | −6.35 a | −6.36 a | 0.13 |

| Electricity | −2.12 | −2.03 | 0.19 a | −7.36 a | −7.37 a | 0.06 |

| Roads & Telecommunication | −1.54 | −1.39 | 0.13 | −5.8 a | −5.76 a | 0.20 |

| Agriculture | ||||||

| GDP | 1.93 | 1.94 | 0.15 a | −6.92 a | −7.37 a | 0.27 |

| Capital Stock | 2.41 | −2.41 | 0.77 a | −6.14 a | −7.61 a | 0.17 |

| Human Capital | −1.94 | −1.94 | 0.81 a | −5.47 a | −5.41 a | 0.06 |

| Aggregate Investment | −2.03 | −2.15 | 0.19 a | −6.73 a | −6.94 a | 0.33 |

| Public Investment | −2.55 | −2.52 | 0.21 a | −6.72 a | −6.82 a | 0.35 |

| Private Investment | −2.45 | −2.51 | 0.11 a | −6.31 a | −6.31 a | 0.11 |

| Electricity | −2.44 | −2.43 | 0.19 a | −7.39 a | −7.4 a | 0.23 |

| Roads & Telecommunication | −2.25 | −2.36 | 0.74 a | −5.82 a | −7.01 a | 0.23 |

| Services | ||||||

| GDP | −2.69 | −2.55 | 0.16 a | −8.57 a | −8.69 a | 0.27 |

| Capital Stock | −3.37 | −1.82 | 0.69 a | −5.6 a | −5.27 a | 0.18 |

| Human Capital | −2.13 | −2.23 | 0.72 a | −6.22 a | −6.22 a | 0.06 |

| Aggregate Investment | −2.29 | −2.22 | 0.22 a | −6.55 a | −7.12 a | 0.32 |

| Public Investment | −2.4 | −2.32 | 0.21 a | −6.46 a | −6.53 a | 0.30 |

| Private Investment | −2.67 | −2.68 | 0.12 a | −6.49 a | −6.49 a | 0.11 |

| Electricity | −2.41 | −2.36 | 0.19 | −7.41 a | −7.42 a | |

| Roads & Telecommunication | −3.46 b | −2.62 | 0.69 a | −6.35 a | −8.81 a | 0.31 |

| Aggregate Eco | Industry | Agriculture | Services | |||||

|---|---|---|---|---|---|---|---|---|

| ADF-Stat | Break Year | ADF-Stat | Break Year | ADF-Stat | Break Year | ADF-Stat | Break Year | |

| Level | ||||||||

| GDP | −5.01 a | 1994 | −3.59 | 1990 | −4.48 | 1990 | −4.23 | 1996 |

| Capital Stock | −4.95 c | 2002 | −4.71 | 2004 | −5.36 c | 1996 | −4.81 | 1985 |

| Human Capital | −5.06 c | 1998 | −4.86 | 1990 | −7.85 a | 1990 | −3.27 | 1996 |

| Aggregate Inv. | −4.88 | 1998 | −3.74 | 1999 | −3.91 | 1999 | −3.98 | 1994 |

| Public Inv. | −4.10 | 1999 | −5.77 a | 1994 | −4.36 | 1990 | −6.29 a | 1999 |

| Private Inv. | −3.92 | 1994 | −3.23 | 2004 | −3.99 | 2004 | −4.49 | 2007 |

| EPP * | −4.21 | 1994 | −4.43 | 1994 | −4.15 | 1994 | −3.84 | 1996 |

| TPP * | −5.68 b | 2003 | −6.02 a | 2005 | −5.26 c | 2005 | −5.68 c | 2003 |

| First Difference | ||||||||

| GDP | -- | -- | −7.94 a | 1994 | −7.67 a | 1996 | −9.14 a | 2002 |

| Capital Stock | −8.06 a | 2009 | −6.41 a | 2009 | −6.80 a | 2000 | −9.50 a | 1986 |

| Human Capital | −7.39 a | 1992 | −6.39 a | 1994 | -- | -- | −7.4 | 1992 |

| Aggregate Inv. | −7.93 a | 1998 | −6.83 a | 2005 | −7.31 a | 1999 | −6.82 a | 2008 |

| Public Inv. | −7.35 a | 2003 | -- | -- | −7.41 a | 2000 | -- | -- |

| Private Inv. | −8.62 a | 1999 | −7.94 a | 1999 | −7.86 a | 1999 | −7.98 a | 1999 |

| EPP * | −9.14 a | 2004 | −8.65 a | 2004 | −8.76 a | 2004 | -8.68 a | 2004 |

| TPP * | -- | -- | -- | -- | -- | -- | -- | -- |

| Trace Statistic | |||||

|---|---|---|---|---|---|

| r = 0 (63.8) | r ≤ 1 (42.9) | r ≤ 2 (25.8) | r ≤ 3 (12.5) | ||

| Aggregate Investment in Infrastructure | |||||

| Whole Economy | 76.4 * | 33.5 | 16.5 | 6.5 | |

| Industrial | 63.97 * | 31.9 | 16.8 | 6.2 | |

| Agriculture | 64.2* | 23.6 | 11.1 | 2.9 | |

| Service | 65.2* | 31.2* | 15.5 | 3.7 | |

| r = 0 (88.8) | r ≤ 1 (63.9) | r ≤ 2 (42.9) | r ≤ 3 (25.9) | r ≤ 3 (12.5) | |

| Public-Private Investment in Infrastructure | |||||

| Whole Economy | 103.6 * | 58.5 | 25.9 | 10.4 | 4.2 |

| Industrial | 97.3 * | 46.3 | 26.3 | 14.6 | 4.7 |

| Agriculture | 92.3 * | 54.1 | 32.6 | 18.6 | 5.9 |

| Service | 98.4 * | 66.2 * | 35.7 | 15.9 | 4.8 |

| Whole Economy | 120.5 * | 73.6 * | 43.2 | 16.8 | 4.2 |

| Industrial | 107.1 * | 53.7 | 27.1 | 13.6 | 5.2 |

| Agriculture | 104.1 * | 51.6 | 29.6 | 15.4 | 5.8 |

| Service | 107.2 * | 64.2 * | 36.1 | 17.3 | 4.3 |

| Maximum Eigenvalue Statistic | |||||

| r = 0 (32.1) | r ≤ 1 (25.8) | r ≤ 2 (19.4) | r ≤ 3 (12.5) | ||

| Aggregate Investment in Infrastructure | |||||

| Whole Economy | 42.9 * | 16.9 * | 9.9 | 6.5 | |

| Industrial | 33.2 * | 15.1 | 10.7 | 6.2 | |

| Agriculture | 36.6 * | 12.6 | 8.2 | 2.9 | |

| Service | 30.9 | 15.7 * | 11.8 | 3.7 | |

| r = 0 (38.3) | r ≤ 1 (32.1) | r ≤ 2 (25.8) | r ≤ 3 (19.4) | r ≤ 3 (12.5) | |

| Public-Private Investment in Infrastructure | |||||

| Whole Economy | 45.2 * | 32.5 * | 15.5 | 6.2 | 4.2 |

| Industrial | 51.3 * | 19.9 | 11.6 | 9.95 | 4.7 |

| Agriculture | 38.2 | 21.4 | 14.0 | 12.6 | 5.9 |

| Service | 32.2 | 30.5 | 19.7 | 11.1 | 4.8 |

| Disaggregated Investment in Infrastructure by type of Infrastructure | |||||

| Whole Economy | 46.9 * | 30.4 | 26.5 | 12.6 | 4.2 |

| Industrial | 53.4 * | 26.6 | 13.4 | 8.4 | 5.2 |

| Agriculture | 52.5 * | 22.04 | 14.2 | 9.5 | 5.8 |

| Service | 43.02 * | 28.1 | 18.8 | 13 | 4.3 |

| Whole Economy | Industrial | Agricultural | Services | |

|---|---|---|---|---|

| Capital Stock | 0.20 b (2.82) | 0.02 (0.06) | 0.12 c (17.4) | 0.20 c (9.59) |

| Human Capital | 0.40 c (4.28) | 0.28 c (3.14) | 0.18 c (7.74) | 0.26 c (6.94) |

| Energy | 0.09 c (3.91) | 0.13 c (5.27) | 0.04 c (10.8) | 0.05 c (6.04) |

| Roads & Tele | 0.12 b (2.70) | 0.22 c (5.44) | 0.14 c (19.8) | 0.03 b (2.16) |

| Constant | 4.39 c (5.52) | 5.78 c (4.99) | 19.89 c (32.1) | 6.43 c (12.4) |

| Trend | 0.01 c (7.73) | 0.01 c (15.5) | 0.01 c (14.3) | |

| Structural Break | 0.02 (0.44) | 0.06 (1.24) | 0.03 c (6.24) | 0.04 c (4.21) |

| R2 | 0.96 | 0.97 | 0.98 | 0.96 |

| Adj R2 | 0.95 | 0.97 | 0.98 | 0.95 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Javid, M. Public and Private Infrastructure Investment and Economic Growth in Pakistan: An Aggregate and Disaggregate Analysis. Sustainability 2019, 11, 3359. https://doi.org/10.3390/su11123359

Javid M. Public and Private Infrastructure Investment and Economic Growth in Pakistan: An Aggregate and Disaggregate Analysis. Sustainability. 2019; 11(12):3359. https://doi.org/10.3390/su11123359

Chicago/Turabian StyleJavid, Muhammad. 2019. "Public and Private Infrastructure Investment and Economic Growth in Pakistan: An Aggregate and Disaggregate Analysis" Sustainability 11, no. 12: 3359. https://doi.org/10.3390/su11123359

APA StyleJavid, M. (2019). Public and Private Infrastructure Investment and Economic Growth in Pakistan: An Aggregate and Disaggregate Analysis. Sustainability, 11(12), 3359. https://doi.org/10.3390/su11123359