How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective

Abstract

1. Introduction

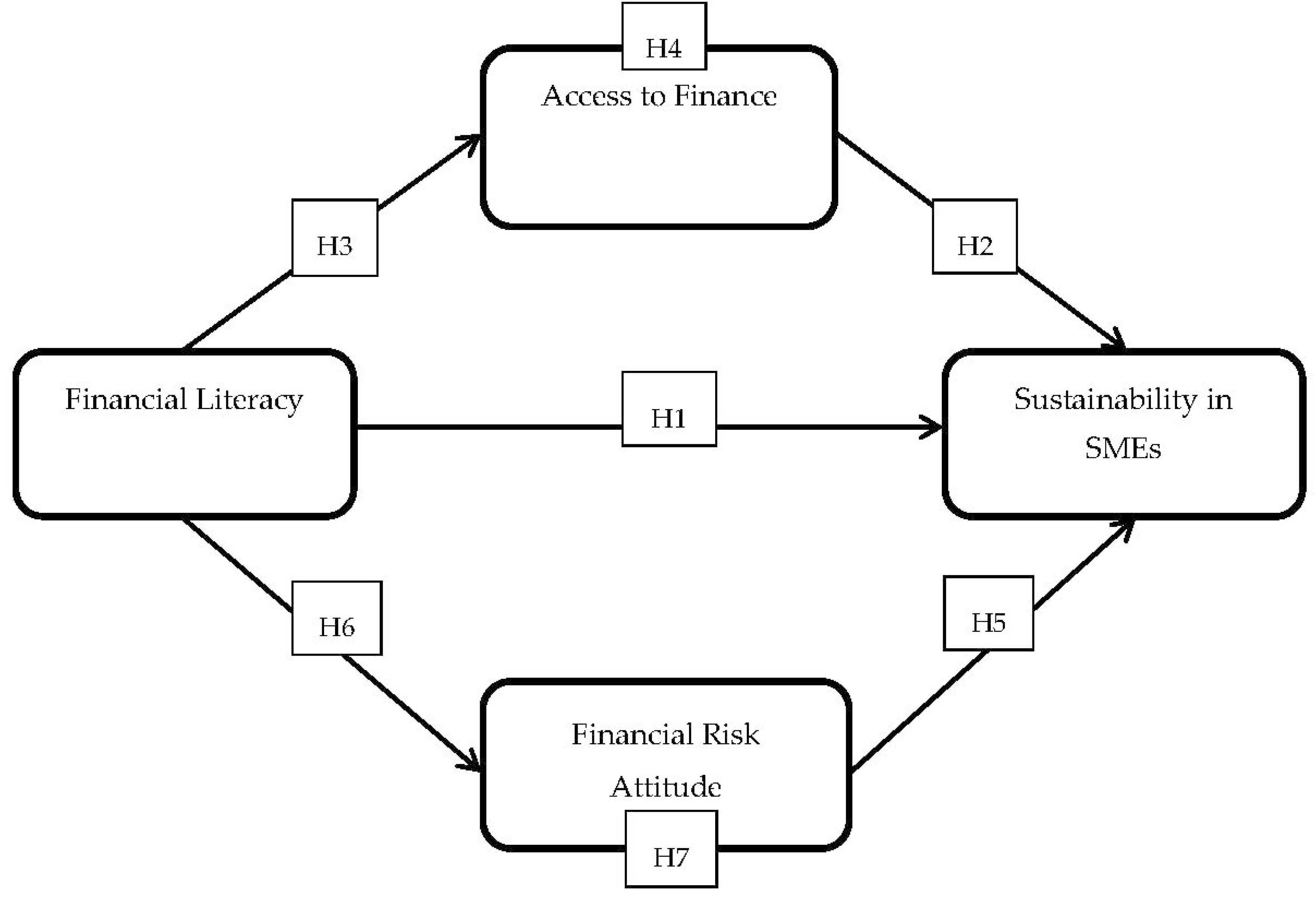

2. Literature Review and Hypotheses Development

2.1. Financial Literacy and the Sustainability of SMEs

2.2. Access to Finance and SMEs’ Sustainability

2.3. The Links between Financial Literacy, Access to Finance and SMEs’ Sustainability

2.4. Financial Risk Attitude and Sustainability in SMEs

2.5. The Links between Financial Literacy, Financial Risk Attitude and Sustainability in SMEs

3. Methodology

3.1. Sample Design and Data Collection

3.2. Measurement of Variables

4. Results

4.1. Preliminary Analysis

4.2. Confirmatory Factor Analysis

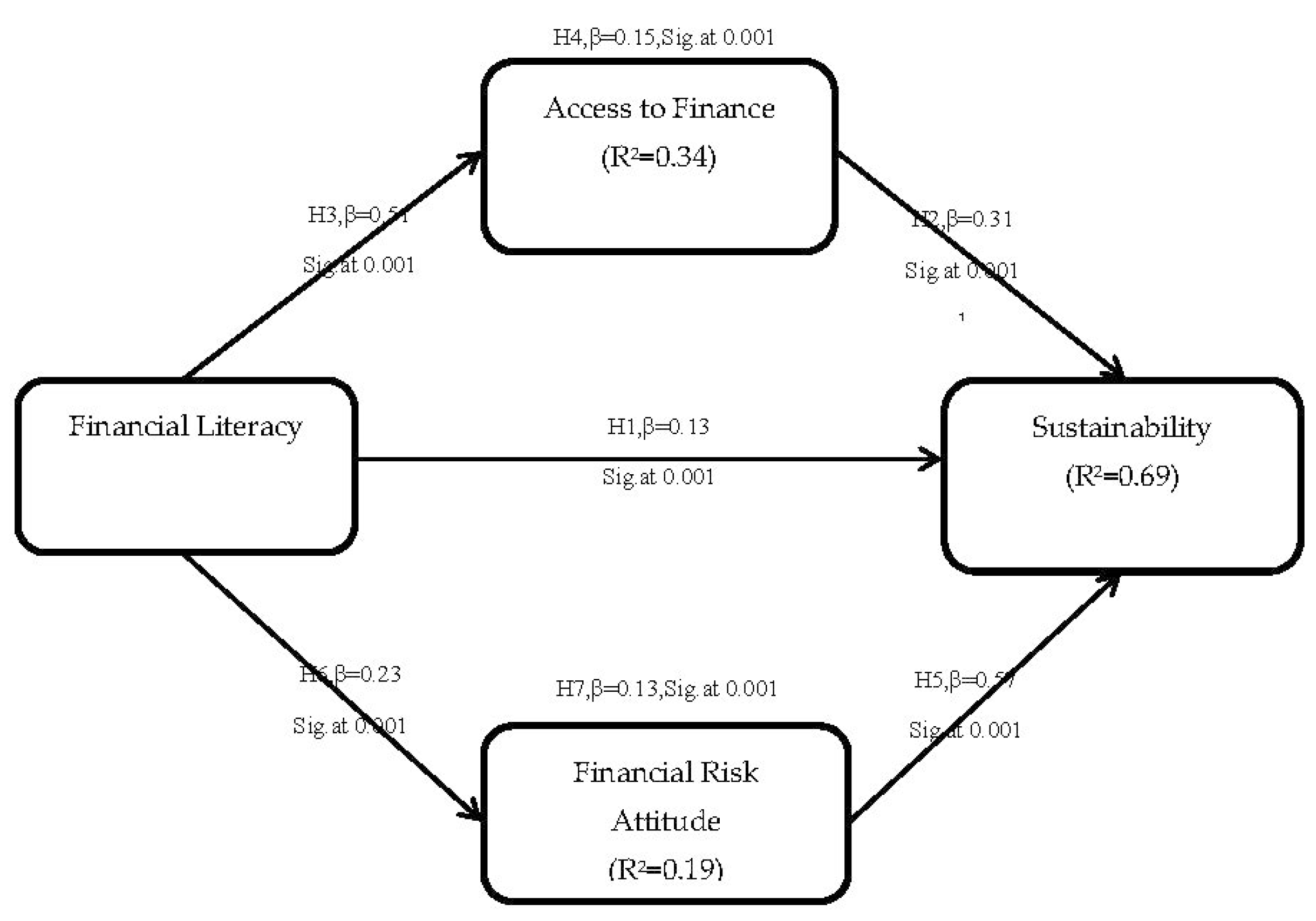

4.3. Structural Model and Hypothesis Testing

5. Discussion

5.1. Discussion of the Findings

5.2. Theoretical Implications

5.3. Implications for Managers

5.4. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Agyei, S.K. Culture, financial literacy, and SME performance in Ghana. Cogent Econ. Financ. 2018, 6, 1463813. [Google Scholar] [CrossRef]

- Arribas, I.; Vila, J.E. Human capital determinants of the survival of entrepreneurial service firms in Spain. Int. Entrep. Manag. J. 2007, 3, 309–322. [Google Scholar] [CrossRef]

- Smallbone, D.; Welter, F.; Voytovich, A.; Egorov, I. Government and entrepreneurship in transition economies: The case of small firms in business services in Ukraine. Serv. Ind. J. 2010, 30, 655–670. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Rabellotti, R. Global value chains meet innovation systems: Are there learning opportunities for developing countries? World Dev. 2011, 39, 1261–1269. [Google Scholar] [CrossRef]

- Hosseini, S.; Fallon, G.; Weerakkody, V.; Sivarajah, U. Cloud computing utilization and mitigation of informational and marketing barriers of the SMEs from the emerging markets: Evidence from Iran and Turkey. Int. J. Inf. Manag. 2019, 46, 54–69. [Google Scholar] [CrossRef]

- Oláh, J.; Kovács, S.; Virglerova, Z.; Lakner, Z.; Kovacova, M.; Popp, J. Analysis and Comparison of Economic and Financial Risk Sources in SMEs of the Visegrad Group and Serbia. Sustainability 2019, 11, 1853. [Google Scholar] [CrossRef]

- Wu, J.; Si, S. Poverty reduction through entrepreneurship: Incentives, social networks, and sustainability. Asian Bus. Manag. 2018, 17, 243–259. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Spender, J.C. Knowing, managing and learning: A dynamic managerial epistemology. Manag. Learn. 1994, 25, 387–412. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Nonaka, I.; Von Krogh, G.; Voelpel, S. Organizational knowledge creation theory: Evolutionary paths and future advances. Organ. Stud. 2006, 27, 1179–1208. [Google Scholar] [CrossRef]

- Degong, M.; Ullah, F.; Khattak, M.; Anwar, M. Do international capabilities and resources configure firm’s sustainable competitive performance? Research within Pakistani SMEs. Sustainability 2018, 10, 4298. [Google Scholar] [CrossRef]

- Eniola, A.A.; Ektebang, H. SME firms performance in Nigeria: Competitive advantage and its impact. Int. J. Res. Stud. Manag. 2014, 3, 75–86. [Google Scholar] [CrossRef]

- Lenny Koh, S.C.; Demirbag, M.; Bayraktar, E.; Tatoglu, E.; Zaim, S. The impact of supply chain management practices on performance of SMEs. Ind. Manag. Data Syst. 2007, 107, 103–124. [Google Scholar] [CrossRef]

- Ying, Q.; Hassan, H.; Ahmad, H. The role of a manager’s intangible capabilities in resource acquisition and sustainable competitive performance. Sustainability 2019, 11, 527. [Google Scholar] [CrossRef]

- Hussain, J.; Salia, S.; Karim, A. Is knowledge that powerful? Financial literacy and access to finance: An analysis of enterprises in the UK. J. Small Bus. Enterp. Dev. 2018, 25, 985–1003. [Google Scholar] [CrossRef]

- Wang, H.; Han, G. Local government’s “black box” in small and medium-sized private enterprises’ trans-ownership M&A failure: Chinese cases. J. Small Bus. Enterp. Dev. 2008, 15, 719–732. [Google Scholar]

- Adomako, S.; Danso, A.; Ofori Damoah, J. The moderating influence of financial literacy on the relationship between access to finance and firm growth in Ghana. Ventur. Cap. 2016, 18, 43–61. [Google Scholar] [CrossRef]

- Korutaro, N.S.; Kasozi, D.; Nalukenge, I.; Tauringana, V. Lending terms, financial literacy and formal credit accessibility. Int. J. Soc. Econ. 2014, 41, 342–361. [Google Scholar] [CrossRef]

- Eniola, A.A.; Entebang, H. SME managers and financial literacy. Glob. Bus. Rev. 2017, 18, 559–576. [Google Scholar] [CrossRef]

- Kotzè, L.; Smit, A. Personal financial literacy and personal debt management: The potential relationships with new venture creation. S. Afr. J. Entrep. Small Bus. Manag. 2008, 1, 35–50. [Google Scholar] [CrossRef]

- Widdowson, D.; Hailwood, K. Financial literacy and its role in promoting a sound financial system. Reserv. Bank N. Z. Bull. 2007, 70, 37–47. [Google Scholar]

- Lusardi, A.; Mitchell, O.S. Financial literacy around the world: An overview. J. Pension Econ. Financ. 2011, 10, 497–508. [Google Scholar] [CrossRef] [PubMed]

- Reich, C.M.; Berman, J.S. Do financial literacy classes help? An experimental assessment in a low-income population. J. Soc. Serv. Res. 2015, 41, 193–203. [Google Scholar] [CrossRef]

- Cowling, M.; Liu, W.; Ledger, A.; Zhang, N. What really happens to small and medium-sized enterprises in a global economic recession? UK evidence on sales and job dynamics. Int. Small Bus. J. 2015, 33, 488–513. [Google Scholar] [CrossRef]

- Forlani, D.; Mullins, J.W. Perceived risks and choices in entrepreneurs’ new venture decisions. J. Bus. Ventur. 2000, 15, 305–322. [Google Scholar] [CrossRef]

- Norton, W.I.; Moore, W.T. The influence of entrepreneurial risk assessment on venture launch or growth decisions. Small Bus. Econ. 2006, 26, 215–226. [Google Scholar] [CrossRef]

- Florio, C.; Leoni, G. Enterprise risk management and firm performance: The Italian case. Br. Account. Rev. 2017, 49, 56–74. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. A resource-based theory of strategic alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Conner, K.R.; Prahalad, C.K. A resource-based theory of the firm: Knowledge versus opportunism. Organ. Sci. 1996, 7, 477–501. [Google Scholar] [CrossRef]

- Carmeli, A.; Tishler, A. The relationships between intangible organizational elements and organizational performance. Strateg. Manag. J. 2004, 25, 1257–1278. [Google Scholar] [CrossRef]

- Jappelli, T.; Padula, M. Investment in financial literacy and saving decisions. J. Bank. Financ. 2013, 37, 2779–2792. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S.; Curto, V. Financial literacy among the young. J. Consum. Aff. 2010, 44, 358–380. [Google Scholar] [CrossRef]

- Huston, S.J. Measuring financial literacy. J. Consum. Aff. 2010, 44, 296–316. [Google Scholar] [CrossRef]

- Wise, S. The impact of financial literacy on new venture survival. Int. J. Bus. Manag. 2013, 8, 30. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- Davidson, W.N., III; Xie, B.; Xu, W. Market reaction to voluntary announcements of audit committee appointments: The effect of financial expertise. J. Account. Public Policy 2004, 23, 279–293. [Google Scholar] [CrossRef]

- Behrman, J.R.; Mitchell, O.S.; Soo, C.K.; Bravo, D. How financial literacy affects household wealth accumulation. Am. Econ. Rev. 2012, 102, 300–304. [Google Scholar] [CrossRef]

- Allgood, S.; Walstad, W.B. The effects of perceived and actual financial literacy on financial behaviors. Econ. Inq. 2016, 54, 675–697. [Google Scholar] [CrossRef]

- Schwab, L.; Gold, S.; Reiner, G. Exploring financial sustainability of SMEs during periods of production growth: A simulation study. Int. J. Prod. Econ. 2019, 212, 8–18. [Google Scholar] [CrossRef]

- Hussain, J.; Matlay, H. Financing preferences of ethnic minority owner/managers in the UK. J. Small Bus. Enterp. Dev. 2007, 14, 487–500. [Google Scholar] [CrossRef]

- Storey, D.J. New firm growth and bank financing. Small Bus. Econ. 1994, 6, 139–150. [Google Scholar] [CrossRef]

- Irwin, D.; Scott, J.M. Barriers faced by SMEs in raising bank finance. Int. J. Entrep. Behav. Res. 2010, 16, 245–259. [Google Scholar] [CrossRef]

- Khan, N.U.; Li, S.; Safdar, M.N.; Khan, Z.U. The Role of Entrepreneurial Strategy, Network Ties, Human and Financial Capital in New Venture Performance. J. Risk Financ. Manag. 2019, 12, 41. [Google Scholar] [CrossRef]

- Gambetta, N.; Azadian, P.; Hourcade, V.; Reyes, M.E. The financing framework for sustainable development in emerging economies: The case of Uruguay. Sustainability 2019, 11, 1059. [Google Scholar] [CrossRef]

- Inoue, T.; Hamori, S. Do workers’ remittances promote access to finance? Evidence from Asia-Pacific developing countries. Emerg. Mark. Financ. Trade 2016, 52, 765–774. [Google Scholar] [CrossRef]

- Aduda, J.; Kalunda, E. Financial inclusion and financial sector stability with reference to Kenya: A review of literature. J. Appl. Financ. Bank. 2012, 2, 95. [Google Scholar]

- Claessens, S. Access to financial services: A review of the issues and public policy objectives. World Bank Res. Obs. 2006, 21, 207–240. [Google Scholar] [CrossRef]

- Ahlstrom, D.; Cumming, D.J.; Vismara, S. New methods of entrepreneurial firm financing: Fintech, crowdfunding and corporate governance implications. Corp. Gov. Int. Rev. 2018, 26, 310–313. [Google Scholar] [CrossRef]

- Carpenter, R.E.; Petersen, B.C. Capital market imperfections, high-tech investment, and new equity financing. Econ. J. 2002, 112, F54–F72. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Wiklund, J.; Haynie, J.M. Moving forward: Balancing the financial and emotional costs of business failure. J. Bus. Ventur. 2009, 24, 134–148. [Google Scholar] [CrossRef]

- Yang, Y.; Chen, X.; Gu, J.; Fujita, H. Alleviating Financing Constraints of SMEs through Supply Chain. Sustainability 2019, 11, 673. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Shahbaz, M.; Islam, F. Does financial development increase rural-urban income inequality? Cointegration analysis in the case of Indian economy. Int. J. Soc. Econ. 2013, 40, 151–168. [Google Scholar] [CrossRef]

- Aranda-Usón, A.; Portillo-Tarragona, P.; Marín-Vinuesa, L.M.; Scarpellini, S. Financial resources for the circular economy: A perspective from businesses. Sustainability 2019, 11, 888. [Google Scholar] [CrossRef]

- Myers, S.C. The capital structure puzzle. J. Financ. 1984, 39, 574–592. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Bolton, J.E. Small Firms: Report of the Commission of Inquiry on Small Firms; Her Majesty’s Stationary Office: London, UK, 1971. [Google Scholar]

- LeCornu, M.R.; McMahon, R.G.; Forsaith, D.M.; Stanger, A.M. The small enterprise financial objective function. J. Small Bus. Manag. 1996, 34, 1. [Google Scholar]

- Lawless, M.; McCann, F. Credit access for small and medium firms: Survey evidence for Ireland. J. Stat. Soc. Inq. Soc. Irel. 2011, 41, 1–23. [Google Scholar]

- Laitinen, E.K. Prediction of failure of a newly founded firm. J. Bus. Ventur. 1992, 7, 323–340. [Google Scholar] [CrossRef]

- Van Praag, C.M. Business survival and success of young small business owners. Small Bus. Econ. 2003, 21, 1–17. [Google Scholar] [CrossRef]

- Gopinath, C. Bank strategies toward firms in decline. J. Bus. Ventur. 1995, 10, 75–92. [Google Scholar] [CrossRef]

- Fatoki, O. The causes of the failure of new small and medium enterprises in South Africa. Mediterr. J. Soc. Sci. 2014, 5, 922. [Google Scholar] [CrossRef]

- Beal, D.J.; Delpachitra, S.B. Financial literacy among Australian university students. Econ. Pap. 2003, 22, 65–78. [Google Scholar] [CrossRef]

- Deakins, D.; Hussain, G. Financial information, the banker and the small business: A comment. Br. Account. Rev. 1994, 26, 323–335. [Google Scholar] [CrossRef]

- Van Auken, H.; Carraher, S. Influences on frequency of preparation of financial statements among SMEs. J. Innov. Manag. 2013, 1, 143. [Google Scholar] [CrossRef]

- Jaroslav, B.; Přemysl, B.; Jozef, H.; Roman, H. Significant attributes of creation and development of the business environment in the SME segment. In Proceedings of the 1st International Conference on Finance and Economics, Ho Chi Minh City, Vietnam, 2–4 June 2014. [Google Scholar]

- Rauch, A.; Frese, M. Psychological approaches to entrepreneurial success: A general model and an overview of findings. Int. Rev. Ind. Organ. Psychol. 2000, 15, 101–142. [Google Scholar]

- Krauss, S.I.; Frese, M.; Friedrich, C.; Unger, J.M. Entrepreneurial orientation: A psychological model of success among southern African small business owners. Eur. J. Work Organ. Psychol. 2005, 14, 315–344. [Google Scholar] [CrossRef]

- Willebrands, D.; Lammers, J.; Hartog, J. A successful businessman is not a gambler. Risk attitude and business performance among small enterprises in Nigeria. J. Econ. Psychol. 2012, 33, 342–354. [Google Scholar] [CrossRef]

- Gärling, T.; Kirchler, E.; Lewis, A.; Van Raaij, F. Psychology, financial decision making, and financial crises. Psychol. Sci. Public Interest 2009, 10, 1–47. [Google Scholar] [CrossRef] [PubMed]

- Caliendo, M.; Fossen, F.; Kritikos, A. The impact of risk attitudes on entrepreneurial survival. J. Econ. Behav. Organ. 2010, 76, 45–63. [Google Scholar] [CrossRef]

- Palich, L.E.; Bagby, D.R. Using cognitive theory to explain entrepreneurial risk-taking: Challenging conventional wisdom. J. Bus. Ventur. 1995, 10, 425–438. [Google Scholar] [CrossRef]

- Goswami, K.; Hazarika, B.; Handique, K. Determinants of financial risk attitude among the handloom micro-entrepreneurs in North East India. Asia Pac. Manag. Rev. 2017, 22, 168–175. [Google Scholar] [CrossRef]

- Cressy, R. Why do most firms die young? Small Bus. Econ. 2006, 26, 103–116. [Google Scholar] [CrossRef]

- Grable, J.; Lytton, R.H. Financial risk tolerance revisited: The development of a risk assessment instrument. Financ. Serv. Rev. 1999, 8, 163–181. [Google Scholar] [CrossRef]

- Díez-Esteban, J.M.; García-Gómez, C.D.; López-Iturriaga, F.J.; Santamaría-Mariscal, M. Corporate risk-taking, returns and the nature of major shareholders: Evidence from prospect theory. Res. Int. Bus. Financ. 2017, 42, 900–911. [Google Scholar] [CrossRef]

- Xiao, J.J.; Alhabeeb, M.J.; Hong, G.S.; Haynes, G.W. Attitude toward risk and risk-taking behavior of business-owning families. J. Consum. Aff. 2001, 35, 307–325. [Google Scholar] [CrossRef]

- Gilmore, A.; Carson, D.; O’Donnell, A. Small business owner-managers and their attitude to risk. Mark. Intell. Plan. 2004, 22, 349–360. [Google Scholar] [CrossRef]

- Chan, C.S.R.; Park, H.D. The influence of dispositional affect and cognition on venture investment portfolio concentration. J. Bus. Ventur. 2013, 28, 397–412. [Google Scholar] [CrossRef]

- Ryack, K. The impact of family relationships and financial education on financial risk tolerance. Financ. Serv. Rev. 2011, 20, 181–193. [Google Scholar]

- Covin, J.G.; Slevin, D.P. A conceptual model of entrepreneurship as firm behavior. Entrep. Theory Pract. 1991, 16, 7–26. [Google Scholar] [CrossRef]

- Cacciotti, G.; Hayton, J.C. Fear and entrepreneurship: A review and research agenda. Int. J. Manag. Rev. 2015, 17, 165–190. [Google Scholar] [CrossRef]

- Hallahan, T.A.; Faff, R.W.; McKenzie, M.D. An empirical investigation of personal financial risk tolerance. Financ. Serv. Rev.-Greenwich 2004, 13, 57–78. [Google Scholar]

- Hsiao, Y.J.; Tsai, W.C. Financial literacy and participation in the derivatives markets. J. Bank. Financ. 2018, 88, 15–29. [Google Scholar] [CrossRef]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial literacy and stock market participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef]

- Wiseman, R.M.; Gomez-Mejia, L.R. A behavioral agency model of managerial risk taking. Acad. Manag. Rev. 1998, 23, 133–153. [Google Scholar] [CrossRef]

- Robson, C.; McCartan, K. Real World Research; John Wiley & Sons: Chichester, UK, 2016. [Google Scholar]

- Collis, J.; Jarvis, R. Financial information and the management of small private companies. J. Small Bus. Enterp. Dev. 2002, 9, 100–110. [Google Scholar] [CrossRef]

- Bell, E.; Bryman, A.; Harley, B. Business Research Methods; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Anwar, M. Business model innovation and smes performance—Does competitive advantage mediate? Int. J. Innov. Manag. 2018, 22, 1850057. [Google Scholar] [CrossRef]

- Yang, S.; Ishtiaq, M.; Anwar, M. Enterprise risk management practices and firm performance, the mediating role of competitive advantage and the moderating role of financial literacy. J. Risk Financ. Manag. 2018, 11, 35. [Google Scholar]

- Bongomin, G.O.C.; Munene, J.C.; Ntayi, J.M.; Malinga, C.A. Exploring the mediating role of social capital in the relationship between financial intermediation and financial inclusion in rural Uganda. Int. J. Soc. Econ. 2018, 45, 829–847. [Google Scholar] [CrossRef]

- Bongomin, G.O.C.; Ntayi, J.M.; Munene, J.C.; Malinga, C.A. The relationship between access to finance and growth of SMEs in developing economies: Financial literacy as a moderator. Rev. Int. Bus. Strategy 2017, 27, 520–538. [Google Scholar] [CrossRef]

- Claessens, S.; Tzioumis, K. Measuring Firms’ Access to Finance; World Bank: Washington, DC, USA, 2006; pp. 1–25. [Google Scholar]

- Ardic, O.P.; Mylenko, N.; Saltane, V. Access to Finance by Small and Medium Enterprises: A Cross-Country Analysis with a New Data Set. Pac. Econ. Rev. 2012, 17, 491–513. [Google Scholar] [CrossRef]

- Weber, E.U.; Blais, A.R.; Betz, N.E. A domain-specific risk-attitude scale: Measuring risk perceptions and risk behaviors. J. Behav. Decis. Mak. 2002, 15, 263–290. [Google Scholar] [CrossRef]

- Runyan, R.; Droge, C.; Swinney, J. Entrepreneurial orientation versus small business orientation: What are their relationships to firm performance? J. Small Bus. Manag. 2008, 46, 567–588. [Google Scholar] [CrossRef]

- Haber, S.; Reichel, A. Identifying performance measures of small ventures—The case of the tourism industry. J. Small Bus. Manag. 2005, 43, 257–286. [Google Scholar] [CrossRef]

- Mikalef, P.; Pateli, A. Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. J. Bus. Res. 2017, 70, 1–16. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach; Guilford Publications: New York, NY, USA, 2013. [Google Scholar]

- Loehlin, J.C. Latent Variable Models; Lawrence Erlbaum Publishers: Hillsdale, NJ, USA, 1992. [Google Scholar]

- Hair, J.F.; Black, W.; Babin, B.; Anderson, R.E.; Tatham, R. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Curran, P.J.; West, S.G.; Finch, J.F. The robustness of test statistics to nonnormality and specification error in confirmatory factor analysis. Psychol. Methods 1996, 1, 16. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Babin, B.J.; Black, W.C. Multivariate Data Analysis: A Global Perspective; Pearson: Upper Saddle River, NJ, USA, 2010; Volume 7. [Google Scholar]

- Field, A. Discovering Statistics Using IBM SPSS Statistics; Sage: London, UK, 2009. [Google Scholar]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Cheung, G.W.; Lau, R.S. Testing mediation and suppression effects of latent variables: Bootstrapping with structural equation models. Organ. Res. Methods 2008, 11, 296–325. [Google Scholar] [CrossRef]

- Purnomo, B.R. Artistic orientation, financial literacy and entrepreneurial performance. J. Enterp. Communities People Places Glob. Econ. 2019. [Google Scholar] [CrossRef]

- Eresia-Eke, C.E.; Raath, C. SMME owners’ financial literacy and business growth. Mediterr. J. Soc. Sci. 2013, 4, 397. [Google Scholar] [CrossRef]

- Carbo-Valverde, S.; Rodriguez-Fernandez, F.; Udell, G.F. Trade credit, the financial crisis, and SME access to finance. J. Money Credit Bank. 2016, 48, 113–143. [Google Scholar] [CrossRef]

- Earle, J.S.; Sakova, Z. Business start-ups or disguised unemployment? Evidence on the character of self-employment from transition economies. Labour Econ. 2000, 7, 575–601. [Google Scholar] [CrossRef]

- Naldi, L.; Nordqvist, M.; Sjöberg, K.; Wiklund, J. Entrepreneurial orientation, risk taking, and performance in family firms. Fam. Bus. Rev. 2007, 20, 33–47. [Google Scholar] [CrossRef]

| Frequency | Percentage | |

|---|---|---|

| Industrial sector | ||

| Manufacturing | 120 | 41.2% |

| Service | 83 | 28.5% |

| Trade | 88 | 30.3% |

| Size | ||

| 5–20 employees | 47 | 16.2% |

| 21–40 employees | 81 | 27.8% |

| 41–60 employees | 79 | 27.1% |

| 61–80 employees | 48 | 16.5% |

| 81–99 employees | 36 | 12.4% |

| Age | ||

| ≤5 years | 64 | 22.0% |

| 6–15 years | 89 | 30.6% |

| 16–25 years | 85 | 29.2% |

| ≥26 years | 53 | 18.2% |

| Variable | CR | AVE | FL | RPr | RPe | AF | FS |

|---|---|---|---|---|---|---|---|

| Financial literacy | 0.872 | 0.688 | 0.829 | ||||

| Risk-taking propensity | 0.924 | 0.656 | 0.503 | 0.809 | |||

| Risk perception | 0.902 | 0.696 | 0.614 | 0.398 | 0.834 | ||

| Access to finance | 0.882 | 0.724 | 0.413 | 0.402 | 0.265 | 0.851 | |

| Sustainability | 0.894 | 0.688 | 0.331 | 0.263 | 0.307 | 0.513 | 0.829 |

| Mean | 3.563 | 3.284 | 3.346 | 3.612 | 3.191 | ||

| Standard deviation | 0.609 | 0.781 | 0.615 | 0.603 | 0.593 | ||

| Cronbach’s α | 0.871 | 0.923 | 0.901 | 0.881 | 0.892 |

| Constructs | Items | Reflective Latent Measures | CFL |

|---|---|---|---|

| Financial literacy | FL1 | We have the ability to analyze our financial performance periodically | 0.81 |

| FL2 | My firm prepares monthly income statements | 0.87 | |

| FL3 | I have received training on book-keeping | Dropped | |

| FL4 | My firm has bought formal insurance for our business | Dropped | |

| FL5 | The management of this firm can compute the cost of its loan capital | 0.78 | |

| FL6 | My firm has a savings account | 0.80 | |

| FL7 | The entrepreneur can prepare basic accounting books | Dropped | |

| FL8 | The firm is aware of the required documents to get a loan from a bank in order to fulfil our financial needs | 0.81 | |

| FL9 | I am aware of the costs and benefits of accessing credit | 0.79 | |

| FL10 | The firm is able to calculate interest rates and loan payments correctly | 0.90 | |

| FL11 | We have the skills required to assess the financial outlook for the firm | 0.89 | |

| FL12 | We have skills for minimizing losses by minimizing bad debts | 0.88 | |

| FL13 | The managers of this business have basic accounting knowledge | 0.81 | |

| Access to finance | AF1 | The financial services offered by the bank have led to an improvement in our business | 0.85 |

| AF2 | The financial services offered by the bank have improved our access to sophisticated technology | 0.81 | |

| AF3 | The financial services offered by the bank have enabled us to pay utility bills | Dropped | |

| AF4 | The saving product provided by the bank is suitable for us | 0.78 | |

| AF5 | The savings product offered by the bank is safe for us | Dropped | |

| AF6 | The loan product provided by the bank suits our needs | 0.86 | |

| AF7 | The terms and conditions on bank loans are favorable to us | 0.81 | |

| AF8 | The financial services provided by the bank are safe for us | 0.81 | |

| AF9 | The account opening fees charged by the bank are affordable | 0.84 | |

| AF10 | The cost of making a trip to the bank is affordable | 0.85 | |

| How likely are you to engage in the following financial activities? | |||

| Risk-taking propensity (RPr) | RPr1 | Bet a day’s income at a high-risk game, such as casino | 0.91 |

| RPr2 | Invest 10% of your annual income in a new business venture | 0.86 | |

| RPr3 | Bet a-day’s income on the outcome of a sporting event, such as a horse race abroad | 0.83 | |

| RPr4 | Invest 10% of your annual income in stocks | 0.90 | |

| RPr5 | Invest 10% of your annual income in an informal savings vehicle that promises a very high return | 0.87 | |

| RPr6 | Invest 10% of your annual income in an IT-BPO industry | 0.88 | |

| How risky do you perceive the following financial activities to be? | |||

| Risk perception (RPe) | RPe1 | Betting a day’s income at a high-risk game, such as casino | 0.78 |

| RPe2 | Investing 10% of your annual income in a new business venture | 0.84 | |

| RPe3 | Betting a day’s income on the outcome of a sporting event, such as a horse race abroad | 0.80 | |

| RPe4 | Investing 10% of your annual income in stocks | 0.83 | |

| RPe5 | Investing 10% of your annual income in an informal savings vehicle that promises a very high return | 0.82 | |

| RPe6 | Investing 10% of your annual income in an IT-BPO industry | 0.84 | |

| Firm’s sustainability | FS1 | Reducing operating costs | 0.87 |

| FS2 | Increasing profit growth rates and growing market shares | 0.78 | |

| FS3 | Increasing customer satisfaction | 0.88 | |

| FS4 | Rapid confirmation of customer orders | Dropped | |

| FS5 | Rapid response to market demand | 0.77 | |

| FS6 | Decreasing product or service delivery cycle time | 0.81 | |

| FS7 | Profits as a percentage of sales | 0.85 | |

| FS8 | Return on investments (ROI) | 0.83 | |

| Path | Estimate | 95% Confidence Level | SE | |

|---|---|---|---|---|

| Lower | Upper | |||

| FL ---> FR ---> FS | 0.15 ** | 0.076 | 0.143 | 0.0314 |

| FL ---> AR ---> FS | 0.13 ** | 0.051 | 0.161 | 0.0421 |

| Hypotheses | Estimate | Decision |

|---|---|---|

| H1: Financial literacy is positively related to sustainability | 0.13 ** | Accepted |

| H2: Access to finance is positively related to sustainability | 0.31 ** | Accepted |

| H3: Financial literacy has a positive effect on access to finance | 0.51 ** | Accepted |

| H4: Access to finance mediates the relationship between financial literacy and sustainability | 0.15 ** | Partially Accepted |

| H5: Financial risk attitude is positively related to sustainability | 0.57 ** | Accepted |

| H6: Financial literacy has a positive effect on financial risk attitude | 0.23 ** | Accepted |

| H7: Financial risk attitude mediates the relationship between financial literacy and sustainability | 0.13 ** | Partially Accepted |

| Financial Literacy → Sustainability (Total Effect) | 0.41 ** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ye, J.; Kulathunga, K. How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability 2019, 11, 2990. https://doi.org/10.3390/su11102990

Ye J, Kulathunga K. How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability. 2019; 11(10):2990. https://doi.org/10.3390/su11102990

Chicago/Turabian StyleYe, Jianmu, and KMMCB Kulathunga. 2019. "How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective" Sustainability 11, no. 10: 2990. https://doi.org/10.3390/su11102990

APA StyleYe, J., & Kulathunga, K. (2019). How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability, 11(10), 2990. https://doi.org/10.3390/su11102990