1. Introduction

The financial distress of 2007 started in the U.S., promptly took the form of full-blown systematic risk in the U.S., and rapidly spread to other developed countries to become a serious global economic crisis [

1,

2,

3,

4,

5]. Because the resultant financial distress had enormous impacts on firms and economies, such as impacting the stability of stock markets, decimating the values of corporations, and impeding the circulation of resources, financial distress prediction is gaining considerably greater interest. If the constructed prediction model is trustworthy and reliable, then managers can initiate some treatments to avoid further deterioration, before financial trouble erupts, and reach the goal of sustainable development, and market participants can adjust their investment strategy to maximize profitability under anticipated risk exposure [

6,

7,

8,

9].

From the seminal work done by Altman [

10], which is grounded on multivariate discriminant analysis (MDA), a large volume of statistical-based techniques and operation research approaches have been consecutively implemented to deal with both credit risk and financial distress prediction. However, the aforementioned techniques have to satisfy some strict statistical assumptions, such as linear separability, multivariate normality, and independence of predictors, which are often violated in real-life applications [

11,

12,

13]. With the rapid improvement of innovative data-driven technologies, computational intelligence (such as neural network (NN), decision tree (DT), and support vector machine (SVM)) not only has the ability to cope with non-linearity, but can also extract meaningful information from vague, imprecise data as well as identify implicit trends that are too complicated to be discovered by either users or traditional systems [

7,

8]. This study adopts computational intelligence due to its (1) superior generalization capability and (2) it does not obey statistical assumptions.

Compared with the well-established research studies in the literature on financial distress and credit risk prediction, works on performance forecasting are quite rare, even as it is widely recognized that the critical trigger for financial distress is bad operating performance [

14,

15,

16]. Kamei [

17] also indicated that bad operating performance is responsible for many financial distress cases (almost 99%). In other words, events such as firm insolvency and defaults on promissory notes do not just happen by coincidence. Instead, there are notable root causes that precede corporate financial distress, and it is the inability to deal with such events properly at an early stage that triggers the demise of these corporations [

18]. In short, bad operating performance is not only an inevitable prior stage before financial distress erupts, but also ruins the goal of corporate sustainable development. This is because the corporation with good financial performance normally poses superior operating efficiency. A corporation’s operating efficiency increase (such as initiatives to improve energy efficiency, reduce CO

2 emissions in production and transportation, reduce water use, eliminate the utilization of virgin materials, and reuse waste) means that it can reduce the operational costs so as to increase its profitability [

19]. For example, Coca-Cola established a monitoring and targeting system in its plant to control and evaluate energy and water use, leading to a 15% reduction in water use, with a 6% increase in production. The solar park of Volkswagen AG in North America is expected to provide the electricity to all the plants when the manufacturing line is not ruining. Furthermore, Wanger and Bloom [

20] identified the relationship between financial performance and sustainability. They divided their samples into two different subgroups based on their financial performance. Their finding showed that financially good-performing corporations have more resources to invest in sustainability, which, in return, lead to better financial results. Eccles et al. [

21] also indicated that good financial performance corporations outperform bad financial performance corporations in terms of sustainable initiatives and accounting rate of return. That is, the corporation with good financial performance has a greater possibility to implement social and environmental sustainability so as to reach the goal of sustainable development.

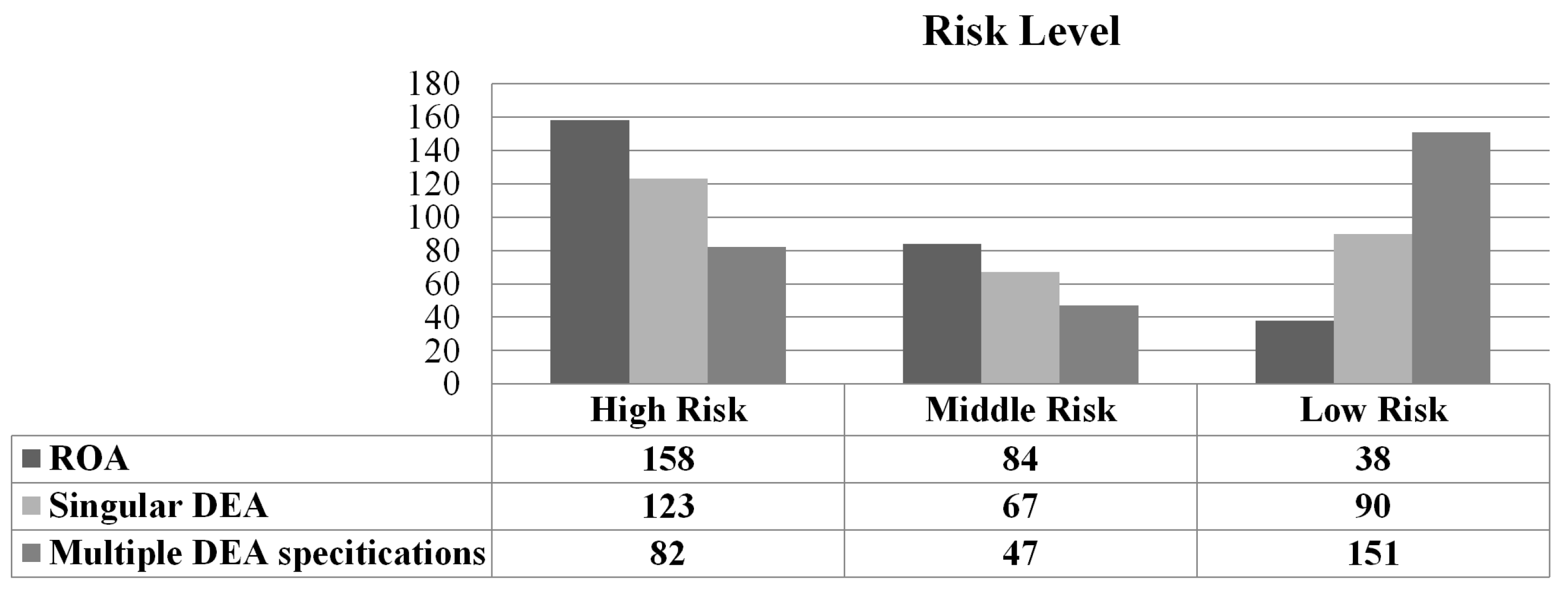

How to evaluate and appropriately determine corporate operating performance is an attractive research topic. Past studies mainly focused on analyzing financial ratios such as return on assets (ROA) and return on investment (ROI), but these measures belong to the category of one-input and one-output techniques. However, merely implementing a one-input and one-output measurement to describe the whole facets of a corporation’s inherent operations is not reliable. In order to provide an overarching assessment to determine the corporation’s inherent operating performance, one can adopt data envelopment analysis (DEA), which handles multiple inputs and multiple outputs simultaneously without a pre-defined production function (e.g., profit maximization or cost minimization) [

22,

23].

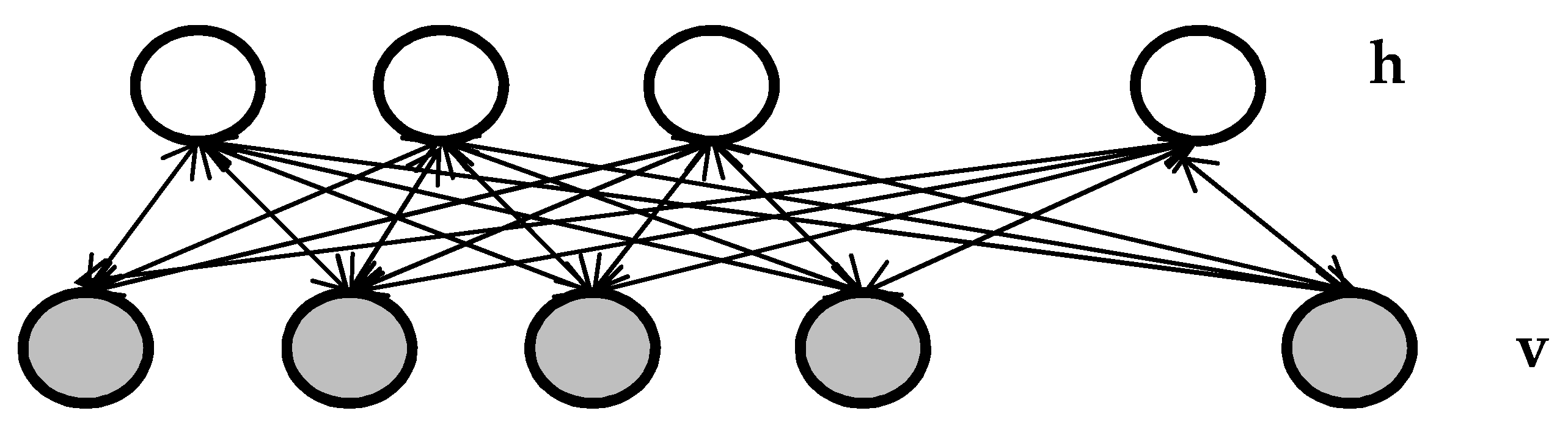

In today’s big data environment, users gather and disseminate data from so many different resources, but too much data without proper handling will confuse the users and push them to maybe even make an inappropriate decision. This is called the curse of dimensionality. DEA has the advantage of handling multiple inputs and multiple outputs simultaneously, but it comes with a weakness in that too much data will deteriorate its discriminant ability—that is, it cannot tell the difference between superior and inferior operating performances. To overcome this challenge, a novel dimensionality reduction technique, named the non-linear fuzzy robust principal component analysis (NFRPCA), was initiated. The analyzed outcome can then be fed into the restricted Boltzmann machine (RBM) to construct a model for corporate operating performance forecasting.

There is a clear requirement for precise decision-making support for both investments and the ongoing monitoring of the health of corporations. Even a fraction of forecasting accuracy improvement can translate into a tremendous amount of future savings [

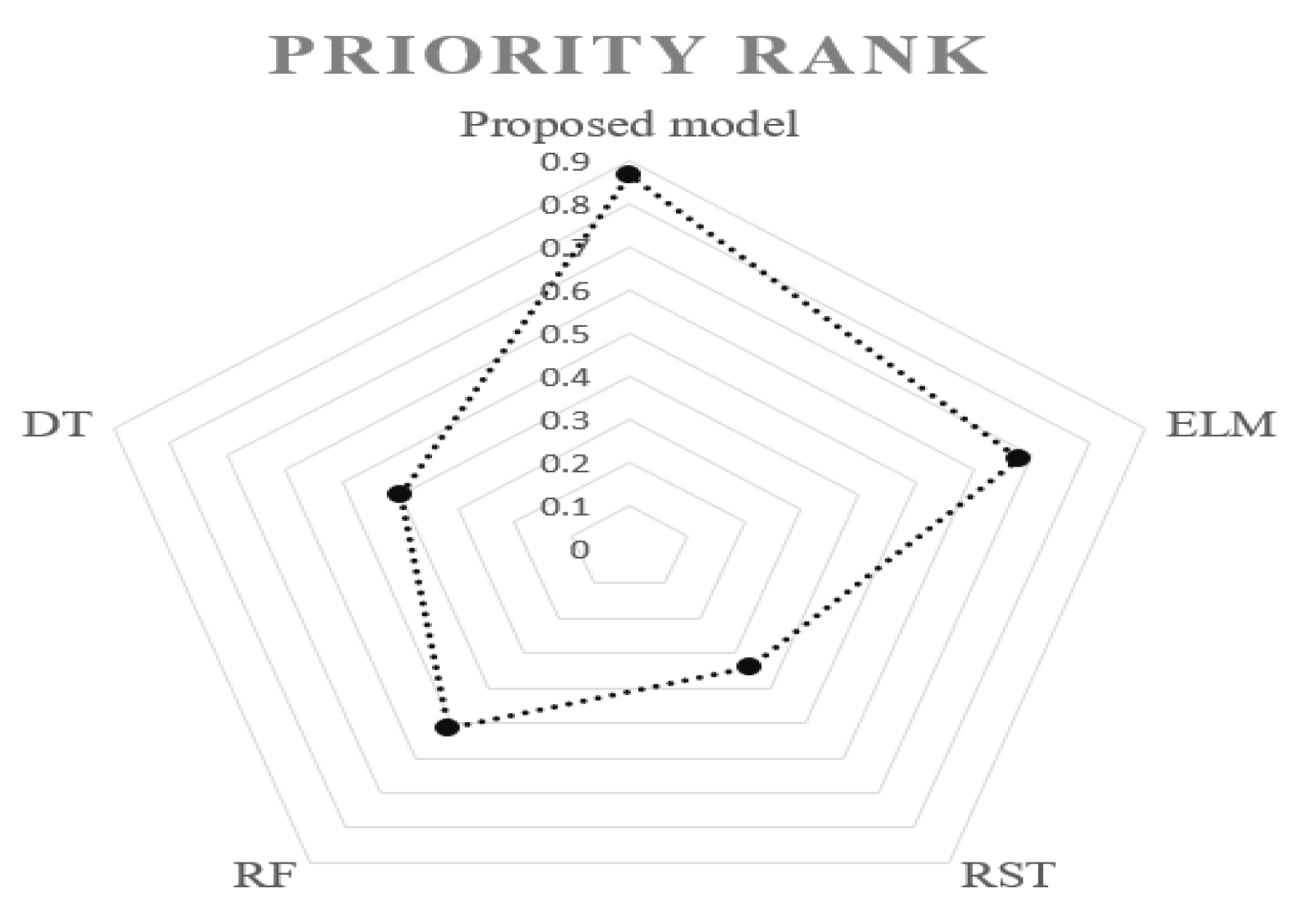

24]. An ensemble learning architecture is a set of individual classifiers whose predictions are integrated, leading to superior forecasting performance versus those from individual classifiers [

25]. The fundamental idea of ensemble learning is to complement the error made by the individual model, which is widely recognized as one of the most efficient ways to improve the performance and robustness of the forecasting problem. Thus, the study used an ensemble learning strategy.

Managers can view the model as a decision support system (DSS) to assist them in forming better decisions under an anticipated risk level as well as reaching the goal of sustainable development. Investors can take the model as an investment guideline to modify their financing strategy and investment portfolio with the target of profit maximization. Policy makers can consider the potential implication of this research outcome and formulate future policies so as to solidify the stability of financial markets and upgrade a nation’s industrial level.

The aim of this study was therefore four-fold as follows:

To provide a sophisticated corporate operating performance forecasting model for managers to reach the goal of sustainable development, this study combined the utilization of financial ratios with a variety of DEA specifications;

To eliminate the curse of dimensionality as well as enhance the discriminant ability of DEA, this study performed a novel dimensionality reduction technique (NFRPCA);

To make the analysis outcome more accessible to non-specialists, this study executed a visualization technique to represent the main structure of the data; and

To improve the model’s forecasting quality as well as eliminate risk exposure to investors, this study adopted an ensemble learning strategy.

The rest of this study is organized as follows.

Section 2 expresses the literature review.

Section 3 briefly describes the implemented methodologies.

Section 4 conducts some experiments to examine and compare the performance of the proposed model. Finally,

Section 5 offers conclusions and some future work ideas.

2. Literature Review

How to diagnose the nature of financial distress is still an open topic in the domain of corporate finance and accounting. As it is widely acknowledged that bad operating performance is the main trigger for financial distress, performance assessment has therefore become an important issue for the business world and academics for several decades. The three most commonly used criteria to describe corporate operating performance are return on assets (ROA), return on investment (ROI), and return on equity (ROE), but they are solely derived from financial statements that could hide some essential information about true financial troubles through different estimation methods and selective accounting principles. Moreover, these criteria belong to the category of one-input and one-output measurement. Merely utilizing these simple criteria to depict the whole structure of a corporation’s operation is not reliable and trustworthy. DEA can deal with this obstacle by simultaneously handling multiple inputs and multiple outputs, and providing a final performance rank for each decision-making unit (DMU). However, the performance rank determined by DEA is affected by the inclusion or exclusion of an input or an output [

26,

27]—that is, the utilization of different inputs or outputs will lead to different performance ranks. Rather than employ a single DEA specification, this study preferred to go beyond a single performance rank and extended into multiple DEA specifications (i.e., it combined inputs and outputs in several dissimilar ways). By doing so, we achieved two objectives at the same time: (1) the assessment mechanism is useful for examining the robustness of the results, and (2) a bundle of performance ranks yields comprehensive information for classifying the units of observations [

28].

Although multiple DEA specifications can provide overarching information for decision makers to form appropriate decisions, they still come with some challenges as too much information will confuse the decision makers and too much data fed into DEA will deteriorate its discriminant ability. To overcome this challenge, one can utilize NFRPCA (i.e., one of the dimensionality reduction techniques). The original data going through the NFRPCA procedure not only can facilitate the decision-making process of the users, but also can enhance DEA’s discriminant ability. By combining the utilization of DEA specifications, financial indicators, and dimensionality reduction technique, we were able to classify corporations into four different categories and designated those that have superior operating performance and those that have inferior operating performance. In other words, we transformed the performance assessment task into a conventional binary classification task. The determined results were then fed into the restricted Boltzmann machine (RBM) to construct the model for corporate operating performance forecasting.

5. Conclusions

Compared with thoroughly studied projects on financial distress prediction, works on performance forecasting are quite rare, even as it is widely acknowledged that a corporation’s bad operating performance is the critical trigger for financial distress. Thus, this study introduced a novel hybrid mechanism that combined different technologies—as financial indicators and efficiency scores—in order to present a comprehensive description of corporate operating performance evaluation for users to make reliable judgments. The financial indicators were collected from financial statements, and the efficiency scores were obtained from 14 different DEA specifications (i.e., inputs and outputs are combined in several dissimilar ways). It has been demonstrated that there are numerous advantages from computing efficiency scores under all possible specifications of the DEA model [

49]. While it is obvious that such a mechanism generates much redundancy, it does provide valuable and useful information. In order to make the outcome accessible to non-specialists, we employed a data reduction technique, called NFRPCA, to visualize the data’s main characteristics. By doing so, we can determine which corporation belongs to the efficient group and which corporation belongs to the inefficient group.

We then sequentially fed the analyzed outcome into the RBME to construct the model for corporate operating performance forecasting. To enhance the model’s forecasting quality, the introduced model was extended to an ensemble structure. Even a fraction of improvement in forecasting accuracy can be converted into tremendous future savings. However, no specific model can attain the best forecasting outcome under all assessment criteria. Model selection is a classical MCDA task, which can be handled through an MCDA algorithm. The model herein, examined by real cases, is a promising alternative for corporate operating performance forecasting. Corporate managers can take this model as a guideline to adjust their firm’s financial structure so as to reduce the cost of capital as well as enhance its profit margin. A corporation with greater profits implies that it has higher risk-absorbing ability to survive in this highly turbulent business environment and greater possibility to reach the goal of sustainable development. Investors can view the model as a roadmap to modify their investment portfolio to maximize personal wealth under anticipated risk level. Policy makers can consider the potential implication of the research outcome and formulate future policies to strengthen financial markets as well as reach the goal of efficient markets.

Future works can consider two potential research directions. First, we worked on the target sample of Taiwan’s electronics industry, which suggests that the ability to generalize the results is limited. Future studies can look into other industries or conduct cross-country analyses. Second, future direction can enhance the model’s forecasting quality by considering much more sophisticated information, such as R&D expenditure and innovation capability. This is because innovation capability has been widely viewed as an essential element for sustainable economic growth as well as for representing the corporation’s competitive advantage [

50,

51,

52,

53,

54].