Measuring Vulnerability of Typhoon in Residential Facilities: Focusing on Typhoon Maemi in South Korea

Abstract

1. Introduction

1.1. Meaning of Extreme Natural Disaster

1.2. Quantification of Natural Disaster Risks

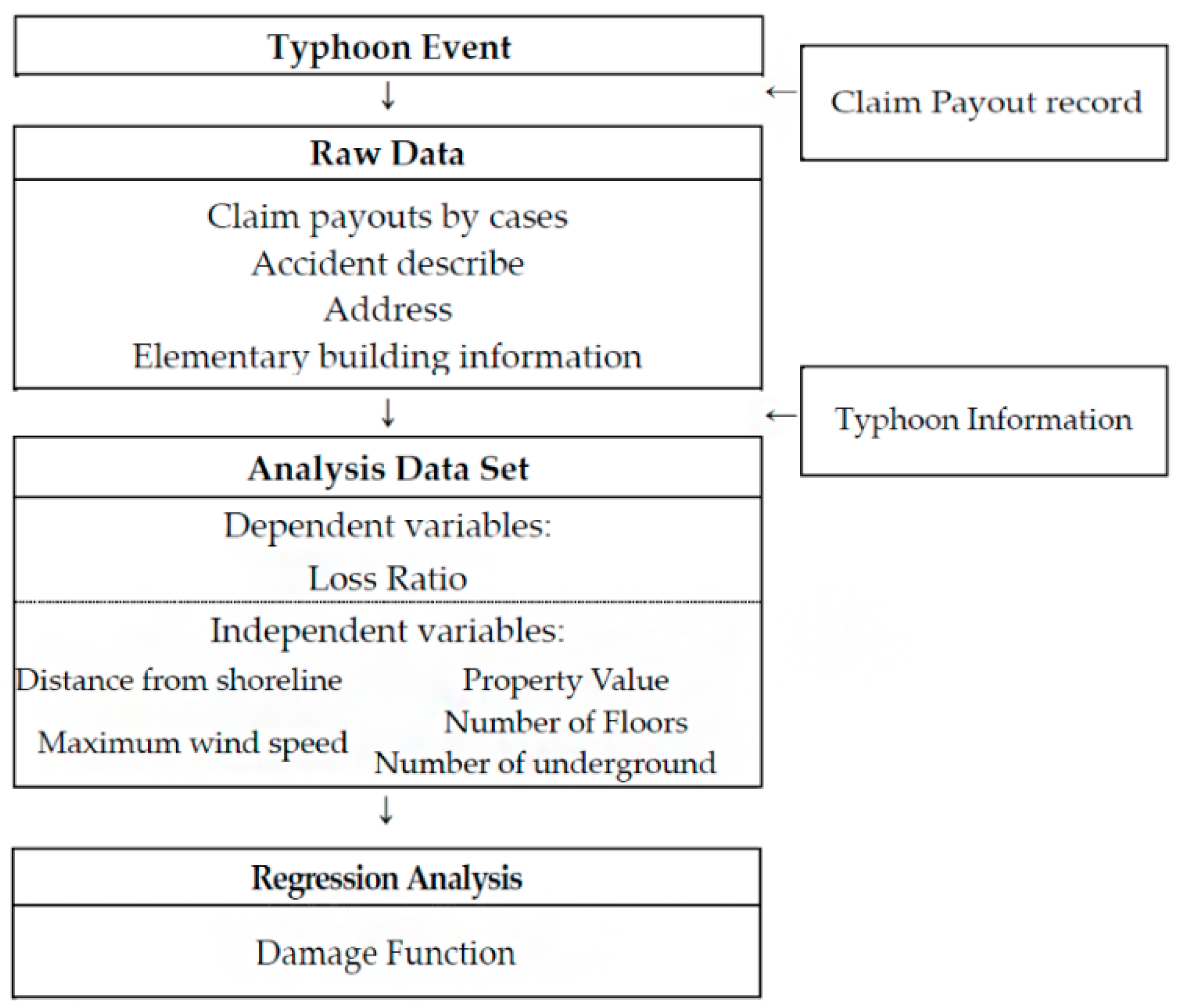

2. Methodology of Research

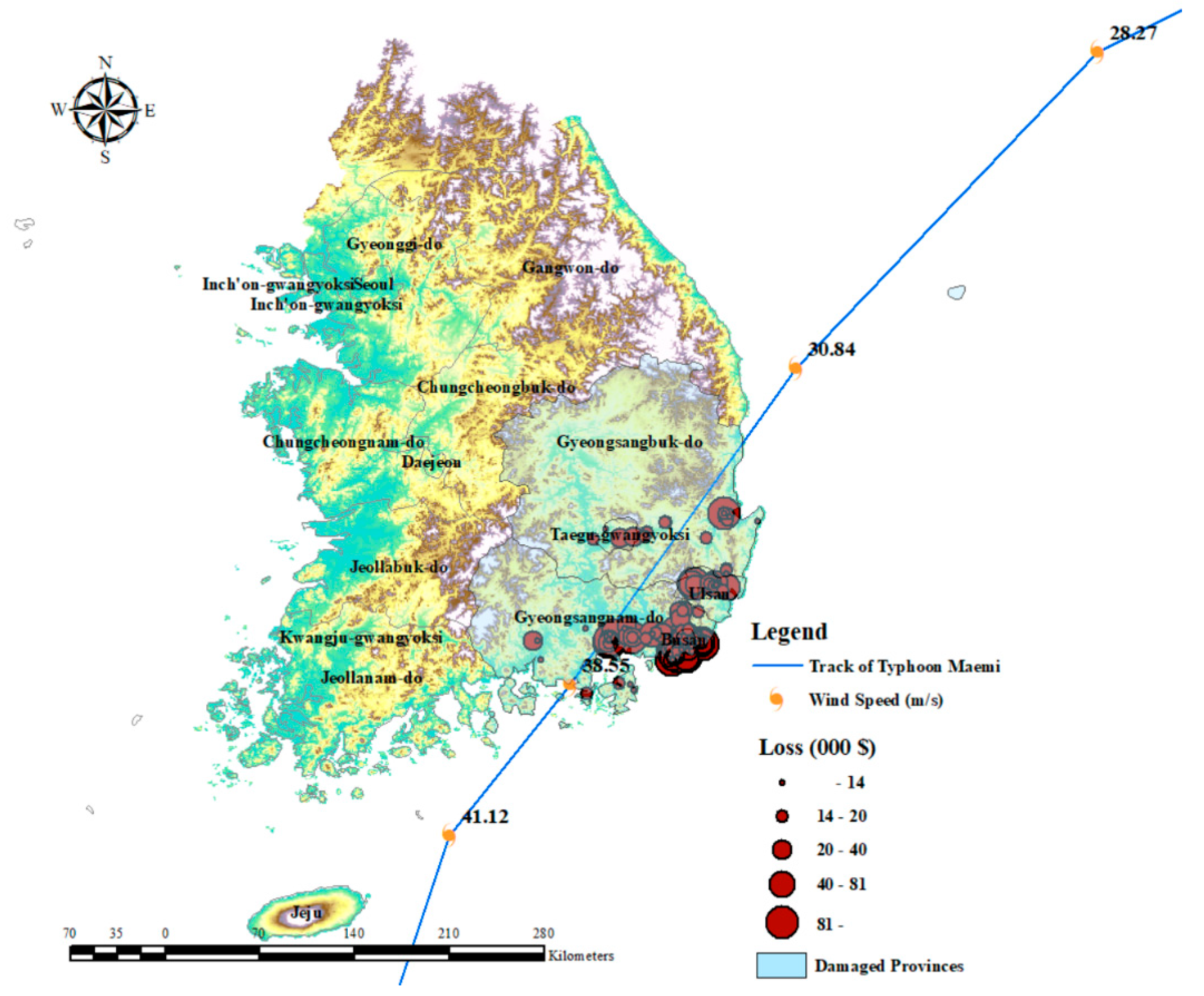

2.1. Damage Records

2.2. The Section of Variables

3. Results

Statistical Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Emmer, A. Geographies and scientometrics of research on natural hazards. Geosciences 2018, 8, 382. [Google Scholar] [CrossRef]

- Blake, E.S.; Rappaport, E.N.; Landsea, C.W. The Deadliest, Costliest, and Most Intense United States Tropical Cyclones from 1851 to 2006 (and Other Frequently Requested Hurricane Facts); NOAA/National Weather Service, National Centers for Environmental Prediction, National Hurricane Center: Miami, FL, USA, 2007. [Google Scholar]

- Blake, E.S.; Kimberlain, T.B.; Berg, R.J.; John, P.C.; Beven, J.L., II. Hurricane Sandy: October 22–29, 2012 (Tropical Cyclone Report); United States National Oceanic and Atmospheric Administration’s National Weather Service: Miami, FL, USA, 2013. [Google Scholar]

- Ulbrich, U.; Fink, A.H.; Klawa, M.; Pinto, J.G. Three extreme storms over Europe in December 1999. Weather 2001, 56, 70–80. [Google Scholar] [CrossRef]

- Del Rosario; Eduardo, D. Final Report Effects of Typhoon YOLANDA (HAIYAN) (pdf) (Report). National Disaster Risk Reduction and Management Council, 2014. Available online: http://www.ndrrmc.gov.ph/attachments/article/1329/FINAL_REPORT_re_Effects_of_Typhoon_YOLANDA_HAIYAN_06-09NOV2013.pdf (accessed on 20 April 2019).

- Khanduri, A.C.; Morrow, G.C. Vulnerability of buildings to windstorms and insurance loss estimation. J. Wind Eng. Ind. Aerod. 2003, 91, 455–467. [Google Scholar] [CrossRef]

- Kim, J.M.; Kim, T.; Son, K. Revealing building vulnerability to windstorms through an insurance claim payout prediction model: A case study in South Korea. Geomat. Nat. Hazards Risk 2017, 8, 1333–1341. [Google Scholar] [CrossRef]

- Watson, C.C.; Johnson, M.E.; Simons, M. Insurance rate filings and hurricane loss estimation models. J. Insur. Regul. 2004, 22, 39–64. [Google Scholar]

- National Typhoon Center. 2011 Typhoon White Book. Available online: http://typ.kma.go.kr/TYPHOON/down/2011/%C0%CE%B8%ED%B9%D7%C0%E7%BB%EA%C7%C7%C7%D8.pdf (accessed on 3 January 2019).

- Crichton, D. The risk triangle. In Natural Disaster Management; Ingleton, J., Ed.; Tudor Rose: London, UK, 1999; pp. 102–103. [Google Scholar]

- Huang, Z.; Rosowsky, D.V.; Sparks, P.R. Hurricane simulation techniques for the evaluation of wind-speeds and expected insurance losses. J. Wind Eng. Ind. Aerod. 2001, 89, 605–617. [Google Scholar] [CrossRef]

- Highfield, W.E.; Peacock, W.G.; Van Zandt, S. Determinants & characteristics of damage in single-family island households from Hurricane Ike1. In Proceedings of the Association of Collegiate Schools of Planning Conference, Minneapolis, MN, USA, 7–10 October 2010. [Google Scholar]

- Kim, J.M.; Woods, P.K.; Park, Y.J.; Son, K. Estimating the Texas Windstorm Insurance Association claim payout of commercial buildings from Hurricane Ike. Nat. Hazards 2016, 84, 405–424. [Google Scholar] [CrossRef]

- Burton, C.G. Social vulnerability and hurricane impact modeling. Nat. Hazards Rev. 2010, 11, 58–68. [Google Scholar] [CrossRef]

- Vickery, P.J.; Skerlj, P.F.; Lin, J.; Twisdale, L.A., Jr.; Young, M.A.; Lavelle, F.M. HAZUS-MH hurricane model methodology. II: Damage and loss estimation. Nat. Hazards Rev. 2006, 7, 94–103. [Google Scholar] [CrossRef]

- D’Ayala, D.; Copping, A.; Wang, H. A conceptual model for multi-hazard assessment of the vulnerability of historic buildings. In Proceedings of the Fifth International Conference, New Delhi, India, 9–11 November 2006. [Google Scholar]

- De Silva, D.G.; Kruse, J.B.; Wang, Y. Spatial dependencies in wind-related housing damage. Nat. Hazards 2008, 47, 317–330. [Google Scholar] [CrossRef]

- Kim, J.M.; Son, K.; Yoo, Y.; Lee, D.; Kim, D. Identifying Risk Indicators of Building Damage Due to Typhoons: Focusing on Cases of South Korea. Sustainability 2018, 10, 3947. [Google Scholar] [CrossRef]

- Sanders, D.E.; Brix, A.; Duffy, P.; Forster, W.; Hartington, T.; Jones, G.; Levi, C.; Paddam, P.; Papachristou, D.; Perry, G.; et al. The Management of Losses Arising from Extreme Events; Convention General Insurance Study Group GIRO: London, UK, 2002. [Google Scholar]

- Kunreuther, H.; Meyer, R.; Van den Bulte, C.; Chapman, R.E. Risk Analysis for Extreme Events: Economic Incentives for Reducing Future Losses; US Department of Commerce, Technology Administration, National Institute of Standards and Technology: Gaithersburg, MD, USA, 2004. [Google Scholar]

- Kim, J.M.; Woods, P.K.; Park, Y.J.; Kim, T.; Son, K. Predicting hurricane wind damage by claim payout based on Hurricane Ike in Texas. Geomat. Nat. Hazards Risk 2016, 7, 1513–1525. [Google Scholar] [CrossRef]

- Shan, X.; Peng, J.; Kesete, Y.; Gao, Y.; Kruse, J.; Davidson, R.A.; Nozick, L.K. Market insurance and self-insurance through retrofit: Analysis of hurricane risk in north carolina. ASCE-ASME J. Risk Uncertain. Eng. Syst. Part A Civ. Eng. 2017, 3, 04016012. [Google Scholar] [CrossRef]

- Kesete, Y.; Peng, J.; Gao, Y.; Shan, X.; Davidson, R.A.; Nozick, L.K.; Kruse, J. Modeling Insurer-Homeowner Interactions in Managing Natural Disaster Risk. Risk Anal. 2014, 34, 1040–1055. [Google Scholar] [CrossRef]

- Peng, J.; Shan, X.G.; Gao, Y.; Kesete, Y.; Davidson, R.A.; Nozick, L.K.; Kruse, J. Modeling the integrated roles of insurance and retrofit in managing natural disaster risk: A multi-stakeholder perspective. Nat. Hazards 2014, 74, 1043–1068. [Google Scholar] [CrossRef]

- Preston, B.L.; Brooke, C.; Smith, T.G.; Measham, T.F.; Gorddard, R. Igniting change in local government: Lessons learned from a bushfire vulnerability assessment. Mitig. Adapt. Strateg. Glob. Chang. 2009, 14, 281–283. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, Z.; Wang, J.; Hu, B.; Ye, M.; Xu, S. Large-scale natural disaster risk scenario analysis: A case study of Wenzhou City, China. Nat. Hazards 2011, 60, 1287–1298. [Google Scholar] [CrossRef]

- Birkmann, J.; Cutter, S.L.; Rothman, D.S.; Welle, T.; Garschagen, M.; Van Ruijven, B.; O’Neill, B.; Preston, B.L.; Kienberger, S.; Cardona, O.D.; et al. Scenarios for vulnerability: Opportunities and constraints in the context of climate change and disaster risk. Clim. Chang. 2015, 133, 53–68. [Google Scholar] [CrossRef]

- Mietzner, D.; Reger, G. Advantages and disadvantages of scenario approaches for strategic foresight. Int. J. Technol. Intell. Plan. 2005, 1, 220–239. [Google Scholar] [CrossRef]

- Khan, F.; Rathnayaka, S.; Ahmed, S. Methods and models in process safety and risk management: Past, present and future. Process Saf. Environ. 2015, 98, 116–147. [Google Scholar] [CrossRef]

- Ben-David, I.; Raz, T. An integrated approach for risk response development in project planning. J. Oper. Res. Soc. 2001, 51, 14–25. [Google Scholar] [CrossRef]

- Fan, C.F.; Yu, Y.C. BBN-based software project risk management. J. Syst. Softw. 2004, 73, 193–203. [Google Scholar] [CrossRef]

- Cagno, E.; Caron, F.; Mancini, M. A multi-dimensional analysis of major risks in complex projects. Risk Manag. 2007, 9, 1–18. [Google Scholar] [CrossRef]

- Cioffi, D.F.; Khamooshi, H. A practical method of determining project risk contingency budgets. J. Oper. Res. Soc. 2009, 60, 565–571. [Google Scholar] [CrossRef]

| Classification | Indicators | Explanation | Measure | Data Source |

|---|---|---|---|---|

| Typhoon information | Distance from shoreline | Distance from shoreline | Km | Korea Hydrographic and Oceanographic Agency |

| Maximum wind speed | Sustained maximum wind speed over 10 min | m/s | Japan Meteorological Agency | |

| Building Information | Property Value | Total value of property | $ | Claim payout record |

| Number of Floors | Total number of buildings’ floors | Number | ||

| Number of underground | Total number of buildings’ underground | Number |

| Province Name | Number of Claim Payouts | Total Claim Payouts (1000 USD) |

|---|---|---|

| Busan | 127 | 4,643,478 |

| Gyongnam | 73 | 4,256,039 |

| Gyongbuk | 48 | 414,493 |

| Ulsan | 46 | 495,652 |

| Daegu | 35 | 78,261 |

| Sum | 329 | 9,887,923 |

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| Dependent Variable | |||||

| Damage ratio (%) | 329 | 0.0 | 0.2 | 0.0 | 0.0 |

| Independent Variables | |||||

| Distance from shoreline (km) | 329 | 1.3 | 117.9 | 27.1 | 19.8 |

| Wind speed (m/s) | 329 | 31.2 | 38.2 | 37.2 | 1.3 |

| Property Value (1000 USD) | 329 | 96 | 152,044 | 30,117 | 27,306 |

| Number of Floor (number) | 329 | 1.0 | 28.0 | 20.4 | 4.1 |

| Number of Underground (number) | 329 | - | 5.0 | 0.6 | 0.9 |

| Variables | Coef. | Beta Coef. | p >|z| | VIF |

|---|---|---|---|---|

| Basic Features of Building | ||||

| Property Value | −1.422E-005 | −0.317 | 0.000 | 1.034 |

| Number of Floor | 0.039 | 0.093 | 0.015 | 1.051 |

| Number of Underground | 0.029 | 0.113 | 0.023 | 1.044 |

| Typhoon Information | ||||

| Distance from shoreline | −0.013 | −0.248 | 0.000 | 1.059 |

| Wind speed | 0.479 | 0.509 | 0.000 | 1.098 |

| Number of Observations | 329 | |||

| F | 46.789 | |||

| Adj-R 2 | 0.534 | |||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.-M.; Kim, T.; Son, K.; Yum, S.-G.; Ahn, S. Measuring Vulnerability of Typhoon in Residential Facilities: Focusing on Typhoon Maemi in South Korea. Sustainability 2019, 11, 2768. https://doi.org/10.3390/su11102768

Kim J-M, Kim T, Son K, Yum S-G, Ahn S. Measuring Vulnerability of Typhoon in Residential Facilities: Focusing on Typhoon Maemi in South Korea. Sustainability. 2019; 11(10):2768. https://doi.org/10.3390/su11102768

Chicago/Turabian StyleKim, Ji-Myong, Taehui Kim, Kiyoung Son, Sang-Guk Yum, and Sungjin Ahn. 2019. "Measuring Vulnerability of Typhoon in Residential Facilities: Focusing on Typhoon Maemi in South Korea" Sustainability 11, no. 10: 2768. https://doi.org/10.3390/su11102768

APA StyleKim, J.-M., Kim, T., Son, K., Yum, S.-G., & Ahn, S. (2019). Measuring Vulnerability of Typhoon in Residential Facilities: Focusing on Typhoon Maemi in South Korea. Sustainability, 11(10), 2768. https://doi.org/10.3390/su11102768