A New Method for Agricultural Market Share Assessment

Abstract

1. Introduction

1.1. Romanian Plant Protection Products Market

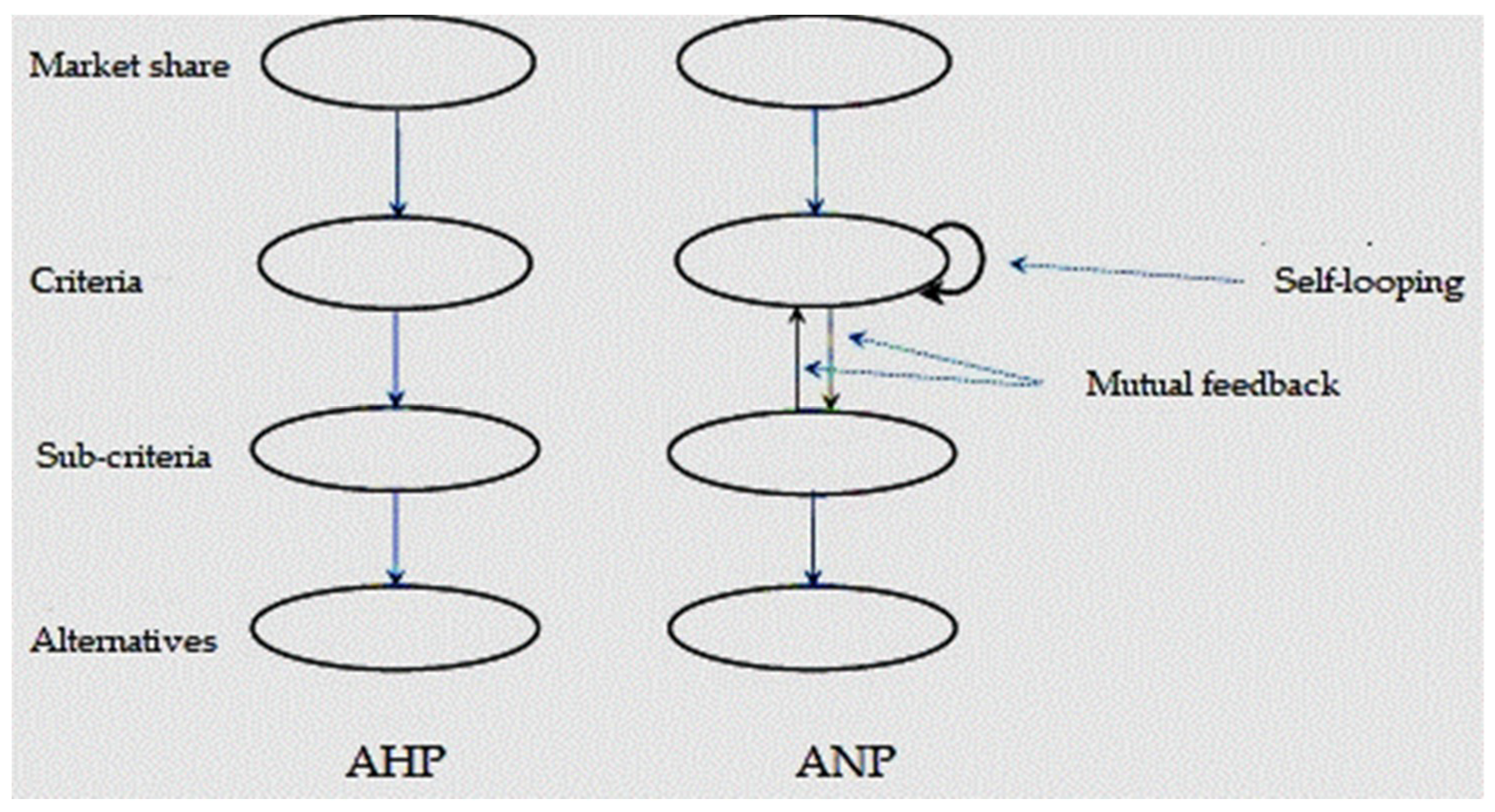

1.2. Analytic Network Process: A New Paradigm for Decision-Making

2. Literature Review

2.1. Analytic Hierarchy Process in Marketing and Supply Chain Management

2.2. Business-to-Business Marketing

3. Research Design and Method

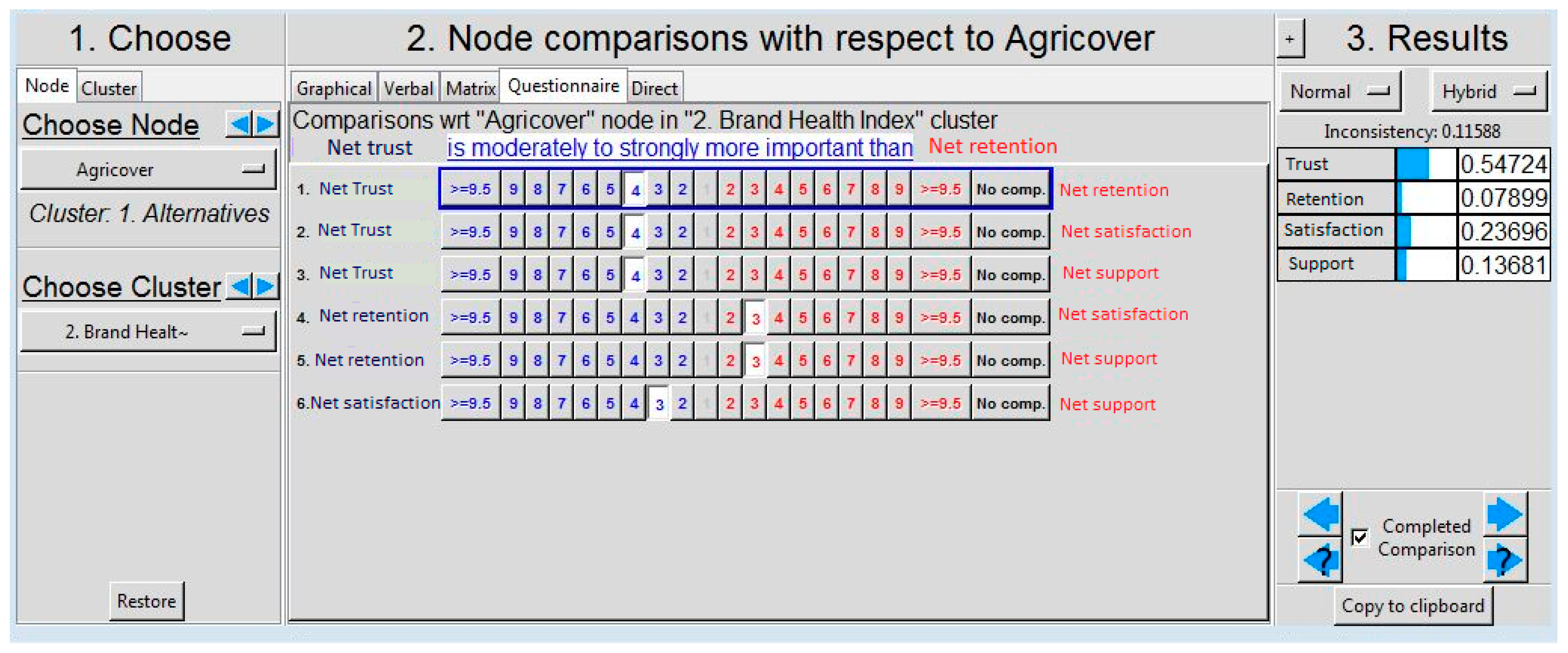

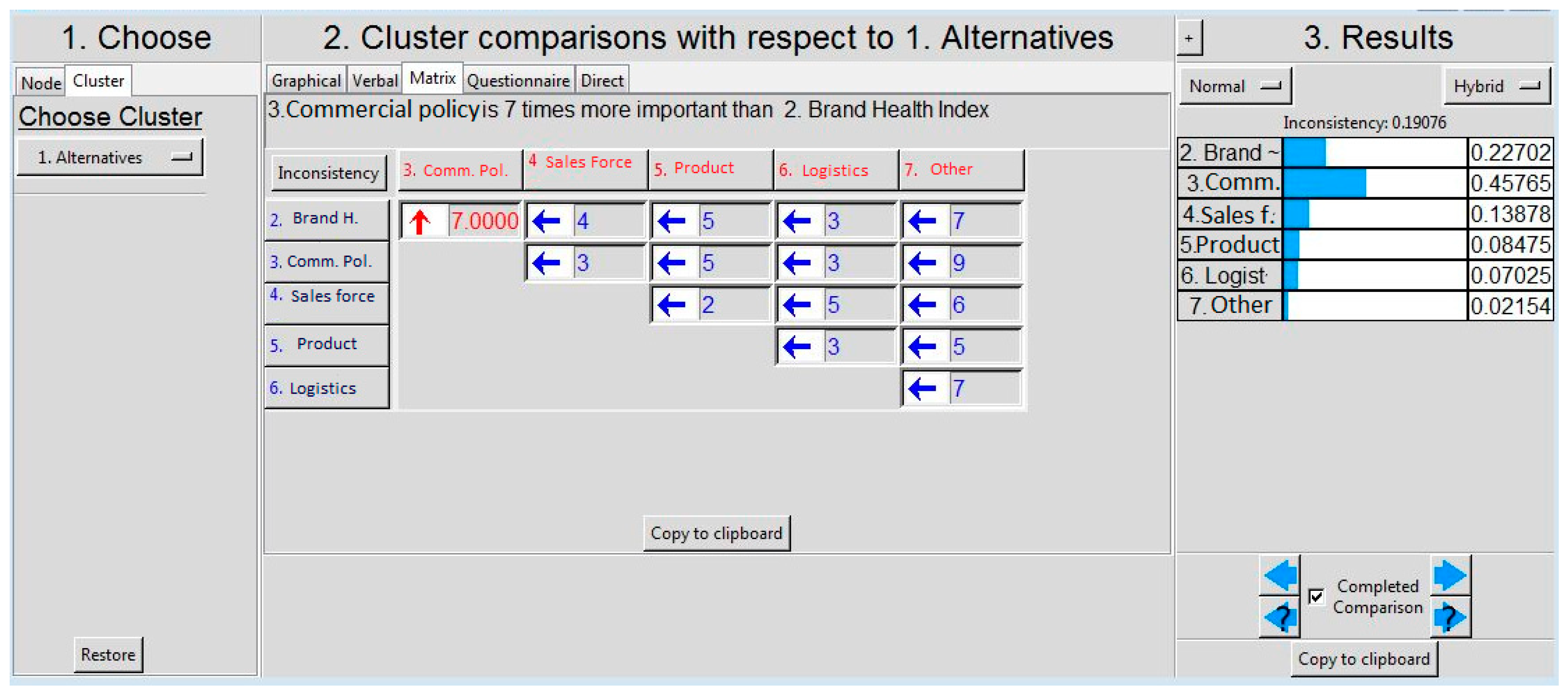

4. Results

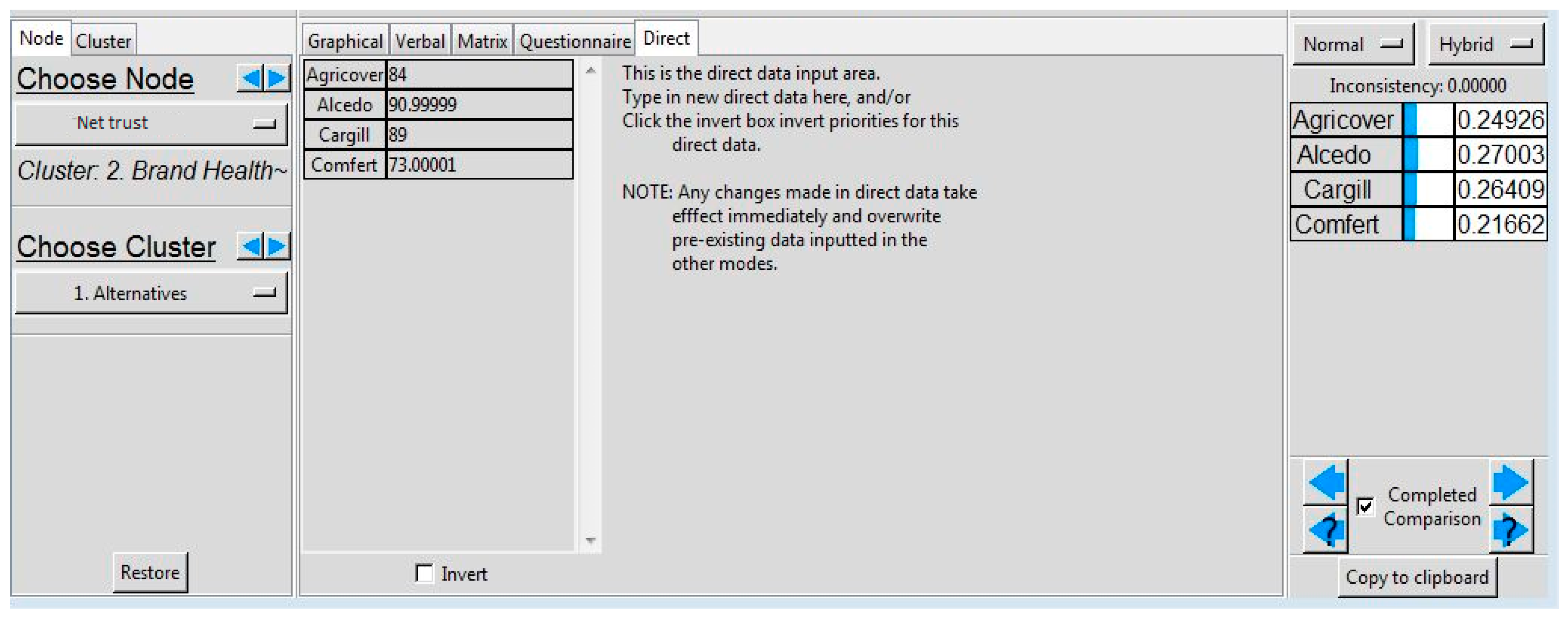

- If we want to compare nodes between themselves, or clusters (in Figure 2 we have nodes);

- The nodes for the pairwise comparisons (net trust); and

- The defining clusters where the compared nodes are (in Figure 2 we have a cluster with the competitors, previously set as the alternatives of the model): Agricover, Alcedo, Cargill, Comfert.

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Gimbasanu, G. The Evolution of the Plant Protection Product Market. Kleffmann Group Romania. 2016. Available online: http://agrointel.ro/41432/cum-a-evoluat-piata-produselor-pentru-protectia-plantelor-studiu-kleffmann-group/ (accessed on 7 April 2016).

- Saaty, T.L. The Analytic Hierarchy and Analytic Network Measurement Processes: Applications to Decisions under Risk. Eur. J. Pure Appl. Math. 2008, 1, 122–156. [Google Scholar]

- Saaty, T.L. Theory and Applications of the Analytic Network Process; RWS Publications: Pittsburgh, PA, USA, 2005; ISBN 978-971-8886031-6-3. [Google Scholar]

- Saaty, T.L. Fundamentals of the Analytic Network Process. In Proceedings of the International Symposium on the Analytic Hierarchy Process, Kobe, Japan, 12–14 August 1999. [Google Scholar]

- Saaty, T.L.; Vargas, L.G. Models, Methods, Concepts & Applications of the Analytic Hierarchy Process; Kluwer Academic Publishers: Boston, MA, USA, 2001. [Google Scholar]

- Saaty, T.L. Highlights and critical points in the theory and application of the Analytic Hierarchy Process. Eur. J. Oper. Res. 1994, 74, 426–447. [Google Scholar] [CrossRef]

- Vargas, L.G.; Saaty, T.L. Financial and intangible factors in fleet lease or buy decision. Ind. Mark. Manag. 1981, 10, 1–10. [Google Scholar] [CrossRef]

- Lu, M.H.; Madu, C.N.; Kuei, C.; Winkour, D. Integrating QFD, AHP and benchmarking in strategic marketing. J. Bus. Ind. Mark. 1994, 9, 41–50. [Google Scholar] [CrossRef]

- Mendes, P.; Leal, J.E.; Thomé, A.M.T. A maturity model for demand-driven supply chains in the consumer product goods industry. Int. J. Prod. Econ. 2016, 179, 153–165. [Google Scholar] [CrossRef]

- Wu, C.-S.; Lin, C.-T.; Lee, C. Optimal marketing strategy: A decision-making with ANP and TOPSIS. Int. J. Prod. Econ. 2010, 127, 190–196. [Google Scholar] [CrossRef]

- Kim, H.-S.; Kim, Y.-G. A CRM performance measurement framework: Its development process and application. Ind. Mark. Manag. 2009, 38, 477–489. [Google Scholar] [CrossRef]

- Lam, P.-K.; Chin, K.-S. Identifying and prioritizing critical success factors or conflict management in collaborative new product development. Ind. Mark. Manag. 2005, 34, 761–772. [Google Scholar] [CrossRef]

- Gorane, S.; Kant, R. A case study for predicting the success possibility of supply chain practices implementation using AHP approach. J. Bus. Ind. Mark. 2016, 31, 137–151. [Google Scholar] [CrossRef]

- Govindan, K.; Kaliyan, M.; Kannan, D.; Haq, A.N. Barriers analysis for green supply chain management implementation in Indian industries using analytic hierarchy process. Int. J. Prod. Econ. 2014, 147, 555–568. [Google Scholar] [CrossRef]

- Fu, H.-P.; Chao, P.; Chang, T.-H.; Chang, Y.-S. The impact of market freedom on the adoption of third-party electronic marketplaces: A fuzzy AHP analysis. Ind. Mark. Manag. 2008, 37, 698–712. [Google Scholar] [CrossRef]

- Cheng, Y.-S.; Lee, F. Outsourcing reverse logistics of high-tech manufacturing firms by using a systematic decision-making approach: TFT-LCD sector in Taiwan. Ind. Mark. Manag. 2010, 39, 1111–1119. [Google Scholar] [CrossRef]

- Liu, F.H.F.; Hai, H.L. The voting analytic hierarchy process method for selecting supplier. Int. J. Prod. Econ. 2005, 97, 308–317. [Google Scholar] [CrossRef]

- Subramanian, N.; Ramanathan, R. A review of applications of Analytic Hierarchy Process in operations management. Int. J. Prod. Econ. 2012, 138, 215–241. [Google Scholar] [CrossRef]

- Vaidya, O.S.; Kumar, S. Analytic hierarchy process: An overview of applications. Eur. J. Oper. Res. 2006, 169, 1–29. [Google Scholar] [CrossRef]

- Boyd, D.E.; Spekman, R.E. Internet usage within B2B relationships and its impact on value creation: A conceptual model and research propositions. J. Bus.-Bus. Mark. 2004, 11, 9–34. [Google Scholar] [CrossRef]

- Goodman, P.S.; Fichman, M.; Lerch, F.J.; Snyder, P.R. Customer-firm relationships, involvement, and customer satisfaction. Acad. Manag. J. 1995, 38, 1310–1324. [Google Scholar]

- Anselmi, K.; Frankel, R.; Whipple, J.M. Performance in product versus service supplier relationships. J. Bus.-Bus. Mark. 2002, 9, 27–43. [Google Scholar] [CrossRef]

- Liu, A.H.; Bui, M.; Leach, M. Considering technological impacts when selecting food suppliers: comparing retailers’ buying behavior in the United States and Europe. J. Bus.-Bus. Mark. 2013, 20, 81–98. [Google Scholar] [CrossRef]

- Mysen, T.; Svensson, G.; Hogevold, N. Relationship quality—relationship value and power balance in business relationships: Descriptives and propositions. J. Bus.-Bus. Mark. 2012, 19, 248–285. [Google Scholar] [CrossRef]

- Kumar, A.; Grisaffe, D.B. Effects of extrinsic attributes on perceived quality, customer value, and behavioral intentions in B2B settings: A comparison across goods and service industries. J. Bus.-Bus. Mark. 2004, 11, 43–74. [Google Scholar] [CrossRef]

- Claycomb, V.; Frankwick, G.L. The dynamics of buyers’ perceived costs during the relationship development process. J. Bus.-Bus. Mark. 1997, 4, 1–37. [Google Scholar] [CrossRef]

- Skard, S.; Nysveen, H. Trusting beliefs and loyalty in B-to-B self-services. J. Bus.-Bus. Mark. 2016, 23, 257–276. [Google Scholar] [CrossRef]

- Rajagopal, A. Buyer-supplier relationship and operational dynamics. J. Oper. Res. Soc. 2009, 60, 313–320. [Google Scholar] [CrossRef]

- Sirdeshmukh, D.; Singh, J.; Sabol, B. Consumer trust, value, and loyalty in relational exchanges. J. Mark. 2002, 66, 15–37. [Google Scholar] [CrossRef]

- Rexha, N. Integrating relationship marketing activities with offering quality in the supplier’s relational marketing program. J. Bus.-Bus. Mark. 2000, 7, 1–17. [Google Scholar] [CrossRef]

- Anderson, J.C.; Narus, J.A. A model of distributor firm and manufacturer firm working partnerships. J. Mark. 1990, 54, 42–58. [Google Scholar] [CrossRef]

- Storbacka, K.; Nenonen, S. Competitive arena mapping: market innovation using morphological analysis in business markets. J. Bus.-Bus. Mark. 2012, 19, 183–215. [Google Scholar] [CrossRef]

- Vieira, A.L.; Winklhofer, H.; Ennew, C. The effects of relationship marketing on share of business—A synthesis and comparison of models. J. Bus.-Bus. Mark. 2014, 21, 85–110. [Google Scholar] [CrossRef]

- Palmatier, R.W.; Dant, R.P.; Grewal, D.; Evans, K.R. Factors influencing the effectiveness of relationship marketing: A meta-analysis. J. Mark. 2006, 70, 136–153. [Google Scholar] [CrossRef]

- Palmatier, R.W.; Sheer, L.K.; Houston, M.B.; Evans, K.R.; Gopalakrishna, S. Use of relationship marketing programs in building customer-salesperson and customer–firm relationships: Differential influences on financial outcomes. Int. J. Res. Mark. 2007, 24, 210–223. [Google Scholar] [CrossRef]

- Fok, D.; Franses, P.H.; Paap, R. Econometric analysis of the market share attraction model. In Advances in Econometrics: Econometric Models in Marketing; Franses, P.H., Montgomery, A., Eds.; Marcel Dekker: New York, NY, USA, 2002; pp. 223–257. [Google Scholar]

- Fok, D.; Franses, P.H. Forecasting market shares from models for sales. Int. J. Forecast. 2001, 17, 121–128. [Google Scholar] [CrossRef]

- Lau, G.T.; Chin, H.W. Trustworthiness of Salespeople in the Business-to-Business Market: The Five C’s. J. Bus.-Bus. Mark. 2003, 10, 1–33. [Google Scholar] [CrossRef]

- Ruiz-Molina, M.E.; Gil-Saura, I. Relationship and market conditions: outcomes in marketing channels. J. Bus.-Bus. Mark. 2012, 19, 289–308. [Google Scholar] [CrossRef]

- King, R.P.; Hand, M.S.; DiGiacomo, G.; Clancy, K.; Gomez, M.I.; Hardesty, S.D.; Lev, L.; McLaughlin, E.W. Comparing the Structure, Size, and Performance of Local and Mainstream Food Supply Chains; Economic Research Report 99; U.S. Department of Agriculture, Economic Research Service: Washington, DC, USA, 2010.

- Agapie, A.; Bratianu, C. survey design using individual numerical scales in the framework of analytic hierarchy process. Manag. Mark. 2011, 6, 195–204. [Google Scholar]

- Bratianu, C.; Agapie, A.; Orzea, I. Modelling organizational knowledge dynamics using Analytic Hierarchy Process (AHP). Electron. J. Knowl. Manag. 2011, 9, 236–247. [Google Scholar]

- Bratianu, C.; Agapie, A.; Orzea, I. Knowledge dynamics modelling using Analytic Hierarchy Process (AHP). In Proceedings of the European Conference on Intellectual Capital, Nicosia, Cyprus, 18–19 April 2011; pp. 94–102. [Google Scholar]

- SuperDecisions Software. Available online: http://www.SuperDecisions.com (accessed on 25 January 2018).

- Radutu, A.; Agapie, A. Analytic Hierarchy Processes (AHP) in service of local knowledge transfer. In Proceedings of the European Conference on Knowledge Management, Belfast, North Ireland, UK, 1–2 September 2016; pp. 1071–1079. [Google Scholar]

- Agapie, A. Determining the best Response using Simulated Annealing for AHP Survey Design. In Proceedings of the International Conference on Business Excellence, Brasov, Romania, 12–13 October 2012; pp. 1–4. [Google Scholar]

- Agapie, A. Numerical scales for decision makers preference judgments in the analytic hierarchy process. In Proceedings of the International Conference on Business Excellence, Brasov, Romania, 15–16 October 2010; pp. 1–4. [Google Scholar]

- Likert, R. A Technique for the measurement of attitudes. Arch. Psychol. 1932, 140, 1–55. [Google Scholar]

- Franek, J.; Kresta, A. Judgement scales and consistency measure in AHP. Procedia Econ. Financ. 2014, 12, 164–173. [Google Scholar] [CrossRef]

| Secondary Research/Literature Review [28,40] | Primary Research/Qualitative and Quantitative Studies (8 Focus Groups Conducted with Experts, 7 in-Depth Interviews Conducted with Farmers) |

|---|---|

| Product based: Demand Preferences Services Availability Product Information Delivery cost | Product: Range of products Product variation Product availability Quality of products |

| Comparative performance: Value for money Price sensitivity Buying cost Services cost Guarantee Cross promotion Value addition Competitiveness Buyer support | Trade Policy: Final prices Flexibility in payment Flexibility in negotiating price Terms of payment Special offers |

| Process control: Quality functions deployment Routing supplies Inventory management Order generation Order compliance Stock transfer Time management Team work Conformance quality | Servicing: Ease of trading Accuracy of documents Time to get the documents |

| Supply design: Display PoS (Point of Sale) support Availability Delivery Responsiveness Prospecting Negotiation Supplier involvement | Delivery: Delivery time Promptness of delivery in emergency situations Accuracy of delivered order |

| Brand functions: Reputation New brand extensions Loyalty Social status Strong referral | Brand Health Index: Advocacy Customer Satisfaction Reputation/Trust Retention |

| Sales Force: Level of technical expertise and understanding of agriculture Promptness and responsiveness Friendliness, willingness to help farmer Stability of personnel Networking skills Seriousness, keeping promises | |

| Others: Loans and financing facilities Technical consulting Loyalty programs |

| 1 | Equal importance |

| 3 | Experience and judgement slightly favor one activity over another |

| 5 | Experience and judgement strongly favor one activity over another |

| 7 | An activity is favored very strongly over another; its dominance is demonstrated in practice |

| 9 | The evidence favoring one activity over another is of the highest possible order of affirmation |

| 2,4,6,8 | Intermediate values |

| Competitor | Super Decisions Normalized Values | Actual Data from Kleffmann Study | Normalized Data from Kleffmann Study |

|---|---|---|---|

| Agricover (A1) | 25.0% | 6.91% | 25% |

| Alcedo (A2) | 26.1% | 11.78% | 42% |

| Cargill (A3) | 24.7% | 4.17% | 15% |

| Comfert (A4) | 24.2% | 5.08% | 18% |

| Alternative 1 | Alternative 2 | Alternative 3 | Alternative 4 | |

| Alternative 1 | A1/A1 | A2/A1 | A3/A1 | A4/A1 |

| Alternative 2 | A1/A2 | A2/A2 | A3/A2 | A4/A2 |

| Alternative 3 | A1/A3 | A2/A3 | A3/A3 | A4/A3 |

| Alternative 4 | A1/A4 | A2/A4 | A3/A4 | A4/A4 |

| Agricover | Alcedo | Cargill | Comfert | |

| Agricover | 1 | 1.04566 | 0.98851 | 0.96649 |

| Alcedo | 0.9563304 | 1 | 0.94535 | 0.92429 |

| Cargill | 101.2% | 1.05781 | 1 | 0.97772 |

| Comfert | 1.0346672 | 1.08191 | 1.02278 | 1 |

| Alternative 1 | Alternative 2 | Alternative 3 | Alternative 4 | |

| Alternative 1 | A1/A1 | A1/A2 | A1/A3 | A1/A4 |

| Alternative 2 | A2/A1 | A2/A2 | A2/A3 | A2/A4 |

| Alternative 3 | A3/A1 | A3/A2 | A3/A3 | A3/A4 |

| Alternative 4 | A4/A1 | A4/A2 | A4/A3 | A4/A4 |

| Agricover | Alcedo | Cargill | Comfert | |

| Agricover | 1 | 0.58651 | 1.65668 | 1.359376 |

| Alcedo | 1.7050117 | 1 | 2.82466 | 2.317753 |

| Cargill | 60% | 0.35403 | 1 | 0.820544 |

| Comfert | 0.7356314 | 0.4314524 | 1.21870 | 1 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Popa, A.; Hadad, S.; Paiusan, R.; Nastase, M. A New Method for Agricultural Market Share Assessment. Sustainability 2019, 11, 88. https://doi.org/10.3390/su11010088

Popa A, Hadad S, Paiusan R, Nastase M. A New Method for Agricultural Market Share Assessment. Sustainability. 2019; 11(1):88. https://doi.org/10.3390/su11010088

Chicago/Turabian StylePopa, Alina, Shahrazad Hadad, Robert Paiusan, and Marian Nastase. 2019. "A New Method for Agricultural Market Share Assessment" Sustainability 11, no. 1: 88. https://doi.org/10.3390/su11010088

APA StylePopa, A., Hadad, S., Paiusan, R., & Nastase, M. (2019). A New Method for Agricultural Market Share Assessment. Sustainability, 11(1), 88. https://doi.org/10.3390/su11010088