The Value of Business–Government Ties for Manufacturing Firms’ Product Innovation during Institutional Transition in China

Abstract

1. Introduction

2. Theory and Hypotheses Development

2.1. The Value of B–G Ties for Firms’ Product Innovation

2.2. Contingent Effects of Specific Institutional Contexts

2.2.1. The Institutions and Institutional Transitions in China

2.2.2. Legal Institutions

2.2.3. Economic Institutions

3. Data and Methods

3.1. Data

3.2. Measures

3.3. Analytical Approach

4. Results

4.1. Descriptive Statistics

4.2. Regression Results

5. Discussion and Conclusions

5.1. Contributions

5.2. Limitations and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Survey Questions |

|---|---|

| Product innovation | 1. In fiscal year 2011, what percent of this establishment’s total annual sales was accounted for by products or services that were introduced in the last three years? 2. In fiscal year 2011, what were this establishment’s total annual sales for ALL products and services? |

| B–G ties | 1. In a typical week over the last year, what percentage of total senior management’s time was spent on dealing with requirements imposed by government regulations? |

| Legal institution | 1. The court system is fair, impartial and uncorrupted. [1 Strongly disagree, 2 Tend to disagree, 3 Tend to agree, 4 Strongly agree] 2. To what degree is/are Courts an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] |

| Business regulation | 1. To what degree is/are Tax Rates an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] 2. To what degree is/are Tax Administration an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] 3. To what degree is/are Business Licensing and Permits an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] |

| Financial systems | 1. To what degree is Access to Finance an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] |

| Infrastructure supporting systems | 1. To what degree is Electricity an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] 2. To what degree is Telecommunications an obstacle to the current operations of this establishment? [0 No obstacle, 1 Minor obstacle, 2 Moderate obstacle, 3 Major obstacle, 4 Very severe obstacle] |

References

- Peng, M.W. Institutional transitions and strategic choices. Acad. Manag. Rev. 2003, 28, 275–296. [Google Scholar] [CrossRef]

- Peng, M.W.; Luo, Y. Managerial ties and firm performance in a transition economy: The nature of a Micro-Macro link. Acad. Manag. J. 2000, 43, 486–501. [Google Scholar] [CrossRef]

- Child, J.; Tse, D.K. China’s transition and its implications for international business. J. Int. Bus. Stud. 2001, 32, 5–21. [Google Scholar] [CrossRef]

- Meyer, K.E.; Nguyen, H.V. Foreign investment strategies and sub-national institutions in emerging markets: Evidence from Vietnam. J. Manag. Stud. 2005, 42, 63–93. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2017, 62, 375–404. [Google Scholar] [CrossRef]

- Sun, P.; Mellahi, K.; Wright, M. The contingent value of corporate political ties. Acad. Manag. Perspect. 2012, 26, 68–82. [Google Scholar] [CrossRef]

- Kotabe, M.; Jiang, C.X.; Murray, J.Y. Examining the complementary effect of political networking capability with absorptive capacity on the innovative performance of emerging-market firms. J. Manag. 2017, 43, 1131–1156. [Google Scholar] [CrossRef]

- Li, H.; Zhang, Y. The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strateg. Manag. J. 2007, 28, 791–804. [Google Scholar] [CrossRef]

- Shaffer, B.; Hillman, A.J. The development of business-government strategies by diversified firms. Strateg. Manag. J. 2000, 21, 175–190. [Google Scholar] [CrossRef]

- Zheng, W.; Singh, K.; Chung, C.-N. Ties to unbind: Political ties and firm sell-offs during institutional transition. J. Manag. 2017, 43, 2005–2036. [Google Scholar] [CrossRef]

- Zheng, W.; Singh, K.; Mitchell, W. Buffering and enabling: The impact of interlocking political ties on firm survival and sales growth. Strateg. Manag. J. 2015, 36, 1615–1636. [Google Scholar] [CrossRef]

- Meyer, K.E.; Estrin, S.; Bhaumik, S.K.; Peng, M.W. Institutions, resources, and entry strategies in emerging economies. Strateg. Manag. J. 2009, 30, 61–80. [Google Scholar] [CrossRef]

- Gao, Y.; Shu, C.; Jiang, X.; Gao, S.; Page, A.L. Managerial ties and product innovation: The moderating roles of macro- and micro-institutional environments. Long Range Plan. 2017, 50, 168–183. [Google Scholar] [CrossRef]

- Schott, T.; Jensen, K.W. Firms’ innovation benefiting from networking and institutional support: A global analysis of national and firm effects. Res. Policy 2016, 45, 1233–1246. [Google Scholar] [CrossRef]

- Lin, C.; Lin, P.; Song, F. Property rights protection and corporate R&D: Evidence from China. J. Dev. Econ. 2010, 93, 49–62. [Google Scholar] [CrossRef]

- Wu, J. Asymmetric roles of business ties and political ties in product innovation. J. Bus. Res. 2011, 64, 1151–1156. [Google Scholar] [CrossRef]

- Chan, C.M.; Makino, S.; Isobe, T. Does subnational regions matter? Foreign affiliate performance in the United States and China. Strateg. Manag. J. 2010, 31, 1226–1243. [Google Scholar] [CrossRef]

- Shi, W.S.; Sun, S.L.; Peng, M.W. Sub-national institutional contingencies, network positions, and IJV partner selection. J. Manag. Stud. 2012, 49, 1221–1245. [Google Scholar] [CrossRef]

- He, C.; Wei, Y.D.; Xie, X. Globalization, institutional change, and industrial location: Economic transition and industrial concentration in China. Reg. Stud. 2008, 42, 923–945. [Google Scholar] [CrossRef]

- Peng, M.W.; Wang, D.Y.L.; Jiang, Y. An institution-based view of international business strategy: A focus on emerging economies. J. Int. Bus. Stud. 2008, 39, 920–936. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: New York, NY, USA, 1990. [Google Scholar]

- Oliver, C. Sustainable competitive advantage: Combining institutional and resource based views. Strateg. Manag. J. 1997, 19, 697–713. [Google Scholar] [CrossRef]

- Peng, M.W.; Sun, S.L.; Pinkham, B.; Chen, H. The Institution-based view as a third leg for a strategy tripod. Acad. Manag. Perspect. 2009, 23, 63–81. [Google Scholar] [CrossRef]

- Wright, M.; Filatotchev, I.; Hoskisson, R.E.; Peng, M.W. Strategy research in emerging economies: Challenging the conventional wisdom. J. Manag. Stud. 2005, 42, 1–33. [Google Scholar] [CrossRef]

- Park, S.H.; Li, S.; Tse, D.K. Market liberalization and firm performance during China’s economic transition. J. Int. Bus. Stud. 2006, 37, 127–147. [Google Scholar] [CrossRef]

- Michelson, E. Lawyers, political embeddedness and institutional continuity in China’s transition from socialism. Am. J. Sociol. 2007, 113, 352–414. [Google Scholar] [CrossRef]

- Shi, W.S.; Markoczy, L.; Stan, C.V. The continuing importance of political ties in China. Acad. Manag. Perspect. 2014, 28, 57–75. [Google Scholar] [CrossRef]

- Nee, V.; Opper, S. Political capital in a market economy. Soc. Forces 2010, 88, 2105–2132. [Google Scholar] [CrossRef]

- Galang, R.M.N. Government efficiency and international technology adoption: The spread of electronic ticketing among airlines. J. Int. Bus. Stud. 2012, 43, 631–654. [Google Scholar] [CrossRef]

- Granville, B.; Leonard, C.S. Do informal institutions matter for technological change in Russia? The impact of communist norms and conventions, 1998–2004. World Dev. 2010, 38, 155–169. [Google Scholar] [CrossRef]

- Zhu, Y.; Wittmann, X.; Peng, M.W. Institution-based barriers to innovation in SMEs in China. Asia Pac. J. Manag. 2012, 29, 1131–1142. [Google Scholar] [CrossRef]

- Marquis, C.; Raynard, M. Institutional strategies in emerging markets. Acad. Manag. Ann. 2015, 9, 291–335. [Google Scholar] [CrossRef]

- World Bank. World Bank’s Enterprise Survey: Understanding the Questionnaire; World Bank: Washington, DC, USA, 2011. (In English) [Google Scholar]

- Luu, N.; Ngo, L.V. Entrepreneurial orientation and social ties in transitional economies. Long Range Plan. 2018. [Google Scholar] [CrossRef]

- Chan, C.M.; Isobe, T.; Makino, S. Which country matters? Institutional development and foreign affiliate performance. Strateg. Manag. J. 2008, 29, 1179–1205. [Google Scholar] [CrossRef]

- Khanna, T.; Palepu, K. The future of business groups in emerging markets: Long-run evidence from Chile. Acad. Manag. J. 2000, 43, 268–285. [Google Scholar] [CrossRef]

- Xin, K.R.; Pearce, J.L. Guanxi: Connections as substitutes for formal institutional support. Acad. Manag. J. 1996, 39, 1641–1658. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Oliver, C. Strategic responses to institutional processes. Acad. Manag. Rev. 1991, 16, 145–179. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Res. Policy 1986, 15, 285–305. [Google Scholar] [CrossRef]

- Goldman, E.; Rocholl, J.; So, J. Politically connected boards of directors and the allocation of procurement contracts. Rev. Financ. 2013, 17, 1617–1648. [Google Scholar] [CrossRef]

- Hillman, A.J.; Hitt, M.A. Corporate political strategy formulation: A model of approach, participation, and strategy decisions. Acad. Manag. Rev. 1999, 24, 825–842. [Google Scholar] [CrossRef]

- Faccio, M.; Masulis, R.W.; McConnell, J.J. Political connections and corporate bailouts. J. Financ. 2006, 61, 2597–2635. [Google Scholar] [CrossRef]

- Khwaja, A.I.; Mian, A. Do lenders favor politically connected firms? Rent provision in an emerging financial market. Q. J. Econ. 2005, 120, 1371–1411. [Google Scholar] [CrossRef]

- Li, J.J. The formation of managerial networks of foreign firms in China: The effects of strategic orientations. Asia Pac. J. Manag. 2005, 22, 423–443. [Google Scholar] [CrossRef]

- Welter, F.; Kautonen, T.; Chepurenko, A.; Malieva, E. Trust environments and entrepreneurial behavior—Exploratory evidence from Estonia, Germany and Russia. J. Enterp. Cult. 2004, 12, 327–349. [Google Scholar] [CrossRef]

- Priem, R.L.; Butler, J.E. Is the resource-based “view” a useful perspective for strategic management research? Acad. Manag. Rev. 2001, 26, 22–40. [Google Scholar] [CrossRef]

- Katila, R.; Shane, S. When does lack of resources make new firms innovative? Acad. Manag. J. 2005, 48, 814–829. [Google Scholar] [CrossRef]

- Powell, W.W.; Koput, K.W.; Smith-Doerr, L. Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Adm. Sci. Q. 1996, 41, 116–145. [Google Scholar] [CrossRef]

- Mahmood, I.P.; Rufin, C. Government’s dilemma: The role of government in imitation and innovation. Acad. Manag. Rev. 2005, 30, 338–360. [Google Scholar] [CrossRef]

- Makino, S.; Isobe, T.; Chan, C.M. Does country matter? Strateg. Manag. J. 2004, 25, 1027–1043. [Google Scholar] [CrossRef]

- Ahlstrom, D.; Bruton, G.D.; Yeh, K.S. Private firms in China: Building legitimacy in an emerging economy. J. World Bus. 2008, 43, 385–399. [Google Scholar] [CrossRef]

- Lu, Y.; Tsang, E.W.K.; Peng, M.W. Knowledge management and innovation strategy in the Asia Pacific: Toward an institution-based view. Asia Pac. J. Manag. 2008, 25, 361–374. [Google Scholar] [CrossRef]

- Zimmerman, M.A.; Zeitz, G.J. Beyond survival: Achieving new venture growth by building legitimacy. Acad. Manag. Rev. 2002, 27, 414–431. [Google Scholar] [CrossRef]

- Peng, M.W.; Heath, P.S. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Acad. Manag. Rev. 1996, 21, 492–528. [Google Scholar] [CrossRef]

- North, D.C. Institutions and the process of economic change. Manag. Int. 2005, 9, 1–7. [Google Scholar]

- Acemoglu, D.; Johnson, S. Unbundling institutions. J. Political Econ. 2005, 113, 949–995. [Google Scholar] [CrossRef]

- Yang, X.; Sun, S.L.; Yang, H. Market-based reforms, synchronization and product innovation. Ind. Mark. Manag. 2015, 50, 30–39. [Google Scholar] [CrossRef]

- Li, H.; Meng, L.; Wang, Q.; Zhou, L. Political connections, financing and firm performance: Evidence from Chinese private firms. J. Dev. Econ. 2008, 87, 283–299. [Google Scholar] [CrossRef]

- Schlevogt, K.-A. Institutional and organizational factors affecting effectiveness: Geoeconomic comparison between Shanghai and Beijing. Asia Pac. J. Manag. 2001, 18, 519–551. [Google Scholar] [CrossRef]

- Acemoglu, D.; Dell, M. Productivity differences between and within countries. Am. Econ. J. Macroecon. 2010, 2, 169–188. [Google Scholar] [CrossRef]

- Luo, Y. Are Joint Venture Partners More Opportunistic in a More Volatile Environment? Strateg. Manag. J. 2007, 28, 39–60. [Google Scholar] [CrossRef]

- Ahuja, G.; Yayavaram, S. Explaining influence rents: The case for an institutions-based view of strategy. Organ. Sci. 2011, 22, 1631–1652. [Google Scholar] [CrossRef]

- Casson, M.C.; Giusta, M.D.; Kambhampati, U.S. Formal and informal institutions and development. World Dev. 2010, 38, 137–141. [Google Scholar] [CrossRef]

- Lenartowicz, T.; Roth, K. Does subculture within a country matter? A cross-culture study of motivational domains and business performance in Brazil. J. Int. Bus. Stud. 2001, 32, 305–325. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction cost economics and organization theory. Inst. Corp. Chang. 1993, 2, 107–156. [Google Scholar] [CrossRef]

- Nguyen, H.; Jaramillo, P.A. Institutions and Firms’ Return to Innovation: Evidence from the World Bank Enterprise Survey; World Bank Policy Research Working Paper No. 6918; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Oluwatobi, S.; Efobi, U.; Olurinola, I.; Alege, P. Innovation in Africa: Why institutions matter. S. Afr. J. Econ. 2015, 83, 390–410. [Google Scholar] [CrossRef]

- Perks, H.; Kahn, K.; Zhang, C. An empirical evaluation of R&D-marketing NPD integration in Chinese firms: The guanxi effect. J. Prod. Innov. Manag. 2009, 26, 640–651. [Google Scholar] [CrossRef]

- Peng, M.W.; Zhou, J.Q. How network strategies and institutional transitions evolve in Asia. Asia Pac. J. Manag. 2005, 22, 321–336. [Google Scholar] [CrossRef]

- Zhang, J.; Tan, J.; Wong, P.K. When does investment in political ties improve firm performance? The contingent effect of innovation activities. Asia Pac. J. Manag. 2015, 32, 363–387. [Google Scholar] [CrossRef]

- Myers, S.C. The capital structure puzzle. J. Financ. 1984, 39, 575–592. [Google Scholar] [CrossRef]

- Levie, J.; Autio, E. A theoretical grounding and test of the GEM model. Small Bus. Econ. 2008, 31, 235–263. [Google Scholar] [CrossRef]

- Bygrave, W.; Hay, M.; Ng, E.; Reynolds, P.D. Executive forums: A study of informal investing in 29 nations composing Global Entrepreneurship Monitor. Venture Cap. Int. J. Entrep. Financ. 2003, 5, 101–116. [Google Scholar] [CrossRef]

- Kusnadi, Y.; Yang, Z.; Zhou, Y. Institutional development, state ownership, and corporate cash holdings: Evidence from China. J. Bus. Res. 2015, 68, 351–359. [Google Scholar] [CrossRef]

- Luo, Y. Industrial dynamics and managerial networking in an emerging market: The case of China. Strateg. Manag. J. 2003, 24, 1315–1327. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Wright, M.; Fitatotchev, I.; Peng, M.W. Emerging multinationals from Mid-range economies: The influence of institutions and factor markets. J. Manag. Stud. 2013, 50, 1295–1321. [Google Scholar] [CrossRef]

- Meon, P.-G.; Weill, L. Is corruption an efficient grease? World Dev. 2010, 38, 244–259. [Google Scholar] [CrossRef]

- Hipp, C.; Grupp, H. Innovation in the service sector: The demand for service-specific innovation measurement concepts and typologies. Res. Policy 2005, 34, 517–535. [Google Scholar] [CrossRef]

- Smith, K. Measuring innovation. In The Oxford Handbook of Innovation; Fagerberg, J., Mowery, D.C., Nelson, R.R., Eds.; Oxford University Press: Oxford, UK, 2005; pp. 148–177. [Google Scholar]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Bliese, P.D. Within-group agreement, non-independence, and reliability: Implications for data aggregation and analysis. In Multilevel Theory, Research, and Methods in Organizations: Foundations, Extensions, and New Directions; Klein, K.J., Kozlowski, S.W.J., Eds.; Jossey-Bass: San Francisco, CA, USA, 2000; pp. 349–381. [Google Scholar]

- Wang, X.; Fan, G.; Yu, J. Marketization Index of China’s Provinces: NERI Report 2016; Social Sciences Academic Press: Beijing, China, 2016. [Google Scholar]

- Gaur, A.S.; Lu, J.W. Ownership strategies and survival of foreign subsidiaries: Impacts of institutional distance and experience. J. Manag. 2007, 33, 84–110. [Google Scholar] [CrossRef]

- Kuncic, A. Institutional quality dataset. J. Inst. Econ. 2014, 10, 135–161. [Google Scholar] [CrossRef]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators Project: Answering the Critics; World Bank Policy Research Working Paper No. 4149; World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Shu, C.; Page, A.L.; Gao, S.; Jiang, X. Managerial ties and firm innovation: Is knowledge creation a missing link? J. Prod. Innov. Manag. 2012, 29, 125–143. [Google Scholar] [CrossRef]

- Acquaah, M. Managerial social capital, strategic orientation, and organizational performance in an emerging economy. Strateg. Manag. J. 2007, 28, 1235–1255. [Google Scholar] [CrossRef]

- Snijders, T.A.B.; Bosker, R.J. Multilevel Analysis: An Introduction to Basic and Advanced Multilevel Modeling, 2nd ed.; Sage Publishers: London, UK, 2012. [Google Scholar]

- Zhou, W. Regional institutional development, political connections, and entrepreneurial performance in China’s transition economy. Small Bus. Econ. 2014, 43, 161–181. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Fixed-effects and related estimators for correlated random-coefficient and treatment-effect panel data models. Rev. Econ. Stat. 2005, 87, 385–390. [Google Scholar] [CrossRef]

- Aguinis, H.; Gottfredson, R.K.; Culpepper, S.A. Best-practice recommendations for estimating cross-level interaction effects using multilevel modeling. J. Manag. 2013, 39, 1490–1528. [Google Scholar] [CrossRef]

- Hofmann, D.A.; Gavin, M.B. Centering decisions in hierarchical linear models: Implications for research in organizations. J. Manag. 1998, 24, 623–641. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Guo, S.Y.; Fraser, M.W. Propensity Score Analysis: Statistical Methods and Applications; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Guo, D.; Guo, Y.; Jiang, K. Government-subsidized R&D and firm innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar] [CrossRef]

- Thornton, P.M. The advance of the party: Transformation or takeover of urban grassroots society? China Q. 2013, 213, 1–18. [Google Scholar] [CrossRef]

- Boisot, M.; Child, J. From fiefs to clans and network capitalism: Explaining China’s emerging economic order. Adm. Sci. Q. 1996, 41, 600–628. [Google Scholar] [CrossRef]

- Lin, R.; Peng, T.; Zhang, H. Venture capital reputation and portfolio firm performance in an emerging economy: The moderating effect of institutions. Asia Pac. J. Manag. 2017, 34, 699–723. [Google Scholar] [CrossRef]

| Product Innovation | Total | |||

|---|---|---|---|---|

| Yes | No | |||

| B–G ties | Yes | 433 (26%) | 396 (23%) | 829 |

| No | 344 (20%) | 519 (31%) | 863 | |

| 777 | 915 | 1692 | ||

| Variable | Obs. | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Firms’ product innovation (log) | 1645 | 6.89 | 7.81 | 0 | 23.61 |

| B–G ties | 1622 | 1.29 | 3.0 | 0 | 35 |

| Manager experience | 1666 | 2.72 | 0.49 | 0 | 3.85 |

| Competition | 1604 | 0.50 | 0.50 | 0 | 1 |

| Employee education | 1655 | 10.18 | 1.88 | 1 | 18 |

| Employee training | 1692 | 0.86 | 0.35 | 0 | 1 |

| Firm size (log) | 1692 | 4.44 | 1.29 | 1.61 | 10.31 |

| Annual sale (log) | 1692 | 16.91 | 1.67 | 11.51 | 24.41 |

| Industry | 1692 | 25 | 5.83 | 15 | 37 |

| R&D intensity | 1586 | 0.20 | 0.06 | 0 | 0.79 |

| Infrastructural supporting system | 25 | 3.57 | 0.27 | 2.82 | 3.97 |

| Business regulations | 25 | 3.33 | 0.54 | 1.89 | 3.88 |

| Financial systems | 25 | 3.17 | 0.42 | 2.21 | 3.74 |

| Legal institutions | 25 | 3.19 | 0.16 | 2.76 | 3.43 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Firms’ product innovation | 1 | |||||||||||||||||

| 2. B–G ties (BGT) | 0.18 * | 1 | ||||||||||||||||

| 3. Infrastructural supporting system (ISS) | −0.14 * | 0.01 | 1 | |||||||||||||||

| 4. Business regulations (BR) | −0.23 * | 0.11 * | 0.32 * | 1 | ||||||||||||||

| 5. Financial systems (FS) | −0.09 * | 0.04 | −0.25 * | 0.41 * | 1 | |||||||||||||

| 6. Legal institutions (LI) | −0.02 | 0.06 * | 0.08 * | 0.46 * | 0.08 * | 1 | ||||||||||||

| 7. Manager experience | 0.10 * | −0.03 | 0.08 * | −0.19 * | −0.20 * | −0.05 * | 1 | |||||||||||

| 8. Competition | 0.16 * | 0.09 * | 0.04 | −0.14 * | −0.29 * | 0.01 | 0.02 | 1 | ||||||||||

| 9. Education | 0.07 * | 0.08 * | 0.06 * | 0.15 * | 0.14 * | 0.01 | 0.04 | −0.07 * | 1 | |||||||||

| 10. Training | 0.16 * | 0.04 | −0.002 | 0.09 * | 0.12 * | 0.04 | −0.03 | −0.06 * | 0.04 | 1 | ||||||||

| 11. Firm size | 0.25 * | 0.09 * | −0.05 | −0.06 * | 0.01 | −0.08 * | 0.16 * | −0.09 * | 0.06 * | 0.21 * | 1 | |||||||

| 12. Annual sale | 0.27 * | 0.08 * | −0.04 | −0.05 * | −0.01 | −0.07 * | 0.20 * | −0.09 * | 0.11 * | 0.19 * | 0.61 * | 1 | ||||||

| 13. Industry | 0.05 * | −0.001 | −0.03 | −0.03 | 0.01 | −0.05 | 0.01 | −0.08 * | 0.15 * | 0.03 | 0.02 | 0.09 * | 1 | |||||

| 14. R&D intensity | 0.25 * | 0.24 * | −0.10 * | 0.01 | −0.02 | 0.01 | −0.07 * | 0.11 * | 0.11 * | 0.05 * | 0.01 | −0.05 | 0.04 | 1 | ||||

| 15. BGT × LI | −0.10 * | −0.07 * | 0.06 * | 0.08 * | 0.04 | −0.06 * | 0.01 | −0.09 * | 0.04 | 0.07 * | 0.03 | 0.04 | −0.03 | −0.02 | 1 | |||

| 16. BGT × BR | 0.03 | 0.05 * | 0.13 * | 0.04 | 0.14 * | 0.09 * | 0.03 | −0.03 | 0.13 * | 0.10 * | 0.01 | 0.07 * | −0.04 | 0.07 * | 0.45 * | 1 | ||

| 17. BGT × FS | −0.01 | 0.14 * | 0.44 * | 0.14 * | 0.27 * | 0.04 | 0.06 * | 0.14 * | 0.05 * | −0.04 | −0.05 * | −0.03 | −0.04 | 0.16 * | 0.04 | 0.43 * | 1 | |

| 18. BGT × ISS | 0.02 | 0.22 * | 0.04 | 0.12 * | 0.39 * | 0.06 * | −0.10 * | −0.11 * | 0.01 | 0.14 * | 0.02 | 0.01 | −0.03 | 0.18 * | 0.08 * | 0.44 * | 0.02 * | 1 |

| VIFs | 1.20 | 1.71 | 2.57 | 2.39 | 1.45 | 1.14 | 1.16 | 1.14 | 1.10 | 2.58 | 2.65 | 1.06 | 1.21 | 1.43 | 2.69 | 2.15 | 1.79 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Intercept | 7.27 *** | 7.855 *** | 7.835 *** | 7.852 *** | 7.840 *** | 7.816 *** |

| (0.729) | (0.854) | (0.852) | (0.855) | (0.852) | (0.853) | |

| Level 1 | ||||||

| B–G ties (BGT) (H1) | 1.214 *** | 1.271 *** | 1.159 *** | 1.060 *** | 1.404 *** | |

| (0.30) | (0.301) | (0.312) | (0.307) | (0.314) | ||

| Manager experience | 0.888 ** | 0.890 ** | 0.877 ** | 0.862 ** | 0.859 ** | |

| (0.375) | (0.375) | (0.376) | (0.375) | (0.375) | ||

| Employee education | 0.315 *** | 0.286 *** | 0.319 *** | 0.322 *** | 0.307 *** | |

| (0.107) | (0.108) | (0.108) | (0.107) | (0.107) | ||

| Employee training | 1.772 *** | 1.795 *** | 1.786 *** | 1.826 *** | 1.753 *** | |

| (0.539) | (0.538) | (0.540) | (0.539) | (0.539) | ||

| Firm size | 0.408 * | 0.389 * | 0.416 * | 0.419 ** | 0.429 ** | |

| (0.213) | (0.213) | (0.213) | (0.213) | (0.213) | ||

| Annual sale | 0.791 *** | 0.816 *** | 0.785 *** | 0.799 *** | 0.772 *** | |

| (0.168) | (0.168) | (0.168) | (0.168) | (0.168) | ||

| Competition | 1.559 *** | 1.546 *** | 1.552 *** | 1.501 *** | 1.516 *** | |

| (0.379) | (0.379) | (0.380) | (0.380) | (0.380) | ||

| Industry | Yes | Yes | Yes | Yes | Yes | |

| Level 2 | ||||||

| Legal institutions (LI) | 1.193 | 1.054 | 1.209 | 1.163 | 1.213 | |

| (4.572) | (4.556) | (4.575) | (4.562) | (4.566) | ||

| Business regulations (BR) | −3.063 * | −3.096 * | −3.058 * | −3.063 * | −3.070 * | |

| (1.732) | (1.726) | (1.733) | (1.728) | (1.730) | ||

| Financial systems (FS) | 0.084 | 0.138 | 0.079 | 0.084 | 0.075 | |

| (1.973) | (1.966) | (1.974) | (1.968) | (1.970) | ||

| Infrastructural supporting systems (ISS) | −2.223 | −2.160 | −2.226 | −2.201 | −2.236 | |

| (2.778) | (2.768) | (2.779) | (2.771) | (2.774) | ||

| Level 1 × Level 2 | ||||||

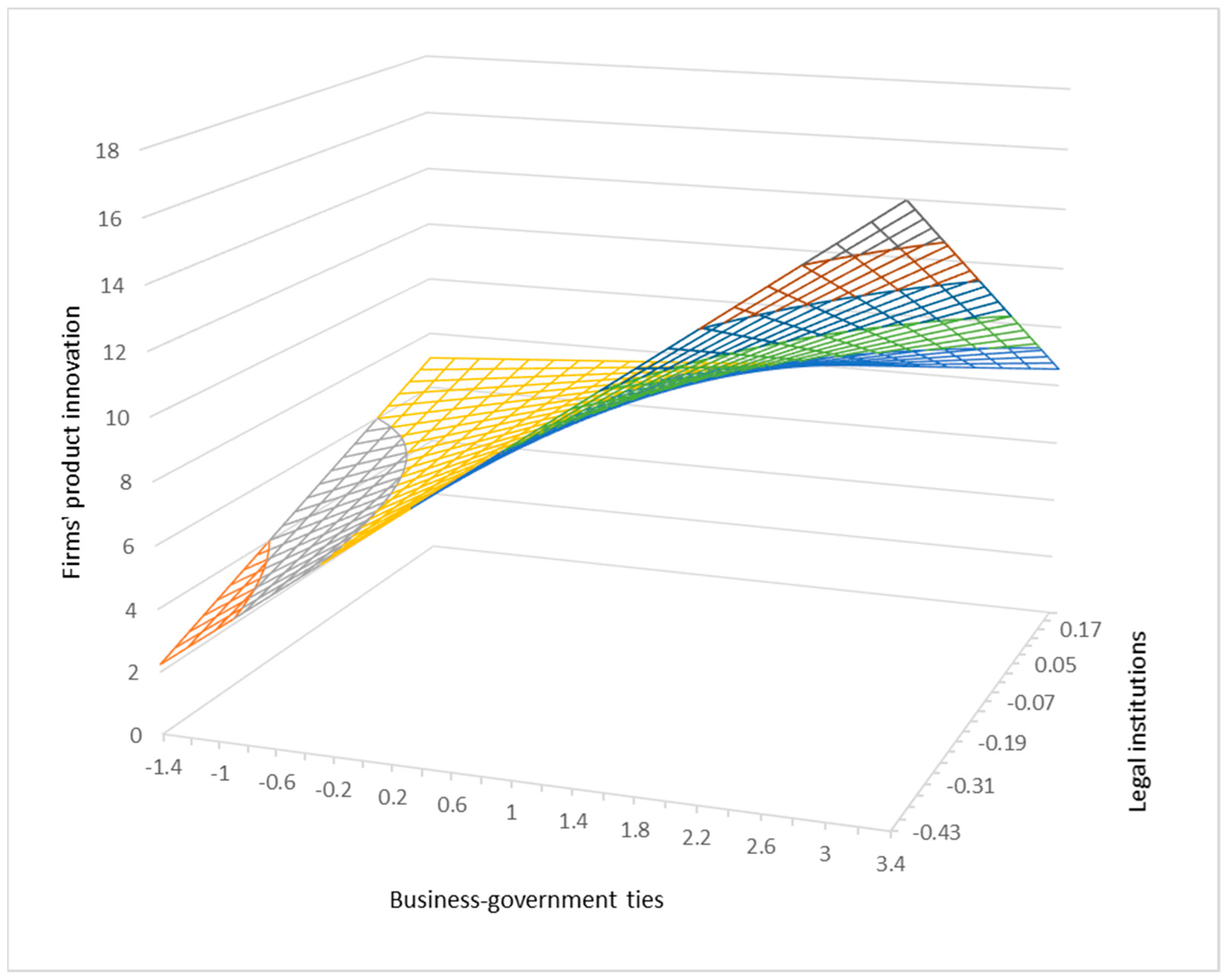

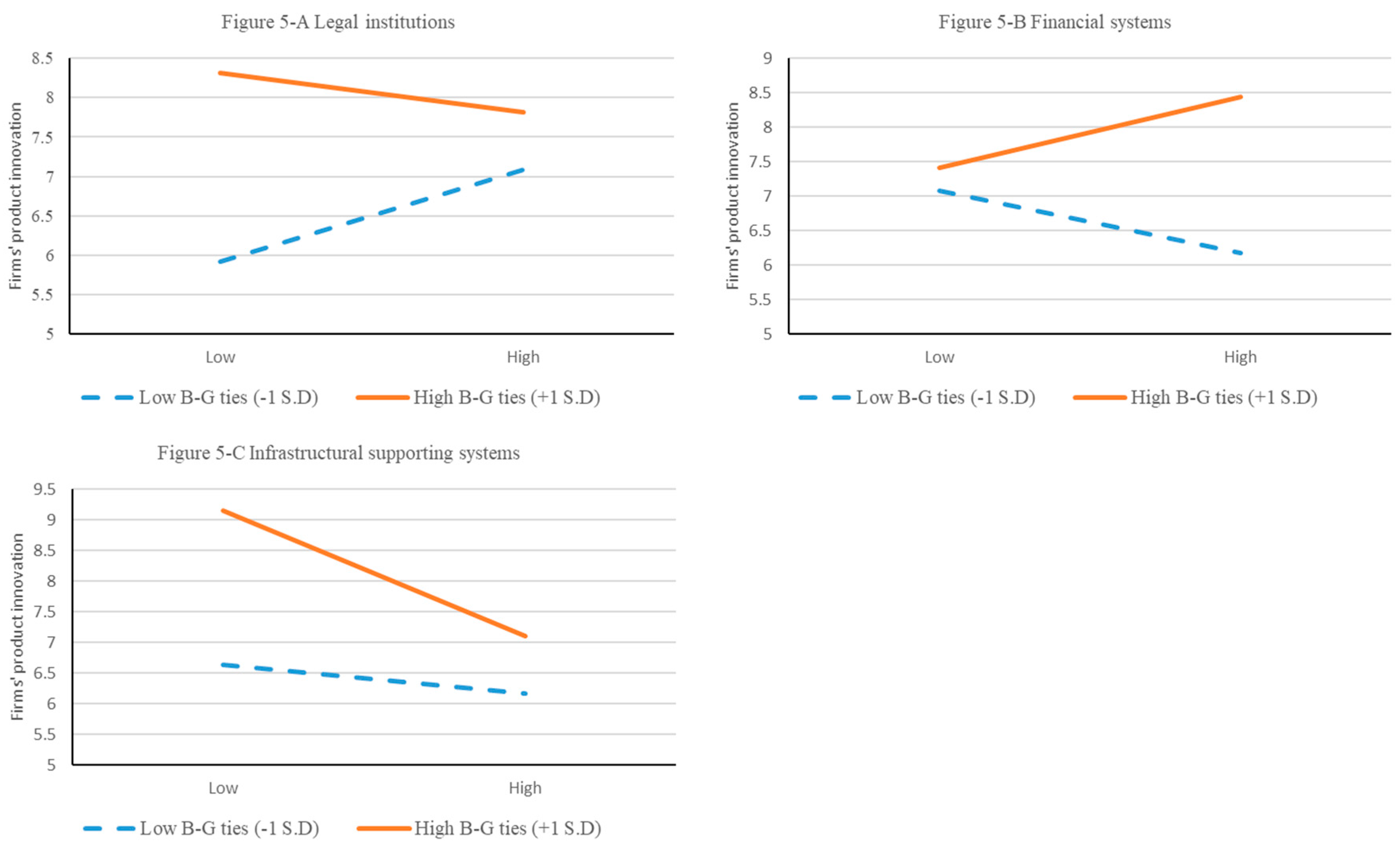

| BGT × LI (H2) | −4.438 ** (2.035) | |||||

| BGT × BR (H3) | 0.387 (0.607) | |||||

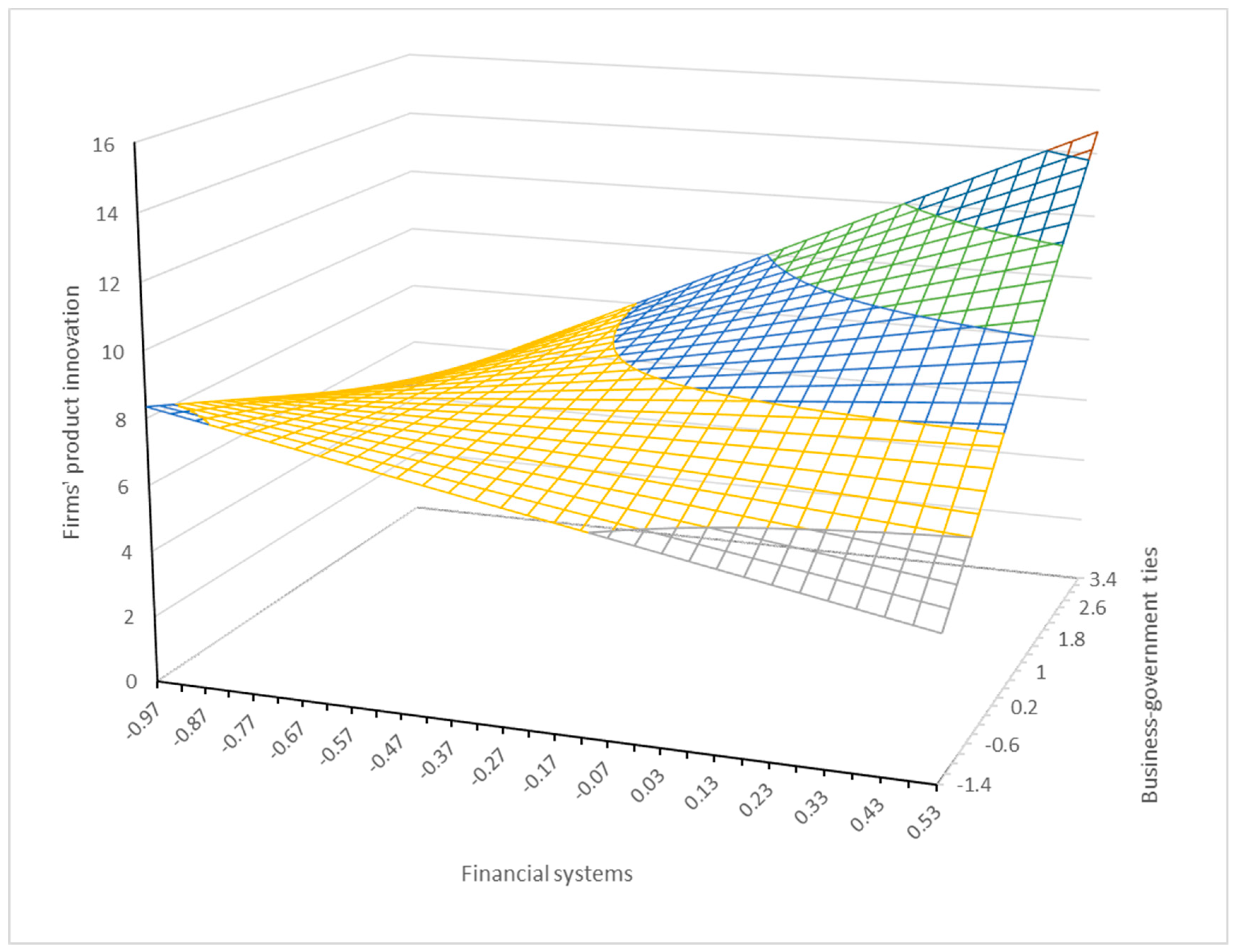

| BGT × FS (H4) | 1.886 ** (0.80) | |||||

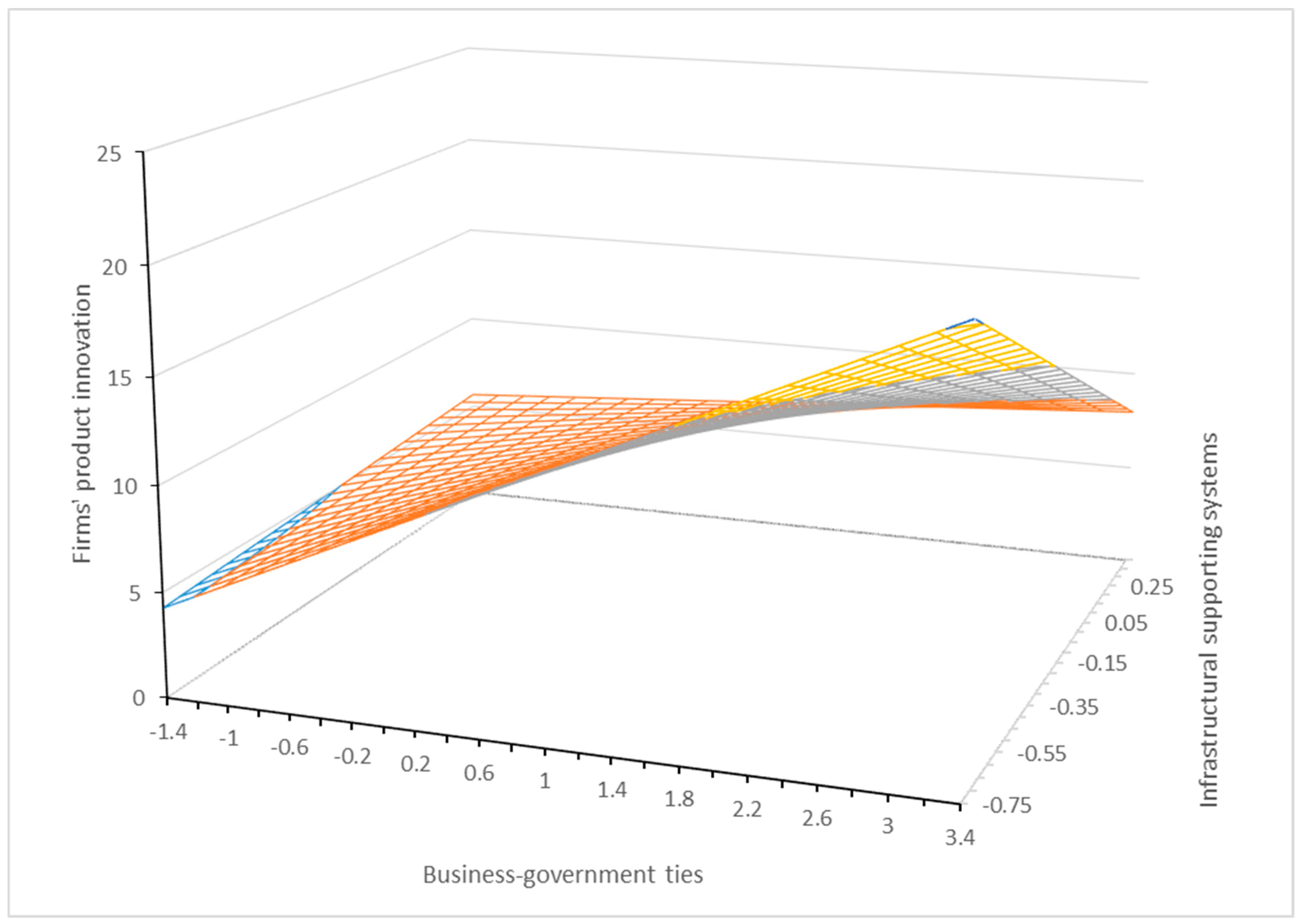

| BGT × ISS (H5) | −2.263 ** (1.108) |

| Hypotheses | Hypothesis Support |

|---|---|

| H1: In transitional China, B–G ties have a positive effect on Chinese manufacturing firms’ product innovation. | Yes |

| H2: The effect of B–G ties on Chinese manufacturing firms’ product innovation is less positive when legal institutions are more developed. | Yes |

| H3: The effect of B–G ties on Chinese manufacturing firms’ product innovation is less positive when business regulations are more developed. | No |

| H4: The effect of B–G ties on Chinese manufacturing firms’ product innovation is less positive when financial systems are more developed. | No |

| H5: The effect of B–G ties on Chinese manufacturing firms’ product innovation is less positive when the infrastructural supporting systems are more developed. | Yes |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| B–G ties | 1.05 *** | 1.115 *** | 1.01 *** | 0.948 *** | 1.279 *** |

| (0.301) | (0.302) | (0.312) | (0.306) | (0.313) | |

| B–G ties × Legal institutions | −4.161 ** | ||||

| (2.016) | |||||

| B–G ties × Business regulations | 0.316 | ||||

| (0.597) | |||||

| B–G ties × Financial systems | 1.403 * | ||||

| (0.78) | |||||

| B–G ties × Infrastructural supporting systems | −2.776 ** | ||||

| (1.104) | |||||

| R&D intensity | 15.54 *** | 15.32 *** | 15.49 *** | 15.08 *** | 16.48 *** |

| (3.10) | (3.09) | (3.10) | (3.11) | (3.12) | |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Intercept | 7.69 *** | 7.67 | 7.68 *** | 7.67 *** | 7.65 *** |

| (0.857) | (0.856) | (0.857) | (0.856) | (0.856) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| B–G ties | 1.359 *** | 1.318 *** | 1.254 *** | 1.132 *** | 1.520 *** |

| (0.350) | (0.350) | (0.362) | (0.357) | (0.361) | |

| Squared B–G ties | −0.129 | 0.041 | −0.055 | −0.028 | −0.053 |

| (0.295) | (0.297) | (0.295) | (0.294) | (0.294) | |

| B–G ties × Legal institutions | −4.545 ** | ||||

| (2.085) | |||||

| B–G ties × Business regulations | 0.410 | ||||

| (0.616) | |||||

| B–G ties × Financial systems | 1.988 ** | ||||

| (0.811) | |||||

| B–G ties × Infrastructural supporting systems | −2.520 ** | ||||

| (1.119) | |||||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Intercept | 7.279 *** | 7.314 *** | 7.332 *** | 7.333 *** | 7.329 *** |

| (0.769) | (0.662) | (0.670) | (0.667) | (0.668) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| B–G ties | 1.282 *** | 1.342 *** | 1.221 *** | 1.115 *** | 1.489 *** |

| (0.418) | (0.411) | (0.388) | (0.377) | (0.427) | |

| B–G ties × Legal institutions | −4.501 * | ||||

| (2.405) | |||||

| B–G ties × Business regulations | 0.413 | ||||

| (0.534) | |||||

| B–G ties × Financial systems | 1.991 ** | ||||

| (0.907) | |||||

| B–G ties × Infrastructural supporting systems | −2.522 * | ||||

| (1.365) | |||||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Intercept | 7.234 *** | 7.328 *** | 7.313 *** | 7.323 *** | 7.311 *** |

| (0.776) | (0.661) | (0.664) | (0.661) | (0.663) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Level 1 | |||||

| B–G ties | 1.286 *** | 1.348 *** | 1.226 *** | 1.122 *** | 1.495 *** |

| (0.303) | (0.304) | (0.316) | (0.310) | (0.316) | |

| Manager experience | 0.856 ** | 0.857 ** | 0.846 ** | 0.828 ** | 0.830 ** |

| (0.379) | (0.379) | (0.379) | (0.379) | (0.379) | |

| Competition | 1.412 *** | 1.404 *** | 1.405 *** | 1.355 *** | 1.375 *** |

| (0.381) | (0.381) | (0.382) | (0.381) | (0.381) | |

| Employee education | 0.359 *** | 0.330 *** | 0.364 *** | 0.367 *** | 0.350 *** |

| (0.106) | (0.107) | (0.107) | (0.106) | (0.106) | |

| Employee training | 1.799 *** | 1.819 *** | 1.820 *** | 1.865 *** | 1.784 *** |

| (0.544) | (0.543) | (0.544) | (0.543) | (0.543) | |

| Firm size | 0.399 * | 0.376 * | 0.408 * | 0.410 * | 0.421 ** |

| (0.214) | (0.214) | (0.214) | (0.213) | (0.214) | |

| Annual sale | 0.794 *** | 0.821 *** | 0.788 *** | 0.801 *** | 0.773 *** |

| (0.168) | (0.168) | (0.168) | (0.168) | (0.168) | |

| Industry | Yes | Yes | Yes | Yes | Yes |

| Level 2 | |||||

| Legal institutions | 1.933 | 2.042 | 1.999 | 2.014 | |

| (3.447) | (3.457) | (3.448) | (3.452) | ||

| Business regulations | −5.027 *** | −5.036 *** | −5.037 *** | −5.028 *** | |

| (1.559) | (1.564) | (1.560) | (1.561) | ||

| Financial systems | 1.638 | 1.567 | 1.560 | 1.568 | |

| (1.802) | (1.807) | (1.802) | (1.804) | ||

| Infrastructural supporting systems | −1.243 | −1.328 | −1.284 | −1.354 | |

| (2.120) | (2.125) | (2.120) | (2.122) | ||

| Group means as level-2 controls | |||||

| B–G ties | 2.485 | 3.566 ** | 3.597 ** | 3.591 ** | 3.592 ** |

| 2.029 | (1.581) | (1.586) | (1.582) | (1.584) | |

| Manager experience | 0.217 | −3.855 | −3.911 | −3.945 | −3.827 |

| 4.78 | (4.671) | (4.685) | (4.673) | (4.678) | |

| Competition | 7.299 ** | 8.020 *** | 8.073 *** | 8.019 *** | 8.068 *** |

| 3.073 | (2.819) | (2.827) | (2.820) | (2.823) | |

| Employee education | −.0437 | 0.722 | 0.739 | 0.734 | 0.747 |

| 0.797 | (0.709) | (0.711) | (0.709) | (0.710) | |

| Employee training | 5.352 | 7.142 | 7.383 | 7.296 | 7.378 |

| 6.416 | (5.295) | (5.310) | (5.297) | (5.302) | |

| Firm size | 3.628 | −0.646 | −0.801 | −0.756 | −0.736 |

| 3.193 | (2.657) | (2.665) | (2.658) | (2.660) | |

| Annual sale | −0.02 | −0.149 | −0.181 | −0.172 | −0.224 |

| 2.206 | (1.785) | (1.790) | (1.785) | (1.787) | |

| Level 1 × Level 2 | |||||

| B–G ties × Legal institutions | −4.476 ** | ||||

| (2.061) | |||||

| B–G ties × Business regulations | 0.422 | ||||

| (0.615) | |||||

| B–G ties × Financial systems | 1.993 ** | ||||

| (0.811) | |||||

| B–G ties × Infrastructural supporting systems | −2.521 ** | ||||

| (1.119) | |||||

| Intercept | −14.356 | 3.603 | 4.563 | 4.456 | 4.688 |

| 30.127 | (25.33) | (25.40) | (25.34) | (25.36) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| B–G ties | 0.157 *** | 0.165 *** | 0.150 *** | 0.137 *** | 0.181 *** |

| (0.039) | (0.039) | (0.041) | (0.040) | (0.041) | |

| B–G ties ×Legal institutions | −0.584 ** | ||||

| (0.264) | |||||

| B–G ties × Business regulations | 0.050 | ||||

| (0.079) | |||||

| B–G ties × Financial systems | 0.241 ** | ||||

| (0.104) | |||||

| B–G ties × Infrastructural supporting systems | −0.286 ** | ||||

| (0.144) | |||||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Intercept | 0.016 | 0.013 | 0.016 | 0.014 | 0.011 |

| (0.111) | (0.110) | (0.111) | (0.110) | (0.110) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| B–G ties | 1.293 *** | 1.359 *** | 1.224 *** | 1.131 *** | 1.484 *** |

| (0.303) | (0.304) | (0.314) | (0.309) | (0.317) | |

| B–G ties*Legal institutions | −4.562 ** | ||||

| (2.037) | |||||

| B–G ties*Business regulations | −0.488 | ||||

| (0.606) | |||||

| B–G ties*Financial systems | 2.014 ** | ||||

| (0.803) | |||||

| B–G ties*Infrastructural supporting systems | −2.249 ** | ||||

| (1.106) | |||||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Cities | Yes | Yes | Yes | Yes | Yes |

| Lambda | −3.990 | −4.279 | −3.95 | −4.257 | −4.248 |

| (3.063) | (3.057) | (3.063) | (3.054) | (3.058) | |

| Intercept | 4.182 | 4.182 | 4.182 | 4.182 | 4.182 |

| (8.50) | (8.50) | (8.50) | (8.50) | (8.50) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| B–G ties | 1.781 ** | 1.723 * | 2.087 ** | 1.330 | 1.983 ** |

| (0.897) | (0.883) | (0.951) | (0.897) | (0.889) | |

| B–G ties*Legal institutions | −13.23 ** | ||||

| (5.831) | |||||

| B–G ties*Business regulations | −1.520 | ||||

| (2.176) | |||||

| B–G ties*Financial systems | 5.825 *** | ||||

| (2.099) | |||||

| B–G ties*Infrastructural supporting systems | −5.788 * | ||||

| (3.444) | |||||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Intercept | 6.413 *** | 1.480 | 1.476 | 1.946 | 1.565 |

| (0.826) | (1.195) | (1.230) | (1.191) | (1.199) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, C.; Bossink, B.; Peverelli, P. The Value of Business–Government Ties for Manufacturing Firms’ Product Innovation during Institutional Transition in China. Sustainability 2019, 11, 63. https://doi.org/10.3390/su11010063

Yang C, Bossink B, Peverelli P. The Value of Business–Government Ties for Manufacturing Firms’ Product Innovation during Institutional Transition in China. Sustainability. 2019; 11(1):63. https://doi.org/10.3390/su11010063

Chicago/Turabian StyleYang, Chun, Bart Bossink, and Peter Peverelli. 2019. "The Value of Business–Government Ties for Manufacturing Firms’ Product Innovation during Institutional Transition in China" Sustainability 11, no. 1: 63. https://doi.org/10.3390/su11010063

APA StyleYang, C., Bossink, B., & Peverelli, P. (2019). The Value of Business–Government Ties for Manufacturing Firms’ Product Innovation during Institutional Transition in China. Sustainability, 11(1), 63. https://doi.org/10.3390/su11010063