A Comparative Analysis on Residents’ Reservation Willingness for Bus Service Based on Option Price

Abstract

:1. Introduction

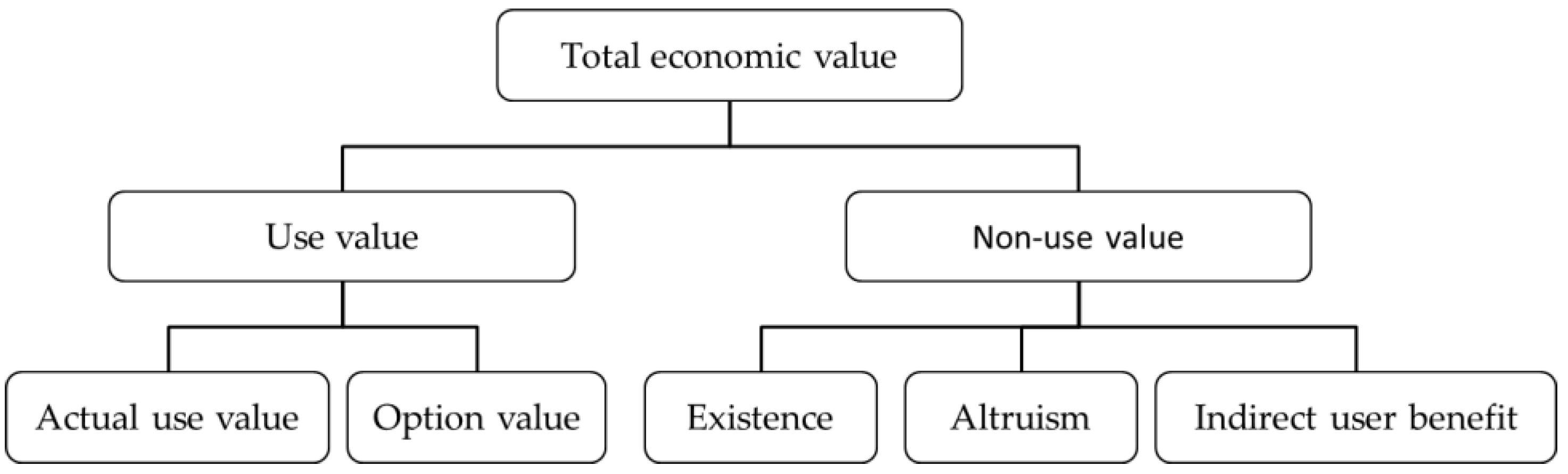

2. Literature Review

3. Methodology

4. Data

5. Estimation Result and Discussions

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Muramatsu, N.; Akiyama, H. Japan: Super-aging society preparing for the future. Gerontology 2011, 2011 51, 425–432. [Google Scholar] [CrossRef]

- Ihori, T.; Kato, R.R.; Kawade, M.; Bessho, S.I. Public debt and economic growth in an aging Japan. In Tackling Japan’s Fiscal Challenges; Palgrave Macmillan: London, UK, 2006; pp. 30–68. ISBN 978-1-137-00156-6. [Google Scholar]

- Statistics Bureau of Japan, Ministry of Internal Affairs and Communications. Population Estimate. 2018. Available online: http://www.stat.go.jp/data/jinsui/2017np/pdf/2017np.pdf (accessed on 9 November 2018).

- Fukawa, T. The effects of the low birth rate on the Japanese social security system. Jpn. J. Soc. Secur. Policy 2008, 7, 57–66. [Google Scholar]

- World Health Organization. World Report on Ageing and Health. 2015. Available online: https://www.who.int/ageing/events/world-report-2015-launch/en/ (accessed on 28 December 2018).

- Gabor, D. The Mature Society, 1st ed.; Praeger: New York, NY, USA, 1972; p. 211. [Google Scholar]

- D’Addio, A.C.; Keese, M.; Whitehouse, E. Population ageing and labour markets. Oxf. Rev. Econ. Policy 2010, 26, 613–635. [Google Scholar] [CrossRef]

- Hara, J. An overview of social stratification and inequality study in Japan: Towards a “mature” society perspective. Asian J. Soc. Sci. 2011, 39, 9–29. [Google Scholar] [CrossRef]

- Boudiny, K. “Active ageing”: From empty rhetoric to effective policy tool. Ageing Soc. 2013, 33, 1077–1098. [Google Scholar] [CrossRef] [PubMed]

- Newman, B.M.; Newman, P.R. Development through Life: A Psychosocial Approach; Cengage Learning: Boston, MA, USA, 2017. [Google Scholar]

- Weight, S.D.; Lund, D.A. Gray and Green? Stewardship and sustainability in an aging society. J. Aging Stud. 2000, 14, 229–249. [Google Scholar]

- Mercado, R.; Paez, A.; Newbold, K.B. Transport policy and the provision of mobility options in an aging society: A case study of Ontario, Canada. J. Transp. Geogr. 2010, 18, 649–661. [Google Scholar] [CrossRef]

- Mercado, R.; Paez, A.; Scott, D.M. Transport policy in aging societies: And international comparison and implications for Cana. Open Transp. J. 2007, 1, 1–13. [Google Scholar] [CrossRef]

- Takahashi, S.; Ishikawa, A.; Kato, H.; Iwasawa, M.; Komatsu, R.; Kaneko, R.; Ikenoue, M.; Fusami, M.; Tsuji, A.; Moriizumi, R. Population projections for Japan 2001–2050. J. Popul. Soc. Secur. 2003, 1, 1–43. [Google Scholar]

- Japan Bus Association. Current Status of Bus Service. 2017. Available online: http://www.bus.or.jp/about/pdf/h29_busjigyo.pdf (accessed on 9 November 2018).

- Ministry of Land, Infrastructure, Transport and Tourism, Japan (MLIT). Report On the Current Status of Bus Service. 2017. Available online: http://www.mlit.go.jp/common/001190066.pdf (accessed on 9 November 2018).

- Ministry of Land, Infrastructure, Transport and Tourism, Japan (MLIT). Subsidy Outline for Local Public Transportation. 2018. Available online: http://www.mlit.go.jp/common/001260516.pdf (accessed on 28 November 2018).

- Weisbrod, B.A. Collective-consumption services of individual-consumption goods. Q. J. Econ. 1964, 78, 471–477. [Google Scholar] [CrossRef]

- Brookshire, D.S.; Eubanks, L.S.; Randall, A. Estimating option prices and existence values for wildlife resources. Land Econ. 1983, 59, 1–15. [Google Scholar] [CrossRef]

- Smith, V.K. Supply uncertainty, option price, and indirect benefit estimation. Land Econ. 1985, 61, 303–307. [Google Scholar] [CrossRef]

- Freeman III, A.M. Uncertainty and option value in environmental policy. In Natural Resources Economics and Policy Applications; Miles, E., Pealy, R., Stokes, R., Eds.; University of Washington Press: Seattle, DC, USA, 1986; pp. 251–271. [Google Scholar]

- Willis, K.G. Option value and non user benefits of wildlife conservation. J. Rural Stud. 1989, 5, 245–256. [Google Scholar] [CrossRef]

- Kridel, D.J.; Lehman, D.E.; Weisman, D.L. Option value, telecommunications demand, and policy. Inf. Econ. Policy 1993, 5, 125–144. [Google Scholar] [CrossRef]

- Boyer, T.; Polasky, S. Valuing urban wetlands: A review of non-market valuation studies. Wetlands 2004, 4, 744–755. [Google Scholar] [CrossRef]

- Bristow, A.L.; Hopkinson, P.G.; Nash, C.A.; Wardman, M. Use and Non-Use Benefits of Public Transport Systems—What Is Their Relevance, Can They Be Valued? In Proceedings of the International Conference Series on Competition and Ownership in Land Passenger Transport, Tampere, Finland, 1992; Available online: https://ses.library.usyd.edu.au/handle/2123/12180 (accessed on 9 November 2018).

- Roson, R. Social cost pricing when public transport is an option value. Innov. Eur. J. Soc. Sci. Res. 2000, 13, 81–94. [Google Scholar] [CrossRef]

- Roson, R. Assessing the option value of a publicly provided service: The case of local transport. Urban Stud. 2001, 38, 1319–1327. [Google Scholar] [CrossRef]

- Humphrey, M.; Fowkes, A.S. The significance of indirect use and non-use values in transport appraisal. Int. J. Transp. Econ. 2006, 33, 17–35. [Google Scholar]

- Geurs, K.; Haaijer, R.; Van Wee, B. Option value of public transport: Methodology for measurement and case study for regional rail links in the Netherlands. Transp. Rev. 2006, 26, 613–643. [Google Scholar] [CrossRef]

- Laird, J.; Geurs, K.; Nash, C. Option and non-use values and rail project appraisal. Transp. Policy 2009, 16, 173–182. [Google Scholar] [CrossRef]

- Chang, J.S. Estimation of option and non-use values for intercity passenger rail services. J. Transp. Geogr. 2010, 18, 259–265. [Google Scholar] [CrossRef]

- Chang, J.S.; Cho, S.Y.; Lee, B.S.; Kim, Y.; Yun, S.K. A dichotomous choice survey for quantifying option and non-use values of bus services in Korea. Transportation 2012, 39, 33–54. [Google Scholar] [CrossRef]

- Lee, S.; Burris, M.W. Estimating the option value of managed lanes. Res. Transp. Econ. 2018. [Google Scholar] [CrossRef]

- Aichi Prefectural Government. Survey Report on Aichi Prefecture Public Transport Actual Condition. 2016. Available online: http://www.pref.aichi.jp/uploaded/attachment/210068.pdf (accessed on 10 November 2018).

- Alberini, A. Optimal Designs for Discrete Choice Contingent Valuation Surveys: Single-Bound, Double-Bound, and Bivariate Models. J. Environ. Econ. Manag. 1995, 28, 287–306. [Google Scholar] [CrossRef]

- Williams, H.C.W.L. On the formation of travel demand models and economic evaluation measures of user benefit. Environ. Plan. A 1977, 9, 285–344. [Google Scholar] [CrossRef]

- Ministry of Internal Affairs and Communications. Classification of local governments. Available online: http://www.soumu.go.jp/main_sosiki/jichi_gyousei/bunken/chihou-koukyoudantai_kubun.html (accessed on 13 November 2018).

- Masuoka, Y. A Consideration about the Directivity of the Public Expenditure to a Community Bus. In Proceedings of the Infrastructure Planning Conference, Yamaguchi, Japan, 21–23 November 2004. (In Japanese). [Google Scholar]

| City Group | Definition: Population Size | Total Population 1 | Age Share 1 | Sample Size | |

|---|---|---|---|---|---|

| Metropolis | 2,260,440 | 2,295,638 | ≤19 years old | 17.2% | - |

| 20–39 years old | 25.0% | 42 | |||

| 40–59 years old | 27.9% | 42 | |||

| ≥60 years old | 29.9% | 21 | |||

| total | 100.0% | 105 | |||

| Major city | >500,000 | 1,502,969 | ≤19 years old | 17.6% | - |

| 20–39 years old | 21.3% | 42 | |||

| 40–59 years old | 27.0% | 42 | |||

| ≥60 years old | 34.1% | 21 | |||

| total | 100.0% | 105 | |||

| Core city | 200,000~500,000 | 3,732,676 | ≤19 years old | 18.9% | - |

| 20–39 years old | 22.6% | 62 | |||

| 40–59 years old | 27.2% | 62 | |||

| ≥60 years old | 31.3% | 31 | |||

| total | 100.0% | 155 | |||

| Medium city | 50,000~200,000 | 7,004,133 | ≤19 years old | 18.7% | - |

| 20–39 years old | 21.9% | 62 | |||

| 40–59 years old | 26.7% | 62 | |||

| ≥60 years old | 32.7% | 31 | |||

| total | 100.0% | 155 | |||

| Ordinary city | 20,000~50,000 | 1,748,441 | ≤19 years old | 18.2% | - |

| 20–39 years old | 20.5% | 84 | |||

| 40–59 years old | 26.2% | 84 | |||

| ≥60 years old | 35.1% | 42 | |||

| total | 100.0% | 210 | |||

| Small city | <20,000 | 846,148 | ≤19 years old | 16.4% | - |

| 20–39 years old | 17.4% | 84 | |||

| 40–59 years old | 25.0% | 84 | |||

| ≥60 years old | 41.3% | 42 | |||

| total | 100.0% | 210 | |||

| Information | Description | Data size | Percentage |

|---|---|---|---|

| Gender | Male | 476 | 50.6% |

| Female | 464 | 49.4% | |

| Occupation | Employee | 340 | 36.2% |

| Civil servant | 61 | 6.5% | |

| Self-employed | 77 | 8.5% | |

| Student | 18 | 1.9% | |

| Stay-at-home spouse | 182 | 19.4% | |

| Part-time job and freelancer | 136 | 14.5% | |

| Unemployed | 111 | 11.8% | |

| Others | 15 | 1.6% | |

| License | Have a license | 874 | 93.0% |

| Do not have a license | 66 | 7.0% | |

| Household composition | Family with elderly person older than 65 years | 324 | 34.5% |

| Family with young person, younger than 15 years | 304 | 32.3% | |

| Family without elderly or young people | 332 | 35.3% | |

| Age group | Young age (20–39) | 376 | 40.0% |

| Middle age (40–59) | 376 | 40.0% | |

| Elderly (60–) | 188 | 20.0% | |

| Vehicle ownership | Household with one or more vehicles | 864 | 91.9% |

| Household without a vehicle | 76 | 8.1% |

| City Group | Commuting (JPY) | Shopping (JPY) | Doctor’s Visit (JPY) |

|---|---|---|---|

| Metropolis | 157.1 | 183.6 | 156.9 |

| Major city | 296.7 | 175.2 | 191.1 |

| Core city | 307.4 | 204.2 | 230.0 |

| Medium city | 253.1 | 230.8 | 367.1 |

| Ordinary city | 319.6 | 262.7 | 324.3 |

| Small city | 341.0 | 322.0 | 398.7 |

| Section | Contents |

|---|---|

| I. Personal and family characteristics | Age, gender, occupation, driver’s license, etc. |

| Household composition, vehicle ownership, family income, etc. | |

| II. Local public transport service level | Distance from the residence to the nearest bus stop, bus operating interval, distance from the residence to the nearest railway station, etc. |

| III. Daily travel behavior | Trip frequencies for three typical trip purposes (commuting, shopping, and doctor’s visits), travel mode, travel time, etc. |

| IV. Bus use frequency | Local bus use frequencies for three typical trip purposes (commuting, shopping, and doctor’s visits) |

| V. Tax paying intention | Double-bounded questions of tax paying intention for maintaining local bus service in respondent’s city. |

| Age 20–39 | Age 40–59 | Age 60– | |||||

|---|---|---|---|---|---|---|---|

| Explanatory Variables | Estimates | t-Stat. | Estimates | t-Stat. | Estimates | t-Stats | |

| (1000 JPY) | −0.507 | −3.57 *** | −0.478 | −4.47 *** | −0.288 | −1.79 * | |

| Constant (Metropolis and Major city) | −0.383 | −2.09 ** | −0.397 | −1.77 * | 0.0205 | 0.07 | |

| Constant (Core and Medium city) | −0.216 | −1.45 | −0.140 | −0.80 | 0.215 | 0.95 | |

| Constant (Ordinary and Small city) | −0.149 | −1.10 | −0.233 | −1.59 | 0.215 | 1.09 | |

| Male | 0.231 | 1.90 * | |||||

| Service frequency at nearest bus stop (number of services/hour in daytime) | 0.0577 | 1.80 * | |||||

| Distance to nearest bus stop (km) | −0.0295 | −1.37 | −0.0105 | −0.28 | |||

| Occupation | Civil servant | 0.879 | 1.92 * | ||||

| Self−employed | −0.586 | −2.75 *** | |||||

| Part−time | −0.253 | −1.72 * | |||||

| Constant (Metropolis and Major city) | −0.403 | −0.91 | 0.626 | 1.09 | 0.213 | 0.54 | |

| Constant (Core and Medium city) | −0.975 | −1.76 * | 0.536 | 0.87 | −3.48 | −0.30 | |

| Constant (Ordinary and Small city) | −0.854 | 1.90 * | 0.814 | 1.42 | −0.844 | −0.80 | |

| Company worker | 0.515 | 1.78 * | |||||

| Driving license | −0.971 | −1.84 * | |||||

| Family annual income (million JPY) | 0.0759 | 1.61 | |||||

| Correlation () | 0.363 | 3.32 *** | 0.840 | 15.19 *** | 0.652 | 6.06 *** | |

| Sample size | 376 | 376 | 188 | ||||

| Log-likelihood LL(0) | −521.2 | −521.2 | −260.6 | ||||

| Log-likelihood LL(β) | −455.1 | −445.7 | −237.4 | ||||

| Adjusted | 0.104 | 0.120 | 0.047 | ||||

| City Group. | Option Price (JPY/month) | Age Group | Option Price (JPY/month) |

|---|---|---|---|

| Metropolis | 995.2 | 20–39 years old 40–59 years old ≥60 years old | 218.2 474.2 1001.9 |

| Major city | 743.2 | ||

| Core city | 569.5 | ||

| Medium city | 490.2 | ||

| Ordinary city | 638.7 | ||

| Small city | 569.4 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, X.; Miwa, T. A Comparative Analysis on Residents’ Reservation Willingness for Bus Service Based on Option Price. Sustainability 2019, 11, 260. https://doi.org/10.3390/su11010260

Zheng X, Miwa T. A Comparative Analysis on Residents’ Reservation Willingness for Bus Service Based on Option Price. Sustainability. 2019; 11(1):260. https://doi.org/10.3390/su11010260

Chicago/Turabian StyleZheng, Xun, and Tomio Miwa. 2019. "A Comparative Analysis on Residents’ Reservation Willingness for Bus Service Based on Option Price" Sustainability 11, no. 1: 260. https://doi.org/10.3390/su11010260

APA StyleZheng, X., & Miwa, T. (2019). A Comparative Analysis on Residents’ Reservation Willingness for Bus Service Based on Option Price. Sustainability, 11(1), 260. https://doi.org/10.3390/su11010260