An Analysis of Corporate Social Responsibility and Firm Performance with Moderating Effects of CEO Power and Ownership Structure: A Case Study of the Manufacturing Sector of Pakistan

Abstract

:1. Introduction

2. Corporate Social Responsibility Insight from Pakistan

3. Review of Literature and Theoretical Framework

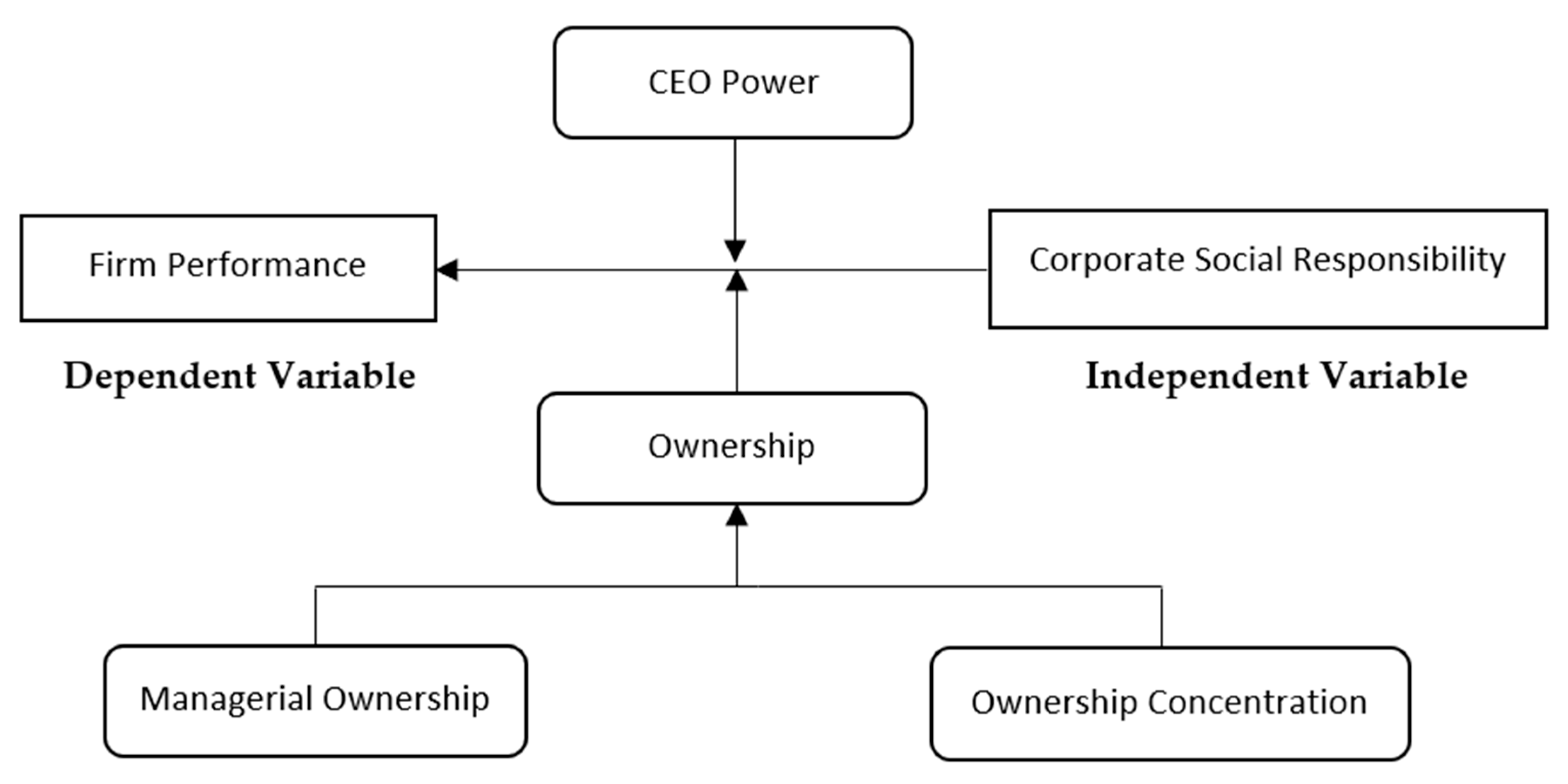

3.1. Corporate Social Responsibility and Firm Performance

3.2. Corporate Social Responsibility and Firm Performance with the Moderating Effect of CEO Power

3.3. Corporate Social Responsibility and Firm Performance with the Moderating Effect of Ownership Structure

4. Materials and Methods

4.1. Sample Selection and Data Collection

4.2. Measurement of Variables

4.2.1. Corporate Social Responsibility

4.2.2. Firm Performance

4.2.3. CEO Power

4.2.4. Ownership Structure

4.2.5. Control Variables

4.3. Empirical Approach

5. Results and Discussion

5.1. Descriptive Statistics

5.2. Empirical Analysis

5.2.1. Hypothesis 1 Examination

5.2.2. Hypothesis 2 Examination

5.2.3. Hypothesis 3 Examination

5.2.4. Hypothesis 4 Examination

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Freeman, I.; Hasnaoui, A. The meaning of corporate social responsibility: The vision of four nations. J. Bus. Ethics 2011, 100, 419–443. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Homburg, C.; Stierl, M.; Bornemann, T. Corporate social responsibility in business-to-business markets: How organizational customers account for supplier corporate social responsibility engagement. J. Mark. 2013, 77, 54–72. [Google Scholar] [CrossRef]

- Khlif, H.; Souissi, M. The determinants of corporate disclosure: A meta-analysis. Int. J. Account. Inf. Manag. 2010, 18, 198–219. [Google Scholar] [CrossRef]

- Kotonen, U. Formal corporate social responsibility reporting in Finnish listed companies. J. Appl. Account. Res. 2009, 10, 176–207. [Google Scholar] [CrossRef]

- Mohd Ghazali, N.A. Ownership structure and corporate social responsibility disclosure: Some Malaysian evidence. Corp. Govern. Int. J. Bus. Soc. 2007, 7, 251–266. [Google Scholar] [CrossRef]

- Eng, L.L.; Mak, Y.T. Corporate governance and voluntary disclosure. J. Account. Public Policy 2003, 22, 325–345. [Google Scholar] [CrossRef]

- Davis, K. The case for and against business assumption of social responsibilities. Acad. Manag. J. 1973, 16, 312–322. [Google Scholar]

- Wahba, H.; Elsayed, K. The effect of institutional investor type on the relationship between CEO duality and financial performance. Int. J. Bus. Govern. Ethics 2014, 9, 221–242. [Google Scholar] [CrossRef]

- Lambertini, L.; Tampieri, A. Incentives, performance and desirability of socially responsible firms in a Cournot oligopoly. Econ. Model. 2015, 50, 40–48. [Google Scholar] [CrossRef]

- Alexander, G.J.; Buchholz, R.A. Corporate social responsibility and stock market performance. Acad. Manag. J. 1978, 21, 479–486. [Google Scholar] [CrossRef]

- Turban, D.B.; Greening, D.W. Corporate social performance and organizational attractiveness to prospective employees. Acad. Manag. J. 1997, 40, 658–672. [Google Scholar]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Org. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Shahin, A.; Zairi, M. Corporate governance as a critical element for driving excellence in corporate social responsibility. Int. J. Qual. Reliab. Manag. 2007, 24, 753–770. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M.; Roberts, R.W. Corporate political strategy: An examination of the relation between political expenditures, environmental performance, and environmental disclosure. J. Bus. Ethics 2006, 67, 139–154. [Google Scholar] [CrossRef]

- Garay, L.; Font, X. Doing good to do well? Corporate social responsibility reasons, practices and impacts in small and medium accommodation enterprises. Int. J. Hosp. Manag. 2012, 31, 329–337. [Google Scholar] [CrossRef] [Green Version]

- Madsen, P.M.; Rodgers, Z.J. Looking good by doing good: The antecedents and consequences of stakeholder attention to corporate disaster relief. Strateg. Manag. J. 2015, 36, 776–794. [Google Scholar] [CrossRef]

- OECD. G20/OECD Principles of Corporate Governance; OECD Publishing: Paris, France, 2015. [Google Scholar]

- Berle, A.; Means, G. Private Property and the Modern Corporation; Mac-Millan: New York, NY, USA, 1932. [Google Scholar]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Caramolis-Cötelli, B. External and Internal Corporate Control Mechanisms and the Role of the Board of Directors: A Review of the Literature; Working Paper 9606; Institute of Banking and FinancialManagement: West Mumba, India, 1995. [Google Scholar]

- Pintea, M. The relationship between corporate governance and corporate social responsibilities. Virgil Madgearu Rev. Econ. Stud. Res. 2015, 1, 91–108. [Google Scholar]

- Welford, R. Corporate governance and corporate social responsibility: Issues for Asia. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 42–51. [Google Scholar] [CrossRef]

- Peters, S.; Miller, M.; Kusyk, S. How relevant is corporate governance and corporate social responsibility in emerging markets? Corp. Govern. Int. J. Bus. Soc. 2011, 11, 429–445. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.-Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business is to Increase its Profits; The New York Times Company: New York, NY, USA, 1970. [Google Scholar]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Friend, I.; Lang, L.H. An empirical test of the impact of managerial self-interest on corporate capital structure. J. Financ. 1988, 43, 271–281. [Google Scholar] [CrossRef]

- Cronqvist, H.; Heyman, F.; Nilsson, M.; Svaleryd, H.; Vlachos, J. Do entrenched managers pay their workers more? J. Financ. 2009, 64, 309–339. [Google Scholar] [CrossRef]

- Pagano, M.; Volpin, P.F. Managers, workers, and corporate control. J. Financ. 2005, 60, 841–868. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Perspective; Pitman: Boston, MA, USA, 1984; p. 13. [Google Scholar]

- Godfrey, P.C. The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. J. Mark. 2009, 73, 198–213. [Google Scholar] [CrossRef]

- Cornell, B.; Shapiro, A.C. Corporate stakeholders and corporate finance. Financ. Manag. 1987, 16, 5–14. [Google Scholar] [CrossRef]

- Sah, R.K.; Stiglitz, J.E. The architecture of economic systems: Hierarchies and polyarchies. Am. Econ. Rev. 1986, 716–727. [Google Scholar]

- Bebchuk, L.A.; Fried, J. Executive compensation as an agency problem. J. Econ. Persp. 2003, 17, 71–92. [Google Scholar] [CrossRef]

- Ceptureanu, S.-I.; Ceptureanu, E.-G.; Orzan, M.C.; Marin, I. Toward a Romanian NPOs sustainability model: Determinants of sustainability. Sustainability 2017, 9, 966. [Google Scholar] [CrossRef]

- Francis, J.; Philbrick, D.; Schipper, K. Shareholder litigation and corporate disclosures. J. Account. Res. 1994, 32, 137–164. [Google Scholar] [CrossRef]

- Botosan, C.A. Disclosure level and the cost of equity capital. Account. Rev. 1997, 323–349. [Google Scholar]

- Bushman, R.M.; Smith, A.J. Financial accounting information and corporate governance. J. Account. Econ. 2001, 32, 237–333. [Google Scholar] [CrossRef] [Green Version]

- Francis, J.; Nanda, D.; Olsson, P. Voluntary disclosure, earnings quality, and cost of capital. J. Account. Res. 2008, 46, 53–99. [Google Scholar] [CrossRef]

- Hui, K.W.; Matsunaga, S.R. Are CEOs and CFOs rewarded for disclosure quality? Account. Rev. 2014, 90, 1013–1047. [Google Scholar] [CrossRef]

- Yasser, Q.R.; Al Mamun, A.; Suriya, A.R. CEO duality structure and firm performance in Pakistan. Asian J. Account. Govern. 2015, 5, 57–69. [Google Scholar] [CrossRef]

- Sheikh, M.F.; Shah, S.Z.A.; Akbar, S. Firm performance, corporate governance and executive compensation in Pakistan. Appl. Econ. 2018, 50, 2012–2027. [Google Scholar] [CrossRef]

- Shafique, Y.; Idress, S.; Yousaf, H. Impact of boards gender diversity on firms profitability: Evidence from banking sector of pakistan. Eur. J. Bus. Manag. 2014, 6, 296–307. [Google Scholar]

- Li, F.; Li, T.; Minor, D. CEO power, corporate social responsibility, and firm value: A test of agency theory. Int. J. Manag. Financ. 2016, 12, 611–628. [Google Scholar] [CrossRef]

- Shah, S.Z.A.; Hussain, Z. Impact of ownership structure on firm performance evidence from non-financial listed companies at Karachi Stock Exchange. Int. Res. J. Financ. Econ. 2012, 84, 6–13. [Google Scholar]

- Garas, S.; ElMassah, S. Corporate governance and corporate social responsibility disclosures: The case of GCC countries. Crit. Persp. Int. Bus. 2018, 14, 2–26. [Google Scholar] [CrossRef]

- Singh, D.A.; Gaur, A.S. Business group affiliation, firm governance, and firm performance: Evidence from China and India. Corp. Govern. Int. Rev. 2009, 17, 411–425. [Google Scholar] [CrossRef]

- Khan, K.; Nemati, A.R.; Iftikhar, M. Impact of corporate governance on firm performance evidence from the Tobacco industry of Pakistan. Int. Res. J. Financ. Econ. 2011, 61, 7–14. [Google Scholar]

- Leung, S.; Horwitz, B. Corporate governance and firm value during a financial crisis. Rev. Quant. Financ. Account. 2010, 34, 459–481. [Google Scholar] [CrossRef]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Bauer, R.; Eichholtz, P.; Kok, N. Corporate governance and performance: The REIT effect. Real Estate Econ. 2010, 38, 1–29. [Google Scholar] [CrossRef]

- Tilt, C.A. Making Social and Environmental Accounting Research Relevant in Developing Countries: A Matter of Context? Soc. Environ. Accountab. J. 2018, 38, 145–150. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Bai, X.; Chang, J. Corporate social responsibility and firm performance: The mediating role of marketing competence and the moderating role of market environment. Asia Pacif. J. Manag. 2015, 32, 505–530. [Google Scholar] [CrossRef]

- Rahman, M.; Rodríguez-Serrano, M.Á.; Lambkin, M. Corporate Social Responsibility And Marketing Performance: The Moderating Role Of Advertising Intensity. J. Advert. Res. 2017, 57, 368–378. [Google Scholar] [CrossRef]

- van Doorn, J.; Onrust, M.; Verhoef, P.C.; Bügel, M.S. The impact of corporate social responsibility on customer attitudes and retention—The moderating role of brand success indicators. Mark. Lett. 2017, 28, 607–619. [Google Scholar] [CrossRef]

- Lai, C.-S.; Chiu, C.-J.; Yang, C.-F.; Pai, D.-C. The effects of corporate social responsibility on brand performance: The mediating effect of industrial brand equity and corporate reputation. J. Bus. Ethics 2010, 95, 457–469. [Google Scholar] [CrossRef]

- Lin, C.-S.; Chang, R.-Y.; Dang, V.T. An integrated model to explain how corporate social responsibility affects corporate financial performance. Sustainability 2015, 7, 8292–8311. [Google Scholar] [CrossRef]

- Lee, S.; Jung, H. The effects of corporate social responsibility on profitability: The moderating roles of differentiation and outside investment. Manag. Decis. 2016, 54, 1383–1406. [Google Scholar] [CrossRef]

- Ansong, A. Corporate social responsibility and firm performance of Ghanaian SMEs: The role of stakeholder engagement. Cogent Bus. Manag. 2017, 4, 1333704. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G. The Role of Normative CSR-Promoting Institutions in Stimulating CSR Disclosures in Developing Countries. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 373–390. [Google Scholar] [CrossRef]

- Runhaar, H.; Lafferty, H. Governing corporate social responsibility: An assessment of the contribution of the UN Global Compact to CSR strategies in the telecommunications industry. J. Bus. Ethics 2009, 84, 479–495. [Google Scholar] [CrossRef]

- Belal, A.R.; Cooper, S. The absence of corporate social responsibility reporting in Bangladesh. Crit. Persp. Account. 2011, 22, 654–667. [Google Scholar] [CrossRef]

- Jamali, D.; Mirshak, R. Corporate social responsibility (CSR): Theory and practice in a developing country context. J. Bus. Ethics 2007, 72, 243–262. [Google Scholar] [CrossRef]

- Khan, F.R.; Lund-Thomsen, P. CSR as imperialism: Towards a phenomenological approach to CSR in the developing world. J. Chang. Manag. 2011, 11, 73–90. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Corporate governance and CSR nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Ferrell, A.; Liang, H.; Renneboog, L. Socially responsible firms. J. Financ. Econ. 2016, 122, 585–606. [Google Scholar] [CrossRef] [Green Version]

- Prieto-Carrón, M.; Lund-Thomsen, P.; Chan, A.; Muro, A.; Bhushan, C. Critical perspectives on CSR and development: What we know, what we don’t know, and what we need to know. Int. Affairs 2006, 82, 977–987. [Google Scholar] [CrossRef]

- Ehsan, S.; Nazir, M.; Nurunnabi, M.; Raza Khan, Q.; Tahir, S.; Ahmed, I. A Multimethod Approach to Assess and Measure Corporate Social Responsibility Disclosure and Practices in a Developing Economy. Sustainability 2018, 10, 2955. [Google Scholar] [CrossRef]

- Waheed, A. Evaluation of the State of Corporate Social Responsibility in Pakistan and a Strategy for Implementation; A Report written for Securities and Exchange Commission of Pakistan and United Nations Development Program. 2005. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.468.7745&rep=rep1&type=pdf (accessed on 25 December 2018).

- Gamerschlag, R.; Möller, K.; Verbeeten, F. Determinants of voluntary CSR disclosure: Empirical evidence from Germany. Rev. Manag. Sci. 2011, 5, 233–262. [Google Scholar] [CrossRef]

- SECP. Securities and Exchange Commission of Pakistan, 2013. Corporate Social Responsibility Voluntary Guideline 2013; SECP: Islamabad, Pakistan, 2013.

- Sheldon, O. The Philosophy of Management; Sir I. Pitman & Sons, Ltd.: London, UK, 1923. [Google Scholar]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Frederick, W.C. Commentary: Corporate social responsibility: Deep roots, flourishing growth, promising future. Front. Psychol. 2016, 7, 129. [Google Scholar] [CrossRef]

- Azim, M.I.; Ahmed, S.; Islam, M.S. Corporate social reporting practice: Evidence from listed companies in Bangladesh. J. Asia-Pacif. Bus. 2009, 10, 130–145. [Google Scholar] [CrossRef]

- Haniffa, R.M.; Cooke, T.E. The impact of culture and governance on corporate social reporting. J. Account. Public Policy 2005, 24, 391–430. [Google Scholar] [CrossRef] [Green Version]

- Amran, A.; Susela Devi, S. The impact of government and foreign affiliate influence on corporate social reporting: The case of Malaysia. Manag. Audit. J. 2008, 23, 386–404. [Google Scholar] [CrossRef]

- Mahadeo, J.D.; Oogarah-Hanuman, V.; Soobaroyen, T. A longitudinal study of corporate social disclosures in a developing economy. J. Bus. Ethics 2011, 104, 545–558. [Google Scholar] [CrossRef]

- Baird, P.L.; Geylani, P.C.; Roberts, J.A. Corporate social and financial performance re-examined: Industry effects in a linear mixed model analysis. J. Bus. Ethics 2012, 109, 367–388. [Google Scholar] [CrossRef]

- Blacconiere, W.G.; Patten, D.M. Environmental disclosures, regulatory costs, and changes in firm value. J. Account. Econ. 1994, 18, 357–377. [Google Scholar] [CrossRef]

- Rehman, A.; Baloch, Q.; Sethi, S. Understanding the relationship between firm’s corporate social responsibility and financial performance: Empirical analysis. Abasyn J. Soc. Sci. 2015, 8, 98–107. [Google Scholar]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Javaid Lone, E.; Ali, A.; Khan, I. Corporate governance and corporate social responsibility disclosure: Evidence from Pakistan. Corp. Govern. Int. J. Bus. Soc. 2016, 16, 785–797. [Google Scholar] [CrossRef]

- Said, R.; Hj Zainuddin, Y.; Haron, H. The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Soc. Responsib. J. 2009, 5, 212–226. [Google Scholar] [CrossRef]

- Scott, S. Corporate social responsibility and the fetter of profitability. Soc. Responsib. J. 2007, 3, 31–39. [Google Scholar] [CrossRef]

- Jennifer Ho, L.C.; Taylor, M.E. An empirical analysis of triple bottom-line reporting and its determinants: Evidence from the United States and Japan. J. Int. Financ. Manag. Account. 2007, 18, 123–150. [Google Scholar] [CrossRef]

- Moskowitz, M. Choosing socially responsible stocks. Bus. Soc. Rev. 1972, 1, 71–75. [Google Scholar]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate social responsibility and firm financial performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar]

- Famiyeh, S. Corporate social responsibility and firm’s performance: Empirical evidence. Soc. Responsib. J. 2017, 13, 390–406. [Google Scholar] [CrossRef]

- Lima Crisóstomo, V.; de Souza Freire, F.; Cortes de Vasconcellos, F. Corporate social responsibility, firm value and financial performance in Brazil. Soc. Responsib. J. 2011, 7, 295–309. [Google Scholar] [CrossRef]

- Feng, M.; Wang, X.; Kreuze, J.G. Corporate social responsibility and firm financial performance: Comparison analyses across industries and CSR categories. Am. J. Bus. 2017, 32, 106–133. [Google Scholar] [CrossRef]

- Casado-Díaz, A.; Nicolau-Gonzálbez, J.; Ruiz-Moreno, F.; Sellers-Rubio, R. The differentiated effects of CSR actions in the service industry. J. Serv. Mark. 2014, 28, 558–565. [Google Scholar] [CrossRef] [Green Version]

- Waddock, S.A.; Graves, S.B. The corporate social performance–financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Preston, L.E.; O’bannon, D.P. The corporate social-financial performance relationship: A typology and analysis. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. The revisited contribution of environmental reporting to investors’ valuation of a firm’s earnings: An international perspective. Ecol. Econ. 2007, 62, 613–626. [Google Scholar] [CrossRef]

- Aerts, W.; Cormier, D.; Magnan, M. Corporate environmental disclosure, financial markets and the media: An international perspective. Ecol. Econ. 2008, 64, 643–659. [Google Scholar] [CrossRef]

- Yu, Y.; Choi, Y. Corporate social responsibility and firm performance through the mediating effect of organizational trust in Chinese firms. Chin. Manag. Stud. 2014, 8, 577–592. [Google Scholar] [CrossRef]

- Amini, C.; Dal Bianco, S. Corporate social responsibility and Latin American firm performance. Corp. Govern. Int. J. Bus. Soc. 2017, 17, 403–445. [Google Scholar] [CrossRef]

- Berger, R.; Dutta, S.; Raffel, T.; Samuels, G. Innovating at the Top: How Global CEOs Drive Innovation for Growth and Profit; Palgrave Macmillan: Basingstoke, UK, 2016. [Google Scholar]

- Papadakis, V.M. Do CEOs shape the process of making strategic decisions? Evidence from Greece. Manag. Decis. 2006, 44, 367–394. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate governance, product market competition, and equity prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

- Coles, J.L.; Li, Z.; Wang, A.Y. Industry tournament incentives. Rev. Financ. Stud. 2017, 31, 1418–1459. [Google Scholar] [CrossRef]

- Core, J.; Guay, W. The use of equity grants to manage optimal equity incentive levels. J. Account. Econ. 1999, 28, 151–184. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.F. Mutual monitoring and corporate governance. J. Bank. Financ. 2014, 45, 255–269. [Google Scholar]

- Veprauskaitė, E.; Adams, M. Do powerful chief executives influence the financial performance of UK firms? Br. Account. Rev. 2013, 45, 229–241. [Google Scholar] [CrossRef]

- Devers, C.E.; Cannella, A.A., Jr.; Reilly, G.P.; Yoder, M.E. Executive compensation: A multidisciplinary review of recent developments. J. Manag. 2007, 33, 1016–1072. [Google Scholar] [CrossRef]

- Javid, A.Y.; Iqbal, R. Ownership concentration, corporate governance and firm performance: Evidence from Pakistan. Pak. Dev. Rev. 2008, 643–659. [Google Scholar] [CrossRef]

- Kamran, K.; Shah, A. The impact of corporate governance and ownership structure on earnings management practices: Evidence from listed companies in Pakistan. Lahore J. Econ. 2014, 19, 27–70. [Google Scholar]

- Basu, S.; Hwang, L.-S.; Mitsudome, T.; Weintrop, J. Corporate governance, top executive compensation and firm performance in Japan. Pac.-Basin Financ. J. 2007, 15, 56–79. [Google Scholar] [CrossRef]

- Conyon, M.J.; He, L. Executive compensation and corporate governance in China. J. Corp. Financ. 2011, 17, 1158–1175. [Google Scholar] [CrossRef] [Green Version]

- Kato, T.; Kim, W.; Lee, J.H. Executive compensation, firm performance, and Chaebols in Korea: Evidence from new panel data. Pac.-Basin Financ. J. 2007, 15, 36–55. [Google Scholar] [CrossRef] [Green Version]

- Song, F.; Thakor, A.V. Information control, career concerns, and corporate governance. J. Financ. 2006, 61, 1845–1896. [Google Scholar] [CrossRef]

- Bayless, M. The myth of executive compensation: Do shareholders get what they pay for? Appl. Financ. Econ. 2009, 19, 795–808. [Google Scholar] [CrossRef]

- Buck, T.; Liu, X.; Skovoroda, R. Top executive pay and firm performance in China. J. Int. Bus. Stud. 2008, 39, 833–850. [Google Scholar] [CrossRef]

- Conyon, M.J.; He, L. CEO Compensation and Corporate Governance in C hina. Corp. Govern. Int. Rev. 2012, 20, 575–592. [Google Scholar] [CrossRef]

- Tosi, H.L.; Werner, S.; Katz, J.P.; Gomez-Mejia, L.R. How much does performance matter? A meta-analysis of CEO pay studies. J. Manag. 2000, 26, 301–339. [Google Scholar] [CrossRef]

- Chang, Y.Y.; Dasgupta, S.; Hilary, G. CEO ability, pay, and firm performance. Manag. Sci. 2010, 56, 1633–1652. [Google Scholar] [CrossRef]

- Jamali, D.; Safieddine, A.; Rabbath, M. Corporate governance and corporate social responsibility synergies and interrelationships. Corp. Govern. Int. Rev. 2008, 16, 443–459. [Google Scholar] [CrossRef]

- Demsetz, H. The structure of ownership and the theory of the firm. J. Law Econ. 1983, 26, 375–390. [Google Scholar] [CrossRef]

- Demsetz, H.; Lehn, K. The structure of corporate ownership: Causes and consequences. J. Political Econ. 1985, 93, 1155–1177. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef] [Green Version]

- Mehran, H. Executive compensation structure, ownership, and firm performance. J. Financ. Econ. 1995, 38, 163–184. [Google Scholar] [CrossRef]

- Feng, Y.; Chen, H.H.; Tang, J. The Impacts of Social Responsibility and Ownership Structure on Sustainable Financial Development of China’s Energy Industry. Sustainability 2018, 10, 301. [Google Scholar] [CrossRef]

- Liang, C.-J.; Lin, Y.-L.; Huang, T.-T. Does endogenously determined ownership matter on performance? Dynamic evidence from the emerging Taiwan market. Emerg. Mark. Financ. Trade 2011, 47, 120–133. [Google Scholar] [CrossRef]

- Mandacı, P.; Gumus, G. Ownership concentration, managerial ownership and firm performance: Evidence from Turkey. South East Eur. J. Econ. Bus. 2010, 5, 57–66. [Google Scholar] [CrossRef]

- Swanson, D.L. Top managers as drivers for corporate social responsibility. In The Oxford Handbook of Corporate Social Responsibility; OUP Oxford: Oxford, UK, 2008; pp. 227–248. [Google Scholar]

- Cheung, Y.-L.; Kong, D.; Tan, W.; Wang, W. Being good when being international in an emerging economy: The case of China. J. Bus. Ethics 2015, 130, 805–817. [Google Scholar] [CrossRef]

- Hope, O.-K.; Kang, T.; Kim, J.W. Voluntary disclosure practices by foreign firms cross-listed in the United States. J. Contemp. Account. Econ. 2013, 9, 50–66. [Google Scholar] [CrossRef]

- Karolyi, G.A. The world of cross-listings and cross-listings of the world: Challenging conventional wisdom. Rev. Financ. 2006, 10, 99–152. [Google Scholar] [CrossRef]

- Elzahar, H.; Hussainey, K. Determinants of narrative risk disclosures in UK interim reports. J. Risk Financ. 2012, 13, 133–147. [Google Scholar] [CrossRef] [Green Version]

- Zeitun, R. Corporate governance, capital structure and corporate performance: Evidence from GCC countries. Rev. Middle East Econ. Financ. 2014, 10, 75–96. [Google Scholar] [CrossRef]

- Karaca, S.S.; Eksi, I.H. The relationship between ownership structure and firm performance: An empirical analysis over Istanbul Stock Exchange (ISE) listed companies. Int. Bus. Res. 2012, 5, 172. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. Corporate ownership around the world. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Feng, L.; Lin, F.; Xu, J. Property rights, ownership concentration and corporate social responsibility. J. Shanxi Financ. Econ. Univ. 2011, 33, 100–107. [Google Scholar]

- Abbas, A.; Naqvi, H.A.; Mirza, H.H. Impact of large ownership on firm performance: A case of non financial listed companies of Pakistan. World Appl. Sci. J. 2013, 21, 1141–1152. [Google Scholar]

- Peng, C.-W.; Yang, M.-L. The effect of corporate social performance on financial performance: The moderating effect of ownership concentration. J. Bus. Ethics 2014, 123, 171–182. [Google Scholar] [CrossRef]

- Dam, L.; Scholtens, B. Ownership concentration and CSR policy of European multinational enterprises. J. Bus. Ethics 2013, 118, 117–126. [Google Scholar] [CrossRef]

- Lau, C.; Lu, Y.; Liang, Q. Corporate social responsibility in China: A corporate governance approach. J. Bus. Ethics 2016, 136, 73–87. [Google Scholar] [CrossRef]

- Kiran, S.; Kakakhel, S.J.; Shaheen, F. Corporate social responsibility and firm profitability: A case of oil and gas sector of Pakistan. City Univ. Res. J. 2015, 5, 110–119. [Google Scholar]

- Qazi, S.; Ahmed, M.; Kashif, S.; Qureshi, Z. Company’s financial performance and CSR: Pakistan context. Global Adv. Res. J. Manag. Bus. Stud. 2015, 4, 196–202. [Google Scholar]

- Depoers, F. A cost benefit study of voluntary disclosure: Some empirical evidence from French listed companies. Eur. Account. Rev. 2000, 9, 245–263. [Google Scholar] [CrossRef]

- WBG: World Development Indicators. 2016. Available online: http://elibraryworldbankorg/doi/abs/101596/978–1–4648-0683-4 (accessed on 5 January 2019).

- Asrar-ul-Haq, M.; Kuchinke, K.P.; Iqbal, A. The relationship between corporate social responsibility, job satisfaction, and organizational commitment: Case of Pakistani higher education. J. Clean. Prod. 2017, 142, 2352–2363. [Google Scholar] [CrossRef]

- Kansal, M.; Joshi, M.; Batra, G.S. Determinants of corporate social responsibility disclosures: Evidence from India. Adv. Account. 2014, 30, 217–229. [Google Scholar] [CrossRef]

- Yuen, K.F.; Thai, V.V.; Wong, Y.D.; Wang, X. Interaction impacts of corporate social responsibility and service quality on shipping firms’ performance. Transp. Res. Part A Policy Pract. 2018, 113, 397–409. [Google Scholar] [CrossRef]

- Zhou, Z.; Ki, E.-J. Exploring the role of CSR fit and the length of CSR involvement in routine business and corporate crises settings. Public Relat. Rev. 2018, 44, 75–83. [Google Scholar] [CrossRef]

- Gomes, M.; Marsat, S. Does CSR impact premiums in M&A transactions? Financ. Res. Lett. 2018, 26, 71–80. [Google Scholar]

- Xia, B.; Olanipekun, A.; Chen, Q.; Xie, L.; Liu, Y. Conceptualising the state of the art of corporate social responsibility (CSR) in the construction industry and its nexus to sustainable development. J. Clean. Prod. 2018, 195, 340–353. [Google Scholar] [CrossRef]

- Han, W.; Zhuangxiong, Y.; Jie, L. Corporate social responsibility, product market competition, and product market performance. Int. Rev. Econ. Financ. 2018, 56, 75–91. [Google Scholar] [CrossRef]

- Blasi, S.; Caporin, M.; Fontini, F. A Multidimensional Analysis of the Relationship Between Corporate Social Responsibility and Firms’ Economic Performance. Ecol. Econ. 2018, 147, 218–229. [Google Scholar] [CrossRef]

- Shen, C.-H.; Wu, M.-W.; Chen, T.-H.; Fang, H. To engage or not to engage in corporate social responsibility: Empirical evidence from global banking sector. Econ. Model. 2016, 55, 207–225. [Google Scholar] [CrossRef]

- Kumar, J. Does Corporate Governance Influence Firm Value? Evidence from Indian Firms. J. Entrep. Financ. Bus. Ventures 2004, 9, 61–93. [Google Scholar]

- Ibrahim, Q.; Rehman, R.; Raoof, A. Role of corporate governance in firm performance: A comparative study between chemical and pharmaceutical sectors of Pakistan. Int. Res. J. Financ. Econ. 2010, 50, 7–16. [Google Scholar]

- Brown, L.D.; Caylor, M.L. Corporate governance and firm operating performance. Rev. Quant. Financ. Account. 2009, 32, 129–144. [Google Scholar] [CrossRef]

- Harada, K.; Nguyen, P. Ownership concentration and dividend policy in Japan. Manag. Financ. 2011, 37, 362–379. [Google Scholar] [CrossRef]

- Kamardin, H. Managerial ownership and firm performance: The influence of family directors and non-family directors. In Ethics, Governance and Corporate Crime: Challenges and Consequences; Emerald Group Publishing Limited: Bingley, UK, 2014; pp. 47–83. [Google Scholar]

- Dang, C.; Li, Z.F.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Li, F. Endogeneity in CEO power: A survey and experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw-Hill: New York, NY, USA, 2003. [Google Scholar]

- Shank, T.; Manullang, D.; Hill, R. “Doing Well While Doing Good” Revisited: A Study of Socially Responsible Firms’ Short-Term versus Long-term Performance. Manag. Financ. 2005, 31, 33–46. [Google Scholar] [CrossRef]

- Park, J.; Park, H.-Y.; Lee, H.-Y. The Effect of Social Ties between Outside and Inside Directors on the Association between Corporate Social Responsibility and Firm Value. Sustainability 2018, 10, 3840. [Google Scholar] [CrossRef]

- Rahman Belal, A.; Owen, D.L. The views of corporate managers on the current state of, and future prospects for, social reporting in Bangladesh: An engagement-based study. Account. Audit. Accountab. J. 2007, 20, 472–494. [Google Scholar] [CrossRef]

- Azizul Islam, M.; Deegan, C. Motivations for an organisation within a developing country to report social responsibility information: Evidence from Bangladesh. Account. Audit. Accountab. J. 2008, 21, 850–874. [Google Scholar] [CrossRef]

- Li, L.; Zhu, B. Family involvement, firm size, and performance of private-owned enterprises. J. Chin. Sociol. 2015, 2, 11. [Google Scholar] [CrossRef] [Green Version]

- Block, J.H.; Wagner, M. The effect of family ownership on different dimensions of corporate social responsibility: Evidence from large US firms. Bus. Strategy Environ. 2014, 23, 475–492. [Google Scholar] [CrossRef]

- Biger, N.; Hoang, Q. Managerial Ownership, firm size and earnings management. Int. J. Financ. 2008, 20. [Google Scholar] [CrossRef]

- Das, S.; Dixon, R.; Michael, A. Corporate social responsibility reporting: A longitudinal study of listed banking companies in Bangladesh. World Rev. Bus. Res. 2015. [Google Scholar] [CrossRef]

- Soliman, M.M.; Ragab, A.A. Audit committee effectiveness, audit quality and earnings management: An empirical study of the listed companies in Egypt. Res. J. Financ. Account. 2014, 5, 155–166. [Google Scholar] [CrossRef]

- Machek, O.; Kubíček, A. The relationship between ownership concentration and performance in Czech Republic. J. Int. Stud. 2018, 11, 177–186. [Google Scholar] [CrossRef]

- Goldman, E.; Slezak, S.L. An equilibrium model of incentive contracts in the presence of information manipulation. J. Financ. Econ. 2006, 80, 603–626. [Google Scholar] [CrossRef]

- Axelson, U.; Baliga, S. Liquidity and manipulation of executive compensation schemes. Rev. Financ. Stud. 2008, 22, 3907–3939. [Google Scholar] [CrossRef]

| Authors | Period | Country | Methodology | Relationship |

|---|---|---|---|---|

| Crisóstomo et al., (2011) | 2001–2006 | Brazil | Lagged effects | CSR & FP (−) |

| A Rehman, Q Baloch and S Sethi [84] | 2006–2012 | Pakistan | Correlation and generalized least square Random effect regression. | CSR & FP (+) |

| Javaid Lone, Ali, & Khan, (2016) | 2010–2014 | Pakistan | Paired-samples t-test and Regression analysis | CSR & FP (+) |

| A B. Casado-Díaz, J L. Nicolau-Gonzálbez, F Ruiz-Moreno and R Sellers-Rubio [95] | 1990–2007 | Spain | The event study technique | CSR & FP (+) |

| Y Li, M Gong, X-Y Zhang and L Koh [25] | 2004–2013 | United Kingdom | An instrumental variable approach and Heckman two-stage estimator | ESG & FP with CEO POWER (+) |

| S Leung and B Horwitz [51] | 1997–1998 | Hong Kong | Univariate T-test and Regression | Managerial ownership & FP (+) |

| S Bhagat and B Bolton [52] | 1998–2007 | United State | Instrumental variable estimation and Hausman OLS & 2OLS | Managerial ownership & FP (+) |

| S Garas and S ElMassah [48] | 2007–2012 | GCC Countries | Multivariate regression analysis | Managerial ownership, Ownership concentration & FP (+) |

| A Abbas, HA Naqvi and HH Mirza [139] | 2006–2009 | Pakistan | Regression analysis | Ownership Concentration & FP (+) |

| Variable Names | Abbreviations | Measures |

|---|---|---|

| Dependent Variable | ||

| Return on Equity | ROE | Operating income/shareholder equity |

| Return on Asset | ROA | Net profits/Total Assets |

| Independent & Control Variables | ||

| Social Contribution Value Per Share | SCV | EPS + (Total Tax + Staff Expenses + Interest + Public Welfare Payout − Social Cost/Total Equity |

| CEO power | CEO power | CEO annual compensation to all board of directors compensation |

| Managerial Ownership | TR | Percentage of shares held by Managers |

| Ownership Concentration | H5 | Major top 5 shareholders to total shares |

| The property, Plant, and Equipment (Control variable) | PPE | The ratio of property, plant, and equipment to total sales |

| Firm Size (Control variable) | LNTA | The natural log of total assets |

| Leverage (Control variable) | LEV | Total liability divided by total assets |

| Asset turnover (Control variable) | ASSETTO | The ratio of total sales to total asset |

| Variable | Observation | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ROE | 990 | 6.4387 | 6.0791 | 0.000 | 28 |

| ROA | 990 | 10.2814 | 9.5045 | 0.000 | 47.223 |

| SCV | 990 | 0.0448 | 0.07195 | 0.0003 | 0.3783 |

| LNTA | 990 | 15.4809 | 1.9426 | 10.752 | 19.588 |

| LEVERAGE | 990 | 0.5698 | 0.3258 | 0.0326 | 2.087 |

| PPE | 990 | 1.2864 | 3.6960 | 0.0077 | 27.415 |

| ASSETTO | 990 | 1.1555 | 0.8599 | 0.000 | 5.006 |

| CEOPOWER | 978 | 0.8833 | 0.5830 | 2.734 | 0.141 |

| SCV*CEOPOWER | 926 | −1.3401 | 0.7078 | 3.848 | 0.2669 |

| TR | 990 | 0.0115 | 0.0154 | 0.0003 | 0.1095 |

| SCV*TR | 925 | −5.6227 | 1.1276 | 9.1820 | 12.6102 |

| H5 | 990 | 0.0661 | 0.0842 | 0.0025 | 0.4323 |

| SCV*H5 | 925 | −1.8752 | 0.6595 | 3.5703 | 7.3174 |

| Dependent Variables | Model 1 | Model 2 | Model 3 | Model 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Independent Variables | ROA | ROE | ROA | ROE | ||||

| FE | GMM | FE. | GMM | FE | GMM | FE | GMM | |

| SCV | 27.63 *** | 26.47 *** | 16.93 *** | 16.13 *** | 28.66 *** | 28.77 *** | 17.35 ** | 17.18 *** |

| 0 | −0.001 | 0 | −0.001 | 0 | 0 | 0 | −0.001 | |

| CEO POWER | 0.558 | 1.02 | −0.031 | 0.221 | ||||

| −0.5693 | −0.43 | −0.963 | −0.794 | |||||

| SCV*CEOPOWER | 2.761 *** | 4.012 *** | 1.208 *** | 2.032 *** | ||||

| 0 | 0 | −0.005 | −0.002 | |||||

| LNTA | −2.46 *** | −3.57 *** | −0.465 | −0.742 | −1.789 ** | −0.192254 | 0.053 | 0.037 |

| −0.0005 | −0.001 | −0.2966 | −0.298 | −0.0143 | −0.912 | −0.962 | ||

| LEVERAGE | −0.34 | 3.39 | −0.0185224 | 2.807 * | −0.036312 | −1.011 | −0.289 ** | −0.002 |

| −0.1612 | −0.145 | −0.062 | −0.712 | −0.044 | −0.999 | |||

| PPE | 0.080 ** | 0.124 | 0.056 ** | 0.093 | 0.090 * | 0.281 * | 0.042 | 0.16 |

| −0.0438 | −0.342 | −0.0251 | −0.27 | −0.091 | −0.093 | −0.241 | −0.142 | |

| ASSET TO | 1.999 *** | 2.32 *** | 1.251 *** | 1.233 ** | 2.357 *** | 2.214 ** | 1.443 *** | 1.216 ** |

| −0.0006 | −0.007 | −0.0007 | −0.027 | −0.0001 | −0.018 | −0.0003 | −0.048 | |

| Constant | 44.86 *** | 56.84 *** | 11.52 * | 12.31 | 38.35 *** | 40.86 ** | 4.774 | 4.501 |

| −0.0001 | −0.002 | −0.099 | −0.289 | −0.0007 | −0.031 | −0.522 | −0.714 | |

| R2 | 0.5822 | 0.5753 | 0.6322 | 0.596 | ||||

| F | 11.86 *** | 11.53 *** | 13.374 *** | 11.471 *** | ||||

| 0 | 0 | 0 | 0 | |||||

| Hausman Test | 36.48 *** | 28.48 *** | 38.872 *** | 28.642 *** | ||||

| −0.0003 | 0 | 0 | 0 | |||||

| Wald Chi2 | 93.30 *** | 54.20 *** | 121.54 *** | 69.03 *** | ||||

| 0 | 0 | 0 | (0.000) | |||||

| Dependent Variables | Model 5 | Model 6 | Model 7 | Model 8 | ||||

|---|---|---|---|---|---|---|---|---|

| Independent Variables | ROA | ROE | ROA | ROE | ||||

| FE | GMM | FE. | GMM | FE | GMM | FE | GMM | |

| SCV | 27.39 *** | 28.77 *** | 21.04 *** | 17.07 *** | 34.53 *** | 27.63 *** | 20.78 *** | 16.67 *** |

| 0 | 0 | 0 | −0.001 | 0 | 0 | 0 | −0.001 | |

| TR | −95.04 *** | −94.82 ** | −85.56 *** | −44.04 | ||||

| −0.0003 | −0.045 | 0 | −0.153 | |||||

| H5 | −13.77 ** | −20.983 ** | −13.148 *** | −10.741 | ||||

| −0.013 | −0.026 | 0 | −0.077 | |||||

| SCV*TR | 1.597 *** | 3.395 *** | 1.033 *** | 1.814 *** | ||||

| 0 | 0 | 0 | 0 | |||||

| SCV*H5 | 4.678 *** | 6.161 *** | 2.603 *** | 3.320 *** | ||||

| 0 | 0 | 0 | 0 | |||||

| LNTA | −2.078 *** | −2.179 * | −0.113 | −0.002 | −1.723 ** | −1.733 | −0.129 | 0.289 |

| −0.003 | −0.06 | −0.81 | −0.999 | −0.017 | −0.147 | −0.789 | −0.705 | |

| LEVERAGE | −6.238 *** | −1.802 | −3.744 *** | −0.423 | −6.343 *** | −1.823 | −3.969 *** | −0.604 |

| 0 | −0.517 | −0.001 | −0.816 | 0 | −0.508 | −0.001 | −0.737 | |

| PPE | 0.272 ** | 0.295 ** | 0.130 * | 0.223 ** | 0.283 ** | 0.374 ** | 0.132 * | 0.207 * |

| −0.015 | −0.018 | −0.082 | −0.041 | −0.013 | −0.024 | −0.081 | −0.056 | |

| ASSET TO | 2.492 *** | 2.525 *** | 1.441 *** | 1.356 ** | 2.554 *** | 2.628 *** | 1.435 *** | 1.416 ** |

| 0 | −0.006 | 0 | −0.025 | 0 | −0.004 | 0 | −0.019 | |

| Constant | 52.93 *** | 3.10 *** | 14.95 * | 12.72 | 45.09 *** | 43.32 ** | 13.39 * | 4.54 |

| 0 | −0.002 | −0.067 | −0.288 | 0 | −0.024 | −0.088 | −0.712 | |

| R2 | 0.6354 | 0.6014 | 0.6369 | 0.6016 | ||||

| F | 17.03 *** | 11.48 *** | 17.67 *** | 11.76 *** | ||||

| 0 | 0 | 0 | 0 | |||||

| Hausman Test | 34.70 *** | 30.40 *** | 41.57 *** | 37.96 *** | ||||

| 0 | −0.001 | 0 | 0 | |||||

| Wald Chi2 | 129.54 *** | 75.86 *** | 130.51 *** | 77.76 *** | ||||

| 0 | 0 | 0 | 0 | |||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Javeed, S.A.; Lefen, L. An Analysis of Corporate Social Responsibility and Firm Performance with Moderating Effects of CEO Power and Ownership Structure: A Case Study of the Manufacturing Sector of Pakistan. Sustainability 2019, 11, 248. https://doi.org/10.3390/su11010248

Javeed SA, Lefen L. An Analysis of Corporate Social Responsibility and Firm Performance with Moderating Effects of CEO Power and Ownership Structure: A Case Study of the Manufacturing Sector of Pakistan. Sustainability. 2019; 11(1):248. https://doi.org/10.3390/su11010248

Chicago/Turabian StyleJaveed, Sohail Ahmad, and Lin Lefen. 2019. "An Analysis of Corporate Social Responsibility and Firm Performance with Moderating Effects of CEO Power and Ownership Structure: A Case Study of the Manufacturing Sector of Pakistan" Sustainability 11, no. 1: 248. https://doi.org/10.3390/su11010248

APA StyleJaveed, S. A., & Lefen, L. (2019). An Analysis of Corporate Social Responsibility and Firm Performance with Moderating Effects of CEO Power and Ownership Structure: A Case Study of the Manufacturing Sector of Pakistan. Sustainability, 11(1), 248. https://doi.org/10.3390/su11010248