Nonlinear Dynamics in the Finance-Inequality Nexus in China-CHNS Data

Abstract

1. Introduction

2. Methodology and Data

2.1. Empirical Model

2.2. Data Variables

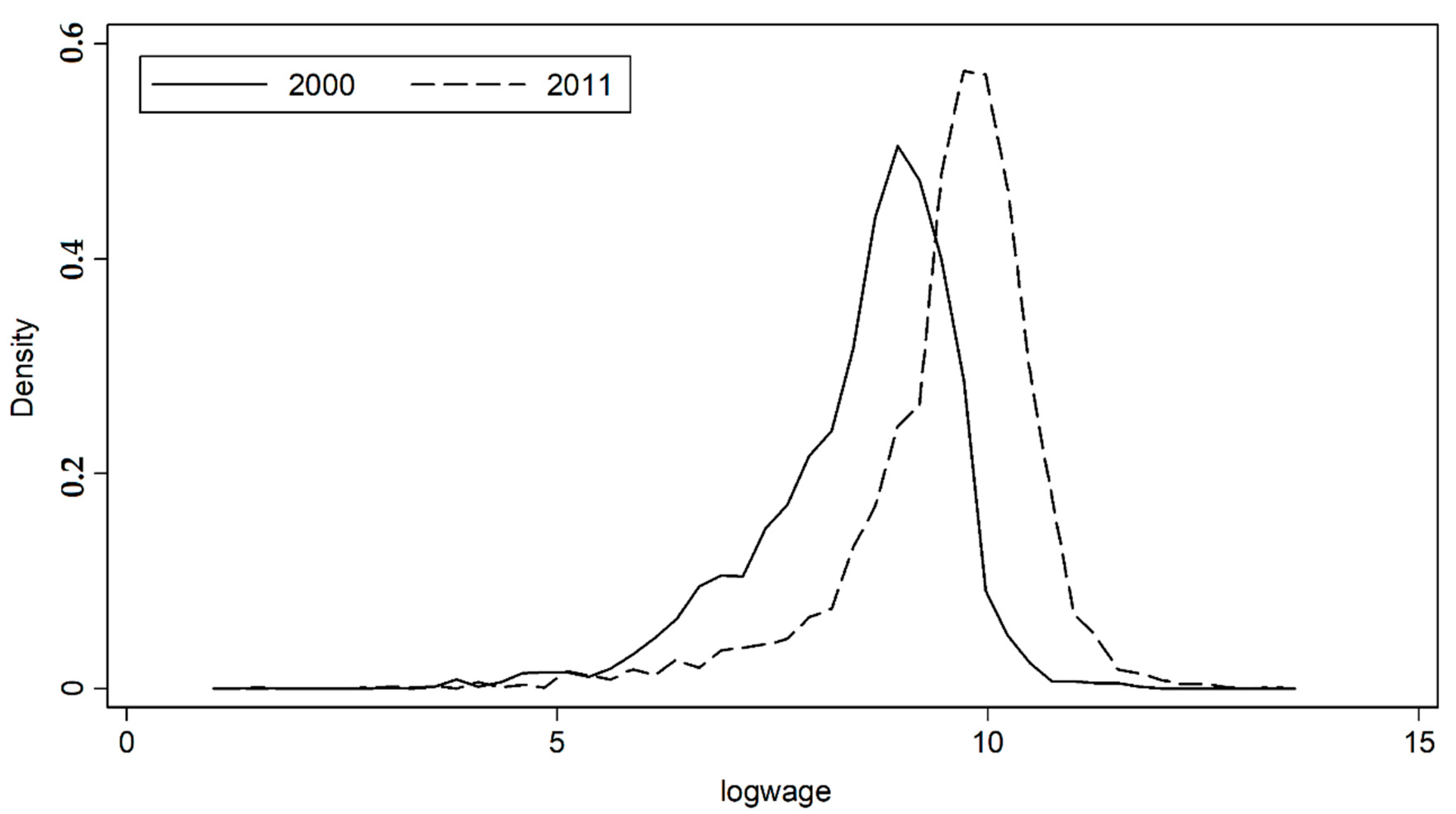

2.3. Descriptive Statistics

3. Findings: Quantile Regression Analysis

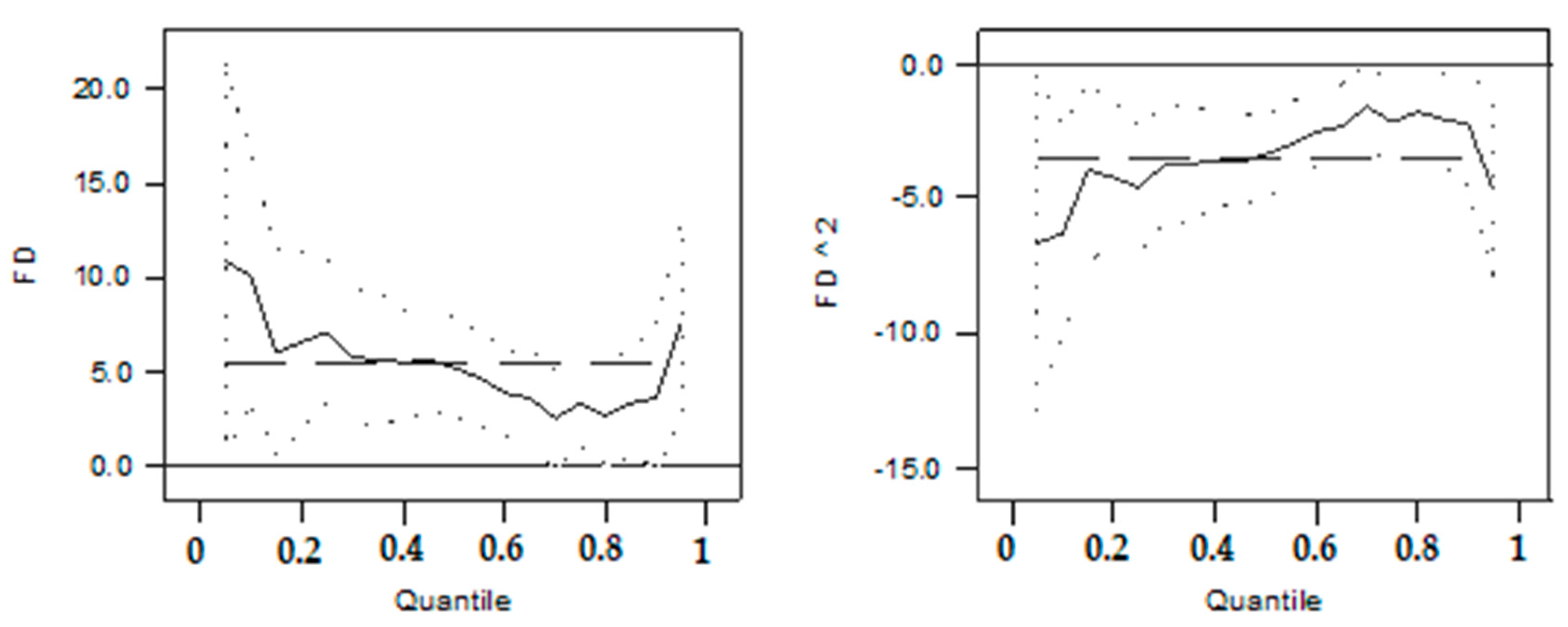

3.1. Results of Quantile Regression

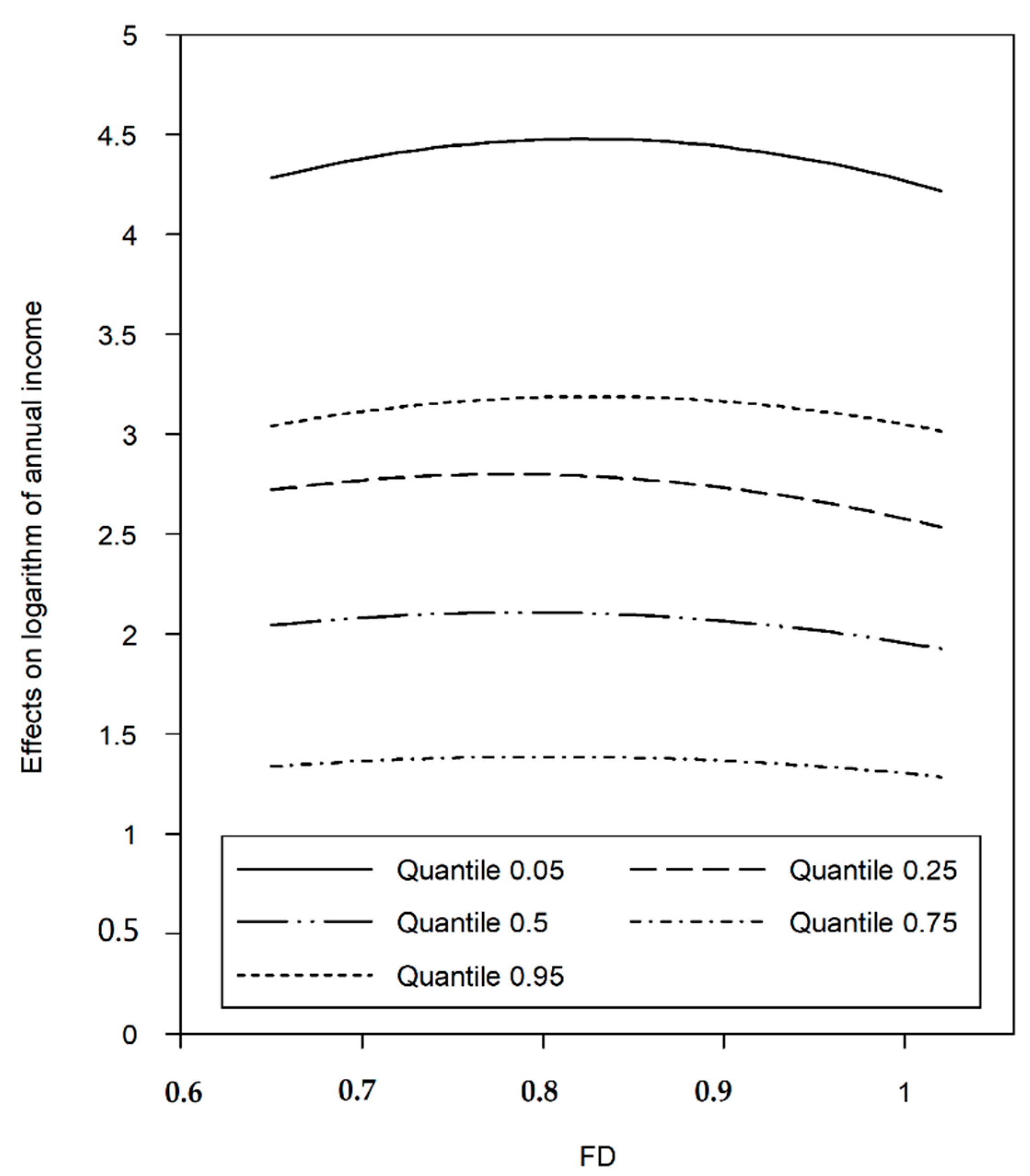

3.2. Effects of Financial Development(FD) on Various Income Groups

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Dependent Variables: Log (Branch/Population) | OLS | Quantile | ||||

|---|---|---|---|---|---|---|

| 0.05 | 0.25 | 0.5 | 0.75 | 0.95 | ||

| FD | 2.235 ** | 5.453 ** | 4.773 *** | 3.234 ** | 2.232 ** | 5.012 ** |

| (1.023) | (2.048) | (1.065) | (1.121) | (1.012) | (1.903) | |

| FD2 | −1.821 ** | −4.231 ** | −3.123 ** | −2.591 ** | −1.989 ** | −4.221 *** |

| (0.708) | (2.001) | (1.131) | (1.013) | (0.901) | (1.223) | |

| Male | 0.179 * | 0.074 | 0.212 * | 0.211 ** | 0.176 * | 0.241 ** |

| (0.089) | (0.038) | (0.077) | (0.069) | (0.074) | (0.060) | |

| Married | 0.331 *** | 0.133 * | 0.126 ** | 0.106 ** | 0.081 ** | 0.125 ** |

| (0.074) | (0.064) | (0.030) | (0.027) | (0.020) | (0.038) | |

| Urban registered permanent residence | 0.212 *** | 0.539 *** | 0.335 ** | 0.501 ** | 0.153 *** | 0.112 *** |

| (0.036) | (0.072) | (0.033) | (0.025) | (0.020) | (0.028) | |

| Length of education | 0.076 *** | 0.128 *** | 0.089 ** | 0.071 ** | 0.054 *** | 0.043 *** |

| (0.002) | (0.007) | (0.003) | (0.002) | (0.002) | (0.004) | |

| Age | 0.001 | 0.009 | −0.004 | 0.004 | −0.002 | −0.005 |

| (0.001) | (0.008) | (0.004) | (0.007) | (0.002) | (0.013) | |

| Provincial fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 18,954 | 18,954 | 18,954 | 18,954 | 18,954 | 18,954 |

References

- Dabla-Norris, E.; Kochhar, K.; Ricka, F.; Suphaphiphat, N.; Tsounta, E. Causes and Consequences of Income Inequality: A Global Perspective; IMF Staff Discussion Note 15/13; IMF: Washington, DC, USA, 2015. [Google Scholar]

- Abiad, A.; Detragiache, E.; Tressel, T. A New Database of Financial Reforms. IMF Econ. Rev. 2010, 57, 281–302. [Google Scholar] [CrossRef]

- Kuznets, S. Economic Growth and Income Inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- National Bureau of Statistics (Various Years), The People’s Republic of China, Various Issue. Available online: http://www.stats.gov.cn/ (accessed on 9 October 2016).

- Institute of the National Development and Reform Commission. Study on the Income gap of Residents in China; National Development and Reform Commission, Economic Research Reference: Beijing, China, 2012; Volume 25, pp. 3–23.

- Li, Y. Blue Book of Social Administration; Chinese Academy for Social Sciences (CASS): Beijing, China, 2012.

- Greenwood, J.; Jovanovich, B. Financial Development, Growth, and the Distribution of Income. J. Political Econ. 1990, 98, 1076–1107. [Google Scholar] [CrossRef]

- Sebastian, J.; Watzka, S. Financial Development and Income Inequality, CESifo Working Paper: Fiscal Policy, Macroeconomics and Growth, No. 3687. 2011. Available online: http://www.econstor.eu/bitstream/10419/55340/1/685220540.pdf (accessed on 9 December 2016).

- Beck, T.; Asli, D.; Levine, R. Finance, Inequality, and Poverty: Cross-Country Evidence; NBER Working Paper 10979; The World Bank: Washington, DC, USA, 2004. [Google Scholar]

- Burgess, R.; Rohini, P. Do Rural Banks Matter? Evidence from the Indian Social Banking Experiment. Am. Econ. Rev. 2005, 95, 780–795. [Google Scholar] [CrossRef]

- Clarke, G.; Lixin, C.X.; Heng, Z. Finance and Income Inequality: Test of Alternative Theories; Policy Research Working Paper; No. 2984; The World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Hoi, L.Q.; Hoi, C.M. Financial Sector Development and Income Inequality in Vietnam: Evidence at the Provincial Level. J. Southeast Asian Econ. 2013, 30, 263–277. [Google Scholar] [CrossRef]

- Kaidi, N.; Sami, M. Financial Development and Income Inequality: The Linear versus the Nonlinear Hypothesis. Econ. Bull. 2016, 36, 609–626. [Google Scholar]

- Shahbaz, M.; Islam, F. Financial Development and Income Inequality in Pakistan: An Application of ARDL Approach. J. Econ. Dev. 2011, 36, 35–58. [Google Scholar]

- Batuo, M.E.; Guidi, F.; Mlambo, K. Financial Development and Income Inequality: Evidence from African Countries; Working Paper; University of Westminster: London, UK, 2014. [Google Scholar]

- de Hann, J.; Strum, J. Finance and income inequality: A review and new evidence. Eur. J. Political Econ. 2017, 50, 171–195. [Google Scholar] [CrossRef]

- Galor, O.; Joseph, Z. Income Distribution and Macroeconomics. Rev. Econ. Stud. 1993, 60, 35–52. [Google Scholar] [CrossRef]

- Banerjee, A.V.; Andrew, F.N. Occupational Choice and the Process of Development. J. Political Econ. 1993, 101, 274–298. [Google Scholar] [CrossRef]

- Arora, R.U. Finance and Inequality: A Study of Indian States. Appl. Econ. 2012, 44, 4527–4538. [Google Scholar] [CrossRef]

- Kim, D.H.; Lin, S.C. Nonlinearity in the Financial Development-income Inequality Nexus. J. Comp. Econ. 2011, 39, 310–325. [Google Scholar] [CrossRef]

- Tan, H.B.; Law, S.K. Nonlinear Dynamics of the Finance-inequality Nexus in Developing Countries. J. Econ. Inequal. 2012, 10, 551–563. [Google Scholar] [CrossRef]

- Zhang, Q.; Chen, R. Financial Development and Income Inequality in China: An Application of SVAR Approach. Procedia Comput. Sci. 2015, 55, 774–781. [Google Scholar] [CrossRef]

- Sun, Y.; Wan, Y. Financial development, opening-up, and urban-rural income gap. J. Financ. Res. 2011, 1, 28–39. [Google Scholar]

- Wan, H.; Shi, L. The impact of residents’ residence discrimination on urban-rural income gap. Econ. Res. J. 2014, 9, 43–55. [Google Scholar]

- Qiao, H.; Li, C. Re-examination of the “inverted U-shaped” relationship between financial development and income gap. Chin. Rural Econ. 2009, 7, 68–76. [Google Scholar]

- Liu, G.; Liu, Y.; Zhang, C. Financial Development, Financial Structure and Income Inequality in China. World Econ. 2017, 40, 1890–1917. [Google Scholar] [CrossRef]

- Koenker, R. Quantile Regression; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

- Carolina Population Center. China Health and Nutrition Survey (CHNS); Carolina Population Center, University of North Carolina: Chapel Hill, NA, USA, 2014; Available online: http://www.cpc.unc.edu/projects/china (accessed on 19 October 2016).

- Arestis, P.; Panicos, O.; Demetriades, K.B. Financial Development and Economic Growth: Role of Stock Markets. J. Money Credit Bank. 2001, 33, 16–41. [Google Scholar] [CrossRef]

- Ze, Y.; Chen, X.; Zheng, S. Can financial development reduce the urban-rural income gap? Evidence from China. J. Financ. Res. 2011, 2, 42–56. [Google Scholar]

- Canavire Bacarreza, G.; Rioja, F. Financial Development and the Distribution of Income in Latin America and the Caribbean. 2008. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1293588 (accessed on 2 January 2019).

- Guillen, J. Does Financial Openness Matter in the Relationship Between Financial Development and Income Distribution in Latin America? Emerg. Mark. Financ. Trade 2016, 52, 1145–1155. [Google Scholar] [CrossRef]

| Variables | Total | Grouped by Incomes | ||

|---|---|---|---|---|

| Low-Income Group | Middle-Income Group | High-Income Group | ||

| Labor market performance | ||||

| Annual income (RMB) | 14,694 | 2257 | 10,408 | 35,684 |

| (22,425) | (1348) | (3640) | (36,745) | |

| Logarithm of annual income | 9.02 | 7.41 | 9.19 | 10.31 |

| (1.21) | (0.99) | (0.37) | (0.49) | |

| FD index | ||||

| Loan size/GDP | 0.81 | 0.80 | 0.81 | 0.82 |

| (0.11) | (0.10) | (0.10) | (0.12) | |

| Social and economic characteristics | ||||

| Age | 47.70 | 48.77 | 47.92 | 46.22 |

| (10.85) | (11.23) | (10.69) | (10.60) | |

| Length of education | 8.30 | 6.72 | 8.30 | 9.85 |

| (3.73) | (3.51) | (3.55) | (3.62) | |

| Male | 0.50 | 0.42 | 0.48 | 0.62 |

| (0.50) | (0.49) | (0.50) | (0.49) | |

| Married | 0.86 | 0.85 | 0.85 | 0.89 |

| (0.35) | (0.36) | (0.36) | (0.32) | |

| Urban registered permanent residence | 0.30 | 0.16 | 0.32 | 0.40 |

| (0.46) | (0.37) | (0.46) | (0.49) | |

| Region | ||||

| Shandong Province | 0.16 | 0.14 | 0.17 | 0.16 |

| (0.37) | (0.35) | (0.37) | (0.37) | |

| Henan Province | 0.16 | 0.23 | 0.13 | 0.13 |

| (0.36) | (0.42) | (0.34) | (0.33) | |

| Jiangsu Province | 0.19 | 0.10 | 0.19 | 0.27 |

| (0.39) | (0.30) | (0.39) | (0.45) | |

| Hubei Province | 0.17 | 0.18 | 0.17 | 0.15 |

| (0.38) | (0.39) | (0.38) | (0.36) | |

| Hunan Province | 0.14 | 0.14 | 0.14 | 0.16 |

| (0.35) | (0.34) | (0.34) | (0.37) | |

| Guangxi Zhuang Autonomous Region | 0.18 | 0.20 | 0.20 | 0.13 |

| (0.39) | (0.40) | (0.40) | (0.33) | |

| Sample size | 18,954 | 4739 | 9473 | 4742 |

| Dependent Variables: Logarithm of Annual Incomes | OLS | Quantile | ||||

|---|---|---|---|---|---|---|

| 0.05 | 0.25 | 0.5 | 0.75 | 0.95 | ||

| FD | 5.5923 *** | 10.8938 ** | 7.1704 *** | 5.3475 *** | 3.4540 *** | 7.7092 *** |

| (1.5477) | (5.3488) | (1.9581) | (1.3109) | (1.1713) | (2.6918) | |

| FD2 | −3.5417 ** | −6.6238 * | −4.593 *** | −3.3920 *** | −2.1527 *** | −4.6596 ** |

| (0.9224) | (3.1652) | (1.1659) | (0.7813) | (0.6992) | (1.6082) | |

| Male | 0.2210 *** | 0.0848 | 0.2185 *** | 0.2346 *** | 0.2236 *** | 0.2558 *** |

| (0.0159) | (0.0541) | (0.0202) | (0.0135) | (0.0121) | (0.0282) | |

| Married | 0.1307 *** | 0.1792 ** | 0.1569 *** | 0.1063 *** | 0.0966 *** | 0.1142 *** |

| (0.0239) | (0.0739) | (0.0294) | (0.0202) | (0.0185) | (0.0425) | |

| Urban registered permanent residence | 0.3117 *** | 0.6783 ** | 0.4053 *** | 0.2406 *** | 0.1731 *** | 0.1063 *** |

| (0.0176) | (0.0594) | (0.0223) | (0.0149) | (0.0132) | (0.0312) | |

| Length of education | 0.0758 *** | 0.1276 ** | 0.0890 *** | 0.0714 *** | 0.0544 *** | 0.0430 *** |

| (0.0024) | (0.0074) | (0.0029) | (0.0020) | (0.0019) | (0.0043) | |

| Age | 0.0015 * | 0.0065 ** | −0.0001 | 0.0003 | −0.0001 | −0.0003 |

| (0.0008) | (0.0030) | (0.0011) | (0.0007) | (0.0006) | (0.0013) | |

| Provincial fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 18,954 | 18,954 | 18,954 | 18,954 | 18,954 | 18,954 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahman, M.M.; Fuquan, G.; Ara, L.A. Nonlinear Dynamics in the Finance-Inequality Nexus in China-CHNS Data. Sustainability 2019, 11, 191. https://doi.org/10.3390/su11010191

Rahman MM, Fuquan G, Ara LA. Nonlinear Dynamics in the Finance-Inequality Nexus in China-CHNS Data. Sustainability. 2019; 11(1):191. https://doi.org/10.3390/su11010191

Chicago/Turabian StyleRahman, Mohammad Masudur, Guan Fuquan, and Laila Arjuman Ara. 2019. "Nonlinear Dynamics in the Finance-Inequality Nexus in China-CHNS Data" Sustainability 11, no. 1: 191. https://doi.org/10.3390/su11010191

APA StyleRahman, M. M., Fuquan, G., & Ara, L. A. (2019). Nonlinear Dynamics in the Finance-Inequality Nexus in China-CHNS Data. Sustainability, 11(1), 191. https://doi.org/10.3390/su11010191