Profiting from Green Innovation: The Moderating Effect of Competitive Strategy

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. Green Innovation and Firm Performance

2.2. Business Strategy

2.3. Hypotheses

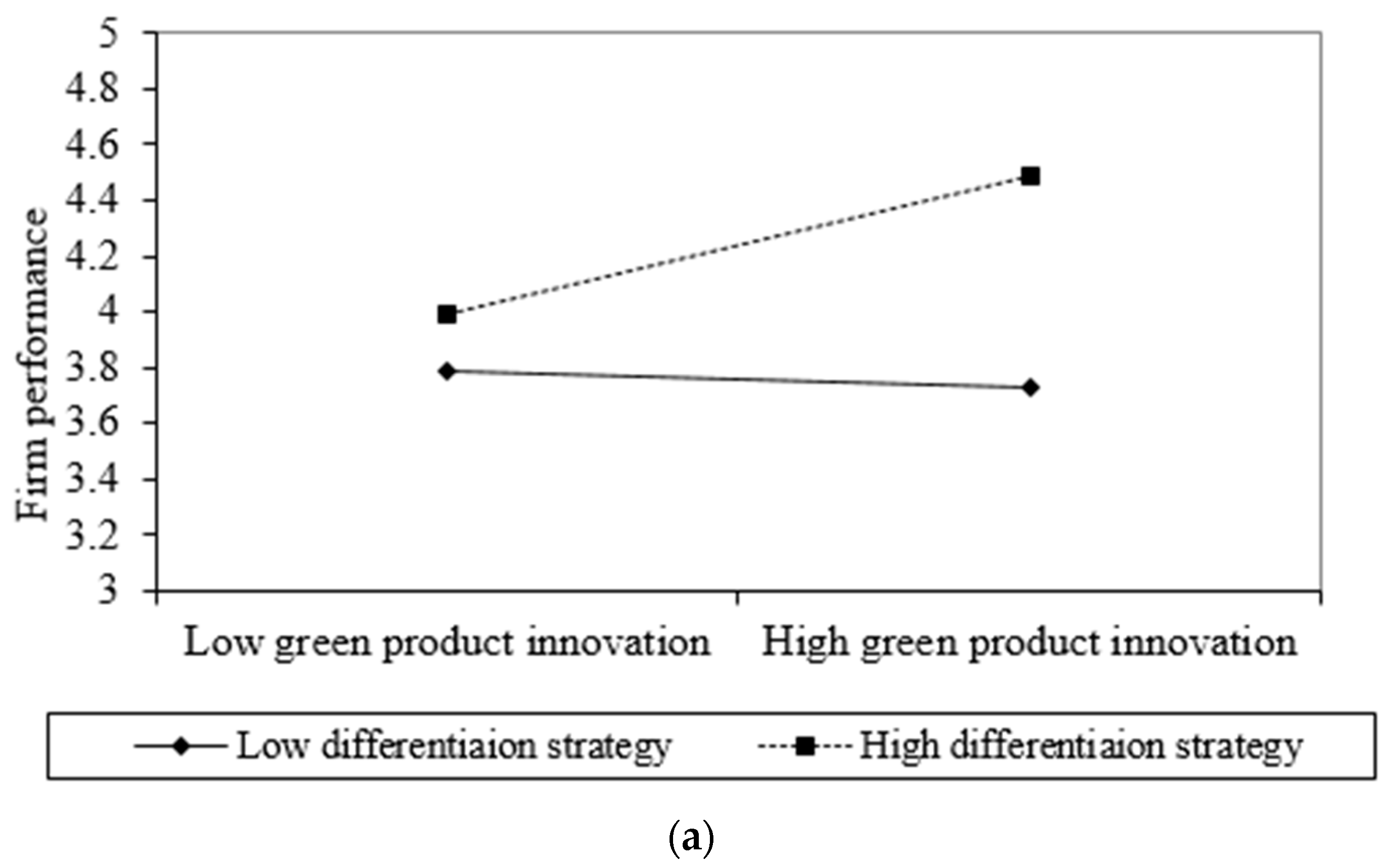

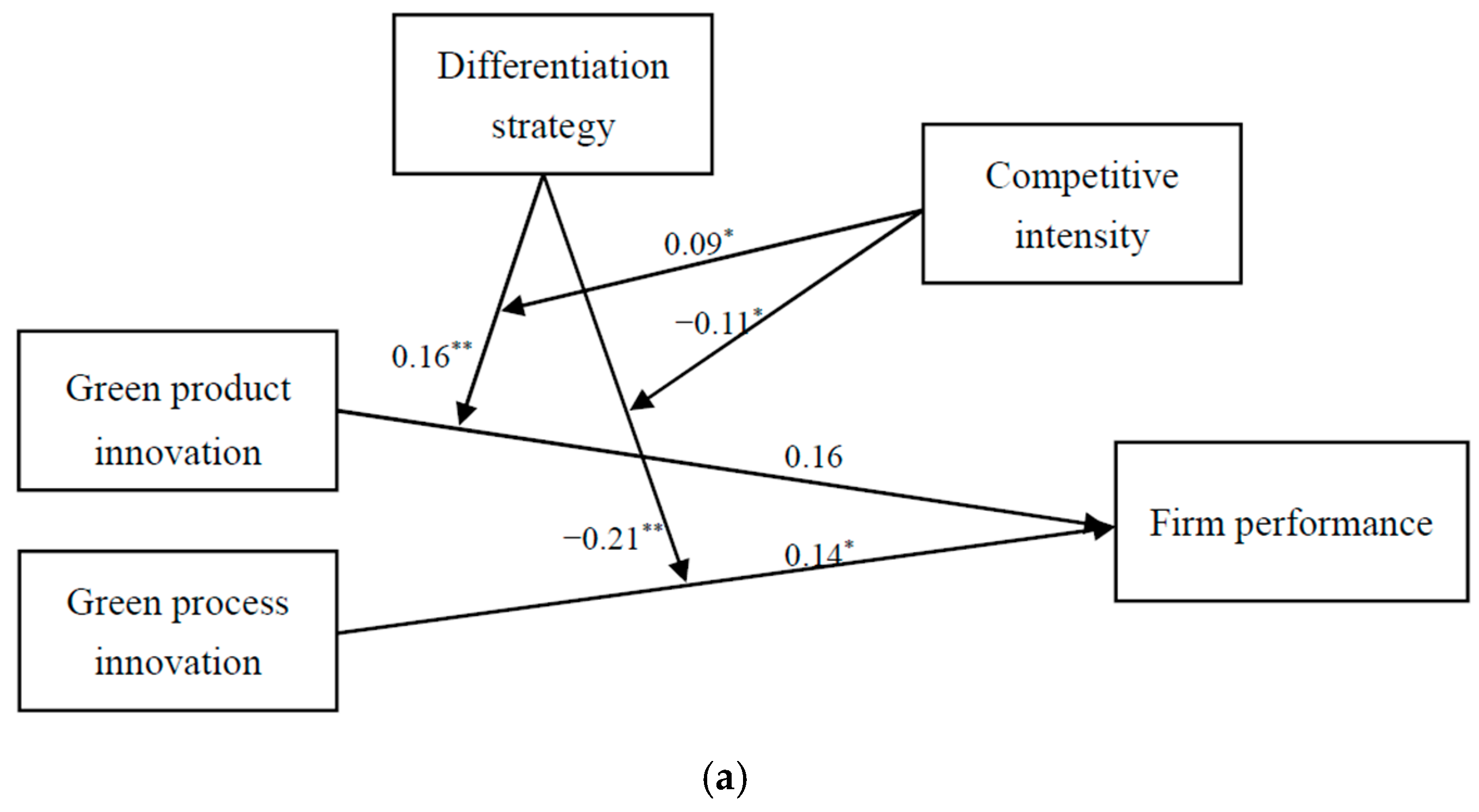

2.3.1. Differentiation Strategy

2.3.2. Cost-Leadership Strategy

2.3.3. Competitive Intensity

3. Methods

3.1. Sample

3.2. Measurement

3.3. Reliability and Validity

4. Results

5. Discussion

5.1. Theoretical contributions

5.2. Managerial Implications

5.3. Limitations and Future Directions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Chen, Y.; Lai, S.; Wen, C. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Richard, A.; Sally, J.; John, B.; David, D.; Patrick, O. Sustainability-oriented innovation: A systematic review. Int. J. Manag. Rev. 2016, 18, 180–205. [Google Scholar]

- Chang, C.H.; Sam, A.G. Corporate environmentalism and environmental innovation. J. Environ. Manag. 2015, 153, 84–92. [Google Scholar] [CrossRef]

- Cai, W.; Zhou, X. On the drivers of eco-innovation: Empirical evidence from China. J. Clean. Prod. 2014, 79, 239–248. [Google Scholar] [CrossRef]

- Lin, H.; Zeng, S.X.; Ma, H.Y.; Qi, G.Y.; Tam, V.W. Can political capital drive corporate green innovation? Lessons from China. J. Clean. Prod. 2014, 64, 63–72. [Google Scholar] [CrossRef]

- Shaked, A.; Sutton, J. Relaxing price competition through product differentiation. Rev. Econ. Stud. 1982, 49, 3–13. [Google Scholar] [CrossRef]

- Bonanno, G.; Haworth, B. Intensity of competition and the choice between product and process innovation. Int. J. Ind. Organ. 1998, 16, 495–510. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Etro, F.; Kraft, K. Endogenous market structures and innovation by leaders: An empirical test. Economica 2014, 81, 117–139. [Google Scholar] [CrossRef]

- Huang, J.; Li, Y. Green innovation and performance: The view of organizational capability and social reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Dangelico, R.M. Green product innovation: Where we are and where we are going. Bus. Strategy Environ. 2016, 25, 560–576. [Google Scholar] [CrossRef]

- Chang, C. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Liu, X.; Dai, H.; Cheng, P. Drivers of integrated environmental innovation and impact on company competitiveness: Evidence from 18 Chinese firms. Int. J. Technol. Glob. 2011, 5, 255–280. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green innovation and financial performance: An institutional approach. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- Ginsberg, J.M.; Bloom, P.N. Choosing the right green-marketing strategy. MIT Sloan Manag. Rev. 2004, 46, 79–84. [Google Scholar]

- McWilliams, A.; Siegel, D.S. Creating and capturing value: Strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. J. Manag. 2011, 37, 1480–1495. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- James, S.D.; Leiblein, M.J.; Lu, S. How firms capture value from their innovations. J. Manag. 2013, 39, 1123–1155. [Google Scholar]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Li, C.B.; Li, J. Achieving superior financial performance in China: Differentiation, cost leadership, or both? J. Int. Mark. 2008, 16, 1–22. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D. Mainstreaming green product innovation: Why and how companies integrate environmental sustainability. J. Bus. Ethics 2010, 95, 471–486. [Google Scholar] [CrossRef]

- Chan, R.Y.; He, H.; Chan, H.K.; Wang, W.Y. Environmental orientation and corporate performance: The mediation mechanism of green supply chain management and moderating effect of competitive intensity. Ind. Mark. Manag. 2012, 41, 621–630. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Christodoulides, P.; Kyrgidou, L.P.; Palihawadana, D. Internal drivers and performance consequences of small firm green business strategy: The moderating role of external forces. J. Bus. Ethics 2017, 140, 585–606. [Google Scholar] [CrossRef]

- Orsato, R.J. Competitive Environmental Strategies: When Does it Pay to Be Green? Calif. Manag. Rev. 2006, 48, 127–143. [Google Scholar] [CrossRef]

- De Medeiros, J.F.; Vidor, G.; Ribeiro, J. Driving factors for the success of the green innovation market: A relationship system proposal. J. Bus. Ethics 2018, 147, 327–341. [Google Scholar] [CrossRef]

- Carton, R.B.; Hofer, C.W. Measuring Organizational Performance: Metrics for Entrepreneurship and Strategic Management Research; Edward Elgar Publishing: Cheltenham, UK, 2006. [Google Scholar]

- Lepak, D.P.; Smith, K.G.; Taylor, M.S. Value creation and value capture: A multilevel perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, R.D. Corporate distinctive competence, strategy, industry and performance. Strateg. Manag. J. 1985, 6, 273–293. [Google Scholar] [CrossRef]

- Hawawini, G.; Subramanian, V.; Verdin, P. Is performance driven by industry-or firm-specific factors? A new look at the evidence. Strateg. Manag. J. 2003, 24, 1–16. [Google Scholar] [CrossRef]

- Mellahi, K.; Frynas, J.G.; Sun, P.; Siegel, D. A review of the nonmarket strategy literature: Toward a multi-theoretical integration. J. Manag. 2016, 42, 143–173. [Google Scholar] [CrossRef]

- Chen, Y. The driver of green innovation and green image—Green core competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Seebode, D.; Jeanrenaud, S.; Bessant, J. Managing innovation for sustainability. R&D Manag. 2012, 42, 195–206. [Google Scholar]

- Zhang, Y.; Sun, J.; Yang, Z.; Li, S. Organizational learning and Green innovation: Does Environmental proactivity matter? Sustainability 2018, 10, 3737. [Google Scholar] [CrossRef]

- Chiou, T.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. E-Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Ge, B.; Yang, Y.; Jiang, D.; Gao, Y.; Du, X.; Zhou, T. An empirical study on green innovation strategy and sustainable competitive advantage: Path and boundary. Sustainability 2018, 10, 3631. [Google Scholar] [CrossRef]

- Leenders, M.; Chandra, Y. Antecedents and consequences of green innovation in the wine industry: The role of channel structure. Technol. Anal. Strat. Manag. 2013, 25, 203–218. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Chen, Y.; Chang, K. The nonlinear effect of green innovation on the corporate competitive advantage. Qual. Quant. 2013, 47, 271–286. [Google Scholar] [CrossRef]

- Chan, H.K.; Yee, R.W.; Dai, J.; Lim, M.K. The moderating effect of environmental dynamism on green product innovation and performance. Int. J. Prod. Econ. 2016, 181, 384–391. [Google Scholar] [CrossRef]

- Martinez-del-Rio, J.; Antolin-Lopez, R.; Cespedes-Lorente, J.J. Being green against the wind? The moderating effect of munificence on acquiring environmental competitive advantages. Organ. Environ. 2015, 28, 181–203. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Katsikeas, C.S.; Fotiadis, T.A.; Christodoulides, P. Antecedents and consequences of an eco-friendly export marketing strategy: The moderating role of foreign public concern and competitive intensity. J. Int. Mark. 2013, 21, 22–46. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, R.D.; Sirmon, D.G.; Trahms, C.A. Strategic entrepreneurship: Creating value for individuals, organizations, and society. Acad. Manag. Perspect. 2011, 25, 57–75. [Google Scholar]

- Hitt, M.A.; Tyler, B.B. Strategic decision models: Integrating different perspectives. Strat. Manag. J. 1991, 12, 327–351. [Google Scholar] [CrossRef]

- Miller, D. Relating Porter’s business strategies to environment and structure: Analysis and performance implications. Acad. Manag. J. 1988, 31, 280–308. [Google Scholar]

- Frambach, R.T.; Prabhu, J.; Verhallen, T.M. The influence of business strategy on new product activity: The role of market orientation. Int. J. Res. Mark. 2003, 20, 377–397. [Google Scholar] [CrossRef]

- Beath, J.; Katsoulacos, Y. The Economic Theory of Product Differentiation; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Matthew, B.M.; Harvey, M.L. The value of pricing control in export channels: A governance perspective. J. Int. Mark. 2001, 9, 1–29. [Google Scholar]

- Zott, C.; Amit, R. The fit between product market strategy and business model: Implications for firm performance. Strat. Manag. J. 2008, 29, 1–26. [Google Scholar] [CrossRef]

- Song, X.M.; Parry, M.E. A cross-national comparative study of new product development processes: Japan and the United States. J. Mark. 1997, 61, 1–18. [Google Scholar] [CrossRef]

- Ward, P.T.; Bickford, D.J.; Leong, G.K. Configurations of manufacturing strategy, business Strategy, environment and structure. J. Manag. 1996, 22, 597–626. [Google Scholar] [CrossRef]

- Aulakh, P.S.; Rotate, M.; Teegen, H. Export strategies and performance of firms from emerging economies: Evidence from Brazil, Chile, and Mexico. Acad. Manag. J. 2000, 43, 342–361. [Google Scholar]

- Block, J.H.; Kohn, K.; Miller, D.; Ullrich, K. Necessity entrepreneurship and competitive strategy. Small Bus. Econ. 2015, 44, 37–54. [Google Scholar] [CrossRef]

- Richard, O.C. Racial diversity, business strategy, and firm performance: A resource-based view. Acad. Manag. J. 2000, 43, 164–177. [Google Scholar]

- Neal, A.; West, M.A.; Patterson, M.G. Do organizational climate and competitive strategy moderate the relationship between human resource management and productivity? J. Manag. 2005, 31, 492–512. [Google Scholar] [CrossRef]

- Jänicke, M. Ecological modernization: New perspectives. J. Clean. Prod. 2008, 16, 557–565. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K. Green supply chain management innovation diffusion and its relationship to organizational improvement: An ecological modernization perspective. J. Eng. Technol. Manag. 2012, 29, 168–185. [Google Scholar] [CrossRef]

- Qi, G.; Zeng, S.; Tam, C.; Yin, H.; Zou, H. Stakeholders’ influences on corporate green innovation strategy: A case study of manufacturing firms in China. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 1–14. [Google Scholar]

- Verreynne, M.; Meyer, D. Small business strategy and the industry life cycle. Small Bus. Econ. 2010, 35, 399–416. [Google Scholar] [CrossRef]

- Augusto, M.; Coelho, F. Market orientation and new-to-the-world products: Exploring the moderating effects of innovativeness, competitive strength, and environmental forces. Ind. Mark. Manag. 2009, 38, 94–108. [Google Scholar] [CrossRef]

- Boehe, D.M.; Barin, C.L. Corporate social responsibility, product differentiation strategy and export performance. J. Bus. Ethics 2010, 91, 325–346. [Google Scholar] [CrossRef]

- Prajogo, D.I. The strategic fit between innovation strategies and business environment in delivering business performance. Int. J. Prod. Econ. 2016, 171, 241–249. [Google Scholar] [CrossRef]

- Michaud, C.; Llerena, D. Green consumer behaviour: An experimental analysis of willingness to pay for remanufactured products. Bus. Strategy Environ. 2011, 20, 408–420. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Schuhwerk, M.E.; Lefkoff-Hagius, R. Green or non-green? Does type of appeal matter when advertising a green product? J. Advert. 1995, 24, 45–54. [Google Scholar] [CrossRef]

- Danaher, P.J.; Hardie, B.; Putsis, P. Marketing-mix variables and the diffusion of successive generations of a technological innovation. J. Mark. Res. 2001, 38, 501–514. [Google Scholar] [CrossRef]

- Tseng, M.; Wang, R.; Chiu, A.S.; Geng, Y.; Lin, Y.H. Improving performance of green innovation practices under uncertainty. J. Clean. Prod. 2013, 40, 71–82. [Google Scholar] [CrossRef]

- Casadesus-Masanell, R.; Ricart, J.E. From strategy to business models and onto tactics. Long Range Plan. 2010, 43, 195–215. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowledge of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Rusinko, C. Green manufacturing: An evaluation of environmentally sustainable manufacturing practices and their impact on competitive outcomes. IEEE Trans. Eng. Manag. 2007, 54, 445–454. [Google Scholar] [CrossRef]

- Rothenberg, S.; Pil, F.K.; Maxwell, J. Lean, green, and the quest for superior environmental performance. Prod. Oper. Manag. 2001, 10, 228–243. [Google Scholar] [CrossRef]

- Amit, R. Cost leadership strategy and experience curves. Strat. Manag. J. 1986, 7, 281–292. [Google Scholar] [CrossRef]

- Nie, W.; Abler, D.; Zhu, L.; Li, T.; Lin, G. Consumer Preferences and Welfare Evaluation under Current Food Inspection Measures in China: Evidence from Real Experiment Choice of Rice Labels. Sustainability 2018, 10, 4003. [Google Scholar] [CrossRef]

- Terlaak, A.; King, A.A. The effect of certification with the ISO 9000 Quality Management Standard: A signaling approach. J. Econ. Behav. Organ. 2006, 60, 579–602. [Google Scholar] [CrossRef]

- Jaworski, B.J.; Kohli, A.K. Market orientation: Antecedents and consequences. J. Mark. 1993, 57, 53–70. [Google Scholar] [CrossRef]

- Auh, S.; Menguc, B. Balancing exploration and exploitation: The moderating role of competitive intensity. J. Bus. Res. 2005, 58, 1652–1661. [Google Scholar] [CrossRef]

- Olivier, C.; Peter, Z. Value creation and value capture with frictions. Strat. Manag. J. 2011, 32, 1206–1231. [Google Scholar]

- Zhou, K.Z. Innovation, imitation, and new product performance: The case of China. Ind. Mark. Manag. 2006, 35, 394–402. [Google Scholar] [CrossRef]

- Desyllas, P.; Miozzo, M.; Lee, H.; Mile, I. Capturing value from innovation in knowledge-intensive business service firms: The role of competitive strategy. Br. J. Manag. 2018, 29, 769–795. [Google Scholar] [CrossRef]

- Cleff, T.; Rennings, K. Determinants of environmental product and process innovation. Environ. Policy Gov. 1999, 9, 191–201. [Google Scholar] [CrossRef]

- Su, Z.; Guo, H.; Sun, W. Exploration and firm performance: The moderating impact of competitive strategy. Br. J. Manag. 2017, 28, 357–371. [Google Scholar] [CrossRef]

- Chaganti, R.; Chaganti, R.; Mahajan, V. Profitable small business strategies under different types of competition. Entrep. Theory Pract. 1989, 13, 21–36. [Google Scholar] [CrossRef]

- Luo, Y. Environment-strategy-performance relations in small businesses in China: A case of township and village enterprises in southern China. J. Small Bus. Manag. 1999, 37, 37–52. [Google Scholar]

- Su, Z.; Peng, J.; Shen, H.; Xiao, T. Technological capability, marketing capability, and firm performance in turbulent conditions. Manag. Organ. Rev. 2013, 9, 115–138. [Google Scholar] [CrossRef]

- Parnell, J.; Long, Z.; Lester, D. Competitive strategy, capabilities and uncertainty in small and medium sized enterprises (SMEs) in China and the United States. Manag. Decis. 2015, 53, 402–431. [Google Scholar] [CrossRef]

- Bowman, C.; Daniels, K. The influence of functional experience on perceptions of strategic priorities. Br. J. Manag. 1995, 6, 157–162. [Google Scholar] [CrossRef]

- Numally, J.C. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Przychodzen, J.; Przychodzen, W. Relationships between eco-innovation and financial performance: Evidence from publicly traded companies in Poland and Hungary. J. Clean. Prod. 2015, 90, 253–263. [Google Scholar] [CrossRef]

- Santos-Vijande, M.L.; López-Sánchez, J.Á.; Trespalacios, J.A. How organizational learning affects a firm’s flexibility, competitive strategy, and performance. J. Bus. Res. 2012, 65, 1079–1089. [Google Scholar] [CrossRef]

- Esty, D.; Winston, A. Green to Gold: How Smart Companies Use Environmental Strategy to Innovate, Create Value, and Build Competitive Advantage; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

| Sample Characteristics | Frequency | Percentage |

|---|---|---|

| Sector | ||

| Electronic component | 41 | 21.0% |

| Chemicals | 35 | 17.9% |

| Metal products | 29 | 14.9% |

| Information hardware | 28 | 14.3% |

| New energy and new materials | 23 | 11.8% |

| Other | 39 | 20.0% |

| Geographic Location | ||

| Guangdong | 76 | 39.0% |

| Shandong | 64 | 32.8% |

| Shaanxi | 55 | 28.2% |

| Firm Age (Years) | ||

| <10 | 86 | 44.1% |

| 10–19 | 95 | 48.7% |

| ≥20 | 14 | 7.2% |

| Firm Size (Number of Employees) | ||

| <50 | 41 | 21.0% |

| 50–100 | 48 | 24.6% |

| 100–299 | 75 | 38.5% |

| 300–499 | 31 | 15.9% |

| Annual Sales (in Millions of RMB) | ||

| <10 | 86 | 44.1% |

| 10–49 | 81 | 41.5% |

| ≥50 | 28 | 14.4% |

| Constructs | Factor Loading |

|---|---|

| Green Product Innovation (Cronbach’s Alpha = 0.845; AVE = 0.574) | |

| The company chooses the materials of the product that produce the least amount of the pollution for conducting the product development or design | 0.779 |

| The company choose the materials of the product that consume the materials of energy and resources for conducting the product development or design | 0.813 |

| The company uses the fewest amount of materials to comprise the products for conducting the product development or design | 0.727 |

| The company would circumspectly deliberate, whether the product is easy to recycle, reuse, and decompose for conducting the product development or design | 0.707 |

| Green Process Innovation (Cronbach’s Alpha = 0.918; AVE = 0.737) | |

| The manufacturing process of the company effectively reduces the emission of hazardous substances or waste | 0.870 |

| The manufacturing process of the company recycles waste and emission that allow them to be treated and re-used | 0.877 |

| The manufacturing process of the company reduces the consumption of water, electricity, coal, or oil | 0.893 |

| The manufacturing process of the company reduces the use of raw materials | 0.791 |

| Differentiation Strategy (Cronbach’s Alpha = 0.899; AVE = 0.626) | |

| Compared to competing products, our products offered superior benefits to customers | 0.718 |

| Our products were unique and nobody but our company could offer them | 0.769 |

| We took great efforts in building a strong brand name, and nobody could easily copy that | 0.845 |

| We successfully differentiated ourselves from others through effective advertising and promotion campaigns | 0.826 |

| Cost-Leadership Strategy (Cronbach’s Alpha = 0.828; AVE = 0.557) | |

| Our manufacturing costs were lower than our competitors’ | 0.713 |

| Our efficient internal operation system decreased the cost of our products | 0.800 |

| Our economy of scale enabled us to achieve a cost advantage | 0.741 |

| We achieve a cost-leadership position in our industry | 0.728 |

| Competitive Intensity (Cronbach’s Alpha = 0.867; AVE = 0.682) | |

| Price competition was a hallmark of our industry | 0.843 |

| Any action that a company took, others made a response swiftly | 0.822 |

| One heard of a new competitive move almost every day | 0.813 |

| Firm Performance (Cronbach’s Alpha = 0.877; AVE = 0.608) | |

| Return on sales | 0.804 |

| Return on asset | 0.766 |

| Return on investment | 0.768 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Firm age | 1 | ||||||||||

| 2. Firm size | 0.35 * | 1 | |||||||||

| 3. Export orientation | 0.17 ** | 0.10 | 1 | ||||||||

| 4. High-tech | 0.16 ** | 0.13 * | 0.06 | 1 | |||||||

| 5. Region | 0.18 ** | 0.04 | 0.05 | 0.05 | 1 | ||||||

| 6. Green product innovation | 0.15 ** | −0.06 | 0.03 | 0.06 | 0.17 ** | 0.757 | |||||

| 7. Green process innovation | 0.12 * | −0.09 * | 0.20 ** | 0.02 | 0.21 ** | 0.22 ** | 0.86 | ||||

| 8. Differentiation strategy | −0.06 | −0.14 ** | 0.15 ** | 0.12 * | 0.16 ** | 0.24 ** | 0.29 ** | 0.79 | |||

| 9. Cost-leadership strategy | 0.11 * | 0.15 * | 0.13 * | −0.06 | −0.10 * | 0.27 ** | 0.34 ** | 0.33 ** | 0.75 | ||

| 10. Competitive intensity | 0.13 * | −0.02 | 0.15 ** | 0.05 | −0.08 | 0.33 ** | 0.33 ** | 0.25 ** | 0.28 ** | 0.83 | |

| 11. Firm performance | 0.03 | 0.05 | −0.01 | 0.18 ** | 0.17 ** | 0.17 ** | 0.16 ** | 0.27 ** | 0.22 ** | −0.07 | 0.78 |

| Mean | 2.34 | 12.03 | 1.45 | 0.38 | 0.63 | 4.28 | 4.09 | 4.79 | 4.93 | 4.48 | 3.69 |

| Standard deviation | 1.07 | 11.54 | 0.57 | 0.39 | 0.83 | 1.22 | 1.03 | 1.14 | 1.21 | 1.04 | 0.98 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Firm age | 0.08 | 0.09 | 0.09 | 0.08 | 0.09 | 0.08 |

| Firm size | 0.04 | 0.03 | 0.07 | 0.02 | 0.06 | 0.02 |

| Export orientation | −0.08 | −0.08 | −0.11 | −0.10 | −0.14 | −0.13 |

| High-tech | 0.21 *** | 0.22 *** | 0.23 *** | 0.22 *** | 0.26 *** | 0.28 *** |

| Region | 0.19 ** | 0.17 ** | 0.18 *** | 0.19 ** | 0.21 ** | 0.22 ** |

| Green product innovation (product) | 0.10 * | 0.11 * | 0.14 * | 0.16 | 0.17 | |

| Green process innovation (process) | 0.07 * | 0.09 * | 0.12 * | 0.14 * | 0.15 * | |

| Differentiation strategy (DS) | 0.24 *** | 0.26 *** | ||||

| Cost-leadership strategy (CS) | 0.20 *** | 0.23 *** | ||||

| Product × DS | 0.14 ** | 0.16 ** | ||||

| Process × DS | −0.27 ** | −0.21 ** | ||||

| Product × CS | −0.18 *** | −0.20 *** | ||||

| Process × CS | 0.21 *** | 0.24 *** | ||||

| Competitive intensity (CI) | −0.02 | 0.01 | ||||

| Product × CI | 0.19 ** | 0.22 ** | ||||

| Process × CI | 0.17 ** | 0.20 ** | ||||

| DS × CI | 0.12 ** | |||||

| CS × CI | −0.21 ** | |||||

| Product × DS × CI | 0.09 * | |||||

| Process × DS × CI | −0.11 * | |||||

| Product × CS × CI | −0.24 *** | |||||

| Process × CS × CI | 0.18 ** | |||||

| R * | 0.10 | 0.18 | 0.24 | 0.20 | 0.29 | 0.25 |

| Adjusted R * | 0.08 | 0.14 | 0.21 | 0.16 | 0.23 | 0.19 |

| F-value | 1.96 *** | 4.15 *** | 5.01 *** | 4.53 *** | 4.81 *** | 4.30 *** |

| Dependent Variable | Firm Performance | |

|---|---|---|

| Independent Variables | Green Product Innovation | Green Process Innovation |

| High differentiation strategy, High competitive intensity | 0.64 ** | −0.05 |

| High differentiation strategy, Low competitive intensity | 0.03 | −0.14 |

| Low differentiation strategy, High competitive intensity | 0.06 | 0.68 ** |

| Low differentiation strategy, Low competitive intensity | −0.11 | 0.07 |

| High cost-leadership strategy, High competitive intensity | −0.14 | 0.87 *** |

| High cost-leadership strategy, Low competitive intensity | 0.01 | 0.01 |

| Low cost-leadership strategy, High competitive intensity | 0.94 *** | −0.15 |

| Low cost-leadership strategy, Low competitive intensity | −0.11 | −0.12 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Liu, L. Profiting from Green Innovation: The Moderating Effect of Competitive Strategy. Sustainability 2019, 11, 15. https://doi.org/10.3390/su11010015

Chen J, Liu L. Profiting from Green Innovation: The Moderating Effect of Competitive Strategy. Sustainability. 2019; 11(1):15. https://doi.org/10.3390/su11010015

Chicago/Turabian StyleChen, Jiawen, and Linlin Liu. 2019. "Profiting from Green Innovation: The Moderating Effect of Competitive Strategy" Sustainability 11, no. 1: 15. https://doi.org/10.3390/su11010015

APA StyleChen, J., & Liu, L. (2019). Profiting from Green Innovation: The Moderating Effect of Competitive Strategy. Sustainability, 11(1), 15. https://doi.org/10.3390/su11010015