1. Introduction

Initial Public Offering (IPO) is an important channel for firms to obtain direct funding in capital markets [

1,

2]. With the rapid development of Chinese stock markets over the past 20 years, many firms have adopted IPO as an effective source of capital funding. During IPOs, information asymmetry is a serious issue which hinders the process of funding from potential investors [

3]. Potential investors possess less information than the firm who undertakes the IPO [

4]. Potential investors face a higher level of uncertainty regarding the firm’s profitability and performance. As investors are more exposed to risk, they will only submit purchase orders at a discounted stock price. To encourage potential investors to participate in IPOs, the underwriter of the IPO firm has to set an offer price lower than the intrinsic value of the share price [

3,

5]. The difference between the intrinsic value and the offer price serves as a risk premium of information asymmetry for potential investors. IPO underpricing is regarded as an indirect cost for firms during the process of capital funding [

6]. Ritter (1987) has shown that increasing information disclosure before IPOs could reduce the cost of capital funding in U.S. stock markets [

6]. Ang and Brau (2002) found a negative relationship between the transparency of a firm’s information and IPO costs, significantly influencing corporate financial performance and sustainable development [

7]. A firm’s capability of raising initial funding is closely related to its sustainable development. With a more effective allocation of funding among the whole society, social resources will be better utilized by firms with a higher efficiency, thus creating more values. Moreover, the IPO market plays a critical part in sustainable economic growth. If the IPO market dries up, this can have long lasting negative effects on the evolution of innovative industries. Innovative firms might run into liquidity problems, and the speed of commercialization of technological innovations might slow down. Ultimately, a country’s economic growth path can be negatively affected [

8].

The 2008 financial crisis is typically regarded as the worst financial crisis since the Great Depression of the 1930s [

9,

10,

11]. The global financial crisis of 2008 was caused by the expansion of subprime mortgages to high-risk borrowers under the situation of information asymmetry. In other words, there was asymmetry of information spun throughout the 2008 financial crisis. The crisis not only resulted in the collapse of famous and giant financial institutions, such as Lehman Brothers, but also impeded global credit markets and required intensive government interventions. After the crisis, governments around the world introduced a series of regulatory proposals and policies to require more information disclosure and increase the transparency of transactions [

12]. Besides, the ensuing period after the 2008 financial crisis was driven by a revolution of information and communication technology (ICT). With the developments and advances in technology, information about firms became more transparent after the crisis [

12].

While there is an extensive body of research on the determinants of IPO underpricing and the impacts of the financial crisis separately [

3,

7,

13,

14,

15,

16,

17,

18], the extant literature has paid little attention to the relationship between financial crisis and a firm’s funding costs or IPO underpricing issues. Song and Lee (2012) studied the long-term effect of the 1998 Asian financial crisis on corporate cash holdings [

19]. They divided the sample into well-established firms before the crisis and IPO firms during and after the crisis, finding that the crisis has dramatically changed firms’ cash-holding policies. IPO companies engaging in aggressive income-increasing earnings management are proved to have a significantly worse market-based performance. For these companies, personal liquidity concerns are an important factor in IPO decisions during the economic crisis [

20]. Blocker and Sandner (2009) found that the financial crisis is related to a 20% decrease in the average amount of funds raised per funding round [

8]. So far, there is no study investigating the role of the financial crisis on IPO underpricing from the aspect of information asymmetry. The collapse of Lehman Brothers in September 2008 and other events leading to the financial crisis provide a good research opportunity to address this question in greater detail. To fill the literature gap, we investigate the influence of information on a firm’s cost of capital funding. Our main study addresses the specific role played by the global financial crisis of 2008.

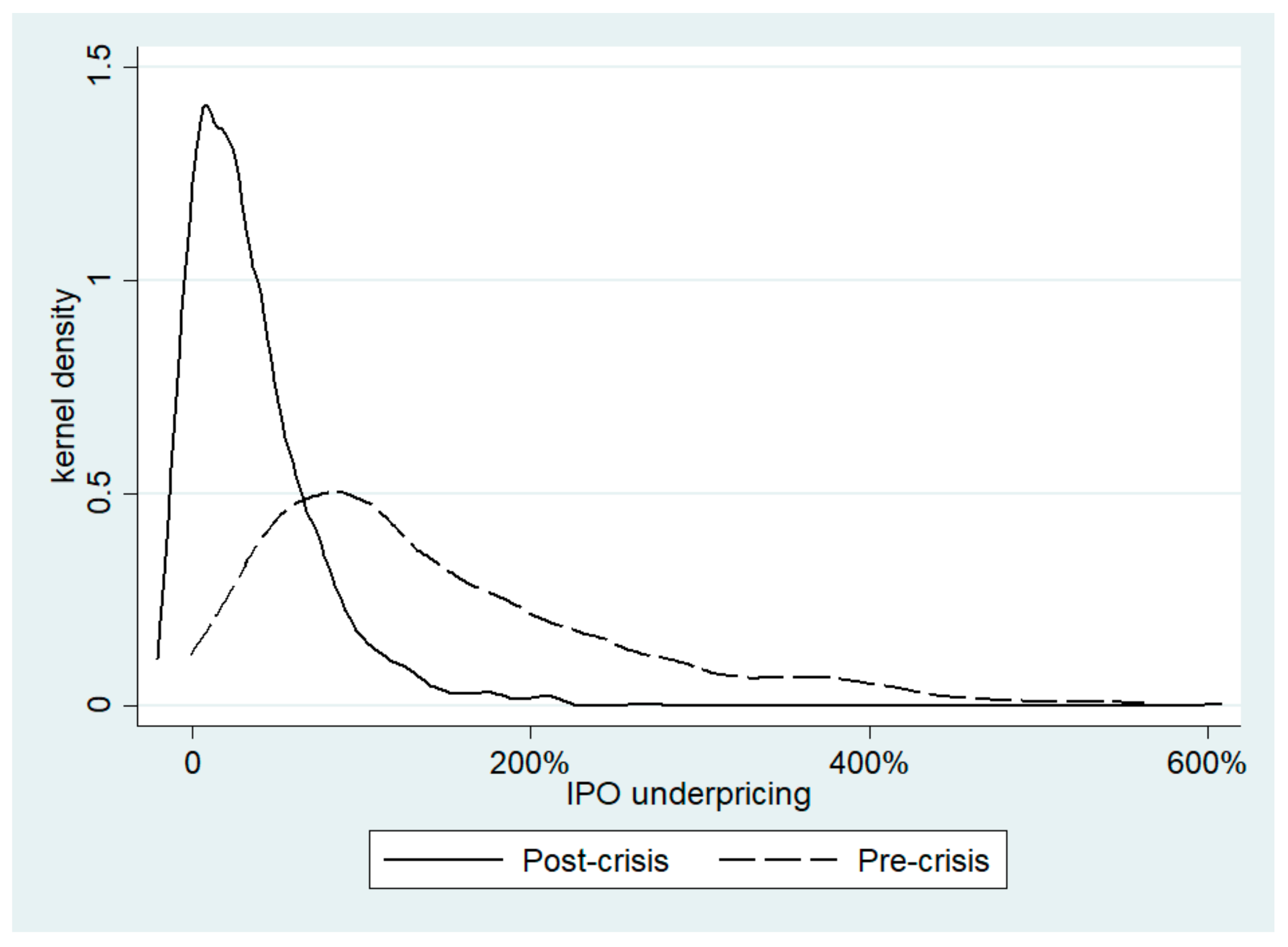

Utilizing 1069 firms going public on Chinese stock exchanges between January 2004 and January 2013, we study the difference in IPO underpricing before and after the financial crisis of 2008. The results suggest that IPOs are significantly less underpriced in the post-crisis period. Moreover, our empirical study goes beyond the original model of IPO underpricing by revealing the moderating effects of firm size on the relationship between the financial crisis and IPO underpricing. It is found that small firms experienced less IPO underpricing than large firms after the financial crisis.

Firstly, to the best of our knowledge and the literature in hand, this study is one of the few to study the nexus between the financial crisis and IPO underpricing from an empirical perspective [

8,

19,

20]. Previous literature has studied the influences of financial crisis on cash holding and market-based performance. Blocker and Sandner (2009) studied the effect of crisis on the funding of US internet start-ups [

8]. However, IPO firms cover a much wider range of industries. Different from the previous research, this study directly focuses on the funding cost of a firm and provides a new insight into the analysis of IPO costs. Secondly, publicly traded equity represents one of the most important sources of external capital to facilitate firm investment [

21]. Although previous research has identified a significant relationship between information and a firm’s IPO cost, we revisit this topic from a novel perspective of financial crisis and highlight the impact of information transparency in reducing a firm’s cost of capital funding. Thirdly, we find that firms of different sizes are affected by the financial crisis to different degrees, which reveals that firm size plays an important role in the process of IPOs.

The remainder of this study is organized as follows:

Section 2 presents the development of our hypotheses and provides the details of our theoretical arguments.

Section 3 details the data and research methods used in our study.

Section 4 reports the results of the empirical estimations and robustness checks.

Section 5 presents the discussion and draws conclusions.

5. Discussion

5.1. Contributions and Implications

In the context of the Chinese IPO process, this paper makes unique contributions. Firstly, to the best of our knowledge and the literature in hand, this study pioneers in studying the relationship between the 2008 financial crisis and IPO underpricing from an empirical perspective. Thus, this study provides a new insight into the analysis of IPO cost.

Secondly, although previous research has identified a significant relationship between information asymmetry and a firm’s IPO cost, we revisit this topic from the novel perspective of the 2008 financial crisis and highlight the impact of information transparency in reducing a firm’s cost of capital funding. This paper contributes to understanding the dynamics and influences of the financial crisis on the stock market from the perspective of information asymmetry.

Thirdly, we find that firms of different sizes are differently affected by the financial crisis, which reveals that firm size plays an important role in the IPO process. In this sense, our study has practical implications for firms going through the IPO process in a transitional economy with developing information technology and improving capital market regulations.

5.2. Limitations and Future Study Directions

Although several interesting findings are presented in our study, the possible limitations should be noted. Firstly, although we clearly address the impact of the 2008 financial crisis on Chinese stock markets, some scholars have argued that China withstood this great recession. They point out that the huge stimulus package put in place by the Chinese government in 2008 meant that China suffered relatively little from the financial crisis. The Chinese government also used state-owned enterprises as a fiscal instrument to implement an aggressive stimulus program in 2009. Further investigation in other developing countries is encouraged to examine the robustness of our findings.

Moreover, we have tested the moderating effects of firm size in the relationship between financial crisis and IPO underpricing. The finding shows that firm-level characteristics are associated with the degree of information asymmetry. However, environmental and institutional factors could also result in the varying degrees of information asymmetry and thus moderate the effect of financial crisis on the IPO process. An examination of these factors may provide deeper insights and is worthy of consideration in future analyses.

6. Conclusions

Utilizing 1069 firms completing IPOs on Chinese stock exchanges between January 2004 and January 2013, we have studied the difference in IPO underpricing before and after the financial crisis of 2008. The results suggest that IPOs are significantly less underpriced in the post-crisis period. Moreover, our empirical study goes beyond the original model of IPO underpricing by revealing the moderating effects of firm size on the relationship between the financial crisis and IPO underpricing. The findings demonstrate that small firms experienced less IPO underpricing than large firms after the 2008 financial crisis. In order to check the robustness, we have calculated the IPO underpricing tendencies each year and performed Robust and OProbit regressions. All results suggest that our empirical analyses are consistent.

IPO is still a relatively new but important activity in emerging markets such as China, but it has become an element vital to the economy. Many questions are left unanswered, thus offering good opportunities for future research. Does the influence of financial crises on IPO activity differ among regions and industries? How do IPO firms receiving funding during the financial crisis differ from firms that had received funding before the financial crisis? How do firms respond to the changes posed by the financial crisis and the difficulties encountered in the search for IPO funding? In addition to IPO firms, will the financial crisis have a similar impact on the funding process of newly emerged business such as start-ups?