3.1. The Real Sector

There is a continuum of small firms. All small firms have access to the same technology; the only difference among them is that they start out with different amounts of capital A. For simplicity, we assume that all initial capital is cash. Conversely, any type of asset could be pledged as collateral with first-period market value A. The distribution of assets across firms is delineated by the cumulative distribution function , measuring the fraction of firms with assets less than A. The aggregate amount of firm capital is .

Assume that each firm has one economically viable project or idea. It costs (in Period 1) to undertake a project. If , a firm needs at least in external funds to be able to invest. In Period 2, the investment generates a verifiable, financial return equaling either 0 (failure) or R (success).

Firms are run by entrepreneurs, who may have incentives to reduce the probability of success in order to enjoy a private benefit if there are no proper incentives or outside monitoring in place. This is a typical moral hazard problem. We follow Holmstrom and Tirole [

16], formalizing this problem by assuming that the entrepreneur can privately choose between three versions of the project as described in

Table 1.

The probability of success is denoted by p. The project is subject to moral hazard. The entrepreneur (also called “borrower”, or “she”) can exert hidden effort to influence the probability of success. The entrepreneur can “behave” (“exert effort” or “take no private benefit”), which yields a high probability of success , or “shirk" (“misbehave” or “take a private benefit”), which yields a lower probability of success . The entrepreneur ceteris paribus prefers to shirk, because shirking can generate a private benefit or to her. (Undertaking a project with no exerting effort may be easier to implement, be more fun, have greater spinoffs in the future for the entrepreneur, benefit a friend, deliver perks, be more “glamorous”, etc.).

Define

. Assume that, in the relevant range of the rate of return on investor capital, denoted by

, only the good project is economically viable; that is,

We introduce two levels of shirking (two bad projects), as did in Holmstrom and Tirole [

16], to have a rich enough way of modeling monitoring (see below). Private benefits are ordered

and may alternatively be regarded as opportunity costs from managing the project assiduously. Note that either level of shirking produces the same probability of success. This implies that the entrepreneur will prefer the high private benefit project (

B-project) over the low private benefit project (

b-project) irrespectively of the financial contract. We employ

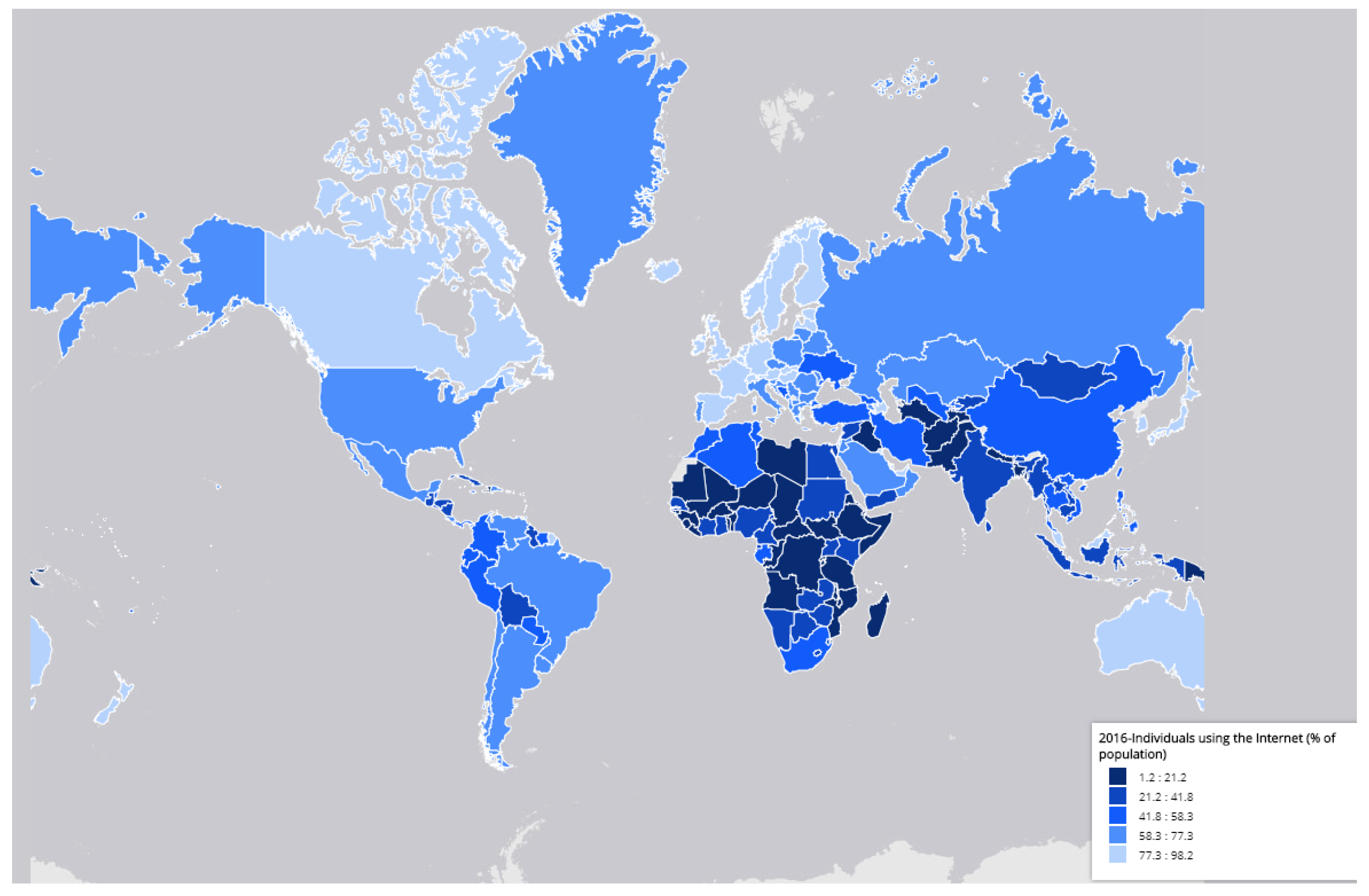

z to measure the degree (depth) of access to the Internet of the entrepreneur. (We do not model financial intermediaries’ or other investors’ access to the Internet for simplicity, or one may assume that financial intermediaries can use the Internet to expand their business timely. This is not a strong assumption, allowing for the reality that financial intermediaries have kept abreast of the development of Internet finance. A good case in point here is the various finance related app programs that are widely applied into life.)

Larger value of

z means that the entrepreneur has access to the Internet in depth, or has high ability to make use of the Internet. Put differently, there are at least three channels through which access to the Internet may act on access to finance. First, if the entrepreneur is able to use the Internet to handle lots of things in daily life, such as collecting economic information, shopping online, making E-payment, releasing business project information, accessing online peer-to-peer loans, etc., then her personal credit record may be tracked or captured by a third party, even a bank-like financial intermediary, which in turn may be used as a basis for evaluating the possible loan demand from her. Secondly, if keeping track of entrepreneur’s personal credit record is not true and illegal by a third party, say a financial intermediary, then the above argument may not be true. However, if potential borrowers have access to online peer-to-peer platforms, they can conveniently disclose their personal information to attract lenders’ interest. On the other hand, for an online peer-to-peer lending contract to be entered into, potential lenders need to access to this sort of borrowers’ information for their credit risk evaluation. In fact, lenders do have right to access to such information on online peer-to-peer platforms, which is common both in (e.g.,

Paipaidai.com and

Yirendai.com) and outside China (e.g.,

Prosper.com and

Lendingclub.com). Moreover, such platforms provide borrowers’ credit record and also their credit scores to potential lenders for reference. Thirdly, lenders can also access borrowers’ information through their websites (we thank the referee for pointing out this possibility), which can further reinforce our assumption. Moreover, borrowers have incentives to show their credit quality via the Internet to have access to external finance to relax their financial constraints. Without access to the Internet, financial intermediaries or non-financial intermediary investors would not have access to such personal credit information so that it is hard or at least more costly to do due-diligence-like work in order to evaluating a potential loan demand from an entrepreneur. More importantly, more personal information disclosed on the Internet makes shirking more expensive for the entrepreneur, which in turn will make shirking less attractive. (Of course, deeply accessing the Internet, on the other hand, also implies that the entrepreneur could capture more information on potential lenders, which will benefit her in the form of expanded choice set of lenders.)

Based on the above analysis, we assume that both and are decreasing functions of z, while is increasing in z, where z is normalized to be in without loss of generality. stands for no access to the Internet, while means the highest degree of access to the Internet. Conversely, we may assume that both and are sufficiently smooth and well-behaved in the sense that they have continuous first order derivatives and with . (This assumption is not artificially imposed. We define and , and then regard as a revenue function of access to the Internet, z. We may assume that . Now, the assumption is equivalent to . According to the law of diminishing marginal revenue, this implies that the rate of decrease of with z is faster than that of . This is natural, because there is a big difference between and , or between and .)

3.2. The Financial Sector

The financial sector consists of lots of intermediaries (also called “lenders”, “financiers”, or “creditors”). (Here, the concept of intermediaries is quite general. Intermediaries not only include banks, but also trust companies, pawn shops, micro-credit companies, etc.)

The function of intermediaries is to monitor firms and thereby mitigate the moral hazard problem. Monitoring may take many forms, such as inspection of a business’s potential cash flow, its balance sheet position, its management, its firm-level governance, and so on. More often than not, monitoring merely amounts to verifying that the firm abides by covenants of the loan contract, such as a minimum solvency ratio or a minimum cash balance. In terms of loan contract, covenants are particularly common and extensive. The purpose of covenants is to reduce the firm’s opportunity cost of being sedulous. Based on this line of reasoning, we assume that the monitor can prevent a firm from undertaking the B-project, which contracts the firm’s opportunity cost of being diligent from to .

Monitoring is not without toll. One important element in our model is the assumption that monitoring is privately costly; the intermediary will have to pay a non-verifiable amount to kill the B-project, where we also assume that , or monitoring cost is a decreasing function of the degree (depth) of access to the Internet of the entrepreneur, z. Videlicet, more relevant record of a potential borrower that can be tracked via the Internet makes monitoring more easier and thereby less costly. This setup implies that intermediaries also face a potential moral hazard problem. Although we assume that each intermediary has sufficient physical capacity to monitor an arbitrary number of potential borrowers, the moral hazard problem exerts a upper bound on the actual amount of monitoring that will take place. Moral hazard forces intermediaries to inject some of their own capital into the firms that they monitor, which makes the aggregate amount of intermediary (or “informed”) capital one of the important constraints on aggregate investment.

Following Holmstrom and Tirole [

16], we assume that all projects financed by an intermediary are perfectly correlated and that the capital of each intermediary is large enough relative to the scale of a project, which is particularly appropriate as far as small firms being concerned. Therefore, the exact distribution of assets among intermediaries is irrelevant. In practice, projects may be correlated since intermediaries have an incentive to choose them so, or alternatively because monitoring requires specialized expertise in a given market or industry. Perfect correlation assumption is nevertheless manifestly unrealistic. The reason that we may still insist on this assumption lies in that, without some extent of correlation, intermediaries would not have an incentive to put up any capital for monitoring (see [

56]).

3.4. A World without Financial Intermediation

We first consider the possibility of financing a project in a world without intermediation. Imagine a small firm that can have access to external finance only from individual investors, Now, turn to a loan contract. A contract first stipulates whether the project is financed. If so, it further specifies how the profit is split between the financiers and the borrower. Suppose that the borrower receives

in the case of success and

in the case of failure. This is equivalent to stipulating that the lenders receives

if the project succeeds, and

if it fails. The borrower’s limited liability implies that both

and

are nonnegative. Thus, the contract space is defined by

where

denotes the nonnegative two-dimensional Euclidean space, and both

and

are observable and verifiable by a third party such as a benevolent court of law. The timing of the contracting process is defined in

Figure 3.

Given Equation (

1), a necessary condition for the borrower to obtain external finance is that she behaves. The borrower will behave if the following “incentive compatibility constraint (IC)” is satisfied:

On the other hand, the individual lenders must be compensated by at least the amount of expected reward they can earn in the open market by investing

. This will be true if the following “individual rationality constraint (IR)” or “participation constraint” is satisfied:

Now, a firm with initial net worth (assets)

will choose its own capital contribution

A, and the loan contract menu

to solve Program

:

subject to Equations (

3) and (

4),

To simplify Program

, we first introduce the following result, essentially following [

57]. See

Appendix A for a formal proof.

Lemma 1. The entrepreneur’s risk neutrality implies that the only relevant loan contract menu is to reward her only if the project succeeds. Namely, the relevant contract menu is .

By Lemma 1, the IC constraint in Equation (

3) can be simplified as

This simplified IC constraint implies that the maximum payoff that can be pledged to the lenders without violating the entrepreneur’s incentives, provided that the project succeeds, is

The (expected) pledgeable payoff to the lenders is defined as

Lemma 1 also suggests that the IR constraint in Equation (

4) can be rewritten as

This means that only borrowers with

can be financed by individual investors. We exclude the uninteresting case that

by assuming that

The condition in Equation (

10) simply states that the net present value (expected profit) or the total surplus from a project is smaller than the minimum expected rent that must be left to the entrepreneur for her with appropriate incentive to be diligent. To have access to external finance, thus, the expected profit must be redistributed between the two parties. Allowing for the limited liability, the only manner that a borrower can redistribute some of the surplus to the lenders is by staking her own assets. One point that one may pay attention to here is that, if a borrower’s net worth

, her project is not funded, although it has positive expected profit. Without strong balance sheet or sufficient cash, the borrower must finance a large amount and so pledge a large proportion of the profit under the circumstance of success. The borrower then share only a small proportion of the project gain and thus could not be well behaved after entering into a loan contract. There is no feasible loan contract that both induces the borrower’s behaving and the lenders’ breaking even. This is so-called

credit rationing. Conversely, if

, then the borrower can guarantee that the project can be financed. Therefore, the necessary and sufficient condition for financing is

Now, consider the IR constraint . We claim that the constraint must be binding at the optimum of . Suppose first that . Then, take with . Then, the borrower can increase by without violating any constraint in . Therefore, at the optimum, the IR inequality cannot be strict.

The optimal choice of A invested in the project by the borrower is also all her wealth . This is because investing less than her endowment cannot improve her welfare. Suppose that the entrepreneur invests only the amount in the project. Then, if , she is able to access to external finance, and then she can still capture all the expected profit of the project. (Note that we have already shown that, at the optimum, the lenders can only break even, and thus the borrower can extract all social surplus.)

On the other hand, if , then the project can not be funded since the lenders cannot break even but would get a loss if financing the project. Put differently, in this case, it becomes more difficult for the project to be funded. We are done then.

In the light of the above analysis, we have proven the following lemma. (For a similar analysis, refer to [

57]).

Lemma 2. The lenders’ participation constraint must be binding at the optimum of , while the optimal investment level of the borrower is to stake all her own capital in the project.

Based on Lemmas 1 and 2, as expected, the entrepreneur obtains the entire expected profit or social surplus generated by the project if it is undertaken. Therefore, the solution of Program

has the following characteristics, as summarized in Proposition 1. See

Appendix A for a formal proof.

Proposition 1. When all agents are risk-neutral, at the optimum of Program , the borrower receives the entire social surplus generated by the project if it is financed. The optimal menu of the loan contract entails:

Thus far, we have demonstrated that there are two factors that may make a firm credit-constrained, which are lower level of firm net worth

and high agency cost measured by combination of the private benefit

and the likelihood ratio

, given the project’s expected profit. We have shown the characteristics of solution of Program

, which delineates the equilibrium under the condition of the project being financed. However, we need to carefully analyze potential mechanisms that may result in credit rationing in depth. Specifically, we need to identify the possible role played by access to the Internet in the process of small and micro firm financing. A simple check suggests that the channel through which access to the Internet affects firm financing is the private benefit

in our model in the scenario of no financial intermediation. By the assumption, we know that

, which implies that access to the Internet will decrease the private benefit

. Intuitively, as aforementioned, there are at least three channels through which access to the Internet may act on access to finance. First, if the entrepreneur is able to use the Internet to handle lots of things in daily life, such as collecting economic information, shopping online, making E-payment, releasing business project information, even accessing to online peer-to-peer loans, etc., then her personal credit record may be tracked or captured by a third party, even a bank-like financial intermediary, which in turn may be used as a basis for evaluating the possible loan demand from her. Secondly, if keeping track of entrepreneur’s personal credit record is not true and illegal by a third party, say a financial intermediary, then the above argument may not be true. However, if potential borrowers have access to online peer-to-peer platforms, they can conveniently disclose their personal information to attract lenders’ interest. On the other hand, for an online peer-to-peer lending contract to be entered into, potential lenders need to access to this sort of borrowers’ information for their credit risk evaluation. In fact, lenders do have right to access to such information on online peer-to-peer platforms, which is common both in (e.g.,

Paipaidai.com and

Yirendai.com) and outside China (e.g.,

Prosper.com and

Lendingclub.com). Moreover, such platforms provide borrowers’ credit record and also their credit scores to potential lenders for reference. Thirdly, lenders can also access borrowers’ information through their websites, which can further reinforce our assumption. Moreover, borrowers have incentives to show their credit quality via the Internet to have access to external finance to relax their financial constraints. This kind of information in turn may be used as a basis for evaluating the possible loan demand from borrowers. Without access to the Internet, individual investors would not have access to such personal credit information so that it is hard or at least more costly to identify relevant credit risk. More importantly, more personal information disclosed on the Internet makes shirking more expensive for the entrepreneur, which in turn will make shirking less attractive. To further uncover the function of access to the Internet, we rearrange Equation (

9) as

By Equation (

12),

is decreasing in

z since

. This implies that access to the Internet can lower the net worth threshold at or above which the entrepreneur can have access to external finance through raising the pledgeable income

via reducing the private benefit

. Because only firms with net worth at or above the threshold

can be funded, access to the Internet can enhance the likelihood of a project being financed. Precisely, since the probability that a project can be financed can be formulated as

, taking the partial derivative of the probability with respect to

z yields that

, where the last inequality comes from

and

. Now, we have shown one of our main results, as summarized in Proposition 2.

Proposition 2. The entrepreneur’s access to the Internet can raise the probability () that the project is funded. The deeper the degree of the entrepreneur’s access to the Internet, the higher the probability. Therefore, access to the Internet leads to more projects with positive expected profit to be undertaken, which improves investment efficiency and social welfare.

Even if in this very simple partial equilibrium framework, we found that access to the Internet has a positive effect on firms’ access to external finance. The main economic mechanism is that a potential borrower’s shirking incentive can be reduced via access to the Internet. Now, we switch to a more complicated world by introducing one more economic agent, financial intermediation.

3.5. A World with Financial Intermediation

In a world with financial intermediation, an intermediary can help alleviate financial constraint of a firm by monitoring. Monitoring debases the entrepreneur’s opportunity of shirking by eliminating the B-project with high agency cost (high private benefit), which contributes to attracting more investors to come in. Now, borrowers face two types of investors, individual (uniformed) investors and financial intermediaries. Therefore, in this case, there are three parties to the loan contract: the entrepreneur, the intermediary, and the individual investors.

Based on the discussion in

Section 3.4, an optimal three-party contract can be characterized by a form analogous to the one analyzed earlier: everyone gets nothing if the project fails; and the total return from the project is divided up so that

if the project succeeds, where the newly added notation,

, stands for the intermediary’s share, while the remaining notations are defined as before.

Now, under the circumstance of monitoring, the entrepreneur is left to choose between the good project and the

b-project with lower private benefit since the

B-project is eliminated. The entrepreneur’s incentive-compatible constraint (IC) is changed to

Since

, firms that can not be funded due to too high agency cost measured by

now may be financed on account of reduced agency cost. We pay more attention to the firms with

, for otherwise the entrepreneur would well behave without monitoring. For the intermediary to monitor, allowing for the monitoring cost, there is one more IC constraint that must be satisfied,

The two IC constraints in Equations (

13) and (

14) give the minimum shares that need to be distributed to the entrepreneur and the intermediary, respectively. The pledgeable (expected) income is defined as the maximum expected income that can be promised to the individual investors as before, which is

Denote by

the amount of capital that an intermediary invests in a firm that it monitors. The rate of return on intermediary capital is then

. We know

must exceed

, taking the monitoring cost into account. This implies that firms prefer individual capital to intermediary capital whenever the former is available. Given Equation (

14), the IC constraint of the intermediary requires that it be paid at least

, hence it will invest at least

in each project that it monitors. On the other hand, all firms that are monitored must demand exactly this level of intermediary capital since it is more expensive than the capital from individual investors. In fact, the motivation of being a monitor for an intermediary comes from the return

. The required investment

stipulates the rate of return on the intermediary capital so that the market for that class of capital clears.

For a project to be undertaken, individual investors must provide the balance

whenever there exists a positive gap between

I and

. Similar to the reasoning in

Section 3.4, a necessary and sufficient condition for a firm to be funded thus is

Rearranging terms yields the following equivalent condition

To make the story interesting, we assume that

for all

(this assumption can be satisfied for a sufficiently small c(0).) which guarantees that

for a lower limit of

that will be defined later on and for all possible

z. Note that a firm with net worth

cannot be financed. It is easy to see that the minimum acceptable rate of return

(if there were a upper limit of

set by a regulation authority,

with

, then the intermediary market would shrink to be zero, or no intermediary capital would be supplied in this case) is pinned down by

or

Now, in the economy, there are three types of firms according to their demand for intermediary capital. One category with sufficiently strong balance sheet (with net worth ) can finance their projects without reckoning on intermediaries. At the other extreme are the firms with sufficiently weak balance sheet (with net worth ), whose projects cannot be funded even though in a world with financial intermediation. The firms with net worth fall in between. These firms can access to external finance but only with the help of monitoring.

The preceding analysis shows that we have almost solved the following program for a firm falling into the moderate category with net worth

.

subject to Equations (

13), (

14) and (

17),

Similar to the reasoning of Proposition 1, the optimal investment level for the entrepreneur is to invest all her own capital in the project. Combing this and the preceding analysis, we obtain the following results.

Proposition 3. When all the agents are risk-neutral, at the optimum of Program , the borrower receives the entire social surplus generated by the project if it is financed. The solution of Program is characterized by

The stakes shared by the borrower, the intermediary, and the individual investors in the case of success arerespectively, and zero otherwise. The optimal investment for the borrower, the intermediary, and the individual investors arerespectively.

Proposition 3 describes the optimal loan contract menu for the firms with net worth . What we care more about is the possible effect of the degree of access to the Internet z on the optimal contract. First, the degree of access to the Internet has a negative effect on the demand for intermediary capital since . This reduces the cost of capital of the firm provided that the project can be funded, because intermediary capital is more expensive than individual investor capital. The channel through which the degree of access to the Internet z has a negative impact on the demand for intermediary capital is that z first reduces the cost of monitoring, which in turn lowers the agency rent extracted by the intermediary, and the demand for intermediary fund is decreased then.

The other side of the same coin is that the degree of access to the Internet z has a positive effect on the demand for individual or uninformed capital (it is easy to see that ), because the total investment of the project is given by a constant number I and the optimal investment level of the borrower is to invest all her own capital (noting that there is no correlation between the borrower’s own investment A and the degree of access to the Internet z). This benefits the firm since individual investors require a lower rate of return than the intermediary. More precisely, individual investors require no agency rent. This leads the external capital with lowest cost provided by them to the firm.

As far as the profit shared by the three parties are concerned, in the case of success, since

z plays a role in reducing monitoring cost and thus the intermediary’s agency rent, the stake owned by the intermediary must decrease as

z increases (

). The preceding analysis shows that the degree of access to the Internet has a negative effect on the demand for intermediary capital and a positive effect on the demand for individual or uninformed capital, given the total investment

I, hence the stake shared by individual investors must be increased as

z increases (

). Whether the borrower’s stake increases in

z is not so manifest. Taking the partial derivative of

with respect to

z at the optimum gives

since

and

. (Since the intermediary has a higher opportunity cost that individual investors, allowing for monitoring cost,

must be less than

.)

This shows that the borrower’s payoff will be enhanced as z increases. Intuitively, access to the Internet lowers the demand for the intermediary capital and meanwhile raises the demand for individual investor capital. The former has a relatively high cost but the latter has a relatively low cost, which implies that the borrower must benefit from access to the Internet in some way. However, the only way in which the borrower’s welfare can be improved is to share more profit. This is the potential mechanism through which the borrower’s welfare could be bettered.

Finally, we try to explore whether or not access to the Internet has an effect on the whole social welfare. The total welfare amounts to the project’s expected profit, expressed as follows.

Taking the first order partial derivative of

with respect to

z at the optimum yields

by Proposition 3 and the fact that the cost of intermediary capital is higher than that of individual investor capital. (Note that we have already known

at the optimum according to our previous derivation. We also make use of this fact here.) Therefore, the total social welfare increases in the degree of access to the Internet

z. It is not hard to find that the economic mechanism for this is that the entrepreneur with deeper access to the Internet takes advantage of attracting more cheap capital (from individual investors) and demanding less expensive capital (from the intermediary) so that the expected profit from the project is enhanced.

We summarize the above analysis as a corollary of Proposition 3 as follows.

Corollary 1. When all the agents are risk-neutral, the optimal solution of Program has the following comparative static properties:

The optimal demand for the intermediary capital decreases as the degree of access to the Internet of the entrepreneur, z, increases, while the optimal demand for individual investors’ capital increases in the the degree of access to the Internet of the entrepreneur, z.

The optimal stake of the intermediary in the profit, , becomes lower when the degree of access to the Internet of the entrepreneur is deeper, and the optimal stake of individual investors in the profit, , turns out to be higher when the degree of access to the Internet of the entrepreneur is deeper.

Finally, the optimal stake of the entrepreneur in the profit, , becomes larger when she has deeper access to the Internet. Furthermore, the expected profit on the project or the total social welfare, π, improves as the degree of access to the Internet of the entrepreneur goes deeper.

Our analysis in this subsection so far has exclusively focused on the firms falling into the moderate category with net worth

. However, another important question is whether access to the Internet can raise the probability that a project is funded, which has not been investigated. We first consider the effect of access to the Internet on the threshold (

) of net worth at or above which a project can be funded. Simple calculation shows that

This implies that access to the Internet can lower the threshold of net worth, and thus allows more projects to be financed. The rationale for this is that access to the Internet can reduce the entrepreneur private benefit, which in turn relaxes the minimum requirement of net worth and allow more firms to have access to external finance. In fact, access to the Internet can inflate the expected pledgeable income (), and therefore boost the ability to borrow then. That borrowing capacity becomes strong directly means that the probability () that a project is funded goes up. (Mathematically, it is easy to see .)

Now, we have shown the following results.

Proposition 4. In a world with financial intermediation, access to the Internet can boost the ability of the entrepreneur to borrow by reducing the agency rents ( and ) of the intermediary, lowering the minimum requirement of net worth, and raising the expected peldgeable profit. Therefore, The entrepreneur’s access to the Internet can heighten the probability () that her project is funded. Since more projects can be undertaken because of access to the Internet, both the investment efficiency and social welfare are improved.

Another interesting question we may investigate is whether there exists a certain effect of access to the Internet on the distance between the two thresholds

and

. Let

denote the distance. Taking the derivative of

with respect to

z yields

where the last inequality comes from our assumptions that

and

and the fact that

. This result implies that access to the Internet acts on both of the thresholds, but the force on the threshold

dominates the one on the threshold

. Therefore, in a world with financial intermediation, access to the Internet widens the distance between the two thresholds, and further incorporates more firms into the middle class of firms in the sense that there are more firms whose net worth falls into the interval

. This results in alleviation of financing difficulty of firms. Formally, we formulate this line of reasoning as follows.

Proposition 5. In a world with financial intermediation, under the assumptions that and , access to the Internet enlarges the set of firms whose net worth falls into the interval by prolonging the length of the interval (both ends of the interval are reduced, while the left one is reduced more). This alleviates financing difficulty of firms.

3.6. Equilibrium in the Credit Market

Similar to Holmstrom and Tirole [

16], since each firm demands the minimum amount of intermediary capital

, the aggregate demand for intermediary capital is

. We only consider the case in which there is no excess supply of intermediary capital at the minimum acceptable rate of return

, the equilibrium

can obtained by making the monitoring market clear.

What is interesting in Equation (

24) is the influence of the degree of access to the Internet,

z, on the equilibrium demand for intermediary capital. By Corollary 1,

is a decreasing function of

z, which inclines to lower the demand for intermediary capital. On the other hand, by Proposition 5, the distance between the two thresholds,

, is increasing in

z, which allows more firms to be successfully financed and thus is a force to potentially increase the demand for intermediary capital. Without knowing the distribution of

A in the economy, the effect of

z on the demand for intermediary capital is ambiguous ex ante. If we further assume that

A follows uniform distribution, then we can reach a clear conclusion about the effect of access to the Internet upon the demand for intermediary capital. Specifically, assume

for some upper bound

W. Rewrite the demand for intermediary capital

as

We claim that access to the Internet pushes up the demand for the intermediary capital. See

Appendix A for a formal proof.

Proposition 6. Assume that firm net worth A follows uniform distribution for some large enough positive number W. Then, the degree of access to the Internet, z, helps push up the aggregate demand for intermediary capital in a world with financial intermediation.

Proposition 6 states that access to the Internet plays a part in increasing in aggregate demand for intermediary capital. A natural question from this Proposition is how the increase in aggregate demand for intermediary capital affects the cost of intermediary capital,

, in equilibrium. The equilibrium condition in Equations (

24) suggests that the demand

is decreasing in

since

is decreasing and

is increasing in

. Therefore, for each pair of

, there is a unique

that clears the market for intermediary capital. Given the supply of intermediary capital

and the rate of return,

, demanded by individual investors, an increase in the demand

must push up the equilibrium cost of intermediary capital

. Equation (

24) fully describes the equilibrium if the rate of return,

, required by individual investors is exogenous. Hence, by Proposition 6, an increase in the degree of access to the Internet will force the cost of intermediary capital,

, higher. Summarizing this strand of analysis yields the following Corollary.

Corollary 2. Given the supply of intermediary capital , the rate of return, τ, required by individual investors, being exogenous, and the assumption that firm net worth A follows uniform distribution for some large enough positive number W, access to the Internet makes the equilibrium cost of capital, ι, demanded by intermediaries, pinned down by Equation (24), more expensive. Consider the case in which the cost of capital,

, required by individual investors is endogenous, or assume that the supply of individual investors’ capital

is imperfectly elastic. We must add one more equilibrium condition for individual capital then. Let

denote the demand for individual capital. (We have eliminated the capital that firms with

or

will invest in the market in the demand function.)

The market clearing condition for individual capital is

For each

and

z, the demand

is decreasing in

. To see this, noting that firms with net worth just above

are squeezed out by an increase in

, while firms with net worth just above

move from financing only from individual investors to from both intermediaries and individual investors, which lowers the demand for individual capital,

must go down when

goes up. In equilibrium for the individual capital market, there is a unique

that solves Equation (

27) for each pair of

. It is not clear how the change in

z impacts on the demand

given in Equations (

26). We replace Equation (

27) with the following condition to determine

and

, by plugging Equation (

24) into Equation (

27),

Our main interest is with the effects that changes in the degree of access to the Internet have on the equilibrium outcome. An increase in

z affects

negatively for each pair of

by Proposition 5. This directly implies an increase in aggregate investment. Since an increase in investment must be funded by either individual or intermediary capital, noting the fact that each firm demands the minimum amount of intermediary capital,

S will have to go up by Equation (

28) to satisfy firms’ financing demand regardless of increase or decrease in aggregate demand for intermediary capital. Therefore, given any distribution of

A, the cost of individual capital will be higher for a deeper access to the Internet. If we assume as before that

A follows uniform distribution, then we already know that access to the Internet also has a positive effect on the cost of intermediary capital by Corollary 2. Now, we finish this section by summarizing the above analysis as the following Proposition.

Proposition 7. If there is an increase in the degree of access to the Internet, there will be an increase in aggregate investment and the cost of individual investor capital τ. If we further assume that firm net worth A follows uniform distribution for some large enough positive number W. Then, the degree of access to the Internet, z, contributes to push up the aggregate demand for intermediary capital, .