Abstract

This study examines the relationship between corporate social responsibility (CSR) and firm value in the context of ownership structure. Specifically, our study explores whether large shareholder and foreign shareholder ownership play an important role in the CSR–firm value relationship. Using a sample of 48 firms listed on the Korea Stock Exchange (KSE) between 2010 and 2014, we find that CSR is positively associated with firm value. We further find that the relationship between CSR and firm value is weaker in firms with high large shareholder ownership than in firms with low large shareholder ownership. However, we find no evidence of the effect of foreign ownership on the relationship between CSR and firm value. This study sheds light on the importance of ownership structure in the relationship between CSR and firm value, suggesting significant implications for academics, practitioners, and policymakers. We contribute to the existing literature by providing empirical evidence on the effect of ownership structure on the CSR–firm value relationship. Policymakers may consider these results in implementing their policies that can enhance CSR activities.

1. Introduction

Corporate social responsibility (CSR) has received a great deal of attention in recent years. This attention is due to the distrust of corporate conducts and behaviors revealed during the financial crisis and of the expectation that companies will emphasize and restore the trust of stakeholders by expanding their commitment to ethical behavior, transparency, accountability and social development. In addition, previous research has shown the potential benefits of CSR in boosting corporate visibility and competitiveness [1]. On the other hand, CSR engagement of a company may be received by stakeholders as a window-dressing and a deliberate attempt to hide unfavorable corporate behaviors, which may not pay off. Thus, CSR is becoming important in both academia and practice [2,3,4,5,6]. A number of studies suggest that CSR is positively related to firm value [2,4,7,8,9,10,11,12,13,14,15,16,17,18,19]. Some studies even find a negative relationship between CSR and firm value [20,21]. In other studies, CSR has neutral effects on corporate financial performances after correcting the misspecification of empirical studies [3]. Although numerous studies provide evidence of a positive association between CSR and firm value, there has been a controversial issue regarding the association [22,23,24,25]. The majority of studies, however, have been dominated in advanced markets, although, most recently, debates on the benefits of CSR have expanded to developing and emerging markets. New insights are reported on the impact of CSR initiatives for firms residing in China and in Asian markets where corporate governance structures are drastically different in the forms and compositions of those practiced in western countries. Therefore, it will be an empirical issue whether CSR activities enhance the firm value for shareholders or if the activities pay too much attention to other stakeholders, thus decreasing shareholder value [6].

The main purpose of this paper is to analyze the impact of ownership structure on the relationship between CSR and firm value in Korea. CSR activities of Korea mainly have been implemented by large conglomerate groups such as Samsung, Hyundai, SK, and LG. More specifically, large Korean firms face growing criticism because they did not tackle stakeholders’ concerns [26]. Thus, these firms are more likely to engage in CSR to cover up the concerns associated with stakeholders, thereby preventing the firm value from decreasing or attempting to promote it. The main characteristics of these business groups are similar to those of individual firms controlled by the head of chaebols, or professional managers, even though affiliated firms are legally independent. Therefore, it is crucial to examine the effect of large shareholder ownership on the relationship between CSR and firm value.

The recent legal scandals of the Samsung Group and Lotte Group stir up the interest in CSR activities of business groups in Korea. For instance, a chairman of Hyundai Motor Group emphasizes that they “should carry out its corporate social responsibility faithfully by ramping up efforts for transparent management and social contributions” [27].

Considering the governance dimension of CSR, Korea presently ranks eighth out of 135 countries in equity net inflows and ranks third in terms of the percentage of foreign ownership over market capitalization among emerging economies. Foreign investors are not only equity providers to the Korean stock market, but also unique monitors of firm management [28]. Furthermore, Korean firms may actively pursue CSR to attract foreign investors [29]. That is, since investors from emerging areas may prefer active CSR engagement for corporate transparency and accountability, foreign shareholders from these countries are likely to exhibit similar behaviors as they exert their power on Korean firms [30,31].

This study contributes to the existing literature on the relationship between CSR and firm value in two ways. First, we provide evidence on the role of ownership structure in a firm’s CSR strategy. More importantly, our findings suggest that practitioners have to consider ownership structure in examining the relationship between CSR and firm value. Second, we use the evidence in Korea, of which there has been few studies on the effect of large shareholder and foreign shareholder ownership on the relationship between CSR and firm value.

2. Literature Review

Does CSR affect firm value? The answer has been suggested by several theories. The stakeholder theory suggested by Freeman [32] proposes that the decision making of firms should consider the expectation and claim of not only shareholders, but all relevant stakeholders [33]. The instrumental stakeholder theory suggests that CSR positively influences the well-being of firms [33]. That is, CSR positively affects firm value through a variety of stakeholders, such as shareholders, creditors, employees, customers, regulators, and communities. Specifically, the instrumental stakeholder theory proposes that CSR enables firms to have competitive advantages through trusting stakeholder relationships [15,34]. CSR signals trustworthiness since it can be incorporated into a firm’s value system [15,35]. Moreover, the stakeholder-agency theory suggests that CSR facilitates the role of monitoring, so managers focus on firm performance, thereby enhancing the relationship between firms and stakeholders [34,36].

A number of prior studies have empirically examined the relationship between CSR and financial performance [2,4,9,10,11,12,15,18,37,38,39]. For example, Aupperle et al. [37] found no relationship between CSR and firm profitability. McGuire et al. [2] showed that (perceived) CSR is more closely associated with firm performance in a previous year than in a subsequent year. Using a meta-analysis of 52 studies, Orlitzky et al. [4] explored the relationship between corporate social performance (CSP) and corporate financial performance (CFP). They showed that CSP is positively related to CFP across industries. Fisman et al. [9] showed that the positive effect of CSR on firm profitability is more pronounced for industries with high competition than for those with low competition. Lin et al. [10] found that CSR positively affects firm performance in the context of Taiwanese firms. Okamoto [38] found a positive relationship between CSR and firm value in the contest of Japan. Using a survey of 150 senior-level Indian managers, Mishra and Suar [11] found that firms actively involved in CSR have more profits than their counterpart firms. Oeyono et al. [12] showed that CSR is beneficial to the top 50 Indonesian firms by enhancing firm value. Lenz et al. [15] showed that the positive effect of CSR on firm value is weaker when there is corporate social irresponsibility. Eom and Nam [39] provided no evidence that firms newly added to the socially responsible investment (SRI) index on the Korea Exchange (KRX) have a high firm value. Lau et al. [18] investigated the moderating effect of institutional environmental on the association between CSR and operational performance using Korean manufacturing firms. They showed that law enforcement and competition intensity positively affect the relationship between CSR and operational performance.

Recently, several studies focus on the value relevance of CSR in the context of Romania, mainland China and Hong Kong, Singapore, and Brazil [14,16,17,19,40]. Using a sample of Romanian firms, Hategan and Curea-Pitorac [14] found that corporate giving activities are positively related to firm value. Singh et al. [16] showed that CSR practices and initiatives have an inverted U-shaped relationship with firm value in mainland China and Hong Kong. That is, as CSR practices and initiatives are prevalent, firm value increases to a certain point and then decreases. For Singapore firms, Loh et al. [40] found that the quality of sustainability reporting positively affects a firm’s market value. Using a sample of Romanian firms, Hategan et al. [17] found that firms engaging in CSR are likely to make more profits than non-CSR firms. Miralles-Quirós et al. [19] examined whether three environmental, social, and corporate governance (ESG) performance measures are associated with firm value based on Brazilian firms. They found that the positive effect of environmental performance on firm value is more pronounced for firms that are not included in environmentally sensitive industries than for firms in the industries. In contrast, they found that the positive effect of social and corporate governance performance on firm value is stronger for firms in environmentally sensitive industries as compared to their counterpart.

On the other hand, from the perspective of ownership structure, Li and Zhang [41] examined whether ownership structure affects CSR using Chinese firms’ social responsibility ranking. They showed that for non-state-owned firms, corporate ownership dispersion is positively associated with CSR, whereas for state-owned firms, whose controlling shareholder is the state, this relation is reversed. They further suggested that it is important to consider ownership type in assessing CSR in emerging markets where state ownership is still prevalent, such as China. Li and Xia [42] found that controlling shareholders significantly have an effect on the relationship between the level of CSR and earnings quality. More specifically, the relationship between the level of CSR and earnings quality is significantly positive in privately owned enterprises but not state-owned enterprises. Among state-owned enterprises, the relationship is weaker in enterprises controlled by the central government than at those controlled by local governments.

3. Hypothesis Development

3.1. The Relationship between CSR and Firm Value

CSR can have a positive impact on firm value in the long-term perspective by increasing the satisfaction of various stakeholders, such as employees, customers, and communities, or by facilitating communication between firms and stakeholders [13]. Likewise, CSR has a positive function in improving the reputation and brand image, thereby leading to better financial performance [43]. Moreover, CSR can decrease financial risk, which enhances firm value. Firms can develop a reasonable and competitive strategy such as brand strategy through CSR. Many firms have recognized that engaging in CSR activities is crucial to achieving a sustainable performance and growth [44]. When firms implement CSR activities to ensure their sustainability, it may be costly; however, the benefits of CSR activities are expected to dominate their relevant costs.

Based on the theoretical and empirical evidence, and our reasoning, we predict a positive relationship between CSR and firm value in Korea like Western countries. We, therefore, propose the following first hypothesis (stated in alternative form):

Hypothesis 1.

There is a positive relationship between ESG disclosure scores and firm value.

Hypothesis 1a.

There is a positive relationship between environmental disclosure scores and firm value.

Hypothesis 1b.

There is a positive relationship between social disclosure scores and firm value.

Hypothesis 1c.

There is a positive relationship between governance disclosure scores and firm value.

3.2. The Effect of Large Shareholder Ownership on the Relationship between CSR on Firm Value

As discussed in the previous section, we predict that CSR is positively related to firm value. The relationship can be influenced by firms’ ownership structure [41,45,46,47]. Thus, it is important to consider the role of ownership types in the CSR–firm value relationship because they can affect decisions on corporate CSR policies.

In the Korean corporate governance system, corporate insiders, such as large shareholders or controlling shareholders, have a significant influence on managerial decisions (e.g., CSR investment decisions). This is due to the fact that large shareholders are usually composed of founding family members and are directly or indirectly engaged in appointing senior managers, such as chief executive officers (CEOs) [48,49]. Large shareholders may have incentives to use their controlling position to extract private gains or benefits at the expense of minority shareholders, thus causing agency problems [50,51,52]. As such, it has been recognized that agency problems between controlling shareholders and minority shareholders are more prevalent in Korea [53]. Unlike developed countries, such as U.S. and U.K., Korea has a relatively weak corporate governance system. In particular, Korea is characterized by weak protection for minority shareholders [48].

Given the situation in Korea, it is likely that corporate insiders, such as large shareholders (and even managers), have more incentives to overinvest in CSR activities for their private interests or purposes at the cost of other shareholders’ wealth, including minority shareholders. Specifically, large shareholders may undertake CSR activities excessively for their private purpose so that they can enhance their own reputation and image as good, CSR-friendly shareholders [47]. This overinvestment in CSR may lead to inefficient allocation of available resources within firms, which likely has a negative impact on firm value.

Based on the above logic, we propose the following second hypothesis (stated in alternative form):

Hypothesis 2.

CSR has a negative impact on firm value when the firms have high large shareholder ownership.

3.3. The Effect of Foreign Ownership on the Relationship between CSR on Firm Value

Foreign investors can possibly enable Korean firms to establish transparent corporate governance and consequently encourage the firms to engage in CSR to some extent. For example, foreign investors in Korea exercise a larger influence on corporate governance systems than ever before [54,55]. Thus, foreign investors have more need and demand to monitor firms’ CSR activities to maximize shareholder value. Consequently, an increase in foreign ownership can induce managers to work actively in their firms’ CSR activities.

Based on the above reasoning, we propose the following third hypothesis (stated in alternative form):

Hypothesis 3.

CSR has a positive impact on firm value when the firms have a high foreign ownership.

4. Materials and Methods

4.1. Sample Selection

This study uses annual data from the Korea Investors Service-Value (KIS-Value) and Bloomberg database between 2010 and 2014. Specifically, we obtain annual financial data from the KIS-Value provided by National Information and Credit Evaluation (NICE) because of its comprehensive financial information on Korean firms. The NICE is affiliated with Standard & Poor’s (S&P) and is one of three major credit rating agencies in Korea. The KIS-Value includes company files and financial statement information data for all public firms. Furthermore, we collect the environment, social, and governance (ESG) data from the Bloomberg database. The Bloomberg provides proprietary ESG disclosure scores for each public firm. The scores range from 0 (no disclosure) to 100 (full disclosure). Each data point is measured by its importance and its relevant industry; each firm is only accessed according to the data associated with its relevant industry.

We remove financial firms because their accounting scheme is different from that of firms in other industries. We delete firm-year observations with missing values and extreme outliers. Our final sample consists of 250 firm-year observations and represents 48 firms listed on the Korea Stock Exchange (KSE).

4.2. Research Methodology

We employ the generalized method of moments (GMM) estimator to test the relationship between CSR and firm value in the context of large shareholder and foreign shareholder ownership. This study further performs a t-test to identify whether there are statistical mean differences in firm characteristics between two groups (e.g., high and low CSR firms). Specifically, we use a panel GMM approach to mitigate potential endogeneity problems between CSR and firm value. Earlier studies have widely used the two-step GMM approach because it is more effective in alleviating potential endogeneity issues than the fixed-effect panel regression method. Although the fixed effect estimation method controls for time-invariant unobserved firm-specific factors, it does not consider controlling for potential endogeneity problems. To conduct a regression analysis, we use the STATA 13 software package [56]. We estimate the following regression models:

Tobin’s Qit = β0 + β1CSR disclosure scoresit + β2Leverageit + β3Assetgrit + β4Profitabilityit + β5Lnassetit + β6Lnageit + β7Large shareholder ownershipit + β8Foreign ownershipit + εit.

Tobin’s Qit = β0 + β1CSR disclosure scoresit + β2CSR disclosure scoresit × Ownership structure dummyit + β3Leverageit + β4Assetgrit + β5Profitabilityit + β6Lnassetit + β7Lnageit + β8Large shareholder ownershipit + β9Foreign ownershipit + εit.

Regarding Tobin’s Q as a dependent variable, we use it as a proxy for firm value. As in Chung and Pruitt [57], we define Tobin’s Q as the book value of total assets minus the book value of equity, plus the market value of equity, divided by the book value of total assets. Tobin’s Q is a variable that measures firm value based on the market value, which is related to the future value of the firms [58,59]. Furthermore, Tobin’s Q reflects the emotion of investors including both optimism and pessimism. As independent variables, CSR has been considered a concept encompassing the environment, employee, community, and shareholder. The environmental, social, and governance (ESG) is the key variable to measure CSR, which is approximated by the Bloomberg’s ESG disclosure score [60]. The ESG refers to the combination of the following three components: environmental disclosure scores, social disclosure scores, and governance disclosure scores. The environmental disclosure score (Environmental) reflects the ability of firms to entirely avoid risks associated with the environment using the ecosystem, for example, the product innovation for the reduction in CO2 emission. The social disclosure score (Social) measures the degree of whether or not firms make a continuous effort to maintain confidence and loyalty to employees, customers, and communities. Specifically, the social disclosure score reflects the reputation of firms, which is known as the main determinant affecting future firm value in the long term. For instance, the social disclosure score measures the contribution of community, product responsibility, human rights, the quality of employees, health and security, and training. The governance disclosure score (Governance) reflects the ability that firms have to regulate the management and responsibility through the management control process and system and through the boards of director from the long-term perspective. For example, this measure considers the function of the board of directors, the structure of directors, compensation policy, and the rights of shareholders.

Turning to the control variable, Leverage is a proxy variable that analyzes the impact of financial distress costs, which is measured as total debt divided by total assets. Assetgr is measured as the percentage of annual growth in total assets. Profitability is measured as the earnings before interest and tax divided by total assets. Lnasset is a proxy variable for firm size, measured as the natural logarithm of total assets. Lnage is measured as the natural logarithm of the number of years since incorporation. Large shareholder ownership is computed as the sum of the common and restricted stock owned by large shareholders divided by shares outstanding at the fiscal year end. Foreign ownership is calculated as the sum of common and restricted stock owned by the foreign investors divided by shares outstanding at the fiscal year end. Finally, in Equation (2), we include an interaction term, CSR disclosure scores × Ownership structure dummy, to investigate the effect of ownership structure on the relationship between CSR and firm value. We generate two ownership structure dummy variables, Largesharedummy and Foreigndummy, respectively. Specifically, Largesharedummy is a dummy variable equal to 1 if the large shareholder ownership is above the industry median, and 0 otherwise. Foreigndummy is a dummy variable equal to 1 if the foreign ownership is above the industry median, and 0 otherwise. Table 1 summarizes the predicted sign of the relationship between each CSR proxy and firm value, as well as the definitions of relevant variables.

Table 1.

The predicted sign of the CSR–firm value relationship.

5. Results and Discussion

5.1. Descriptive Statistics

Table 2 shows descriptive statistics for the relevant variables used in our analysis. The mean (standard deviation) value of Tobin’s Q is 1.409 (1.086), suggesting that Korean firms have high growth opportunities. The mean (standard deviation) values of ESG, Environmental, Social, and Governance are 23.908 (21.802), 20.521 (21.433), 38.346 (16.809), and 50.556 (15.357), respectively, indicating that Governance (ESG) has the highest mean (standard deviation) value. The mean (standard deviation) values of Leverage, Assetgr, Profitability, Lnasset, and Lnage are 38.8% (18.8%), 7.262% (18.635%), 6.1% (22.5%), 9.350 (0.899), and 2.684 (0.879), respectively. Moreover, the mean (standard deviation) values of Large shareholder ownership and Foreign ownership are 38.833% (18.241%) and 22.629% (18.385%), respectively, indicating that the percentage of large shareholders is higher than that of foreign investors.

Table 2.

The descriptive statistics.

5.2. Preliminary Analysis

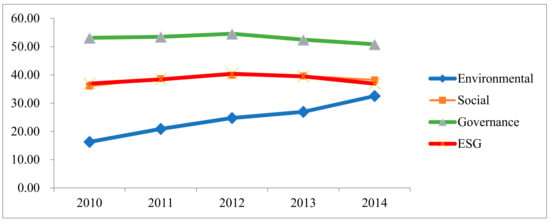

This section examines the pattern and financial characteristics of CRS disclosure scores, such as ESG, environmental, social, and governance disclosure scores. Figure 1 shows the pattern of CSR disclosure scores by year. Environmental disclosure scores (Environmental) increased gradually from 2010 to 2014. More specifically, environmental disclosure scores dramatically increased in 2013. In recent years, there has been considerable attention paid to the importance of environmental CSR by academics and practitioners [5]. This recent development of environmental CSR is highlighted by a survey of 766 CEOs conducted by Accenture and the United Nations Global Compact (UNGC). In the survey, about 93% of the CEOs rated sustainability as a critical factor for their future business success, and 91% responded that their company will adopt new technologies to tackle issues associated with sustainability [61]. In particular, the environmental responsibility (e.g., the reduction in CO2 emissions) in Korea is an important component in implementing CSR activities. Likewise, governance disclosure scores (Governance) are highest among other CSR disclosure scores; they increased by 2012 and then decreased gradually. As such, social disclosure scores (Social) increase gradually, and they have decreased since 2012. Taken together, ESG disclosure scores gradually increased between 2010 and 2012, and then declined.

Figure 1.

The pattern of CSR disclosure scores.

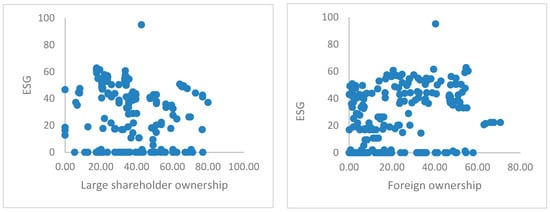

Figure 2 shows the scatter plot between large shareholder ownership and ESG, and between foreign ownership and ESG. The left-hand figure presents the negative correlation between large shareholder ownership and ESG. In contrast, the right-hand figure illustrates the positive correlation between foreign ownership and ESG.

Figure 2.

The scatter plot between ESG and ownership structure.

Table 3, Table 4 and Table 5 compare the descriptive statistics of variables between high and low CSR firms, between high and low large shareholder ownership, and between high and low foreign ownership. To do this, we perform a parametric t-test to examine whether the mean difference in each variable between these two groups is statistically significant. We define high (low) CSR firms as those with above (below) the industry median ESG value. We also define firms with high (low) large shareholder and foreign ownership as those with above (below) the industry median value of these variables.

Table 3.

The descriptive statistics by high versus low CSR Firms.

Table 4.

The descriptive statistics by high versus low large shareholder ownership firms.

Table 5.

The descriptive statistics by high versus low foreign ownership firms.

Table 3 presents the results of the t-test of the mean difference in each variable between high and low CSR firms. Specifically, the magnitude of Tobin’s Q is larger for high CSR firms relative to low CSR firms (e.g., mean Tobin’s Q = 1.569 for high CSR firms and 1.262 for low CSR firms). The mean difference in Tobin’s Q between the two groups is statistically significant (p < 0.05), suggesting that high CSR firms have higher firm value than low CSR firms. For CSR disclosure scores, we find higher mean values of ESG, Environmental, Social, and Governance for high CSR firms than for low CSR firms. The mean differences in ESG, Environmental, Social, and Governance between the two groups are statistically significant (p < 0.01). The mean value of Leverage in high CSR firms is insignificantly higher than that of Leverage in low CSR firms. The mean value of Assetgr in high CSR firms is significantly higher than that of Assetgr in low CSR firms (p < 0.01). The mean value of Profitability in high CSR firms are insignificantly lower than that of Profitability in low CSR firms. In addition, we find higher mean values of Lnasset and Lnage for high CSR firms than for low CSR firms. The mean differences in Lnasset and Lnage between the two groups are statistically significant (p < 0.01 for Lnasset and p < 0.1 for Lnage). Furthermore, we find a lower mean value of Large shareholder ownership for high CSR firms than for low CSR firms. The mean difference in Large shareholder ownership between the two groups are statistically significant (p < 0.01). In contrast, the mean value of Foreign ownership for high CSR firms is higher than for low CSR firms. The mean difference in Foreign ownership between the two groups are statistically significant (p < 0.01).

Taken together, our results show that high CSR firms have higher firm value, have higher asset growth rates, are larger, are older, have lower large shareholder ownership, and have higher foreign ownership than low CSR firms.

Table 4 presents the results of the t-test of the mean difference in each variable between high and low large shareholder ownership. The mean value of Tobin’s Q in firms with high large shareholder ownership is insignificantly higher than that of Tobin’s Q in firms with a low large shareholder ownership. For CSR disclosure scores, we find lower mean values of ESG and Environmental for firms with high large shareholder ownership than for firms with a low large shareholder ownership. The mean differences in ESG and Environmental between the two groups are statistically significant (p < 0.01). The mean value of Social in firms with a high large shareholder ownership is insignificantly lower than that of Social in firms with a low large shareholder ownership. Furthermore, we find a lower mean value of Governance for firms with high large shareholder ownership than for firms with a low large shareholder ownership. The mean difference in Governance between the two groups are statistically significant (p < 0.01). The mean differences in Leverage, Assetgr, and Profitability between the two groups are statistically insignificant. We find lower mean values of Lnasset and Lnage for firms with high large shareholder ownership than for firms with a low large shareholder ownership. The mean differences in Lnasset and Lnage between the two groups are statistically significant (p < 0.01). The mean value of Foreign ownership in firms with high large shareholder ownership is significantly lower than that of foreign ownership in firms with a low large shareholder ownership (p < 0.01).

Taken together, our results indicate that firms with a high large shareholder ownership have lower CSR disclosure scores, are smaller, are younger, and have lower foreign ownership than firms with a low large shareholder ownership.

Table 5 shows the results of the t-test of the mean difference in each group between high and low foreign ownership. We find a higher mean value of Tobin’s Q for firms with a high foreign ownership than for firms with a low foreign ownership. The mean difference in Tobin’s Q between the two groups are statistically significant (p < 0.01). Regarding CSR disclosure scores, we find higher mean values of ESG, Environmental, Social, and Governance for firms with a high foreign ownership than for firms with a low foreign ownership. The mean differences in ESG, Environmental, Social, and Governance between the two groups are statistically significant (p < 0.01). The mean difference in Leverage between the two groups is statistically insignificant. The mean value of Assetgr in firms with a high foreign ownership is significantly higher than that of Assetgr in firms with a low foreign ownership (p < 0.01). The mean difference in Profitability between the two groups is positive but statistically insignificant. The mean value of Lnasset in firms with a high foreign ownership is significantly higher than in firms with a low foreign ownership (p < 0.01). Moreover, the mean difference in Lnage between the two groups is positive but statistically insignificant. We find a lower mean value of Large shareholder ownership for firms with high a foreign ownership than for firms with low foreign ownership. The mean difference in Large shareholder ownership is statistically significant (p < 0.01).

Taken together, our results suggest that firms with a high foreign ownership have higher firm value, have higher CSR disclosure scores, have higher asset growth rates, are larger, and have lower large shareholder ownership than firms with low foreign ownership.

5.3. Univariate Analysis

Table 6 reports the Pearson and Spearman correlations among the variables used in our analyses. According to the Pearson correlations, Tobin’s Q is positively and significantly correlated with ESG (0.173), Social (0.256), Assetgr (0.211), Profitability (0.179), and Foreign ownership (0.373), while Tobin’s Q is negatively and significantly correlated with Lnage (−0.294). We also find that Tobin’s Q is positively and insignificantly correlated with Environmental (0.079) and Governance (0.025). In particular, there are high correlations between ESG and three individual CSR disclosure scores are mechanical because ESG is the combination of the three proxies.

Table 6.

The Pearson and Spearman correlation coefficients.

Hategan and Curea-Pitorac [14] find a positive correlation between CSR (i.e., corporate giving) and firm value (measured as Tobin’s Q). In a similar vein, Lenz et al. [15] find a positive correlation between CSR and firm value (measured as Tobin’s Q). Miralles-Quirós et al. [19] present a positive correlation between each individual CSR performance measure (i.e., environmental, social, and corporate governance performance variables) and firm value (measured as a firm’s share price), which is similar to those reported in ours. These findings are similar to that presented in our analysis. Furthermore, we present the Spearman rank correlations. All results are identical with the results of Pearson correlations at the 1% or 5% significance level except that Tobin’s Q is positively and significantly correlated with Environmental (Spearman rank correlation of 0.138). Although the Pearson and Spearman rank correlations show that these independent variables have some correlations with each other, there appears to be little possibility of multicollinearity problems in our regression equations because such correlations are not significantly high.

5.4. The Relationship between CSR and Firm Value

Table 7 presents the results of GMM estimation on the association between CSR and firm value. Column (1) shows a positive and significant relationship between ESG and Tobin’s Q (p < 0.01), suggesting that firms with higher CSR have higher firm value, which is consistent with our first hypothesis (Hypothesis 1). Moreover, we examine the relationship between each disclosure score and firm value. Specifically, column (2) shows a positive and significant relationship between Environmental and Tobin’s Q (p < 0.01), suggesting that firms with higher environmental disclosure scores have higher firm value. This finding is consistent with the subsidiary hypothesis (Hypothesis 1a). Likewise, column (3) shows a positive and significant relationship between Social and Tobin’s Q (p < 0.05). This result indicates that firms with higher social disclosure scores have higher firm value, which is consistent with the subsidiary hypothesis (Hypothesis 1b). Furthermore, column (4) exhibits a positive but insignificant relationship between Governance and Tobin’s Q, which is inconsistent with the subsidiary hypothesis (Hypothesis 1c). Turning to control variables, the coefficients on Leverage, Profitability, and Foreign ownership are positive and significant. Furthermore, we find negative and significant coefficients on Lnasset and Lnage. Taken together, our findings suggest that CSR plays a significant role in enhancing firm value.

Table 7.

The multiple regression of CSR on firm value.

5.5. The Effect of Large Shareholder Ownership on the Relationship between CSR and Firm Value

Table 8 reports the results of GMM estimation with respect to the effect of large shareholder ownership on the relationship between CSR firm value. In all columns (1) through (4), each CSR measure is positively related to Tobin’s Q, confirming our previous results in Table 7. We further include an interaction term (Each CSR disclosure score × Largesharedummy) to examine whether large shareholder ownership influences the relationship between CSR and firm value. Column (1) shows a negative and significant relationship between ESG × Largesharedummy and Tobin’s Q (p < 0.1). Column (2) shows a negative and significant relationship between Environmental × Largesharedummy and Tobin’s Q (p < 0.1), suggesting that the positive relationship between environmental disclosure scores and firm value is weaker in firms with high large shareholder ownership than in firms with low large shareholder ownership. In a similar vein, column (3) shows a negative and significant relationship between Social × Largesharedummy and Tobin’s Q (p < 0.05). Column (4) shows a negative and significant relationship between Governance × Largesharedummy and Tobin’s Q (p < 0.05). In addition, the estimated sign of each control variable is consistent with the findings reported in Table 7. Taken together, our findings are consistent with the second hypothesis (Hypothesis 2) and suggest that the large shareholder ownership negatively affects the relationship between CSR and firm value.

Table 8.

The effect of large shareholder ownership on the relationship between CSR on firm value.

5.6. The Effect of Foreign Ownership on the Relationship between CSR and Firm Value

Table 9 presents the results of the GMM estimation regarding the effect of foreign ownership on the relationship between CSR and firm value. In columns (1) through (3), each CSR disclosure score is positively associated with Tobin’s Q, confirming our previous results in Table 7 and Table 8. Furthermore, we include an interaction term (Each CSR disclosure score × Foreigndummy) to investigate whether foreign ownership affects the relationship between CSR and firm value. In all columns (1) through (4), we find no significant coefficient on each interaction term, which is inconsistent with our third hypothesis (Hypothesis 3). Furthermore, we find that the estimated sign of each control variable is consistent with our previous results presented in Table 7 and Table 8. Taken together, our results indicate that foreign ownership plays an insignificant role on the relationship between CSR and firm value.

Table 9.

The effect of foreign ownership on the relationship between CSR on firm value.

5.7. Additional Analysis

In this section, we repeat our previous analyses by dividing into two group, specifically high versus low large shareholder ownership and high versus low foreign ownership, respectively.

Table 10 presents the results of the GMM estimation on the relationship between CSR and firm value in terms of high and low large shareholder ownership. We find that the coefficient on each CSR disclosure score is positive but insignificant in columns (1) through (4). In contrast, we find a positive and significant coefficient on each CSR disclosure score in columns (5) through (8), confirming our previous results reported in Table 8.

Table 10.

The relationship between CSR and firm value by high and low large shareholder ownership.

Table 11 shows the results of GMM estimation on the relationship between CSR and firm value in terms of high versus low foreign ownership. In columns (1) through (4), the coefficients on ESG and Environmental are positive and significant. Likewise, we find positive and significant coefficients on ESG, Environmental, and Social in columns (5) through (8), which partially confirms our previous results presented in Table 9.

Table 11.

The relationship between CSR and firm value by high and low foreign ownership.

6. Conclusions

More concerns are exhibited in the lack of understanding about the role of ownership structure in the relationship between CSR and firm value due to inconsistent results on its relationship in prior studies. One dimension to better understand these conflicting results is to analyze the association between CSR and firm value from the perspective of ownership structure. In this study, we investigate the effect of ownership structure on the relationship between CSR and firm value. Based on the argument that ownership structure plays a crucial role in alleviating the conflicts of interest between managers and shareholders, we hypothesize that large shareholder ownership negatively affects the relationship between CSR and firm value. We further hypothesize that foreign ownership positively influences the relationship between CSR and firm value.

To test these hypotheses, we conduct the panel GMM estimation using a sample of 48 Korean firms between 2010 and 2014. In our analyses, we use the Bloomberg database, which covers CSR activities of Korean firms, and we combine it with the annual financial data obtained from the KIS-Value. We use Tobin’s Q as a proxy for firm value, measured as the market value of the firm scaled by total assets. Moreover, we use environmental, social and governance (ESG) disclosure scores as a proxy for CSR. We also use three individual disclosure scores as alternative proxies for CSR.

The main findings of this study are as follows. First, we find that CSR has a positive and significant impact on firm value, which is consistent with our first hypothesis. Specifically, ESG disclosure scores are positively and significantly related to firm value. Likewise, we find that environmental disclosure scores are positively and significantly related to firm value. This finding indicates that environmental responsibilities contribute to enhancing firm value by attracting potential investors. We also find a positive and significant relationship between social disclosure scores and firm value, suggesting that social responsibilities have been considered an essential factor in CSR activities. However, we find no evidence that governance disclosure scores are positively associated with firm value. Activities to improve corporate governance have been implemented by many practitioners and policymakers. Thus, it is not clear whether or not continuing activities of corporate governance positively affect firm value. Second, we find that the positive relationship between CSR and firm value is weaker in firms with high large shareholder ownership than in firms with low large shareholder ownership. This finding is consistent with our second hypothesis, suggesting the conflicting role of large shareholder ownership in the CSR–firm value relationship. Third, we find no evidence of the impact of foreign ownership on the association between CSR and firm value, which is inconsistent with our third hypothesis. This finding indicates that foreign ownership may not contribute to the increasing firm value through CSR activities.

Our study fills the gap in the literature by highlighting the importance of ownership structure in the relationship between CSR and firm value. Ownership structure is important because it can affect firms’ decision making on their CSR activities and further long-term objectives. Thus, our study provides a better understanding of the role of ownership structure in the CSR–firm value relationship. Our study also suggests meaningful implications for academics and practitioners. Firms are now aware that pursuing CSR investments enables them to achieve sustainable growth, which is consequently beneficial to shareholders and leads to maximizing shareholder wealth [44]. In particular, our results provide implications for practitioners, such as managers and policymakers, who pursue CSR activities because the activities are closely linked to shareholders’ wealth. Policymakers may consider these results in implementing their policies that can enhance CSR activities. Furthermore, in a competitive business environment, it is essential to implement CSR activities in order to maintain firms’ long-term sustainability. CSR activities enable firms to achieve competitive advantages by enhancing the firm’s image or maintaining reputational capitals, which can possibly lead to sustainable firm performance.

Our study has some limitations, as follows. First, we explore the value-enhancing effect of CSR on firm value in the context of ownership structure based on the Korean firms. Unlike firms in other countries, many Korean firms are characterized by their unique ownership structure, such as family business groups, known as chaebols. Thus, one should be cautious to interpret our results when applying to firms in other countries. Further research should study the role of ownership structure in the CSR–firm value relationship using a comprehensive data set covering emerging markets. Second, we focus on the role of large shareholder and foreign shareholder ownership in the CSR–firm value relationship. Even though other ownership structures and governance mechanisms—such as managerial ownership, inside director ownership, and shareholder rights—affect the relationship, we do not control for these variables in our analysis. Thus, further research should consider the variables when examining the relationship between CSR and firm value in the framework of various ownership structure. Third, we cannot totally rule out the possibility of an endogeneity problem because unidentified factors may be correlated with CSR and firm value. Thus, such endogeneity issues may prevent us from drawing strong results from our empirical analysis. Fourth, we use a limited sample period between 2010 and 2014 in our analysis. We cannot extend our sample period due to the limitation of data availability such as large shareholder and foreign shareholder ownership. Therefore, further research should examine the effect of ownership structure on the relationship between CSR and firm value using extended sample periods.

Author Contributions

W.S.K. designed the paper, collected the data, summarized the literature review, developed the hypotheses, and conducted the empirical analysis. K.P. contributed to the hypothesis development, performed the empirical analysis, and finalized the manuscript. S.H.L. contributed to the development of the hypotheses and provided valuable suggestions and comments regarding the manuscript. All authors discussed the implications and wrote the paper.

Funding

This research received no external funding.

Acknowledgments

We gratefully acknowledge the comments and suggestions of three anonymous referees.

Conflicts of Interest

The authors declare no conflict of interest.

References

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate social responsibility: Strategic implications. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate social responsibility and firm financial performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Flammer, C. Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Acad. Manag. J. 2013, 56, 758–781. [Google Scholar] [CrossRef]

- Servaes, H.; Tamayo, A. The impact of corporate social responsibility on firm value. Manag. Sci. 2013, 59, 1045–1061. [Google Scholar] [CrossRef]

- Orlitzky, M. Does firm size confound the relationship between corporate social performance and financial performance? J. Bus. Ethics 2001, 33, 167–180. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Fisman, R.; Heal, G.; Nair, V.B. Corporate Social Responsibility: Doing Well by Doing Good? Working Paper; Columbia University: New York, NY, USA, 2005; Available online: apps.olin.wustl.edu/jfi/pdf/corporate.social.responsibility.pdf (accessed on 4 July 2018).

- Lin, C.-H.; Yang, H.-L.; Liou, D.-Y. The impact of corporate social responsibility on financial performance: Evidence from business in Taiwan. Technol. Soc. 2009, 31, 56–63. [Google Scholar] [CrossRef]

- Mishra, S.; Suar, D. Does corporate social responsibility influence firm performance of Indian companies? J. Bus. Ethics 2010, 95, 571–601. [Google Scholar] [CrossRef]

- Oeyono, J.; Samy, M.; Bampton, R. An examination of corporate social responsibility and financial performance: A study of the top 50 Indonesian listed corporations. J. Glob. Responsib. 2011, 2, 100–112. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saeaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Curea-Pitorac, R.-I. Testing the Correlations between Corporate Giving, Performance and Company Value. Sustainability 2017, 9, 1210. [Google Scholar] [CrossRef]

- Lenz, I.; Wetzel, H.A.; Hammerschmidt, M. Can doing good lead to doing poorly? Firm value implications of CSR in the face of CSI. J. Acad. Market. Sci. 2017, 45, 677–697. [Google Scholar] [CrossRef]

- Singh, P.J.; Sethuraman, K.; Lam, J.Y. Impact of Corporate Social Responsibility Dimensions on Firm Value: Some Evidence from Hong Kong and China. Sustainability 2017, 9, 1532. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Sirghi, N.; Curea-Pitorac, R.-I.; Hategan, V.-P. Doing Well or Doing Good: The Relationship between Corporate Social Responsibility and Profit in Romanian Companies. Sustainability 2018, 10, 1041. [Google Scholar] [CrossRef]

- Lau, A.K.W.; Lee, S.H.N.; Jung, S. The Role of the Institutional Environment in the Relationship between CSR and Operational Performance: An Empirical Study in Korean Manufacturing Industries. Sustainability 2018, 10, 834. [Google Scholar] [CrossRef]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Valente Gonçalves, L.M. The Value Relevance of Environmental, Social, and Governance Performance: The Brazilian Case. Sustainability 2018, 10, 574. [Google Scholar] [CrossRef]

- Marcus, A. The deterrent to dubious corporate behavior: Profitability, probability, and safety recalls. Strateg. Manag. J. 1989, 10, 233–250. [Google Scholar] [CrossRef]

- Wright, P.; Ferris, S. Agency conflict and corporate strategy: The effect of divestment on corporate value. Strateg. Manag. J. 1997, 18, 77–83. [Google Scholar] [CrossRef]

- Griffin, J.J.; Mahon, J.F. The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research. Bus. Soc. 1997, 36, 5–31. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Stanwick, P.A.; Stanwick, S.D. The relationship between corporate social performance, and organizational size, financial performance, and environmental performance: An empirical examination. J. Bus. Ethics 1998, 17, 195–204. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. People and Profits: The Search for a Link between a Company’s Social and Financial Performance, 1st ed.; Psychology Press: New York, NY, USA, 2001; ISBN 10-0805840117. [Google Scholar]

- Nam, Y.-S. The changing landscape of corporate social responsibility in Korea. Rev. Educ. COGEIME 2011, 20, 145–158. [Google Scholar] [CrossRef]

- Conglomerates Pushing Reform After Graft Scandal. Available online: http://koreabizwire.com/conglomerates-pushing-reform-after-graft-scandal/76130 (accessed on 24 March 2018).

- Choi, H.M.; Sul, W.; Min, S.K. Foreign board membership and firm value in Korea. Manag. Decis. 2012, 50, 207–233. [Google Scholar] [CrossRef]

- Lee, J.; Kim, S.-J.; Kwon, I. Corporate Social Responsibility as a Strategic Means to Attract Foreign Investment: Evidence from Korea. Sustainability 2017, 9, 2121. [Google Scholar] [CrossRef]

- Chapple, W.; Moon, J. Corporate social responsibility in Asia: A seven country study of CSR website reporting. Bus. Soc. 2005, 44, 415–441. [Google Scholar] [CrossRef]

- Oh, W.Y.; Chang, Y.K.; Martynov, A. The effect of ownership structure on corporate social responsibility: Empirical evidence from Korea. J. Bus. Ethics 2011, 104, 283–297. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach, 1st ed.; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Jones, R.; Murrell, A.J. Signaling positive corporate social performance: An event study of family-friendly firms. Bus. Soc. 2001, 42, 59–78. [Google Scholar] [CrossRef]

- Hill, C.W.L.; Jones, T.M. Stakeholder-agency theory. J. Manag. Stud. 1992, 29, 131–154. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. Rev. 1985, 28, 446–463. [Google Scholar] [CrossRef]

- Okamoto, D. Social relationship of a firm and the CSP–CFP relationship in Japan: Using artificial neural networks. J. Bus. Ethics 2009, 87, 117–132. [Google Scholar] [CrossRef]

- Eom, K.; Nam, G. Effect of Entry into Socially Responsible Investment Index on Cost of Equity and Firm Value. Sustainability 2017, 9, 717. [Google Scholar] [CrossRef]

- Loh, L.; Thomas, T.; Wang, Y. Sustainability Reporting and Firm Value: Evidence from Singapore-Listed Companies. Sustainability 2017, 9, 2112. [Google Scholar] [CrossRef]

- Li, W.; Zhang, R. Corporate social responsibility, ownership structure, and political interference: Evidence from China. J. Bus. Ethics 2010, 96, 631–645. [Google Scholar] [CrossRef]

- Li, A.; Xia, X. Are controlling shareholders influencing the relationship between corporate social responsibility and earnings quality? Evidence from Chinese listed companies. Emerg. Mark. Financ. Trade 2018, 54, 1047–1062. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, L.-Y.; Leung, A.S.M. Corporate social responsibility, firm reputation, and firm performance: The role of ethical leadership. Asia Pac. J. Manag. 2014, 31, 925–947. [Google Scholar] [CrossRef]

- Cockburn, I.A.; Henderson, R.M.; Stern, S. Untangling the origins of competitive advantage. Strateg. Manag. J. 2000, 21, 1123–1145. [Google Scholar] [CrossRef]

- Keim, G.D. Managerial behavior and the social responsibilities debate: Goals versus constraints. Acad. Manag. J. 1978, 21, 57–68. [Google Scholar] [CrossRef]

- Ullmann, A.A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of U.S. firms. Acad. Manag. Rev. 1985, 10, 540–577. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Chang, S.J. Ownership structure, expropriation, and performance of group-affiliated companies in Korea. Acad. Manag. J. 2003, 46, 238–253. [Google Scholar] [CrossRef]

- Cho, D.-S.; Kim, J. Outside directors, ownership structure and firm profitability in Korea. Corp. Gov. 2007, 15, 239–250. [Google Scholar] [CrossRef]

- Claessens, S.; Djankov, S.; Lang, L.H.P. The separation of ownership and control in East Asian corporations. J. Financ. Econ. 2000, 58, 81–112. [Google Scholar] [CrossRef]

- Johnson, S.; La Porta, R.; Lopez-De-Silanes, F.; Shleifer, A. Tunneling. Am. Econ. Rev. 2000, 90, 22–27. [Google Scholar] [CrossRef]

- Bae, K.-H.; Kang, J.-K.; Kim, J.-M. Tunneling or value added? Evidence from mergers by Korean business groups. J. Financ. 2002, 57, 2695–2740. [Google Scholar] [CrossRef]

- Kim, B.; Lee, I. Agency problems and performance of Korean companies during the Asian financial crisis: Chaebol vs. non-chaebol firms. Pac. Basin Financ. J. 2003, 11, 327–348. [Google Scholar] [CrossRef]

- Joh, S.W. Corporate governance and firm profitability: Evidence from Korea before the economic crisis. J. Financ. Econ. 2003, 68, 287–322. [Google Scholar] [CrossRef]

- Kim, H.; Kim, H.; Lee, P.M. Ownership structure and the relationship between financial slack and R&D investments: Evidence from Korean firms. Organ. Sci. 2008, 19, 404–418. [Google Scholar] [CrossRef]

- StataCorp. Stata Statistical Software: Release 13; StataCorp LP: College Station, TX, USA, 2013. [Google Scholar]

- Chung, K.H.; Pruitt, S.W. A simple approximation of Tobin’s q. Financ. Manag. 1994, 23, 70–74. [Google Scholar] [CrossRef]

- McConnell, J.J.; Servaes, H. Additional evidence on equity ownership and corporate value. J. Financ. Econ. 1990, 27, 595–612. [Google Scholar] [CrossRef]

- Berger, P.G.; Ofek, E. Diversification’s effect on firm value. J. Financ. Econ. 1995, 37, 39–65. [Google Scholar] [CrossRef]

- Nollet, J.; Filis, G.; Mitrokostas, E. Corporate social responsibility and financial performance: A non-linear and disaggregated approach. Econ. Model. 2016, 52, 400–407. [Google Scholar] [CrossRef]

- Lacy, P.; Cooper, T.; Hayward, R.; Neuberger, L. A New Era of Sustainability: UN Global Compact–Accenture CEO Study; United Nations Global Compact and Accenture: New York, NY, USA, 2010; Available online: https://www.unglobalcompact.org/docs/news_events/8.1/UNGC_Accenture_CEO_Study_2010.pdf (accessed on 2 April 2018).

- White, H. A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).