Corporate Social Responsibility and Operational Inefficiency: A Dynamic Approach

Abstract

1. Introduction

2. Corporate Social Responsibility and Operational Inefficiency

2.1. Corporate Social Responsibility and Corporate Performance

2.2. Resource-Based View and Operational Inefficiency

3. Methods

3.1. The Measurement of Dynamic Inefficiency

3.2. The Analysis of the Relation between CSR and Dynamic Inefficiency

4. Dataset and Variables

4.1. Dataset

4.2. Variables to Compute Dynamic Inefficiency

4.3. Variables to be Used in the Regression

5. Results and Discussion

5.1. Results of Dynamic Inefficiency Indicators

5.2. Results of Regression

5.2.1. Main Analysis and Hypotheses Testing: CSR and Its Components

5.2.2. Additional Analysis: CSR by Strengths and Concerns

5.2.3. Endogeneity of Dynamic Inefficiency

5.2.4. Robustness Tests

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Carroll, A.B. A three-dimensional conceptual model of corporate social performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Florackis, C.; Kim, H. Advancing the corporate governance research agenda. Corp. Gov. Int. Rev. 2016, 24, 172–180. [Google Scholar] [CrossRef]

- Surroca, J.; Tribo, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Andrews, K.R. Can best corporations be made moral. Harv. Bus. Rev. 1973, 51, 57–64. [Google Scholar]

- Burke, L.; Logsdon, L.M. How corporate social responsibility pays off. Long Range Plan. 1996, 29, 495–502. [Google Scholar] [CrossRef]

- Antal, A.B.; Sobczak, A. Corporate social responsibility in France: A mix of national traditions and international influences. Bus. Soc. 2007, 46, 9–32. [Google Scholar] [CrossRef]

- Jain, A. The mandatory CSR in India: A boon or bane. Indian J. Appl. Res. 2014, 4, 301–304. [Google Scholar] [CrossRef]

- Barth, M.E.; Cahan, S.F.; Chen, L.; Venter, E.R. The economic consequences associated with integrated report quality: Early evidence from a mandatory setting. Capital market and real effects. Account. Organ. Soc. 2017, 62, 43–64. [Google Scholar] [CrossRef]

- Vallentin, S.; Murillo, D. Governmentality and the politics of CSR. Organization 2012, 19, 825–843. [Google Scholar] [CrossRef]

- Orlitzky, M.; Benjamin, J.D. Corporate social performance and firm risk: A meta-analytic review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Friedman, M. Capitalism and Freedom; University of Chicago Press: Chicago, IL, USA, 1962. [Google Scholar]

- Friedman, M. The Social Responsibility of Business Is to Increase Its Profits. 1970. Available online: https://www.colorado.edu/studentgroups/libertarians/issues/friedman-soc-resp-business.html (accessed on 20 October 2017).

- Preston, L.E.; O’Bannon, D.P. The corporate social-financial performance relationship: A typology and analysis. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman Publishing: Boston, MA, USA, 1984. [Google Scholar]

- Donaldson, T.; Preston, L. The stakeholder theory of the corporation: Concepts, evidence and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Jones, T. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Garriga, E.; Melé, D. Corporate social responsibility theories: Mapping the territory. J. Bus. Ethics 2004, 53, 51–71. [Google Scholar] [CrossRef]

- Mosca, F.; Civera, C. The evolution of CSR: An integrated approach. Symphonya Emerg. Issues Manag. 2017, 1, 16–35. [Google Scholar]

- European Commission. A renewed EU strategy 2011–2014 for Corporate Social Responsibility. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; European Commission: Brussels, Belgium, 2011; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52011DC0681&from=EN (accessed on 20 June 2018).

- Salvioni, D.M.; Gennari, F.; Bosetti, L. Sustainability and convergence: The future of corporate governance systems? Sustainability 2016, 8, 1203. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate social responsibility and resource-based perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Vitaliano, D.F.; Stella, G.P. The cost of corporate social responsibility: The case of the community reinvestment act. J. Product. Anal. 2006, 26, 235–244. [Google Scholar] [CrossRef]

- Fried, H.O.; Lovell, C.A.K.; Schmidt, S.S. The Measurement of Productive Efficiency and Productivity Change; Oxford University Press: Oxford, UK, 2008. [Google Scholar]

- Silva, E.; Lansink, A.O.; Stefanou, S.E. The adjustment-cost model of the firm: Duality and productive efficiency. Int. J. Prod. Econ. 2015, 168, 245–256. [Google Scholar] [CrossRef]

- Kapelko, M.; Lansink, A.O.; Stefanou, S.E. Assessing dynamic inefficiency of the Spanish construction sector pre- and post-financial crisis. Eur. J. Oper. Res. 2014, 237, 349–357. [Google Scholar] [CrossRef]

- Silva, E.; Stefanou, S.E. Dynamic efficiency measurement: Theory and application. Am. J. Agric. Econ. 2007, 89, 398–419. [Google Scholar] [CrossRef]

- Silva, E.; Stefanou, S.E. Nonparametric dynamic production analysis and the theory of cost. J. Prod. Anal. 2003, 19, 5–32. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A Resource-based Perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- Dawkins, C.; Fraas, J.W. Coming clean: The impact of environmental performance and visibility on corporate climate change disclosure. J. Bus. Ethics 2010, 100, 303–322. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. Industry performance and investment in R&D and capital goods. J. High Technol. Manag. Res. 1994, 5, 1–17. [Google Scholar]

- Lu, W.-M.; Wang, W.-K.; Lee, H.-L. The relationship between corporate social responsibility and corporate performance: Evidence from the US semiconductor industry. Int. J. Prod. Res. 2013, 51, 5683–5695. [Google Scholar] [CrossRef]

- Wang, W.-K.; Lu, W.-M.; Kweh, Q.L.; Lai, H.-W. Does corporate social responsibility influence the corporate performance of the U.S. telecommunications industry? Telecommun. Policy 2014, 38, 580–591. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Jo, H.; Na, H. Does CSR reduce firm risk? Evidence from controversial industry sectors. J. Bus. Ethics 2012, 110, 441–456. [Google Scholar] [CrossRef]

- Kim, Y.; Park, M.S.; Wier, B. Is earnings quality associated with corporate social responsibility? Account. Rev. 2012, 87, 761–796. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, Z.O.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.; Mishra, D. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G. The impact of corporate social responsibility on the cost of bank loan. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The relationship between corporate social responsibility and shareholder value: An empirical test of the risk managment hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Godfrey, P.C. The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Guillamon-Saorin, E.; Guiral, A.; Blanco, B. Managing risk with socially responsible actions in firms involved in controversial activities and earnings management. Span. J. Financ. Account. 2018, 47, 1–24. [Google Scholar] [CrossRef]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Thauer, C. Goodness comes from within: Intra-organizational dynamics of corporate social responsibility. Bus. Soc. 2014, 53, 483–516. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Sirghi, N.; Curea-Pitorac, R.-I.; Hategan, V.-P. Doing well of doing good: The relationship between corporate social responsibility and profit in Romanian companies. Sustainability 2018, 10, 1041. [Google Scholar] [CrossRef]

- Flammer, C. Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manag. Sci. 2015, 61, 2549–2568. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Lev, B.; Petrovits, C.; Radhakrishnan, S. Is doing good good for you? How corporate charitable contributions enhance revenue growth. Strateg. Manag. J. 2010, 31, 182–200. [Google Scholar] [CrossRef]

- Callan, S.J.; Thomas, J.M. Corporate financial performance and corporate social performance: An update and reinvestigation. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 61–78. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporal social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Hull, C.E.; Rothenberg, S. Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strateg. Manag. J. 2008, 29, 781–789. [Google Scholar] [CrossRef]

- Pavelin, S.; Porter, L.A. The corporate social performance content of innovation in the UK. J. Bus. Ethics 2007, 80, 711–725. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Feng, Y.; Chen, H.H.; Tang, J. The impacts of social responsibility and ownership structure on sustainable financial development of China’s energy industry. Sustainability 2018, 10, 301. [Google Scholar] [CrossRef]

- Lee, M.; Kim, H. Exploring the organizational culture’s moderating role of effects of corporate social responsibility (CSR) on firm performance: Focused on corporate contributions in Korea. Sustainability 2017, 9, 1883. [Google Scholar] [CrossRef]

- Wang, D.H.M.; Chen, P.H.; Yu, T.H.K.; Hsiao, C.Y. The effects of corporate social responsibility on brand equity and firm performance. J. Bus. Res. 2015, 68, 2232–2236. [Google Scholar] [CrossRef]

- Blanco, B.; Guillamón-Saorín, E.; Guiral, A. Do Non-socially responsible companies achieve legitimacy through socially responsible actions? The mediating effect of innovation. J. Bus. Ethics 2013, 117, 67–87. [Google Scholar] [CrossRef]

- Al Abri, I.; Bi, X.; Mullally, C.; Hodges, A. Under what conditions does it pay to be sustainable? Sources of heterogeneity in corporate sustainability impacts. Econ. Lett. 2017, 159, 15–17. [Google Scholar] [CrossRef]

- Servaes, H.; Tamayo, A. The impact of corporate social responsibility on firm value: The role of customer awareness. Manag. Sci. 2013, 59, 1045–1061. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strateg. Manag. J. 2008, 29, 1325–1343. [Google Scholar] [CrossRef]

- Price, J.M.; Sun, W. Doing good and doing bad: The impact of corporate social responsibility and irresponsibility on firm performance. J. Bus. Res. 2017, 80, 82–97. [Google Scholar] [CrossRef]

- Grougiou, V.; Dedoulis, E.; Leventis, S. Corporate social responsibility reporting and organizational stigma: The case of “sin” industries. J. Bus. Res. 2016, 69, 905–914. [Google Scholar] [CrossRef]

- Morrison-Paul, C.J.; Siegel, D.S. Corporate social responsibility and economic performance. J. Prod. Anal. 2006, 26, 207–2011. [Google Scholar] [CrossRef]

- Sun, L.; Stuebs, M. Corporate social responsibility and firm productivity: Evidence from the chemical industry in the United States. J. Bus. Ethics 2013, 118, 251–263. [Google Scholar] [CrossRef]

- Chapple, W.; Harris, R.; Morrison Paul, C.J. The cost implications of waste reduction: Factor demand, competitiveness and policy implications. J. Prod. Anal. 2006, 26, 245–258. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Pasurka, C.A. Social responsibility: U.S. power plants 1985–1998. J. Prod. Anal. 2006, 26, 259–267. [Google Scholar] [CrossRef]

- Shadbegian, R.J.; Gray, W.B. Assessing multi-dimensional performance: Environmental and economic outcomes. J. Prod. Anal. 2006, 26, 2013–2234. [Google Scholar] [CrossRef]

- Granderson, G. Parametric analysis of cost inefficiency and the decomposition of productivity growth for regulated firms. Appl. Econ. 1997, 29, 339–348. [Google Scholar] [CrossRef]

- Puggioni, D.; Stefanou, S.E. The Value of Being Socially Responsible: A Primal-Dual Approach. 2018. Available online: https://ssrn.com/abstract=3179144 (accessed on 20 June 2018).

- Belu, C.; Manescu, C. Strategic corporate social responsibility and economic performance. Appl. Econ. 2013, 45, 2751–2764. [Google Scholar] [CrossRef]

- Chen, C.-M.; Delmas, M. Measuring corporate social performance: An efficiency perspective. Prod. Oper. Manag. 2011, 20, 789–804. [Google Scholar] [CrossRef]

- Fahy, J.; Smithee, A. Strategic marketing and the Resource Based View of the Firm. J. Acad. Mark. Sci. Rev. 1999, 10, 1–20. [Google Scholar]

- Hunt, S.D. A general theory of business marketing: R-A theory, Alderson, the ISBM Framework and the IMP theoretical structure. Ind. Mark. Manag. 2013, 41, 283–293. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Hamel, G. The Core Competence of the Corporation. Harv. Bus. Rev. 1990, 68, 79–91. [Google Scholar]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Guest editors’ introduction, corporate social responsibility: Strategic implications. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef]

- Mathews, J.A. A resource-based view of Schumpetenian economic dynamics. J. Evol. Econ. 2003, 12, 29–54. [Google Scholar] [CrossRef]

- Dierickx, I.; Cool, K. Asset stock accumulation and sustainability of competitive advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Wright, P.M.; Dunford, B.B.; Snell, S.A. Human resources and the resource based view of the firm. J. Manag. 2001, 27, 701–721. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Fombrun, C.; Shanley, M. What´s in a name? Reputation building and corporate strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar]

- Weigelt, K.; Camerer, C. Reputation and corporate strategy: A review of recent theory and applications. Strateg. Manag. J. 1988, 9, 443–454. [Google Scholar] [CrossRef]

- Tang, Z.; Hull, E.; Rothenberg, S. How corporate social responsibility engagement strategy moderates the CSR-financial performance relationship. J. Manag. Stud. 2012, 49, 1274–1303. [Google Scholar] [CrossRef]

- Pablo, G.-C.; Encarna, G.-S.; Osma, B.G. The illusion of CSR: Drawing the line between core and supplementary CSR. Sustain. Account. Manag. Policy J. 2016, 7, 125–151. [Google Scholar]

- Klassen, R.D.; Whybark, D.C. The impact of environmental technologies on manufacturing performance. Acad. Manag. J. 1999, 42, 599–615. [Google Scholar]

- Fallah-Fini, S.; Triantis, K.; Johnson, A.L. Reviewing the literature on non-parametric dynamic efficiency measurement: State-of-the-art. J. Prod. Anal. 2014, 41, 51–67. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA: A slacks-based measure approach. Omega 2010, 38, 145–156. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S. Intertemporal Production Frontiers: With Dynamic DEA; Kluwer Academic Publishers: Boston, MA, USA, 1996. [Google Scholar]

- Nemoto, J.; Goto, M. Dynamic Data Envelopment Analysis: Modeling intertemporal behavior of a firm in the presence of productive inefficiencies. Econ. Lett. 1999, 64, 51–56. [Google Scholar] [CrossRef]

- Chen, C.-M.; Van Dalen, J. Measuring dynamic efficiency: Theories and an integrated methodology. Eur. J. Oper. Res. 2010, 203, 749–760. [Google Scholar] [CrossRef]

- Chen, C.-M. A network-DEA model with new efficiency measures to incorporate the dynamic effect in production networks. Eur. J. Oper. Res. 2009, 194, 687–699. [Google Scholar] [CrossRef]

- Kao, C. Dynamic data envelopment analysis: A relational analysis. Eur. J. Oper. Res. 2013, 227, 325–330. [Google Scholar] [CrossRef]

- Treadway, A. Adjustment costs and variable inputs in the theory of the competitive firm. J. Econ. Theory 1970, 2, 329–347. [Google Scholar] [CrossRef]

- Lucas, R.E. Adjustment costs and the theory of supply. J. Political Econ. 1967, 75, 321–334. [Google Scholar] [CrossRef]

- Eisner, R.; Strotz, R.H. Determinants of Business Investment; Prentice-Hall Inc.: New York, NY, USA, 1963. [Google Scholar]

- O’Donnell, C.J.; Prasada Rao, D.S.; Battese, G.E. Metafrontier frameworks for the study of firm-level efficiencies and technology ratios. Empir. Econ. 2008, 34, 231–255. [Google Scholar] [CrossRef]

- Wooldridge, J. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, UK, 2002. [Google Scholar]

- Li, M. Using the propensity score method to estimate causal effects. A review and practical guide. Organ. Res. Methods 2013, 16, 188–226. [Google Scholar] [CrossRef]

- Prior, D.; Surroca, J.; Tribo, J.A. Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corp. Gov. 2008, 16, 160–177. [Google Scholar] [CrossRef]

- Shen, C.-H.; Chang, Y. Ambitious versus conscience, does corporate social responsibility pay off? J. Bus. Ethics 2009, 88, 133–153. [Google Scholar] [CrossRef]

- Salazar, J.; Husted, B.; Biehl, M. Thoughts on the evaluation of corporate social performance through projects. J. Bus. Ethics 2012, 105, 175–186. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The central role of propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Beck, N.; Brüderl, J.; Woywode, M. Momentum or deceleration? Theoretical and methodological reflections on the analysis of organizational change. Acad. Manag. J. 2008, 51, 413–435. [Google Scholar] [CrossRef]

- Love, J.H.; Roperb, S.; Vahterc, P. Dynamic complementarities in innovation strategies. Res. Policy 2014, 43, 1774–1784. [Google Scholar] [CrossRef]

- Cassiman, B.; Veugelers, R. In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar]

- Cheng, M.; Dhaliwal, D.; Zhang, Y. Does investment efficiency improve after the disclosure of material weaknesses in internal control over financial reporting? J. Account. Econ. 2013, 56, 1–18. [Google Scholar] [CrossRef]

- Dehejia, R.; Wahba, S. Propensity score-matching methods for nonexperimental causal studies. Rev. Econ. Stat. 2002, 84, 151–161. [Google Scholar] [CrossRef]

- Stuart, E.A. Matching methods for causal inference: A review and a look forward. Stat. Sci. 2010, 25, 1–21. [Google Scholar] [CrossRef] [PubMed]

- Kim, Y.; Li, H.; Li, S. Corporate social responsibility and stock price crash risk. J. Bank. Financ. 2014, 43, 1–13. [Google Scholar] [CrossRef]

- Siegel, D.S.; Vitaliano, D.F. An empirical analysis of the strategic use of corporate social responsibility. J. Econ. Manag. Strategy 2007, 16, 773–792. [Google Scholar] [CrossRef]

- Kang, J. The relationship between corporate diversification and corporate social performance. Strateg. Manag. J. 2013, 34, 94–109. [Google Scholar] [CrossRef]

- Hong, H.; Kacperczyk, M. The price of sin: The effects of social norms on markets. J. Financ. Econ. 2009, 93, 15–36. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Levine, D.I.; Toffel, M.W. How well do social ratings actually measure corporate social responsibility? J. Econ. Manag. Strategy 2009, 18, 125–169. [Google Scholar] [CrossRef]

- MSCI. MSCI USA IMI (USD). Available online: https://www.msci.com/documents/10199/3c4c8412-5d81-4aa9-a9c8-4490f9f5e04a (accessed on 20 October 2017).

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Simar, L. Detecting outliers in frontier models: A simple approach. J. Prod. Anal. 2003, 20, 391–424. [Google Scholar] [CrossRef]

- You, T.; Zi, H. The economic crisis and efficiency change: Evidence from the Korean construction industry. Appl. Econ. 2007, 39, 1833–1842. [Google Scholar] [CrossRef]

- Bureau of Labor Statistics. Producer Price Indexes. 2017. Available online: https://www.bls.gov/ppi/ (accessed on 15 May 2017).

- Venturelli, A.; Caputo, F.; Cosma, S.; Leopizzi, R.; Pizzi, S. Directive 2014/95/EU: Are Italian Companies Already Compliant? Sustainability 2017, 9, 1385. [Google Scholar] [CrossRef]

- Matuszak, Ł.; Różańska, E. CSR disclosure in Polish-listed companies in the light of Directive 2014/95/EU Requirements: Empirical evidence. Sustainability 2017, 9, 2304. [Google Scholar] [CrossRef]

- Lys, T.; Naughton, J.P.; Wang, C. Signaling through corporate accountability reporting. J. Account. Econ. 2015, 60, 56–72. [Google Scholar] [CrossRef]

- Mahoney, L.; Roberts, R.W. Corporate social performance, financial performance and institutional ownership in Canadian firms. Account. Forum 2007, 31, 233–253. [Google Scholar] [CrossRef]

- National Bureau of Economic Research. US Business Cycle Expansions and Contractions. 2012. Available online: http://www.nber.org/cycles.html (accessed on 20 January 2018).

- Kruger, P. Corporate goodness and shareholder wealth. J. Financ. Econ. 2015, 115, 304–329. [Google Scholar] [CrossRef]

- Mattingly, J.E.; Berman, S. Measurement of corporate social actions: Discovering taxonomy in the Kinder Lydenburg Domini ratings data. Bus. Soc. 2006, 45, 20–46. [Google Scholar] [CrossRef]

- Lansink, A.O.; Stefanou, S.E.; Serra, T. Primal and dual dynamic Luenberger productivity indicators. Eur. J. Oper. Res. 2015, 241, 555–563. [Google Scholar] [CrossRef]

| Year | Number of Observations | Percentage |

|---|---|---|

| 2004 | 2239 | 9.5034% |

| 2005 | 1979 | 8.3998% |

| 2006 | 1955 | 8.2980% |

| 2007 | 1895 | 8.0433% |

| 2008 | 1931 | 8.1961% |

| 2009 | 2016 | 8.5569% |

| 2010 | 2034 | 8.6333% |

| 2011 | 2079 | 8.8243% |

| 2012 | 2028 | 8.6078% |

| 2013 | 1801 | 7.6443% |

| 2014 | 1794 | 7.6146% |

| 2015 | 1809 | 7.6783% |

| Total | 23,560 | 100.00% |

| Description | 2-Digit SIC | Number of Observations | Percentage |

|---|---|---|---|

| Construction | 10 | 328 | 1.3922% |

| Finance | 37 | 3061 | 12.9924% |

| Manufacturing | 38 | 10,162 | 43.1324% |

| Mining | 39 | 1048 | 4.4482% |

| Retail Trade | 48 | 1784 | 7.5722% |

| Services | 49 | 4030 | 17.1053% |

| Transportation | 50 | 2439 | 10.3523% |

| Wholesale Trade | 51 | 708 | 3.0051% |

| Total | 23,560 | 100.00% |

| Variable | Mean | Std. Dev. | Coefficient of Variation |

|---|---|---|---|

| Fixed assets | 1593.0723 | 6614.7583 | 4.1522 |

| Number of employees | 0.0156 | 0.06133 | 3.9195 |

| Costs of goods sold | 2422.1287 | 10,171.1768 | 4.1993 |

| Revenues | 4052.5167 | 14,113.2248 | 3.4826 |

| Investments | 332.2238 | 1394.8208 | 4.1984 |

| Variable | Mean | Std. Dev. | Coefficient of Variation |

|---|---|---|---|

| Dependent variables | |||

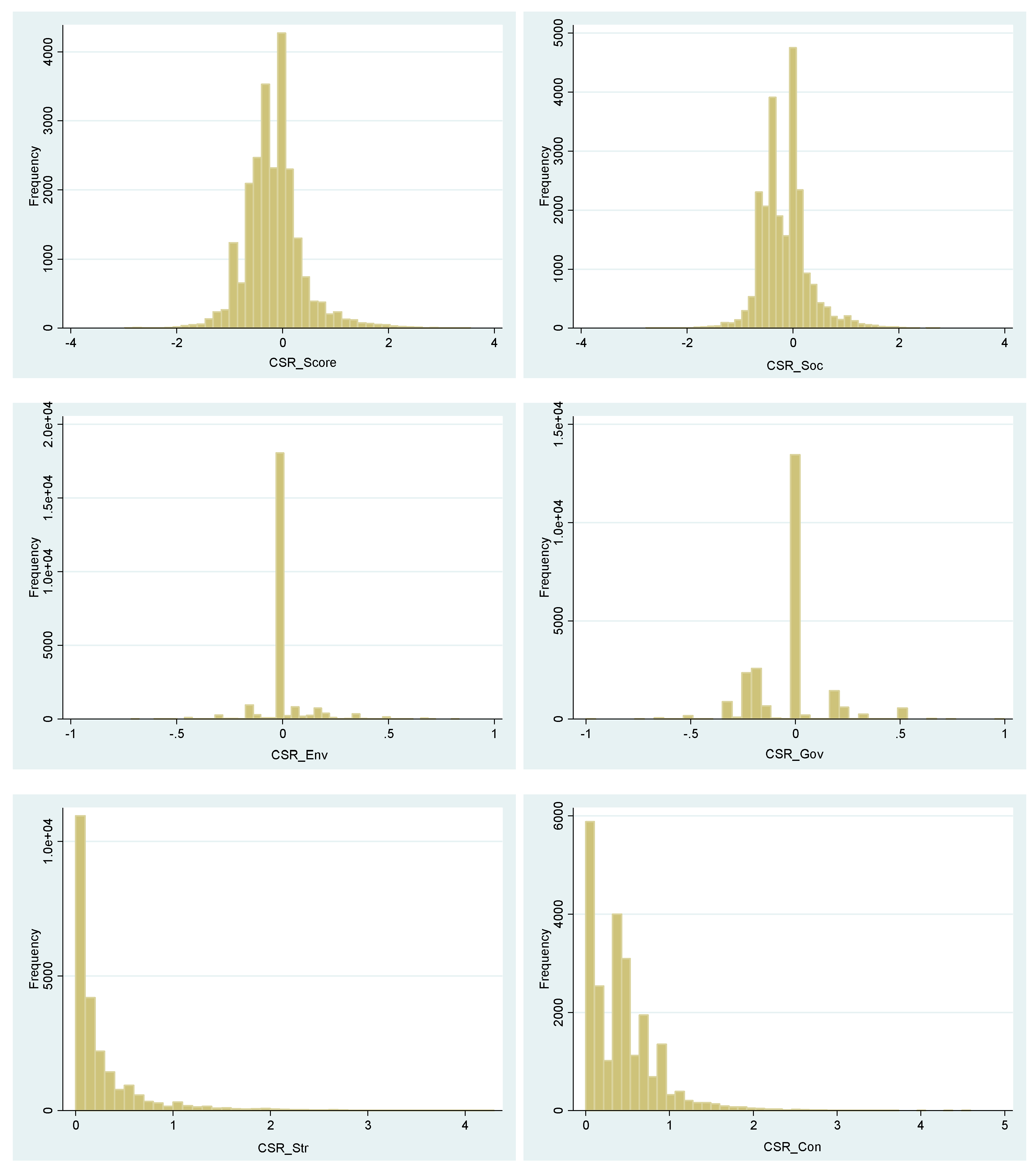

| CSR_Score | −0.1687 | 0.5503 | −3.2620 |

| CSR_Soc | −0.1475 | 0.4519 | −3.0637 |

| CSR_Env | 0.0116 | 0.1096 | 9.4483 |

| CSR_Gov | −0.0329 | 0.1715 | −5.2128 |

| CSR_Str | 0.2655 | 0.4622 | 1.7409 |

| CSR_Con | 0.4342 | 0.4329 | 0.9970 |

| Variable of interest | |||

| Inefficiency | 0.7447 | 0.2029 | 0.2724 |

| Control variables | |||

| Size | 7.4137 | 1.6861 | 0.2274 |

| Leverage | 0.1906 | 0.2148 | 1.1268 |

| MTB | 3.1425 | 40.4531 | 12.8727 |

| ROA | 0.0247 | 0.1535 | 6.2163 |

| R&D | 2.5188 | 188.5142 | 74.8429 |

| Marketing | 0.01289 | 0.0709 | 5.5004 |

| Cash flow | 0.0624 | 0.1552 | 2.4852 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) CSR Score | 1.0000 | |||||||||||||

| (2) CSR_Soc | 0.9252 (0.0000) | 1.0000 | ||||||||||||

| (3) CSR_Env | 0.4431 (0.0000) | 0.2419 (0.0000) | 1.0000 (0.0000) | |||||||||||

| (4) CSR_Gov | 0.4882 (0.0000) | 0.1796 (0.0000) | 0.1457 (0.0000) | 1.0000 (0.0000) | ||||||||||

| (5) CSR_Str | 0.6469 (0.0000) | 0.5705 (0.0000) | 0.4433 (0.0000) | 0.2893 (0.0000) | 1.0000 | |||||||||

| (6) CSR_Con | −0.5807 (0.0000) | −0.5671 (0.0000) | −0.0900 (0.0000) | −0.3118 (0.0000) | 0.2452 (0.0000) | 1.0000 | ||||||||

| (7) Inefficiency | −0.1135 (0.0000) | −0.1410 (0.0000) | −0.0099 (0.1280) | 0.0138 (0.0341) | −0.2840 (0.0000) | −0.1590 (0.0000) | 1.0000 | |||||||

| (8) Size | 0.2050 (0.0000) | 0.2263 (0.0000) | 0.1182 (0.0000) | −0.0139 (0.0323) | 0.5043 (0.0000) | 0.2778 (0.0000) | −0.3592 (0.0000) | 1.0000 | ||||||

| (9) Leverage | −0.0292 (0.0000) | −0.0189 (0.0037) | −0.0123 (0.0588) | −0.0361 (0.0000) | 0.0094 (0.1507) | 0.0472 (0.0000) | 0.0031 (0.6333) | 0.1865 (0.0000) | 1.0000 | |||||

| (10) MTB | 0.0060 (0.3548) | 0.0054 (0.4108) | 0.0054 (0.4076) | 0.0018 (0.7849) | 0.0072 (0.2712) | −0.0001 (0.9987) | −0.0083 (0.2042) | −0.0028 (0.6684) | −0.0076 (0.2421) | 1.0000 | ||||

| (11) ROA | 0.0478 (0.0000) | 0.0473 (0.0000) | 0.0352 (0.0000) | 0.0060 (0.3595) | 0.0830 (0.0000) | 0.0279 (0.0000) | −0.0421 (0.0000) | 0.1901 (0.0000) | −0.0982 (0.0000) | −0.0020 (0.7574) | 1.0000 | |||

| (12) R&D | 0.0013 (0.8431) | 0.0043 (0.5081) | −0.0013 (0.8407) | −0.0064 (0.3272) | −0.0013 (0.8389) | −0.0031 (0.6393) | 0.0123 (0.0584) | −0.0128 (0.0501) | 0.0124 (0.0567) | −0.0001 (0.9925) | −0.0606 (0.0000) | 1.0000 | ||

| (13) Marketing | 0.0289 (0.0000) | 0.0307 (0.0000) | 0.0259 (0.0001) | −0.0049 (0.4538) | 0.0144 (0.0267) | −0.0213 (0.0011) | −0.0184 (0.0048) | −0.0249 (0.0001) | −0.0013 (0.8416) | 0.0039 (0.5482) | −0.0440 (0.0000) | −0.0015 (0.8194) | 1.0000 | |

| (14) Cash flow | 0.0364 (0.0000) | 0.0380 (0.0000) | 0.0290 (0.0000) | −0.0019 (0.7666) | 0.0797 (0.0000) | 0.0388 (0.0000) | −0.0355 (0.0000) | 0.1618 (0.0000) | −0.0608 (0.0000) | −0.0015 (0.8202) | 0.9797 (0.0000) | −0.0609 (0.0000) | −0.0439 (0.0000) | 1.0000 |

| Period | All | Construction | Finance | Manufacturing | Mining | Retail Trade | Services | Transportation | Wholesale Trade |

|---|---|---|---|---|---|---|---|---|---|

| 2004 | 0.7366 | 0.6828 | 0.6839 | 0.7648 | 0.4928 | 0.7919 | 0.7604 | 0.6924 | 0.7543 |

| 2005 | 0.7559 | 0.6661 | 0.7033 | 0.7898 | 0.5667 | 0.7967 | 0.7793 | 0.7067 | 0.7454 |

| 2006 | 0.7649 | 0.7152 | 0.7241 | 0.7901 | 0.6043 | 0.8134 | 0.7817 | 0.7337 | 0.7539 |

| 2007 | 0.7423 | 0.7395 | 0.7176 | 0.7674 | 0.5604 | 0.8010 | 0.7664 | 0.6874 | 0.7109 |

| 2008 | 0.7774 | 0.7591 | 0.7533 | 0.8103 | 0.6799 | 0.8107 | 0.7991 | 0.6850 | 0.7155 |

| 2009 | 0.7348 | 0.8248 | 0.7010 | 0.7593 | 0.5785 | 0.8097 | 0.7453 | 0.6490 | 0.7707 |

| 2010 | 0.7416 | 0.7872 | 0.6812 | 0.7706 | 0.6146 | 0.8077 | 0.7527 | 0.6878 | 0.7308 |

| 2011 | 0.7622 | 0.8275 | 0.7018 | 0.8014 | 0.5797 | 0.8191 | 0.7755 | 0.6963 | 0.7254 |

| 2012 | 0.5814 | 0.8425 | 0.6577 | 0.3835 | 0.6518 | 0.8289 | 0.7855 | 0.7082 | 0.7639 |

| 2013 | 0.7666 | 0.8506 | 0.6234 | 0.8050 | 0.6374 | 0.8443 | 0.7783 | 0.7227 | 0.7772 |

| 2014 | 0.7786 | 0.8487 | 0.6072 | 0.8238 | 0.6482 | 0.8657 | 0.7917 | 0.7351 | 0.7758 |

| 2015 | 0.8098 | 0.8849 | 0.7054 | 0.8310 | 0.6945 | 0.8906 | 0.8460 | 0.7716 | 0.8220 |

| 2004–2015 | 0.7447 | 0.7935 | 0.6907 | 0.7551 | 0.6069 | 0.8220 | 0.7793 | 0.7048 | 0.7540 |

| Pre-crisis | 0.7517 | 0.6887 | 0.7027 | 0.7807 | 0.5562 | 0.8002 | 0.7728 | 0.7108 | 0.7512 |

| Crisis | 0.7513 | 0.7761 | 0.7241 | 0.7785 | 0.6056 | 0.8070 | 0.7698 | 0.6736 | 0.7324 |

| Post-crisis | 0.7375 | 0.8414 | 0.6672 | 0.7296 | 0.6315 | 0.8415 | 0.7876 | 0.7186 | 0.7657 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CSR_Score | CSR_Soc | CSR_Env | CSR_Gov | |

| Variable of interest | ||||

| Inefficiency | −0.1739 *** | −0.1504 *** | 0.0079 * | −0.0314 *** |

| (0.0244) | (0.0213) | (0.0045) | (0.0083) | |

| Control variables | ||||

| Size | 0.0958 *** | 0.0890 *** | −0.0140 *** | 0.0208 *** |

| (0.0152) | (0.0119) | (0.0025) | (0.0047) | |

| Leverage | 0.1322 *** | 0.0834 *** | 0.0036 | 0.0451 *** |

| (0.0365) | (0.0302) | (0.0062) | (0.0121) | |

| MTB | 0.0001 | 0.0001 | −4.24 × 10−6 | 2.62 × 10−5 |

| (0.0001) | (0.0001) | (9.21 × 10−6) | (3.15 × 10−5) | |

| ROA | −0.1979 | −0.5346 ** | 0.2164 *** | 0.1204 |

| (0.3246) | (0.2485) | (0.0549) | (0.1094) | |

| R&D | 2.41 × 10−5 *** | 2.12 × 10−5 *** | 1.81 × 10−6 *** | 1.03× 10−6 |

| (3.12 × 10−6) | (2.22 × 10−6) | (3.59 × 10−7) | (1.15 × 10−6) | |

| Marketing | 0.0385 * | 0.0293 ** | 0.0014 | 0.0078 |

| (0.0215) | (0.0131) | (0.0044) | (0.0069) | |

| Cash flow | 0.1332 | 0.4744* | −0.2202 *** | −0.1210 |

| (0.3298) | (0.2529) | (0.0560) | (0.1115) | |

| Pre-crisis period | −0.1109 *** | −0.0376 *** | −0.0593 *** | −0.0139 *** |

| (0.0163) | (0.0121) | (0.0036) | (0.0050) | |

| Crisis period | −0.1229 *** | −0.0578 *** | −0.0481 *** | −0.0170 *** |

| (0.0138) | (0.0105) | (0.0029) | (0.0041) | |

| Constant | −0.7197 *** | −0.7041 *** | 0.1446 *** | −0.1602 *** |

| (0.1174) | (0.0921) | (0.0204) | (0.0362) | |

| Fixed effects | Yes | Yes | Yes | Yes |

| Observations | 23,560 | 23,560 | 23,560 | 23,560 |

| R2 | 0.0542 | 0.0745 | 0.0753 | 0.0099 |

| (1) | (2) | |

|---|---|---|

| CSR_Str | CSR_Con | |

| Variable of interest | ||

| Inefficiency | −0.1016 *** | 0.0723 *** |

| (0.0192) | (0.0167) | |

| Control variables | ||

| Size | 0.0279 *** | −0.0679 *** |

| (0.0098) | (0.0106) | |

| Leverage | 0.0185 | −0.1137 *** |

| (0.0223) | (0.0278) | |

| MTB | 1.32 × 10−5 | −0.0001 |

| (4.51 × 10−5) | (0.0001) | |

| ROA | −0.1618 | 0.0361 |

| (0.1929) | (0.2308) | |

| R&D | 1.64 × 10−5 *** | −7.67 × 10−6 *** |

| (1.49 × 10−6) | (2.27 x 10−6) | |

| Marketing | −0.0083 | −0.0468 ** |

| (0.0077) | (0.0199) | |

| Cash flow | 0.0964 | −0.0368 |

| (0.1963) | (0.2360) | |

| Pre-crisis period | −0.1250 *** | −0.0141 |

| (0.0107) | (0.0101) | |

| Crisis period | −0.0865 *** | 0.0364 *** |

| (0.0085) | (0.0090) | |

| Constant | 0.1826 ** | 0.9024 *** |

| (0.0774) | (0.0804) | |

| Fixed effects | Yes | Yes |

| Observations | 23,560 | 23,560 |

| R2 | 0.1973 | 0.0722 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| First-Stage Dynamic Inefficiency | Matched-Sample CSR_Score | Matched-Sample CSR_Soc | Matched-Sample CSR_Env | Matched-Sample CSR_Gov | Matched-Sample CSR_Str | Matched-Sample CSR_Con | |

| Variable of interest | |||||||

| Inefficiency | −0.2341 *** | −0.1971 *** | 0.0206 *** | −0.0575 *** | −0.0339 *** | 0.2002 *** | |

| (0.0118) | (0.0097) | (0.0023) | (0.0038) | (0.0088) | (0.0076) | ||

| Control variables | |||||||

| Size | −0.1199 *** | 0.0912 *** | 0.0756 *** | −0.0137 *** | 0.0293 *** | 0.0482 *** | −0.0430 *** |

| (0.0094) | (0.0083) | (0.0067) | (0.0015) | (0.0028) | (0.0056) | (0.0058) | |

| Leverage | 0.1824 ** | 0.1731 *** | 0.0818 *** | 0.0325 *** | 0.0588 *** | 0.0693 *** | −0.1039 *** |

| (0.0884) | (0.0258) | (0.0204) | (0.0043) | (0.0091) | (0.0163) | (0.0181) | |

| MTB | −0.0008 ** | −4.7 × 10−5 | −4.46 × 10−5 | −5.53 × 10−6 | 3.14 × 10−6 | −0.0001 | −1.27 × 10−5 |

| (0.0004) | (0.0001) | (0.0001) | (1.09 × 10−5) | (2.2 × 10−5) | (4.53 × 10−5) | (4.53 × 10−5) | |

| ROA | 1.7503 *** | −0.8402 *** | −0.5108 *** | 0.3026 *** | −0.6320 *** | −0.6245 *** | 0.2156 * |

| (0.5331) | (0.1900) | (0.1429) | (0.0342) | (0.0804) | (0.1172) | (0.1266) | |

| R&D | 2.3 × 10−5 | 2.8 × 10−5 *** | 2.18 × 10−5 *** | 3.24 × 10−6** | 2.50 × 10−6 | 2.03 × 10−5*** | −7.26 × 10−6 |

| (0.0002) | (9.92 × 10−6) | (7.01 × 10−6) | (1.34 × 10−6) | (3.30 × 10−6) | (4.90 × 10−6) | (5.69 × 10−6) | |

| Marketing | 1.1013 * | 0.0394 | 0.0281 | 0.0024 | 0.0090 | −0.0120 * | −0.0514 ** |

| (0.6482) | (0.0261) | (0.0182) | (0.0038) | (0.0068) | (0.0064) | (0.0240) | |

| Cash flow | −1.5446 *** | 0.8210 *** | 0.4848 *** | −0.3154 *** | 0.6516 *** | 0.5622 *** | −0.2587 ** |

| (0.5203) | (0.1931) | (0.1452) | (0.0349) | (0.0821) | (0.1193) | (0.1288) | |

| Pre-crisis period | 0.4430 *** | −0.1374 *** | −0.0536 *** | −0.0598 *** | −0.0240 *** | −0.1455 *** | −0.0082 |

| (0.0466) | (0.0100) | (0.0079) | (0.0021) | (0.0035) | (0.0073) | (0.0072) | |

| Crisis period | 0.4933 *** | −0.1423 *** | −0.0759 *** | −0.0508 *** | −0.0156 *** | −0.1111 *** | 0.0312 *** |

| (0.0486) | (0.0081) | (0.0064) | (0.0016) | (0.0027) | (0.0057) | (0.0056) | |

| Constant | 2.6398 *** | −0.7156 *** | −0.5888 *** | 0.1203 *** | −0.2471 *** | −0.0386 | 0.6769 *** |

| (0.0808) | (0.0626) | (0.0508) | (0.0114) | (0.0215) | (0.0425) | (0.0447) | |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 23,560 | 23,558 | 23,558 | 23,558 | 23,558 | 23,558 | 23,558 |

| R2 | 0.0574 | 0.6651 | 0.6671 | 0.6711 | 0.4880 | 0.7708 | 0.7656 |

| Treated sample: | |||||||

| CSR_Soc/CSR_ Env/CSR_Gov mean | −0.1734 | −0.1512 | 0.0117 | −0.0338 | 0.2568 | 0.4301 | |

| Observations | 22,858 | 22,858 | 22,858 | 22,858 | 22,858 | 22,858 | |

| Control sample: | |||||||

| CSR_Soc/CSR_ Env/CSR_Gov mean | −0.0169 | −0.0242 | 0.0090 | −0.0016 | 0.5512 | 0.5681 | |

| Observations | 699 | 699 | 699 | 699 | 699 | 699 | |

| Mean difference—t test | −0.1565 *** | −0.1270 *** | 0.0027* | −0.0322 ** | −0.2945 *** | −0.1380 *** |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guillamon-Saorin, E.; Kapelko, M.; Stefanou, S.E. Corporate Social Responsibility and Operational Inefficiency: A Dynamic Approach. Sustainability 2018, 10, 2277. https://doi.org/10.3390/su10072277

Guillamon-Saorin E, Kapelko M, Stefanou SE. Corporate Social Responsibility and Operational Inefficiency: A Dynamic Approach. Sustainability. 2018; 10(7):2277. https://doi.org/10.3390/su10072277

Chicago/Turabian StyleGuillamon-Saorin, Encarna, Magdalena Kapelko, and Spiro E. Stefanou. 2018. "Corporate Social Responsibility and Operational Inefficiency: A Dynamic Approach" Sustainability 10, no. 7: 2277. https://doi.org/10.3390/su10072277

APA StyleGuillamon-Saorin, E., Kapelko, M., & Stefanou, S. E. (2018). Corporate Social Responsibility and Operational Inefficiency: A Dynamic Approach. Sustainability, 10(7), 2277. https://doi.org/10.3390/su10072277