1. Introduction

Public–Private Partnership (PPP) is a long-time cooperative relationship between the government and private company [

1], which has become an important way of infrastructure construction and public service providence [

2,

3]. As the supervisor of the projects, the public sector cares about the total benefits of PPP projects, including economic, social and environmental aspects, which are in accordance with the sustainability, while the private sector pays more attention to the profits of company through finishing the construction, financing, operation and other tasks according to the contract as the implementor of the projects. The capital structure of a PPP project includes the source and structure of equity and debt funds, equity–debt ratio, etc., which determine the sufficiency and stability of funds [

4]. In practice, many PPP projects suffer from the difficulties of unreasonable capital structure. The main reason why Wuhan Metro Line 8 project was examined by China’s Ministry of Finance is that its debt is in the name of equity and the irrational rate of return [

5]. Moreover, with the increase of investment in Hangzhou Bay Sea-Crossing Bridge, the private sector suffered high pressure of huge funding gap and finally quit [

6]. Additionally, Taiwan high-speed railway project faced the high debt ratio caused by the shortage of capital funds, thus the revenues cannot cover the repayments [

7]. Meanwhile, Channel Tunnel also had huge financial burdens due to the increase of financing costs and insufficient revenues that cannot repay the debts [

8]. Hungary M1–M15 road was nationalized because of huge financial gap caused by the shortage of stable funds [

9]. To sum up, unreasonable capital structure cannot guarantee ample funds of a project, which impacts the benefits of private and public sectors and even leads to the failure of a project. Therefore, investigating the critical factors on capital structure of PPP projects plays an important role in achieving proper capital structure and promoting the success of PPP projects.

At the same time, the core concept of sustainability is expanded from “meeting the needs of modern society without affecting future development” [

10] to 3E–3P framework, which includes economy, environment, ethics, people, profit and planet [

11]. United Nations set 17 goals, many of which share the same scope of PPP projects such as infrastructure, sustainable city and community [

12]. Moreover, United Nations Economic Commission for Europe proposed 27 criteria for PPP mode based on sustainable development to deeply combine PPP projects with sustainability [

13]. However, sustainability has not been widely applied, where funds problem is highlighted. During the determination of capital structure in PPP projects, the lack of sustainability causes the partners to only care about the short-term economic indicators but omit the long-term impacts on society and the environment, which leads to high costs and insufficient funds at the operation stage of PPP projects [

14]. Thus, analyzing the sustainability of the critical factors can help each participant to consider the life-cycle funds and social and environmental impacts of PPP projects and to build more scientific and reliable capital structure that can better satisfy the practical needs.

This study aimed to identify and analyze the critical factors influencing the capital structure of PPP projects from a sustainability perspective and investigate the relationship between factors and the capital structure based on Qualitative Comparative Analysis (QCA). The literature review indicated that recent studies cared more about quantitative models and economic indicators of the capital structure rather than systematic analysis of critical factors and their impacts on long-term healthy operation of PPP projects. A literature analysis was conducted to identify the critical factors. After that, QCA was applied to investigate the relationship between the seven critical factors and capital structure of PPP projects clearly based on 15 PPP projects. Finally, combined the literature and result of QCA, the importance of these factors was discussed. The findings not only enrich the theoretical research of the capital structure in PPP projects, but also provide reference to scientific and reasonable capital structure of PPP projects in practice. Moreover, the study promotes the application of sustainability in PPP projects to facilitate the long-term healthy development of PPP projects, industry, region and the whole society.

2. Literature Review

2.1. Sustainability and Its Application in PPP Projects

2.1.1. Concept of Sustainability

Sustainability is originated from the Brundtland Report, which concentrates on environmental protection and economic development [

10]. Studies offer rich explanations of sustainability. Daly [

15] indicated that sustainable development of capital concentrated on the multi-level relationship of capitals and the maximum of sustainable annual returns, which accentuated the process of transforming resources through capital and labor. Moreover, Kates et al. [

11] expanded the concept from several facets, indicating sustainability was an open, dynamic and evolving idea that required participation of diverse perspectives, such as nature, human, economy and society, and reconciliation of different and sometimes opposite goals. Based on relevant studies, Kuhlman and Farrington [

16] pointed out that the traditional three dimensions of sustainability, namely economy, society and environment, should combine with human well-being to embody the interrelationships of factors from different dimensions. However, Imran et al. [

17] believed sustainability not only emphasized human well-being, but also became eco-centered to achieve the well-being of all creatures. Besides, Manderson [

18] stated sustainability was the interactions among multi systems, which had different contents under diverse background, covering resource, economy, society, industry, city, etc. Ostrom [

19] further considered the sustainability of social-eco system according to the interactions of many subsystems such as resource, user and supervision.

To sum up, the concept of sustainability is expanded from two-dimensions to three-dimensions, i.e., economy, environment and society, and considers several other dimensions and subsystems to search for the coordination and long-term development of factors, where capital is an essential facet.

2.1.2. Sustainability and PPP Projects

Sustainability should be applied throughout the life-cycle of PPP projects. Villalba-Romero et al. [

20] analyzed the sustainability of PPP projects from the traditional aspects (economy, society and environment), considering finance, construction, operation and other phrases of PPP projects. Combining the characteristics of PPP projects with sustainability. Xiong and Chu [

21] proposed an original PPP 3.0 strategy to strengthen financial function, improve construction efficiency and protect sustainable developments of the society, economy and environment. Moreover, Zhang et al. [

22] divided the sustainability of PPP projects into five facets: construction, economy, society, environment and management. Economic sustainability has close relationship with the Value for Money framework, while the environmental sustainability influences the financial ability of PPP projects [

23]. Besides, operational sustainability, political sustainability and technological sustainability are necessary parts of sustainable development in PPP projects [

24]. Furthermore, partnership is an important point of sustainability in PPP projects. Building sustainable contractual relationship is benefit to the achievement of social benefits and the improvement of future social values of PPP projects [

25]. In addition, objective consistency, long-term cooperation, equal coordination and benefit–risk sharing relationship among government, private company and public should be considered to maintain sustainable partnerships in PPP projects [

26].

In light of the above, the introduction of sustainability provides new ideas of PPP projects in several facets, where financial aspect is the core one. Therefore, sustainability has close relationship with the capital structure of PPP projects. Nevertheless, current studies initially focus on the theory level rather than applying sustainability to the specific phrase of PPP projects, which should be improved in the future.

2.2. Capital Structure and Its Application in PPP Projects

2.2.1. General Concept of Capital Structure

Capital structure is the structure of debt and equity funds in the corporate finance, which is a dynamic and complex process that represents the investment behavior of investors and the corporation value [

27]. The theories of capital structure developed through several stages, including traditional capital structure theory [

28], MM theory [

29] and its revision [

30,

31], trade-off theory [

32,

33], agency cost theory [

34], signaling theory [

35], corporate control theory [

36,

37,

38] and industry organization model [

39]. To sum up, capital structure theories explain the relationship between the capital structure and corporation value and analyze the rational management and maximum benefits, which can also be applied to PPP projects.

Moreover, there are many studies about the capital structure. Onaolapo et al. [

40] indicated the leverage ratio had negative impact on the profitability, while the firm size and asset tangibility had positive influence on the leverage proxies. Meanwhile, Feld et al. [

41] investigated that taxation had positive impact on the equity–debt ratio. Besides, many new firms rely on debt funds [

42], while family firms prefer equity capital rather than debt funds [

43]. As for the costs of debt and equity, weighted average cost of capital (WACC) is a commonly used indicator, which considers the costs of different sources and their proportion [

44]. Additionally, the project-specific WACC can be applied to reflect the character of the individual PPP projects [

45]. In the formula of WACC, K

e and K

d are two important indicators. K

e is the cost of equity, that is, the expected return of equity provider, which is often calculated by the Capital Asset Pricing Model (CAPM) [

46], while K

d means the cost of debt that covers the loans, bonds and other resources [

47]. These indicators are all important in the analysis of capital structure.

2.2.2. Capital Structure of PPP Projects

Many researchers analyzed the capital structure of PPP projects from different aspects such as benefit, financial cost, risk, etc.

First, from the perspective of benefit, Sharma et al. [

48] indicated the best equity–investment ratio should maximize the benefits of private funds when the public interests can be guaranteed. Moreover, Sheng et al. [

49] used the maximization of private sector’s benefits as the goal to determine the equity structure and combined the project cash flow forecast with benefit functions of stakeholders to get reasonable capital structure. Toms et al. [

50] also pointed out that the investments of partners should be equal to the benefits they can obtain to achieve the stability of cooperation in PPP projects.

Second, financial cost also attracts many researchers’ concerns. It plays an integral part of life-cycle costs in PPP projects and has deep relationship with risk sharing and transitional costs of bank [

51]. Tao and Ji [

52] believed financing cost rate was related to the return rate of investment and financing efficiency which were the basis of government’s investment decision. Furthermore, Demirag et al. [

53] indicated the increase of financing costs, the shortage of equity funds and short-term debt preference led to the difficulties of risk avoidance in England PPP projects. Thus, government should consider the characteristics and preferences of equity and debt investment of private sector in PPP projects.

Third, risk is a necessary part in the analysis of capital structure. Zhang [

4] analyzed the capital structure of PPP projects considering construction risk, financial bankruptcy risk and other economic risks from different stakeholders. Moreover, Yun et al. [

54] used Monte-Carlo simulation to analyze the risks of lenders and operators and optimized the capital structure through multi-objective genetic algorithm. Then, Demirag et al. [

55] indicated different investors cared about different risks: an equity investor focuses on the equal distribution of risks, while a debt investor prefers low-risk projects. However, the indicators of investment decision-making are alike, including economic indicators, internal rate of return, investment return period, etc., and non-economic indicators, reputation, familiarity, experience, etc. Internal rate of return is the most popular indicators while there are many unreasonable points [

56]. Average internal rate of return is a better indicator [

57].

Besides, government support is a key point. Transportation Infrastructure Finance and Innovative Act is a project supporting important transportation PPP projects, which accounts for 7% of the total funds of PPP projects in America [

58]. Shuai and Hubo [

59] indicated government stimulation was deeply related with investment of private sector. The income guarantee, extended period of concession and one-time or unit subsidy all promote the increase of equity–investment from private sector.

Considering above, researchers analyzed the capital structure from many aspects. However, recent studies care more about the quantitative model rather than the systematic analysis of critical factors. Moreover, these studies rely on economic indicators ignoring the impacts on long-term healthy operation of PPP projects. Therefore, this study analyzed the critical factors influencing capital structure of PPP projects from the sustainability perspective to provide references for selection of the capital structure in practice.

3. Methodology

3.1. Literature Analysis

Literature analysis identified critical factors through the systematic analysis and organization of relevant literature [

60]. It was chosen in this study due to its clear and reliable process that achieves the objective and comprehensive identification of critical factors, while other methods, such as questionnaire and case study, are more suitable for the subsequent analysis of critical factors instead of the primary identification [

61,

62,

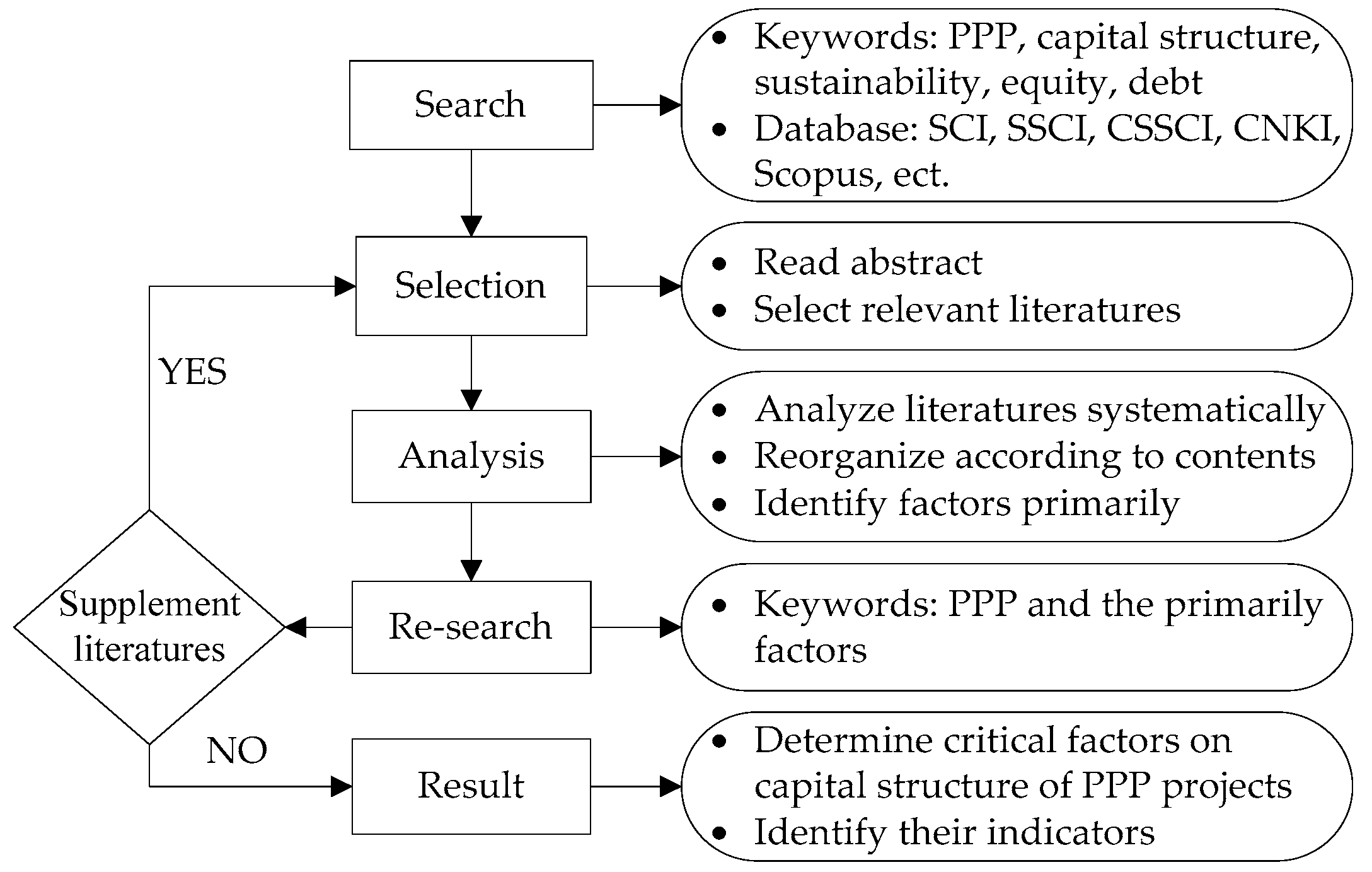

63]. This study used a four-step process to identify critical factors on capital structure of PPP projects as

Figure 1.

First, this study used PPP, capital structure, sustainability, equity and debt as key words to search for literature in the Scopus. More than 500 studies were searched covering many databases, such as Science Citation Index, Social Science Citation Index, China National Knowledge Infrastructure, etc. Second, after skimming the abstracts and learning about the core contents, more than 100 studies closely related to the research topic were selected. Then, through full-text reading and analysis, seven influencing factors were identified primarily. Based on these factors, the studies were culled again to get 58 core studies and then they were reclassified. After that, it is necessary to research supplementary literature using PPP and each factor as key word, respectively. When no supplement literature in direct relationship with this topic was missing, the seven critical factors and their indicators were determined with references to 65 studies. These factors are benefit, risk, ability, cost, project condition, government support and external situation.

3.2. Qualitative Comparative Analysis (QCA)

Qualitative Comparative Analysis (QCA) is a method using quantitative analysis of data from several cases to make up the insufficiency of qualitative analysis and interpreting the quantitative results by qualitative analysis [

64,

65]. It is suitable for small samples, medium-scale samples and large-scale samples [

66,

67], while small and medium samples are more common [

64,

68]. It has been applied to investigate the relationships between the critical factors and outcomes [

65,

68,

69]. As popular methods of analyzing critical factors, questionnaire survey requires a large amount of data and detailed analysis by other techniques [

61,

62], while single-case study cannot get a general finding due to its limitation of one case [

70]. Therefore, QCA is a suitable method that can achieve a comprehensive result based on the data of real cases [

65,

71]. Additionally, the configuration analysis, as the core of QCA, realizes the analysis of multiple concurrent causality [

72]. The causal relationship depends on the situation and configuration. This is in accordance with the complexity of relationships between the capital structure and its critical factors. The mainstream statistical methods should be applied under strict constraints and hypotheses that are not suitable for the capital structure of PPP projects [

66]. Besides, the replicability and transparency of process can strengthen the reliability of results [

66]. QCA has been widely used in studies of a similar nature (e.g., [

70,

71,

73,

74,

75]).

Therefore, QCA was applied in this study based on 15 PPP projects to investigate the relationship between the critical factors and capital structure of PPP projects.

Due to the complexity of capital structure, it cannot be represented by a single indicator [

27]. Therefore, this study chose equity–debt ratio and equity–investment ratio of private sector as the dependent variables. The equity–debt ratio is the most important indicator of the capital structure that obtains many researchers’ attentions and can be quantified clearly [

39,

41,

42,

43]. Meanwhile, the equity–investment ratio of private sector is also very essential and determines the equity structure because the private sector is the major equity provider in PPP projects. Therefore, the two dependent variables can represent the results of capital structure in PPP projects.

Moreover, seven critical factors were independent variables. In PPP projects, the content of each variable can be shown clearly by the binary threshold (“1” indicating full membership in the set and “0” indicating non-membership [

66]). Thus, crisp set QCA (csQCA), where each variable is a dichotomous variable and assigned one of two possible membership scores by binary threshold [

66], was selected to investigate the relationships between factors and the capital structure of PPP projects. The process is shown in

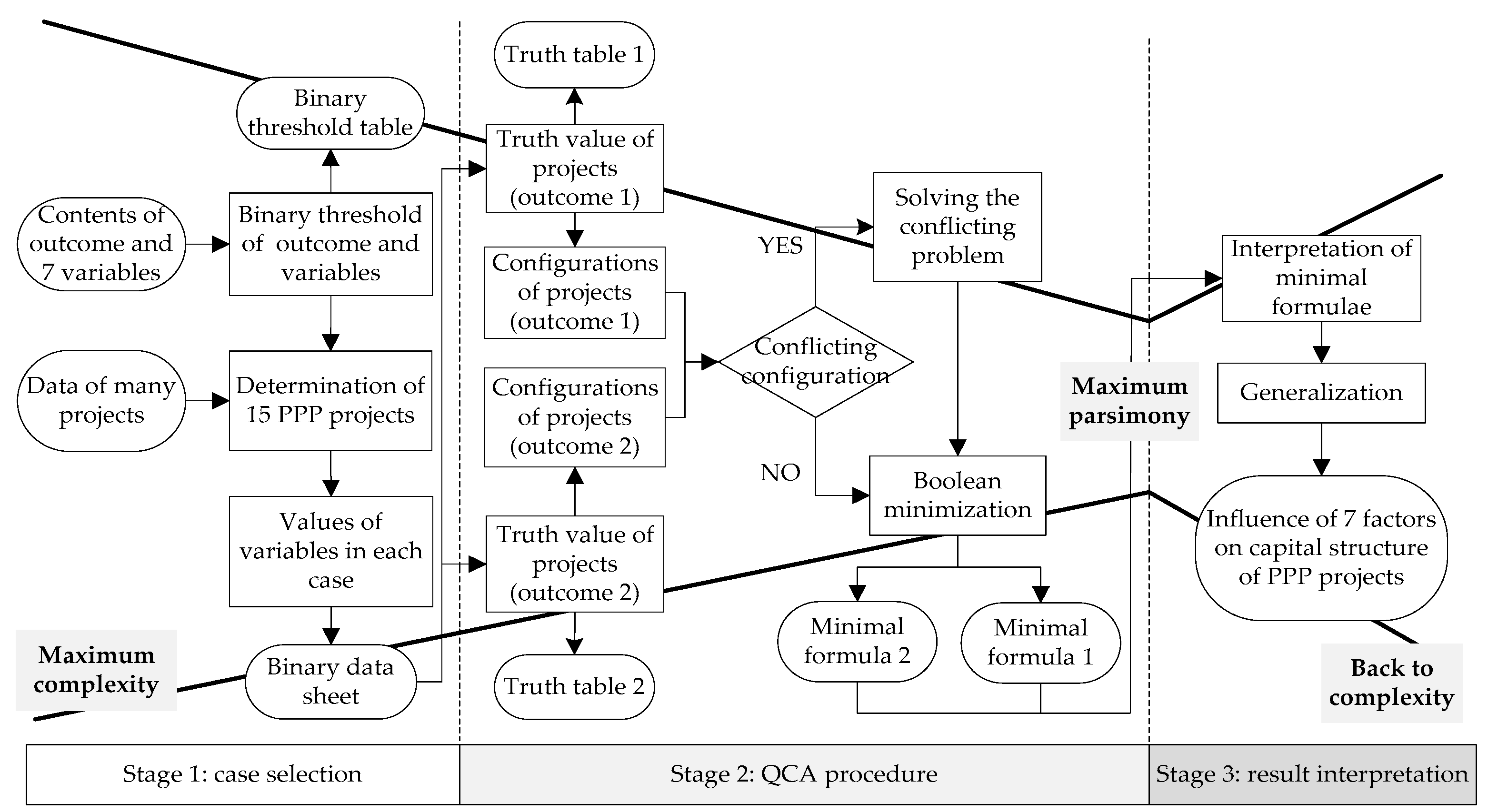

Figure 2.

3.2.1. Case Selection

Data of cases are the basis of QCA, which means the reasonability of case selection can directly impact the reliability of the results. Therefore, case selection follows the scientific procedure shown in

Figure 2. This study used successful PPP projects as cases to investigate the factors influencing capital structure. First, many PPP projects with ample data were collected covering different countries and types to represent the maximum complexity of reality. Next, according to the contents of seven factors, this study determined the binary threshold of each factor as the rule of assignment of every case. Then, based on the information of 15 PPP projects, each variable was assigned “0” or “1”, obtaining the binary data sheet as the basic data of QCA.

3.2.2. Qualitative Comparative Analysis

After the selection of 15 successful PPP projects, this study applied TOSMANA software to analyze the configurations using csQCA method [

66]. There are two dependent variables in this study, thus two analyses were conducted. First, this study integrated the configurations of 15 cases to get the truth table and configurations of each outcome. The cases that have the same value of each variable show the same configuration and should be conflated. Moreover, the truth table shows the binary data of all different configurations, when one configuration has one or more corresponding cases [

67]. Then, if there is conflicting configuration, adjusting variables and changing cases are useful methods to solve the conflicting problem. When there was no conflicting configuration, Boolean minimization was conducted to minimize these formulae of configurations under each outcome and get the final minimal formulae. This process narrows the maximum complexity of reality to maximum parsimony of formulae [

67].

3.2.3. Result Analysis

Comparing and analyzing the results of two QCA processes, it is necessary to illustrate each formula that represents the relationships between factors and outcomes. Thus, the changes of equity–debt ratio and equity–investment ratio of private sector under the variations of critical factors can be explicated to achieve the scientific analysis of critical factors influencing capital structure of PPP projects from a sustainability perspective. Though this step, the maximum parsimony can be back to complexity linking with practice [

67].

4. Identification and Analysis of Critical Factors on Capital Structure of PPP Projects

4.1. Identification of Critical Factors Based on the Literature

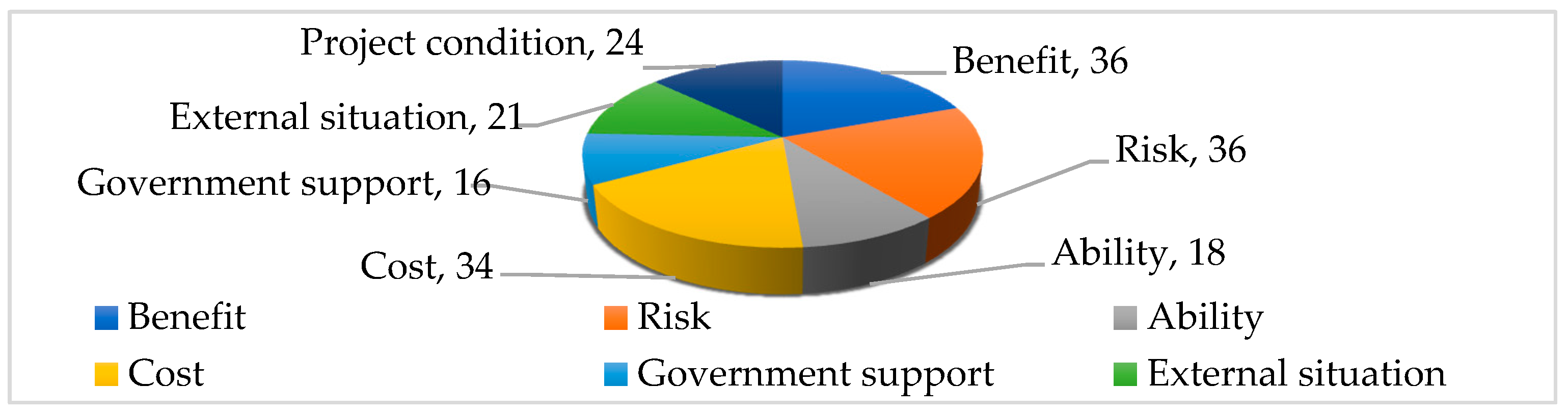

The frequencies of seven factors appearing in the 65 studies are shown in

Figure 3.

Risk and benefit are the most frequently mentioned factors, for more than 36 times, covering 56% each. Then, cost is also very important and accounts for 53%. Besides, project condition and external situation draw many researchers’ attention. More than 20 studies referred to each factor. Finally, ability and government support are indicators that cannot be ignored. More than 15 studies illustrated at least one of the two factors. In light of the above, all seven factors are important for the capital structure in PPP projects. The studies and their relationships with critical factors are shown in

Table 1.

4.2. Analysis of Factors

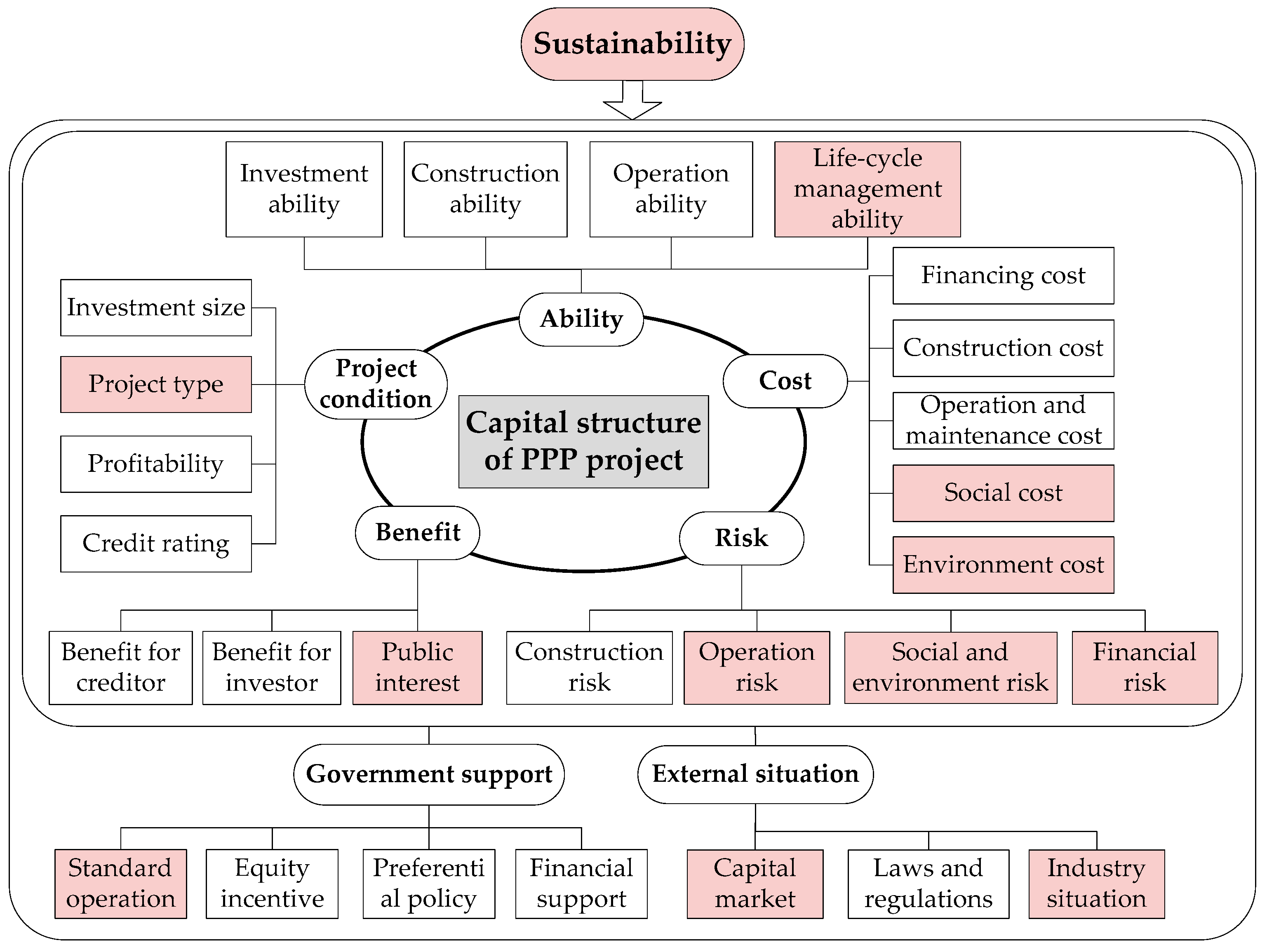

Contents and indicators of the seven critical factors are shown in

Table 2. The benefit, risk, cost, ability and project condition are internal factors that represent the situation of project itself or the private sector, while the government support and external situation are external factors that care about the outside condition’s impact on the capital structure of PPP projects. Besides, each factor has several indicators from both project level and social level that illustrate the contents of factors clearly and help to determine the binary data of cases.

- 1)

Benefit

Benefit is the core issue that all participants of PPP projects care about [

129]. In many models of the capital structure in PPP projects, it is the most important indicator [

48]. As the investor of PPP projects, the private sector is concerned with return of investment [

92], while the public sector cares more about the public interests, such as social and environment benefits rather than economic benefits [

48]. Besides, the financing institution focuses on the stability of repayment of debt funds and the benefits of creditors [

79].

- 2)

Risk

Risk appears throughout the life-cycle of PPP projects [

3] and has close relation with the capital structure [

55]. First, the capital structure is an integral part of the financial phrase in PPP projects, thus financial risk is an important indicator [

77]. Second, construction impacts the quality and operation of projects, which means construction risk cannot be ignored [

83]. Moreover, operational stage covers most of the contract period, thus its result directly influences the achievement of targets in PPP projects. Therefore, operation risk should be paid enough attention by stakeholders [

4]. Besides, general public is the end-user and actual provider of governmental funds [

130]. The social risk and environment risk that correlate with public are essential.

- 3)

Ability

As the implementor of PPP projects that undertakes the major financing work, the ability of private sector is very important [

131]. Investment ability is not only an important indicator when the public sector selects proper partner [

132], but also the critical aspect that financial institutions care when they provide debt funds [

55]. Moreover, construction ability, operation ability and life-cycle management ability all impact the success of PPP projects. Therefore, the public sector and financial institution both take these into account to analyze the future cash flow of projects to select proper capital structure [

79].

- 4)

Cost

Similar to benefit, cost has been widely applied and analyzed in many models and formulae of the capital structure in PPP projects [

49]. The minimization of financing cost is the core objective of capital structure [

54]. Moreover, operation and maintenance last for a long period in PPP projects, thus costs of operation and maintenance play an important role in the cash flow of PPP projects that relates closely with selection of the capital structure [

84]. Besides, intangible costs of PPP projects such as social costs and environmental costs also should be concerned in the capital structure to guarantee the success of PPP projects [

87].

- 5)

Project condition

Profitability is a key indicator that financial institution considers when providing funds. As for non-profit PPP projects, such as public medical institution, it would be harder to finance enough funds without assistant measures comparing with projects that have strong profitability [

80]. Furthermore, considering the characters of different industries, the equity–debt ratio and resources of funds would be diverse due to its project type [

85]. Additionally, investment scale determines the total amount of funds of projects, which suits for different equity–debt ratio [

90]. Besides, credit rating is a necessary supporting indicator for financial institution [

55].

- 6)

Government support

As initiator and supervisor of PPP projects, government supports from several facets have essential impact on the capital structure. Financial support is the major aid from government to strengthen cash flow of PPP projects through minimum rate of return guarantees, subsidizes, etc. [

78]. Thus, PPP projects can obtain sufficient funds with lower financial costs [

82]. Moreover, equity incentive is also an important measure adopted by government. Injecting of public funds not only stimulates the investment of private sector, but also improves the financial institutions’ confidence in PPP projects [

59]. Besides, the preferential policies of relevant industries and regions and the government’s supervision of standard operation can help projects to get ample funds to promote the healthy operation of PPP projects [

52].

- 7)

External situation

Capital market indicates the whole situation of capital operation. The development trend and condition of capital market have indispensable impact on the finance of different kinds of projects including PPP projects [

53]. When determining the capital structure, every participant should consider conditions of capital market to make decisions that are suitable for current situation [

91]. Moreover, industry condition shows the current status and trend of different sectors especially in the location of PPP projects, which would influence the confidence and investment behavior of investor and creditor [

23]. Besides, laws and regulations are important for the capital structure through influencing the implementation and cash flow of PPP projects [

81].

5. Impact of Sustainability on Capital Structure of PPP Projects

Sustainability is an important and international trend, which should be concerned in PPP projects. The core concept of sustainability is that current behavior should not impact future development from three aspects: economy, society and environment [

10,

16]. Capital structure of PPP projects from a sustainability perspective means current capital structure should neither influence the future development of PPP projects nor bring about any bad impacts on the environment and public of the industry, region and even the whole society. That is, PPP projects can achieve life-cycle healthy operation to guarantee the economic, social and environmental benefits rather than just satisfying current funds demand.

However, previous studies of the capital structure in PPP projects mostly relied on economic indicators while ignoring the sustainability [

79,

92]. In practice, sustainability has not been embodied in PPP projects, which means participants cares more about the short-term demand of funds rather than long-term development of projects when deciding the capital structure. Therefore, this study introduced sustainability into the analysis of capital structure in PPP projects to promote long-term healthy operation and development of PPP projects.

The framework of critical factors influencing capital structure of PPP projects under the sustainability is shown in

Figure 4. The shaded areas show the indicators that closely relate to sustainability. All seven factors have deep relationship with sustainability.

- 1)

Public interest

Traditional capital structure often cares about benefits of investors and creditors [

48]. From a sustainability perspective, public interest should be concerned in the capital structure of PPP projects. Many problems that will harm public interests, such as too high rate of return of the private sector, should be avoided to assure the social and environmental benefits of PPP projects and improve the healthy impact on the sustainable development of industry, region and society.

- 2)

Risks

Analyzing risks under the context of sustainability is more comprehensive. Combining the life-cycle cash flow prediction and analysis with the future development and long-term effects of PPP projects, the financial risks can be analyzed reasonably. Moreover, operation stage covers a long period of PPP projects, which directly impact the healthy operation result. Thus, operation risks should be evaluated considering sustainability to maintain the successful operation of PPP projects. Besides, social risk and environmental risk that link with long-term effects are important indicators from a sustainability perspective.

- 3)

Social and environment costs

From a sustainability perspective, social and environmental costs caused by different capital structure are essential indicators. It is inconsistent with sustainability to make irretrievable damage to public lives, natural environment or the region to achieve the economic targets of investors. Too high social and environmental costs of PPP projects should be avoided in the capital structure. Thus, the intangible costs should be reasonably evaluated to realize the healthy and sustainable operation of PPP projects and do not influence the future development of the region and whole society.

- 4)

Life-cycle management ability

Considering the abilities of private sector, life cycle management ability of the private sector should be concerned from a sustainability perspective, because it impacts the efficiency, relationship, profitability and future development of PPP projects [

132]. Fully considering the life-cycle management condition helps the participants to build reasonable capital structure to achieve the targets of projects and promote the development of industry, region and society.

- 5)

Standard operation

In terms of government support, standard operation has the closest correlation with sustainability. Supervising the behaviors of each participant and assuring the standard operation are key tasks of government [

130]. Standard operation not only guarantees the efficient and healthy operation of PPP projects, but also strengthens the confidences of financiers and investors to incentivize investment behaviors and change the capital structure.

- 6)

Project type

Different types of projects have different financial abilities and social and environmental effects. Participants should consider the character and trend of industry to design the capital structure that is suitable for the project type to protect the stability of funds during the life-cycle of PPP projects. In this way, the economic, social and environmental objectives can be realized to promote the development of projects, industry and regional economy.

- 7)

Capital market and industry situation

As for external situation, participants should care about the characters of the capital market and industry of project. Capital structure that suits the preference of the capital market and follows the trend of industry can provide ample funds for the construction and operation to assure the long-term successful operation of PPP projects. Meanwhile, successful PPP projects can support the complete of capital market and development of industry.

In other words, analyzing the capital structure of PPP projects from a sustainability perspective emphasizes the non-economic indicators as well as the traditional economic indicators. Combined with these factors, the capital structure can become more scientific to guarantee the success of PPP projects and lead to good effect on the industry, region and society.

6. Case-Based Qualitative Comparative Analysis

6.1. Case Selection and Data

The 15 successful PPP projects are either from Chinese national demonstrative project database or were widely recognized by researchers and practitioners [

9,

133,

134,

135,

136], covering several sectors, such as transportation, hospital, waste, etc., and different countries such as China, Germany, Canada, etc. With the application of many modes including build–operate–transfer (BOT), design–build–finance–operate–maintain (DBFOM), transfer–operate–transfer (TOT) and rebuild–operate–transfer (ROT), the 15 PPP projects can represent the complexity of reality. The basic information is shown in

Table 3.

This study set the binary threshold of variables according to the content of each factor and the practical condition, which is shown in

Table 4.

Tang [

118] indicated the optimal equity–debt ratio of PPP projects is 29.17%. However, due to the large investment of PPP projects, high equity–debt ratio leads to high financial pressure to the private sector. Therefore, considering the practical condition, the binary threshold of equity–debt ratio was set to 25% (1/4). Moreover, public and private sectors are the equity investors of PPP projects. Although 50% is a critical point in the corporate governance in ordinary projects, it is not suitable for PPP projects as this threshold cannot realize the scientific division of value of this outcome. As the role of initiation and supervision of PPP projects, public sector often provides only a small part of funds to support the projects, while the private sector should offer a large part of equity–investment [

48]. Considering the data of many PPP projects, the binary threshold of equity–investment ratio of private sector was set as 70%. Besides, due to the complexity of critical factors that include several indicators, the binary thresholds were determined by degree instead of specific digit to evaluate the variables reasonably. According to the binary thresholds and data of projects, the binary data sheet of 15 cases is shown in

Table 5.

6.2. QCA: Equity–Debt Ratio

6.2.1. Qualitative Comparative Analysis

In this step, the outcome of QCA is the equity–debt ratio of PPP projects. Based on the binary data sheet, the cases that have the same value for each variable were conflated to get the truth table (

Table 6).

In the 15 cases, Beijing Metro Line 4 (Case ID = 1) and Luoyang Ancient City Protection and Renovation (Case ID = 14) have the same value for each variable, which means they show the same configuration. Thus, the two cases were combined. Finally, there are 14 different configurations. Analyzing the data of cases that have the same outcome by TOSMANA, this study obtained the formulae in

Table 7. In the analysis, the remainders, which mean the areas that the 15 PPP projects cannot cover, were included to assure the reliability of the results [

66]. There are nine cases (Case ID = 1, 2, 3, 5, 6, 11, 12, 14, 15) of result 1, which means equity–debt ratio of cases is greater than or equal to 1/4, while six cases (Case ID = 4, 7, 8, 9, 10, 13) show result 0, that is, equity–debt ratio is smaller than 1/4. As shown in

Table 7, there are 14 formulae of result 1 and two formulae representing result 0.

6.2.2. Minimal Formula: Equity–Debt Ratio

After the Boolean minimization of these formulae, the intersection of formulae from the same result, that is, the minimal formula of each result, is shown in Equations (1) and (2).

- 1)

Result 1: equity–debt ratio ≤ 1/4

Equation (1) indicates that result 1 will happen under three circumstances.

- (1)

PPP projects that have low costs and high benefits but high risks with strong support of government, good external situation and private sector whose ability is weak

Low costs and high benefits can assure the stable cash flow which brings reasonable return to investors and creditors and achieves the successful operation of PPP projects. Moreover, strong support from government and good external situation are important aids for projects to improve capabilities, finish standard operation and realize expected targets. Under the combination of the four factors, the investors can keep confidence in the future development of PPP projects and raise the expected rate of investment even though the project has high-level risk and the private sector has weak ability. Thus, investors will offer a larger proportion of equity capital to obtain more benefits and contribute to the development of industry, region and society.

- (2)

PPP projects with high costs, high risks, low benefits and bad project condition

Under this condition, the future development of PPP project is not optimistic, which means it cannot attract ample funds to maintain. Therefore, investors will increase the equity–debt ratio properly. More equity capital can improve the financial ability of projects and reduce the worries of financial institutions to support the successful implementation of PPP projects. In general, public sector will invest more funds to incentivize the investment of private sector and financiers to achieve the long-term healthy operation of PPP projects.

- (3)

PPP projects that have high benefits, good project condition and private sector with strong abilities

Combined with the three good conditions of PPP projects, investors will have positive prediction of the results of PPP projects. Thus, they are willing to invest more funds to obtain benefits for companies and contribute to the development of industry, region and society.

- 2)

Result 0: equity–debt ratio < 1/4

Equation (2) shows the minimal formula of result 0. There are also three situations:

- (1)

PPP projects with low benefits and good project condition

Low expected benefits make the investment behaviors of investors more deliberate, which means equity–investment will decrease. Meanwhile, good project condition can support the stability of cash flow to promote the healthy life-cycle operation of PPP projects and increase the stability of repayments of debt funds. Therefore, financial institutions are likely to provide more debt funds, which increases the equity–debt ratio.

- (2)

PPP projects with good project condition but private sector whose abilities is weak

Good project condition, such as strong profitability and high credit rating, can enhance the confidence of creditors, encouraging them to provide high proportion of debt funds. Moreover, the private sector that has weak abilities may face many difficulties during the implementation of projects. Therefore, the private sector will be more cautious about the equity–investment, thus decreasing the equity–debt ratio.

- (3)

PPP projects that have high benefits and private sector with strong abilities but high costs and bad project condition

High benefits and the private sector that has strong abilities can assure the positive expectation of projects. Therefore, although the projects have high costs and some bad conditions, financial institutions can keep confidence in the expected long-term operation of projects. Thus, they will provide more funds to decrease the equity–debt ratio.

6.3. QCA: Equity–Investment Ratio of Private Sector

6.3.1. Qualitative Comparative Analysis

Making equity–investment ratio of private sector as the outcome, 13 different configurations are shown in

Table 8. Beijing Metro Line 4 (Case ID = 1) and Luoyang Ancient City Protection and Renovation (Case ID = 14) have the same configuration. Sludge Treatment Project in Sudbury (Case ID = 8) and Relocation and Extension of Chinese Medicine Hospital in Luxi (Case ID = 15) also show the same value of each variable and outcome.

The configurations can be expressed as formulae, as shown in

Table 9. Result 1 means the equity–investment ratio of private sector is larger than or equal to 70% (Case ID = 1, 4, 5, 7, 8, 9, 10, 12, 13, 14, 15), while result 0 shows the equity–investment ratio of private sector is smaller than 70% (Case ID = 2, 3, 6, 11). There are 11 equations of result 1 and four formulae of result 0 (

Table 9).

6.3.2. Minimal Formula: Equity–investment Ratio of Private Sector

After the Boolean minimization of formulae, the minimal formulae are shown as Equations (3) and (4).

- 1)

Result 1: equity–investment ratio of private sector ≥ 75%

As shown in Equation (3), there are three configurations of result 1.

- (1)

PPP projects that have good conditions and high benefits but weak government support and private sector whose ability is weak

Projects with high benefits and good project conditions can strengthen confidences of private sector in the future development of projects. Thus, they will have high expectation of the rate of return and healthy and sustainable operation. Under such favorable condition, even though the government support and private sector’s ability are weak, the development of PPP projects will not be weakened. Thus, the private sector is willing to invest more equity funds.

- (2)

PPP projects with high benefits and good project conditions

The high rate of return of private sector as well as other targets of projects can be achieved in this kind of PPP projects, which means the PPP projects can be finished successfully with great possibility. Thus, the private sector is likely to invest more equity funds to gain more benefits in the PPP projects.

- (3)

PPP projects with good external situation and project condition

Good project condition can promote the achievement of targets and good external situation can strongly support the success of projects. Therefore, the long-term healthy operation of PPP projects can be assured, which can attract private sector to provide more funds.

- 2)

Result 0: equity–investment ratio of private sector < 75%

There are two situations of result 0 shown in Equation (4).

- (1)

PPP projects with high costs, high risks, low benefits and bad project condition

There are obvious disadvantages of this kind of PPP projects, which will impact the confidence of participants. Thus, there may be many difficulties during the implementation of PPP projects. Public sector will increase the equity–investment ratio to attract the investment from the private sector and financial institution to promote the development of PPP projects.

- (2)

PPP projects with strong government support and abilities of the private sector but bad external situation

The finance of PPP projects follows the trends and conditions of external situation, which impact the investment behavior of the private sector. Bad external situation will lead the private sector to decrease investments to isolate risks, while the public sector will increase the investments and provide other support measures to incentivize the investment of the private sector and financial institution.

6.4. Discussion of the Results

First, benefit is the most important factor, which is accordance with the result of literature analysis. Under different configurations, this factor is the core concern of all participants of PPP projects [

129]. The private sector and financial institution care more about the economic benefits [

48,

79], while the public interest is also essential indicator including social and environmental benefits. The capital structure that considers both the economic and non-economic benefits can promote the healthy development of PPP projects, industry, region and society [

92].

Second, project condition shows salient importance. Different project condition will impact the predictions of projects and change the participants’ investment decisions. Good profitability of projects [

80], project type that can attract ample funds [

85], proper investment scale that is neither very large to bring financial burden nor very small to obtain insufficient support [

90], and good credit rating can bolster the confidence of investors and financiers to increase the equity–investment ratio of private sector and decrease the equity–debt ratio by attracting more debt funds [

55]. Meanwhile, good project condition contributes to the life-cycle success of PPP projects and healthy development of industry, region and society.

Moreover, external situation and cost are embodied in the formulae. Both the investment behavior of private sector and financial institution have close relationship with the external situation [

23,

91,

94,

102]. With favorable capital market, industry condition, laws and regulations, private sector as well as financial institution will be willing to provide more funds. Thus, the equity–debt ratio and equity–investment ratio of private sector will increase. At the same time, the minimization of costs is an important target when determining the capital structure [

54,

84]. The intangible costs should be concerned as well as economic costs to promote the life-cycle healthy operation of PPP projects and not bring about bad impact on the development of industry, region and society [

87].

Besides, the ability of private sector and government support should be considered. The support measures of government can strengthen the projects to attract more funds and assure the successful operation of PPP projects [

52,

86]. Government’s financial support, equity incentive and preferential policies encourage the private sector and financial institution to offer capital [

105,

126]. Additionally, the supervision of standard operation directly influences the life-cycle operation and result of PPP projects. Meanwhile, the ability of private sector is an essential indicator that influences the investment decision of each participant [

131,

132]. Strong abilities of private sector help the projects to realize targets at each stage and promote the healthy and successful life-cycle operation. Therefore, strong abilities of private sector can attract more funds from financiers to decrease the equity–debt ratio.

However, it is not in accordance with the result of literature analysis that risk does not show great importance in the formulae. This is because risk is throughout the life-cycle of PPP projects and has deep correlation with the other six factors [

93]. Even though risk does not show great importance in the result of QCA, the variations of other factors will lead to the dynamic adjustment of risk identification, allocation and control [

137]. Therefore, the risk factor should be analyzed comprehensively combined with other factors to reasonably predict the costs and result of risk control and its influences of long-term development of PPP projects to select scientific capital structure.

7. Conclusions

This study investigated the critical factors influencing the capital structure of PPP projects from a sustainability perspective. The results of literature analysis showed that there were seven critical factors: benefit, cost, ability, risk, project condition, government support and external situation. Moreover, all the seven factors were related to sustainability. The public interest, social and environment costs, life-cycle management ability, standard operation, project type, capital market, industry situation and all indicators of risk factor should be emphasized from a sustainability perspective. Then, the results of QCA clearly showed the relationship between factors and the capital structure of PPP project.

The major implications are: (i) as benefit was found to be the most important factor, both public interests and the economic benefits should be considered; (ii) the profitability, investment size and credit rating are essential economic factors, while the development of industry should be assessed according to project types; (iii) in addition to the traditional economic costs, social and environmental costs have critical impacts and are thus worth attention; (iv) both investors and financiers have concerns regarding the capital market, industry condition, laws and regulations to achieve the capital structure that not only provides ample funds but also follows the trends of industry and society; (v) the life-cycle management ability of the private sector can strongly influence the long-term operation of PPP projects, while the financing, construction and operation abilities impact the specific phrases in the life cycle; and (vi) support from the government not only incentivizes the investment of private sector and financing institutions, but also promotes the standard operation to assure the long-term healthy operation of PPP projects. Thus, considering these factors, proper capital structure can be selected to provide ample funds for PPP projects and promote the long-term healthy operation of projects and future development of the industry, region and society.

From the theoretical perspective, this study not only enriches the research of the capital structure of PPP projects, but also provides new idea for the combination of sustainability and PPP projects. In practice, the findings can offer references for the solution of unreasonable capital structure in PPP projects and help the participants to think more comprehensively. Besides, the research expands the application of sustainability on the practice of PPP projects to achieve the selection of proper capital structure and promote healthy development of PPP projects.

Despite achievement of the research objectives, there are still some limitations. Due to the complexity of capital structure of PPP projects, this study selected two indicators as dependent variables. In the future, the deep analysis of capital structure can be conducted. Other aspects of the capital structure will be analyzed as the dependent variables, such as the source and proportion of debt funds, to investigate the capital structure comprehensively. Moreover, this paper did not fully consider the different role of public sector and private sector, which may impact the sustainability of PPP projects and participation of private sector. Future study will pay more attention to the differences to achieve a more comprehensive result. Additionally, how the leverage incentives of the public sector to involve the private company as well as private sector to participate the PPP project was not discussed in this study. In the future, the impacts of different capital structure on the behaviors of public sector and private sector will be analyzed. Besides, considering the character of different fields or countries, future study may focus on one specific area or country to make deep and targeted analysis.