The Role of Environment in Sustainable Entrepreneurial Orientation. The Case of Family Firms

Abstract

1. Introduction

2. Materials and Methods

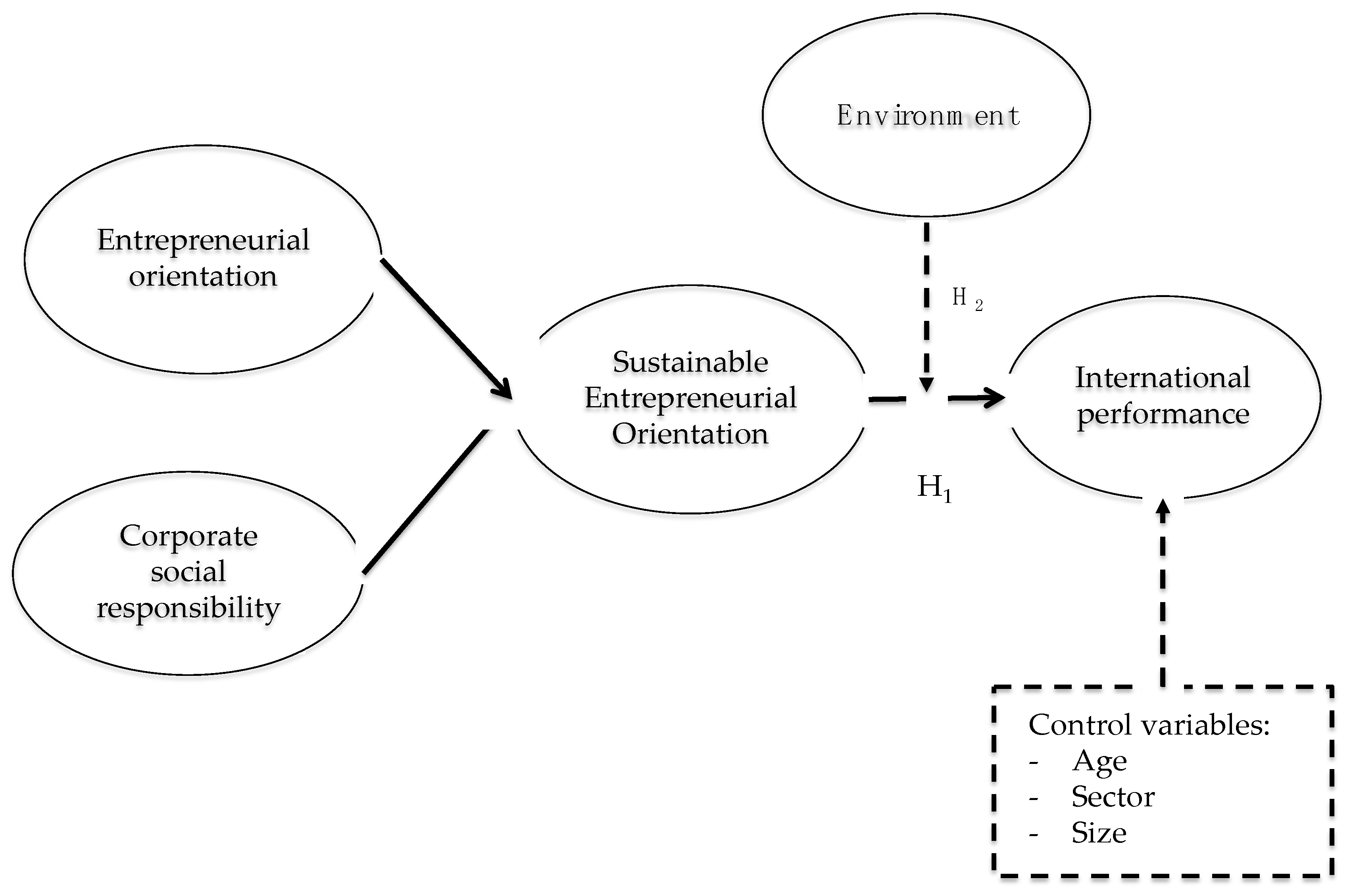

2.1. Model Proposed

2.2. Data

2.3. Measures of Variables

2.3.1. Sustainable Entrepreneurial Orientation

2.3.2. International Performance of Family Firms

- (1)

- (2)

- (3)

2.3.3. Environment

2.3.4. Control Variables

3. Results

3.1. Assessment of the Measurement Model

3.2. Assessment of the Structural Model

4. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Gómez-Mejía, L.R.; Haynes, K.T.; Nunez-Nickel, M.; Jacobson, K.J.; Moyano-Fuentes, J. Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Adm. Sci. Q. 2007, 52, 106–137. [Google Scholar] [CrossRef]

- Masulis, R.W.; Pham, P.K.; Zein, J. Family firm groups around the world: Financing advantages, control motivations, and organizational choices. Rev. Financ. Stud. 2011, 24, 3556–3600. [Google Scholar] [CrossRef]

- Gedajlovic, E.; Carney, M.; Chrisman, J.J.; Kellermanns, F.W. The adolescence of family firm research taking stock and planning for the future. J. Manag. 2012, 38, 1010–1037. [Google Scholar] [CrossRef]

- Poza, E.J.; Daugherty, M.S. Family Firm, 4th ed.; Cengage Learning: Mason, OH, USA, 2013. [Google Scholar]

- Chang, E.P.; Memili, E.; Chrisman, J.J.; Kellermanns, F.W.; Chua, J.H. Family social capital, venture preparedness, and start-up decisions: A study of Hispanic entrepreneurs in New England. Fam. Firm Rev. 2009, 22, 279–292. [Google Scholar] [CrossRef]

- Fan, J.P.; Wei, K.J.; Xu, X. Corporate finance and governance in emerging markets: A selective review and an agenda for future research. J. Corp. Financ. 2011, 2, 207–214. [Google Scholar] [CrossRef]

- Matthews, C.H.; Echavarria, D.; Schenkel, M.T. Family Firm: A Global Perspective from the Panel Study of Entrepreneurial Dynamics and the Global Entrepreneurship Monitor, Understanding Family Firmes (9–26); Carsrud, A.L., Brännback, M., Eds.; Springer: New York, NY, USA, 2012. [Google Scholar]

- Astrachan, J.H.; Shanker, M.C. Family firmes’ contribution to the US economy: A closer look. Fam. Firm Rev. 2003, 16, 211–219. [Google Scholar] [CrossRef]

- Memili, E.; Fang, H.; Chrisman, J.J.; De Massis, A. The impact of small-and medium-sized family firms on economic growth. Small Bus. Econ. 2015, 45, 771–785. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Kellermanns, F.W.; Chan, K.C.; Liano, K. Intellectual foundations of current research in family firm: An identification and review of 25 influential articles. Fam. Firm Rev. 2010, 23, 9–26. [Google Scholar] [CrossRef]

- Sharma, P.; Chrisman, J.J.; Gersick, K.E. 25 years of family firm review: Reflections on the past and perspectives for the future. Fam. Firm Rev. 2012, 25, 5–15. [Google Scholar] [CrossRef]

- Corona, J.; Del Sol, I. La Empresa Familiar en España (2015); Instituto de la Empresa Familiar: Barcelona, Spain, 2016. [Google Scholar]

- Aldrich, H.E.; Cliff, J.E. The pervasive effects of family on entrepreneurship: Toward a family embeddedness perspective. J. Bus. Ventur. 2003, 18, 573–596. [Google Scholar] [CrossRef]

- Zahra, S.A.; Hayton, J.C.; Salvato, C. Entrepreneurship in family vs. non-family firms: A resource-based analysis of the effect of organizational culture. Entrep. Theory Pract. 2004, 28, 363–381. [Google Scholar] [CrossRef]

- Eddleston, K.A.; Kellermanns, F.W.; Sarathy, R. Resource configuration in family firms: Linking resources, strategic planning and technological opportunities to performance. J. Manag. Stud. 2008, 45, 26–50. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Moreno-García, J.; Yáñez-Araque, B. Using fuzzy-set qualitative comparative analysis to develop an absorptive capacity-based view of training. J. Bus. Res. 2016, 69, 1510–1515. [Google Scholar] [CrossRef]

- Lu, W.; Chau, K.W.; Wang, H.; Pan, W. A decade’s debate on the nexus between corporate social and corporate financial performance: A critical review of empirical studies 2002–2011. J. Clean. Prod. 2014, 79, 195–206. [Google Scholar] [CrossRef]

- Lozano, R.; Carpenter, A.; Huisingh, D. A review of ‘theories of the firm’ and their contributions to Corporate Sustainability. J. Clean. Prod. 2015, 106, 430–442. [Google Scholar] [CrossRef]

- Herrera-Madueño, J.; Larrán-Jorge, M.; Martínez-Conesa, I.; Martínez-Martínez, D. Relationship between corporate social responsibility and competitive performance in Spanish SMEs: Empirical evidence from a stakeholders’ perspective. BRQ Bus. Res. Q. 2016, 19, 55–72. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. A conceptual model of entrepreneurship as firm behavior. Entrep. Theory Pract. 1991, 16, 7–25. [Google Scholar] [CrossRef]

- Zahra, S.A.; Neubaum, D.O.; Huse, M. The effect of the environment on export performance among telecommunications new ventures. Entrep. Theory Pract. 1997, 22, 25–46. [Google Scholar] [CrossRef]

- Kreiser, P.M.; Marino, L.D.; Dickson, P.; Weaver, K.M. Cultural influences on entrepreneurial orientation: The impact of national culture on risk taking and proactiveness in SMEs. Entrep. Theory Pract. 2010, 34, 959–983. [Google Scholar] [CrossRef]

- Nicolls, A. Social Entrepreneurship—New Models of Sustainable Social Change; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Beltz, F.M.; Binder, J.K. Sustainable entrepreneurship: A convergent process model. Bus. Strategy Environ. 2017, 26, 1–17. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Hammond, A. Serving the world’s poor, profitably. Harv. Bus. Rev. 2002, 80, 48–59. [Google Scholar] [PubMed]

- Schaltegger, S. A framework for ecopreneurship: Leading bioneers and environmental managers to ecopreneurship. Greener Manag. Int. 2002, 38, 45–58. [Google Scholar] [CrossRef]

- O´Neill, K.; Gibbs, D. Rethinking Green Entrepreneurship—Fluid Narratives of the Green Economy. Environ. Plan. 2016, 48, 1727–1749. [Google Scholar] [CrossRef]

- Ndubisi, N.O.; Nair, S.R. Green Entrepreneurship (GE) and Green Value Added (GVA): A conceptual framework. Int. J. Entrep. 2009, 13, 21–34. [Google Scholar]

- Criado-Gomis, A.; Cervera-Taulet, A.; Iniesta-Bonillo, M.A. Sustainable Entrepreneurial Orientation: A Business Strategic Approach for Sustainable Development. Sustainability 2017, 9, 1667. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Rung-Hoch, N. Sustainable entrepreneurial orientation in family firms. Sustainability 2017, 9, 1212. [Google Scholar] [CrossRef]

- Covin, J.G.; Miller, D. International entrepreneurial orientation: Conceptual considerations, research themes, measurement issues, and future research directions. Entrep. Theory Pract. 2014, 38, 11–44. [Google Scholar] [CrossRef]

- Winter, S.G. Understanding dynamic capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. The development and validation of the organizational innovativeness construct using confirmatory factor analysis. Eur. J. Innov. Manag. 2004, 7, 303–313. [Google Scholar] [CrossRef]

- Day, G.S. The capabilities of market-driven organizations. J. Mark. 1994, 58, 37–52. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Govindan, K.; Antucheviciene, J.; Turskis, Z. Hybrid multiple criteria decision-making methods: A review of applications for sustainability issues. Econ. Res. Ekon. Istraž. 2016, 29, 857–887. [Google Scholar] [CrossRef]

- Kuckertz, A.; Wagner, M. The influence of sustainability orientation on entrepreneurial intentions—Investigating the role of business experience. J. Bus. Ventur. 2010, 25, 524–539. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Patzelt, H. Researching Entrepreneurships’ Role in Sustainable Development. In Trailblazing in Entrepreneurship; Palgrave MacMillan: Cham, Switzerland, 2017; pp. 149–179. [Google Scholar]

- Hockerts, K.; Wüstenhagen, R. Greening Goliaths versus emerging Davids—Theorizing about the role of incumbents and new entrants in sustainable entrepreneurship. J. Bus. Ventur. 2010, 25, 481–492. [Google Scholar] [CrossRef]

- Cohen, B.; Smith, B.; Mitchell, R. Toward a sustainable conceptualization of dependent variables in entrepreneurship research. Bus. Strategy Environ. 2008, 17, 107–119. [Google Scholar] [CrossRef]

- Cohen, B.; Winn, M.I. Market imperfections, opportunity and sustainable entrepreneurship. J. Bus. Ventur. 2007, 22, 29–49. [Google Scholar] [CrossRef]

- Dean, T.J.; McMullen, J.S. Toward a theory of sustainable entrepreneurship: Reducing environmental degradation through entrepreneurial action. J. Bus. Ventur. 2007, 22, 50–76. [Google Scholar] [CrossRef]

- Stål, H.I.; Bonnedahl, K. Conceptualizing strong sustainable entrepreneurship. Small Enterp. Res. 2016, 23, 73–84. [Google Scholar] [CrossRef]

- Elkington, J. Enter the Triple Bottom Line. In The Triple Bottom Line, Does It All Add Up? Assessing the Sustainability of Business and CSR; Henriques, A., Richardson, J., Eds.; Earthscan Publications Ltd.: London, UK, 2004; pp. 1–16. [Google Scholar]

- Tilley, F.; Young, W. Sustainability entrepreneurs. Could they be the true wealth generators of the future? Greener Manag. Int. 2009, 55, 79–92. [Google Scholar]

- Schlange, L.E. Stakeholder identification in sustainability entrepreneurship. The role of managerial and organizational cognition. Greener Manag. Int. 2006, 55, 13–32. [Google Scholar] [CrossRef]

- George, B.A.; Marino, L. The epistemology of entrepreneurial orientation: Conceptual formation, modeling, and operationalization. Entrep. Theory Pract. 2011, 35, 989–1024. [Google Scholar] [CrossRef]

- Satori, G. Concept mis formation in comparative politics. Am. Political Sci. Rev. 1970, 64, 1033–1053. [Google Scholar] [CrossRef]

- Miller, D. Miller (1983) revisited: A reflection on EO research and some suggestions for the future. Entrep. Theory Pract. 2011, 35, 873–894. [Google Scholar] [CrossRef]

- Rauch, A.; Wiklund, J.; Lumpkin, G.T.; Frese, M. Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrep. Theory Pract. 2009, 33, 761–787. [Google Scholar] [CrossRef]

- Roig Dobon, S.; Ribeiro Soriano, D. Exploring alternative approaches in service industries: The role of entrepreneurship. Serv. Ind. J. 2008, 28, 877–882. [Google Scholar] [CrossRef]

- Wales, W.; Monsen, E.; McKelvie, A. The organizational pervasiveness of entrepreneurial orientation. Entrep. Theory Pract. 2011, 35, 895–923. [Google Scholar] [CrossRef]

- Méndez-Picazo, M.T.; Galindo-Martín, M.Á.; Ribeiro-Soriano, D. Governance, entrepreneurship and economic growth. Entrep. Reg. Dev. 2012, 24, 865–877. [Google Scholar] [CrossRef]

- Ribeiro-Soriano, D.; Peris-Ortiz, M. Subsidizing technology: How to succeed. J. Bus. Res. 2011, 64, 1224–1228. [Google Scholar] [CrossRef]

- Eddleston, K.A.; Kellermanns, F.W.; Floyd, S.W.; Crittenden, V.L.; Crittenden, W.F. Planning for growth: Life stage differences in family firms. Entrep. Theory Pract. 2013, 37, 1177–1202. [Google Scholar] [CrossRef]

- González, A.C.; Rodriguez, Y.E.; Sossa, A. Leadership and Governance Decisions in Family Business Performance: An Application of Fuzzy Sets Logic. J. Small Bus. Strategy 2017, 27, 51–66. [Google Scholar]

- Kellermanns, F.W.; Eddleston, K.A. Corporate entrepreneurship in family firms: A family perspective. Entrep. Theory Pract. 2006, 30, 809–830. [Google Scholar] [CrossRef]

- Zahra, S.A. Governance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Acad. Manag. J. 1996, 39, 1713–1735. [Google Scholar]

- Casillas, J.C.; Moreno, A.M. The relationship between entrepreneurial orientation and growth: The moderating role of family involvement. Entrep. Reg. Dev. 2010, 22, 265–291. [Google Scholar] [CrossRef]

- Zahra, S.A. Entrepreneurial risk taking in family firms. Fam. Firm Rev. 2005, 18, 23–40. [Google Scholar] [CrossRef]

- Naldi, L.; Nordqvist, M.; Sjöberg, K.; Wiklund, J. Entrepreneurial orientation, risk taking, and performance in family firms. Fam. Firm Rev. 2007, 20, 33–47. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A.; Zellweger, T.M. Extending the socioemotional wealth perspective: A look at the dark side. Entrep. Theory Pract. 2012, 36, 1175–1182. [Google Scholar] [CrossRef]

- Cruz, C.; Nordqvist, M. Entrepreneurial orientation in family firms: A generational perspective. Small Bus. Econ. 2012, 38, 33–49. [Google Scholar] [CrossRef]

- Zahra, S.A.; Hayton, J.C.; Neubaum, D.O.; Dibrell, C.; Craig, J. Culture of family commitment and strategic flexibility: The moderating effect of stewardship. Entrep. Theory Pract. 2008, 32, 1035–1054. [Google Scholar] [CrossRef]

- Covin, J.G.; Green, K.M.; Slevin, D.P. Strategic process effects on the entrepreneurial orientation-sales growth rate relationship. Entrep. Theory Pract. 2006, 30, 57–81. [Google Scholar] [CrossRef]

- Knight, G.A. Cross-cultural reliability and validity of a scale to measure firm entrepreneurial orientation. J. Bus. Ventur. 1997, 12, 213–225. [Google Scholar] [CrossRef]

- Kreiser, P.M.; Marino, L.D.; Weaver, K.M. Assessing the psychometric properties of the entrepreneurial orientation scale: A multicountry analysis. Entrep. Theory Pract. 2002, 26, 71–94. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Miller, D. The correlates of entrepreneurship in three types of firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. Strategic management of small firms in hostile and benign environments. Strateg. Manag. J. 1989, 10, 75–87. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P. Strategy making and environment: The third link. Strateg. Manag. J. 1983, 4, 221–235. [Google Scholar] [CrossRef]

- Kropp, F.; Lindsay, N.J.; Shoham, A. Entrepreneurial, market, and learning orientations and international entrepreneurial business venture performance in South African firms. Int. Market. Rev. 2006, 23, 504–523. [Google Scholar] [CrossRef]

- Chandra, Y.; Styles, C.; Wilkinson, I. The recognition of first time international entrepreneurial opportunities: Evidence from firms in knowledge-based industries. Int. Market. Rev. 2009, 26, 30–61. [Google Scholar] [CrossRef]

- Krauss, S.; Frese, M.; Friedrich, C.; Unger, J. Entrepreneurial orientation: A psychological model successamong southern African small business owners. Eur. J. Work Organ. Psychol. 2005, 14, 315–344. [Google Scholar] [CrossRef]

- Hansen, J.D.; Deitz, G.D.; Tokman, M.; Marino, L.D.; Weaver, K.M. Cross-national invariance of the entrepreneurialorientation scale. J. Bus. Ventur. 2001, 26, 61–78. [Google Scholar] [CrossRef]

- Covin, J.G.; Wales, W.J. The measurement of entrepreneurial orientation. Entrep. Theory Pract. 2012, 36, 677–702. [Google Scholar] [CrossRef]

- Hernández-Perlines, F. Entrepreneurial orientation in hotel industry: Multi-group analysis of quality certification. J. Bus. Res. 2016, 69, 4714–4724. [Google Scholar] [CrossRef]

- Engelen, A.; Gupta, V.; Strenger, L.; Brettel, M. Entrepreneurial orientation, firm performance, and the moderating role of transformational leadership behaviors. J. Manag. 2015, 41, 1069–1097. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Pett, T.; Wolff, J.A. Entrepreneurial orientation and learning in high and low-performing SMEs. J. Small Bus. Strategy 2016, 26, 71–86. [Google Scholar]

- Escalonilla-Solano, S.; Plaza-Casado, P.; Ureba, S.F. Análisis de la divulgación de la información sobre la responsabilidad social corporativa en las empresas de transporte público urbano en España. Revista de Contabilidad 2016, 19, 195–203. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery Loves Companies: Rethinking Social Initiatives by Business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Wu, M.L. Corporate social performance, corporate financial performance, and firm size: A meta-analysis. J. Am. Acad. Bus. 2006, 8, 163–171. [Google Scholar]

- Alvarado Herrera, A.; Bigné Alcañiz, E.; Currás Pérez, R. Theoretical perspectives for studying corporate social responsibility: A rationality-based classification. Estud. Gerenc. 2011, 27, 115–138. [Google Scholar]

- Garcia-Castro, R.; Ariño, M.A.; Canela, M.A. Does social performance really lead to financial performance? Accounting for endogeneity. J. Bus. Ethics 2010, 92, 107–126. [Google Scholar] [CrossRef]

- Mar Miras-Rodríguez, M.; Carrasco-Gallego, A.; Escobar-Pérez, B. Are Socially Responsible Behaviors Paid Off Equally? A Cross-cultural Analysis. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 237–256. [Google Scholar] [CrossRef]

- Martínez-Campillo, A.; Cabeza-García, L.; Marbella-Sánchez, F. Responsabilidad social corporativa y resultado financiero: Evidencia sobre la doble dirección de la causalidad en el sector de las Cajas de Ahorros. Cuadernos de Economía y Dirección de la Empresa 2013, 16, 54–68. [Google Scholar] [CrossRef]

- Li, F.; Li, T.; Minor, D. CEO power, corporate social responsibility, and firm value: A test of agency theory. Int. J. Manag. Financ. 2016, 12, 611–628. [Google Scholar] [CrossRef]

- Hernández-Perlines, F. Influencia de la responsabilidad social en el desempeño de las empresas familiares. Revista de Globalización Competitividad y Gobernabilidad 2017, 11, 58–73. [Google Scholar]

- Cuomo, M.T.; Tortora, D.; Mazzucchelli, A.; Festa, G.; Di Gregorio, A.; Metallo, G. Impacts of Code of ethics on financial performance in the Italian listed companies of bank sector. J. Bus. Account. Financ. Perspect. 2018, in press. [Google Scholar] [CrossRef]

- Mikušová, M. To be or not to be a business responsible for sustainable development? Survey from small Czech businesses. Econ. Res. Ekon. Istraž. 2017, 30, 1318–1338. [Google Scholar] [CrossRef]

- Gamerschlag, R.; Möller, K.; Verbeeten, F. Determinants of voluntary CSR disclosure: Empirical evidence from Germany. Rev. Manag. Sci. 2011, 5, 233–262. [Google Scholar] [CrossRef]

- Campopiano, G.; De Massis, A. Corporate social responsibility reporting: A content analysis in family and non-family firms. J. Bus. Ethics 2015, 129, 511–534. [Google Scholar] [CrossRef]

- Chen, L.; Feldmann, A.; Tang, O. The relationship between disclosures of corporate social performance and financial performance: Evidences from GRI reports in manufacturing industry. Int. J. Prod. Econ. 2015, 170, 445–456. [Google Scholar] [CrossRef]

- Mintzberg, H. Strategy-making in three modes. Calif. Manag. Rev. 1973, 16, 4–53. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations; SAGE: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Zahra, S.A. Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. J. Bus. Ventur. 1993, 8, 319–340. [Google Scholar] [CrossRef]

- Antoncic, B.; Hisrich, R.D. Corporate entrepreneurship contingencies and organizational wealth creation. J. Manag. Dev. 2004, 23, 518–550. [Google Scholar] [CrossRef]

- Al Wakil, A. When Gambling is Not Winning: Exploring Optimality of VIX Trading under the Expected Utility Theory. J. Bus. Account. Financ. Perspect. 2018, in press. [Google Scholar] [CrossRef]

- Bednarska, M.A. Complementary Person-environment fit as a predictor of job pursuit intentions in the service industry. Contemp. Econ. 2016, 10, 27–38. [Google Scholar] [CrossRef]

- Russell, R.D.; Russell, C.J. An examination of the effects of organizational norms, organizational structure, and environmental uncertainty on entrepreneurial strategy. J. Manag. 1992, 18, 639–656. [Google Scholar] [CrossRef]

- Tan, J. Regulatory environment and strategic orientations in a transitional economy: A study of Chinese private enterprise. Entrep. Theory Pract. 1996, 21, 31–47. [Google Scholar] [CrossRef]

- Balabanis, G.; Katsikea, E. Being an entrepreneurial exporter: Does it pay? Int. Bus. Rev. 2004, 12, 233–252. [Google Scholar] [CrossRef]

- Goll, I.; Rasheed, A. Rational decision-making and firm performance: The moderating role of the environment. Strateg. Manag. J. 1997, 18, 583–591. [Google Scholar] [CrossRef]

- Francis, J.; Collins-Dodd, C. The impact of firms’ export orientation on the export performance of high-tech small and medium-sized enterprises. J. Int. Mark. 2000, 8, 84–103. [Google Scholar] [CrossRef]

- Zahra, S.A.; Bogner, W.C. Technology strategy and software new ventures’ performance: Exploring the moderating effect of the competitive environment. J. Bus. Ventur. 2000, 15, 135–173. [Google Scholar] [CrossRef]

- Zahra, S.A.; Garvis, D.M. International corporate entrepreneurship and firm performance: The moderating effect of international environmental hostility. J. Bus. Ventur. 2000, 15, 469–492. [Google Scholar] [CrossRef]

- Cohen, J. A power primer. Psychol. Bull. 1992, 112, 155–159. [Google Scholar] [CrossRef] [PubMed]

- Faul, F.; Erdfelder, E.; Buchner, A.; Lang, A.G. Statistical power analyses using G* power 3.1: Tests for correlation and regression analyses. Behav. Res. Methods 2009, 41, 1149–1160. [Google Scholar] [CrossRef] [PubMed]

- Morgan, N.A.; Kaleka, A.; Katsikeas, C.S. Antecedents of export venture performance: A theoretical model and empirical assessment. J. Mark. 2004, 68, 90–108. [Google Scholar] [CrossRef]

- Cavusgil, S.T.; Zou, S. Marketing strategy-performance relationship: An investigation of the empirical link in export market ventures. J. Mark. 1994, 58, 1–21. [Google Scholar] [CrossRef]

- Dimitratos, P.; Lioukas, S.; Carter, S. The relationship between entrepreneurship and international performance: The importance of domestic environment. Int. Bus. Rev. 2004, 13, 19–41. [Google Scholar] [CrossRef]

- Robertson, C.; Chetty, S.K. A contingency-based approach to understanding export performance. Int. Bus. Rev. 2000, 9, 211–235. [Google Scholar] [CrossRef]

- Etchebarne, M.S.; Geldres, V.V.; García-Cruz, R. El impacto de la orientación emprendedora en el desempeño exportador de la firma. ESIC Mark. Econ. Bus. J. 2010, 137, 165–220. [Google Scholar]

- Chrisman, J.J.; Chua, J.H.; Sharma, P. Trends and directions in the development of a strategic management theory of the family firm. Entrep. Theory Pract. 2005, 29, 555–576. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair, J.F., Jr. Partial least squares structural equation modeling (PLS-SEM): A useful tool for family firm researchers. J. Fam. Bus. Strategy 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Jöreskog, K.G.; Wold, H.O. Systems Under Indirect Observation: Causality, Structure, Prediction 139; Elsevier: Amsterdam, The Netherlands, 1982. [Google Scholar]

- Astrachan, C.B.; Patel, V.K.; Wanzenried, G. A comparative study of CB-SEM and PLS-SEM for theory development in family firm research. J. Fam. Bus. Strategy 2014, 5, 116–128. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. Smart PLS 3; SmartPLS GmbH: Boenningstedt, Germany, 2015; Available online: https://www.smartpls.com (accessed on 30 March 2018).

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to causal modeling: Personal computer adoption and use as an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems (193–221); Mora, M., Gelman, O., Steenkamp, A., Raisinghani, M., Eds.; IGI Global: Hershey, PA, USA, 2012. [Google Scholar]

- Carmines, E.G.; Zeller, R.A. Reliability and Validity Assessment; Sage Publications: Beverly Hills, CA, USA, 1979; Volume 17. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Wright, R.T.; Campbell, D.E.; Thatcher, J.B.; Roberts, N. Operationalizing multidimensional constructs in structural equation modeling: Recommendations for IS research. Commun. Assoc. Inf. Syst. 2012, 30, 367–412. [Google Scholar]

- Diamantopoulos, A.; Riefler, P.; Roth, K.P. Advancing formative measurement models. J. Bus. Res. 2008, 6, 1203–1218. [Google Scholar] [CrossRef]

- Diamantopoulos, A.; Winklhofer, H.M. Index construction with formative indicators: An alternative to scale development. J. Mark. Res. 2001, 38, 269–277. [Google Scholar] [CrossRef]

- Kleinbaum, D.G.; Kupper, L.L.; Muller, K.E.; Nizam, A. One Way Analysis of Variance. In Applied Regression Analysis and Other Multivariable Methods; PWS-Kent Publishing: Boston, MA, USA, 1988. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychol. Methods 1998, 3, 424–453. [Google Scholar] [CrossRef]

- Benavides-Espinosa, M.; Ribeiro-Soriano, D. Cooperative learning in creating and managing joint ventures. J. Bus. Res. 2014, 67, 648–655. [Google Scholar] [CrossRef]

- Kolesnikov, Y.A.; Epifanova, T.V.; Usenko, A.M.; Parshina, E.; Ostrovskaya, V.N. The peculiarities of state regulation of innovation activities of enterprises in the global economy. Contemp. Econ. 2016, 10, 343–352. [Google Scholar] [CrossRef]

| Sample Size | 1.045 |

| Scope of application | Spain |

| Valid answers | 174 |

| Sample processing | Simple random |

| Confidence level | 95%, p = 50%; α = 0.05 |

| Response rate | 16.65% |

| Sampling error | 6.79% |

| Fieldwork | November 2015–February 2016 |

| Composite | Composed Reliability | Cronbach Alpha | AVE a |

|---|---|---|---|

| SEO 1 | 0.747 | 0.792 | 0.694 |

| EO 2 | 0.850 | 0.733 | 0.756 |

| CSR 3 | 0.827 | 0.882 | 0.809 |

| EN 4 | 0.937 | 0.866 | 0.882 |

| IPF 5 | 0.744 | 0.780 | 0.695 |

| SEO 1 | CSR 2 | EO 3 | EN 4 | IPF 5 | |

|---|---|---|---|---|---|

| SEO 1 | 0.833 * | ||||

| CSR 2 | 0.642 | 0.899 * | |||

| EO 3 | 0.701 | 0.647 | 0.869 * | ||

| EN 4 | 0.548 | 0.684 | 0.563 | 0.939 * | |

| IPF 5 | 0.687 | 0.713 | 0.671 | 0.695 | 0.833 * |

| SEO 1 | CSR 2 | EO 3 | EN 4 | IPF 5 | |

|---|---|---|---|---|---|

| SEO 1 | |||||

| CSR 2 | 0.676 | ||||

| EO 3 | 0.784 | 0.743 | |||

| EN 4 | 0.687 | 0.712 | 0.693 | ||

| IPF 5 | 0.610 | 0.636 | 0.702 | 0.698 |

| Original Data (O) | Mean of Data (M) | 5.0% | 95.0% | Mean of Data (M) | Bias | 5.0% | 95.0% | |

|---|---|---|---|---|---|---|---|---|

| CSR 3 SEO 1 | 0.636 | 0.622 | 0.275 | 0.657 | 0.622 | −0.014 | 0.277 | 0.658 |

| EO 2 SEO 1 | 0.702 | 0.696 | 0.258 | 0.758 | 0.696 | −0.006 | 0.247 | 0.754 |

| SEO 2 IPF 5 | 0.707 | 0.706 | 0.635 | 0.770 | 0.706 | 0.001 | 0.630 | 0.767 |

| EN 4 IPF 5 | 0.902 | 0.908 | 0.882 | 0.928 | 0.908 | 0.006 | 0.882 | 0.928 |

| EO 2 | ||

| Factor | Loads (λ) | VIF |

| Innovativeness | 0.478 | 1.905 |

| Proactiveness | 0.429 | 1.703 |

| Risk taking | 0.308 | 1.28 |

| SEO 1 | ||

| Factor | Loads (λ) | VIF |

| EO 2 | 0.632 | 2.253 |

| CSR 3 | 0.529 | 2.398 |

| R 2 | B | t-Value | Support | |

|---|---|---|---|---|

| SEO 1 IPF 5 | 0.586 | 0.404 | 8.563 | Yes |

| SEO 1 IPF 5 EN 4 IPF 5 | 0.647 | 0.482 0.395 | 6.681 5.854 | |

| SEO 1 × EN 4 IPF 5 | 0.735 | 0.375 0.412 0.290 | 9.837 7.543 4.759 | Yes |

| Variable | ß | t-Value |

|---|---|---|

| Age | −0.086 | 0.976 |

| Sector | −0.089 | 0.751 |

| Size | −0.072 | 0.864 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hernández-Perlines, F.; Ibarra Cisneros, M.A. The Role of Environment in Sustainable Entrepreneurial Orientation. The Case of Family Firms. Sustainability 2018, 10, 2037. https://doi.org/10.3390/su10062037

Hernández-Perlines F, Ibarra Cisneros MA. The Role of Environment in Sustainable Entrepreneurial Orientation. The Case of Family Firms. Sustainability. 2018; 10(6):2037. https://doi.org/10.3390/su10062037

Chicago/Turabian StyleHernández-Perlines, Felipe, and Manuel Alejandro Ibarra Cisneros. 2018. "The Role of Environment in Sustainable Entrepreneurial Orientation. The Case of Family Firms" Sustainability 10, no. 6: 2037. https://doi.org/10.3390/su10062037

APA StyleHernández-Perlines, F., & Ibarra Cisneros, M. A. (2018). The Role of Environment in Sustainable Entrepreneurial Orientation. The Case of Family Firms. Sustainability, 10(6), 2037. https://doi.org/10.3390/su10062037