Green Product Development with Consumer Heterogeneity under Horizontal Competition

Abstract

:1. Introduction

2. Literature Review

3. Model Development

3.1. Firms

3.2. Consumers

3.3. Notation and Consumer Utility

4. Analysis

4.1. Benchmark: Product Development without Consumer Heterogeneity

4.1.1. Scenario 1

4.1.2. Scenario 2

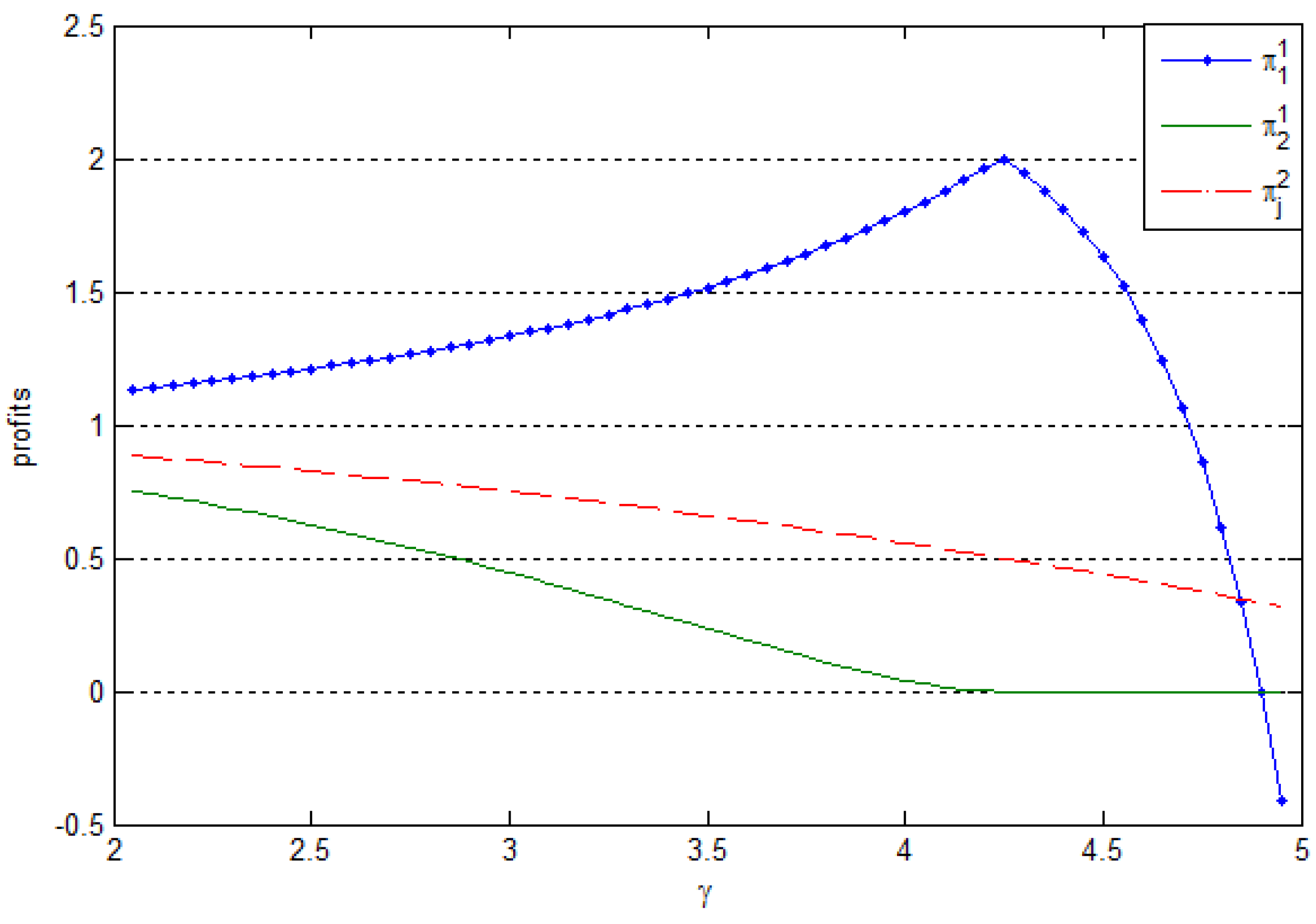

4.1.3. Comparative Analysis between Two Scenarios

4.2. Product Development with Consumer Heterogeneity

4.2.1. Scenario 3

4.2.2. Scenario 4

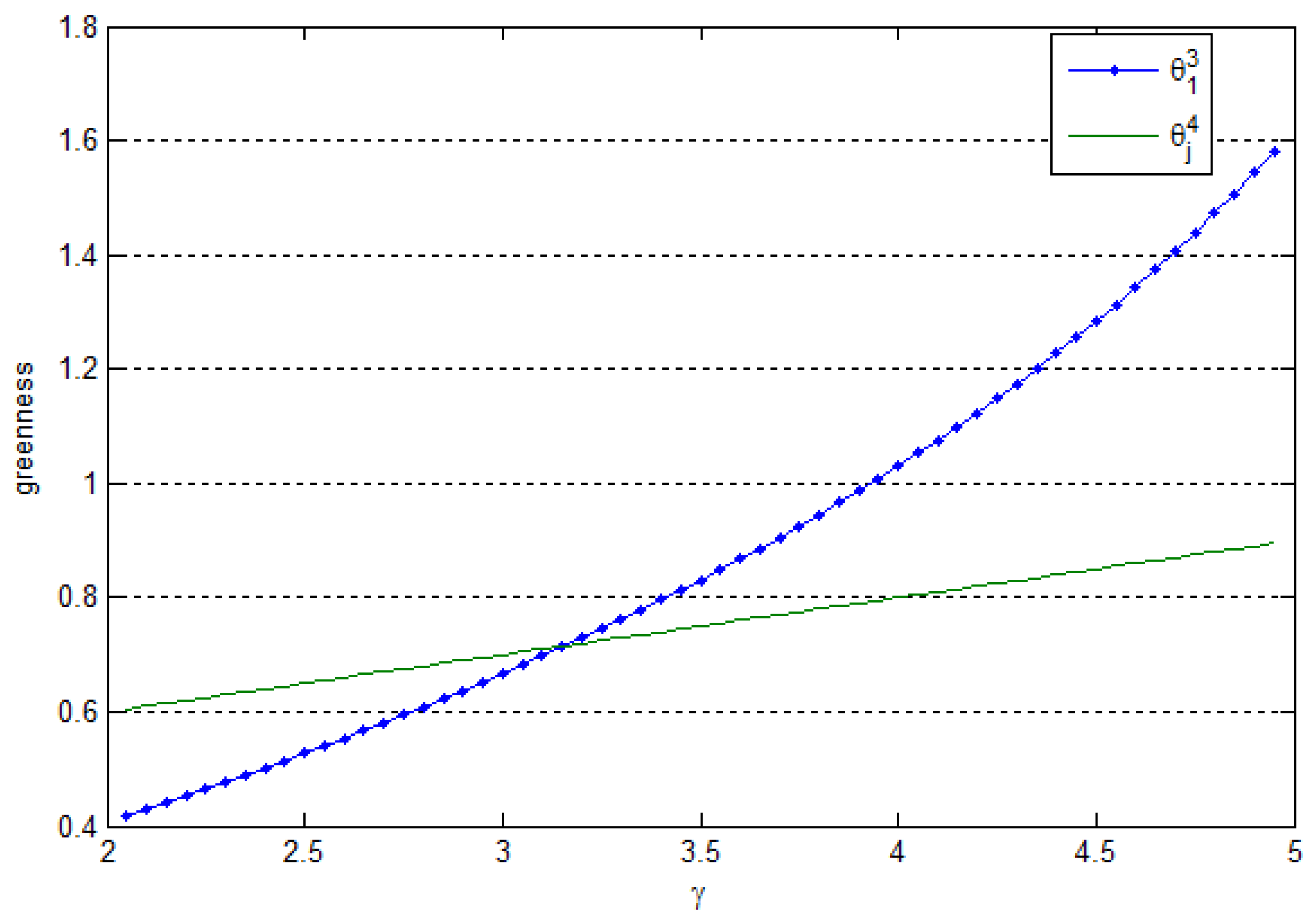

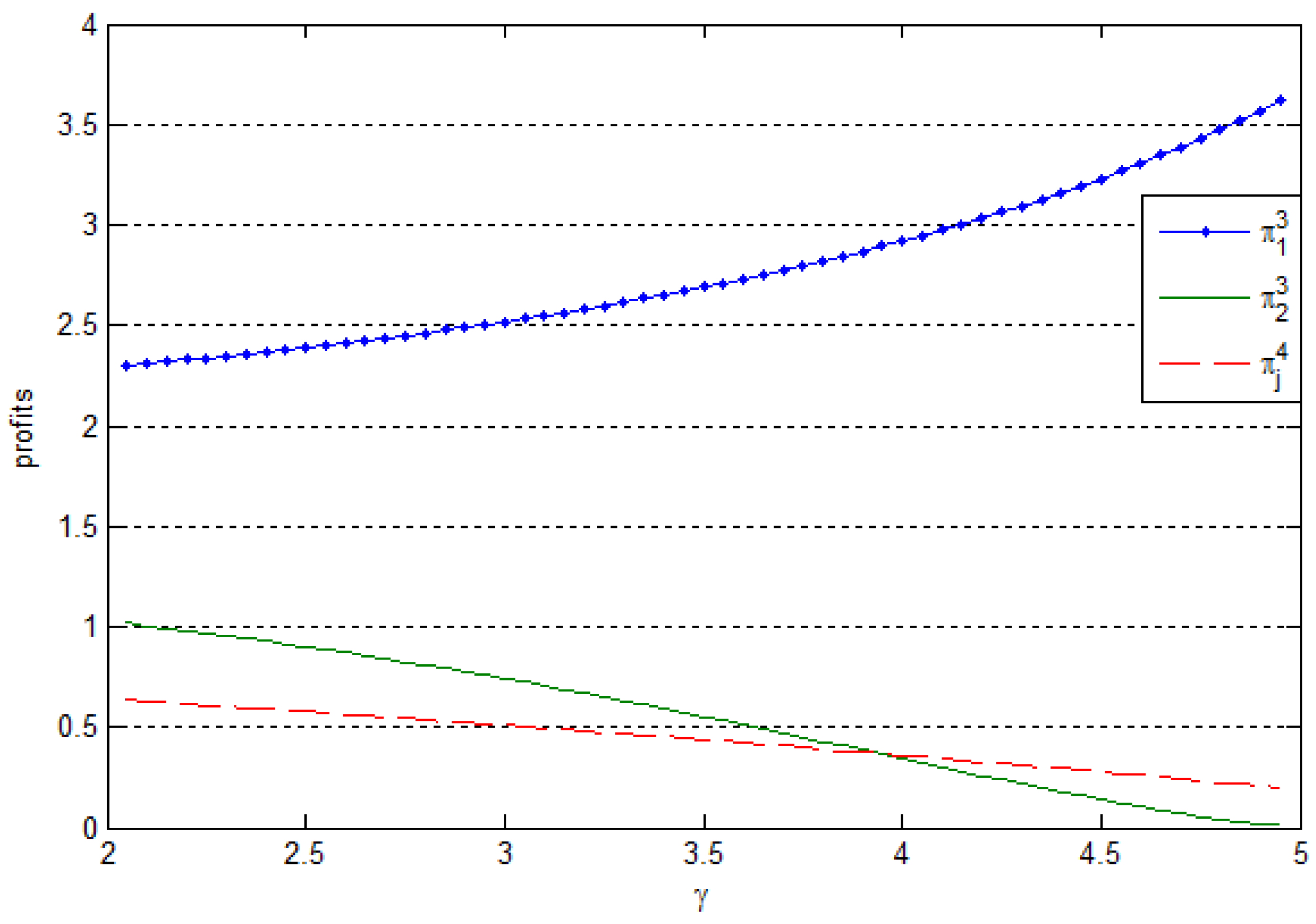

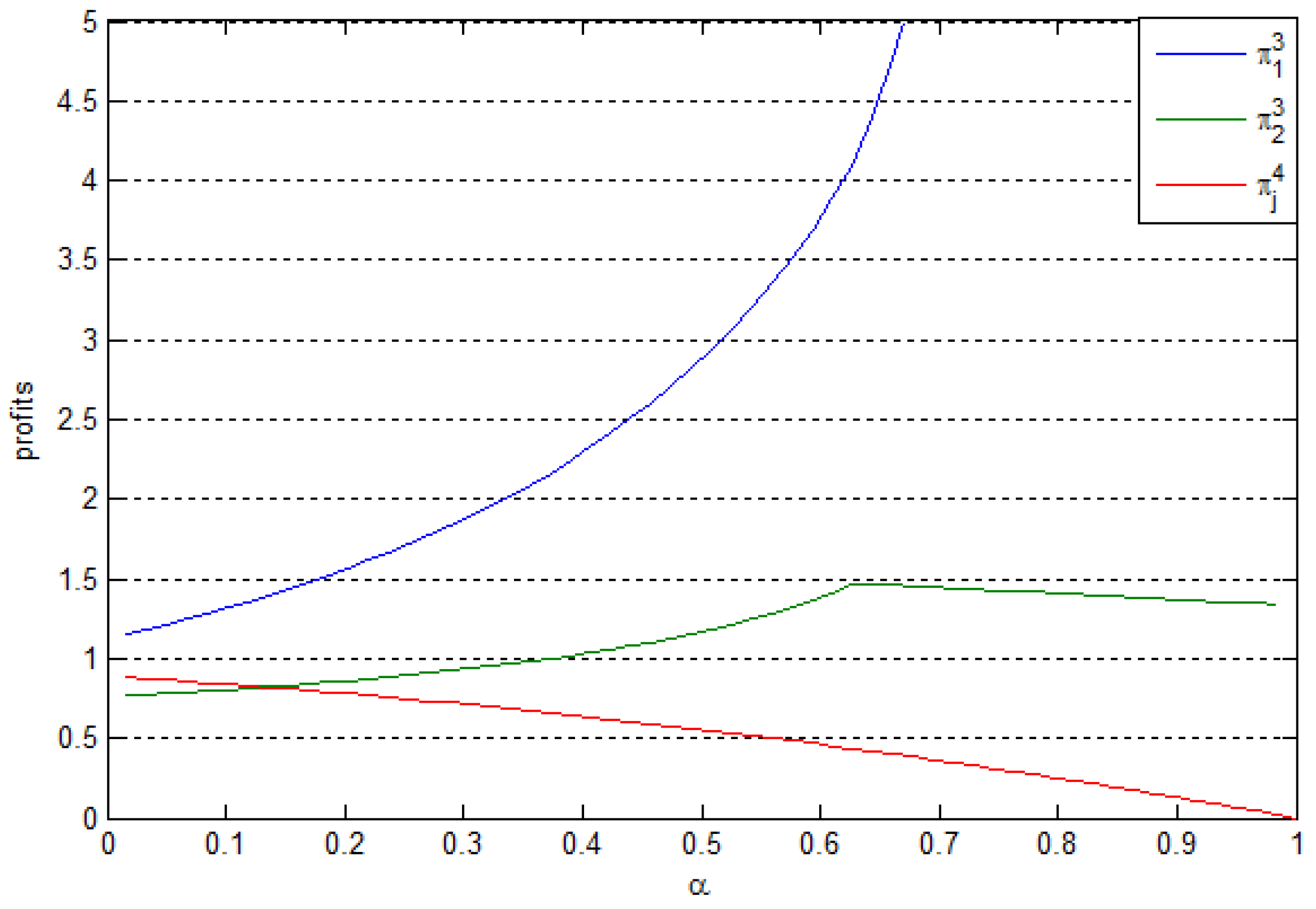

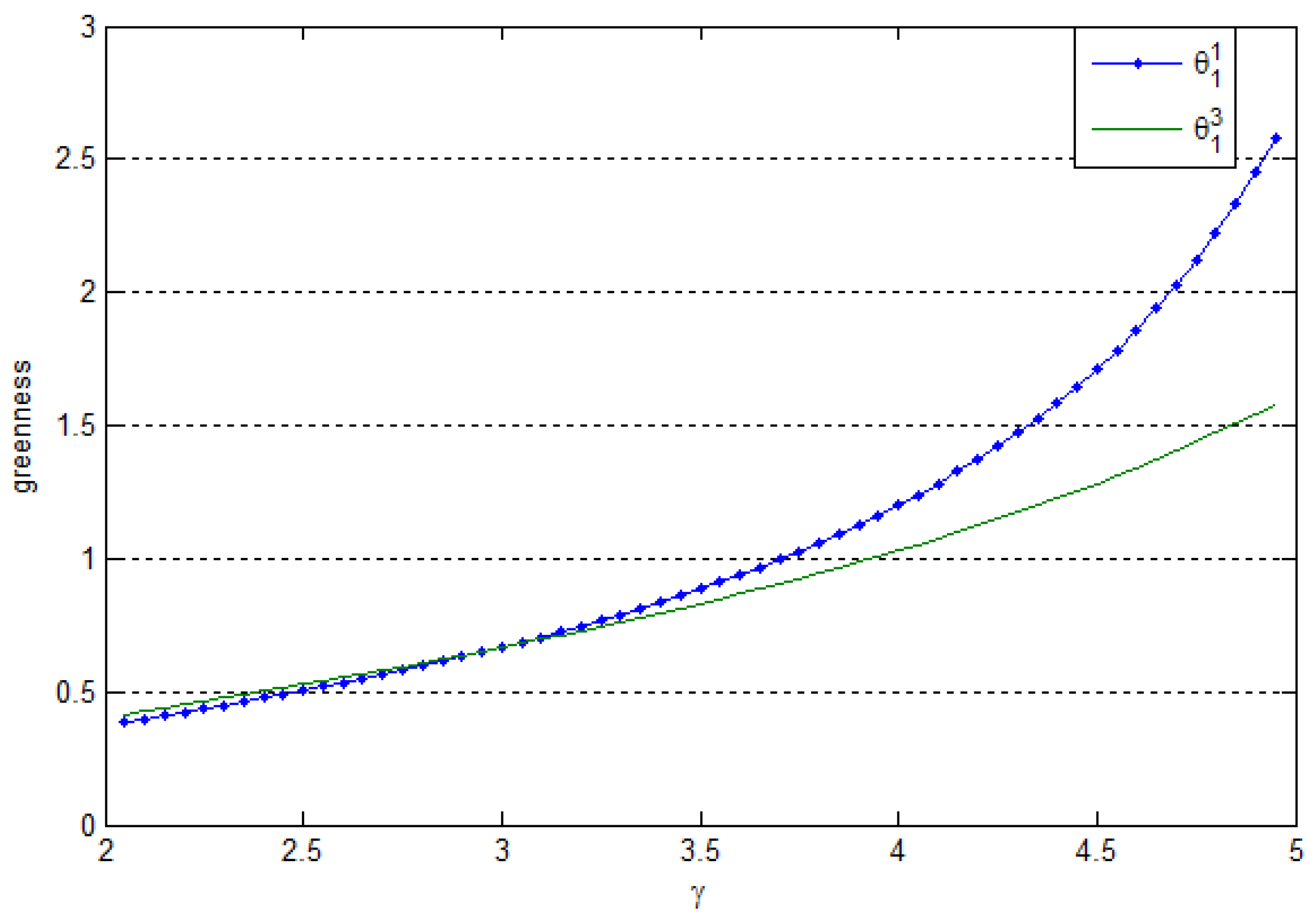

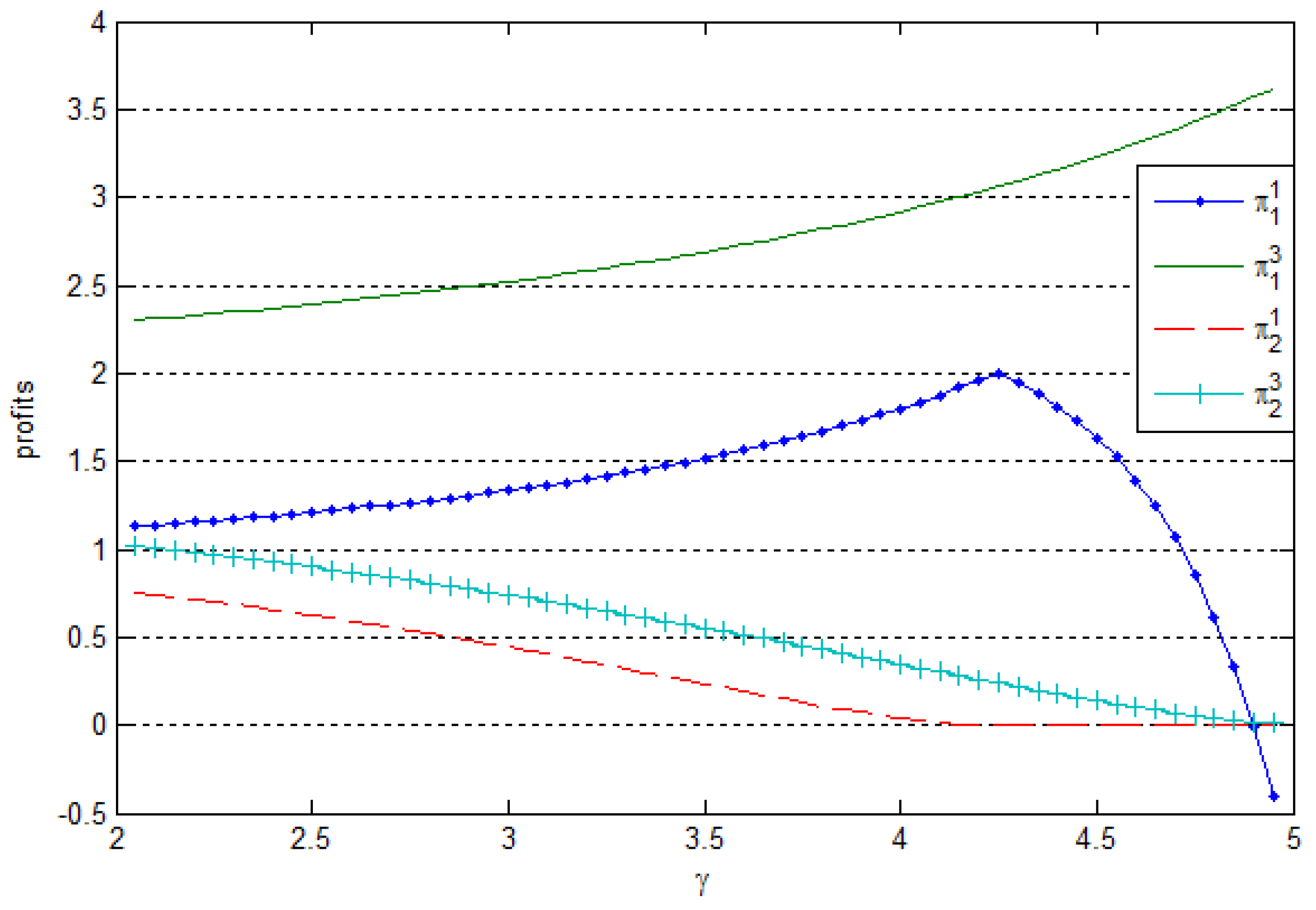

4.2.3. Comparative Analysis between Two Scenarios

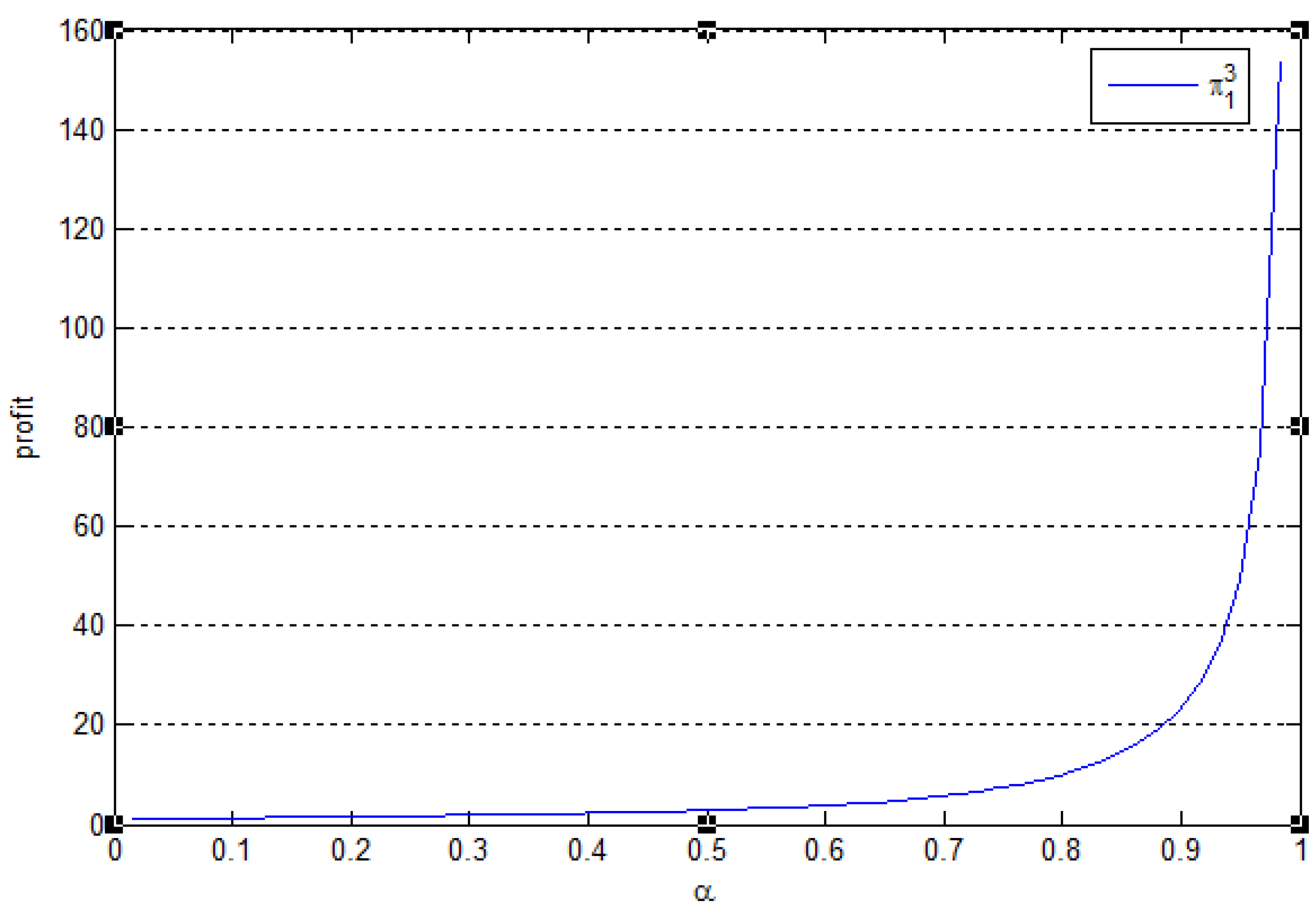

5. Effects of Consumer Heterogeneity

6. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

References

- Chen, Y.S. The drivers of green brand equity: Green brand image, green satisfaction, and green trust. J. Bus. Ethics 2010, 93, 307–319. [Google Scholar] [CrossRef]

- Chen, Y.S. The driver of green innovation and green image–green core competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Bei, L.T.; Simpson, E.M. The determinants of consumers’ purchase decisions for recycled products: An application of acquisition-transaction utility theory. ACR N. Am. Adv. 1995, 22, 257–261. [Google Scholar]

- Du, B.; Liu, Q.; Li, G. Coordinating Leader-Follower Supply Chain with Sustainable Green Technology Innovation on Their Fairness Concerns. Int. J. Environ. Res. Public Health 2017, 14, 1357. [Google Scholar] [CrossRef] [PubMed]

- Chen, B.; Abeles, E.; Burke, A.; Sperling, D. Effect of Emissions Regulation on Vehicle Attributes, Cost, and Price. Contract 2004, 2, 310. [Google Scholar]

- Chen, C. Design for the environment: A quality-based model for green product development. Manag. Sci. 2001, 47, 250–263. [Google Scholar] [CrossRef]

- De Bakker, F.G.; Fisscher, O.A.; Brack, A.J. Organizing product-oriented environmental management from a firm’s perspective. J. Clean. Prod. 2002, 10, 455–464. [Google Scholar] [CrossRef]

- Nielsen, P.H.; Wenzel, H. Integration of environmental aspects in product development: A stepwise procedure based on quantitative life cycle assessment. J. Clean. Prod. 2002, 10, 247–257. [Google Scholar] [CrossRef]

- Bovea, M.; Pérez-Belis, V. A taxonomy of ecodesign tools for integrating environmental requirements into the product design process. J. Clean. Prod. 2012, 20, 61–71. [Google Scholar] [CrossRef]

- Lindahl, M. Engineering designers’ experience of design for environment methods and tools–Requirement definitions from an interview study. J. Clean. Prod. 2006, 14, 487–496. [Google Scholar] [CrossRef]

- Zhou, X.; Schoenung, J.M. An integrated impact assessment and weighting methodology: Evaluation of the environmental consequences of computer display technology substitution. J. Environ. Manag. 2007, 83, 1–24. [Google Scholar] [CrossRef] [PubMed]

- Gluch, P.; Baumann, H. The life cycle costing (LCC) approach: A conceptual discussion of its usefulness for environmental decision-making. Build. Environ. 2004, 39, 571–580. [Google Scholar] [CrossRef]

- Elkington, J.; Hailes, J. The Green Consumer Guide; Victor Gollancz: London, UK, 1988. [Google Scholar]

- Albino, V.; Balice, A.; Dangelico, R.M. Environmental strategies and green product development: An overview on sustainability-driven companies. Bus. Strategy Environ. 2009, 18, 83–96. [Google Scholar] [CrossRef]

- Earl, P.E.; Wakeley, T. Economic perspectives on the development of complex products for increasingly demanding customers. Res. Policy 2010, 39, 1122–1132. [Google Scholar] [CrossRef]

- Lacourbe, P.; Loch, C.H.; Kavadias, S. Product Positioning in a Two-Dimensional Market Space. Prod. Oper. Manag. 2009, 18, 315–332. [Google Scholar] [CrossRef]

- Qian, L. Product price and performance level in one market or two separated markets under various cost structures and functions. Int. J. Prod. Econ. 2011, 131, 505–518. [Google Scholar] [CrossRef]

- Krishnan, V.; Zhu, W. Designing a family of development-intensive products. Manag. Sci. 2006, 52, 813–825. [Google Scholar] [CrossRef]

- Simpson, D.F.; Power, D.J. Use the supply relationship to develop lean and green suppliers. Supply Chain Manag. Int. J. 2005, 10, 60–68. [Google Scholar] [CrossRef]

- Handfield, R.; Sroufe, R.; Walton, S. Integrating environmental management and supply chain strategies. Bus. Strategy Environ. 2005, 14, 1–19. [Google Scholar] [CrossRef]

- Ashby, A.; Leat, M.; Hudson-Smith, M. Making connections: A review of supply chain management and sustainability literature. Supply Chain Manag. Int. J. 2012, 17, 497–516. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Swami, S.; Shah, J. Channel coordination in green supply chain management. J. Oper. Res. Soc. 2013, 64, 336–351. [Google Scholar] [CrossRef]

- Wang, K.H.; Huang, Y.C.; Tung, C.T.; Lee, Y.J. Inventory management and pricing decisions for a supply chain with demand leakage and a return-policy contract. Int. J. Inf. Manag. Sci. 2015, 26, 51–65. [Google Scholar]

- Guo, D.; He, Y.; Wu, Y.; Xu, Q. Analysis of supply chain under different subsidy policies of the government. Sustainability 2016, 8, 1290. [Google Scholar] [CrossRef]

- He, R.; Xiong, Y.; Lin, Z. Carbon emissions in a dual channel closed loop supply chain: The impact of consumer free riding behavior. J. Clean. Prod. 2016, 134, 384–394. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Li, H.; Wang, C.; Shang, M.; Ou, W. Pricing, carbon emission reduction, low-carbon promotion and returning decision in a closed-loop supply chain under vertical and horizontal cooperation. Int. J. Environ. Res. Public Health 2017, 14, 1332. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.; Zheng, X.X.; Gong, B.G.; Gui, Y.M. Joint Decision-Making and the Coordination of a Sustainable Supply Chain in the Context of Carbon Tax Regulation and Fairness Concerns. Int. J. Environ. Res. Public Health 2017, 14, 1464. [Google Scholar] [CrossRef] [PubMed]

- Zhu, W.; He, Y. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Raza, S.A.; Rathinam, S.; Turiac, M.; Kerbache, L. An integrated revenue management framework for a firm’s greening, pricing and inventory decisions. Int. J. Prod. Econ. 2018, 195, 373–390. [Google Scholar] [CrossRef]

- Zhao, S.; Zhu, Q.; Cui, L. A decision-making model for remanufacturers: Considering both consumers’ environmental preference and the government subsidy policy. Resour. Conserv. Recycl. 2018, 128, 176–186. [Google Scholar] [CrossRef]

- He, Y.; Xu, Q.; Xu, B.; Wu, P. Supply chain coordination in quality improvement with reference effects. J. Oper. Res. Soc. 2016, 67, 1158–1168. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| firms | |

| Products’ greenness for firm in scenario | |

| Price for firm in scenario | |

| Profit for firm in scenario | |

| Unit variable cost | |

| consumers | |

| Consumer valuation on products | |

| Fixed cost coefficient | |

| Greenness sensitivity of consumers with no preference | |

| Greenness sensitivity of consumers preferring green product | |

| for | Transportation cost for consumers with no preference at location |

| Fraction of consumers preferring green product | |

| Fraction of consumers with no preference | |

| Utility for consumers purchasing from firm in scenario |

| Firm 1 | Firm 2 | |

|---|---|---|

| Greenness | _ | |

| Price | ||

| Profit |

| Firm 1 | Firm 2 | |

|---|---|---|

| Greenness | ||

| Price | ||

| Profit |

| Firm 1 | Firm 2 | |

|---|---|---|

| Greenness | _ | |

| Price | ||

| Profit |

| Firm 1 | Firm 2 | |

| Greenness | ||

| Price | ||

| Profit |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, B.; Xu, Q.; Bo, Q.; Hu, Q. Green Product Development with Consumer Heterogeneity under Horizontal Competition. Sustainability 2018, 10, 1902. https://doi.org/10.3390/su10061902

Xu B, Xu Q, Bo Q, Hu Q. Green Product Development with Consumer Heterogeneity under Horizontal Competition. Sustainability. 2018; 10(6):1902. https://doi.org/10.3390/su10061902

Chicago/Turabian StyleXu, Bing, Qingyun Xu, Qiushi Bo, and Qifan Hu. 2018. "Green Product Development with Consumer Heterogeneity under Horizontal Competition" Sustainability 10, no. 6: 1902. https://doi.org/10.3390/su10061902

APA StyleXu, B., Xu, Q., Bo, Q., & Hu, Q. (2018). Green Product Development with Consumer Heterogeneity under Horizontal Competition. Sustainability, 10(6), 1902. https://doi.org/10.3390/su10061902