To judge whether a country’s foreign exchange reserve is appropriate or not, it is necessary to take the optimal scale of foreign exchange reserve as the basis, and measure it with empirical data. This paper draws lessons from the model of Jeanne and Rancière (2011). The model uses the idea of utility maximization and the three-period model to simulate the foreign exchange reserve as a buffer mechanism that buffers the change of domestic absorption and reduces changes in the balance of payments when the capital suddenly stops. In terms of constraints, under the framework of maximum utility, the cost of holding foreign exchange reserves mainly lies in the cost of holding external liabilities when countries hold large amounts of foreign exchange reserves, which are lower than the interest rate gains. Under cost constraints and utility functions, the ratio of the foreign exchange reserve scale to GDP is used as a function of seven measurable variables: the probability of capital halt, the economic growth rate, the risk-free interest rate, the risk aversion coefficient, the time premium, the output loss rate, and the ratio of short-term foreign debt to output, which is used to measure the optimal scale of foreign exchange reserves in different emerging market countries according to their actual economic development.

3.1. Hypothesis and Derivation of the Model

Considering the small open economy in an emerging market, output

can be expressed as the sum of domestic absorption

and trade account balances

. Thus, domestic absorption

can be expressed as:

Under the international balance of payments, the balance

of the trade account can be expressed as the reverse variable capital and financial account balance

and foreign income and transfer payments

, as well as the sum of change amount

of the current foreign exchange reserves.

Through the simultaneous calculation of Equations (1) and (2), international absorption can be expressed as a function of total output, capital and financial account balances, income and transfer payments from abroad, and changes in foreign exchange reserves in the current period, that is:

Equation (3) is the change mechanism of relevant variables in the normal flow of capital under the open economy. Then, we consider the change of the variable mechanism under the crisis situation, and assume that when capital inflows suddenly stop, and the KA account balance plummets, domestic absorption will decline accordingly. Since output Y and capital and financial account KA are also changing in the same direction, the domestic absorption due to the impact of capital halt will be amplified by the output effect. At this point, the government’s strategy will be to use the reduction of foreign exchange reserves to compensate for the enlargement influence of the sudden halt of capital inflows on the domestic absorption, namely, adjusting to a negative value and consuming foreign exchange reserves. In reality, it can be understood that the government uses foreign exchange reserves to make up for the foreign debt that is difficult to pay because of the sudden halt of capital.

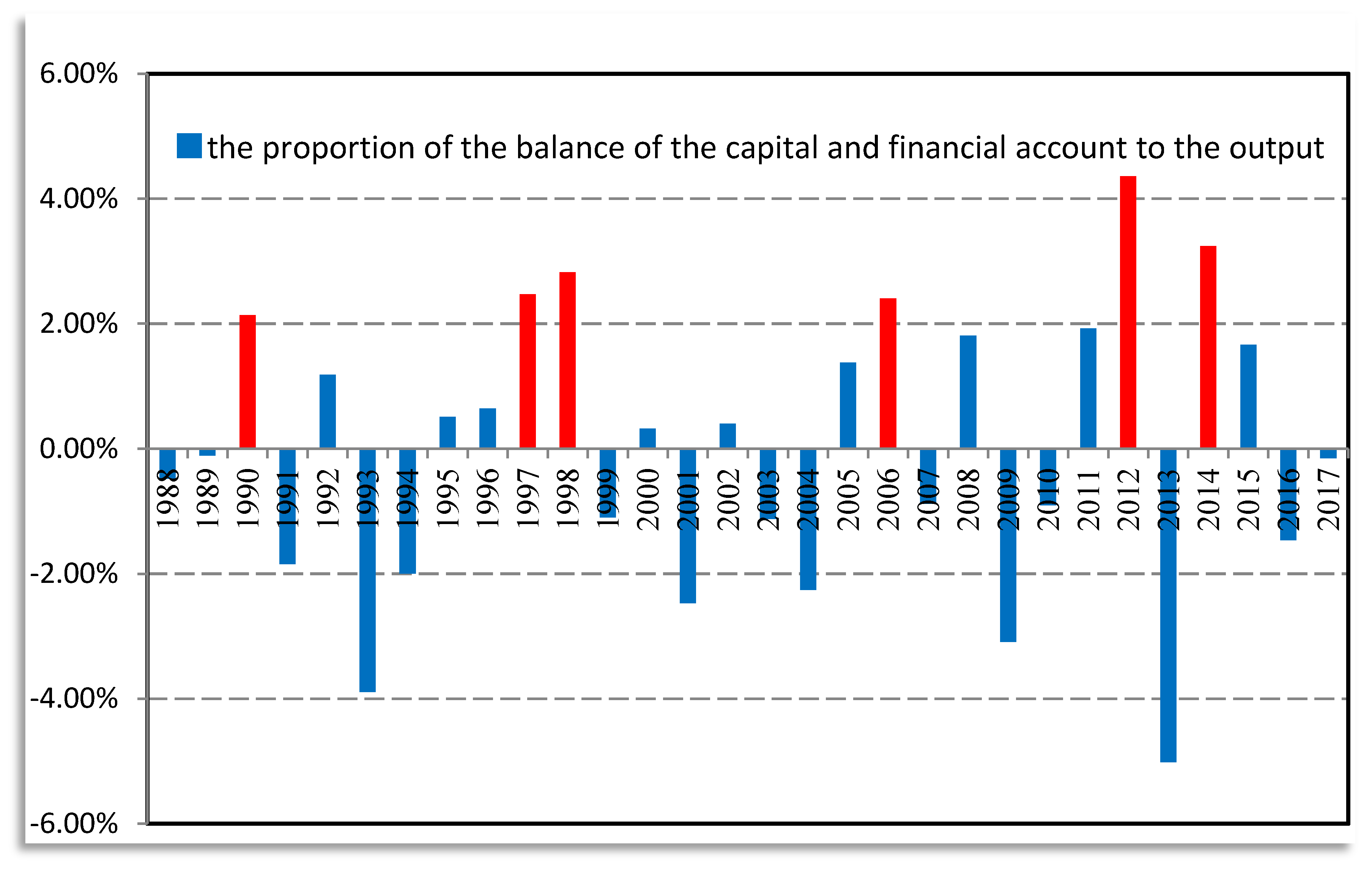

The ratio of financial account balances to the country’s current GDP output is more than 5% lower than that of the t − 1 period, in which the sudden halt of capital inflow is defined as the capital of a country in the period of t. Namely, in defining , moreover , and a sudden halt of capital inflows is considered to have occurred in the t period.

Continuing, we consider a small open economy, in a discrete period of

t = 0, 1, 2, … where a commodity is consumed both at home and abroad. Without taking into account the real exchange rate movements, the only foreign shock to an economy is the risk of a sudden halt in capital inflows, without which the economy will continue to develop healthily along the path of output growth. The domestic economy consists of two parts of the private sector and the government sector. There is a representative consumer in the private sector, whose budget constraints are as follows:

Among them, is the current consumption, is the current foreign debt, represents the previous foreign debt, and is the transfer payment from the government, which can be understood as a contract signed between the government and consumers to help consumers in the event that they are unable to pay their foreign debts to reduce the foreign exchange reserve account, subsidize consumers, ensure the level of consumption, and pay off certain foreign debts. The short-term interest rate r is defined as a constant value. Therefore, when the consumer does not default on foreign debts, the current consumption budget is equal to the total output of the current period minus the remaining capital after repaying the current and last period of the foreign debt , and plus the subsidy of the government’s reserve contracts .

It is assumed that the two sectors of the economy, the private sector and the government sector, are growing at a constant rate of growth g, provided that capital inflows are normal. This growth will stop when the capital inflow is suddenly stopped. In the event of a sudden halt in capital inflows, there is a risk that foreign debt will not be repaid in the current period as a result of a decline in total output. In other words, there are two situations when capital inflow stops: one is that the representative consumer is unable to rollover the current foreign debt, and the other is that output Y has decreased at a rate relative to its long-term growth trajectory.

Suppose that the foreign debt of consumers is all short-term. When the capital suddenly stops, consumers cannot borrow from outside. The current external debt income L is reduced to 0, and the output is also out of the original growth trend and has decreased the ratio. After the collapse of the crisis of capital halt, the foreign debt income is still 0, and the output Y comes back to the original long-term growth path. It is assumed that the probability of each period of capital halt is . After the capital halt, all of the uncertainties were removed, and the economy grew at a rate g less than the short-term risk-free rate r.

In order to simplify, assume that the crisis occurs only once, and b, d, and a are defined as three periods before, at, and after the occurrence of a sudden capital halt. λ represents the ratio of foreign debt to total output before the crisis, namely . Therefore:

Before the crisis, ;

At the time of the crisis, ;

After the crisis, ;

Next, we consider the situation of government sector. Unlike the private sector, which can borrow only short-term foreign debt, governments can issue a long-term bond that does not require immediate repayment in the event of a capital standstill. The government-issued bonds pay a unit of the country’s merchandise to bondholders as compensation until a capital halt occurs, and after a sudden capital halt, the bonds cease to yield. The term of government bonds tends to be very long, because the probability of sudden capital halt is very small, and in order to be able to ensure that the term is long enough to cover the non-payment of the short-term foreign debt of the private sector, its term would be a relatively large value. For example, it is equal to 0.1, which means that government bonds should have a lifespan of 10 years.

Before the sudden stop of capital, the price of the government bond should be equal to the discount value of a unit commodity that it needs to pay in the next period, plus the present value of the expected value of the market value of the bond. When calculating a unit of merchandise to be paid in each period, whether or not they are stopped, each period of payment will occur, that is,

. When calculating the expected average value of the bond market value, we must make sure that the price of the long-term bond is constant before the capital halt occurs, and it will be reduced to 0 when the capital suddenly stops, so the expected value should consider the probability π of capital sudden halt, that is:

And the following was solved:

Assuming that the interest rate level that was used to calculate the present value of long-term bonds is higher than the short-term interest rate level r, then the difference between the long-term and short-term interest rates exists as a time premium in the formula.

The government issued the long-term bonds to finance foreign exchange reserves because the government bonds cannot be issued at the time of capital arrest; then, foreign exchange reserves must rely on long-term bonds to accumulate foreign exchange reserves to a certain extent before the capital halt. Supposing that

is the number of long-term bonds issued by the government in the period of

t, then the accumulated foreign exchange reserves are as follows:

Before the capital halt, with the government budget constraints, it means that government revenue and expenditure are equal, namely:

The left side of Equation (6) is the sum of the total government expenditure in the current period, including the transfer payment to representative consumers, the value of the goods repaid in the previous period, and the necessary foreign exchange reserves for the current period. The right side of the Equation (9) is the total revenue of the current government, namely, the net income from the repayment of the principal of the previous long-term bond and the current period of borrowing, plus the present value of the foreign exchange reserves held for the t − 1 period in the current period.

Taking advantage of Equation (5) as well as replacing and in Equation (6), in order to solve the expression of the transfer payment

Z that the government subsidizes to the representative consumer in order to guarantee the level of consumption before the sudden halt occurs:

As can be understood from Equation (7), prior to the occurrence of a capital halt, the transfer payment is a negative value, which is a tax levied by the government on the representative consumer to offset the cost to the government holding the reserve without investment, which is expressed as a proportion of the reserve, namely, the sum of the time premium δ and the probability of capital halt π.

When capital halt occurs, the government, while taxing, will transfer the entire net foreign exchange reserves of the previous period to subsidize the consumer and help him or her repay his or her short-term foreign debt, which cannot be postponed. Then, the transfer payment is:

Assuming , in the event of a capital halt, the transfer payments are positive values, so that the government subsidizes consumers.

After a sudden halt of capital, the transfer of the government stops, at which time the foreign exchange reserves , transfer payments , and the number of long-term bonds N are all reduced to zero.

Then, we take advantage of Equations (7) and (8), as well as replace the transfer payments

of Equation (4), so as to solve out the domestic consumer budget constraints before, during, and after the capital halt occurs.

Equations (9) and (10) can well describe two aspects of trade-offs in the choice of the optimal scale of foreign exchange reserves: increasing the previous period of foreign exchange reserves can increase domestic consumption C at the time of capital halt in this period, but it will also reduce domestic consumption (taxes that consumers have to pay to reduce the cost of holding excess foreign exchange reserves) when the current period of capital halt does not occur. In fact, the accumulation of foreign exchange reserves could be equivalent to an insurance measure that would transfer a portion of the purchasing power under the state of a steady capital flow to the state of capital halt to compensate for reduced domestic consumption.

In order to further close the model and obtain the closed solution of the optimal foreign exchange reserve, we need to introduce the constraint condition, that is, the government’s objective effect function. Following the general social welfare theory, we assume that the government’s goal is to optimize the welfare of this representative consumer. After the welfare function is added to the

t period, every capital sudden halt may have the consumption utility function, and discounting:

Among them, the consumption utility function contains a constant relative risk aversion coefficient; the higher the degree of consumer risk aversion, the higher the welfare utility due to consumption.

At this point, the government’s strategy is to find out the scale of a foreign exchange reserve in order to maximize the greatest utility of this representative consumer obtained in the t period before every capital sudden halt may occur.

Combining the budget constraints of the representative consumer and the government budget constraints, namely, Equations (4) and (6), the following equation could be obtained:

Equation (14) shows that the amount of foreign exchange reserve R is equivalent to replacing consumers’ non-renewable short-term debt, L, with the government’s long-term debt, PN, in all of the foreign debt of a country. Under the constraints of the overall budget, holding foreign exchange reserves is equivalent to the government using the issuance of long-term bonds to repay the short-term foreign debt that a representative consumer cannot repay in the event of a sudden halt. Although long-term foreign debt reduces the risk that short-term foreign debt cannot be repaid, it brings higher holding costs.

3.2. Model Solution

At this time, the model is solved by the closed method. The optimal scale of foreign exchange reserves chosen by the government is the scale that maximizes consumer utility at time t before each sudden capital halt (which may or may not occur). According to the consumption utility function

u, we can conclude that the optimum of

is only related to the consumption level of the

t + 1 period. The optimal scale of the foreign exchange reserve in the t period maximizes the expected value of the utility function of the consumption level in the

t + 1 period.

Among them, and are defined by the Equations (7) and (8) of the t + 1 period.

Then, the first condition is that the expected function has a derivative

of 0 to the first order, that is:

The left side of Equation (16) is the marginal cost of the probability without capital halt multiplied by the holding foreign exchange reserves without capital halt, and the right side of the equation is the marginal utility of the probability with capital halt multiplied by the consuming foreign exchange reserves in the event of capital halt. This condition can produce a closed solution to the optimal scale of foreign exchange reserves. Defining

is identically equal to the marginal substitution rate of consumption in cases of sudden halt and non-sudden halt, that is:

Substituting utility function

u(

C) can also be obtained:

Considering a situation in which the time premium is zero, that is, the holding costs of long-term and short-term foreign debt are the same, the cost of using foreign exchange reserves to cope with the capital crisis is equal to the cost of servicing short-term foreign debt. There is no additional cost of holding foreign exchange reserves, and the consumption substitution rate p is identically equal to 1, which fully subsidizes the income budget and consumption that domestic consumers will lose because of sudden capital halt. If the time premium is positive, then p > 1, which means that domestic consumption would decrease when the capital stops abruptly.

In order to characterize the optimal scale of foreign exchange reserves and solve it conveniently, it is defined that under the premise of normal capital flow, the optimal scale of foreign exchange reserves is a constant proportion of output

in the next period, namely:

The expressions of

as well as the output and short-term liabilities under the two period conditions of

b and

d are replaced by the two-period consumer budget Equations (9) and (10), and the consumer budget constraints under the two-period conditions are re-expressed. Then, simultaneously with Equation (18), the ratio of the optimal foreign exchange reserve to the output level is solved, which obtains the following equation:

Then, Equation (20) is the measurement model of the optimal foreign exchange reserve scale based on utility maximization.

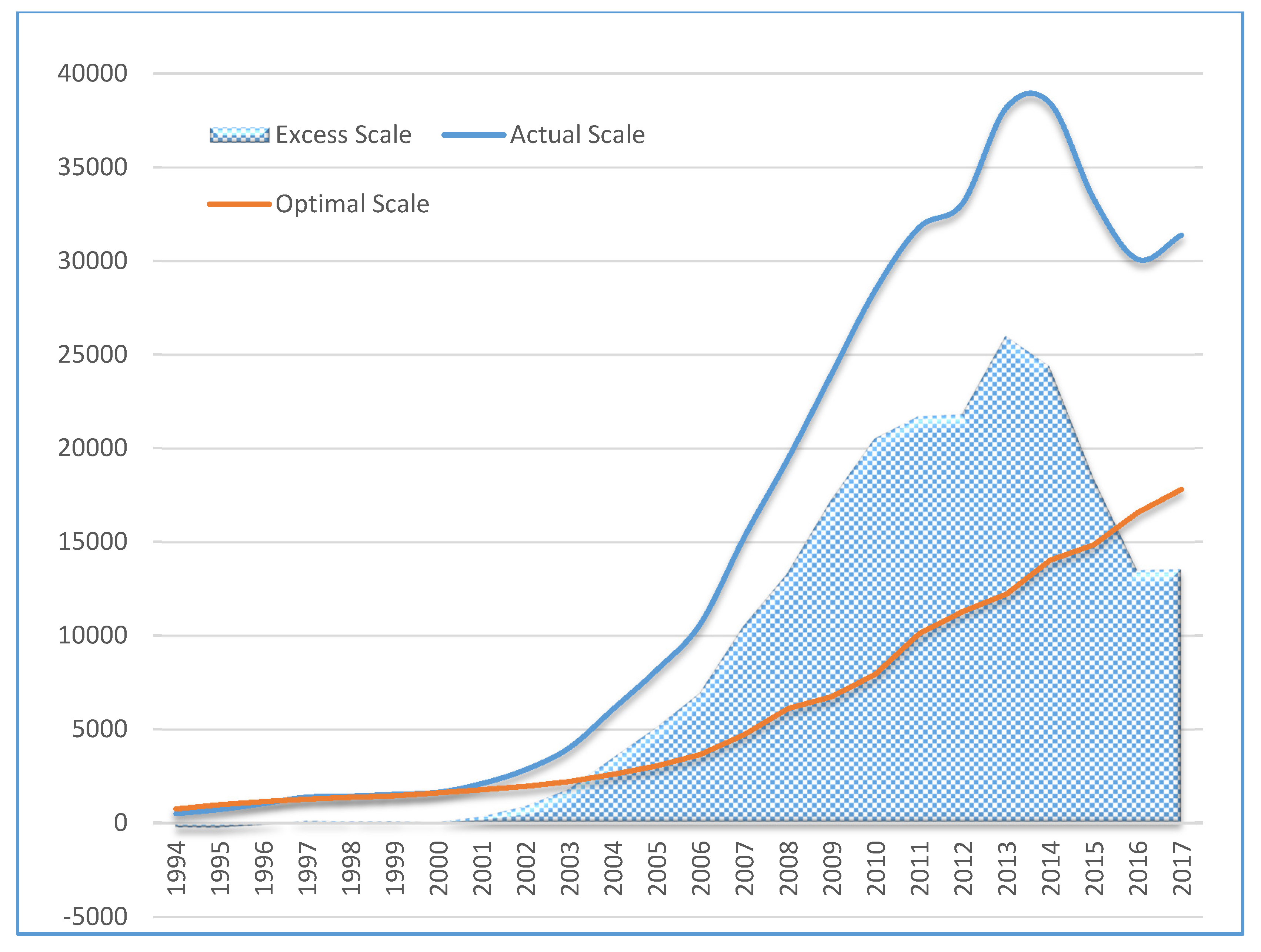

Under the framework of utility maximization analysis, we can use seven macroeconomic variables to measure the optimal scale of foreign exchange reserves. The optimal scale of foreign exchange reserves , which are measured by output, are proportional to the probability of sudden capital halt π, time premium , economic growth rate g, and the risk aversion coefficient of consumer . Through a certain mathematical verification, the optimal scale of foreign exchange reserves is also proportional to the rate of decline in output γ due to sudden capital halt and the ratio of short-term foreign debt to output λ.

It should be noted that this model does not fully consider the impact of real exchange rate movements on the scale of foreign exchange reserves. In fact, the fluctuation of the exchange rate is also one of the important factors affecting the fluctuation of capital flows and foreign exchange reserves. When the public expects that the exchange rate of a country has started to appreciate, the capital will flow into the country to gain the income of the foreign exchange, achieve the goal of its appreciation, and further strengthen the appreciation of the exchange rate. The process of capital inflow is also the process of the accumulation of foreign exchange reserves. When a country’s exchange rate is expected to devalue, the international capital, especially hot money, will quickly flow into foreign countries, assuming the sudden stop and reversal of capital inflow, which not only causes the fluctuation of the country’s exchange rate, but also strengthens the expected depreciation of the exchange rate of this country, thereby reducing foreign exchange reserves. In order to facilitate the study, this article assumes that the exchange rate is the same when constructing the optimal model of foreign exchange reserves, based on utility maximization. Of course, this does not mean that the optimal scale model of foreign exchange reserves based on utility maximization fails to consider the effect of exchange rate. In fact, when choosing the parameters, variables, and data, we will take full account of the impact of exchange rate fluctuations on foreign exchange reserves.