The Macroeconomic Determinants of International Casino Travel: Evidence from South Korea’s Top Four Inbound Markets

Abstract

1. Introduction

2. Literature Review

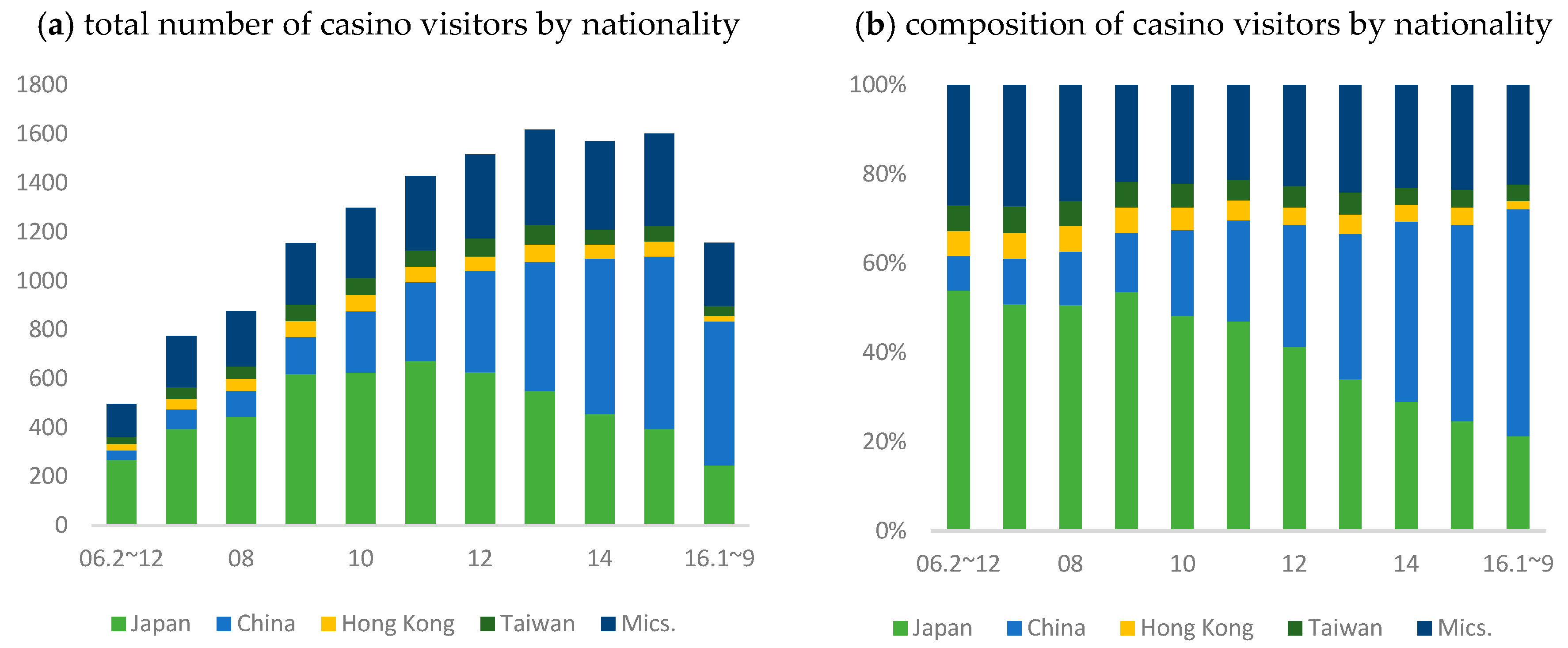

2.1. The South Korean Casino Industry

2.2. Review of the Casino Literature

2.3. Determinants of Tourism Demand

2.4. Variables in the Literature

3. Methodology and Data

3.1. Model

3.2. Data

4. Results

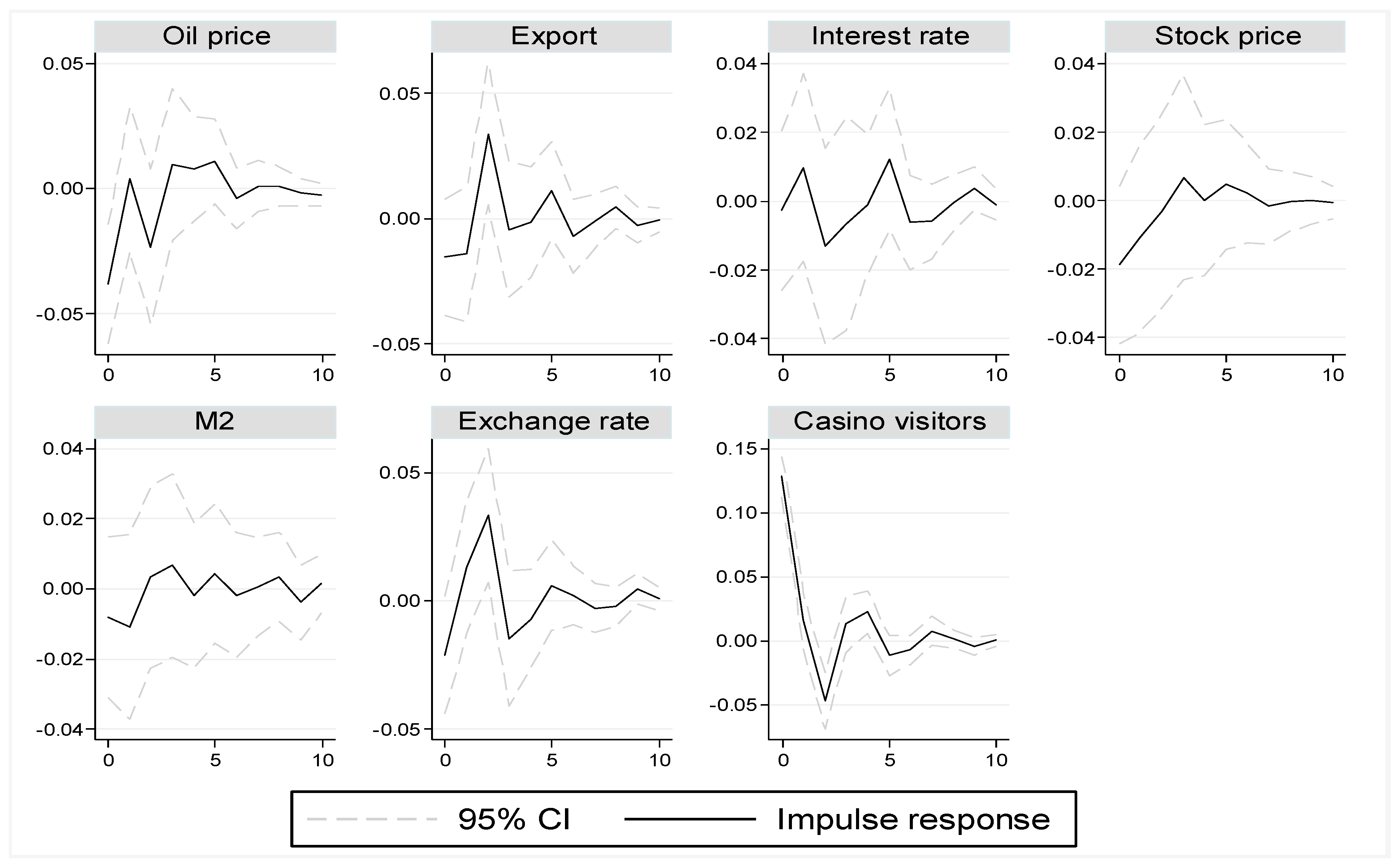

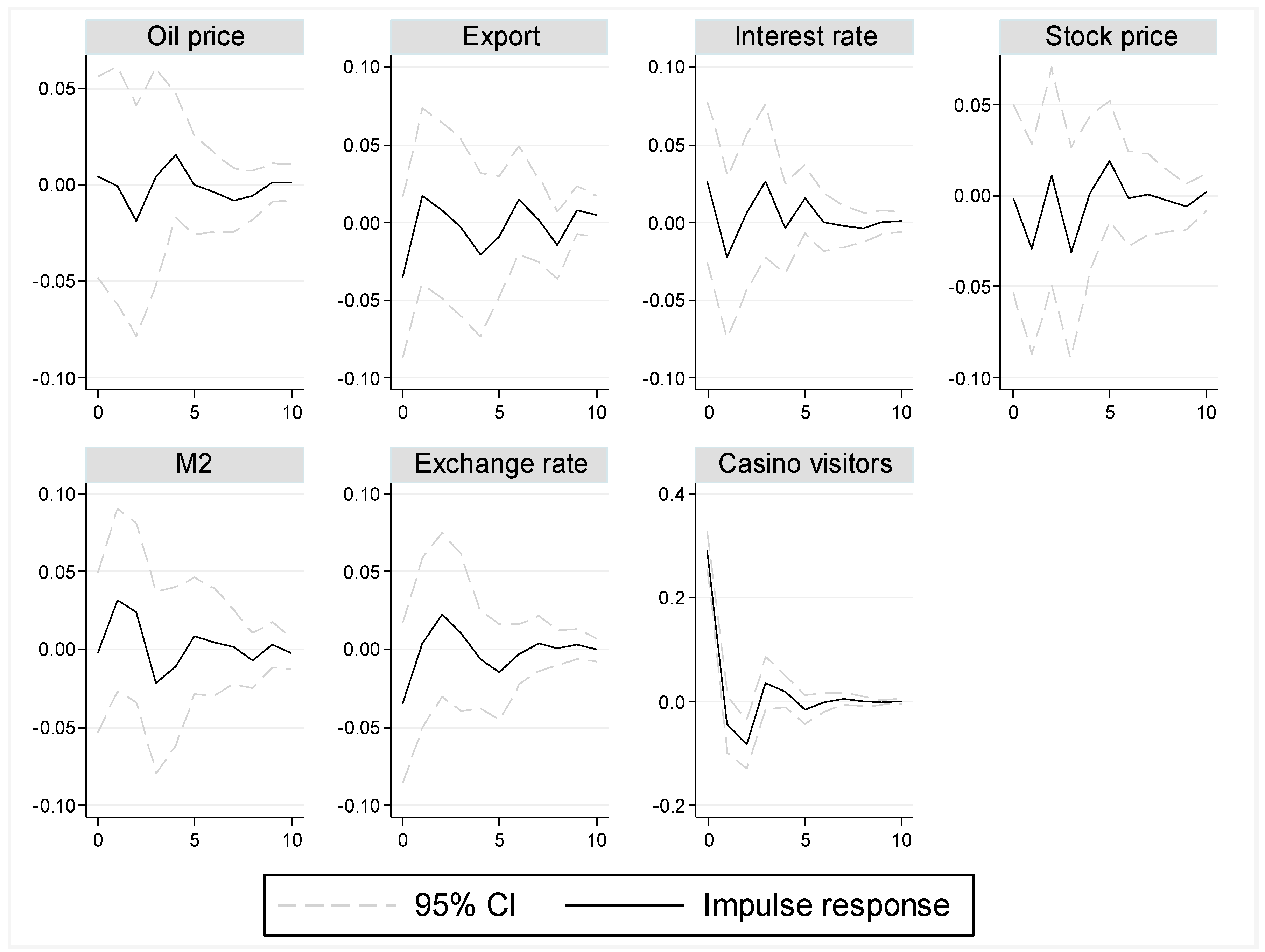

4.1. Impulse Response Functions

4.2. Forecast Error Variance Decomposition

4.3. Granger Causality Test

4.4. The Event Effects

5. Conclusions and Implications

Author Contributions

Conflicts of Interest

References

- Kralj, A.; Solnet, D. Service climate and customer satisfaction in a casino hotel: An exploratory case study. Int. J. Hosp. Manag. 2010, 29, 711–719. [Google Scholar] [CrossRef]

- PwC. Global Gaming Industry Regulatory Frameworks. PricewaterhouseCoopers International Limited. 2015. Available online: http://www.pwc.com (accessed on 21 February 2018).

- Walker, D.M. The Economic Effects of Casino Gambling: A Perspective from the US. 2009. Available online: http://walkerd.people.cofe.edu/pubs/Walker_Macao_ss.pdf (accessed on 21 February 2018).

- Siu, R.C.S. After the games in Macau and Singapore, what next? Casino Gaming Int. 2008, 4, 17–21. [Google Scholar]

- Valadkhani, A.; Smyth, R.; O’Mahony, B. Asymmetric causality between Australian inbound and outbound tourism flows. Appl. Econ. 2017, 49, 33–50. [Google Scholar] [CrossRef]

- Wong, I.A.; Fong, L.H.N.; Law, R. A longitudinal multilevel model of tourist outbound travel behavior and the dual-cycle model. J. Travel Res. 2016, 55, 957–970. [Google Scholar] [CrossRef]

- Wang, Y.S. The impacts of crisis events and macroeconomic activity on Taiwan’s international inbound tourism demand. Tour. Manag. 2009, 30, 75–82. [Google Scholar] [CrossRef]

- Chang, W.S.; Lee, Y.-H. The macroeconomic contribution to foreign-exchange earnings from tourism in Taiwan. Curr. Issues Tour. 2017, 20, 1110–1115. [Google Scholar] [CrossRef]

- Horváth, C.; Paap, R. The effect of recessions on gambling expenditures. J. Gambl. Stud. 2012, 28, 703–717. [Google Scholar] [CrossRef] [PubMed]

- Kim, S.H.; Kim, D.J. Determining revenue-generating casino visitors using a Vector Autoregressive Model: The case of the G casino in Korea. J. Qual. Assur. Hosp. Tour. 2016, 17, 257–273. [Google Scholar] [CrossRef]

- Demir, E.; Alıcı, Z.A.; Lau, M.C.K. Macro explanatory factors of Turkish tourism companies’ stock returns. Asia Pac. J. Tour. Res. 2017, 22, 370–380. [Google Scholar]

- Postrado, L. Mohegan Sun to Get $750M from South Korea Casino. 2016. Available online: CalvinAyre.com (accessed on 21 February 2018).

- Malek, K.; Kim, J. Convention attendance and gaming volume in South Korean casinos. Int. J. Event Festiv. Manag. 2016, 7, 66–80. [Google Scholar] [CrossRef]

- Korea Casino Association. Statistics of Casino Visitors and Revenues; Korean Casino Association: Seoul, Korean, 2014. [Google Scholar]

- Korea Casino Association. 2015 Casino Insight; Korea Casino Association: Seoul, Korean, 2015. [Google Scholar]

- Kim, J.; Ahlgren, M.B.; Byun, J.-W.; Malek, K. Gambling motivations and superstitious beliefs: A cross-cultural study with casino customers. Int. Gambl. Stud. 2016, 16, 296–315. [Google Scholar] [CrossRef]

- Li, G.; Gu, X.; Siu, R.C.S. The impacts of gaming expansion on economic growth: A theoretical reconsideration. J. Gambl. Stud. 2010, 26, 269–285. [Google Scholar] [CrossRef] [PubMed]

- Koo, H.; Ko, J. Study on the relationships between foreign customers’ casino motivation and their satisfaction. Korean J. Hotel Adm. 2010, 19, 171–186. [Google Scholar]

- Suh, E.; Dang, T.T.; Alhaery, M. Examining the effects of various promotion types on slot gaming volumes. Int. J. Hosp. Manag. 2014, 37, 68–79. [Google Scholar] [CrossRef]

- Wu, S.-T.; Chen, Y.-S. The social, economic and environmental impacts of casino gambling on the residents of Macau and Singapore. Tour. Manag. 2015, 48, 285–298. [Google Scholar] [CrossRef]

- Wan, Y.K.P. The social, economic and environmental impacts of casino gaming in Macao: The community leader perspective. J. Sustain. Tour. 2012, 20, 737–755. [Google Scholar] [CrossRef]

- Lee, C.K.; Lee, Y.; Bernhard, B.; Yoon, Y. Segmenting casino gamblers by motivation: A cluster analysis of Korean gamblers. Tour. Manag. 2006, 27, 856–866. [Google Scholar] [CrossRef]

- Kim, W.G.; Cai, L.; Jung, K. A profile of the Chinese casino vacationer to South Korea. J. Hosp. Leisure Mark. 2004, 11, 65–79. [Google Scholar] [CrossRef]

- Tseng, F.-M.; Huang, W.C. The long-term effects of tourist policy adjustments on the development of tourism in Taiwan: Consideration of time trends and Fourier component test results. Int. J. Tour. Res. 2017, in press. [Google Scholar] [CrossRef]

- Song, H.; Lin, S.; Zhang, X.; Gao, Z. Global financial/economic crisis and tourist arrival forecasts for Hong Kong. Asia Pac. J. Tour. Res. 2010, 15, 223–242. [Google Scholar] [CrossRef]

- Li, S.; Blake, A.; Cooper, C. China’s tourism in a global financial crisis: A computable general equilibrium approach. Curr. Issues Tour. 2010, 13, 435–453. [Google Scholar] [CrossRef]

- Li, F.; Wen, J.; Ying, T. The influence of crisis on tourists’ perceived destination image and revisit intention: An exploratory study of Chinese tourists to North Korea. J. Destin. Mark. Manag. 2017, in press. [Google Scholar] [CrossRef]

- Lee, C.-K. Major determinants of international tourism demand for South Korea: Inclusion of marketing variable. J. Travel Tour. Mark. 1996, 5, 101–118. [Google Scholar] [CrossRef]

- Seo, J.H.; Park, S.Y.; Yu, L. The analysis of the relationships of Korea outbound tourism demand: Jeju Island and three international destinations. Tour. Manag. 2009, 30, 530–543. [Google Scholar] [CrossRef]

- Ridderstaat, J.; Croes, R. The link between money supply and tourism demand cycles: A case study of two Caribbean destinations. J. Travel Res. 2017, 56, 187–205. [Google Scholar] [CrossRef]

- Cho, V. Tourism Forecasting and Its Relationship with Leading Economic Indicators. J. Hosp. Tour. Res. 2001, 25, 399–420. [Google Scholar] [CrossRef]

- Jayaraman, K.; Lin, S.K.; Haron, H.; Ong, W.L. Macroeconomic factors influencing Malaysian tourism revenue, 2002–2008. Tour. Econ. 2011, 17, 1347–1363. [Google Scholar] [CrossRef]

- De Vita, G. The long-run impact of exchange rate regimes on international tourism Flows. Tour. Manag. 2014, 45, 226–233. [Google Scholar] [CrossRef]

- Lennox, J. Impacts of high oil prices on tourism in New Zealand. Tour. Econ. 2012, 18, 781–800. [Google Scholar] [CrossRef]

- Wheaton, W.C.; Rossoff, L. The Cyclic behavior on the US lodging industry. Real Estate Econ. 1998, 26, 67–82. [Google Scholar] [CrossRef]

- Canina, L.; Walsh, K.; Enz, C.A. The effects of gasoline-price changes on room demand: A study of branded hotels from 1988 through 2000. Cornell Hotel Restaur. Adm. Q. 2003, 44, 29–37. [Google Scholar] [CrossRef]

- Bonn, M.A.; Line, N.D.; Cho, M. Low gasoline prices: The effects upon auto visitor spending, numbers of activities, satisfaction and return intention. J. Travel R. 2017, 56, 263–278. [Google Scholar] [CrossRef]

- Oh, C.-O.; Hammitt, W.E. Impact of increasing gasoline prices on tourism travel patterns to a state park. Tour. Econ. 2011, 17, 1311–1324. [Google Scholar] [CrossRef]

- Shan, J.; Wilson, L. Causality between trade and tourism: Empirical evidence from China. Appl. Econ. Lett. 2001, 8, 279–283. [Google Scholar] [CrossRef]

- Easton, S.T. Is tourism just another commodity? links between commodity trade and tourism. J. Econ. Integr. 1998, 13, 522–543. [Google Scholar] [CrossRef]

- Sevil, T.; Polat, A. Macro-economic determinants of travel and leisure sector: A co-integration analysis from Turkey. Res. J. Finan. Account. 2015, 6, 213–223. [Google Scholar]

- Chen, C.-M.; Lin, Y.-L.; Chang, T.-T. The effects of macroeconomic and weather conditions on the business cycle of Taiwan’s adventure tourism. Curr. Issues Tour. 2017, 20, 447–454. [Google Scholar] [CrossRef]

- Shi, W.; Li, K.X. Impact of unexpected events on inbound tourism demand modeling: Evidence of Middle East Respiratory Syndrome outbreak in South Korea. Asia Pac. J. Tour. Res. 2017, 22, 344–356. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Amisano, G.; Giannini, C. Topics in Structural VAR Econometrics, 2nd ed.; Springer: Heidelberg, Germany, 1997. [Google Scholar]

- Hamilton, J.D. Time Series Analysis; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Engle, R.F.; Granger, C.W.J. Cointegration and error correction: Representation, estimation and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of co-integration vectors in Gaussian Vector Autoregressive Models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Gani, A.; Clemes, M.D. The main determinants effecting international visitor arrivals in New Zealand: Some empirical evidence. Tour. Econ. 2017, 23, 921–940. [Google Scholar] [CrossRef]

- Lin, V.S.; Liu, A.; Song, H. Modeling and Forecasting Chinese Outbound Tourism: An Econometric Approach. J. Travel Tour. Mark. 2015, 32, 34–49. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating causal relations by econometric models and cross spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Wong, I.A.; Law, R.; Zhao, X. When and where to travel? A longitudinal multilevel investigation on destination choice and demand. J. Travel Res. 2017, 56, 868–880. [Google Scholar] [CrossRef]

- Timothy, D.J.; Kim, S. Understanding the tourism relationships between South Korea and China: A review of influential factors. Curr. Issues Tour. 2015, 18, 413–432. [Google Scholar] [CrossRef]

- Vergura, D.T.; Luceri, B. The antecedents of gambling behaviour from a social marketing perspective. J. Gambl. Bus. Econ. 2015, 9, 1–12. [Google Scholar]

- Cheng, K.M. Tourism demand in Hong Kong: Income, prices and visa restrictions. Curr. Issues Tour. 2012, 15, 167–181. [Google Scholar] [CrossRef]

- Jang, S.C.; Bai, B.; Hong, G.-S.; O’Leary, J.T. Understanding travel expenditure patterns: A study of Japanese pleasure travelers to the United States by income level. Tour. Manag. 2004, 25, 331–341. [Google Scholar] [CrossRef]

- Prentice, C.; Wong, I.A. Casino marketing, problem gamblers or loyal customers? J. Bus. Res. 2015, 68, 2084–2092. [Google Scholar] [CrossRef]

- Devan, J.; Rowland, M.; Woetzel, J. A Consumer Paradigm for China. McKinsey Q. 2009, 4, 36–49. [Google Scholar]

- Lim, S.; Giouvris, E. Tourist arrivals in Korea: Hallyu as a pull factor. Curr. Issues Tour. in press. [CrossRef]

| Mean | Median | S.D. | Max | Min | ||

|---|---|---|---|---|---|---|

| Japan | Oil price | −0.003 | 0.004 | 0.084 | 0.215 | −0.302 |

| Export | 0.000 | 0.007 | 0.046 | 0.106 | −0.170 | |

| Interest rate | 0.002 | 0.000 | 0.050 | 0.350 | −0.250 | |

| Stock price | 0.000 | 0.002 | 0.060 | 0.121 | −0.272 | |

| M2 | 0.003 | 0.007 | 0.003 | 0.010 | −0.010 | |

| Exchange rate | 0.001 | −0.004 | 0.037 | 0.222 | −0.097 | |

| Casino visitors | 0.011 | 0.014 | 0.165 | 0.877 | −0.668 | |

| Mainland China | Export | 0.006 | 0.003 | 0.078 | 0.221 | −0.409 |

| Interest rate | −0.008 | 0.000 | 0.190 | 1.080 | −1.350 | |

| Stock price | 0.011 | 0.018 | 0.108 | 0.269 | −0.406 | |

| M2 | −0.001 | −0.001 | 0.023 | 0.109 | −0.117 | |

| Exchange rate | 0.001 | 0.000 | 0.026 | 0.152 | −0.089 | |

| Casino visitors | 0.028 | 0.036 | 0.122 | 0.676 | −0.425 | |

| Hong Kong SAR | Export | 0.003 | 0.004 | 0.059 | 0.299 | −0.267 |

| Interest rate | −0.041 | 0.000 | 0.246 | 0.250 | −2.000 | |

| Stock price | 0.003 | 0.008 | 0.065 | 0.158 | −0.254 | |

| M2 | 0.000 | 0.001 | 0.030 | 0.111 | −0.097 | |

| Exchange rate | 0.002 | 0.000 | 0.028 | 0.166 | −0.086 | |

| Casino visitors | 0.020 | −0.012 | 0.365 | 2.167 | −1.407 | |

| Taiwan | Export | 0.000 | −0.003 | 0.066 | 0.321 | −0.193 |

| Interest rate | −0.007 | 0.000 | 0.110 | 0.250 | −0.750 | |

| Stock price | 0.003 | 0.010 | 0.056 | 0.140 | −0.209 | |

| M2 | 0.000 | 0.000 | 0.006 | 0.016 | −0.015 | |

| Exchange rate | 0.000 | −0.003 | 0.022 | 0.150 | −0.059 | |

| Casino visitors | 0.022 | 0.021 | 0.221 | 1.211 | −0.803 |

| t-Value | p-Value | ||

|---|---|---|---|

| Japan | Oil price | −5.54 | 0.00 |

| Export | −7.07 | 0.00 | |

| Interest rate | −6.73 | 0.00 | |

| Stock price | −7.59 | 0.00 | |

| M2 | −13.28 | 0.00 | |

| Exchange rate | −6.24 | 0.00 | |

| Casino visitors | −10.05 | 0.00 | |

| Mainland China | Export | −11.66 | 0.00 |

| Interest rate | −7.24 | 0.00 | |

| Stock price | −6.23 | 0.00 | |

| M2 | −10.31 | 0.00 | |

| Exchange rate | −8.34 | 0.00 | |

| Casino visitors | −12.86 | 0.00 | |

| Hong Kong SAR | Export | −12.35 | 0.00 |

| Interest rate | −5.04 | 0.00 | |

| Stock price | −6.84 | 0.00 | |

| M2 | −9.58 | 0.00 | |

| Exchange rate | −8.14 | 0.00 | |

| Casino visitors | −12.02 | 0.00 | |

| Taiwan | Export | −9.13 | 0.00 |

| Interest rate | −4.14 | 0.00 | |

| Stock price | −6.50 | 0.00 | |

| M2 | −7.42 | 0.00 | |

| Exchange rate | −8.46 | 0.00 | |

| Casino visitors | −11.07 | 0.00 |

| 2-Step | 5-Step | 10-Step | ||

|---|---|---|---|---|

| Japan | Oil price | 0.07 | 0.08 | 0.08 |

| Export | 0.02 | 0.06 | 0.06 | |

| Interest rate | 0.01 | 0.01 | 0.02 | |

| Stock price | 0.02 | 0.02 | 0.02 | |

| M2 | 0.01 | 0.01 | 0.01 | |

| Exchange rate | 0.03 | 0.08 | 0.08 | |

| Casino visitors | 0.87 | 0.74 | 0.72 | |

| Mainland China | Oil price | 0.02 | 0.02 | 0.02 |

| Export | 0.05 | 0.06 | 0.06 | |

| Interest rate | 0.05 | 0.05 | 0.05 | |

| Stock price | 0.01 | 0.04 | 0.04 | |

| M2 | 0.01 | 0.02 | 0.02 | |

| Exchange rate | 0.01 | 0.02 | 0.03 | |

| Casino visitors | 0.84 | 0.78 | 0.78 | |

| Hong Kong SAR | Oil price | 0.00 | 0.01 | 0.01 |

| Export | 0.02 | 0.02 | 0.02 | |

| Interest rate | 0.01 | 0.02 | 0.02 | |

| Stock price | 0.01 | 0.02 | 0.02 | |

| M2 | 0.01 | 0.02 | 0.02 | |

| Exchange rate | 0.01 | 0.02 | 0.02 | |

| Casino visitors | 0.94 | 0.90 | 0.88 | |

| Taiwan | Oil price | 0.01 | 0.02 | 0.02 |

| Export | 0.00 | 0.03 | 0.10 | |

| Interest rate | 0.01 | 0.05 | 0.05 | |

| Stock price | 0.10 | 0.08 | 0.08 | |

| M2 | 0.00 | 0.01 | 0.02 | |

| Exchange rate | 0.04 | 0.04 | 0.04 | |

| Casino visitors | 0.82 | 0.77 | 0.69 |

| F-Statistic | p-Value | ||

|---|---|---|---|

| Japan | Oil price | 1.12 | 0.34 |

| Export | 1.95 | 0.12 | |

| Interest rate | 0.70 | 0.55 | |

| Stock price | 0.65 | 0.58 | |

| M2 | 0.45 | 0.72 | |

| Exchange rate | 1.88 | 0.10 | |

| Mainland China | Oil price | 0.61 | 0.54 |

| Export | 0.45 | 0.64 | |

| Interest rate | 1.20 | 0.30 | |

| Stock price | 1.10 | 0.33 | |

| M2 | 0.73 | 0.48 | |

| Exchange rate | 1.86 | 0.16 | |

| Hong Kong SAR | Oil price | 0.12 | 0.95 |

| Export | 0.67 | 0.57 | |

| Interest rate | 0.77 | 0.51 | |

| Stock price | 0.95 | 0.41 | |

| M2 | 0.97 | 0.41 | |

| Exchange rate | 0.25 | 0.86 | |

| Taiwan | Oil price | 0.32 | 0.87 |

| Export | 1.47 | 0.21 | |

| Interest rate | 2.35 | 0.05 | |

| Stock price | 0.78 | 0.54 | |

| M2 | 0.38 | 0.82 | |

| Exchange rate | 0.60 | 0.67 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suh, H.; Kim, S.-B. The Macroeconomic Determinants of International Casino Travel: Evidence from South Korea’s Top Four Inbound Markets. Sustainability 2018, 10, 554. https://doi.org/10.3390/su10020554

Suh H, Kim S-B. The Macroeconomic Determinants of International Casino Travel: Evidence from South Korea’s Top Four Inbound Markets. Sustainability. 2018; 10(2):554. https://doi.org/10.3390/su10020554

Chicago/Turabian StyleSuh, Hyunduk, and Sung-Bum Kim. 2018. "The Macroeconomic Determinants of International Casino Travel: Evidence from South Korea’s Top Four Inbound Markets" Sustainability 10, no. 2: 554. https://doi.org/10.3390/su10020554

APA StyleSuh, H., & Kim, S.-B. (2018). The Macroeconomic Determinants of International Casino Travel: Evidence from South Korea’s Top Four Inbound Markets. Sustainability, 10(2), 554. https://doi.org/10.3390/su10020554