As outlined above, the key areas of analysis in terms of accounting principles relate to the unit of accounting, the normalization principles applied in order to arrive at performance benchmarks, the allocation and consolidation rules, and accounting boundaries.

3.1. Unit of Accounting

The unit of accounting is arguably the most basic element when it comes to accounting principles, and indeed the one that has received the most attention in the academic and practitioner’s literature. The accounting units are generally classified in three categories [

13,

15]: carbon footprinting, green/brown metrics, and climate scores. Each of these will be illustrated using the automobile manufacturer BMW as an illustrative example of their application.

Carbon footprinting is the most commonly used metric for climate friendliness and an integral part of the Montreal Pledge—a voluntary commitment framework launched by the PRI for the disclosure of the carbon footprint [

3]. For 15 years, companies have used the Greenhouse Gas (GHG) Protocol (GHG Protocol) standard to calculate their carbon footprint [

21]. Over 5000 companies in 2014 used the GHG Protocol approach to report to CDP (formerly Carbon Disclosure Project), with most reporting GHG emissions information [

15]. Given the growth of such data over time, a large number of organizations use it to estimate and compare the carbon footprint for companies and their value chains and for portfolios of companies.

The key question for financial institutions is the carbon footprint of the portfolio, or the financed emissions. The 2° Investing Initiative reviewed the state of the art of such financed emissions methods in 2013, and the number of data providers has continued to grow since then, with a focus on listed equity (due to both the size of typical equity portfolios and data availability for listed companies) [

1]. One key question for GHG emissions accounting relates to data quality [

16] and the inability to capture low-carbon alternatives, which do not emit GHG.

According to Dupré et al. [

15], “green/brown metrics are sector-specific indicators distinguishing between climate solutions and climate problems. This category includes two main types of metrics: (1) ratios of exposure to different technologies or business lines and (2) sector-specific energy or emissions intensity/efficiency metrics.”

Finally, climate scores are qualitative indicators that combine quantitative and qualitative assessments to develop a scoring system.

The indicators will briefly be elaborated on a stylized example for all the three indicators using BMW as the case study. For the case study, each of the three groups of indicators will be reviewed, namely carbon footprint, green/brown shares, and qualitative climate scores.

The most common indicator is carbon footprinting. BMW’s GHG emissions reporting is among the most detailed in the world, breaking down Scope 1 (related to direct GHG emissions), Scope 2 (related to indirect GHG emissions associated with electricity and heat consumption) and Scope 3 (related to other indirect GHG emissions).

The challenge is that all these values are reported at group level and not connected to actual economic activities by BMW. Thus, the user of this information does not know how much GHG emissions are associated with any individual car sold, nor how each unit of GHG is broken down by business segment. BMW is the rare example where Scope 3 gets reported, which in the case of BMW make up around 95% of their GHG emissions (see 3.2 for a discussion of accounting boundaries). Currently, a significant share of GHG emissions data related to listed companies is estimated, even when considering just Scope 1 and Scope 2. The number gets even higher for Scope 3.

When shifting to green/brown shares, the problems are different, but the challenges remain similar. Aggregated ‘green’ shares for example as intermediated by data providers like FTSE Russell cannot discriminate between hybrid and electric vehicles, products with relatively significant different profiles.

Finally, there is qualitative reporting, which for all its upside in seeking to provide a ‘holistic’ picture, relies on qualitative assessments and weightings of several factors. Thus, a grading of BMW’s climate strategy independent of its operations may yield different results by different ESG data providers.

Generally, the most appropriate choice of indicator is a function of the purpose of the analysis, which can obviously differ widely. A few stylized conclusions may be relevant in this regard.

First, intuitively, quantitative indicators are needed for quantitative analyses. In other words, qualitative indicators are not appropriate where climate accounting is an intermediate step or input into financial risk or valuation models for example.

Second, if climate accounting is specifically designed to be an intermediate step for financial analysis, quantitative indicators—whether carbon footprint or green/brown metrics—need to be linked to economic activity. Without this linkage, the unit cannot be related to one of the key three inputs into financial analysis—price of the good, cost of the good, or the volume sold.

Third, more holistic use cases seeking to explore both the ‘negative’ and ‘positive’ climate impact likely need to resort to an alternative to carbon footprint, since this indicator by design only captures the ‘negative’.

Fourth, more subtle distinctions between different actors on the high-carbon side similarly may need to resort to indicators beyond the carbon footprint. For example, investors may take a different view—from a risk or climate alignment perspective—on the high-carbon activities of a company in the cement sector, for which the options regarding zero-carbon alternatives are more limited than for example the high-carbon activities of an electric utility, where the low-carbon alternatives are more accessible currently. Indeed, this distinction is reflected in ‘divest’ strategies from investors that generally do not extend to high-emitters in the industrial sectors, but rather focus on upstream fossil fuel sectors.

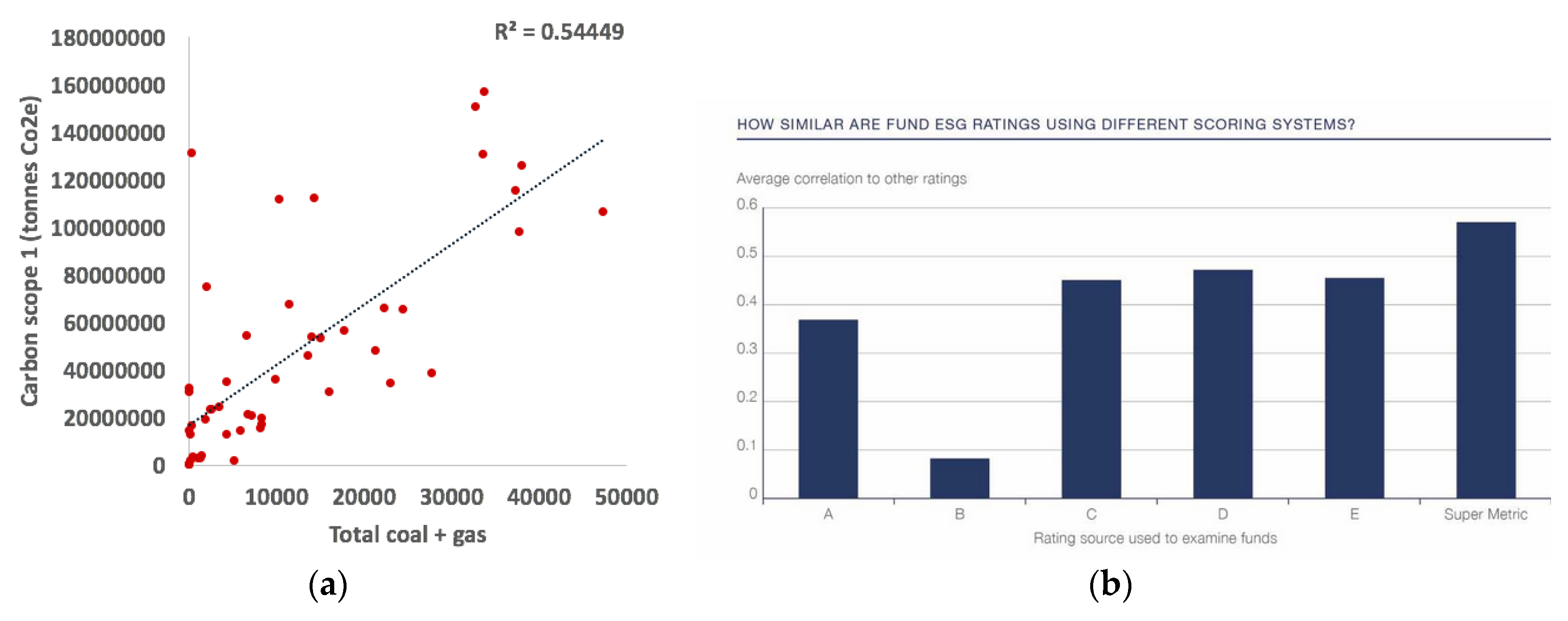

As shown by the discussion above, the relative merits of different accounting units are a function of the use case and the underlying data quality that informs each of these indicators, which is outside the scope of this article. However, it is relevant to highlight that the choice of indicators may not be cleanly correlated. By extension, the choice of one or the other accounting unit may materially impact the results of the analysis and potentially even the sign of the results. Research by Schroeders shows a low correlation between different ESG scores (

Figure 1b) [

22]. Similar research by Chatterji et al. from 2013 suggest that the overlap in ratings ranges between 19% and 60% [

23]. They conclude that “low convergent validity between SRI raters is not only driven by different theorizations, but also by low commensurability among most pairs of raters.” [

23]

Similarly, commonly used metrics used as proxies for company level climate impact may not have significant correlation. As a simple analysis demonstrating this point, the author mapped the correlation between the absolute Scope 1 GHG emissions, as measured by Trucost (based on 2015 data), for a sample of 50 electric utilities and their absolute installed capacity for coal power and gas power of the associated electric utilities (also using 2015 data) (

Figure 1a).

While correlated, as would be expected, there are a number of utilities with significant outliers, related both to the underlying uncertainty of the data (notably related to estimations of production associated with installed capacity), but also to the fact that indicators like installed capacity do not capture the complete business of a utility, nor necessarily issues like utilization rates.

3.2. Boundary Principles

A key challenge for corporate and financial accounting, as well as for the issue under discussion here, is the question of the accounting boundary. When it comes to the unit of accounting, it is not just a question of defining the unit, but also the boundary with which to determine the unit. A range of boundaries can be considered here, notably temporal boundaries (i.e., which time horizon is covered by the accounts), ownership boundaries (i.e., what is the scope of corporate structures covered by the accounts), and business activity boundaries (i.e., what is the scope of business activities covered by the accounts).

There are of course other boundary issues that may arise, but it is these three that are considered the most salient for the question of climate accounting principles. While each of these may warrant their own deep-dive articles, this article will seek to constrain itself by simply mapping the key questions and issues associated with the accounting boundary principles. Each of the three boundary issues flagged above will be discussed in turn.

3.2.1. Temporal Boundaries

One key boundary question related to climate accounting is whether backward or forward-looking indicators are considered. The three options in this regard are ‘point-in time’ indicators, usually covering the last year, ‘historical cumulative’ indicators, based on cumulative actions or historical trends, and ‘forward-looking’ indicators based on some level of forward-looking analysis.

All financed emissions frameworks are currently based on point-in time indicators [

13,

15]. At the same time, there are some attempts to start considering trends [

24], as well as consider historical cumulative GHG emissions [

25]. The historical approach has been deployed in the context of allocating legal responsibility to major GHG emitters, as done recently in the case of a Peruvian farmer against RWE (decision pending) [

26].

In the past two years, increased emphasis has been placed on also considering forward-looking indicators. The 2 °C portfolio assessment framework developed by the Sustainable Energy Investing Metrics consortium for example takes a five-year forward-looking time horizon [

27]. The choice of this time horizons is based on the typical capital expenditure planning time horizons of companies. The analysis of the Carbon Tracker Initiative on oil and gas companies generally takes an 8–10-year time horizon on capital expenditure (2017–2025) and an 18–20-year time horizon on production (2017–2035) [

28].

The somewhat longer time horizon can be explained by the fact that the capital expenditure planning horizon for oil and gas companies may be a little longer than 5 years [

29] and since the approach does not provide cross-sectoral analysis, a more long-term time horizon that may be ‘too long-term’ for electric utilities for example may be more appropriate. Given the relative limited application of forward-looking indicators to date, consensus ore more general trends in terms of the boundary of forward-looking time horizons has not been established.

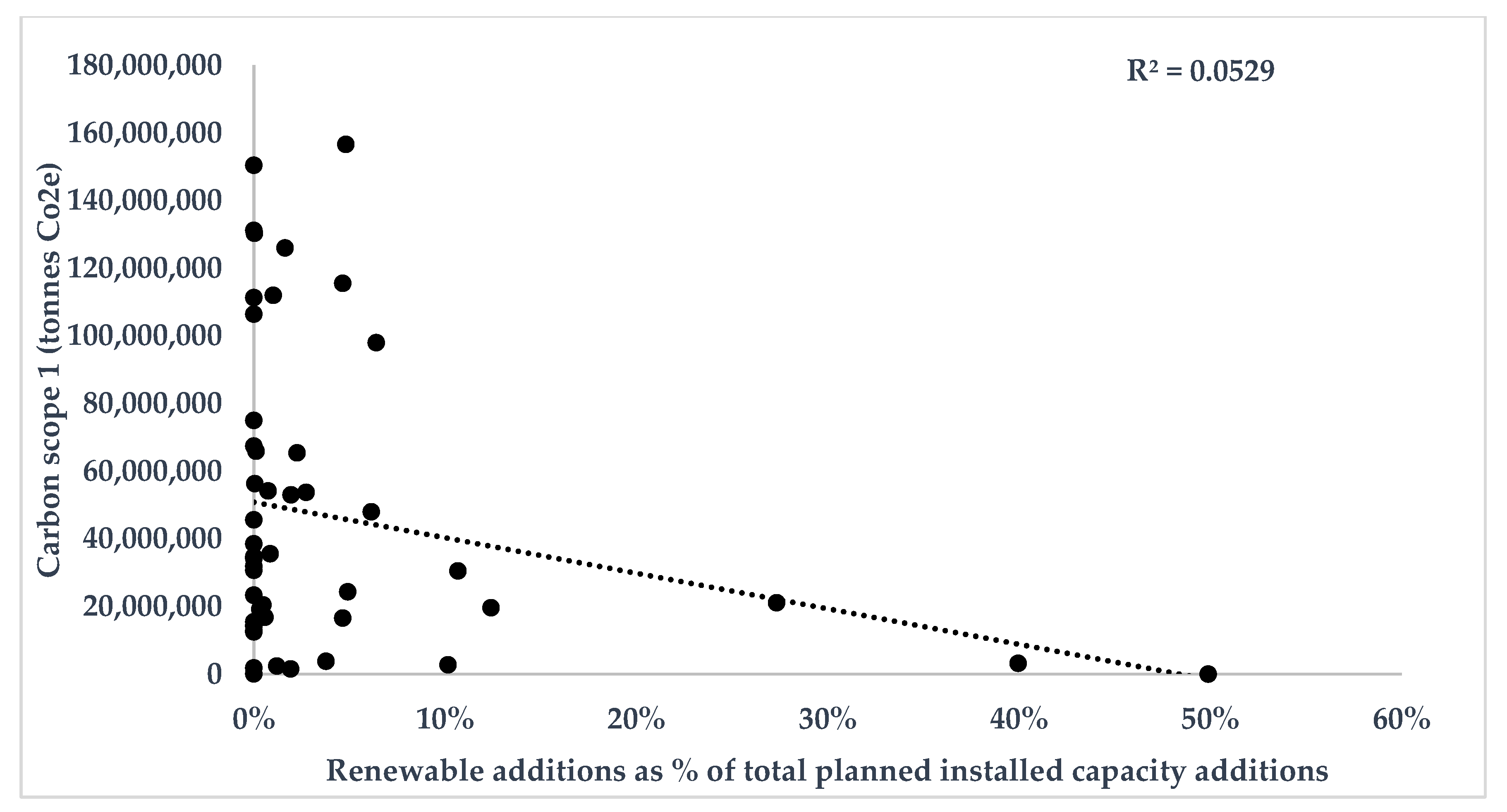

One critical aspect in this respect is that the temporal boundary is critical in terms of driving results and may lead to non-correlated results. For example, point-in time indicators of the share of high-carbon power production for electric utilities (expressed in Scope 1 CO

2e) show basically no correlation—positive or negative—with planned renewable power capacity additions (

Figure 2). In other words, electric utilities that are more high-carbon currently do not necessarily invest more or less in low-carbon alternatives in the future. This lack of correlation, at least to the extent that it is identified for one indicator, suggests that temporal boundary choices are critical for determining the climate unit of accounting and may lead to inconsistent results.

3.2.2. Ownership Boundaries

Another key boundary issue relates to ownership boundaries. For corporate accounting, this is a critical element, as it relates to questions of how to account subsidiaries in annual accounts and partially owned assets. There is a rich literature as to the rules and principles for accounting these types of assets. Notable approaches in this regard relate to the ‘equity share’ accounting, which allocates economic or financial activity based on the equity stake in the underlying asset or subsidiary. Another approach is the management control approach, where 100% of the activity gets allocated to the entity that has management control of the asset or subsidiary. Thus, if the entity owns 51% of a power plant, it would get allocated 100% of the installed capacity and associated production.

The choice of these or other approaches may be specific to the accounting objective, and indeed will not necessarily be consistently applied in one annual report of a company. While critical from a climate accounting perspective, the issues here are the same as you would see in traditional corporate accounting and thus not necessarily of additional significant interest for the purpose of this paper. Suffice it to say that ownership boundaries are critical at the entity level in order to correctly and comprehensively capture a company’s activity. At the same time, it is an issue that is of primary concern at entity and not portfolio level, insofar as the portfolio will import the accounting choices made at entity level.

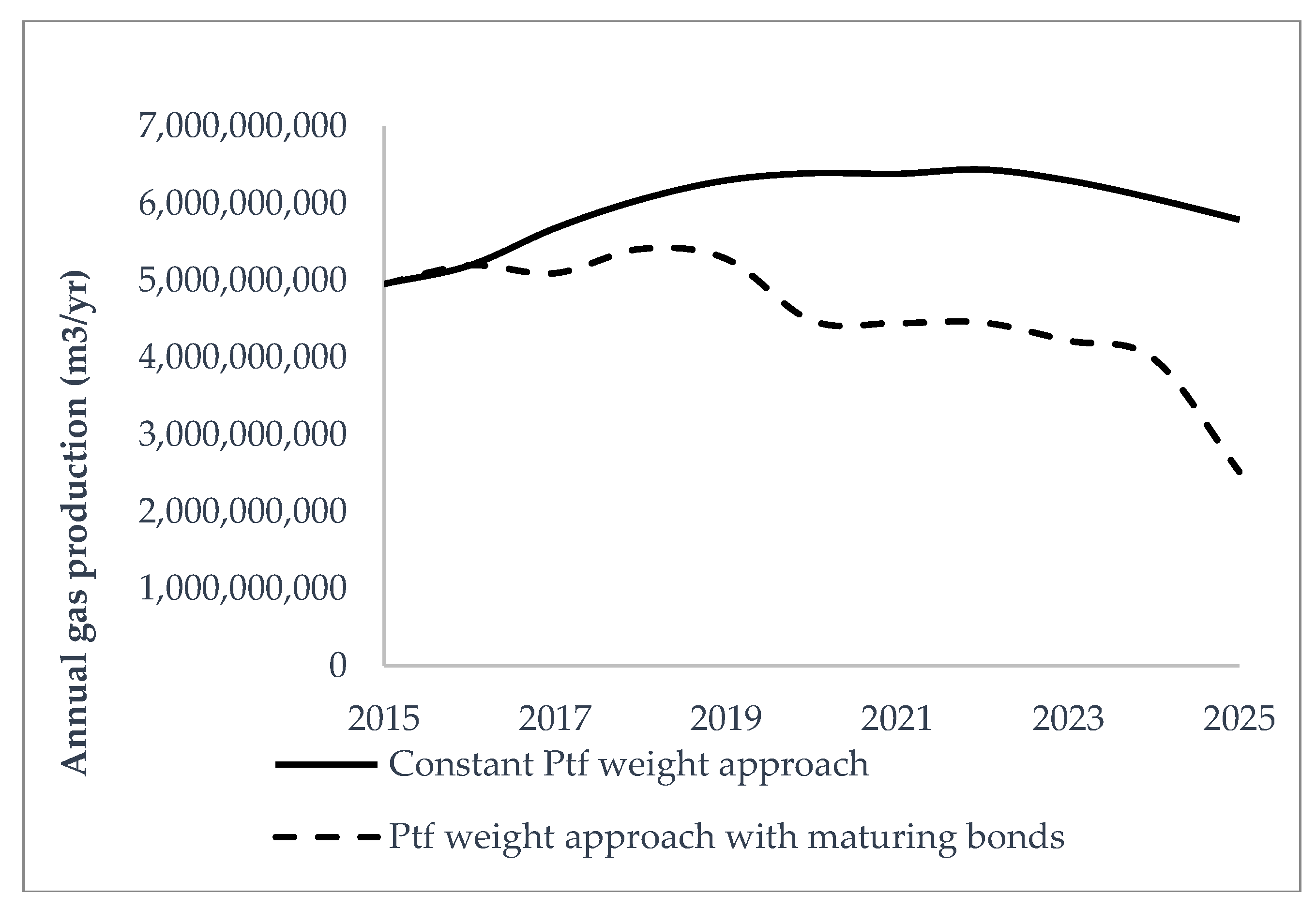

At portfolio level, the ownership boundary that is of interest from the perspective of climate accounting is the question of the maturity of credit instruments. The issue here can be summarized as follows: When a company projects future activities or revenues, it does this based on the current fixed asset base and commitments as to the evolution of that asset base based on investments and mergers and acquisitions. In the case of a credit portfolio with maturities, this future commitment does not exist by default, since the instruments mature, and it is not given that the instruments will be refinanced (even if likely), nor that the portfolio manager will reinvest in the same company or instrument. By extension, a 5 or 10-year forward-looking analysis of the portfolio will be influenced by the accounting assumptions taken around maturing instruments.

Figure 3 demonstrates the impact of this choice. Here, the annual gas production of a corporate bonds portfolio, allocated based on the portfolio weight approach (see

Section 3.3 for a discussion of allocation rules), is shown over a 10-year time horizon. The line shows the trajectory assuming no maturity of bond instruments, whereas the dotted line represents the annual gas production assuming the maturity of bond instruments. In the second case, the gas production in the portfolio is reduced by 50% over a ten-year time horizon as a result of the maturing instruments.

The choice for one or the other cannot be described in absolute terms but is rather a function of underlying strategies. Investors that assume a refinancing approach may be more inclined to assume no maturity, whereas investors that specifically target no refinancing may be inclined to go for the dotted line. Allianz for example as part of its coal divestment strategy has not committed to selling bonds in their portfolio, but rather excluding coal from future investments, based on the categories they have defined. In their case, the dotted line, at least when considering coal production, may be more appropriate. Given the general view of refinancing, however, the straight line may be a more appropriate general application.

3.2.3. Business Activity

The final key boundary issue of interest here is the boundary of business activity. From a climate perspective, there is a key hierarchy of business activities that have a more or less significant impact on climate change. These can be mapped differently to the business segments of a company and its associated financial instruments. Around 20% of a typical financial portfolio account for around 80% of the GHG emissions of associated companies [

30]. When mapping the sectors in the 2 °C scenario of the International Energy Agency to companies in stock markets, the percentage similarly fluctuates at around 15–25% [

31].

By extension, climate accounting for financial portfolios may limit itself to only specific business segments of investee companies and/or specific parts of the portfolio. For example, the 2 °C scenario analysis of TPT Retirement Scheme [

32] and AXA [

33] only considers around 15% of the portfolio. Similarly, the analysis of Trucost for ERAFP [

34] on the power sector only looks at the power generation activities of utilities and does not look at their other business segments (e.g., distribution, mining). The boundary issue on climate is thus not just one of the scope of corporate ownership, but also activity.

Part of the boundary issue is function of the units of accounting. If the unit of accounting is power capacity for example, other activities are obviously not considered. The question here then becomes the scope. For example, is the power capacity owned by Apple, which represents a rounding error in the overall revenues of the company, considered together with those of electric utilities or not. These types of choices are less accounting choices than data choices.

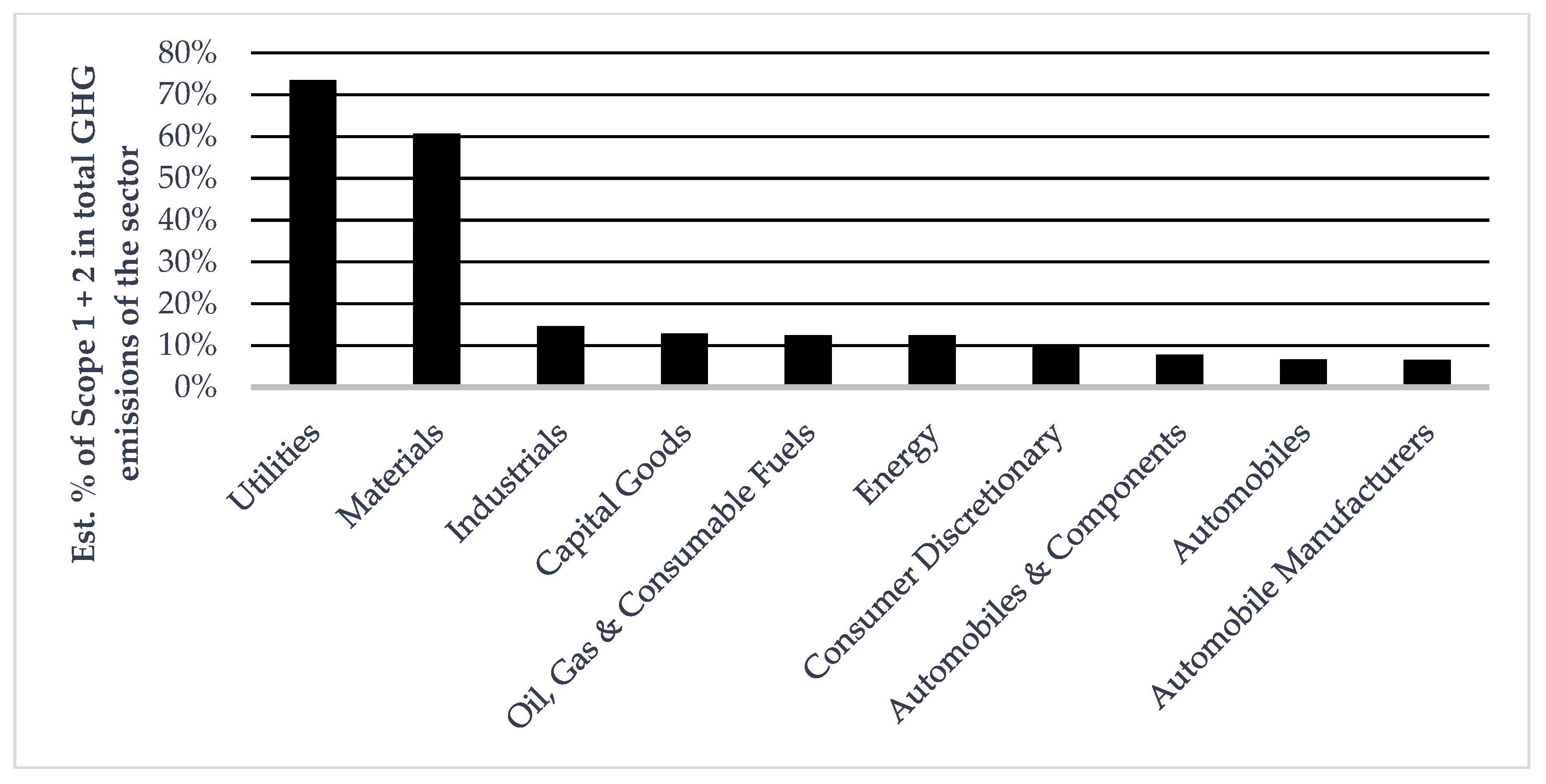

For GHG emissions, however, the boundary issue becomes quite significant. Current carbon footprinting frameworks rely almost exclusively on Scope 1 and Scope 2 GHG emissions [

13]. In some cases, supply-chain emissions are estimated, as is the case for Trucost [

15]. Thus, while they seek to cover the complete universe of business activities of a company, they do not cover the complete universe of climate impacts of the products and services associated with these business activities. Crucially missing from these business activities are the GHG emissions from the use case of the product. This implies that for 8 of 10 sectors, less than 20% of the climate impact is covered in the analysis (

Figure 4). While there is some inherent uncertainty in the data estimates, even a somewhat more benign estimation still would suggest the majority of GHG emissions are not covered in the analysis.

3.3. Allocation Principles

Once the unit of accounting is defined, the next key accounting challenge is how to allocate the economic activity of a company to financial instruments. Indeed, this accounting principle is arguably the most complex, since it has no real role model in traditional accounting frameworks. Traditional corporate finance research looks at ways to minimize the impact of financial institutions’ strategies on share prices. Indeed, organizations like State Street have dedicated departments to help financial institutions transition their portfolios without impacting share prices [

35]. Classical corporate finance literature in the spirit of Modigliani–Miller seek to demonstrate the fungibility of different asset classes in influencing corporate finance conditions [

36]. From the perspective of climate, the interest tends to be in actual seeking to impact investment in the real economy, in favor of investments consistent with the transition to a low-carbon economy and global climate objectives.

In this context, allocating responsibility or accountability of economic activity to financial instruments cannot rely on a rich body of literature for guidance, when it comes to allocating economic activity to different asset classes without double counting (i.e., allocating the same unit of economic activity to two different financial instruments).

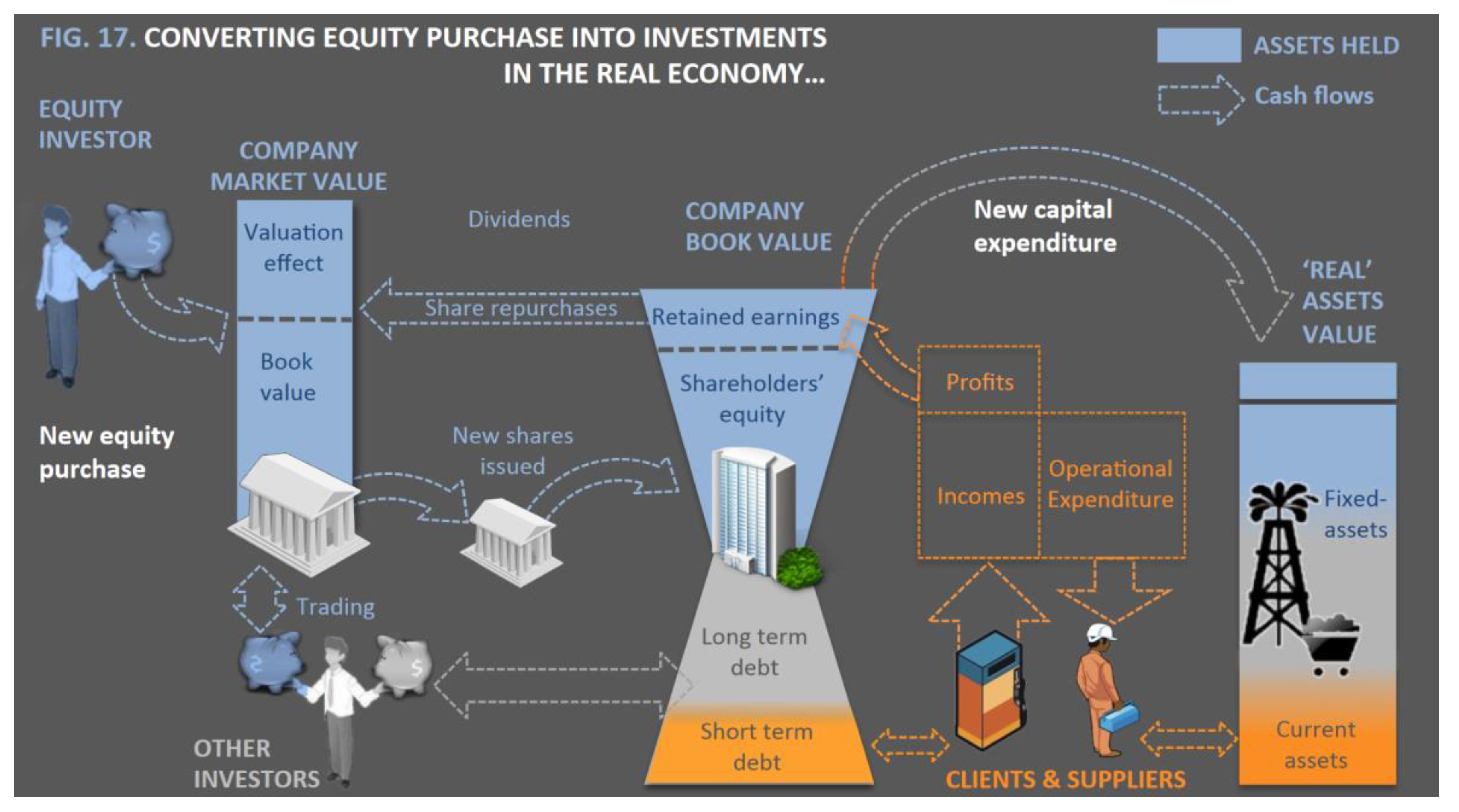

The complexity for example in tracing economic impact in equity investments in terms of investments in the real economy is elucidated by Dupré et al. (2015) [

1], see

Figure 5 below. In response to this challenge, two types of allocation principles have been developed, which are defined here as the ‘portfolio-weight’ approach and the ‘balance sheet’ approach. Each of these will be discussed in turn.

The equation summarizing this accounting challenge can be summarized as

where

is the climate unit allocated to the portfolio,

ui the absolute climate unit of company

,

the value of the financial instrument of company

in the financial portfolio, and

the allocation factor. The key question here then is the definition of

a, with

basically representing the climate unit ‘to be allocated’ and

representing the amount ownership of the financial instrument that will determine the allocation rule. Thus,

jointly determine how much of the climate unit of a specific company is allocated to the portfolio, based on the amount of capital invested in the company and the way this capital is set in relation to an external factor (the allocation factor), discussed in further detail below and relating either to the portfolio-weight or balance sheet approach.

The balance sheet approach, arguably the more common of the two, involves allocating economic activity to the balance sheet based on the definition of a fixed allocation key. Within this approach, different applications can be considered.

The first option for

is allocating all economic activity to the equity instruments of a company, in the logic of allocating ‘ownership’ of economic activity to only those instruments that directly account for ownership. This approach is currently being applied by the Swedish pension funds [

4]. While internally consistent and an attractive solution for those financial institutions exclusively invested in or concerned with accounting equity instruments, it gives rise to the double counting issue that if all economic activity is allocated to equity and then allocated again—in some to be determined formula—to credit instruments, it gets counted twice. Crucially, the equity principle cannot by design be applied to other financial instruments.

The upside of this approach however is that because equity ownerships can be expressed in percent of total, the allocation rule is not biased by fluctuations in market prices (e.g., share prices). Moreover, there exists some logical consistency in allocating all economic activity to its owners. Indeed, this approach is the only area where an extension of traditional corporate consolidation rules can be extended to financial instruments, in the spirit of the way companies prepare their corporate accounts when considering their own subsidiaries.

Of course, allocation rules can also be defined based on either line items in a balance sheet, notably enterprise value, an approach chosen by Mirova for the climate accounting of their portfolios [

37]. The upside here is that this approach avoids double counting and allows for applicability across different asset classes. The downside is that the approach is highly sensitive to market prices. In other words, intensities will fluctuate as enterprise value fluctuates (an issue revisited in

Section 3.4). While not of primary concern here, there can also be challenges for non-listed companies in deriving their enterprise value. Finally, the approach creates an arbitrary equivalence between different asset classes, which may not be intuitive and correct, since they serve fundamentally different functions in many cases, especially when it comes to climate change [

38].

The alternative accounting principle is allocating economic activity based on the portfolio weight of the company in the portfolio. In this case,

represents the size of the portfolio itself. It is the approach chosen in the ESG ratings of both MSCI and Morningstar/Sustainalytics [

39,

40], as well as the climate ratings of ISS-Ethix/CDP [

41]. This approach is generally used to weight normalized or scored indicators rather than allocating absolute climate units, as it represents the relative weight of different scores or intensities in the portfolio.

While the balance sheet approach described above can be said to be more intuitive for equity portfolios, the portfolio weight approach is more intuitive for credit portfolios, since it can be said to represent the capital allocation decision of the portfolio manager behind the portfolio, given the link between book value and capital allocation decisions. In other words, the portfolio value of a credit instrument, as measured in book value, can be said to represent the money allocation of the portfolio manager, whereas the same is not necessarily the case for equity portfolios, given the potential fluctuation of the book and equity value of a company. An investor, who invested in Tesla in 2013 and still holds the stock, will have a different portfolio value in their portfolio today than four years ago.

Another factor that speaks for the portfolio weight approach is the more intuitive link to financial risk. While out of scope, accounting based on portfolio weight allows for a representation of the size of the exposure of the portfolio to the company. This more intuitively links to risk since the overall ‘size of the exposure’ is captured through such an approach (measured in financial terms or share in the portfolio), which may be at risk of loss. Of course, these aspects situate themselves in a broader conversation around the impact of different macroeconomic risks and microeconomic ‘technology’ or ‘legal risks’ that will impact each of these factors differently, as well as the response by the portfolio managers.

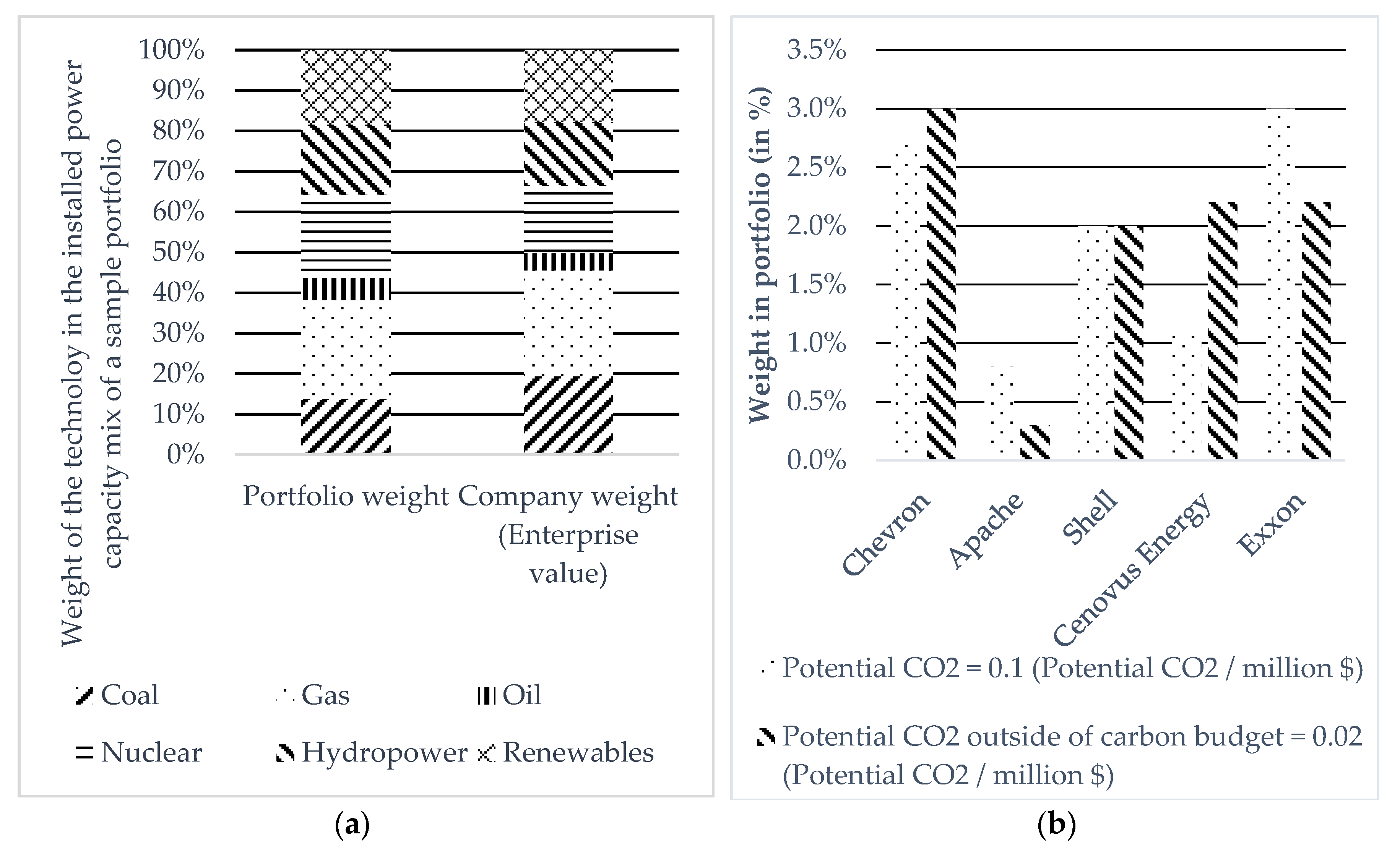

Figure 6a shows the implication of choosing different allocation rules for a sample corporate bonds portfolio. The actual portfolio composition is based on a corporate bonds portfolio provided by a European insurance company for the purpose of this study. The portfolio is based on a composition of instruments from 2016 invested in developed markets. The results are illustrative and thus the exact composition of the portfolio is not of primary concern here, it is rather to demonstrate that the results will differ based on using different approaches. While in aggregate the results do not fluctuate wildly, the different measured technology weights are arguably significant. Thus, the weight of coal power capacity in the portfolio weight approach is 13.8%, versus 19.4% in the company weight approach using enterprise value.

As highlighted above, another conclusion of the analysis is that portfolio weight is more intuitive for financial risk assessments and considerations, given the relevance of the portfolio weight for exposure. On the flipside, the share of a portfolio in a company’s outstanding debt is secondary for risk considerations. This potential disconnect is demonstrated in

Figure 6b.

Figure 6b shows the weight of five different oil and gas companies in a portfolio, where the residual portfolio weight has a carbon intensity of zero, that is consistent with a potential future CO

2 intensity of 0.1 (Potential CO

2 emissions/million

$ invested) or consistent with a potential CO

2 intensity outside of the carbon budget of 0.02 (Potential CO

2 emissions/million

$ invested). Emissions estimates are based on analysis from Carbon Tracker Initiative on future emissions [

28]. The results show that identical emissions, allocated based on a balance sheet approach (in this case allocated based on market capitalization of the company) can be associated with significant different portfolio exposure to underlying carbon-intensive companies. Given that the analysis assumes the rest of the portfolio contains no carbon whatsoever, the results show that identical footprints can lead to differences in the percent of the portfolio exposed to climate-related transition risk of less than 0.5% to up to 3%.

3.4. Normalization Principles

Normalization is a critical part of climate accounting in financial markets as it is required to derive performance benchmarks related to climate. The absolute carbon emissions of a company for example or absolute installed coal power capacity may not be meaningful without understanding the size of the company itself. A large electric utility would be expected to have more installed coal power capacity than a smaller utility, et ceteris paribus, and of course more coal power capacity than a non-utility. Some climate strategies related to climate accounting do not require normalization e.g., an investor that does not want to invest in companies that own any coal-fired power plants does not need to know any more information other than whether the company owns coal-fired power. Mergers and acquisitions, as well as changes to business segments, also make it difficult to work with absolute GHG emissions data for example, since this number may increase or decrease as a function of changes in the company’s size and not related to actual business changes. The cement company HeidelbergCement, an example explored further below, demonstrates this.

However, most investor strategies will demand some contextualization. For example, if an electric utility, hypothetically, owns one gigawatt of coal-fired power and 20 GW of renewable power, this context would be relevant, even if in absolute terms one gigawatt is a significant amount of coal power. Thus, investors that have chosen to divest from coal (e.g., AXA, Allianz) have in almost all cases defined thresholds in terms of the share of coal in a company’s business activities [

42,

43].

The equation underlying this accounting principle is shown below:

where

is the normalized climate intensity of company

,

is the original climate unit of company

,

is the normalization factor for company

, and c is a constant that may be applied to express the outcome in a desired unit (e.g., one million

$, ton of cement). The same equation can be expressed at portfolio level albeit slightly adjusted

where

is the normalized climate intensity of the portfolio.

In terms of normalization, there are two types of accounting approaches that can be applied. Climate data can either be normalized by economic activity, expressed in economic units (e.g., capacity, production), or company size, expressed in monetary units. The approach of normalizing by economic units implies that the nominator, which represents the identified climate unit (e.g., installed renewable power capacity in MW, GHG emissions) is normalized either by a unit of output or production capacity. In the case where the unit in the nominator and denominator is identical, the related indicator can then be expressed in percent, or otherwise as a specific unit.

For GHG emissions, by design these can only be expressed to signify the percent of types of GHG emissions (e.g., Scope 1, Scope 2, Scope 3) in total emissions. The choice to normalize by economic activity can be seen in the climate accounting and reporting frameworks developed by Trucost for ERAFP [

34], and in the Sustainable Energy Investing Metrics model, funded by the European Union H2020 programme [

27]. It is also the approach taken by the Swiss government in the context of the 2 °C scenario analysis pilot launched in 2017 [

44].

The key challenge in terms of normalizing by economic activity is that this only allows for business-segment specific analysis and thus by extension does not lend itself to cross-business segment and portfolio-level aggregation. It is not possible to aggregate indicators with different denominators (e.g., GHG emissions/MW and GHG emissions/ton of cement) without developing some type of conversion factor, which likely in turn requires some variant of scoring (see previous sections) in order to be expressed as a unit of accounting. By extension, normalizing by economic activity can be an effective approach at stock-picking and portfolio analysis, but not in the context of seeking to report aggregated indicators [

20].

An alternative to normalizing by economic activity is to normalize by company size, expressed in monetary units. Normalizing by company size can also be interpreted to normalize by financial activity if elements like market capitalization or a company’s balance sheet are set to reflect future financial returns. This normalization approach is used across all financed emissions methodologies currently used by financial institutions in the market. It solves the question of aggregation by providing a denominator that exists for and can be consistently applied by all companies. The most prominent types of indicators in this regard are revenues, market capitalization, or enterprise value [

13].

The use of the enterprise value for an allocation key here is different to the use of enterprise value for normalization purposes described above as in the one case the enterprise value is used to normalize the climate unit in order to derive an intensity for a company (or portfolio), and in the other case an absolute volume of GHG emissions for example is allocated to individual financial instruments based on the weight of the financial instrument (in monetary terms) in total enterprise value.

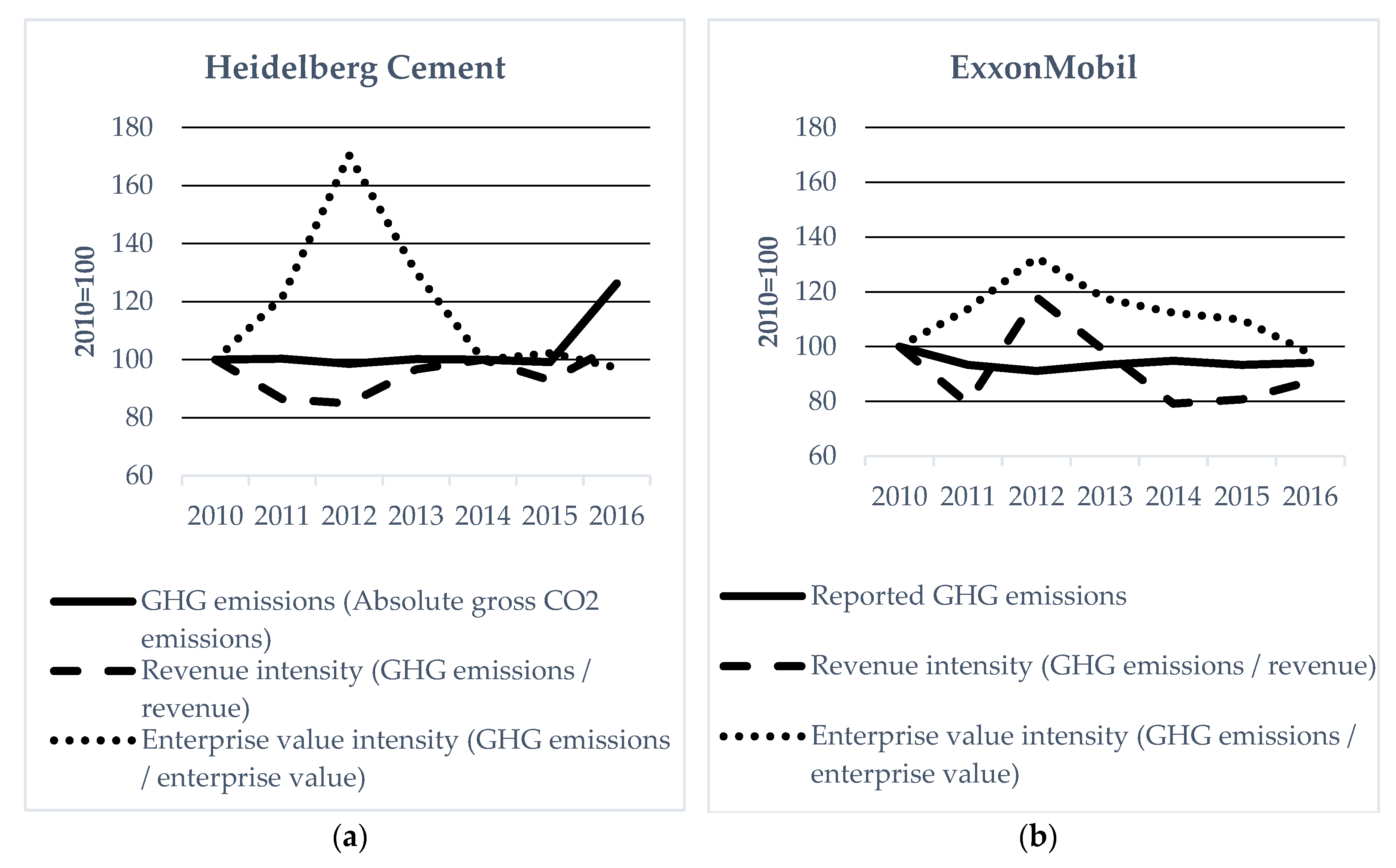

Given that this indicator however must rely on monetary units, it can create biases in the results. The following example for an oil and gas company (ExxonMobil) and a cement company (HeidelbergCement) illustrate this point.

Figure 7 shows the absolute GHG emissions (Scope 1 and Scope 2) for each company and the normalized GHG emissions for the time period of 2010 to 2016. The results demonstrate the significant volatility embedded in the denominator when normalizing by revenues and enterprise value. While not consistent across both companies, normalized results fluctuate wildly even if absolute GHG emissions do not move materially.

The relative stability in absolute GHG emissions suggest relatively stable scope of company economic activity, but changes in prices (revenues) and/or the balance sheet (enterprise value) lead to these fluctuations. Interestingly, in the case of ExxonMobil, as ExxonMobil expands its balance sheet through increased debt issuance, and by extension increases its enterprise value as its stock price does not adjust, the normalized GHG emissions intensity goes down. While not in scope of this paper, this suggests that this type of normalization may be inversely correlated with risk trends as a more leverage company will lower its GHG emissions but potentially increase its credit risk. Here again different types of risk pass-through mechanisms in different asset classes will impact conclusions and require further analysis. To highlight the challenge with revenues using an example for a different sector, Ferrari might sell one car for two or three cars sold by BMW, even while the revenues or sales might be identical. The climate impact of each however is obviously different.

While in both cases normalization by revenue is associated with lower volatility, volatility is still significant around ±20%. For enterprise value, this number jumps above 60% in the case of HeidelbergCement. Crucially, this volatility is not driven by the actual ‘climate performance’ or impact of the company, but exogenous indicators. Thus, while this accounting approach allows for aggregation, it can create significant biases in the interpretation of climate accounting at individual security level and by extension may not be applicable for the implementation of passive or active investing strategies, as well as company engagement.