1. Introduction

The financial sector’s prominence in modern economic systems has often been associated with direct and indirect impacts on society and the environment [

1,

2]. The 2008 US triggered financial crisis impacted European governance [

3] and the financial stability of national economies [

4] that retrospectively have been scrutinized by policy analysts, regulators, organizations, investors and citizens. This led to a questionable Basel III response setting capital adequacy, stress testing and liquidity risk regulations [

5,

6].

It has also contributed to policy analysts and scholars becoming more engaged with the practical implications of sustainability, pointing their focus on to the relationship between finance and sustainable development [

1,

2,

7]. A key aspect of this relationship is identified through the lens of financial intermediation’s risk management, a fundamental function of the financial realm, which bridges inherent information gaps and provides added value to both investors and savers [

1,

8]. Nonetheless, in many cases, there is no provision for the social and/or environmental impacts of such for-profit activities, while sustainability can often be intertwined with or contradictory to imperatives pertaining to short-term financial results [

2]. Against this background, bounded complexity must extend beyond just balancing short-term financial targets to consider broader and long-term sustainability imperatives.

Across increasingly volatile and less predictable markets, risk management has become a critical function for financial institutions. It is a core service of contemporary financial intermediation, partially explaining the sector’s multidimensional impact on modern economies [

1,

8,

9,

10]. Financial intermediaries are fast becoming globally interconnected through technology-based innovations. This is introducing the number of new trading platforms and mechanisms (e.g., bitcoin, hedge fund transactions, fin-tech, cashless transactions) along with their associated governance risks (e.g., Libor rate fixing, data storage, privacy, account security, fraud prevention).

Sustainability risk (SR) is defined as the likelihood and significance of a loan’s default due to environmental and/or socioeconomic factors derived from the loan’s terms and, therefore, compromising the borrower’s ability to repay the loan [

11]. Notwithstanding the fact that financial intermediaries (FIs) implement risk management mainly to minimize their exposure to financial risks and maximize their profit margins, there are also underlying or emerging risks stemming from their business activities related to sustainability [

12,

13,

14,

15]. In this respect, the notion of shared-value creation [

16] posits how the benefits of doing business should be distributed to all stakeholders, further implying that all risks associated with economic activities also need to be adequately addressed and managed [

2]. For instance, in the case of financial institutions, a borrower’s environmental risk can become the bank’s financial risk [

9]. Hence, the financial sector’s accountability is not to be limited to the financial reporting of risks but should also account for environmental and social risks, which encapsulate trade-offs in terms of value under the scope of sustainable development [

1,

2,

13].

In this context, the purpose of this study is to provide up-to-date evidence from the first line of financial intermediation regarding the adoption of sustainability considerations, and how these affect business lending decisions. Existing studies in this field merely focus on environmental risks, their impact on credit risk assessments or the cost of debt, and correlations between a borrower’s environmental and financial performance and how it affects the loan’s probability of default [

11,

12,

17,

18,

19].

To our knowledge, there is no recent evidence of how banks and other types of FIs (i.e., asset management companies, investment funds, or real estate agencies) incorporate sustainability risks into their business operations. Hence, our paper contributes to the existing literature on the integration of nonfinancial risks into the credit risk management of European banks [

11,

20,

21], by investigating whether financial intermediaries (FIs) in Greece assess such risk perspectives as part of their risk management process or portfolio analysis prior to any lending decision. As sustainability risks may also derive from real estate collaterals associated with bad loans [

11,

12], i.e., loans that their borrowers are unable (or unwilling) to repay, the paper investigates provisions of sustainability risk assessment in the management or acquisition of bad loans in order to complement the primary research objective.

Focusing on the Greek financial sector [

22], a mixed-methods approach was employed using online questionnaires and semi-structured interviews with a senior banking executive, a line officer, an associate consultant of an asset management company, and the Special Sectoral Secretariat for Private Debt Management of the Ministry of Economy and Development. The purpose of combining two analytical methods is to provide a deeper understanding of existing mechanisms and measures (policies and methods, tools, motives, etc.) that key representatives of the domestic financial sector employ for sustainability risk assessment as part of their core business offerings.

The core business of the Greek financial sector, as it is structured today, mainly pertains to private lending and the management or acquisition of ‘bad loans’ (i.e., nonperforming exposures—NPEs) [

23,

24]. The associated sustainability risks of companies engaged in financial intermediation are mostly due to contaminated real estate collaterals used as loan securities [

11,

12]. Moreover, sustainability or environmental risk management that assesses the borrower’s environmental performance can be linked to the borrower’s probability of default and, subsequently, the generation of new NPEs [

11,

18,

19,

25]. Still, there is only sparse evidence of how sustainability considerations are being incorporated into business lending decisions, either through risk management, due diligence, or other types of portfolio analysis [

19,

20].

The rest of the paper is structured as follows. In the next section, we review background literature on financial intermediation, risk management, and sustainability and their intersections and commonly-used reporting tools or frameworks. Specific reference is made to the recent 2014/95/EU Directive, which has made nonfinancial information disclosure compulsory for publicly-traded companies, effective from 2017. This background section includes an overview of the Greek context, especially with regards to nonperforming exposures (NPEs) management, as this remains the primary challenge of the Greek financial sector. The next sections outline our methodology and the findings, respectively. The paper concludes by highlighting key points on the adoption of sustainability by the Greek financial sector, implications for policy-making, and managerial practice, along with future research perspectives.

3. Methodology and Sample Identification

Drawing on the scant literature of this emerging topic [

11,

12,

13,

20,

35], our study focused on a national context, where companies operate under common regulatory frameworks and economic and market conditions and the domestic financial sector was until recently under continuous European supervision by the Troika. Troika is the decision group formed by the European Commission (EC), the European Central Bank (ECB), and the International Monetary Fund (IMF) that represent the European Union in its foreign relations [

23]. During a period of financial turbulence, the Greek banking system experienced intensive restructuring, privatizations, and conglomerations [

23]. Consequently, the system now comprises only 4 core–systemic banks, along with a small number of peripheral–less systemic financial institutions. Furthermore, the tremendous exposure to bad loans practically renders the Greek financial sector and the whole economy a captive of its nonperforming assets [

23,

24,

37]. By taking into account the high importance of private lending and NPE management for financial stability and economic development in Greece [

23,

24,

37], the paper highlights practices adopted by the FIs with regards to environmental and social risks (i.e., sustainability risk management).

The mixed methods employed examine the mechanisms and measures (policies, methods, tools, motives, etc.) that the Greek financial sector is developing or has in place in order to address sustainability risks embedded in lending decisions and the management of NPEs. The collection of primary data was vital in order to offer a comprehensive outlook on current domestic trends and developments on the topic. In line with Thompson and Cowton [

12], a two-stage data collection approach was followed; first, using online questionnaires and second, through semi-structured interviews. The online questionnaires were distributed to 70 executives, line managers, and associate consultants from a range of FIs, currently active or about to penetrate the Greek market. The role of the business manager providing valuable insights on the incorporation of these practices throughout the risk management process was deemed to be critical for this study. Our sample consisted of financial institutions (banks), investment funds and loan management companies (LMCs), audit and financial consulting firms, real estate/asset management companies, and supervisory and regulatory bodies, thereby ensuring that every type of FI was represented. As the response rate to online questionnaires was relatively low, the validity of this research was further enhanced with face-to-face semi-structured interviews with three (3) business executives and one (1) government official. Particularly, our qualitative investigation and further analysis addressed the following 3 levels: (a) Policy and Methods, (b) Operations, and (c) Materiality and Motives. In order to capture the FI’s different business perspectives and, subsequently, different perceptions of sustainability risk, questions were modified accordingly to address each interest group.

4. Findings

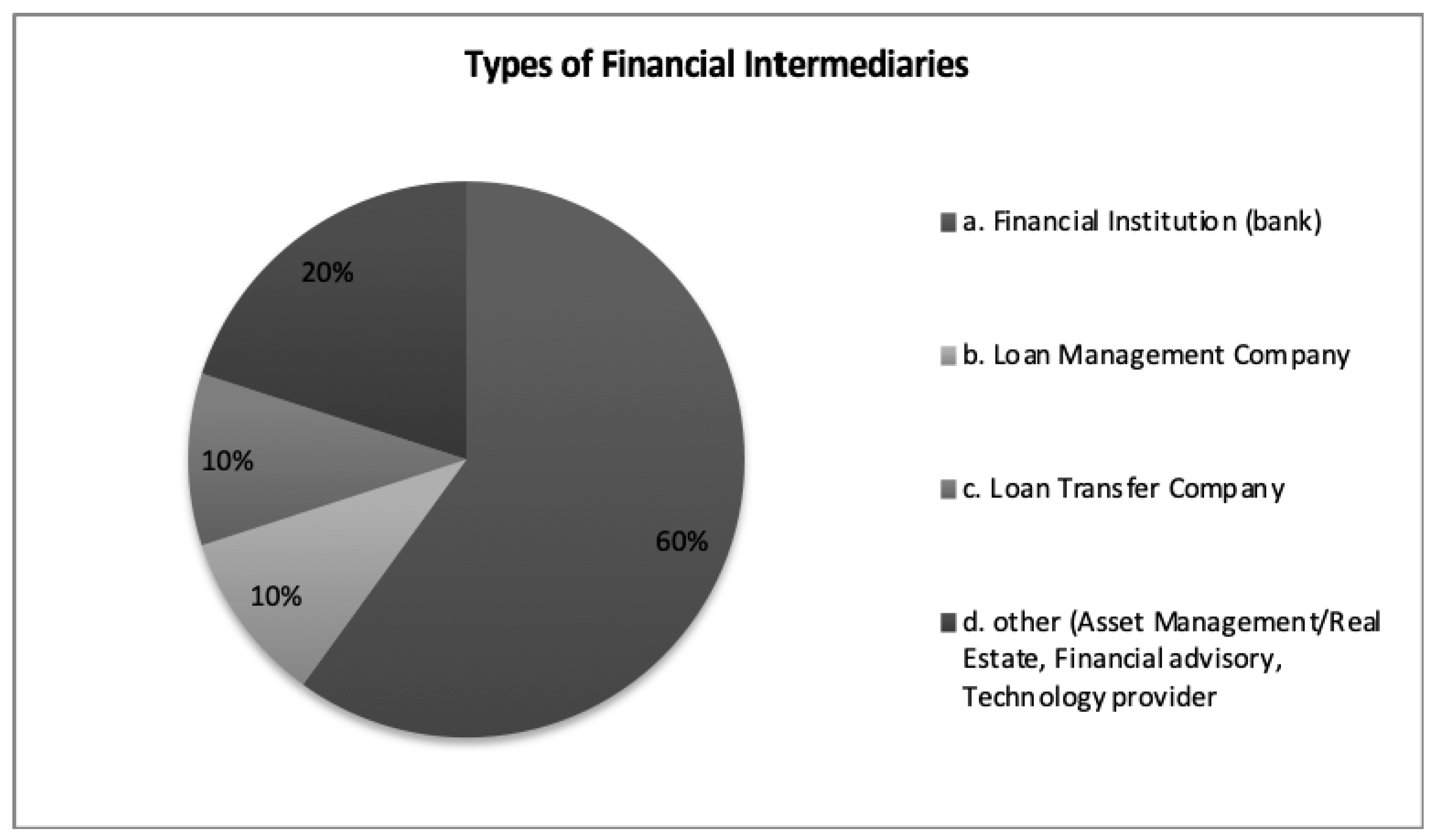

From the initial sample of 70 business executives that received the questionnaire via email, 33 responded to our invitation and only 20 questionnaires were fully completed to allow further analysis. Most of the respondents were working in a financial institution (bank), while a lot fewer responses came from LTCs and LMCs (investment fund). The remainder of the responses were received from FIs engaged with asset management and real estate, financial advisory, or technology (see

Figure 2).

4.1. Policy and Methods

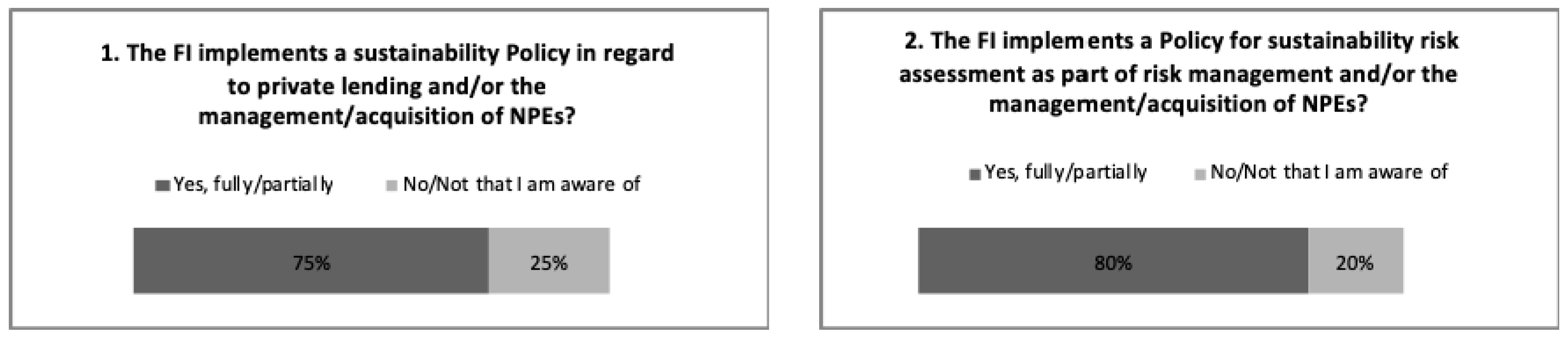

In the first level of analysis, we investigated whether a policy and/or a methodology for the management of sustainability and environmental or social risks exists within the FI’s policies and procedures manual. Any reference to environmental or sustainability risk management as part of a wider sustainability, environmental, or CSR policy would also count. Next, we considered whether the FI’s policy is affecting the credit risk management process and/or the management or acquisition of NPEs. Third, we asked managers’ opinion on whether that policy should form an integral part of the risk management process. These three areas of questioning received 75–80% affirmative responses from the sample, i.e., recognition that policy should exist and cover broader aspects (see

Figure 3). We then proceeded to assess the particular impact of such a policy on the FIs’ core business functions, namely: Credit risk assessments, NPE management, and private lending. Arrears management, which mainly refers to the management, sale, or acquisition of NPEs, ranked highest in terms of sustainability policy impact, while the second ranking was attributed to credit risk assessments.

Regarding methods for assessing sustainability risks, the respondents were asked to indicate their level of familiarity with and implementation of each of the most commonly used and widely adopted sustainability tools and frameworks. The tools and frameworks that our respondents were most familiar with are the GRI Guidelines, the ecomanagement and audit scheme (EMAS), ISO 14001, and nonfinancial management systems (ESMS). In terms of penetration, ESMS appear to be the most widely adopted by FIs, followed by the GRI Guidelines and EMAS. This is partially explained by the fact that the majority of respondents are from the banking industry, which is subject to a period of transformation and reorientation of activities to comply with sustainability. One of our interviewees (Inter 2), part of the ESMS team in a systemically significant financial institution, shared insights on the specific matter:

“We (our institution) implement a sustainability Policy and a policy that refers explicitly to the management of environmental risks. From the beginning of the year (2018), however, we have been actively engaged in the formulation of an ESMS, in response to the demands of our new shareholders, who perceive environmental risk management as a prerequisite of their investment. This is a common case in at least 3 out of the 4 Significant Financial Institutions in Greece. The ultimate goal is to integrate ESMS into credit risk management of business loans”.

(Inter 2, Bank, Significant)

In a similar vein, the Chief Risk Officer of a less significant financial institution in Greece (Inter 4) expressed his opinion accordingly:

“In order to be effective, sustainability risk assessments must be integrated into the whole culture of credit underwriting. Timing is perfect to strive for a sustainable banking system, because of the restructuring phase that is taking place”.

(Inter 4, Bank, Less Significant)

4.2. Operations

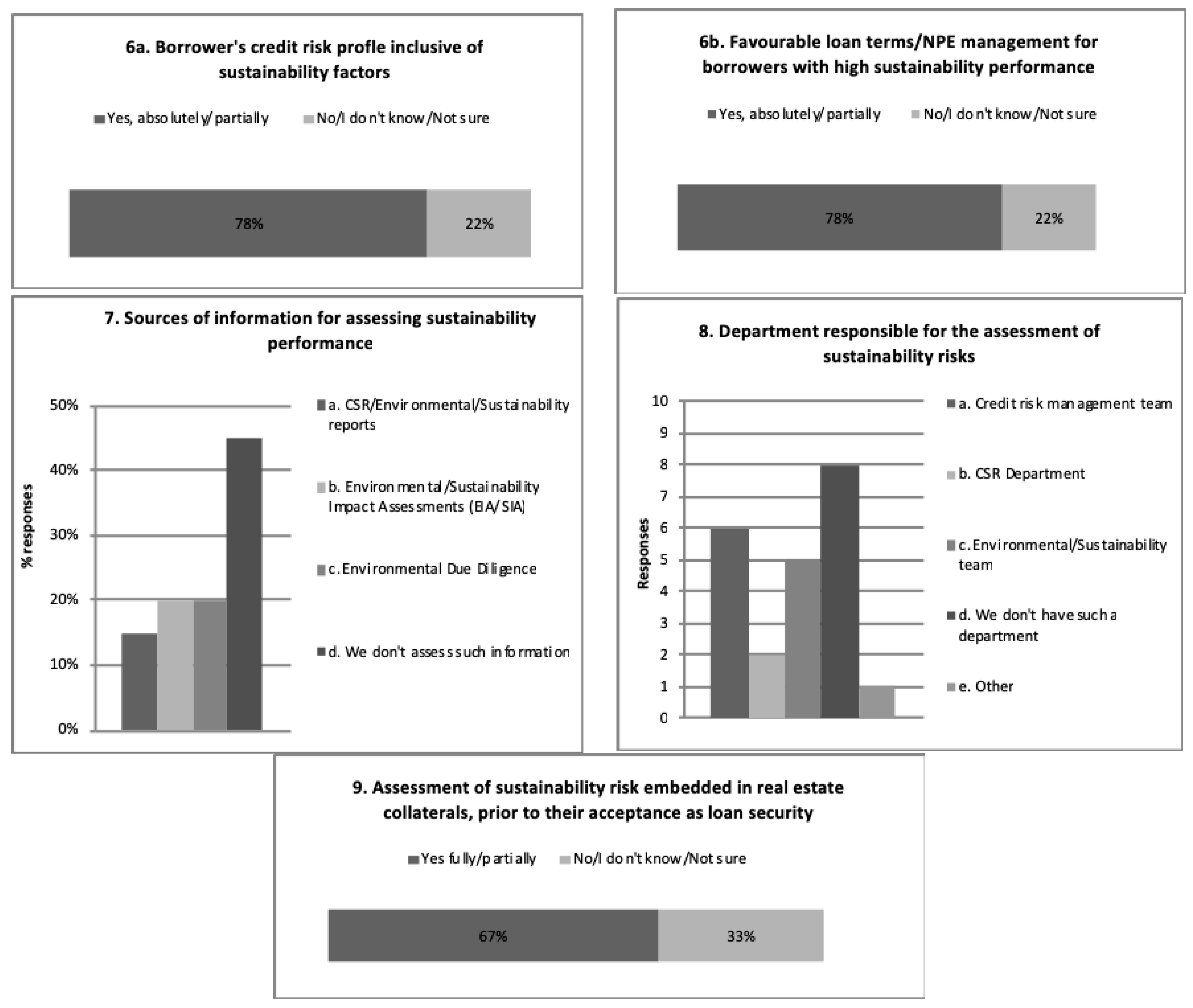

The next level of our analysis investigated the extent to which sustainability risk assessments are incorporated into core business operations, mostly private lending and NPE management/acquisition. We asked managers whether the borrower’s credit risk profile is inclusive of sustainability factors and whether they would consider a borrower’s sustainability performance when working on the loan terms. In both cases, almost 80% of respondents gave an affirmative answer (see

Figure 4). Inter 4 shared an important aspect that we may have overlooked, partly placing more emphasis to the rating agencies that evaluating the borrower’s credit risk profile:

“We (banks) don’t possess such (sustainability) information when we calculate the borrower’s Probability of Default. Nonetheless, this kind of information should be properly quantified by the rating agencies in order to be credible and readily available to financial institutions. Considering the management of NPEs, sustainability criteria will provide more information and contribute to the proper evaluation of a debtor’s viability in the long run, which will eventually determine the decision for business revival or liquidation”.

(Inter 4, Bank, Less Significant)

In this respect, we attempted to shed light on the Government’s position through discussions with a high-level official of the Special Sector Secretary for Private Debt Management (Inter 3). The official’s opinion encapsulates some particularly actionable insights:

“In order for private lending mechanisms to be functioning right, they must involve the assessment of every possible source of risk which, of course, includes environmental and social aspects, thereby providing a more long-term approach in credit risk management. Banks should ask borrowers and external auditors for more certifications that evaluate their sustainability performance. That is because a borrower’s sustainability performance is a type of security for the bank (although there is not a direct causal relationship) reducing uncertainty with respect to the ability to keep up with the loan’s terms. The same applies to the management of NPEs, where the debtor’s viability assessment that includes sustainability criteria will score higher, thereby reducing the risk of re-default and leading to safer debt restructuring”.

(Inter 3, Government Official, Special Sector Secretary for Private Debt Management)

In order to investigate another operational aspect relating to the management of a borrower’s real estate collaterals, we questioned managers on whether they evaluate assets with sustainability criteria prior to acceptance as loan security. A 67% of our sample gave a positive response, while the rest of the responses were negative, unaware, or uncertain. From our interview with an associate consultant working for an LMC (Inter 1), we confirmed previous findings that real estate collaterals are primary sources of environmental risk for banks:

“We take the mandate from banks to perform a holistic risk assessment of NPE portfolios using the right algorithms. Collaterals ranked at the highest level of risk (from 1 to 5) are usually the ones associated with environmental risks and banks are strongly advised not to invest in acquiring those assets”.

(Inter 1, LMC)

Another area of questioning focused on information sources regarding a borrower’s sustainability performance. Here, we identified an operational deficit, as 45% of our sample admitted that they do not assess such information. Of the remaining responses, 20% referred to environmental/sustainability impact assessments (EIA/SIA) and environmental due diligence and 15% relied their assessments on CSR, environmental, or sustainability reports. It is interesting to note that in most of our sample group, there was a lack of specific department within the organization that handled assessments of sustainability risk. For the ones that have incorporated such a function, in most cases, it was implemented by the credit risk management team and, to a lesser extent, by the environmental/sustainability team.

4.3. Materiality and Motives

The final group of questions examined the executive’s opinions about the importance of sustainability risk assessment for their business, as well as the particular drivers for their decisions to engage in such a practice. Sustainability risk assessment’s materiality for financial intermediation is based on the latter’s unique nature of business, suggesting that the customer’s risk is an indirect source of risk for the intermediary [

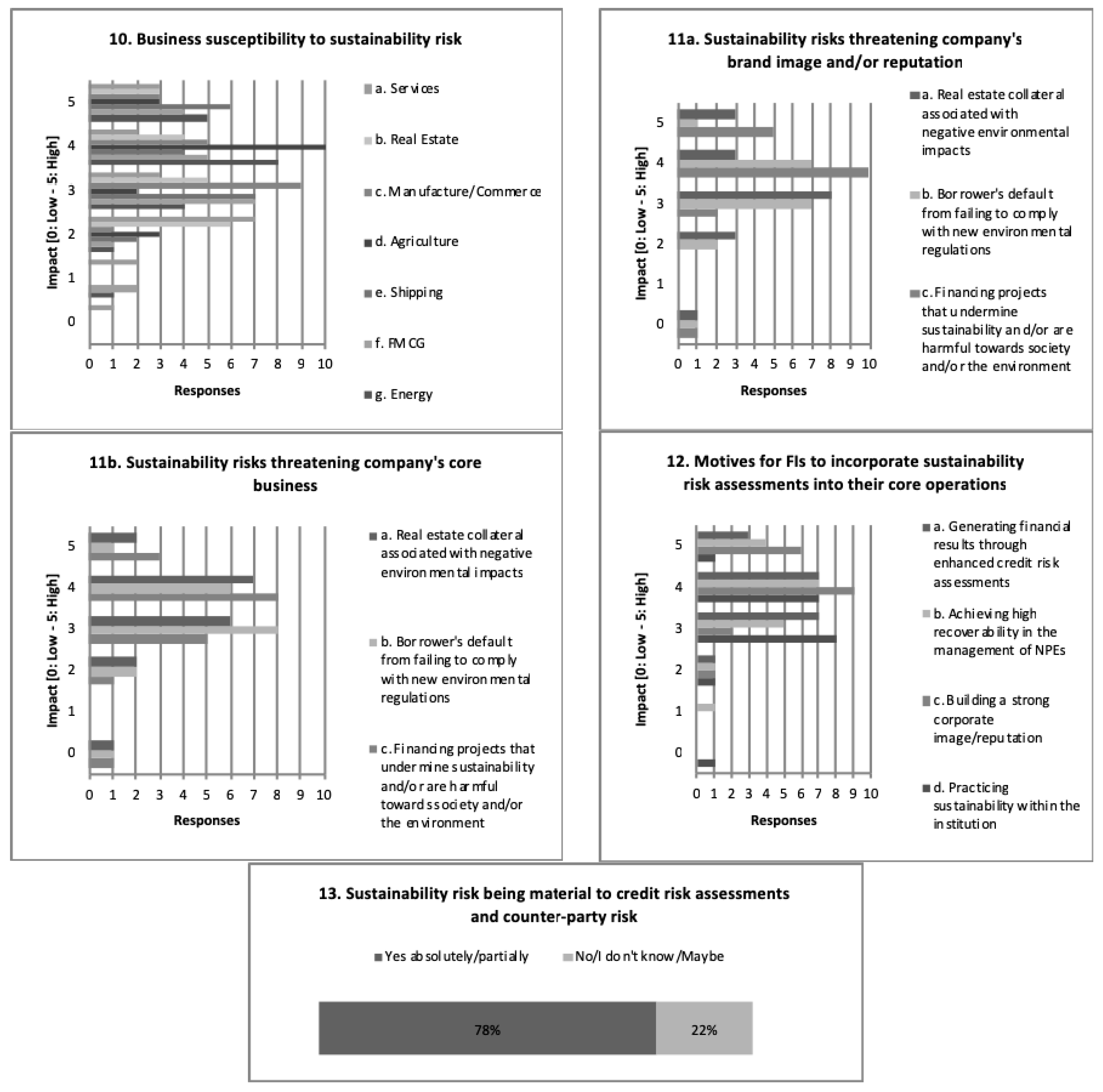

11]. Thus, executives were asked to indicate, based on their experience, the economic sectors that have proved to be more vulnerable to sustainability risks. Not surprisingly, the majority of their responses pointed at the energy, agriculture, and shipping sectors that all share a level of environmental sensitivity. Services and real estate companies, both widely represented in this survey, are generally considered less susceptible to direct sustainability risks, probably because of their indirect relationship with ecological infrastructure (see

Figure 5).

Our next group of questions were dedicated to identifying sustainability risks that threaten organizational reputation and core business. In both cases, the representatives indicated the financing of projects that undermine and/or are harmful towards society and/or the environment as a primary source of risk. A borrower’s default from failing to comply with environmental regulation was considered second in terms of importance for a company’s brand image. Regarding the FI’s activity, real estate collaterals that are linked with negative environmental impacts are also considered an important source of risk directly related to their business. Inter 2 confirmed our findings, at least from the financial institutions point of view:

“Reputational risk is particularly high in business loans that are not sustainability-oriented”.

(Inter 2, Bank, Significant)

It is worth noting that when the bank representative (Inter 2) and the Government official (Inter 3) were questioned accordingly about the sources of sustainability risk for FIs, they both referred to the case of a large significant Greek bank repossessing a debtor’s real estate collateral as a case example. What first appeared to be the bank’s refund for part of the borrower’s unpaid debt has cost an exponential growth of time and money costs, at the same time damaging the bank’s brand image, due to an incident of severe environmental pollution [

39].

Regarding the drivers that motivate FIs to incorporate sustainability risk assessment into their risk management, these appear to be based on reputational considerations. Thus, building a strong corporate image is the most important motive for a manager’s decisions on sustainability. The second motive is the achievement of higher recoverability rates in the management of NPEs. Third is the generation of financial results. The last two motives, in particular, show that executives consider sustainability risk assessment as being material to the company’s profitability, as it is directly linked to their core operations. Finally, relating to credit risk assessments and counter-party risk, a high level of materiality for day-to-day business was supported by 78% of managers. Inter 3 relatively commented:

“Even though there is no clear relationship of cause and effect that links a borrower’s sustainability performance with lower default rates and less costs for the bank, it is common that the companies that manage to cover from every potential source of risk (including environmental and social risks) by the same time reducing bank’s exposure to credit risk, are considered better borrowers and tend to achieve better loan terms”

(Inter 3, Government Official, Special Sector Secretary for Private Debt Management)

5. Discussion

In this paper, our goal was to present the results of a multilevel analysis focused on the integration of sustainability risk considerations into credit risk management policies and methods, operations, materiality, and motives. Direct access to information, as well as the context of a national economy recovering from almost a decade of economic downturn, provides a unique setting and supports our decision to limit the scope of the study in the Greek financial sector. Similar to Thompson and Cowton [

12], we adopted a mixed-methods approach for data collection implemented in two steps; first, through online questionnaires, followed by face-to-face semi-structured interviews. This allowed for accurate responses on a set of standardized questions looking at each of the three areas of analysis (policy, operations, materiality), along with a more in-depth investigation with carefully selected roles critical to sustainability within FIs. In total, 33 people responded to our questionnaires and we engaged in 4 in-depth interviews. More than half of the participants in our survey are currently working, or have worked in the past, for financial institutions (banks).

Credit risk management is fundamental to the business of financial intermediation and an essential function of private lending [

10,

13]. Given the fact that the financial sector in Greece is confronted with a vast amount of bad loans, partly attributed to inadequate credit risk management for private lending products, the topic of this research is intertwined with the issue of private debt management. As Inter 4 stated:

“Greece’s NPL issue is the result of inadequate credit risk management and wrong estimations of borrower’s probability of default”.

(Inter 4, Bank, Less Significant)

A secondary objective of this study was to identify the relationship between the level of incorporating sustainability risk assessment and the efficient management of bad loans (NPEs). The results of our analysis also suggest previous findings on the correlation between a borrower’s high sustainability performance, the decrease in probability of default [

18] and the lower cost of debt [

19]. Furthermore, we add to previous findings from different national contexts suggesting that environmental risks directly affect the outcome of credit risk assessments [

13]. However, the call remains to evidence the different phases of the credit risk management process that employ sustainability indicators and treat them as valuable inputs [

20].

Our analysis initially focused on the availability of policies and methods for sustainability risk assessments, revealing strong policy context and familiarity with internationally accredited tools and frameworks. However, the structure and frameworks are less clear in terms of implementation and sustainability benefits. Similar sentiments emerged from face-to-face interviews with managers. Most of them mentioned practical implications, including the lack of an accessible database with sustainability information and in-house expertise in quantifying environmental and social risks.

With regard to operational concerns, there is consensus among business executives that the borrower’s credit risk profile should also include sustainability information, and that real estate collaterals are a potential source of environmental risk for banks. In the same vein, the majority of FIs being willing to award sustainability performance with more favorable terms of lending and/managing the debtor’s NPEs reinforce previous findings on similar topics [

17,

18,

19]. Nonetheless, basic operational matters affecting sources of sustainability information, and departments in the organizational chart that are responsible for the collection and assessment of that information, are still at a premature stage of development.

Sustainability considerations are considered material for financial intermediation by the majority of participant executives, with particular reference in cases of project financing. Hence, the decision to finance a project that undermines sustainability is considered a direct source of risk for both the company’s reputation and core business. A borrower’s default from changes in environmental regulation is another important source of sustainability risk for FIs. The aforementioned are consistent with previous research findings on the impact of the financial sector on sustainable development [

2,

10,

12]. Generally, building a strong corporate image is prevalent among FIs’ motives to incorporate sustainability risk assessments into their core operations, while many of them relate it to the achievement of high results from the efficient management of NPEs.

6. Concluding Remarks

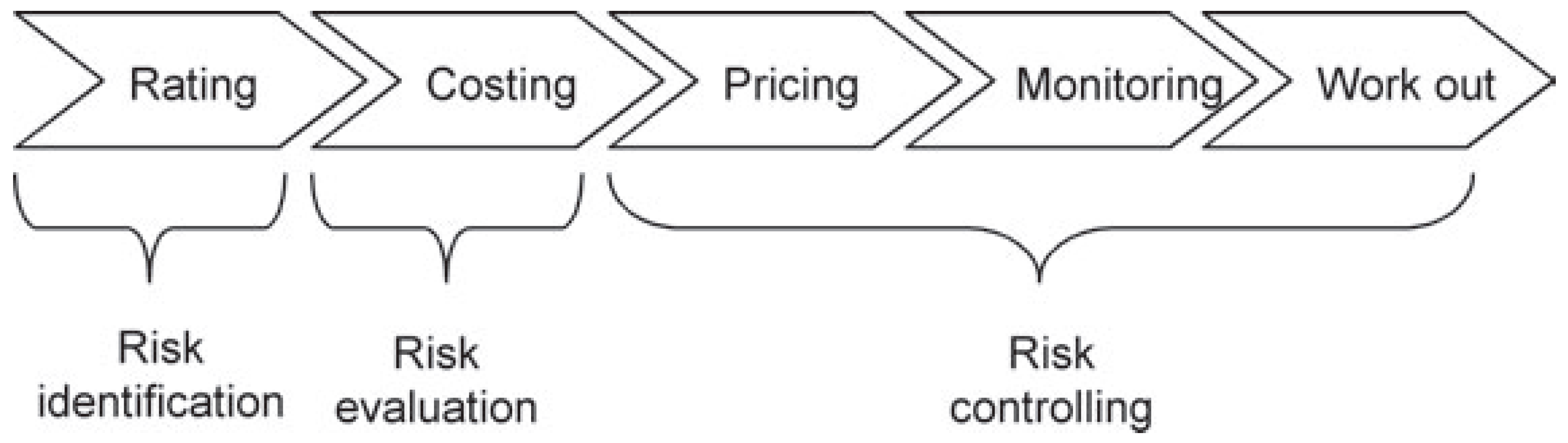

Sustainability risk management is directly linked to the financial sector through its most vital function, the credit risk management process. The results of this survey indicate that every type of FI represented by their managers, coming from all levels of the organizational hierarchy, acknowledges the importance of sustainability-oriented private lending. The efficient management of NPEs has also proven to be, in their minds, inextricably linked with an effective and holistic credit risk management process. In both cases, even if managers initiate sustainability risk management in their respective institutions, there needs to be a consistent methodological process under continuous monitoring throughout all phases of the credit risk management process. From that point of view, the incorporation of sustainability considerations into the credit risk management process of Greek banks may lead the transformation to a sustainable banking system.

Significant financial institutions in Greece, facing the imminent threat of exacerbating nonperforming exposures, are forced by supervising bodies to lower their NPE to total loans ratio to levels that will ensure the viability of the banking system and that of the financial sector as a whole. Moreover, international investors in three out of the four Greek systemic banks are requesting ESMS systems and procedures to start being incorporated in private lending functions. In the authors’ view, these are two mutually reinforcing conditions that could set the fundamentals for sustainable banking and finance sectors in Greece. The Greek financial sector, throughout a process of intense transformation, has a unique opportunity to support a new business model, one that aligns the mission and vision objectives of each FI with goals of sustainability.