China’s Outward FDI in Indonesia: Spatial Patterns and Determinants

Abstract

:1. Introduction

2. Literature Review

2.1. Institutional Factors

2.2. Political Relations

2.3. Economic Development Level

2.4. Openness Level

2.5. Human Resources

3. Data and Research Methods

3.1. Data

3.1.1. Dependent Variable: Investment and Project of China’s OFDI in Indonesia

3.1.2. Explanatory Variable: Influence Factor Variables

3.2. Research Methods

3.2.1 Geographic Concentration Indexing Method

3.2.2. Spatial Center of Gravity Migration Model

3.2.3. Geostatistical Trend Analysis

3.2.4. Description of the Models and Variables

4. Evolution of China’s OFDI in Indonesia

4.1. Temporal Characteristics of China’s OFDI in Indonesia

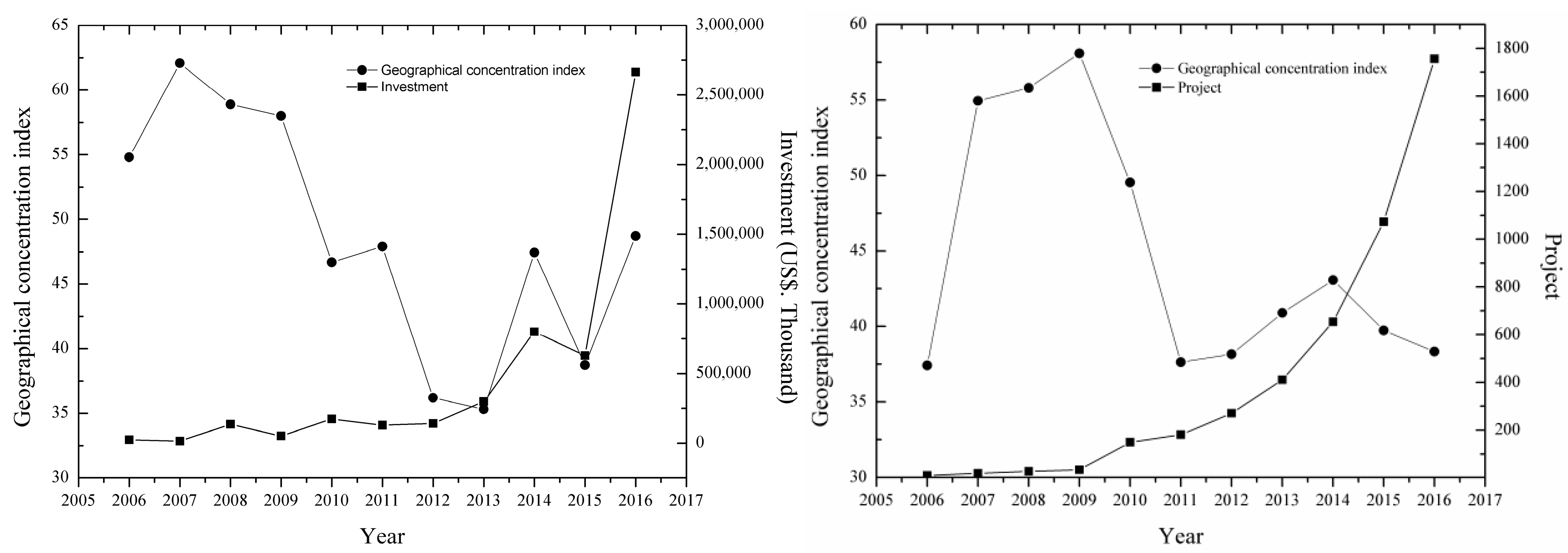

4.1.1. Continued Rise in the Amounts of Fluctuating Investments and Number of Investment Projects

4.1.2. Investment Amounts and Number of Projects Are Generally Dispersed in Geospatial Locations

4.2. Spatial Characteristics of China’s OFDIs in Indonesia

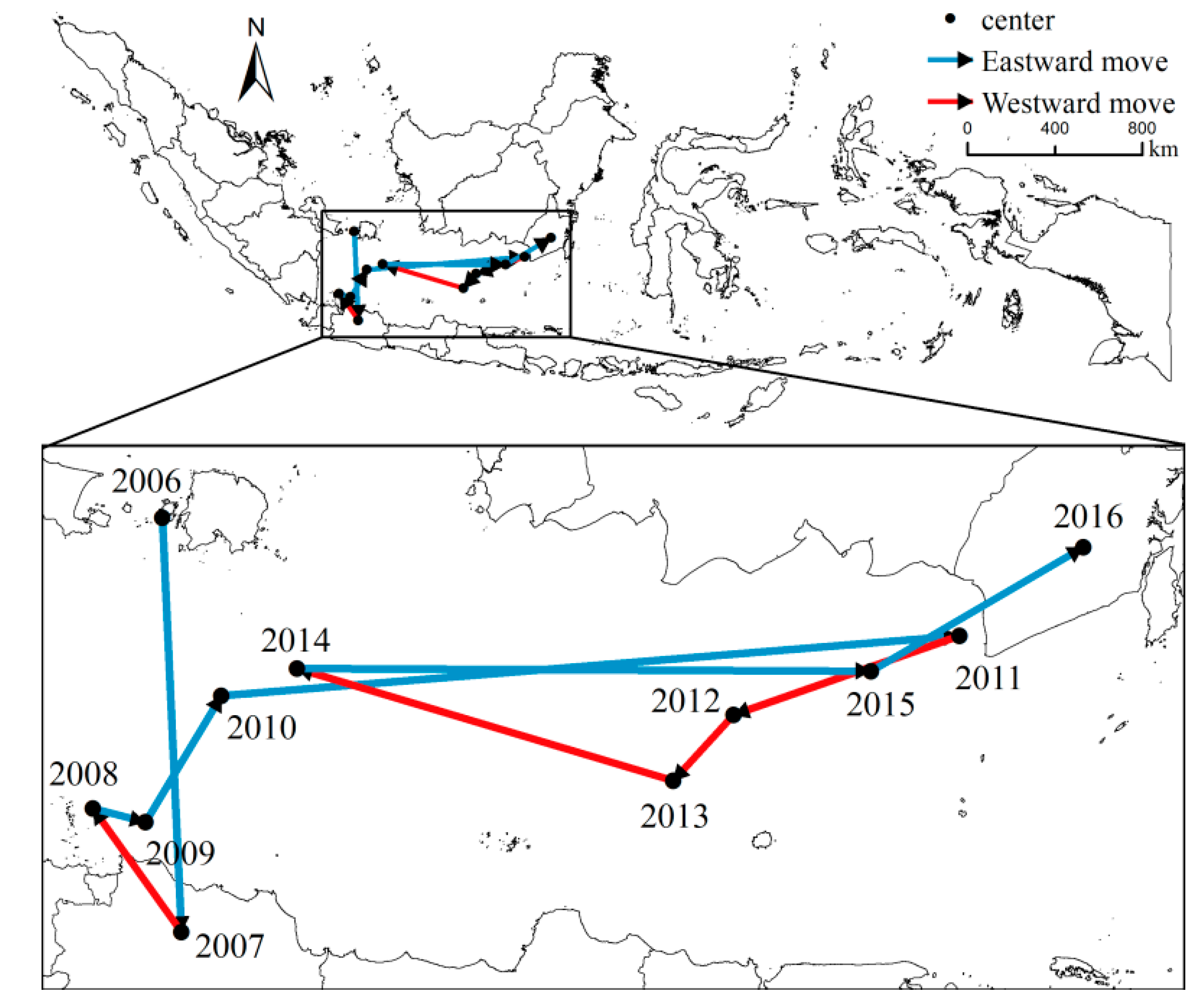

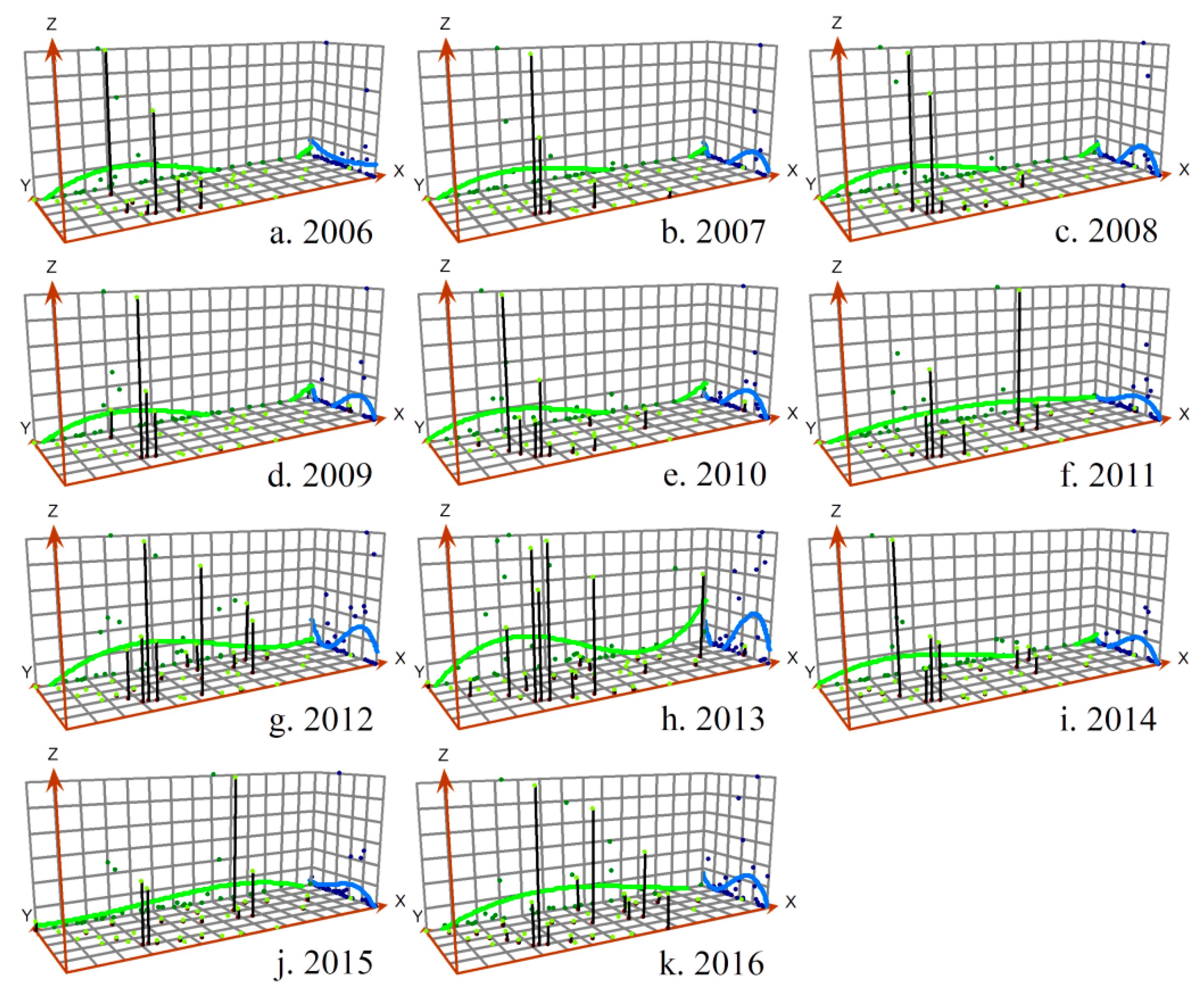

4.2.1. Overall Spatial Evolution Characteristics of China’s OFDIs in Indonesia

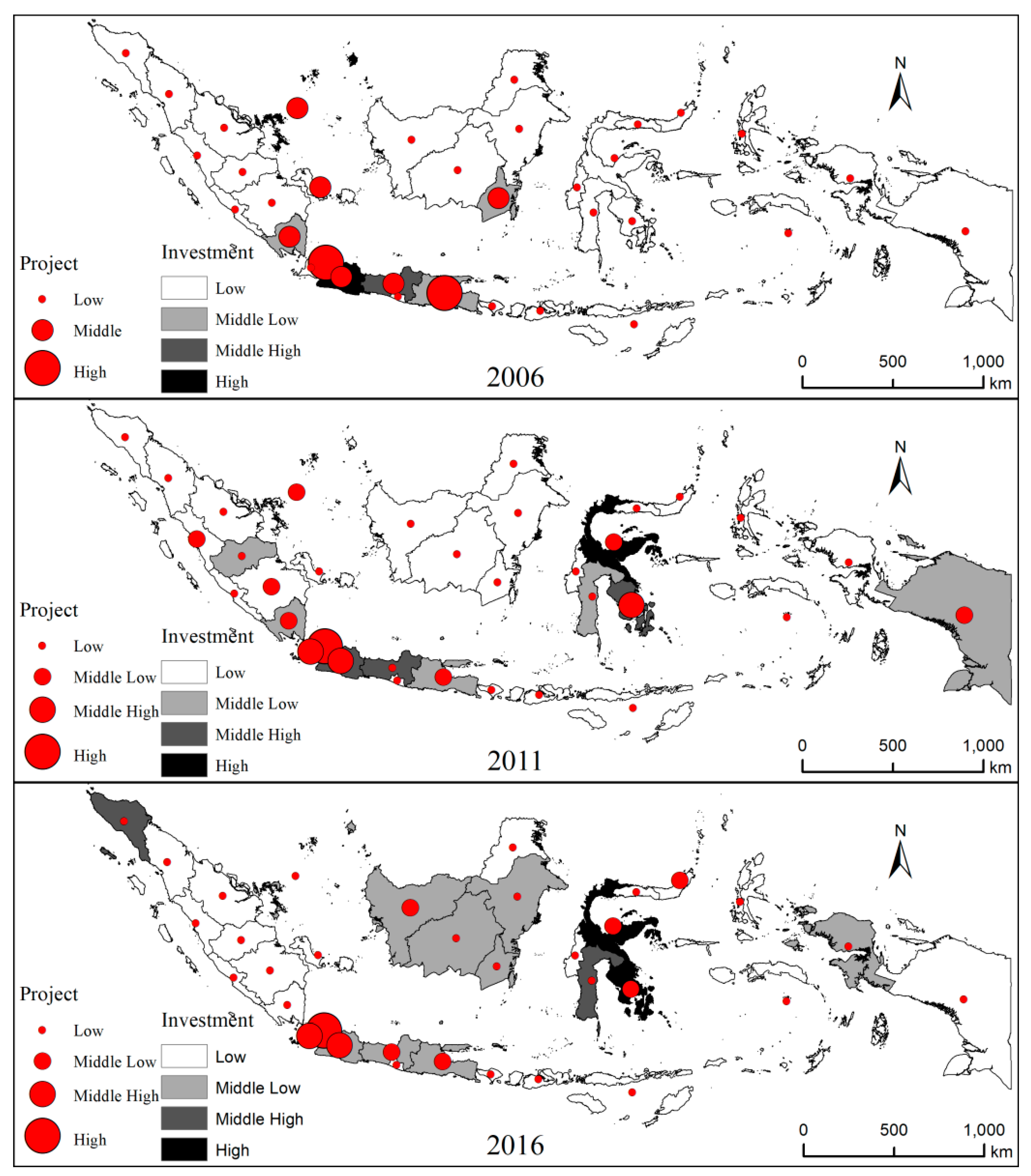

4.2.2. Local Spatial Evolution Characteristics of China’s OFDI in Indonesia

5. Influences on China’s OFDI Location Choices in Indonesia

5.1. Institutional Factors

5.2. Political Relations

5.3. Economic Development Levels

5.4. Openness Levels

5.5. Human Resources

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- The Ministry of Commerce of the People’s Republic of China. Foreign Direct Investment Statistics Bulletin. Available online: http://www.mofcom.gov.cn/article/tongjiziliao/dgzz/201309/20130900295526.shtml (accessed on 1 October 2018).

- The Ministry of Commerce of the People’s Republic of China. Foreign Direct Investment Statistics Bulletin. Available online: http://fec.mofcom.gov.cn/article/tjsj/tjgb/201809/20180902791493.shtml (accessed on 1 October 2018).

- Kang, L.; Peng, F.; Zhu, Y.; Pan, A. Harmony in diversity: Can the one belt one road initiative promote China’s outward foreign direct investment? Sustainability 2018, 10, 3264. [Google Scholar] [CrossRef]

- Du, J.; Zhang, Y. Does one belt one road initiative promote Chinese overseas direct investment? China Econ. Rev. 2018, 47, 189–205. [Google Scholar] [CrossRef]

- Liu, H.; Jiang, J.; Zhang, L.; Chen, X. OFDI agglomeration and Chinese firm location decisions under the “Belt and Road” initiative. Sustainability 2018, 10, 4060. [Google Scholar] [CrossRef]

- Pasierbiak, P. Development of Chinese foreign direct investment in the ASEAN (2000–2013). Dimens. Reg. Process. Asia-Pac. Reg. 2015, 413, 136–148. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2017—Investment and the Digital Economy; United Nation Publication: New York, NY, USA, 2017. [Google Scholar]

- Tambunan, T.T.H. Inward FDI in Indonesia and Its Policy Context. Available online: https://academiccommons.columbia.edu/doi/10.7916/D8S189C6 (accessed on 20 November 2018).

- McKinsey Global Institute. The Archipelago Economy: Unleashing Indonesia’s Potential. Available online: http://www.asiabusinesscouncil.org/docs/newsletter/McKinsey Indonesia.pdf (accessed on 20 November 2018).

- Lim, T.W. Asian diplomacy: The “fulcrum” role of two major powers in east Asia? J. Northeast Asian Hist. 2016, 13, 59–91. [Google Scholar]

- Leitão, N.C. The impact of foreign direct investment on economic growth: The Portuguese experience. Theor. Appl. Econ. 2013, 578, 51–62. [Google Scholar]

- Ali, N.; Mingque, Y. Does foreign direct investment lead to economic growth? Evidences from Asian developing countries. Int. J. Econ. Financ. 2018, 10, 109–119. [Google Scholar] [CrossRef]

- Dunning, J.H. Reappraising the eclectic paradigm in an age of alliance capitalism. J. Int. Bus. Stud. 1995, 26, 461–491. [Google Scholar] [CrossRef]

- Liu, H.Y.; Tang, Y.K.; Chen, X.L.; Poznanska, J. The determinants of Chinese outward FDI in countries along “One Belt One Road”. Emerg. Mark. Financ. Trade 2017, 53, 1374–1387. [Google Scholar] [CrossRef]

- Denisia, V. Foreign direct investment theories: An overview of the main FDI theories. Eur. J. Interdiscip. Stud. 2010, 2, 104–110. [Google Scholar]

- Quer, D.; Claver, E.; Rienda, L. Political risk, cultural distance, and outward foreign direct investment: Empirical evidence from large Chinese firms. Asia Pac. J. Manag. 2012, 29, 1089–1104. [Google Scholar] [CrossRef]

- Gammeltoft, P. Chinese foreign direct investment in Indonesia. CIBEM Work. Pap. Ser. 2011, 6, 1–29. [Google Scholar] [CrossRef]

- Sánchez-Martín, M.E.; De Arce, R.; Escribano, G. Do changes in the rules of the game affect FDI flows in Latin America? A look at the macroeconomic, institutional and regional integration determinants of FDI. Eur. J. Political Econ. 2014, 34, 279–299. [Google Scholar] [CrossRef]

- Kakinaka, M.; Kotani, K. Foreign direct investment and infrastructure development in Indonesia: Evidence from province data. Asian J. Empir. Res. 2014, 4, 79–94. [Google Scholar]

- Sodik, J.; Sarungu, J.; Soesilo, A.; Aisyah, S. Spatial dynamics and determinant of foreign direct investment in Indonesia: A comparative study of pre and post autonomous area 1990–2014. RJOAS 2018, 9, 37–51. [Google Scholar] [CrossRef]

- Kang, Y. Regulatory institutions, natural resource endowment and location choice of emerging-market FDI: A dynamic panel data analysis. J. Multinatl. Financ. Manag. 2018, 45, 1–14. [Google Scholar] [CrossRef]

- CEFTA. Trade Integration, Industry Concentration and FDI Inflows: The Experience in Central and South Eastern Europe. Available online: https://www.oecd.org/global-relations/CEFTA%20WP3_TradeFDI_NEW_Nov%202010.pdf (accessed on 20 November 2018).

- Gammeltoft, P.; Lepi, T.T. Chinese foreign direct investment in Indonesia: Trends, drivers and impacts. Int. J. Technol. Learn. Innov. Dev. 2013, 6, 136–160. [Google Scholar] [CrossRef]

- Demir, F. Effects of FDI flows on institutional development: Does it matter where the investors are from? World Dev. 2016, 78, 341–359. [Google Scholar] [CrossRef]

- Uddin, M.; Chowdhury, A.; Zafar, S.; Shafique, S.; Liu, J. Institutional determinants of inward FDI: Evidence from Pakistan. Int. Bus. Rev. 2018, 1–15. [Google Scholar] [CrossRef]

- Shah, S.H.; Ahmad, M.H.; Ahmed, Q.M. The nexus between sectoral FDI and institutional quality: Empirical evidence from Pakistan. Appl. Econ. 2016, 48, 1591–1601. [Google Scholar] [CrossRef]

- Aziz, O.G. Institutional quality and FDI inflows in Arab economies. Financ. Res. Lett. 2018, 25, 111–123. [Google Scholar] [CrossRef]

- Chanegriha, M.; Stewart, C.; Tsoukis, C. Identifyng the robust economic, geographical and politic determinants of FDI: An extreme bounds analysis. Empir. Econ. 2016, 52, 759–776. [Google Scholar] [CrossRef]

- Stevens, C.E.; Newenham-Kahindi, A. Legitimacy spillovers and political risk: The case of FDI in the east african community. Glob. Strategy J. 2017, 7, 10–35. [Google Scholar] [CrossRef]

- Khan, M.; Akbar, M. Impact of Political Risk on Foreign Direct Investment. Available online: http://mpra.ub.uni-muenchen.de/47283/ (accessed on 20 November 2018).

- Nazeer, A.M.; Masih, M. Impact of Political Instability on Foreign Direct Investment and Economic Growth: Evidence from Malaysia. Available online: https://mpra.ub. uni-muenchen.de/79418/ (accessed on 20 November 2018).

- Topal, M.H.; Gul, O.S. The effect of country risk on foreign direct investment: A dynamic panel data analysis for developing countries. J. Econ. Libr. 2016, 3, 141–155. [Google Scholar]

- Hayakawa, K.; Kimura, F.; Lee, H.H. How does country risk matter for foreign direct investment? Dev. Econ. 2013, 51, 60–78. [Google Scholar] [CrossRef]

- Atje, R.; Gaduh, A.B. Indonesia-China economic relations: An indonesian perspective. Econ. Work. Pap. Ser. 1999, 52, 1–24. [Google Scholar]

- Buthe, T.; Milner, H.V. The politics of foreign direct investment into developing countries: Increasing FDI through trade agreements. Am. J. Political Sci. 2008, 52, 741–762. [Google Scholar] [CrossRef]

- Levent, T.B.; Kundak, S.; Gulumser, A.A. City-to-city linkages in a mobile society: The role of urban networks in Eurocities and Sister Cities. Int. J. Serv. Technol. Manag. 2008, 10, 83–109. [Google Scholar] [CrossRef]

- Wang, M.J.; Xu, Y.P. Chinese OFDI in America: Basic features and determinants. Acta Geogr. Sin. 2017, 72, 1373–1391. [Google Scholar] [CrossRef]

- Selimi, S.N.; Zekiri, S.J. Internationalization of businesses and selection of entry modes in other markets. ILIRIA Int. Rev. 2017, 7, 64–81. [Google Scholar] [CrossRef]

- Soumaré, I. Does FDI improve economic development in north African countries? Appl. Econ. 2015, 47, 5510–5533. [Google Scholar] [CrossRef]

- Belloumi, M. The relationship between trade, FDI and economic growth in Tunisia: An application of the autoregressive distributed lag model. Econ. Syst. 2014, 38, 269–287. [Google Scholar] [CrossRef]

- Sayari, N.; Sari, R.; Hammoudeh, S. The impact of value-added components of GDP and FDI on economic freedom in Europe. Econ. Syst. 2018, 42, 282–294. [Google Scholar] [CrossRef]

- Khaliq, A.; Noy, I. Foreign direct investment and economic growth: Empirical evidence from sectoral data in Indonesia. J. Econ. Lit. 2017, 45, 313–325. [Google Scholar] [CrossRef]

- Rininta, N. The Causality of FDI Inflow and Economic Growth in Indonesia. Available online: http://mpra.ub.uni-muenchen.de/46572/ (accessed on 20 November 2018).

- Wacker, K.M. Do multinationals deteriorate developing countries’ export prices? The impact of FDI on net barter terms of trade. World Econ. 2016, 39, 1974–1999. [Google Scholar] [CrossRef]

- Morrison, W.M. China’s Economic Rise: History, Trends, Challenges, and Implications for the United States. Available online: http://www.fas.org/sgp/crs/row/RL33534.pdf (accessed on 20 November 2018).

- Albahi, M. Export-import and foreign direct investment (FDI): Indonesian economic study. IOSR J. Econ. Financ. 2016, 7, 37–44. [Google Scholar] [CrossRef]

- Mahadika, I.N.; Kalayci, S.; Altun, N. Relationship between GDP, foreign direct investment and export volume: Evidence from Indonesia. Int. J. Trade Econ. Financ. 2017, 8, 51–54. [Google Scholar] [CrossRef]

- Salike, N. Role of human capital on regional distribution of FDI in China: New evidences. China Econ. Rev. 2016, 37, 66–84. [Google Scholar] [CrossRef]

- Tao, D.; Yang, D.T. Has China lost its global labor advantage? IZA Discuss. Pap. Ser. 2010, 15, 482–504. [Google Scholar] [CrossRef]

- Fan, H.; Lin, F.; Tang, L. Minimum wage and outward FDI from China. J. Dev. Econ. 2018, 135, 1–19. [Google Scholar] [CrossRef]

- Lipsey, R.E.; Sjolom, F. Foreign direct investment and wages in Indonesian manufacturing. J. Dev. Econ. 2004, 73, 415–422. [Google Scholar] [CrossRef]

- Jin, S.T.; Li, B.; Yang, Y.C.; Shi, P.J.; Shi, K.B.; Da, F.W. The distribution of cities in China and its influencing factors. Geogr. Res. 2015, 34, 1352–1366. [Google Scholar] [CrossRef]

- Li, Z.J. The regional gravity evolution of consumption, economy and population based on the multiple time scales in China. Econ. Geogr. 2014, 34, 85–90. [Google Scholar] [CrossRef]

- Liu, Y.S.; Yang, R. The spatial characteristics and formation mechanism of the county urbanization in China. Acta Geogr. Sin. 2012, 8, 1011–1020. [Google Scholar] [CrossRef]

- Yang, H.M. Changing spatial pattern and accessibility of primary and secondary schools in a poor mountainous county: A case study of Song County, Henan Province. Prog. Geogr. 2018, 4, 556–566. [Google Scholar] [CrossRef]

- Lee, J.W. China’s economic growth and convergence. World Econ. 2017, 40, 2455–2474. [Google Scholar] [CrossRef]

- Liang, Y.T.; Huang, H.Y.; Liu, Y.; Zhou, Z.K. Location choice of Chinese multinational enterprise in Southeast Asian based on the perspective of enterprise ownership. Sci. Geogr. Sin. 2018, 38, 645–653. [Google Scholar] [CrossRef]

- Goodspeed, T.; Vaquez, M.Z.; Zhang, L. Are Other Government Policies More Important than Taxation in Attracting FDI? A Working Paper 06-28; Department of Economic International Studies Georgia State University: Atlanta, GA, USA, 2006; Available online: https://icepp.gsu.edu/files/2015/03/ispwp0614.pdf (accessed on 3 December 2018).

- Lampreave, P. Anti-Tax avoidance measures in China and India: An evaluation of specific court decisions. Bull. Int. Tax. 2013, 67, 49–60. [Google Scholar]

- Ajudua, E.I.; Davis, O.J.P.; Government expenditure, foreign direct investment and economic growth in Nigeria. J. Econ. Sustain. Dev. 2015, 6, 8. Available online: https://www.iiste.org/Journals/index.php/JEDS/article/viewFile/21907/22248 (accessed on 5 November 2018).

- Bengoa, M.; Sanchez-Robles, B. Foreign direct investment, economic freedom and growth: New evidence from Latin America. Eur. J. Political Econ. 2003, 19, 529–545. [Google Scholar] [CrossRef]

- Borensztein, E.; De Gregorio, J.; Lee, J.-W. How does foreign direct investment affect economic growth? J. Int. Econ. 1997, 46, 115–135. [Google Scholar] [CrossRef]

- Lu, J.; Liu, X.; Wang, H. Motives for outward FDI of Chinese private firm: Firm resources, Industry Dynamics and Government Policies. Manag. Organ. Rev. 2010, 7, 223–248. [Google Scholar] [CrossRef]

- Tadese, B.; Ryan, M. Export platforms and the industry-specific FDI-Trade relationship. J. Econ. Integr. 2005, 20, 644–671. [Google Scholar] [CrossRef]

- Gray, H.P. International Trade and Foreign Direct Investment: The Interface in Globalization, Trade and Foreign Direct Investment; Dunning, J.H., Ed.; Elsevier: Oxford, UK, 1998; pp. 19–27. [Google Scholar]

- Camarero, M.; Tamarit, C. The export and import demand for manufactured goods: The role of FDI. Rev. World Econ. 2004, 140, 347–375. [Google Scholar] [CrossRef]

- Braconier, H.; Norback, P.-J.; Urban, D. Multinational enterprises and wage cost: Vertical FDI revisited. J. Int. Econ. 2005, 67, 446–470. [Google Scholar] [CrossRef]

- Deng, P. Outward investment by Chinese MNCs: Motivation and implications. Bus. Horiz. 2004, 47, 8–16. [Google Scholar] [CrossRef]

- Lipsey, R.E.; Sjöholm, F. FDI and wage spillovers in Indonesian manufacturing. Rev. World Econ. 2004, 140, 321–332. [Google Scholar] [CrossRef]

- Cesare, L.D.; Sportelli, M. Fiscal policy lags and income adjustment processes. Chaos Soliton Fractals 2013, 45, 433–438. [Google Scholar] [CrossRef]

| Variable Name | Variable Symbol | Variable Description | Data Sources |

|---|---|---|---|

| Investment | Dependent variable | Indonesian Coordinating Investment Board | |

| Project | |||

| Investment convenience | ED | Electricity distribution in Indonesian provinces (GWH) | The Indonesian statistical yearbook |

| Human resources | WN | The number of labors in Indonesian provinces (person) | The Indonesian statistical yearbook |

| WA | Monthly average worker wages in Indonesian provinces (thousand rupiahs) | The Indonesian statistical yearbook | |

| Economic development | PGDP | Per capita GDP in Indonesian provinces (thousand rupiahs) | The Indonesian statistical yearbook |

| Openness level | EX | Export amount in Indonesian provinces (million dollars) | The Indonesian statistical yearbook |

| FDI | All foreign direct investment in Indonesia provinces (million dollars) | The Indonesian statistical yearbook | |

| Institutional factors | FE | Government fiscal expenditures in Indonesia provinces (million rupiahs) | The Indonesian statistical yearbook |

| DT2014 | One year after “21st Century Maritime Silk Road” was proposed | Time dummy variable | |

| Political relations | FC | The number of friendly cities in China and Indonesia | The China Friendship Cities Federation website |

| Variable | Investment Random Effects Model | Project Random Effects Model | ||||

|---|---|---|---|---|---|---|

| Regression Coefficient | Z Value | Sig. | Regression Coefficient | Z Value | Sig. | |

| ED | 1.852 | 1.32 | 0.188 | 1.080 | 1.31 | 0.191 |

| WN | 1.021 | 0.84 | 0.403 | −0.796 | −1.06 | 0.288 |

| FE | −3.801 | −2.21 | 0.027 | −0.104 | −0.13 | 0.897 |

| WA | 1.416 | 0.39 | 0.700 | 0.534 | 0.24 | 0.808 |

| FC | −3.180 | −1.70 | 0.089 | −0.273 | −0.22 | 0.824 |

| PGDP | 1.402 | 1.95 | 0.051 | 0.391 | 1.41 | 0.159 |

| EX | −0.290 | −2.28 | 0.022 | −0.087 | −1.99 | 0.046 |

| FDI | 0.624 | 1.39 | 0.166 | 0.050 | 0.33 | 0.743 |

| DT2014 | −0.206 | −0.12 | 0.907 | 0.853 | 1.15 | 0.248 |

| Variable | Investment Step-Wise Regression Model | Project Step-Wise Regression Model | ||||

|---|---|---|---|---|---|---|

| Regression Coefficient | T Value | Sig. | Regression Coefficient | T Value | Sig. | |

| EX | −0.198 | −1.74 | 0.099 | |||

| WN | 1.376 | 4.61 | 0.000 | |||

| FC | −3.959 | −3.47 | 0.003 | |||

| FE | 0.871 | 5.66 | 0.000 | |||

| WA | 2.503 | 2.97 | 0.008 | |||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, Y.; Supriyadi, A.; Wang, T. China’s Outward FDI in Indonesia: Spatial Patterns and Determinants. Sustainability 2018, 10, 4632. https://doi.org/10.3390/su10124632

Fu Y, Supriyadi A, Wang T. China’s Outward FDI in Indonesia: Spatial Patterns and Determinants. Sustainability. 2018; 10(12):4632. https://doi.org/10.3390/su10124632

Chicago/Turabian StyleFu, Yu, Agus Supriyadi, and Tao Wang. 2018. "China’s Outward FDI in Indonesia: Spatial Patterns and Determinants" Sustainability 10, no. 12: 4632. https://doi.org/10.3390/su10124632

APA StyleFu, Y., Supriyadi, A., & Wang, T. (2018). China’s Outward FDI in Indonesia: Spatial Patterns and Determinants. Sustainability, 10(12), 4632. https://doi.org/10.3390/su10124632