1. Introduction

Over the last year, there was a significant stabilization of socio-economic relations in the Russian Federation. Inflation processes slowed down dramatically, economic indicators improved, and recovery began in many mining and processing industries of the country. Russia’s sovereign ratings continue to rise to investment with a stable positive outlook, leaving them out of the category of so-called “junk”. At the same time, the external environment still leaves much to be desired. Political and economic contradictions with a number of states, in particular with the United States, Britain and France, have again become aggravated. Sanction risks continue to remain very high, the trends of isolation of national economies are growing, and ignoring the principles of a free global market. Leaders of world economic development are on the verge of brutal trade wars and competitive struggle is intensifying. In these difficult conditions, the Russian government has continued to restore order in the financial sector using fiscal policy and is seeking reserves to stabilize economic relations and ensure the sustainable development of the national economy. It can be argued that, despite all the difficulties, due to the powerful tension of forces, in terms of countering the crisis phenomena and the consequences of international sanctions, the economy of the Russian Federation not only survived, but is beginning to slowly gain momentum and increase competitiveness.

At present, Russia is experiencing low inflation, a reduction in non-earmarked expenses and an increase in revenues from the sale of various export-oriented products, but at the same time very serious problems are arising in credit policy and the free access of enterprises to the investments necessary for their development. Credit risks constantly increase, efficiency of corporate management falls and enterprise activity of the population decreases. Many representatives of big business express certain displeasure with the development of relations with the West. All this makes it necessary again and again to turn to topical issues of ensuring the economic sustainability of economic entities in the context of the growing uncertainty of the socio-economic situation in world relations.

Analysis of research and the practice of management of gold mining enterprises showed that one of the most important problems characteristic of Russian companies and posed in our research is the imperfection of the model and mechanism of strategic management of gold mining enterprises, inattention to specific aspects of activity, ignoring modern, pragmatic tools of choice and the evaluation of business strategies.

For several years, we have studied the activities of gold mining enterprises, paying particular attention to the strategic component of managing change in an organization. First of all, we were interested in finding and identifying the most optimal conditions for organizing the process of strategic management of a company, which would contribute to the smooth establishment of all procedural, technological, production and other aspects of mining enterprises.

In the proposed article, the main goal of the presented research was to improve the model and mechanism of strategic management of gold mining enterprises of the Russian Federation, which would enable the management of mining companies to make a better choice of enterprise strategy that ensures and consolidates the course towards sustainable business development.

The implementation of the main goal of the stated research assumed the achievement of the tasks set in this work and reflected the relevant aspects of the strategic management of the firm. Thus, as an important task, we highlight the optimization of the company’s investment policy, within which it is necessary to improve the capital structure of the company and create an insurance reserve adequate to the actual conditions of the company.

Often, gold mining enterprises in Russia make serious mistakes in the implementation of investment strategies due to an incorrect determination of the size of investments and insurance reserves, which is connected, in many respects, with the use of outdated mineral exploration technologies and the determination of the amount of gold ore reserves at the production site. Based on this, another task of the study was to attract the attention of specialists and business owners to the introduction and widespread use in the gold industry of more advanced exploration and evaluation technologies, which is one of the necessary components of our proposed model of strategic enterprise management.

Finally, within the framework of improving the strategic management model and the process of choosing a sustainable development strategy, we considered the improvement of tools for evaluating gold companies’ business strategies based on the organization’s life cycle as an important task.

2. Literature Review

An analysis of the theory and practice of the strategic management of gold mining companies in Russia and abroad showed that there were certain research gaps that we paid close attention to. The issues of building dynamic models of firms are thoroughly examined in the works of J. Forrester, P. Loon, J. Monden, I.A. Baev, V.I. Shiryaev, B.V. Shmakov, A.V. Schmidt, T.A. Khudyakova [

1]. Unfortunately, they are dedicated to the activities of industrial enterprises in general and do not fully reflect the relevant business processes of modern gold companies, in particular, the problems of managing exploration, appraisal, and investment policy of a company. We analyzed these specific aspects of the activities of gold mining companies and paid them due attention in the formation of graphic and mathematical models that reflected our recommendations for improving the strategic management of the company.

We studied the practice of Russian enterprises in the gold mining industry and identified problems associated with optimizing the company’s capital structure and creating insurance reserves. After analyzing the work related to this issue, such researchers as A.S. Goretsky, N.N. Kotova, L. Correia, T. Pablo, and others, we saw a certain discrepancy between the methods they used to form insurance reserves in developing investment projects and the specifics of the country’s leading gold companies [

2,

3,

4,

5].

This prompted us to the idea of the need to develop and use a new tool for the gold mining business—a range of reducing the size of dividends of the company’s owners. The introduction of this tool allows you to more accurately take into account the costs of the organization, improve the quality of management and social responsibility of business, which is extremely important in the face of growing contradictions between business owners and employees, as well as local people.

When shaping the strategy of an enterprise, it is necessary to carry out an accurate assessment of the strategy. The use of a balanced scorecard for evaluating the strategy of the company devoted a significant amount of work. This system has been successfully used in many industrial enterprises, but there are also shortcomings that should be taken into account. Some of the works are of a theoretical nature [

6], have an educational orientation [

7], do not reflect the realities of the gold mining business and do not take into account the stage of the development of enterprises [

8]. Therefore, we proposed to rely on a method of evaluating business strategies based on the life cycle of an organization.

In the process of this research, we tried to realize the stated goals and objectives and thereby make an appropriate contribution to the theory and practice of the strategic management of the sustainable development of gold mining enterprises in Russia.

This study presents our proposed model of strategic management of gold mining enterprises, which reflects the specifics of activities in this particular industry, taking into account environmental factors. For the first time, this model includes such components as exploration of deposits and the quality of output, taking into account their influence on the investment policy of the enterprise.

A new tool for creating insurance reserves, which is new for Russian gold companies, is proposed.

An integrated approach to the assessment of business strategies, taking into account the stages of the life cycle of the organization, is proposed.

Furthermore, in the course of the study, trends in the development of gold mining in Russia and abroad were carefully studied, and positive and negative factors of the external and internal environment that affected the sustainability of business in this industry were highlighted. These are considered in more detail.

For over a decade, Russia has consistently upheld independence in foreign and domestic policy, paying particular attention to the most competitive and strategically important sectors of the national economy. Among such industries, of course, is the extraction of precious metal. The Central Bank of Russia is constantly increasing the purchase of gold from domestic enterprises. This is being done to diversify the country’s gold and foreign exchange reserves and reduce dependence on the U.S. dollar. In previous years there has been a sharp increase in the extraction of precious metals by domestic companies. It should be noted that as of 1 January 2007, the physical volume of gold in the international reserves of the country was 402 tons. In 2017, Russia increased its gold reserves by 14%, increased total gold production by 280.7 tons, that is, more than 7%. Production of ore and loose deposits increased by 6%, and concentrates—by 13%. As of 1 January 2018, gold reserves amounted to 59.1 million oz, or 1838.22 tons. The value of gold in the reserves of the Russian Federation increased by 27.3% and reached

$76.647 billion for the same period of time. Already on 1 August 2018 gold reserves amounted to 66.3 million oz, or 1968.22 tons. By the end of 2018, gold mining and production in Russia will grow by about 3% compared with the previous year and will be 328 tons. Analysis of the activities of Russian enterprises showed that the effectiveness of gold mining companies depended on competent strategic management of the company, an ability to build business processes, the technical base and gold production technologies meeting modern market requirements and the ability to determine the optimal development strategy based on an accurate assessment of the organization’s production potential [

9].

Unfortunately, not all mining enterprises of the Russian Federation, especially those representing small and medium-sized businesses, or those who have received the most favored treatment at the federal and local levels, adhere to a verified, pragmatic line of conduct. Many companies do not pay enough attention to improving the management mechanism, taking cost-cutting measures, and increasing efficiency. Analysis of the theory and practice of world gold mining shows that the peak of mining of the precious metal has been reached and will soon be passed. Furthermore, due to the depletion of ore reserves at key deposits of the world, gold mining will definitely begin to decline. The decline in gold production will occur next year. This will lead to higher gold prices, which fell in 2018 due to the financial policies of the United States.

Russia ranks fourth along with Canada in explored reserves of gold ore. Inferred resources are more than 25,000 tons. This is the second place in the world after South Africa. About 80% of gold reserves are located in ore deposits, which require large-scale investments for their development, which means that they carry out rational policy of strategic management. Thus, for the gold mining industry in Russia, on the one hand, favorable conditions are created for further growth, and on the other hand, the risks caused by a number of objective and subjective factors increase. Gold miners have already faced serious problems that have led to a decrease in the efficiency of many companies. This article identifies the main problems of the gold-mining industry in Russia that affect the steady state of the business.

First, the initial signs of the beginning deficit of the mineral resource base of gold mining resources appeared. This is evidenced by the minimum number of auctions. The share of ore reserves that are difficult to get and not very reliable in reliability is too high.

Second, the explored reserves of gold ore are found in areas with special climatic conditions, where there is a harsh climate, permafrost, rugged terrain, and severe waterlogging.

Third, in Russia there are a large number of placer deposits, the use of which is most effective, since it requires less time and less costs than the development of ore deposits. However, this efficiency is rather relative, since the deposits of loose gold in our country are located in very inaccessible areas where there are no good roads, no household infrastructure and a few skilled personnel.

Fourth, almost all explored deposits are located in Siberia, in the north of the country. Gold mining is carried out in 15 regions that are not particularly suitable for living. Over 90% of gold-bulls provide Chukotka, Kolyma, Magadan, Yenisei Ridge, Yakutia, the Amur region, Krasnoyarsk Territory. In these territories, where traditionally active activities are conducted, the outflow of the able-bodied population continues. Last year, 15% more people left this land than they arrived at their permanent place of residence. Moreover, among those who left, 70% were qualified workers. People leave the gold ore territories due to poor living conditions, the cold climate, high prices and an unsatisfactory level of social security.

Fifth, the decrease in the number of explored deposits with loose gold made the leading Russian campaigns test and develop ore deposits, which required the use of modern and costly technologies. The extraction of metal by underground mining is a very capital-intensive process, it requires multiple increases in costs and long-term investments [

10].

Sixth, in Russia for many years they have not paid due attention to geological exploration, the search strategy for gold areas has been conducted for more than 15 years using standard methods, and geological exploration tools have not been improved for a long time.

Finally, small and medium businesses are not able to apply advanced technologies for the exploration and development of deposits, which leads to a loss of up to 25% of gold, which remains in the deposits [

10].

Along with macroeconomic risks, there are positive factors that inspire some optimism and allow us to predict the growth of gold mining in Russia. We highlight the opportunities for sustainable development of the gold mining industry. The state requires a steady increase in gold reserves, allocating more and more funds for the purchase of precious metal. The increasing complexity of the gold mining conditions forces the owners of mining enterprises to finance the development and implementation of modern Russian mining technologies. The reduction in the world level of gold production will lead to a significant increase in prices, which will attract additional investment in the industry.

The absence of easily accessible explored territories will force the management of enterprises to engage in the optimization of production and management and the search for opportunities to improve efficiency. The existing ore reserves are located in complex deposits, where adjacent mineral resources are located next to each other, which will require the use of new technologies, foreign experience and investments. The inaccessibility of deposits and the complexity of their development will lead to a concentration of production and capital, which will increase the capacity of enterprises and investment growth.

The government will continue to stimulate gold miners, create a favorable infrastructure and will propose legislative measures for the development of entrepreneurial activity in the field of gold mining. Thus, the analysis of positive and negative factors that determine the sustainable development of the gold industry leads to the need to find conditions for increasing the effectiveness of the strategic management of gold mining companies in Russia, improving the mechanism for developing and evaluating business strategies, taking into account the organization’s life cycle. Improving the management mechanism allows you to attract the necessary investments and ensure the sustainable development of the company.

3. Mechanism for Managing the Sustainable Development of Gold Mining Enterprises

In this section, we refer to the scientific and practical research on the problems of achieving and maintaining the sustainability of the organization, developing and evaluating business strategies, investment opportunities for entrepreneurial activity in the gold mining industry, consider the model of managing the strategic development of a company, and suggest a mechanism for evaluating and developing an investment strategy.

3.1. Theoretical Framework

The theoretical and methodological basis of the study were based on the works of foreign and domestic experts in the field of sustainable development of the economy, strategic management, modeling business processes, investment activities and the management of gold mining enterprises in Russia.

In the process of analyzing a wide range of scientific sources, it was revealed that there were a large number of works affecting the topic of the presented research. However, as the analysis showed, there were practically no works that would fully meet the main goal and objectives of our research. Therefore, as a review literature, we identified works that were close to us in the nature and direction of research or affected certain aspects of the strategic management of industrial and gold mining companies that were relevant to this study.

Numerous studies of foreign scientists are devoted to the improvement of processes and mechanisms of strategic management. The works of G. Mintzberg, J. Quinn, S. Goshal, who proposed the concept of developing, implementing and adapting the company’s strategy to external conditions of activity [

11], were considered as a basic source. This study outlined the procedural aspects and an algorithm for developing strategic scenarios, but there was no modern model for implementing strategic management and it did not reflect the specifics of the activities of mining enterprises.

L. Correia, C. Vasconcellos and R. Campos presented practical recommendations on the implementation of a strategic method for managing the incubation process of industrial companies in Brazil [

4]. This method could be considered by the management of Russian enterprises due to some coincidences in the economic development of Russia and Brazil, but it does not allow for the full implementation of the objectives of this study related to the investment component of the proposed model of strategic management of gold mining enterprises in Russia.

Of particular interest is the work of Z. Mateljak, D. Mihanovic, which offers strategic planning tools for the sustainable development of production companies and a dynamic set of balanced indicators for implementing the company’s strategy, but not all of these indicators can be used in the strategic management of gold enterprises due to their specificity [

8].

Very relevant for this study is the work devoted to the study of the possibilities of implementation and the impact of automated information systems on the effectiveness of investment and innovation strategies [

12]. The results obtained by the authors allowed us to further expand the scope of this study, incorporating the information component into the model of the strategic management of the gold enterprise.

Based on the ambiguity and variability of activity conditions in the gold mining and processing of precious metals and the main goal of the study, we analyzed the work, which examined the possibility of using dynamic models aimed at solving the macroeconomic problems of modern enterprises.

The Leontopev’s single-product macroeconomic model was considered as a basic model. This model is very convenient for our research, as it includes interrelated indicators: Capital investments, production funds, gross and final products, and labor resources, etc. [

13].

Working on improving the mechanism of strategic management of gold mining companies, we came to the need to rely on the works of R. Loon, whose dynamic model orients owners and managers to maximize shareholder value of the company, which is very important for Russian enterprises in the context of increasing socio-economic instability [

14].

When modeling the optimal conditions for managing the strategic development of a company, we relied on the concept of the performance of G. Kokins, which made it possible to detect gaps between the proposed organization strategy and real processes [

15]. Unfortunately, the author did not consider in this concept the possibility of creating insurance investment reserves, determining their optimal size, which did not give full confidence in the reliability and sufficient effectiveness of the tools offered to them.

In the presented study, we relied on the principles of modeling the mechanisms of the stable development of an enterprise, considered in the work of I.A. Baev and V.I. Shiryaev [

16]. This work is among the works associated with the formation of the dynamic theory of the company. It reflects the specifics of the activities of Russian industrial enterprises. It offers algorithms for optimization of strategic management and its adaptation to changes in the situation on the market in conditions of crisis phenomena. However, it is difficult to fully take this model as a basis, since it has an extended character and includes a large number of parameters in its structure, which is not relevant for use in the management model of a gold mining company.

Research of A.V. Zagibalov made it possible to supplement the improved model of management of a gold mining enterprise with variables related to the technological component of estimating the volume of field production [

10].

Of particular value for the present study is the work of Y. Ouoba, which addresses the economic sustainability of gold companies in Burkina Faso [

17]. Thanks to this research, it was possible to clarify similar problems in the gold mining industry in Russia and other countries, and also to affirm the need to include components such as gold mining technology, quality of production, exploration methods, and the creation of insurance reserves in the implementation of investment projects in the company’s strategic management model.

Any management model, no matter how perfect it is, can ultimately not satisfy the company’s management if it does not have a business strategy assessment system that is adapted to the realities of the environment. Without this component, the management model cannot claim success. The issues of business valuation and the definition of sustainable development criteria are the subject of numerous studies used in this work.

The works by T.A. Khudyakova and A.V. Schmidt describe in detail the methodology for assessing the effectiveness of the management of the company according to several criteria [

18].

The studies by A.S. Gorevsky considered key parameters that influenced the formation of indicators of economic sustainability of enterprises that had been adapted to the mining and processing of precious metals [

2].

In the course of the study, the proposals of Shiryaev and Bayev were used in the field of application of multi-criteria optimization in the process of adapting an enterprise to changes in the conditions of activity during an increase in crisis phenomena [

19].

We pay tribute to and largely agree with the conclusions set forth in the work of B. Sharp, D. Bergh, L. Ming, who suggested using testing tools for industrial enterprises in the process of implementing strategic changes [

20].

Nevertheless, the analysis of the presented works does not allow us to fully agree with the authors’ suggestions on the assessment of business strategies in the gold industry, since none of the assessment methodologies fully reflect the specific conditions of extractive companies. Therefore, we decided to try to adapt the proposals discussed above, and also to turn to studies that suggested evaluating the effectiveness of enterprises at different stages of the organization’s life cycle, and tried to synthesize these methods within a single model [

6].

Thus, the analysis of theoretical sources allowed us to clarify the methodological basis of the study, indicate the parameters for improving the strategic management model of a gold mining company, and propose an algorithm for its implementation.

3.2. Materials and Methods

The practice of gold mining in the Russian Federation global trends in the mining industry and the analysis of theoretical studies requires the most careful consideration of identifying, evaluating and developing measures to achieve leveling of the negative impact of objective and subjective factors that impede the sustainable development of the gold mining business [

21]. This is precisely the direction of strategic management, which allows the management of enterprises to make competent decisions on a long-term basis, of a promising nature and in a timely manner.

Analysis of sources on the topic of this work and the practice of the strategic management of Russian and foreign companies enabled the clear defining of the methodological basis of the study. We relied on a systems approach and systems theory. According to the theoretical principles of the system approach, any enterprise is a dynamic, open, changeable, goal-oriented system [

22]. This approach means a systematic change of all components of the system, which ensures the creation of conditions for updating the status of the gold mining company, its internal components, and also allows the owners to create new quality characteristics of the updated system that are really necessary to ensure the competitiveness of the company. The sustainable development of an enterprise depends on the correct actions of management, on an optimally built management decision-making mechanism, based on methods of economic and mathematical modeling [

23].

It is necessary to distinguish such concepts as “stable development” and “sustainable development”. As a rule, sustainable development refers to the ability of a certain system to maintain the current state that characterizes the organization’s static position [

24]. Stable state means sustainable development of the system for a certain period of time [

1]. The stable development of an organization is a process consisting of certain stages, concrete steps, and operations of an activity. Each stage involves the use of a clear algorithm of management decisions, a set of methods, tools, forms of management, and consideration of macro and microeconomic environmental factors [

25,

26].

Under economic sustainability understand the internal state of the production entity, which develops under the influence of many factors [

18].

Analysis of research shows that, in general, the economic sustainability of an industrial enterprise is determined by three main factors: Economic growth as a determining factor; economic equilibrium (state of the internal and external environment of an industrial enterprise), ensuring the functioning of the enterprise subsystems; the level of management that ensures the full development of the enterprise in the course of its activities [

27].

As was stated earlier, in many respects, the economic sustainability of Russian enterprises and their development depend on the introduction of innovative technologies for gold mining, systematic geological exploration, and development of new deposits, which requires optimization of the strategic management model and improvement of investment policy [

28].

Based on the main objective of this study, various approaches to the modeling of firm management were analyzed. We considered a variety of dynamic, economic and mathematical models designed for the study of business processes and enterprise management. These included: Leontyev’s dynamic model, Loon’s model, diffuse models, J. Forrester’s approach to the construction of simulation models of production facilities, the model of the evolution of firms, and the model of “pulling” production management systems.

There are advanced dynamic models and simplified models. In the expanded model, the company’s operations are described in more detail and a solid amount of factors and parameters are taken into account. For example, production capacity, financial flows, materials, personnel and many other components are taken into account [

29].

The possibilities of our research and the real specificity of the activities of Russian gold mining enterprises led to the decision to turn to simplified models. This is Loon’s model and Leontiev’s model. Loon’s dynamic model is built, assuming that the company produces homogeneous products using uniform costs (labor, means of production); can only select a finite number of consumers at a time; maintains consistency of technology [

14]. The Leontiev’s model has even greater simplicity, in which there are such parameters as gross and final product, capital investments, production assets, labor resources, and consumption [

13].

Therefore, we relied on simplified, single-product models. The enterprise management model is built on the basis of the observations of real firms. In the process of building a model, the influence of the selected parameters of the company on its behavior were investigated, which allowed for identifying the parameters that had the greatest impact on the business and finding their values that would ensure the development of the firm within the chosen strategy.

Long-term observations and experiments on the implementation of the improved strategic management model proposed by us into the practice of enterprises in Eastern Siberia and Sakha-Yakutia allowed us to specify the parameters of single-product models and offer additional ones that corresponded to the specifics of gold-mining enterprises.

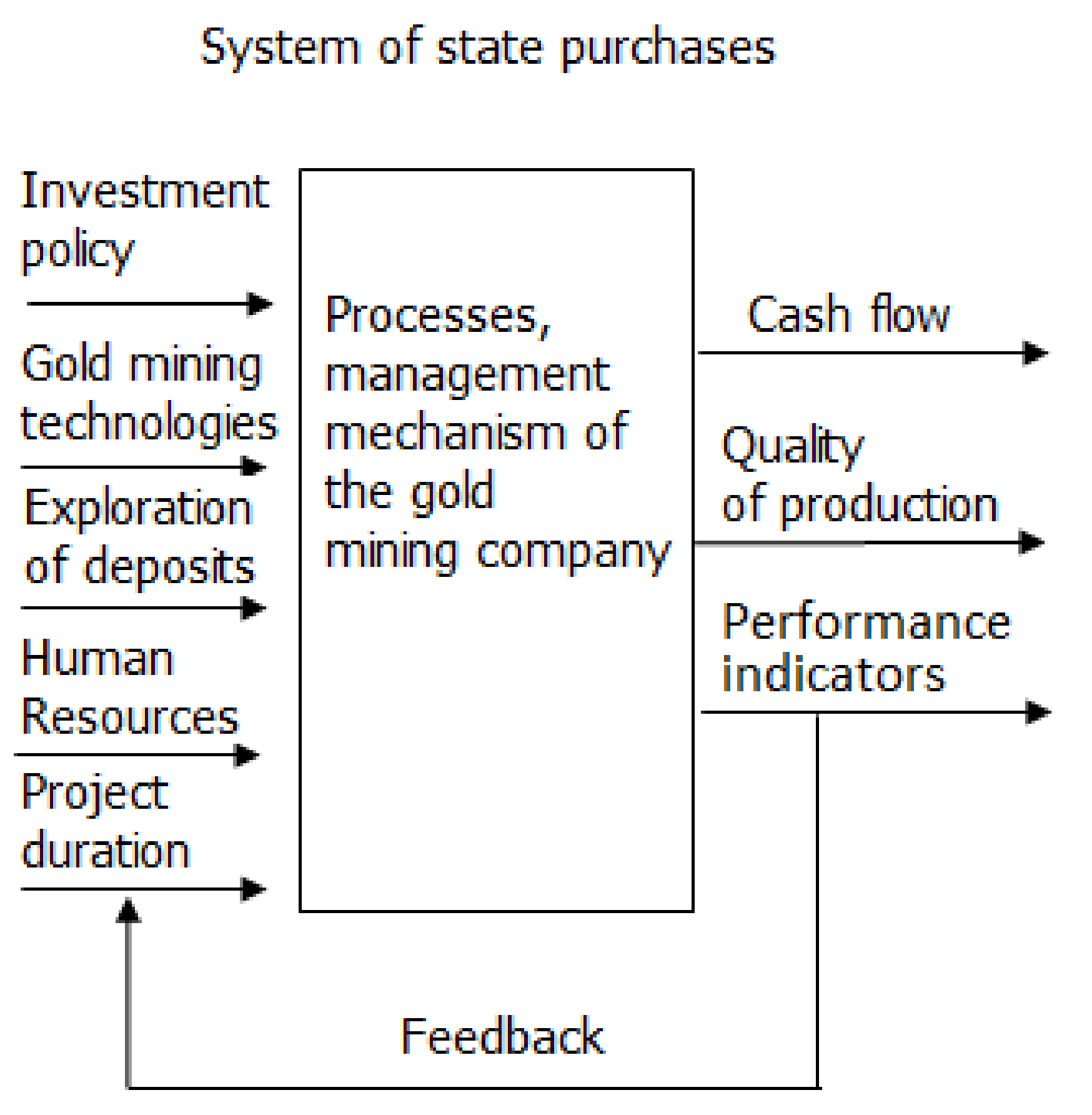

A graphical model of the strategic management of a firm is presented in the appropriate section. In addition to the usual components of simplified models, it presents specifically for Russian gold mining companies: Exploration of the deposits, the duration of the project, and the quality of output. The components related to the implementation of investment policies and the assessment of business strategies were also subject to adjustment. We will explain why we chose these components that affect each other.

The effective, progressive development of gold ore enterprises in modern conditions was determined by the availability of affordable investment [

24]. An analysis of the practice of gold mining companies in Russia indicated a close relationship between the size and value of investments and the quality of mining, the renewal of production assets, and the reproduction of the resource base of enterprises. The optimal investment policy, strategically adjusted management of investment projects in the conditions of overcoming the crisis allowed us to achieve sustainable development of enterprises.

Analysis of the activities of gold ore enterprises in Eastern Siberia, Sakha-Yakutia and Kamchatka showed a rather low efficiency of investment management, which led to a serious increase in costs, especially during the crisis and international sanctions, and the closure of many business structures.

In developing recommendations for improving the firm’s investment policy and the formation of an appropriate capital structure, the works of M. Blok, J. Sterman, V. Shiryaev, E. Shiryaev, N. Kotova, Z. Rumyantseva were analyzed.

It is known that the capital structure of a firm includes resources directed to the fixed assets of an organization, to working capital of an enterprise, and assets that are used in the implementation of investment projects [

30]. When a company lacks financial resources, management begins to reduce the amount of investments in working capital, which very quickly leads first to financial and then to production problems of an enterprise [

31].

The management of the majority of domestic enterprises in the gold mining industry is trying to solve these problems in the usual, many times approved way, attracting new loans and credits. This, in turn, usually leads to additional costs, increases the total cost of projects, reduces efficiency, and adversely affects the sustainable development of companies.

In a number of our earlier articles, we have already indicated that, unfortunately, the owners and managers of gold mining companies in Siberia and the Far East often underestimate the amount of investment in determining the required financial resources, which is associated with inaccurate delineation of deposits, calculation of ore reserves, climatic and social factors [

32].

As a result, it turns out that the invested capital is not enough and it is necessary either to reduce the amount of work due to the lack of funds, or to attract additional investments, the size of which exceeds the initial investment by 8–15%, which leads to a decrease in potential income. In this regard, reducing the amount of borrowed funds in the capital structure of the enterprise and increasing the insurance reserve of funds was proposed.

In addition to all of the above, close attention needs to be paid to the exact assessment of the gold mining company’s development strategy [

20]. Analysis of theoretical studies of foreign and domestic authors and the practice of Russian enterprises showed the need to incorporate into the mechanism of the strategic management of the company, new business assessment tools that are based on the organization’s life cycle model [

3]. The activities of Russian gold mining enterprises allow the use of a functional assets definition model as a tool for evaluating business strategies.

Thus, the methodological basis of this study are: System theory and a systematic approach to the implementation of a sustainable development strategy; economic and mathematical models of firm management based on a single-product model; investment design, based on improving the capital structure of the company and the introduction of new tools for the formation of insurance investment reserves; theoretical studies in the field of business valuation.

3.3. Graphic Model of Strategic Management of Sustainable Development of Gold Mining Enterprises

The need to ensure sustainable development and an increase in the efficiency of activities in the gold mining industry makes us constantly look for the optimal model of strategic management of gold mining enterprises. Based on the experience of Russian mining companies, an analysis of the works of foreign and domestic authors and our own research, a simulation model of management was proposed that allowed for more precise decision-making, determination of costs and necessary investments [

33].

The proposed model is also based on the work of T.G. Kasyanenko, who proposed the consideration of the mechanism of stable development of the company as a system of integrated management decisions and the effects of the subject of management on the components of microeconomic relations to create opportunities for sustainable growth and implementation of investment projects of the organization [

34]. The model of strategic management of sustainable development of gold mining enterprises provides for a clear algorithm of operations, a comprehensive implementation of basic management functions, a mechanism for controlling the sustainability of an enterprise based on a system of financial, production, economic, social, technical and other indicators [

8] (

Figure 1).

The algorithm of strategic management of a gold mining enterprise includes the following steps:

The stage of forecasting—taking into account the macroeconomic factors of the development of the domestic and world economy, the world political system, the conjuncture of the precious metals market, and the possibilities for investing in the mining industry.

Stage of analysis and assessment—analysis of the external and internal environment of gold mining companies, identifying strengths and weaknesses, opportunities and threats, strategic prospects for the company, and a precise definition of the size of investment.

The stage of organization and coordination of activities is the development, formation and implementation of the optimal model, and the perfect mechanism for the sustainable development of the gold mining enterprise.

The stage of implementation of management decisions—a systematic approach to the implementation of management decisions, the achievement of goals, objectives, enterprise strategies, and the implementation of investment projects.

Stage of assessment and adjustment of activities—evaluation of the implemented decisions, monitoring the implementation of the strategy, evaluation and adjustment of the company’s investment policy.

Despite the rapid growth of the precious metal mined in Russia and the increase in its purchases by the state, the efficiency of gold mining enterprises is far from ideal. The cost of gold mining is increasing, and investment management remains irrational. There is a lack of investment and financial risks are growing. As many Russian researchers note, many mining companies do not pay enough attention to the development of business processes and to the introduction of modern management technologies [

35]. That is why it is so important to constantly improve the management model of gold mining companies.

Taking as a basis the simplified management models of the company, we suggested using the technology of gold mining, exploration of deposits, and project terms as the necessary components of the strategic management model of a gold mining company. On the problems associated with the exploration, implementation of innovations, in addition to the Russian representative A.V. Zagibalov, some foreign researchers indicate [

17].

A close relationship was found between these components and the firm’s investment policy. In particular, the lack of qualified specialists in the field of exploration of the subsoil, their ignorance of modern methods for assessing and delineating production, the lack of new production technologies which led to an inaccurate determination of potential reserves of gold ore, unreasonable costs, an increase in borrowed funds, a shortage of investment, inhibition of investment projects, and a delay implementation. As a result, the economic performance of the company began to decline, the quality of work fell, and the value of the company decreased. The proposed improved model makes it possible to link the parameters taken as a basis into a single complex, to ensure a better process for the organization’s management to carry out its functions, to make sound management decisions of a strategic nature, to achieve sustainable growth, and to increase the value of the company.

The next section presents proposals related to the economic and mathematical modeling of the management processes of a company.

3.4. Economic and Mathematical Model of Strategic Management of Sustainable Development of Gold Mining Enterprises

The economic-mathematical model in our study is presented on the basis of the integration of the economic development of the organization and the state of investment activity.

In the conditions of the war of sanctions, the transition to new conditions of world economic activity, changes in market factors and dynamic models should be applied and oriented to solving macroeconomic problems. With regard to the practice of domestic gold mining by companies, our research shows that it is possible to successfully apply the open one-product dynamic model of Leontiev, which means that gross investments in full are spent on the growth of fixed assets during the calendar year and depreciation charges.

In a discrete form, this relationship is as follows (Equation (1)).

where

is increase in fixed assets in

year;

is the model parameter;

is depreciation charges.

In the continuous version, the analog of this equation is as follows (Equation (2)):

Combining these equations, we obtain a one-product model in a discrete form (Equation (3)):

where

is production costs in the year

,

is non-productive consumption in the year

.

Our research showed that a single-product macroeconomic model based on Leontiev’s and Loon’s models were logical and simple to use and could be modified for the majority of gold mining enterprises in Russia. This model provided that the company produced homogeneous products using homogeneous means of production and a uniform workforce; at any point in the project implementation time, only a finite number of operations can be used; during the project, the technology of work remains constant [

13]. All this makes it possible to simplify the task of increasing the value of an enterprise and optimizing its investment policy.

The Loona’s model focuses management attention on two major areas: Operations of production activities—labor-intensive and capital-intensive, which is extremely important in the field of gold mining [

14]. Also, this restriction does not in any way diminish the quality of the imitational model, the adequacy of the managerial decisions made, and does not disrupt the balance of labor and capital distribution in the organization. The production process in the sphere of gold mining is linear, and the products are produced using labor resources and enterprise capital in fixed proportions.

Considering the above, trying to achieve the integration of the economic development of the company and the investment policy, we suggested linking the methods, technologies of ore development and the capital structure of the company. We proposed to determine the level of output by the following formula (Equation (4)).

where

is the sum of the fixed capital,

is the level of output, and

is the efficiency of the use of the company’s fixed capital.

The level of employment is determined by Equation (5):

where

is the level of employment of the company,

is gross capital investments.

The amount of fixed capital that a firm has represented the following expression (Equation (6)):

Equations (4)–(6) indicated a direct relationship between the structure of the enterprise’s finances and the way of production (Equation (7)):

where

is gross investment, and

is the final product.

It is usually assumed that the increase in equity should occur at the expense of retained earnings and acquired investment subsidies [

36]. By assumption, the level of investment subsidies should be proportional to the level of gross investment. Then, to determine the cost of equity, we can propose a differential equation (Equation (8)):

where

is the profit tax,

is the gold sales volume,

is labor compensation,

is the depreciation capital,

is the interest for the loan,

is the dividend, and

is the investment subsidy rate.

In addition to modeling the management of the company’s business processes, in order to achieve a sustainable growth in the value of the gold mining enterprise of the Russian Federation, it is necessary to create an insurance stock, as sources of which are the company’s own and borrowed funds, within the framework of strategic investment management, as we showed in previous studies. Directions for using one’s own funds are investments, as well as dividends of the company’s shareholders.

To improve the strategic management of investment projects, we propose to use a range of dividends for business owners that is acceptable for the enterprise and shareholders, which will constitute a certain amount of the insurance stock of the company, its reserve—

(Equation (9)):

where

is reserve of funds, which is formed from the company’s own funds,

is the size of the firm’s equity,

is the amount of dividends that the firm pays to shareholders.

The insurance stock allows the company to reduce the amount of loan reserves, and improve the efficiency of the enterprise.

The proposed model and mechanism for managing the sustainable development of a gold mining enterprise was based on the implementation of a systematic approach to managing and taking into account a set of factors that influenced the company’s successful operations [

37]. The most important among them were: The optimal combination of management methods, the decision-making process, the firm’s investment policy and the exploration and evaluation of potential gold ore reserves in the fields [

38].

The collapse of the geological exploration system at the end of the last century and a serious decline in the quality of labor resources in Eastern Siberia, Yakutia created serious problems in determining the exact gold reserves in the excavation area. An error in the exploration of the potential of the field leads to increased costs and incorrect calculations in investment planning.

Determination of gold reserves in mines and in placer deposits should be carried out using the method of A.V. Zagibalov. A well-known scientist proposed to obtain data on metal reserves by drilling a series of parallel well lines, using the method of vertical sections [

10].

According to the methodology of the Russian researcher, the error in determining the gold production reserved is determined by the errors in establishing the boundaries of the counting block and determining the gold reserves on the exploration lines (Equation (10)):

where

is the error in determining the reserves of the precious metal,

is the gold content in the rock (g/m

3),

is the diameter of the borehole drilling,

is the sampling interval for the proposed deposit,

is the median of the granulometric spectrum of gold.

Insufficient qualification and outdated methods lead very often to understated output. To reduce errors, it is necessary to observe the exact size of the intervals during drilling operations, and correctly determine and take into account the transverse size of the production on the proposed gold location. Accurate determination of the error value reduces errors in the determination of gold reserves, allows you to correctly calculate the amount of necessary investment and form an optimal strategy for the development of the enterprise. In particular, the application of this reconnaissance technology by qualified engineers allowed, with the support of the dynamic model of sustainable development proposed by us, to reduce the size of the exploration error of the field development by 8–14%.

Exploration of deposits and the definition of reserves of gold ore is one of the key components of the management model of the company. Production reserves, as well as the production capacity of the enterprise, determine the upper limit of the possible extraction of the precious metal in a certain period of time. This parameter has a very powerful influence on the behavior of a company and contributes to the growth of production or becomes a serious limitation of a company’s activity.

We were not able to reflect the impact of the limitations of this parameter on the sustainable development of the gold mining firm in a quantitative context, since we have not yet properly analyzed the relevant information. In the future, if we continue to work on the development of an optimal economic model for a gold mining firm, which will allow us to tie together all the management parameters outlined earlier, we will definitely identify the impact of the relevant restrictions and take them into account when modeling business processes.

The model of management of a gold mining enterprise cannot be considered perfect without making major changes to the technology for evaluating business strategies. The experience of many years of research conducted by us has shown the need to use an adequate tool to model and evaluate business performance based on the organization’s life cycle theory. A company can achieve efficiency at a separate stage of the life cycle center with the correct definition of a strategy, as specified by the research of I. Adizes, L. Greiner, V.I. Shiryaev, B. Sharp [

20]. We were repelled by the LRC consumer life expectancy model, which we would like to use when evaluating alternative strategies, starting from the first stages of the operation of the gold mining enterprise. The formula is as follows (Equation (11)).

where

is the lifetime profitability of the buyer;

is profit from the buyer for a period of time

;

is the discount rate;

is the retention coefficient.

In our case, the gold mining enterprises of Russia are in the third and fourth stages of the organization’s life cycle. In the third phase of the organization’s life cycle, the long-term goal of gold mining companies is to penetrate the enterprise into new sales markets. Therefore, you should pay attention to the financial performance of the company, which is reflected through the model for evaluating the effectiveness of the implemented strategy. The conditions for the development of the gold mining industry in Russia, as we have shown earlier, are pushing enterprises to choose market concentration strategies, innovation strategies, or strategies of directed efforts. It is the implementation of these strategies that contributes to the formation of the main existing assets of the company. Thus, for business valuation and making further decisions on investing in gold mining, we offer a tool for determining the functional assets of CVA (Equation (12)).

where

is cash flow arising from changes in the assets of the company;

is the present value of cash flows;

is the estimated value of the final cash flow for n years;

is the carrying value of the enterprise.

When a company transitions to the fourth stage of the organization’s life cycle, as a rule, the consumer base of the firm’s products is reformed in favor of strategic buyers. In this case, when evaluating the strategy, non-financial indicators as well as the rate of return on investment are a priority. In this case, strategic scenarios will most often be based on customer orientation strategies, a complete transformation of the enterprise, and implementation strategies. Then, in addition to the previous business strategy assessment tool, you can also use the model of the total lifetime profitability of the company’s client base. This model is described by the following equation (Equation (13)).

where

is the value of the company’s business;

is the contingent of buyers;

is the number of buyers in the contingent;

is consumer spending;

is the discount rate.

Such are the models [

39] for evaluating the strategy of gold mining companies’ activities, which, in our opinion, make it possible to improve strategic management and optimize the company’s investment.

Thus, the sustainable development of gold mining enterprises involves the consideration of macro and microenvironment factors of the enterprise and the modeling of optimal conditions for the implementation of business processes.

We have attempted with the help of economic modeling to describe the strategic aspects of managing a gold mining company, highlighting the main parameters of the model and the corresponding description. The results do not allow us to say that the economic-mathematical model is holistic and complete, but, nevertheless, it sets the contours for the formation of a more sophisticated management model and defines further guidelines for the continuation of research studies.

4. Conclusions

In recent years in Russia there has been a sharp rise in gold mining. The state is rapidly increasing its gold reserves in storage facilities and buying large amounts of precious metal, which stimulates the development of domestic companies. Unfortunately, there are serious shortcomings in the activities of Russian mining companies, which lead to higher costs, additional costs, and reduced efficiency. The crisis phenomena in the Russian economy, the war of sanctions, the lack of modern technologies for mining and processing gold ore, the difficult climatic conditions of activity, and a certain reduction in the level of personnel qualifications have led to certain problems in implementing the strategy for the sustainable development of gold mining enterprises. The situation is also exacerbated by the imperfection of investment policy in the sphere of gold mining.

In addition to external factors that hamper the development of gold enterprises, a very serious, objective problem is the incomplete fit of the model and mechanism of the strategic management of the firm with the realities of economic activity.

As part of this study, we tried to analyze the scientific sources and the practice of gold companies, to substantiate theoretically the need for transformation, to identify the methodological basis of research and to offer an improved management model of the company that would take into account the specifics of the gold mining business.

The methodological basis of this research is the theory of systems, the system approach, the theory of sustainable development, and the theory of modeling socio-economic processes. An industrial enterprise is a dynamic, open, goal-oriented nonlinear system. The dynamics of the system can be represented as a change in properties and indicators, which leads to a completely new state of the system, ensuring the sustainability of the introduction of qualitative characteristics [

18]. It is best to imagine this using the system modeling method.

In worldwide scientific literature there is a wide range of works devoted to the study and design of various models describing the processes and mechanisms for the sustainable development of enterprises. We know, according to studies by a number of authors, that the use of the company’s sustainable development mechanism causes a synergistic effect based on improving production processes, reducing costs and increasing the income of an industrial enterprise [

4]. Unfortunately, there are certain gaps in the scientific literature in the field of modeling the management of firms representing the gold mining industry. We have tried, as far as possible, to eliminate some of these gaps or to attract the attention of the scientific community to these gaps.

The main dynamic models of business process management were reviewed. As a guideline, the open single-product Leontief model was identified, allowing for fairly free adjustment to its components [

13] and the simplified Loon model; the application of which aims at maximizing the company’s shareholder value [

14].

Based on the capabilities provided by these dynamic models, a more advanced model of strategic management of gold mining enterprises was proposed, which included components specific to the gold mining industry: Gold mining technology, project duration and exploration. These parameters have the most direct impact on the performance of the company, on its sustainable development for a long time, and act as restrictions affecting the growth of the company’s performance.

Additionally, special attention during the formation of the model and the development of the management mechanism of the firm was paid to the investment aspects of the gold mining enterprise [

40]. Namely, the process of determining the optimal capital structure of a company and introducing into the practice of a company, a tool for establishing a range of reduction of dividends for business owners acceptable for a company and shareholders. This made it possible to create a certain amount of the insurance stock of the company, its reserve, necessary for the implementation of investment projects in Russia.

Based on the corresponding simulation models, an assessment is made of the statistical probability of a crisis occurring, and the occurrence of possible losses at the end of a given period of enterprise activity, taking into account changes in environmental parameters characteristic of the industry [

20]. Our model also provides for an appropriate assessment, but is based on the use of a business performance assessment model based on the organization’s life cycle theory, as this allows for a more objective assessment, taking into account the realities of the Russian gold industry.

The practical significance of the research lies, in our opinion, in the substantiation and successful application in the activities of a number of gold mining companies in Siberia, Sakha-Yakutia, of an improved dynamic open single-product model for managing gold companies, which rather successfully solves macroeconomic problems facing the owners of the gold mining business.

Additionally, the improved model and mechanisms for the strategic management of gold ore companies provide for the application of a methodology for estimating potential gold reserves in the deposit by applying the method of vertical sections, which allows for the reduction in errors and much more accurate determination of the volumes of gold ore. The use of this method in assessing the estimated reserves of precious ore allowed a systematic, comprehensive approach to the issue of taking into account the mutual influence of technical and economic aspects of the investment strategy, and ultimately reduces the error of exploration output by 12–14% and, accordingly, more accurately determines the amount of necessary investments.

In general, the use in the practice of gold mining enterprises of the proposed model and an improved mechanism for managing the sustainable development of an organization has allowed a number of gold mining companies to achieve positive results. For example, it was possible to reduce the size of unplanned and unrecorded investments from 8–14% to 4–6%, and in some Sakha-Yakutia firms altogether abandon additional investments leading to a decrease in the level of efficiency of the gold mining business.

These studies were carried out by us over the last 7 to 8 years and show a positive trend in improving the financial and economic indicators of gold mining enterprises. Indeed, the proposed model has certain drawbacks. Eg., it is not possible to fully take into account all macroeconomic factors affecting the sustainability of the enterprise, to achieve an optimal synergistic effect within the selected parameters and conditions for the operation of this model and the corresponding mechanism for its implementation.

In this study we have not yet succeeded in achieving one of the very important tasks that we set for ourselves, starting work on the topic of research, namely, to create a holistic, complete economic and mathematical model that fully describes the mechanism of management of a gold mining enterprise. The study of the strategic aspects of the sustainable development of gold companies in Russia continues, obtaining the necessary additional information and its full analysis will allow us in the future to eliminate existing shortcomings and form a management model that links together all the parameters of the system characteristic of the gold mining business and meets the needs of managers and owners of companies.

It is with the identification of the characteristics of the sustainable development of the gold industry and the refinement of the components and model parameters that our further research is connected, which ultimately should lead to the creation of an optimal model for managing the sustainable development of a gold mining company and describing it using economic and mathematical modeling. Thus, the continuation of work in this direction, the use of experience of foreign companies, theoretical developments of world-class specialists, the establishment of scientific and practical interaction with stakeholders allows you to see new guidelines and set new scientific tasks on the way to improving the activities of mining companies and ensure stable and sustainable development gold mining enterprises.