1. Introduction

In the European Union (EU), the responsible use of biomass for food, feed, material and energy applications has gained policy gravitas under the auspices of the so-called bioeconomy strategy [

1,

2] (EC, 2012; EC, 2014). To successfully promote such a dramatic societal and institutional shift in support of a truly sustainable model of prosperity, a thorough consideration of the (inter alia) economic (i.e., biotechnological efficiency, competitiveness), environmental (biodiversity, air, water and soil quality), and social (i.e., equity, justice and human rights) implications is required. Taking an economic focus, this paper employs a consistent macroeconomic accounting database for each of the EU member states (MS), known as the BioSAMs [

3]. The aim is to calculate structural economic indicators of biobased performance and through the use of statistical tests, employ said indicators as profiling variables to classify typologies of regional EU clusters.

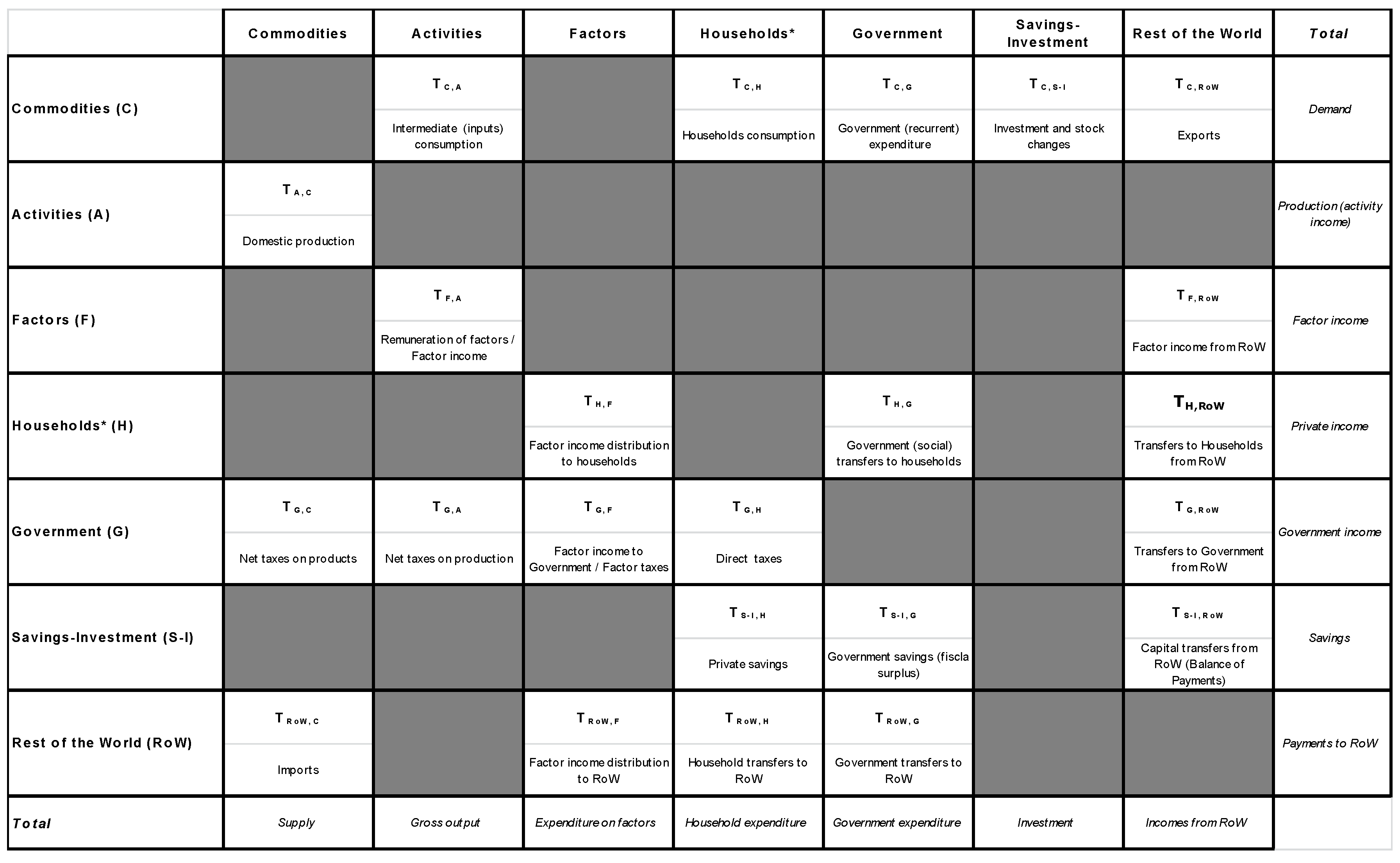

To evaluate the structural performance of individual activities taking explicit account of both the input-output interlinkages with surrounding sectors and domestic and foreign market demands, the social accounting matrix (SAM) national accounts data set [

4] constitutes an ideal starting point. Dating back to the seminal work of Rasmussen [

5], there are relevant (agricultural) examples of linear Computable General Equilibrium (CGE) models [

6,

7,

8] which calculate sectorial multipliers from the SAM database to ascertain the relative influence of a given sector through the strength of its transactional interlinkages within an economic system. Hitherto, however, a key limiting factor in the use of this tool is that within the standard statistical classification of EU economic activities (NACE) [

9]), specific biobased activities are not explicitly disaggregated but rather hidden within their parent industry classifications [

10].

To remedy this issue, Müller et al. [

11], constructed a series of SAMs for each of the EU MS with detailed accounts for 30 agricultural activities and 11 food activities, benchmarked to the year 2000. This database was employed to conduct a structural multiplier analysis of Spain’s agricultural sector [

12]. An update of these accounts to 2007 was subsequently employed as a basis for a further structural multiplier analysis covering all EU MS, facilitated by statistical clustering and segmentation tests to generate ‘typical’ EU regional groupings with comparable agricultural sector structures [

13]. Their results reveal six groups of EU countries, whilst raw milk and dairy were found to generate significant wealth effects.

Building on the seminal work of Müller et al. [

11], Mainar and Philippidis [

3] update to the year 2010 and further augment the biobased sector accounts to encompass additional sources of biomass, as well as contemporary applications of biomass in the fields of liquid fuels, electricity and chemicals. The resulting BioSAMs have been subsequently employed by Fuentes-Saguar et al. [

14] to calculate output and employment multipliers for biobased activities in the 28 EU MS. Simply employing mean multiplier values, the authors compare with the EU bloc average. They conclude that the average EU biobased multiplier is below the corresponding result for non biobased EU activities. Moreover the EU biobased output multiplier average masks considerable variation between higher performing (e.g., livestock activities) and lower performing (e.g., bioenergy, bioindustry) biobased activities. Finally, average employment generation in biobased sectors is higher than non biobased activities, although doubts are raised regarding the quality (i.e., skill level) of said employment generation effects.

This study also employs the BioSAMs to undertake a structural analysis of the EU MS biobased sectors, although it improves on the study by Fuentes-Saguar et al. [

14] in two ways. Firstly, following other relevant studies [

12,

13], the current study calculates both backward-linkage (BL) and forward-linkage (FL) multipliers (see

Section 2 and

Supplementary Materials), which in comparison with Fuentes-Saguar et al. [

14], yields a more comprehensive picture of the structural influence of the biobased economy. On the one hand, the sum of the total BL multiplier effect from a given sector ‘j’ is equivalent to the output multiplier, as both represent the cumulative value of economic activity resulting from an additional unit of final demand for a given commodity [

15,

16]. On the other hand, further structural insights are attained from using total FL multipliers, which characterize an input multiplier effect based on the change in output of all sectors given an additional unit of available input from activity ‘j’ [

15,

16]. In addition, Fuentes-Saguar et al. [

14] do not examine in any detail, specific cases of high (or low) performing biobased sector and region combinations. In the current analysis, this is performed by normalising the BL and FL multipliers to generate indices of influence (see

Section 2.2), which in turn are used to identify the presence of ‘key’ biobased sectors (i.e., high performers).

Secondly, the analysis conducted in Fuentes-Saguar et al. [

14] restricts itself to a simple comparison of means. It does not draw on statistical analysis to understand the structural diversity of biobased industries across the EU MS. This study employs an approach akin to Philippidis et al. [

13], in that BL and FL performance indicators are used as segmenting variables in tandem with statistical clustering and bivariate comparison tests. The objective is to establish EU region typologies as a function of the economic strength of their biobased sector activities. As a result, a key aim is to statistically establish the degree of variability of biobased sector performance across the EU MS and the extent to which these activities constitute a viable and potentially sustainable model of growth.

The rest of this paper is structured as follows. Section two briefly discusses the database and the structural and statistical tools of analysis. Section three reports the results. Section four contextualises the results with previous studies and provides a policy discussion. Section five concludes.

3. Results

3.1. Statistical Profiling of the Biobased Sector Multipliers

To make the analysis more manageable, the 53 biobased accounts of the BioSAMs are aggregated to 32 representative sectors, whilst a further four sectors represent the remaining 27 non-biobased accounts. The definitions of the 36 sectors can be found in Fuentes-Saguar et al. [

14].

Subsequently, a hierarchical cluster analysis is conducted using the BL and FL multipliers for each of the 32 biobased sectors in each of the 28 EU Member States as segmenting variables, which leads to five clusters (

Table 1). These clusters are labelled Northern and Central EU (‘Northern & Central’), the EU Mediterranean islands and Luxembourg (‘Isles & Lux’), a group mainly consisting of newer accession members (‘Mainly Eastern’), two Baltic MS (‘Baltic’) and the Mediterranean region (‘Mediterranean’). This final selection is a compromise between statistical criteria and economic insight. Indeed, running the CH rule in the range 4 to 9, the maximum CH value corresponds to four clusters, while five clusters, with the separation of the Baltics from the ‘Northern and Central’ cluster, is the second best choice. (The CH rule is run for the range 4–9, in order to reconcile the requirement of a minimum number of countries per cluster with a sufficiently differentiated wealth generating profile across the selected clusters.) The decision to select five clusters rested on the statistically significant idiosyncratic bioeconomic wealth generating characteristics of the Baltic countries (see later discussion) that distinguish them from the “Northern & Central” cluster.

Table 2 summarises the mean FL and BL multipliers for the 32 biobased sectors across the five regional clusters (and the EU28).

Paired t-tests between the mean BL and FL biobased multipliers within each regional cluster reveal numerous examples of statistically significant differences. (Specific test results are available from the authors upon request.) More specifically, the pervasiveness of higher BL multipliers in ‘Mainly Eastern’ (31 cases), ‘Mediterranean’ (28 cases) and ‘Northern & Central EU’ (31 cases), which represents 23 EU MS, statistically confirms that the vast majority of biobased activities exhibit a high degree of ‘backward orientation’. In the ‘Isles & Lux’ and ‘Baltic’ regions, statistical evidence of relatively stronger BL mean multipliers are restricted to only 11 and four sectors, respectively. (The small sample size especially in the ’Baltic’ cluster may compromise the power of the paired t-test.)

Comparing across the five regional EU clusters, one-way Anova tests (or W-tests) independently search for statistical differences in (i) BL multipliers and (ii) FL multipliers. Alternatively, when non-normality is observed, the Kruskal-Wallis is applied. In 29 (22) of the 32 sectors, there are statistically significant structural differences in the BL (FL) across the five clusters. In short, on a sector-by-sector basis, biobased wealth generation is statistically found to be heterogeneous across the five clusters, particularly in the case of demand driven wealth.

Table 3 provides a summary of the key characteristics in each of the regional clusters. Thus, in the ‘Mediterranean’ (four EU MS) and ‘Mainly Eastern’ (nine EU MS) clusters, the bioeconomy is ‘active’ with particularly strong backward orientation (BL mean ≈ 2, FL mean ≈ 0.8). Across the 32 biobased sectors, above average demand driven wealth (BL > 1) is highly pervasive, particularly in the ‘Mediterranean’, whilst above average supply driven wealth (FL >1), although more limited, is also observed. In both regional clusters, these wealth properties are consistent across sectors (relatively low CoVs), whilst approximately one-in-three of the biobased activities is a key sector (Key sectors are discussed further in

Section 3.3) (i.e., BL > 1 and FL > 1).

The ‘Baltic’ cluster (two EU MS) is characterised by ‘moderately’ active biobased activity with strong backward orientation (BL mean ≈ 1.5, FL mean ≈ 0.7). Across the 32 sectors, demand driven wealth generation is almost comparable to the Mediterranean and ‘Mainly Eastern’ regions, although it is much less consistent across sectors (relatively high CoV). Evidence of supply driven wealth is intermittent and inconsistent across the 32 sectors (relatively higher CoV). Approximately one-in-five biobased activities, is a key sector.

The ‘Northern & Central’ regional cluster (ten EU MS) has a comparable degree of demand driven growth to the ‘Baltic’ region (BL mean ≈ 1.5, FL mean ≈ 0.6), although like the ‘Baltic’ region, it is inconsistent. Evidence of supply driven wealth in the ‘Northern & Central’ regional cluster is scarce as this cluster only contains four key sectors. Finally, the ‘Isles & Lux’ cluster (consisting of three EU MS) exhibits a weak bioeconomy (BL mean < 1, FL mean = 0.4), whilst examples of supply driven wealth are restricted to one sector. The relatively higher CoV reflects the more heterogeneous wealth generating capacity of biobased activity within the region (existence of zero BL multipliers—see

Table 2) which is explained by both the limited land area (source of biomass) and relatively active services (Luxembourg and Malta) and tourism (Cyprus and Malta) sectors in this regional grouping. This cluster only contains one key sector (raw milk).

3.2. Profiling Regional Clusters with Employment Multipliers

As in Fuentes-Saguar et al. [

14], structural employment multiplier (EM) indicators are calculated. The EM defines the number of jobs created per unit (million euros) of additional demand. In the current paper, we cross-reference these multipliers with the segmented ‘typologies’ arising from the statistical clustering tests, to statistically identify the degree to which stronger or weaker biobased regional typologies, described in the previous section, are also characterised by employment generation potential.

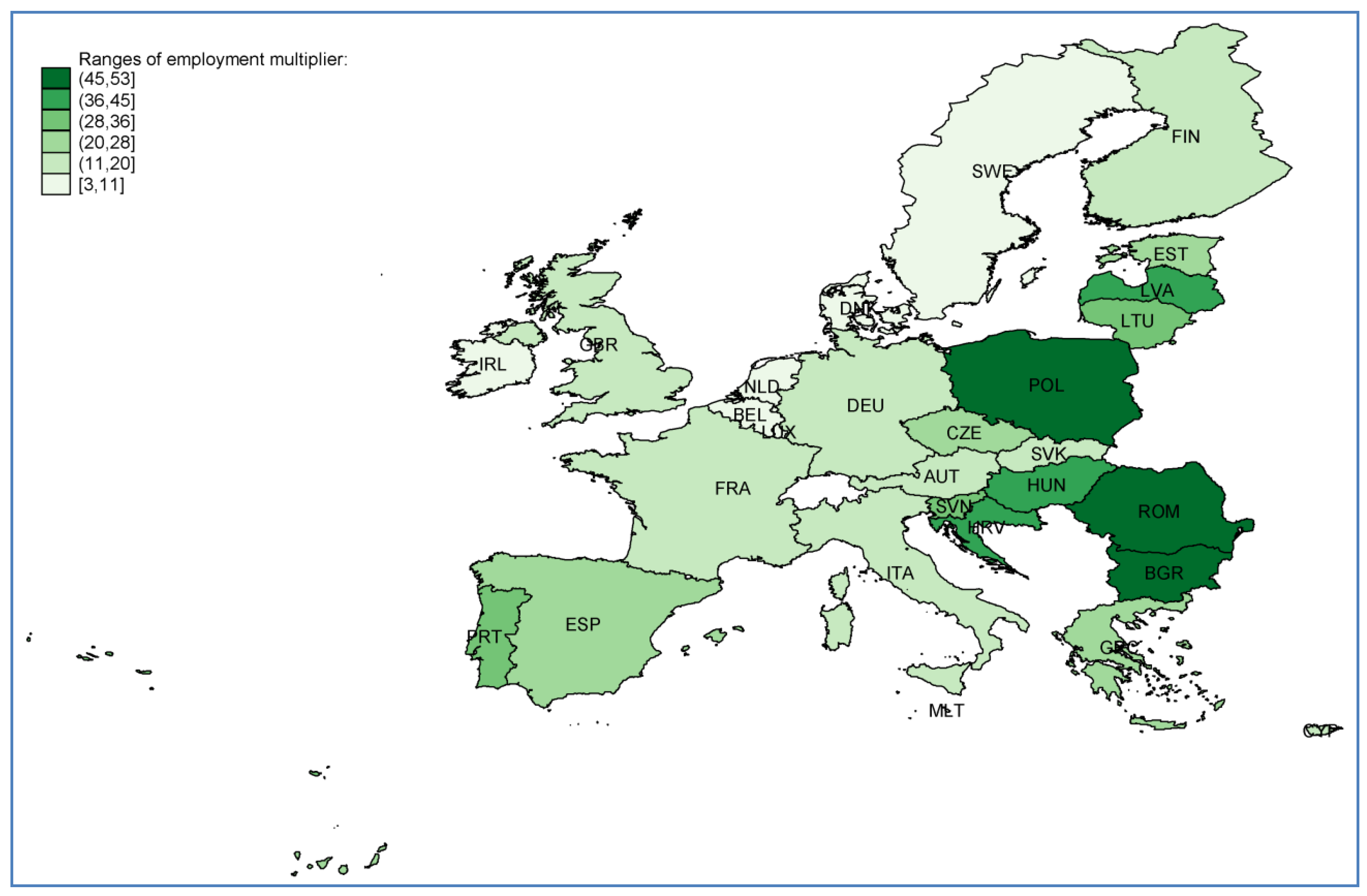

From a broad perspective,

Figure 2 shows the average employment multiplier arising from the collective of biobased activities in each of the EU MS. Not surprisingly, and as noted in Fuentes-Saguar et al. [

14], the highest EMs in Bulgaria, Poland and Romania, are driven by the (relatively larger) agricultural sectors.

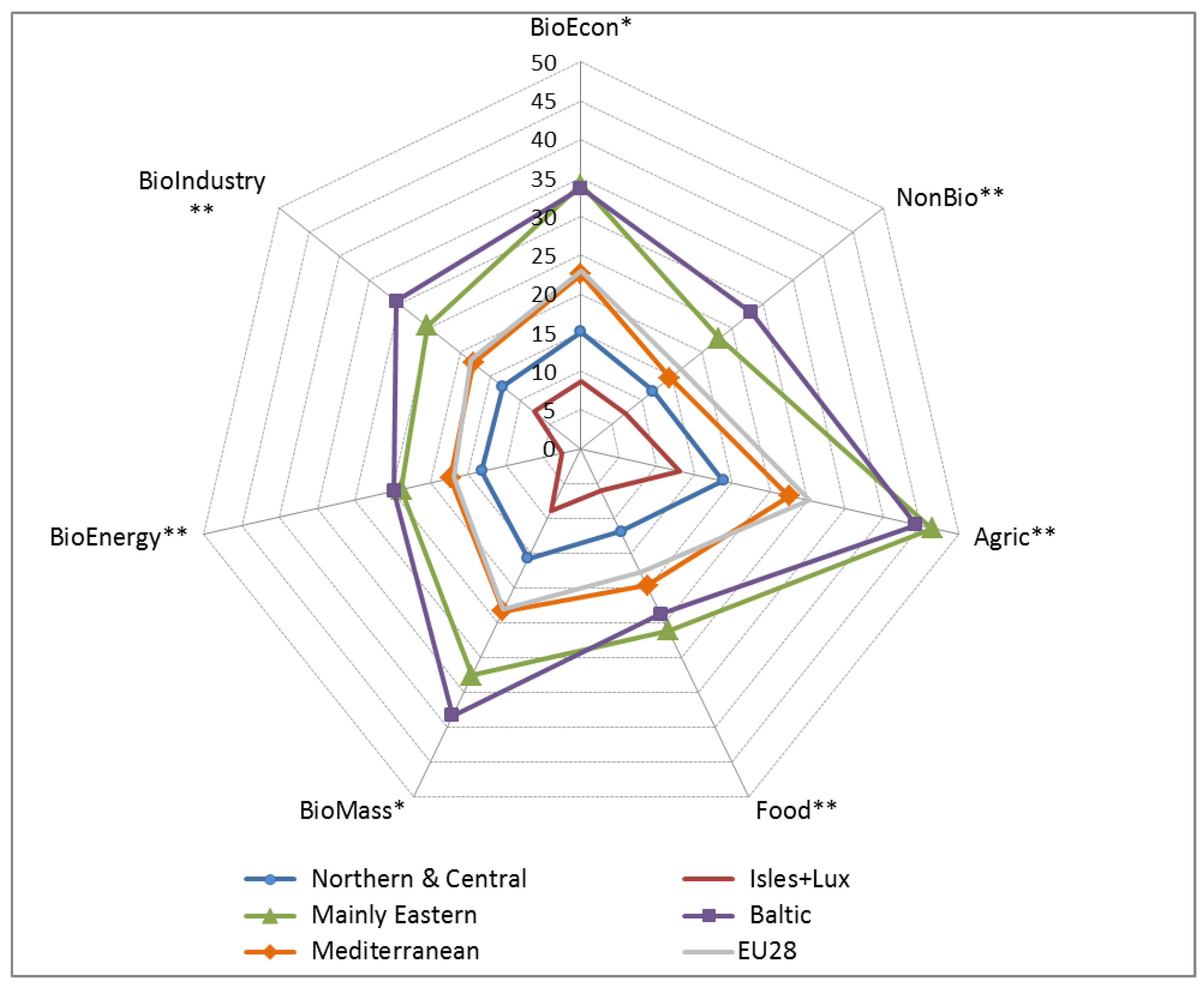

Anova tests (or W-tests) confirm that mean EMs for the seven activity aggregates of sector activity shown in

Figure 3, differ statistically between the different regional groupings, whilst (with some qualifications) there is some correlation between wealth and employment generation across the clusters. In the regional clusters of ‘Mainly Eastern’ and ‘Baltic’, where biobased BL and FL multipliers are relatively strong, the average employment generation prospects are the strongest across each of the biobased sector classifications (

Figure 3). Similarly, in the weak biobased regional cluster ‘Isles & Lux’, job creation in biobased sectors is also limited with, for example, as few as three jobs per million euros of additional output in bioenergy (compared with 17 jobs in the EU28). On the other hand, in the ‘Mediterranean’ grouping, which exhibits the strongest FL and BL multiplier effects of all the clusters, employment generation in each of the biobased sector classifications in

Figure 3, is approximately the same as the EU28 bloc average.

3.3. Key Sector Analysis

In

Section 3.1, a brief discussion of the key sector (BL > 1; FL > 1) frequencies in each of the five group clusters reveals 30 individual cases of key sectors highlighted in green (see

Table 2), whilst 13 cases of potential key sectors (i.e., BL > 1, FL ≈ 0.9) are marked in red. The most prolific key sectors are generally in the agriculture and food industries, whilst in 20 of the biobased sector categories, there are no examples of key sector performance.

The activity which exhibits key sector status in all five of the regional clusters, is ‘raw milk’ production. Another sector with particularly strong key sector credentials across four of the regional clusters is ‘intensive livestock’, whilst in the fifth cluster (Isles & Lux) it is a potential key sector. The sectors of ‘cereals’, ‘animal feed’, ‘forestry’, ‘wood’ and ‘other food’ are strong contenders (three regional clusters), whilst in a fourth regional cluster group (‘Northern & Central’), both ‘animal feed’ and ‘wood’ exhibit ‘potential key sector’ status. Of the newer biobased activities (i.e., first- and second-generation biofuels, biochemicals, bioelectricity, biomass from energy crops and pellets), there are no key sector examples, although bioelectricity has potential key sector status in three group clusters.

Cross-referencing each activity’s key sector status (

Table 2) with its employment generation potential, (The employment multiplier calculations are reported in Fuentes-Saguar et al. [

14].) both ‘industrial crops’ and ‘other crops’ which exhibit very high employment multipliers are not key sectors in any of the clusters. On the other hand, ‘raw milk’ and ‘intensive livestock’ are sectors which score exceptionally well in both the indicators of relative wealth and employment generation. Both ‘cereal’ and ‘animal feed’ also generate employment above the EU28 bioeconomy average and score well as key sectors. As noted above, the newer biobased activities (bioenergy, biochemicals, biomass from pellets and energy crops) are characterised by an absence of key sector status and are below the average EU28 biobased employment multipliers.

4. Discussion

Employing a SAM multiplier analysis, the economic value added of biobased activity is found to be highly heterogeneous, both across sectors and regional EU clusters. For example, in two of the regional clusters (‘Mediterranean’ and ‘Mainly Eastern’), the bioeconomy is a key engine of wealth generation. On the other hand, the dominance of services and tourism sectors and the lack of land area as a principal supply source of biomass in the cluster entitled ‘Mediterranean Islands and Luxembourg’, relegate the relative importance of biobased activities. From the relatively high backward-linkage (BL) multipliers reported here, the observation that biobased wealth generation is predominantly demand driven is consistent with the existence of a multi-layered logistical network of intermediate input suppliers to biobased activities. This concept has particular resonance in the primary agricultural sectors, which rely on a diverse portfolio of inputs (e.g., fertilisers, pesticides, veterinary services, machinery, transport services, energy requirements) which generate, in relative terms, greater than average economic ripple effects through the rest of the economy. As noted in Philippidis et al. [

13], in developed economies and the EU in particular, higher demand driven wealth owing to highly diversified input requirements are perhaps to be expected, given strict legal regulations regarding food standards, food safety requirements and animal welfare.

In common with Philippidis et al. [

13], this study reveals that supply driven wealth in biobased sectors is relatively weaker (i.e., FL < 1). The explanation for the generally low FL multipliers is that the supply chain for biobased outputs is concentrated into a smaller number of possible outlets and requires relatively less ancillary service support to process and distribute one unit of biobased sector output to end users. As a result, this generates relatively smaller downstream ripple effects throughout the economy. For example, in primary agriculture and biomass supply sectors, the output remains as an unprocessed or raw good, with few alternate uses. Similarly, biofuel is an intermediate product which is solely targeted (via transportation suppliers) to blenders for use in petroleum. An exception to this observation is raw milk with its multiple products (e.g., cheese, butter, skimmed milk powder, whey), which acts as an essential input to numerous downstream processed food activities, thereby exhibiting an above average supply driven multiplier effect.

Cross-referencing employment potential with the regional clusters, a statistically significant difference arises across regional groups, although a ‘strong-bioeconomy-strong-employment’ relationship cannot be clearly established. Indeed, when comparing employment generation multipliers with ‘key sectors’, a clear pattern does not arise, although there is tentative evidence of greater employment potential in agricultural key sectors. Nevertheless, Ronzon and M’barek [

19] observe that of all EU biobased activities, value added per person is lowest in agriculture. Similarly, where we find weak employment multipliers in highly capitalised bioindustrial (particularly biochemicals) and bioenergy sectors, Ronzon and M’barek [

19] report some of the highest levels of value added per worker. Moreover, at the member state level, the finding of Ronzon and M’barek [

19] of lower levels of labour productivity in many Eastern member states is consistent with the view that less affluent regions of the EU28 employ lower skilled, lower remunerated labour, or part time labour, reflecting the less commercial agricultural orientation of the enterprise. Moreover, it should be recognised that comparing employment potentials using multiplier analysis should be reconciled with employment availability. More specifically, in those regions where unemployment rates are already relatively low, the effectiveness of public policies to reallocate labour to alternative (rural) activities is increasingly challenging.

To compare with Fuentes-Saguar et al. [

14], using their 28 output multipliers for ‘bioeconomy’, we calculate aggregate bioeconomy output multiplier for each of the five EU clusters defined in our study, and compare with the EU28 average. To some extent there is a consistency between the ranking of the aggregate output multiplier magnitudes for our five EU typologies and the relative strength of these same regional groupings reported in our analysis. For example, in the strongest group (i.e., ‘Meditterranean’), the regional output multipliers reported in Fuentes-Saguar et al. [

14] of its four EU regions are all above the EU28 average. Similarly, in the weakest (i.e., ‘Isles and Luxembourg’) all three of its EU members’ output multipliers, are below the EU average. Given the equivalence between BL and output multipliers noted in section one, this convergence reflects the dominance of the BL multipliers over the FL multipliers in each of the clusters. On the other hand, whilst the cluster ‘Mainly Eastern’ exhibits higher scoring BL and FL multipliers and more key sectors than ‘Baltic’, it returns a lower average output multiplier. In part, this may be explained by the significantly higher coefficient of variation of the BL multipliers (i.e., there are some high performing large biobased sectors). Similarly, since our regional clusters are also a function of FL multipliers, the presence of, and particularly high coefficient of variation of these structural multipliers in the Baltic cluster also plays a role.

Taken from a policy perspective, a logical conclusion would be to recommend greater investment in the ‘key sectors’ identified in this study. On the other hand, under the auspices of the Common Agricultural Policy (CAP), many of these key sectors (predominantly from agrifood activities) already enjoy considerable public policy support. Moreover, the decision on which sectors to invest rests not only on market performance barometers, but should also respect multiple policy objectives to avoid well-recognised problems of policy incoherence or even conflicts [

1,

20,

21]. For example, in economic terms, raw milk and intensive livestock sectors both feature as strong key sectors, although they are also responsible for generating considerable emissions of non-CO2 non-combustion greenhouse gases [

22,

23].

A further observation relates to the absence of key sector status within the ‘newer’ bioindustrial activities (i.e., chemicals, plastics). This is largely explained by the low commercialisation of biotechnological innovations [

24], which in Europe, is said to be below that of other international competitors [

25]. With the promotion of bioindustry materials seen as a high value-added activity within the cascading model of biomass usage [

1], these (currently underperforming) sectors should be targeted for further investment and improved technology transfer from the public to the private sector, a view shared by policy makers and academia [

1,

26]. Other promotion strategies could focus on public procurement policies as seen in the US, which oblige federal agencies to favour products with greater biobased content [

21]. Similarly, other commentators [

27,

28] extoll the benefits of a ‘petrochemical model’ for bio-refineries, which promotes diversified multiple outputs to withstand market fluctuations in energy markets, whilst Philp [

28] also discusses the role of public institutions in reducing investment risk and enhancing supply chain value added.

Finally, it is interesting to note that the frequency of key sectors reported here diverges considerably from Cardenete et al. [

12] and Philippidis et al. [

13]. Employing SAMs for 2007, Philippidis et al. [

13] only report key sector status for milk and dairy activities, whilst the study of the Spanish economy in the year 2000 by Cardenete et al. [

12] reports a total absence of key sectors. In comparison, 21 of the 53 disaggregated biobased sector backward and forward linkage multipliers from our BioSAM of Spain exhibit key sector status. (These results are available from the authors on request.) On the basis of this evidence, one may be drawn to the conclusion that biobased activities have exhibited greater resilience to the process of structural economic change that has occurred between 2000 [

12], 2007 [

13], and 2010 (this study). At least in the case of agriculture, this finding would be consistent with OECD-FAO [

29], who suggested that with typically lower income elasticities of demand, these sectors have withstood the downturn in consumer confidence arising from the ongoing process of macro adjustment.

5. Conclusions

According to 2014 figures, the biobased sectors in the European Union (EU) account for approximately 2.2 billion euros in turnover and 18.6 million jobs [

30]. Consequently, the bioeconomy strategy has a non-trivial role to play in contributing to a sustainable model of EU wealth and employment. To profile the relative wealth and employment generating properties of biobased activities across sectors and EU regions, a linear CGE model approach with statistical clustering techniques is followed. A key conclusion is that the economic potential of the European Bioeconomy is highly heterogeneous, both across sectors and regional EU clusters. Indeed, the strongest potential bioeconomy wealth generation is reported for the ‘Mainly Eastern’ and ‘Mediterranean’ regions, whilst the weakest is in the ‘Isles & Lux’ region. In all regional clusters, wealth generation is found to be predominantly backward oriented (i.e., demand driven) whilst supply driven wealth in biobased sectors is relatively weak (i.e., FL < 1). In this paper, 12 of the 32 biobased categories considered are key sectors, a significant number of which are from the agrifood industry, whilst none of the more contemporary biobased activities exhibit key sector status. Finally, cross-referencing employment and wealth generating potential within the regional clusters, a ‘strong-bioeconomy-strong-employment’ relationship cannot be statistically established.

On a general cautionary note, the data demands of the SAM are extremely high resulting in datasets, which are often outdated. Consequently, the 2010 structural multipliers presented here do not reflect the resulting structural change, which has occurred in the ensuing period. Moreover, whilst SAM multipliers are useful for analysing the relative structure and influence of different actors within an economic system, the assumption of fixed proportions technologies, which are implicit within such a model, are more characteristic of a shorter time period. For longer term assessments, flexible price CGE model treatments are more adept, where non-linear technology assumptions apply and (plausible) technology change assumptions for nascent biobased technologies are permitted. Finally, to echo the observation of Budzinski et al. [

10], research efforts should continue to be directed toward the construction of economy-wide datasets with even greater representation of the biobased economy in order to further deepen our understanding of the economic contribution of this broad and diverse collective of economic activities.