Impact of Property Tax on Housing-Market Disequilibrium in Different Regions: Evidence from Taiwan for the period 1982–2016

Abstract

1. Introduction

2. Literature Review

2.1. Evidence from Disequilibrium of Housing Markets in Different Regions is Lacking

2.2. Criticism of the Property Tax System of Taiwan

3. Materials and Methods

3.1. Empirical Procedure

3.1.1. First Step: Panel Unit Root to Examine the Stationarity of Variables

3.1.2. Second Step: Autoregressive Distributed Lag Model (ARDL) to Examine the Co-Integration Relationship

3.1.3. Third Step: Two-Stage Least Squares (TLSL) to Estimate Long-Run Model and Seemingly Unrelated Regression Model (SURM) to Examine the Short-RUN Model

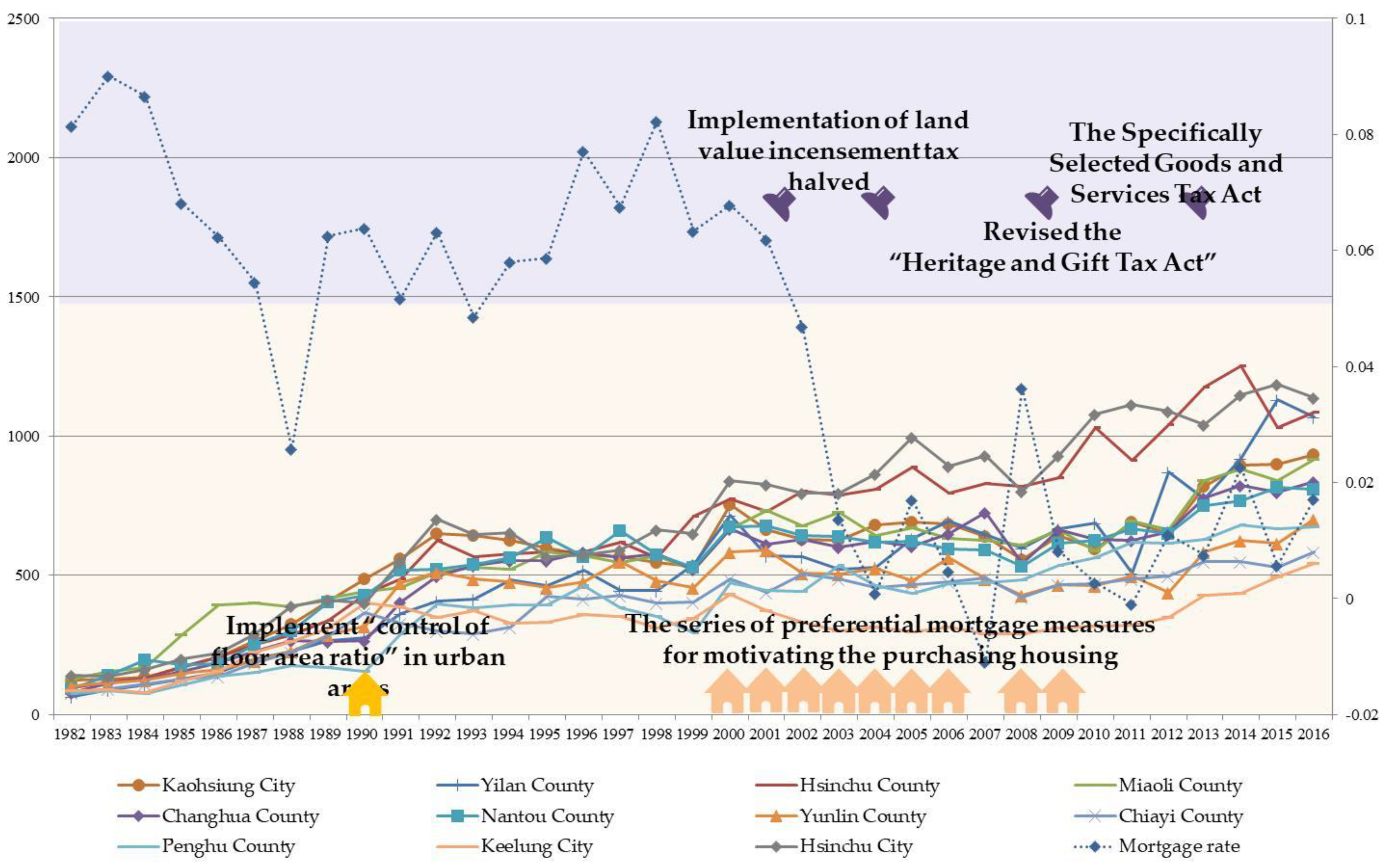

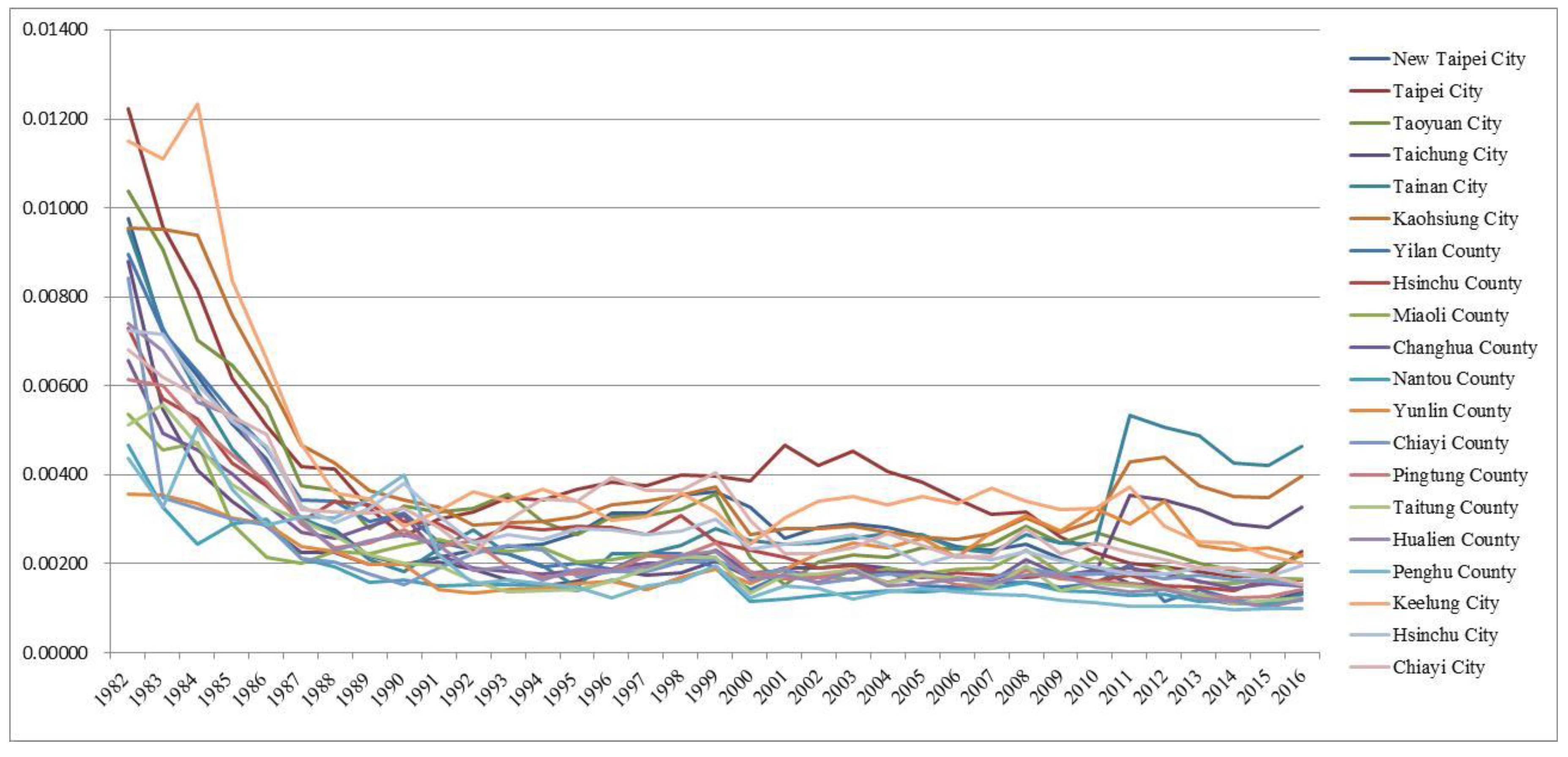

3.2. Empirical Variables

3.3. Empirical Model

3.3.1. Housing Demand Model

3.3.2. Housing Supply Model

4. Results

4.1. Related Test

4.2. Results

5. Discussion

5.1. The Effect of Property Taxation on Housing Demand in Different Regional Markets

5.2. The Effect of Property Tax on Housing Supply in Different Regional Markets

5.3. The Effect of Property Taxation on the Housing-Market Disequilibrium in Different Regions

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Over-Supply Regions | |||||||||

| Demand Side | Supply Side | ||||||||

| HP | DI | MIR | PTR | Correlation | HP | FC | CC | PTR | |

| HP | 1.0000 | 0.7580 | −0.5625 | −0.5750 | HP | 1.0000 | |||

| DI | 0.7580 | 1.0000 | −0.3194 | −0.3747 | FC | −0.5279 | 1.0000 | ||

| MIR | −0.5625 | −0.3194 | 1.0000 | 0.4362 | CC | 0.7364 | −0.7221 | 1.0000 | |

| PTR | −0.5750 | −0.3747 | 0.4362 | 1.0000 | PTR | −0.5750 | 0.4472 | −0.5169 | 1.0000 |

| Under-Supply Regions | |||||||||

| HP | 1.0000 | HP | 1.0000 | ||||||

| DI | 0.7397 | 1.0000 | FC | −0.4404 | 1.0000 | ||||

| MIR | −0.4458 | −0.2231 | 1.0000 | CC | 0.5975 | −0.7221 | 1.0000 | ||

| PTR | −0.3943 | −0.2892 | 0.4896 | 1.0000 | PTR | −0.3943 | 0.5114 | −0.5443 | 1.0000 |

| Over-Supply Regions | ||||||||

| Correlation | HP | HP(−2) | FC(−1) | FC(−2) | CC(−1) | CC(−2) | PTR(−1) | PTR(−2) |

| HP | 1.0000 | |||||||

| HP(−2) | 0.9384 | 1.0000 | ||||||

| FC(−1) | −0.4801 | −0.4814 | 1.0000 | |||||

| FC(−2) | −0.4915 | −0.5004 | 0.7009 | 1.0000 | ||||

| CC(−1) | 0.7024 | 0.7280 | −0.6981 | −0.7657 | 1.0000 | |||

| CC(−2) | 0.7074 | 0.7224 | −0.6787 | −0.7004 | 0.9854 | 1.0000 | ||

| PTR(−1) | −0.5153 | −0.5296 | 0.3985 | 0.4034 | −0.4824 | −0.4720 | 1.0000 | |

| PTR(−2) | −0.5343 | −0.5851 | 0.4184 | 0.4345 | −0.5273 | −0.5084 | 0.9445 | 1.0000 |

| Under-Supply Regions | ||||||||

| HP | 1.0000 | |||||||

| HP(−2) | 0.9407 | 1.0000 | ||||||

| FC(−1) | −0.4063 | −0.3812 | 1.0000 | |||||

| FC(−2) | −0.4333 | −0.4182 | 0.7009 | 1.0000 | ||||

| CC(−1) | 0.5574 | 0.5868 | −0.6981 | −0.7657 | 1.0000 | |||

| CC(−2) | 0.5658 | 0.5870 | −0.6787 | −0.7004 | 0.9854 | 1.0000 | ||

| PTR(−1) | −0.3060 | −0.3485 | 0.4816 | 0.4818 | −0.5241 | −0.5058 | 1.0000 | |

| PTR(−2) | −0.3235 | −0.4074 | 0.4943 | 0.5041 | −0.5664 | −0.5409 | 0.9529 | 1.0000 |

References

- Mieszkowski, P.; Zodrow, G.R. Taxation and the Tiebout model: The differential effects of head taxes, taxes on land rents, and property. J. Econ. Lit. 1989, 27, 1098–1146. [Google Scholar]

- Maxwell, D.; Vigor, A. Time for Land Value Tax? Institute for Public Policy Research: London, UK, 2005. [Google Scholar]

- Bowman, J.H. Property tax policy responses to rapidly rising home values: District of Columbia, Maryland, and Virginia. Nat. Tax J. 2006, 9, 717–733. [Google Scholar] [CrossRef]

- Cocconecelli, L.; Medda, F.R. Boom and bust in the Estonian real estate market and the role of land tax as a buffer. Land Use Policy 2013, 30, 392–400. [Google Scholar] [CrossRef]

- Du, Z.C.; Zhang, L. Home-purchase restriction, property tax and housing price in China: A counterfactual analysis. J. Econom. 2015, 188, 558–568. [Google Scholar] [CrossRef]

- Wenner, F. Sustainable urban development and land value taxation: The case of Estonia. Land Use Policy 2016, 77, 790–880. [Google Scholar] [CrossRef]

- Zheng, X. Expectation, volatility and liquidity in the housing market. Appl. Econ. 2015, 47, 4020–4035. [Google Scholar] [CrossRef]

- Zabel, J. A dynamic model of the housing market: The Role of Vacancies. J. Real Estate Financ. Econ. 2016, 53, 368–391. [Google Scholar] [CrossRef]

- Riddel, M. Housing-market disequilibrium: An examination of housing-market prices and stock dynamic 1967–1998. J. Hous. Econom. 2004, 13, 120–135. [Google Scholar] [CrossRef]

- Riddel, M. Housing market dynamic under stochastic growth: An application to the housing market in Boulder, Colorado. J. Reg. Sci. 2000, 40, 771–788. [Google Scholar] [CrossRef]

- DiPasquale, D.; William, W. Housing market dynamics and the future of housing prices. J. Urban Econ. 1994, 35, 1–27. [Google Scholar] [CrossRef]

- Wigren, R.; Wilhelmsson, M. Housing stock and price adjustments in 12 west European countries between 1976 and 1999. Hous. Theory Soc. 2007, 24, 133–154. [Google Scholar] [CrossRef]

- Stevenson, S.; Young, J. A multiple error-correction model of housing supply. Hous. Stud. 2014, 29, 362–379. [Google Scholar] [CrossRef]

- Jones, T.; Gatzlaff, D.; Sirmans, G.S. Housing Market Dynamics: Disequilibrium, Mortgage Default, and Reverse Mortgages. J. Real Estate Financ. Econ. 2016, 53, 269–281. [Google Scholar] [CrossRef]

- Case, K.E.; Shiller, R.J. The efficiency of the market for single family homes. Am. Econ. Rev. 1989, 79, 125–137. [Google Scholar]

- Mankiw, N.G.; Weil, D.N. The baby boom, the baby bust, and the housing-market. Reg. Sci. Urban Econ. 1989, 19, 235–258. [Google Scholar] [CrossRef]

- Steiner, E. Estimating a stock-flow model for the Swiss housing market. Swiss J. Econ. Stat. 2010, 146, 601–627. [Google Scholar] [CrossRef]

- Caldera, A.; Johansson, A. The price responsiveness of housing supply in OECD countries. J. Hous. Econo. 2013, 22, 231–249. [Google Scholar] [CrossRef]

- Arrazola, M.; Hevia, J.D.; Romero-Jordán, D.; Sanz-Sanz, J.F. Long-run supply and demand elasticities in the Spanish housing market. J. Real Estate Res. 2015, 7, 371–404. [Google Scholar]

- Hwang, M.; Quigley, J.M. Economic fundamentals in local housing markets: Evidence from U.S. metropolitan regions. J. Reg. Sci. 2006, 46, 425–453. [Google Scholar] [CrossRef]

- Lin, T.C. Property tax inequity resulting from inaccurate assessment—The Taiwan experience. Land Use Policy 2010, 27, 511–517. [Google Scholar] [CrossRef]

- Tsai, C.Y. Land tax reform: Land value tax and land value increment tax. Public Financ. Rev. 1997, 29, 77–87. (In Chinese) [Google Scholar]

- Lam, A.H.S.; Tsui, S.W. Policies and Mechanisms on Land Value Capture: Taiwan Case Study. Technical Report. Lincoln Institute of Land Policy, 1998. Available online: https://www.lincolninst.edu/sites/default/files/pubfiles/144_lamtsui98.pdf (accessed on 3 February 2017).

- Hsieh, J.H. Can the land tax reach the equalization of land rights? Public Financ. Rev. 2004, 36, 59–85. (In Chinese) [Google Scholar]

- Peng, C.W.; Wu, S.T.; Wu, S.H. The influences of effective property tax rates on housing values: Evidence from Ta-tung and Nei-hu districts in Taipei city. J. Taiwan Land Res. 2007, 10, 49–66. (In Chinese) [Google Scholar]

- Lin, T.C.; Lin, T.Y. Evaluating the performance of property assessment in the public sector—An equity perspective. J. Hous. Stud. 2008, 17, 63–80. (In Chinese) [Google Scholar]

- Zhuo, H.W. The Housing Market has been Stirring for 50 Years; Wealth Magazine: Taipei City, Taiwan, 2014. (In Chinese) [Google Scholar]

- Chan, N.; Chen, F.Y. A comparison of property taxes and fees in Sydney and Taipei. Prop. Manag. 2011, 29, 146–159. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Peng, C.W. Why is Taiwan’s homeownership rate so high? Urban Stud. 2011, 48, 2887–2904. [Google Scholar] [CrossRef]

- Chen, P.J. The relationship between house prices and credit constraints: Evidence from Taiwan housing markets. Taipei Econ. Inq. 2015, 51, 225–256. (In Chinese) [Google Scholar]

- Wang, H.W. Examine Land Value Tax Equity in Taipei. Public Adm. Policy 2010, 51, 47–76. (In Chinese) [Google Scholar]

- Tsai, C.Y. Land tax in Taiwan: Problems, impact and reforms. J. Prop. Tax Assess. Adm 2001, 6, 81–108. (In Chinese) [Google Scholar]

- Im, K.S.; Pesaran, M.H.; Shin, Y.C. Testing for unit roots in heterogeneous panels. J. Econom. 2002, 115, 53–74. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, C.P.; Chen, P.F. Energy-income causality in OECD countries revisited: The key role of capital stock. Energy Econ. 2005, 30, 2359–2373. [Google Scholar] [CrossRef]

- Ohler, A.; Fetters, I. The causal relationship between renewable electricity generation and GDP growth: A study of energy sources. Energy Econ. 2014, 43, 125–139. [Google Scholar] [CrossRef]

- Akıncı, M.; Akıncı, G.Y.; Yılmaz, Ö. The relationship between central bank independence, financial freedom, and economic growth: A panel ARDL financial bounds testing approach. Cent. Bank Rev. 2015, 15, 1–14. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the Analysis of level relationships. J. Appl. Econ. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A.; Menegaki, A.N. Renewable vs non-renewable electricity and the industrial production nexus: Evidence from an ARDL bounds test approach for Greece. Renew. Energy 2016, 96, 645–655. [Google Scholar] [CrossRef]

- Li, D.H. Households’ movements and the private rented sector in Taiwan. Habitat Int. 2008, 32, 74–85. [Google Scholar] [CrossRef]

- Hua, C.C. An Exploration on Prosperity in Real Estate, Market Mechanism and Policy Studies; Research Report No. OIS893018; Research center on building and construction: Taipei City, Taiwan, 2000. (In Chinese) [Google Scholar]

- Yip, N.M.; Chang, C.O. Housing in Taiwan: State intervention in a market driven housing system. J. Comp. Asian Dev. 2003, 2, 93–113. [Google Scholar] [CrossRef]

- Chen, Y.L. New prospects for social rental housing in Taiwan: The role of housing affordability crises and the housing movement. Int. J. Hous. Policy 2011, 11, 305–318. [Google Scholar] [CrossRef]

- Tsai, I.C.; Peng, C.W. Bubbles in the Taiwan housing market: The determinants and effects. Habitat Int. 2011, 35, 379–390. [Google Scholar] [CrossRef]

- Lin, T.Y. Monetary Policy and the Housing Price, National Science Foundation. Research Report No. NSC 100-2410-H-004-198. 2014. Available online: https://nccur.lib.nccu.edu.tw/bitstream/140.119/52370/1/100-2410-H-004-198.pdf (accessed on 3 April 2017).

- Hakfoort, J.; Matysiak, G. Housing investment in the Nertherlands. Econ. Model. 1997, 14, 501–516. [Google Scholar] [CrossRef]

- Lin, S.J.; Lin, C.C. An estimation of elasticity of housing supply in Taiwan. J. Hous. Stud. 2001, 10, 17–27. (In Chinese) [Google Scholar]

- Chang, C.O.; Chen, M.C. Construction financing in Taiwan: Current state and policy regime. In The Global Financial Crisis and Housing: A New Policy Paradigm; Wacheter, S., Cho, M., Tcha, M.J., Eds.; Edward Elgar: Cheltenham, UK, 2014; pp. 180–207. [Google Scholar]

- Glaser, E.; Gyourko, J.; Saiz, A. Housing supply and housing bubbles. J. Urban Econ. 2008, 64, 198–217. [Google Scholar] [CrossRef]

- Dye, R.F.; England, R.W. Assessing the Theory and Practice of Land Value Taxation. 2010. Available online: http://www.friendsusa.org/uploads/2/3/5/8/23587798/1760_983_assessing-the-theory-and-practice-of-land-value-taxation.pdf (accessed on 3 April 2017).

- Raslanas, S.; Zavadskas, E.K.; Kaklauskas, A. Land value tax in the context of sustainable urban development and assessment. Part II—analysis of land valuation techniques: The case of Vilnius. Int. J. Strat. Prop. Manag. 2010, 14, 173–190. [Google Scholar] [CrossRef]

| Variables | Definition | Data Sources |

|---|---|---|

| Dependent variables | ||

| Housing Demand, | Housing demand = Housing stock/(ownership ratio*number of household) | The data of ownership ratio and number of households from 1982 to 1993 was calculated by authors following the related definition based on Survey of Family Income and Expenditure, and data from 1994 to 2016 from the Report on the Survey of Family Income and Expenditure. |

| Housing stock, | Numbers of housing stock = Prior to housing stock + number of the housing completion − subtract the number of housing demolished | Data from 1991 to 2007 from Housing Statistics, and then data from 1982 to 1990 and 2008 to 2016 were calculated by the same way. |

| Independent variables | ||

| Housing Prices, | Median housing price per household (in NTD 1 million) | Data from 1982 to 1991 from the report on the housing survey in Taiwan area, data from 1992 to 2010 from second-hand real estate transactions prices, and data from 2011 to 2016 from registering the actual selling price. |

| Disposal income, | Median disposal income per household (in NTD) | Data from 1982 to 1997 from the Report on the Survey of Family Income and Expenditure, and 1998 to 2016 from the counties and cities statistics handbook |

| Mortgage rate, | Average mortgage rates of five major banks for purchasing the new housing | Taiwan Economic Journal |

| Effective rate of property tax per household, | Effective rate of property tax per household = (actual land value and housing taxation ÷ ownership – adjusted number of households)/(housing price) | Actual land value and housing taxation from 1982 to 2016 was obtained from the census and statistics report. |

| Financing cost, | Average benchmark interest rate of five major banks for lending | Taiwan Economic Journal |

| Construction cost, | Construction cost index of Taipei city | Taipei’s counties and cities statistics handbook |

| Demand-generated disequilibrium, | Residual from housing demand in long-run model | |

| Supply-generated disequilibrium, | Residual from housing supply in long-run model | |

| Over-Supply Regions | ||||||||

| Variables | Mean | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque–Bera | Obs. |

| HD | 1.1583 | 1.9462 | 0.8232 | 0.1688 | 1.6069 | 6.4291 | 354.3236 *** | 385 |

| HS | 200,732 | 998,052 | 21,802 | 202,474 | 2.5805 | 9.2605 | 1056.0120 *** | 385 |

| HP | 503.5221 | 1250.3940 | 65.8767 | 244.5471 | 0.3241 | 2.9703 | 6.75343 ** | 385 |

| DI | 699,124 | 1,124,580 | 326,855 | 180,407 | 0.0698 | 2.4066 | 5.9609 * | 385 |

| MIR | 0.0422 | 0.0902 | −0.0109 | 0.0297 | −0.1799 | 1.6312 | 32.1308 *** | 385 |

| FC | 0.0457 | 0.0902 | 0.0079 | 0.0249 | 0.0456 | 1.6880 | 27.7470 *** | 385 |

| CC | 72.2826 | 106.1900 | 40.4200 | 21.9423 | 0.1197 | 1.7822 | 24.7092 *** | 385 |

| PTR | 0.0027 | 0.0123 | 0.0010 | 0.0016 | 2.7724 | 12.9149 | 2070.1620 *** | 385 |

| Under-Supply Regions | ||||||||

| HD | 1.2117 | 1.8105 | 0.1157 | 0.1839 | −0.5817 | 9.0329 | 495.4563 *** | 315 |

| HS | 453,859 | 1,441,727 | 50,890 | 369,738 | 0.7404 | 2.7511 | 29.5937 **** | 315 |

| HP | 571.7096 | 2398.2730 | 59.6291 | 350.7525 | 1.9590 | 10.0029 | 845.1277 *** | 315 |

| DI | 755477 | 1,298,557 | 346,347 | 219,817 | 0.3167 | 2.6874 | 6.5498 ** | 315 |

| MIR | 0.0422 | 0.0902 | −0.0109 | 0.0297 | −0.1799 | 1.6312 | 26.2888 *** | 315 |

| FC | 0.0457 | 0.0902 | 0.0079 | 0.0249 | 0.0456 | 1.6880 | 22.7021 *** | 315 |

| CC | 72.2826 | 106.1900 | 40.4200 | 21.9487 | 0.1197 | 1.7822 | 20.2166 *** | 315 |

| PTR | 0.0029 | 0.0122 | 0.0010 | 0.0017 | 2.2113 | 9.0964 | 744.5079 *** | 315 |

| Over-Supply Regions | Under-Supply Regions | |||

|---|---|---|---|---|

| Level | Differences | Level | Differences | |

| HD | −4.7197 *** | −21.4144 *** | −3.8789 *** | −14.5667 *** |

| HS | 2.8783 | −8.4047 *** | 2.5710 | −10.1195 *** |

| HP | −1.4521 * | −18.4144 *** | 0.0917 | −12.6655 *** |

| DI | 1.2955 | −24.0873 *** | 2.3266 | −14.3581 *** |

| MIR | −3.0847 *** | −23.2942 *** | −2.7902 ** | −21.0704 *** |

| FC | −5.2941 *** | −22.7287 *** | −4.7887 *** | −20.5588 *** |

| CC | 1.2145 | −12.9718 *** | 1.0986 | −11.7335 *** |

| PTR | −9.2067 *** | −13.5144 **** | −8.1525 *** | −11.3633 *** |

| Over-Supply Regions | Under-Supply Regions | |||||||

|---|---|---|---|---|---|---|---|---|

| Demand Side (Dependent Variable = HD) | Supply Side (Dependent Variable = HS) | Demand Side (Dependent Variable = HD) | Supply Side (Dependent Variable = HS) | |||||

| Variable | Panel 1 | Panel 2 | Panel 3 | Panel 4 | Panel 5 | Panel 6 | Panel 7 | Panel 8 |

| HP | −0.0947 *** | −0.1354 *** | 0.5851 * | 0.7840 * | −0.0662 * | −0.1236 ** | 0.7185 ** | 1.1498 * |

| DI | 0.9610 | 0.0012 | −0.2180 *** | −0.2228 *** | ||||

| MIR | 0.0223 | 0.8578 *** | 0.0975 | 0.0729 | ||||

| FC | −0.2326 | −0.4233 | −1.0004 | −1.0686 | ||||

| CC | −0.1216 | −0.2157 | −0.2899 | −0.7810 | ||||

| PTR | −14.1705 | 120.5529 | −28.1383 | 45.0861 | ||||

| C | 1.9932 *** | 1.9665 *** | 8.8395 *** | 7.7277 *** | 4.5571 *** | 5.0555 *** | 9.4096 *** | 8.6983 *** |

| Adjusted R2 | 0.7372 | 0.7267 | 0.9773 | 0.9456 | 0.5080 | 0.5070 | 0.7646 | 0.8092 |

| Sample | 374 | 374 | 374 | 374 | 306 | 306 | 306 | 306 |

| Over-Supply Regions | Under-Supply Regions | |||||||

|---|---|---|---|---|---|---|---|---|

| Demand Side | Supply Side | Demand Side | Supply Side | |||||

| Variable | Panel 1 | Panel 2 | Panel 3 | Panel 4 | Panel 5 | Panel 6 | Panel 7 | Panel 8 |

| △DI | 0.4232 *** | 0.2314 *** | 0.8027 *** | 0.5069 *** | ||||

| △HS(−1) | −0.1652 | −0.1717 | −0.6532 ** | −0.6761 *** | ||||

| △MIR | 0.1400 | 0.2671 | −0.3761 | −0.3772 | ||||

| △CC | −0.2985 ** | −0.0523 | −0.2020 | −0.0563 | ||||

| △HP | −0.0035 | −0.0075 | 0.0116 | 0.0072 | ||||

| △HP(−2) | 0.0118 | 0.0114 | −0.0096 | −0.0390 ** | ||||

| △FC(−1) | 0.0494 | 0.0533 | 0.1582 | 0.2022 ** | ||||

| △FC(−2) | −0.1001 | −0.0958 | −0.2404 ** | −0.1641 | ||||

| △CC(−1) | −0.0005 | −0.0004 | −0.0014 | −0.0005 | ||||

| △CC(−2) | 0.0002 | 0.0003 | −0.0005 | −0.0003 | ||||

| △PTR | −208.6405 *** | −186.8485 *** | ||||||

| △PTR(−1) | −1.0395 | −18.0653 *** | ||||||

| △PTR(−2) | −0.1283 | −4.1260 | ||||||

| Demand-generated disequilibrium | −0.0551 | −0.0752 | −0.0055 | −0.0126 | −0.0455 | −0.0652 | 0.0053 | 0.0022 |

| Supply-generated disequilibrium | 0.2732 *** | 0.1488 *** | −0.0271 *** | −0.0294 *** | 0.1877 *** | 0.0230 | −0.0254 ** | −0.0279 *** |

| C | 0.0620 *** | 0.0347 *** | 0.0143 *** | 0.0143 *** | 0.0670 *** | 0.0418 *** | 0.0209 *** | 0.0178 *** |

| Adjusted R2 | 0.2075 | 0.6522 | 0.0763 | 0.0817 | 0.3165 | 0.6674 | 0.0734 | 0.1748 |

| Data | 363 | 363 | 352 | 352 | 297 | 297 | 297 | 297 |

| Housing Demand | Housing Supply | |

|---|---|---|

| Demand-generated disequilibrium | −* Boulder Colorado, USA [10] −* USA [9] −◆ 12 West European countries [12] −* Irish [13] − Over-supply regions in Taiwan − Under-supply regions in Taiwan | − Boulder Colorado, USA [10] − USA [9] −◆ 12 West European countries [12] − Irish [13] − Over-supply regions in Taiwan − Under-supply regions in Taiwan |

| Supply-generated disequilibrium | + Boulder Colorado, USA [10] +* USA [9] −♦ 12 West European countries [12] +* Irish [13] +* Over-supply regions in Taiwan +* Under-supply regions in Taiwan | −* Boulder Colorado, USA [10] −* USA [9] −♦ 12 West European countries [12] −* Irish [13] −* Over-supply regions in Taiwan −* Under-supply regions in Taiwan |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, S.-H.; Li, J.-H.; Hsieh, J.-C.; Huang, X.; Chen, J.-T. Impact of Property Tax on Housing-Market Disequilibrium in Different Regions: Evidence from Taiwan for the period 1982–2016. Sustainability 2018, 10, 4318. https://doi.org/10.3390/su10114318

Lin S-H, Li J-H, Hsieh J-C, Huang X, Chen J-T. Impact of Property Tax on Housing-Market Disequilibrium in Different Regions: Evidence from Taiwan for the period 1982–2016. Sustainability. 2018; 10(11):4318. https://doi.org/10.3390/su10114318

Chicago/Turabian StyleLin, Sheng-Hau, Jia-Hsun Li, Jing-Chzi Hsieh, Xianjin Huang, and Jia-Tsong Chen. 2018. "Impact of Property Tax on Housing-Market Disequilibrium in Different Regions: Evidence from Taiwan for the period 1982–2016" Sustainability 10, no. 11: 4318. https://doi.org/10.3390/su10114318

APA StyleLin, S.-H., Li, J.-H., Hsieh, J.-C., Huang, X., & Chen, J.-T. (2018). Impact of Property Tax on Housing-Market Disequilibrium in Different Regions: Evidence from Taiwan for the period 1982–2016. Sustainability, 10(11), 4318. https://doi.org/10.3390/su10114318