Risk Assessment of Ex-Post Transaction Cost in Construction Projects Using Structural Equation Modeling

Abstract

1. Introduction

2. Literature Review

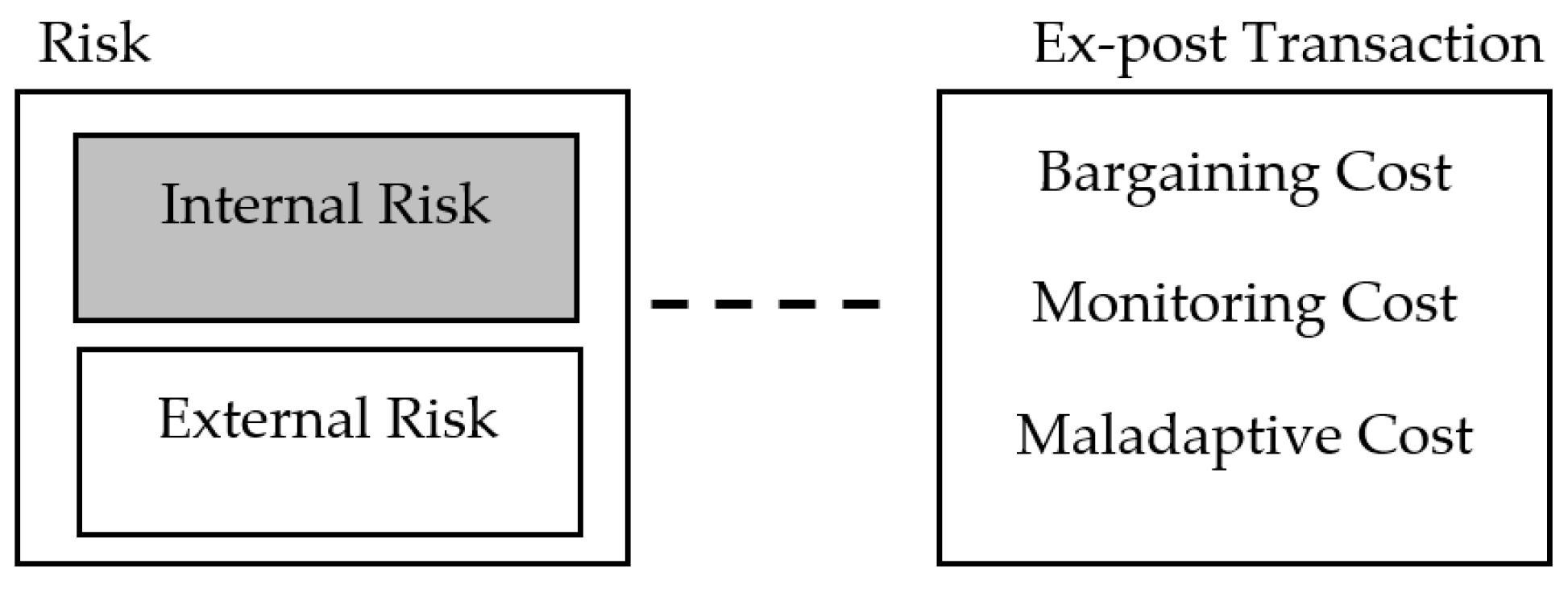

2.1. Risk Identification for Ex-Post Transaction Cost

2.1.1. Internal Risk for Ex-Post Transaction Cost

2.1.2. External Risk and Ex-Post Transaction Cost

2.2. Classification of Ex-Post Transaction Cost

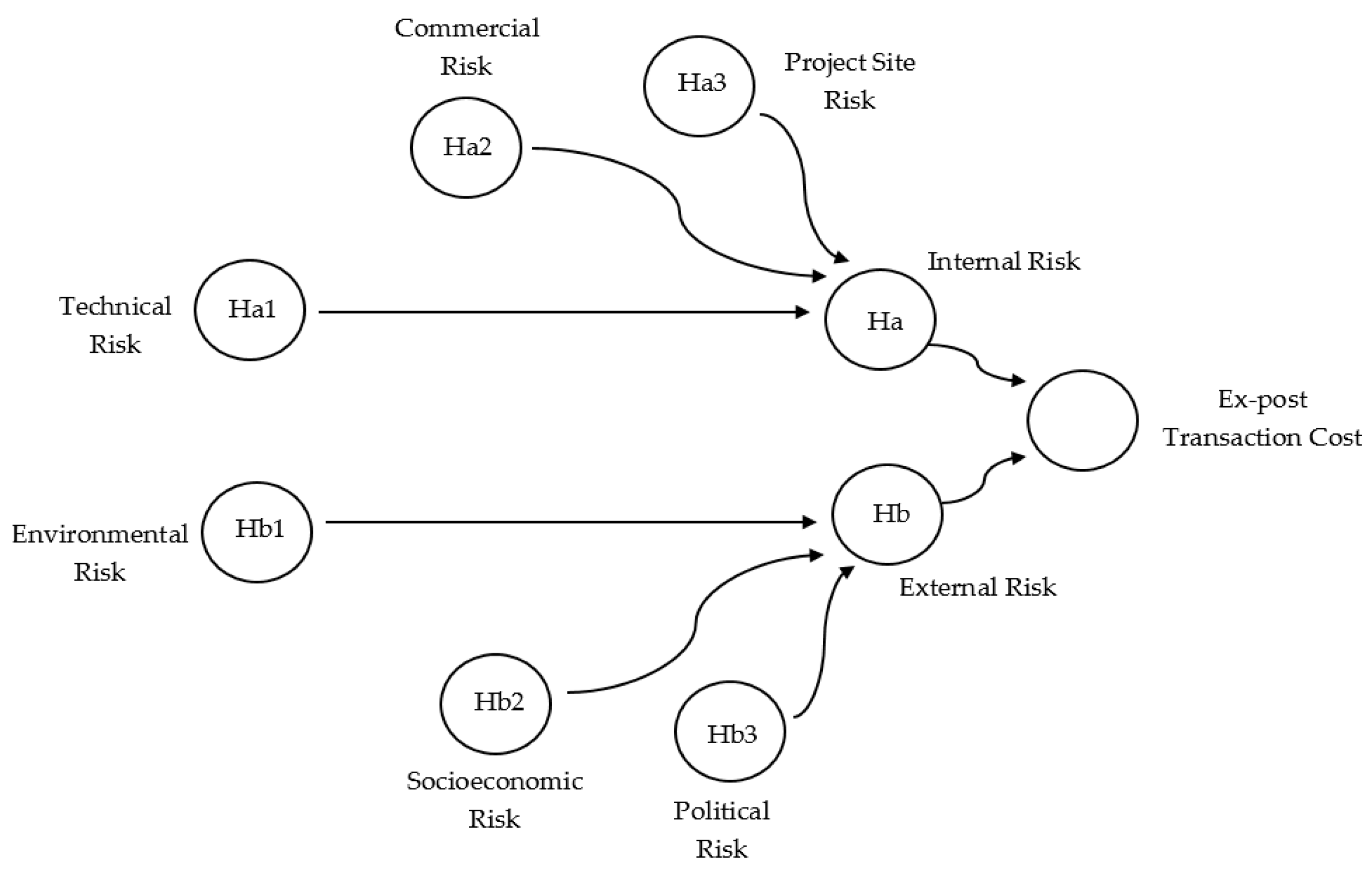

2.3. Conceptual Model and Hypothesis Development

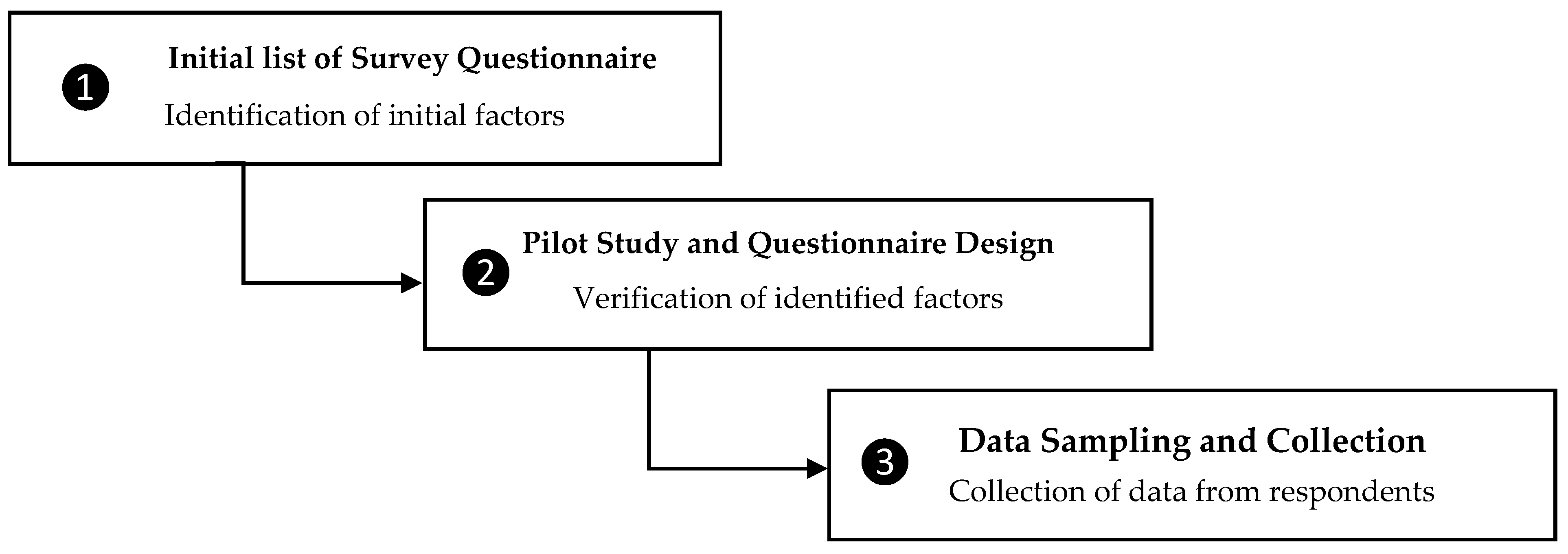

3. Research Methodology

3.1. Initial List of Survey Questionnaire

3.2. Pilot Study and Questionnaire Design

3.3. Data Sampling and Collection Procedure

4. Data Analysis

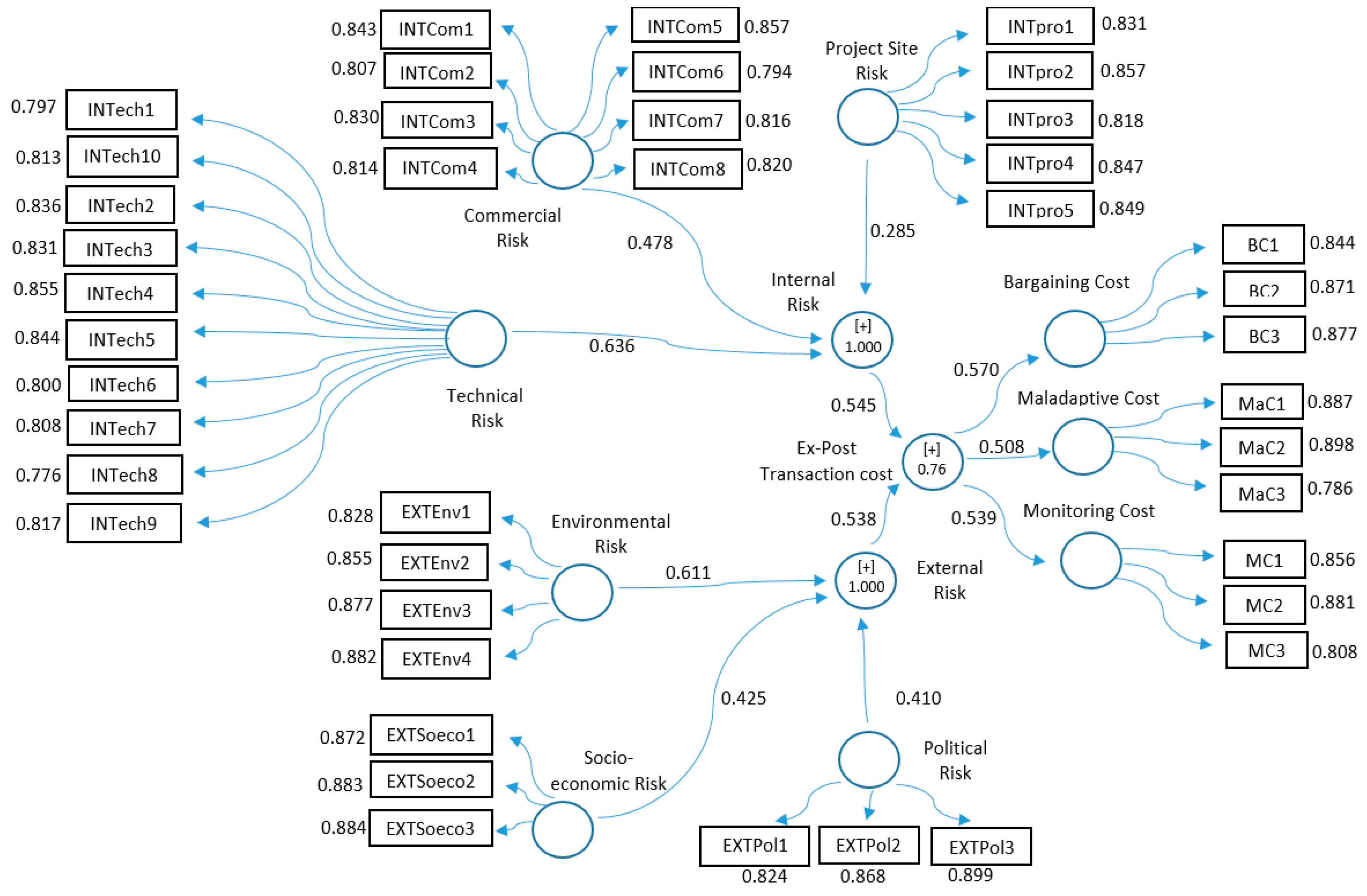

4.1. Measurement Model Assessment

4.2. Structural Model Assessment

4.2.1. The Coefficient of Determination (R2) Analysis

4.2.2. Path Coefficient Estimation and T-Test Estimation

4.2.3. Predictive Relevance (Q2)

4.2.4. Goodness-of-Fit Analysis (GOF)

5. Discussion

6. Conclusions

- Both the technical risk and environmental risk are very critical to escalate TC. The internal risk is a controllable risk. The owner can mitigate internal risk by concentrating on the procurement management to deal with the technical issue. This study found that factors, such as the procurement approach effect, competitive tendering process, and realistic cost estimation in the procurement phase, are more significant to control ex-post TC escalation. The risk of the procurement approach effect, if not adequately addressed, results in all project risk being transferred to the trading partner. The partner offsets the risk opportunistically with markup claims during an uncertainty situation, hence the risk of TC escalates. In this situation, human skills are fundamental to deal with technical issues. For instance, the competitive tendering process needs to incorporate correct details analysis and investigation of contractors before contracting the projects. Similarly, the environmental risk was also found to significantly escalate TC. To overcome the influence of risk from the uncontrollable environment, owners should discourage opportunistic contractors through strict policies on the written contingency clauses. This control can be further strengthened if formal and informal supervisory mechanisms are adapted to stop the opportunistic contractor from getting unjustified compensatory claims.

- In project risks, mitigation requires risk classification and an understanding of the magnitude of all risks from different sources. This study has classified the sources of risk and confirm that the most important sources of risk are derived from technical and environmental origins. The project participants can focus on these critical sources of risk and rank them to make a possible strategy to mitigate it. The project designer can bear some additional ex-ante TC on each source of risk to reduce ex-post TC escalation.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Jaafari, A. Management of risks, uncertainties and opportunities on projects: Time for a fundamental shift. Int. J. Proj. Manag. 2001, 19, 89–101. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting; The Free Press: New York, NY, USA, 1985; ISBN 002934820X. [Google Scholar]

- Whittington, J. When to partner for public infrastructure?: Transaction cost evaluation of design-build delivery. J. Am. Plan. Assoc. 2012, 78, 269–285. [Google Scholar] [CrossRef]

- Arditi, D.; Pulket, T. Predicting the outcome of construction litigation using an integrated artificial intelligence model. J. Comput. Civ. Eng. 2009, 24, 73–80. [Google Scholar] [CrossRef]

- Shane, J.S.; Molenaar, K.R.; Anderson, S.; Schexnayder, C. Construction Project Cost Escalation Factors. J. Manag. Eng. 2009, 25, 221–229. [Google Scholar] [CrossRef]

- Gkritza, K.; Labi, S. Estimating Cost Discrepancies in Highway Contracts: Multistep Econometric Approach. J. Constr. Eng. Manag. 2008, 134, 953–962. [Google Scholar] [CrossRef]

- Hallikas, J.; Virolainen, V.; Tuominen, M. Understanding risk and uncertainty in supplier networks—A transaction cost approach. Int. J. Prod. Res. 2010, 7543. [Google Scholar] [CrossRef]

- Lu, W.; Zhang, L.; Pan, J. Identification and analyses of hidden transaction costs in project dispute resolutions. Int. J. Proj. Manag. 2015, 33, 711–718. [Google Scholar] [CrossRef]

- KarimiAzari, A.; Mousavi, N.; Mousavi, S.F.; Hosseini, S. Risk assessment model selection in construction industry. Expert Syst. Appl. 2011, 38, 9105–9111. [Google Scholar] [CrossRef]

- Jobin, D. A Transaction cost-based approach to partnerships perfromance evaluation. Evaluation 2008, 14, 437–465. [Google Scholar] [CrossRef]

- Manu, E.; Ankrah, N.; Chinyio, E.; Proverbs, D. Trust influencing factors in main contractor and subcontractor relationships during projects. Int. J. Proj. Manag. 2015, 33, 1495–1508. [Google Scholar] [CrossRef]

- Lee, H.; Seo, J.; Park, M.; Asce, M.; Ryu, H.; Kwon, S. Transaction-Cost-Based Selection of Appropriate General Contractor-Subcontractor Relationship Type. J. Constr. Eng. Manag. 2009, 135, 1232–1240. [Google Scholar] [CrossRef]

- Soliño, A.S.; de Santos, P.G. Transaction costs in transport public-private partnerships: Comparing procurement procedures. Transp. Rev. 2010, 30, 389–406. [Google Scholar] [CrossRef]

- Farajian, M. Transaction Cost Model for Infrastructure Public Private Partnerships in the US. Master’s Thesis, University of Maryland, College Park, MD, USA, 2010. [Google Scholar]

- Li, H.; Arditi, D.; Zang, Z. Factors that affect transaction costs in construction projects. J. Constr. Eng. Manag. 2013, 139, 60–68. [Google Scholar] [CrossRef]

- Guo, L.; Li, H.; Li, P.; Zhang, C. Transaction costs in construction projects under uncertainty. Kybernetes 2016, 45, 866–883. [Google Scholar] [CrossRef]

- Creedy, G.D.; Skitmore, M.; Wong, J.K.W. Evaluation of Risk Factors Leading to Cost Overrun in Delivery of Highway Construction Projects. J. Constr. Eng. Manag. 2011, 136, 528–537. [Google Scholar] [CrossRef]

- El-Sayegh, S.M.; Mansour, M.H. Risk Assessment and Allocation in Highway Construction Projects in the UAE. J. Manag. Eng. 2015, 31, 04015004. [Google Scholar] [CrossRef]

- El-Sayegh, S.M. Risk assessment and allocation in the UAE construction industry. Int. J. Proj. Manag. 2008, 26, 431–438. [Google Scholar] [CrossRef]

- Chang, A.S.-T. Reasons for Cost and Schedule Increase for Engineering Design Projects. J. Manag. Eng. 2002. [Google Scholar] [CrossRef]

- Li, H.; Arditi, D.; Wang, Z. Transaction costs incurred by construction owners. Eng. Constr. Archit. Manag. 2014, 21, 444–458. [Google Scholar] [CrossRef]

- Rasheli, G.A.; Rasheli, G.A. Procurement contract management in the local government authorities ( LGAs) in Tanzania A transaction cost approach. Int. J. Public Sect. Manag. 2016, 29, 545–564. [Google Scholar] [CrossRef]

- Whittington, J.M. The transaction Cost Economics of Highway Project Delivery: Design-Build Contracting in Three States. Ph.D. Dissertation, University of California, Berkeley, CA, USA, 2008. [Google Scholar]

- Hussain, S.; Fangwei, Z.; Siddiqi, A.F.; Ali, Z.; Shabbir, M.S. Structural Equation Model for Evaluating Factors Affecting Quality of Social Infrastructure Projects. Sustainability 2018, 10, 1415. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Los Angeles, CA, USA, 2016; ISBN 978-1483377445. [Google Scholar]

- Hussain, S.; Zhu, F.; Ali, Z.; Xu, X. Rural residents’ perception of construction project delays in Pakistan. Sustainability 2017, 9, 2108. [Google Scholar] [CrossRef]

- Mentis, M. Managing project risks and uncertainties. Mentis For. Ecosyst. 2015, 2. [Google Scholar] [CrossRef]

- Brown, T.L.; Potoski, M. TRANSACTION COSTS and Conracting: The Practitioner Perspective. Public Perform. Manag. Rev. 2005, 28, 326–351. [Google Scholar] [CrossRef]

- Sfakianaki, E.; Iliadis, T.; Zafeiris, E. Crisis management under an economic recession in construction: The Greek case. Int. J. Manag. Decis. Mak. 2015, 14, 373. [Google Scholar] [CrossRef]

- Perminova, O.; Gustafsson, M.; Wikstrom, K. Defining uncertainty in projects—A new perspective. Int. J. Proj. Manag. 2008, 26, 73–79. [Google Scholar] [CrossRef]

- Siemiatycki, M. Cost Overruns on Infrastructure Projects: Patterns, Causes, and Cures; Institute of Muncipal Finance & Governance (IMFG): Toronto, ON, Canada, 2015.

- Winch, G.; Leiringer, R. Owner project capabilities for infrastructure development: A review and development of the “strong owner” concept. Int. J. Proj. Manag. 2016, 34, 271–281. [Google Scholar] [CrossRef]

- Ozorhon, B.; Arditi, D.; Dikmen, I.; Birgonul, M. Performance of International Joint Ventures in Construction. J. Manag. Eng. 2010, 26, 209–222. [Google Scholar] [CrossRef]

- Silva, H. De Using ICT to reduce transaction costs in agriculture through better communication: A case study from Sri Lanka. LIRNEasia, Colombo Sri Lanka 2008. [Google Scholar] [CrossRef]

- Li, H.; Arditi, D.; Wang, Z. Determinants of transaction costs in construction projects. J. Civ. Eng. Manag. 2015, 21, 548–558. [Google Scholar] [CrossRef]

- Sambasivan, M.; Deepak, T.J.; Salim, A.N.; Ponniah, V. Analysis of delays in Tanzanian construction industry. Eng. Constr. Archit. Manag. 2017, 24, 308–325. [Google Scholar] [CrossRef]

- Alaloul, W.S.; Liew, M.S.; Amila, N.; Abdullah, W. Identification of coordination factors affecting building projects performance. Alexandria Eng. J. 2016, 55, 2689–2698. [Google Scholar] [CrossRef]

- OGP. Cost Control: Price Variation Clauses; Offiice of Government procurment (OGP), Department of Public expenditure and Reforms, Governmet of Dublin: Dublin, Ireland, 2016.

- Chaturvedi, S.; Thakkar, J.J.; Shankar, R. Labor productivity in the construction industry: An evaluation framework for causal. Benchmarking Int. J. 2018, 25, 334–356. [Google Scholar] [CrossRef]

- Semple, C.; Hartman, F.T.; Jergeas, G. Construction Claims and Disputes: Causes and Cost/Time Overruns. J. Constr. Eng. Manag. 1994, 120, 785–795. [Google Scholar] [CrossRef]

- Krajangsri, T.; Pongpeng, J. Effect of Sustainable Infrastructure Assessments on Construction Project Success Using Structural Equation Modeling. J. Manag. Eng. 2016, 33, 4016056. [Google Scholar] [CrossRef]

- Yean, F.; Ling, Y.; To, V.; Hoang, P. Political, Economic, and Legal Risks Faced in International Projects: Case Study of Vietnam. J. Prof. Issues Eng. Educ. Pract. 2010, 136, 156–164. [Google Scholar]

- Cheung, S.O.; Pang, K.H.Y. Anatomy of Construction Disputes. J. Constr. Eng. Manag. 2013, 139, 15–23. [Google Scholar] [CrossRef]

- Chang, T.; Deng, X.; Hwang, B.; Zhao, X. Political Risk Paths in International Construction Projects: Case Study from Chinese Construction Enterprises. Adv. Civ. Eng. 2018, 2018, 6939828. [Google Scholar] [CrossRef]

- Adeleke, A.Q.; Bahaudin, A.Y.; Kamaruddeen, A.M.; Bamgbade, J.A.; Salimon, M.G.; Khan, M.W.A.; Sorooshian, S. The Influence of Organizational External Factors on Construction Risk Management among Nigerian Construction Companies. Saf. Health Work 2018, 9, 115–124. [Google Scholar] [CrossRef] [PubMed]

- Ho, S.P.; Asce, A.M.; Levitt, R.; Asce, D.M.; Tsui, C.; Hsu, Y. Opportunism-focused transaction cost analysis of public-private partnerships. J. Manag. Eng. 2015, 31, 1–11. [Google Scholar] [CrossRef]

- Dahlstrom, R.; Nygaard, A. Empirical Investigation of in Ex Post Transaction Costs Distribution Channels Franchised. J. Mark. Res. 1999, 36, 160–170. [Google Scholar] [CrossRef]

- Becker, J.; Klein, K.; Wetzels, M. Hierarchical Latent Variable Models in PLS-SEM: Guidelines for Using Reflective-Formative Type Models. Long Range Plan. 2012, 45, 359–394. [Google Scholar] [CrossRef]

- Ali, F.; Rasoolimanesh, S.M.; Sarstedt, M.; Ringle, C.M.; Ryu, K. An assessment of the use of partial least squares structural equation modeling (PLS-SEM) in hospitality research. Int. J. Contemp. Hosp. Manag. 2018, 30, 514–538. [Google Scholar] [CrossRef]

- Tech, I.; Social, B.; Survey, A.; Rabe-hesketh, S.; Skrondal, A.; Rabe-hesketh, S.; Hall, T. Generalized multilevel structural equation modeling. Psychometrika 2004, 69, 167–190. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Shah, S.; Ahmad, N.; Shen, Y.; Pirdavani, A.; Basheer, M.; Brijs, T. Road Safety Risk Assessment: An Analysis of Transport Policy and Management for Low-, Middle-, and High-Income Asian Countries. Sustainability 2018, 10, 389. [Google Scholar] [CrossRef]

- Eybpoosh, M.; Dikmen, I.; Birgonul, M.T. Identification of risk paths in international construction projects using structural equation modeling. J. Constr. Eng. Manag. 2011, 137, 1164–1175. [Google Scholar] [CrossRef]

- Fukunaga, K.; Huffman, W.E. The role of risk and transaction costs in contract design: Evidence from farmland lease contracts in U.S. agriculture. Am. J. Agric. Econ. 2009, 91, 237–249. [Google Scholar] [CrossRef]

- Li, M.; Li, Q.; Deng, X. Transaction Cost Analysis of PPP Risk Share. In International Conference on Construction and Real Estate Management; QUT, Digital Repository: Toronto, ON, Canada, 2008; pp. 4–5. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 7th ed.; Pearson Education Limited: London, UK, 2016. [Google Scholar]

- Ye, G.; Jin, Z.; Xia, B.; Skitmore, M. Analyzing Causes for Reworks in Construction Projects in China. J. Manag. Eng. 2015, 31, 04014097. [Google Scholar] [CrossRef]

- Günhan, S.; Arditi, D.; Doyle, J. Avoiding Change Orders in Public School Construction. J. Prof. Issues Eng. Educ. Pract. 2007, 133, 67–73. [Google Scholar] [CrossRef]

- Assaf, S.; Hassanain, M.A.; Al-zahrani, S. Causes of Contractors’ Failure in Industrial Projects in Saudi Arabia Causes of Contractors’ Failure in Industrial Projects in Saudi Arabia. Res. J. Appl. Sci. Eng. Technol. 2015, 9, 158–164. [Google Scholar] [CrossRef]

- Love, P.E.D.; Edwards, D.J.; Smith, J.; Walker, D.H.T. Divergence or Congruence? A Path Model of Rework for Building and Civil Engineering Projects. J. Perform. Constr. Facil. 2009, 23, 480–488. [Google Scholar] [CrossRef]

- Babbie, E. The Practice of Social Research, 13th ed.; Wadsworth, Cengage Learning: Belmont, CA, USA, 2013. [Google Scholar]

- Ullman, J.B.; Bentler, P.M. Structural Equation Modeling. In Handbook of Psychology, 2nd ed.; Weiner, I.B., Ed.; Wiley Online Library: New York, NY, USA, 2013. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. Adv. Int. Mark. 2009, 20, 277–319. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M.; Mena, J.A. An assessment of the use of partial least squares structural equation modeling in marketing research. J. Acad. Mark. Sci. 2012, 40, 414–433. [Google Scholar] [CrossRef]

- Ringle, C.M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Tenenhaus, M.; Vinzi, V.E.; Chatelin, Y.-M.; Lauro, C. PLS path modeling. Comput. Stat. Data Anal. 2005, 48, 159–205. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Barber, R.B. Understanding internally generated risks in projects. Int. J. Proj. Manag. 2005, 23, 584–590. [Google Scholar] [CrossRef]

- Hughes, W.; Hillebrandt, P.; Greenwood, D.; Kwawu, W. Procurement in the Construction Industry: The Impact and Cost of Alternative Market and Supply Processes; Taylor & Francis: London, UK; New York, NY, USA, 2006. [Google Scholar]

- Kapelko, M.; Oude, A.; Stefanou, S.E. Assessing dynamic inefficiency of the Spanish construction sector pre- and post-financial crisis. Eur. J. Oper. Res. 2014, 237, 349–357. [Google Scholar] [CrossRef]

- Ferris, J.M.; Graddy, E. Production Costs, Transactions Costs and Local Government Contractor Choice. Econ. Inq. 1989, 29, 541–554. [Google Scholar] [CrossRef]

- Laptali, E.; Erdis, E. Crisis management in Turkish construction industry. Build. Environ. 2006, 41, 1498–1503. [Google Scholar] [CrossRef]

- Maqbool, R.; Sudong, Y. Critical success factors for renewable energy projects; empirical evidence from Pakistan. J. Clean. Prod. 2018, 195, 991–1002. [Google Scholar] [CrossRef]

- Brown, T.L.; Potoski, M. Managing Contract Performance: A Transaction Costs Approach. J. Policy Anal. Manag. 2003, 22, 275–297. [Google Scholar] [CrossRef]

- Chou, J.; Pramudawardhani, D. Cross-country comparisons of key drivers, critical success factors and risk allocation for public-private partnership projects. Int. J. Project Manag. 2015, 33, 1136–1150. [Google Scholar] [CrossRef]

| Risk Factors | Code | References |

|---|---|---|

| Internal Risk | ||

| Technical Risk | ||

| Ambiguous contract provisions | INTTech1 | [5] |

| Poor project estimation | INTTech2 | [5] |

| Scope vagueness | INTTech3 | [57] |

| Procurement approach effect | INTTech4 | [5] |

| Competitive Tendering | INTTech5 | [14] |

| Contract document conflicts | INTTech6 | [20] |

| Change orders | INTTech7 | [58] |

| Project design errors | INTTech8 | [6] |

| Inadequate investigation and preparation | INTTech9 | [31] |

| Project schedule changes | INTTech10 | [5] |

| Commercial Risk | ||

| Quality of communication | INTCom1 | [34] |

| Qualification of contractor | INTCom2 | [21] |

| Conflict Management | INTCom3 | [35] |

| Monitoring and control | INTCom4 | [10] |

| Delay payments | INTCom5 | [33] |

| Environmental instability | INTCom6 | [14] |

| Incentive Payments | INTCom7 | [31] |

| Coordination cost | INTCom8 | [10] |

| Project Site Risk | ||

| Material and Labor shortage | INTPro1 | [6] |

| Poor contract management | INTPro2 | [59] |

| Faulty scheduling | INTPro3 | [20] |

| Project Uncertainty | INTPro4 | [15] |

| Frequency of claims | INTPro5 | [15] |

| External Risk | ||

| Environmental Risk | ||

| Labor strike | EXTEnv1 | [39] |

| Project stability | EXTEvn2 | [6] |

| Unforeseen events | EXTEvn3 | [5] |

| Unforeseen conditions | EXTEvn4 | [5] |

| Socio-Economic Risk | ||

| Criminal act | EXTSoeco1 | [19] |

| Inflation | EXTSoeco2 | [19] |

| Local stakeholders’ concerns | EXTSoeco3 | [5] |

| Political Risk | ||

| Change of Regulation | EXTPol1 | [43] |

| Political Uncertainty | EXTPol2 | [29,44] |

| Political force Majeure | EXTpol3 | [1,45] |

| Ex-post Transaction cost | ||

| Monitoring cost | MC | |

| Cost for monitoring citizen and civil societies’ complaints | - | [28] |

| Cost for analyzing the contractor data | - | [28] |

| Cost for contractor’s auditing | - | [28] |

| Maladaptive Cost | MaC | |

| Errors in project documentation | - | [5,60] |

| Contract documents conflict | - | [20] |

| Incomplete design and specifications | - | [43] |

| Bargaining Cost | BC | |

| Design changes | - | [58] |

| Work Acceleration | - | [4] |

| Extra work | - | [40] |

| Total No | Percentage | ||

|---|---|---|---|

| Experience | Years 5> | 103 | 22 |

| 10> | 302 | 64 | |

| 20> | 70 | 15 | |

| Qualification | PhD | 0 | 0 |

| Masters | 98 | 21 | |

| Bachelors | 345 | 73 | |

| Diploma | 32 | 7 | |

| Designation | Executive Engineer | 45 | 9 |

| Project Manager | 72 | 15 | |

| Project Engineer | 150 | 32 | |

| Associate Engineers | 101 | 21 | |

| Architects | 40 | 8 | |

| Consultants | 67 | 14 | |

| Organizations | PWD | 136 | 29 |

| WAPDA | 221 | 47 | |

| CDA | 118 | 25 | |

| Item | Loading | Cronbach’s Alpha | (AVE) | CR | |

|---|---|---|---|---|---|

| Bargaining Cost | BC1 | 0.843 | 0.830 | 0.747 | 0.899 |

| BC2 | 0.873 | - | - | - | |

| BC3 | 0.876 | - | - | - | |

| Maladaptive Cost | MC1 | 0.858 | 0.820 | 0.737 | 0.893 |

| MC2 | 0.883 | - | - | - | |

| MC3 | 0.802 | - | - | - | |

| Monitoring Cost | MaC1 | 0.888 | 0.805 | 0.720 | 0.885 |

| MaC2 | 0.899 | - | - | - | |

| MaC3 | 0.783 | - | - | - | |

| Technical Risk | INTTech1 | 0.797 | 0.945 | 0.669 | 0.953 |

| INTTech2 | 0.836 | - | - | - | |

| INTTech3 | 0.832 | - | - | - | |

| INTTech4 | 0.855 | - | - | - | |

| INTTech5 | 0.844 | - | - | - | |

| INTTech6 | 0.800 | - | - | - | |

| INTTech7 | 0.807 | - | - | - | |

| INTTech8 | 0.776 | - | - | - | |

| INTTech9 | 0.817 | - | - | - | |

| INTTech10 | 0.813 | - | - | - | |

| Commercial Risk | INTCom1 | 0.843 | 0.932 | 0.677 | 0.944 |

| INTCom2 | 0.807 | - | - | - | |

| INTCom3 | 0.830 | - | - | - | |

| INTCom4 | 0.814 | - | - | - | |

| INTCom5 | 0.857 | - | - | - | |

| INTCom6 | 0.794 | - | - | - | |

| INTCom7 | 0.816 | - | - | - | |

| INTCom8 | 0.820 | - | - | - | |

| Project site Risk | INTPro1 | 0.831 | 0.896 | 0.707 | 0.923 |

| INTPro2 | 0.857 | - | - | - | |

| INTPro3 | 0.818 | - | - | - | |

| INTPro4 | 0.847 | - | - | - | |

| INTPro5 | 0.850 | - | - | - | |

| Environmental Risk | EXTEnv1 | 0.828 | 0.883 | 0.741 | 0.92 |

| EXTEnv2 | 0.855 | - | - | - | |

| EXTEnv3 | 0.877 | - | - | - | |

| EXTEnv4 | 0.882 | - | - | - | |

| Political Risk | EXTPol1 | 0.823 | 0.830 | 0.746 | 0.898 |

| EXTPol2 | 0.868 | - | - | - | |

| EXTPol3 | 0.899 | - | - | - | |

| Socio-Economic Risk | EXTSoeco1 | 0.872 | 0.854 | 0.774 | 0.911 |

| EXTSoeco2 | 0.883 | - | - | - | |

| EXTSoeco3 | 0.884 | - | - | - |

| BC | ComR | ER | MaC | MC | PR | PSR | SR | TR | |

|---|---|---|---|---|---|---|---|---|---|

| BC | 0.864 | - | - | - | - | - | - | - | - |

| ComR | 0.305 | 0.823 | - | - | - | - | - | - | - |

| ER | 0.294 | 0.157 | 0.861 | - | - | - | - | - | - |

| MaC | 0.058 | 0.319 | 0.289 | 0.858 | - | - | - | - | - |

| MC | 0.107 | 0.313 | 0.308 | 0.033 | 0.849 | - | - | - | - |

| PR | 0.284 | 0.166 | 0.217 | 0.274 | 0.333 | 0.864 | - | - | - |

| PSR | 0.320 | 0.215 | 0.114 | 0.293 | 0.308 | 0.160 | 0.841 | - | - |

| SR | 0.280 | 0.138 | 0.210 | 0.308 | 0.304 | 0.176 | 0.147 | 0.880 | - |

| TR | 0.310 | 0.231 | 0.125 | 0.312 | 0.298 | 0.175 | 0.236 | 0.143 | 0.818 |

| BC | ComR | ER | MaC | MC | PR | PSR | SR | TR | |

|---|---|---|---|---|---|---|---|---|---|

| BC | - | - | - | - | - | - | - | - | - |

| ComR | 0.347 | - | - | - | - | - | - | - | - |

| ER | 0.342 | 0.172 | - | - | - | - | - | - | - |

| MaC | 0.070 | 0.365 | 0.343 | - | - | - | - | - | - |

| MC | 0.129 | 0.361 | 0.365 | 0.051 | - | - | - | - | - |

| PR | 0.343 | 0.189 | 0.247 | 0.335 | 0.406 | - | - | - | - |

| PSR | 0.371 | 0.236 | 0.131 | 0.343 | 0.365 | 0.184 | - | - | - |

| SR | 0.332 | 0.154 | 0.239 | 0.370 | 0.369 | 0.203 | 0.166 | - | - |

| TR | 0.350 | 0.245 | 0.137 | 0.357 | 0.341 | 0.196 | 0.256 | 0.160 | - |

| Original Sample (O) β | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p Values | |

|---|---|---|---|---|---|

| Bargaining Cost→Ex-post TC | 0.662 | 0.646 | 0.109 | 6.102 | 0.000 |

| Commercial Risk→Internal Risk | 0.468 | 0.463 | 0.025 | 18.477 | 0.000 |

| Environmental Risk→External Risk | 0.635 | 0.638 | 0.035 | 18.203 | 0.000 |

| External Risk→Ex-post TC | 0.538 | 0.537 | 0.023 | 22.92 | 0.000 |

| Internal Risk→Ex-post TC | 0.545 | 0.545 | 0.023 | 23.306 | 0.000 |

| Maladaptive Cost→Ex-post TC | 0.413 | 0.394 | 0.175 | 2.355 | 0.019 |

| Monitoring Cost→Ex-post TC | 0.521 | 0.496 | 0.120 | 4.347 | 0.000 |

| Political Risk→External Risk | 0.393 | 0.390 | 0.029 | 13.400 | 0.000 |

| Project site Risk→Internal Risk | 0.256 | 0.252 | 0.023 | 11.081 | 0.000 |

| Socio-Economic Risk→External Risk | 0.411 | 0.408 | 0.031 | 13.168 | 0.000 |

| Technical Risk→Internal Risk | 0.664 | 0.667 | 0.031 | 21.623 | 0.000 |

| Hypothesized Variables | Standardized Regression Loading | Weight of Relative Importance (%) | |

|---|---|---|---|

| External Risk | 0.538 | 49.68 | |

| Environmental Risk | 0.611 | 22.88 | |

| EXTEnv1 | 0.828 | 24.06 | |

| EXTEnv2 | 0.855 | 24.84 | |

| EXTEnv3 | 0.877 | 25.48 | |

| EXTEnv4 | 0.882 | 25.62 | |

| Political Risk | 0.410 | 15.36 | |

| EXTPol1 | 0.823 | 31.78 | |

| EXTPol2 | 0.868 | 33.51 | |

| EXTPol3 | 0.899 | 34.71 | |

| Socio-Economic Risk | 0.250 | 9.36 | |

| EXTSoeco1 | 0.872 | 33.04 | |

| EXTSoeco2 | 0.883 | 33.46 | |

| EXTSoeco3 | 0.884 | 33.50 | |

| Internal Risk | 0.545 | 50.32 | |

| Technical Risk | 0.636 | 23.82 | |

| INTTech1 | 0.797 | 9.75 | |

| INTTech2 | 0.836 | 10.22 | |

| INTTech3 | 0.832 | 10.17 | |

| INTTech4 | 0.855 | 10.46 | |

| INTTech5 | 0.844 | 10.32 | |

| INTTech6 | 0.800 | 9.78 | |

| INTTech7 | 0.807 | 9.87 | |

| INTTech8 | 0.776 | 9.49 | |

| INTTech9 | 0.817 | 9.99 | |

| INTTech10 | 0.813 | 9.94 | |

| Commercial Risk | 0.478 | 17.90 | |

| INTCom1 | 0.843 | 12.81 | |

| INTCom2 | 0.807 | 12.81 | |

| INTCom3 | 0.830 | 12.61 | |

| INTCom4 | 0.814 | 12.37 | |

| INTCom5 | 0.857 | 13.02 | |

| INTCom6 | 0.794 | 12.07 | |

| INTCom7 | 0.816 | 12.40 | |

| INTCom8 | 0.82 | 12.46 | |

| Project Site Risk | 0.285 | 10.67 | |

| INTPro1 | 0.831 | 19.77 | |

| INTPro2 | 0.857 | 20.39 | |

| INTPro3 | 0.818 | 19.46 | |

| INTPro4 | 0.847 | 20.15 | |

| INTPro5 | 0.850 | 20.22 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, Z.; Zhu, F.; Hussain, S. Risk Assessment of Ex-Post Transaction Cost in Construction Projects Using Structural Equation Modeling. Sustainability 2018, 10, 4017. https://doi.org/10.3390/su10114017

Ali Z, Zhu F, Hussain S. Risk Assessment of Ex-Post Transaction Cost in Construction Projects Using Structural Equation Modeling. Sustainability. 2018; 10(11):4017. https://doi.org/10.3390/su10114017

Chicago/Turabian StyleAli, Zaigham, Fangwei Zhu, and Shahid Hussain. 2018. "Risk Assessment of Ex-Post Transaction Cost in Construction Projects Using Structural Equation Modeling" Sustainability 10, no. 11: 4017. https://doi.org/10.3390/su10114017

APA StyleAli, Z., Zhu, F., & Hussain, S. (2018). Risk Assessment of Ex-Post Transaction Cost in Construction Projects Using Structural Equation Modeling. Sustainability, 10(11), 4017. https://doi.org/10.3390/su10114017