Abstract

Decreasing trends in birth rates in developed countries during the past decades, which threaten the sustainability of their populations, raise concerns in the areas of employment and social security, among others. A decrease in willingness to bear children has been examined in the international literature from several (biological, socio-cultural, economic, and spatial, etc.) aspects. Among these, the question of the effectiveness of fiscal incentives has been raised, with arguments that these are positive, but not significant, to birth rates; our study also concludes this. In Hungary, from 2010 onwards, the government has introduced very high tax allowances for families and, from 2015, has provided direct subsidies for housing purposes, all within a framework of a new family policy regime. This paper presents an evaluation of family policy interventions (e.g., housing support, tax allowances, other child-raising benefits), with the conclusion that fiscal incentives cannot be effective by themselves; a sustainable level of birth rates can only be maintained, but not necessarily increased, with an optimal design of family policy incentives. By studying the Hungarian example of pro-birth policies there is shown to be a policy gap in housing subsidies.

1. Introduction

Family patterns have changed substantially over the past 50 years, with the shift in mentality about childbearing. The 1960s ended a long-lasting period called the “Golden Age of the Family”, when marriages and childbearing were common at a young age, and the incidence of divorces and non-traditional family forms was very low. At present, a wide variety of family forms co-exist [1], marriage and parenthood have been delayed to more mature ages, or not entered at all, and marital relationships have become less stable even among couples with children [2]. Statistically, in nearly all European countries, fertility rates have declined well below the necessary level for population replacement (replacement level fertility is 2.1 children per woman on average). These trends may raise concerns over the sustainability of economic growth in low birth-rate countries [3]. This issue may call for a modernization of family-support policies involving a broad spectrum of state interventions related to many aspects of the lives of women, men, couples, parents, and children [4], as well as the reconciling of work and family responsibilities [5].

This article aims to contribute substantially to the empirical literature on the effect that pro-birth policies with tax related tools might exercise on fertility in the example of one of the Central European countries, Hungary. In evaluating family policy interventions, the authors hypothesize that fiscal incentives may improve birth rates, but not increase them enough to reach the desired sustainable level.

The paper is structured as follows. Section 2 summarises the methodology of the study, which was mainly composed of the literature review and the statistical methods related to the authors’ own surveys. Section 3 depicts the demographic trends of decreasing birth rates, and the causes behind these trends, based upon the literature. Regarding the pro-birth fiscal incentives, the example of the Hungarian family support regime has both the tax allowance and the home subsidy element, as described in Section 4.1 of this study. Descriptions of data from the survey are provided in Section 4.2. The conclusions (i.e., that the home setup support scheme positively influences young adults’ desire to have children, but does not cause a significant change in actual childbearing) are included in Section 4.3. Finally, Section 5 provides a summary of the conclusions.

2. Methods

To illustrate the decreasing fertility rates across Europe, descriptive statistics have been employed, i.e., time series of the total fertility rates, and data about changes in age structure. From these data, the authors examined the income and housing determinants of childbearing, as pointed out in the literature [6], and connected them to the use of fiscal policy incentives.

The Hungarian study shows how pro-birth incentives were added to the tax and housing matters of families with children. Additionally, the authors examined whether the intentions of young people reaching the age of peak fertility are potentially changed by the existence of the pro-birth housing support scheme in Hungary. A first questionnaire-based survey carried out by the authors involved 1332 students in higher education. Then, in a repeated questionnaire in the first few months of 2018, the authors asked 15,700 students studying at higher education in the 10 most prominent university campuses across the country. To analyse the answers, descriptive statistics and the Chi-Square Test of independence have been employed for the relationship between planned inhabitancy and the inclination for having children. Statistically, Pearson Chi2 is for testing if two categorical variables are related; and a measure that does indicate the strength of the association is Cramer V. It is important to note though, that the correlation coefficient is used for (nearly) linear stochastic relationships. The Pearson Chi2 is not suitable for describing the relationship between values on a more complex function curve. This method converts metric variables to nominal variables to examine if a relationship existed between housing costs and childbearing intentions.

3. Drives of Fertility

3.1. Decreasing Birth Rates and the Problems They Raise

Population trends in European countries are described by low (below replacement level) rates of fertility, as a long-term result of socio-demographic trends that are examined below.

3.1.1. Trends in Total Fertility Rates

The most commonly used fertility indicator is the total fertility rate. In a specific year, it is defined as the total number of children that would be born to each woman if she were to live to the end of her child-bearing years and give birth to children in accordance with the prevailing age-specific fertility rates. It is calculated by totalling the age-specific fertility rates as defined over five-year intervals [7].

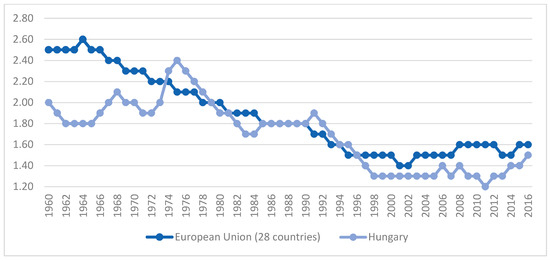

This indicator is measured in children per woman and reached a value of 2.5 in 1960 for the EU (28 countries) average, with a corresponding figure of 1.6 in 2015 [8]. (Hungary reached a total fertility rate of 2.0 in 1960, with a figure of 1.5 in 2015, respectively. Figure 1 shows the trends.) The reasons for the dramatic decline in birth rates during the past few decades include postponed family formation and childbearing and a decrease in desired family sizes. Current levels of fertility rates across Europe do not ensure the replacement-level fertility of 2.1 children per woman on average [9].

Figure 1.

Fertility rates, total, children/woman, 1960–2016.

Childlessness also contributes to the decrease in average birth rates (the decline in fertility) in these countries. It has been relatively low in Central and Eastern European countries in the past century, but has increased among women born in the late 1960s and early 1970s. By comparison, in Western European countries, the rate of childlessness climbed to 20% on average during the past decades, then has stabilized at this level, but is likely to continue rising in Southern Europe, especially in Italy and in Spain [10]. Women in southern Europe are on track to have the highest levels of childlessness in Europe, at around 25% [11]. However, the trends in childlessness are difficult to predict due to socio-cultural changes in behaviour.

3.1.2. The Problem of Aging Societies, as Reflected by the Population Pyramid

According to the United Nations Demographic and Social Statistics, the estimated percentage for the European population at the age of 65 or above was 17.9 in 2016 [12]. Meanwhile, the percentage of the population at the age of 14 or below was only 15.8. These figures are highlighted from the perspective of welfare and social security issues, which result from the higher percentages of the elderly [13]. Alongside the potentially weak family savings for old age, which are partly hindered by legal constraints on investing in many countries [14,15], governments face the unsolved issue of funding social security systems for the forthcoming decades [16,17].

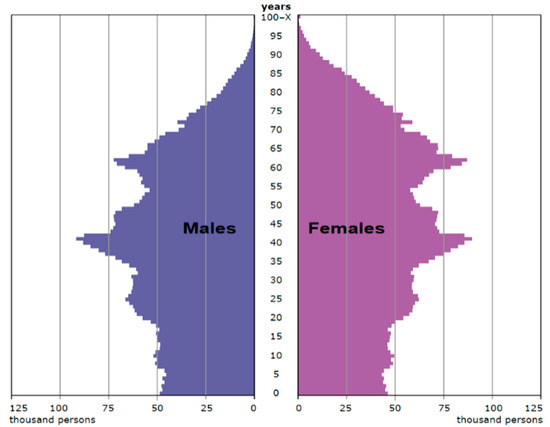

Alongside the increase in the share of older persons in the total population, the proportion of people of a working age in the European countries is shrinking while the relative number of those retired is expanding [18]. The population pyramid, showing the age structure of the population by sex, is transforming due to the above birth and population trends. The pyramid in general is a graphical illustration about the distribution of various age groups for each gender in a geographical area, such as the European Union, a country, or a region. It is also called the age structure diagram or the age-sex pyramid, which for Hungary, displays a contracting shape (see Figure 2). Out of the total 9,797,561 inhabitants, the portion of middle-age and elderly persons is higher than of younger people, therefore, the population pyramid is depicting an aging population [19]. In particular, there are relatively more persons at the ages of 60–65, and 37–42, which has resulted from a government decree prohibiting abortions during the 1950s (from 1950 till 1956).

Figure 2.

Population number of Hungary by sex and age, 1 January 2017.

3.2. Causes behind the Low Levels of Birth Rates

Decreasing trends in fertility in the scientific literature are linked to biological, socio-cultural, economic, and spatial factors. The review of them is summarized below.

The focus of the theories that explore the influence of fertility variables is unquestionably the biological ability of a woman to have a child, which leads to conception, or even failure. The question of how a marriage (family) provides a positive, supportive environment for childbearing has been raised by many research studies [20,21]. It has been noted that age patterns of natural marital fertility are not primarily affecting childbearing [22]. Instead, the frequency of sexual intercourse and birth control/contraception, and the age patterns of natural marital fertility together are recognized as the proximate determinants of fertility [23,24]. In the socio-cultural models of childbearing, the supply of births is raised from the natural rate of fertility (defined as the potential number of births without contraception and abortion), and is constrained by family planning, that is, the demand for births [25,26].

During the period of the first demographic transition in the 19th and 20th centuries, fertility rates decreased even though the proportion of people living in marriages increased (people got married at younger ages, divorce rates were low, and re-marriage rates were high). Childbearing was common in marriages; parents had their first child at a younger age, but typically did not have any further children. The single-child family model became the norm in society, alongside family values, such as household income, working and housing conditions, healthcare, and schooling [27].

The spread of contraception, the delayed marriage of women, and the deterioration of fertility indicators characterized the second demographic transition period [28], which started after the Second World War, and came into full swing with the sexual revolution of the 1960s. The proportion of people living in marriages decreased, people got married later, divorce rates became high, and remarriage rates were low. Although the proportion of unexpected pregnancies among teenagers increased, fertility declined, mainly due to the postponement of childbearing [29]. Forms of non-marital cohabitation have spread, and the proportion of children born out of wedlock jumped. Family values were replaced by individual values, and male-female roles became more uniform [30].

The economic theories of fertility decline [31] have added the time and opportunity cost variables, as well as the mother’s income and labour market participation [32] to the models of childbearing. Within the economics of households, the available resources of labour, capital, and time are allocated to childbearing as well, in accordance with its utility measures [33,34]. However, socio-economic factors are added as explanatory variables to these models, admitting the positive feedback of society in the birth of the first child and especially in the case of further childbirth [35,36].

In today’s literature on fertility, studies focus on regional factors, revealing the fact that in the suburban districts of cities and, especially, in rural areas, fertility rates are higher [37,38]. In this context, the living area (green residential areas, playground, nursery and kindergarten, medical services) influences the parents’ decision on childbearing, and childbearing on their selection of home [39]. The spatial differences may have a considerable effect on childbirths, especially in the case of the second and the third child [40].

4. Pro-Birth Fiscal Incentives: Policy Design and Perception

The governmental policy responses differ across European countries, and, more importantly, throughout time. There is a dynamic pattern to how these countries design their family policy instruments, and how fast they respond to the decrease in fertility rates. After the demographic tendencies had been traced, most of the EU countries introduced active family policy measures to initiate childbearing and provide financial help for child raising.

In a narrow sense, these family policies can be interpreted as the total set of government subsidies and services with the purpose of supporting families who raise children. These tools perform as exogenous variables when decisions are made on childbearing or postponement, in relation to changes in the cost of childrearing [41]. In this respect, the cash subsidies and housing supports represent direct forms of policy tools, and the tax allowance is an indirect form.

Alongside the increase of a household’s disposable income, the willingness to have children can be depicted by a U-shape curve [42]. This means that in lower income levels, the direct policy incentives exercise a welfare effect on the household, possibly resulting in not having or postponing to have a second or an additional child. In contrast to this, in higher income level households, the indirect policy tools have a positive feedback on subsequent births. In general, pro-birth policies have no measurable effect on childlessness, but a minor (significant) effect on the number of children borne by maternal women [43].

The latest figures show that family incentives are substantial in most EU countries, as households with children have a lower net personal average tax rate than the same household type without children, and the difference is considerably more pronounced for a single worker at a lower level of wage income [44]. These fiscal incentives are supplemented by different sources of parental support, aimed at enhancing parenting skills and practices to address children’s physical, emotional, and social needs [45].

4.1. Hungarian Policy

The GDP per capita in Purchasing Power Standards (PPS) in Hungary was HUF 6,297,920 (EUR 19,681) in 2016 [46]. The minimum regional average in the country was HUF 4,000,000 (EUR 12,500), and the maximum was HUF 9,536,000 (EUR 29,800) [47]. Based on these figures, the budgetary subsidies exercise a substantial impact on families’ income.

On 1 January 2011, a new family tax regime was introduced in Hungary [48]. The essence of this regime has common roots with Western European regimes and applies tax allowances. In contrast to tax credits, tax allowances reduce the consolidated tax base of the taxable principal wage earner on a monthly basis. The amount of the benefit depends on the number of dependent children.

The amount of the family tax allowance increased substantially in 2011: Families raising one or two children enjoyed a monthly benefit of HUF 62,500 (approx. EUR 200) per child, while families with three children could retain a monthly sum of HUF 206,250. The benefit considerably reduced families’ tax burden: Compared to 2010, the net (after-tax) income of an average family with children increased by 10–20% and the majority of families with multiple children were totally exempt from personal income tax payments in 2011.

In 2012, the family tax allowance did not change compared to the previous year. However, the amount of payable tax decreased due to changes in the calculation of the tax base. This tax reduction mainly affected families with one or two children, and high-income families with more children. To ensure fairness, a reduction was required in the differences between the respective family allowances in the personal income tax regime in 2015. Since 2016, the tax benefit for families with two children has increased. As the allowance, which reduces the consolidated tax base, is increasing year by year, disposable income has grown by HUF 20,000 per child by 2018. This tax allowance is also granted to pregnant mothers from the 91st day of pregnancy until the birth of the child.

By 2013, the fiscal budget position had stabilized, and Hungary became exempt from the excess deficit procedure as the fiscal deficit had decreased below 3% of the GDP. With the continuous increase of GDP [49], the government could implement much larger amounts of further family incentives.

In 2015, the family social contribution allowance was added to the family tax allowance. This is granted if the consolidated tax base is eligible only for a part of the family allowance. While the family tax allowance reduces the tax base and the tax liability, the social contribution allowance reduces the payable social contribution. Eligibility for family allowances does not alter social security benefits (pension, healthcare, transfers, etc.) nor the amount of benefits of the insured person. The extension of the benefit to individual contributions mainly affects families with three or more children and single parents with two children.

Changes in family benefits since 1 January 2016 include a decrease in the personal income tax rate from 16 to 15%, and an increase in the childcare allowance for families with two children. Since 1 January 2017, the personal income tax rate has remained at 15%, and the rate of social security contributions at 18.5% (calculated as a total of contributions to the pension fund at 10%, to healthcare at 7%, and to the labour market fund at 1.5%).

In 2017, the family tax allowance was HUF 66,670 per month for families raising one child (this sum reduces the personal income tax payable by HUF 10,000). The tax allowance is HUF 100,000 per month per child in the case of two dependent children, and this sum is equal to a HUF 15,000 per child decrease in the tax payable. Finally, the tax allowance is HUF 220,000 per month per child in the case of a minimum three dependent children, which reduces the tax payable by HUF 33,000 per child. Consequently, the personal income tax regime grants proportionally more benefit to families raising two, three, or more children. Moreover, from 2017, family benefits have been extended to the spouses’ close relatives if they live in the same household.

Besides the wide range of tax benefits, child-related housing subsidies were introduced in 2015. The authors proved in a former study [50] that in addition to tax benefits, housing subsidies may also positively influence childbearing, and for that reason, they provided an overview of the housing market trends since the turn of the millennium. This is confirmed by an increase in the number of applications and contracts for housing: Between July 2015 and September 2017, 59,042 applications were approved for family and housing subsidies and for interest subsidies in a total of HUF 161,991 million. Up to 30 September 2017, 42,443 contracts were signed in a total amount of HUF 131,064 million.

In 2016, approximately one-third (31%) of the applications included commitments to having a child in the near future (the requirement is that at least one of the spouses must be younger than 40; in most cases, this condition is met by the mother). The remaining two-thirds of the applications referred to children already born, up to the age of 25 (mostly by couples under the age of 50).

Data are available for the year, 2016, for the types of subsidies (for the first, second, or third child). Of the contracts for housing subsidies signed in 2016, 69% of them referred to children already born, and 31% to planned children. Regarding the latter figure, it is worth mentioning that the percentage is lower (29%) in the case of newly built flats, and is higher (33%) in the case of resold flats. The ratio of commitments to have additional children is the lowest (24%) in applications for HUF 10 million to subsidize new homes, with 62% committed to having one child, 26% two children, and 12% three children. Considering the resold flats, 58% of the beneficiaries made commitments for one child, and 42% for two or more children in their applications for housing subsidies. Altogether, about 7000 of the contracting families have made a commitment to have about 10,000 children in the near future; this figure totals approximately 8000 families with 11–12,000 children for 2016. In summary, each family has committed to have an average 1.4 children within a six-year period.

The budgeted figures for family subsidies were HUF 277.0 billion (approx. EUR 870 million) and HUF 316.0 billion (approx. EUR 1000 million) in 2017 and 2018, respectively. These figures also include marital allowances, withdrawn in the amount of HUF 0.5 billion and 2.2 billion in 2015 and 2016, respectively, which are predicted to have grown in the years, 2017 and 2018. Increases in subsidy disbursements correlates with the increased tax allowances for families with two children (HUF 20,000 per month per child in 2015, HUF 25,000 in 2016, HUF 30,000 in 2017, HUF 35,000 in 2018, and HUF 40,000 in 2019, and so on). This means that subsidies for families with two children increased by approximately one-third (31%), amounting to HUF 23 billion, from 2015 to 2016. Further growth in family subsidies might also be expected for 2019.

4.2. Data Collection

To evaluate the long-term impact of the family and home subsidies regime on the change of the willingness to have children among young adults, the authors conducted their own questionnaire interviews among university students in Hungary. This survey took place in 2016 for the first time, when 1332 students responded to the questionnaire. Then, in a repeated series of interviews in 2018, 15,700 university students took part (Table 1). Out of the total of 15,700 responders, 40% were men, and 60% were women. In the first survey, students from one university in the capital city and one in a provincial city participated by filling in the questionnaire; whilst the repeated survey was extended to the 12 largest university campuses in Hungary. These 12 campuses have 174,338 full-time students altogether (as of 2018), which account for 86.2% of the 202,300 full-time university students in Hungary. The survey was also representative of the population of tertiary-educated young adults with potentially high incomes (they account for 23.7% of the total population of their age group).

Table 1.

Responders in the surveys, by university.

The first part of the questionnaire asked the gender, age, place of residence, number of siblings, and housing situation of respondents, as well as their job experiences, to learn about some of their demographic characteristics. To discover how respondents think about the incentive effect of family and home subsidies on the willingness to have children, two main questions were asked: “Do you think that the new home setup support measures will increase your desire to have children?” and “To what extent can the currently implemented home setup scheme contribute to the acquisition or development of the housing you expected to have?”

4.3. Results and Discussion

The authors empirically surveyed whether the subsidies alter the desire to have children among young adults. Results from the first questionnaire survey showed that according to 73.4% of the respondents, housing subsidies improve their willingness to have children; however, only 36.7% answered that they would want to have more children if the subsidies remained in place. It was concluded that housing subsidies do give a stimulus to childbearing.

The extended survey included the 20 most prominent university campuses across the country, totalling approximately 7.8% of the total number of higher education students in Hungary. Forty five percent of the respondents study in the capital, the rest of them study in the provinces, which represents the geographical distribution of the Hungarian universities. The questionnaire asked if the extension of the family and home subsidizing regime, together with the publicity it had gained, had substantially changed the willingness to have children among this population. Statistical methods used in the research were: Descriptive statistics, cross tabulation, and hypothesis analysis.

The results confirmed that 75% of these young adults consider the pro-birth fiscal incentives to be useful for raising children (Table 2). However, only 20.9% (a significantly lower proportion of respondents than in the previous survey) answered that if the subsidies remained they would want to have more children and benefit from the home subsidy (Table 3).

Table 2.

Perception of the pro-birth fiscal incentives in raising children: Usefulness of the incentives.

Table 3.

Perception of the pro-birth fiscal incentives in raising children: Inclination to benefit from the incentives.

The results confirm the relatively high prevalence of the intention not to have or to postpone having children, with the main reasons being difficulties in finding the appropriate partner/spouse (40%) and the insufficient supply of child-raising benefits (pre-schooling, medical care, etc.; 38%). Moreover, only two thirds of them intend to settle down in their home country of Hungary.

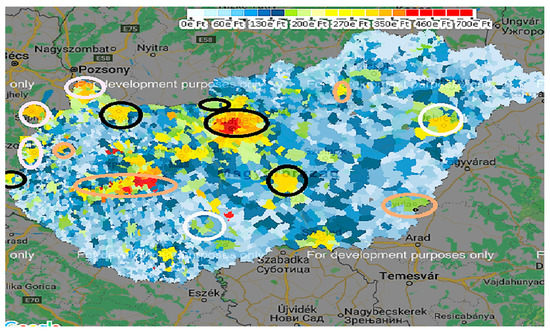

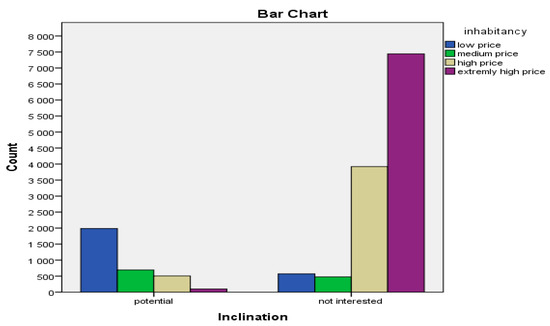

Housing prices vary across the country. In order to depict the significance of the home settlement support, the authors considered the price levels of the locations where the university students plan to settle down. Based on local real estate prices, these categories were set: Low-cost housing around €0–625/sqm (e.g., Békéscsaba, Eger, Miskolc, Szolnok); low to middle cost housing around €625–1100/sqm (e.g., Debrecen, Kecskemét, Pécs, Szeged); middle to high cost housing around €1100–1400/sqm (e.g., Győr, Kaposvár, Veszprém); and high cost housing above €1400/sqm (Budapest). The heat map of Hungary by housing prices is shown in Figure 3. The authors examined the relationship between the price level of the planned place of settlement and the inclination to benefit from the home settlement support (the results are shown in Figure 4).

Figure 3.

The heat map of Hungary by the real estate prices. Major industrial centres are marked by black circles, touristic areas by brown ones, regions near to the border (close to Vienna and Bratislava) by pink ones, and developing regions by white ones.

Figure 4.

Planned inhabitancy and the inclination for childbearing, displayed by bar chart. Source: SPSS output.

The results show that housing subsidies are perceived as beneficial among those respondents who plan to settle down in low or low to middle price locations after graduation. In contrast, those who plan to purchase housing in more costly locations do not intend to benefit from the housing subsidies.

The cross-table for the planned location of settlement confirms that the respondents are more likely to benefit from home settlement subsidies in less developed regions, where they can presumably afford housing (Table 4).

Table 4.

Planned inhabitancy and the inclination for having children, cross-table and analysis from SPSS output.

The analysis verified that a correlation exists between the housing price level of the planned inhabitancy and the respondents’ inclination for benefitting from the housing child subsidy. The null hypothesis for a chi-square independence test is that two categorical variables are independent in some population. In our calculations, the Pearson Chi2 test is less than 5% (the significance level marked in social sciences); and, based on the expected values, the test was proved to be reliable. Results from the Chi2 test were confirmed by the likelihood ratio and the significance level of the linear by linear association. Statistically, Cramer V is a number between 0 and 1 that indicates how strongly two categorical variables are associated. Regarding the strength of the relationship as measured by the Cramer V (Cramer V= 0.613 p = 0.00%), in our case, there is a middle to strong relationship between the two variables, i.e., the price levels of the planned inhabitancy and the inclination for having children (and, consequently, benefit from the governmental subsidy).

The statistical analysis led to the conclusion that young adults who plan to settle down in lower housing cost locations, where they are able to have a home without bank debts, are those who wish to benefit from the home settlement subsidising regime. From this aspect, the home settlement subsidy is not attractive for young adults who plan to live in the more popular, higher-priced locations (e.g., in the capital city or near to other developed industrial areas).

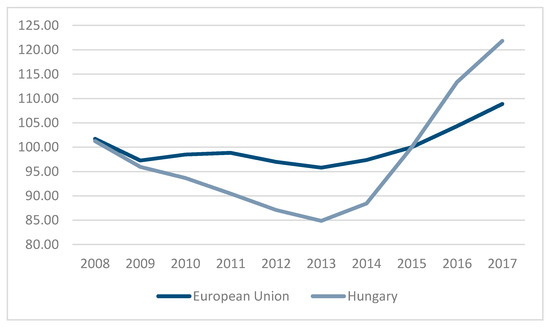

The results also imply that the amount of the housing subsidies is not sufficiently high to encourage having children, especially given the fact that these young adults will seek employment and accommodation in the more developed larger cities, where housing is becoming more and more expensive (see Figure 5). Housing prices became volatile during the past few years in Hungary [51], with the current boom destroying the effects of the housing benefits, not just in the capital (Budapest), but also in provincial towns.

Figure 5.

House price index—annual data (2015 = 100).

According to the national statistics, housing subsidies have had an inflationary effect on the housing market in that housing prices have grown by approximately 4.5–5.1% per year on average, as a result of the regulatory changes [52]. This contradictory effect partly destroyed the intended purpose of the governmental policy, i.e., to ease the housing conditions of families.

Among university locations, Budapest, Gödöllő, Győr, Kaposvár, Sopron, Szombathely, and Veszprém Zalaegerszeg are the most popular ones, with two or three times higher housing prices than Miskolc or Nyíregyháza. The former locations are characterised by significantly higher GDP/capita figures, as they offer more job opportunities at multinational companies (e.g., Budapest: Shared service centres, banks, audit companies; Győr: Audi; Kecskemét: Mercedes Benz, County of Vas: GE Opel, etc.). The housing prices are also significantly higher in the former locations, due to the increased demand there (Table 5).

Table 5.

GDP/capita and housing prices at the locations of the universities.

The results suggest that the governmental home settlement subsidies provide greater support for young adults who plan to live and work in the less developed locations in the country. As most of the young adults prefer to live and work in the more popular sub-regions, where the housing costs tend to be high, the home settlement subsidies have less impact on their childbearing decisions.

5. Conclusions

As this study has shown, the decrease in childbearing and the below-replacement fertility rates across Europe, together with the aging of the populations, have raised concerns about the financial sustainability of the social security systems in these countries [53]. States are reacting to declining fertilities by applying tax-related types of pro-birth policies, and by targeting marriage, child-raising, and the re-entrance of women to the labour market. Fiscal expenditures are being phased into the personal income tax regimes, and are being supplemented by parental support [54].

In the case of Hungary, the low fertility rates are attributable to changing family formation patterns, more years spent in education, and the transformation of family models and life concerns. The uncertainty of youth employment and the difficulty of housing opportunities appear as principal economic factors. For this reason, the authors argue that pro-birth fiscal incentives should also include tax allowances (income channel) and housing support (accommodation channel). The Hungarian model embraces both of these legs, with a considerable amount of government expenditure. This argument is the novelty of this study, since the corresponding literature mentions cash-benefit policies, tax policies, and maternity leave systems as the only supporting policy elements for subsidizing families [55,56], but does not include housing support.

The authors’ surveys among young adults in higher education confirmed that low rates of fertility are likely to remain in Hungary. Pro-birth tax incentives are perceived as fiscal stimulus for these high-income, or potentially high-income, young adults, but—as the relevant literature concludes—this has not changed their willingness to have children (or to have children earlier). Housing incentives have not fulfilled their intended purpose either. The results of the authors’ own questionnaire imply that among full-time university students between the age of 18 and 27 who are planning to set up their own family with children, the inclination to benefit from the home settlement support highly depends on the price level of the housing. In the more popular locations, housing prices are high enough to discourage young adults from drawing the housing benefits (for example, in Budapest, the amount of the housing subsidy is fully absorbed by the high housing prices).

Government intervention through the housing support system has solely influenced the demand side of the housing market in Hungary, without regulating the supply side of them, which has resulted in an unwanted further increase in housing prices. The authors regard this regulatory gap in the housing market as an obstacle to encouraging families to have more children, preferably at an earlier age.

The authors also argue that the long-term unfavourable consequences of low fertility cannot be fully mitigated by pro-birth policies. Fiscal incentives cannot be effective on their own; a sustainable level of birth rates can only be maintained, but not necessarily increased, with an optimal design of family policy incentives.

Finally, the authors noted that their survey was conducted on tertiary-educated young adults in Hungary. However, recent studies in the literature [57] suggest that a positive association between women’s level of education and lifetime fertility intentions exists also on a more general country level. The authors see opportunities in further research in this field.

Author Contributions

The authors developed the idea for this paper together. J.S. conceptualized the analysis and wrote the paper. C.L. contributed substantially to the analysis of results and with overall guidance of the project. (Conceptualization, J.S.; Formal analysis, J.S. and C.L.; Writing—original draft, J.S.; Writing—review & editing, C.L.)

Funding

This study was funded by the Hungarian National Bank through C.L.’s participation in the PADA Leader Expert Program.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; and in the decision to publish the results.

References

- Neyer, G.; Thévenon, O.; Monfardini, C. European Policy Brief. Policies for Families: Is there a Best Practice? Families and Societies 2016. pp. 1–12. Available online: https://ec.europa.eu/research/social-sciences/pdf/policy_briefs/policy_brief_families-and-societies_122016.pdf (accessed on 19 July 2018).

- Oláh, L.S. Changing Families in the European Union: Trends and Policy Implications. Families and Societies 2015, Working Paper 44, 2015. pp. 1–41. Available online: http://www.un.org/esa/socdev/family/docs/egm15/Olahpaper.pdf (accessed on 19 July 2018).

- Elgin, C.; Tumen, S. Can Sustained Economic Growth and Declining Population Coexist? Barro-Becker Children Meet Lucas. Econ. Model. 2012, 29, 1899–1908. [Google Scholar] [CrossRef]

- Thévenon, O.; Neyer, G. Family Policies and Their Influence in Fertility and Labour Market Outcomes. In Family Policies and Diversity in Europe: The State-of-the-Art Regarding Fertility, Work, Care, Leave, Laws and Self-Sufficiency; Thévenon, O., Neyer, G., Eds.; European Union: Brussels, Belgium, 2014; pp. 2–13. [Google Scholar]

- OECD. Doing Better for Families; OECD Publishing: Paris, France, 2011; pp. 1–275. ISBN 978-92-64-09872-5. Available online: http://www.oecd.org/els/soc/doingbetterforfamilies.htm (accessed on 19 July 2018).

- Kelm, H. Are Women in Family Business Supported Enough by the Polish Family Policy? Available online: http://bazekon.icm.edu.pl/bazekon/element/bwmeta1.element.ekon-element-000171517434 (accessed on 19 July 2018).

- OECD. Fertility Rates (Indicator); OECD: Paris, France, 2018. [Google Scholar] [CrossRef]

- OECD. Demographic References; OECD: Paris, France, 2018; Available online: https://data.oecd.org/pop/fertility-rates.htm (accessed on 19 July 2018).

- UN Population Department. Methodology. 2018. Available online: http://www.un.org/esa/sustdev/natlinfo/indicators/methodology_sheets/demographics/total_fertility_rate.pdf (accessed on 27 October 2018).

- Beaujouan, E.; Sobotka, T.; Brzozowska, Z.; Zeman, K. Has childlessness peaked in Europe? Population & Societies, 2017; Number 540. pp. 1–4. Available online: https://www.ined.fr/fichier/s_rubrique/26128/540.population.societies.2017.january.en.pdf (accessed on 19 July 2018).

- Sobotka, T. Childlessness in Europe: Reconstructing Long-Term Trends Among Women Born in 1900–1972. In Childlessness in Europe. Contexts, Causes, and Consequences; Kreyenfeld, M., Konietzka, D., Eds.; Demographic Research Monographs Series (A Series of the Max Planck Institute for Demographic Research); Springer: Cham, Switzerland, 2017; pp. 17–53. ISBN 978-3-319-44665-3. Available online: https://doi.org/10.1007/978-3-319-44667-7_2 (accessed on 19 July 2018).

- United Nations Demographic Yearbook 2016; Table 2—Estimates of Population and Its Percentage Distribution, by Age and Sex and Sex Ratio for All Ages for the World, Major Areas and Regions, 2016. pp. 1–2. Available online: https://unstats.un.org/unsd/demographic-social/products/dyb/documents/dyb2016/table02.pdf (accessed on 19 July 2018).

- Fehr, H.; Kallweit, M.; Kindermann, F. Families and social security. Euro. Econ. Rev. 2017, 91, 30–56. [Google Scholar] [CrossRef]

- Kecskés, A. Recent Trends in Hungarian Investment Law. Jahrbuch für Ostrecht, 2018. Volume 59, pp. 69–78. Available online: https://www.ostrecht.de/fileadmin/user_upload/2018-1.pdf (accessed on 19 July 2018).

- Börsch-Supan, A.; Ludwig, A.; Winter, J. Ageing, Pension Reform and Capital Flows: A Multi-Country Simulation Model. Economica 2006, 73, 625–658. [Google Scholar] [CrossRef]

- Amrik, J.; Hittig, G.G.; Gál, Z.; Bárczi, J.; Zéman, Z. Investing in the Future. Polgári Szemle/Civic Review: Gazdasági és Társadalmi Folyóirat 2018, 14, 140–164. [Google Scholar] [CrossRef]

- Lentner, C. Hungary in 2025, World Futures Studies Federation—Futures Bulletin, 2010. In Magyarország 2025, 1st ed.; Nováky, E., Ed.; MTA Gazdasági és Szociális Tanács: Budapest, Hungary, 2010; Volume 35, pp. 13–17. ISBN 978-963-88419-3-3. [Google Scholar]

- Eurostat. Population Structure and Ageing, 2018. Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Population_structure_and_ageing#Past_and_future_population_ageing_trends_in_the_EU (accessed on 19 July 2018).

- Hungarian Central Statistical Office Internal Database. The Interactive Population Pyramid of 120 Years. Available online: https://www.ksh.hu/interaktiv/korfak/orszag_en.html (accessed on 19 July 2018).

- Easterlin, R.A.; Pollak, R.A.; Wachter, M.L. Toward a More General Economic Model of Fertility Determination: Endogenous Preferences and Natural Fertility. In Population and Economic Change in Developing Countries; Easterlin, R.A., Ed.; University of Chicago Press: London, UK, 1980; pp. 81–150. Available online: http://www.nber.org/chapters/c9664.pdf (accessed on 19 July 2018).

- Freedman, R.; Freedman, D. The role of family planning performances as a fertility determinant. In Family Planning Programs and Fertility; Phillips, J., Ross, J., Eds.; Oxford University Press: Oxford, UK, 1991. [Google Scholar]

- Coale, A.J.; Trussell, T.J. Model fertility schedules: Variation in the age structure of child bearing in human populations. Popul. Index 1974, 40, 185–258. [Google Scholar] [CrossRef]

- Bongaarts, J. A Framework for Analyzing the Proximate Determinants of Fertility. Popul. Dev. Rev. 1978, 4, 105–132. [Google Scholar] [CrossRef]

- Bongaarts, J. The proximate determinants of fertility. Technol. Soc. 1987, 9, 243–260. [Google Scholar] [CrossRef]

- Bongaarts, J. The Supply-Demand Framework for the Determinants of Fertility: An Alternative Implementation. Popul. Stud. 1993, 47, 437–456. [Google Scholar] [CrossRef]

- Easterlin, R.A. The economics and sociology of fertility: A synthesis. In Historical Studies of Changing Fertility; Tilly, C., Ed.; Princeton University Press: Princeton, UK, 1978; pp. 1–402. ISBN 9780691615219. [Google Scholar]

- Lesthaeghe, R. The second demographic transition: A conceptual map for the understanding of late modern demographic developments in fertility and family formation. Hist. Soc. Res. 2011, 36, 179–218. [Google Scholar] [CrossRef]

- Van de Kaa, D.J. Europe’s Second Demographic Transition. Popul. Bull. 1987, 42, 1–59. [Google Scholar]

- Surkyn, J.; Lesthaeghe, R. Values Orientations and the Second Demographic Transition (SDT) in Northern, Western and Southern Europe: An Update. Demogr. Res. 2004, S3, 63–98. [Google Scholar] [CrossRef]

- Reher, D.S. Family Ties in Western Europe: Persistent Contrasts. Popul. Dev. Rev. 1998, 24, 203–234. [Google Scholar] [CrossRef]

- Leibenstein, H. The Economic Theory of Fertility Decline. Q. J. Econ. 1975, 89, 1–31. [Google Scholar] [CrossRef]

- Maestripieri, L. A Job of One’s Own. Does Women’s Labor Market Participation Influence the Economic Insecurity of Households? Societies 2018, 8, 1–32. [Google Scholar] [CrossRef]

- Nerlove, M. Economic Growth and Population: Perspectives of the New Home Economics; Northwestern University: Evanston, IL, USA, 1975; Available online: http://library.isical.ac.in:8080/jspui/bitstream/10263/5128/2/marc%20nerlove%20speech%20type.pdf (accessed on 19 July 2018).

- Willis, R.J. A New Approach to the Economic Theory of Fertility Behavior. J. Polit. Econ. 1973, 81, 14–64. [Google Scholar] [CrossRef]

- Simon, J.L. Puzzles and Further Explorations in the Interrelationships of Successive Births with the Husband’s Income, Spouse’s Education and Race. Demography 1975, 12, 259–274. [Google Scholar] [CrossRef]

- Simon, J.L. The Effect of Income and Education upon Successive Births. Popul. Stud. 1975, 29, 109–122. [Google Scholar] [CrossRef] [PubMed]

- Ekert-Jaffe, O.; Joshi, H.; Lynch, K.; Mougin, R.; Rendall, M. Fertility, timing of births and socio-economic status in France and Britain: Social policies and occupational polarization. Population-E 2002, 57, 475–508. [Google Scholar] [CrossRef]

- Rendall, M.; Ekert-Jaffe, O.; Joshi, H.; Lynch, K.; Mougin, R. Universal versus economically polarized change in age at first birth: A French–British comparison. Popul. Dev. Rev. 2009, 35, 89–115. [Google Scholar] [CrossRef]

- Basten, S.; Huinink, J.; Klüsener, S. Spatial variation of sub-national trends in Austria, Germany and Switzerland. Comp. Popul. Stud. 2012, 36, 573–614. [Google Scholar]

- Fiori, F.; Graham, E.; Feng, Z. Geographical variations in fertility and transition to second and third birth in Britain. Adv. Life Course Res. 2014, 21, 149–167. [Google Scholar] [CrossRef]

- Milligan, K. Subsidizing the Stork: New Evidence on Tax Incentives and Fertility. Rev. Econ. Stat. 2005, 87, 539–555. [Google Scholar] [CrossRef]

- Barro, R.; Becker, G. Fertility Choice in a Model of Economic Growth. Econometrica 1989, 57, 481–501. [Google Scholar] [CrossRef]

- Kalwij, A. The Impact of Family Policy Expenditure on Fertility in Western Europe. Demography 2010, 47, 503–519. [Google Scholar] [CrossRef]

- OECD. Taxing Wages, 2018; OECD Publishing: Paris, France, 2018; pp. 1–596. ISBN 9789264300200. [Google Scholar]

- European Commission. EPIC Policy Brief on Parenting Support, 2016. pp. 1–30. Available online: http://ec.europa.eu/social/BlobServlet?docId=15978&langId=fr (accessed on 19 July 2018).

- Hungarian Central Statistical Office. Per Capita Gross Domestic Product, 1995–2017. Available online: http://www.ksh.hu/docs/eng/xstadat/xstadat_annual/i_qpt016.html (accessed on 27 October 2018).

- Hungarian Central Statistical Office. Regional per Capita Gross Domestic Product, 2005–2016. Available online: https://www.ksh.hu/docs/hun/eurostat_tablak/tabl/tgs00005.html (accessed on 27 October 2018).

- Sági, J.; Lentner, C.; Tatay, T. Family Allowance Issues—Hungary in Comparison to Other Countries. Polgári Szemle/Civic Review Gazdasági Társadalmi Folyóirat 2018, 14, 290–301. [Google Scholar] [CrossRef]

- Kolozsi, P. How Can We Escape the Middle Income Trap? Pénzügyi Szemle/Public Financ Q. 2017, 62, 71–83. [Google Scholar]

- Sági, J.; Lentner, C.; Tatay, T. Certain Effects of Family and Home Setup Tax Benefits and Subsidies. Pénzügyi Szemle/Public Financ. Q. 2017, 62, 171–187. [Google Scholar]

- Eurostat. House Price Index—Annual Data (2015 = 100) [prc_hpi_a]. Available online: http://ec.europa.eu/eurostat/data/database?node_code=prc_hpi_a (accessed on 19 July 2018).

- Hungarian National Bank. Housing Market Report, May 2018. HNB Budapest, Hungary. 2018, pp. 1–38, ISSN 2498-6712. Available online: https://www.mnb.hu/letoltes/lakaspiaci-jelentes-2018-majus-en.pdf (accessed on 19 July 2018).

- Bradatan, C.; Firebaugh, G. History, population policies, and fertility decline in Eastern Europe: A case study. J. Fam. Hist. 2007, 32, 179–192. [Google Scholar] [CrossRef]

- Novoszáth, P. New Hungarian Economic Philosophy to Improve Households’ Financial Situation. Polgári Szemle/Civic Review Gazdasági Társadalmi Folyóirat 2018, 14, 47–66. [Google Scholar] [CrossRef]

- Georges, P.; Seçkin, A. From pro-natalist rhetoric to population policies in Turkey? An OLG general equilibrium analysis. Econ. Model. 2016, 56, 79–93. [Google Scholar] [CrossRef]

- Mengzhen, W.Y.S. Pro-birth Policies and Their Effects: International Experience, Review and Outlook. J. Zhejiang Univ. 2017, 47, 10–21. [Google Scholar]

- Testa, M.R. On the positive correlation between education and fertility intentions in Europe: Individual- and country-level evidence. Adv. Life Course Res. 2014, 21, 28–42. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).