Does the Impact of China’s Outward Foreign Direct Investment on Reverse Green Technology Process Differ across Countries?

Abstract

1. Introduction

2. Literature Review

3. Reverse Technology Spillover Mechanism and Analysis Framework of OFDI

3.1. The Impact Mechanism of China’s OFDI on Green Technology Progress in Different Countries

3.2. The Basic Model of OFDI Reverse Green Technology Spillover in China

4. Research Methods and Variable Descriptions

4.1. Measurement of GTFP

4.2. Panel Data Model for the Impact of OFDI on Green Technology Progress

4.3. Variable Description

5. The Empirical Analysis of OFDI Investment in Different Countries on Green Technological Progress

5.1. Analysis of Green Technology Progress in China

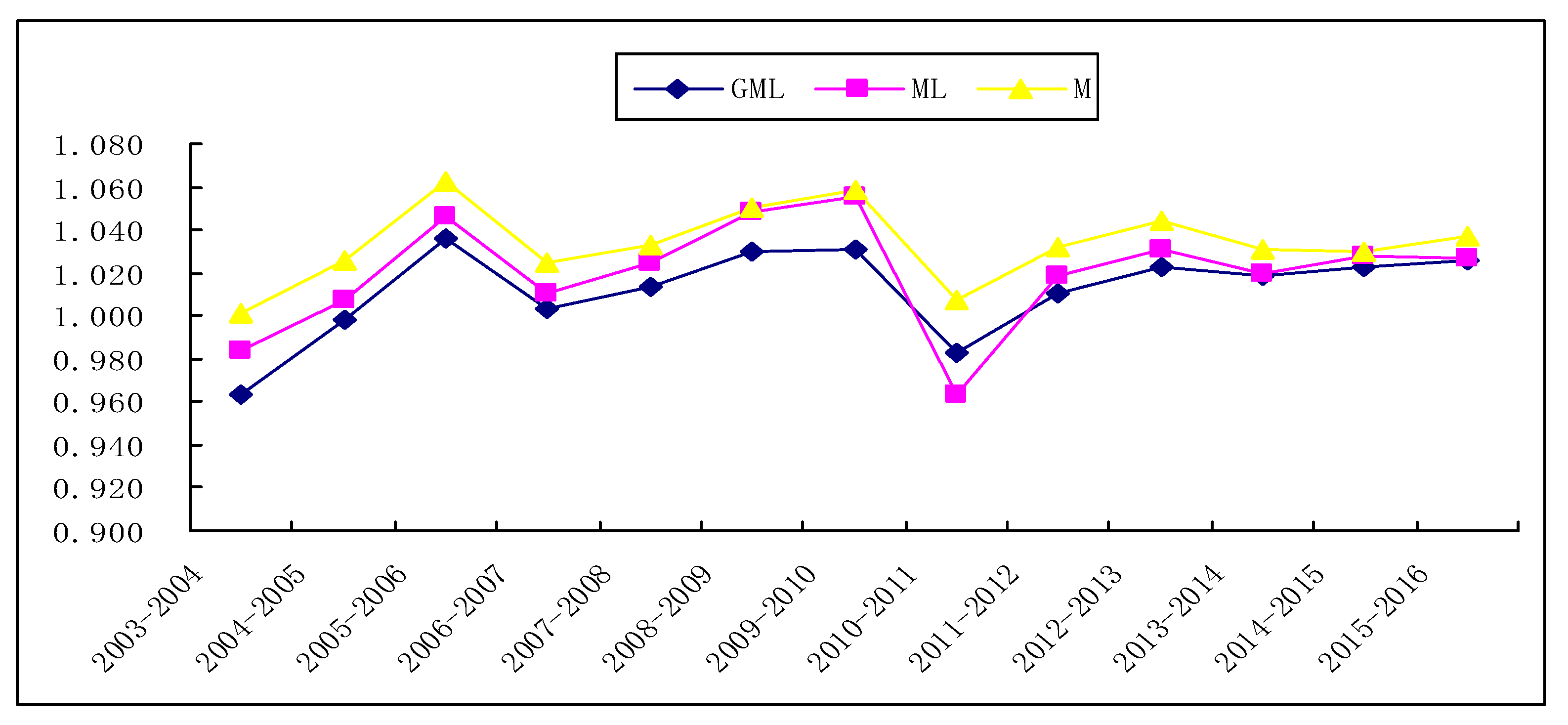

5.1.1. The Comparative Analysis of China’s GTFP Index Based on Different Measurement Methods

5.1.2. The Analysis of China’s GTFP Index

5.2. The Empirical Results Analysis

5.2.1. Selection of Estimation Methods

5.2.2. The Regression Analysis of Total Samples

5.2.3. The Comparative Analysis of Reverse Green Technology Progress of OFDI in Different Regions of China

5.3. The Endogeneity Problem and Robustness Test

6. Conclusions and Recommendations

Author Contributions

Funding

Conflicts of Interest

References

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Cai, F.; Du, Y.; Wang, M.Y. The Political Economy of Emission in China: Will a Low Carbon Growth Be Incentive Compatible in Next Decade and Beyond? Econ. Res. J. 2008, 29, 17–27. [Google Scholar]

- Lu, N.A.; Li, G. Under EKC Framework Study of the Effects of the Social Capital on the Environmental Quality: From China’s 1995–2007 Panel Data. Stat. Res. 2009, 26, 68–76. [Google Scholar]

- Wang, Y.; Hai, Y.U.; Zhang, Y.L.; Yang, C.; Zhang, Y. Turning point of China’s environmental quality: Empirical judgment based on EKC. China Popul. Resour. Environ. 2016, 26, 1–7. [Google Scholar]

- Copeland, B.R.; Taylor, M.S. North-South Trade and the Environment. Q. J. Econ. 1994, 109, 755–787. [Google Scholar] [CrossRef]

- Jing, W.; Zhang, L.; University, N. Environmental Regulation, Economic Opening and China’s Industrial Green Technology Progress. Econ. Res. J. 2014, 49, 34–47. [Google Scholar]

- Bai, J.H.; Nie, L. Technological Progress and Environmental Pollution—An Inverted U-shaped Hypothesis. R D Manag. 2017, 29, 131–140. [Google Scholar]

- Wang, S.; Wang, X.; Teng, Z. Productivity Effects of Bidirectional FDI in China under the Constraint of Resource and Environment. Int. Bus. 2017, 65–78. [Google Scholar] [CrossRef]

- Yang, S.D.; Han, X.F.; Song, W.F. Does OFDI Affect China Green TFP. J. Shanxi Univ. Financ. Econ. 2017, 39, 14–26. [Google Scholar]

- Chen, H.; Wu, W. Country difference of Chinese OFDI and technological progress. Stud. Sci. Sci. 2016, 34, 49–56. [Google Scholar]

- Lichtenberg, F.R. International R&D spillovers: A comment. Eur. Econ. Rev. 1998, 42, 1483–1491. [Google Scholar]

- Grossman, G.M.; Helpman, E. Innovation and Growth in the Global Economy; MIT Press: Cambridge, MA, USA, 1991; pp. 323–324. [Google Scholar]

- Braconier, H.; Ekholm, K.; Knarvik, K.H.M. In search of FDI-transmitted R&D spillovers: A study based on Swedish data. Rev. World Econ. 2001, 137, 644–665. [Google Scholar]

- Vahter, P.; Masso, J. Home versus Host Country Effects of FDI: Searching for New Evidence of Productivity Spillovers. Appl. Econ. Q. 2007, 53, 165–196. [Google Scholar] [CrossRef]

- Driffield, N.; Love, J.H.; Taylor, K. Productivity and Labour Demand Effects of Inward and Outward FDI on UK Industry. Manch. Sch. 2008, 77, 171–203. [Google Scholar] [CrossRef]

- Branstetter, L. Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. J. Int. Econ. 2000, 68, 325–344. [Google Scholar] [CrossRef]

- Zhao, W.; Liu, L.; Zhao, T. The contribution of outward direct investment to productivity changes within China, 1991–2007. J. Int. Manag. 2010, 16, 121–130. [Google Scholar] [CrossRef]

- Bitzer, J.; Kerekes, M. Does foreign direct investment transfer technology across borders? New evidence. Econ. Lett. 2008, 99, 355–358. [Google Scholar] [CrossRef]

- Bitzer, J.; Görg, H. Foreign Direct Investment, Competition and Industry Performance. World Econ. 2010, 32, 221–233. [Google Scholar] [CrossRef]

- Lee, G. The effectiveness of international knowledge spillover channels. Eur. Econ. Rev. 2006, 50, 2075–2088. [Google Scholar] [CrossRef]

- Bertrand, O.; Betschinger, M.A. Performance of domestic and cross-border acquisitions: Empirical evidence from Russian acquirers. J. Comp. Econ. 2012, 40, 413–437. [Google Scholar] [CrossRef]

- Zhou, L.; Pang, S.C. Home Country Environmental Effects of China’s Foreign Direct Investment: Based on the perspective of regional differences. China Popul. Resour. Environ. 2013, 23, 131–139. [Google Scholar]

- Xu, K.; Wang, Y. The Influence of China’s OFDI on Domestic CO2 Emissions: An Empirical Analysis Based on Province-Level Panel Data from 2003 to 2011. Ecol. Econ. 2015, 31, 47–54. [Google Scholar]

- Wang, J.; Hu, Y. Measure and Analysis of Skill-biased Technological Progress in China’s Manufacturing Industry. J. Quant. Tech. Econ. 2015, 32, 82–96. [Google Scholar]

- León-Ledesma, M.A.; Mcadam, P.; Willman, A. Identifying the Elasticity of Substitution with Biased Technical Change. Am. Econ. Rev. 2010, 100, 1330–1357. [Google Scholar] [CrossRef]

- Klump, R.; Mcadam, P.; Willman, A. Factor Substitution and Factor-Augmenting Technical Progress in the United States: A Normalized Supply-Side System Approach. Rev. Econ. Stat. 2007, 89, 183–192. [Google Scholar] [CrossRef]

- He, X.G.; Wang, Z.L. Energy Biased Technology Progress and Green Growth Transformation—An Empirical Analysis Based on 33 Industries of China. China Ind. Econ. 2015, 32, 50–62. [Google Scholar]

- Binswanger, H.P. The Measurement of Technical Change Biases with Many Factors of Production. Am. Econ. Rev. 1973, 64, 964–976. [Google Scholar]

- Färe, R.; Grifelltatjé, E.; Grosskopf, S.; Knox Lovell, C.A. Biased Technical Change and the Malmquist Productivity Index. Scand. J. Econ. 1997, 99, 119–127. [Google Scholar] [CrossRef]

- Yu, M.; Tian, W. Firm Productivity and Outbound Foreign Direct Investment: A Firm-Level Empirical Investigation of China. China Econ. Q. 2012, 11, 383–408. [Google Scholar]

- Coe, D.T.; Helpman, E. International R&D spillovers. Eur. Econ. Rev. 1993, 39, 859–887. [Google Scholar]

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and Undesirable Outputs: A Directional Distance Function Approach. Microeconomics 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. A directional slacks-based measure of technical inefficiency. Socio-Econ. Plan. Sci. 2009, 43, 274–287. [Google Scholar] [CrossRef]

- Chambers, R.G.; Fāure, R.; Grosskopf, S. Productivity growth in APEC countries. Pac. Econ. Rev. 1996, 1, 181–190. [Google Scholar] [CrossRef]

- Oh, D. A global Malmquist-Luenberger productivity index. J. Prod. Anal. 2010, 34, 183–197. [Google Scholar] [CrossRef]

- Zhu, S.; Ye, A. Does Foreign Direct Investment Improve Inclusive Green Growth? Empirical Evidence from China. Economies 2018, 6, 44. [Google Scholar] [CrossRef]

- Lichtenberg, F. Does Foreign Direct Investment Transfer Technology across Borders? Rev. Econ. Stat. 2001, 83, 490–497. [Google Scholar]

- Fu, Y.J.; Hu, J.; Cao, X. Different Sources of FDI, Environmental Regulation and Green Total Factor Productivity. J. Int. Trade 2018, 134–148. [Google Scholar]

- Antweiler, W.; Copeland, B.R.; Taylor, M.S. Is Free Trade Good for the Environment? Am. Econ. Rev. 2001, 91, 877–908. [Google Scholar] [CrossRef]

- National Burearu of Statistics of China (NBSC). China Compendium of Statistics 1949–2018; China Statistical Press, National Burearu of Statistics of China: Beijing, China, 2010.

- Zhang, Y.; Gong, L. The Fenshuizhi Reform, Fiscal Decentralization, and Economic Growth in China. China Econ. Q. 2005, 49, 1–21. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Cambridge Working Papers in Economics; University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Friedman, M. The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J. Am. Stat. Assoc. 1939, 32, 675–701. [Google Scholar] [CrossRef]

- Li, B.; Qi, Y.; Li, Q. Fiscal Decentralization, FDI and Green Total Factor Productivity—A Empirical Test Based on Panel Data Dynamic GMM Method. J. Int. Trade 2016, 7, 119–129. [Google Scholar]

- Yue, S.; Yang, Y.; Hu, Y. Does Foreign Direct Investment Affect Green Growth? Evidence from China’s Experience. Sustainability 2016, 8, 158. [Google Scholar] [CrossRef]

- Shea, J. Instrument Relevance in Multivariate Linear Models. Rev. Econ. Stat. 1997, 79, 348–352. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Sargan, J.D. The Estimation of Economic Relationships using Instrumental Variables. Econometrica 1958, 26, 393–415. [Google Scholar] [CrossRef]

- Yuan, D.; Xin, C.; Bin, Y.U. Does FDI Propel the Urbanization in China—The Threshold Effect Test from the Financial Development Perspective. J. Int. Trade 2017, 5, 126–138. [Google Scholar]

- Xu, W.B.; Ye, W. FDI, Growth, and Dual-threshold Effect of Financial Development. J. Appl. Stat. Manag. 2016, 6, 972–983. [Google Scholar]

| Variables | Sample Size | Mean Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| ln(GTFP) | 406 | 0.052 | 0.026 | −0.412 | 0.511 |

| ln(SD) | 406 | 4.161 | 1.621 | −1.309 | 7.296 |

| ln(SOFDI1) | 406 | −1.985 | 2.235 | −8.354 | 3.252 |

| ln(SOFDI2) | 406 | −3.652 | 2.986 | −11.937 | 1.627 |

| ln(SFDI) | 406 | 0.258 | 2.098 | −7.323 | 3.841 |

| ln(R) | 406 | −0.627 | 0.635 | −0.355 | −1.712 |

| ln(SIM) | 406 | 2.766 | 1.856 | −1.542 | 6.775 |

| ln(H) | 406 | 6.884 | 0.145 | 6.421 | 7.189 |

| ln(FD) | 406 | 1.391 | 0.612 | −0.607 | 3.122 |

| ln(GDP) | 406 | 3.105 | 0.220 | 0.981 | 4.406 |

| Provinces | GML (2003–2007) | GML (2008–2012) | GML (2013–2016) | Provinces | GML (2003–2007) | GML (2008–2012) | GML (2013–2016) |

|---|---|---|---|---|---|---|---|

| Beijing | 1.048 | 1.037 | 1.032 | Hubei | 1.064 | 1.026 | 1.009 |

| Tianjin | 1.034 | 1.025 | 1.022 | Hunan | 0.975 | 0.992 | 1.028 |

| Hebei | 0.977 | 1.018 | 1.029 | Guangdong | 1.023 | 1.013 | 1.016 |

| Shanxi | 0.985 | 1.011 | 1.026 | Guangxi | 0.957 | 0.991 | 1.014 |

| Inner Mongolia | 0.982 | 1.012 | 1.023 | Hainan | 1.039 | 1.042 | 0.996 |

| Liaoning | 0.939 | 0.999 | 1.018 | Sichuan | 1.026 | 1.016 | 1.020 |

| Jilin | 0.978 | 1.019 | 1.011 | Guizhou | 0.987 | 1.025 | 1.018 |

| Heilongjiang | 0.980 | 1.029 | 1.048 | Yunnan | 1.031 | 0.991 | 1.013 |

| Shanghai | 1.042 | 1.041 | 1.035 | Shaanxi | 0.992 | 1.018 | 1.023 |

| Jiangsu | 1.032 | 1.033 | 1.033 | Gansu | 0.961 | 0.987 | 1.009 |

| Zhejiang | 1.033 | 0.975 | 1.027 | Qinghai | 1.060 | 1.028 | 1.040 |

| Anhui | 0.919 | 0.990 | 1.020 | Ningxia | 0.980 | 1.022 | 0.991 |

| Fujian | 1.048 | 1.047 | 1.032 | Xinjiang | 0.979 | 0.991 | 1.020 |

| Jiangxi | 1.010 | 0.975 | 1.032 | Eastern Region | 1.023 | 1.024 | 1.024 |

| Shandong | 1.033 | 1.028 | 1.022 | Central Region | 0.985 | 1.001 | 1.022 |

| Henan | 0.971 | 0.963 | 1.003 | Western Region | 0.995 | 1.008 | 1.017 |

| wooldridge test for autocorrelation in panel data |

| F(1, 28) = 67.344 Prob > F = 0.000 |

| Cross-sectional dependence test |

| Friedman’s test of cross sectional independence = 25.696, Pr = 0.589 |

| Pesaran’s test of cross sectional independence = 0.774, Pr = 0.439 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| C | −0.725 *** | −0.692 *** | −0.745 *** | −0.769 *** |

| (0.151) | (0.146) | (0.153) | (0.154) | |

| ln(SD) | 0.046 ** | 0.047 *** | 0.044 ** | 0.069 *** |

| (0.021) | (0.019) | (0.022) | (0.021) | |

| ln(SOFDI1) | 0.194 *** | 0.421 *** | 0.267 *** | 0.502 ** |

| (0.034) | (0.119) | (0.038) | (0.254) | |

| ln(SOFDI2) | −0.201 ** | −0.195 *** | −0.281 *** | −0.237 *** |

| (0.092) | (0.027) | (0.045) | (0.038) | |

| ln(SFDI) | −0.056 | −0.251 | −0.118 | −0.013 ** |

| (0.069) | (2.623) | (0.157) | (0.006) | |

| ln(R) | 0.601 ** | 0.795 *** | 0.682 *** | 0.737 *** |

| (0.292) | (0.225) | (0.093) | (0.298) | |

| ln(SIM) | 0.065 * | 0.073 *** | 0.076 *** | 0.075 *** |

| (0.041) | (0.027) | (0.028) | (0.012) | |

| ln(H)ln(SOFDI1) | 0.041 * | 0.051 *** | ||

| (0.026) | (0.024) | |||

| ln(SD)ln(SOFDI2) | 0.002 | 0.038 ** | ||

| (0.003) | (0.019) | |||

| ln(FD) | −0.005 | −0.006 | −0.012 * | −0.019 ** |

| (0.004) | (0.007) | (0.009) | (0.009) | |

| ln(GDP) | −0.247 | −0.322 | −0.321 * | −0.287 *** |

| (0.256) | (0.487) | (0.214) | (0.119) | |

| R2 | 0.562 | 0.589 | 0.571 | 0.612 |

| F value (Wald) | 42.471 *** | 41.954 *** | 39.883 *** | 36.952 *** |

| Hausman test | 25.622 *** | 23.142 ** | 21.214 ** | 19.367 ** |

| sample size | 406 | 406 | 406 | 406 |

| Variables | The Eastern Region | The Central Region | The Western Region | ||||||

|---|---|---|---|---|---|---|---|---|---|

| (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | |

| C | −1.732 *** | −1.766 *** | −2.112 *** | −0.683 *** | −0.749 *** | −0.863 *** | −0.621 *** | −1.267 *** | −1.778 *** |

| (0.257) | (0.502) | (0.653) | (0.152) | (0.294) | (0.231) | (0.204) | (0.653) | (0.414) | |

| ln(SD) | 0.047 *** | 0.044 ** | 0.069 *** | 0.045 *** | 0.042 ** | 0.76 *** | 0.049 *** | 0.048 * | 0.073 *** |

| (0.019) | (0.022) | (0.031) | (0.017) | (0.023) | (0.025) | (0.016) | (0.032) | (0.021) | |

| ln(SOFDI1) | 0.461 *** | 0.294 *** | 0.564 ** | 0.432 *** | 0.286 *** | 0.532 ** | 3.417 ** | 0.211 *** | 0.454 ** |

| (0.117) | (0.049) | (0.244) | (0.149) | (0.072) | (0.261) | (0.156) | (0.047) | (0.268) | |

| ln(SOFDI2) | −0.195 *** | −0.281 *** | −0.237 *** | −0.195 *** | −0.281 *** | −0.237 *** | −0.195 *** | −0.281 *** | −0.237 *** |

| (0.027) | (0.045) | (0.038) | (0.027) | (0.045) | (0.038) | (0.027) | (0.045) | (0.038) | |

| ln(SFDI) | −0.551 | −0.321 | −0.214 | −0.371 | −0.135 | −0.014 | −0.251 | −0.123 * | −0.015 ** |

| (1.581) | (0.355) | (0.331) | (2.443) | (0.158) | (1.106) | (2.623) | (0.078) | (0.007) | |

| ln(R) | 0.802 *** | 0.784 *** | 0.862 *** | 0.799 *** | 0.581 *** | 0.635 *** | 0.425 ** | 0.312 *** | 0.611 ** |

| (0.327) | (0.083) | (0.231) | (0.231) | (0.077) | (0.232) | (0.215) | (0.053) | (0.287) | |

| ln(SIM) | 0.098 *** | 0.086 *** | 0.078 *** | 0.076 ** | 0.072 *** | 0.077 *** | 0.065 *** | 0.066 *** | 0.057 *** |

| (0.032) | (0.027) | (0.033) | (0.037) | (0.029) | (0.023) | (0.021) | (0.019) | (0.016) | |

| ln(H)ln(SOFDI1) | 0.051 * | 0.049 ** | 0.045 ** | 0.032 * | 0.042 * | 0.029 * | |||

| (0.033) | (0.025) | (0.026) | (0.024) | (0.026) | (0.019) | ||||

| ln(SD)ln(SOFDI2) | 0.003 | 0.028 ** | 0.004 * | 0.138 | 0.002 | 0.030 * | |||

| (0.003) | (0.017) | (0.003) | (0.119) | (0.002) | (0.021) | ||||

| ln(FD) | −0.008 | −0.013 | −0.021 ** | −0.006 | −0.013 | −0.018 ** | −0.009 * | −0.014 * | −0.021 ** |

| (0.007) | (0.011) | (0.012) | (0.006) | (0.010) | (0.008) | (0.006) | (0.009) | (0.009) | |

| ln(GDP) | −0.221 | −0.348 * | −0.289 ** | −0.379 | −0.323 | −0.286 ** | −0.198 | −0.386 ** | −0.288 ** |

| (0.487) | (0.224) | (0.149) | (0.496) | (0.254) | (0.146) | (0.487) | (0.214) | (0.167) | |

| R2 | 0.589 | 0.571 | 0.612 | 0.589 | 0.571 | 0.612 | 0.589 | 0.571 | 0.612 |

| F value (Wald) | 36.923 *** | 37.685 *** | 33.458 *** | 41.343 *** | 38.461 *** | 30.214 *** | 31.546 *** | 30.158 *** | 26.241 *** |

| Hausman test | 21.332 ** | 20.123 ** | 19.947 ** | 26.156 *** | 27.211 *** | 16.367 * | 24.121 *** | 20.219 ** | 18.997 ** |

| sample size | 154 | 154 | 154 | 112 | 112 | 112 | 140 | 140 | 140 |

| Variables | (14) | (15) | (16) |

|---|---|---|---|

| C | −0.953 *** | −0.652 * | −0.731 * |

| (0.243) | (0.323) | (0.378) | |

| ln(SD) | 0.046 *** | 0.081 * | 0.051 * |

| (0.011) | (0.042) | (0.026) | |

| ln(SOFDI1) | 0.606 * | 0.496 ** | 0.433 ** |

| (0.314) | (0.216) | (0.188) | |

| ln(SOFDI2) | −0.153 *** | −0.231 *** | −0.331 ** |

| (0.042) | (0.052) | (0.144) | |

| ln(SFDI) | −0.018 * | −0.014 | −0.160 |

| (0.009) | (0.012) | (0.202) | |

| ln(R) | 0.439 ** | 0.536 ** | 0.318 * |

| (0.199) | (0.232) | (0.177) | |

| ln(SIM) | 0.045 *** | 0.061 * | 0.072 * |

| (0.014) | (0.031) | (0.038) | |

| ln(H)ln(SOFDI1) | 0.050 * | 0.035 * | |

| (0.026) | (0.017) | ||

| ln(L)ln(SOFDI1) | 0.051 ** | ||

| (0.022) | |||

| ln(SD)ln(SOFDI2) | 0.045 * | 0.039 * | 0.046 * |

| (0.023) | (0.020) | (0.025) | |

| ln(FD) | −0.021 * | −0.136 | −0.216 |

| (0.011) | (0.192) | (0.392) | |

| ln(GDP) | −0.168 | 0.258 | −0.233 |

| (0.146) | (0.161) | (0.172) | |

| R2 | 0.526 | 0.63 | |

| Control variables | No | No | Yes |

| Hausman’ J test | [0.431] | ||

| Hausman test | 18.161 ** | ||

| GMM C test | [0.192] | ||

| Arellano-Bond test | [0.52] | ||

| Sargan test | [0.26] |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, S.; Ye, A. Does the Impact of China’s Outward Foreign Direct Investment on Reverse Green Technology Process Differ across Countries? Sustainability 2018, 10, 3841. https://doi.org/10.3390/su10113841

Zhu S, Ye A. Does the Impact of China’s Outward Foreign Direct Investment on Reverse Green Technology Process Differ across Countries? Sustainability. 2018; 10(11):3841. https://doi.org/10.3390/su10113841

Chicago/Turabian StyleZhu, Songping, and Azhong Ye. 2018. "Does the Impact of China’s Outward Foreign Direct Investment on Reverse Green Technology Process Differ across Countries?" Sustainability 10, no. 11: 3841. https://doi.org/10.3390/su10113841

APA StyleZhu, S., & Ye, A. (2018). Does the Impact of China’s Outward Foreign Direct Investment on Reverse Green Technology Process Differ across Countries? Sustainability, 10(11), 3841. https://doi.org/10.3390/su10113841