Alliance Portfolio Management and Sustainability of Entrepreneurial Firms

Abstract

:1. Introduction

2. Theoretical Background

2.1. Sustainability Development

2.2. The Alliance Portfolio Management Capability

2.3. Board of Directors

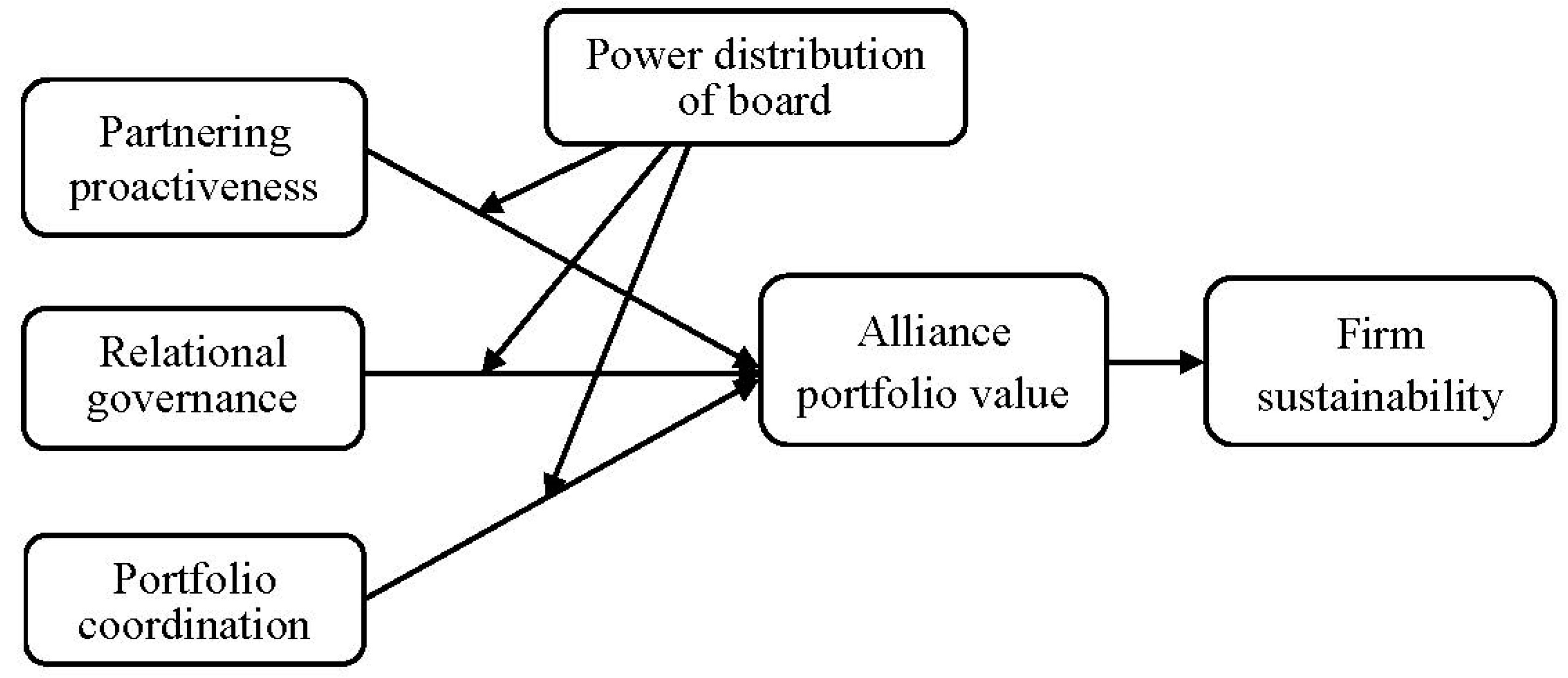

3. Hypothesis

3.1. Mediation of the Alliance Portfolio Value in the Relationship of the Alliance Portfolio Management Capability and Sustainability

3.1.1. Partnering Proactiveness

3.1.2. Relational Governance

3.1.3. Portfolio Coordination

3.2. The Moderation of the Power Distribution of the Board in the Mediation Effect

4. Methodology

4.1. Data and Sample

4.2. Measurement

4.2.1. Dependent Variable

4.2.2. Independent Variables

4.2.3. Mediating Variable

4.2.4. Moderating Variable

4.2.5. Control Variables

4.3. Common Method Bias

5. Data Analysis and Findings

5.1. Descriptive Statistics

5.2. Findings

5.3. Sensitivity Analysis

5.4. Endogeneity Analysis

6. Conclusions and Discussion

6.1. Conclusions

6.2. Discussion

6.3. Limitations

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Construct | Indicators | Sources |

|---|---|---|

| Partnering proactiveness | We actively monitor our environment to identify collaboration or alliance opportunities. | Adapted from Sarker et al. 2009; Castro, etc. 2015 |

| We routinely gather information about potential partners from diverse forums. | ||

| We are alert to market developments that create potential alliance opportunities. | ||

| We strive to preempt our competition by entering into alliances with the key firms before they can. | ||

| We often take the initiative in approaching firms with alliance proposals. | ||

| Relational governance | Staying together during adversities/challenges is very important in our relationships. | Adapted from Sarker et al. 2009; Castro, etc. 2015 |

| We endeavor to build relationships based on mutual trust and commitment. | ||

| We strive to be flexible and accommodate partners when problems/needs arise.When disagreements arise in our alliances, we usually reassess facts to try and reach a mutually satisfactory compromise.Information exchange with partners takes place frequently and informally, and not only according to prespecified agreements. | ||

| Portfolio coordination | We consider our alliances as a portfolio that requires overall coordination, and not as independent, one-off arrangements. | Adapted from Sarker et al. 2009; Castro, etc. 2015 |

| Our activities across different alliances are well coordinated. | ||

| We systematically coordinate our strategies across different alliances. | ||

| We have processes to systematically transfer knowledge across alliance partners. | ||

| Managers from different departments meet periodically to examine how we can create synergies across our alliances. | ||

| Alliance portfolio value | Overall we are satisfied with the performance of our alliances. Generally our alliances satisfy our initial objectives. | Adapted from Schilke et al. 2010 |

| We are satisfied with the knowledge accumulated from participating in alliances. | ||

| Our alliances have been profitable investments. |

References

- Brüderl, J.; Preisendörfer, P.; Ziegler, R. Survival Chances of Newly Founded Business Organizations. Am. Sociol. Rev. 1992, 57, 227–242. [Google Scholar] [CrossRef]

- Stinchcombe, A.L. Social Structure and Organization. In Handbook of Organization; March, J.G., Ed.; Rand McNally: Chicago, IL, USA, 1965; Volume 7, pp. 142–193. [Google Scholar]

- Chen, F.W.; Fu, L.W.; Wang, K. The Influence of Entrepreneurship and Social Networks on Economic Growth—From a Sustainable Innovation Perspective. Sustainability 2018, 10, 2510. [Google Scholar] [CrossRef]

- Li, D. Multilateral R&D Alliances by New Ventures. J. Bus. Ventur. 2013, 28, 241–260. [Google Scholar]

- Jiang, R.J.; Tao, Q.T.; Santoro, M.D. Alliance Portfolio Diversity and Firm Performance. Strat. Manag. J. 2010, 31, 1136–1144. [Google Scholar] [CrossRef]

- Anand, B.N.; Khanna, T. Do Firms Learn to Create Value? The Case of Alliances. Strat. Manag. J. 2000, 21, 295–315. [Google Scholar] [CrossRef]

- Baum, J.A.; Calabrese, T.; Silverman, B.S. Don’t Go It Alone: Alliance Network Composition and Startups’ Performance in Canadian Biotechnology. Strat. Manag. J. 2000, 21, 267–294. [Google Scholar] [CrossRef]

- Schreiner, M.; Kale, P.; Corsten, D. What Really is Alliance Management Capability and How does It Impact Alliance Outcomes and Success? Strat. Manag. J. 2009, 30, 1395–1419. [Google Scholar] [CrossRef]

- Ozcan, P.; Eisenhardt, K.M. Origin of Alliance Portfolios: Entrepreneurs, Network Strategies, and Firm Performance. Acad. Manag. J. 2009, 52, 246–279. [Google Scholar] [CrossRef]

- Lavie, D. Alliance Portfolios and Firm Performance: A Study of Value Creation and Appropriation in the US Software Industry. Strat. Manag. J. 2007, 28, 1187–1212. [Google Scholar] [CrossRef]

- Wassmer, U. Alliance Portfolios: A Review and Research Agenda. J. Manag. 2010, 36, 141–171. [Google Scholar] [CrossRef]

- Steensma, H.K.; Marino, L.K.; Weaver, K.M.; Dickson, P.H. The Influence of National Culture on the Formation of Technology Alliances by Entrepreneurial Firms. Acad. Manag. J. 2000, 43, 951–973. [Google Scholar]

- Wassmer, U.; Dussauge, P. Network Resource Stocks and Flows: How Do Alliance Portfolios Affect the Value of New Alliance Formations? Strat. Manag. J. 2012, 33, 871–883. [Google Scholar] [CrossRef]

- Sarkar, M.B.; Aulakh, P.S.; Madhok, A. Process Capabilities and Value Generation in Alliance Portfolios. Organ. Sci. 2009, 20, 583–600. [Google Scholar] [CrossRef]

- Castro, I.; Galán, J.L.; Casanueva, C. Management of Alliance Portfolios and the Role of the Board of Directors. J. Bus. Econ. Manag. 2016, 17, 215–233. [Google Scholar] [CrossRef]

- Hoffmann, W.H. How to Manage a Portfolio of Alliances. Long Range Plan. 2005, 38, 121–143. [Google Scholar] [CrossRef]

- Beckman, C.M.; Schoonhoven, C.B.; Rottner, R.M.; Kim, S.-J. Relational Pluralism in De Novo Organizations: Boards of Directors as Bridges or Barriers to Diverse Alliance Portfolios? Acad. Manag. J. 2014, 57, 460–483. [Google Scholar] [CrossRef]

- Heimeriks, K.H.; Duysters, G. Alliance Capability as a Mediator between Experience and Alliance Performance: An Empirical Investigation into the Alliance Capability Development Process. J. Manag. Stud. 2007, 44, 25–49. [Google Scholar] [CrossRef]

- Reuer, J.J.; Ragozzino, R. Agency Hazards and Alliance Portfolios. Strat. Manag. J. 2006, 27, 27–43. [Google Scholar] [CrossRef]

- Reynolds, P.; Miller, B. New Firm Gestation: Conception, Birth, and Implications for Research. J. Bus. Ventur. 1992, 7, 405–417. [Google Scholar] [CrossRef]

- Shane, S.; Cable, D. Network Ties, Reputation, and the Financing of New Ventures. Manag. Sci. 2002, 48, 364–381. [Google Scholar] [CrossRef] [Green Version]

- Davidsson, P.; Gordon, S.R. Panel Studies of New Venture Creation: A Methods-focused Review and Suggestions for Future Research. Small Bus. Econ. 2012, 39, 853–876. [Google Scholar] [CrossRef] [Green Version]

- Carter, N.M.; Williams, M.; Reynolds, P.D. Discontinuance among New Firms in Retail: The Influence of Initial Resources, Strategy, and Gender. J. Bus. Ventur. 1997, 12, 125–145. [Google Scholar] [CrossRef]

- Dimov, D. Nascent Entrepreneurs and Venture Emergence: Opportunity Confidence, Human Capital, and Early Planning. J. Manag. Stud. 2010, 47, 1123–1153. [Google Scholar] [CrossRef]

- Liao, J.; Welsch, H. Roles of Social Capital in Venture Creation: Key Dimensions and Research Implications. J. Small Bus. Manag. 2005, 43, 345–362. [Google Scholar] [CrossRef]

- Guo, C.; Miller, J.K. Guanxi Dynamics and Entrepreneurial Firm Creation and Development in China. Manag. Organ. Rev. 2010, 6, 267–291. [Google Scholar] [CrossRef]

- Lichtenstein, B.B.; Carter, N.M.; Dooley, K.J. Gartner, W.B. Complexity Dynamics of Nascent Entrepreneurship. J. Bus. Ventur. 2007, 22, 236–261. [Google Scholar] [CrossRef]

- Lu, J.; Tao, Z. Determinants of Entrepreneurial Activities in China. J. Bus. Ventur. 2010, 25, 261–273. [Google Scholar] [CrossRef] [Green Version]

- Marino, L.; Strandholm, K.; Steensma, H.K.; Weaver, K.M. The Moderating Effect of National Culture on the Relationship between Entrepreneurial Orientation and Strategic Alliance Portfolio Extensiveness. Entrep. Theory Pract. 2002, 26, 145–160. [Google Scholar] [CrossRef]

- Kale, P.; Singh, H. Managing Strategic Alliances: What Do We Know Now, and Where Do We Go from Here? Acad. Manag. Perspect. 2009, 45–62. [Google Scholar] [CrossRef]

- Hoang, H.; Rothaermel, F.T. The Effect of General and Partner-specific Alliance Experience on Joint R&D Project Performance. Acad. Manag. J. 2005, 48, 332–345. [Google Scholar]

- Kale, P.; Dyer, J.H.; Singh, H. Alliance Capability, Stock Market Response, and Long-term Alliance Success: The Role of the Alliance Function. Strat. Manag. J. 2002, 23, 747–767. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Determinants of Absorptive Capacity: The Value of Technology and Market Orientation for External Knowledge Acquisition. J. Bus. Ind. Mark. 2016, 31, 600–610. [Google Scholar] [CrossRef]

- Haider, S.; Mariotti, F. The Orchestration of Alliance Portfolios: The Role of Alliance Portfolio Capability. Scand. J. Manag. 2016, 32, 127–141. [Google Scholar] [CrossRef]

- Castro, I.; Roldán, J.L. Alliance Portfolio Management: Dimensions and Performance. European Manag. Rev. 2015, 12, 63–81. [Google Scholar] [CrossRef]

- Hoetker, G.; Mellewigt, T. Choice and Performance of Governance Mechanisms: Matching Alliance Governance to Asset Type. Strat. Manag. J. 2009, 30, 1025–1044. [Google Scholar] [CrossRef]

- De Vries, J.; Schepers, J.; Van Weele, A.; Van der Valk, W. When Do They Care to Share? How Manufacturers Make Contracted Service Partners Share Knowledge. Ind. Mark. Manag. 2014, 43, 1225–1235. [Google Scholar] [CrossRef]

- Tihanyi, L.; Ellstrand, A.E. The Involvement of Board of Directors and Institutional Investors in Investing in Transition Economies: An Agency Theory Approach. J. Int. Manag. 1998, 4, 337–351. [Google Scholar] [CrossRef]

- Salancik, G.R.; Pfeffer, J. Who Gets Power and How They Hold on to it: A Strategic- contingency Model of Power. Organ. Dyn. 1977, 5, 3–21. [Google Scholar] [CrossRef]

- Baysinger, B.D.; Kosnik, R.D.; Turk, T.A. Effects of Board and Ownership Structure on Corporate R&D Strategy. Acad. Manag. J. 1991, 34, 205–214. [Google Scholar]

- Xue, Y. Make or Buy New Technology: The Role of CEO Compensation Contract in a Firm’s Route to Innovation. Rev. Account. Stud. 2007, 12, 659–690. [Google Scholar] [CrossRef]

- Su, Y.; Xu, D.; Phan, P.H. Principal-Principal Conflict in the Governance of the Chinese Public Corporation. Manag. Organ. Rev. 2008, 4, 17–38. [Google Scholar] [CrossRef]

- Kogut, B. The Stability of Joint Ventures: Reciprocity and Competitive Rivalry. J. Ind. Econ. 1989, 38, 183–198. [Google Scholar] [CrossRef]

- Simonin, B.L. The Importance of Collaborative Know-how: An Empirical Test of the Learning Organization. Acad. Manag. J. 1997, 40, 1150–1174. [Google Scholar]

- Newbert, S.L.; Tornikoski, E.T. Supporter Networks and Network Growth: A Contingency Model of Organizational Emergence. Small Bus. Econ. 2012, 39, 141–159. [Google Scholar] [CrossRef]

- Phillips, N.; Tracey, P.; Karra, N. Building Entrepreneurial Tie Portfolios through Strategic Homophily: The Role of Narrative Identity Work in Venture Creation and Early Growth. J. Bus. Ventur. 2013, 28, 134–150. [Google Scholar] [CrossRef]

- Sarkar, M.B.; Echambadi, R.; Cavusgil, S.T.; Aulakh, P.S. The Influence of Complementarity, Compatibility, and Relationship Capital on Alliance Performance. J. Acad. Mark. Sci. 2001, 29, 358–373. [Google Scholar] [CrossRef]

- Davidsson, P. Entrepreneurial Opportunities and the Entrepreneurship Nexus: A Re-conceptualization. J. Bus. Ventur. 2015, 30, 674–695. [Google Scholar] [CrossRef]

- Barney, J.B.; Zhang, S. The Future of Chinese Management Research: A Theory of Chinese Management Versus a Chinese Theory of Management. Manag. Organ. Rev. 2009, 5, 15–28. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The Relational View: Cooperative Strategy and Sources of Interorganizational Competitive Advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Riordan, M.H.; Williamson, O.E. Asset Specificity and Economic Organization. Int. J. Ind. Organ. 1985, 3, 365–378. [Google Scholar] [CrossRef]

- Navis, C.; Glynn, M.A. How New Market Categories Emerge: Temporal Dynamics of Legitimacy, Identity, and Entrepreneurship in Satellite Radio, 1990–2005. Adm. Sci. Q. 2010, 55, 439–471. [Google Scholar] [CrossRef]

- Poppo, L.; Zenger, T. Do Formal Contracts and Relational Governance Function as Substitutes or Complements? Strat. Manag. J. 2002, 23, 707–725. [Google Scholar] [CrossRef]

- Uzzi, B. The Sources and Consequences of Embeddedness for the Economic Performance of Organizations: The Network Effect. Am. Sociol. Rev. 1996, 61, 674–698. [Google Scholar] [CrossRef]

- Williamson, O.E. The Theory of the Firm as Governance Structure: From Choice to Contract. J. Econ. Perspect. 2002, 16, 171–195. [Google Scholar] [CrossRef] [Green Version]

- Powell, W.W.; Koput, K.W.; Smith-Doerr, L. Interorganizational Collaboration and the Locus of Innovation: Networks of Learning in Biotechnology. Adm. Sci. Q. 1996, 41, 116–145. [Google Scholar] [CrossRef]

- Parise, S.; Casher, A. Alliance Portfolios: Designing and Managing Your Network of Business-partner Relationships. Acad. Manag. Perspect. 2003, 17, 25–39. [Google Scholar] [CrossRef]

- Gimeno, J. Competition Within and Between Networks: The Contingent Effect of Competitive Embeddedness on Alliance Formation. Acad. Manag. J. 2004, 47, 820–842. [Google Scholar]

- Vassolo, R.S.; Anand, J.; Folta, T.B. Non-additivity in Portfolios of Exploration Activities: A Real Options-based Analysis of Equity Alliances in Biotechnology. Strat. Manag. J. 2004, 25, 1045–1061. [Google Scholar] [CrossRef]

- Carpenter, M.A.; Westphal, J.D. The Strategic Context of External Network Ties: Examining the Impact of Director Appointments on Board Involvement in Strategic Decision Making. Acad. Manag. J. 2001, 44, 639–660. [Google Scholar] [Green Version]

- Collins, J.D. Social Capital as a Conduit for Alliance Portfolio Diversity. J. Manag. Issues 2013, 25, 62–78. [Google Scholar]

- Hillman, A.J.; Dalziel, T. Boards of Directors and Firm Performance: Integrating Agency and Resource Dependence Perspectives. Acad. Manag. Rev. 2003, 28, 383–396. [Google Scholar] [CrossRef] [Green Version]

- Garg, S. Venture Boards: Distinctive Monitoring and Implications for Firm Performance. Acad. Manag. Rev. 2013, 38, 90–108. [Google Scholar] [CrossRef]

- Halevy, N.Y.; Chou, E.D.; Galinsky, A. A Functional Model of Hierarchy: Why, How, and When Vertical Differentiation Enhances Group Performance. Organ. Psychol. Rev. 2011, 1, 32–52. [Google Scholar] [CrossRef]

- Finkelstein, S.; Mooney, A.C. Not the Usual Suspects: How to Use Board Process to Make Boards Better. Acad. Manag. Perspect. 2003, 17, 101–113. [Google Scholar] [CrossRef]

- Christie, A.M.; Barling, J. Beyond Status: Relating Status Inequality to Performance and Health in Teams. J. Appl. Psychol. 2010, 95, 920–934. [Google Scholar] [CrossRef] [PubMed]

- Higgins, R.C. How Much Growth can a Firm Afford? Financ. Manag. 1977, 6, 7–16. [Google Scholar] [CrossRef]

- Van Horne, J.C. Sustainable Growth Modeling. J. Corp. Financ. 1988, 1, 19–24. [Google Scholar]

- Van Horne, J.C.; Frayret, J.; Poulin, D. Creating Value with Innovation: From Center of Expertise to the Forest Products Industry. For. Policy Econ. 2006, 8, 751–761. [Google Scholar] [CrossRef]

- Schilke, O.; Goerzen, A. Alliance Management Capability: An Investigation of the Construct and its Measurement. J. Manag. 2010, 36, 1192–1219. [Google Scholar] [CrossRef]

- Finkelstein, S. Power in Top Management Teams: Dimensions, Measurement, and Validation. Acad. Manag. J. 1992, 35, 505–538. [Google Scholar]

- Dang, C.; Li, F.; Yang, C. Measuring Firm Size in Empirical Corporate Finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Beckman, C.M. The Influence of Founding Team Company Affiliations on Firm Behavior. Acad. Manag. J. 2006, 49, 741–758. [Google Scholar] [CrossRef] [Green Version]

- Hallen, B.L. The Causes and Consequences of the Initial Network Positions of New Organizations: From Whom Do Entrepreneurs Receive Investments? Adm. Sci. Q. 2008, 53, 685–718. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS Procedures for Estimating Indirect Effects in Simple Mediation Models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef] [PubMed]

- Baron, R.M.; Kenny, D.A. The Moderator-mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Aguinis, H.; Edwards, J.R.; Bradley, K.J. Improving Our Understanding of Moderation and Mediation in Strategic Management Research. Organ. Res. Methods 2016, 1, 1–21. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic Capabilities: Routines versus Entrepreneurial Action. J. Manag. Stud. 2012, 49, 1395–1401. [Google Scholar] [CrossRef] [Green Version]

- Li, F. Endogeneity in CEO Power: A Survey and Experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Pettigrew, A.M.; Thomas, H.; Whittington, R. Strategic Management: The Strengths and Limitations of a field. In Handbook of Strategy and Management; Pettigrew, A.M., Thomas, H., Whittington, R., Eds.; Sage: London, UK, 2001; pp. 3–30. [Google Scholar]

- Li, H.; Zhang, Y. The Role of Managers’ Political Networking and Functional Experience in New Venture Performance: Evidence from China’s Transition Economy. Strat. Manag. J. 2007, 28, 791–804. [Google Scholar] [CrossRef]

| Variables | EFA | CFA | |||

|---|---|---|---|---|---|

| α | GFI | CFI | TLI | RMR | |

| Partnering proactiveness | 0.909 | 0.927 | 0.958 | 0.916 | 0.060 |

| Relational governance | 0.841 | 0.921 | 0.945 | 0.890 | 0.052 |

| Portfolio coordination | 0.811 | 0.889 | 0.876 | 0.752 | 0.096 |

| Alliance portfolio value | 0.896 | 0.967 | 0.985 | 0.954 | 0.042 |

| Type | Abbreviation | Variable | Measurement |

|---|---|---|---|

| Dependent variable | FS | Firms’ sustainability | The firm‘s sustainability was measured by the growth of profit and sales of the entrepreneurial firm. |

| Independent variable | PP | Partnering proactiveness | Three dimensions of the alliance portfolio management capability were measured by a multiple-items survey adapted from Sarker et al. (2009); Castro, etc. (2015). |

| RG | Relational governance | ||

| PC | Portfolio coordination | ||

| Mediating variable | APV | Alliance portfolio value | Alliance portfolio value was measured by a four-item scale based on Schilke et al.2010. |

| Moderating variable | PDB | Power distribution of board | Firstly, we coded the share of each director in the board and calculated the difference of the maximum share and the minimum share. Secondly, we coded 1 when the difference was higher than the mean and coded 0 when the difference was lower than the mean. |

| Control variables | TC/EM | Firm size | The firm size was measured by using the total capital (TC) and the number of employees (EM). |

| AG | Firm age | The firm age was measured from the time from when it started to 2017. | |

| BS | Board size | The board size was measured using the number of board members in the entrepreneurial firm. | |

| DI | Diversity of knowledge in board | The diversity of knowledge in the board was measured by the Blau index to determine the diversity of majors among the board members. |

| Index | Items | n | % |

|---|---|---|---|

| Region | Northeast area (3 provinces) | 3 | 3 |

| Area around Beijing | 44 | 43.6 | |

| Yangtze River Delta (around Shanghai) | 20 | 19.8 | |

| Pearl River Delta (around Guangzhou) | 18 | 17.8 | |

| West area (12 provinces) | 7 | 6.9 | |

| Middle area (6 provinces) | 9 | 8.9 | |

| Age (started) | Below 8 years | 47 | 46.5 |

| 8–10 years | 22 | 21.8 | |

| Above 10 years | 32 | 31.7 | |

| Age (IPO) | 2 years | 17 | 16.8 |

| 3 years | 60 | 59.4 | |

| 4 years | 17 | 16.8 | |

| 5 years | 7 | 6.9 | |

| Number of directors | Below 5 | 5 | 5 |

| 5 | 75 | 74.3 | |

| 6 | 7 | 6.9 | |

| 7 | 13 | 12.9 | |

| 9 | 1 | 1 | |

| Total | 101 | 100.0 |

| PP | RC | PG | APV | BN | TC | EM | AG | DI | PDB | GR_P | GR_S | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PP | ||||||||||||

| RC | 0.626 ** | |||||||||||

| PG | 0.708 ** | 0.580 ** | ||||||||||

| APV | 0.537 ** | 0.614 ** | 0.407 ** | |||||||||

| BN | 0.137 | 0.135 | 0.096 | 0.089 | ||||||||

| TC | 0.094 | 0.251 * | 0.108 | 0.177 | 0.036 | |||||||

| EM | 0.127 | 0.255 * | 0.162 | 0.034 | 0.194 | 0.429 ** | ||||||

| AG | −0.103 | −0.104 | −0.047 | −0.071 | −0.214 * | 0.073 | −0.041 | |||||

| DI | 0.053 | 0.131 | 0.119 | 0.080 | 0.080 | 0.021 | −0.045 | −0.120 | ||||

| PDB | −0.101 | −0.067 | −0.016 | −0.069 | −0.052 | −0.062 | −0.071 | 0.057 | −0.019 | |||

| GR_P | 0.228 * | 0.372 ** | 0.182 * | 0.354 ** | 0.207 * | 0.086 | 0.053 | −0.097 | 0.190 | 0.077 | ||

| GR_S | 0.270 * | 0.049 | 0.147 * | 0.231 * | 0.223 * | −0.109 | 0.036 | −0.028 | 0.176 | 0.067 | 0.152 |

| Path | Beta | LLCI | ULCI | Model Fit | ||

|---|---|---|---|---|---|---|

| R2 | F | sig | ||||

| Direct effect | Model: X→M | |||||

| PP→Gr_P | 0.0073 | −0.0496 | 0.0642 | 0.3171 | 7.2743 | 0 |

| RG→Gr_P | 0.0051 | −0.0582 | 0.0685 | 0.2009 | 3.9397 | 0.0015 |

| PC→Gr_P | 0.0546 | −0.0061 | 0.1153 | 0.401 | 10.4865 | 0 |

| Indirect effect | Model: X→M→Y | |||||

| PP→APV→Gr_P | 0.0412 | 0.0112 | 0.1031 | 0.1804 | 2.9252 | 0.0082 |

| RG→APV→Gr_P | 0.0383 | 0.0135 | 0.0916 | 0.1801 | 2.9184 | 0.0083 |

| PC→APV→Gr_P | 0.0301 | −0.0022 | 0.0879 | 0.2071 | 3.4703 | 0.0024 |

| Path | Beta | LLCI | ULCI | Model Fit | ||

|---|---|---|---|---|---|---|

| R2 | F | sig | ||||

| Direct effect | Model: X→M | |||||

| PP→Gr_P | 0.0073 | −0.0496 | 0.0642 | 0.3197 | 5.404 | 0 |

| RG→Gr_P | 0.0051 | −0.0582 | 0.0685 | 0.22 | 3.2441 | 0.0027 |

| PC→Gr_P | 0.0546 | −0.0061 | 0.1153 | 0.402 | 7.7317 | 0 |

| Indirect effect | Model: X→M→Y | |||||

| PP→APV→Gr_P | 0.0082 | 0.0175 | 0.0512 | |||

| PDB = 1 | 0.045 | 0.0123 | 0.1076 | 0.1804 | 2.9252 | 0.0082 |

| PDB e = 0 | 0.0367 | 0.0075 | 0.1109 | |||

| RG→APV→Gr_P | 0.0259 | 0 | 0.0906 | |||

| PDB = 1 | 0.0529 | 0.0191 | 0.1292 | 0.1801 | 2.9184 | 0.0083 |

| PDB = 0 | 0.027 | 0.0055 | 0.0836 | |||

| PC→APV→Gr_P | 0.0008 | −0.0314 | 0.0155 | |||

| PDB = 1 | 0.0297 | −0.0021 | 0.0922 | 0.2071 | 3.4703 | 0.0024 |

| PDB = 0 | 0.0305 | −0.0008 | 0.0985 | |||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, W.; Chen, F.-W.; Deng, Y. Alliance Portfolio Management and Sustainability of Entrepreneurial Firms. Sustainability 2018, 10, 3815. https://doi.org/10.3390/su10103815

Han W, Chen F-W, Deng Y. Alliance Portfolio Management and Sustainability of Entrepreneurial Firms. Sustainability. 2018; 10(10):3815. https://doi.org/10.3390/su10103815

Chicago/Turabian StyleHan, Wei, Feng-Wen Chen, and Yu Deng. 2018. "Alliance Portfolio Management and Sustainability of Entrepreneurial Firms" Sustainability 10, no. 10: 3815. https://doi.org/10.3390/su10103815

APA StyleHan, W., Chen, F.-W., & Deng, Y. (2018). Alliance Portfolio Management and Sustainability of Entrepreneurial Firms. Sustainability, 10(10), 3815. https://doi.org/10.3390/su10103815