1. Introduction

Rural Vitalization is a global issue [

1]. In the context of globalization and urbanization, developed countries in both North America and Europe [

2,

3], and developing countries in Asia and Africa [

4,

5], are exploring policies and measures to coordinate urban–rural integration and promote rural revitalization according to their national conditions. Rural revitalization is a process of sustained development for industry-fed agriculture and urban-fed rural areas [

6,

7]. Industrialized countries and regions have achieved rich experience in coordinating the relationship between urban and rural areas [

8]. Rapid industrialization and urbanization bring “urban diseases” to European and American countries, such as high population density, traffic jams, and the heat island effect in urban development; then, they started the strategy of rural revitalization, such as the development of new towns in the United States in the 1960s, the construction of rural central villages in the United Kingdom, and the “rural revitalization plan” in France [

3,

6,

8]. While Japan and South Korea, as the representatives of the post-industrialized countries in East Asia, drew lessons from them and launched rural revitalization later [

9]. In the 1970s, Korea launched the “new rural movement”, and Japan started the demonstration project of comprehensive rural construction [

1]. These countries took serval actions to promote rural area, including the construction of rural community infrastructure, activating the use of rural land resources and assets, improving rural production and living conditions, and attracting people to return home, thus stimulating the vitality of rural development [

10].

The government of China implemented the “rural vitalization strategy” at the 19th Communist Party of China (CPC) National Congress, aiming to address the imbalanced and insufficient development caused by the traditional dual structure of urban and rural areas under the background of rapidly developed new-type urbanization [

11]. It has become the priority of work and a core task of government at various levels [

12]. In fact, Taiwan drew lessons from Japan and South Korea [

13] and started to implement the rural vitalization strategy [

14,

15] back in the 1980s, accumulating valuable experience in delicate agriculture [

16], new-type professional farmers [

17], rural eco-environmental issues [

18], factor mobility between urban and rural areas [

19], and rural governance systems [

20]. With the reform and opening up policy being carried out, more Taiwanese compatriots got a proper environment for financing innovation and entrepreneurship in mainland China, such as township enterprises [

21,

22], Taiwanese farmer pioneer parks [

23], and leisure farms [

24]. Greater Straits of connectivity help to gather a large number of Taiwanese talents, who engaged in Taiwanese investment parks, Taiwanese farmer pioneer parks, leisure farms, and traditional homestay hotels. Various business models substantially boosted the local rural industrial vitalization. Both sides of the Taiwanese Strait share the same ancestry. The experience and achievements of Rural Revitalization in Taiwan have crossed the Taiwanese Strait and have spread in the mainland. We have summarized Taiwan’s experience in rural vitalization, putting into play the leading and demonstrating role of Taiwanese compatriots in rural industrial vitalization [

25], aiming to provide some valuable guides for mainland rural vitalization in theory and practice.

Rural vitalization is a systematic project [

26] that covers various aspects, such as society, economy, culture, and ecology [

27]. (1) Regarding the content of rural vitalization, domestic and overseas research shows that the primary task of rural vitalization is to promote rural industrial vitalization, that is, establishing a rural industrial system that focuses on modern agriculture, and improves the integration of rural primary, secondary, and tertiary industries [

1]. Liu summarizes rural vitalization into “five constructions”, among which industrial prosperity is an important foundation of economic construction. He also emphasizes the importance of resource integration, industrial cultivation, economic transformation, and income growth [

11]. However, the study fails to pay sufficient attention to Chinese traditional rural governance culture [

28,

29]. (2) In terms of a specific path, the successful implementation of various “new village movement” strategies in Europe, America, Japan, and South Korea lies in the practice of the top-down or bottom-up approach. At the early stage, the government is the main force promoting rural development; during the growth period, civilians independently spare no efforts to advance rural industrial development, environmental improvement, and cultural construction; at the mature stage, civilians drive community civilization construction and economic development entirely independently [

30,

31,

32]. In China, rural vitalization at the early stage is predominated and promoted by the government [

33]. Such a top-down mode is unitary in form, prone to excessive bureaucratization and formalization in the process of implementation, and is difficult to sustain. (3) In terms of participators, many participators are involved in rural vitalization, not only the local stakeholders [

34], such as the government, villagers, new village elites, enterprises, and technicians, but also the incoming participating stakeholders such as enterprises, technicians, public welfare organizations, and volunteers. On such a basis, an industrial development system based on rural land, tied by talent and technology, and driven by capital is shaped [

35]. Besides, at different vitalization stages in different countries and regions, the participators and the role they play may differ [

36,

37]. (4) For spatial diffusion, the strategy of rural revitalization was put forward and transitioned from Europe and America to Asia. In this new era, with the gradual completion of industrialization and urbanization in the vast areas of the mainland, the experience of rural revitalization in the developed countries and regions of Europe, America, and East Asia is bound to be further widespread and disseminated in the mainland, and will be gradually internalized and absorbed into the policies and measures of rural revitalization with mainland characteristics [

38].

Rural industrial vitalization is the core and foundation of rural vitalization, and is also a popular yet difficult issue in the domestic and foreign study on rural vitalization [

32,

39]. At present, China has made significant research achievements in rural vitalization, but has neglected that, to a great extent, special participators such as new village elites, Taiwanese compatriots, and overseas Chinese citizens, can play an important role in the rural industrial vitalization [

34], especially Taiwanese compatriots who have experience of Taiwanese rural vitalization, and have engaged themselves in rural industrial vitalization in Fujian and other areas in mainland China for over 20 years, accumulating rich and valuable experience. Despite the availability of some studies on spatial diffusion and the devolvement of Taiwanese enterprises in mainland China, they seldom focus on rural industrial vitalization. This perspective not only reflects the general features of the spatial layout of Taiwanese enterprises in mainland China, but also highlights the particularity based on rural geographical location. Therefore, it is necessary to review and summarize the general features of the Taiwanese compatriots participating in rural industrial vitalization in mainland China, and to further clarify the spatial diffusion path of Taiwanese enterprises in rural areas. Thus, we can help to improve the theoretical system on the rural industrial structure and offer reference for the implementation of rural industrial vitalization in mainland China.

2. Data and Methods

2.1. Data Collection

The Provisions of the State Council on Encouraging Investment by Taiwanese Compatriots, promulgated in 1988, encourages Taiwanese companies, enterprises, and individuals to invest in industry, agriculture, services, and other industries, in line with the direction of the social and economic development direction in mainland China in seven forms, including setting up enterprises entirely invested by Taiwan, setting up joint ventures and cooperative enterprises, conducting compensation trade, processing and assembling and cooperative production, purchasing stocks and bonds of enterprises, purchasing housing, and legally acquiring land use right, as well as development, operation, and other investment forms permitted by the laws and regulations. Among the seven forms, setting up sole proprietorship enterprises and joint ventures by Taiwanese compatriots are the most popular. The statistics across the Straits are available and reliable. The study takes the sole proprietorship Taiwanese enterprises and joint ventures as the major source of data for the engagement of Taiwanese compatriots in rural industrial vitalization.

The data in the study is derived from the Approved Investment Statistics of Taiwanese Investment Commission, a branch of the Ministry of Economic affairs. We collected the investment data in mainland China by listed Taiwanese enterprises and over-the-counter (OTC) Taiwanese enterprises, including the name, place of registration, time of registration, and code of getting listed for the OTC Taiwanese enterprises, and name of investment enterprises, registration place of investment enterprises, registration time of investment enterprises, and contact information of the investment enterprises. The listed and OTC Taiwanese enterprises are corporations whose stocks are publically traded at security exchanges with the approval of Taiwanese securities authorities, and the capital threshold is 600 million New Taiwan Dollar(TWD) for the listed enterprises and 50 million TWD for the OTC enterprises. They are both strong in credit and strength, large in size and high in level, and are fully capable of spatial diffusion. From 1997 to 2017, a total of 1540 listed (OTC) Taiwanese enterprises set up 4857 enterprises in mainland China, covering 18 industries in 29 provinces, autonomous regions, and municipalities. The wide and profound influence of their spatial diffusion in mainland China is representative across China and even the world, and thus is of great value for study. We collected 941 enterprises from these, which are registered in the towns and villages of rural areas. These data will greatly show Taiwanese compatriots participating in rural mainland vitalization (hereinafter, “rural Taiwanese enterprises”). Although these rural Taiwanese enterprises account for an estimated 5% of the total enterprises, they involve in 16 industries and cover 23 provinces, with an average registered capital of about 14 million U.S. dollars, and an average employment scale of 150–200 people. Therefore, these samples have good representativeness, which provides reliable data for our research.

2.2. Methodology

2.2.1. GIS Spatial Analysis

We use ArcGIS 10.3 (ESRI, Redlands, America) to build a database for the 941 rural Taiwanese enterprises, including information such as the company code, industry, region, establishment time, type of enterprise, and state of existence. We also analyze features of the spatial distribution of rural Taiwanese enterprises. We adopted the kernel density analysis to calculate their density, and used the geo-statistical analysis to predict the tendency of spatial diffusion.

2.2.2. Spatial Diffusion Model

The cultural diffusion model describes and explains the law and process of certain cultures spreading from the diffusion source outwards, and can be expressed with a basic diffusion model equation [

38,

40]. This model can be applied to economics activity diffusion and technology diffusion [

8]. We assumed that, at any time point, the diffusion rate of rural Taiwanese enterprises is a function of the difference between the number of enterprises that could possibly be set up at the time point and the number of enterprises that are already established at the time point (

). The spatial diffusion model of rural Taiwanese enterprises is illustrated with Formula (1).

In Formula (1), N(t) represents the number of rural Taiwanese enterprises accumulated at the time point t, and means the potential number of the enterprises at the time point t; indicates the diffusion rate at the time point t, and g(t) shows the diffusion coefficient.

Formula (1) shows a deterministic rate equation, where the form of relation and nature between the diffusion rate and the number of enterprises that could potentially be set up, , are represented or controlled by the diffusion coefficient, g(t). The value of g(t) is determined by the features of the diffusion process, including the culture sharing of rural Taiwanese enterprises, the diffusion relationship, diffusion medium, and way of diffusion.

According to previous research results [

41], the spatial diffusion of Taiwanese enterprises in mainland China is influenced by both internal factors and external factors. The former refers to cost, need for expanded operation and management, and so on, while the latter includes TWD depreciation, reform and opening up in mainland China, and so on. Therefore, the diffusion model with mixed factors should be adopted, as shown in Formula (2).

can be regarded as the asymptote of the spatial diffusion curve.

2.2.3. Spatial Diffusion Index for Rural Taiwanese Enterprises

2.2.3.1. Create Evaluation System

This study creates a spatial diffusion system of rural Taiwanese enterprises in order to reflect the spatial diffusion of the Taiwanese compatriots engaging in rural industrial vitalization. Five indices namely, the type of enterprise, registered capital, establishment time, registered status, and terms of operation, are used as the main evaluation indices for the spatial diffusion index (

Table 1). We argue that these five indices have a significant relationship with the spatial diffusion of rural Taiwanese enterprises, with the following exceptions: (a) Joint venture rural Taiwanese enterprises may be more likely to diffuse than sole proprietorship enterprises. Joint venture Taiwanese enterprises have more frequent communications with local villages, which is conducive to their spatial diffusion. (b) A higher registered capital reflects the stronger strength of the enterprises and is more helpful for the spatial diffusion. (c) An earlier establishment of the enterprises reflects a deeper integration with local areas and is better for the spatial diffusion. (d) Enterprises that currently exist and are in business are considered business activities, and this works to the advantage of spatial diffusion. (e) A longer duration means that the enterprises have more opportunities and a higher ability to diffuse.

2.2.3.2. Standardization of the Evaluation Indices

The evaluation indices are standardized so as to address the discrepancy between the indices’ dimensions and their physical significance, as well as the incomparability of parameters. The range method is used to assign value to the correlation between the evaluation indices and spatial diffusion. The greater the positive correlation, the stronger the diffusion ability; the greater the negative correlation, the lower the diffusion ability.

The graded value assignment method is used to evaluate the type of enterprise, registered capital, date of establishment, terms of operation, and registered status, and the natural breaks class is adopted to normalize the registered capital and date of establishment (

Table 2). The terms of operation are subject to extremum normalization and the type of enterprise and registered status are subject to a direct graded value assignment, according to expertise and actual diffusion laws.

2.2.3.3. Identification of the Index Weight

The analytic hierarchy process (AHP) is adopted to analyze the weight of the five indices. We invited 15 experts in geography, economics, and management science to compare their relative importance. Five geography experts, two economics experts, and two management science experts came from universities and research institutions, and another three economics experts and three management science experts came from economics and management sections. These experts assigned values from one to nine, after comparing the importance of each index. We ran the Yaahp v10 software (Meta decision software technology Co., Ltd., Shanxi, China) to statistically analyze the weight of these values, and the results are shown in

Table 3.

2.2.3.4. Spatial Diffusion Index

The spatial diffusion index (SDI) of rural Taiwanese enterprises is built so as to evaluate their capability of spatial diffusion. Based on the spatial diffusion evaluation index system, the SDI is further calculated by considering the impact of all of the indices on spatial diffusion of the enterprises, as follows:

In Formula (3), SDIn represents the spatial diffusion index of the nth rural enterprise, while Xn, Yn, Zn, Sn, and Tn refer to the index value of the type of enterprise, registered capital, date of establishment, term of operation, and registered status of the nth rural enterprise.

4. Conclusion and Discussion

Industrial vitalization is the foundation and key to rural vitalization. Taiwanese compatriots have accumulated rich experience in rural industrial vitalization. They also invest in mainland towns and villages so as to facilitate rural vitalization. The study collects the basic data on 941 Taiwanese enterprises that have been investing in mainland towns and villages for the past 30 years, and adopts a GIS spatial analysis method and cultural diffusion model to analyze the spatial pattern and spatial evolvement of rural Taiwanese enterprises. The following conclusions are drawn.

(1) In terms of temporal and spatial evolvement, the growth of rural Taiwanese enterprises is closely related to the domestic policies and international economic situation. They experienced explosive growth at the beginning of the 21st century, but slowed down slightly later. The spatial distribution of the enterprises shows the dual-core pattern around the Yangtze River Delta and Pearl River Delta, which differs from the “axe-shaped” general spatial distribution in the four core areas, Yangtze River Delta, Pearl River Delta, Beijing–Tianjin–Hebei, and Chengdu–Chongqing, of the Taiwanese enterprises in mainland China. The latter indicates that the Taiwanese enterprises in mainland China are predominated by city diffusion in Beijing–Tianjin–Hebei and Chengdu–Chongqing. The institutional dividend at the early stage shaped the agglomeration core foundation of Dongguan and Kunshan, and the combined effect was further enhanced and diffused at the stage of explosive growth, forming the “core- periphery” spatial structure. As the growth of rural the Taiwanese enterprises slowed down, the combined effect slightly weakened and the enterprises started to be diffused towards other Eastern, Central, and Western regions.

(2) Rural Taiwanese enterprises are mostly engaged in secondary industry, small in size, and highly independent. Generally speaking, their investment is limited by size and mainly goes to manufacturing and other labor-intensive and technology-intensive industries with low value added. Spatially speaking, they are mainly distributed in secondary cities in economically developed areas, so as to reduce cost and maximize profit. Regarding the methods of investment, sole proprietorship enterprises are dominant, with the exception of Fujian, which is home to more joint ventures. This reflects the low degree of cultural integration and exchange of Taiwanese enterprises in investment destinations.

(3) In terms of the general spatial diffusion process, the high-grade spatial diffusion index of rural Taiwanese enterprises displays the V-shaped spatial feature in Guangdong–Fujian–Zhejiang–Jiangsu–Shandong and Guangdong–Guizhou–Sichuan. The comprehensive index shows the feature increase at first and decrease later, while the average spatial index remains around five. Regarding the industrial features, the diffusion index is featured by the low-level development of the primary industry, the increase at first and decrease later of the secondary industry, and the decrease at first and increase later of the tertiary industry.

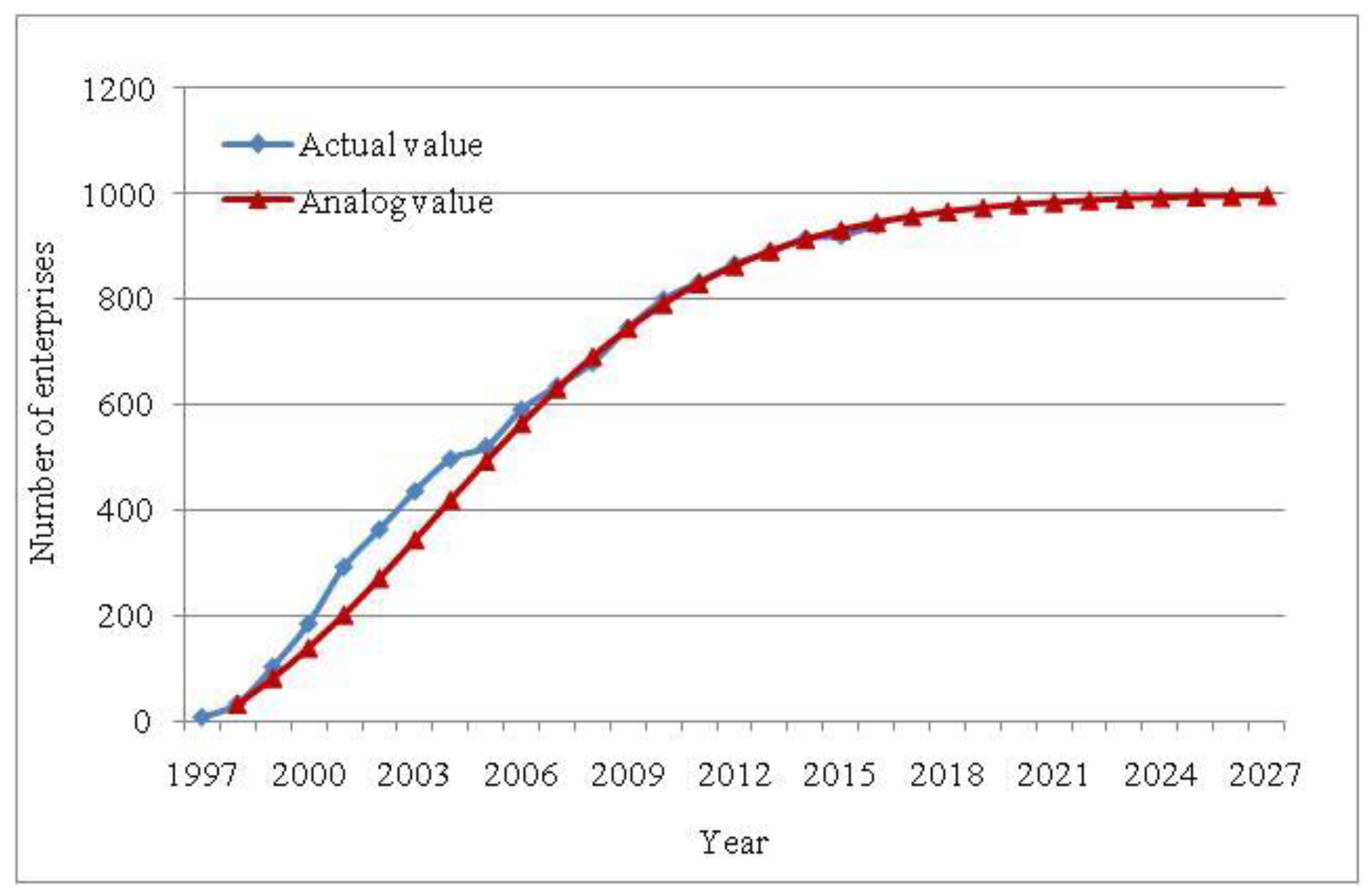

(4) The diffusion model fitting with mixed influencing factors shows that the cumulative number of rural Taiwanese enterprises displays an S-shaped growth trend and is predicted to slow down in the next ten years, approaching 1000 by 2027. As forecast with the geo-statistical analysis method, the diffusion trend is noticeable in the Pearl River Delta, but is weak in the Yangtze River Delta, and new high-diffusion-index core areas are taking shape in the Sichuan–Chongqing area and Fujian–Zhejiang area.

The research also has important policy implications for China and other developing countries.

Firstly, the local state is powerful and its decision is crucial for attracting investment so as to promote rural industry. With the rapid economic development and the accelerated pace of urbanization, the Chinese government calls on all its policymakers at all levels to intensify action so as to promote rural development. The local state continues to be indispensable in rural industrial vitalization. In particular, officials favor policies that support direct investment and accelerate the capital, technology, and human capital exchange. The role of government policy in Taiwanese rural enterprises’ location decisions, although still important, is shrinking as the significance of agglomeration increases.

Secondly, weak linkages with local economies, in a way, become barriers to cooperative development. A large percentage of Taiwanese rural enterprises are wholly-owned enterprises, and few local people have little control over the making of key decisions, although they have a higher level of insight into the local culture and local market. There is no incentive for Taiwanese rural enterprises to embed with local economies in research, technology, and strategy, which is consistent with findings based on other regions of China [

44,

45]. Taiwanese enterprises tend to adopt the strategy of group investment and geographical clustering, due to a similar cultural background, existing business relations, and the common political risks they face [

46]. This clustering is also based on the production, credit, and social relations that were established among these firms in Taiwan, before they relocated to mainland China [

47]. In order to reduce information barriers, both must find effective ways to collaborate.

Thirdly, China’s rural area right now desperately needs a new engine of growth, and institution innovation seems like the obvious way to go. We are aware of the importance of the local state in the early stage, however, the land policy, market-access policy, and tax incentive method provide less of a boost to foreign investment after the initial growth stage. To reduce the dependence of foreign investment, the local state should better promote endogenous innovation capacities and the development of business services and private enterprises. “Creative platforms” are required in order to create incentives for research and development, attract domestic and foreign funding, and encourage cooperation and innovation. Rural area will be better off if more attention is paid to institution innovation.

In the study, space remains for improvement in the future. Firstly, the source of data still needs to be diversified, and data on the non-listed (OTC) Taiwanese enterprises setting up business in the mainland countryside can be added. Secondly, the engagement of Taiwanese compatriots in rural industrial vitalization in mainland China can also be realized through non-regular employment approaches such as technical consultation and service. The related information is not registered with the Taiwanese Compatriot Association and needs be acquired through interviews.