Abstract

Businesses, investors, and insurers are requiring better quantitative assessments of their exposure to climate risks and their impact on climate change. They are incorporating these assessments in their day-to-day management and long-term investment decisions. Already, there are efforts to develop international guidelines, common policies and legal frameworks for such assessments, as well as the desire to foster climate financing. We examine recent progress in East Asia and the rest of the world in setting targets, pricing policies, and other mechanisms to reduce climate risks. We develop a model that demonstrates how reduced climate risk management may lower the total cost of capital of firms, thus making them more attractive to investors. We discuss the additional policies needed to support improved climate risk management in investment decisions, private investments in climate science, technology and innovation (STI) expansion, and more widespread adoption of climate financing and principles. Central banks, financial authorities, and governments can advance this objective by creating financial incentives to support investment decision-making. This would take into account factors such as improving climate performance, establishing better climate risk management and reporting requirements to foster green STI, and developing international guidelines and common policy and legal frameworks to support better climate risk management, assessments and reporting.

1. Introduction

The purpose of the following paper is to examine recent progress in corporate initiatives in East Asia and the rest of the world in setting targets, pricing policies and other mechanisms to reduce their exposure to climate risks and their impact on climate change. Reducing climate risks will require national and international policies that promote green market-based incentives, improve environmental regulations and foster innovation [1,2]. However, as the main players in global markets, large businesses, investors, and insurers have the most important economic impact on the climate and face significant risks from climate change. For example, nearly two-thirds of historic carbon dioxide and methane emissions globally can be attributed to just 90 producers of fossil fuels and cement [3]. The combined costs of pollution, ecosystem depletion and health impacts amount to over US$3 trillion annually for global companies. If businesses had to pay for these costs, profits would be reduced to zero [4]. Around two-thirds of the world’s largest global corporations are exposed to water risk, especially in terms of water security and stress, with 405 companies reporting total losses of more than US$2.5 billion due to water scarcity [5].

There is increasing evidence that the private sector is beginning to take a lead in fostering global climate responsibility and stewardship. Ahead of the opening of the Paris climate change conference in December 2015, Bill Gates of Microsoft, Mark Zuckerberg of Facebook, and other high-tech entrepreneurs, announced the formation of the Breakthrough Energy Coalition that will fund a worldwide public-private partnership among governments, research institutions, and investors to finance clean energy innovation and low-carbon development worldwide [6]. The Coalition will target research and development (R&D) in “green” electricity generation and storage, transportation, industrial use, agriculture, and energy systems efficiency. Ten global corporations have committed to greenhouse gas reduction targets consistent with limiting global warming to less than 2 °C—the threshold that scientists widely agree would help avoid the most disastrous effects of climate change [7]. For example, Sony Corporation, based in Japan, has achieved its target of a 30% reduction in GHG emissions from 2000 to 2015. Aggregate reductions by these ten corporations will amount to 799 million metric tons of carbon dioxide equivalent (MtCO2e), which is 2% of the world total. Other corporations are expected to make similar commitments, which would further boost the chances of meeting the 2 °C global warming limit.

A report on global corporate response to climate change noted that over 200 companies are directly engaging with policy makers in support of carbon pricing legislation, that companies “are already advanced in their use of carbon pricing”, and that “they are ahead of their governments in planning for climate change risks, costs, and opportunities” [8]. It was recorded that in 2017 over 1400 companies worldwide impose a price on carbon in their internal operations and investment decisions [9]. This is a substantial increase from 150 companies in 2014, and includes more than 100 Fortune Global 500 companies with total annual revenues of US$7 trillion [9]. In East Asia, Japan has 129 companies using or planning to use an internal carbon price, and China has doubled the total number of companies internalizing the price of carbon from 54 to 105 between 2015–2017, including companies such as China Vanke, Shanghai Electric and China Mobile [9]. South Korea has established the first national Emissions Trading System in Asia, and China plans to implement their own carbon Emissions Trading Scheme by the end of 2017, which will provide further momentum to the internalization of the price of carbon by corporations in South Asia.

There is growing evidence that improved climate risk management by firms affects their overall cost of capital and their attractiveness to potential investors [10,11,12,13,14,15,16,17]. Improved climate risk management and performance signal to financial investors that firms can sustain higher debt capacity, require less expensive debt, and warrant lower equity risk premiums. In turn, investors are requiring better quantitative assessments of how firms are managing the climate risks, mitigating the damages that arise from climate change, and incorporating these assessments in their long-term investment decisions [12,18,19,20,21,22]. For example, 75% of 36 surveyed global financial institutions state that they monitor climate and environmental risks of transactions, and 42% account explicitly for such risks in their credit assessments [22]. Over 1750 investors, from over 50 countries and representing approximately US$70 trillion, have agreed voluntarily to incorporate six key principles for responsible environment, social and governance goals into their investment analysis and decision making process [23]. Greater transparency concerning firms’ climate risk management and performance will, therefore, increase the willingness of investors to provide long-term financing of such firms, as well as increase the rate of return on such investments.

Already, there are efforts to develop international guidelines, common policy, and legal frameworks to support innovative corporate initiatives to reduce climate risk. At Shanghai in February 2016, finance ministers and central bank governors of the G20 major economies committed to developing such frameworks. Members agreed to “green” the US$90 trillion of investments required over the next 15 years to achieve global sustainable development and climate objectives [24]. The G20 has also launched the Green Finance Study Group, co-chaired by China and the UK, to explore ways of mobilizing private capital for green investments. Further government action is required to assist in the establishment of common practical frameworks, methodologies, and tools to provide a systematic approach to monitor and integrate climate factors into credit and investment risk assessments [22].

We begin in Section 2 by defining the climate risks faced by firms and discussing how the management of climate risk by business may lead to three types of impacts. First, we discuss how climate risk management may reduce the exposure of businesses to threats from climate change and climate-related regulations. Second, we discuss how climate risk management by business may affect their cost of capital and attractiveness to investors. We look at the reasons why firms increasingly have incentives to reduce such risks, and how investors are requiring greater assessment of firms’ exposure to climate risk. We illustrate the relationship between climate risk and the cost of supplying debt diagrammatically. Third, we look at how climate risk may change the systematic risk of a firm, and thus how attractive it is to investors. In order to illustrate the impact of climate risk on the cost of capital, we develop a theoretical model of the relationship between climate risk, systematic risk and the cost of equity capital to demonstrate how reduced climate risk may lower a firm’s after-tax cost of capital, thus making it more attractive to investors and lenders.

In Section 3, we discuss how businesses worldwide, and in particular in East Asia, are becoming increasingly aware of the impacts of climate risk management identified in Section 2. We distinguish the two types of progress in this area: climate risk management initiatives undertaken by businesses (e.g., measurement and reporting, targets and pledges, pricing mechanisms and business models, forums, and events), and initiatives to create more climate-friendly corporate investments. In Section 4, we discuss the additional policies needed to support improved climate risk management in business and investment decisions, private investments in climate science, technology and innovation (STI) expansion, and more widespread adoption of green financing and principles, along the lines suggested by the 2016 Shanghai Communiqué of G20 Finance Ministers. In our conclusion, we note that firms and investors in East Asia and the rest of the world are benefitting from improved climate risk management in their business and finance decisions. Innovative corporate initiatives to reduce climate risk offer an important contribution to more sustainable economic growth and development.

2. Materials and Methods

2.1. Climate Risks Faced by Firms

Risk reflects the chance that the actual return on an investment may be very different to the expected return. One way to measure risk is to calculate the variance and standard deviation of the distribution of the returns. Thus, for a firm, climate change may impose greater risk if it increases the variability in the distribution of outcomes around the expected return from an investment. Economy-wide activities by a firm may result in climate damages from greenhouse gas emissions, which in turn threaten the firm with undesirable consequences. Alternatively, risks might arise from changes in the surrounding climate, such as from climate change and associated weather variability and extremes. Whilst these factors are beyond the control of a firm, they may also impose damaging impacts. However, such externally imposed climate risks are not easily differentiated, especially where evidence suggests that humankind’s economic activities are the major cause of global climate change [25].

Even though the firm has little control over how or when the impact from external climate risk might occur, the firm will likely incur some additional costs if exposed to the risk. Thus, climate risk management implies that the firm undertakes some preventive or remedial action to avoid or reduce its exposure to such threats due to climate change. The increased variability in climate change may affect the choice and mix of such mitigation and adaptation strategies [26], but could involve investments to protect or adapt to sea-level rise, contingency plans for increased water shortfalls or chronic scarcity, setting aside emergency funds for unexpected storms that interrupt production and distribution, improved health and safety measures to protect employees, and so forth.

Climate and risk management by a firm can also involve reducing or preventing its own climate-damaging activities [17,20]. This can be achieved in two ways: first, climate laws and regulations often entail threatening a firm with penalties, litigation, and stricter environmental controls if it fails to comply with such measures. Consequently, conforming to climate laws and regulations governing pollution, waste disposal, natural resource use and greenhouse gas emissions may be one form of climate risk management. Properly designed climate standards may motivate a company to innovate and reduce their production costs and/or improve the value of their product. Thus, depending on how the company responds to climate laws and regulations, they have an opportunity to improve their competitiveness [27]. In addition, a firm may choose to reduce the occurrence and impacts of damage to the climate from its own operations, such as investing in greenhouse gas emissions reduction, internal pricing to reduce greenhouse gas emissions, switching to alternatives to fossil fuels, and so forth. Managing these regulations and operational climate threats can be significant to a firm. Evidence from 88 firms indicates that climate and environmental risk to the firm from failing to comply with regulations is most frequently associated with a large probability of major detrimental impacts, while whilst impacts of a firm’s operations on the climate and environment can be catastrophic, but often have a low probability [20].

2.2. Climate Risks and Firm Debt

There is growing evidence that climate risk management by businesses affects their overall cost of capital and their attractiveness to potential investors [10,11,12,13,14,15,16,17]. Improved climate risk management and performance signal to financial investors that firms can sustain higher debt capacity, require less expensive debt and warrant lower equity risk premiums. In turn, investors are requiring better quantitative assessments of how firms are managing climate and environmental risks and mitigating any potential damages [10,11,12,13,14,15,16]. Greater transparency concerning firms’ climate risk management and performance will, therefore, increase the willingness of investors to provide long-term financing of such firms, as well as increase the rate of return on such investments [12,18,19,20,21,22].

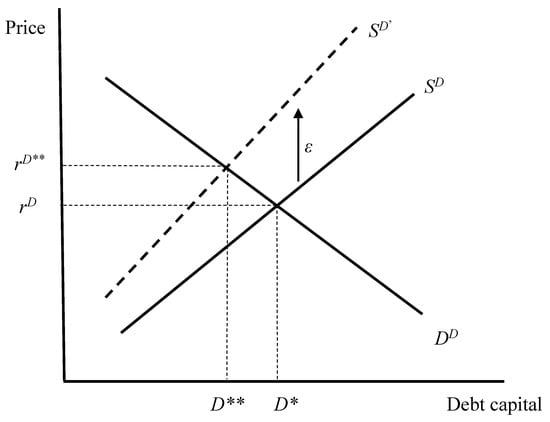

The impact of climate risk, ε, on the cost and amount of firm debt can be illustrated through use of a simple diagram (see Figure 1). Total debt capital is supplied to a representative firm by either by private (e.g., bank loans) or publicly means (e.g., the market for debt securities). We assume that these private and public sources of debt financing can be aggregated into a single market for debt capital for the firm, where SD is the total supply of debt, and DD is the total demand for debt capital by the firm. As shown in Figure 1, equilibrium in the debt market determines the price (cost) of debt rD* as well as the amount of debt capital D* held by the firm. The solid lines in Figure 1 indicate this initial equilibrium.

Figure 1.

Climate risk and the market for debt. An increase in climate risk, ε, increases the cost of supplying debt from private and public sources to a firm. The result is an increase in the price (cost) of debt to the firm rD and a reduction in its debt capital D.

However, if the firm faces increased climate risk, ε, then this raises the likelihood that it will encounter climate damages or face the consequences of failing to control its own undesirable climate impacts (including compliance penalties). From the standpoint of the public and private providers of debt, the firm represents a riskier investment that warrants more expensive debt. Providers are willing to supply debt to the firm, but only at a premium. As shown in Figure 1, the supply curve of debt available to the firm shifts up to SD’. The result is an increase in the price (cost) of debt to the firm rD** and a reduction in its debt capital to D**.

Recent studies confirm that increases in climate risk or poor environmental performance by firms either increases the cost of debt, lowers debt capital, or both [12,18,19,20,21,22,28]. Given this evidence and the effects of the cost and amount of debt illustrated in Figure 1, it follows that for an individual firm:

However, climate risk has a third effect, which is to increase the systematic risk of a firm, thus making it less attractive to investors. Evidence suggests that firms with poor climate and environmental risk management and performance will have a higher cost of equity capital [13,14,15,16,17,29]. Investors recognize that a firm exposed to higher risks from future natural or human-made climate and environmental hazards, or to a greater likelihood of fines, compliance penalties or litigation costs from its own climate and environmental damages, is likely to make fewer dividend payments, internal investments or acquisitions. Consequently, because it is perceived as a riskier investment by potential investors in equity markets, the firm faces a higher risk premium on its cost of equity capital.

3. Results

3.1. Impact of Climate Risk on the Cost of Capital

The relationship between climate risk, systematic risk and the cost of equity capital for a firm can be illustrated through employing the standard capital-asset pricing model, as shown in Sharfman and Fernando (2008) [16].

In Equation (3), the cost of equity capital of a firm rE is determined by the risk-free rate r plus a risk premium. The latter consists of the difference between the return on the market portfolio of the firm rP and the risk-free rate () multiplied by a measure of the firm’s systematic risk . If investors perceive that a firm’s systematic risk is impacted by poor climate risk management and performance, then . If this is the case, then investments in reducing climate risk will reduce the firm’s overall systematic risk, . It follows from (3) that the overall cost of equity capital to the firm will also increase with environmental risk, or

Following [16], if a firm is financed by both equity and debt, then its after-tax weighted average cost of capital rW is

where sE is the share of equity in the firm’s total capital, sD is the share of debt in the firm’s total capital, and T is the firm’s rate of corporate taxation. Letting E denote equity capital, it follows from (2) that

An increase in climate risk raises the share of equity but decreases the share of debt in the total capital of the firm.

The impact of climate risk on the after-tax cost of capital can now be determined by totally differentiating (5)

Note that the first three terms are positive, but the last one is negative, as (7) indicates that . However, the latter effect means that, by lowering the share of debt in total capital, climate risk exposes the firm to more taxation on its capital since .

Finally, Equation (8) suggests that poor climate risk management and performance will increase the after-tax cost of capital for a firm if Such an outcome also appears to be more likely if the firm faces a higher rate of corporate taxation T, and recent evidence suggests that this is often the case. The increased climate risk and poor performances increase the after-tax cost of capital of firms, thus imposing a significant overall capital constraint [14,15,16,17,18].

3.2. Business Climate Initiatives

As businesses worldwide become increasingly aware of these incentives and the benefits from improved climate risk management, they are developing new initiatives to foster science, technology, and innovation (STI) to reduce climate risk in all areas of their operations. To date, these initiatives have included improved measurement and reporting, setting targets and pledges, designing new pricing mechanisms and business models, and establishing forums and events. Investors and insurers are also requiring better quantitative assessments of these risks, and there are efforts to develop international guidelines for such assessments and to foster green financing. In the following sections, we distinguish two types of progress in this area: climate business initiatives and climate finance initiatives, and we examine recent progress in corporate initiatives in East Asia and the rest of the world to set targets, pricing policies, and other mechanisms to reduce climate risks.

3.2.1. Measurement and Reporting

There is increasing measurement and reporting of economic, environmental and social impacts of businesses, including exposure to climate risk at the firm and industry level. There is also substantial development of internationally comparative and meaningful statistics, or “metrics”, using STI to assist in this process. An increasing number of private sector enterprises in East Asia, particularly in the industrial sector, have adopted voluntary corporate disclosure initiatives. However, measurement and reporting with full public disclosure are relatively new in this region. East Asia is making important contributions through STIs to develop a more economically efficient and environmentally effective measurement and reporting process. Business may receive market benefits from transparency, in terms of improved market position, if their metrics show relatively low environmental damage and positive improvements in environmental impacts over time.

There are a growing number of international initiatives to assist firms in developing metrics and guidelines for measuring and reporting climate risks. Some of these initiatives are especially relevant for East Asia. For example, in 2012 the Responsible Business Forum on Sustainable Development launched the Economics of Ecosystems and Biodiversity (TEEB) for Business Coalition, with headquarters in Singapore. TEEB for Business Coalition initiated and supported thinking and action, and achieved tangible outcomes by business in relation to natural capital scarcity. Since 2016, TEEB for Business Coalition has reformulated as the Natural Capital Coalition. It released the Natural Capital Protocol, which offers a standardized framework for business to identify, measure, and value impacts and dependencies on natural capital [29]. Another organization, the International Council of Forest and Paper Associations (ICFPA), collects data on sustainability, and in particular on its members’ efforts to tackle climate change. The ICFPA records that member green-house gas emissions reduced 17% from 2004/5 to 2012/13, and that 61% of onsite energy needs are now met by biomass and renewable fuel sources [30]. In Japan, fossil fuel consumption and carbon emissions intensity fell by 31% and 23% from its 1990 baseline, to 69% and 77% respectively. Japan has set further emissions reductions target for its paper and paperboard production industry for 2020 [30].

Global Reporting Initiative (GRI) has pioneered corporate sustainability reporting since 1997. GRI is an international, independent organization that helps businesses, governments, and other organizations understand and communicate on critical sustainability issues. The GRI Standards were constructed to enable organizations to measure and understand their most critical environmental, social and economic impacts in a consistent and comparative manner [31]. GRI has partnerships with international organizations and the International Organization for Standardization (ISO). It also advises governments, stock exchanges, and market regulators in their policy development to help create a more conducive environment for sustainability reporting. However, its main impact by far has been on the international business community. Of the world’s largest 250 corporations, 93% report on their sustainability performance, and 82% of these use GRI’s Standards to do so. GRI also encourages transparency in this reporting, which it facilitates through the Sustainability Disclosure Database. This is a collection of all the sustainability reports that GRI is aware of, and has made public [32]. GRI has a strong and growing presence in Asia, with regional offices currently located in Beijing, Manila and New Delhi.

The CDP (formerly the Carbon Disclosure Project) runs a global disclosure system, with offices and partners in 50 countries. The CDP enables companies, cities, states, and regions to measure and manage their environmental impacts using a comprehensive collection of self-reported environmental data. According to the CDP, over 5600 companies have responded to questionnaires concerning impacts on climate change, water, forests and supply chain, CDP’s 89 supply chain members represent a combined purchasing power of over $2 trillion. To date, 827 investors with US$100 trillion in assets have requested information on climate change, water or forests [33].

Corporate Knights (CK) provide an index of and ranks the top 100 most sustainable corporations in the world [34]. Currently, corporations in East Asia and the Pacific are not among the leading sustainable corporations, with only the Commonwealth Bank of Australia ranked among the top ten, and City Developments Ltd. (Singapore), POSCO (Pohang, Korea), Shinhan Financial Group (Korea), and National Australia Bank listed among the top 50.

The GreenBiz Group provides over two dozen metrics on the sustainable business landscape [35]. Tracking and measuring the aggregate performance of the companies listed in the S&P 500 provides an indication of the greening of business. The State of Green Business report, produced annually by GreenBiz, includes an index of sustainability. Linked to GreenBiz is TruCost, which provides sustainability data and metrics to encourage profitable but environmentally sound business models and investment strategies worldwide [36].

3.2.2. Targets and Pledges

Setting target and pledges, and meeting these objectives through collaborative sharing of STI, is critical for inducing and enabling corporate initiatives for reducing climate-related risks. Increased climate metric transparency may help improve market share, but setting targets based on these metrics can also position a business to deal with future climate risks and impending climate policy more effectively.

The International Organization for Standardization (ISO) 14000 series was set up to promote more effective and efficient climate and environmental management in organizations by providing standards that encourage the best organizational practices available for gathering, interpreting, and communicating environmentally relevant information. These standards are voluntary, with their main aim being to assist companies in continually improving their environmental performance and complying with any applicable regulation. Organizations are responsible for setting their own targets and performance measures, but are provided with a standard to assist them in meeting objectives and goals and in any subsequent monitoring and measurement of improved environmental performance. The ISO 14001 represents the core set of standards used by organizations for designing and implementing effective environmental management systems. There are currently more than 300,000 certifications to ISO 14001 in 171 countries [37]. In East Asia, an increasing number of private industrial enterprises have adopted ISO 14000 certification programs to encourage more sustainable environmental management systems.

The Association of Southeast Asian Nations (ASEAN) has made considerable progress in establishing a consensus on climate and environmental performance standards and targets for its member countries. In 2015, ASEAN adopted its 2025 strategic action plan, ASEAN 2025: Forging Ahead Together [38]. The main aims are to promote green STI through development of clean energy and related technologies, including renewable energy, enhanced sustainable consumption and production, and reductions in greenhouse gas emissions. To curb its emissions, ASEAN established targets to improve the region’s use of sustainable energy technologies. This includes cutting its energy intensity by a fifth by 2020 compared to 2005 levels, and increasing the share of renewables in its energy mix to 23% by 2025, up from 10% in 2013 [39].

3.2.3. Pricing Mechanisms and Business Models

Improved climate measurement and reporting, as well as settings targets and establishing forums, are necessary for business initiatives in East Asia and the rest of the world to reduce climate risks. However, they are not sufficient. There is also a need to use these metrics and targets in a dynamic and meaningful way to assess, predict and create incentives to improve climate performance. Such developments may also form the basis of sustainable environmental business models.

One option for business to use their metrics and targets in a more dynamic way to improve climate performance is through the use of both “leading” and “lagging” indicators. Lagging indicators are typically “output” oriented: easy to measure but hard to improve or influence. In contrast, leading indicators are typically “input” oriented: more difficult to measure yet more easy to change. The use of both lagging and leading indicators enables a company to look forward as well as backwards at its interaction with the environment. For example, in the case of electricity production, a lagging indicator might be the number of emissions generated through power generation, while a leading indicator could be the mix of energy sources being used to produce electricity, and thus ultimately emissions.

Typically, most businesses assess their climate and environmental performance through lagging indicators, because they are easier to measure. But leading indicators may be more important for directing STI that can improve climate performance. If leading indicators are utilized with real time data, they can be used to predict climate target constraints, uncertainties, and risks. Tracking proactive leading indicators can enable a company to respond and alter production activities in response to changing climate conditions. If the leading indicator shows that a company’s choice and mix of inputs may lead to planned production levels that endanger compliance with environmental regulations and targets, then the business could undertake timely STI to prevent this from occurring.

Because of the growing importance of leading and lagging indicators in fostering green STI, new business opportunities are emerging to provide such services. One example is ABB technology, which operates globally, and has offices throughout East Asia [40]. The ABB technology pioneers the use of digital technologies to provide businesses with the indicators necessary to enable them to meet climate and environment goals, and protect themselves from their associated risks. The main clients for ABB’s services are utility, industry, transportation and infrastructure companies that may benefit from STI to improve environmental performance.

Businesses are also estimating the economic costs and benefits of their various impacts on the climate. These economic values, or “shadow prices”, can be integrated into an appropriate business model alongside the standard costs and benefits included in the “bottom line” of a corporation’s profit and loss calculations. The use of such shadow pricing mechanisms for climate impacts creates incentives for businesses to achieve efficiency gains, minimize environmental damages, and reduce exposure to climate risk. It also enables businesses to position themselves to respond effectively to future environmental regulations through implementing green STI. Costing their climate impacts in terms of the “bottom line” can be a powerful incentive for many businesses. For example, it has been estimated that, if they had to pay for the $3.4 trillion environmental and social costs of their natural resource use and pollution generated in 2015, nearly half of the world’s 1200 largest companies would be unprofitable [4].

Shadow pricing has proven especially valuable in helping companies raise awareness of the potential economic costs and risks of their water use. In 2016, water scarcity—the lack of clean fresh water—resulted in more than $14 billion of costs to business operations worldwide, including fines, loss of production, new treatment systems, and securing water from new sources. Increasingly, companies are incorporating water valuation tools that provide them with a “shadow” water price they can use to estimate these risks [5,41]. China Water Risk, a leading non-government organization (NGO) in East Asia on water-related issues, uses these tools to apply shadow water prices to assist major power producers in the region to understand and value water risks [42]. Internal water pricing by companies can also be a spur to the spread of new STI such as smart meters, which provide real-time data on water use and water losses, and can give businesses information they need to conserve water, thereby lowering their water bills.

3.2.4. Forums and Events

Business forums and events enabling collaboration and sharing of information are critical for fostering STI corporate initiatives for reducing climate-related risks. For example, GreenBiz runs both an Annual Forum, which informs business leaders of the pressing challenges, emerging trends and biggest opportunities in sustainable business today, and Verge, which is a meeting for corporate executives, startup entrepreneurs and government officials to learn about and share the latest information on clean energy technologies, tools and trends [43]. Similarly, The Economist magazine runs an annual Sustainability Summit, which brings together leading scholars, policymakers, and business leaders to offer strategies, ideas and solutions to critical sustainability issues. For example, in 2017, the Sustainability Summit evaluated progress and scalability of various global sustainability initiatives, examined the worldwide business consequences of the Paris Climate Change Agreement and the push for greater environmental sustainability [44].

Specific events and forums are also occurring regularly in East Asia. For example, Global Initiatives in Singapore runs several event series, including Business for Environment, aimed at assisting collaboration of governments, NGOs, and businesses in solving critical environmental challenges globally and in Asia [45]. These events have led to business proposals on resource productivity, smart systems, natural capital accounting, reducing climate change, sustainable landscapes and biodiversity restoration. Sustainable Energy & Technology Asia (SETA), based in Bangkok, Thailand, provides a platform for discussion and sharing experiences among experts in the clean energy sector, especially on alternative fuels, renewable energy, and green technology [46]. IE Expo, established in China in 2004, has grown to be one of Asia´s most comprehensive and important showcases for the region’s environmental technology market [47]. In 2016, IE Expo in China had 1303 exhibitors, 42,408 visitors and 72,000 square meters of exhibition space.

3.3. Climate Finance Initiatives

A number of initiatives have emerged to guide the global financial system in supporting investment decision-making that takes into account improved climate performance, establishes mandatory, enforceable and transparent climate risk management and reporting requirements, adjusts capital provisioning to account for underpriced environmental risks, including those from climate change, natural disasters and natural resource scarcity, and establishes a global “climate risk insurance” initiative [18,19,21,41,48].

For example, the Equator Principles is a risk management framework, adopted by financial institutions for determining, assessing and managing environmental and social risk for clients seeking financial backing for investment projects worldwide [21]. The aim of these Principles is to provide a minimum standard for due diligence to support responsible risk decision-making through ensuring that the assessment process addresses compliance with relevant host country laws, regulations, and permits covering environmental and social issues. In countries with evolving environmental and social regulatory capacity, the assessment process should evaluate compliance with internationally acceptable environmental, safety and health standards. Currently, 82 financial institutions in 36 countries have officially adopted the Equator Principles, covering over 70% of international project finance debt in emerging market economies [49]. In October 2003, the Mizhuo Corporate Bank in Japan became the first bank in East Asia to adopt the Equator Principles.

At Shanghai in February 2016, finance ministers and central banks governors of the G20 major economies committed to developing such frameworks to “green” the US$90 trillion of investments required over the next 15 years to achieve global sustainable development and climate objectives [24].

The G20 has also launched the Green Finance Study Group, co-chaired by China and the UK, to explore ways of mobilizing private capital for green investments. In December 2016, the recommendations of the G20’s Financial Stability Board’s Task Force on Climate-Related Financial Disclosure (TCFD) provided its first set of guidelines to assist companies and investors worldwide in climate-risk reporting [5]. The aim of the TCFD is to develop transparent procedures for voluntary, consistent climate-related financial risk disclosure for use by companies in providing information to investors, lenders, insurers, and other stakeholders. The TCFD guidelines are geared towards helping firms understand what financial markets want from disclosures in order to measure and respond to climate change risks, and encourage firms to align their disclosures with investors’ needs.

The United Nations Environment Programme–Finance Initiative (UNEP FI) is a partnership between UNEP and the global financial sector, which promotes sustainable finance worldwide. Over 200 financial institutions, including banks, insurers, and investors, currently work with UNEP FI [21]. In the East Asia and Pacific region, UNEP FI launched the Investor Obligations and Duties in 6 Asian Markets report, which analyzes the best financial investment and policy practices in China, Hong Kong, India, Malaysia, Singapore and South Korea that integrate environmental, social and governance factors in their investment decision-making processes [50]. UNEP FI Principles of Sustainable Insurance Initiative (PSI) and Philippines Insurers and Reinsurers Association held an international forum in 2016 to examine new financing approaches and instruments to address the risks of loss and damage associated with the adverse effects of climate change, ensuring climate and disaster resilience, and supporting innovations and solutions for sustainable development [51].

4. Discussion

4.1. Policies to Support Climate Business and Finance

Better climate risk management could potentially benefit both investors and firms in East Asia and worldwide, as well as lead to less overall environmental damage from pollution, natural resource scarcity, and climate change. The result should be a closer correlation between the climate and financial performance of businesses, thus fostering more environmentally sustainable investments, more sustainable growth and development, and increased incentives for green STI. Although our review indicates that green business and finance initiatives in East Asia and globally are growing rapidly, additional policies could be implemented to help support better measurement and reporting of climate and environmental risks and to improve the efforts of business to further instigate targets and pledges to spur green STI. To encourage more widespread and consistent implementation of environmental risk management, assessments and reporting will require three key policies:

- Financial regulations that support investment decision-making that takes into account improved environmental performance.

- Establishing better risk management and reporting requirements to improve environmental performance and green STI.

- Developing international guidelines and common policy and legal frameworks to support better and more comprehensive environmental risk management, assessments and reporting.

We discuss each of these policy initiatives in turn.

4.1.1. Support of Climate Risk Management in Investment Decisions

As prudential authorities and regulators of the financial system, central banks should ensure that the rules governing the financial system support investment decision-making that takes into account improved climate performance [18,19,21,41]. Without such policies and regulations imposed by financial authorities, firms are likely to under-invest in climate risk management. As argued by Cai et al. ([12], p. 26), although initiatives to reduce corporate environmental risk (CER) and improve environmental performance are generally associated with lower levels of systematic risk and capital constraints for firms, such initiatives “typically require initial investments that do not have a short-term payoff and are likely to have no positive pay-off even in the long-run.” Consequently, “managers do not invest in CER initiatives unless legally required to do so” ([12], p. 26).

Mandated and enforced climate and environmental risk and performance reporting can be seen as a complementary regulatory instrument to data provided by public registers in assessing environmental performance [19]. If such mandated disclosures are fully transparent, they can induce firms to reduce and manage climate risk in order to mitigate interventions by investors, environmental stakeholders, and regulatory authorities. In addition, financial authorities could assist with best practice and guidance on standardized climate and environmental risk and performance reporting, which would assist firms in developing positive linkages between improved environmental performance, systemic risk management, and financial success.

Finally, firm managers are increasingly taking climate and sustainability reporting seriously, and are looking for better guidance and regulations from policymakers on such measures [52,53]. In fact, the lack of direction from financial authorities has been cited as a key barrier to improved corporate environmental management, more widespread adoption of reporting and public policy [52].

Over the long term, financial authorities and central banks in East Asia and the rest of the world need to develop better methods of ensuring that the public and private sources of capital provisioning in the economy take into account currently underpriced climate and environmental risks. This is especially important with respect to the growing risks to firms from climate change and natural disasters. For example, Covington et al. ([18], p. 156) argue that there needs to be “more and better quantitative assessments of systemic climate risk and, in particular, the risk to investment portfolios, to help to clarify the relevant obligations” of investors, lenders and firms. In addition, financial authorities and central banks need to work with credit rating agencies, investment analysts and regulators of equity markets to develop greater transparency in how they include environmental factors in their analysis of firms, as well as develop common reporting standards. As noted by UNEP FI ([41], p. 46), there is currently clear weaknesses in the current approach, which is “a patchwork of overlapping requirements and gaps in the coverage of issues, such as the impact of natural disasters and the potential for asset stranding in high carbon sectors.”

4.1.2. Improving Climate Performance and Green STI

Whether mandatory or voluntary, climate and environmental risk management and reporting requirements must become more effective in improving the overall climate and financial performance of firms and encouraging them to engage in green STI. Recent insights suggest that are several ways in which such measures can achieve this goal [10,52,53,54,55,56]:

- Climate and environmental management measures, which include the development of a corporate climate and environmental strategy, integration of environmental issues into strategic planning processes, environmental practices, process-driven initiatives, product-driven management systems, environmental certification, environmental management system adoption, and participation in voluntary environmental improvement programs.

- Climate and environmental performance assessments, which evaluate climate and environmental impacts through use of specific indicators such as carbon dioxide emissions, physical waste, water consumption, toxic release, chemical spills, raw material input use, or materials recycling.

- Climate and environmental disclosures, which describe the various environmental impacts of a firm’s activities, and may involve information on toxic releases, environmental accidents, and crises, as well as announcements of specific environmental investments.

Overall evidence suggests that the positive link between a company’s financial, climate and environmental performance is most enhanced by environmental management measures as opposed to environmental performance assessments or disclosures, which tend to be ad hoc, varied in quality, and sporadic [10,54,55,56]. There seem to be several reasons for this outcome. First, compared to environmental performance assessments and disclosures, environmental management measures are less subject to “green washing”, i.e., aiming to improve a firm’s external image with respect to environmental performance regardless of whether or not an actual improvement takes place [10,54,55]. Second, the adoption of climate management measures often signals that managers are undertaking a proactive and positive approach to improving a company’s climate performance and green STI, and have begun integrating such an approach into the overall operational objectives and strategy of the firm [10,53,54,55]. Third, there appears to be a positive link between greater adoption of climate management measures and “integrated reporting”, which is an assessment of a firm’s financial, governance, climate, and social performance [54,55,56]. Finally, businesses that implement climate management measures, especially as part of integrated reporting, usually seek outside assurance or verification of the legitimacy and quality of such initiatives and reports [54,56].

However, improving a firm’s climate and environmental performance and green STI may not necessarily always lead to improve profitability. For example, Rexhäuser and Rammer [57] find that innovations that increase a firm’s resource efficiency in terms of material or energy consumption per unit of output generally have a positive impact on profitability. This positive link seems to occur whether the green innovation is voluntarily adopted by the firm or is induced through environmental regulation. In contrast, STI that is not related to improved resource efficiency has little effects on firm’s profits. Thus, it is important to understand the various channels through which improved environmental and risk management and reporting influence green STI by firms, and how such innovations in turn affect financial performance.

In sum, there are three principal ways that public policies could enhance the effectiveness of climate risk management and reporting by firms in fostering green STI and overall financial and climate performance. First, the overall aim of policies should be to encourage and assist businesses in developing a corporate climate strategy that integrates climate risk and performance management and green STI into strategic planning processes. That is, the most effective approach to climate risk management appears to be the adoption of climate improvement measures as a strategic goal by a company’s managers.

Second, as far as possible, any climate reporting requirements and measures should also encourage businesses to adopt such assessments through integrated reporting of their financial, governance, environmental, and social performance. However, to facilitate more widespread adoption of integrated or sustainability reporting, public authorities must develop more reliable and comprehensive guidelines, which should improve business performance by highlighting key priorities, providing benchmarks and targets, and assisting comparisons across business sectors [52]. In addition, climate reporting measures, as well as any integrated reporting, need external, monitoring, assurance and verification of their legitimacy and quality.

Third, additional public policies could encourage more voluntary strategic climate actions by businesses. As summarized by Ervin et al. ([53], p. 405), “policies that enable firms to differentiate themselves based on their environmental performance and increase their competitiveness, that provide technical assistance and lower costs of adoption and that raise the significance of environmental issues for firms can induce more voluntary initiatives.” Specifically, “actions to assure competitive markets, improve credible information about facility environmental management and performance for investors and consumers and provide technical assistance to lower development costs and educational programs to enhance public environmental consciousness and increase firms’ expertise could accelerate voluntary business environmental activity” ([53], p. 405).

4.1.3. International Climate Guidelines and Frameworks

To evaluate climate impacts and improve reporting procedures across countries requires the development of international guidelines and common policy and legal frameworks with standardized data and risk measures [21,38,54]. There is also a need for global and regional cooperation on coordinating and developing common practical frameworks, methodologies and tools to provide a systematic approach to monitor and integrate climate and other environmental factors into credit and investment risk assessments [21]. The various green finance initiatives previously discussed show promise for developing such common international frameworks and reporting procedures, but they need to be urgently expanded and more widely applied to have a widespread impact across East Asia and the rest of the word. For example, as noted previously, the Equator Principles is clearly impacting project lending, as it currently covers over 70% of international project finance debt in emerging market economies. However, only US$240 billion is lent annually through project finance worldwide, which is a relatively small proportion of total global financial assets and lending. Clearly, extending and developing similar international standards for environmental risk management for a wider range of financial transactions in addition to investment project lending should be a priority.

Equally important is expanding global initiatives on corporate sustainability and reporting. As noted previously, the Global Reporting Initiative (GRI) is an independent international organization that has developed guidelines to assist companies worldwide in systematically assessing, measuring and communicating their social and environmental performance through sustainability reporting. Currently, over 40,000 GRI reports have been issued and over 30,100 participants trained through GRI certified training courses [58]. In recent years, such reporting has been growing [53,54]. As of October 2017, CorporateRegister.com, which is the world’s largest online directory of corporate responsibility reports, contains 92,682 reports across 15,340 organizations [59]. To establish international standards on such integrated reporting, a global coalition of regulators, investors, companies, standard setters, the accounting profession and non-governmental organizations have created the International Integrated Reporting Council (IIRC). In 2013, the IIRC introduced the International Integrating Reporting Framework, which provides guidelines on integrated reporting to businesses and investors, and is currently being used by over 1000 businesses globally [60]. An important step in the further development of these various global initiatives should be to promote improved environmental risk reporting procedures and common practices internationally, so that businesses worldwide could draw on a common framework of accurate reporting on environmental and climate risks.

5. Conclusions

The mounting global problems of climate change, ecosystem degradation, natural resource degradation, and pollution are indications that the creation of economic wealth is currently underpricing these environmental risks [61]. There is growing evidence that both firms and investors in East Asia and the rest of the world would benefit from considering better climate risk management in their investment and business decisions. The potential economic and environmental gains to investors, firms, and society suggest that there is an important role for policies that support such efforts by businesses. Central banks, financial authorities, and governments can advance this objective by developing financial regulations that support investment decision-making that takes into account factors such as improving climate and environmental performance, establishing better climate risk management and reporting requirements to foster green STI, and developing international guidelines and common policy and legal frameworks to support better climate risk management, assessments and reporting.

Although firms and investors in East Asia and globally are increasingly taking climate and sustainability reporting seriously, they are looking for better guidance and regulations from policymakers on such measures. Financial authorities and central banks must take the lead in ensuring that the public and private sources of capital provisioning in the economy take into account currently underpriced climate risks. Also, governments in East Asia and internationally must cooperate to develop common policy, and legal and regulatory frameworks to support such initiatives. The current lack of coherent policy direction and coordination remains a key barrier to more widespread adoption of improved environmental performance and risk management by businesses in East Asia and globally.

Developing such a policy strategy is likely to produce a self-reinforcing gain to firms, investors, and society across East Asia. Better climate risk management and performance will benefit businesses and their investors by overcoming capital constraints on financial operations and strategic projects. It will also provide the incentives to further reduce any environmentally damaging activities that may contribute to climate change, decrease natural resource scarcity and pollution, and may foster corporate governance and management practices that further improve climate performance, aid risk management and green STI, as well as encourage more reliable environmental assessments and reporting. The eventual merging of environmental and financial performance of companies may be the best hope of overcoming climate change and other key global environmental problems facing humankind, and encouraging more sustainable economic growth and development.

Acknowledgments

This research was funded by the 2017 STEPI Fellowship, Science and Technology Policy Institute, Seoul, Republic of Korea, awarded to Edward B. Barbier.

Author Contributions

Edward B. Barbier and Joanne C. Burgess conceived and designed the research; Edward B. Barbier developed the analysis; Edward B. Barbier and Joanne C. Burgess wrote the paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Barbier, E.B. The Green Economy Post Rio+20. Science 2012, 338, 887–888. [Google Scholar] [CrossRef] [PubMed]

- Barbier, E.B. Policies to Promote Green Economy Innovation in East Asia and North America. STI Policy Rev. 2015, 6, 54–69. [Google Scholar]

- Heede, R. Tracing anthropogenic carbon dioxide and methane emissions to fossil fuel and cement producers, 1854–2010. Clim. Chang. 2014, 122, 229–241. [Google Scholar] [CrossRef]

- State of Green Business 2017. Available online: https://www.greenbiz.com/report/state-green-business-2017 (accessed on 20 December 2017).

- Carbon Disclosure Project (CDP). CDP Global Water Report 2015. 2015. Available online: https://www.cdp.net/CDPResults/CDP-Global-Water-Report-2015.pdf (accessed on 20 December 2017).

- CAIT Climate Data Explorer. Business Emissions Targets; World Resources Institute: Washington, DC, USA, 2016. [Google Scholar]

- Carbon Disclosure Project (CDP). Global Corporate Use of Carbon Pricing: Disclosures to Investors. 2014. Available online: http://www.cdp.net/CDPResults/global-price-on-carbon-report-2014.pdf (accessed on 20 December 2017).

- Carbon Disclosure Project (CDP). More than Eight-Fold Leap over Four Years in Global Companies Pricing Carbon into Business Plans—CDP. 2017. Available online: https://www.cdp.net/en/articles/media/more-than-eight-fold-leap-over-four-years-in-global-companies-pricing-carbon-into-business-plans (accessed on 20 December 2017).

- Aktas, N.; De Bodt, E.; Cousin, J.-G. Do financial markets care about SRI? Evidence from mergers and acquisitions. J. Bank. Financ. 2011, 35, 1753–1761. [Google Scholar] [CrossRef]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Barbier, E.B.; Burgess, J.C. Policies to Support Environmental Risk Management in Investment Decisions. Int. J. Glob. Environ. Issues 2017, in press. [Google Scholar]

- Cai, L.; Cui, J.; Jo, H. Corporate Environmental Responsibility and Firm Risk. J. Bus. Ethics 2016, 139, 563–594. [Google Scholar] [CrossRef]

- Chava, S. Environmental Externalities and Cost of Capital. Manag. Sci. 2014, 60, 2223–2247. [Google Scholar] [CrossRef]

- Ghoul, E.S.; Guedhami, O.; Kim, H.; Park, K. Corporate Environmental Responsibility and the Cost of Capital: Empirical Evidence; KAIST Business School Working Paper Series, KCB-WP-2014-008; KAIST College of Business: Soeul, Korea, 2014. [Google Scholar]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analysis of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Sharfman, M.R.; Fernando, C.S. Environmental Risk Management and the Cost of Capital. Strateg. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate Social Responsibility and Access to Finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Covington, H.; Thornton, J.; Hepburn, C. Shareholders must vote for climate change mitigation. Nature 2016, 530, 156–157. [Google Scholar] [CrossRef] [PubMed]

- Dobler, M.; Lajili, K.; Zéghal, D. Environmental Performance, Environmental Risk Management and Risk Management. Bus. Strateg. Environ. 2014, 23, 1–17. [Google Scholar] [CrossRef]

- Nandy, M.; Lodh, S. Do banks value the eco-friendliness of firms in their corporate lending decision? Some empirical evidence. Int. Rev. Financ. Anal. 2012, 25, 83–93. [Google Scholar] [CrossRef]

- UN Environment Programme (UNEP). The Financial System We Need: Aligning the Financial System with Sustainable Development; UN Environment Programme (UNEP): Nairobi, Kenya, 2015; Available online: http://web.unep.org/inquiry (accessed on 20 December 2017).

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2014: Synthesis Report; Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Core Writing Team, Pachauri, R.K., Meyer, L.A., Eds.; Intergovernmental Panel on Climate Change (IPCC): Geneva, Switzerland, 2014. [Google Scholar]

- Principles for Responsible Investment. About the PRI. 2017. Available online: https://www.unpri.org/about (accessed on 20 December 2017).

- G20 Finance Ministers and Central Bank Governors Meeting Shanghai. Available online: http://www.g20.utoronto.ca/2016/160227-finance-en.html (accessed on 20 December 2017).

- Kane, S.; Shogren, J.F. Linking Adaptation and Mitigation in Climate Change Policy. Clim. Chang. 2000, 45, 75–102. [Google Scholar] [CrossRef]

- Porter, M.D.; van der Linde, C. Toward a New Conception of the Environment Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Heinkel, R.; Kraus, A.; Zechner, J. The Effect of Green Investment on Corporate Behavior. J. Financ. Quant. Anal. 2001, 36, 431–449. [Google Scholar] [CrossRef]

- Natural Capital Coalition. Available online: http://naturalcapitalcoalition.org/protocol/ (accessed on 20 December 2017).

- International Council of Forest and Paper Associations (ICFPA). ICFPA Sustainability Progress Report. Available online: http://www.icfpa.org/uploads/Modules/Publications/2015-icfpa-sustainability-progress-report.pdf (accessed on 20 December 2017).

- Global Reporting Initiative (GRI). Consolidated Set of GRI Sustainable Reporting Standards 2016. Available online: https://www.globalreporting.org/standards (accessed on 20 December 2017).

- Global Reporting Initiative (GRI). Sustainability Reporting Database. Available online: http://database.globalreporting.org/ (accessed on 20 December 2017).

- CDP Disclosure Insight Action. 2017. Available online: https://www.cdp.net/en (accessed on 20 December 2017).

- Corporate Knights. 2017 Global 100 Results. Available online: http://www.corporateknights.com/reports/2017-global-100/2017-global-100-results-14846083/ (accessed on 20 December 2017).

- Makower, J. 10th Annual State of Green Business 2017. Available online: https://www.greenbiz.com/ (accessed on 20 December 2017).

- Moving Forward with SDGs: Metrics for Action. Available online: https://www.trucost.com/ (accessed on 20 December 2017).

- International Organization for Standardization (ISO). Survey of Management System Standardization Certification. 2016. Available online: https://www.iso.org/iso-14001-environmental-management.html (accessed on 20 December 2017).

- Association of Southeast Asian Nations (ASEAN). ASEAN 2025: Forging Ahead Together; ASEAN Secretariat: Jakarta, Indonesia, 2015; Available online: http://www.asean.org/storage/2015/12/ASEAN-2025-Forging-Ahead-Together-final.pdf (accessed on 20 December 2017).

- ASEAN Centre for Energy (ACE). ASEAN Plan of Action for Energy Cooperation (APAEC) 2016–2025. Phase I: 2016–2020; ASEAN Centre for Energy (ACE): Jakarta, Indonesia, 2015; Available online: https://app.box.com/s/g6b4ynph5wwiuvtxgol3s2rwjwcmrtbj (accessed on 20 December 2017).

- ABB. Let’s Write the Future. Available online: http://new.abb.com/ (accessed on 20 December 2017).

- UN Environment Programme Financial Initiative (UNEP FI); Global Canopy Programme. Towards Including Natural Resource Risks in Cost of Capital, State of Play and the Way Forward, Natural Capital Declaration; UN Environment Programme (UNEP): Nairobi, Kenya, 2015; Available online: http://www.unepfi.org/fileadmin/documents/NCD-NaturalResourceRisksScopingStudy.pdf (accessed on 20 December 2017).

- China Water Risk. Vision and Mission. Available online: http://chinawaterrisk.org/about/vision-mission/ (accessed on 20 December 2017).

- GreenBiz. Events. Available online: https://www.greenbiz.com/events/ (accessed on 20 December 2017).

- The Economist. The Sustainability Summit. Available online: http://www.economist.com/events-conferences/emea/sustainability-summit-2017/ (accessed on 20 December 2017).

- Global Initiatives. Advancing Partnership Solutions to Global Challenges. Available online: http://www.globalinitiatives.com/ (accessed on 20 December 2017).

- Sustainable Energy and Technology Asia (SETA). Exhibit @ SETA 2018. Available online: https://www.seta.asia/ (accessed on 20 December 2017).

- IFAT. World’s Leading Trade Fair for Water, Sewage, Waste and Raw Materials Management. Available online: http://www.ifat.de/index-2.html (accessed on 20 December 2017).

- Mechler, R.; Schinko, T. Identifying the Policy Space for Climate Loss and Damage. Science 2016, 354, 290–292. [Google Scholar] [CrossRef] [PubMed]

- The Equator Principles. The Equator Principles III. Available online: http://www.equator-principles.com (accessed on 20 December 2017).

- Sullivan, R.; Feller, E.; Martindale, W.; Robinson, J. Investor Obligations and Duties in 6 Asian Markets; UN Environmental Programme Financial Initiative/Principles for Responsible Investment/The Generation Foundation: Nairobi, Kenya, 2016; Available online: http://www.unepfi.org/fileadmin/documents/Investor_obligations_and_duties_in_six_asian_markets.pdf (accessed on 20 December 2017).

- United Nations Climate Change. 2016 Forum of Standing Committee on Finance. Available online: http://unfccc.int/cooperation_and_support/financial_mechanism/standing_committee/items/9410.php (accessed on 20 December 2017).

- Beare, D.; Buslovich, R.; Searcy, C. Linkages between Corporate Sustainability Reporting and Public Policy. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 336–350. [Google Scholar] [CrossRef]

- Ervin, D.; Wu, J.; Khanna, M.; Jones, C.; Wirkkala, T. Motivations and Barriers to Corporate Environmental Management. Bus. Strateg. Environ. 2013, 22, 390–409. [Google Scholar] [CrossRef]

- Lai, A.; Melloni, G.; Stacchezzini, R. Corporate Sustainable Development: Is ‘Integrated Reporting’ a Legitimization Strategy? Bus. Strateg. Environ. 2014, 25, 165–177. [Google Scholar] [CrossRef]

- Pérez-López, D.; Moreno-Romero, A.; Barkemeyer, R. The Relationship between Sustainability Reporting and Sustainability Management Practices. Bus. Strateg. Environ. 2015, 24, 720–734. [Google Scholar] [CrossRef]

- Sierra-García, L.; Zorio-Grima, A.; García-Benau, M.A. Stakeholder Engagement, Corporate Social Responsibility and Integrated Reporting: An Exploratory Study. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 286–304. [Google Scholar] [CrossRef]

- Rexhäuser, S.; Rammer, C. Environmental innovations and firm profitability: Unmasking the Porter hypothesis. Environ. Resour. Econ. 2014, 57, 145–167. [Google Scholar] [CrossRef]

- GRI. Driving Global Change Since 1997. Available online: https://www.globalreporting.org (accessed on 20 December 2017).

- Corporate Register. The World’s Largest CR Report Directory. Available online: http://www.corporateregister.com/ (accessed on 20 December 2017).

- Integrated Reporting. Progress through Reporting. Available online: http://integratedreporting.org/ (accessed on 20 December 2017).

- Barbier, E.B. Nature and Wealth: Overcoming Environmental Scarcities and Inequality; Palgrave MacMillan: London, UK, 2015. [Google Scholar]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).