Taxation of Electric Vehicles in Europe: A Methodology for Comparison

Abstract

1. Introduction

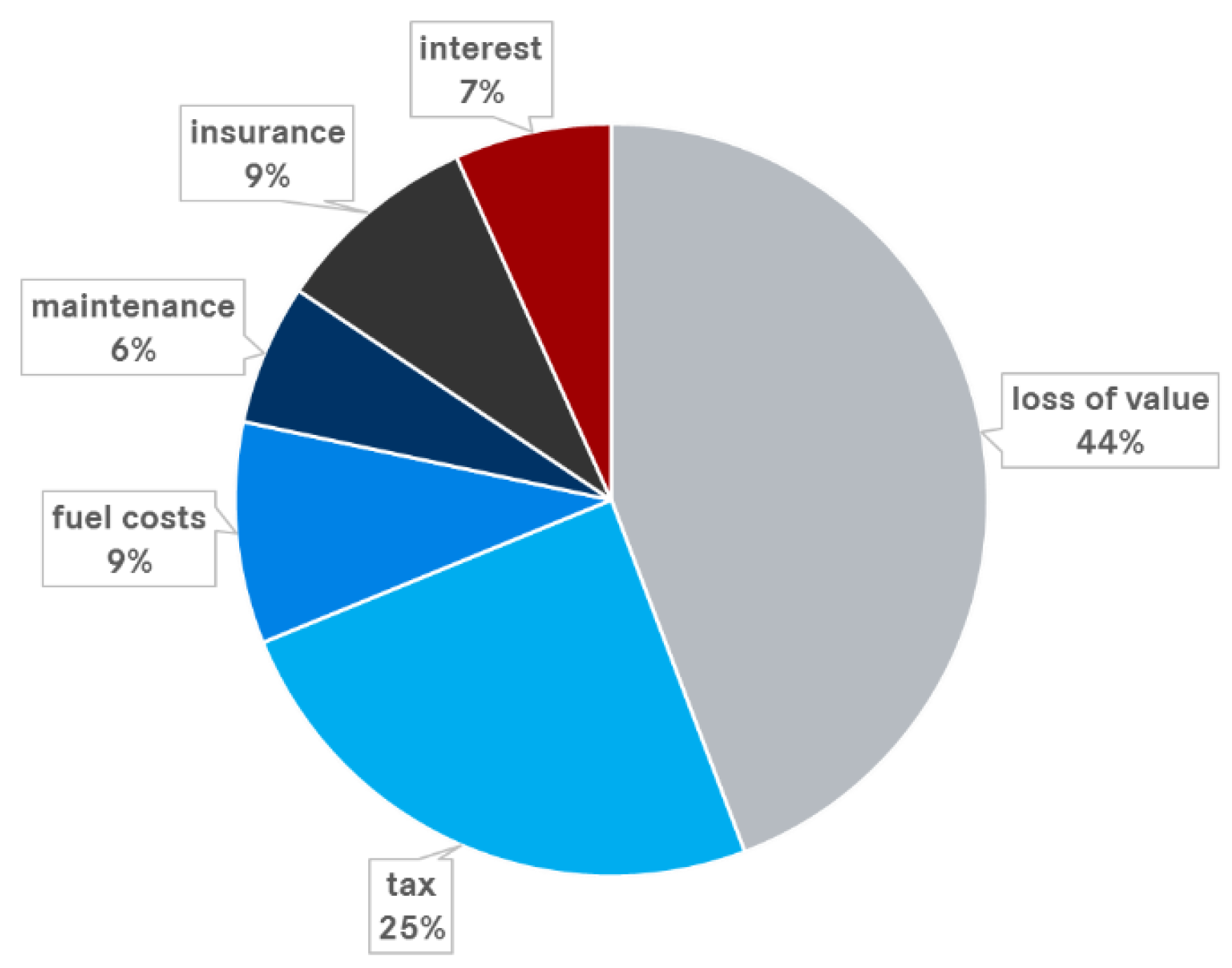

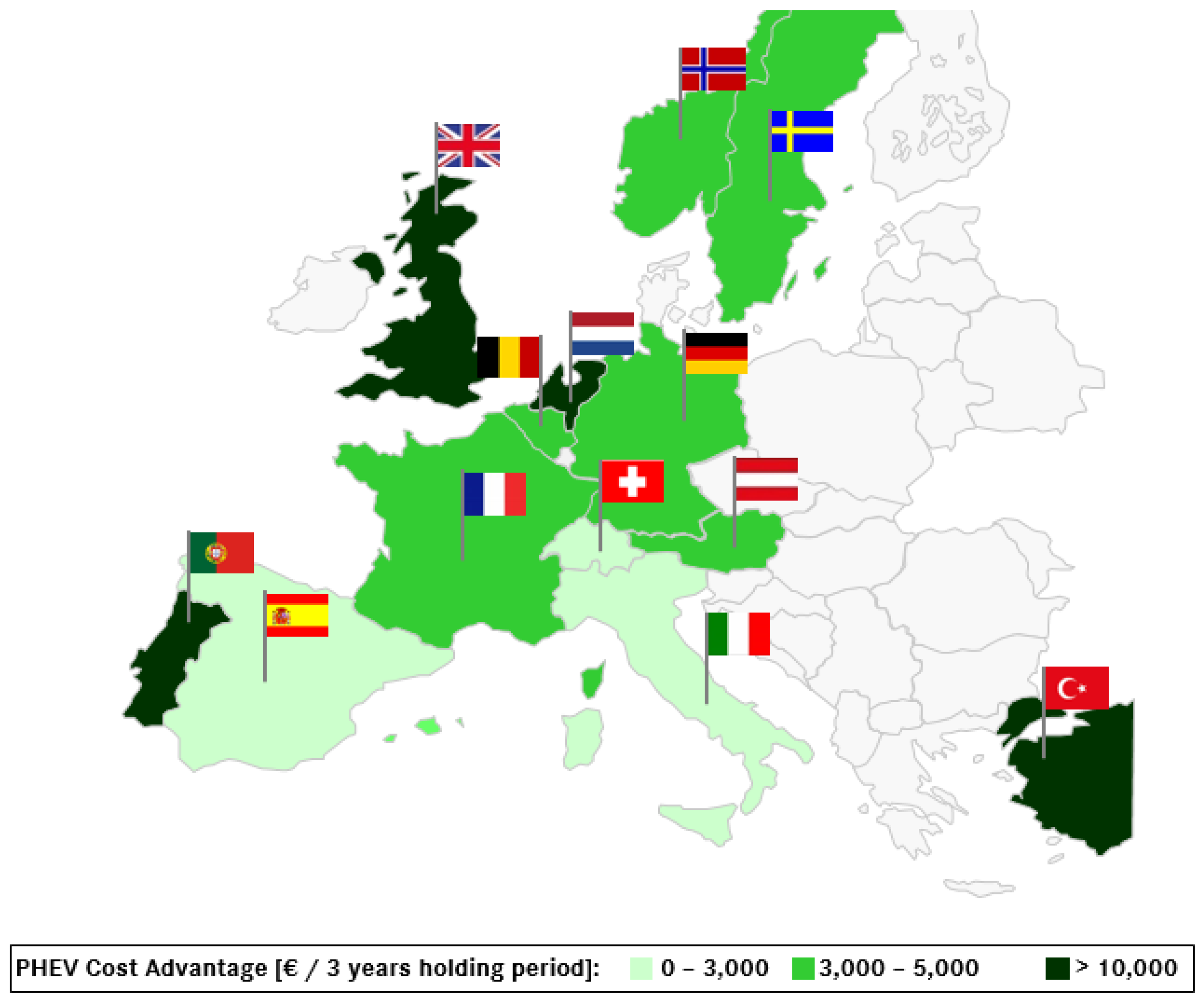

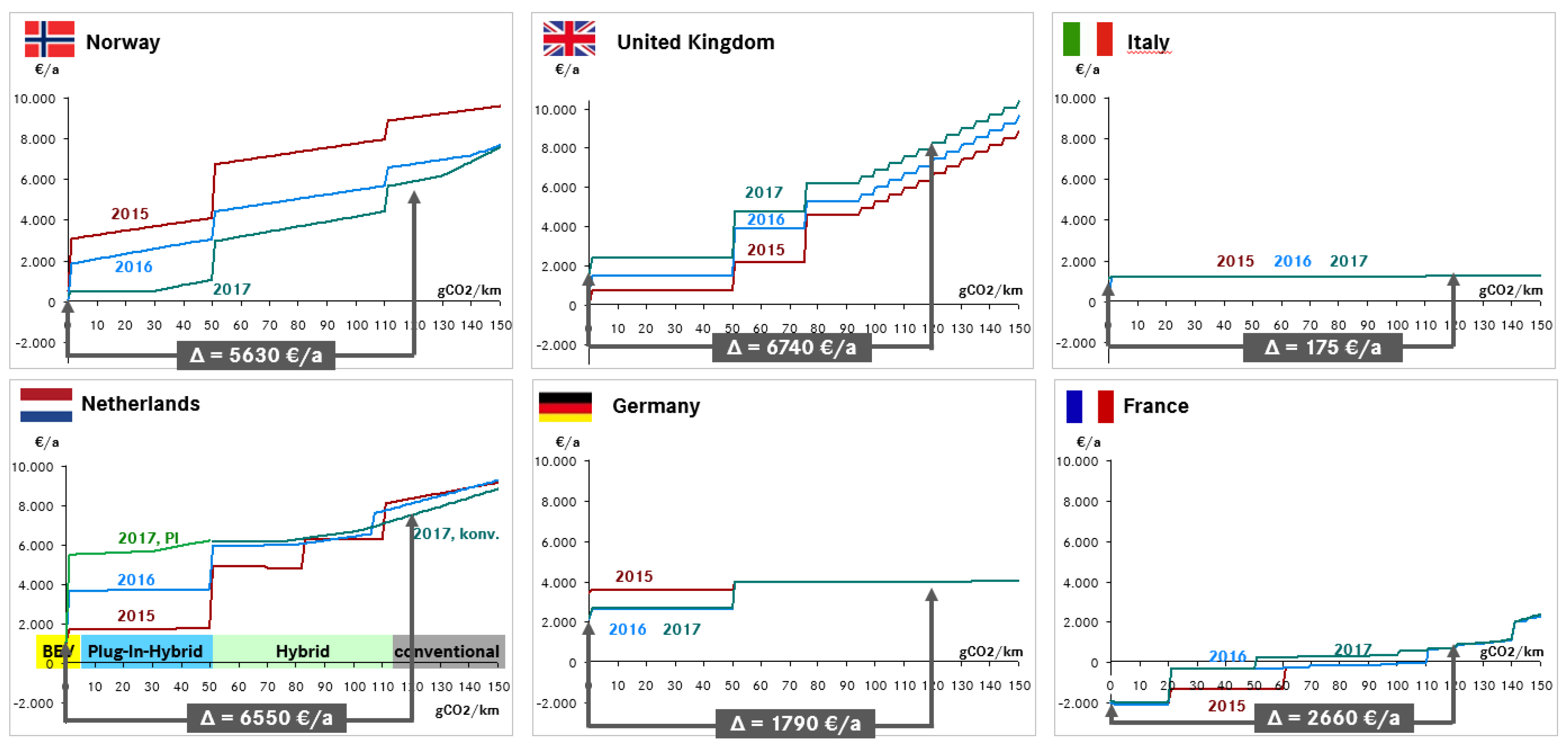

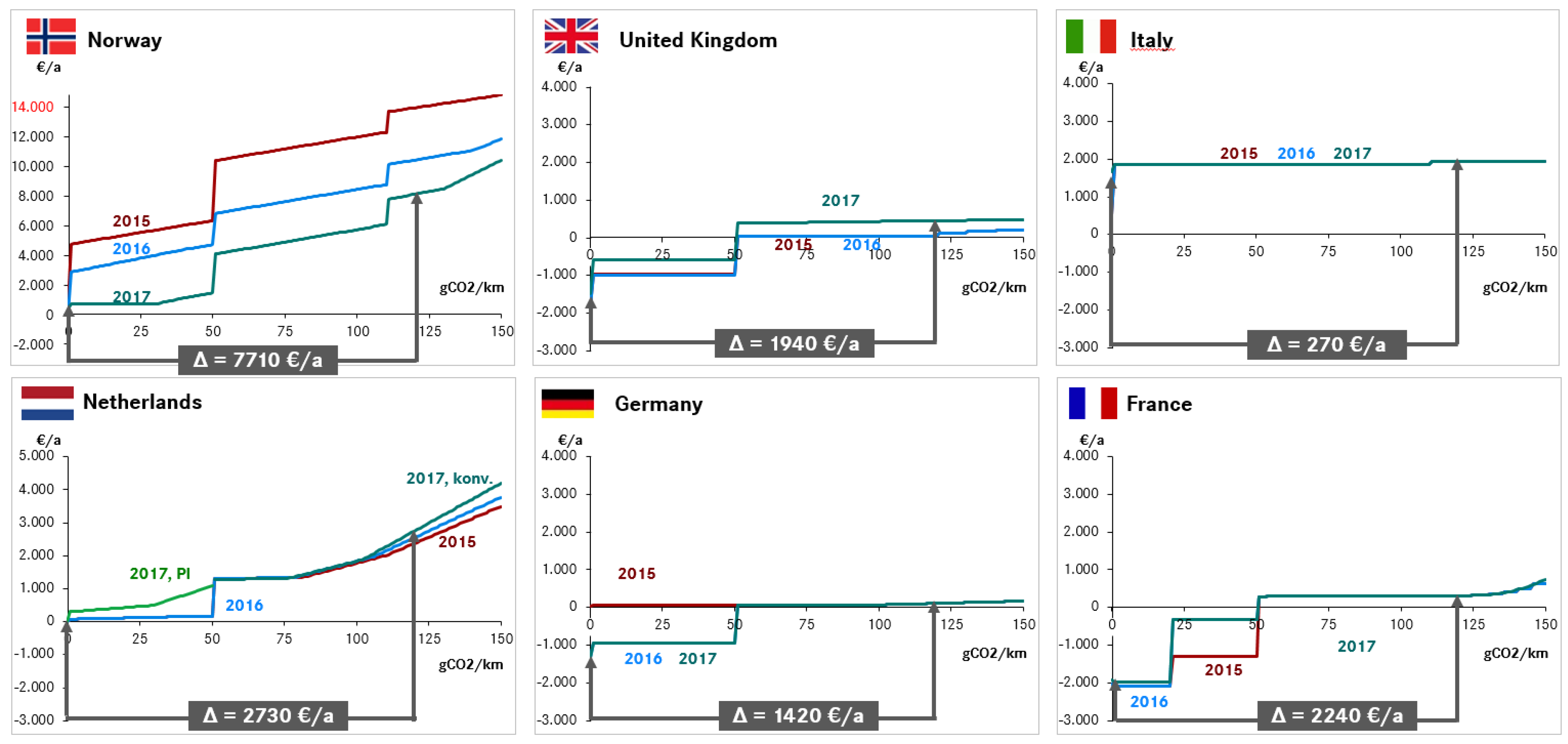

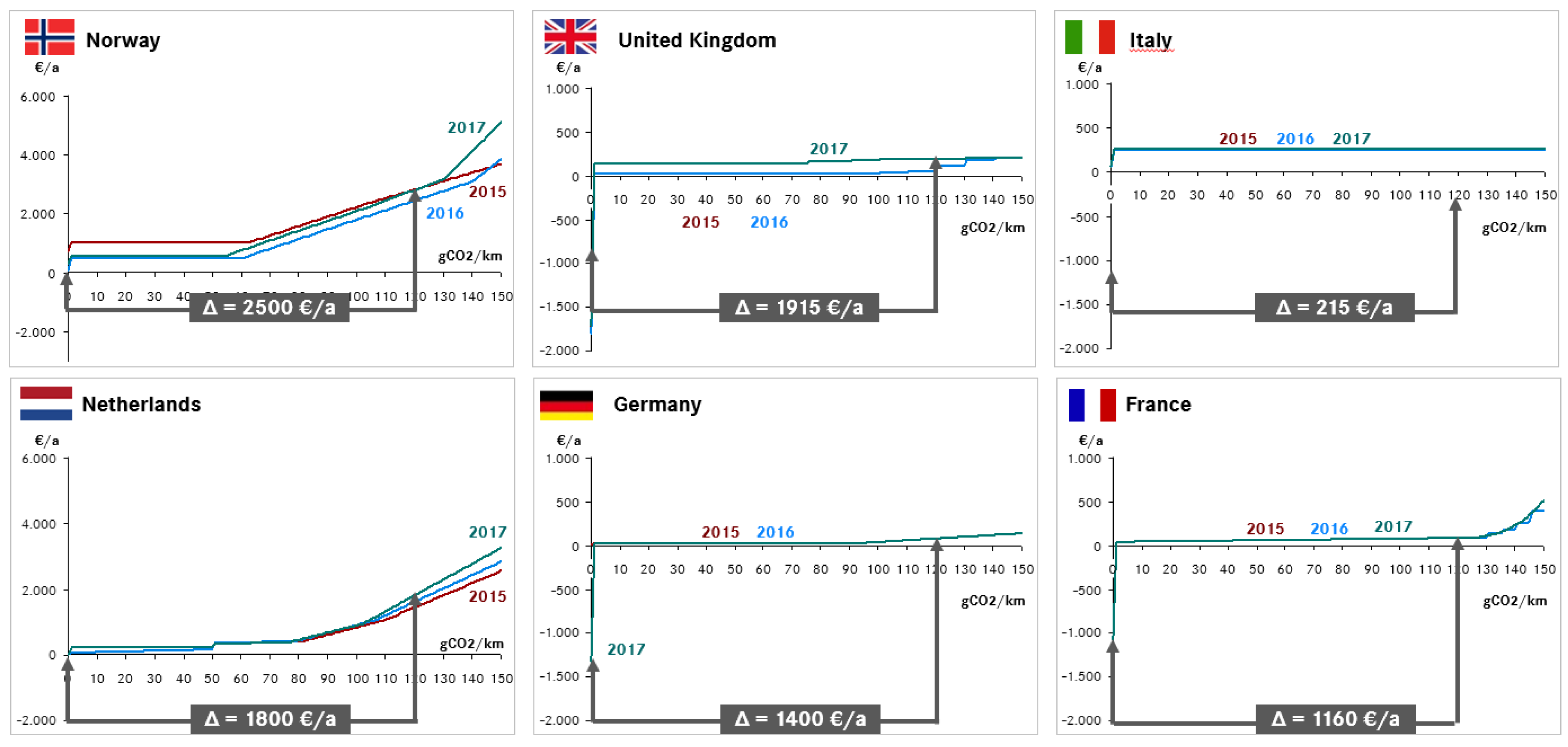

1.1. Total Cost of Ownership

1.2. Vehicle Taxation in Europe

1.2.1. Germany

1.2.2. The Netherlands

1.2.3. Italy

1.2.4. Norway

1.2.5. The United Kingdom

- Category 1 = €5230 (CO2 emissions less than 50 g/km, zero emission range of at least 70 miles)

- Category 2 = €2910 (CO2 emissions less than 50 g/km, zero emission range between 10 and 69 miles)

- Category 3 = €2910 (CO2 emissions between 50 and 75 g/km, zero emission range of at least 20 miles)

1.2.6. France

1.3. Additional xEV Benefits

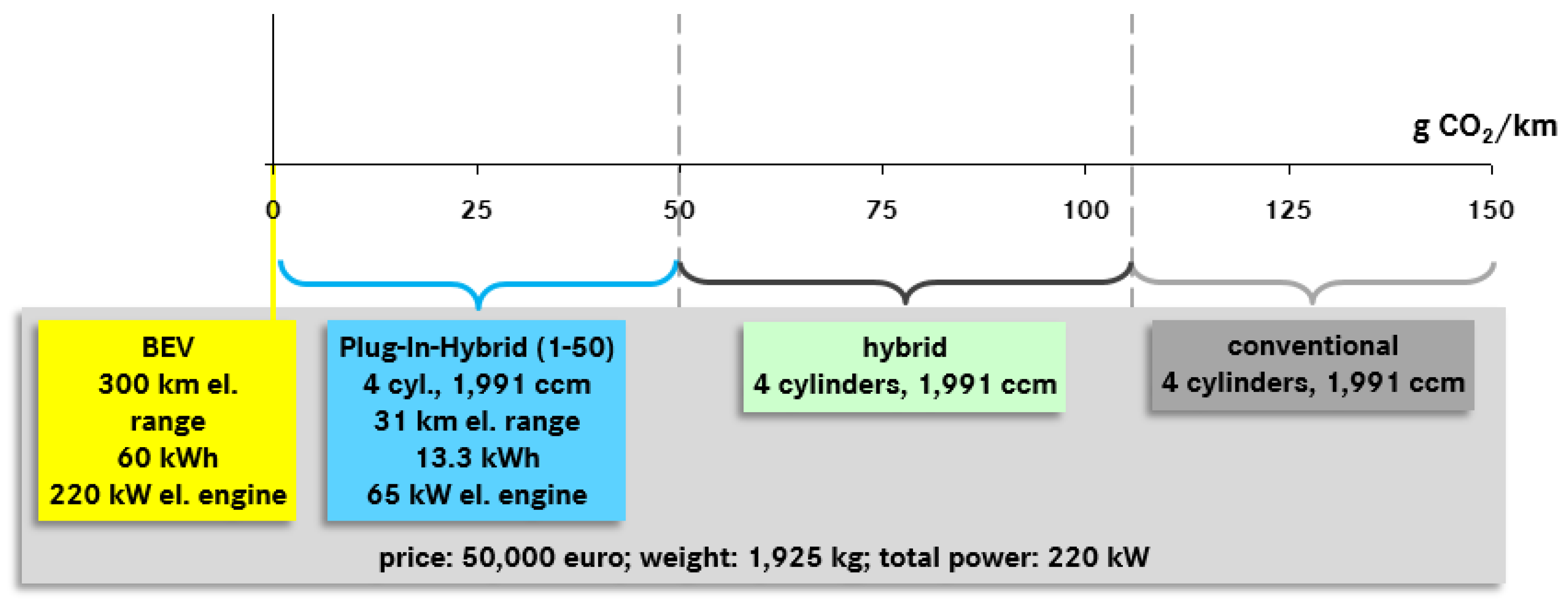

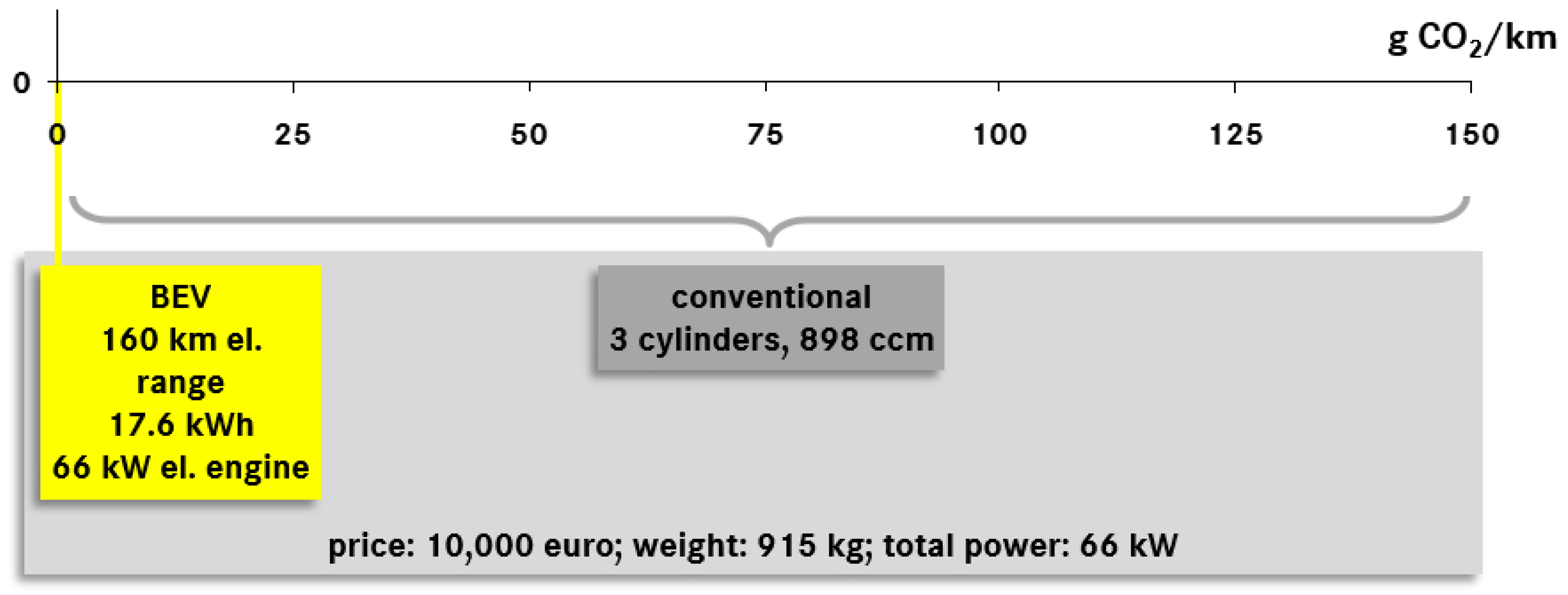

2. Methodology for a Comparison of Vehicle Taxation Schemes

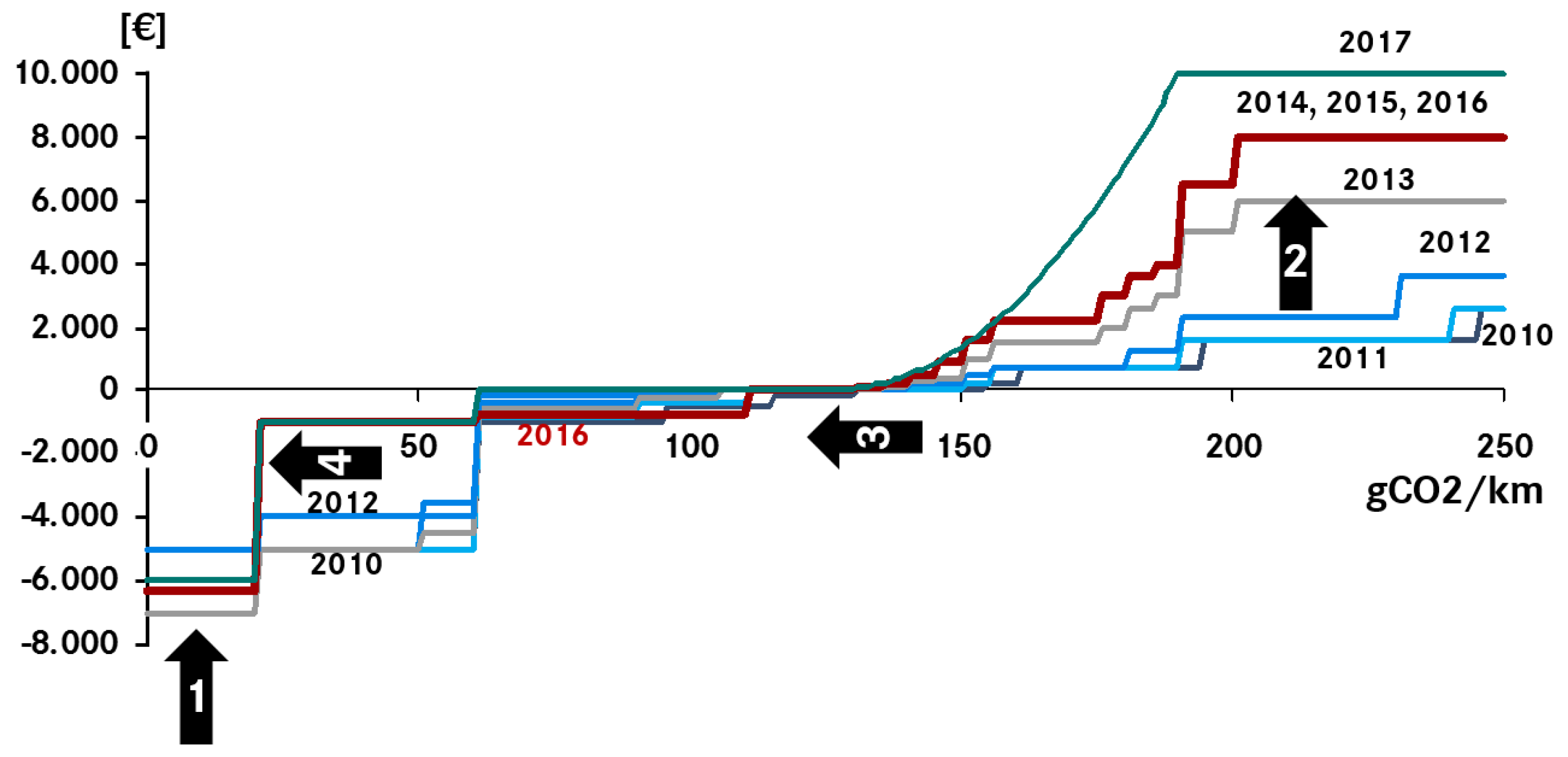

3. Results

4. Outlook

4.1. France

- Decreasing bonus level,

- Increasing malus level,

- The starting point of the malus is shifted to lower CO2 values,

- CO2 limits for subsidies are lowered.

4.2. The United Kingdom

4.3. The Netherlands

4.4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Al-Alawi, B.M.; Bradly, T.H. Total cost of ownership, payback, and consumer preference modeling of plug-in hybrid electric vehicles. Appl. Energy 2013, 103, 488–506. [Google Scholar] [CrossRef]

- Bubeck, S.; Tomascheck, J.; Fahl, U. Perspectives of electric mobility: Total cost of ownership of electric vehicles in Germany. Transp. Policy 2016, 50, 63–77. [Google Scholar] [CrossRef]

- Pfahl, S.; Jochem, P.; Fichtner, W. When Will Electric Vehicles Capture the German Market? And why? In Proceedings of the 2013 World Electric Vehicle Symposium and Exhibition (EVS27), Barcelona, Spain, 17–20 November 2013. [Google Scholar]

- Chandra, A.; Gulati, S.; Kandlikar, M. Green drivers or free riders? An analysis of tax rebates for hybrid vehicles. J. Environ. Econ. Manag. 2010, 60, 78–93. [Google Scholar] [CrossRef]

- Figenbaum, E.; Kobenstvedt, M. Learning from Norwegian Battery Electric and Plug-in Hybrid Vehicle Users: Results from a Survey of Vehicle Owners; TØI Report 1492/2016; Institute of Transport Economics (TØI): Oslo, Norway, 2016. [Google Scholar]

- Kunert, U.; Kuhfeld, H. The diverse structures of passenger car taxation in Europe and the EU Commissions proposal for reform. Transp. Policy 2007, 14, 306–316. [Google Scholar] [CrossRef]

- ACEA. European Automobile Manufacturers Association. Available online: http://www.acea.be/statistics/tag/category/by-country-registrations (accessed on 8 June 2018).

- European Alternative Fuels Observatory (EAFO). Available online: http://www.eafo.eu/eu (accessed on 8 June 2018).

- HM Revenue & Customs. Benefits in Kind Statistics. Available online: https://www.gov.uk/government/collections/taxable-benefits-in-kind-and-expenses-payments-statistics (accessed on 8 June 2018).

- KBA. Kraftfahrt-Bundesamt. Available online: https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/Halter/2016_n_halter_dusl.html?nn=652344 (accessed on 8 June 2018).

- ACEA. ACEA Tax Guide; ACEA: Brussels, Belgium, 2017. [Google Scholar]

- Gallagher, K.S.; Muehlegger, E. Giving green to get green? Incentives and consumer adoption of hybrid vehicle technology. J. Environ. Econ. Manag. 2011, 61, 1–15. [Google Scholar] [CrossRef]

- International Energy Agency. Global EV Outlook 2017; International Energy Agency: Paris, France, 2017; Available online: www.iea.org (accessed on 8 June 2018).

- Zhang, Y.; Qian, Z.S.; Sprei, F.; Li, B. The impact of car specifications, prices and incentives for battery electric vehicles in Norway: Choices of heterogeneous consumers. Transp. Res. Part C Emerg. Technol. 2016, 69, 386–401. [Google Scholar] [CrossRef]

- Service, GDS Government Digital. Available online: https://www.gov.uk/government/publications/budget-2016-documents/budget-2016 (accessed on 8 June 2018).

- GOV.UK. Available online: https://www.gov.uk/government/publications/income-tax-cars-appropriate-percentage-increasing-the-diesel-supplement/income-tax-cars-appropriate-percentage-increasing-the-diesel-supplement (accessed on 12 June 2018).

- European Comission. Guidelines on Financial Incentives for Clean end Energy Efficient Vehicles; European Comission: Brussels, Belgium, 2013. [Google Scholar]

- Plötz, P.; Funke, S.A.; Jochem, P.; Wietschel, M. CO2 Mitigation Potential of Plug-in Hybrid Electric Vehicles larger than expected. Sci. Rep. 2017, 7, 16493. [Google Scholar] [CrossRef] [PubMed]

- ICCT. CO2 Emissions from New Passenger Cars in the EU: Car Manufacturers’ Performance in 2016; ICCT: Washington, DC, USA, 2017. [Google Scholar]

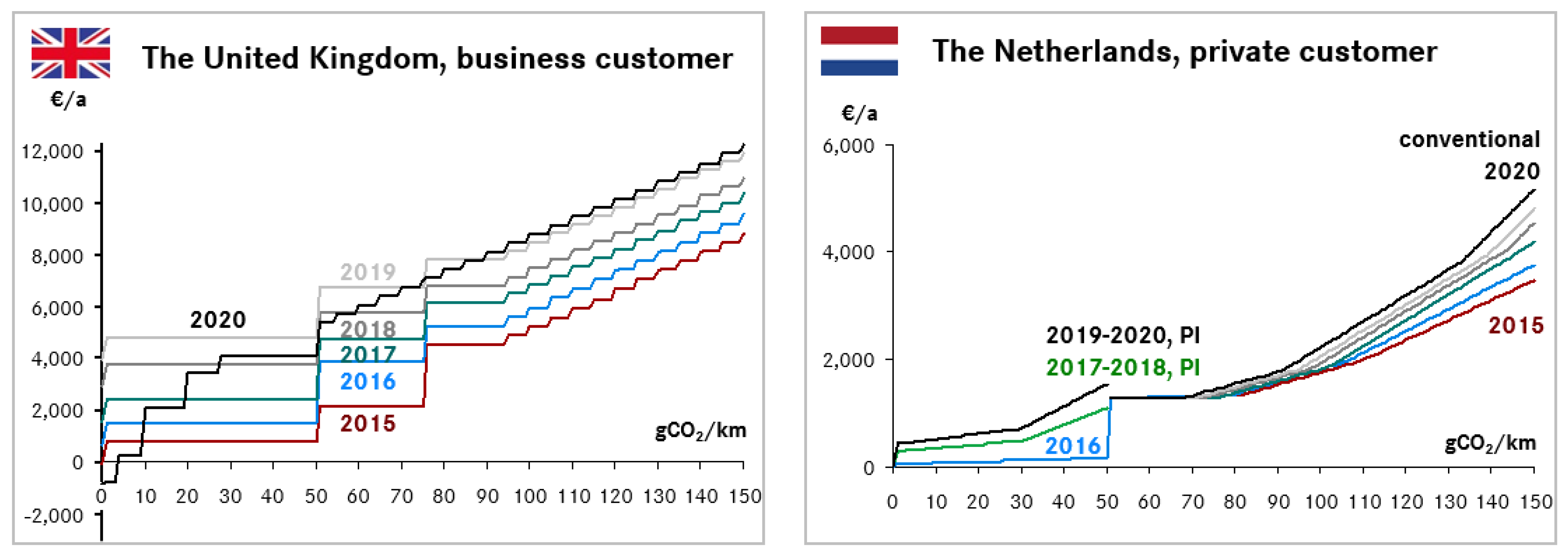

| Private customer in the Netherlands | ||||||

| year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| vehicle emission (gCO2/km) | 116.4 | 112.5 | 109.5 | 106.0 | 103.5 | 100.0 |

| delta vs. previous year (%) | 3.3 | 2.6 | 3.2 | 2.4 | 3.4 | |

| Business customer in UK | ||||||

| year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| vehicle emission (gCO2/km) | 140 | 130 | 120 | 110 | 95 | 90 |

| delta vs. previous year (%) | 7.1 | 7.7 | 8.3 | 13.6 | 5.3 | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hauff, K.; Pfahl, S.; Degenkolb, R. Taxation of Electric Vehicles in Europe: A Methodology for Comparison. World Electr. Veh. J. 2018, 9, 30. https://doi.org/10.3390/wevj9020030

Hauff K, Pfahl S, Degenkolb R. Taxation of Electric Vehicles in Europe: A Methodology for Comparison. World Electric Vehicle Journal. 2018; 9(2):30. https://doi.org/10.3390/wevj9020030

Chicago/Turabian StyleHauff, Karin, Stefan Pfahl, and Rolf Degenkolb. 2018. "Taxation of Electric Vehicles in Europe: A Methodology for Comparison" World Electric Vehicle Journal 9, no. 2: 30. https://doi.org/10.3390/wevj9020030

APA StyleHauff, K., Pfahl, S., & Degenkolb, R. (2018). Taxation of Electric Vehicles in Europe: A Methodology for Comparison. World Electric Vehicle Journal, 9(2), 30. https://doi.org/10.3390/wevj9020030