Abstract

In Europe, a heterogeneous range of national vehicle taxation systems exists in parallel, so that a simple comparison of electric vehicle (xEV) tax advantages is not straightforward. In this contribution, various European vehicle taxation systems are examined and a methodology is introduced which allows a comprehensible comparison and overview by calculating CO2 based taxation step curves. This methodology provides a powerful tool for benchmarking xEV technologies and analyzing consumer acceptance of xEVs and enables furthermore the discussion about possible future taxation and incentive schemes.

1. Introduction

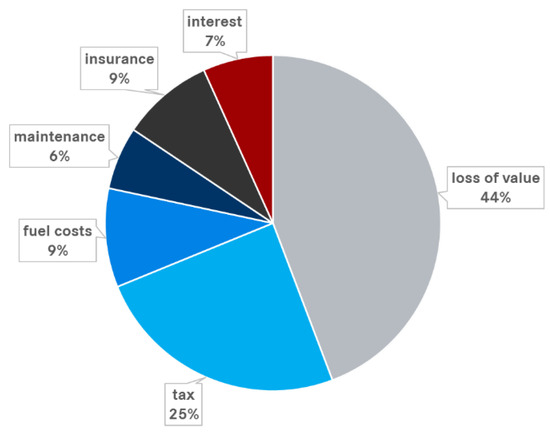

1.1. Total Cost of Ownership

The purchase decision of vehicle customers strongly depends on the total cost of ownership (TCO) [1] which comprise the loss of value, taxes, insurance, maintenance, interests and fuel costs [2,3]. Among these, the loss of value is typically the biggest cost component. Figure 1 shows exemplarily the TCO shares of a typical E-segment diesel vehicle of a business customer in the United Kingdom in 2016 over three-year holding time. Company car taxation is included which is paid by the employee for the benefit in kind of privately using a company car. It can be seen that taxes hold the second largest share adding up to 25% in the shown example. Compared to this, fuel costs, maintenance, insurance and interest have minor shares.

Figure 1.

Total cost of ownership shares of a typical E-segment diesel vehicle of a business customer in the United Kingdom in 2016 based on three-year holding time.

Hence, the consumer acceptance of electric vehicles is strongly influenced by vehicle taxation in specific countries [4,5]. The aim of this paper is to identify these countries and to give a comparison of electric vehicles (xEV) versus conventional vehicle taxation by calculating CO2 based taxation step curves. In this contribution, xEV refers to an electric vehicle with an external plug that is either a battery electric vehicle (BEV) or a plug-in hybrid electric vehicle (PHEV). Fuel cell electric vehicles are not included in this study.

Vehicle taxation systems differ not only in their taxation levels but also in terms of their structural principles [6]. Due to the wide range of calculation schemes, a direct comparison of tax levels is not expedient. In the following, six European vehicle taxation systems are examined (Germany, the Netherlands (NL), Italy, Norway, the United Kingdom (UK) and France) and a methodology is introduced that allows a comparison of different systems by looking at their CO2 dependency in a range between 0 and 150 gCO2/km in 1 gCO2/km steps. Germany, UK, France and Italy are chosen as they have the highest new registration numbers of passenger vehicles in total in Europe [7] and are hence the four largest European vehicle markets. In addition, we consider two countries with above-average xEV sales: The Netherlands had an xEV share of 2.2% in new vehicle registrations in 2017 and Norway 39.2%, whereas the average in the European Union was 1.4% [8].

Moreover, business and private customers are discussed separately. For the business customer, we sum up the components that affect the employer (registration tax, annual ownership tax, grants) and the tax paid by the employee for the benefit in kind of privately using a company car. This is important as yearly tax advantages of xEVs often derive from company car taxation [8]. As company cars are typically new vehicles and are kept for a short holding period [9], they have a severe impact on renewing the vehicle fleet and hence also on future xEV penetration. For example, in Germany, 90% of passenger cars in the vehicle stock are privately owned, whereas 60% of annual first registrations are undertaken by a company or organization [10]. In the UK, 0.94 million employees paid benefit in kind taxes for using a company car vehicle privately in the period from April 2013 to March 2014 [9], whereas 2.26 million new vehicles were registered in the UK in 2013 [7].

In addition, two different segments will be analyzed (B- and E-segment). By applying this methodology, an outlook can be given for future vehicle taxation.

1.2. Vehicle Taxation in Europe

In Europe, a heterogeneous range of national vehicle taxation systems exists in parallel, varying both through taxation components in place (purchase subsidies and registration taxes at point of sale, annual ownership taxes, company car taxes) and through the parameters determining the tax burden (CO2, engine power, engine displacement, electrical driving range, vehicle weight, vehicle list price, fuel type). Subsequently, the vehicle taxation of six examined European countries (Germany, the NL, Italy, Norway, the UK and France) will be described in more detail for the year 2017 [8,11]. Regional taxes are not taken into account.

Hybrid electric vehicles (HEV, without external plug) are only mentioned in Norway as they were treated the same as a conventional vehicle in the other countries.

1.2.1. Germany

In Germany, there is no registration tax. There is only an overall registration fee of about €26.30 depending on the city. The annual vehicle tax is dependent on both the displacement (Diesel: €9.50/Gasoline: €2 for every 100 cubic centimetr and part thereof) and CO2 (€2 for every gram above 95 gCO2/km).

Purchase subsidies were introduced in June 2016 and run until June 2019 (€4000 for BEV and €3000 for PHEV with less than 50 gCO2/km and not exceeding €60,000 net list price of the base model). Half of the subsidy is paid by the government and the other half is paid by the automobile manufacturer. As the manufacturer subsidy reduces, the net list price in addition less value added tax (19%) has to be paid by the customer (this sums up to €380 for BEV and €285 for PHEV).

The company car tax is commonly calculated as 1% of the gross list price times the personal income tax rate. As a calculation basis for company car taxation of BEV and PHEV, the gross list price is reduced by €500 per kWh storage capacity of the battery with a cap at 20 kWh (€10,000) for vehicles bought before 31 December 2013. After 2013, this amount is reduced by €50 every year (i.e., −450 €/kWh in 2014, −400 €/kWh in 2015, etc.). This compensation is available only for vehicles bought before 31 December 2022.

1.2.2. The Netherlands

The registration tax is determined by the car’s CO2 emissions. It is not charged for BEV. In addition, there is a separate rating scheme for PHEV. Diesel vehicles are charged extra if exceeding 65 gCO2/km. The annual tax depends on the vehicle’s weight and fuel type (vehicles with less than 50 gCO2/km pay half tariff, vehicles with 0 gCO2/km are entirely exempted).

The company car taxation is implemented by adding a percentage of the vehicle’s consumer price to the personal salary. In case of 0 gCO2/km, the percentage is 4% if the list price is not exceeding €50,000. For all other vehicles, 22% is applied.

1.2.3. Italy

In Italy, vehicle taxation is only depending on engine power. Nevertheless, there are local differences as each province can increase the nationwide base rate by up to 30%. Electric vehicles are exempted from paying vehicle taxes for five years from the date of the first registration. Afterwards, they must pay a charge equal to a quarter of the amount of their corresponding gasoline vehicles.

1.2.4. Norway

The registration tax depends on the vehicle’s weight (about €405 up to 1200 kg, about €620 from 1200 kg). An exchange rate of 9.1 NOK/€ is used. Norway is charging an import tax which takes into account the vehicle’s weight, CO2-emissions and NOx-emissions. The vehicle weight of PHEV is reduced by 26% for the calculation of the import tax. HEVs get a weight advantage of 10%. Until 2016, the engine power was also part of the calculation scheme. Furthermore, BEVs are exempted from the 25% value added tax.

The annual tax is about €313 apart from two exemptions: BEVs pay only about €50 and diesel vehicles without a particle filter pay €365.

1.2.5. The United Kingdom

The registration fee is a fixed amount of €64 (exchange rate of 0.86 £/€ is used).

There are three categories of purchase subsidies (in addition, a maximum list price of €69,800 applies for eligibility of categories 2 and 3):

- Category 1 = €5230 (CO2 emissions less than 50 g/km, zero emission range of at least 70 miles)

- Category 2 = €2910 (CO2 emissions less than 50 g/km, zero emission range between 10 and 69 miles)

- Category 3 = €2910 (CO2 emissions between 50 and 75 g/km, zero emission range of at least 20 miles)

A new annual tax scheme was introduced on 1 April 2017. First year rates are strongly depending on CO2, whereby only 0 gCO2/km is free of charge. From the second year onwards, tax rates depend on the vehicle price. The company car tax rate is CO2-dependent with a lower rate in the range between 0 and 50 gCO2/km. For diesel, a surcharge of 3% is added to the company car tax rate.

1.2.6. France

The registration tax is depending on both the horse power and CO2-emission (“Malus Ecologique”). The yearly vehicle tax applies only to vehicles above 190 gCO2/km. The company car tax is CO2-dependent as well.

Vehicles below 20 gCO2/km get a subsidy of €6000 with a cap at 27% of the acquisition price. Between 21 and 60 gCO2/km, the subsidy is €1000 (max. 20% of the acquisition price). An additional subsidy applies if a diesel vehicle (registered before January 2007) is replaced with a new BEV or PHEV. This scrapping subsidy amounts €4000 when purchasing a vehicle below 20 gCO2/km and €2500 for vehicles between 21 and 60 gCO2/km. Scrapping subsidies are not considered in the CO2 step curves as the requirement of holding a 10 year-old diesel vehicle is fulfilled only by a minor part of the stock.

The annual tax is a fixed rate of €160/year for vehicles > 190 gCO2/km.

Company car taxation is depending on CO2 (starting from 50 gCO2/km) plus a fixed rate of €20/year for gasoline and €40/year for diesel.

1.3. Additional xEV Benefits

Fuel cost savings are an additional xEV benefit [12] caused partly by lower excise duties on electricity. Excise duties are included in the fuel costs and will not be taken into account in the CO2 step curves.

Road charges are not taken into account, even though xEVs might be exempted from certain charges in some local region (e.g., London, Oslo). Additionally, xEVs might profit from free parking in city areas or free use of ferries (Norway) [5,13] or bus lane access [14]. As these advantages are limited to locally restricted areas, they are not taken into account since we want to describe the common situation in the countries considered.

Some countries grant subsidies for installing a home charging station (e.g., UK €580 [8]). Such grants are not considered in the step curve calculation as they are purely focused on explicit vehicle taxation schemes.

2. Methodology for a Comparison of Vehicle Taxation Schemes

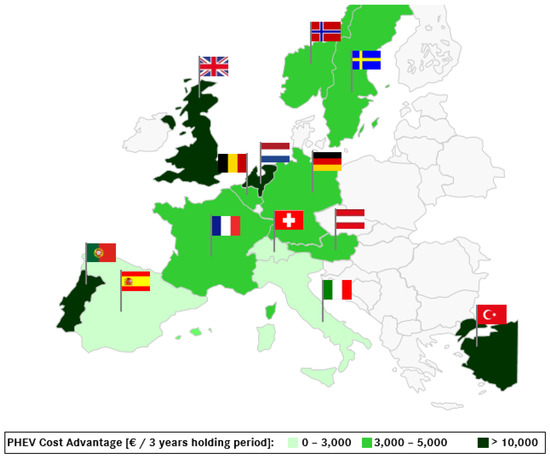

The typical way of comparing tax advantages in Europe is a direct comparison of two vehicles. Figure 2 is an example for this and illustrates the large variance in Europe of the overall tax advantage in a three-year holding period of a PHEV to a conventional vehicle (both E-segment). For all calculations in this paper, the personal income tax is assumed to be 40% for the calculation of the company car taxation.

Figure 2.

The overall tax advantage of a plug-in hybrid electric vehicle (PHEV) compared to a conventional vehicle in the E-segment for a business customer. This comprises purchase subsidies, registration taxes at point of sale and yearly ownership taxes paid by the employer as well as company car taxes paid by the employee.

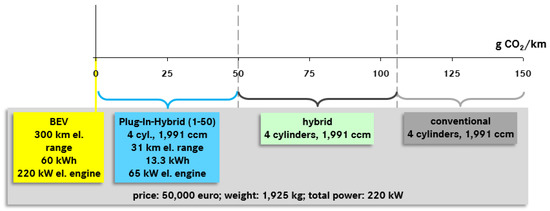

Instead of comparing different vehicle combinations over and over, the method of CO2 step curves is used to compare a whole bundle of vehicles. Hereby, the comparison of national vehicle taxation systems is achieved by looking at hypothetical CO2 based taxation curves between 0 to 150 gCO2/km in 1 gCO2/km-steps. The vehicle characteristics are derived from actual vehicles such as a typical E-segment vehicle in Figure 3. For comparison reasons, all vehicles are supposed to be equal in price, weight and engine power. In addition, 0 gCO2/km represents a BEV. In the range between 1 and 50 gCO2/km, a PHEV is depicted with both an electric and a combustion engine. From 51 to 110 gCO2/km, a hybrid vehicle is implied. The range between 111 and 150 gCO2/km represents a conventional vehicle.

Figure 3.

Vehicle characteristics of a typical E-segment vehicle.

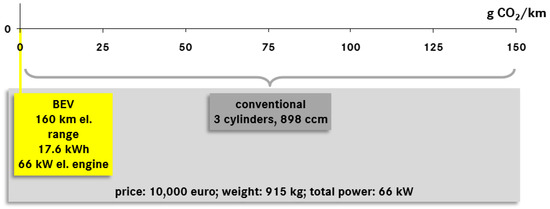

In Figure 4, vehicle characteristics of a typical B-segment car (small cars) are shown. PHEVs are not offered in this segment due to the fact that size and price do not allow an installation of two drive-trains. As a consequence, these cars are either electric or conventional.

Figure 4.

Vehicle characteristics of a typical B-segment vehicle.

In this paper, we focus on CO2 step curves of gasoline vehicles as PHEVs are nowadays largely fueled by gasoline. Nevertheless, the methodology of CO2 step curves can be applied similarly to diesel vehicles.

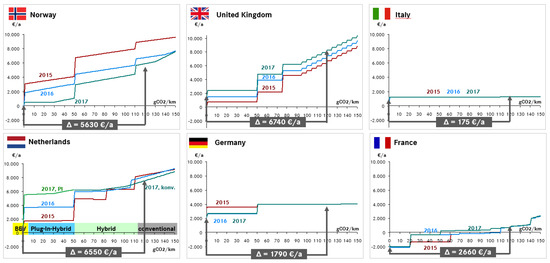

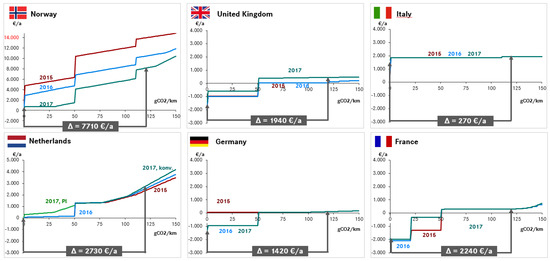

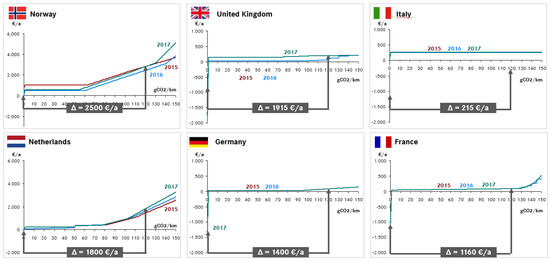

The resulting taxation curves (Figure 5, Figure 6 and Figure 7) are solely dependent on CO2 emissions. Since the characteristic lines comprise all taxation and incentive components for three-year holding time, both one-time taxation (registration tax and grants) and yearly tax items (annual tax and, in the case of business use, the benefit in kind tax paid by the employee) are included. For comparability, a three-year holding period is used for both the business and the private customer.

Figure 5.

CO2 based step curves of vehicle taxation of business customers based on a typical E-segment gasoline vehicle in three-year holding time, including one-time and yearly taxation/incentives in 2015, 2016 and 2017.

Figure 6.

CO2 based step curves of vehicle taxation of private customers based on a typical E-segment gasoline vehicle in three-year holding time, including one-time and yearly taxation/incentives in 2015, 2016 and 2017.

Figure 7.

CO2 based step curves of vehicle taxation of private customers based on a typical B-segment gasoline vehicle in three-year holding time, including one-time and yearly taxation/incentives in 2015, 2016 and 2017.

3. Results

Figure 5 shows CO2 based taxation step curves of a business customer vehicle based on a typical E-segment vehicle for the past three years in Norway, the UK, Italy, the NL, Germany and France. It can be seen that the UK and France have stepwise changes in taxation with increasing CO2 values. This was the reason to call the methodology CO2-based taxation step curves. Contrary to that, Norway, the NL and Germany have continuous correlations between vehicle CO2 emissions and taxation levels, meaning that each additional gram of CO2 is charged. The steps at 50 and 110 gCO2/km in Norway are caused by the weight reduction advantage of PHEV and hybrids. Hybrid electric vehicles without an external plug get only in Norway an additional benefit (weight of HEV is reduced by 10% for the calculation of the import tax). For this reason, a step in taxation arises at 110 gCO2/km in Norway (from 50 to 110 gCO2/km an HEV is assumed). Italy has no dependency on CO2 at all.

Moreover it can be seen from Figure 5 that some countries like the UK, the NL, Norway and France adapt vehicle taxation on a yearly basis, whereas Germany and Italy keep their taxation schemes for several years.

In addition, the yearly tax difference in Euro per year between a BEV with 0 gCO2/km versus a conventional vehicle with 120 gCO2/km is shown in the grey arrays in Figure 5. In Italy, the advantage of a BEV is only €175 per year in the case considered. In Germany and France, the BEV advantage is in a medium range of €1790 respectively €2660 per year and represents a combination of the purchase subsidy for xEVs and CO2-dependent taxation. The largest BEV advantage occurs in Norway (€5630 per year), the NL (€6550 per year) and in the UK (€6740 per year). Norway and the Netherlands grant no purchase subsidies but rather implemented a strong CO2-dependency in the registration tax that is quite advantageous for a 0 gCO2/km-vehicle. In addition, the UK and the NL admit xEVs large benefits in company car taxation.

Looking at the tax and incentive advantage between BEV and PHEV, the difference from 0 to 1 gCO2/km-vehicles has to be considered in the CO2-based taxation step curves. In Figure 5, it can be observed that Norway reduced this step in 2016 and nearly eliminated it in 2017 so that PHEV benefits nearly in the same way from tax exemptions like a BEV. Vice versa, the NL increased the taxation on PHEV in the last years and hence increased the difference from 0 to 1 gCO2/km-vehicles. In the UK and Germany, there is only a small difference in taxation between BEV and PHEV. This is true in France as well as long the PHEV is below 20 gCO2/km. This demonstrates the heterogeneous fiscal classification of electrified vehicles in Europe.

Figure 6 shows the CO2 based step curve for a private customer for a vehicle based on a typical E-segment gasoline vehicle. In the UK and the NL, the tax difference between a conventional vehicle and a BEV or PHEV is much higher for a business costumer (see Figure 5) than for a private customer (see Figure 6) due to the CO2-dependent taxation of the benefit in kind for the private use of company cars in these countries. For example, the private customer has a benefit of €1940 per year for a BEV versus a conventional vehicle with 120 gCO2/km, whereas the business customer has a yearly advantage of €6740 in the considered case. In Norway, the private customers additionally profit from a value added tax exemption (VAT is not included in the CO2-step curve).

Figure 7 depicts the CO2 based taxation of a B-segment vehicle for a private customer. In comparison to Figure 7, it can be seen that the taxation level of a B-segment vehicle is much lower than of a E-segment vehicle due to the lower price (the UK), less engine power (Italy), the lower weight (Norway, NL) and less displacement (Germany, France). In Norway, the NL, the UK, France and Germany, the B-segment-BEV advantages for private customers compared to a conventional vehicle are in the range of €1000 to €2500 per year. In Italy, the advantage is much smaller.

4. Outlook

In this section, the benefit of analyzing CO2 step curves is demonstrated on the one hand by analyzing retrospectively the bonus/malus system in France and, on the other hand, by discussing the announced development of company car taxation in the UK and registration tax in the NL. As the UK, the NL and France adapt their taxation schemes nearly every year, we focus on them in this section.

4.1. France

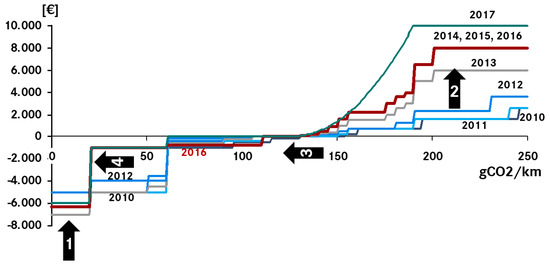

As described in Section 1.2.6, France has installed a bonus/malus system at the point of vehicle registration in which the bonus is a purchase subsidy for vehicles with low CO2 emissions and the malus is a fee for vehicles with high CO2 emissions. In Figure 8, the respective bonus/malus scheme is shown from 2010 onwards. It can be seen that it was adjusted regularly with the following trends (marked in Figure 8 with numbered arrows):

Figure 8.

Bonus/malus scheme in France from 2010 to 2017.

- Decreasing bonus level,

- Increasing malus level,

- The starting point of the malus is shifted to lower CO2 values,

- CO2 limits for subsidies are lowered.

In 2017, the malus steps are eliminated respectively reduced to an increment of 1 gCO2/km.

4.2. The United Kingdom

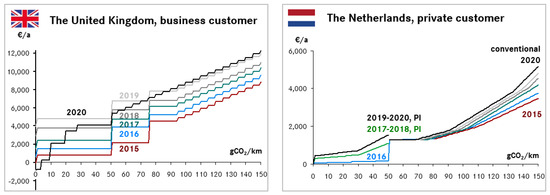

The UK plans a yearly increase of company car tax rates until 2019 (see Figure 9). From 2020 onwards, it is under discussion to introduce a dependency of the company car taxation to the electric driving range of PHEVs (1–50 gCO2/km) [15]. A long-range PHEV with more than 130 miles in zero CO2 emission mode is treated equally to a BEV. Both would have a company car tax rate of only 2%, which would be a significant drop compared to the previous years. In Figure 9, we roughly illustrate the discussed dependency of electric driving range by translating the electric driving range in gCO2/km. For illustration, we assume that 130 miles correspond to less than 3 gCO2/km, 70 miles correspond to 9 gCO2/km, 40 miles correspond to 19 gCO2/km and 30 miles correspond to 27 gCO2/km. In the end, this will depend on the CO2-emission in charge sustaining mode and hence on the specific combustion engine.

Figure 9.

CO2 based step curves of vehicle taxation of business customers in the UK and private customers in the Netherlands from 2017 to 2020. The CO2 step curves for the UK in 2020 are illustrating the ongoing discussion on introducing a dependency of electric driving range for PHEVs.

The Diesel surcharge will stay in place and be dependent on compliance of Real Driving Emissions test Step 2 (RDE 2) from April 2018 onwards [16].

4.3. The Netherlands

In the Netherlands, an increase in vehicle taxation will be undertaken every year until 2020 (see Figure 9). The separate PHEV registration tax rates (introduced in 2017) will be increased in 2019 (compare the range of 1 to 50 gCO2/km). Table 1 shows the CO2 vehicle emissions by which a private customer has the same tax burden over the years. In 2020, a vehicle has to emit 100 gCO2/km in order to have the same tax burden (€2224 each year over a three-year holding period) like a 116.4 gCO2/km-vehicle in 2015. Hence, a technical improvement of 2.5 to 3.5% has to be achieved every year to maintain the identical tax level.

Table 1.

CO2-values for having the same tax burden every year in absolute values (gCO2/km) and relatively to previous year (%) for business customers in the UK and private customers in the Netherlands.

4.4. Discussion

In principle, every gram CO2-emission has the same impact on the environment. From this point of view, there is no reason to have steps in vehicle taxation at certain CO2 levels. Steps are more or less randomly chosen and hence lead to an unfair situation between vehicles, which differ only in 1 gCO2/km. From a customer’s point of view, continuous CO2-dependancy is fairer and follows the guidelines on financial incentives for clean and energy efficient vehicles [17]. This was implemented for bonus/malus in France in January 2017 (see Section 4.1).

According to the plans in the UK, a long-range PHEV with more than 130 miles in zero CO2 emission mode will be treated equally to a BEV in company car taxation (Section 4.2). This follows the assumption that a PHEV with a high mileage in zero-CO2-emission-mode can be considered to drive predominantly electrically and should be promoted like a BEV. A recent study even revealed that PHEVs with about 60 km of real-world range currently electrify as many annual vehicles’ kilometers as BEV with a much smaller battery [18]. Such long-range PHEV will help to convince a larger share of the population to drive an electric vehicle as they help to overcome driving range limitations in areas with limited (public) charging infrastructure and to manage the one or two long distance vacation trips per year.

In terms of CIP-percentage (continuous improvement process), the average CO2-emission of the European vehicle fleet improved with 3.2% CIP the last years [19]. Looking at Table 1, a CIP-percentage of 2.5 to 3.5% has to be achieved every year to maintain the identical tax level in the Netherlands, which is hence a reasonable value. Looking at a business customer in the UK, the mean CIP-percentage would be about 7.5% to have the same tax burden as in the previous year (Table 1). This is far beyond that of the CIP of 3.2% observed in Europe so far [19]. As a consequence, a part of the company car users will choose a xEV due to the advantage in company car taxation. Nevertheless, an additional consequence is that the number of company car users decreased over the past last years (12% less in 2013 compared to 2008 [9]) as xEVs are not yet suitable for all customers (dependency on charging infrastructure, limited variety of xEV models, missing confidence in new technology).

5. Conclusions

In this contribution, a methodology is introduced which gives a comprehensible overview of the heterogeneous and complex vehicle taxation landscape. By calculating CO2 based taxation step curves, the influence of CO2 on vehicle taxation in different European countries is demonstrated and compared for private and business customers as well as for different vehicle segments (full-size cars in E-segment and small cars in B-segment). This methodology enables the discussion about the development of taxation and incentive schemes and provides a powerful tool for benchmarking xEV technologies in a comprehensive European comparison. By applying the method to six European countries, it can be learned that the change frequency of vehicle taxation differs very much. France, the UK, the NL, and Norway adapt on a yearly basis unlike Germany and Italy. Moreover, it can be seen that the taxation level for the same vehicle is quite different in Europe. This also applies to xEVs as their incentivation is very heterogeneous in Europe. The CO2-based taxation step curves reveal severe CO2-steps in taxation in some countries (e.g., France, the UK). Private and business use has to be differentiated as large tax advantages for low-emission vehicles arise from company car taxation (e.g., the NL, the UK) for the benefit in kind of privately using a company car.

Author Contributions

Conceptualization & Methodology: K.H.; Visualization: R.D.; Supervision: S.P.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Al-Alawi, B.M.; Bradly, T.H. Total cost of ownership, payback, and consumer preference modeling of plug-in hybrid electric vehicles. Appl. Energy 2013, 103, 488–506. [Google Scholar] [CrossRef]

- Bubeck, S.; Tomascheck, J.; Fahl, U. Perspectives of electric mobility: Total cost of ownership of electric vehicles in Germany. Transp. Policy 2016, 50, 63–77. [Google Scholar] [CrossRef]

- Pfahl, S.; Jochem, P.; Fichtner, W. When Will Electric Vehicles Capture the German Market? And why? In Proceedings of the 2013 World Electric Vehicle Symposium and Exhibition (EVS27), Barcelona, Spain, 17–20 November 2013. [Google Scholar]

- Chandra, A.; Gulati, S.; Kandlikar, M. Green drivers or free riders? An analysis of tax rebates for hybrid vehicles. J. Environ. Econ. Manag. 2010, 60, 78–93. [Google Scholar] [CrossRef]

- Figenbaum, E.; Kobenstvedt, M. Learning from Norwegian Battery Electric and Plug-in Hybrid Vehicle Users: Results from a Survey of Vehicle Owners; TØI Report 1492/2016; Institute of Transport Economics (TØI): Oslo, Norway, 2016. [Google Scholar]

- Kunert, U.; Kuhfeld, H. The diverse structures of passenger car taxation in Europe and the EU Commissions proposal for reform. Transp. Policy 2007, 14, 306–316. [Google Scholar] [CrossRef]

- ACEA. European Automobile Manufacturers Association. Available online: http://www.acea.be/statistics/tag/category/by-country-registrations (accessed on 8 June 2018).

- European Alternative Fuels Observatory (EAFO). Available online: http://www.eafo.eu/eu (accessed on 8 June 2018).

- HM Revenue & Customs. Benefits in Kind Statistics. Available online: https://www.gov.uk/government/collections/taxable-benefits-in-kind-and-expenses-payments-statistics (accessed on 8 June 2018).

- KBA. Kraftfahrt-Bundesamt. Available online: https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/Halter/2016_n_halter_dusl.html?nn=652344 (accessed on 8 June 2018).

- ACEA. ACEA Tax Guide; ACEA: Brussels, Belgium, 2017. [Google Scholar]

- Gallagher, K.S.; Muehlegger, E. Giving green to get green? Incentives and consumer adoption of hybrid vehicle technology. J. Environ. Econ. Manag. 2011, 61, 1–15. [Google Scholar] [CrossRef]

- International Energy Agency. Global EV Outlook 2017; International Energy Agency: Paris, France, 2017; Available online: www.iea.org (accessed on 8 June 2018).

- Zhang, Y.; Qian, Z.S.; Sprei, F.; Li, B. The impact of car specifications, prices and incentives for battery electric vehicles in Norway: Choices of heterogeneous consumers. Transp. Res. Part C Emerg. Technol. 2016, 69, 386–401. [Google Scholar] [CrossRef]

- Service, GDS Government Digital. Available online: https://www.gov.uk/government/publications/budget-2016-documents/budget-2016 (accessed on 8 June 2018).

- GOV.UK. Available online: https://www.gov.uk/government/publications/income-tax-cars-appropriate-percentage-increasing-the-diesel-supplement/income-tax-cars-appropriate-percentage-increasing-the-diesel-supplement (accessed on 12 June 2018).

- European Comission. Guidelines on Financial Incentives for Clean end Energy Efficient Vehicles; European Comission: Brussels, Belgium, 2013. [Google Scholar]

- Plötz, P.; Funke, S.A.; Jochem, P.; Wietschel, M. CO2 Mitigation Potential of Plug-in Hybrid Electric Vehicles larger than expected. Sci. Rep. 2017, 7, 16493. [Google Scholar] [CrossRef] [PubMed]

- ICCT. CO2 Emissions from New Passenger Cars in the EU: Car Manufacturers’ Performance in 2016; ICCT: Washington, DC, USA, 2017. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).