Mediating Role of 6V-Based SBMI Between Competitive Strategies and Firm Performance: An Empirical Study of China’s Electric Vehicle Industry

Abstract

1. Introduction

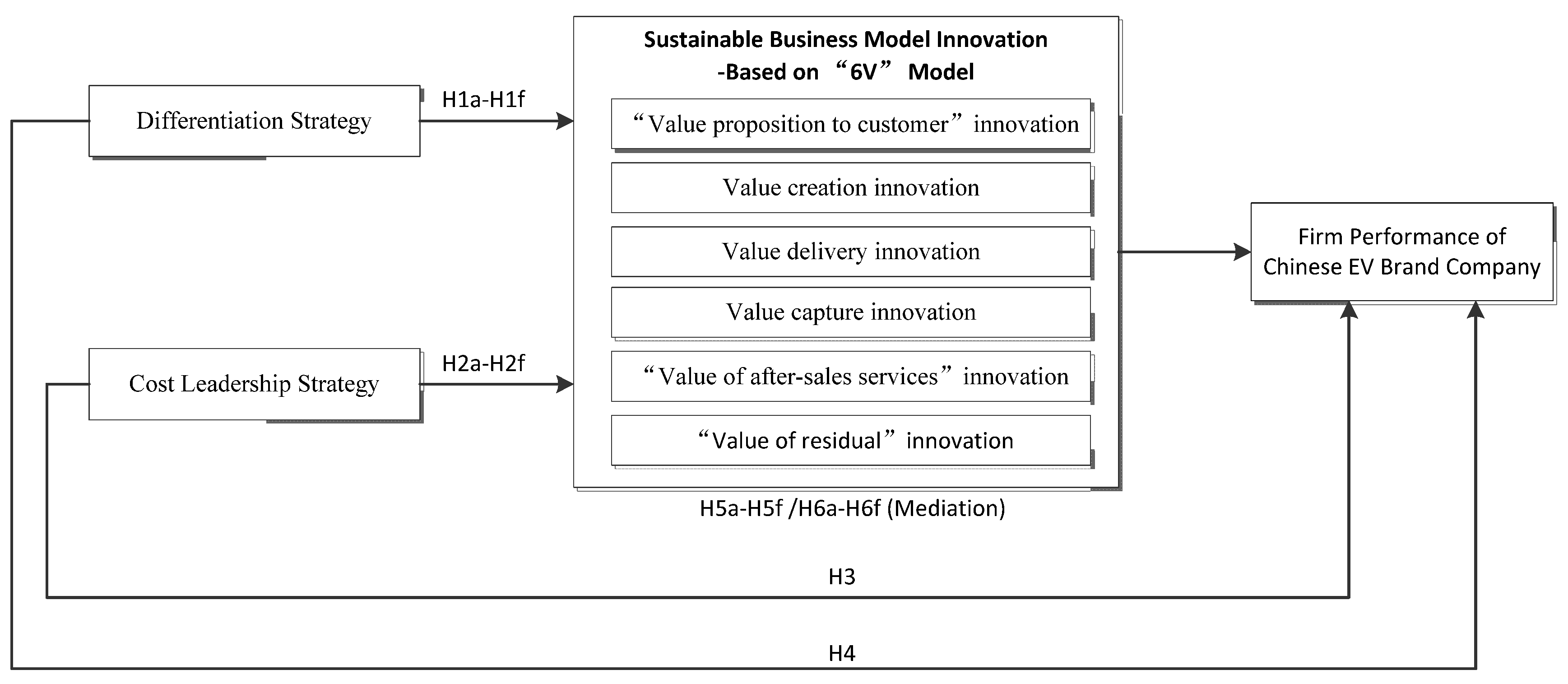

2. Literature Review and Hypotheses Development

2.1. Competitive Strategies and Sustainable Business Model Innovation

2.2. Competitive Strategies and Firm Performance

2.3. The Mediating Role of Sustainable Business Model Innovation Between Competitive Strategies and Company Performance

2.3.1. The Mediating Role of Sustainable Business Model Innovation Between Differentiation Strategy and Firm Performance

2.3.2. The Mediating Role of Sustainable Business Model Innovation Between Cost Leadership Strategy and Firm Performance

3. Research Method

3.1. Research Design

3.2. Measures

3.3. Survey Administration and Data Collection

4. Results

4.1. Demographic Profiles

4.2. Measurement Model Evaluation

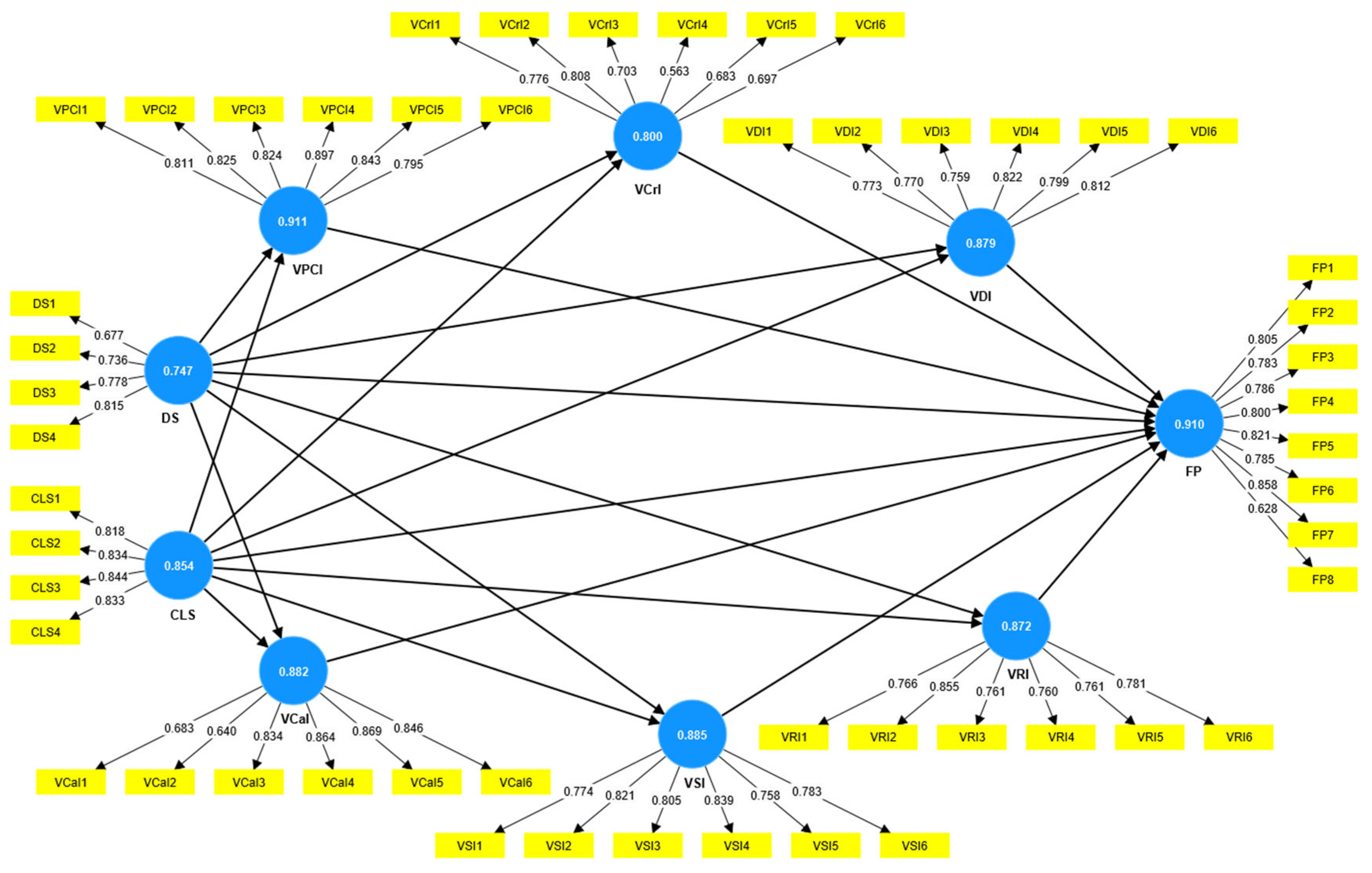

4.2.1. Indicator Reliability, Internal Consistency Reliability, and Convergent Validity

4.2.2. Discriminant Validity

4.3. Structure Model Assessment

4.3.1. Assess Collinearity Issues of the Structural Model

4.3.2. Hypothesis Testing

5. Discussion and Conclusions

5.1. Discussion

5.1.1. Relationship Between Competitive Strategies and Sustainable Business Model Innovation

5.1.2. Relationship Between Competitive Strategies and Firm Performance

5.1.3. The Mediating Role of Sustainable Business Model Innovation Between Competitive Strategies and Firm Performance

5.2. Contributions

5.2.1. Theoretical Implications

5.2.2. Practical Implications

5.3. Limitations and Future Research

5.4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Construct | Measurement Item | |

|---|---|---|

| Cost Leadership Strategy | CLS1 | Our company purchases raw materials and components costs are lower than competitors. |

| CLS2 | Our company manufacturing costs are lower than competitors. | |

| CLS3 | Our company products’ prices are lower than competitors. | |

| CLS4 | Our company gaining economies of scale. | |

| Differentiation Strategy | DS1 | Our company emphasizes brand building and identification. |

| DS2 | Our company adjusts the product to meet the customer’s changing needs. | |

| DS3 | Our company’s products have more advanced technology and configuration than competitors. | |

| DS4 | Our company products’ quality is higher than our competitors. | |

| “Value Proposition to Customer” Innovation | VPCI1 | Our company regularly address new, unmet customer needs. |

| VPCI2 | Our company products or services are very innovative as compared to our competitors. | |

| VPCI3 | Our company products or services regularly solve customer needs, which were not solved by competitors. | |

| VPCI4 | Our company regularly take opportunities which arise in new or growing markets. | |

| VPCI5 | Our company regularly address new, untouchable market segments. | |

| VPCI6 | Our company are constantly seeking new customer segments and markets for our products and services. | |

| Value Creation Innovation | VCrI1 | We permanently reflect which new competencies need to be established in order to adapt to changing market requirements. |

| VCrI2 | We regularly utilize new technical opportunities in order to extend our product and service portfolio. | |

| VCrI3 | We are constantly searching for new collaboration partners. | |

| VCrI4 | New collaboration partners regularly help us to further develop our business model. | |

| VCrI5 | We utilize innovative procedures and processes during manufacturing of our products. | |

| VCrI6 | Existing processes are regularly assessed and significantly changed if needed. | |

| Value Delivery Innovation | VDI1 | Our company regularly utilize new distribution channels for our products and services. |

| VDI2 | Constant changes in our channels led to improved efficiency of our channel functions. | |

| VDI3 | Our company consistently changed our portfolio of distribution channels. | |

| VDI4 | Our company often use new exchange and interactive platforms to transmit information to consumers. | |

| VDI5 | Our company often uses new ways to advertise our products or services. | |

| VDI6 | Our company constantly changed the information of our products or services delivery ways. | |

| Value Capture Innovation | VCaI1 | Our company recently developed new revenue opportunities, such as trading-in old motor vehicles for new one. |

| VCaI2 | Our company increasingly offer integrated services such as auto finance services available, in order to realize long-term financial returns. | |

| VCaI3 | Our company regularly reflect our price-quantity plan. | |

| VCaI4 | Our company actively seek for opportunities to save manufacturing costs. | |

| VCaI5 | Our company constantly examine purchase cost and if necessary amended according to market prices. | |

| VCaI6 | We utilize opportunities, which arise through price differentiation. | |

| “Value of Service” Innovation | VSI1 | We try to increase customer retention by new service offerings. |

| VSI2 | We emphasize innovative actions to increase customer retention. | |

| VSI3 | We recently took many actions in order to strengthen customer relationships. | |

| VSI4 | Our company constantly change the way how to service customers. | |

| VSI5 | Customers can always feel impress though our service. | |

| VSI6 | Our company have many new customers referred by used customers. | |

| “Value of Residual” Innovation | VRI1 | Our company constantly take various measures to raise the price of second-hand products. |

| VRI2 | Our company often provides customers with a channel to trade second-hand products. | |

| VRI3 | Our company always pays close attention to the second-hand products market in this industry. | |

| VRI4 | Our company provides recycling channels for end-of-life product. | |

| VRI5 | Our company offers reprocessing of end-of-life product to reduce the negative impact on the environment. | |

| VRI6 | Our company can benefit financially from the end-of-life product reprocessing. | |

| Firm Performance | FP1 | Our company’s brand is gradually becoming better known. |

| FP2 | Relative to our competitors, our company had a greater market share. | |

| FP3 | Relative to our competitors, the sales growth of our company was growing faster. | |

| FP4 | Relative to our competitors, the product development speed of our company was faster. | |

| FP5 | Relative to our competitors, our company financial performance was much better. | |

| FP6 | Relative to our competitors, the development of our company was much better. | |

| FP7 | Employee loyalty in our company is high. | |

| FP8 | Customer loyalty in our company is high. | |

References

- Dan, Z.; Jian, M. Development Status, problems and Future of Electric Vehicles in China. J. Chang. Univ. 2020, 22, 51–61. [Google Scholar]

- Zang, X.; Abdullah, R.N.; Liu, L.; Li, B. What Happened to China’s New Energy Vehicles Brand Companies? In Proceedings of the 3rd International Conference on Big Data Economy and Digital Management, BDEDM 2024, Ningbo, China, 12–14 January 2024; EAI: Ningbo, China, 2024. [Google Scholar]

- Zang, X.; Abdullah, R.N.; Li, L.; Hussain, I.A. Leveraging Six Values for Company Performance: Adaptation of Sustainable Business Model Innovation Strategies in Chinese Electric Vehicle Brand Enterprises. World Electr. Veh. J. 2024, 15, 526. [Google Scholar] [CrossRef]

- Huy, P.Q.; Phuc, V.K. Does Effectiveness of Digital Accounting System Intensify Sustainable Business Model Innovation with Mediating Role of Digital Business Ecosystem? J. Innov. Entrep. 2025, 14, 3. [Google Scholar] [CrossRef]

- Coffay, M.; Bocken, N. Sustainable by Design: An Organizational Design Tool for Sustainable Business Model Innovation. J. Clean. Prod. 2023, 427, 139294. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Pieroni, M.P.; Pigosso, D.C.; Soufani, K. Circular Business Models: A Review. J. Clean. Prod. 2020, 277, 123741. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F.; Carroux, S.; Joyce, A.; Massa, L.; Breuer, H. The Sustainable Business Model Pattern Taxonomy—45 Patterns to Support Sustainability-Oriented Business Model Innovation. Sustain. Prod. Consum. 2018, 15, 145–162. [Google Scholar] [CrossRef]

- Mignon, I.; Bankel, A. Sustainable Business Models and Innovation Strategies to Realize Them: A Review of 87 Empirical Cases. Bus. Strategy Environ. 2023, 32, 1357–1372. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Fifteen Years of Research on Business Model Innovation: How Far Have We Come, and Where Should We Go? J. Manag. 2017, 43, 200–227. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy. Meas. Bus. Excell. 1997, 1, 12–17. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Xiaohui, Z.; Abdullah, R.N.; Lihua, L.; Jing, L. New Paradigm for Business Model Design and Innovation: An Insight of Product Lifetime Value Based on Electric Vehicle. E3S Web Conf. 2024, 528, 03007. [Google Scholar] [CrossRef]

- Bhatti, S.H.; Santoro, G.; Khan, J.; Rizzato, F. Antecedents and Consequences of Business Model Innovation in the IT Industry. J. Bus. Res. 2021, 123, 389–400. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable Business Model Innovation: A Review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Roome, N.; Louche, C. Journeying Toward Business Models for Sustainability: A Conceptual Model Found Inside the Black Box of Organisational Transformation. Organ. Environ. 2016, 29, 11–35. [Google Scholar] [CrossRef]

- Shakeel, J.; Mardani, A.; Chofreh, A.G.; Goni, F.A.; Klemeš, J.J. Anatomy of Sustainable Business Model Innovation. J. Clean. Prod. 2020, 261, 121201. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; Geradts, T.H.J. Barriers and Drivers to Sustainable Business Model Innovation: Organization Design and Dynamic Capabilities. Long Range Plan. 2020, 53, 101950. [Google Scholar] [CrossRef]

- Casadesus-Masanell, R.; Ricart, J.E. From Strategy to Business Models and to Tactics. Long Range Plan. 2010, 43, 195–215. [Google Scholar] [CrossRef]

- Clauss, T.; Abebe, M.; Tangpong, C.; Hock, M. Strategic Agility, Business Model Innovation, and Firm Performance: An Empirical Investigation. IEEE Trans. Eng. Manag. 2019, 68, 767–784. [Google Scholar] [CrossRef]

- Hambrick, D.C. Some Tests of the Effectiveness and Functional Attributes of Miles and Snow’s Strategic Types. Acad. Manag. J. 1983, 26, 5–26. [Google Scholar] [CrossRef]

- Dess, G.D.; Davis, P.S. Porter Generic Strategies as Determinants of Strategic Group Membership and Organization Performance. J. Acad. Manag. 1984, 27, 467–488. [Google Scholar] [CrossRef]

- Akan, O.; Allen, R.S.; Helms, M.M.; Spralls, S.A., III. Critical Tactics for Implementing Porter’s Generic Strategies. J. Bus. Strategy 2006, 27, 43–53. [Google Scholar] [CrossRef]

- Pulaj (Brakaj), E.; Kume, V.; Cipi, A. The Impact of Generic Competitive Strategies on Organizational Performance. The Evidence from Albanian Context. Eur. Sci. J. 2015, 11, 28. [Google Scholar]

- Islami, X.; Mustafa, N.; Topuzovska Latkovikj, M. Linking Porter’s Generic Strategies to Firm Performance. Future Bus. J. 2020, 6, 3. [Google Scholar] [CrossRef]

- Jatra, M.; Giantari, I.G.A.K. The Role of Differentiation Strategy and Innovation in Mediating Market Orientation and the Business Performance. TR1001 2019, 6, 39–60. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A Literature and Practice Review to Develop Sustainable Business Model Archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Li, Z.; Liang, F.; Cheng, M. Research on the Impact of High-End Ev Sales Business Model on Brand Competitiveness. Sustainability 2021, 13, 14045. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook. In Classroom Companion: Business; Springer International Publishing: Cham, Switzerland, 2021; ISBN 978-3-030-80519-7. [Google Scholar]

- Purwanto, A.; Sudargini, Y. Partial Least Squares Structural Squation Modeling (PLS-SEM) Analysis for Social and Management Research: A Literature Review. J. Ind. Eng. Manag. Res. 2021, 2, 114–123. [Google Scholar] [CrossRef]

- Dash, G.; Paul, J. CB-SEM vs. PLS-SEM Methods for Research in Social Sciences and Technology Forecasting. Technol. Forecast. Soc. Change 2021, 173, 121092. [Google Scholar] [CrossRef]

- Anwar, M.; Shah, S.Z.A. Entrepreneurial Orientation and Generic Competitive Strategies for Emerging SMEs: Financial and Nonfinancial Performance Perspective. J. Public Aff. 2021, 21, e2125. [Google Scholar] [CrossRef]

- Li, C.B.; Li, J.J. Achieving Superior Financial Performance in China: Differentiation, Cost Leadership, or Both? J. Int. Mark. 2008, 16, 1–22. [Google Scholar] [CrossRef]

- Navaia, E.; Moreira, A.; Ribau, C. Differentiation Strategy and Export Performance in Emerging Countries: Mediating Effects of Positional Advantage among Mozambican Firms. Economies 2023, 11, 44. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of Business Performance in Strategy Research: A Comparison of Approaches. Acad. Manag. Rev. 1986, 11, 801. [Google Scholar] [CrossRef]

- James, K.; Betty, N.; Thaddeo, M.J.; Kirabira, J.B. Blood Production Factors Affecting Transfusion Sustainability: A Study by Using Smart PLS-SEM Approach. J. Open Innov. Technol. Mark. Complex. 2024, 10, 100247. [Google Scholar] [CrossRef]

- Russo, D.; Stol, K.-J. PLS-SEM for Software Engineering Research: An Introduction and Survey. ACM Comput. Surv. 2022, 54, 1–38. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to Use and How to Report the Results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Usakli, A.; Rasoolimanesh, S.M. Which SEM to Use and What to Report? A Comparison of CB-SEM and PLS-SEM. In Cutting Edge Research Methods in Hospitality and Tourism; Okumus, F., Rasoolimanesh, S.M., Jahani, S., Eds.; Emerald Publishing Limited: Leeds, UK, 2023; pp. 5–28. ISBN 978-1-80455-064-9. [Google Scholar]

- Albayraktaroglu, A. Strategic Agility, Exaptation, and Business Model Innovation: The Case of an SME. IEEE Trans. Eng. Manag. 2024, 71, 7195–7206. [Google Scholar] [CrossRef]

| Variables | Category | Frequency | % |

|---|---|---|---|

| Gender | Male | 177 | 67.8 |

| Female | 84 | 32.2 | |

| Age | Under 25 years | 21 | 8 |

| 26–35 years | 64 | 24.5 | |

| 36–45 years | 153 | 58.6 | |

| Over 46 years | 23 | 8.8 | |

| Educational level | Below undergraduate | 25 | 9.6 |

| Undergraduate | 187 | 71.6 | |

| Postgraduate | 41 | 15.7 | |

| Ph.D. graduate and above | 8 | 3.1 | |

| Position level | Top manager | 15 | 5.7 |

| Middle manager | 59 | 22.6 | |

| Under the middle manager | 187 | 71.6 | |

| Department | Marketing department | 48 | 18.4 |

| R&D department | 67 | 25.7 | |

| Purchasing department | 61 | 23.4 | |

| Production and manufacturing department | 31 | 11.9 | |

| Human resource department | 9 | 3.4 | |

| Finance department | 6 | 2.3 | |

| Others | 39 | 14.9 |

| Constructs | Items | Outer Loadings ≥0.5 | Cronbach’s Alpha ≥0.7 | CR (rho_a) ≥0.7 | CR (rho_c) ≥0.7 | AVE ≥0.5 |

|---|---|---|---|---|---|---|

| CLS | CLS1 | 0.818 | 0.854 | 0.871 | 0.900 | 0.693 |

| CLS2 | 0.834 | |||||

| CLS3 | 0.844 | |||||

| CLS4 | 0.833 | |||||

| DS | DS1 | 0.677 | 0.747 | 0.761 | 0.839 | 0.567 |

| DS2 | 0.736 | |||||

| DS3 | 0.778 | |||||

| DS4 | 0.815 | |||||

| FP | FP1 | 0.805 | 0.910 | 0.917 | 0.928 | 0.617 |

| FP2 | 0.783 | |||||

| FP3 | 0.786 | |||||

| FP4 | 0.800 | |||||

| FP5 | 0.821 | |||||

| FP6 | 0.785 | |||||

| FP7 | 0.858 | |||||

| FP8 | 0.628 | |||||

| VCaI | VCaI1 | 0.683 | 0.882 | 0.901 | 0.910 | 0.632 |

| VCaI2 | 0.640 | |||||

| VCaI3 | 0.834 | |||||

| VCaI4 | 0.864 | |||||

| VCaI5 | 0.869 | |||||

| VCaI6 | 0.846 | |||||

| VCrI | VCrI1 | 0.776 | 0.800 | 0.819 | 0.857 | 0.503 |

| VCrI2 | 0.808 | |||||

| VCrI3 | 0.703 | |||||

| VCrI4 | 0.563 | |||||

| VCrI5 | 0.683 | |||||

| VCrI6 | 0.697 | |||||

| VDI | VDI1 | 0.773 | 0.879 | 0.881 | 0.908 | 0.623 |

| VDI2 | 0.770 | |||||

| VDI3 | 0.759 | |||||

| VDI4 | 0.822 | |||||

| VDI5 | 0.799 | |||||

| VDI6 | 0.812 | |||||

| VPCI | VPCI1 | 0.811 | 0.911 | 0.912 | 0.931 | 0.694 |

| VPCI2 | 0.825 | |||||

| VPCI3 | 0.824 | |||||

| VPCI4 | 0.897 | |||||

| VPCI5 | 0.843 | |||||

| VPCI6 | 0.795 | |||||

| VRI | VRI1 | 0.766 | 0.872 | 0.879 | 0.904 | 0.611 |

| VRI2 | 0.855 | |||||

| VRI3 | 0.761 | |||||

| VRI4 | 0.760 | |||||

| VRI5 | 0.761 | |||||

| VRI6 | 0.781 | |||||

| VSI | VSI1 | 0.774 | 0.885 | 0.886 | 0.913 | 0.635 |

| VSI2 | 0.821 | |||||

| VSI3 | 0.805 | |||||

| VSI4 | 0.839 | |||||

| VSI5 | 0.758 | |||||

| VSI6 | 0.783 |

| CLS | DS | FP | VCaI | VCrI | VDI | VPCI | VRI | VSI | |

|---|---|---|---|---|---|---|---|---|---|

| CLS | 0.832 | 0.519 | 0.527 | 0.436 | 0.359 | 0.467 | 0.506 | 0.288 | 0.267 |

| DS | 0.440 | 0.753 | 0.737 | 0.660 | 0.783 | 0.588 | 0.661 | 0.621 | 0.695 |

| FP | 0.486 | 0.628 | 0.786 | 0.517 | 0.771 | 0.764 | 0.725 | 0.714 | 0.700 |

| VCaI | 0.390 | 0.544 | 0.482 | 0.795 | 0.662 | 0.637 | 0.482 | 0.545 | 0.621 |

| VCrI | 0.310 | 0.620 | 0.673 | 0.573 | 0.709 | 0.740 | 0.714 | 0.679 | 0.785 |

| VDI | 0.411 | 0.491 | 0.690 | 0.580 | 0.627 | 0.789 | 0.581 | 0.669 | 0.708 |

| VPCI | 0.458 | 0.547 | 0.670 | 0.457 | 0.620 | 0.525 | 0.833 | 0.562 | 0.687 |

| VRI | 0.259 | 0.524 | 0.643 | 0.475 | 0.575 | 0.592 | 0.511 | 0.781 | 0.710 |

| VSI | 0.242 | 0.568 | 0.634 | 0.558 | 0.671 | 0.629 | 0.622 | 0.630 | 0.797 |

| VIF <5 | VIF <5 | VIF <5 | VIF <5 | ||||

|---|---|---|---|---|---|---|---|

| CLS1 | 2.018 | FP6 | 2.406 | VCrI5 | 1.514 | VPCI6 | 2.666 |

| CLS2 | 2.587 | FP7 | 2.779 | VCrI6 | 1.565 | VRI1 | 2.179 |

| CLS3 | 2.504 | FP8 | 1.538 | VDI1 | 1.838 | VRI2 | 2.538 |

| CLS4 | 1.852 | VCaI1 | 2.323 | VDI2 | 1.774 | VRI3 | 2.135 |

| DS1 | 1.436 | VCaI2 | 2.150 | VDI3 | 1.749 | VRI4 | 1.938 |

| DS2 | 1.536 | VCaI3 | 2.300 | VDI4 | 2.493 | VRI5 | 2.513 |

| DS3 | 1.537 | VCaI4 | 3.250 | VDI5 | 2.286 | VRI6 | 2.260 |

| DS4 | 1.659 | VCaI5 | 3.264 | VDI6 | 2.141 | VSI1 | 2.013 |

| FP1 | 2.798 | VCaI6 | 2.661 | VPCI1 | 2.101 | VSI2 | 2.358 |

| FP2 | 2.502 | VCrI1 | 1.684 | VPCI2 | 2.919 | VSI3 | 2.078 |

| FP3 | 2.592 | VCrI2 | 1.837 | VPCI3 | 2.594 | VSI4 | 2.347 |

| FP4 | 2.620 | VCrI3 | 1.479 | VPCI4 | 3.592 | VSI5 | 1.800 |

| FP5 | 2.497 | VCrI4 | 1.250 | VPCI5 | 3.024 | VSI6 | 1.951 |

| VIF <5 | VIF <5 | ||

|---|---|---|---|

| CLS → FP | 1.543 | DS → VDI | 1.240 |

| CLS → VCaI | 1.240 | DS → VPCI | 1.240 |

| CLS → VCrI | 1.240 | DS → VRI | 1.240 |

| CLS → VDI | 1.240 | DS → VSI | 1.240 |

| CLS → VPCI | 1.240 | VCaI → FP | 1.889 |

| CLS → VRI | 1.240 | VCrI → FP | 2.594 |

| CLS → VSI | 1.240 | VDI → FP | 2.303 |

| DS → FP | 2.080 | VPCI → FP | 2.173 |

| DS → VCaI | 1.240 | VRI → FP | 1.974 |

| DS → VCrI | 1.240 | VSI → FP | 2.692 |

| H | Path | β | SD | T | p | LLCI | ULCI |

|---|---|---|---|---|---|---|---|

| H1a | DS → VPCI | 0.429 | 0.058 | 7.440 | 0.000 | 0.336 | 0.526 |

| H1b | DS → VCrI | 0.599 | 0.047 | 12.762 | 0.000 | 0.524 | 0.678 |

| H1c | DS → VDI | 0.385 | 0.059 | 6.573 | 0.000 | 0.291 | 0.486 |

| H1d | DS → VCaI | 0.462 | 0.050 | 9.247 | 0.000 | 0.379 | 0.545 |

| H1e | DS → VSI | 0.572 | 0.050 | 11.392 | 0.000 | 0.490 | 0.657 |

| H1f | DS → VRI | 0.509 | 0.051 | 9.883 | 0.000 | 0.425 | 0.594 |

| H2a | CLS → VPCI | 0.269 | 0.046 | 5.872 | 0.000 | 0.194 | 0.346 |

| H2b | CLS → VCrI | 0.047 | 0.057 | 0.815 | 0.207 | −0.046 | 0.143 |

| H2c | CLS → VDI | 0.242 | 0.069 | 3.484 | 0.000 | 0.124 | 0.354 |

| H2d | CLS → VCaI | 0.186 | 0.057 | 3.294 | 0.000 | 0.093 | 0.280 |

| H2e | CLS → VSI | −0.010 | 0.059 | 0.162 | 0.436 | −0.104 | 0.091 |

| H2f | CLS → VRI | 0.035 | 0.069 | 0.503 | 0.307 | −0.078 | 0.151 |

| H3 | DS → FP | 0.155 | 0.058 | 2.694 | 0.004 | 0.058 | 0.247 |

| H4 | CLS → FP | 0.151 | 0.042 | 3.577 | 0.000 | 0.083 | 0.221 |

| H5a | DS → VPCI → FP | 0.084 | 0.022 | 3.784 | 0.000 | 0.050 | 0.124 |

| H5b | DS → VCrI → FP | 0.096 | 0.042 | 2.290 | 0.011 | 0.028 | 0.166 |

| H5c | DS → VDI → FP | 0.104 | 0.025 | 4.109 | 0.000 | 0.063 | 0.146 |

| H5d | DS → VCaI → FP | −0.057 | 0.025 | 2.245 | 0.012 | −0.098 | −0.016 |

| H5e | DS → VSI → FP | 0.033 | 0.038 | 0.865 | 0.193 | −0.026 | 0.098 |

| H5f | DS → VRI → FP | 0.098 | 0.030 | 3.309 | 0.000 | 0.054 | 0.151 |

| H6a | CLS → VPCI → FP | 0.053 | 0.017 | 3.093 | 0.001 | 0.028 | 0.084 |

| H6b | CLS → VCrI → FP | 0.007 | 0.010 | 0.749 | 0.227 | −0.008 | 0.024 |

| H6c | CLS → VDI → FP | 0.065 | 0.024 | 2.693 | 0.004 | 0.028 | 0.107 |

| H6d | CLS → VCaI → FP | −0.023 | 0.012 | 1.916 | 0.028 | −0.044 | −0.005 |

| H6e | CLS → VSI → FP | −0.001 | 0.005 | 0.103 | 0.459 | −0.011 | 0.006 |

| H6f | CLS → VRI → FP | 0.007 | 0.014 | 0.480 | 0.316 | −0.016 | 0.030 |

| β | SD | T | p | LLCI | ULCI | |

|---|---|---|---|---|---|---|

| FP | 0.697 | 0.029 | 24.434 | 0.000 | 0.660 | 0.755 |

| VCaI | 0.324 | 0.045 | 7.232 | 0.000 | 0.258 | 0.406 |

| VCrI | 0.386 | 0.049 | 7.884 | 0.000 | 0.315 | 0.476 |

| VDI | 0.288 | 0.047 | 6.146 | 0.000 | 0.222 | 0.376 |

| VPCI | 0.358 | 0.056 | 6.439 | 0.000 | 0.276 | 0.459 |

| VRI | 0.276 | 0.047 | 5.807 | 0.000 | 0.209 | 0.366 |

| VSI | 0.322 | 0.050 | 6.386 | 0.000 | 0.250 | 0.417 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zang, X.; Abdullah, R.N.; Feng, Y.; Wu, M.; Lu, Y.; Zhu, E.; Zhang, Y. Mediating Role of 6V-Based SBMI Between Competitive Strategies and Firm Performance: An Empirical Study of China’s Electric Vehicle Industry. World Electr. Veh. J. 2025, 16, 288. https://doi.org/10.3390/wevj16050288

Zang X, Abdullah RN, Feng Y, Wu M, Lu Y, Zhu E, Zhang Y. Mediating Role of 6V-Based SBMI Between Competitive Strategies and Firm Performance: An Empirical Study of China’s Electric Vehicle Industry. World Electric Vehicle Journal. 2025; 16(5):288. https://doi.org/10.3390/wevj16050288

Chicago/Turabian StyleZang, Xiaohui, Raja Nazim Abdullah, Yi Feng, Mingling Wu, Yanqiu Lu, Enzhou Zhu, and Yingfeng Zhang. 2025. "Mediating Role of 6V-Based SBMI Between Competitive Strategies and Firm Performance: An Empirical Study of China’s Electric Vehicle Industry" World Electric Vehicle Journal 16, no. 5: 288. https://doi.org/10.3390/wevj16050288

APA StyleZang, X., Abdullah, R. N., Feng, Y., Wu, M., Lu, Y., Zhu, E., & Zhang, Y. (2025). Mediating Role of 6V-Based SBMI Between Competitive Strategies and Firm Performance: An Empirical Study of China’s Electric Vehicle Industry. World Electric Vehicle Journal, 16(5), 288. https://doi.org/10.3390/wevj16050288