How to Cross the Chasm for the Electric Vehicle World’s Laggards—A Case Study in Kuwait

Abstract

:1. Introduction

- (i)

- To identify the preferences of EV early majority/pragmatic consumers in Kuwait, as perceived by conventional ICE car drivers;

- (ii)

- To examine the influence of several selected demographic variables on preferences of early majority/pragmatic consumers, which might sway them to switch over from ICE vehicles to EVs, thus creating a mass market for EVs in Kuwait.

2. Problem Statement and Significance: Highest EV Adopters vs. the Lowest Ones

- 1.

- Absence of fast-charging and powerful EV public charging stations that rely on 300 kW Direct Current (DC to DC), which could charge the most popular large-battery EVs in Kuwait to an 80% charge in about 20 min [26].

- 2.

- The reluctance of Kuwaiti landlords (as ex-pats are not permitted to own real estate by law in the State of Kuwait) to allow ex-pat-owners of EVs to install fast-charging 11 kW EV amplifier wall-boxes in or around their rented apartments, which could reduce the charging-time from up to 48 h for the biggest batteries down to only 5–10 h.

- 3.

- The State of Kuwait subsidizes petrol for its residents and, as a result, has one of the world’s lowest retail gasoline prices (at USD 0.34 per liter). In comparison, one liter of retail petrol costs just over USD 2 (almost six times more) in Norway [27].

- 4.

- Neither the State of Kuwait nor its municipalities offer financial incentives to buy or own EVs instead of ICE cars. In comparison, Norway offers a long list of incentives, including

- a.

- Import and value-added tax exceptions from the purchasing price;

- b.

- Road tax exceptions;

- c.

- Ferry and toll-road fee exceptions;

- d.

- Permission to drive EVs on designated fast lanes for buses;

- e.

- Free municipal parking.

- 5.

- The lack of an EV community and exposure, stemming from the low number of EVs on the streets, indicate that EVs have not yet “crossed the chasm” in Kuwait—a term used for a disruptive innovation in which a certain type of technology eventually takes over the existing one [28]. The main hurdle is when the market is dominated by an early niche market made up of “innovators and techies” on the one hand, along with “visionaries and early adopters,” while the market has not yet reached the “early-majority or the pragmatists.” The reasons for this inability to reach the mass market can be explained by the Technology Acceptance Model (TAM), which provides two explanations: “the lack of perceived usefulness” along with “the unease of use” [29]. Our study supports this theory, as the most commonly sold EV in 2021 in Kuwait was the Porsche Taycan EV for approximately USD 200,000. This was bought primarily as the third or fourth car by affluent Kuwaiti males in their fifties and sixties as a status symbol rather than as a primary mode of transport. According to a dealership interview, the benefit of ownership for buyers was not primarily environmental but rather to be significantly faster than supercars such as those of Ferrari, Lamborghini, and so on, as the gearless EV powertrain allows for acceleration which no ICE car can compete with [3].

- 6.

- Potential EV drivers have apprehension as to how many years the battery will last in the extreme heat of Kuwait, as many have witnessed their cell phones automatically shutting down outside or inside of a car due to heat exposure. Generally, there is an 8-year guarantee on the battery (or about 150,000 km driven). The average life of an ICE car is 12–13 years, about 5 years longer than the EV battery warranty lasts. As a new EV car battery in the ninth year might cost more than the market value of the car at that time, replacing the battery might not be deemed worth the money. Thus, the life of the battery might dictate the life of the car. With potentially 30–40% less lifetime, rapid depreciation might represent the highest cost of ownership to EV owners. Luckily, KISR—the National Laboratory of Kuwait—has researched this phenomenon and has and will continue to publish data that will hopefully appease the concerns of consumers regarding this issue.

- 7.

- The almost total lack of maintenance, due to EVs only having 20 moving parts vs. up to 2000 in ICE cars, can actually pose a problem. EV owners complain that because EVs do not need as much maintenance, dealerships are reluctant to build up technical capacity or parts inventories. For example, Tesla does not even have a dealership in Kuwait, as all updates and inspections are conducted online. Such a lack of facilities has proven problematic in the case of accidents or other mishaps [3].

- 8.

- EV owners have pointed out that the ground clearance of the car is especially important for EVs in Kuwait (i.e., the distance from the lowest point of the car to the ground). High speedbumps in residential areas aiming to keep out low-riding power cars are a problem, as they may damage the battery at the bottom of the EV.

- 9.

- Some efforts have been made by municipalities, shopping centers, and transportation authorities to have designated parking spaces with or without charging facilities. However, as no penalty is typically levied on ICE car drivers—in contrast to those who park in handicapped parking spaces—virtually all EV owners we talked to complained that the designated parking was not respected as exclusive to EVs.

- 10.

- Although farfetched, there is a moderate to strong correlation when comparing the percentage of women in national congresses worldwide, and the percentage of EVs sold that year. For example, the national parliament in Norway is represented by 46% women, with 9 out of 19 ministers being women. The Kuwait parliament, on the other hand, only has 2 women out of 50 seats and 1 woman out of 12 ministers. Several studies conducted by the Organization for Economic Cooperation and Development (OECD), among others, have demonstrated that women in power demonstrate more environmental concern than their male counterparts. This ratio might explain, in part, why the State of Kuwait has been slower than Norway to provide a support system for EV adoption [4].

3. Literature Review

4. Data Collection and Methodology

4.1. Research Instrument

4.2. Sampling Procedures and Size

4.3. Data Collection Procedure

4.4. Statistical Analysis

4.5. Data Analysis and Findings

- High agreement: Calculated mean (M ≥ 3.5);

- Medium agreement: Calculated mean (2.5 ≥ M < 3.5);

- Low agreement: Calculated mean (M < 2.5)

5. Discussion

6. Limitations and Future Studies

7. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ottesen, A.; Banna, S.; Alzougool, B. Attitudes of Drivers towards Electric Vehicles in Kuwait. Sustainability 2022, 14, 12163. [Google Scholar] [CrossRef]

- Ottesen, A.; Banna, S. Why so few EVs are in Kuwait and how to amend it. Int. J. Eng. Technol. 2021, 10, 181–189. Available online: https://www.sciencepubco.com/index.php/ijet/issue/view/559 (accessed on 30 January 2023). [CrossRef]

- Ottesen, A.; Toglaw, S.; AlQuaoud, F.; Simovic, V. How to Sell Zero Emission Vehicles when the Petrol is almost for Free: Case of Kuwait. J. Manag. Sci. 2022, 9, 1–20. [Google Scholar] [CrossRef]

- Ottesen, A.; Banna, S.; Alzougool, B.; Simovic, V. Driving factors for women’s switch to electric vehicles in conservative Kuwait. J. Women Entrep. Educ. 2022, 3, 1–21. [Google Scholar]

- Rosellon, M.A.D. Clean Energy Technology in the Philippines: Case of the Electric Vehicle Industry (No. 2021-15); PIDS Discussion Paper Series; Public Institute for Development Study Manila: Makati, Philippines, 2021. [Google Scholar]

- Pardi, T. Heavier, Faster and Less Affordable Cars: The Consequence of EU Regulations for Car Emissions; ETUI Research Paper-Report 7; European Trade Union Institute: Brussels, Belgium, 2022. [Google Scholar]

- Kalghatgi, G. Is it really the end of internal combustion engines and petroleum in transport? Appl. Energy 2018, 225, 965–974. [Google Scholar] [CrossRef]

- Bloomberg, N.E.F. Electric Vehicle Outlook. 2022. Available online: https://about.bnef.com/electric-vehicle-outlook/ (accessed on 30 January 2023).

- Tirachini, A. Ride-hailing, travel behavior and sustainable mobility: An international review. Transportation 2020, 47, 2011–2047. [Google Scholar] [CrossRef]

- Yegin, T.; Ikram, M. Analysis of Consumers’ Electric Vehicle Purchase Intentions: An Expansion of the Theory of Planned Behavior. Sustainability 2022, 14, 12091. [Google Scholar] [CrossRef]

- Cid-López, A.; Hornos, M.J.; Carrasco, R.A.; Herrera-Viedma, E. Decision-making model for designing telecom products/services based on customer preferences and non-preferences. Technol. Econ. Dev. Econ. 2022, 28, 1818–1853. [Google Scholar] [CrossRef]

- Musumali, B. An Analysis why customers are so important and how marketers go about in understanding their decisions. Bus. Mark. Res. J. 2019, 23, 230–246. [Google Scholar]

- Crespo, B.; Míguez-Álvarez, C.; Arce, M.E.; Cuevas-Alonso, M.; Míguez, J.L. The Sustainable Development Goals: An Experience on Higher Education. Sustainability 2017, 9, 1353. [Google Scholar] [CrossRef]

- Ikram, M.; Sroufe, R.; Awan, U.; Abid, N. Enabling Progress in Developing Economies: A Novel Hybrid Decision-Making Model for Green Technology Planning. Sustainability 2021, 14, 258. [Google Scholar] [CrossRef]

- Ikram, M.; Ferasso, M.; Sroufe, R.; Zhang, Q. Assessing Green Technology Indicators for Cleaner Production and Sustainable Investments in a Developing Country Context. J. Clean. Prod. 2021, 322, 129090. [Google Scholar] [CrossRef]

- IEA. Oil Market Report. 2022. Available online: https://www.iea.org/reports/oil-market-report-august-2022 (accessed on 28 January 2023).

- Worldometer. Norway and Kuwait Population. 2023. Available online: https://www.worldometers.info/world-population (accessed on 28 January 2023).

- World Population Review—Reserve by Country. 2023. Available online: https://worldpopulationreview.com/country-rankings/oil-reserves-by-country (accessed on 28 January 2023).

- Sovern Investor Leadership Conference. 2023. Available online: https://www.swfinstitute.org/fund-rankings/sovereign-wealth-fund (accessed on 28 January 2023).

- IMF. GDP Per Capita. 2023. Available online: https://www.imf.org/external/datamapper/NGDPDPC@WEO/OEMDC/ADVEC/WEOWORLD (accessed on 28 January 2023).

- World Bank (2023) CO2 Emission (Metric Ton Per Capita). Available online: https://data.worldbank.org/indicator/EN.ATM.CO2E.PC (accessed on 28 January 2023).

- Alvik & Bakken. How Norway’s EVs Have Cut Emission Globally. 2021. Available online: https://eto.dnv.com/2019/how-norways-evs-have-cut-emissions-globally (accessed on 20 January 2023).

- UN Sustainable Development Goals Report Kuwait. 2022. Available online: https://www.un.org/sustainabledevelopment/climate-change/ (accessed on 28 January 2023).

- Hamwi, H.; Rushby, T.; Mahdy, M.; Bahaj, A.S. Effect of High Ambient Temperature on Electric Vehicle Efficiency and Range: Case Study of Kuwait. Energies 2022, 15, 3178. [Google Scholar] [CrossRef]

- Hamwi, H.; Alasseri, R.; Aldei, S.; Al-Kandari, M. A Pilot Study of Electric Vehicle Performance, Efficiency, and Limitation in Kuwait’s Harsh Weather and Environment. Energies 2022, 15, 7466. [Google Scholar] [CrossRef]

- Charged Kuwait. Charging Station in Kuwait. 2023. Available online: https://www.chargedkw.com/where-to-charge (accessed on 28 January 2023).

- Global Petrol Prices. Gasoline Prices, Liter, 19th of December 2022. Available online: https://www.globalpetrolprices.com/gasoline_prices/ (accessed on 22 December 2022).

- Christensen, C.; Horn, M.B.; Johnson, C. Disrupting Class: How Disruptive Innovation Will Change the Way the World Learns, 2nd ed.; MacGraw Hill: New York, NY, USA, 2011. [Google Scholar]

- Muller, J.M. Comparing Technology Acceptance for Autonomous Vehicles, Battery Electric Vehicles, and Car Sharing—A study across Europe, China and North America. Sustainability 2019, 11, 4333. [Google Scholar] [CrossRef]

- National Transportation Safety Board. 2021. Available online: https://data.ntsb.gov/Docket/?NTSBNumber=HWY19SP002 (accessed on 28 January 2023).

- Insider. Elon Musk Calls Gas-Power Cars a Passing Fad. 2019. Available online: https://www.businessinsider.com/teslas-elon-musk-calls-gas-powered-cars-a-passing-fad-2019-8 (accessed on 28 January 2023).

- Global Petrol Prices. Kuwait Electricity Prices. 2022. Available online: https://www.globalpetrolprices.com/Kuwait/electricity_prices/#:~:text=Kuwait%2C%20June%202022%3A%20The%20price,of%20power%2C%20distribution%20and%20taxes (accessed on 28 January 2023).

- United State Environmental Agency. Electric Vehicle Myths. 2022. Available online: https://www.epa.gov/greenvehicles/electric-vehicle-myths#Myth1 (accessed on 28 January 2023).

- Nour, M.; Chaves-Ávila, J.P.; Magdy, G.; Sánchez-Miralles, Á. Review of Positive and Negative Impacts of Electric Vehicles Charging on Electric Power Systems. Energies 2020, 13, 4675. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, H.; Zhu, L.; Campana, P.E.; Lu, H.; Wallin, F.; Sun, Q. Factors influencing the economics of public charging infrastructures for EV—A review. Renew. Sustain. Energy Rev. 2018, 94, 500–509. [Google Scholar] [CrossRef]

- Mansouri, S.A.; Nematbakhsh, E.; Jordehi, A.R.; Tostado-Véliz, M.; Jurado, F.; Leonowicz, Z. A Risk-Based Bi-Level Bidding System to Manage Day-Ahead Electricity Market and Scheduling of Interconnected Microgrids in the presence of Smart Homes. In Proceedings of the IEEE International Conference on Environment and Electrical Engineering and 2022 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Prague, Czech Republic, 28 June–1 July 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Mansouri, S.A.; Nematbakhsh, E.; Ahmarinejad, A.; Jordehi, A.R.; Javadi, M.S.; Marzband, M. A hierarchical scheduling framework for resilience enhancement of decentralized renewable-based microgrids considering proactive actions and mobile units. Renew. Sustain. Energy Rev. 2022, 168, 112854. [Google Scholar] [CrossRef]

- Mansouri, S.A.; Jordehi, A.R.; Marzband, M.; Tostado-Véliz, M.; Jurado, F.; Aguado, J.A. An IoT-enabled hierarchical decentralized framework for multi-energy microgrids market management in the presence of smart prosumers using a deep learning-based forecaster. Appl. Energy 2023, 333, 120560. [Google Scholar] [CrossRef]

- Aziz, H.; Tabrizian, M.; Ansarian, M.; Ahmarinejad, A. A three-stage multi-objective optimization framework for day-ahead interaction between microgrids in active distribution networks considering flexible loads and energy storage systems. J. Energy Storage 2022, 52, 104739. [Google Scholar] [CrossRef]

- Ravi, S.S.; Aziz, M. Utilization of electric vehicles for vehicle-to-grid services: Progress and perspectives. Energies 2022, 15, 589. [Google Scholar] [CrossRef]

- Ben Slama, S. Prosumer in smart grids based on intelligent edge computing: A review on Artificial Intelligence Scheduling Techniques. Ain Shams Eng. J. 2021, 13, 101504. [Google Scholar] [CrossRef]

- Solanke, T.U.; Ramachandaramurthy, V.K.; Yong, J.Y.; Pasupuleti, J.; Kasinathan, P.; Rajagopalan, A. A review of strategic charging–discharging control of grid connected electric vehicles. J. Energy Storage 2020, 28, 101193. [Google Scholar] [CrossRef]

- Ahmad, A.; Khan, Z.A.; Saad Alam, M.; Khateeb, S. A review of the electric vehicle charging techniques, standards, progression and evolution of EV technologies in Germany. Smart Sci. 2018, 6, 36–53. [Google Scholar] [CrossRef]

- Ahmadi, A.; Tavakoli, A.; Jamborsalamati, P.; Rezaei, N.; Miveh, M.R.; Gandoman, F.H.; Heidari, A.; Nezhad, A.E. Power quality improvement in smart grids using electric vehicles: A review. IET Electr. Syst. Transp. 2019, 9, 53–64. [Google Scholar] [CrossRef]

- Ahmad, A.; Alam, M.S.; Chabaan, R. A Comprehensive Review of Wireless Charging Technologies for Electric Vehicles. IEEE Trans. Transp. Electrif. 2017, 4, 38–63. [Google Scholar] [CrossRef]

- Amjad, M.; Ahmad, A.; Rehmani, M.H.; Umer, T. A review of EVs charging: From the perspective of energy optimization, optimization approaches, and charging techniques. Transp. Res. Part D Transp. Environ. 2018, 62, 386–417. [Google Scholar] [CrossRef]

- Knez, M.; Zevnik, G.K.; Obrecht, M. A review of available chargers for electric vehicles: United States of America, European Union, and Asia. Renew. Sustain. Energy Rev. 2019, 109, 284–293. [Google Scholar] [CrossRef]

- Al-Ogaili, A.S.; Hashim Tengku, T.J.; Rahmat, N.A.; Ramasamy, A.K.; Marsadek, M.B.; Faisal, M.; Hannan, M.A. Review on scheduling, clustering, and forecasting strategies for controlling electric vehicle charging: Challenges and recommendations. IEEE Access 2019, 7, 128353–128371. [Google Scholar] [CrossRef]

- Adnan, N.; Nordin, S.M.; Rahman, I.; Amini, M.H. A market modeling review study on predicting Malaysian consumer behavior towards widespread adoption of PHEV/EV. Environ. Sci. Pollut. Res. 2017, 24, 17955–17975. [Google Scholar] [CrossRef]

- Archsmith, J.; Muehlegger, E.; Rapson, D. Future Paths of Electric Vehicle Adoption in the United States: Predictable Determinants, Obstacles and Opportunities. NBER Working Paper No. w28933. 2021. Available online: https://ssrn.com (accessed on 30 January 2023).

- Mandys, F. Electric vehicles and consumer choices. Renew. Sustain. Energy Rev. 2021, 142, 110874. [Google Scholar] [CrossRef]

- Guerra, E.; Daziano, R. Electric vehicles and residential parking in an urban environment: Results from a stated preference experiment. Transp. Res. Transp. Environ. Part D Transp. Environ. 2020, 79, 10222. [Google Scholar] [CrossRef]

- Miranda, J.L.; Delgado, C.J.M. Determinants of Electric Car Purchase Intention in Portugal. In Governance and Sustainability (Developments in Corporate Governance and Responsibility); Crowther, D., Seifi, S., Eds.; Emerald Publishing Limited: Bingley, UK, 2020; Volume 15, pp. 161–172. [Google Scholar]

- Higueras-Castillo, E.; Molinillo, S.; Coca-Stefaniak, J.; Liébana-Cabanillas, F. Potential Early Adopters of Hybrid and Electric Vehicles in Spain—Towards a Customer Profile. Sustainability 2020, 12, 4345. [Google Scholar] [CrossRef]

- Rietmann, N.; Lieven, T. How policy measures succeeded to promote electric mobility—Worldwide review and outlook. J. Clean. Prod. 2019, 206, 66–75. [Google Scholar] [CrossRef]

- Kowalska-Pyzalska, A.; Kott, M.; Kott, J. How Much Polish Consumers Know about Alternative Fuel Vehicles? Impact of Knowledge on the Willingness to Buy. Energies 2021, 14, 1438. [Google Scholar] [CrossRef]

- Kowalska-Pyzalska, A.; Michalski, R.; Kott, M.; Skowrońska-Szmer, A. Consumer preferences towards alternative fuel vehicles. Results from the conjoint analysis. Renew. Sustain. Energy Rev. 2022, 155, 111776. [Google Scholar] [CrossRef]

- De Oliveira, B.; Ribeiro da Silva, M.; Jugend, H.; De Camargo Fiorini, D.; Carlos Eduardo, P. Factors influencing the intention to use electric cars in Brazil. Transp. Res. Part A Policy Pract. 2022, 155, 418–433. [Google Scholar] [CrossRef]

- Lashari, Z.A.; Ko, J.; Jang, J. Consumers’ Intention to Purchase Electric Vehicles: Influences of User Attitude and Perception. Sustainability 2021, 13, 6778. [Google Scholar] [CrossRef]

- Dasharathraj, S.; Smaran, S.; Lewlyn, R.; Nithesh, N.; Chetana, M.; Namesh, M.; Nilakshman, S. Barriers to widespread adoption of plug-in electric vehicles in emerging Asian markets: An analysis of consumer behavioral attitudes and perceptions. Cogent Eng. 2020, 7, 1796198. [Google Scholar] [CrossRef]

- Colak, M.; Kaya, I. Providing the spark: Impact of financial incentives on battery electric vehicle adoption. J. Environ. Econ. Manag. 2020, 98, 102295. [Google Scholar]

- Li, L.; Wang, Z.; Chen, L.; Wang, Z. Consumer preferences for battery electric vehicles: A choice experimental survey in China. Transp. Res. Part D Transp. Environ. 2020, 78, 102185. [Google Scholar] [CrossRef]

- Bhalla, P.; Ali, I.; Nazneen, A. A Study of consumer perception and purchase intention of electric vehicles. Eur. J. Sci. Res. 2018, 149, 362–368. [Google Scholar]

- Zhang, X.; Bai, X.; Shang, J. Is subsidized electric vehicles adoption sustainable: Consumers’ perceptions and motivation toward incentive policies, environmental benefits, and risks. J. Clean. Prod. 2018, 192, 71–79. [Google Scholar] [CrossRef]

- Eneizan, B. The adoption of electrics vehicles in Jordan based on theory of planned behavior. Am. J. Econ. Bus. Manag. 2019, 2, 1–14. [Google Scholar] [CrossRef]

- Kim, S.; Choi, J.; Yi, Y.; Kim, H. Analysis of Influencing Factors in Purchasing Electric Vehicles Using a Structural Equation Model: Focused on Suwon City. Sustainability 2022, 14, 4744. [Google Scholar] [CrossRef]

- Ho, J.C.; Huang, Y.H.S. Evaluation of electric vehicle power technologies: Integration of technological performance and market preference. Clean. Responsible Consum. 2022, 5, 100063. [Google Scholar] [CrossRef]

- Kongklaew, C.; Phoungthong, K.; Prabpayak, C.; Chowdhury, S.; Khan, I.; Yuangyai, N.; Yuangyai, C.; Techato, K. Barriers to Electric Vehicle Adoption in Thailand. Sustainability 2021, 13, 12839. [Google Scholar] [CrossRef]

- Khurana, A.; Kumar, R.; Sidhpuria, M. A Study on the Adoption of Electric Vehicles in India: The Mediating Role of Attitude. Vision 2020, 24, 23–34. [Google Scholar] [CrossRef]

- Haider, S.W.; Zhuang, G.; Ali, S. Identifying and bridging the attitude-behavior gap in sustainable transportation adoption. J. Ambient. Intell. Humaniz. Comput. 2019, 10, 3723–3738. [Google Scholar] [CrossRef]

- Ottesen, A.; Banna, S. Early Adopter Nation for Electric Vehicles: The Case of Iceland. In Gulf Conference on Sustainable Built Environment; Bumajdad, A., Bouhamra, W., Alsayegh, O., Kamal, H., Alhajraf, S., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Hardman, S.; Jenn, A.; Tal, G.; Axsen, J.; Beard, G.; Daina, N.; Figenbaum, E.; Jakobsson, N.; Jochem, P.; Kinnear, N.; et al. A review of consumer preferences of and interactions with electric vehicle charging infrastructure. Transp. Res. Part D Transp. Environ. 2018, 62, 508–523. [Google Scholar] [CrossRef]

- Bhaskar, M.G.; Narahari, N.S.; Guptha, C.K.G. Consumer Preferences for mid-Segment electric cars—An Indian Perspective. Int. J. Eng. Res. Technol. 2020, 9, 1303–1309. [Google Scholar] [CrossRef]

- Shareeda, A.; Al-Hashimi, M.; Hamdan, A. Smart cities and electric vehicles adoption in Bahrain. J. Decis. Syst. 2021, 30, 321–343. [Google Scholar] [CrossRef]

- Jreige, M.; Abou-Zeid, M.; Kaysi, I. Consumer preferences for hybrid and electric vehicles and deployment of the charging infrastructure: A case study of Lebanon. Case Stud. Transp. Policy 2021, 9, 466–476. [Google Scholar] [CrossRef]

- Vilchez, J.J.G.; Smyth, A.; Kelleher, K.; Lu, H.; Rohr, C.; Harrison, G.; Thiel, C. Electric Car Purchase Price as a Factor Determining Consumers’ Choice and their Views on Incentives in Europe. Sustainability 2019, 11, 6357. [Google Scholar] [CrossRef]

- Fan, R.; Chen, R. Promotion policies for electric vehicle diffusion in China considering dynamic consumer preferences: A network-based evolutionary analysis. Int. J. Environ. Res. Public Health 2022, 19, 5290. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Why people want to buy electric vehicle: An empirical study in first-tier cities of China. Energy Policy 2018, 112, 233–241. [Google Scholar] [CrossRef]

- Al-Buenain, A.; Al-Muhannadi, S.; Falamarzi, M.; Kutty, A.A.; Kucukvar, M.; Onat, N.C. The Adoption of Electric Vehicles in Qatar Can Con-tribute to Net Carbon Emission Reduction but Requires Strong Government Incentives. Vehicles 2021, 3, 618–635. [Google Scholar] [CrossRef]

- Vongurai, R. Factors Affecting Customer Brand Preference toward Electric Vehicle in Bangkok, Thailand. J. Asian Financ. Econ. Bus. 2020, 7, 383–393. [Google Scholar] [CrossRef]

- Krejcie, R.V.; Morgan, D.W. Determining sample size for research activities. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar] [CrossRef]

- Comrey, A.L.; Lee, H.B. A First Course in Factor Analysis; Erlbaum: Hillsdale, NJ, USA, 1992. [Google Scholar]

- Pallant, J. SPSS Survival Manual: A Step-by-Step Guide to Data Analysis Using SPSS for Windows (Version 15), 7th ed.; Allen & Unwin: London, UK, 2022. [Google Scholar]

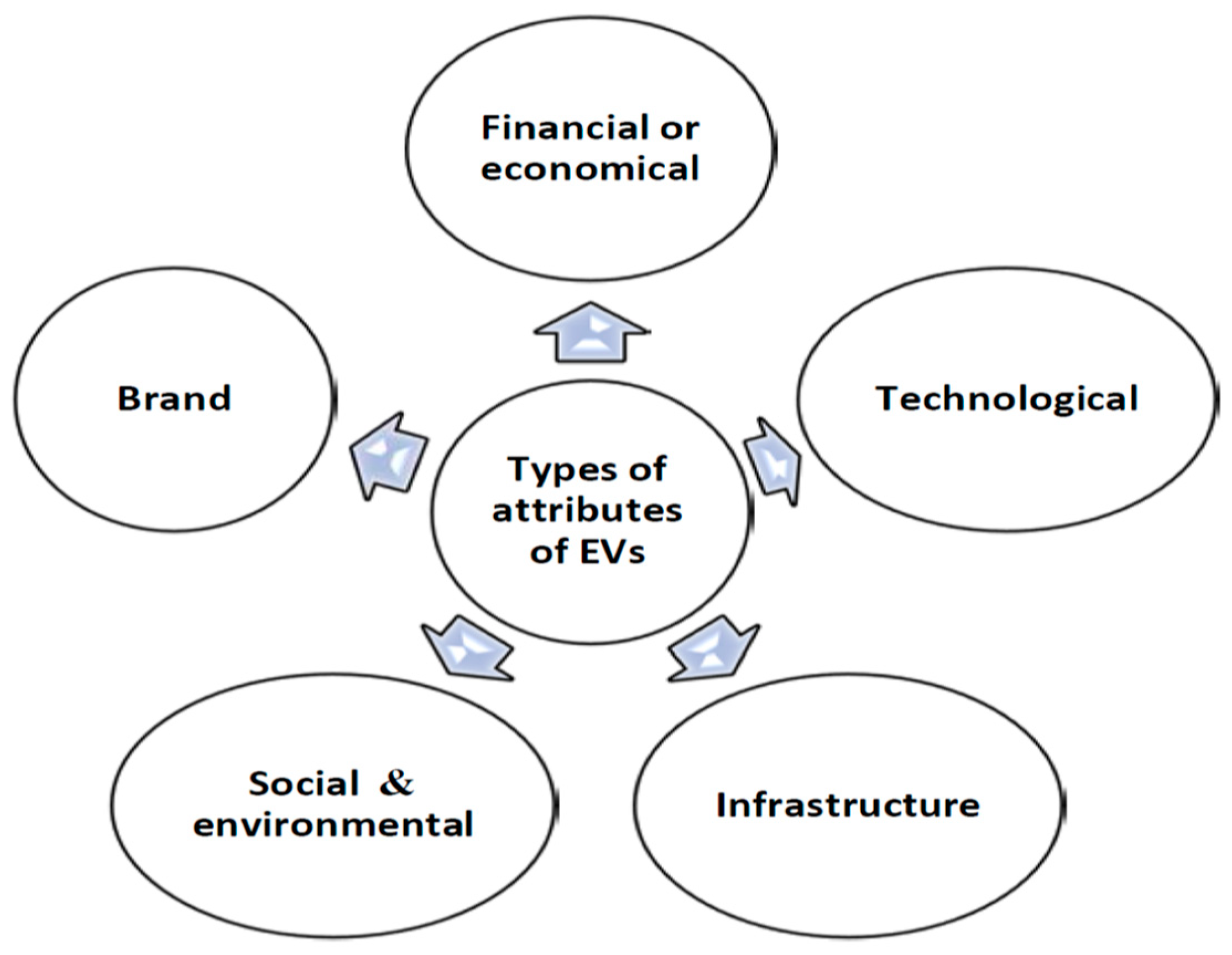

| Types of Attributes | Industrialized Countries (Global North) | Developing Countries (Global South Excluding MENA Region) | MENA Region (Arab World) |

|---|---|---|---|

| Financial or economical attributes | Archsmith et al. (2021) [50], Mandys (2021) [51], Guerra and Daziano (2020) [52] Miranada and Delgado (2020) [53], Higueras-Castillo et al. (2019) [54], Rietmann and Lieven (2019) [55], Kowalska-Pyzalska et al. (2021–22) [56,57] | De Oliveira et al. (2022) [58], Lashari et al. (2021) [59], Dasharathraj et al. (2020) [60], Colak and Kaya (2020) [61], Li et al. (2020) [62], Bhalla et al. (2018) [63], Zhang et al. (2018) [64] | Eneizan (2019, Jordan) [65] |

| Technological attributes | Mandys (2021) [51], Archsmith et al. (2021), [50], Higueras-Castillo et al. (2019) [54] | De Oliveira et al. (2022) [58], Kim et al. (2022) [66] Ho and Huang (2022) [67], Kowalska-Pyzalska et al. (2021–22) [56,57], Kongklaew et al. (2021) [68], Khurana et al. (2020) [69], Colak and Kaya (2020) [61], Khurana et al. (2020) [70], Dasharathraj et al. (2020) [60], Haider et al. (2019) [70] | Hamwi (2022, Kuwait) [24,25] |

| Infrastructure attributes | Archsmith et al. (2021) [50], Miranada and Delgado (2020) [53], Guerra and Daziano (2020) [52], Rietmann and Lieven (2019) [55], Ottesen and Banna (2018) [71], Hardman et al. (2018) [72] | Kim et al. (2022) [66], De Oliveira et al. (2022) [58], Kongklaew et al. (2021) [68], Khurana et al. (2020) [70], Bhaskar et al. (2020) [73], Haider et al. (2019) [70], Bhalla et al. (2018) [63] | Shareeda et al. (2021, Bahrain) [74], Jreige et al. (2021, Lebanon) [75] |

| Social and environmental attributes | Archsmith et al. (2021) [50], Higueras-Castillo et al. (2020) [54], Miranada and Delgado (2020) [53], Vilchez et al. (2019) [76], Rietmann and Lieven (2019) [55] | Fan and Chen (2022) [77], Kim et al. (2022) [66], De Oliveira et al. (2022) [58], Dasharathraj et al. (2020) [60], Colak and Kaya (2020) [61], Haider et al. (2019) [70], Lin and Wu (2018) [78], Zhang et al. (2018) [35] | Al-Buenain et al. (2021, Qatar) [79], Shareeda et al. (2021, Bahrain), [74], Eneizan (2019, Jordan), [65] |

| Brand attributes | Kowalska-Pyzalska et al. (2021–22) [56,57] | Vongurai (2020) [80], Dasharathraj et al. [60] |

| Variable | Categories | N = 472 | % |

|---|---|---|---|

| Gender | Male | 238 | 50.4% |

| Female | 234 | 49.6% | |

| Age Range | 18–25 years | 168 | 35.6% |

| 26–39 years | 222 | 47.0% | |

| 40–49 years | 61 | 12.9% | |

| 50–60 years | 21 | 4.4% | |

| Marital Status | Single | 272 | 57.6% |

| Married without kids | 37 | 7.8% | |

| Married with 1 kid | 35 | 7.4% | |

| Married with 2 kids | 42 | 8.9% | |

| Married with 3 kids or more | 86 | 18.2% | |

| Ethnicity | Kuwaiti | 287 | 60.8% |

| Arab Non-Kuwaiti | 144 | 30.5% | |

| Asian Non-Arab | 38 | 8.1% | |

| American, European, or Australian | 2 | 0.4% | |

| African Non-Arab | 1 | 0.2% | |

| Number of Cars in household | One car | 62 | 13.1% |

| Two cars | 139 | 29.4% | |

| Three cars | 70 | 14.8% | |

| Four cars | 66 | 14.0% | |

| Five cars or more | 135 | 28.6% | |

| Educational Level | Less than high school | 8 | 1.7% |

| High School diploma | 108 | 22.9% | |

| Trade/Commerce degree | 55 | 11.7% | |

| Bachelor’s degree | 259 | 54.9% | |

| Master’s degree | 31 | 6.6% | |

| PhD | 11 | 2.3% | |

| Employment | Private sector | 176 | 37.3% |

| Public sector | 152 | 32.2% | |

| Unemployed | 83 | 17.6% | |

| Self-employed | 35 | 7.4% | |

| Family-owned business | 26 | 5.5% | |

| Field of employment | Other private services | 139 | 29.4% |

| Government and Ministries | 125 | 26.5% | |

| Family business | 61 | 12.9% | |

| Education—government or private | 46 | 9.7% | |

| Oil and Gas sector | 32 | 6.8% | |

| Large Kuwaiti corporation | 29 | 6.1% | |

| Health Care—government or private | 26 | 5.5% | |

| Military or police | 14 | 3.0% | |

| Which of the following best describes your role in industry? | Middle Management | 102 | 21.6% |

| Administrative Staff | 80 | 16.9% | |

| Upper Management | 59 | 12.5% | |

| Student—Not working | 54 | 11.4% | |

| Lower Management | 38 | 8.1% | |

| Support Staff | 34 | 7.2% | |

| Temporary Employee | 28 | 5.9% | |

| Self-employed/Business Partner | 27 | 5.7% | |

| Trained Professional expert | 22 | 4.7% | |

| Researcher | 12 | 2.5% | |

| Consultant | 8 | 1.7% | |

| Skilled Laborer | 8 | 1.7% | |

| Monthly Income | Less than KWD 500 (USD 1650) | 149 | 31.6% |

| KWD 500–999 | 104 | 22.0% | |

| KWD 1000–1499 | 111 | 23.5% | |

| KWD 1500–1999 | 59 | 12.5% | |

| KWD 2000 and above (USD 6600) | 49 | 10.4% |

| Type of Attribute (Features) | To What Extent You Agree/Disagree about the Most Favorable Features of EV? | Mean | SD |

|---|---|---|---|

| Social attributes—pro-environmental | Environmental friendliness, less CO2 that leads to better air quality | 3.74 | 1.308 |

| Financial/economic attributes | Much lower fuel price than gasoline | 3.54 | 1.279 |

| Technological attributes | Soundless engine | 3.52 | 1.305 |

| Technological attributes | Increased safety in terms of fire and crash tests | 3.49 | 1.305 |

| Technological attributes | Faster and more powerful air conditioning | 3.46 | 1.246 |

| Technological attributes | Much faster acceleration (from 0 to 100 km) | 3.32 | 1.236 |

| Financial/economic attributes | Much lower maintenance and associated cost | 3.24 | 1.311 |

| Types of Attributes (Features) | I Would Buy an EV if … | Mean | SD |

|---|---|---|---|

| Financial/economic attributes | If the guarantee of the battery lasted at least 10 years or 150,000 km | 3.54 | 1.189 |

| Infrastructure attributes | If there was a fast-charging station within 5 km from almost every place in Kuwait | 3.51 | 1.193 |

| Social attributes—pro-environmental | If I start to see noticeable change in air quality because people are driving EVs | 3.47 | 1.162 |

| Technological attributes | If the range (how far you can drive) per full charge would be at least 400 km | 3.47 | 1.160 |

| Brand attribute | If they were cool and unique design | 3.43 | 1.217 |

| Financial/economic attributes | The price was same or lower than equivalent gasoline car | 3.39 | 1.287 |

| Financial/economic attributes | If the reselling value was equivalent or higher than gasoline car | 3.39 | 1.164 |

| Financial/economic attributes | If gasoline prices increased three-fold | 3.33 | 1.220 |

| Infrastructure attributes | There was a special EV lane on major highways such as highway 30 and 40 | 3.27 | 1.165 |

| Social attributes—social acceptance | If most of my friends or family bought an EV | 2.97 | 1.152 |

| Variables | Categories (N) | The Highly Preferred Favorable Features of EVs | ||

|---|---|---|---|---|

| Environmental Friendliness, Less CO2 and Sod That Lead to Better Air Quality | Much Lower Fuel Price than Gasoline | Soundless Engine | ||

| Mean | Mean | Mean | ||

| Gender | Male (N = 238) | 3.79 | 3.63 | 3.61 |

| Female (N = 234) | 3.70 | 3.46 | 3.42 | |

| Sig. (2-tailed) | 0.482 | 0.163 | 0.113 | |

| Marital Status | Single (N = 272) | 3.69 | 3.57 | 3.43 |

| Married (N = 200) | 3.82 | 3.51 | 3.64 | |

| Sig. (2-tailed) | 0.277 | 0.668 | 0.084 | |

| Ethnicity | Kuwaiti (N = 287) | 3.73 | 3.56 | 3.57 |

| Non-Kuwaiti (N = 185) | 3.76 | 3.52 | 3.43 | |

| Sig. (2-tailed) | 0.805 | 0.728 | 0.247 | |

| Number of cars | One to Two cars (N = 201) | 3.91 | 3.65 | 3.68 |

| Three cars or more (N = 271) | 3.62 | 3.46 | 3.40 | |

| Sig. (2-tailed) | 0.020 | 0.117 | 0.024 | |

| Age Range | 18–25 years (N = 168) | 3.67 | 3.49 | 3.40 |

| 26–39 years (N = 222) | 3.75 | 3.55 | 3.55 | |

| 40–60 years (N = 82) | 3.89 | 3.65 | 3.67 | |

| Sig. (2-tailed) | 0.447 | 0.655 | 0.260 | |

| Education | Less than high school (N = 8) | 3.00 | 3.00 | 3.00 |

| High School diploma (N = 108) | 3.83 | 3.67 | 3.44 | |

| Trade/Commerce degree (N = 55) | 3.38 | 3.31 | 3.15 | |

| Bachelor’s degree (N = 259) | 3.78 | 3.56 | 3.65 | |

| Master’s degree (N = 31) | 4.00 | 3.55 | 3.55 | |

| Ph.D. (N = 11) | 3.64 | 3.64 | 3.36 | |

| Sig. (2-tailed) | 0.118 | 0.499 | 0.104 | |

| Monthly Income | Less than KD 500 (N = 149) | 3.61 | 3.45 | 3.34 |

| KD 500–999 (N = 104) | 3.75 | 3.53 | 3.52 | |

| KD 1000–1499 (N = 111) | 3.89 | 3.77 | 3.74 | |

| KD 1500 and above (N = 108) | 3.77 | 3.46 | 3.55 | |

| Sig. (2-tailed) | 0.392 | 0.204 | 0.105 | |

| Employment | Self-employed (N = 35) | 3.77 | 3.69 | 3.46 |

| Family-owned business (N = 26) | 2.81 | 2.81 | 2.77 | |

| Private sector (N = 176) | 3.81 | 3.63 | 3.58 | |

| Public sector (N = 152) | 3.91 | 3.69 | 3.68 | |

| Unemployed (N = 83) | 3.58 | 3.28 | 3.35 | |

| Sig. (2-tailed) | 0.001 | 0.004 | 0.011 | |

| Variables | Categories (N) | I Would Buy an EV if … | |

|---|---|---|---|

| If the Guarantee of the Battery Would Last as Least 10 Years or 150.000 km | If There Was a Fast-Charging Station Within 5 km from Almost Every Place in Kuwait | ||

| Mean | Mean | ||

| Gender | Male (N = 238) | 3.57 | 3.51 |

| Female (N = 234) | 3.51 | 3.51 | |

| Sig. (2-tailed) | 0.592 | 0.998 | |

| Marital Status | Single (N = 272) | 3.55 | 3.53 |

| Married (N = 200) | 3.53 | 3.48 | |

| Sig. (2-tailed) | 0.837 | 0.666 | |

| Ethnicity | Kuwaiti (N = 287) | 3.60 | 3.58 |

| Non-Kuwaiti (N = 185) | 3.45 | 3.41 | |

| Sig. (2-tailed) | 0.189 | 0.136 | |

| Number of cars | One to Two cars (N = 201) | 3.56 | 3.56 |

| Three cars or more (N = 271) | 3.52 | 3.48 | |

| Sig. (2-tailed) | 0.705 | 0.486 | |

| Age Range | 18–25 years (N = 168) | 3.53 | 3.55 |

| 26–39 years (N = 222) | 3.48 | 3.42 | |

| 40–60 years (N = 82) | 3.72 | 3.68 | |

| Sig. (2-tailed) | 0.288 | 0.198 | |

| Education | Less than high school (N = 8) | 2.63 | 2.13 |

| High School diploma (N = 108) | 3.41 | 3.64 | |

| Trade/Commerce degree (N = 55) | 3.55 | 3.36 | |

| Bachelor’s degree (N = 259) | 3.60 | 3.47 | |

| Master’s degree (N = 31) | 3.68 | 3.81 | |

| PhD (N = 11) | 3.64 | 4.18 | |

| Sig. (2-tailed) | 0.206 | 0.002 | |

| Monthly Income | Less than KD 500 (N = 149) | 3.44 | 3.43 |

| KD 500–999 (N = 104) | 3.33 | 3.30 | |

| KD 1000–1499 (N = 111) | 3.81 | 3.82 | |

| KD 1500 and above (N = 108) | 3.60 | 3.52 | |

| Sig. (2-tailed) | 0.014 | 0.009 | |

| Employment | Self-employed (N = 35) | 3.40 | 3.34 |

| Family-owned business (N = 26) | 3.00 | 3.12 | |

| Private sector (N = 176) | 3.56 | 3.52 | |

| Public sector (N = 152) | 3.64 | 3.66 | |

| Unemployed (N = 83) | 3.52 | 3.42 | |

| Sig. (2-tailed) | 0.129 | 0.162 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ottesen, A.; Banna, S.; Alzougool, B. How to Cross the Chasm for the Electric Vehicle World’s Laggards—A Case Study in Kuwait. World Electr. Veh. J. 2023, 14, 45. https://doi.org/10.3390/wevj14020045

Ottesen A, Banna S, Alzougool B. How to Cross the Chasm for the Electric Vehicle World’s Laggards—A Case Study in Kuwait. World Electric Vehicle Journal. 2023; 14(2):45. https://doi.org/10.3390/wevj14020045

Chicago/Turabian StyleOttesen, Andri, Sumayya Banna, and Basil Alzougool. 2023. "How to Cross the Chasm for the Electric Vehicle World’s Laggards—A Case Study in Kuwait" World Electric Vehicle Journal 14, no. 2: 45. https://doi.org/10.3390/wevj14020045

APA StyleOttesen, A., Banna, S., & Alzougool, B. (2023). How to Cross the Chasm for the Electric Vehicle World’s Laggards—A Case Study in Kuwait. World Electric Vehicle Journal, 14(2), 45. https://doi.org/10.3390/wevj14020045